UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ Annual Report pursuant to SectionANNUAL REPORT PURSUANT TO SECTION 13 orOR 15(d) of the Securities Exchange Act ofOF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedended: December 31, 20202023

or

☐ Transition Report pursuantTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to Section 13 or 15(d) of the Securities Exchange Act of 1934_______________

Commission File Number: 333-165972001-41594

BOXSCORE BRANDS,AMERICAN BATTERY MATERIALS, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 22-3956444 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

(800) 998-7962800-998-7962

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: NoneAct

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities ActAct. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐☒ No ☒☐

Indicate by check mark whether the registrant has submitted electronically every Interactive DateData File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”filer”, “smaller reporting company,“company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.Act ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit reportreport. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined byin Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregateAggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $127,545 based upon the price of the registrant’s common stock on June 30, 2020. 2023: $13,963,544

The number of shares outstanding of the registrant’s common stock $0.001 par value per share, was 226,604,039 sharesoutstanding as of September 24, 2021.April 1, 2024: 11,375,459.

Documents Incorporated by Reference: NoneDOCUMENTS INCORPORATED BY REFERENCE

None.

BOXSCORE BRANDS,

AMERICAN BATTERY MATERIALS, INC.

Table of Contents

FORM 10-K

December 31, 2023

TABLE OF CONTENTS

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

PART I

Forward Looking Information

This annual reportExcept for historical information, this Annual Report on Form 10-K (the “Annual Report”) contains forward-looking statements about future events and expectations that are characterized as “forward-looking statements.” Forward-lookingwithin the meaning of the federal securities laws. Such forward-looking statements are based uponon management’s beliefs,current expectations, assumptions, and expectations. Forward-lookingbeliefs concerning future developments and their potential effect on our business, and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition, and stock price. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” “will,” “would”, “if, “shall”, “might”, “will likely result, “projects”, “goal”, “objective”, or “continues”, or the negative of these terms or other comparable terminology, although the absence of these words does not necessarily mean that a statement is not forward-looking. Additionally, statements concerning future matters such as our business strategy, development of new products, sales levels, expense levels, cash flows, future commercial and financing matters, future partnering opportunities and other statements regarding matters that are not historical are forward-looking statements.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We believe that these risks and uncertainties include, but are not limited to, those described in the “Risk Factors” section of this Annual Report, which include, but are not limited to, the following:

| ● | doubt regarding our ability to continue as a going concern; |

| ● | the need for additional capital to fund our operations; |

| ● | potential challenges and uncertainties in our new lithium extraction operation, such as unexpected geological formations, technological hurdles, regulatory changes, unforeseen costs, and construction delays; |

| ● | anticipated exploration results, feasibility assessments, regulatory approvals, and property development plans; |

| ● | expected growth in the lithium battery market; |

| ● | intense competition in our market and the lack of sufficient financial and other resources to maintain and enhance our competitive position; |

| ● | our expectations, beliefs, future plans, strategies, and anticipated developments; |

| ● | anticipated government regulations concerning electric and gas-powered vehicles; |

| ● | evaluation of strategic alternatives related to our business; |

| ● | timeframe for addressing internal control weaknesses and improving disclosure controls; |

| ● | our expectation of obtaining or renewing permits; |

| ● | other risks detailed in the “Risk Factors” section. |

The risks described above should not be construed as exhaustive and should be read with the other cautionary statements in this Annual Report.

ii

Although we base these forward-looking statements on assumptions that we believe are reasonable when made, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this Annual Report. The matters summarized under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Business”, and elsewhere in this Annual Report could cause our actual results performance, andto differ significantly from those contained in our forward-looking statements. In addition, even if our results of operations, financial condition and liquidity, and industry developments are consistent with the forward-looking statements contained in this Annual Report, those results or developments may not be indicative of results or developments in subsequent periods.

We operate in a very competitive and rapidly changing environment. New risks emerge from time-to-time. It is not possible for our management to bepredict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially different from the expectations of future results, performance, and financial conditionthose contained in any forward-looking statements we express or imply in such forward-looking statements. You are cautioned not to put undue reliance on forward-looking statements. Exceptmay make. Moreover, except as required by federal securities laws,law, neither we disclaimnor any intent orother person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements whetherfor any reason after the date of this Annual Report to conform these statements to actual results or to changes in our expectations. You should, however, review the risks we describe in the reports we will file from time to time with the SEC after the date of this Annual Report. Readers are urged to carefully review and consider the various disclosures made in this Annual Report.

Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

CERTAIN REFERENCES AND NAMES OF OTHERS USED HEREIN

This Annual Report may contain additional trade names, trademarks, and service marks of others, which are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

OTHER INFORMATION

As used in this Annual Report on Form 10-K, the terms “we”, “us”, “our”, “BLTH”, the “registrant”, and the “Company” refer to AMERICAN BATTERY MATERIALS, INC., a Delaware corporation, unless otherwise stated. “SEC” and the “Commission” refer to the Securities and Exchange Commission. Reverse split occurred and is reflected (p. F-13)

iii

PART I

Item 1. Business.

Overview of Our Company

We operate as a resultU.S. based renewable energy company focused on the extraction, refinement and distribution of new information, future events, or otherwise.

Overview

BoxScore Brands, Inc. (formerly U-Vend Inc.) (the “Company”)technical minerals in an environmentally responsible manner. We formerly developed, marketed and distributed various self-serve electronic kiosks and mall/airport co-branded islands throughout North America. Due to the nationwide shutdown related to the COVID-19Covid-19 pandemic, the Companywe spent a portion of 2020 restructuring and retiring certain corporate debt and obligations. The Company focusedobligations, and focusing on implementing a new operational direction. After

Through the corporate reorganization and repositioning process, we found a thorough evaluationunique opportunity to acquire mining claims that historically reported high levels of lithium and other tech minerals. We hired and affiliated ourselves with industry veterans that bring decades of experience, credibility and relationships.

On November 5, 2021, we acquired the rights to 102 federal mining claims located in the Lisbon Valley of Utah for $100,000 plus the future payment of royalties based on a percentage of the net revenue from the sale of lithium produced from a portion of the mining property. The acquisition was driven by historical mineral data from seven existing wells with brine aquifer access. We have not yet commenced any mining operations, and we are an exploration stage issuer, as defined in SEC Regulation S-K Item 1300 (“Regulation S-K 1300”). An independent third-party technical report indicated that further investment and development in the claims was warranted, although no determination has been made whether we have any reserves of minerals. Similarly, no determination has been made whether mineralization could be economically and legally produced or extracted. We have no mineral reserves as defined by Regulation S-K 1300 and have had no mining revenue to date.

In July 2023, we acquired and staked additional lithium mining claims adjacent to our Lisbon Valley Project in Utah. The new claims have been registered with the Bureau of Land Management (BLM). We now own a total of 743 placer claims over 14,320 acres, comprised of the 102 original claims held and the 641 new claims.

Our Growth Strategy

Our strategic goal is to become a producer of lithium in the United States. We believe that a strategy of employing advanced brine extractive technology methodologies for selective mineral extraction is the most cost-effective and environmentally friendly approach currently available. We believe that this approach is environmentally friendly because we would not deconstruct land structures which leave dirty tailings, but rather we would extract the desired minerals and metals from subsurface brines that re-inject the brines back down into the aquafer to maintain pressure after lithium extraction. We plan, as part of our sustainability goals within our overall environmental, social and governance (“ESG”) strategy, to develop sustainable production operations. Our plan is to develop our projects and strategic equity investments on a measured timeline to provide the potential for both near-term cash flow and long-term value maximization.

We have been executing the necessary steps to determine analytical results from our technical report, which should provide current results, analytical, geotech modeling, aquifer modeling, recharge, flows and depth. We have engaged RESPEC Company LLC as our geotech, engineering and resource management partner to assist in the exploration of the Lisbon Valley brine extraction project. Leveraging its expertise, we will focus on several initiatives, which include the following:

| ● | advancement of geotech, engineering, geology and fieldwork to complete technical reports on the Lisbon Valley Project; |

| ● | understanding Lisbon Valley brines, on and around owned leases; |

| ● | develop a well plan to re-enter, sample and test the “Superior Well,” that has a historical lithium concentration of 340 ppm (parts per million); |

| ● | enter other prospective plugged and abandoned wells, taking brine samples and performing hydrological testing at each identified high potential zone to evaluate the properties of the clastic formation; |

| ● | as information is advanced, prepare technical reports following the Regulation S-K 1300 Standards of Disclosure for Mineral Projects, initially a Preliminary Economic Assessment (PEA) and longer term, a Preliminary Feasibility Study (PFS); |

| ● | test the collected brines for lithium, but also for previously identified high value elements such as cobalt, manganese, magnesium, and suites of metals in the alkaline earth metals, transition metals, and halogens group; and |

| ● | based on the results of the Superior well, develop area resource estimates. |

The Lisbon Valley of Utah also provides many added benefits:

| ● | historically rich industrial and natural resource extraction area; |

| ● | a developed infrastructure including high voltage electrical, proximity to major roadways and rail spurs; and |

| ● | state and local agency support through the Utah Division of Oil, Gas and Mining (UDOGM) and the Trust Land Administration (SITLA). |

We will also look to expand our holdings in the Lisbon Valley area with the acquisition of additional mineral claims and joint venture opportunities. We continue to explore and evaluate opportunities to further expand our resource base and production capacity through the possible acquisition of properties and projects in other areas of the United States, as well as in South America, particularly Argentina.

As part of our strategy for growth, our projects and strategic investments will be developed on a measured timeline, and we will evaluate all opportunities to further expand our resource base and production capacity. We understand that our timelines are subject to a variety of risks and variables, including, without limitation, obtaining permits, approvals and funding. We are also focused on the implementation of direct lithium extraction (DLE) technologies, which we believe have the potential to significantly increase the supply of lithium from our brine projects, similar to the impact which shale did for oil.

To achieve our goal of becoming a producer of lithium, we will rely on our competitive strengths and experienced management team to explore and consider all opportunities to generate revenue and increase our projects, properties and assets, as well as all potential funding options. Some opportunities for growth may be in the form of (i) strategic partnerships, (ii) off-take agreements, (iii) diversification of projects and properties, (iv) acquisitions of companies and technologies, and (v) participation in related commercial development activities.

The Lithium Market

Lithium is on the list of the 35 minerals considered critical to the economic and national security of the United States, as first published by the U.S. Department of the Interior on May 18, 2018. In June 2021, the U.S. Department of Energy published a report titled “National Blueprint for Lithium Batteries 2021-2030” (the “NBLB Report”) which was developed by the Federal Consortium for Advanced Batteries (“FCAB”), a collaboration by the U.S. Departments of Energy, Defense, Commerce, and State. According to the Report, one of the main goals of this U.S. government effort is to “secure U.S. access to raw materials for lithium batteries.” In the NBLB Report, Jennifer M. Granholm, the U.S. Secretary of Energy, states: “Lithium-based batteries power our daily lives from consumer electronics to national defense. They enable electrification of the transportation sector and provide stationary grid storage, critical to developing the clean-energy economy.”

The NBLB Report summarizes the U.S. government’s views on the need for lithium and the expected growth of the lithium battery market as follows:

| ● | “A robust, secure, domestic industrial base for lithium-based batteries requires access to a reliable supply of raw, refined, and processed material inputs…” |

| ● | “The worldwide lithium battery market is expected to grow by a factor of 5 to 10 in the next decade.” |

The growth in electric vehicles (“EVs”) will provide the greatest needs for lithium-based batteries. The NBLB Report states: “Bloomberg projects worldwide sales of 56 million passenger electric vehicles in 2040, of which 17% (about 9.6 million EVs) will be in the U.S. market.” Source: NBLB Report (defined above). Original Source: Bloomberg NEF Long-Term Electric Vehicle Outlook 2019.

In a February 2021 report, Canalys, a global technology market analyst firm, states that global sales of EVs in 2020 increased by 39% year on year to 3.1 million units. This compares with a sales decline of 14% of the total passenger car market in 2020. Canalys forecasts that the number of EVs sold will rise to 30 million in 2028 and EVs will represent nearly half of all passenger cars sold globally by 2030.

Bloomberg’s Long-Term Electric Vehicle Outlook 2021 report states: “The outlook for EV adoption is getting much brighter, due to a combination of more policy support, further improvements in battery density and cost, more charging infrastructure being built, and rising commitments from automakers. Passenger EV sales are set to increase sharply in the next few years, rising from 3.1 million in 2020 to 14 million in 2025. Globally, this represents around 16% of passenger vehicle sales in 2025, but some countries achieve much higher shares. In Germany, for example, EVs represent nearly 40% of total sales by 2025, while China — the world’s largest auto market — hits 25%.”

Regarding the lithium battery growth derived from grid storage demands, the NBLB Report states: “In addition to the EV market, grid storage uses of advanced batteries are also anticipated to grow, with Bloomberg projecting total global deployment to reach over 1,095 GW by 2040, growing substantially from 9 GW in 2018;” and “Bloomberg forecasts 3.2 million EV sales in the U.S. for 2028, and over 200 GW of lithium-ion battery-based grid storage deployed globally by 2028. With an average EV battery capacity of 100 kWh, 320 GWh of domestic lithium-ion battery production capacity will be needed just to meet passenger EV demand.

On August 25, 2022, the Washington Post published an article titled “Did California just kill the gas-powered car?” and with the sub-heading “California’s decision to ban the sales of combustion engine cars is the latest victory in the transition to electric vehicles.” A particularly relevant passage from this article reads as follows:

“…the transition from gas-powered, internal combustion engine vehicles to electric vehicles no longer feels niche, or speculative. It feels inevitable. And this week, another profound development: California, which already leads the nation with 18 percent of new cars sold electric, is expected to approve a regulation to ban the sales of new gas-only powered vehicles by 2035. In addition to EVs, only a limited number of plug-in hybrids will be allowed to be sold. This is a big deal: California’s car market is only slightly smaller than those of France, Italy and Britain — and while many countries have promised to phase out sales of gas cars by such-and-such date, few have concrete regulations like California. Sixteen states have traditionally followed California’s lead in setting its own independent fuel standards — they could soon follow.”

Although no assurances can be given, these recent developments, if left unchallenged, may potentially increase demand for lithium in the U.S., as well as globally. Benchmark Mineral Intelligence, a global consulting firm specializing in the battery supply chain market, in a September 6, 2022 report, predicted that:

| ● | demand for lithium-ion batteries is set to grow six-fold by 2032 as global automakers scale up production of EVs; and |

| ● | to meet the world’s lithium requirements would require 74 new lithium mines with an average size of 45,000 tonnes by 2035. |

While these figures are robust relative to historical data, there can be no guarantee that ultimate consumer adoption for EVs and plug-in-hybrid vehicles (PHEV) will drive lithium demand as predicted.

Lithium Brine Deposits and Direct Lithium Extraction

Lithium is mined from three different deposit types: lithium brine deposits, pegmatite lithium deposits (also referred to as “hard rock”), and sedimentary lithium deposits (also referred to as clay deposits). Brine deposits are the most common, accounting for more than half of the world’s known lithium reserves. All our projects are in brine deposits.

As described by the U.S. Geological Survey, lithium brine deposits are accumulations of saline groundwater that are enriched in dissolved lithium. All producing lithium brine deposits share a number of first-order characteristics: (1) arid climate, (2) closed basin containing a playa or salar, (3) tectonically driving subsidence, (4) associated igneous or geothermal activity, (5) suitable lithium source-rocks, and (6) one or more adequate aquifers. South American countries Chile and Argentina are where the majority of the lithium produced from brines originates, as well as Nevada, to a much smaller extent.

It is anticipated that we will use a direct lithium extraction (“DLE”), and reinjection of the processed brine back into the subsurface, rather than using evaporation ponds to recover the lithium and other potential mineral from brines, should the project advance to the production stage. This method has been gaining favor in the lithium industry over the last several years because it does not involve the use of evaporation ponds. DLE uses a much smaller footprint than evaporation ponds and is therefore more acceptable from an environmental standpoint. As yet, we have not done any testing for the possibility of using DLE and will not be able to do any testing until samples of brine are acquired from the target formations.

DLE technologies precipitate lithium out of brine using filters, membranes, ceramic beads, or other equipment, which is often housed in a small warehouse, significantly shrinking the environmental footprint of evaporation ponds used to produce commercial quantities of lithium traditionally. In a DLE operation, brine is pumped to a processing unit where an adsorption, resin or membrane material is used to extract only the lithium from the brine, while spent brine can be reinjected into the basin aquifers. The more rapid production time frame and possible brine reinjection into the aquifer is a key environmental differentiator between the DLE process and traditional lithium process that uses evaporation ponds.

While there may still be challenges around scalability, water consumption, and the Company foundpossible dilutive effects of brine reinjection, over the past decade many DLE technologies have arisen to separate lithium from brine. DLE has the potential to significantly impact the lithium industry, with implementation on the extraction of lithium brines potentially having a dramatic positive impact on production, capacity, timing, and environmental impact. Similar to the impact shale exploration had on the oil industry, DLE has the potential to significantly increase the supply of lithium from brine projects, nearly doubling lithium production/yield (taking recoveries from 40-60% to 70-90%+) and improving project returns. DLE should also offer lower perceived environmental risk and yield significant environmental benefits when compared to traditional brine ponds, offering sustainability benefits and ESG credentials. It is estimated that approximately 12% of the world’s lithium supply in 2019 was produced using DLE technology. DLE technologies are broadly grouped into three main categories: adsorption, ion exchange and solvent extraction.

| ● | Adsorption physically absorbs LiCl molecules onto the surface of a sorbent from a lithium loaded solution. The lithium is then stripped from the surface of the sorbent with water. |

| ● | Ion exchange takes lithium ions from the solution and replaces them with a different positively charged cation that is contained in the sorbent material. An acidic (or basic) solution is required to strip the lithium from the material and regenerate the sorbent material. |

| ● | Solvent extraction removes lithium ions from solution by contacting the solution with an immiscible fluid (i.e., oil or kerosene) that contains an extractant that attaches to lithium ions and brings them into the immiscible fluid. The lithium is then stripped from the fluid with water or chemical treatment. |

Our identification as an “environmentally friendly” business is evidenced by our commitment to deploy direct lithium extraction rather than the typical extraction techniques of hard-rock mining or underground brine water. Unlike those traditional methods for producing lithium, DLE uses filters, membranes, or resin materials to extract the mineral from brine water, resulting in:

| ● | usage of less water; |

| ● | recycling of the majority of the brine water used; |

| ● | consumption of less fossil fuels; |

| ● | reduction in the need for additional processing and alternative mining sources; and |

| ● | leaving a smaller environmental footprint. |

Traditionally, lithium produced from brine water is stored in evaporation ponds. As the water evaporates, the other elements of the brine such as magnesium or calcium precipitate out, leaving the brine more concentrated to produce lithium carbonate. The evaporation process can take 9-18 months depending on the type of project and weather conditions. With DLE, that process can be shortened to days or even hours. DLE also reduces the amount of land required for the pond evaporation process, while the potential to reinject the remaining brine water after the process further reduces the environmental impact.

Our Market Opportunity

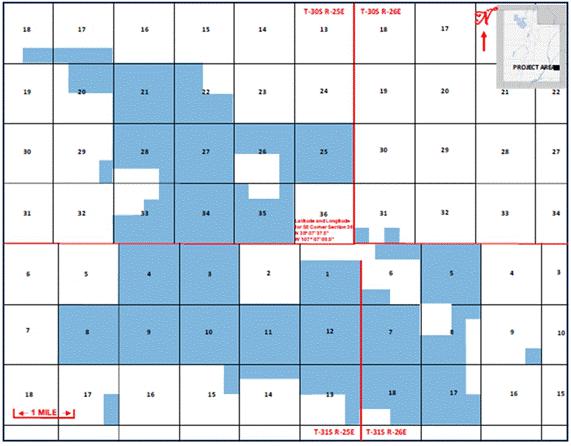

Our Lisbon Valley Project (the “Project”) is located in San Juan County, Utah, approximately 35 miles southeast of the city of Moab, part of an area known as the Paradox Basin. The Project consists of 743 placer mining claims staked on U. S. government land administered by the BLM covering 14,300 acres, part of a semi-contiguous group named the LVL Group. The below map shows the approximate location of our claims:

The maps above are referenced with Professional Land Survey System (PLSS) and a latitude/longitude reference coordinate, accurate to 50 feet.

Our placer claims are plotted on the figures above, which is a Public Land Survey System (PLSS) map using Salt Lake City Prime Meridian. The claims are located in Southeast Utah in sections 17-18, 20-22, 25-29, 33-35 of Township 30 South and Range 25 East; sections 1, 3, 4, 8-15 of Township 31 South and Range 25 East; sections 31 of Township 30 South and Range 26 East and sections 5-9, 17 and 18 of Township 31 South and Range 26 East. The latitude and longitude of the southeast corner of Section 36, Township 30 South, 25 East is noted on the figure is accurate to +/- 50 feet.

There is a network of dirt and paved roads within the claims area, which service the oil and gas wells and the Lisbon Valley Copper Mine. Two existing natural gas pipelines traverse the claims. Power is supplied to the copper mine, also within the claim area, for use in their electrowinning copper recovery process. Nine wellbores (8 oil and gas and 1 potash) are available for re-entry and nearby water rights and private land are available for sale or lease.

Moab, Utah, the nearest population center to the property, is a city of 5,336 persons (2020 Census). It is located in a relatively remote portion of Utah but is easily accessed by U. S. Highway 191. Highway 191 intersects with Interstate 70 about 30 miles (48 kilometers) north of Moab, at Crescent Junction. Moab is a tourist destination and has numerous motels and restaurants. Moab would also be the nearest source of labor in the region.

The region has a history of mining, primarily uranium and vanadium that dates back as far as 1881. The Lisbon Valley Copper Mine is in the heart of the Lisbon Valley and is currently producing copper cathode. An all-weather road and electric power supply the mine. A few gravel roads cross the property. Oil and gas drilling and production, along with ranching have made the area relatively accessible.

There has been no exploration or drilling conducted on the property by us or our predecessors other than the gathering and assimilation of data from all available sources. It will be necessary for us to re-enter an oil and gas well or to drill a new well to obtain brine samples for analysis and metallurgical testing. Permits for such operations will be required from the BLM and the UDOGM. We are in the process of permitting two appraisal wells.

We believe there is abundant evidence from oil, gas and potash wells drilled in the Paradox Basin indicating a probability of identifying and producing super saturated brines from beneath the Project. The geology of the area of the Project and of the Paradox Basin as a whole is complex, although zones have been targeted and proven and they are mappable within and beyond the claims area. It is not likely that the same zones vary significantly in terms of reservoir quality and thickness as evidenced by log analysis; however, these parameters have not been confirmed by actual testing by us.

We have not calculated mineral and resource estimation and has no revenue being generated from the subject property. The only way to determine if the lithium enriched brines exist and can be economically produced from the target zones is to drill exploration wells to produce and test brine from the targeted zones. We through our wholly owned operating company Mountain Sage Minerals, LLC intends to drill two appraisal wells on the subject property to evaluate reservoir properties (porosity, permeability and pressure), flow rates and in situ mineral concentrations. Information from the two wells will be used to assess the resource potential and devise a detailed development plan.

The subsurface data collected from the two wells will be used to refine our proprietary subsurface model. The development model will include a proprietary 3D seismic survey to refine the subsurface model and delineate reservoir(s) continuity below the subject property and allow the team to select optimal spacing of future well locations and the network of production and injection wells required to fully develop potential mineral (brine) resources. Based on a substantial number of studies with lithium analyses from the Paradox Basin, we believe there is a substantial long-term demandindication that lithium mineralization in brines occurs beneath the Project.

We have retained a third-party consulting firm to assist with drilling, completion and review of test results for specific commodities relatingthe two appraisal wells. Any extracted brines should be tested to batterydetermine lithium and new energy technologies.other important mineral concentrations and to prove the economic viability of a pilot and permanent production program. We have identified an appraisal and development program that is proprietary. This presents a timelyinformation will be disclosed in an advanced technical report after the appraisal wells are drilled and unique opportunity basedindividual zones are identified and fully evaluated. Cost estimates and authority for expenditures for both well tests and the 3D Survey are currently in process.

The Technical Report Summary on rising demand characteristics. By capitalizingthe Project prepared by Bradley C. Peek, MSc. of CPG Peek Consulting, Inc., in accordance with Regulation S-K 1300, is included as an exhibit to our registration statement, filed on market trends and current sustainable energy government mandates and environmental, social, and corporate governance (ESG) initiatives, we will focus on bringing a vertically-integrated solution to market.

Asset Sale

On March 18, 2019, the Company approved an asset saleFebruary 12, 2024. The effective date of the assetsreport is October 31, 2023.

Internal Controls

Even though we have yet to establish mineral resource and reserve estimates, we have established internal controls for reviewing and documenting the information we intend to use to support mineral reserve and mineral resource estimates. We have engaged third party service providers and specialists in geosciences, and data and engineering for exploration and mine productivity and efficiency. A review of all progress on the development of our mineral resources and reserves estimates, including related to the legacy MiniMelts brand for $350,000 in cash, which was approvedassumptions, is undertaken and finalized by a majority of its shareholders. These MiniMelts assets generated 100% of the revenue reported during the year ended December 31, 2019. Part of the proceeds from the sale was used to retire certain lease obligationsour qualified person (“QP”).

When determining resources and reserves, as well as the differences between resources and reserves, our QP will develop specific criteria, each of which must be met to qualify as a resource or reserve, respectively. The QP and our management must agree on the reasonableness of the criteria for general operating purposes.the purposes of estimating resources and reserves. These criteria, such as demonstration of economic viability, points of reference, and grade, must be specific and attainable. All estimates require a combination of historical data and key assumptions and parameters. When possible, historical data and resources, data from public information, and generally accepted industry sources will be used to develop these estimations.

EmployeesWe have developed quality control and quality assurance (“QC/QA”) procedures at our Lisbon Valley property, which were reviewed by our QP to ensure the process for developing mineral resource and reserve estimates is sufficiently accurate. QC/QA procedures include independent checks on samples by third party laboratories, and duplicate sampling, among others. In addition, our QP will review the consistency of historical production as part of its analysis of the QC/QA procedures.

We recognize the risks inherent in mineral resource and reserve estimates, such as the geological complexity, interpretation and extrapolation of data, changes in operating approach, macroeconomic conditions and new data, among others. Overestimated resources and reserves resulting from these risks could have a material effect on future profitability.

Raw Materials

We do not have any material dependence on any raw materials or raw material suppliers. All the raw materials that we need are available from numerous suppliers and at market-driven prices.

Intellectual Property

We do not own or license any intellectual property which we consider to be material.

Sales and Marketing

We currently do not have the commercial capabilities required to market and distribute lithium. There is no assurance that we will be able to attain the necessary sales and marketing capabilities or secure the services of a firm to provide those capabilities, to achieve our sales expectations.

Customers

We have no customers and have no off-take agreements with customers at this stage of our development.

Future Production and Sales

We expect the demand for our lithium, if and when in production, to be facilitated by increasing global demand for lithium. We intend on utilizing intermediaries for sales in order to focus on our core competencies of exploration and extraction.

Competition and Market Barriers

We compete with other mineral and chemical processing companies in connection with the acquisition of suitable exploration properties and the engagement of qualified personnel. Many of our competitors possess greater financial resources and technical facilities than we do. Although we aspire to be a leading lithium producer, the lithium mining and chemical industries are fragmented. We are one of many participants in these sectors. Many of our competitors, as compared to us, have been in business longer, have established more strategic partnerships and relationships, and have greater financial accessibility.

While we compete with other exploration companies in acquiring suitable properties, we believe there will be readily available purchasers of lithium chemical products or other industrial minerals if they are produced from any of our owned or leased properties. The price of our planned products may be affected by factors beyond our control, including fluctuations in the market prices for lithium, supplies of lithium, demand for lithium, and mining activities of others. If we identify lithium mineralization that is determined to be of economic grade and in sufficient quantity to justify production, additional capital would be required to develop, mine and sell that production.

Government Regulation

Exploration and development activities for our projects are subject to extensive laws and regulations, which are overseen and enforced by multiple U.S. federal, state and local authorities as well as foreign jurisdictions. These applicable laws govern exploration, development, production, exports, various taxes, labor standards, occupational and mine health and safety, waste disposal, protection and remediation of the environment, protection of endangered and protected species, and other matters. Various permits from government bodies are required for drilling, mining, or manufacturing operations to be undertaken, and we cannot be assured such permits will be received. Environmental laws and regulations may also, among other things:

| ● | require notice to stakeholders of proposed and ongoing exploration, drilling, environmental studies, mining, or production activities; |

| ● | require the installation of pollution control equipment; |

| ● | restrict the types, quantities and concentrations of various substances that can be released into the environment in connection with exploration, drilling, mining, lithium manufacturing, or other production activities; |

| ● | limit or prohibit drilling, mining, lithium manufacturing or other production activities on lands located within wetlands, areas inhabited by endangered species and other protected areas, or otherwise restrict or prohibit activities that could impact the environment, including water resources; |

| ● | impose substantial liabilities for pollution resulting from current or former operations on or for any preexisting environmental impacts from our projects; |

| ● | require significant reclamation obligations in the future as a result of our extraction and chemical operations; and |

| ● | require preparation of an environmental assessment or an environmental impact statement. |

Compliance with environmental laws and regulations may impose substantial costs on us, subject us to significant potential liabilities, and have an adverse effect on our capital expenditures, results of operations, or competitive position. Violations and liabilities with respect to these laws and regulations could result in significant administrative, civil, or criminal penalties, remedial clean-ups, natural resource damages, permit modifications and/or revocations, operational interruptions and/or shutdowns, and other liabilities, as well as reputational harm, including damage to our relationships with customers, suppliers, investors, governments or other stakeholders. The costs of remedying such conditions may be significant, and remediation obligations could adversely affect our business, results of operations, and financial condition. Federal, state, and local legislative bodies and agencies frequently revise environmental laws and regulations, and any changes in these regulations, or the interpretations thereof, could require us to expend significant resources to comply with new laws or regulations or changes to current requirements and could have a material adverse effect on our business operations. As of September 24, 2021, the Company had one full-time employeeDecember 31, 2023, we have not been required to spend material amounts on compliance regarding environmental regulations.

Permits

Obtaining and renewing governmental permits is a part time employee.

Websites

complex and time-consuming process and involves numerous jurisdictions, public hearings, and possibly costly undertakings. The Company maintains one active website, www.boxscore.com, which serves as its corporate websitetimeliness and contains information about the Company and its business.

Corporate Information and Incorporation

BoxScore Brands, Inc. was incorporated in March 2007 as a Delaware corporation and we refer to the company as “we”, “us”, the “Company”, “BoxScore Brands” or “BoxScore” in this annual report. In February 2018, we filed an amendment tosuccess of permitting efforts are contingent upon many variables not within our certificate of incorporation to change our corporate name from U-Vend Inc. to BoxScore Brands, Inc. to better reflect the nature of our current business operations. We are headquartered in Las Vegas, NV. Our corporate office is located at 3275 South Jones Blvd, Suite 104, Las Vegas, NV 98146 and our telephone number is (800) 998-7962. Our corporate website address is www.boxscore.com. Information contained on our websites is not a part of this annual report.

Available Information

Under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company files annual, quarterly and current reports with the SEC. You may read and copy any document we file with the SEC at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information about the public reference room. The SEC maintains a website at http://www.sec.gov that contains reports and other information regarding issuers that file electronically with the SEC. The Company files electronically with the SEC. The SEC makes available, free of charge, through the SEC Internet website, the Company’s filings on Forms 10-K, 10-Q and 8-K, and amendments to those reports, as soon as they are filed with the SEC.

An investment in our securities is subject to numerous risks,control, including the Risk Factors described below. Our business, operating results or financial condition could be materially adversely affectedinterpretation of permit approval requirements administered by any of the following risks. The risks described below are not the only ones we face. Additional risks we are not presently aware of or that we currently believe are immaterial may also materially affect our business. In such case, weapplicable permitting authority. We may not be able to proceed withobtain or renew permits that are necessary for our planned operations, or the cost and your investmenttime required to obtain or renew such permits may be lost entirely. The trading priceexceed our expectations. Any unexpected delays or costs associated with the permitting process could delay the exploration, development and/or operation of our common stock could decline dueprojects.

Environmental, Social and Governance

We are committed to ESG causes. As we start to hire employees for our projects, our hiring efforts will focus on hiring workers from communities near our project areas. Many such communities have high levels of unemployment.

Human Capital Management

As of April 1, 2024, we had two full-time employees, who are our Co-Chief Executive Officers. We also utilize four independent contractors, two to provide us with accounting support and two for geological expertise. We are committed to diversity, equity, and inclusion as part of our growth strategy. We will treat each employee and job applicant without regard to race, color, age, sex, religion, national origin, citizenship, sexual orientation, gender identity, ancestry, veteran status, or any of these risks. In assessing theseother category protected by law. We believe in allocating resources and establishing, in an equitable manner, policies and procedures that are fair, impartial, and just. To provide a diverse and inclusive workplace, we will focus our efforts on creating a culture where all employees can contribute their skills and talents and be themselves.

Item 1A. Risk Factors.

You should carefully consider the risks you should also refer todescribed below, together with all the other information contained or incorporated by reference in this Form 10-K, including our consolidated financial statements. An investment in our securities should only be acquired by persons who can afford to lose their entire investment without adversely affecting their standard of living or financial security.

We have a limited operating history and may not be able to achieve financial or operational success.

We were founded in March 2007, initiated our first operating business in October 2009, exited from our first operating business in March 2013, and acquired another operating business in January 2014, which we modified, sold certain operating assets and retained others. Our current focus in the renewable energy sector will rely heavily on our management teams market knowledge. We management does have operating history with respect to this new corporate direction we have to identify, acquire and operate a new line of business. As a result, we may not be able to achieve sustained financial or operational success, given the risks, uncertainties, expenses, delays and difficulties associated with an early-stage business in an evolving market.

Our growth strategy includes acquisitions that entail significant execution, integration and operational risks.

We are pursuing a growth strategy based in part on acquisitions, with the objective of creating a combined company that we believe can achieve increased cost savings and operating efficiencies through economies of scale especially in the integration of administrative services. We will seek to make additional acquisitions in the future to increase our revenue.

This growth strategy involves significant risks. There is significant competition for acquisition targets in our markets. Consequently, we may not be able to identify suitable acquisitions or may have difficulty finding attractive businesses for acquisition at reasonable prices.Annual Report. If we are unable to identify future acquisition opportunities, reach agreement with such third parties or obtain the financing necessary to make such acquisitions, we could lose market share to competitors who are able to make such acquisitions.

If we are unable to develop and market new offerings or fail to predict or respond to emerging trends, our revenue and any profitability will suffer.

Our future success will depend on our management team’s implementation of their new business plan and the success of the initial key renewal energy projects. The volatility of natural resources may also affect the viability of projects.

We depend on key management, product management, technical and marketing personnel for continued success.

Our success and future growth depend, to a significant degree, on the skills and continued services of our management team, including Andrew Boutsikakis, our President and Chief Executive Officer, and Pat Avery, our Chief Operating Officer. Our ongoing success also depends on our ability to identify, hire and retain skilled and qualified technical and marketing personnel in a highly competitive employment market. As we develop and acquire new products and services, we will need to hire additional employees. Our inability to attract and retain well-qualified managerial, technical and sales and marketing personnel may have a negative effect on our business, operating results and financial condition.

We may be required to seek additional funding, and such funding may not be available on acceptable terms or at all.

We may seek additional funding, however due to a number of factors beyond our expectations or control, including a shortfall in revenue, increased expenses, a need for working capital for growth, increased investment in capital equipment or the acquisition of businesses, services or technologies. The required funding may not be available on acceptable terms, or at all. If we are unable to obtain sufficient funding, our business would be harmed. Even if we were able to find outside funding sources, we might be required to issue securities in a transaction that could be highly dilutive to our investors or we may be required to issue securities with greater rights than the securities we have outstanding today. We may also be required to take other actions that could lessen the value of our common stock, including borrowing money on terms that are not favorable to us. If we are unable to generate or raise capital that is sufficient to fund our operations, we may be required to curtail operations, reduce our services, defer or cancel expansion or acquisition plans or cease operations in certain jurisdictions or completely.

The termination, non-renewal or renegotiation on materially adverse terms of our contracts or relationships with one or more of our significant host locations, product suppliers and partners could seriously harm our business, financial condition and results of operations.

The success of our business depends in large part on our ability to maintain contractual relationships with our host locations in profitable locations. Our typical host location agreement ranges from one to three years and automatically renews until we or the host retailer gives notice of termination. Certain contract provisions with our host locations vary, including product and service offerings, the commission fees we are committed to pay each host location, and the ability to cancel the contract upon notice after a certain period of time. We strive to provide direct and indirect benefits to our host locations that are superior to, or competitive with, other providers or systems or alternative uses of the floor space that our kiosks occupy. If we are unable to provide our host retailers with adequate benefits, we may be unable to maintain or renew our contractual relationships on acceptable terms, causingfollowing risks occur, our business, financial condition and results of operations could be seriously harmed, and you could lose all or part of your investment. Further, if we fail to suffer.

meet the expectations of the public market in any given period, the market price of our common stock could decline. We operate in a competitive environment that involves significant risks and uncertainties, some of which are outside of our control. If any of these risks actually occurs, our business and financial condition could suffer and the price of our stock could decline. We caution you that the risks, uncertainties and other factors referred to below and elsewhere in our Annual Report may not contain all the risks, uncertainties, and other factors that may affect our future results and operations. Our future results and operations could also be affected by factors, events, or uncertainties that are not presently known to us or that we cannot execute oncurrently do not consider to present a material risk. It is not possible for our renewable energy strategy.management to predict all risks.

Business Risks

Our strategyfuture performance is based upon leveraging our core competenciesdifficult to evaluate because we have a limited operating history in the renewable energy spacelithium industry.

We entered the lithium industry in November 2021. We have not realized any revenues to date from the sale of lithium, and relationships with certain land surveyorsour operating cash flow needs have been financed primarily through issuances of debt and mineral distributorsequity securities, and refiners. To be competitive, we need to locate, develop, or otherwise provide, sought after minerals and service offerings that are accepted by the market and establish third-party relationships necessary to develop and commercialize such product and service offerings. We are exploring new businesses to enter, and new products and services to offer, however, the complexities and structures of these new businesses could create conflicting priorities, constrain limited resources, and negatively impactnot through cash flows derived from our core businesses. We may use our financial resources and managements’ time and focus to invest in other companies’ offerings in the renewable energy sector, or we may seek to grow businesses organically. We may enter into joint ventures through which we may expand our offerings.

Litigation, arbitration, mediation, regulatory actions, investigations or other legal proceedings could result in material rulings, decisions, settlements, fines, penalties or publicity that could adversely affect our business, financial condition and results of operations.

Our industry has in the past been, and may in the future continue to be, party to class actions, regulatory actions, investigations, arbitration, mediation and other legal proceedings. The outcome of such proceedings is often difficult to assess or quantify. Plaintiffs, regulatory bodies or other parties may seek very large or indeterminate amounts of money from us or substantial restrictions on our business activities, and the results, including the magnitude, of lawsuits, actions, settlements, decisions and investigations may remain unknown for substantial periods of time. The cost to defend, settle or otherwise finalize lawsuits, regulatory actions, investigations, arbitrations, mediations or other legal proceedings may be significant and such proceedings may divert management’s time. In addition, there may be adverse publicity associated with any such developments that could decrease consumer acceptance of our products and services. As a result, litigation, arbitration, mediation, regulatory actionswe have little historical financial and operating information from our lithium business to help you evaluate our performance.

We have a history of losses and expect to continue to incur losses in the future.

We have an accumulated deficit of approximately $20,239,639 as of December 31, 2023. We expect to continue to incur losses unless and until such time as our projects or investigations involving us may adversely affectone of our future acquired properties enters into commercial production and generates sufficient revenues to fund continuing operations and we are able to develop at least one economic deposit. We recognize that if we are unable to generate cash flows from our operations, we will not be able to earn profits or continue operations. At this early stage of our lithium operations, we also expect to face the risks, uncertainties, expenses and difficulties encountered by companies at the mineral exploration stage. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition. In the report by our auditor dated April 1, 2024 the auditor expressed doubt about our ability to continue as a going concern.

There is uncertainty regarding our ability to implement our business plan and to grow our operations with our existing financial condition and results of operations.

We are subjectresources without additional financing. Our ability to substantial federal, state, local and foreign laws and government regulation specific to our business.

Our business is subject to federal, state, local and foreign laws and government regulation, including those relating to copyright law, federal and state laws around rare earths and the renewable energy sector, The application of existing laws and regulations, changes in laws or enactment of new laws and regulations, that apply, or may in the future apply, to our current or future products or services, changes in governmental authorities’ interpretation of the application of various government regulations toimplement our business orplan is dependent on us generating cash from operations, the failure or inability to gain and retain required permits and approvals could materially and adversely affect our business.

In addition, many jurisdictions require us to obtain certain licenses in connection with the operationssale of our businesses.stock and/or obtaining debt financing. Historically, we have funded our operations primarily through the issuance of debt and equity securities. Management’s plan to fund our capital requirements and ongoing operations includes the generation of revenue from our lithium operations and projects. Management’s secondary plan to cover any shortfall is selling our equity securities and obtaining debt financing. There can beis no assurance that we will be granted all necessary licensessuccessful in implementing our business plan or permitsthat we will be able to generate sufficient cash from operations, sell securities or borrow funds on favorable terms or at all. Our inability to generate significant revenue or obtain additional financing could have a material adverse effect on our ability to fully implement our business plan and grow our business to a greater extent than we can with our existing financial resources.

We are an exploration stage company, and there is no guarantee that our development will result in the commercial extraction of mineral deposits.

As defined under Regulation S-K 1300, we are an exploration stage company as we have no known mineral reserves, and we have not yet conducted any mining operations. Accordingly, we cannot assure you that we will ever realize any profits. Any profitability in the future that current licenses or permitsfrom our business will be reneweddependent upon the development of an economic deposit of minerals and further exploration and development of other economic deposits of minerals, each of which is subject to numerous risk factors. Further, we cannot assure you that any of our property interests can be commercially mined or that regulatorsany exploration programs will result in profitable commercial mining operations. The exploration and development of mineral deposits involves a high degree of financial risk over a significant period of time, which may or may not revoke current licensesbe reduced or permits. Giveneliminated through a combination of careful evaluation, experience, and skilled management. While discovery of additional ore-bearing deposits may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenses may be required to construct processing facilities and to establish reserves.

Our exploration prospects may not contain any reserves and any funds spent on evaluation and exploration may be lost. We do not know with certainty that economically recoverable lithium exists on our properties. In addition, the uniquequantity of any reserves may vary depending on commodity prices. Any material change in the quantity or grade of reserves may affect the economic viability of our properties.

Exploration and development projects like ours have no operating history upon which to base estimates of future operating costs and capital requirements. Actual operating costs and economic returns of any and all exploration projects may materially differ from the costs and returns estimated, and accordingly, our financial condition, results of operations, and cash flows may be negatively affected.

We face numerous risks related to exploration, construction, and extraction of mineral deposits.

Our level of profitability, if any, in future years will depend to a great degree on lithium prices and whether our properties can be brought into production. Exploration and development of lithium resources are highly speculative in nature, and it is impossible to ensure that any of our existing properties will establish reserves. Whether it will be economically feasible to extract lithium depends on a number of factors, including, but not limited to: (i) the particular attributes of the deposit, such as size, grade, and proximity to infrastructure; (ii) lithium prices; (iii) extraction, processing, and transportation costs; (iv) the willingness of lenders and investors to provide project financing; (v) labor costs and possible labor strikes; (vi) non-issuance of permits; and (vii) governmental regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations.

We are also subject to the risks normally encountered in the lithium industry, which include, without limitation:

| ● | the discovery of unusual or unexpected geological formations; |

| ● | accidental fires, floods, earthquakes, severe weather, seismic activity, or other natural disasters; |

| ● | unplanned power outages and water shortages; |

| ● | construction delays and higher than expected capital costs due to, among other things, supply chain disruptions, higher transportation costs, and inflation; |

| ● | the ability to obtain suitable or adequate machinery, equipment, or labor; |

| ● | shortages in materials or equipment and energy and electrical power supply interruptions or rationing; |

| ● | environmental liability; and |

| ● | other unknown risks involved in the conduct of lithium exploration and operations. |

The nature of these risks is such that liabilities could exceed any applicable insurance policy limits or could be excluded from coverage. There are also risks against which we cannot insure or against which we may elect not to insure. The potential costs, which could be associated with any liabilities not covered by insurance or in excess of insurance coverage, or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, adversely affecting our future earnings, competitive position, and potentially our financial viability.

The mineral and chemical processing industry is intensely competitive.

The mineral and chemical processing industry is intensely competitive. We may be at a competitive disadvantage because we must compete with other individuals and companies, many of which have greater financial resources, operational experience and technical capabilities than we do. Increased competition could adversely affect our ability to attract necessary capital funding or acquire suitable exploration properties. We may also encounter increasing competition from other mineral and chemical processing companies in our efforts to locate acquisition targets, hire experienced mining professionals and acquire exploration resources.

Our quarterly and annual operating and financial results and our revenue are likely to fluctuate significantly in future periods.

Our quarterly and annual operating and financial results are difficult to predict and may fluctuate significantly from period to period. Our revenues, net income and results of operations may fluctuate as a result of a variety of factors that are outside our control including, but not limited to, lack of sufficient working capital, equipment malfunction and breakdowns, inability to timely find spare machines or parts to fix the broken equipment, regulatory or licensing delays and severe weather phenomena.

Our long-term success will depend ultimately on our ability to generate revenues, achieve and maintain profitability, and develop positive cash flows from our lithium activities.

Our ability to (i) acquire additional lithium projects, and (ii) initiate and continue exploration, development, commissioning of lithium ultimately depends on our ability to generate revenues, achieve and maintain profitability, and generate positive cash flow from our operations. The economic viability of our future extraction activities has many risks and uncertainties including, but not limited to:

| ● | significant, prolonged decrease in the market price of lithium; |

| ● | significantly higher than expected construction and extraction costs; |

| ● | significantly lower than expected lithium extraction; |

| ● | significant delays, reductions, or stoppages in lithium extraction activities; |

| ● | significant shortages of adequate and skilled labor or a significant increase in labor costs; |

| ● | significantly more stringent regulatory laws and regulations; and |

| ● | significant difficulty in marketing and/or selling lithium or lithium hydroxide; |

It is common for a new lithium extraction operation to experience unexpected costs, problems, and delays during construction, commissioning and start-up. Most similar projects suffer delays during these periods due to numerous factors, including the factors listed above. Any of these factors could result in changes to economic returns or cash flow estimates of the project or have other negative impacts on our financial position. There is no assurance that our projects will commence commercial production on schedule, or at all, or will result in profitable operations. If we are unable to develop our projects into a commercial operating mine, our business and new productsfinancial condition will be materially adversely affected. Moreover, even if a feasibility study supports a commercially viable project, there are many additional factors that could impact the project’s development, including terms and services we may developavailability of financing, cost overruns, litigation or acquireadministrative appeals concerning the project, delays in the future, the application of various lawsdevelopment, and regulations to our business is uncertain. Further, as governmental and regulatory scrutiny and action with regard to many aspects of our business increase, we expect that our costs of complying with the applicable legal requirements may increase, perhaps substantially.

Failure to comply with these laws and regulations could result in,any permitting changes, among other things, revocationfactors.

Our future lithium extraction activities may change as a result of required licenses or permits, loss of approved status, termination of contracts, administrative enforcement actions and fines, class action lawsuits, cease and desist orders and civil and criminal liability. The occurrence ofany one or more of these events,risks and uncertainties. We cannot assure you that any of our activities will result in achieving and maintaining profitability and developing positive cash flows.

We depend on our ability to successfully access the capital and financial markets. Any inability to access the capital or financial markets may limit our ability to meet our liquidity needs and long-term commitments, fund our ongoing operations, execute our business plan or pursue investments that we may rely on for future growth.

Until commercial production is achieved from our planned projects, we will continue to incur operating and investing net cash outflows associated with including, but not limited to, maintaining and acquiring exploration properties, undertaking exploration activities, and the development of our planned projects. As a result, we rely on access to capital markets as wella source of funding for our capital and operating requirements. We require additional capital to meet our liquidity needs related to expenses for our various corporate activities, including the costs related to our status as a publicly traded company, fund our ongoing operations, explore and define lithium mineralization, and establish any future lithium operations. We cannot assure you that such additional funding will be available to us on satisfactory terms, or at all.

To finance our future ongoing operations, and future capital needs, we may require additional funds through the increased costissuance of compliance,additional equity or debt securities. Depending on the type and terms of any financing we pursue, stockholders’ rights and the value of their investment in our common stock could materiallybe reduced. Any additional equity financing will dilute shareholdings. If the issuance of new securities results in diminished rights to holders of our common stock, the market price of our common stock could be negatively impacted. New or additional debt financing, if available, may involve restrictions on financing and operating activities. In addition, if we issue secured debt securities, the holders of the debt would have a claim to our assets that would be prior to the rights of stockholders until the debt is paid. Interest on such debt securities would increase costs and negatively impact operating results.

If we are unable to obtain additional financing, as needed, at competitive rates, our ability to fund our current operations and implement our business plan and strategy will be affected. These circumstances may require us to reduce the scope of our operations and scale back our exploration, development and extraction programs. There is, however, no guarantee that we will be able to secure any additional funding or be able to secure funding to provide us with sufficient funds to meet our objectives, which may adversely affect our business and financial conditionposition.

We are dependent upon key management employees.

The responsibility of overseeing the day-to-day operations and resultsthe strategic management of operations.our business depends substantially on our senior management and key personnel. Loss of any such personnel may have an adverse effect on our performance. The success of our operations will depend upon numerous factors, many of which, in part, are beyond our control, including our ability to attract and retain additional key personnel in sales, marketing, technical support, and finance. Certain areas in which we operate are highly competitive and competition for qualified personnel is significant. We may be unable to hire suitable field personnel for our technical team or there may be periods of time where a particular position remains vacant while a suitable replacement is identified and appointed. We may not be successful in attracting and retaining the personnel required to grow and operate our business profitably.

If we cannot

Our ability to manage our growth effectively, we could experience a material adverse effectwill have an impact on our business, financial condition, and results of operations.

AsFuture growth may place strains on our financial, technical, operational, and administrative resources and cause us to rely more on project partners and independent contractors, thus, potentially adversely affecting our financial position and results of operations. Our ability to grow will depend on a number of factors, including, but not limited to:

| ● | our ability to develop existing prospects; |

| ● | our ability to identify and acquire or lease new exploratory prospects; |

| ● | our ability to maintain or enter into new relationships with project partners and independent contractors; |

| ● | our ability to continue to retain and attract skilled personnel; |

| ● | our access to capital; |

| ● | the market price for lithium products; and |

| ● | our ability to enter into agreements for the sale of lithium products. |

Lawsuits may be filed against us and an adverse ruling in any such lawsuit may adversely affect our business, financial condition, or liquidity or the market price of our common stock.

We may become involved in, named as a party to, or be the subject of, various legal proceedings, including regulatory proceedings, tax proceedings, and legal actions relating to personal injuries, property damage, property taxes, land rights, the environment, and contract disputes.

The outcome of future legal proceedings cannot be predicted with certainty and may be determined adversely to us and as a result, could have a material adverse effect on our assets, liabilities, business, financial condition, or results of operations. Even if we beginprevail in any such legal proceeding, the proceedings could be costly, time-consuming, and may divert the attention of management and key personnel from our business operations, which could adversely affect our financial condition.

Our success as a company producing lithium and related products depends to a great extent on our research and development capabilities for direct lithium extraction and our ability to secure capital for the implementation of brine processing plants.

Our success as a producer of lithium and related products is dependent on our ability to develop and implement more efficient production capabilities based on mineral rich brine and implementation of direct lithium extraction (DLE) technologies, which while having the potential to significantly increase the supply of lithium from brine projects, the technology for DLE remains subject to many questions. A number of DLE technologies are emerging and being tested at scale, with a handful of projects already in commercial construction. However, there remain challenges around scalability and water consumption/ brine reinjection. We expect to make significant investment in research and development of the DLE process, and we will need to continue to invest heavily to scale our businessmanufacturing to ultimately producing sufficient amounts of lithium. We cannot assure you that our future product research and development projects and financing efforts will be successful or be completed within the anticipated time frame or budget. There is no guarantee we will achieve anticipated sales target or in a profitable manner. In addition, we cannot assure you that our existing or potential competitors will not develop products which are similar or superior to our products or are more competitively priced. As it is often difficult to project the time frame for developing new products and the duration of market window for these products, there is a substantial risk that we may make errorshave to abandon a potential product that is no longer commercially viable, even after we have invested significant resources in predictingthe development of such product and reactingour facilities. If we fail in our product launching efforts, our business, prospects, financial condition and results of operations may be materially and adversely affected.

The development of non-lithium battery technologies could adversely affect us.