FORM 10-K

☒ þANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

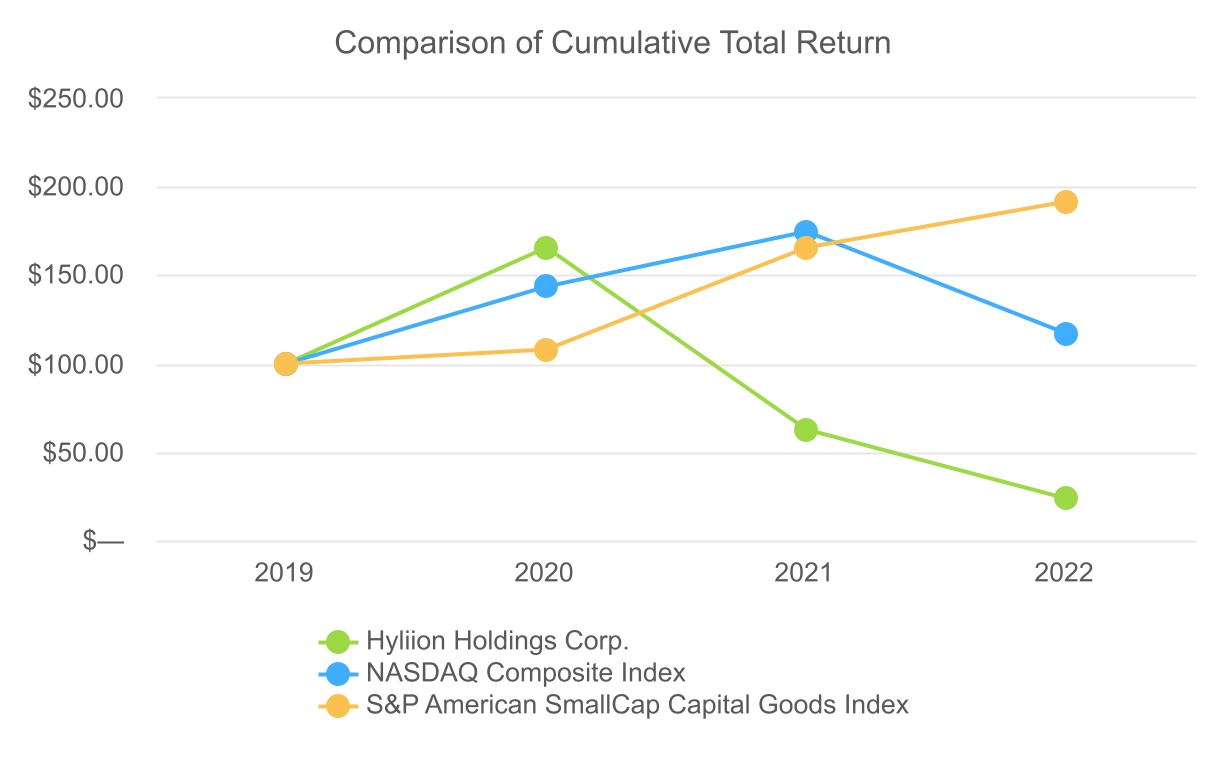

_______________ Trading Symbol(s) None Additionally, the risks and uncertainties described are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business. expect. The ability of our operating results. In addition, if integrated software. If our objectives. Some errors, bugs or vulnerabilities inherently may be difficult to detect and may only be discovered after the code has been released for external or internal use. If whom are single-source suppliers, for the provision and development of many of the key components and materials used in our electrified powertrain solutions, such as natural gas generators. Any failure of these suppliers or outsourcing partners to perform could require us to seek alternative suppliers or to expand our production capabilities, which could incur additional costs and have a negative impact on our cost or supply of components or finished goods. While we plan to obtain components from multiple sources whenever possible, some of the components used in our vehicles will be purchased by us from a single source. Our stockholders. other financial institutions. the foreseeable future. the NASDAQ Composite Index and the S&P American SmallCap Capital Goods Index assumes an investment of $100 on January 1, 2020 and reinvestment of dividends. expenses increased $6.7 million primarily due to: Note 15 of the notes to the consolidated financial statements for further information of our obligations. We expect to recognize these costs over a period up to two years from the sale of each Hybrid powertrain system. probability of technical success, revenue growth, future revenues and expenses and discount rate. position or results of operations under adoption. financial statements Sponsoring Organizations of the Treadway Commission (“COSO”), and our report dated February 28, 2023 expressed an unqualified opinion. opinion Our GRANT THORNTON LLP thousands, except share data) per share data) thousands, except share data) Description of Organization and Business Combination. and Uncertainty of the Coronavirus Pandemic Hybrid system represent a single performance obligation. We do not offer any sales returns. Amounts billed to customers related to shipping and handling are classified as revenue, and we have elected to recognize the cost for freight and shipping when control has transferred to the customer as a cost of revenue. Our policy is to a customer, judgment is required to determine if we are the principal or agent in the arrangement. We consider factors such as, but not limited to, which entity has the primary responsibility for fulfilling the promise to provide the specified good or service, which entity has inventory risk before the specified good or service has been transferred to a customer and which entity has discretion in establishing the price for the specified good or service. We have determined that we are the principal in transactions involving the resale of Class 8 semi-trucks outfitted with the Hybrid system. returns. closing date and $1.2 million in direct transaction costs. $3.6 million was recorded as property and equipment with expected useful lives of primarily five years and $28.8 million was recorded as research and development expense. All assets were valued using level 3 inputs, with property and equipment valued using a market approach and IPR&D valued using an income approach based on Company management’s projections. The on a cashless basis. On the Closing Date, there were 11,650,458 Public Warrants issued and outstanding. operations. Name and Address of Beneficial Owner(1) President and Chief Executive Officer /s/ /s/ , 2019OR☐ 2022

Tortoise Acquisition Corp.(Exact Name of Registrant as Specified in its Charter)Delaware83-2538002 Delaware83-2538002(State or Other Jurisdictionother jurisdiction ofIncorporation

incorporation or Organization)organization)(I.R.S. Employer