UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20172022

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to .__________.

Commission File Number 001-38348

Commission file number: 001-38348

RANPAK HOLDINGS CORP.

One Madison Corporation

(Exact Namename of Registrantregistrant as Specifiedspecified in Its Charter)its charter)

Delaware | 98-1377160 | |

(State or | (I.R.S. Employer | |

incorporation or organization) | Identification Number) |

3 East 28th Street, 8th Floor7990 Auburn Road

New York, New York 10016Concord Township, Ohio44077

(Address of Principal Executive Offices)principal executive offices) (Zip Code)

Tel: 212-763-0930

(440) 354-4445

Registrant’s telephone number, including area code)code

Securities registered pursuant to Section 12(b) of the Act:

| Trading Symbol(s) | Name of |

Class A

| PACK | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☐No☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes☐No☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒ No☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes☒ No☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☒ | ||

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | ||

Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☒ ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐ No☒

The registrant was not a public company at June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, and therefore it cannot calculate the aggregate market value of its voting and non-votingshares of Class A common equitystock, par value $0.0001 per share held by non-affiliates at such date. The registrant’s Units began tradingof the registrant was approximately $322,517,100, based on the closing sale price of $7.00 per share as reported on the New York Stock Exchange on January 18, 2018 and the registrant’s Class A ordinary shares began separate trading on the New York Stock Exchange on February 21, 2018. At December 31, 2017,June 30, 2022.

As of March 13, 2023, the registrant had no Class A ordinary shares outstanding.

As of March 28, 2018, the registrant had 30,000,00079,468,609 of its Class A ordinarycommon shares, $0.0001 par value per share, outstanding and 11,250,0002,921,099 of its Class B ordinaryC common shares, $0.0001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2023 Annual Meeting of Stockholders, to be held on May 25, 2023, are incorporated by reference into Part II and Part III of this Form 10-K.

Ranpak Holdings Corp.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2022

Table of Contents

Page | ||||

Part I | ||||

Item | 2 | |||

Item | 12 | |||

Item | 28 | |||

Item | 28 | |||

Item | 29 | |||

Item | 29 | |||

Part II | ||||

Item | 29 | |||

Item | 30 | |||

Item | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 30 | ||

Item | 43 | |||

Item | 45 | |||

Item | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 81 | ||

Item | 81 | |||

Item | 86 | |||

Item 9C | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 86 | ||

Part III | ||||

Item | 86 | |||

Item | 86 | |||

Item | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 86 | ||

Item | Certain Relationships and Related Transactions, and Director Independence | 86 | ||

Item | 86 | |||

Part IV | ||||

Item | 86 | |||

Item 16 | 87 | |||

90 | ||||

i

Except where the context otherwise requires, all referencesCautionary Notice Regarding Forward-Looking Statements

All statements other than statements of historical fact included in this Annual Report on Form 10-K (“Report”), including, without limitation, statements under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding our financial position, business strategy and the plans and objectives of management for future operations, are forward-looking statements. When used in this Report, words such as “may,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “continue,” or the negative of such terms or other similar expressions, as they relate to the “Company”, “we”, “us”, “our” or similar words or phrases are to One Madison Corporation, a Cayman Islands exempted company. References to our “management”us or our “management team” refer to our executive officers and directors, and references to the “sponsor” refer to One Madison Group, LLC, a Delaware limited liability company,management, identify forward-looking statements.

The forward-looking statements contained in which our founder, Omar M. Asali, together with certain affiliates, holds a controlling 80% ownership interest. References to our “initial shareholders” refer to the sponsor, the anchor investors (as defined below), the BSOF Entities (as defined below)this Report and the Company’s management.

Introduction

WeExhibits attached hereto are a blank check company incorporatedbased on July 13, 2017 as a Cayman Islands exempted company incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. We have reviewed,our current expectations and continuebeliefs concerning future developments and their potential effects on us taking into account information currently available to review, opportunities to enter into a business combination, but we are not able to determine at this time whether weus. There can be no assurance that future developments affecting us will complete a business combination with any of the target businessesbe those that we have reviewed or with any other target business. We also have neither engaged in any operations nor generated any revenue to date. Based on our business activities, the Company isanticipated. These forward-looking statements involve a “shell company” as defined under the Exchange Act of 1934 (the “Exchange Act”) because we have no operations and nominal assets consisting almost entirely of cash.

On January 22, 2018, we consummated our initial public offering (the “initial public offering”) of 30,000,000 units (the “units”). Each unit consists of one Class A ordinary share and one-half of one warrant. Each whole warrant entitles the holder thereof to purchase one Class A ordinary share at a price of $11.50 per share. The units were sold at an offering price of $10.00 per unit, generating gross proceeds, before expenses, of $300 million. Prior to the consummation of the initial public offering, the Sponsor purchased 8,625,000 Class B ordinary shares for an aggregate purchase price of $25,000, or approximately $0.003 per share, and certain other investors (the “anchor investors”) purchased 3,750,000 Class B ordinary shares for an aggregate purchase price of $37,500, or approximately $0.01 per share (together, the “founder shares”). The founder shares were issued to the anchor investors in connection with their agreement to purchase an aggregate of 15,000,000 ordinary shares (13,025,000 Class A ordinary shares and 1,975,000 Class C ordinary shares) (“forward purchase shares”), plus an aggregate of 5,000,000 redeemable warrants (“forward purchase warrants”) for $10.00 per share, for an aggregate purchase price of $150 million, in a private placement to occur concurrently with the closing of the initial business combination (the “forward purchase agreements”). We also entered into the strategic partnership agreement (the “Strategic Partnership Agreement), pursuant to which the sponsor transferred 525,000 founder shares to BSOF Master Fund L.P., a Cayman Islands exempted limited partnership, and BSOF Master Fund II L.P., a Cayman Islands exempted limited partnership, both affiliates of The Blackstone Group L.P. (together, the “BSOF Entities”). On March 8, 2018, the Sponsor surrendered 1,125,000 Class B ordinary shares to the Company for no consideration, which the Company cancelled, following the expiration of the underwriters’ over-allotment option granted in the initial public offering.

Upon execution of the forward purchase agreements, each anchor investor elected to receive a fixed number of Class A ordinary sharesrisks, uncertainties (some of which are beyond our control) or Class C ordinary shares. The Class C ordinary shares have identical terms as the Class A ordinary shares, except the Class C ordinary shares do not grant their holders any voting rights. Our amended and restated memorandum and articles of association provideother assumptions that following the consummation of our initial business combination, the Class C ordinary shares may cause actual results or performance to be converted into Class A ordinary shares on a one-for-one basis (i) at the election of the holder with 65 days’ written noticematerially different from those expressed or (ii) upon the transfer of such Class C ordinary share to an unaffiliated third party.

Pursuant to the Strategic Partnership Agreement, the BSOF Entities have agreed to act as our strategic partner and may provide debt or equity financing in connection with our initial business combination,implied by these forward-looking statements. These risks include, but are not requiredlimited to:

Simultaneously with the closing of the initial public offering, the Company consummated the private placement (“Initial Private Placement”) of 8,000,000 warrants (“Private Placement Warrants”) each exercisable to purchase one Class A ordinary share or Class C ordinary share, as applicable, at $11.50 per share, at a price of $1.00 per Private Placement Warrant, generating gross proceeds of $8 million.

Upon the closing of the initial public offering and the Initial Private Placement, $300 million ($10.00 per unit) from the net proceeds thereof was placed in a U.S.-based trust account at J.P. Morgan Chase Bank, N.A, maintained by Continental Stock Transfer & Trust Company, acting as trustee (“Trust Account”), and is invested in a money market fund selected by the Company until the earlier of: (i) the completion of the initial business combination or (ii) the redemption of the Company’s public shares if the Company is unable to complete a business combination by January 22, 2020, subject to applicable law.

After the payment of underwriting discounts and commissions (excluding the deferred portion of $10,500,000 in underwriting discounts and commissions, which amount will be payable upon consummation of our initial business combination if consummated) and approximately $1,000,000 in expenses relating to the initial public offering, approximately $1,000,000 of the net proceeds of the initial public offering and Initial Private Placement was not deposited into the Trust Account and was retained by us for working capital purposes. The net proceeds deposited into the Trust Account remain on deposit in the Trust Account earning interest.

Effecting Our Initial Business Combination

General

We are not presently engaged in, and we will not engage in, any operations for an indefinite period of time following our initial public offering. We intend to effectuate our initial business combination using cash held in the Trust Account, our equity, debt or a combination of these as the consideration to be paid in our initial business combination. We may seek to complete our initial business combination with a company or business that may be financially unstable or in its early stages of development or growth, which would subject us to the numerous risks inherent in such companies and businesses.

If our initial business combination is paid for using equity or debt securities, or not all of the funds released from the Trust Account are used for payment of the consideration in connection with our initial business combination or used for redemptions of our Class A ordinary shares, we may apply the balance of the cash released to us from the Trust Account for general corporate purposes, including for maintenance or expansion of operations of the post-transaction company, the payment of principal or interest due on indebtedness incurred in completing our initial business combination, to fund the purchase of other companies or for working capital.

Selection of a target business and structuring of our initial business combination

While we may pursue an acquisition opportunity in any industry or location, we intend to focus on the consumer sector and consumer-related businesses based predominantly in North America with global reach. We believe our management team has the skills and experience to identify, evaluate and consummate a business combination and is positioned to assist businesses we acquire in the following categories: (i) consumer products or services, (ii) food and beverage and (iii) adjacent manufacturing or industrial services businesses linked to a consumer end-user. We intend to target businesses that have stable cash flows, strong management teams, and attractive growth prospects over the long term. Our management and our operating and advisory committee have extensive experience not only identifying and executing the acquisition of private and public companies, but also the running and operating of businesses post-transaction.

Our initial business combination must occur with one or more target businesses that together have an aggregate fair market value of at least 80% of the assets held in the Trust Account (excluding the deferred underwriting commissions and taxes payable on the interest earned on the Trust Account) at the time of our signing a definitive agreement in connection with our initial business combination. If our board of directors is not able to independently determine the fair market value of the target business or businesses, we will obtain an opinion from an independent investment banking firm which is a member of FINRA or a valuation or appraisal firmpreferences with respect to the satisfaction of such criteria. While we consider it unlikely that our board will not be able to make an independent determination of the fair market value of a target business or businesses, it may be unable to do so if the board is less familiar or experienced with the target company’s business, there is a significant amount of uncertainty as to the value of the company’s assets or prospects, including if such company is at an early stage of development, operations or growth, or if the anticipated transaction involves a complex financial analysis or other specialized skills and the board determines that outside expertise would be helpful or necessary in conducting such analysis. Since any opinion, if obtained, would merely state that the fair market value of the target business meets the 80% of assets threshold, unless such opinion includes material information regarding the valuation of a target business or the consideration to be provided, it is not anticipated that copies of such opinion would be distributed to our shareholders. However, if required under applicable law, any proxy statement that we deliver to shareholders and file with the SEC in connection with a proposed transaction will include such opinion.

We anticipate structuring our initial business combination so that the post-transaction company in which our public shareholders own shares will own or acquire 100% of the equity interests or assets of the target business or businesses. We may, however, structure our initial business combination such that the post-transaction company owns or acquires less than 100% of such interests or assets of the target business in order to meet certain objectives of the target management team or shareholders or for other reasons, but we will only complete such business combination if the post-transaction company owns or acquires 50% or more of the outstanding voting securities of the target or otherwise acquires a controlling interestpaper products generally;

In evaluating a prospective target business, we expect to conduct a due diligence review which may encompass, among meet expectations;

The time required to evaluate a target business and to structure and complete our initial business combination, and the costs associated with this process, are not currently ascertainable with any degree of certainty. Any costs incurred with respect to the evaluation of, and negotiation with, a prospective target business with which our business combination is not ultimately completed will result in our incurring losses and will reduce the funds we can use to complete another business combination.

Redemption rights for holders of public shares upon consummation of our initial business combination

We will provide our shareholders with the opportunity to redeem all or a portion of their Class A ordinary shares sold as part of the units sold in the initial public offering (the “public shares”) upon the completion of our initial business combination at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, calculated as of two business days prior to the consummation of our initial business combination, including interest, less income taxes payable, divided by the number of then outstanding public shares, subject to the limitations described herein. There will be no redemption rights upon the completion of our initial business combination with respect to our warrants. Our initial shareholders have agreed to waive their redemption rights with respect to their founder shares, and with respect to the initial shareholders other than the anchor investors, any public shares they may hold in connection with the consummation of the initial business combination.

3

Conduct of redemptions pursuant to tender offer rules

If we conduct redemptions pursuant to the tender offer rules of the U.S. Securities and Exchange Commission (the “SEC”),.

PART I

Throughout this Report, when referring to “Ranpak,” the “Company,” “we,” “our,” or “us,” we will, pursuantare referring to Ranpak Holdings Corp. and all of our subsidiaries, except where the context indicates otherwise.

Unless otherwise noted, references to a particular year are to our amended and restated memorandum and articles of association: (a) conductfiscal year, which corresponds to the redemptions pursuant to Rule 13e-4 and Regulation 14Ecalendar year ended or ending on December 31 of the Exchange Act,same year. For example, a reference to “2022” is a reference to the year ended December 31, 2022.

Non-U.S. Generally Accepted Accounting Principles (“GAAP”) Information

Our consolidated financial statements are prepared in accordance with U.S. GAAP. We have, however, also presented below Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) and adjusted EBITDA (“AEBITDA”), which regulate issuer tender offers;are non-GAAP financial measures. We have included EBITDA and (b) file tender offer documentsAEBITDA because they are key measures used by our management and Board of Directors to understand and evaluate our operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, the exclusion of certain expenses in calculating EBITDA and AEBITDA can provide a useful measure for period-to-period comparisons of our primary business operations. Adjusting AEBITDA for comparability for constant currency also assists in this comparison as it allows a better insight into the performance of our businesses that operate in currencies other than our reporting currency. Before consolidation, our Europe/Asia financial data is derived in Euros. To calculate the adjustment that we apply to present AEBITDA on a constant currency basis, we multiply this

1

Euro-derived data by 1.15 to reflect an exchange rate of 1 Euro to 1.15 U.S. dollars (“USD”), which we believe is a reasonable exchange rate to use to give a stable depiction of the business without currency fluctuations between periods, to calculate Europe/Asia data in constant currency USD. An exchange rate of 1.15 approximates the average exchange rate of the Euro to USD over the past five years. We also present non-GAAP constant currency net revenue and derive it in the same manner. We believe that EBITDA and AEBITDA provide useful information to investors and others in understanding and evaluating the Company’s operating results in the same manner as our management and Board of Directors.

However, EBITDA and AEBITDA have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. In particular, EBITDA and AEBITDA should not be viewed as substitutes for, or superior to, net income (loss) prepared in accordance with GAAP as a measure of profitability or liquidity. Some of these limitations are:

EBITDA — EBITDA is a non-GAAP financial measure that we calculate as net income (loss), adjusted to exclude: benefit from (provision for) income taxes; interest expense; and depreciation and amortization.

AEBITDA — AEBITDA is a non-GAAP financial measure that we present on a constant currency basis and calculate as net income (loss), adjusted to exclude: benefit from (provision for) income taxes; interest expense; depreciation and amortization; stock-based compensation expense; and, in certain periods, certain other income and expense items; as further adjusted to reflect the performance of the business on a constant currency basis.

In addition, we include certain other unaudited, non-GAAP constant currency data for 2022 and 2021. This data is based on our historical financial statements included elsewhere in this Report, adjusted (where applicable) to reflect a constant currency presentation between periods for the convenience of readers. We reconcile this data to our GAAP data for the same period under “Presentation and Reconciliation of GAAP to Non-GAAP Measures” for 2022 and 2021.

ITEM 1. BUSINESS

Our Business

Ranpak is a leading provider of environmentally sustainable, systems-based, product protection and end-of-line automation solutions for e-commerce and industrial supply chains. Since our inception in 1972, we have delivered high quality protective packaging solutions, while maintaining our commitment to environmental sustainability. We differentiate ourselves by our:

Submissionmost of our initialPPS systems. This business combinationmodel is designed to a shareholder vote

Ingenerate attractive margins that are recurring in nature through the event that we seek shareholder approvalsale of our initialpaper consumables. Our business combination, we will distribute proxyis global, with a strong presence in the U.S. and Europe along with an expanding footprint in Asia, serving end-users in approximately 57 countries across 6 continents. End-users rely on our paper consumables for use exclusively with our installed base of systems.

2

If we seek shareholder approval, we will complete our initial business combination only ifcurb-side recyclable to customers. Our paper packaging materials contain little or no plastic or other resin-based inputs. Additionally, a majority of our paper packaging materials are manufactured from entirely or partially recycled content. In 2022, approximately 54.5% of our raw paper supply was Forest Stewardship Council (“FSC”) certified. Through our proprietary PPS systems and value-added kraft paper consumables, we offer a reliable, fast, and effective suite of protective packaging solutions. We believe that preference for environmentally sustainable packaging solutions will be a key driver of growth moving forward, particularly to the outstanding ordinary shares votedextent plastics and other resin-based solutions come under increasing public scrutiny.

These solutions offer end-users numerous benefits including the reduction of shipping costs, waste, and labor, resulting in improved efficiency.

3

In addition to expanding our offerings through internal development, we seek to provide value added solutions to our customers through acquisitions as well as strategic investments and partnerships. In 2021, we made two strategic investments to supplement our portfolio:

4

Our PPS Products

Our PPS products are designed to be flexible and responsive to the needs of our end-users. The flexibility and breadth of our full range of systems allows us to provide our end-users with the optimal protective solution to meet their specific needs and help ensure that their products reach their shipping destination in a cost-effective manner with minimal breakage. We derive substantially all of our net revenue (over 90% in 2022 and 2021) through the sale of high-margin paper consumables that work exclusively with our PPS systems. These PPS systems, which include the accompanying paper consumables, fall into three broad categories:

We retain ownership of most of our PPS systems (other than, e.g., certain disposable Wrapping systems and FillPak® Manual). This model allows distributors and end-users access to our proprietary systems at little or no capital expense and enables us or our distributors to reclaim un- or under-utilized units for refurbishment and redeployment, which benefits us, our distributors, and our end-users through increased efficiency and cost savings. As of December 31, 2022, we had an installed base of approximately 139,100 PPS systems.

Our consumables ship in bulk, which is efficient for customers in shipping and require less storage space than many competing products. We convert the vast majority of raw paper to create rolls and bundles of paper that integrate with our PPS systems and into direct or consumable products. Our PPS systems predominantly use kraft paper of varying weights, sizes, and configurations. Unlike many competitive products (e.g., foam, air pillows, bubble wrap, loose fill, etc.), our paper packaging materials are fiber-based, renewable, and environmentally sustainable. With the exception of the pouches used for our Recycold cool packs, none of our paper

5

consumables include plastic or other resin-based components. Instead, they are paper-based and biodegradable, renewable, and curb-side recyclable. Additionally, a majority of our paper consumables sold to end-users are created from entirely or partially recycled content. In 2022, 54.8% of the pulp used to manufacture our paper consumables was recycled fiber, with 8.3% recycled from post-industrial waste and 46.5% recycled from post-consumer waste. In 2022, approximately 54.5% of our raw paper supply was FSC certified.

Our Automation Products

Our AS solutions are comprised of configurable automated systems that fulfill the needs of end-of-line packaging automation for product distribution and shipping. We utilize one-dimensional box reduction that optimizes the size of corrugated boxes to fit the contents being shipped. In addition to optimizing box-size, our AS solutions can be configured to automatically erect and form corrugated boxes, and apply glued lids to seal the box. Our solutions allow end-users to minimize dunnage use, utilize sustainable dunnage, and improve the speed and efficiency of end-of-line packaging operations as well as help reduce product returns from damage during shipment.

Our APS solutions utilize proven Ranpak paper converter technology and help end users automate the void filling and box closure processes after product packing is complete. Using machine vision, these technologies dispense the proper amount of void fill to protect products while minimizing labor requirements to pack and, depending on end-user need, can be configured to close the box, insert sustainable paper cushioning liners within boxes, and/or apply shipping labels. Our solutions provide for the capability to insert void and close multiple dimensions of box sizes to suit the end user needs. Our APS solutions can be fully automated or semi-automated, depending on end-user business process requirements. These systems allow end-users to minimize labor, optimize their use of dunnage, improve protection for items being shipped, and make end-of-line packaging operations more efficient.

Unlike our PPS systems and APS solutions, we do not retain ownership of our AS solutions. Rather, we design and sell our AS solutions outright to our customers and derive revenue by designing, manufacturing, installing, and servicing AS solutions at end-user facilities. Depending on the needs of a customer, our APS solutions may consist of components that are sold outright to the customer or may include a mix of components sold outright and components of which we retain ownership. However, in all cases, our current business model for our Automation product line involves the direct or indirect sale of highly customized systems, designed on the basis of our consultancy and product engineering expertise. As the market for our Automation products is rapidly evolving, we have extended our Automation services to offer extended service warranties beyond the initial shareholderswarranty period, packaging line solutions, and the sale of spare parts. Our Automation products accounted for 4.6% of our net revenue in 2022.

Our Distribution Model

We sell the vast majority of our paper packaging materials to an established network of approximately 300 distributors worldwide who, in turn, store, market and sell our products, including bundles and rolls, to end-users. Moreover, substantially all of our net revenue from distributors is generated by those who have agreed to vote their founder sharesexclusivity with our products and any public shares purchased duringnot to sell or afterpromote competitors’ paper-based solutions. Our sales and marketing teams, as well as our highly skilled engineers, work closely with distributors and ultimate end-users, on-site or remotely, to optimize the initial public offering in favorcustom configuration and installation of our initialPPS systems and Automation products at the end-user’s facility. For each product, we set targets for minimum annual paper consumption in order to justify the capital deployed to that account. Accordingly, our sales team, in conjunction with our distributors, help end-users select which products meet their specific needs based on their own volume requirements and business combination. Each public shareholder may elect to redeem their public shares irrespectiveobjectives. Sales through our global distributor network accounted for 90.5% of whether they vote for or against the proposed transaction. our net revenue in 2022.

In addition, we sell our initial shareholdersPPS systems and Automation products directly to certain select end-users. In some cases, these end-users operate some of the largest, most complex and sophisticated warehouse operations into which our PPS and Automation systems are integrated. Our engineering and other teams also assist our direct-sale end-users in ensuring the optimal customized installation of our products at their facilities. Direct sales to end-users accounted for 9.5% of our net revenue in 2022.

Through our distributor network and our direct sales, we serve greater than 36,000 end-users including participants in e-commerce, the auto after-market, electronics, machinery, home goods, industrial, warehousing/transport services, healthcare, and other markets. Our field of end-users is diverse, with greater than 75.8% of distributor-serviced end-users generating less than $10,000 of our net revenue in 2022.

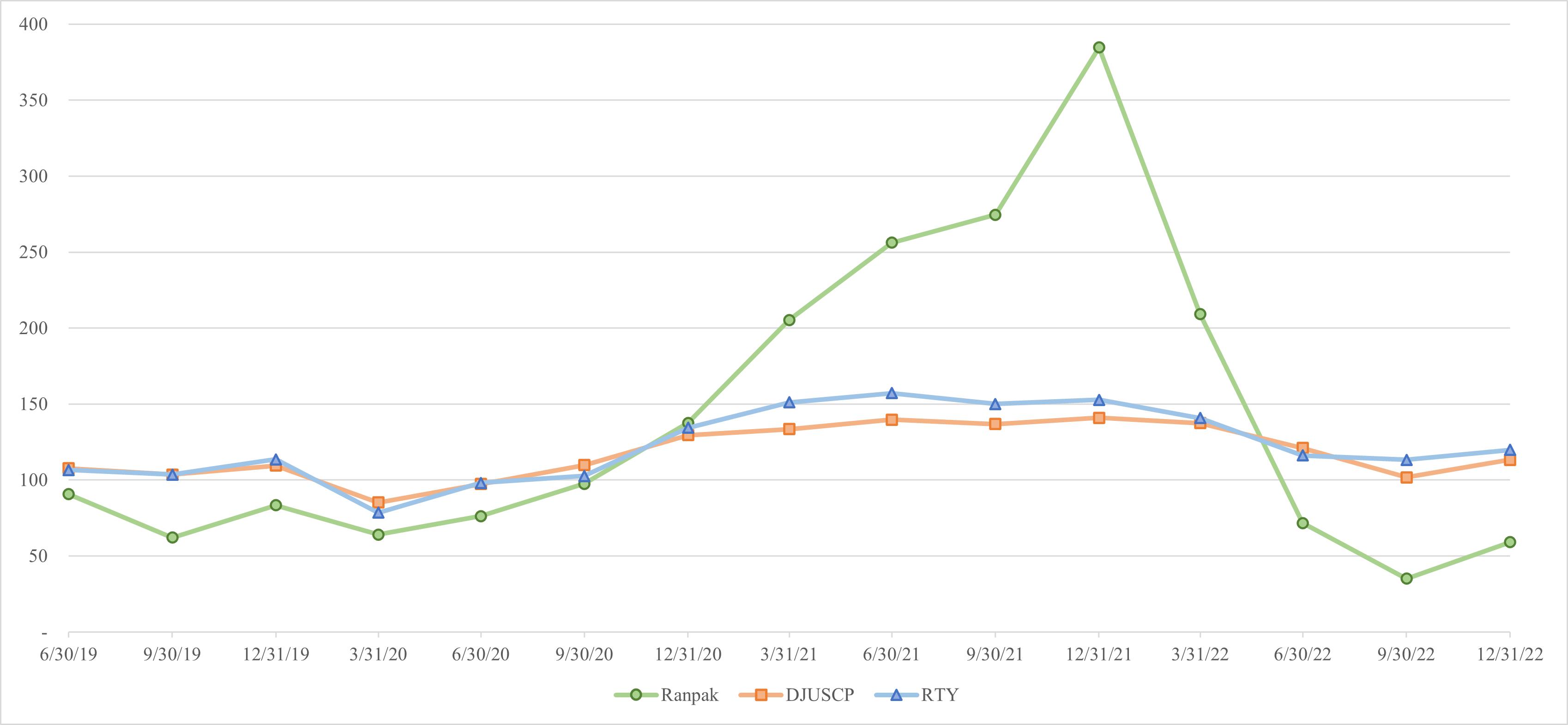

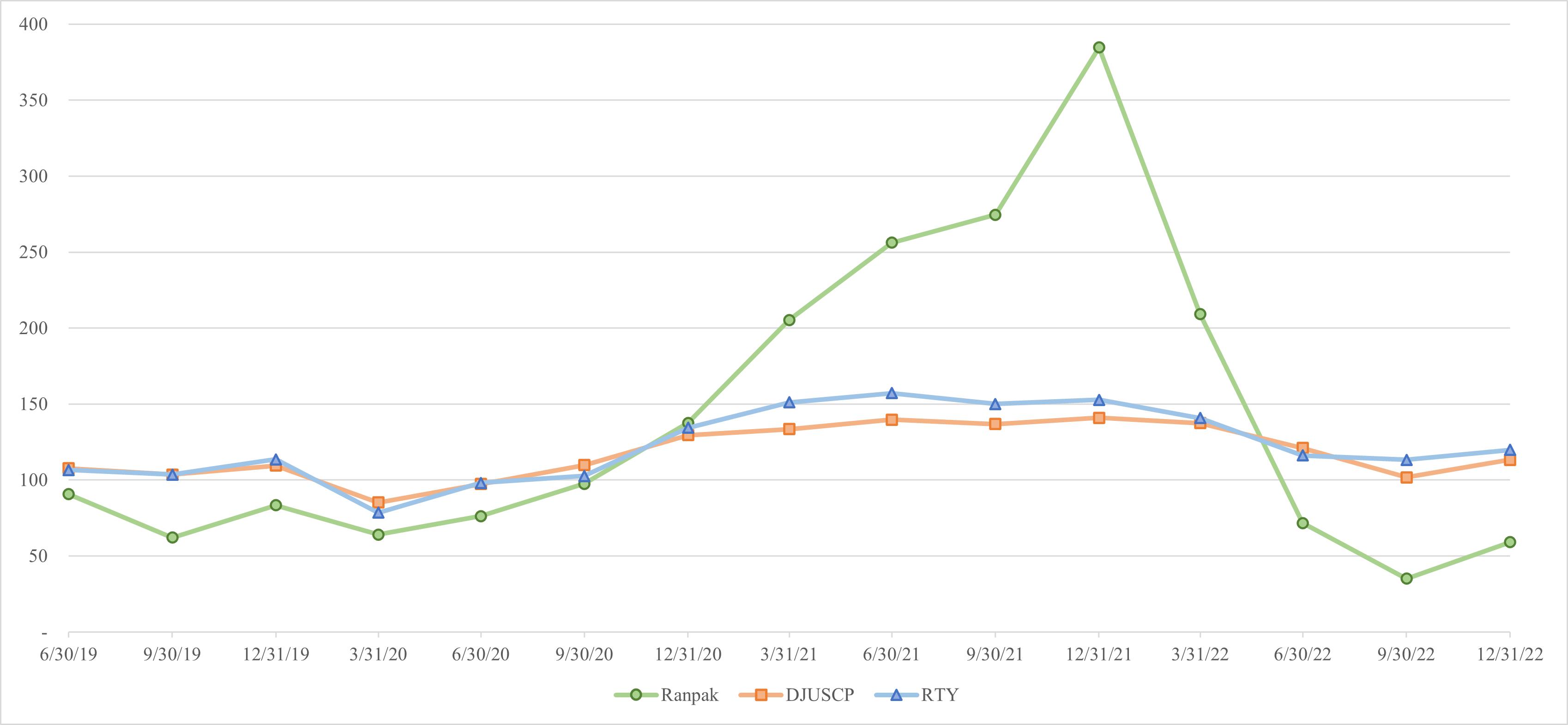

Our Performance

In 2022, we generated net revenue of $326.5 million and $42.5 million of income from operations. Our revenues are geographically diverse, with 43.3% of our 2022 net revenue generated from end-users in North America, 46.5% generated from end-users in Europe, and 10.2% generated from end-users in Asia and other locations. In addition, approximately 58.3% of our net revenue in 2022 was generated from outside the United States.

6

Our Strategy

Our strategy for adding to our customer base includes investing in innovation, our sales force and distributor relationships across all end markets as well as expanding geographically. Beyond our leading position in paper-based Void-Fill and Cushioning protective packaging systems, we expect to also focus on other emerging applications, such as Wrapping, Automation, Cold Chain, and Retail Consumables, for continued growth. While still relatively small, representing 12.4% of our net revenue in 2022, we believe our Wrapping product line can provide a platform for growth largely due to our Geami® products, which provide a highly effective and environmentally friendly alternative to plastic bubble wrap, as well as an opportunity to expand our distribution channels into the retail and retail shipping segments. Our December 2021 acquisition of Recycold helps us to provide a more comprehensive sustainable Cold Chain solution for customers. We also have invested in the development of alternative and more sustainable paper pulps and substrates through our investment in Creapaper.

Our Automation products represented only 4.6% of our net revenue in 2022, however, following development through acquisitions and organic growth, we believe it will serve as a platform for expansion to better serve end-users with higher volume requirements and more sophisticated end-of-line needs. In 2021, we created R Squared Robotics, a division of Ranpak, that uses three-dimensional computer vision and artificial intelligence technologies to improve end-of-line packaging and logistics functions. Additionally, in July 2021, we advanced our focus on Automation with a strategic investment in Pickle. We are currently building facilities in both the United States and the Netherlands with dedicated space for Automation functions. All of these efforts complement and expand our focus on our Automation products. We believe our Automation products provide us with an opportunity to increase our penetration with existing customers and broaden our customer base to include business segments that we have not historically served. We will also continue to identify additional product and service opportunities for our current and future end-user markets.

We are pursuing expansion of our customer base in several ways. We have a global sales organization that works hand-in-hand with the sales representatives of our approximately 300 distributors to introduce our products and services to potential accounts. Our broad product portfolio allows us to serve any type of business with protective packaging needs across all end markets. We will also seek to broaden our customer base through geographic expansion by enhancing our regional capabilities in sales and marketing and expanding sales of our existing product lines in growth regions, such as Asia-Pacific (“APAC”), South America, and Central and Eastern Europe. We have recently established a full-service paper conversion facility in Malaysia, which we anticipate to be operational in the second half of 2023. We believe the Malaysia facility can improve our ability to serve customers in the region by shortening lead times as well as provide a more attractive cost profile to the APAC market than we have historically been able to offer. Combined with the localized presence and connection to Southeast Asia, we believe the Malaysia facility can bring favorable growth opportunities.

We seek to enhance our position as a leading global provider of innovative sustainable packaging solutions that our customers rely on to improve performance, cost competitiveness and automation to enhance productivity within their operations. In order to achieve these goals, we are focused on the following strategic priorities.

7

Industry

The macroeconomic effects of COVID-19 emphasized the importance of the broader global protective packaging industry in the world economy. The global protective packaging industry is fragmented and competitive with market leaders accounting for a relatively small share of the market. This fragmentation is due primarily to the variety of product types and the myriad of applications in which they are used around the world.

Protective packaging is used to store and protect goods during shipping and handling from shock, vibration, abrasion and other damages. It is mainly used to fill the empty space between the product/merchandise and exterior carton or container (often referred to as dunnage), or to protect goods during shipment. As a general matter, the value of the goods being shipped, as well as the potential cost of breakage, far outweigh the cost of in-the-box protective packaging, which drives the demand for effective protective packaging solutions like ours. Protective packaging comes in various forms such as foam, air pillows, bubble wrap, cushion products, loose fill (e.g., Styrofoam packing peanuts), paperboard protectors and protective mailers, as well as non-engineered solutions such as newsprint, tissue paper, shredded corrugated cardboard and other materials.

The protective packaging industry is characterized by a diversity of applications and end markets, within both the industrial and consumer segments. Historically, growth in the protective packaging industry has been positively impacted by trends such as expedited delivery of individualized packages, globalization of the supply chain, and increased focus on efficiency and reduced shipping costs. We believe more recent and future growth drivers include further expansion of e-commerce activity, increased customization of protective packaging systems in markets such as electronics, and increased demand for environmentally friendly protective packaging. In our view, those markets most closely linked to e-commerce and/or sustainable packaging are those best positioned for growth in the future.

Our Market

Our end-user market consists of any business that sells and ships products requiring packaging. Accordingly, these end-users are highly dependent on their ability to obtain a cost-effective and efficient in-the-box packaging solution. Our end-users operate in a variety of businesses, including e-commerce, the automotive after-market, electronics, machinery/manufacturing, home goods, pharmaceuticals, retail and others.

We primarily sell our products to our distributors which, in turn, market and sell our products to our end-users. We also sell products directly to select end-users. In 2022, 90.5% of our net revenue was derived from sales to our distributors and approximately 9.5% of our net revenue was derived from sales directly to end-users.

Distributors. We primarily sell our products to our network of approximately 300 distributors worldwide. These distributors vary in size and, generally, offer a broad suite of packaging and other warehousing products and services to the end-users they serve, including other protective packaging systems, such as plastic bubble wrap and air pillows. Substantially all of our net revenue from distributors is generated by those who have agreed to waive their redemption rightsexclusivity with our products and not to sell or promote competitors’ paper-based solutions.

Additionally, our distributors benefit from the collaborative approach we foster with our internal sales, engineering and marketing organization. We work with our distributors to win additional end-users of our paper-based products that the distributor, in turn, can service on an on-going basis with a broad suite of packaging equipment and supplies. Our distributors also typically address the needs of our end-users directly with respect to any ongoing protective system service needs. In order to facilitate the collaborative process, we meet with our distributors to discuss end-user needs and potential solutions, provide training programs (including through our

8

Ranpak Academy program) for distributors that are designed to cultivate their founder shares,knowledge of, and with respectloyalty to, our brands, as well as provide the tools they need to successfully market and place our systems.

As a result of these and other efforts, we have built and maintained a well-established distributor network that is comprised primarily of long-term business relationships and the continuity of these relationships evidences the strength of our business model, as well as the value proposition for our distributors and end-users. Furthermore, the depth and longevity of these relationships result in a distributor network that is highly knowledgeable and well versed in conveying the benefits of our systems to end-users. We believe that our distributor-based distribution model is particularly well suited to the initial shareholdershighly fragmented nature of the protective packaging solution end-user market we seek to serve by enabling us to reach a broad range of end users across size, industry and geography while maintaining a lean internal salesforce and capital base.

End-Users. We have greater than 36,000 global end-users. These end-users operate in a wide variety of businesses and rely on our systems for a cost-effective and efficient paper-based protective packaging solution that meets their operational and shipping needs. Our field of end-users is diverse and historically stable, with greater than 75.8% of distributor-serviced accounts generating less than $10,000 in annual net revenue in 2022. Our end-users vary in size from extremely small specialty manufacturers or retailers to some of the largest global e-commerce companies. While most of our end-users purchase our products from our distributors, we also sell our products directly to select end-users. Direct sales to end-users accounted for approximately 9.5% of our net revenue in 2022.

E-commerce. We believe changing consumer preferences and buying habits will drive continued e-commerce growth, both among pure-play e-commerce companies, as well as among historical brick-and-mortar companies seeking to expand their e-commerce presence. We further believe the critical necessity of brand owners to optimize supply chains and reduce capital spend drives the important trend in concentration of logistics through third-party logistics providers that in turn drives increasing needs for efficient packaging end-of-line solutions. The availability of a broader product selection on-line, faster delivery times, and increased in-store pickup options all drive significant growth in on-line sales. This expansion of e-commerce is a worldwide trend that we believe will continue to accelerate as on-line penetration grows in developed and emerging markets. Although some of our e-commerce end-users are focused on the responsible reduction of their need for void-fill material more broadly, they generally require protective packaging solutions that can be integrated into their existing supply and distribution infrastructures on a low-cost and efficient basis. Most commonly, our e-commerce end-users purchase our Void-Fill solutions, but many also use our Automation, Wrapping, and Cushioning systems. Sales to our e-commerce end-users, directly and through distributors accounted for approximately 31.0% of our net revenue in 2022.

The COVID-19 pandemic demonstrated the growing macroeconomic emphasis on e-commerce in the global economy. In 2022, many of the obstacles on daily life brought on by the COVID-19 pandemic began to subside and we saw consumers eager to embrace a return to normalcy and experience-based activities in their discretionary spending, including shopping in a physical store or eating out at restaurants. While this resulted in decreased e-commerce activity in 2022 compared to recent years, we believe that brick-and-mortar experiences and e-commerce activity will complement each other thanas companies work to balance both presences for their businesses, and e-commerce will continue to be an important piece of the anchor investors, any public shares they may holdglobal economy.

Industrial Manufacturing. Our industrial manufacturing end market includes end users manufacturing products utilized for tools, construction supplies, energy and utilities, chemicals, paints, and metals. We believe demand in connectionthese sectors will increase as growing populations and expanding middle classes in developing countries generate more disposable income. Higher demand for advanced machines spurs increased spending on tools and robotics while higher demand for housing, infrastructure and commercial buildings benefits the tools and construction supplies sectors. Sales to industrial manufacturing end-users accounted for approximately 12.5% of our net revenue in 2022.

Automotive Aftermarket. The automotive after-market is driven by the need for replacement parts as automobiles age, as well as by the desire of consumers to customize vehicles to enhance performance and improve aesthetics. Increasing average age of vehicles and digitalization of component delivery sales and services, along with the consummationadvent of on-line portals distributing after-market components is expected to contribute to the continued growth of the business combination.

If we seek shareholder approvalautomotive after-market industry. Our automotive after-market end-users require protective packaging solutions that have strong protective qualities, as the products they ship are often heavy, require greater care in handling, and have a higher individual per-unit value. Accordingly, these end-users most commonly purchase our Cushioning solutions. Our packaging solutions are typically designed to integrate into these end-users’ existing industrial processes for the production and distribution of automotive parts. Sales to our automotive after-market end-users accounted for approximately 9.8% of our initial business combinationnet revenue in 2022.

Electronics. Widespread product innovation combined with an expanding working population, a corresponding growth in household formation and disposable incomes are key factors contributing to the growth of the global consumer electronics market. Thriving demand for smartphones across the globe and the miniaturization of electronic devices are additional factors boosting growth in the global consumer electronics market. We believe this demand for electronics will continue to grow as innovation, such as the Internet-of-Things and voice-connected devices, drives increased demand for the latest electronics hardware. Our electronics end-users

9

customarily sell products such as computer hardware and electronics that are often already securely packaged in primary packages by the manufacturer and, as a result, require less robust protective packaging systems from us. Sales to our electronics end-users accounted for approximately 7.3% of our net revenue in 2022.

Industrial Machinery. We believe demand for industrial machinery and equipment used in sectors such as agriculture, construction, mining, packaging, and food processing will increase as economies expand, thus requiring additional infrastructure spend as well as increasing the need to feed growing middle-class populations across the globe. Sales to our machinery end-users accounted for approximately 6.4% of our net revenue in 2022.

Other. Our end-users also operate in many other industries, including [Warehousing (6.9% of net revenue in 2022), Home Furnishings (4.5%), Printing and Business Services (2.7%), and other various industries (18.8%)].

Our Paper Suppliers

We purchase kraft paper from various suppliers for conversion into the paper consumables we do not conduct redemptionssell. The kraft paper we purchase includes paper that is substantially manufactured from virgin pulp, as well as paper that is substantially manufactured from recycled post-industrial and/or post-consumer waste. Before we determine to purchase paper from any supplier, the supplier must undergo a qualification process to ensure that its product meets our exacting requirements. This qualification process involves an evaluation of the physical specifications of the potential supply source, as well as extensive testing for the paper’s convertibility – on the fan-folding, rewinding and die-cutting raw paper converters in connectionour facilities – and in the protective packaging systems we place with our initialend-users. Much of our paper is sourced from suppliers that are FSC certified. As a result, in 2022, approximately 54.5% of our raw paper supply was FSC certified. Once a supplier is qualified, we purchase large rolls of kraft paper from that supplier for integration into our existing supply and production chain. The paper rolls are converted at our facilities before sale to our distributors and direct end-users for use with our Void-Fill, Cushioning and Wrapping protective systems.

In 2022, we purchased paper from approximately 31 paper suppliers and our largest single source of paper supplies sold us approximately 43.7% and 21.7% of the paper supplies purchased in North America and globally, respectively. While the cost of paper supplies is our largest input cost, we typically negotiate supply and pricing arrangements with most of our paper suppliers annually, many of which we have long-standing relationships with, which helps us mitigate shorter term fluctuations in paper cost. In 2021 and 2022, global inflation and other macroeconomic factors, including COVID-19 and the conflict in Ukraine, have contributed to the increases in the cost of paper. Where we can, we will look to pass these increased market costs on to our customers to mitigate the impact of these costs. We are unable to predict our ability to pass these costs on to our customers and how much of these increases we will be able to pass on to our customers. As such, we expect some continued pressure on our gross margin in the medium term relative to our historical margin profile.

Our Competition

We compete with companies producing competing products that are well-established, have significant scale, and have a broad product offering. There are other manufacturers of protective packaging products, some of which are companies offering similar products that operate across regions and others that operate in a single region or single country. Our primary competitors include Sealed Air Protective Division, Pregis (FP International/Easypack), Intertape Polymer Group (IPG), Storopack and Sprick. Most competing manufacturers offer multi-substrate solutions including foam, loose-fill, plastic air pillows, and plastic bubble wrap in addition to a fiber-based offering. We believe we are the only major “in-the-box” protective packaging specialist that has a focus on a single environmentally friendly substrate (i.e., fiber) which enables us to have a best-in-class product offering as well as the credibility with customers that we are truly devoted to seeking environmentally sustainable solutions. We believe that we are one of the leading suppliers of fiber-based packaging materials and related systems in the principal geographic areas in which we offer those products. Additionally, we believe we are a leader in automated void reduction systems technology.

Human Capital Resources

We are a global organization that values life experiences, ideas, and cultures that each of our employees bring to Ranpak, striving to create an atmosphere of acceptance and respect, facilitating an encouraging environment, and helping employees attain professional and educational goals. We are proud to count men and women of all races and ethnicities as members of our Board of Directors, management team, and employee workforce. We are a Charter Pledge Partner in The Board Challenge, which is an initiative to improve diverse representation in corporate U.S. boardrooms. As a Charter Pledge Partner, we acknowledge that we already have diversity in our boardroom and pledge to use our resources to accelerate change within other companies. We utilize interview guides in our hiring processes to help identify different competencies, such as diversity, equity, and inclusion competencies, to ensure that new hires are developed in these areas. Additionally, we developed robust anti-bias training to ensure that every potential candidate is given a fair and merit-based evaluation of their skills.

10

We strive to maintain an active dialogue with our employees and provide employees a comprehensive benefits package including competitive wages, medical, life, and accident insurance, incentive bonus programs, and a 401(k) plan with an employer matching contribution. We have departmental budgets set aside for training and also provide a tuition reimbursement program for employees seeking bachelors or masters degrees. Certain employees are also eligible for stock-based compensation programs that are designed to encourage long-term performance aligned with Company objectives. In June 2019 and September 2021, every employee (excluding those eligible for stock-based compensation programs) received an equity award, providing a community of employee-owners who can personally share in the reward of our collective success.

As of December 31, 2022, we had 819 employees worldwide, 330 of whom were located in the United States. We have 159 of our employees located in Europe who are covered by collective bargaining agreements.

Our Intellectual Property

Our intellectual property provides a strong competitive advantage. We own or license over 774 U.S. and foreign patents and patent applications directed to various innovations related to packaging machines, stock material, packaging processes, and packaging products, as well as more than 264 U.S. and foreign trademark registrations and trademark applications that protect our branding of our packaging products, services, and equipment. We continue to innovate and advance that competitive advantage and file numerous U.S. and foreign patent applications each year. We are also vigilant in protecting our intellectual property, by monitoring competitor activity, providing notice to potential infringers, and bringing litigation whenever and wherever necessary and appropriate.

Seasonality

We estimate that approximately 31.0% of our net revenue in 2022, either directly or to distributors, was destined for end-users in the e-commerce sectors, whose businesses frequently follow traditional retail seasonal trends, including a concentration of sales in the holiday period in the fourth quarter. Our results tend to follow similar patterns, with the highest net revenue typically recorded in our fourth fiscal quarter and the slowest sales in our first fiscal quarter of each fiscal year. We expect this seasonality to continue in the future and, as a result, our results of operations between fiscal quarters in a given year may not be directly comparable.

Governmental Regulation

Federal, State, Local, and International Regulations

We are required to comply with numerous laws and regulations covering areas such as workplace health and safety, data privacy and protection, labor and employment. We monitor changes in these laws to maintain compliance with applicable requirements. Compliance with, or liability under, these laws and regulations may require us to incur significant costs and have a material adverse effect on our capital expenditures, earnings, and competitive position.

Environmental Matters

We are subject to a number of federal, state, local and international environmental-related health and safety laws and regulations that govern, among other things, the manufacture and assembly of our products; the discharge or pollutants into the air, soil and water; the use, handling, transportation, storage and disposals of hazardous materials; and environmental remediation or reclamation activities. We are required to hold various permits to conduct our operations. Compliance with, or liability under, these laws, regulations and permits can require us to incur significant costs and have a material adverse effect on our capital expenditures, earnings, and competitive position.

Legal Proceedings

From time to time, we have and may again become party to intellectual property litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. Historically, one category of legal proceeding to which we have been a party has involved claims of patent or other intellectual property infringement. While we are judicious in initiating litigation to those circumstances justified by legal and business combinationconsiderations, we have initiated and will continue to initiate affirmative action to protect our intellectual property. This litigation includes defending counterclaims brought by the counterparty against whom we have initiated a claim of infringement as part of their infringement-defense strategy.

Corporate Information

We are publicly traded on the New York Stock Exchange (“NYSE”) under the ticker symbol “PACK.” Our corporate headquarters is located at 7990 Auburn Road, Concord Township, Ohio 44077. Our telephone number is (440) 354-4445. We maintain a website at www.ranpak.com. We make available, free of charge, on this website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to the tender offer rules, our initial shareholders, directors, executive officers, advisorsSection 13(a) or their affiliates may purchase shares or public warrants in privately negotiated transactions or in the open market either prior to or following the completion15(d) of our initial business combination. However, other than as expressly stated herein, they have no current commitments, plans or intentions to engage in such transactions and have not formulated any terms or conditions for any such transactions. None of the funds held in the Trust Account will be used to purchase shares or public warrants in such transactions. If they engage in such transactions, they will not make any such purchases when they are in possession of any material nonpublic information not disclosed to the seller or if such purchases are prohibited by Regulation M under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after such reports are available,

11

electronically filed with, or furnished to the Securities and Exchange Act.Commission (“SEC”). These reports are also available at the SEC’s website, www.sec.gov. Apart from SEC filings, we also use our website to publish information which may be important to investors, such as analyst and investor presentations. Any information on our website or obtained through our website is not part of this Report.

ITEM 1A. RISK FACTORS

Summary Risk Factors

Our business faces significant risks. In addition to the summary below, you should carefully review the “Risk Factors” section of this Report. We do not currently anticipate that such purchases, if any, would constitute a tender offermay be subject to the tender offer rules under the Exchange Actadditional risks and uncertainties not presently known to us or a going-private transaction subject to the going-private rules under the Exchange Act; however, if the purchasers determine at the timethat we currently deem immaterial. Our business, financial condition and results of any such purchases that the purchases are subject to such rules, the purchasers will comply with such rules.

The purpose of any such purchases of sharesoperations could be to vote such sharesmaterially adversely affected by any of these risks, and the trading prices of our common stock could decline by virtue of these risks. These risks should be read in favorconjunction with the other information in this Report. Some of the more significant risks relating to our business combinationinclude:

Limitation on redemption rights upon completion of our initial business combination if we seek stockholder approval

Notwithstanding the foregoing redemption rights, if we seek shareholder approval of our initial business combination and we do not conduct redemptions in connection with our business combination pursuant to the tender offer rules, our amended and restated memorandum and articles of association provide that a public shareholder, together with any affiliate of such shareholder or any other person with whom such shareholder is acting in concert or as a “group” (as defined under Section 13 of the Exchange Act), will be restricted from redeeming its shares with respect to more than an aggregate of 20% of the shares sold in the initial public offering. We believe the restriction described above will discourage shareholders from accumulating large blocks of shares, and subsequent attempts by such holders to use their ability to redeem their shares as a means to force us or our management to purchase their shares at a significant premium to the then-current market price or on other undesirable terms. Absent this provision, a public shareholder holding more than an aggregate of 20% of the shares sold in the initial public offering could threaten to exercise its redemption rights against a business combination if such holder’s shares are not purchased by us or our management at a premium to the then-current market price or on other undesirable terms. By limiting our shareholders’ ability to redeem to no more than 20% of the shares sold in the initial public offering, we believe we will limit the ability of a small group of shareholders to unreasonably attempt to block our ability to complete our business combination, particularly in connection with a business combination with a target that requires as a closing condition that we have a minimum net worth or a certain amount of cash. However, we would not be restricting our shareholders’ ability to vote all of their shares (including all shares held by those shareholders that hold more than 20% of the shares sold in the initial public offering) for or against our business combination.

Redemption of public shares and liquidation if no initial business combination

The sponsor, the anchor investors, our management and the BSOF Entities have agreed that we will have until January 22, 2020 to complete our initial business combination. If we are unable to complete our initial business combination by January 22, 2020, we will: (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest (less up to $100,000 of interest to pay dissolution expenses and net of taxes payable), divided by the number of then outstanding public shares, which redemption will completely extinguish public shareholders’ rights as shareholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining shareholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under Cayman Islands law to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire worthless if we fail to complete our initial business combination by January 22, 2020.

Competition

In identifying, evaluating and selecting a target business for our initial business combination, we may encounter intense competition from other entities having a business objective similar to ours, including other blank check companies, private equity groups and leveraged buyout funds, public companies and operating businesses seeking strategic acquisitions. Many of these entities are well established and have extensive experience identifying and effecting business combinations directly or through affiliates. Moreover, many of these competitors possess greater financial, technical, human and other resources than us. Our ability to acquire larger target businesses will be limited by our available financial resources. This inherent limitation gives others an advantage in pursuing the acquisition of a target business. Furthermore, our obligation to pay cash in connection with our public shareholders who exercise their redemption rights may reduce the resources available to us for our initial business combination and our outstanding warrants, and the future dilution they potentially represent, may not be viewed favorably by certain target businesses. Either of these factors may place us at a competitive disadvantage in successfully negotiating an initial business combination.

Employees

We currently have three executive officers and no other employees. These individuals are not obligated to devote any specific number of hours to our matters but they intend to devote as much of their time as they deem necessary to our affairs until we have completed our initial business combination. The amount of time they will devote in any time period will vary based on whether a target business has been selected for our initial business combination and the stage of the business combination process we are in.

5

Available Information

We are required to file Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q with the SEC on a regular basis, and are required to disclose certain material events (e.g., changes in corporate control, acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business and bankruptcy) in a Current Report on Form 8-K. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The SEC’s Internet website is located at http://www.sec.gov.

An investment in our securities involves a high degree of risk. You should consider carefully all of the risks described below, together with the other information contained in this Annual Report, the prospectus associated with our initial public offering andreliance on third-party suppliers to provide both the registration statement of which such prospectus forms a part, before making a decision to investcomponents used in our securities. If anyprotective packaging systems as well as certain fully assembled protective packaging systems.

operations.

We are a recently formed company incorporated under the laws of the Cayman Islands with no operating results, and we will not commence operations until completing a business combination. Because we lack an operating history and have no operating results, you have no basis upon which to evaluate our ability to achieve our business objective of completing our initial business combination with one or more target businesses. We have no current arrangements or understandings with any prospective target business concerning a business combination and may be unable to complete our initial business combination. costs.

Our public shareholders may not be afforded an opportunity to vote on our proposed initial business combination, which means we may complete our initial business combination even though a majority of our public shareholders do not support such a combination.

We may choose not to hold a shareholder vote before we complete our initial business combination if the business combination would not require shareholder approval under applicable law or stock exchange listing requirement. Accordingly, we may complete our initial business combination even if holders of a majority of our ordinary shares do not approve of the business combination we complete.

If we seek shareholder approval of our initial business combination, our initial shareholders (other than the BSOF Entities with respect to any of their public shares, if any) have agreed to vote in favor of such initial business combination, regardless of how our public shareholders vote.

Our initial shareholders have agreed to vote their founder shares, as well as any public chaser purchased during or after the initial public offering, in favor of our initial business combination. We expect that our initial shareholders will own approximately 26% of our outstanding ordinary shares at the time of any such shareholder vote. Accordingly, if we seek shareholder approval of our business combination, it is more likely that the necessary shareholder approval will be received than would be the case if such persons agreed to vote their founder shares in accordance with the majority of the votes cast by our public shareholders.

Your only opportunity to affect the investment decision regarding a potential business combination may be limited to the exercise of your right to redeem your shares from us for cash, unless we seek shareholder approval of the initial business combination.

You will not be provided with an opportunity to evaluate the specific merits or risks of one or more target businesses. Since our board of directors may complete a business combination without seeking shareholder approval, public shareholders may not have the right or opportunity to vote on the business combination, unless we seek such shareholder vote. Accordingly, if we do not seek shareholder approval, your only opportunity to affect the investment decision regarding a potential business combination may be limited to exercising your redemption rights within the period of time (which will be at least 20 business days) set forth in our tender offer documents mailed to our public shareholders in which we describe our initial business combination.

In evaluating a prospective target business for our initial business combination, our management will rely on the availability of all of the funds from the sale of the forward purchase shares to be used as part of the consideration to the sellers in the initial business combination. If the sale of some or all of the forward purchase shares fails to close, we may lack sufficient funds to consummate our initial business combination.

We have entered into forward purchase agreements pursuant to which the anchor investors have agreed to purchase an aggregate of 15,000,000 forward purchase shares plus 5,000,000 redeemable warrants for a purchase price of $10.00 per forward purchase share, or $150,000,000 in the aggregate, in a private placement to close concurrently with our initial business combination. The funds from the sale of forward purchase shares may be used as part of the consideration to the sellers in our initial business combination, expenses in connection with our initial business combination or for working capital in the post-transaction company. The obligations under the forward purchase agreements do not depend on whether any public shareholders elect to redeem their sharestrademarks, patents and provide us with a minimum funding level for the initial business combination. However, if the sale of the forward purchase shares does not close for any reason, including by reason of the failure by some or all of the anchor investors to fund the purchase price for their forward purchase shares, for example, we may lack sufficient funds to consummate our initial business combination. Further, the forward purchase agreements provide that prior to signing a definitive agreement with respect to a potential initial business combination, and prior to making any material amendment to such definitive agreement following signing, anchor investors representing over 50% of the forward purchase shares must approve such potential initial business combination or amendment, as applicable. If we fail to obtain such approval,other intellectual property, we may not be able to consummateprevent competitors from developing similar products or from marketing their products in a manner that capitalizes on our initialtrademarks, and this loss of a competitive advantage may have a material adverse effect on our business, combination. Additionally,financial position or results of operations.

12

Risks Related to Our Business

We may be unable to secure a sufficient supply of paper to meet our production requirements given the limited number of suppliers that produce paper suitable for our products.

A limited number of paper mills produce paper that is suitable for use in our products in the markets in which we operate, and if they fail, experience interruptions in service, or are otherwise unable or unwilling to fill our purchase orders, we may not be able to produce enough of our paper consumables to meet our own production requirements. In addition, there are several grades or types of paper that we use in our products that we obtain from a single source due to the specificity of our requirements and limitations in the available paper products in a given market. For example, in 2022, we purchased approximately 43.7% and 21.7% of our raw paper requirements in North America and globally, respectively, from a single supplier, WestRock Company (“WestRock”). Increasing consolidation among our suppliers or the paper supply market more broadly may increase our reliance on existing suppliers or impact our ability to obtain alternative suppliers, if necessary. If WestRock or one of our other major suppliers of paper in any of the markets in which we operate, fails or experiences an interruption or delay in service, there may be short-term or long-term disruption in our ability to secure paper from qualified sources and we may not have enough inventory to maintain our production schedule or continue to provide paper consumables to our distributors and end-users on a timely basis, or at all. For example, at most of our facilities, quantities of raw paper stored on-site represent approximately one to three weeks of paper consumables production at such facilities due to cost savings and storage limitations. Any such failure, interruption or delay may result in on-site paper storage at our paper consumable production facilities being depleted and, as a result, a reduction in the volume of production and sales of our paper consumables, which may have a material adverse effect on our business, results of operations and financial condition.

Additionally, in 2021, we purchased approximately 18.5% of our raw paper requirements in Europe (which approximated 11.4% of global supply) from a supplier in Russia. However, in response to Russia’s invasion of Ukraine, we eliminated our paper sourcing from Russian suppliers and reallocated our purchases to other mills across the globe in the third quarter of 2022. Nevertheless, the continuation or expansion of this conflict could constrain our ability to obtain the paper we use in our products, which, in turn, could have a material adverse effect on our business, results of operations and financial condition.

Adverse changes in input costs, such as kraft paper or energy pricing, may negatively impact our results of operations, including our profit margins, and financial condition.