UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ANNUAL REPORT UNDERPURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For fiscal year ended: December 31, 20202023

ORor

☐TRANSITION REPORT UNDERPURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission file number: 001-39336

Aditx Therapeutics, Inc.

Aditxt, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 82-3204328 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (650) 870-1200

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, par value $0.001 per share | ADTX | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in this filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2020,2023, based on a closing price of $5.06$18.00 was approximately $20,079,659.$3,008,286.

As of March 24, 2020,April 12, 2024, the registrant had 14,225,3011,665,265 and 14,124,4981,665,214 shares of common stock, $0.001 par value per share, issued and outstanding, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement relating to its 20212023 annual meeting of stockholders (the “2021“2023 Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The 20212023 Proxy Statement will be filed with the Securities and Exchange Commission (the “SEC”) within 120 days after the end of the fiscal year to which this report relates.

ADITX THERAPEUTICS,ADITXT, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 20202023

TABLE OF CONTENTS

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “can,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “seek,” “estimate,” “continue,” “plan,” “point to,” “project,” “predict,” “could,” “intend,” “target,” “potential” and other similar words and expressions of the future. The matters discussed in these forward-looking statements are subject to risks, uncertainties and other factors that could cause our actual results to differ materially from those projected, anticipated or implied in the forward-looking statements. As a result, you should not place undue reliance on any forward-looking statements. Except to the limited extent required by applicable law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

ii

RISK FACTOR SUMMARY

Our business is subject to numerous risks and uncertainties, including those highlighted in Section 1A titled “Risk Factors,” that represent challenges that we face in connection with the successful implementation of our strategy. The occurrence of one or more of the events or circumstances described in the section titled “Risk Factors,” alone or in combination with other events or circumstances, may have an adverse effect on our business, cash flows, financial condition and results of operations. Such risks include, but are not limited to:

| ● | we have generated no significant revenue from commercial sales to date and our future profitability is uncertain; |

| ● | if we fail to obtain the capital necessary to fund our operations, we will be unable to continue or complete our product development and you will likely lose your entire investment; |

| ● | our financial situation creates doubt whether we will continue as a going concern; |

| ● | we may need to raise additional funding, which may not be available on acceptable terms, or at all; |

| ● | even if we can raise additional funding, we may be required to do so on terms that are dilutive to you.; |

| ● | the regulatory approval process is expensive, time-consuming and uncertain and may prevent us from obtaining approvals for the commercialization of our future product candidates, if any; |

| ● | we may encounter substantial delays in completing our clinical studies which in turn will require additional costs, or we may fail to demonstrate adequate safety and efficacy to the satisfaction of applicable regulatory authorities; |

| ● | if our future pre-clinical development and future clinical Phase I/II studies are unsuccessful, we may be unable to obtain regulatory approval of, or commercialize, our product candidates on a timely basis or at all; |

| ● | even if we receive regulatory approval for any of our product candidates, we may not be able to successfully commercialize the product and the revenue that we generate from their sales, if any, may be limited; |

| ● | adverse events involving our products may lead the FDA or applicable foreign regulatory agency to delay or deny clearance for our products or result in product recalls that could harm our reputation, business and financial results; |

| ● |

| ● | if we were to lose our CLIA certification or state laboratory licenses, whether as a result of a revocation, suspension or limitation, we would no longer be able to offer our assays (including our AditxtScore™ platform), which would limit our revenues and harm our business. If we were to lose, or fail to obtain, a license in any other state where we are required to hold a license, we would not be able to test specimens from those states; |

| ● | our results of operations will be affected by the level of royalty and milestone payments that we are required to pay to third parties; |

| ● | we face substantial competition, which may result in others discovering, developing or commercializing products before or more successfully than we do; |

iii

| ● | our technologies and products under development, and our business, may fail if we are not able to successfully commercialize them and ultimately generate significant revenues as a result; |

| ● | customers may not adopt our products quickly, or at all; |

| ● |

| the failure to obtain or maintain patents, licensing agreements and other intellectual property could materially impact our ability to compete effectively; |

| ● | some of our intellectual property may be subject to “march-in” rights by the U.S. federal government; |

| ● | we do not expect to pay dividends in the foreseeable future; |

| ● |

| ● | future sales or issuances of substantial amounts of our common stock, including, potentially as a result of future acquisitions or strategic transactions, including the transaction with Cellvera Global, could result in significant dilution; |

| ● | while we have entered into a Share Exchange Agreement with Cellvera Global, we cannot assure you that the transaction contemplated by the Share Exchange Agreement will be consummated or, that if such transaction is consummated, that it will be accretive to stockholder value; |

| ● | we may engage in future acquisitions or strategic transactions, including the transaction with Cellvera Global, which may require us to seek additional financing or financial commitments, increase our expenses and/or present significant distractions to our management; |

| ● | we received the determination from Nasdaq that we regained compliance with the Nasdaq continued listing requirements, however, we remain subject to a panel monitor of our ongoing compliance until December 29, 2024 and if we fail to comply with such requirements during the panel monitor, it could result in the delisting of our securities by Nasdaq; and |

| ● | exclusive forum provisions in our amended and restated certificate of incorporation and amended and restated bylaws. |

iiiiv

PART I

Item 1. Business.

Overview and Mission

We believe the world needs—and deserves—a new approach to innovating that harnesses the power of large groups of stakeholders who work together to ensure that the most promising innovations make it into the hands of people who need them most.

We were incorporated in the State of Delaware on September 28, 2017, and our headquarters are a biotech innovationin Richmond, Virginia. The company was founded with a mission of bringing stakeholders together, to transform promising innovations into products and services that could address some of the most challenging needs. The socialization of innovation through engaging stakeholders in every aspect of it, is key to transforming more innovations, more rapidly, and more efficiently.

At inception, the first innovation we took on was an immune modulation technology titled ADI/Adimune with a focus on prolonging life and enhancing itslife quality by improvingof patients that have undergone organ transplants. Since then, we expanded our portfolio of innovations, and we continue to evaluate a variety of promising health innovations.

Our Model

Aditxt is not about a single idea or a single molecule. It is about making sure the right innovation is made possible. Our business model has three main components as follows:

| (1) | Securing an Innovation: Our process begins with identifying and securing innovations through licensing or acquisition of an innovation asset. Assets come from a variety of sources including research institutions, government agencies, and private organizations. |

| (2) | Growing an Innovation: Once an innovation is secured, we surround it with activation resources that take a systemized approach to bringing that idea to life. Our activation resources include innovation, operations, commercialization, finance, content and engagement, personnel, and administration. |

| (3) | Monetizing an Innovation: Our goal is for each innovation to become commercial-stage and financially and operationally self-sustainable, to create shareholder value. |

We engage various stakeholders for each of our programs on every level. This includes identifying researchers and research institution partners, such as Stanford University; leading health institutions to get critical trials underway, such as Mayo Clinic; manufacturing partners who enable us to take innovations from preclinical to clinical; municipalities and governments, such as the city of Richmond and the state of Virginia and public health agencies who work with us to launch our program, Pearsanta’s laboratory; and thousands of shareholders around the globe. We seek to enable promising innovation to become purposeful products that have the power to change lives.

Our Value Proposition

We believe that far too often, promising treatment or technology does not reach commercialization due to lack of expertise, key resources, or efficiency. As a result, potentially life-changing and lifesaving treatments are not available to the individuals who so desperately need them.

Aditxt seeks to bring the holistic concept of an efficient, socialized ecosystem for advancing and accelerating innovations. Our process: We seek to license or acquire promising innovations. We will then form and build out a subsidiary around each innovation and support the subsidiaries through innovation, operation, commercialization, content and engagement, finance, personnel, and administration to thrive and grow as a successful, monetizable business.

Since our inception, we have built infrastructure consisting of innovation, operation, commercialization, content and engagement, finance, personnel, and administration, to support the rapid transformation of untapped innovations. Each of the immune system.main components of our infrastructure has established global access to partnerships with industry leaders, top-rated research and medical institutions, universities, manufacturing and distribution companies, and critical infrastructure such as CLIA-certified state-of-the art labs and GMP manufacturing.

The Shifting Landscape of Innovation

Innovation in general, and health innovations specifically, require significant resources. The convergence of biotech, high-tech, and media offers new possibilities of accelerating breakthrough innovations faster and more efficiently. This approach reflects our mission of “Making Promising Innovations Possible, Together”.

People deserve innovative solutions, which have never been more within reach. We believe the best idea, best product and the best solution will come from creating an ecosystem where all stakeholders, such as vendors, customers, municipalities, and shareholders contribute. When we disrupt the way we’re innovating, through our collaborative model, we believe we can move faster and more efficiently to activate viable solutions that have the potential to make a measurable impact.

Our Growth Strategy

We are developing biotechnologies specifically focused on improvingbelieve that the era of precision and personalized medicine is here and that people around the globe would benefit from health diagnostics and treatments that more accurately pinpoint the problems and more precisely treat the condition. In addition to our current programs, Adimune and Pearsanta, we look to bring in future health innovations in the areas of the immune system through immune reprogrammingsoftware and monitoring. Our immune reprogrammingAI, medical devices, therapeutics, and other technologies are currently at the pre-clinical stagethat take a fundamentally different approach to health because they prioritize personalized precision medicine, timely disease root cause analysis, and are designed to retrain the immune system to induce tolerance with an objective of addressing rejection of transplanted organs, autoimmune diseases, and allergies. Our immune monitoring technologies are designed to provide a personalized comprehensive profile of the immune system andtargeted treatments.

Year over year, we plan to utilize themcontinue building our infrastructure and securing more personalized and precision health innovations that align with our mission. These opportunities may come in different forms such as IP, an early-stage company, or a late-stage company. We will continue to scale our upcoming reprogrammingsystemized approach to the innovation process, making large-scale automation and enterprise systems available to our portfolio companies at every stage of their growth. Specifically, certain subsidiaries will need to grow through further M&A activities, operational infrastructure implementation, and development or acquisition of critical technologies.

Our Team

Aditxt is led by an entrepreneurial team with passion for transforming promising innovations into successful businesses. Our leadership come from a variety of different industries, with collective expertise in founding startup innovation companies, developing and marketing biopharmaceutical and diagnostic products, designing clinical trials, manufacturing, and management of private and public companies. We have deep experience in identifying and accessing promising health innovations and developing them into products and services with the ability to monitor subjects’scale. We understand the capital markets, both public and private, as well as M&A and facilitating complex IPOs.

The following are profiles of three subsidiaries we have formed, including the terms of the intellectual property licenses that have been sublicensed from Aditxt to help build each of the businesses.

THE ADITXT PROGRAMS

ADIMUNE, INC.

Formed in January 2023, Adimune™, Inc. (“Adimune”) is focused on leading our immune response before, duringmodulation therapeutic programs. Adimune’s proprietary immune modulation product Apoptotic DNA Immunotherapy™, or ADI-100™, utilizes a novel approach that mimics the way our bodies naturally induce tolerance to our own tissues. It includes two DNA molecules designed to deliver signals to induce tolerance. ADI-100 has been successfully tested in several preclinical models (e.g., skin grafting, psoriasis, type 1 diabetes, multiple sclerosis).

In May 2023, Adimune entered into a clinical trial agreement with Mayo Clinic to advance clinical studies targeting autoimmune diseases of the central nervous system (“CNS”) with the initial focus on the rare, but debilitating, autoimmune disease Stiff Person Syndrome (“SPS”). According to the National Organization of Rare Diseases, the exact incidence and after drug administration.prevalence of SPS is unknown; however, one estimate places the incidence at approximately one in one million individuals in the general population.

Pending approval by the International Review Board and U.S. Food and Drug Administration, a human trial for SPS is expected get underway in 2024 with enrollment of 10-15 patients, some of whom may also have type 1 diabetes. ADI-100 will initially be tested for safety and efficacy. ADI-100 is designed to tolerize against an antigen known as glutamic acid decarboxylase (“GAD”), which is implicated in type-1 diabetes, psoriasis, and in many autoimmune diseases of the CNS. IND-enabling work is also near completion in support of a Clinical Trial Application submission to the Paul Ehrlich Institute, the regulatory agency in Germany, to initiate clinical trials in psoriasis and type 1 diabetes.

Immune Reprogramming

Background

The discovery of immunosuppressive (anti-rejection and monoclonal) drugs over 40 years ago has made possible life-saving organ transplantation procedures and blocking of unwanted immune responses in autoimmune diseases. However, immune suppression leads to significant undesirable side effects, such as increased susceptibility to life-threatening infections and cancers, because it indiscriminately and broadly suppresses immune function throughout the body. While the use of these drugs has been justifiable because they prevent or delay organ rejection, their use for treatment of autoimmune diseases and allergies may not be acceptable because of the above-mentionedaforementioned side effects. Furthermore, often transplanted organs often ultimately fail despite the use of immune suppression, and about 40% of transplanted organs survive no more than 5five years.

New, focused therapeutic approaches are needed that modulate onlyThrough Aditxt, Adimune has the small portionright of immune cells that are involved in rejection of the transplanted organ, as this approach can be safer for patients than indiscriminate immune suppression. Such approaches are referred to as immune tolerance, and when therapeutically induced, may be safer for patients and also potentially allow long-term survival of transplanted tissues and organs.

In the late 1990s, academic research on these approaches was conducted at the Transplant Center at Loma Linda University in connection with a project that secured initial grant funding from the U.S. Department of Defense. The focus of that project was for skin grafting for burn victims. Twenty years of research at LLU and an affiliated incubator led to a series of discoveries that have been translated into a large patent portfolio of therapeutic approaches that may be applieduse to the modulation of the immune system in order to induce tolerance to self and transplanted organs.

We have an exclusive worldwide license from LLU for commercializing thisADI nucleic acid-based technology (which is currently at the pre-clinical stage), called Apoptotic DNA Immunotherapy™ (ADi™), which utilizes from Loma Linda University. ADI uses a novel approach that mimics the way our bodiesthe body naturally induceinduces tolerance to our own tissues (“therapeutically induced immune tolerance”). While immune suppression requires continuous administration to prevent rejection of a transplanted organ, induction of tolerance has the potential to retrain the immune system to accept the organ for longer periods of time. Thus, ADi™ADI may allow patients to live with transplanted organs with significantly reduced immune suppression. ADi™ADI is a technology platform which we believe can be engineered to address a wide variety of indications.

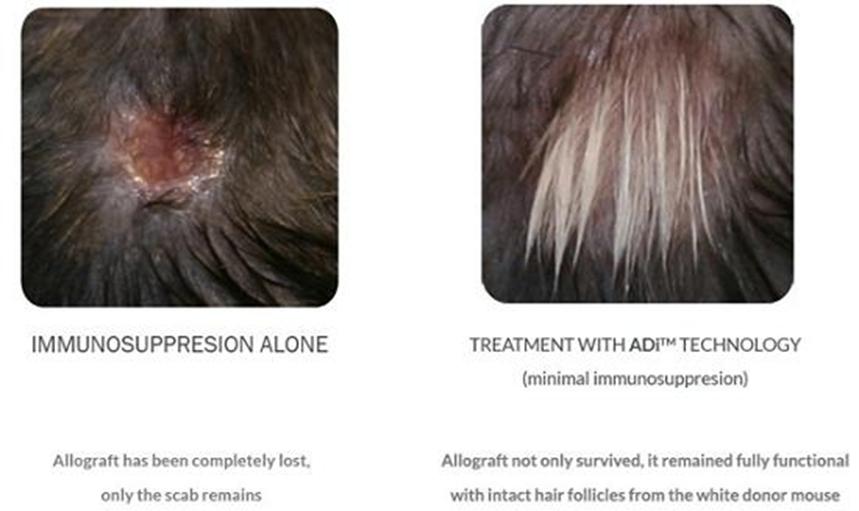

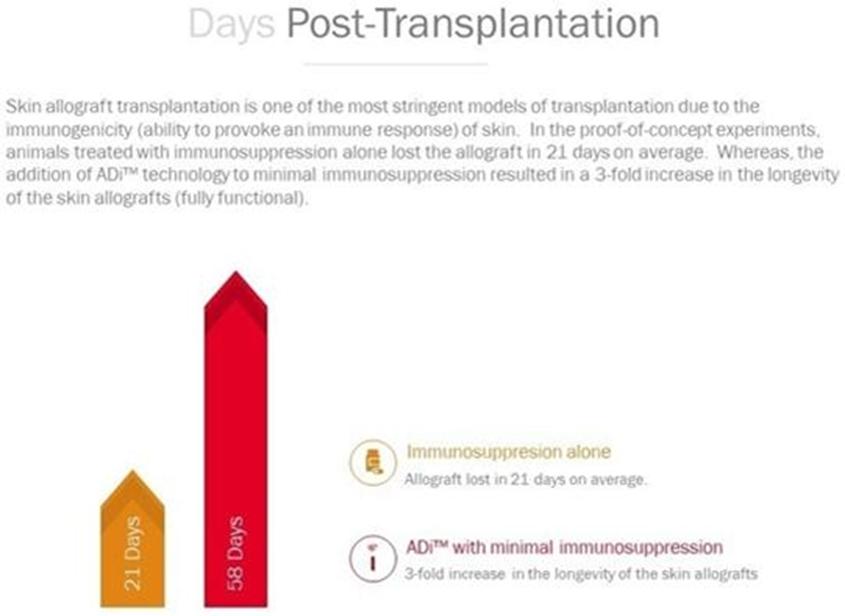

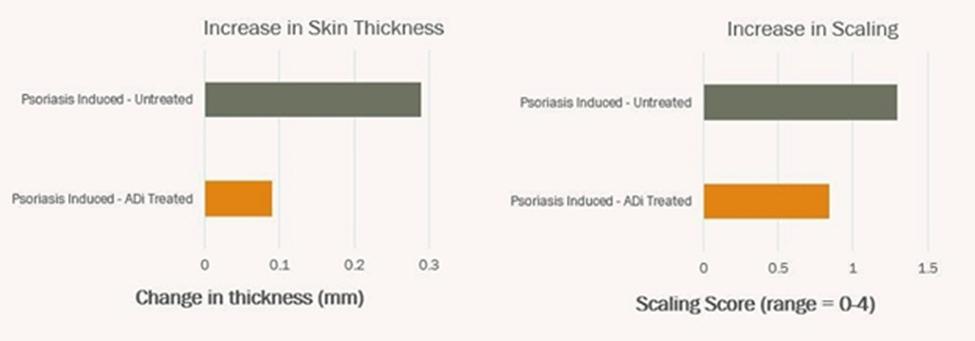

We are developing ADi™ products for organ transplantation including skin grafting, autoimmune diseases, and allergies, with the initial focus on skin allografts and psoriasis, as we believe these indications will be most efficient in providing safety and efficacy data in clinical trials. To submit a Biologics License Application (“BLA”) for a biopharmaceutical product, clinical safety and efficacy must be demonstrated in a series of clinical studies conducted with human subjects. For products in our class of drugs, the first-in-human trials will be a combination of Phase I (safety/tolerability) and Phase II (efficacy) in affected subjects. To obtain approval to initiate the Phase I/IIa studies, an Investigational New Drug Application will be submitted to compile non-clinical efficacy data as well as manufacturing and pre-clinical safety/toxicology data. To date, we have conducted non-clinical studies in a stringent model of skin transplantation using genetically mismatched donor and recipient animals demonstrating a 3-fold increase in the survival of the skin graft in animals that were tolerized with ADi™ compared to animals that receive immune suppression alone. Prolongation of graft life was observed despite discontinuation of immune suppression after the first 5 weeks. Additionally, in an induced non-clinical model for psoriasis, ADi™ treatment resulted in a 69% reduction in skin thickness and a 38% decrease in skin flaking (two clinical parameters for assessment of psoriasis skin lesions). The Phase I/IIa studies in psoriasis will evaluate the safety/tolerability of ADi™ in patients diagnosed with psoriasis. Since the drug will be administered in subjects diagnosed with psoriasis, effectiveness of the drug to improve psoriatic lesions will also be evaluated. In another Phase I/IIa study, patients requiring skin allografts will receive weekly intra-dermal injections of ADi™ in combination with standard immune suppression to assess safety/tolerability and possibility of reducing levels of immunosuppressive drugs as well as prolongation of graft life. Later phase trials are planned after successful completion of these studies in preparation for submission for a BLA to regulatory agencies.

Advantages

ADi™ Advantages

ADi™ADI™ is a nucleic acid-based technology (e.g., plasmid DNA-based), which we believe selectively suppresses only those immune cells involved in the rejection of tissueattacking or rejecting self and organ transplants.transplanted tissues and organs. It does so by tapping into the body’s natural process of cell death (apoptosis)turnover (i.e., apoptosis) to reprogramretrain the immune system to stop unwanted attacks on self or transplanted tissues. Apoptosis is a natural process of “immune tolerance” used by the body to clear dying cells and to allow recognition and tolerance to self-tissue. ADi™self-tissues. ADI triggers this process by enabling the naturalcells of the immune system cells to recognize the targeted tissues as “self”.“self.” Conceptually, it is designed to retrain the immune system to become accepting ofaccept the organtissues, similar to how natural apoptosis reminds our immune system to be tolerant to our own “self” tissues.

While efforts have been made by various groups to promotehave promoted tolerance through cell therapies and ex vivo manipulation of patient cells (takes(i.e., takes place outside the body typically requiring hospitalization)body), to our knowledge, we will be unique in our approach of using in-body induction of apoptosis to promote tolerance to specific tissues. In addition, ADi™ADI treatment itself will not require additional hospitalization but only an injection inof minute amounts of the therapeutic drug into the skin.

Reduce Chronic Rejection

While immunosuppressants control acute rejection during the early time-period after receiving an organ, chronic rejection of the organ that occurs one or more years after the transplant procedure continues to pose a major challenge for organ recipients.

Chronic rejection has been likened to autoimmunity (a misdirected immune response that occurs when the immune system goes awry), where specific tissues in the transplanted organ are attacked by the immune system. In other words, chronic rejection may not be caused just by differences between the donor and the recipient, but rather by an immune response by the recipient to specific tissues in the organ. Our pre-clinical studies suggest that ADi™ has the ability to tolerize to specific tissues in a transplanted organ, and conceivably, reducing incidences of chronic rejection.

Moreover, preclinical studies have demonstrated that ADi™ADI treatment significantly and substantially prolongs graft survival, in addition to successfully “reversing” other established immune-mediated inflammatory processes.

Reduce immune suppression

Studies in animal models have shown that conditioning/desensitizing the animals to receive the transplant, prolongs the survival of the transplanted tissue or organ. These studies have used repeated exposure to low doses of protein components in specific organs to reduce immunologic recognition and attack on the transplanted organ.

Based on some of our data, we believe that with ADi™ treatment, recipients can be conditioned/desensitized ahead of transplantation, thereby retraining the immune system to more readily accept the organ and also reduce the levels of immunosuppressive drugs needed post-transplantation.

Preformed Antibodies

Studies have shown that presence of preformed antibodies prior to transplantation procedures increases the rate of organ rejection. Preformed antibodies can develop in previously transplanted patients, patients who have given birth, and patients who have previously received blood transfusions. With more than 113,000 patients on transplant waiting lists in the U.S. alone, patients with pre-existing antibodies have much lower chances at qualifying to receive organs due to their increased risk of rejection – even with immune suppression.

Sadly, transplanted patients have a probability of needing re-transplantation at some point due to eventual chronic rejection of their transplanted organ, with the possible exception of some newborn recipients. With increased incidence of preformed antibodies, these patients may never have the opportunity to receive another organ. Based on experimental data, we believe that ADi™ may have the potential to address this issue providing these individuals better opportunities at receiving an organ transplantation.

ADi™ Key Differentiators

Ease of Delivery

Therapeutic products are typically administered systemically (i.e., by mouth in pill form or injected intramuscularly/intravenously). This requires repeated large doses of the drug to allow sufficient concentrations to reach the affected sites. ADi™ is a DNA-based product that can be injected directly into the skin where the target cells of the immune system reside, thereby significantly simplifying the delivery of the product and reducing the amount of product needed.

Repeat Dosing

DNA-based products are less likely to result in formation of neutralizing antibodies, which lend themselves to repeat dosing as may be required by ADi™ products.

Cost of Goods Advantage

ADi™ products are DNA-based and cost-effective to manufacture. Furthermore, DNA-based products are very stable and do not require adherence to cold chain (temperature-controlled) protocols for shipping. This also makes the product ideal for global distribution.

Simplified Therapy Delivery System

We believe that tolerance induction using ADi™ may potentially obviate the need for hospitalization because it can simply be injected into the skin. This approach reduces treatment costs and complexities in treatment delivery. The anticipated administration of ADi™ will include an initial priming regimen that will require injections administered once a week for several weeks. Thereafter, booster or maintenance doses will be provided on an individual basis as determined by immune and inflammation testing. ADi™ treatments will be significantly more convenient and comfortable for patients because they do not require removal of patient cells for ex vivo manipulation.

ADi™ Technology Platform

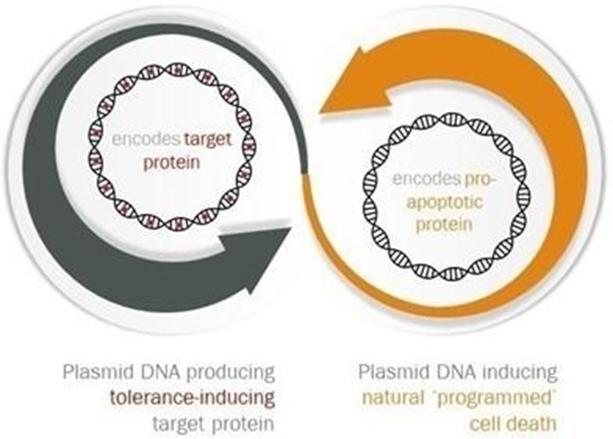

ADi™ utilizes a novel approach that mimics the way our bodies naturally induce tolerance to our own tissues. It is a technology platform which we believe can be engineered to address a wide variety of indications. ADi™ includes two DNA molecules which are designed to deliver signals to induce tolerance. The first DNA molecule encodes a pro-apoptotic protein, which induces ‘programmed’ cell death. This is a core component of the technology because it is intended to greatly increase the recruitment of dendritic cells, which are implicated in regulating the immune system. The second DNA molecule encodes the protein of interest (guiding antigen), which is modified to promote a path of tolerance. The guiding antigen is intended to result in tolerance induction specific to the tissue where the protein is found.

ADi™ has been successfully tested in several preclinical models (skin grafting, psoriaris, type 1 diabetes, alopecia areata) and its efficacy can be attributed to multiple factors:

Proof of Concept: Skin Grafting

Results shown are 5 weeks post-transplantation

The proof of concept experiment performed in transplantation was a skin allograft transplantation procedure in which the donor skin was obtained from white BALB/c mice and transplanted to black C57BL/6 mice. The experiment was designed to address a more challenging scenario where the donor tissue was obtained from a donor which is genetically mismatched with the recipient. This is unlike clinical scenarios where the donor and recipient are genetically matched as much as possible. While these experiments were repeated in several separate experiments, the results shown here were obtained from a study conducted with 14 mice in the ADi™ treatment group and 7 mice in the control group. Prior to submission of an Investigational New Drug Application, additional non-clinical studies will be conducted in a pig model to establish the precise protocol (e.g. timing of vaccine administration, dosing, and appropriate immunosuppressive agents that will be used in combination with ADi™) that will be used in the clinical trials. In addition, IND-enabling safety/toxicology studies will be conducted by a GLP lab to ensure product safety for clinical testing.

Proof of Concept: Psoriasis

Proof of Concept: Type 1 Diabetes

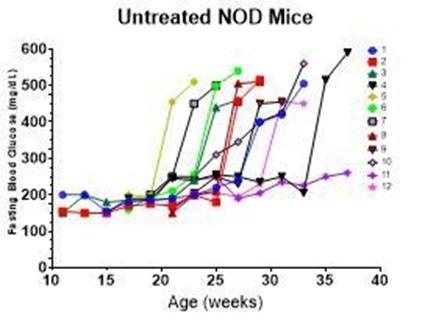

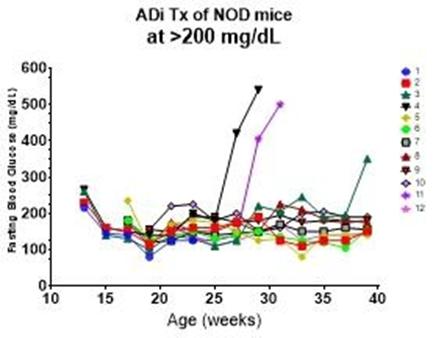

90% of female NOD mice developed spontaneous autoimmune diabetes. Disease progression may be different for individual animals.

ADi™ was administered once a week for 8 weeks after each animal developed hyperglycemia. All animals responded with 80% showing durable response for the entire 40-week study period.

Proof of Concept: Alopecia Areata

ADi™ protects hair follicles from autoimmune attack

Immune Monitoring

We believe that understanding the status of an individual’s immune system is key to developing and administering immunotherapies such as ADi™. We have secured an exclusive worldwide license for commercializing a technology platform which provides a personalized comprehensive profile of the immune system. It is intended to be informative for individual immune responses to viruses, bacterial antigens, peptides, drugs, bone marrow and solid organ transplants, and cancer. It has broad applicability to many other agents of clinical interest impacting the immune system, including those not yet identified such as future infectious agents. We plan to brand this technology, and other future licensed and/or in-house developed monitoring technologies collectively as AditxtScore™.

AditxtScore™ is being designed to allow individuals to understand, manage and monitor their immune profiles in order to be informed about attacks on or by their immune system. We believe AditxtScore™ can also assist the medical community in anticipating possible immune responses and reactions to viruses, bacteria, allergens and transplanted organs. It can be useful in anticipating attacks on the body by having the ability to determine its potential response and for developing a plan to deal with an undesirable reaction by the immune system. Its advantages include the ability to provide a simple, rapid, accurate, high throughput, single platform assay that can be multiplexed to determine the immune status with respect to several factors simultaneously, in 3-16 hours, as well as detect antigen and antibody in a single test (i.e. infectious, recovered, immune). In addition, it can determine and differentiate between various types of cellular and humoral immune responses (T and B cells). It also provides for simultaneous monitoring of cell activation and levels of cytokine release (i.e., cytokine storms).

We plan to utilize AditxtScore™ in our upcoming clinical trials to monitor subjects’ immune response before, during and after ADi™ drug administration. We are working with regulatory consultants with the objective to obtain FDA approval for AditxtScore™ as a clinical assay. We are currently securing marketing and distribution partnerships for application of AditxtScore™ in the infectious diseases market. To obtain FDA approval to use AditxtScore™ as a clinical assay, we are performing validation studies to demonstrate AditxtScore™’s utility to evaluate various components of the immune system reproducibly. We believe that these data will show AditxtScore™’s ability to measure various components of the immune system (e.g. humoral and cell-mediated immune responses) to provide a broader view of the immune system and its status in health and disease. Our plan is to submit a 510(K) application to the FDA after compilation of these data. Beyond infectious diseases, we plan to develop AditxtScore™ for applications in additional markets such as organ rejection, allergies, drug/vaccine response, and disease susceptibility. The following are further descriptions of the applications of AditxtScoreTM:

(1) Organ Rejection

Typically, by the time a transplanted or a native organ shows signs of failure, the damage is already done, and reversal of the tissue injury becomes challenging. Access to early warning signs of damage would be invaluable to reverse or even prevent the damage. There are currently no practical, efficient assays available to measure cellular immune responses and available tools do not provide timely information for patients. AditxtScore™ can be used to provide a sensitive and rapid tool to determine T cell response and to differentiate between various types of cellular immune responses. It can be multiplexed providing information about the number of cells responding as well as quantifying the amounts of various cytokines released by the cells in a single assay. Determination of cellular response has valuable applications for prediction, monitoring, early detection, and treatment of disease, including organ failure/rejection, as well as treatment efficacy. It can also reveal dysfunction of the immune system potentially contributing to more severe disease.

(2) Allergies

Our immune system protects us by acting as a barrier against foreign substances and by eliminating them when they penetrate our bodies. Once the initial exposure has occurred, memory cells develop to prepare the body against a future exposure. This process is called immunity. In certain situations, however, instead of immunity, the immune system develops memory cells that result in a more severe reaction during a future exposure to the same substance. This type of response is called a hypersensitivity response, commonly known as an allergic response. AditxtScore™ can be used to develop multiplex assays each designed to test and monitor immune response to allergens. Based on the ability of this technology to run multiple tests in a single assay, 100 or more substances can potentially be tested for simultaneously.

(3) Drug/Vaccine Response

There are currently no effective assays to predict and easily assess responses to vaccination. To determine whether an individual has responded to a particular vaccine, antibody titers are measured. This process may take several days. Furthermore, for vaccines that require a series of injections, titers are not measured between injections and may not be known for months. AditxtScore™ can be used to determine whether a patient is a responder or non-responder. It can provide an effective and rapid tool for potentially determining beneficial responses to a vaccine and can be used to monitor titer development post vaccination. It can allow evaluation of multiple vaccines in a single test (for memory B cell detection). This application can be useful for vaccines, cancer therapeutics anti-rejection drugs, anti-viral drugs, among others.

(4) Disease Susceptibility

Disease susceptibility can vary from one individual to another and it can be a function of various factors, including genetic variability and differences in human leukocyte antigens (HLA) encoded by major histocompatibility complex (MHC) and responsible for regulation of the immune system in humans. People with certain HLA types may have higher or lower susceptibility to diseases. AditxtScore™ can be used to develop assays to evaluate differences in HLA types in individuals to help elucidate the relationship between certain HLA types and susceptibility to various diseases.

(5) Infectious Diseases

Infectious diseases can cause a major predicament for scientific and medical professionals, epidemiologists, and infectious disease specialists, among others, who need to determine how to treat patients in real time while efficacious therapies are still being developed. Proper decision making requires understanding why some affected individuals show minor or no symptoms, some recover, and others die. This is fundamental to creating effective targeted therapeutics which may differ depending on the underlying profile of the individual at risk for, or with, disease. The immune system plays a major role in how any given individual responds to the infectious agent. This response can be inadequate or too robust or appropriately effective. Regardless, the kinetics of the response by the cellular and humoral (antibody) immune systems to the infectious agent are often unknown. A basic critical question, then, is what do the dynamics of the immune response look like from exposure to and through the disease period and during convalescence for those who survive and those who don’t; and how might vaccines and therapies alter these profiles such that predictions of vaccine/drug efficacy could be inferred prior to vaccination/treatment and/or disease severity or progression be prognosticated. AditxtScore™ can be used to help address these questions with multiplex assays each designed to test and monitor the immune response to infectious agents. Based on the ability to run multiple tests in a single assay, 100 or more agents can potentially be tested for simultaneously.

License Agreement with Loma Linda University

On March 8, 2018, we entered into an Assignment Agreement (the “Assignment Agreement”) with Sekris Biomedical, Inc. (“Sekris”). Sekris was a party to a License Agreement with Loma Linda University (“LLU”), entered into and made effective on May 25, 2011, and amended on June 24, 2011, July 16, 2012 and December 27, 2012 (the “Original Agreement,” and together with the Assignment Agreement, the “Sekris Agreements”). Pursuant to the Assignment Agreement, Sekris transferred and assigned all of its rights and obligations in and to and liabilities under the Original Agreement, of whatever kind or nature, to us. In exchange, on March 8, 2018, we issued a warrant to Sekris to purchase up to 500,000 shares of our common stock (the “Sekris Warrant”). The warrant was immediately exercisable and has an exercise price of $4.00 per share. The expiration date of the warrant is March 8, 2023.

On March 15, 2018, aswe entered into a License Agreement with LLU, which was subsequently amended on July 1, 2020, we entered into a LLU License Agreement directly with Loma Linda University, which amends and restates the Sekris Agreements.

2020. Pursuant to the LLU License Agreement, we obtained the exclusive royalty-bearing worldwide license in and to all intellectual property, including patents, technical information, trade secrets, proprietary rights, technology, know-how, data, formulas, drawings, and specifications, owned or controlled by LLU and/or any of its affiliates (the “LLU Patent and Technology Rights”) and related to therapy for immune-mediated inflammatory diseases (the ADi™Adi™ technology). In consideration for the LLU License Agreement, we issued 25,000625 shares of Common Stock to LLU.

PEARSANTA, INC.

Formed in January 2023, our majority owned subsidiary Pearsanta™, Inc. (“Pearsanta”) seeks to take personalized medicine to a new level by delivering “Health by the Numbers.” On November 22, 2023, Pearsanta entered into an assignment agreement with FirstVitals LLC, an entity controlled by Pearsanta’s CEO, Ernie Lee (“FirstVitals”), pursuant to which FirstVitals assigned its rights in certain intellectual property and website domain to Pearsanta in consideration of the issuance of 500,000 shares of Pearsanta common stock to FirstVitals. On December 18, 2023, the board of directors of Pearsanta adopted the Pearsanta 2023 Omnibus Equity Incentive Plan (the “Pearsanta Omnibus Incentive Plan”), pursuant to which it reserved 15 million shares of common stock of Pearsanta for future issuance under the Pearsanta Omnibus Incentive Plan and the Pearsanta 2023 Parent Service Provider Equity Incentive Plan (the “Pearsanta Parent Service Provider Plan”) and approved the issuance of 9.32 million options, exercisable into shares of Pearsanta common stock under the Pearsanta Parent Service Provider Plan and the issuance of 4.0 million options, exercisable into shares of Pearsanta common stock, subject to LLU.vesting, and 1.0 million restricted common stock shares under the Pearsanta Omnibus Incentive Plan.

Pursuant

Since its founding, Pearsanta has been building the platform for enabling our vision of lab quality testing, anytime, anywhere. Our plan for Pearsanta’s platform is for it to be the LLU License Agreement, wetransactional backbone for sample collection, sample processing (on- and off-site), and reporting. This will require the development and convergence of multiple components developed by Pearsanta, or through transactions with third parties, including collection devices, “lab-on-a-chip” technologies, Lab Developed Test (LDT) assays, a data-driven analysis engine, and telemedicine. According to a comprehensive research report by Market Research Future, the clinical and consumer diagnostic market is estimated to hit $429.3 billion by 2030.

We believe that timely and personalized testing enables far more informed treatment decisions. Pearsanta’s platform is being developed as a seamless digital healthcare solution. This platform will integrate at-location sample collection, Point-of-Care (“POC”) and LDT assays, and an analytical reporting engine, with telemedicine-enabled visits with licensed physicians to review test results and, if necessary, order a prescription. Pearsanta’s goal of extending its platform to enable consumers to monitor their health more proactively as the goal is to provide a more complete picture about someone’s dynamic health status, factoring in genetic makeup and their response to medication. The POC component of Pearsanta would enable diagnostic testing at-home, at work, in pharmacies, and more to generate results quickly so that an individual can access necessary treatment faster. With certain infections, prescribing the most effective treatment according to one’s numbers can prevent hospital emergency room admissions and potentially life-threatening consequences.

Examples of indication-focused tests for the evaluation of advanced urinary tract infections (“UTIs”), COVID-19/flu/respiratory syncytial virus, sexually transmitted infections, gut health, pharmacogenomics (i.e., how your genes affect the way your body responds to certain therapeutics), and sepsis. We believe that these offerings are requirednovel and needed as the current standard of care using broad spectrum antibiotic treatment can be ineffective and potentially life-threatening. For example, improperly prescribed antibiotics may approach 50% of outpatient cases. Further, according to pay an annual license feearticle published in Physician’s Weekly, only 1% of board-certified critical care medicine physicians are trained in infectious disease.

Licensed Technologies – AditxtScoreTM

We issued Pearsanta an exclusive worldwide sub-license for commercializing the AditxtScore™ technology which provides a personalized comprehensive profile of the immune system. AditxtScore is intended to LLU. Also, we paid LLU $455,000detect individual immune responses to viruses, bacteria, peptides, drugs, supplements, bone marrow and solid organ transplants, and cancer. It has broad applicability to many other agents of clinical interest impacting the immune system, including those not yet identified such as emerging infectious agents.

AditxtScore is being designed to enable individuals and their healthcare providers to understand, manage and monitor their immune profiles and to stay informed about attacks on or by their immune system. We believe AditxtScore can also assist the medical community and individuals by being able to anticipate the immune system’s potential response to viruses, bacteria, allergens, and foreign tissues such as transplanted organs. This technology may be able to serve as a warning signal, thereby allowing for more time to respond appropriately. Its advantages include the ability to provide simple, rapid, accurate, high throughput assays that can be multiplexed to determine the immune status with respect to several factors simultaneously, in July 2020approximately 3-16 hours. In addition, it can determine and differentiate between distinct types of cellular and humoral immune responses (e.g., T and B cells and other cell types). It also provides for outstanding milestone paymentssimultaneous monitoring of cell activation and license fees. levels of cytokine release (i.e., cytokine storms).

We are also requiredactively involved in the regulatory approval process for AditxtScore assays for clinical use and securing manufacturing, marketing, and distribution partnerships for application in the various markets. To obtain regulatory approval to payuse AditxtScore as a clinical assay, we have conducted validation studies to LLU milestone paymentsevaluate its performance in connection with certain development milestones. Specifically, we are requireddetection of antibodies and plan to make the following milestone payments: $175,000 on March 31, 2022; $100,000 on March 31, 2024; $500,000 on March 31, 2026; and $500,000 on March 31, 2027. Additionally, as considerationcontinue conducting additional validation studies for prior expenses incurred by LLU to prosecute, maintain and defend the LLU Patent and Technology Rights, we made the following payments to LLU:, $70,000 due at the end of December 2018, and a final payment of $60,000 due at the end of March 2019. We are required to defend the LLU Patent and Technology Rights during the termnew applications in autoimmune diseases.

Advantages

The sophistication of the LLU License Agreement. Additionally, we will owe royalty payments of (i) 1.5% of Net Product Sales and Net Service Sales on any Licensed Products (defined as any finished pharmaceutical products which utilizesAditxtScore technology includes the LLU Patent and Technology Rights in its development, manufacture or supply), and (ii) 0.75% of Net Product Sales and Net Service Sales for Licensed Products and Licensed Services not covered by a valid patent claim for technology rights and know-how for a three (3) year period beyond the expiration of all valid patent claims. We also are required to produce a written progress report to LLU, discussing our development and commercialization efforts, within 45 days following the end of each year. All intellectual property rights in and to LLU Patent and Technology Rights shall remain with LLU (other than improvements developed by or on our behalf).following:

| ● | greater sensitivity/specificity. |

The LLU License Agreement shall terminate on the last day that a patent granted to us by LLU is valid and enforceable or the day that the last patent application licensed to us is abandoned. The LLU License Agreement may be terminated by mutual agreement or by us upon 90 days written notice to LLU. LLU may terminate the LLU License Agreement in the event of (i) non-payments or late payments of royalty, milestone and license maintenance fees not cured within 90 days after delivery of written notice by LLU, (ii) a breach of any non-payment provision (including the provision that requires us to meet certain deadlines for milestone events (each, a “Milestone Deadline”)) not cured within 90 days after delivery of written notice by LLU and (iii) LLU delivers notice to us of three or more actual breaches of the LLU License Agreement by us in any 12-month period. Additional Milestone Deadlines include: (i) the requirement to have regulatory approval of an IND application to initiate a first-in-human clinical trials on or before March 31, 2022, (ii) the completion of first-in-human (phase I/II) clinical trials by March 31, 2024, (iii) the completion of Phase III clinical trials by March 31, 2026 and (iv) biologic licensing approval by the FDA by March 31, 2027.

| ● | 20-fold higher dynamic range, greatly reducing signal to noise compared to conventional assays. |

| ● | ability to customize assays and multiplex a large number of analytes with speed and efficiency. |

| ● | ability to test for cellular immune responses (i.e., T and B cells and cytokines). |

| ● | proprietary reporting algorithm. |

License Agreement with Leland Stanford Junior University (“Stanford”)

On February 3, 2020, we entered into an exclusive license agreement (the “February 2020 License Agreement”) with Stanford with regard to a patent concerning a method for detection and measurement of specific cellular responses. Pursuant to the February 2020 License Agreement, we received an exclusive worldwide license to Stanford’s patent with regard to use, import, offer, and sale of Licensed Products (as defined in the agreement). The license to the patented technology is exclusive, including the right to sublicense, beginning on the effective date of the agreement, and ending when the patent expires. Under the exclusivity agreement, we acknowledged that Stanford had already granted a non-exclusive license in the Nonexclusive Field of Use, under the Licensed Patents in the Licensed Field of Use in the Licensed Territory (as those terms are defined in the February“February 2020 License Agreement”). However, Stanford agreed not to not grant further licenses under the Licensed Patents in the Licensed Field of Use in the Licensed Territory.

We were obligated On December 29, 2021, we entered into an amendment to pay and paid a fee of $25,000 to Stanford within 60 days of February 3, 2020. We also issued 18,750 shares of the Company’s common stock to Stanford. An annual licensing maintenance fee is payable by us on the first anniversary of the February 2020 License Agreement which extended our exclusive right to license the technology deployed in the amount of $40,000 for 2021 through 2024 AditxtScoreTM and $60,000 startingsecuring worldwide exclusivity in 2025 until the license expires upon the expiration of the patent. The Company is required to pay and has paid $25,000 for the issuances of certain patents. The Company will pay milestone fees of $50,000 on the first commercial sales of a licensed product and $25,000 at the beginning of any clinical study for regulatory clearance of an in vitro diagnostic product developed and a potential licensed product. We are also required to: (i) provide a listing of the management team or a schedule for the recruitment of key management positions by March 31, 2020 (which has been completed), (ii) provide a business plan covering projected product development, markets and sales forecasts, manufacturing and operations, and financial forecasts until at least $10,000,000 in revenue by June 30, 2020 (which has been completed), (iii) conduct validation studies by September 30, 2020 (which has been completed), (iv) hold a pre-submission meeting with the FDA by September 30, 2020 (which has been completed), (v) submit a 510(k) application to the FDA, Emergency Use Authorization (“EUA”), or a Laboratory Developed Test (“LDT”) by March 31, 2021, (vi) obtain FDA approval by December 31, 2021, (vii) complete a prototype assay kit by December 31, 2021 and (viii) have a written agreement with Stanford on further development and commercialization milestones for specificall fields of use by December 31, 2021.

of the licensed technology.

In addition

ADIVIR, INC.

Formed in April of 2023, Adivir™, Inc. is a wholly owned subsidiary, dedicated to the annual license maintenance fees outlined above,clinical and commercial development of innovative products, including anti-viral and other anti-infective products, for population health. These products have the potential to address a wide range of infectious diseases, including those that currently lack viable treatment options.

Background

On April 18, 2023, we entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with Cellvera Global Holdings LLC (“Cellvera Global”), Cellvera Holdings Ltd. (“BVI Holdco”), Cellvera, Ltd. (“Cellvera Ltd.”), Cellvera Development LLC (“Cellvera Development” and together with Cellvera Global, BVI Holdco, Cellvera Ltd. and Cellvera Development (the “Sellers”), AiPharma Group Ltd. (“Seller Owner” and collectively with the Sellers, “Cellvera”), and the legal representative of Cellvera, pursuant to which, the Company will pay Stanford royalties on Net Sales (as such term ispurchase Cellvera’s 50% ownership interest in G Response Aid FZE (“GRA”), certain other intellectual property and all goodwill related thereto (the “Acquired Assets”). Unless expressly stated otherwise herein, capitalized terms used but not defined herein have the meanings ascribed to them in the February 2020 License Agreement) duringAsset Purchase Agreement. Pursuant to the Asset Purchase Agreement, the consideration for the Acquired Assets consists of (A) $24.5 million, comprised of: (i) the forgiveness of the Company’s $14.5 million loan to Cellvera Global, and (ii) approximately $10 million in cash, and (B) future revenue sharing payments for a term of seven years. GRA holds an exclusive, worldwide license for the agreementantiviral medication, Avigan® 200mg, excluding Japan, China and Russia. The other 50% interest in GRA is held by Agility, Inc. (“Agility”).

Additionally, upon the closing, the Share Exchange Agreement previously entered into as follows: 4% when Net Sales are below or equal to $5 million annually or 6% when Net Sales are above $5 million annually. of December 28, 2021, between Cellvera Global Holdings, LLC f/k/a AiPharma Global Holdings, LLC (together with other affiliates and subsidiaries) and the Company, and all other related agreements will be terminated.

The February 2020 License Agreement may be terminated upon our election on at least 30 days advance notice to Stanford, or by Stanford if we: (i) are delinquent on any report or payment; (ii) are not diligently developing and commercializing Licensed Product; (iii) miss certain performance milestones; (iv) are in breach of any provisionobligations of the February 2020 License Agreement;Company to consummate the Closing are subject to the satisfaction or (v) provide any false reportwaiver, at or prior to Stanford. Should any events in the preceding sentence occur, we have a thirty (30) day cure periodClosing of certain conditions, including but not limited to, remedy such violation.the following:

Plan of Operations – Immune Reprogramming

High-level objectives for skin allograft clinical program:

| (i) | |||

Our FIH clinical studies will combine Phase I (designed to test clinical safety) and Phase IIa (designed to obtain proof of effectiveness in human subjects), in subjects requiring skin and other organ and/or tissue allografts. We have selected this indication for several reasons, including:

| (ii) |

| (iii) |

| (iv) |

| (v) | Receipt by the Company of a release from Agility; |

| (vi) | Execution of an agreement acceptable to the Company with respect to the acquisition by the Company of certain intellectual property presently held by a third party; |

| (vii) | Execution of an amendment to an asset purchase agreement previously entered into by Cellvera with a third party that effectively grants the Company the rights to acquire the intellectual property from the third party under such agreement; |

| (viii) | Receipt of a fairness opinion by the Company with respect to the transactions contemplated by the Asset Purchase Agreement; and |

| (ix) | Receipt by the Company from the Seller Owner of written consent, whether through its official liquidator or the Board of Directors of Seller Owner, to the sale and purchase of the |

There can be no assurance that |

We have already identified a clinical trial center with adequate patients, which we believe will simplify and reduce the time required for patient recruitment. Upon approval by the FDA and/or the applicable regulatory agency, and once the exact protocol has been determined in the preclinical studies, clinical trialsconditions to closing will be initiated.

High-level objectives for psoriasis clinical program:

Our FIH clinical studies will combine Phase I (designed to test clinical safety) and Phase IIa (designed to obtain proof of effectiveness in human subjects), in psoriasis patients. We have selected this indication for several reasons, including:

Wesatisfied or that the proposed acquisition will be identifying clinical trial centers with adequate patients. Upon approval by the FDA and/completed as proposed or the applicable regulatory agency clinical trials will be initiated.at all.

We are developing

Our commitment to building our immune monitoring platforms with the objective of utilizing them as clinical assays in pre-clinicalantiviral portfolio is strategic and clinical studies. The multiplex technologies could potentially allow evaluation of more analytes with less tissue samples.

Drug Approval Process

In the United States, FDA approval is required before any new drugs can be introduced to the market. We currently have a product candidate for our first-in-human studies, but as of the date of report, we have not submitted an application to the regulatory agencies for approval.

We are working with a contract manufacturer who has the know-how, product ingredients including plasmid DNA molecules, and our patent-pending bacterial strain. Several batch runs have been successfully completed to demonstrate our ability to produce the DNA plasmids in a GMP facility. Based on validation studies, we are reasonably confident in our ability to produce clinical grade product candidates at larger scales. The contract manufacturer has provided a proposal for manufacturing of our clinical grade material, which will be signed and accepted once we are ready to initiate GMP manufacturing. We are not currently party to an agreement with this contract manufacturer.

The product candidate selected for clinical trials must be subjected to pre-clinical safety/toxicology studies by an independent GLP (Good Laboratory Practice) laboratory to demonstrate its suitability for clinical testing in human patients. Upon completion of manufacturing and safety/toxicology testing, an Investigational New Drug (IND) application will be prepared for submission to the regulatory agencies.

Upon receipt of clearance to initiate clinical testing, the ADi™ product can be tested in human patients. Our product will be tested in clinical trials, one in patients with psoriasis and one in patients who require skin allografting. Therefore, our first-in-human studies will be combined Phase I/Phase IIa studies in which safety and efficacy data will be obtained. We plan to start with in skin indications (psoriasis and skin allografting) because we believe these indications will be most efficient in providing safety and efficacy data in clinical trials. In parallel, we will continue to develop additional product formulations for other indications.

We are developing our immune monitoring platforms with the objective of utilizing them as clinical assays in pre-clinical and clinical studies. The multiplex technologies could potentially allow evaluation of more analytes with less tissue samples. In the U.S., FDA approval is required before any In Vitro Diagnostic (“IVD”) device can be introduced to the market for clinical use (excluding research purposes). This process does not require clinical trials, but it does require validation data demonstrating accuracy of the device.

Target Market

In the U.S. alone, there are over 36,000 patients who receive organ transplantations each year, with more than 113,000 on transplant waiting lists.

The field of organ transplantation has been made possible and continues to rely on broad-acting immunosuppressive drugs, high levels of which can result in a compromised immune system that renders organ recipients susceptible to cancer and potentially life-threatening infections including re-activation of latent viruses.

In addition, immunosuppressants control acute rejection during the early time-period after receiving an organ but chronic rejection of the organ remains an unmet challenge for surgeons and transplant recipients.

While efforts have been made by various groups to promote tolerance through cell therapies and ex vivo manipulation of patient cells, these procedures take place outside the body and typically require hospitalization.

Moreover, transplanted patients will need re-transplantation at some point, with the possible exception of some newborn recipients. With increased incidence of preformed antibodies, these patients may never have the opportunity to receive another organ. Preformed antibodies can develop in previously transplanted patients, patients who have given birth, and patients who have previously received blood transfusions. These patients have much lower chances at qualifying to receive organs due to their increased risk of rejection – even with immune suppression. The potential to reduce formation of preformed antibodies in these patients will provide better opportunities for them to receive another transplanted organ.

There are gaps between current approaches and what the market needs.timely. We believe that ADi™ addresses these gaps. ADi™ is easythere has never been a more important time to administer (does not require ex-vivo treatment of patient cells), it does not appear to suppressaddress the immune system, it may allow patients to live with transplanted organs with significantly reduced immune suppression, it may provide for long-term survival of transplanted tissues and organs, may be more effective because it does not rely on a single immune pathway/mechanism, and potentially provides patients with pre-existing antibodies a chance to qualify to receive organs.

While these advantages present opportunities for unmet medical needs in the field of organ transplantation, the industry in which we operate is highly competitive. A small company such as us will meet significant challenges including regulatory requirements for approval of a new class of therapeutic agents, challenges in large scale manufacturing and marketing, cost of developing a novel therapeutic agent, which may require co-development partners who may or may not be willing to work with us, and the willingness of transplant surgeons to adopt our therapeutic vaccines in their existing immune suppression protocols. These challenges pose risks that we may not be able to overcome.

Operational Advantages

Location

We lease laboratory space in Mountain View, CA, located near resources including Stanford University (“Stanford”).

Strategic Partners

Our plan is to work with strategic partners to leverage common resources to accomplish milestones over the next 3 years and potentially get access to expertise, materials, and infrastructure (such as laboratory space) which we believe can be advantageous to our development. We hope that this strategy will reduce costs by obviating thegrowing global need to duplicate resources.

Intellectual Property (IP)

We strive to protect and enhance the proprietary technology, inventions, and improvementsuncover new treatments or commercialize existing ones that are commercially important to our business, including seeking, maintaining and defending patent rights, whether developed internally or licensed from third parties. Our policy is to seek to protect our proprietary position by, among other methods, filing patent applications in the United States and in jurisdictions outside of the United States, to protect our proprietary technology, inventions, improvements and product candidates that are important to the development and implementation of our business. We also rely on trade secrets and know-how relating to our proprietary technology and product candidates, continuing innovation, and in-licensing opportunities to develop, strengthen and maintain our proprietary position in the field of immuno-therapy. We also plan to rely on data exclusivity, market exclusivity, and patent term extensions when available. Our commercial success will depend in part on our ability to obtain and maintain patent and other proprietary protection for our technology, inventions, and improvements; to preserve the confidentiality of our trade secrets; to obtain and maintain licenses to use intellectual property owned by third parties; to defend and enforce our proprietary rights, including any patents that we may own in the future; and to operate without infringing on the valid and enforceable patents and other proprietary rights of third parties.

The ADi™ technology and its various components are protected by multiple families of patents and patent applications, including several U.S. and non-U.S. issued patents. As of the date of this report, our patent portfolio licensed from LLU includes 8 U.S. patents, 3 U.S. pending patent applications, 87 foreign patents, and 14 foreign pending patent applications directed to ADi™ and related technologies. The ADi™ patents are broadly categorized into three groups, one for autoimmune diseases and type 1 diabetes; one for organ transplantation and a method of producing plasmid DNA that is mammalian-like to prevent immune activation; and one providing patent protection for a composition of matter for a tolerance delivery system for antigens of interest that would be relevant for various given indications. The third group is the basis for a platform allowing development of a new class of immunotherapeutics for various indications. The projected expiration dates for these ADi™ patents ranges from 2021 to 2034. The AditxtScore™ technology licensed from Stanford is protected by a U.S. patent which encompasses methods, systems and kits for detection and measurement of specific immune responses. The patent has been issued by the USPTO and expires on December 28, 2037. We also possess and/or in-license substantial know-how and trade secrets relating to the development and commercialization of our product candidates, including related manufacturing processes and technology. We plan to continue expanding and strengthening our IP portfolio with additional patent applications in the future.

In March 2021, Aditxt has signed an agreement with a regulatory consultant based in Munich, Germany, which will play a central role in navigating the first AditxtReprogrammingTM therapeutic program through the clinical trial and regulatory process. The firm will work with the Aditxt's AditxtReprogrammingTM team to submit an Investigational New Drug application (IND) to the regulatory agency in Germany. Psoriasis is the first indication being targeted for clinical trial in the AditxtReprogrammingTM therapeutics pipeline. Other candidates that are advancing toward clinical trials include ADi™ for type 1 diabetes and skin allografting.

Plan of Operations – Immune Monitoring

As previously announced on August 6, 2020, the initial application of the platform will be AditxtScore™ for COVID-19 which has been designed to provide a more complete assessment of an individual’s infection and immunity status with respect to the SARS-CoV-2 virus. Infection status will be determined by evaluating the presence or absence of the virus, and immunity status by measuring levels of antibodies againsttreat life-threatening global viral antigens and their ability to neutralize the virus. We will soon be expanding the panel to measure other components of the immune response such as cellular immunity.

In August 2020, we filed for an Emergency Use Authorization (EUA) with the FDA with the ultimate objective of filing a 510(K) application. We are in the process of filing an amended application to incorporate additional data and information about the use of the assay. In the meantime, we are providing AditxtScore™ as a service as a Laboratory Developed Test (LDT) to assess immunity status to COVID-19.

In early 2021, we established our AditxtScore™ Immune Monitoring Center in Richmond, Virginia (the “Center”). The Center operates as a Clinical Laboratory Improvement Amendments (CLIA) certified facility for the processing of our AditxtScore™ for COVID-19 Lab Developed Test (LDT) for our prospective channel partners, including labs and hospitals.infections.

Employees

We have forty-three (43)forty-seven (47) full time employees.employees as of December 31, 2023. We consider the relations with our employees to be good.

Item 1A. Risk Factors.

You should carefully consider the risks described below, as well as general economic and business risks and the other information in this Annual Report on Form 10-K. The occurrence of any of the events or circumstances described below or other adverse events could have a material adverse effect on our business, results of operations and financial condition and could cause the trading price of our common stock to decline. Additional risks or uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

Risks Related to Our Financial Position and Need for Capital

We have generated no significant revenue from commercial sales to date and our future profitability is uncertain.

We were incorporated in September 2017 and have a limited operating history and our business is subject to all of the risks inherent in the establishment of a new business enterprise. Our likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with development and expansion of a new business enterprise. Since inception, we have incurred losses and expect to continue to operate at a net loss for at least the next several years as we commence our research and development efforts, conduct clinical trials and develop manufacturing, sales, marketing and distribution capabilities. Our net loss for the years ended December 31, 20202023 and 20192022 was $9,149,227$32,390,447 and $5,827,728,$27,549,876, respectively, and our accumulated deficit as of December 31, 20202023 was $20,879,178.$127,635,389. There can be no assurance that the products under development by us will be approved for sale in the U.S. or elsewhere. Furthermore, there can be no assurance that if such products are approved, they will be successfully commercialized, and the extent of our future losses and the timing of our profitability are highly uncertain. If we are unable to achieve profitability, we may be unable to continue our operations.

If we fail to obtain the capital necessary to fund our operations, we will be unable to continue or complete our product development and you will likely lose your entire investment.

We will need to continue to seek capital from time to time to continue development of our lead drug candidate beyond our initial combined Phase I/IIa clinical trial and to acquire and develop other product candidates. Once approved for commercialization, we cannot provide any assurances that any revenues it may generate in the future will be sufficient to fund our ongoing operations. Our current cash position, we expect to be sufficient to satisfy our capital requirements sufficient to fund our operations for the foreseeable future.

Our business or operations may change in a manner that would consume available funds more rapidly than anticipated and substantial additional funding may be required to maintain operations, fund expansion, develop new or enhance products, acquire complementary products, business or technologies or otherwise respond to competitive pressures and opportunities, such as a change in the regulatory environment or a change in preferred treatment modalities. In addition, we may need to accelerate the growth of our sales capabilities and distribution beyond what is currently envisioned, and this would require additional capital. However, we may not be able to secure funding when we need it or on favorable termsterms. We may not be able to raise sufficient funds to commercialize the product candidates we intend to develop.

If we cannot raise adequate funds to satisfy our capital requirements, we will have to delay, scale back or eliminate our research and development activities, clinical studies or future operations. We may also be required to obtain funds through arrangements with collaborators, which arrangements may require us to relinquish rights to certain technologies or products that we otherwise would not consider relinquishing, including rights to future product candidates or certain major geographic markets. This could result in sharing revenues which we might otherwise retain for ourselves. Any of these actions may harm our business, financial condition and results of operations.