UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20212023

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-37513

CODE CHAIN NEW CONTINENTGD CULTURE GROUP LIMITED

(Exact name of registrant as specified in its charter)

| Nevada | 47-3709051 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification |

| ||

| (Address of principal executive offices) | (Zip Code) |

Issuer’sRegistrant’s telephone number:number, including area code: +86 028-8411-29411-347-2590292

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Trading Symbol(s) | Name of Each Exchange on Which Registered: | ||

| Common Stock, par value $0.0001 per share | GDC | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

Warrants, each to purchase one-half of one share of Common StockNone

Title of Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management'smanagement’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2021,2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common stock outstanding held by non-affiliates of the registrant, computed by reference to the closing sales price for the common stock of $2.11,$4.27 as of such date, as reported on the Nasdaq Capital Market, was approximately $61.1 million.$12,654,414.

As of March 31, 2022,April 1, 2024, there were 38,429,6177,887,411 shares of common stock, par value $0.0001 per share, of the registrant issued and outstanding.

TABLE OF CONTENTS

i

Conventions that Apply to this Annual Report

Unless otherwise indicated or the context requires otherwise, references in this annual report (the “Report”) to:

| ● | “ |

| ● | “Citi Profit” are to Citi Profit Investment Holding Limited, a British Virgin Islands company, which is wholly owned by |

| ● | “ |

| ● | “Highlight HK” are to Highlights Culture Holding Co., Limited, a Hong Kong SAR company, which is wholly owned by Citi Profit; |

| ● | “ |

| ● | “PRC” or “China” are to the People’s Republic of China, excluding, for the purpose of this report, Taiwan, Hong Kong and Macau; |

| ● | “RMB” or “Renminbi” are to the legal currency of China; and |

| ● | “Shanghai Xianzhui” are to Shanghai Xianzhui Technology Co., Ltd., a joint venture, of which Highlight Entertainment Co. Ltd. owns 73.3333% of the total equity interest; |

| ● | “we”, “our”, “us” are to the Company and its subsidiaries; |

| ● | “Yuan Ma” are to Shanghai Yuanma Food and Beverage Management Co., Ltd., a PRC company, which is a variable interest entity for accounting purposes; |

| ● | “$”, “US$” or “U.S. Dollars” are to the legal currency of the United States. |

Unless otherwise indicated, all references to common stock, warrants to purchase common stock, share data, per share data, and related information have been retroactively adjusted, where applicable, in this Report to reflect a 1-to-30 reverse stock split of our common stock which became effective on November 9, 2022 as if they had occurred at the beginning of the earlier period presented.

ii

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This Annual Report contains statements that may be deemed to be “forward-looking statements” within the meaning of the federal securities laws. These statements relate to anticipated future events, future results of operations and or future financial performance. In some cases, you can identify forward-looking statements by their use of terminology such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “ought to,” “plan,” “possible,” “potentially,” “predicts,” “project,” “should,” “will,” “would,” negatives of such terms or other similar terms. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The forward-looking statements in this Annual Report include, without limitation, statements relating to:

| ● | our goals and strategies; | |

| ● | our future business development, results of operations and financial condition; | |

| ● | our estimates regarding expenses, future revenues, capital requirements and our need for additional financing; | |

| ● | our estimates regarding the market opportunity for our services; | |

| ● | the impact of government laws and regulations; | |

| ● | our ability to recruit and retain qualified personnel; | |

| ● | our failure to comply with regulatory guidelines; | |

| ● | uncertainty in industry demand; | |

| ● | general economic conditions and market conditions in the | |

| ● | future sales of large blocks or our securities, which may adversely impact our share price; and | |

| ● | depth of the trading market in our securities. |

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties, including those described in Item 1A “Risk Factors.”

You should not unduly rely on any forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report, to conform these statements to actual results or to changes in our expectations.

iiiii

PART I

Item 1. Business

GeneralOverview

Code Chain New ContinentGD Culture Group Limited (“CCNC”, formerly(formerly known as JM Global Holding Company, and TMSR Holding Company Limited, and Code Chain New Continent Limited) is a holding, focuses its business on three segments mainly through the Company and two subsidiaries, AI Catalysis and Shanghai Xianzhui: 1) AI-driven digital human creation and customization; 2) Live streaming and e-commerce and 3) Live streaming interactive game. The company incorporated inhas relentlessly been focusing on serving its customers and creating value for them through the State of Nevada with no material operationscontinual innovation and optimization of its own. We currently conduct business through Wuge Network Games Co., Ltd. (“Wuge”). For accounting purposes, we receive the economic benefits of Wuge through the VIE agreements, which enable us to consolidate the financial results of Wuge in our consolidated financial statements under U.S. GAAPproducts and the structure involves unique risks to investors. The VIE agreements have not been tested in a court of law and the Chinese regulatory authorities could disallow this VIE structure, which would likely result in a material change in our operations and the value of our securities, including that it could cause the value of such securities to significantly decline or become worthless. For more details on the VIE structure, please see “Item 1. Business – Corporate Structure - Contractual Arrangements between Wuge And Makesi WFOE” and “Item 1A. Risk Factors – Risks Related to Our Corporate Structure”.services.

Wuge focuses its businessFor AI-driven digital human creation and customization sector, the Company uses AI algorithms and software to generate realistic 3D or 2D digital human models. AI algorithms and machine learning models are used to simulate human characteristics, such as facial expressions, body movements, and even speech patterns. These models can be customized to create and personalize lifelike digital representations of humans. Customization may involve adjusting facial features, body proportions, skin textures, hair styles, clothing, and more. Once created and customized, digital humans find applications in a wide range of industries, including gaming, entertainment, advertising, education, and more. Depending on research, developmentthe specific industry and the application of Internet of Things (IoT)scenario, the Company helps the customers to define the objectives to achieve with digital humans, choose the technology for character customization, then create unique aviators and electronic tokens Wuge digital door signs.deploy in the chosen platform.

Wuge For live streaming and e-commerce sector, the Company applies digital door signs combinehuman technology in live streaming e-commerce businesses. Livestream usage is taking off globally. The integration of cutting-edge AI digital human technologies and live streaming platforms will transform the five-W elements (when, where, who, why, what), geographic location via the Beidou satellite systemway businesses, sellers and identity information using Code Chain technology.consumers engage in online commerce. Digital anchors can offer long-duration intelligent live broadcasting. It is the digitalization of a physical store by means of animation and other technical means presentedalso supports customized avatars that perfectly adapt to different live streaming scenarios. The company has introduced online e-commerce businesses on the internet and Internet of Things (IoT). It is based on the geographic location of the store. Wuge door sign can be used in our mobile application Wuge Social, available on Android platform. The mobile application provides a display of the map and store based on real cities and uses the IoT Grid as the access point to access e-commerce by Code Chain. Through the mobile application and Wuge Manor, the game within the mobile application, users can have access to hundreds of vendors and business owners in China, participate in activities those businesses set up and collect points, which can be redeemed as equipment in the game or coupons usable when making purchase at that business. Code Chain access to e-commerce includes Online to Offline (O2O) “scanning QR Code” and social media that seamlessly link offline and online and connect real and virtual directly, so that each IoT Grid becomes an e-commerce access to realize the decentralization of e-commerce access and complete the basic layout for blockchain e-commerce. Wuge digital door sign can be purchased. Such purchaser can use Wuge Social to promote the store of which the Wuge digital door sign was purchased and receive commissions and other incentive from the store owner.TikTok under different accounts.

Prior to March 30, 2021, we were also engaged in coal wholesales and sales of coke, steel, construction materials, mechanical equipment and steel scrap through Jiangsu Rong Hai Electric Power Fuel Co., Ltd. (“Rong Hai”), a then VIE of the Company. On March 30, 2021,For live streaming interactive game sector, the Company entered intohas launched a share purchase agreement with a buyer unaffiliated withlive-streamed game called “Trible Light.” This game is owned by the Company (the “Buyer”), and Qihai Wang, former director of the Company (the “Payee”). Pursuant to the agreement, the Company agreed to sell and the Buyer agreed to purchase all the issued and outstanding ordinary shares (the “Tongrong Shares”) of Tongrong Technology (Jiangsu) Co., Ltd. (“Tongrong WFOE”), a PRC company, and an indirect subsidiary ofwe independently operate it. Currently, the Company. The Payee agreedgame is being livestreamed on TikTok (TikTok account: almplify001). In addition to be responsible“Trible Light,” we have also introduced other licensed games on the same TikTok account, providing a diverse gaming experience for the payment of the purchase price on behalf of the Buyer. On March 31, 2021, the Company closed the sale of the Tongrong Sharesplayers.

We aim to generate revenue from: 1) Service revenue and caused the CCNC Shares to be cancelled. Tongrong WFOE had a series of VIE agreements with Rong Haiadvertising revenue from digital human creation and the shareholders of Rong Hai. The sale of Tongrong Shares included disposition of Rong Hai. As a result, as of March 31, 2021, operations of Tongrong WFOEcustomization; 2) Products’ sales revenue from social live streaming e-commerce business; and Rong Hai have been designated as discontinued operations.3) Virtual paid gifts revenue from live streaming interactive gaming.

Our principal executive offices areoffice is located at No 119 South Zhaojuesi Road, 2nd810 Seventh Avenue, 22nd Floor, Room 1, Chenghua District, Chengdu, Sichuan, China 610047,New York, NY 10019, and our telephone number is: +86 028-84112941. Our website is www.ccnctech.com.+1-347-2590292.

Corporate History and Structure

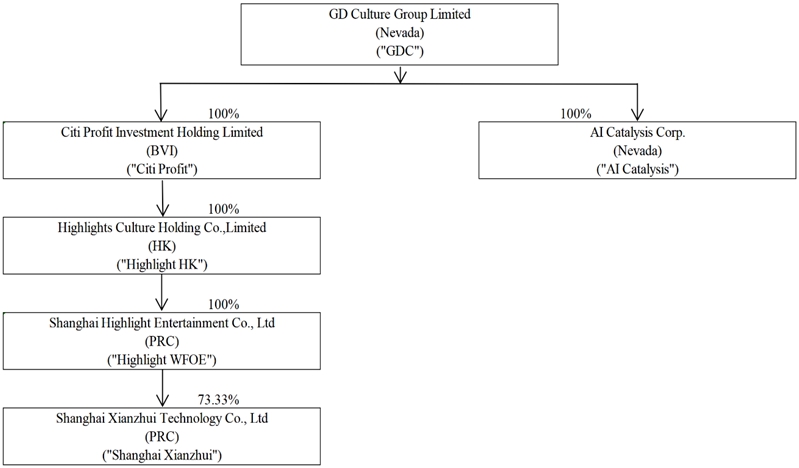

Corporate HistoryThe following is an organizational chart setting forth our corporate structure as of the date of this Report.

Overview

GDC, formerly known as Code Chain New Continent Limited, formerly known as TMSR Holding Company Limited and JM Global Holding Company, was a blank check company incorporated in Delaware on April 10, 2015. The Company was formed for the purpose of acquiring, through a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, exchangeable share transaction or other similar business transaction, one or more operating businesses or assets. On June 20, 2018, the Company consummated the reincorporation. As a result, the Company changed its state of incorporation from Delaware to Nevada and implemented a 2-for-1 forward stock split of the Company’s common stock.

Citi Profit is a company formed under the laws of the British Virgin Islands in August 2019 and is wholly owned by GDC. It is a holding company with no material operations of its own.

Highlight HK is a company formed under the laws of Hong Kong SAR in November 2022 and is wholly owned by Citi Profit. It is a holding company with no material operations of its own.

Highlight WFOE or Shanghai Highlight is a company formed under the laws of the PRC in January 2023 and is wholly owned by Highlight HK. It is a holding company with no material operations of its own.

Shanghai Xianzhui is a company formed under the laws of the PRC in August 2023 for social media marketing purposes. It is a joint venture, of which Highlight WFOE owns 73.3333% of the total equity interest.

AI Catalysis is a company formed under the laws of Neveda in May 2023, and is a wholly-owned subsidiary of GDC. It is an operating company focusing on AI-driven digital human creation and customization, live streaming and e-commerce, and live streaming interactive game.

As previously disclosed in the current reports on Form 8-K of the Company filed on September 19, 2022 and February 28, 2023, on September 16, 2022, Makesi IoT Technology (Shanghai) Co., Ltd., a then indirect subsidiary of the Company (“Makesi WFOE”), Shanghai Highlight Media Co., Ltd., a PRC company (“Highlight Media”), and the shareholders of Shanghai Highlight (the “Highlight Media Shareholders”) entered into certain Technical Consultation and Services Agreement., Equity Pledge Agreement, Equity Option Agreement, Voting Rights Proxy and Financial Support Agreement, which was assigned by Makesi WFOE to Highlight WFOE on February 27, 2023 (such agreements, as assigned, the “VIE Agreements”). The VIE Agreements established a “Variable Interest Entity” (VIE) structure, pursuant to which the Company treated Highlight Media as a consolidated affiliated entity and consolidated the financial results and balance sheet of Highlight Media in the Company’s consolidated financial statements under accounting principles generally accepted in the United States of America (“U.S. GAAP”).

On September 26, 2023, Highlight WFOE entered into a termination agreement (the “Termination Agreement”) with Highlight Media, the Highlight Media Shareholders and a third party to terminate the VIE Agreements and for the third party to pay the Company $100,000 as consideration to the termination of the VIE Agreements. As a result of such termination, the Company will no longer treat Highlight Media as a consolidated affiliated entity or consolidate the financial results and balance sheet of Highlight Media in the Company’s consolidated financial statements under U.S. GAAP.

Reverse Stock Split

On November 4, 2022, the Company filed a Certificate of Amendment to the Articles of Incorporation (the “Certificate of Amendment”) with the Nevada Secretary of State to effect a reverse stock split of the outstanding shares of common stock, par value $0.0001 per shares, of the Company at a ratio of one-for-thirty (30), which became effective at 12:01 a.m. on November 9, 2022. Upon effectiveness of the reverse stock split, every thirty (30) outstanding shares of common stock were combined into and automatically become one share of common stock. The Company’s warrants (OTC Pink: CCNCW) was adjusted so that each warrant is to purchase one-half of one shares of common stock at a price of $86.40 per half share ($172.50 per whole share). The warrants expired on February 5, 2023.

Unless otherwise indicated, all references to common stock, warrants to purchase common stock, share data, per share data, and related information have been retroactively adjusted, where applicable, in this Report to reflect the reverse stock split of our common stock as if they had occurred at the beginning of the earlier period presented.

Name Change

Effective as of May 18, 2020,January 10, 2023, the Company changed its corporate name from “TMSR Holding Company Limited” to “Code Chain New Continent Limited” to “GD Culture Group Limited” pursuant to a Certificate of Amendment to the Company’s Articles of Incorporation. In connection with the name change, effective as of the opening of trading on May 18, 2020,January 10, 2023, the Company’s common stock is trading on the Nasdaq Capital Market under the ticker symbol “CCNC” and the Company’s warrants to purchase one-half of one shares of Common Stock at a price of $2.88 per half share ($5.75 per whole share) is quoting on the OTC Pink Market under the ticker symbol “CCNCW”“GDC”.

Business Combination with China Sunlong

On February 6, 2018, China Sunlong Environmental Technology Inc. (“China Sunlong”) consummated the business combination with JM Global. This transaction is accounted for as a “reverse merger” and recapitalization at the dateImpact of the consummation of the transaction since the shareholders of China Sunlong owns the majority of the outstanding shares of JM Global immediately following the completion of the transaction and JM Global’s operations was the operations of China Sunlong following the transaction. Accordingly, China Sunlong was deemed to be the accounting acquirer in the transaction and the transaction was treated as a recapitalization of China Sunlong.

After the business combination and prior to May 1, 2018, all of the Company’s business activities were carried out by the wholly owned operating Chinese company, Hubei Shengrong Environmental Protection Energy-Saving Science and Technology Ltd. (“Hubei Shengrong”).

Disposition of TJComex

On April 2, 2018, the Company disposed of its subsidiary, TJComex International Group Corporation (“TJComex BVI”), a British Virgin Islands corporation, in consideration of (i) its minimum contribution to the Company’s results of operation and (ii) the unsatisfactory synergy between the TJComex BVI business and the rest of the Company’s business. The Company’s decision to dispose TJComex BVI is to (i) improve the Company’s overall financial condition and results of operations, (ii) reduce the complexity of the Company’s business, (iii) focus the Company’s resources on the solid waste recycling business as well as developing environmental control business opportunities; and (iv) make it possible for the Company to pursue acquisition opportunities for more compatible business.

Acquisition of Wuhan Host

On May 1, 2018, the Company completed the acquisition of 100% equity interest in Wuhan Host Coating Materials Co., Ltd. (“Wuhan Host”), a PRC corporation engaging in the research and development, production and sale of Zinc-rich coating materials. Wuhan Host was the largest manufacturer of inorganic Zinc-rich resin and one-component epoxy Zinc-rich resin in China with customers including leading enterprises in various industries such as electricity, metallurgy, machinery, chemicals, bridge and shipping.

Acquisition of Rong Hai

On November 30, 2018, the Company’s indirectly subsidiary, Shengrong Environmental Protection Technology (Wuhan) Co. Ltd. (“Shengrong WFOE”), a PRC company, entered into VIE agreements with Jiangsu Rong Hai Electric Power Fuel Co., Ltd. (“Rong Hai”). The VIE agreements were assigned in whole to the Company’s indirectly subsidiary, Tongrong Technology (Jiangsu) Co., Ltd. (“Tongrong WFOE”), a PRC company, in April 2020, through which Tongrong WFOE shall receive economic benefits of Rong Hai and consolidate the financial results of Rong Hai in the consolidated financial statement of the Company under U.S. GAAP for accounting purposes. Rong Hai is a PRC company incorporated in Jiangsu China, engaging in coal wholesales and sales of coke, steels, construction materials, mechanical equipment and steel scrap.

Disposition of Hubei Shengrong

On December 27, 2018, the Company, disposed one of its operating subsidiaries, Hubei Shengrong, a PRC company, pursuant to that certain Equity Purchase Agreement by and among the Company, the Company’s subsidiary Shengrong WFOE, Hubei Shengrong and Hopeway International Enterprises Limited (the “Hoepway”). Pursuant to the Equity Purchase Agreement, Shengrong WFOE sold 100% equity interests in Hubei Shengrong to Hopeway to irrevocably forfeit and cancel all the shares owned by Hopeway.

Acquisition of Wuge

On January 3, 2020, the Company’s indirectly subsidiary, Tongrong WFOE, entered into a share purchase agreement with Wuge and all the shareholders of Wuge (“Wuge Shareholders”). Pursuant to the share purchase agreement, the Company agreed to issue an aggregate of 4,000,000 shares of the common stock of the Company to the Wuge Shareholders, in exchange for Wuge Shareholders’ agreement to enter into, and their agreement to cause Wuge to enter into, certain VIE agreements (“VIE Agreements”) with Tongrong WFOE, the Company’s then indirect subsidiary, through which Tongrong WFOE shall receive economic benefits of Wuge and consolidate the financial results of Wuge in the consolidated financial statement of the Company under U.S. GAAP for accounting purposes.COVID-19 Pandemic

The Wuge Shareholders are Wei Xu, who becameCOVID-19 pandemic did not have a director of the Company as a result of the acquisition and was subsequently appointed as the Chief Executive Officer, President and Chairman of the Board of the Company, Bibo Lin, who was subsequently appointed as a vice president and a director of the Company, Jiangsu Lingkong Network Joint Stock Co., Ltd., which is controlled by Wei Xu, and Anhui Shuziren Network Technology Co., Ltd., which is controlled by Wei Xu.

On January 11, 2021, Tongrong WFOE entered into a series of assignment agreements with Makesi Iot Technology (Shanghai) Co., Ltd. (“Makesi WFOE”), pursuant to which Tongrong WFOE assign all its rights and obligations under the VIE Agreements to Makesi WFOE. As a result, for account purposes, Makesi WFOE shall have receive economic benefits of Wuge and consolidate the financialmaterial impact on our business or results of Wuge inoperation during the consolidated financial statement offiscal years ended December 31, 2023 and 2022. However, the Company under U.S. GAAP for accounting purposes.

Disposition of China Sunlong

On June 30, 2020, the Company disposed China Sunlong and its subsidiaries, including Shengrong Environmental Protection Holding Company Limited (“Shengrong BVI”), a British Virgin Islands company, Hong Kong Shengrong Environmental Company Limited (“Sunrong HK”), a Hong Kong company, Shengrong WFOE, and Wuhan Host pursuantextent to a share purchase agreement with Jiazhen Li, a former Chief Executive Officer of the Company, and Long Liao and Chunyong Zheng, former shareholders of Wuhan Host. Pursuant to the share purchase agreement, the Company sold 100% equity interests in China Sunlong to Jiazhen Li in exchange for forfeition and cancellation of all 1,012,932 shares of common stock of the Company held by Long Liao and Chunyong Zheng. The Company sold its equity interest in China Sunlong due to the economic disruption in China’s Hubei Province as a result ofwhich the COVID-19 pandemic where Shengrong Environmental Protection Technology (Wuhan) Limitedmay negatively impact the general economy and Wuhan Host Coating Materials, Limited, indirect subsidiaries of China Sunlong, were located.

Disposition of Tongrong WFOE

On March 30, 2021, the Company entered into a share purchase agreement with a buyer unaffiliated with the Company (the “Buyer”), and Qihai Wang, former director of the Company (the “Payee”). Pursuant to the agreement, the Company agreed to sell and the Buyer agreed to purchase all the issued and outstanding ordinary shares (the “Tongrong Shares”) of Tongrong WFOE. The Payee agreed to be responsible for the payment of the purchase price on behalf of Buyer. The purchase price for the Tongrong Shares shall be $2,464,411, payable in the form of cancelling 426,369 shares of common stock of the Company owned by the Payee (the “CCNC Shares”). The CCNC Shares are valued at $5.78 per share, based on the average closing price of the Company’s common stock during the 30 trading days immediately prior to the date of the agreement from February 12, 2021 to March 26, 2021. On March 31, 2021, the Company closed the sale of the Tongrong Shares and caused the CCNC Shares to be cancelled. Tongrong WFOE had a series of VIE agreements with Rong Hai and the shareholders of Rong Hai. The disposition of Tongrong WFOE included disposition of Rong Hai.

Coronavirus (COVID-19) Update

Due to the impact of the COVID-19 pandemic, the offices of our then subsidiaries Shengrong Environmental Protection Technology (Wuhan) Co., Ltd. (“Shengrong WFOE”) and Wuhan HOST Coating Materials Co., Ltd. (“Wuhan HOST”) in Hubei Province, China were closed on January 23, 2020 to adhere to the emergency quarantine measures required by local governments. The economic disruption caused by COVID-19 were catastrophic to the coating material business of Shengrong WFOE and Wuhan HOST, which had no revenue and negative operating income since the fourth quarter of 2019 and no revenue or operating income for the first and second quarter of 2020. Shengrong WFOE and Wuhan HOST lost employees, suppliers and customers and were not able to recover. As a result, we sold our businesses located in Wuhan in June 2020. For more details, please see “Item 1. Business – Corporate History and Structure - Disposition of China Sunlong”. In addition, the office of the then VIE Rong Hai in Jiangsu Province and the office of Wuge in Sichuan Province in China were temporarily closed from early February until early March 2020.

The extent to which COVID-19 negatively impacts our business is highly uncertain and cannot be accurately predicted. We believe that the coronavirus outbreak and the measures taken to control it may have a significant negative impact on not only our business, but economic activities globally. The magnitude of this negative effect on the continuity of our business operation in China remains uncertain. These uncertainties may impede our ability to conduct our daily operations and could materially and adversely affect our business, financial condition and results of operations, and as a result could adversely affect our stock price and create more volatility.

Corporate Structure

The Company is a holding company incorporated in the State of Nevada with no material operations of its own. We currently conduct business through Wuge. For accounting purposes, we receive the economic benefits of Wuge through the VIE agreements, which enable us to consolidate the financial results of Wuge in our consolidated financial statements under U.S. GAAP.

The following is an organizational chart setting forth our corporate structure as of the date of this Annual Report.

Contractual Arrangements between Wuge And Makesi WFOE

Technical Consultation and Services Agreement.Pursuant to the technical consultation and services agreement between Wuge and Tongrong WFOE dated January 3, 2020 and the assignment agreement between Tonrong WFOE and Makesi WFOE dated January 11, 2021, Makesi WFOE has the exclusive right to provide consultation services to Wuge relating to Wuge’s business, including but not limited to business consultation services, human resources development, and business development. Makesi WFOE exclusively owns any intellectual property rights arising from the performance of this agreement. Makesi WFOE has the right to determine the service fees based on Wuge’s actual operation on a quarterly basis. This agreement will be effective as long as Wuge exists. Makesi WFOE may terminate this agreement at any time by giving a 30 days’ prior written notice to Wuge.

Equity Pledge Agreement.Under the equity pledge agreement among Tongrong WFOE, Wuge and Wuge Shareholders dated January 3, 2020 and the assignment agreement between Tonrong WFOE and Makesi WFOE dated January 11, 2021, Wuge Shareholders pledged all of their equity interests in Wuge to Makesi WFOE to guarantee Wuge’s performance of relevant obligations and indebtedness under the technical consultation and services agreement. In addition, Wuge Shareholders will complete the registration of the equity pledge under the agreement with the competent local authority. If Wuge breaches its obligation under the technical consultation and services agreement, Makesi WFOE, as pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. This pledge will remain effective until all the guaranteed obligations are performed or the Wuge Shareholders cease to be shareholders of Wuge.

Equity Option Agreement.Under the equity option agreement among Tongrong WFOE, Wuge and Wuge Shareholders dated January 3, 2020 and the assignment agreement between Tonrong WFOE and Makesi WFOE dated January 11, 2021, each of Wuge Shareholders irrevocably granted to Makesi WFOE or its designee an option to purchase at any time, to the extent permitted under PRC law, all or a portion of his equity interests in Wuge. Also, Makesi WFOE or its designee has the right to acquire any and all of its assets of Wuge. Without Makesi WFOE’s prior written consent, Wuge’s shareholders cannot transfer their equity interests in Wuge and Wuge cannot transfer its assets. The acquisition price for the shares or assets will be the minimum amount of consideration permitted under the PRC law at the time of the exercise of the option. This pledge will remain effective until all options have been exercised.

Voting Rights Proxy and Financial Support Agreement.Under the voting rights proxy and financial support agreement among Tonrong WFOE, Wuge and Wuge Shareholders dated January 3, 2020 and the assignment agreement between Tonrong WFOE and Makesi WFOE dated January 11, 2021, each Wuge Shareholder irrevocably appointed Makesi WFOE as its attorney-in-fact to exercise on such shareholder’s behalf any and all rights that such shareholder has in respect of his equity interests in Wuge, including but not limited to the power to vote on its behalf on all matters of Wuge requiring shareholder approval in accordance with the articles of association of Wuge. The proxy agreement is for a term of 20 years and can be extended by Makesi WFOE unilaterally by prior written notice to the other parties.

Recent Regulatory Developments

On January 4, 2022, the Cyberspace Administration of China, or CAC, issued the revised Measures on Cyberspace Security Review (the “Revised Measures”), which came into effect on February 15, 2022. Under the Revised Measures, any “network platform operator” controlling personal information of no less than one million users which seeks to list in a foreign stock exchange should also be subject to cyber security review.

We dobelieve Shanghai Xianzhui is not believe Wuge is a “network platform operator” who control over one million personal information as mentioned above, given that: (i) WugeShanghai Xianzhui does not possess a large amount of personal information in our business operations and (ii) data processed in Wuge’sShanghai Xianzhui’s business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. As such, we believe we areShanghai Xianzhui is not currently not be subject to the cyber security review by the CAC. However, the definition of “network platform operator” is unclear and it is also unclear on how it will be interpreted and implemented by the relevant PRC governmental authorities. See “Risk factors — Risk Factors Related to Doing Business in China — WugeShanghai Xianzhui may become subject to a variety of laws and regulations in the PRC regarding privacy, data security, cybersecurity, and data protection. WugeShanghai Xianzhui may be required to suspend its business, be liable for improper use or appropriation of personal information provided by our customers or face other penalties.”

On July 6, 2021, the relevant PRC governmental authorities made public the Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law. These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies and proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed companies. As these opinions arewere recently issued, official guidance and related implementation rules have not been issued yet and the interpretation of these opinions remains unclear at this stage. As of the date of this Report, we have not received any inquiry, notice, warning, or sanctions regarding listing abroad or offshore offering from the China Securities Regulatory Commission (“CSRC”) or any other PRC governmental authorities. See “Risk Factors — Risk Factors Related to Doing Business in China — The Chinese government exerts substantial influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S exchanges, however, if WugeShanghai Xianzhui or the holding companyGDC were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange and the value of our common stock may significantly decline or become worthless, which would materially affect the interest of the investors.”

On February 17, 2023, the CSRC released the Trial Administrative Measures for Administration of Overseas Securities Offerings and Listings by Domestic Companies (the “Trial Measures”) and five supporting guidelines, which came into effect on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, both directly and indirectly, should fulfill the filing procedures and report relevant information to the CSRC. If a domestic company fails to complete the filing procedures or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject to administrative penalties by the CSRC, such as order to rectify, warnings, fines, and its controlling shareholders, actual controllers, the person directly in charge and other directly liable persons may also be subject to administrative penalties, such as warnings and fines. As a listed company, we believe that we and all of our PRC subsidiaries are not required to fulfill filing procedures with the CSRC to continue to offer our securities, or continue listing on the Nasdaq Capital Market. However, there are substantial uncertainties regarding the interpretation and application of the dateRegulation on Mergers and Acquisitions of this annual report, we have not received any inquiry, notice, warning, or sanctions regarding listing abroad or offshore offering from the CSRC or anyDomestic Companies by Foreign Investors (“M&A Rules”), other PRC Laws and future PRC laws and regulations, and there can be no assurance that any governmental authorities.agency will not take a view that is contrary to or otherwise different from our belief stated herein. See “Risk Factors - Risk Factors Relating to Doing Business in China - The CSRC has released the Trial Measures for Administration of Overseas Securities Offerings and Listings by Domestic Companies (the “Trial Measures”). With such rules in effect, the Chinese government may exert more oversight and control over offerings that are conducted overseas and foreign investment in China-based issuers, which could significantly limit or completely hinder our ability to continue to offer our securities to investors and could cause the value of our securities to significantly decline or become worthless.”

We believe that we are currently not required to obtain any permission or approval from the China Securities Regulatory Commission (“CSRC”)CSRC and Cyberspace Administration of China (“CAC”)the CAC in the PRC to issue securities to foreign investors. However, there is no guarantee that this will continue to be the case in the future in relation to any future offerings of our company or the continued listing of our company’s securities on the Nasdaq Capital Market, or even in the event such permission or approval is required and obtained, it will not be subsequently revoked or rescinded. If we do not receive or maintain the approvals, or we inadvertently conclude that such approvals are not required, or applicable laws, regulations, or interpretations change such that we are required to obtain approval in the future, we may be subject to an investigation by competent regulators, fines or penalties, or an order prohibiting us from conducting an offering, and these risks could result in a material adverse change in our operations and the value of our securities, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless.

On December 24, 2021, CSRC issued Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Administration Provisions”), and the Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (the “Measures”), which are open for public comments by January 23, 2022. The Administration Provisions and Measures for overseas listings lay out specific requirements for filing documents and include unified regulation management, strengthening regulatory coordination, and cross-border regulatory cooperation. Domestic companies seeking to list abroad must carry out relevant security screening procedures if their businesses involve supervisions such as foreign investment security and cyber security reviews. Companies endangering national security are among those off-limits for overseas listings. According to Relevant Officials of the CSRC Answered Reporter Questions (“CSRC Answers”), after the Administration Provisions and Measures are implemented upon completion of public consultation and due legislative procedures, the CSRC will formulate and issue guidance for filing procedures to further specify the details of filing administration and ensure that market entities could refer to clear guidelines for filing, which means it will still take time to put the Administration Provisions and Measures into effect. As the Administration Provisions and Measures have not yet come into effect, we are currently unaffected by them. However, according to CSRC Answers, only new initial public offerings and refinancing by existing overseas listed Chinese companies will be required to go through the filing process; other existing overseas listed companies will be allowed a sufficient transition period to complete their filing procedure. However, it is uncertain when the Administration Provision and the Measures will take effect or if they will take effect as currently drafted.

Implication of the Holding Foreign Company Accountable Act

The Holding Foreign Companies Accountable Act, or the HFCAA, was enacted on December 18, 2020. The HFCAA states that if the SEC determines that an issuer’s audit reports issued by a registered public accounting firm have not been subject to inspection by the PCAOBPublic Company Accounting Oversight Board (United States) (the “PCAOB”) for three consecutive years beginning in 2021, the SEC shall prohibit such issuer’s securities from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCAA. We will be required to comply with these rules if the SEC identifies us as having a “non-inspection” year under a process to be subsequently established by the SEC. If we fail to meet the new rules before the deadline specified thereunder, we could face possible prohibition from trading on a national securities exchange oron the OTCQB,OTC Markets, deregistration from the SEC and/or other risks, which may materially and adversely affect, or effectively terminate, our securities trading in the United States. On December 2, 2021, the SEC issued amendments to finalize rules implementing the submission and disclosure requirements in the HFCAA. The rules apply to registrants that the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that PCAOB is unable to inspect or investigate completely because of a position taken by an authority in foreign jurisdictions. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by President Biden, which if enacted, would amendcontained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCAA and requireby requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges or the over-the-counter markets if its auditor is not subject to PCAOB inspections for two consecutive years instead of three.

Pursuant tothree, thus reducing the HFCAA,time period for triggering the Public Company Accounting Oversight Board (United States)prohibition on trading. On August 26, 2022, the CSRC, the Ministry of Finance of the PRC (the “PCAOB”“MOF”) issued a Determination Report on December 16, 2021 which found that, and the PCAOB is unablesigned a Statement of Protocol (the “Protocol”), governing inspections and investigations of audit firms based in mainland China and Hong Kong, taking the first step toward opening access for the PCAOB to inspect orand investigate completely registered public accounting firms headquartered in: (1)in mainland China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong. In addition,Pursuant to the PCAOB’s report identifiedfact sheet with respect to the specificProtocol disclosed by the U.S. Securities and Exchange Commission (the “SEC”), the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15, 2022, the PCAOB determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms which are subjectheadquartered in mainland China and Hong Kong and voted to these determinations.vacate its previous determinations to the contrary. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB will consider the need to issue a new determination.

Our previous auditor, WWC, P.C., the independent registered public accounting firm that issues the audit report in this annual report, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess our auditor’s compliance with the applicable professional standards. Our auditor is headquartered in San Mateo, California, and is subject to inspectionEnrome LLP, has been inspected by the PCAOB on a regular basis. Therefore, we believe that, as ofbasis in the date of this annual report, ouraudit period. Our current auditor, is not subject to the determinations as to the inability to inspect or investigate registered firms completely announcedHTL International, LLC (“HTL”), has been inspected by the PCAOB on December 16, 2021.

a regular basis as well. If it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, investors may be deprived of the benefits of such inspection. Any audit reports not issued by auditors that are completely inspected by the PCAOB, or a lack of PCAOB inspections of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures, could result in a lack of assurance that our financial statements and disclosures are adequate and accurate. Moreover, if trading in our securities is prohibited under the HFCAA in the future because the PCAOB determines that it cannot inspect or fully investigate our auditor at such future time, an exchange may determine to delist our securities. See “Risk Factors—Risks Related to Doing Business in China — The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies”companies.”

Consolidation

We conduct all of our business in China through Wuge, the VIE. For accounting purposes, we receive the economic benefits of Wuge through the VIE agreements, which enable us to consolidate the financial results of Wuge in our consolidated financial statements under U.S. GAAP and the structure involves unique risks to investors.

The following tables present selected condensed consolidated financial data of the company and its subsidiaries and the VIE for the fiscal years ended December 31, 2021 and 2020, and balance sheet data as of December 31, 2021 and 2020, which have been derived from our audited consolidated financial statements for those years.

SELECTED CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (LOSS)

| For the Year Ended December 31, 2021 | ||||||||||||||||||||

| CCNC | Subsidiaries | VIE | Eliminations | Consolidated Total | ||||||||||||||||

| Revenue | $ | - | $ | - | $ | 25,029,949 | $ | - | $ | 25,029,949 | ||||||||||

| Net income (loss) | $ | (24,721,486 | ) | $ | - | $ | 3,721,527 | $ | (5,970,933 | ) | $ | (26,970,892 | ) | |||||||

| Comprehensive income (loss) | $ | (24,721,486 | ) | $ | - | $ | 3,750,662 | $ | (6,709,848 | ) | $ | (27,680,672 | ) | |||||||

| For the Year Ended December 31, 2020 | ||||||||||||||||||||

| CCNC | Subsidiaries | VIE | Eliminations | Consolidated Total | ||||||||||||||||

| Revenue | $ | - | $ | - | $ | 591,455 | $ | - | $ | 591,455 | ||||||||||

| Net income (loss) | $ | (1,445,522 | ) | $ | - | $ | (158,591 | ) | $ | 4,114,569 | $ | 2,510,456 | ||||||||

| Comprehensive income (loss) | $ | (1,445,522 | ) | $ | - | $ | (72,076 | ) | $ | 5,795,958 | $ | 4,278,360 | ||||||||

SELECTED CONDENSED CONSOLIDATED BALANCE SHEETS

| As of December 31, 2021 | ||||||||||||||||||||

| CCNC | Subsidiaries | VIE | Eliminations | Consolidated Total | ||||||||||||||||

| Cash | $ | 202,781 | $ | - | $ | 14,385,549 | $ | - | $ | 14,588,330 | ||||||||||

| Total current assets | $ | 1,457,545 | $ | - | $ | 17,258,309 | $ | (2,784,501 | ) | $ | 15,931,353 | |||||||||

| Investments in subsidiaries and VIE | $ | 27,660,000 | $ | - | $ | $ | (27,660,000 | ) | $ | |||||||||||

| Total assets | $ | 51,739,299 | $ | - | $ | 19,367,508 | $ | (20,571,550 | ) | $ | 50,535,257 | |||||||||

| Total liabilities | $ | 5,471,427 | $ | - | $ | 15,833,781 | $ | (2,849,942 | ) | $ | 18,455,266 | |||||||||

| Total shareholders’ equity | $ | 46,267,872 | $ | - | $ | 3,533,727 | $ | (17,721,608 | ) | $ | 32,079,991 | |||||||||

| Total liabilities and shareholders’ equity | $ | 51,739,299 | $ | - | $ | 19,367,508 | $ | (20,571,550 | ) | $ | 50,535,257 | |||||||||

| As of December 31, 2020 | ||||||||||||||||||||

| CCNC | Subsidiaries | VIE | Eliminations | Consolidated Total | ||||||||||||||||

| Cash | $ | - | $ | - | $ | 308,110 | $ | 690,607 | $ | 998,717 | ||||||||||

| Total current assets | $ | 7,527,552 | $ | - | $ | 1,048,385 | $ | 3,403,256 | $ | 11,979,193 | ||||||||||

| Investments in subsidiaries and VIE | $ | 27,660,000 | $ | - | $ | $ | (27,660,000 | ) | $ | |||||||||||

| Total assets | $ | 35,187,552 | $ | - | $ | 2,304,566 | $ | (12,356,999 | ) | $ | 25,135,119 | |||||||||

| Total liabilities | $ | 2,046,099 | $ | - | $ | 2,521,501 | $ | (1,345,236 | ) | $ | 3,222,364 | |||||||||

| Total shareholders’ equity | $ | 33,141,453 | $ | - | $ | (216,935 | ) | $ | (11,011,763 | ) | $ | 21,912,755 | ||||||||

| Total liabilities and shareholders’ equity | $ | 35,187,552 | $ | - | $ | 2,304,566 | $ | (12,356,999 | ) | $ | 25,135,119 | |||||||||

SELECTED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the Year Ended December 31, 2021 | ||||||||||||||||||||

| CCNC | Subsidiaries | VIE | Eliminations | Consolidated Total | ||||||||||||||||

| Net cash provided by (used in) operating activities | $ | (13,402,262 | ) | $ | - | $ | 14,262,544 | $ | (6,371,334 | ) | $ | (5,511,052 | ) | |||||||

| Net used in investing activities | $ | - | $ | - | $ | (308,778 | ) | $ | (961,706 | ) | $ | (1,270,484 | ) | |||||||

| Net cash provided by (used in) financing activities | $ | 22,539,996 | $ | - | $ | 255,766 | $ | - | $ | 22,795,762 | ||||||||||

| For the Year Ended December 31, 2020 | ||||||||||||||||||||

| CCNC | Subsidiaries | VIE | Eliminations | Consolidated Total | ||||||||||||||||

| Net cash provided by (used in) operating activities | $ | (4,472,402 | ) | $ | 537,243.00 | $ | 1,972,313 | $ | 1,960,745 | $ | (2,101 | ) | ||||||||

| Net used in investing activities | $ | (7,200,000 | ) | $ | (3,165,786.00 | ) | $ | (1,183,234 | ) | $ | 7,018,212 | $ | (4,530,808 | ) | ||||||

| Net cash used in financing activities | $ | 2,511,657 | $ | - | $ | 547,538 | $ | - | $ | 3,059,195 | ||||||||||

Asset Transfer between our Company and our Subsidiaries and the VIE

As of the date of this annual report, our Company, our subsidiaries, and Wuge have not distributed any earnings or settled any amounts owed under the VIE agreements. Our Company, our subsidiaries, and Wuge do not have any plan to distribute earnings or settle amounts owed under the VIE agreements in the foreseeable future.

During the fiscal years ended December 31, 2021, there was no cash transfers and transfers2023, GDC transferred a total of other assets between our Company, our subsidiaries, and Wuge. $2,100,000 to its subsidiary AI Catalysis Corp.

During the fiscal years ended December 31, 2020, cash transfers and transfers2022, there was no transfer of other assets between our Company, our subsidiaries,GDC and Wuge were as follows: its subsidiaries.

| For the Year Ended December 31, 2020 | ||||||||||

| No. | Transfer From | Transfer To | Approximate Value ($) | Note | ||||||

| 1 | Tongrong | VIE | 1,226,072 | Cash (as working capital) borrowed by the VIE from Tongrong | ||||||

Our Products and Services – Wuge Digital Door Signs

Wuge creates digital door signs that combine the five-W elements (when, where, who, why, what), geographic location via the Beidou satellite system and identity information using Code Chain technology. It is the digitalization of a physical store by means of animation and other technical means presented on the internet and Internet of Things (IoT). It is based on the geographic location of the store. Wuge door sign can be used in our mobile application Wuge Social, available on Android platform. The mobile application provides a display of the map and store based on real cities and uses the IoT Grid as the access point to access e-commerce by Code Chain. Through the mobile application and Wuge Manor, the game within the mobile application, users can have access to hundreds of vendors and business owners in China, participate in activities those businesses set up and collect points, which can be redeemed as equipmentGDC operates in the game or coupons usable when making purchase at that business. Code Chain access tofollowing distinct business sectors through the Company and two subsidiaries, AI Catalysis Corp. and Shanghai Xianzhui: 1) AI-driven digital human creation and customization; 2) Live streaming and e-commerce includes Online to Offline (O2O) “scanning QR Code” and social media that seamlessly link offline3) Live streaming interactive game. The company has relentlessly been focusing on serving its customers and onlinecreating value for them through the continual innovation and connect realoptimization of its products and virtual directly, so that each IoT Grid becomes an e-commerce access to realize the decentralization of e-commerce access and complete the basic layout for blockchain e-commerce. Wuge digital door sign can be purchased. Such purchaser can use Wuge Social to promote the store of which the Wuge digital door sign was purchased and receive commissions and other incentive from the store owner.services.

| 1. | AI-Driven Digital Human |

Our Customers

| - | Digital Human Creation and Customization |

The Company uses AI algorithms and software to generate realistic 3D or 2D digital human models. AI algorithms and machine learning models are used to simulate human characteristics, such as facial expressions, body movements, and even speech patterns. These models can be customized to create and personalize lifelike digital representations of humans. Customization may involve adjusting facial features, body proportions, skin textures, hair styles, clothing, and more.

| - | Digital Human Technology Application |

Once created and customized, digital humans find applications in a wide range of industries, including gaming, entertainment, advertising, education, and more. Depending on the specific industry and the application scenario, the Company helps the customers to define the objectives to achieve with digital humans, choose the technology for character customization, then create unique aviators and deploy in the chosen platform.

The customers of Wuge are mainly natural person customers. Wuge does not have customers that individually accountsCompany currently plans to generate lifelike digital humans for 10% of its revenue.the following key business areas:

| ● | Virtual Influencers and Social Media |

The Company aims to create digital humans to gain popularity as virtual influencers on social media platforms. These virtual personalities can collaborate with brands and engage with followers, blurring the line between fiction and reality.

Our SuppliersA well-thought-out narrative to create digital characters with diversified personal identity, appearance, storytelling, and actions can resonate with its audience and influence them on notable social media platforms. It aims to attract a large following on social media and has the ability to produce responsible content 24/7. The Company also uses open source AI tools to create unconventional digital characters and videos.

| ● | Online Marketing and Advertising |

Digital humans can be used in marketing campaigns and advertisements to engage with consumers. They can serve as virtual brand ambassadors or spokespersons, providing a more personal and interactive experience. The Company creates customized digital humans to support the clients’ marketing efforts.

Wuge relies

| 2. | E-Commerce and Live Streaming |

| - | Digital Human in E-Commerce and Live Streaming |

The Company applies digital human technology in live streaming e-commerce businesses. Livestream usage is taking off globally. The integration of cutting-edge AI digital human technologies and live streaming platforms will transform the way businesses, sellers and consumers engage in online commerce. Digital anchors can offer long-duration intelligent live broadcasting. It also supports customized avatars that perfectly adapt to different live streaming scenarios.

| - | E-Commerce on Social Media Platforms |

The company has introduced online e-commerce businesses on one supplierTikTok. Our focus is on capturing TikTok’s popular trend by offering carefully selected product choices with smooth delivery. We aim to redefine the online shopping experience by providing a diverse range of products with real-time interaction capabilities. Currently, our product offerings include popular Asian snacks, small home appliances, gardening tools, 3C products, and more. We plan to introduce additional product types, such as Asian branded beauty products, personal care, fashion, and more trending popular items in Asia, to TikTok consumers.

| - | E-Commerce Live Streaming Businesses |

The Company intends to expand its e-commerce offerings on the social media platform into live-streaming. We plan to diversify our livestream hosts by incorporating different styles and personalities. In addition to the real-time improvisation by hosts during each live streaming session, our community interactions generate another form of content. The variety of real-time interactions between viewers and hosts or among viewers creates viewer-generated content, which becomes part of the fiscal year ended December 31, 2020, Ali Cloud Computing Co. Ltd.overall entertainment and social experience offered on our platform. Such content enhances the sense of involvement and makes it more enjoyable to watch live streaming while customers are shopping online.

| 3. | Live Streaming Interactive Game |

The Company has launched a live-streamed game called “Trible Light.” This game is owned by the company, and we independently operate it. Currently, the game is being livestreamed on TikTok (TikTok account: almplify001). In addition to “Trible Light,” we have also introduced other licensed games on the same TikTok account, providing a diverse gaming experience for the players.

Wuge reliesThese interactive live streaming games on one supplierthe TikTok platform are specifically designed for young game enthusiasts worldwide. They offer real-time and immersive gaming experiences, where viewers can actively participate as players during the fiscal year ended December 31, 2021, Ali Cloud Computing Co. Ltd.livestream. Our livestream hosts enhance the experience by providing commentary, tips, and insights to engage and excite the players. Furthermore, this unique live streaming format allows viewers to gift virtual tokens to their favorite hosts, fostering a sense of community among our gaming audience.

This innovative gaming style is already popular in Asia which offers instant, thrill-packed experiences for TikTok enthusiasts. The game is user-friendly, entertaining, and available whenever players decide to participate. We plan to continuously diversify our game offerings to provide more enjoyable options based on viewers’ preferences. AI Catalysis intends to expand anchor personalities. Currently, the company has collaborated with two hosts - one with a great sense of humor and another with keen gaming insights. The game has gained significant momentum and has captured the attention of many TikTok users.

AI Catalysis plans to diversify its game offerings and collaborate with various TikTok personalities. In both e-commerce and live streaming and live streaming interactive game business sectors, AI Catalysis is committed to serving the TikTok audience 24/7. We also have plans to introduce digital hosts to ensure continuous entertainment.

Research and Development and Our TechnologyRevenue Model

Wuge has a strong technology development team, consisted of 26 experienced members, that focused on research, improvementWe aim to generate revenue from: 1) Service revenue and maintenance the existingadvertising revenue from digital human creation and developing games and Code Chain technology.

Copyrights

As of March 31, 2022, Wuge has one software copyright registered in China.customization; 2) Products’ sales revenue from social live streaming e-commerce business; 3) Virtual paid gifts revenue from live streaming interactive gaming.

|

| |||||||||

The Company will monetize our services through:

Competition

| - | Services fee for custom avatar creation: to provide customized services to our customers for designing and generating unique digital human avatars. Our target customers are mainly individuals or small and medium-sized businesses (“SMB”) in the consumer industry. For SMB customers, digital humans can be used in advertising and marketing campaigns to create engaging content, or engaging with consumers on social media platforms as a brand ambassador or spokespeople to increase brand visibility and loyalty. We can also provide ongoing maintenance, updates, and support for their digital humans. Based on the scope of work and complexity of the project, the company provides advice, project planning, and strategy development in exchange for consulting fees. |

| - | Advertising partnership fee: When the Company’s own virtual influencers gain a significant following or visibility on the social media platforms, we consider partnering with brands for sponsored content or advertising opportunities related to the digital human work. |

| - | Licensing fee: license the right to clients to use, deploy, or integrate digital human avatars or characters created by the company for a fee. Licensing agreements can vary based on usage, duration, and exclusivity. |

| 2. | Social and Live Streaming E-Commerce Gross Merchandise Value |

| - | Product sales: Hosts or influencers showcase products, answer questions from viewers, and encourage viewers to make purchases of the products in real time during live streaming. |

| - | Virtual gifts and tipping: Viewers have the option to send virtual gifts or tips to hosts or influencers during live streams. These virtual gifts are purchased with real money, and the platform and the host/influencers share the revenue generated from virtual gifting. |

| 3. | Live Streaming Interactive Gaming |

| - | Virtual paid gifts: Virtual paid gifts from viewers are the main revenue source for the live streaming gaming industry. Virtual gifting is a considerably successful business model that stimulates streamers’ content generation and viewer-streamer interactions. Live streaming platforms earn revenues from sales of paid gifts, and streamers earn a proportion of the received gifts or donations or tips from fans. |

Code Chain technology and electronic token are at a developing stage in China. There is currently no established competitor in the market in China.Our Customers

Recent Business Development

AI Catalysis’ main business is conducting virtual human live streams and bullet chat game broadcasts on TikTok, with expected revenue primarily coming from user tips.

August 2020 Private Placement

On August 11, 2020, pursuant to certain securities purchase agreements, dated May 1, 2020, the Company issued 1,674,428 shares of its common stock, at a per share purchase price of $1.50, to eleven investors. The gross proceeds to the Company from this private placement were approximately $2.51 million. None of the investors is a “U.S. person” as defined under Regulation S. The shares of common stock issued in the private placement are exempt from the registration requirements of the Securities Act, pursuant to Regulation S promulgated thereunder.

February 2021 Offering

Registered Direct Offering and Private Placement

On February 18, 2021, we entered into a securities purchase agreement (the “Securities Purchase Agreement”) with certain purchasers, pursuant to which, on February 22, 2021, we sold (i) 4,166,666 shares of common stock, (ii) registered warrants (the “Registered Warrants”) to purchase an aggregate of up to 1,639,362 shares of common stock and (iii) unregistered warrants (the “Unregistered Warrants”) to purchase up to 2,527,304 shares (the “Warrant Shares”) of common stock in a registered direct offering (the “Registered Direct Offering”) and a concurrent private placement (the “Private Placement,” and together with the Registered Direct Offering, the “Offering”). The terms of the Offering were previously reported in a Form 8-K filed with the SEC on February 18, 2021 and the closing of the Offering was reported in a Form 8-K filed with the Commission on February 22, 2021.Our Suppliers

The gross proceeds of the Offering of $24,999,996, before deducting placement agent feesCompany’s top three suppliers are Lida Global Limited, Shanghai Alliance Information Technology Co., Ltd. and other expenses, are being used for working capital and general business purposes.Jinhe Capital Limited.

The Registered Warrants have a term of five years and are exercisable immediately at an exercise price of $6.72 per share, subject to adjustments thereunder, including a reduction in the exercise price, in the event of a subsequent offering at a price less than the then current exercise price, to the same price as the price in such offering (a “Price Protection Adjustment”).Employees

The Unregistered Warrants have a termAs of five and one-half years and are first exercisable on the date that is the earlier of (i) six months after the date of issuance or (ii) the date on which theApril 1, 2024, our Company obtains stockholder approval approving the sale of the securities sold under the Securities Purchase Agreement, to purchase an aggregate of up to 2,527,304 shares of common stock. The Unregistered Warrants have an exercise price of $6.72 per share, subject to adjustments thereunder, including (x) a Price Protection Adjustment and (y)has 8 full-time employees in the event the exercise price is more than $6.10, a reduction of the exercise price to $6.10, upon obtaining such stockholder approval.total.

The Offering was conducted pursuant to a placement agency agreement, dated February 18, 2021 (the “Placement Agency Agreement”), between the CompanyWe have not experienced any significant labor disputes and Univest Securities, LLC (the “Placement Agent”), on a “reasonable best efforts” basis. The Company paid the Placement Agent a cash fee of $2,310,000, including $2,000,000 in commission which was equal to eight percent (8.0%) of the aggregate gross proceeds raised in this Offering, $250,000 in non-accountable expense which was equal to one percent (1%) of the aggregate gross proceeds raised in the Offering, and $60,000 in accountable expenses. Additionally, the Company issued to the Placement Agent warrants to purchase up to 208,333 shares of common stock,consider our relationship with a term of five years first exercisable six months after the date of issuance and at an exercise price of $6.00 per share.

Stockholder Approval

Pursuant to the Securities Purchase Agreement, we are required to hold a meeting of our stockholders not later than April 29, 2021 to seek such approval as may be required from our stockholders (the “Stockholder Approval”), in accordance with applicable law, the applicable rules and regulations of the Nasdaq Stock Market, our certificate of incorporation and bylaws and the Nevada Revised Statutes with respect to the issuance of the securities in the Offering, including the Warrants sold in the Private Placement, so that the issuance by us of shares of common stock in excess of the 6,954,059 shares (19.99% of the shares of common stock outstanding as of February 17, 2021, the date prior to entering into the Securities Purchase Agreement) in the aggregate (the “Issuable Maximum”), will be in compliance with Nasdaq Listing Rules 5635(a) and 5635(d) as described herein, and investors in the Offering will be able to exercise the Warrants prior to six months after the closing of the Offering.

In the event that despite our reasonable best efforts we are unable to obtain the Stockholder Approval by that date, we are required to hold an additional special meeting of stockholders and obtain Stockholder Approval by July 31, 2021. In the event that despite our reasonable best efforts we are unable to obtain Stockholder Approval by that date, we are required to hold additional meetings of our stockholders each fiscal quarter until Stockholder Approval has been obtained. Until we have obtained Stockholder Approval, we may not consummate any subsequent financings at less than an effective price of $6.72 per share of our common stock.

Asset Purchase Agreement dated February 23, 2021, as amended on April 16, 2021 and May 28, 2021

On February 23, 2021, the Company entered into an asset purchase agreement with Sichuan RiZhanYun Jisuan Co., Ltd. (the “Seller”), which was amended and restated on April 16, 2021, and further amended on May 28, 2021. Pursuant to the asset purchase agreement, the Company purchased a total of 10,000 Bitcoin mining machines (the “Assets”) for a total purchase price of RMB 40,000,000 or US$6,160,000 based on the exchange rate as of April 8, 2021 (the “Purchase Price”), payable in the form of 1,587,800 shares of common stock of the Company, valued at US$3.88 per share, which is the closing bid price of the common stock of the Company on the Nasdaq Stock Market on April 8, 2021. The Seller shall cause revenue and any other source of income from the operation of the Assetsemployees to be paid to the Company, payable in cryptocurrency to be deposited into a cryptocurrency wallet heldgood. Our employees are not covered by the Company on a daily basis. The Company shall issue to the Seller or its designees RMB 5,000,000 or US$770,000 worth of common stock of the Company (the “Bonus Shares”) if the Assets generate an average net profit per day/10,000 machines (the “Daily Profit”) on behalf of the Company during the one-year period from March 19, 2021 to March 19, 2022 (the “Valuation Period”) equals to RMB 200,000 or US$30,800 and if the Assets generate an average net profit per month/10,000 machines (the “Monthly Profit”) on behalf of the Company during the Valuation Period equals to RMB 6,000,000 or US$924,000. If the Daily Profit is more than RMB 200,000 or US$30,800 and the Monthly Profit is more than RMB 6,000,000 or US$924,000, the Company shall issue to the Seller or its designees additional shares of common stock in proportion to the amount that is in excess. If the Daily Profit is less than RMB 200,000 or US$30,800 or the Monthly Profit is less than RMB 6,000,000 or US$924,000, the Company shall not issue to the Seller or its designees any Bonus Shares and such month is deemed a “Re-evaluated Month”. At the end of the Valuation Period, the Monthly Profit of such Re-evaluated Month(s) shall be aggregated (the “Aggregate Profit”), and the Company shall issue RMB5,000,000 or US$770,000 worth of common stock of the Company for every RMB6,000,000 or US$924,000 in Aggregate Profit on a pro rata basis. Such Daily Profit and Monthly Profit shall be determined on a monthly basis on the first day of the next month. Such Bonus Shares and additional shares, when applicable, shall be issued on the fifteenth day of the next month. For any month that has 28 days or 31 days, the Monthly Profit is calculated based on the actual number of days in the month. Notwithstanding the foregoing, no share pursuant to this Agreement shall be issued earlier than May 24, 2021 in any event. The total number of shares of common stock, including the Bonus Shares, issuable to the Seller or its designees pursuant to the Agreement shall in no event be more than 19.99% of the total shares issued and outstanding of Company as of the February 23, 2021, the date of the asset purchasecollective bargaining agreement.

On June 1, 2021,As we continue to expand our business, we believe it is critical to hire and retain top talent. We believe we have the Company issuedability to a designee of the Seller 2,513,294 shares of common stock, consisted of (i) the Purchase Price in the form of 1,587,800 shares of common stockattract and (ii) 925,494 Bonus Shares, valued at US$2.51 per share, which is the closing bid price of the common stock of the Companyretain high quality talents based on the Nasdaq Stock Market on May 12, 2021,our competitive salaries, annual performance-based bonus system, and equity incentive program for meetingsenior employees and exceeding the Daily Profit and Monthly Profit benchmark.

Sales and Purchase Agreement dated March 3, 2021

The Company entered into a sales and purchase agreement with Bitmain Technologies Limited, pursuant to which the Company agreed to purchase 2,000 units of Antminer S19j (90 TH/s) cryptocurrencies mining machines, for a total price of $9,632,640. The machines have not been delivered.

Joint Venture Agreement dated June 1, 2021

On June 1, 2021, the Company entered into a joint venture agreement with Zhongyou Technology (Shenzhen) Co., Ltd. to jointly establish Zero Carbon Energy (Shenzhen) Co., Ltd. (the “Joint Venture”), a digital energy carbon neutral innovation platform which uses digital technology to open up the upstream and downstream of the energy industry chain to achieve carbon neutrality and boost the transformation and upgrading of the industry and carbon emission reduction. The registered capital of the Joint Venture shall be one million U.S. dollars, to be contributed by the Company. The Company will hold 51% interest of the Joint Venture. As of March 31, 2022, the Company has not made any contribution nor has the joint venture been established.executives.

Recent Development

Asset Purchase Agreement dated July 28, 2021 and Termination Agreement dated February 23, 2022Disposition of Wuge