UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.WASHINGTON, DC 20549

FORM 10-K

(Mark One)

þxANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31 2019, 2023

☐or

¨TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition periodTransition Period from __________ to

__________

Registration No. 33-234282Commission File Number: 001-39136

GREENVISION ACQUISITION CORPORATIONmicromobility.com, Inc.

(Exact Namename of Registrant as Specifiedregistrant specified in Its Charter)

its charter)

| Delaware | 84-3015108 | |

| (State or | (I.R.S. Employer Identification No.) |

One Penn Plaza, 36th Floor, 500 Broome Street, New York, NY 1001910013

(Address of principal executive offices) (Zip Code)

Principal Executive Offices)

Issuer’sRegistrant’s telephone number, including area code (212) 786-7429code: (917)675-7157

Securities registered pursuantRegistered Pursuant to Section 12(b) of the Exchange ActAct:

| Title of Each Class | Trading Symbol(s) | Name of | ||

Securities registered pursuantRegistered Pursuant to Section 12(g) of the Securities Exchange Act: NONE None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ ¨Noþx

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d)Section 15(d) of the Securities Exchange Act. Yes ☐ ¨ Noþx

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐x No þ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐x No þ

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (ss.229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitionsdefinition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | ||||

| Non-accelerated filer | x | Smaller reporting company | x | ||||

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ¨Nox

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ ¨Noþx

As of December 31, 2019, the

The aggregate market value of the shares of common stock of the registrantvoting securities held by non-affiliates of the registrant was $56,522,500 (based upon a per share closing priceas of $9.83).

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of eachlast business day of the registrant’s classesmost recently completed second fiscal quarter, June 30, 2023, was approximately $5.5 million based upon the closing sale price of $16.95.

As of April 9, 2024, there were shares of the registrant’s common stock, $0.00001 par value, outstanding.

TABLE OF CONTENTS

Explanatory Note

All per share amounts in this annual report (except where otherwise indicated) account for (i) a 1:50 reverse stock split of our common stock that occurred on March 30, 2023 and (ii) a 1:150 reverse stock split of our common stock that occurred on December 4, 2023.

On August 12, 2023, the Company’s issued and outstanding shares of Class B common stock were automatically converted into shares of Class A common stock and such Class B Shares thereafter ceased to be an authorized class of the Company’s capital stock. As there is currently only one class of common stock, as of the latest practicable date: On March 23, 2020 there were 7,187,500 shares outstanding ofall references in this annual report to common stock ofare to Class A common Stock unless the registrant.context requires otherwise.

DOCUMENTS INCORPORATED BY REFERENCEForward-Looking Statements

List hereunder the followingStatements contained in this annual report and any documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated:.

None

TABLE OF CONTENTS

i

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statementsherein that are not strictly historical may be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, or the “Securities Act,” and Section 21E of the Securities Exchange Act and involve a number of 1934,risks and uncertainties. There are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward-looking statements, many of which are outside of the Exchange Act. Thecontrol of the Company, and you should not place undue reliance on any such forward-looking statements. Forward-looking statements contained in this reportmay be identified by the use of words such as "anticipate," "believe," "expect," "estimate," "plan," "outlook," and "project" and other similar expressions that predict or indicate future events or trends or that are not purelystatements of historical are forward-looking statements. Ourmatters. These forward-looking statements include, butreflect the current analysis of existing information and are not limitedsubject to statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would”various risks and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this Form 10-K may include, for example, statements about our:uncertainties.

The forward-looking statements contained in this Form 10-K are based on our current expectationsmade herein speak only as of the date hereof and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or shouldthe Company does not assume any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements,statement, whether as a result of new information, future events and developments or otherwise, except as may be required under applicable securities laws.by law.

| i |

PART I

ii

General

GENERALWe provide innovative and sustainable transportation solutions that help people move seamlessly within cities. Our journey began with e-scooters in Italy in 2018, and today we have evolved into a multi-modal micro-mobility ecosystem offering micro-mobility electric vehicles.

Company Profile

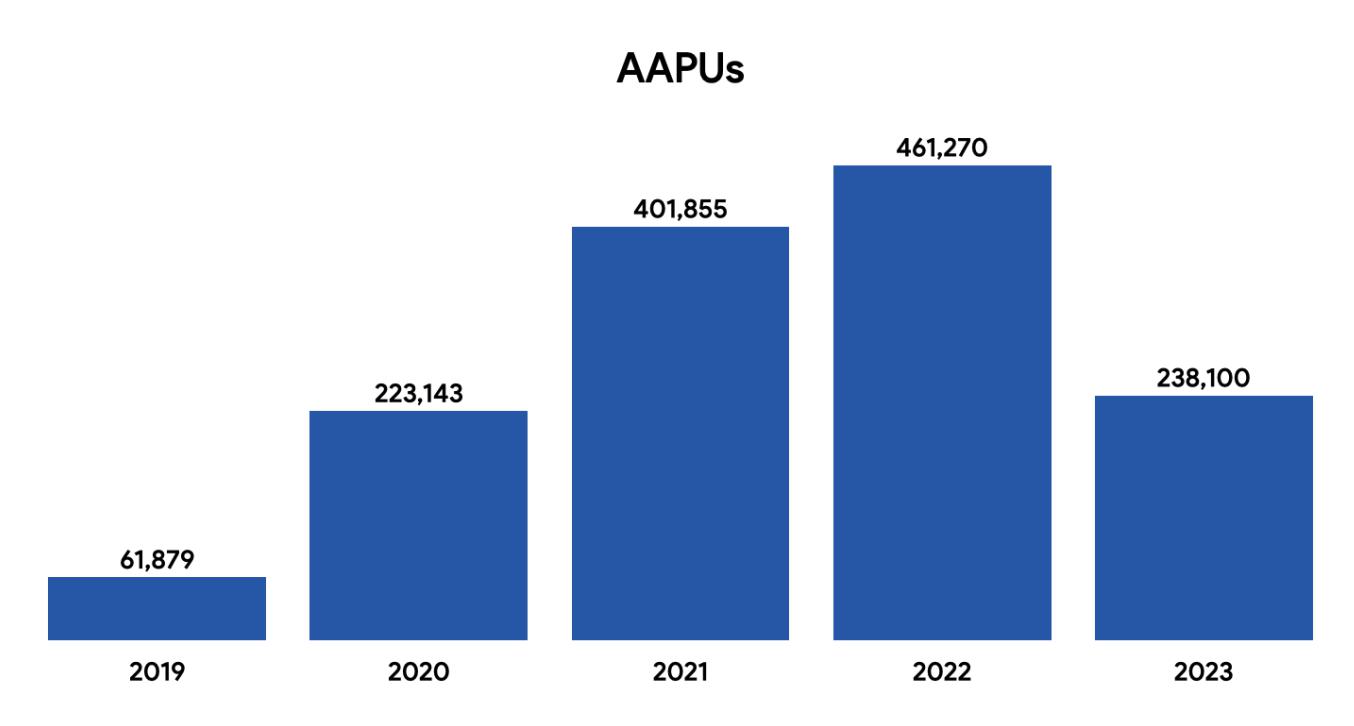

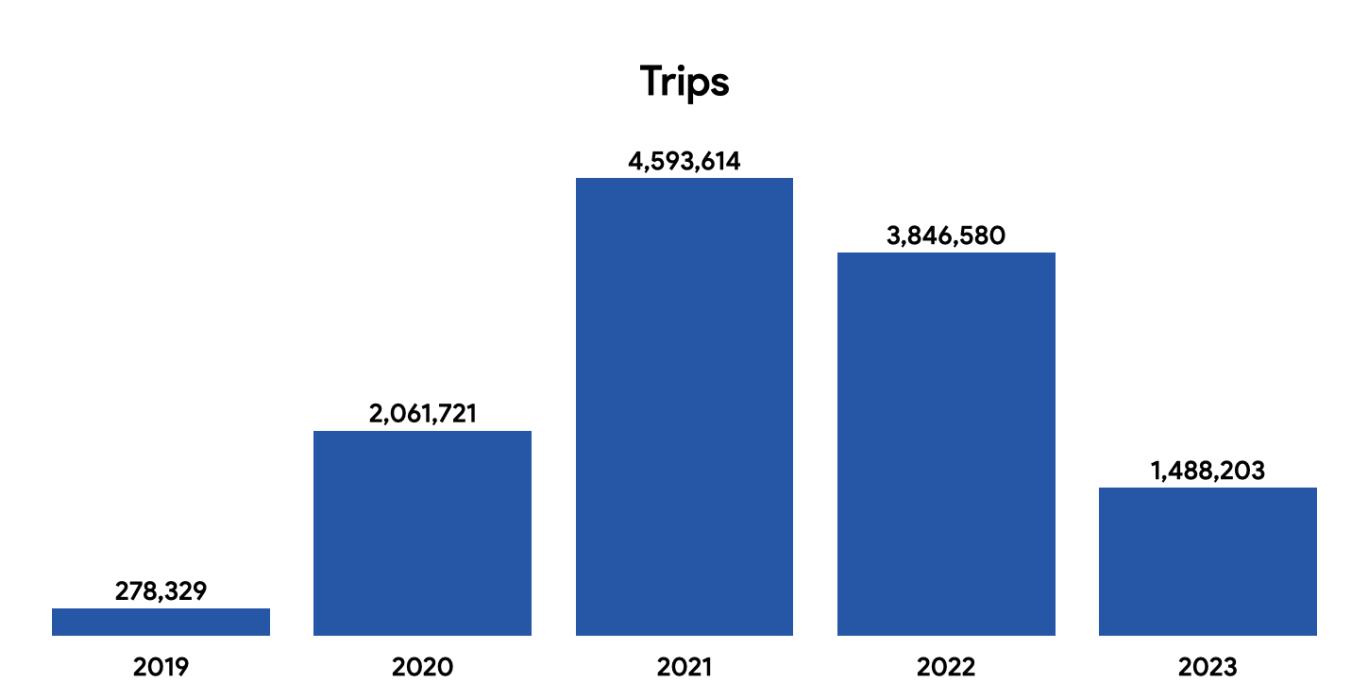

GreenVision Acquisition Corp isWe primarily offer short-term rentals of shares e-vehicles in several cities and service areas (such as university campuses), in the United States and Italy. Since the start of our 2023 fiscal year, we have had to significantly reduce the number of cities and service areas in which we operate and the size of our fleets of vehicles in those cities in response to the cost of our operations, our ability to attract a recently formed blank check company formed undernecessary number of new customers, the lawsfailure of the Statemicromobility in general to meet expected growth projections and general financial market conditions. We may need to further reduce our shared micromobility operations to meet our continued budget constraints.

Our micromobility offerings also include a Wheels vehicle, a sit-down e-scooter, rentable on a monthly basis. We also generate a minor portion of Delaware on September 11, 2019. our revenue by selling advertising opportunities related to our offerings.

We were formedalso operated Helbiz Kitchen, our service through which users can order food for delivery through our mobile app, and Helbiz Media, our wholly-owned subsidiary dedicated to the purposeacquisition and distribution of engaging in a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination, with one or more target businesses or entities. Our efforts to identify a prospective target business will not be limited to a particular industry or geographic region, although we intendcontent over an internally developed stand-alone app. In an effort to focus our searchoperations on target businessesour micromobility services and to reduce our operating in North America, Europecosts, we discontinued our Helbiz Kitchen operations and Asia (excluding China) in the life sciences and healthcare industries. In connection with our listing application with the Nasdaq Stock Market, we agreed that we would not undertake our initial business combination with any entity with its principal businesssignificantly reduced Helbiz Media operations in China.our fiscal 2023.

Our Platform

On November 21, 2019,Helbiz is built around its technology and operational strengths.

Technology

Seamlessly Integrated Ecosystem

We have built an ecosystem of tools, software and hardware for consumers, operations, and drivers. Instead of relying on a variety of limited third-party solutions, every tool we consummateduse is crafted in-house in conjunction with each other to create an ecosystem that was specifically built around our initial public offering (“IPO”)operations, practices and needs. The result is a framework with total operational control. Our main mobile platforms are our Helbiz app for consumers and our Helbiz Driver App for operational drivers managing our fleet. Both platforms are built on our proprietary “Core Platform Engine”.

Operational Strength

A driver network and infrastructure were built to ensure that vehicles are properly distributed, batteries charged and maintained. Every city we operate in has a local on-ground operations team, drivers with extensive local knowledge and a global support system. The long-term success, of 5,750,000 units (the “Units”), inclusiveany micro-mobility operator is directly linked to the quality and efficiency of operations.

Benefits of the over-allotment option of 750,000 Units. Each unit consisted of one share of common stock, par value $0.00001, one redeemable warrant,Our Mobility Platform

Key Benefits for Users

Across our mobile platforms and one rightconsumer offerings we strive to receive one-tenth (1/10) ofcreate an experience that becomes a share of common stock upon consummation of a business combination. The units were sold at an offering price of $10.00 per unit, generating gross proceeds of $57,500,000. Simultaneously with the closingseamless extension of the IPO, the Company consummateduser, intuitively creating a private placement (“Private Placement”)convenient, affordable, and reliable experience when interacting with its sponsor, GreenVision Capital Holdings LLC. (“Sponsor”) for the purchase of 2,100,000 warrants (the “Private Warrants”) attheir city. We aim to offer our user a price of $1.00 per Private Warrant, generating total proceeds of $2,100,000, pursuantconvenient, affordable and reliable experience.

• Convenience

We designed our proprietary technology to the Sponsor Subscription Agreement dated September 19, 2019. In addition, the Company sold to I-Bankers Securities Inc., for $100, a share purchase warrant to purchase up to 287,500 shares exercisable at $12.00 per share, commencing on the later of the consummation of the Company’s initial business combination and 360 days from the effective date of the Registration Statement, pursuant to the Share Purchase Warrant dated November 21, 2019.

As of November 21, 2019, a total of $57,500,000 of the net proceeds from the IPO and the Private Placement were deposited in a trust account established for the benefit of the Company’s public shareholders.

Since our IPO, our sole business activity has been identifying and evaluating suitable acquisition transaction candidates and engaging in non-binding discussions with potential target entities. To date we have not entered into any binding agreement with any target entity. We presently have no revenue and have had losses since inception from incurring formation and operating costs since completion of our IPO.

Management Business Combination Experience

Our management team is led by Zhigeng (David) Fu, Qi (Karl) Ye, He (Herbert) Yu, and Jonathan Intrater; each has distinctive and complementary backgrounds and extensive networks in the life science and healthcare industries, as well as other various industries in China, and other regions of Asia, Europe and North America which we believe can provide a rich selectionconvenient and frictionless user experience and well distributed, maintained and charged fleets across a variety of potential targets.modes to suit the users’ needs. We intendstrive to focus on targeting middle market entitiesreduce the friction of moving and to always ensure available vehicles in your vicinity that allow you to beat traffic with a valuation range inease without the $100 millionhassle of having to $300 million range.deal with congestion, parking, ownership or cash transactions.

• Affordability

We believe everyone has the right to move freely on their own terms, and have the ability to optimize across cost, time and comfort. Our dockless e-vehicles enable customers to move and connect with their city at a low cost. For commuters and frequent riders, we have an unlimited subscription plan, allowing users to take up to 50, 30-minute trips for a fixed monthly price.

• Reliability

Our mission is to be reliable enough to the point where our customers do not need to rely on cars or other modes of transportation or to plan ahead of time. We strive to properly serve cities and maintain e-vehicle density to meet the demand in all areas so that users always have access to a charged vehicle when they need one. We aim to continue to improve our management teamquality, service, offerings and hardware, while accurately optimizing our operating structure.

| 1 |

Our Offerings and Products

We offer our users the opportunity to take advantage of several modes of micromobility options.

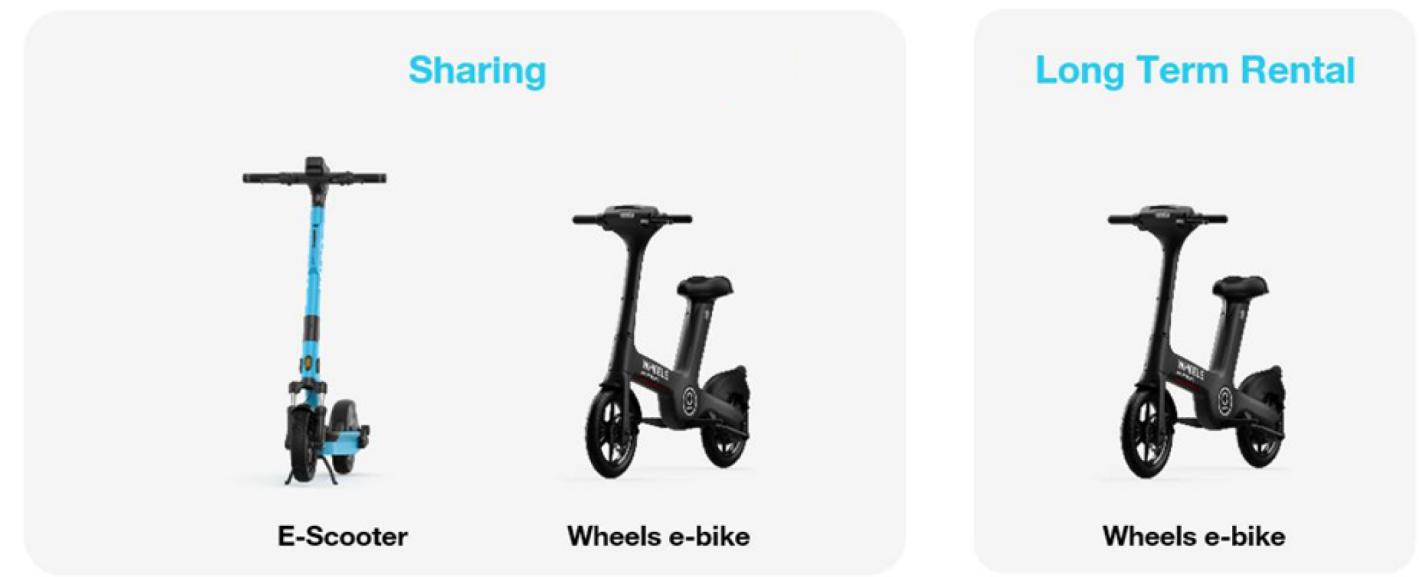

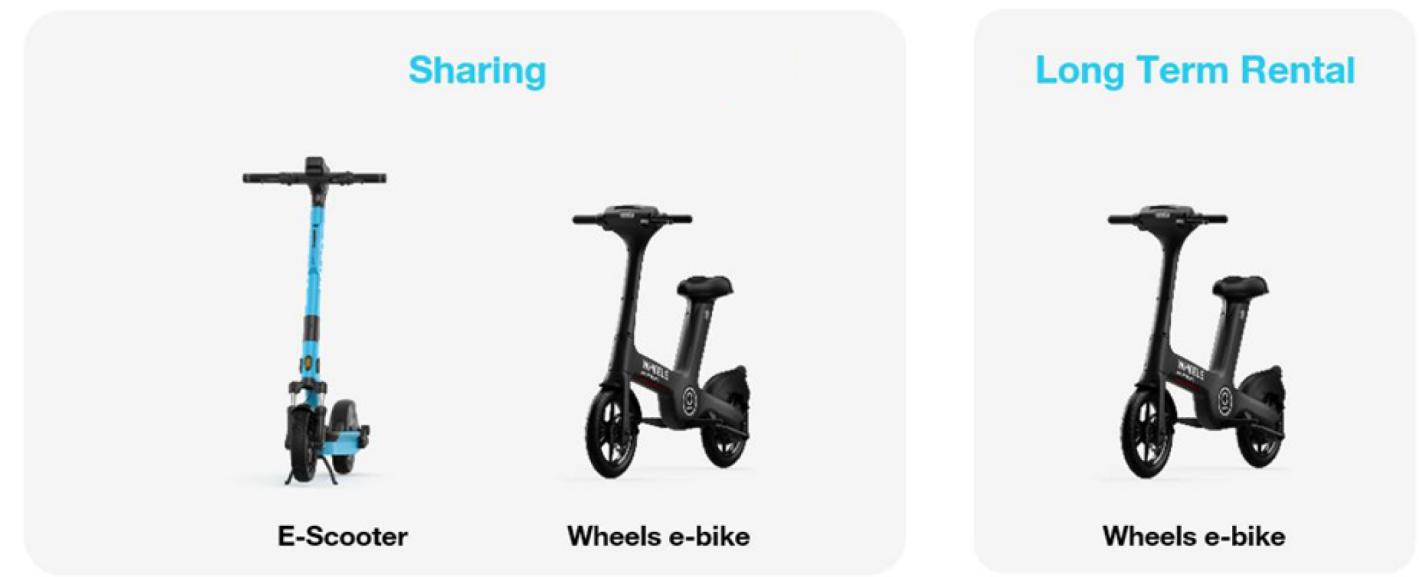

• E-Scooter and Wheels e-Bikes

We have established a network of shared owned e-scooters and Wheels e-bikes in a number of cities serving the needs of a diverse demographic looking for affordable, efficient, green and more active alternatives for short trips.

• Wheels Long-Term Rental/Sales

Wheels offers a long-term rental option allowing riders to rent their own sit-down scooter for personal use.

The Rider Experience

Our mission is well positioned to identify attractive business combination opportunities with compelling growth records and further potential. Membersprovide sustainable mobility solutions that solve the transportation needs of our management team haveriders and enable them to reach their destinations quickly, conveniently and affordably. This mission all starts with the Helbiz app, the core part of the our experience which connect our users with our vast network of vehicles and platforms.

The Helbiz app provides users the ability to get around and connect with their city through a variety of transportation modes. The Helbiz app is designed to be fast, intuitive, and frictionless enabling users to rent and ride with ease. Our typical rental process can be summarized in the four steps in the following graphics:

Additional app functionality includes the ability to book and reserve vehicles, briefly pause and lock a vehicle in ride, an extensive experiencehelp toolkit and spoken, written and in-app support 24 hours per day in executing business combinations, as theysix languages. We are long-term professionals as legal counseldedicated to buyerscontinuing to improve our platform and sellers in mergers and acquisitions, private equity investors or buy and sell side investment bankers. David Fu, our Chief Executive Officer, is an Of Counsel of Global Law Office, Shanghai, China. Mr. Fu has more than 25 years legal experience in foreign direct investment, mergers and acquisitions, private equity investment and restructuring of foreign-invested enterprises in China as well as outbound acquisitions and overseas securities offerings and listings by Chinese companies. Qi (Karl) Ye is a veteran investment manager in Shanghai, China. He has more than 13 years of broadfeatures to continue to offer the best experience in the financial industry, specializing in capital markets, mutual fund investment, private equityindustry.

| 2 |

Subscription Plans

In addition to our pay-as-you-ride per minute ride structure, we also offer a subscription plan for riders on a monthly basis. We see our subscription plan as an important step toward providing a convenient transportation alternative that address our riders’ preferences and venture capital investment,budgets to make micro-mobility through us their commute of choice. Our subscription plan is purchased upfront and has managed over $5 billion in assets under management. Professor Herbert Yu, oneguarantees access to a set amount of time, and all subscriptions can be cancelled at any time.

Types of subscriptions include:

• Wheels Long-Term Rental

Wheels offers a long-term rental option allowing riders to rent their own sit-down scooter for personal use. The subscription can be canceled any time after return of the members of our Board of Directors has been director of The Cancer Epidemiology Program University of Hawaii Cancer Center since March 5, 2012. Professor He served as an Assistant Professor, Associate Professor and Full Professor at the School of Medicine at Yale University and has over 20 years involvement in leading edge cancer research including the areas of carcinogenic factors and molecular epidemiology. Mr. Intrater, another member of our Board, is a Managing Director in the investment banking department at United States’ based Ladenburg, Thalmann & Co., Inc. and has extensive experience in merger advisory transactions.vehicle.

• Helbiz Plus

Our management team continues to actively source target candidates where they believe will be attractive candidatesTake 50 trips with each trip of maximum 30 minutes on our e-scooters and e-bikes on a monthly basis for acquisition, utilizing their deal-making track record, professional relationships, and capital markets expertise to enhance the growth potential and value of a target business and provide opportunities for an attractive return to our stockholders.

BUSINESS STRATEGYfixed price.

The Advertisement Experience

Our business strategy isusers are always on the move and interacting with their local communities. Advertisers have the opportunity to identifyput relevant content in front of them at every stage of this journey. Unlike other ad platforms, we interact directly with consumers and completetheir environment while they are on-the-go. We have understood this unique opportunity since our business combination withearly days, but only begun to fully translate it into a company that meets one or more criteria ofvalue adding ad product suite in late 2020 as our reach and potential significantly increased.

While we are actively working on expanding our offering and tools it currently includes:

| • |

| • |

| • |

| • | Vehicle co-branding: which custom wraps our vehicles for a |

Field Operations Excellence

Along with vehicle quality and the user app experience, we aim to differentiate our shared mobility service through field operations. In each city in which we operate, our operation team is tasked with ensuring that our vehicles are properly distributed, charged, maintained and always ready to rent. Some of the operations teams are inhouse while others are outsourced.

Sales & Marketing

We are marketing our offering to users through brand advertising, direct marketing and fostering rapid adoption through on-street presence and strategic partnerships. We use a variety of broad campaigns from television ads to strategic joint partnerships with strong local brands to promote our platform and extend our service to existing loyal user bases. Our direct marketing is made up of promotions, referrals and time-based incentives where we attract consumers through a tailored combination, depending in the city, of sponsored search, targeted social media, push & text notifications and email campaigns.

Other business lines

Helbiz Media

We formed Helbiz Media, our wholly-owned subsidiary dedicated to the acquisition and distribution of content over Helbiz Live, a new internally developed app that is separate from our micro-mobility app. Helbiz Live was included in our monthly subscription: Helbiz Plus (formerly know as Helbiz Unlimited), our offering of unlimited monthly e-bike and e-scooter use for a fixed fee, and we may make it available through other subscription models. Helbiz Media was charged with acquiring the rights to stream media content on Helbiz Live, with a focus on acquiring the rights to broadcast sporting events. The first content that Helbiz Media has acquired, for the Italian territory, were approximately 390 regular season games in the Italian Serie B soccer league. League Serie B took care of the TV productions of all matches and provided the feeds to Helbiz Media. Helbiz Live expanded its content offering (i) in October 2021 by acquiring the rights to broadcast on its app in Italy two live soccer matches per day during the German Cup (DFB-Pokal) and highlights of each round of the German Cup as well as weekly highlights of NFL football games and other NFL branded content (ii) in November 2021 by partnering with ESPN to broadcast on its App in Italy (a) two NCAA college football games and two NCAA men’s college basketball games per week, (b) 10 NCAA football bowl games, including the semifinals and finals and (c) 20 NCAA men’s basketball tournament games, including the semi-finals and the finals and (iii) in March 2022 by acquiring the rights to stream live and on demand up to four Major League Baseball games weekly, in addition to all playoff games, for three seasons.

In June 2023, the Company received communications from LNPB, the main live content provider, notifying that it was terminating early the agreements related to the commercialization and broadcast of the LNPB content. The communications also requested the immediate payment of the invoices overdue amounting to $11,394. In February 2024, the Company entered into a Settlement agreement with LNPB. In detail, the main amended term was the full satisfaction of the Company’s obligations under the original agreements in exchange of a payment of $5,392, divided in three payments on or prior November 30, 2024, half of the amount has been paid in March 2024. As a result of the early termination of LNPB agreements, Helbiz Media significantly reduced its operations. Helbiz Media represented approximately 41.9% of our revenue in our 2022 fiscal year and 40.4% of our revenue in our 2023 fiscal year.

Helbiz Kitchen

Helbiz Kitchen, was a delivery-only “ghost kitchen” restaurant concept that specializes in preparing healthy-inspired, high-quality, fresh, made-to-order meals. Users were able to order meals on our mobile App for delivery to their home, office or other desired location, and we would prepare and deliver such meals using our e-vehicles.

We launched Helbiz Kitchen in June 2021 with a pilot ghost kitchen in Milan, Italy. Our approximately 21,500 square foot facility in Milan offered six menus of dishes (pizza, hamburgers, poke, salads, sushi and ice cream) for 12 hours a day, seven days a week. We discontinued the Helbiz Kitchen operations in our fiscal 2023. We did not consider revenue from Helbiz Kitch to be material in either our fiscal 2022 or fiscal 2023.

Competition

We provide transportation services, particularly those in the urban micro-mobility category (generally, intra-city trips that less than five miles). As a result, we compete with other modes and providers of transport. For our e-scooter and e-bike sharing services, this includes busses, subways, bicycles, cars, trains, motorcycles, scooters and walking, among other short-distance transportation modes.

Our services compete directly with many transportation-as-a-service (“TaaS”) companies. The market for TaaS networks is intensely competitive and characterized by rapid changes in technology, shifting rider needs and frequent introductions of new service and offerings. We expect competition to continue, both from current competitors, who may be well-established and enjoy greater resources or other strategic advantages, as well as new entrants into the market, some of which may become significant competitors in the future. Our main competitors in the micro-mobility sharing market vary by market but include Lime and Lyft. We also compete with car sharing services such as Uber and Lyft, certain non-ridesharing TaaS network companies, public transportation, taxicab, and livery companies as well as traditional automotive manufacturers, such as BMW, which have entered the TaaS market, among others.

Our selection process will leverage

| 4 |

We believe the essential competitive factors in our management team’s broadmarket include the following:

• coverage and deep relationship network, industry experiencesavailability of access;

• scale of network;

• product design;

• ease of adoption and deal sourcing capabilitiesuse;

• partnerships and integrations;

• branding;

• safety;

• innovation;

• regulatory relations; and

• prices.

Many of our competitors and potential competitors are larger and have greater brand name recognition, longer operating histories, larger marketing budgets, established marketing relationships, access to access a broad spectrumlarger customer bases and significantly greater resources for the development of differentiated opportunities. Our management teamtheir offerings. For additional information about the risks to our business related to competition, see our Risk Factors.

Strategy

We have suspended our strategies previously disclosed in in our prior annual report. Those strategies centered on growth. Given our current financial condition and the difficulty of raising capital, our current strategy is to focus our operations on our micromobility offerings in the cities and service areas in which we operate that have the most potential for profitable operations and to continue rentals of our Wheels vehicle. We are considering several options to achieve this strategy including, among others, selling the rights that we have to provide micromobility services in certain cities or regions in which we operate (or selling the subsidiaries offering those services), ceasing to offer micromobility services in certain cities or regions in which we operate and/or reducing the scope of offerings in certain cities or regions in which we operate.

Seasonality

Each city and region where we operate or intend to operate has a distinctive combination of capabilities including:

Our founders have,unique seasonality, events and will continue to communicate with their networks of relationships to articulate the parametersweather that can increase or decrease rider demand for our searchplatform. We expect to experience different levels of seasonality in each market in which we operate, typically correlated to changes in the number of local residents and visitors. Ride volume can also be impacted by general trends in business or travel and tourism. Certain holidays can have an impact on ride volume on the holiday itself or during the preceding and subsequent weekends. In addition, rain, snow and cold weather tend to increase the demand for a target companycar-based transportation but reduce the demand for e-scooter and a potential business combinatione-bike rentals.

Intellectual Property

We generally rely on trademark, copyright and begintrade secret laws and employee and third-party non-disclosure agreements to protect our intellectual property and proprietary rights. We are currently in the process of pursuing trademark protection for our name and reviewing potential opportunities. Our management teamlogos in the United States. Although we believe that our pending trademark applications will be granted by the United States Patent and Trademark Office, such trademarks might not be granted, might be challenged, invalidated, or circumvented or might not provide competitive advantages to us.

We also utilizeplan to rely on patents to protect our intellectual property and proprietary technology, to the servicesextent feasible, and plan to consult with intellectual property counsel to determine what patents we may be able to file to protect our intellectual property. Wheels has already made strides in this area with a number of key innovations, such as our micro-controller technology that allows users to control all vehicle functions via Bluetooth, WiFi, and cellular networks. One of the unique features we have filed a patent for is a pedal-less bike body specifically designed for micro-mobility sharing use, which sets us apart from competitors and offers users a distinctive mode of transportation. Another important innovation is the electrical integration of helmets into the chassis of our investment banker, I-Bankers Securities, Inc.Wheels devices, promoting safety, as well as other advisors.the helmet can be unlocked and locked when the device is in use or not. To promote hygiene in our shared-use service, we have developed an anti-microbial film inside the helmets, enabling users to replace the film rather than reusing the previous customer's film. Furthermore, we hold patents on the use of gear motors to improve climb performance for hill climbs, providing a better experience for users in hilly terrain. As of the date of this annual report, we have filed a patent application in the United States for our smart parking technology (patent application number: 16/673,518). Although we believe that some of our technology may be patentable, such patents might not be granted, might be challenged, invalidated, or circumvented, or the rights granted thereunder or under licensing agreements might not provide competitive advantages to us. We believe that due to the rapid pace of technological innovation for technology, mobile, and internet products, our ability to establish and maintain a position of technological leadership in the ridesharing industry depends more on the skills of our development personnel than the legal protection afforded our existing technology.

| 5 |

Our objectivesuccess depends in part, upon our proprietary software technology and proprietary App. We have not yet protected our software through copyright or other regulatory measures. Our standard intellectual property confidentiality and assignment agreement with employees, consultants and others who participate in the development of our software might be breached, we might not have adequate remedies for any breach, or our trade secrets might not otherwise become known to or independently developed by competitors. Our efforts to protect our proprietary technology might not prevent others from developing and designing products or technology similar to or competitive with those of ours. Our success depends in part, on our continued ability to license and use third-party technology that is integral to generatethe functionality of our products and App. This includes functions such as our payment gateway that we use for handling credit card payments, subscriptions and wallet top-ups (which we license through Stripe), interfacing with vehicles from certain suppliers (such as our license with Segway), hosting our server infrastructure (provided by Amazon Web Services) and hosting our data for analytics (provided by Google Cloud). An inability to continue to procure or use such technology likely would have a material adverse effect on our business, operating results or financial condition.

Our intellectual property is secured to a syndicated loan and security agreement entered into in 2021 and amended in 2023.

Authorizations and licenses in force

We work closely with the cities where we operate to determine the local services we provide. This includes determining fleet size, deployment locations, hours of operation and pricing. After local operations begin, we revise these determinations using real-time data. We consider compliance with requirements around parking, deployment and redistribution, and rider education to be of the utmost importance. We operate in the following cities in the following countries.

Italy

We operates in Italy in the micro-mobility environment. As of April 9, 2024, we hold licenses in 7 cities in Italy for approximately 2,000 e-vehicles, though the number of vehicles that we offer in these cities is significantly less than that. As of April 9, 2024, we operate in 5 cities Parma, Modena, Pisa, San Benedetto and Turin.

United States

In 2019, we started our expansion to the United States. As of April 9, 2024, we hold 2 sharing licenses, in Tampa (Florida) and Santa Monica (California).

Insurance

Although we pride ourselves on our commitment to safety, the sheer volume of users increases the likelihood or serious injury or property damage as a result of the use of our vehicles. To mitigate our exposure to liability from any such injuries or damage, we provide general liability insurance in the cities where we operate to cover third-party bodily injury or property damage resulting from one of our vehicles. The insurance does not cover instances where the user is at fault, but rather damages arising from faulty vehicles or maintenance issues. Additionally, such general liability insurance is required in the U.S. and Italian cities in which we operate and seek to operate.

Insurance in the micro-mobility industry is unique as it is a limited marketplace. There are only a handful of carriers that will write insurance for it and even less for multi city operators. We have our insurance policies with Apollo Underwriting Ltd. covering the U.S. market and Societa’ Reale Mutua Assicurazione for the Italian market. These policies give us the ability to purchase coverage if and when we get permits for additional cities.

Suppliers

We subcontract the manufacturing, assembly and testing of our vehicles to third-party suppliers mainly located in Asia.

The typical supply chain timeline requires on average six-months from manufacturing the e-vehicles, delivery to deploying in the relevant markets. The process depends on the typical supply lines running via sea, train and air. A mix of local suppliers and suppliers based in Asia, are responsible for providing us spare parts for our e-vehicles.

Overall, we depend upon a limited number of third parties to perform these functions, some of which are only available from single sources with which we have flexible contracts in place. In particular, we rely on:

• Stripe for the processing of customer payments;

• Segway Group for the supply of our electric fleet, excluding Wheels; and

• I-Walk for the supply of Wheels electric fleet.

| 6 |

Stripe

Under the terms of our arrangement, the service fees for debit and credit card transactions are not calculated on a monthly transaction volume basis. Instead, Stripe provides a consistent billing mechanism that remains in effect as long as the account is open, without the need for expiration dates or custom agreements. This means that our partnership with Stripe continues indefinitely, ensuring a stable and predictable fee structure for all card payments processed through our account.

Segway

According to our agreement with Segway, we acquired approximately 7,000 e-scooters in 2020. Unlike traditional usage-based billing models, Segway implements a fixed fee structure for its technology licensing. This fixed fee applies to any vehicle that has an attractive return for stockholders through a merger with an industry leaderactive SIM card, irrespective of the months of activity or the extent of usage. Each active SIM card comes with a strong growth recordspecified amount of data included. Should the usage exceed the included data amount, additional consumption is billed on a pay-as-you-go basis. This pricing model simplifies financial planning for our fleet operations by eliminating variability in monthly fees based on usage, ensuring that costs are predictable and growth potential. We expectaligned with our operational needs. Furthermore, our partnership agreement with Segway is automatically renewed every year. This arrangement provides us with a continuous and uninterrupted access to favor opportunitiesSegway's licensed technology, facilitating long-term planning and stability for our e-scooter fleet operations.

Employees

As of March 31, 2024, we have 39 full-time employees, no part-time employees. None of our employees are subject to a collective bargaining agreement, and we believe that our relations with certain industry and business characteristics such as compelling long-term growth prospects, attractive competitive dynamics, consolidation opportunities, leading technological position and strong management. We will also consider additional factors such as high barriers to entry, significant streams of recurring revenue, high incremental margins and attractive free cash flow characteristics.our employees generally are good.

ACQUISITION CRITERIA

Consistent withThe following table sets out the number of our business strategy, we have identified the following general criteria and guidelines that we believe are important in evaluating prospective target businesses. We will use these criteria and guidelines in evaluating acquisition opportunities, but we may ultimately decide to enter into our initial business combination withemployees on a target business that does not meet these criteria and guidelines. We intend to seek to acquire one or more companies or businesses that we believe:full-time basis:

| Position | ||||

| Management and administration | 14 | |||

| Operations | 10 | |||

| Customer Support | 4 | |||

| Technology/Research & Development | 11 | |||

| Total | 39 | |||

Material Agreements

These criteria are not intended to be exhaustive. Any evaluation relating to the merits of a particular initial business combination may be based, to the extent relevant, on these general guidelines as well as other considerations, factors and criteria that our management may deem relevant. If we decide to enter into our business combination with a target business that does not meet all or some of the above criteria and guidelines, we will disclose that the target business does not meet the above criteria in our stockholder communications relatedIn addition to our initial business combination, which, as discussedcompensation agreements with management and other material agreements described elsewhere in this Form 10-K, would be inannual report, we have entered into the form of proxy solicitation materialsfollowing material agreements under which we still have obligations or tender offer documents thatrights:

Loan and Security Agreement

On March 23, 2021, we would file with the SECentered into a Loan and deliver to stockholders.

Past performance is not a guarantee (i) that we will be able to identify a suitable candidate for our initial business combination or (ii) of success with respect to any business combination we may consummate. Stockholders should not rely on the historical record of our management’s performance as indicative of our future performance.

OUR ACQUISITION PROCESS

In evaluating one or more prospective target business or businesses, we expect to conduct a thorough due diligence review that will encompass, among other things, meetings with incumbent managementSecurity Agreement (the “Loan and key employees, document reviews and inspection of facilities, as well as a review of financialSecurity Agreement”) and other information that will be made available to us.

We are not prohibited from pursuing an initial business combinationrelated agreements with a company that is affiliated with our sponsor, officers or directors. In the event we seek to complete our initial business combination with a company that is affiliated with our sponsor, officers or directors, we, or a committee of independent directors, will obtain an opinion from an independent investment banking firm which is a member of FINRA or an independent accounting firm that our initial business combination is fair to our company from a financial point of view. Our stockholders may not be provided with a copy of such opinion and they may not be able to rely upon such opinion.

Members of our management team and our independent directors own securities which will be worthless if we fail to complete a business combination and, accordingly, may have a conflict of interest in determining whether a particular target business is an appropriate business with which to effectuate our initial business combination. Further, each of our officers and directors may have a conflict of interest with respect to evaluating a particular business combination if the retention or resignation of any such officers and directors was included by a target business as a condition to any agreement with respect to our initial business combination.

Each of our officers and directors presently has, and any of them in the future may have additional, fiduciary or contractual obligations to another entity pursuant to which such officer or director is or will be required to present a business combination opportunity to such entity. Accordingly, if any of our officers or directors becomes aware of a business combination opportunity which is suitable for an entity to which he or she has then-current fiduciary or contractual obligations, he or she will honor his or her fiduciary or contractual obligations to present such business combination opportunity to such other entity, subject to their fiduciary duties under Delaware law. We do not believe, however, that the fiduciary duties or contractual obligations of our officers or directors will materially affect our ability to complete our initial business combination.

We are subject to the rules and regulations promulgated under the Exchange Act. We have no current intention of filing a Form 15 to suspend our reporting or other obligations under the Exchange Act prior or subsequent to the consummation of our initial business combination.

EFFECTING A BUSINESS COMBINATION

We will either (1) seek stockholder approval of our initial business combination at a meeting called for such purpose at which stockholders may seek to convert their shares, regardless of whether they vote for or against the proposed business combination, into their pro rata share of the aggregate amount then on deposit in the trust account (net of taxes payable), or (2) provide our stockholders with the opportunity to sell their shares to us by means of a tender offer (and thereby avoid the need for a stockholder vote) for an amount equal to their pro rata share of the aggregate amount then on deposit in the trust account (net of taxes payable), in each case subject to the limitations described herein. The decision as to whether we will seek stockholder approval of our proposed business combination or allow stockholders to sell their shares to us in a tender offer will be made by us, solely in our discretion, and will be based on a variety of factors such as the timing of the transaction and whetherfour institutional lenders. Under the terms of the transaction would otherwise requireLoan and Security Agreement, the aggregate principal amount of the loan was $15 million dollars and we received net proceeds of $11.9 million thereunder. We are required to pay back such loan and any accrued and unpaid interest thereon on December 1, 2023.

The loan carries interest at 9.2% per annum, which increases in the event of a default under the loan to 13.2%. The interest of the loan is due monthly, but no payments need be made directly by us during the first year as twelve months of interest payments were held in reserve and the first interest payments are paid from that reserve until it is reduced to seek stockholder approval.zero. At closing, we were required to pay in advance an intellectual property insurance premium of 3.5% per annum (or part thereof).

In connection with the loan, we granted the lenders a security interest in certain intellectual property held by us. In the caseevent of a tender offer,default, the lenders may acquire that intellectual property to settle any amounts due under the loan.

On December 8, 2023, we will file tender offer documentsentered into an Assignment and Release Agreement (the “Assignment Agreement”) by and among the holder of the obligations under the Agreement (the “Assignor”) and YA II PN, Ltd. (the “Assignee”). Pursuant to that Assignment Agreement, in exchange for the settlement amount of approximately $3.6 million, the Assignor assigned and conveyed the aggregate principal amount outstanding (the “Principal”) under a loan agreement the Company entered into with the SEC which will contain substantiallyAssignor on March 23, 2021, to the same financial and other information aboutAssignee. In connection with the initial business combination as is required underAssignment Agreement, we also agreed to grant the SEC’s proxy rules. In either case, we will consummate our initial business combination only if we have net tangible assetsAssignee conversion rights subject to the outstanding balance of at least $5,000,001 upon such consummation and, if we seek stockholder approval,$5,750,000 (the “New Principal”), the remaining principal, subject to a majorityconversion price of $1.25 per share of common stock of the Company (the “Conversion Price”). As a result, the Assignee may convert the New Principal in its sole discretion at any time on or prior to maturity at the Conversion Price. We may not convert any portion of the New Principal if such conversion would result in the Assignee beneficially owning more than 4.99% of our then issued common stock, provided that such limitation may be waived by the Assignee with 65 days’ notice.

| 7 |

Acquisition of Wheels Labs, Inc.

On November 18, 2022, we acquired all of the issued and outstanding shares of commoncapital stock voted are voted in favor of the business combination.

We have until 12 months (or upon extension, 15 or 18 months, as applicable) from the closing ofWheels Labs, Inc. (“Wheels”), and Wheels became our initial public offering (completed on November 21, 2019) to consummate an initial business combination. If we are unable to consummate an initial business combination within such time period, we will redeem 100% of our outstanding public shares for a pro rata portion of the funds held in the trust account, equal to the aggregate amount then on deposit in the trust account including interest earned on the funds held in the trust account (net of taxes payable), divided by the number of then outstanding public shares, subject to applicable lawwholly-owned subsidiary when another wholly-owned subsidiary (“Merger Sub”) merged with and as further described herein, and then seek to liquidate and dissolve. We expect the pro rata redemption price to be $10.00 per share (regardless of whether or not the underwriters exercise their over-allotment option), without taking into account any interest earned on such funds. However, we cannot assure stockholders that we will in fact be able to distribute such amounts as a result of claims of creditors which may take priority over the claims of our public stockholders.

NASDAQ rules require that our business combination must occur with one or more target businesses that together have an aggregate fair market value of at least 80% of the assets held in the trust account (excluding taxes payable on the interest earned on the trust account) at the time of our signing a definitive agreement in connection with our business combination. The fair market value of the target or targets will be determined by our board of directors based upon one or more standards generally accepted by the financial community (such as actual and potential sales, earnings, cash flow and/or book value)Wheels (the “Merger”). Although our board of directors will rely on generally accepted standards, our board of directors will have discretion to select the standards employed. In addition, the application of the standards generally involves a substantial degree of judgment. Accordingly, investors will be relying on the business judgment of the board of directors in evaluating the fair market value of the target or targets. The proxy solicitation materials or tender offer documents used by us in connection with any proposed transaction will provide public stockholders with our analysis of the fair market value of the target business, as well as the basis for our determinations. If our board is not able independently to determine the fair market value of the target business or businesses, we will obtain an opinion from an independent investment banking firm, or another independent entity that commonly renders valuation opinions, with respect to the satisfaction of such criteria. Our stockholders may not be provided with a copy of such opinion nor will they be able to rely on such opinion. However, if NASDAQ delists our securities from trading on its exchange after our IPO, we would not be required to satisfy the fair market value requirement described above and could complete a business combination with a target business having a fair market value substantially below 80% of the balance in the trust account.

COMPETITIVE STRENGTHS

We believe we have the following competitive strengths:

Status as a public company

We believe our structure will make us an attractive business combination partner to target businesses. As an existing public company, we offer a target business an alternative to the traditional initial public offering through a merger or other business combination. In this situation, the owners of the target business would exchange their shares of stock in the target business for our shares of common stock or for a combination of our shares of common stock and cash, allowing us to tailor the consideration to the specific needs of the sellers. We believe target businesses might find this method a more certain and cost-effective method to becoming a public company than the typical initial public offering. In a typical initial public offering, there are additional expenses incurred in marketing, roadshow and public reporting efforts that will likely not be present to the same extent in connection with a business combination with us. Furthermore, once the business combination is consummated, the target business will have effectively become public, whereas an initial public offering is always subject to the underwriters’ ability to complete the offering, as well as general market conditions that could prevent the offering from occurring. We believe the target business would then have greater access to capital and an additional means of providing management incentives consistent with stockholders’ interests than it would have as a privately-held company. It can offer further benefits by augmenting a company’s profile among potential new customers and vendors and aid in attracting talented employees.

While we believe that our status as a public company will make us an attractive business partner, some potential target businesses may view the inherent limitations in our status as a blank check company as a deterrent and may prefer to effect a business combination with a more established entity or with a private company. These inherent limitations include limitations on our available financial resources, which may be inferior to those of other entities pursuing the acquisition of similar target businesses; the requirement that we seek stockholder approval of a business combination, which may delay the consummation of a transaction; and the existence of our outstanding rights, which may represent a source of future dilution.

Financial position

With funds in the trust account of $57,500,000 available to use for a business combination, we offer a target business a variety of options such as providing the owners of a target business with shares in a public company and a public means to sell such shares, providing capital for the potential growth and expansion of its operations or strengthening its balance sheet by reducing its debt ratio. Because we are able to consummate our initial business combination using our cash, debt or equity securities, or a combination of the foregoing, we have the flexibility to use the most efficient combination that will allow us to tailor the consideration to be paid to the target business to fit its needs and desires. In connection with any potential acquisition,the Merger, we may be required to obtain acquisition financing. However, since we have no specific business combination under consideration, we have not taken any steps to secure third party financingentered into an Amended and there can be no assurance that it will be available to us.

Management ExpertiseRestated Agreement and Plan of Merger (the “Amended Merger Agreement”) on October 24, 2022 with Wheels and Merger Sub and an Escrow Agreement with Wheels, Merger Sub, an escrow agent and an authorized representative of certain security holders of Wheels.

We will seek to capitalize on the operating experience and contacts of our officers and directors in consummating an initial business combination. We believe the network and skills of these individuals make them valuable resources to our company and will assist us in consummating a transaction. Past performance of our management team or their affiliates is not a guarantee either (i) of success with respect to any business combination we may consummate or (ii) that we will be able to identify a suitable candidate for our initial business combination.

CRITERIA FOR SELECTING BUSINESS COMBINATION

General

We are not presently engaged in, and we will not engage in, any substantive commercial business for an indefinite period of time following our IPO (completed on November 21, 2019). We intend to utilize cash derived from the proceeds of our IPO and the private placement of private warrants, our capital stock, debt or a combination of these in effecting a business combination which has not yet been identified. Accordingly, investors in our IPO are investing without first having an opportunity to evaluate the specific merits or risks of any one or more business combinations. A business combination may involve the acquisition of, or merger with, a company which does not need substantial additional capital but which desires to establish a public trading market for its shares, while avoiding what it may deem to be adverse consequences of undertaking a public offering itself. These include time delays, significant expense and potential loss of voting control, among others. In the alternative, we may seek to consummate a business combination with a company that may be financially unstable or in its early stages of development or growth. We may determine to acquire more than one business or entity for our initial business combination, however, any such determination could tax our management and financial resources and adversely affect our time to complete a business combination.

We Have Not Identified a Target Business or Businesses

To date, we have not selected any target business on which to concentrate our search for a business combination. Although we are not required or bound to acquire a business in a particular geographic region or industry sector, we expect to focus our efforts in North America, Europe and Asia (excluding China), and in the life and health sciences sectors. We shall not undertake our initial business combination with any entity with its principal business operations in China. None of our officers, directors, promoters and other affiliates has engaged in any binding discussions on our behalf with representatives of other companies regarding the possibility of a potential business combination with us. As a result, we cannot assure stockholders that we will be able to locate a target business or that we will be able to engage in a business combination with a target business on favorable terms or at all.

SubjectPursuant to the requirement that while we are listed on NASDAQ our target business have a fair market value of 80% of the trust account balance (excluding taxes payable on the interest earned on the trust account), as described below, we will have virtually unrestricted flexibility in identifying and selecting a prospective acquisition candidate. Except as described below, we have not established any other specific attributes or criteria (financial or otherwise) for prospective target businesses. Accordingly, there is no basis for investors in our IPO to evaluate the possible merits or risks of the target business with which we may ultimately complete a business combination. To the extent we effect a business combination with a financially unstable company or an entity in its early stage of development or growth, including entities without established records of sales or earnings, we may be affected by numerous risks inherent in the business and operations of financially unstable and early stage or potential emerging growth companies. Although our management will endeavor to evaluate the risks inherent in a particular target business, we cannot assure stockholders that we will properly ascertain or assess all significant risk factors.

Sources of Target Businesses

While we have not yet identified any acquisition candidates, we believe based on our management’s business knowledge and past experience that there are numerous acquisition candidates. We expect that our principal means of identifying potential target businesses will be through the extensive contacts and relationships of our founders, officers and directors. While our officers and directors are not required to commit any specific amount of time in identifying or performing due diligence on potential target businesses, we believe that the relationships they have developed over their careers will generate a number of potential business combination opportunities that will warrant further investigation. We also anticipate that target business candidates will be brought to our attention from various unaffiliated sources, including investment bankers, venture capital funds, private equity funds, leveraged buyout funds, management buyout funds and other members of the financial community. Target businesses may be brought to our attention by such unaffiliated sources as a result of being solicited by us through calls or mailings. These sources may also introduce us to target businesses they think we may be interested in on an unsolicited basis, since many of these sources will have read this Form 10-K and know what types of businesses we are targeting. Our founders, officers and directors, as well as their affiliates, may also bring to our attention target business candidates that they become aware of through their business contacts as a result of formal or informal inquiries or discussions they may have, as well as attending trade shows or conventions. While we do not presently anticipate engaging the services of professional firms or other individuals that specialize in business acquisitions on any formal basis, we may engage these firms or other individuals in the future, in which event we may pay a finder’s fee, consulting fee or other compensation to be determined in an arm’s length negotiation based on the terms of the transaction. In no event, however, will our sponsor, officers, directors or their respective affiliates be paid any finder’s fee, consulting fee or other compensation prior to, or for any services they render in order to effectuate, our initial business combination (regardless of the type of transaction that it is), the repayment of non-interest-bearing loans and reimbursement of any out-of-pocket expenses. Our audit committee will review and approve all reimbursements and payments made to our officers, directors or our or their respective affiliates, with any interested director abstaining from such review and approval. We have no present intention to enter into a business combination with a target business that is affiliated with any of our officers or directors or their affiliates. However, we are not restricted from entering into any such transactions and may do so if (i) such transaction is approved by a majority of our disinterested independent directors and (ii) we obtain an opinion from an independent investment banking firm, or another independent entity that commonly renders valuation opinions, that the business combination is fair to our unaffiliated stockholders from a financial point of view.

Selection of a Target Business and Structuring of a Business Combination

Subject to the limitations that while we are listed on NASDAQ a target business have a fair market value of at least 80% of the balance in the trust account (approximately $45,600,000) (excluding taxes payable on the income earned on the trust account) at the time of the execution of a definitive agreement for our initial business combination, as described below in more detail, our management will have virtually unrestricted flexibility in identifying and selecting a prospective target business. We have not established any specific attributes or criteria (financial or otherwise) for prospective target businesses. In evaluating a prospective target business, our management may consider a variety of factors, including one or more of the following:

These criteria are not intended to be exhaustive. Any evaluation relating to the merits of a particular business combination will be based, to the extent relevant, on the above factors as well as other considerations deemed relevant by our management in effecting a business combination consistent with our business objective. In evaluating a prospective target business, we will conduct an extensive due diligence review which will encompass, among other things, meetings with incumbent management and inspection of facilities, as well as review of financial and other information which is made available to us. This due diligence review will be conducted either by our management or by unaffiliated third parties we may engage, although we have no current intention to engage any such third parties.

The time and costs required to select and evaluate a target business and to structure and complete the business combination cannot presently be ascertained with any degree of certainty. Any costs incurred with respect to the identification and evaluation of a prospective target business with which a business combination is not ultimately completed will result in a loss to us and reduce the amount of capital available to otherwise complete a business combination.

Fair Market Value of Target Business

The target business or businesses that we acquire must collectively have a fair market value equal to at least 80% of the balance of the funds in the trust account (approximately $45,600,000) (excluding taxes payable on the income earned on the trust account) at the time of the execution of a definitive agreement for our initial business combination, although we may acquire a target business whose fair market value significantly exceeds 80% of the trust account balance (excluding taxes payable on the interest earned on the trust account). The fair market value of the target will be determined by our board of directors based upon one or more standards generally accepted by the financial community (such as actual and potential sales, earnings, cash flow and/or book value). The proxy solicitation materials or tender offer documents used by us in connection with any proposed transaction will provide public stockholders with our analysis of the fair market value of the target business, as well as the basis for our determinations. If our board is not able to independently determine that the target business has a sufficient fair market value, we will obtain an opinion from an unaffiliated, independent investment banking firm, or another independent entity that commonly renders valuation opinions, with respect to the satisfaction of such criteria. We will not be required to obtain an opinion from an investment banking firm, or another independent entity that commonly renders valuation opinions, as to the fair market value if our board of directors independently determines that the target business complies with the 80% threshold.

If NASDAQ delists our securities from trading on its exchange after our IPO, we would not be required to satisfy the fair market value requirement described above and could complete a business combination with a target business having a fair market value substantially below 80% of the balance in the trust account.

We currently anticipate structuring a business combination to acquire 100% of the equity interests or assets of the target business or businesses. We may, however, structure our initial business combination where we merge directly with the target business or where we acquire less than 100% of such interests or assets of the target business in order to meet certain objectives of the target management team or stockholders or for other reasons, but we will only complete such business combination if the post-transaction company owns or acquires 50% or more of the outstanding voting securities of the target or otherwise acquires a controlling interest in the target sufficient for it not to be required to register as an investment company under the Investment Company Act. Even if the post-transaction company owns or acquires 50% or more of the voting securities of the target, our stockholders prior to the business combination may collectively own a minority interest in the post-transaction company, depending on valuations ascribed to the target and us in the business combination transaction. For example, we could pursue a transaction in which we issue a substantial number of new sharesAmended Merger Agreement, in exchange for all of the outstanding share capital stock of Wheels, Merger Sub merged with and into Wheels and became our wholly-owned subsidiary. The following is a target. In this case, we could acquire a 100% controlling interest in the target; however, as a resultsummary of the issuanceAmended Merger Agreement, and we suggest that you review the entire Agreement, which is attached as an exhibit to this Current Report, if you would like to have a deeper understanding of a substantial numberits terms.

Consideration

In exchange for all of new shares,the outstanding share capital of Wheels, we issued to security holders of Wheels approximately 6,751,823 Series A convertible preferred stock equal to six and ninety-nine hundredths (6.99%) of our stockholderstotal issued and outstanding common stock immediately prior to our initial business combination could own less than athe Closing (as may be adjusted downwards pursuant to the terms and conditions of the Amended Merger Agreement). The Series A convertible preferred stock converted into 904 shares of the Company’s Class A common stock upon the approval of the majority of our issued and outstanding shares subsequent to our initial business combination. If less than 100%the holders of the equity interests or assets ofCompany’s common stock to allow for such issuance under Nasdaq Rule 5635 (the “Stockholder Approval”).

Serie B Licenses

On June 7, 2021, we entered into two agreements with Lega Nazionale Professionisti Serie B (“League Serie B”) to acquire the rights to broadcast approximately 390 regular season soccer games in Serie B for the next three seasons, on a target business or businesses are owned or acquirednon-exclusive basis. Additionally, Helbiz Media has been appointed by the post-transaction company,League Serie B as the portion of such business or businesses that is owned or acquired is what will be valued for purposesexclusive distributor of the 80% of trust account balance test. In order to consummate such an acquisition, we may issue a significant amount of our debt or equity securitiesSerie B international media rights. Pursuant to the sellersagreements with the League Serie B, Helbiz Media will commercialize such international rights on behalf of such businesses and/or seekthe League Serie B. Under these agreements, Serie B will take care of the TV productions of all matches and will provide the feeds to raise additional funds through a private offering of debt or equity securities. SinceHelbiz Media. The agreements that we have no specific business combination under consideration, we have not entered into any such fund-raising arrangement andwith League Serie B for rights outside of Italy gives us the right to distribute the rights to third parties to broadcast the Serie B games outside of Italy, including Helbiz Media itself. We have no current intentionguaranteed Serie B a minimum annual payment of doing so.

Lack of Business Diversification

We expect to complete only a single business combination. Therefore, at least initially, the prospects for our success may be entirely dependent upon the future performance of a single business operation. Unlike other entities which may have the resources to complete several business combinations of entities operating in multiple industries or multiple areas of a single industry, it is probable that we will not have the resources to diversify our operations or benefit from the possible spreading of risks or offsetting of losses. By consummating a business combination with only a single entity, our lack of diversification may:

If we determine to simultaneously acquire several businesses and such businesses are owned by different sellers, we may need for each of such sellers to agree that our purchase of its business is contingent on the simultaneous closings of the other acquisitions, which may make it more difficult for us, and delay our schedule, to complete the business combination. With multiple acquisitions, we could also face additional risks, including additional burdens and costs with respect to possible multiple negotiations and due diligence investigations (if there are multiple sellers) and the additional risks associated with the subsequent assimilation of the operations and services or products of the acquired companies in a single operating business.

Limited Ability to Evaluate the Target Business’ Management

Although we intend to scrutinize the management of a prospective target business when evaluating the desirability of effecting a business combination, we cannot assure stockholders that our assessment of the target business’ management will prove to be correct. In addition, we cannot assure stockholders that the future management will have the necessary skills, qualifications or abilities to manage a public company. Furthermore, the future role of our officers and directors, if any, in the target business following a business combination cannot presently be stated with any certainty. While it is possible that some of our key personnel will remain associated in senior management or advisory positions with us following a business combination, it is unlikely that they will devote their full-time efforts to our affairs subsequent to a business combination. Moreover, they would only be able to remain with the company after the consummation of a business combination if they are able to negotiate employment or consulting agreements€2.5 million (approximately $3 million) in connection with the business combination. Such negotiations would take place simultaneouslydistribution of the rights outside of Italy, and any amounts received after €2.5 million (approximately $3 million) will be divided among us and League Serie B.

The agreements that we entered into with Serie B for rights in Italy are non-exclusive rights. The rights to broadcast in Italy have been sold to two other over-the-top providers pursuant to agreements on the same terms as well as to one provider for terrestrial and/or cable and satellite broadcast. We are required to pay €12 million (approximately $14 million) per year in connection with these right.

In June 2023, the Company received communications from League Serie B notifying if of League Serie B’s early termination of the agreements related to the commercialization and broadcast of the LNPB content. The communications also requested the immediate payment of the invoices overdue amounting to $11.4 million. In February 2024, the Company entered into a Settlement agreement with LNPB pursuant to which the Company’s obligations under the original agreements will be satisfied in exchange of a payment of $5.4 million, divided in three payments on or prior November 30, 2024.

SEPAs

On March 8, 2023, we entered into a SEPA with Yorkville (the “March SEPA”, and together with the negotiationOctober SEPA and the March SEPA, the “SEPAs”). Pursuant to the March SEPA, we have the right, but not the obligation, to sell to Yorkville up to $50,000,000 of shares of Class A common stock at our request any time during the commitment period commencing on March 8, 2023 and terminating on the earliest of (i) the first day of the business combinationmonth following the 24-month anniversary of the March SEPA and (ii) the date on which Yorkville shall have made payment of any advances requested pursuant to the March SEPA for shares of our Class A common stock equal to the commitment amount of $50,000,000. Each sale we request under the March SEPA (an “Advance”) may be for a number of shares of Class A common stock equal to the greater of: (i) an amount equal to 100% of the average daily traded amount of the shares during the five Trading Day immediately preceding the delivery of an Advance Notice, or (ii) 5,000,000 shares of common stock. The shares would be purchased at 95.0% of the Option 1 Market Price, which is the lowest VWAP (the daily volume weighted average price of our Class A common stock for the applicable date on the Nasdaq Capital Market as reported by Bloomberg L.P. during regular trading hours) in each of the three consecutive trading days commencing on the trading day following our submission of an Advance Notice to Yorkville, or 92.0% of the Option 2 Market Price, which is the VWAP during the period commencing upon receipt of such Advance Notice and ending on 4:00 p.m. on such day. An Advance with an Option 2 Market Price can only be selected with the consent of Yorkville. The purchase would be subject to certain limitations, including that Yorkville could providenot purchase any shares that would result in it owning more than 9.99% of our Class A common stock or any shares that, aggregated with any related transaction, would exceed 48,119,674, unless shareholder approval was obtained allowing for themissuances in excess of the Exchange Cap. The Exchange Cap will not apply under certain circumstances, including to receive compensationthe extent that (and only for so long as) the average price for all shares of Class A common stock purchased pursuant to the March SEPA shall equal or exceed the Minimum Price (as defined in Nasdaq Listing Rule 5635(d)).

| 8 |