UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 20222023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number:file number: 001-40064

VIRPAX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 82-1510982 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification |

1055 Westlakes Drive, Suite 300 Berwyn, PA | 19312 | |

| (Address of principal executive offices) | (Zip |

(610) 727-4597

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of | Trading | Name of Registered | ||

| Common Stock, par value $0.00001 per share | VRPX | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2022,2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $14,614,844$9,398,700 based on the closing sale price on June 30, 2022,2023, as reported on the NASDAQNasdaq Capital Markets.

As of March 21, 202322, 2024 the number of outstanding shares of the registrant’s common stock, par value $0.00001 per share, was 11,714,284.1,171,233.

DOCUMENTS INCORPORATED BY REFERENCE

None.

VIRPAX PHARMACEUTICALS, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 20222023

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This reportAnnual Report on Form 10-K contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this report on Annual Report on Form 10-K may include, for example, statements about:

| ● | our lack of operating history; |

| ● | the expectation that we will incur significant operating losses for the foreseeable future and will need significant additional capital; | |

| ● | our current and future capital requirements to support our development and commercialization efforts for our product candidates and our ability to satisfy our capital needs; | |

| ● | the outcome of certain current litigation in which we and our former Chief Executive Officer are named as defendants (See Part 1-Item 1A-Risk Factors, Item 3-Legal Proceedings); |

| ● | our ability to raise additional capital; |

| ● | our dependence on our product candidates, which are still in preclinical or early stages of clinical development; |

| ● | our, or that of our third-party manufacturers, ability to manufacture current good manufacturing practice (“cGMP”) quantities of our product candidates as required for preclinical and clinical trials and, subsequently, our ability to manufacture commercial quantities of our product candidates; |

| ● | our ability to complete required clinical trials for our product candidates and obtain approval from the US Food and Drug Administration (“FDA”) or other regulatory agencies in different jurisdictions; |

| ● | our lack of a sales and marketing organization and our ability to commercialize our product candidates if we obtain regulatory approval; |

| ● | our dependence on third-parties to manufacture our product candidates; |

| ● | our reliance on third-party contract research organizations (“CROs”) to conduct our clinical trials; |

| ● | our ability to maintain or protect the validity of our intellectual property; |

| ● | our ability to internally develop new inventions and intellectual property; |

| ● | interpretations of current laws and the passages of future laws; |

| ● | acceptance of our business model by investors; |

| ● | the accuracy of our estimates regarding expenses and capital requirements; |

| ● | our ability to maintain our Nasdaq listing; and |

| ● | our ability to adequately support organizational and business |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may cause our actual results to differ from those anticipated in such forward-looking statements. Please see “Part I—Item 1A—Risk Factors” for additional risks which could adversely impact our business and financial performance.

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this report or the date of the document incorporated by reference into this report. We have no obligation, and expressly disclaims any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise. We have expressed our expectations, beliefs and projections in good faith and believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will result or be achieved or accomplished.

ii

PART I

ITEM 1. BUSINESS

All referencesForward-Looking Statements

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties. The forward-looking statements are contained principally in Part I, Item 1. “Business,” Part I, Item 1A. “Risk Factors,” and Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” but are also contained elsewhere in this reportAnnual Report and in some cases you can identify forward-looking statements by terminology such as “may,” “should,” “potential,” “continue,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” and similar expressions. These statements are based on our current beliefs, expectations, and assumptions and are subject to “Virpax,”a number of risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual results to differ materially from those expressed, projected or implied in or by the “Company,”forward-looking statements.

You should refer to Item 1A. “Risk Factors” section of this Annual Report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We do not undertake any obligation to update any forward-looking statements. Unless the context requires otherwise, references to “we,” “us,” or “our” mean“our,” and “Virpax,” refer to Virpax Pharmaceuticals, Inc. and its subsidiaries unless we state otherwise or the context otherwise indicates.subsidiaries.

Our CompanySummary Risk Factors

Risks Related to Our Financial Position and Need for Additional Capital

| ● | We are a preclinical stage biopharmaceutical company with a limited operating history. |

| ● | We have incurred losses since inception and anticipate that we will continue to incur losses for the foreseeable future. We are not currently profitable, and we may never achieve or sustain profitability. |

| ● | The report of our independent registered public accounting firm for the fiscal years ended December 31, 2023 and 2022 contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. |

| ● | We will require additional capital to fund our operations, we may not be able to raise additional capital, and if we fail to obtain necessary financing, we will not be able to complete the development and commercialization of our drugs. |

| ● | Raising additional capital will cause dilution to our stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates. |

| ● | Our ability to use our net operating loss carryforwards to offset future taxable income will be subject to certain limitations. |

| ● | Our ability to further develop our product candidates will be adversely affected by the terms of the Settlement Agreement (See Part 1-Item 1A-Risk Factors, Item 3-Legal Proceedings and Recent Developments – Litigation). |

| ● | The Company has been affected by significant litigation which requires the Company to pay an additional $2.5M by July 1, 2024, as part of the Settlement Agreement, and may in the future be affected by new litigation and indemnification and contribution claims related to our recently settled litigation with Sorrento Therapeutics, Inc. and Scilex Pharmaceuticals, Inc., which such claims may be material, and potential estimated separation payments that we make to our former Chief Executive Officer, which may be material. In addition, our officers and directors may be subject to various types of litigation in the future, and our insurance may not be sufficient to cover damages related to those claims. See “Risk Factor- Our business, financial condition and results of operations could be adversely affected by indemnification and other claims related to the damages awarded in our recently settled litigation with Sorrento Therapeutics, Inc. and Scilex Pharmaceuticals, Inc”, (See Part 1-Item 1A-Risk Factors, and Item 3-Legal Proceedings and Recent Developments – Litigation). |

Risks Related to Development, Clinical Testing, Manufacturing and Regulatory Approval

| ● | Clinical trials are expensive, time-consuming and difficult to design and implement, and involve an uncertain outcome. |

| ● | Disruptions in the global economy and supply chains may have a material adverse effect on our business, financial condition and results of operations. |

| ● | Adverse global conditions, including economic uncertainty, may negatively impact our financial results. |

| ● | Our development activities for Probudur are conducted in Israel. The war in the Middle East, may affect our operations. |

| ● | The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our Product Candidates or any other product candidates, our business will be substantially harmed. |

| ● | If we are unable to file for approval of Epoladerm and Probudur under Section 505(b)(2) of the FDCA or if we are required to generate additional data related to safety and efficacy in order to obtain approval under Section 505(b)(2), we will be unable to meet our anticipated development and commercialization timelines. |

| ● | Enrollment and retention of patients in clinical trials is an expensive and time-consuming process and could be made more difficult or rendered impossible by multiple factors outside our control. |

| ● | The COVID-19 pandemic has adversely affected our business and a resurgence of COVID-19 or another health epidemic or pandemic may have an adverse impact on our business in the future. |

| ● | Results of preclinical studies, early clinical trials or analyses may not be indicative of results obtained in later trials. |

| ● | Interim “top-line” and preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data. |

| ● | Our product candidates may cause serious adverse events or undesirable side effects, which may delay or prevent marketing approval, or, if approved, require them to be taken off the market, require them to include safety warnings or otherwise limit their sales. |

| ● | The market opportunities for our Product Candidates, if approved, may be smaller than we anticipate. |

| ● | We have never obtained marketing approval for a product candidate and we may be unable to obtain, or may be delayed in obtaining, marketing approval for any of our product candidates. |

| ● | Even if we obtain FDA approval for our Product Candidates or any other product candidate in the United States, we may never obtain approval for or commercialize our Product Candidates or any other product candidate in any other jurisdiction, which would limit our ability to realize their full market potential. |

| ● | Even if we obtain regulatory approval for our Product Candidates or any product candidate, we will still face extensive and ongoing regulatory requirements and obligations and any product candidates, if approved, may face future development and regulatory difficulties. |

| ● | Potential product liability lawsuits against us could cause us to incur substantial liabilities and limit commercialization of any products that we may develop. |

Risks Related to Commercialization

| ● | We face significant competition from other biotechnology and pharmaceutical companies and our operating results will suffer if we fail to compete effectively. |

| ● | The successful commercialization of our Product Candidates and any other product candidate we develop will depend in part on the extent to which governmental authorities and health insurers establish adequate coverage, reimbursement levels, and pricing policies. Failure to obtain or maintain coverage and adequate reimbursement for our product candidates, if approved, could limit our ability to market those products and decrease our ability to generate revenue. |

| ● | Even if our Product Candidates or any product candidate we develop receives marketing approval, it may fail to achieve market acceptance by physicians, patients, third-party payors or others in the medical community necessary for commercial success. |

| ● | If we are unable to establish sales, marketing, and distribution capabilities either on our own or in collaboration with third parties, we may not be successful in commercializing our Product Candidates, if approved. |

| ● | A variety of risks associated with operating internationally could materially adversely affect our business. |

Risks Related to Our Dependence on Third Parties

| ● | Our employees and independent contractors, including principal investigators, CROs, consultants, vendors, and any third parties we may engage in connection with development and commercialization, may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements, which could have a material adverse effect on our business. |

| ● | We currently rely on third-party contract manufacturing organizations (“CMOs”) for the production of clinical supply of our Product Candidates and intend to rely on CMOs for the production of commercial supply of our Product Candidates, if approved. Our dependence on CMOs may impair the development and commercialization of the drug, which would adversely impact our business and financial position. |

| ● | We intend to rely on third parties to conduct, supervise and monitor our clinical trials. If those third parties do not successfully carry out their contractual duties, or if they perform in an unsatisfactory manner, it may harm our business. |

Risks Related to Healthcare Laws and Other Legal Compliance Matters

| ● | Enacted and future healthcare legislation may increase the difficulty and cost for us to obtain marketing approval of and commercialize our product candidates, if approved, and may affect the prices we may set. |

| ● | Our business operations and current and future relationships with investigators, healthcare professionals, consultants, third-party payors, patient organizations, and customers will be subject to applicable healthcare regulatory laws, which could expose us to penalties. |

| ● | Any clinical trial programs we conduct or research collaborations we enter into in the European Economic Area may subject us to the General Data Protection Regulation. |

| ● | We are subject to environmental, health and safety laws and regulations, and we may become exposed to liability and substantial expenses in connection with environmental compliance or remediation activities. |

Risks Related to Our Intellectual Property

| ● | If we fail to comply with our obligations under our existing intellectual property licenses, we risk losing the rights to our intellectual property. |

| ● | If we are unable to obtain and maintain patent protection for our technology, products, and product candidates or if the scope of the patent protection obtained is not sufficiently broad, we may not be able to compete effectively in our markets. |

| ● | We may become subject to third parties’ claims alleging infringement of their patents and proprietary rights, or we may need to become involved in lawsuits to protect or enforce our patents, which could be costly, time consuming, delay or prevent the development and commercialization of our products and product candidates or put our patents and other proprietary rights at risk. |

| ● | We may not identify relevant third-party patents or may incorrectly interpret the relevance, scope or expiration of a third-party patent, which might adversely affect our ability to develop, manufacture and market our products and product candidates. |

| ● | Changes in patent laws or patent jurisprudence could diminish the value of patents in general, thereby impairing our ability to protect our products and product candidates. |

| ● | Obtaining and maintaining our patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements. |

| ● | We enjoy only limited geographical protection with respect to certain patents and we may not be able to protect our intellectual property rights throughout the world. |

| ● | If we do not obtain patent term extension in the United States under the Hatch-Waxman Act and in foreign countries under similar legislation, thereby potentially extending the term of marketing exclusivity for our products, our business may be materially harmed. |

| ● | Intellectual property rights do not address all potential threats to our competitive advantage. |

| ● | Our reliance on third parties requires us to share our trade secrets, which increases the possibility that our trade secrets will be misappropriated or disclosed, and confidentiality agreements with employees and third parties may not adequately prevent disclosure of trade secrets and protect other proprietary information. |

| ● | If our trademarks and trade names are not adequately protected, then we may not be able to build name recognition in our markets of interest and our business may be adversely affected. |

| ● | We may need to license certain intellectual property from third parties, and such licenses may not be available or may not be available on commercially reasonable terms. |

| ● | We may be subject to claims that our employees, consultants, collaborators contractors or advisors have wrongfully used or disclosed confidential information of their former employers or other third parties. |

| ● | Our proprietary information may be lost, or we may suffer security breaches. |

Risks Related to Our Employees, Managing Our Growth and Our Operations

| ● | We have experienced turnover in our senior management team, and the loss of one or more of our executive officers or key employees or an inability to attract and retain highly skilled employees could adversely affect our business. |

| ● | We expect to expand our development, regulatory, and sales and marketing capabilities, and as a result, we may encounter difficulties in managing our growth, which could disrupt our operations. |

| ● | We may engage in acquisitions that could disrupt our business, cause dilution to our stockholders or reduce our financial resources. |

| ● | Our business and operations would suffer in the event of system failures. |

| ● | We are increasingly dependent on information technology, and our systems and infrastructure face certain risks, including cybersecurity and data leakage risks. |

Risks Related to Our Common Stock

| ● | Our failure to meet the continued listing requirements of The Nasdaq Capital Market could result in a de-listing of our common stock. |

| ● | The market price of our common stock has been volatile and can fluctuate substantially, which could result in substantial losses for purchasers of our common stock. |

| ● | We could be subject to securities class action litigation. |

| ● | Our directors, executive officers and certain stockholders (one of which is an affiliate of our former Chief Executive Officer) will continue to own a significant percentage of our common stock and, if they choose to act together, will be able to exert significant control over matters subject to stockholder approval. |

| ● | If securities or industry analysts do not publish research or reports about our business, or if they issue an adverse or misleading opinion regarding our common stock, our stock price and trading volume could decline. |

| ● | Because we do not anticipate paying any cash dividends on our common stock in the foreseeable future, capital appreciation, if any, will be your sole source of gain. |

| ● | We have incurred and will continue to incur increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives and corporate governance practices. |

| ● | We are an “emerging growth company,” and the reduced reporting requirements applicable to emerging growth companies may make our common stock less attractive to investors. |

| ● | Anti-takeover provisions contained in our certificate of incorporation and bylaws, as well as provisions of Delaware law, could impair a takeover attempt. |

| ● | Our certificate of incorporation, as amended, designates the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or other employees. |

Our Company

We are a preclinical-stage pharmaceutical company focused on developing novel and proprietary drug delivery systems across various pain indications in order to enhance compliance and optimize each product candidate in our pipeline. Our drug-delivery systems and drug-releasing technologies being developed are focused on advancing non-opioid and non-addictive pain management treatments and treatments for central nervous system (“CNS”) disorders to enhance patients’ quality of life.

We have exclusive global rights to the following proprietary patented technologies: (i) Molecular Envelope Technology (“MET”) that uses an intranasal device to deliver enkephalin for the management of acute and chronicsevere pain, including post cancer pain associated with cancer (Envelta™) and PTSD (PES200)post-traumatic stress disorder (“PTSD”), (ii) Injectable “local anesthetic” Liposomal Gel Technology for postoperative pain management (Probudur™), and (iii) Topical Spray Film Delivery Technology for osteoarthritis pain (Epoladerm™). We intend to utilize these delivery technologies to selectively develop a portfolio of patented 505(b)(2) and new chemical entity (“NCE”) candidates for commercialization. We also have exclusive global rights to develop and commercialize an investigationalInvestigational formulation delivered via the nasal route to enhance pharmaceutical-grade cannabidiol (“CBD”) transport to the brain (“NobrXiolTMNobrXiol™”, formerly VRP324) to potentially treat epileptic seizures associated with tuberous sclerosis complex (“TSC”), Lennox-Gastaut syndrome (LGS) and Dravet syndrome (DS) in pediatric patients one yeartwo years of age and older.

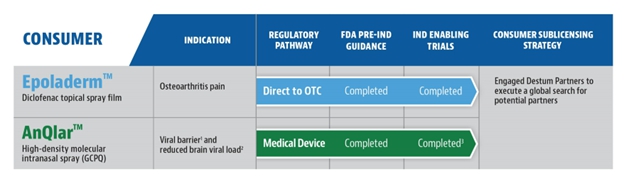

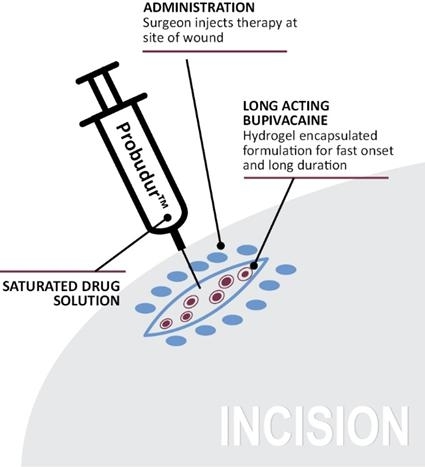

While we We are currently focused on advancing non-opioid and non-addictive pain management treatments and treatmentsalso exploring value creative opportunities for CNS disorders, we also plan on using our proprietary delivery technologies to develop our anti-viral therapy (AnQlar™)two nonprescription product candidates including seeking regulatory approval for commercialization of such products: AnQlarTM, which is being developed as a 24 hour prophylactic viral barrier to potentially preventinhibit viral infection by influenza or reduce the risk or the intensity of viral infections in humans, including, but not limitedSARS-CoV-2, and Epoladerm™, which is a topical diclofenac epolamine metered dosed spray film formulation being developed to influenza and SARS-CoV-2 (“COVID 19”).We have exclusive global rights for AnQlar pursuant to a collaboration and license agreement.manage pain associated with osteoarthritis.

Our PortfolioRecent Developments

Reverse Stock Split

On February 29, 2024, we filed a certificate of amendment to our Amended and Restated Certificate of Incorporation for purposes of effecting a 1-for-10 reverse stock split (the “Reverse Split”) of our outstanding shares of common stock such that, effective upon March 1, 2024, the day after the filing thereof, every 10 issued and outstanding shares of our common stock were subdivided and reclassified into one validly issued, fully paid and non-assessable share of our common stock.

Litigation

On February 29, 2024, Sorrento Therapeutics, Inc. (“Sorrento”), and Scilex Pharmaceuticals Inc. (“Scilex” and together with Sorrento, the “Plaintiffs”) and the Company entered into a Settlement Agreement and Mutual Release (the “Settlement Agreement”) to fully resolve all issues related to the litigation with Plaintiffs captioned Sorrento Therapeutics, Inc. and Scilex Pharmaceuticals Inc. v. Anthony Mack and Virpax Pharmaceuticals, Inc., Case No. 2021-0210-PAF (the “Action”), subject to the entry by the United States Bankruptcy Court for the Southern District of Texas, which is handling the Sorrento bankruptcy filing (the “Bankruptcy Court”), of an order approving the Settlement Agreement (the “Settlement Order”). On March 1, 2024, the Plaintiffs filed a motion to approve the Settlement Agreement and grant the related relief with the Bankruptcy Court. On March 14, 2024, the Bankruptcy Court entered an order approving the Settlement Agreement and on March 20th the Plaintiffs filed a Stipulation of Dismissal with the Chancery Court dismissing the Action. See “Part I—Item 3—Legal Proceedings” for additional information regarding the litigation with the Plaintiffs.

As settlement consideration, the Company agreed to pay Sorrento and Scilex a total cash payment of $6 million, of which $3.5 million was paid two business days after the date that the Settlement Order was entered by the Bankruptcy Court (the “Effective Date”), which payment was made on March 18, 2024 and the remaining $2.5 million is to be paid on or before July 1, 2024. Additionally, the Company agreed to pay to Plaintiffs royalties of 6% of annual net sales of products developed from drug candidates Epoladerm, Probudur and Envelta until the earlier of the expiration of the last-to-expire valid patent claim of such product and the expiration of any period of regulatory exclusivity for such product.

Pursuant to the Settlement Agreement, each of the Plaintiffs and the Company provided mutual releases of all claims as of the Effective Date, whether known or unknown, arising from any allegations set forth in the Action. Plaintiffs’ release relates to claims against the Company only. Plaintiffs’ release as to the Company was effective upon the Company’s initial payment of $3.5 million, and the Company’s release of the Plaintiffs was effective on the Effective Date.

Our Portfolio

Our portfolio currently consists of multiple preclinical stage product candidates: Epoladerm, Probudur, Envelta, PES200, AnQlar and NobrXiol. In the accompanying section we will describe each product candidate, its benefits, and our market strategy for each product candidate. The dates reflected in the below table are estimates only, and there can be no assurances that the events included in the table will be completed on the anticipated timeline presented, or at all.

We are also developing Envelta for a second indication, PES200, which utilizes the same delivery mechanism as Envelta. PES200 enables the delivery of a metabolically labile peptide drug (Enkephalin) into the brain for post-traumatic stress disorder.

1

Long-acting Bupivacaine Liposomal-gel 3.0% (LBL100 or ProbudurTM™)

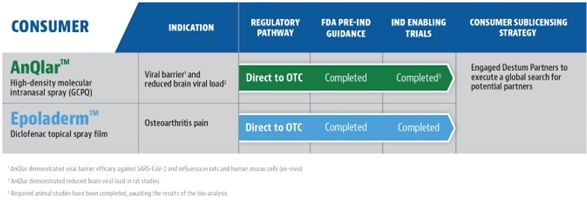

Probudur is a drug product candidate based on a unique liposomal delivery system utilizing large multi-vesicularmulti-lamellar vesicles (“LMVVs”MLV”) encapsulating a high dose of the local anesthetic bupivacaine. These drug-loaded liposomes are composed of lecithin and cholesterol which are GRAS by the FDA. These LMVVs are embedded in hydrogel beads to form a Lipogel. The system delivers a local analgesic medicine from the Lipogel. Early non-clinicalpreclinical animal studies produced data which suggestsdemonstrated that Probudur may be able to provideprovided significantly improved onset and duration and peak performance propertiesof analgesic effect as compared to a similar product on the market. The animal studies were conducted by administering Probudur byinfiltrating the surgical/wound site with Probudur. Probudur’s prolonged effectiveness is due to the formulation’s ability to keep the local infiltration of the surgical site which resulted in keeping the active ingredient localizedanesthetic at the surgicalsurgical/wound site for a longeran extended period of time.time (at least 96 hours). Four nonclinical trials were conducted using three animal models. Data from these animal studies showed that after treatment with Probudur (50 mg/kg), statistically demonstrated significant analgesic activity (measured as threshold pressure at animal’s withdrawal of the treated extremity) was observed in comparison to control (vehicle), for as long as 96 hours post-treatment (22.33±3.67g vs 5.00±0.58g; p<0.05), which is 24 hours longer than the leading product on the market.

If we are able to demonstrate a successful Phase III clinical trial, we believe Probudur may represent the first long actinglong-acting local anesthetic with an opioid sparing label. The slow release of the drug from the liposomal depot reduces the peak plasma levels, reducing toxicity while also potentially providing longer-lasting post-operativepostoperative pain control. We believe this property may permit administration of higher bupivacaine doses (3% versus 1.3% in leading market product); however, there can be no assurances, based on these animal studies, that Probudur will be safe and effective as these determinations are solely within the authority of the FDA. Further, there can be no assurance that Probudur will receive FDA approval.

Image 2 below illustrates the results of the early animal studies of Probudur:

Image 2

In September 2023, we announced results of two pre-clinical Probudur dose escalation studies, where superior efficacy was demonstrated in head-to-head animal studies against Exparel®. The first study compared Probudur to Exparel utilizing a planar incision model. Two doses of Probudur, at 3 mg and 6 mg, were administered to rats. The results demonstrated three times longer efficacy for Probudur than Exparel. In the second study, two different formulations at the same dose of Probudur were compared to Exparel in rat incision models. In this study, Probudur demonstrated a four to five times longer effect than the comparable product.

In the studies, Probudur demonstrated longer duration and higher peak activity compared to Exparel. Persistent analgesia (sustained pain control) with Probudur was noted at 96 hours, which is 24 hours longer than claims of our competitors. Probudur also demonstrated biphasic release for fast onset and duration and peak activity at 6 hours with a single injection. Additional studies for efficacy, toxicity, and pharmacokinetics are ongoing. Assuming the success of our Phase 3 trials, we believe that Probudur has the potential to receive Opioid Sparing Label.

2

We plan to market Probudur to general surgeons, anesthesiologists, and orthopedic surgeons within the $35 billion post operativepostoperative pain management market local anesthetic post-surgical market. If the product candidate isBased on head-to-head preclinical studies compared to an approved liposomal bupivacaine formulation, if used appropriately, we believe this product candidate could potentiallyProbudur has the potential to eliminate or significantly reduce the need forto prescribe opioids for post-operativepostoperative pain relief. As a result of our IND review,pre-IND meeting, the FDA has indicated that it is reasonable for us to pursue a 505(b)(2) accelerated NDA for Probudur. There can be no assurance that we will be successful in securing regulatory approval under the 505(b)(2) pathway or that we will be successful in mitigating risks associated with the clinical development of this product candidate.

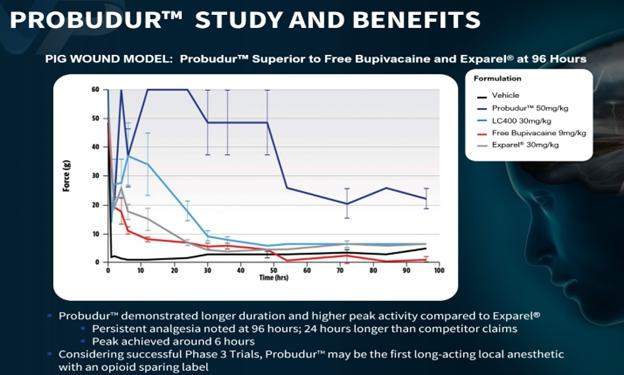

Image 3, below, displays the planned delivery of Probudur at the wound site:

Image 3

Charles River Laboratories was engaged to perform seven preclinical animal studies during the second half of 2021, including method, dosage, and toxicity as part The development of the required FDA enabling trials for an IND filing for Probudur. However, we elected to strategically delay these trialsProbudur formulation was successfully completed in order to enhance the formulationthird quarter of Probudur to increase stability for manufacturing purposes and to possibly extend the lifetime of a relevant patent.2023. We anticipate this relevant provisional patentpatents will be filed at some point duringin the first half of 2023.2024. Lipocure RX, Ltd. (“Lipocure”) is currently in the process of working through the scale up of Probudur to a larger batch size. If Lipocure is able to achieve scale up of the enhanced formula, we anticipate IND enabling studies have started. The FDA minutes indicated that we are to commence towardsinitiate our clinical studies in targeted patient populations following the endcompletion of 2023.our nonclinical toxicity studies. We anticipate filing an IND in 2024; however, we may need to adjust this timeline if Lipocure, a company based in Israel, becomes unable to continue development work due to the war in the Middle East.

Image 3, below, displays the planned delivery of Probudur at the wound site:

Image 3

Current Development Status

Our research and development activities for our product candidates are performed for us by third parties that we contract with.

On June 30, 2021, we entered into an Agreement for Rendering of Research Services with Yissum Research Development Company of the Hebrew University of Jerusalem Ltd (“Yissum”) (the “June 2021 Yissum Research Agreement”). Under the June 2021 Yissum Research Agreement, we provided funding for research and development studies performed by researchers at Hebrew University related to the optimization of the Liposomal Bupivacaine formulation of Probudur and to increase stability for manufacturing purposes. In consideration for the research services, we paid research service fees of $337,500 in six equal quarterly installments. All services provided$337,500. On January 31, 2023, we entered into an Agreement for Rendering of Research Services with Yissum (the “January 2023 Yissum Research Agreement”) on substantially similar terms and conditions as detailed above under the June 2021 Yissum Research Agreement. In consideration for the research services, we paid research service fees of $326,000. On January 1, 2024, we entered into an Agreement initiatedfor Rendering of Research Services with Yissum (the “January 2024 Yissum Research Agreement”) for additional work on July 1, 2021formulation, method development, animal studies and were substantially complete bypatent related work. In consideration for the endresearch services, we will pay research service fees of 2022.$343,467 in four equal quarterly installments. We may terminate the agreement at any time and will only be responsible to pay Yissum for work performed through the date of termination.

3

On June 29, 2021, we entered into an Agreement for Rendering of Research Services with Lipocure RX, Ltd. (the “June 2021 Lipocure Research Agreement”). Under the June 2021 Lipocure Research Agreement, we shall provideprovided funding for research and development related to the optimization of the Liposomal Bupivacaine formulation of Probudur and eventual manufacturing of preclinical batches including for stability testing, animal studies, toxicology, and toxicologypatent related work. This will also include work associated with the potential filing of additional provisional patent applications. We may terminate the agreement at any time upon 30 days written notice and shall be only responsible to pay Lipocure for work performed through the date of such notice. In consideration for the research services, we agreed to paypaid research service fees of $200,000 upon execution, as well as $400,000 in July 2021, $270,000 in both September 2021 and January 2022, and three additional payments$1,890,000. On February 1, 2023, we entered into an Agreement for Rendering of $270,000 during 2022. We also agreed to pay $250,000 to Lipocure upon successful completion of Chemistry, Manufacturing and Controls (“CMC”) filing with the FDA. All services to be provided under the June 2021Research Services (the “February 2023 Lipocure Research Agreement initiatedAgreement”) with Lipocure on July 1, 2021similar terms and were substantially complete byconditions and for similar services - optimization of the endLiposomal Bupivacaine formulation, manufacture of 2022. We recorded $990,000pre-clinical batches including batches for stability testing, animal studies and $870,000 in research and development expensetoxicology work. In consideration for the yearsresearch services, we paid research service fees of $1,453,000 for the year ended December 31, 2022 and 2021, respectively, associated with this agreement.2023.

On April 28, 2022, we entered into a cooperative research and development agreement (“CRADA”) with the U.S. Army Institute of Surgical Research (“USAISR”) to evaluate Probudur as well as thea potential novel analgesics for our other potential product candidates.battlefield injury-induced pain solution. The current research project will evaluate the analgesic effectiveness and physiologic effects of Probudur. ThisThe initial term of the agreement will automaticallywas to expire on September 30, 2023 unless it iswas revised by mutual written agreement. The CRADA was modified and signed on October 10, 2023, and extended the terms of the agreement until September 2024. No funding is being provided by either party to the other party under the agreement. Each party is responsible for funding its own work performed and other activities undertaken for the research project under this agreement. The parties may elect to terminate this agreement, or portions thereof, at any time by mutual consent. Either party may unilaterally terminate this entire agreement at any time by giving the other party written notice, not less than thirty (30) days prior to the desired termination date.

On January 31, 2023, we entered into an Agreement for Rendering of Research Services with Yissum (the “January 2023 Yissum Research Agreement”) on substantially similar terms and conditions as detailed above under the June 2021 Yissum Research Agreement. Under the January 2023 Yissum Research Agreement, we will provide funding for research and development studies to be performed by researchers at Hebrew University related to the optimization of the Liposomal Bupivacaine formulation and to increase stability for manufacturing purposes. We may terminate the agreement at any time and will only be responsible to pay Yissum for work performed through the date of termination. In consideration for the research services, we agreed to pay aggregate research service fees of $326,000 in four equal quarterly installments ($81,500 per calendar quarter). All services to be provided under the January 2023 Yissum Research Agreement initiated on January 1, 2023, and are anticipated to be completed by the end 2023.

On February 1, 2023, we entered into an Agreement for Rendering of Research Services (the “January 2023 Lipocure Research Agreement”) with Lipocure. Under the January 2023 Lipocure Research Agreement, we shall provide funding for research and development related to the optimization of the Liposomal Bupivacaine formulation and eventual manufacture of pre-clinical batches including batches for stability testing, animal studies and toxicology work. This will also include work associated with the potential filing of additional provisional patent applications. We may terminate the agreement at any time upon 30 days written notice and shall be only responsible to pay Lipocure for work performed through the date of such notice. In consideration for the research services, we agreed to pay research service fees of $1,286,000 in four equal quarterly installments ($321,500 per calendar quarter). All services to be provided under the January 2023 Lipocure Research Agreement initiated on January 1, 2023, and are anticipated to be completed towards the end 2023.

Molecular Envelope Technology Enkephalin Intranasal Spray (EnveltaTM™)

EnveltaTM™ is a nanotechnology-based intranasal spray drug product candidate which enables the delivery of a metabolically labile peptide drug (Enkephalin) into the brain. It is manufactured using high pressure homogenization and spray drying. There is pharmacological evidence of activity of MET enabled enkephalin in morphine-tolerant animals. Preclinical studies were conducted in animals for between 6 and 28 days through intravenous, oral and intranasal dosing. Twelve studies were conducted using three animal models whereby the animal studies were aimed at determining safety pharmacology and genetic toxicology. The preliminary data from these early animal studies of Envelta have shown that Envelta exhibited pain control in morphine tolerant animals, without the development of tolerance itself. These animal models tested the anti-hyperalgesic effects in rats against evoked stimuli in a model of chronic inflammatory pain and against ongoing neuropathic pain in a conditioned placement preference model with spinal nerve ligation. Envelta and morphine were compared at the same dose level of 7.5 mg kg-1in this model and Envelta was determined to have a similar analgesic effect. With respect to respiratory depression, delta opioid receptor agonists may actually reverse the respiratory depression caused by morphine agonists, meaning that we believe Envelta will be unlikely to cause respiratory depression. However, there can be no assurances, based on these preclinical animal studies, that Envelta will be safe and effective. Further, there can be no assurance that Envelta will receive FDA approval.

We believe we have identified a large unmet need and market opportunity for current prescribers of opioids, including pain and hospice treatment centers. Currently, these prescribers may be using morphine-like opioids, which target three opioid receptors: mu, delta and kappa. Most analgesics used clinically target mu receptor, however, this receptor is also responsible for the majority of undesirable side effects associated with opioids. Currently, enkephalins are limited in their therapeutic potential by their pharmacokinetic profiles due to their inability to cross the blood-brain barrier to reach opioid receptors located in the central nervous system. However, we believe Envelta’s novel nasally delivered formulation, based on early animal studies, enhances enkephalin transport to the brain by protecting the drug in a molecular envelope (MET),MET, facilitating its crossing of the blood-brain barrier. Enkephalins, which are naturally occurring analgesics that are quickly metabolized in the body and lack an endogenous mechanism to allow them to cross the blood-brain barrier and reach their target delta-receptor, bind predominantly to the delta-receptor which is typically not associated with the dangers associated with opioids. Envelta has many competitive advantages including naturally occurring analgesics in our body, delta receptor agonist, the absence of liver first pass effect, and a comparable efficacy to morphine. We believe Envelta may have analgesic potential without opioid tolerance, and has not exhibited any indications of withdrawal, respiratory depression, euphoria, or addiction in the early animal studies. A study published in Proceedings of the National Academy of Sciences (PNAS) indicates, “Delta opioid receptors have a built-in mechanism for pain relief and can be precisely targeted with drug-delivering nanoparticles, making them a promising target for treating chronic inflammatory pain with fewer side effects.” There can be no assurances, based on these preclinical animal studies, that Envelta will be safe and effective in human trials.

4

Additionally, we believe Envelta may significantly reduce constipation and early animal clinical trials have not demonstrated any opioid dependence, drug seeking or respiratory depression. We plan to use the endogenous NCE regulatory pathway to bring this product candidate to market. We plan to target our marketing and selling efforts to pain specialists, anesthesiologists, orthopedics, surgeons, PCPs, Nurse Practitioners (“NPs”), oncologists, and neurologists within the $20 billiontreating patients with severe pain, including post cancer pain, and non-cancer pain market.which market is valued at approximately $20 billion.

Envelta is a neuroactive peptide drug product (enkephalin) with a proprietary composition formulated for administration by all routes except the topical route. A preassembled device and cartridge would be used to propel the enkephalin formulation through the nose to the brain via the olfactory nerve/bulb route of transmission. A MET will encapsulate the drug product, protecting it from degradation, and help to carry the drug across the blood-brain barrier to promptly suppress pain.

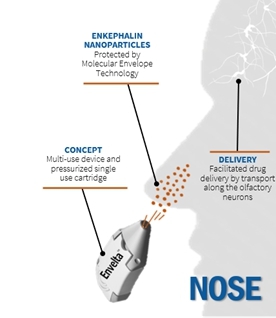

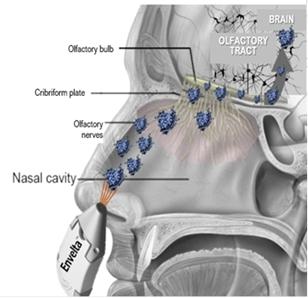

Image 4 and Image 5, below, display the planned delivery of enkephalin peptide nanoparticles to the brain via the olfactory route:

Image 4

Image 5

5

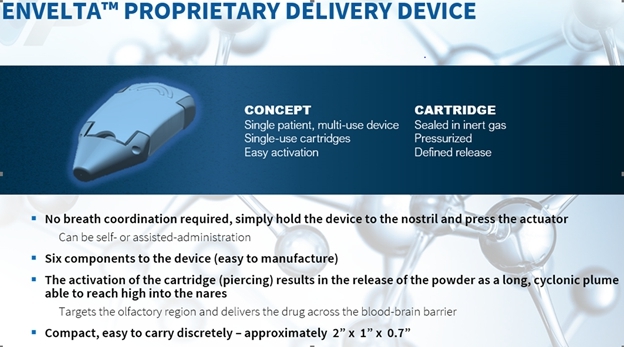

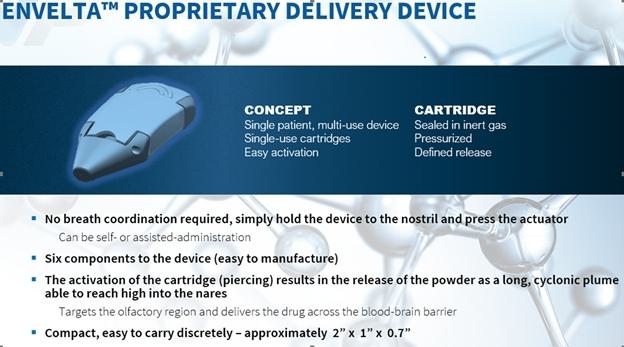

Image 6 below illustrates the concept Envelta delivery device:

Image 6

We may also develop Envelta for a second indication utilizing the same delivery mechanism as Envelta, which we refer to as PES200. PES200 enables the delivery of a metabolically labile peptide drug (Enkephalin) into the brain and is also covered under the same intellectual property listed elsewhere in this Annual Report on Form 10-K for Envelta. We believe PES200’s capabilities and attributes are the same as Envelta and we may be able to reference the Envelta PreIND and possible Phase I studies to open a potential PES200 IND followed by potential Phase II trials. Our plan is to validate proof-of-concept followed by IND-enabling studies for the development of a novel enkephalin-based formulation to treat Post-Traumatic Stress Disorder.

Current Development Status

On August 25, 2020, we entered into the CRADA with NCATS. This collaboration is for the continued development of our product candidate, Envelta, an intranasal peptide, for the management of acute and chronic non-cancerto control severe pain, including post cancer pain. The term of the CRADA is for a period of four years from the effective date of the agreement and can be terminated by both parties at any time by mutual written consent. In addition, either party may unilaterally terminate the CRADA at any time by providing written notice of at least sixty (60) days before the desired termination date. The agreement provides for studies that are focused on the pre-clinical characterization of Envelta as a novel analgesic for acute and chronic non-cancerto control severe pain, including post cancer pain., and for studies to further develop Envelta through IND enabling studies. There are certain development “Go/No Go” provisions within the agreement whereby, if certain events occur, or do not occur, NCATS may terminate the CRADA. These “No GO” provisions include: i) lack of efficacy in all animal pain models, ii) no reliable and sensitive bioanalytical method can be developed, iii) manufacturing failure due to inherent process scalability issues, iv) unacceptable toxicity or safety profile to enable clinical dosing, and v) inability to manufacture the Envelta dosage form. As of March 25, 2024, we have not received any Go/No Go notifications from NCATS.

With respect to NCATS rights to any invention made solely by an NCATS employee(s) or made jointly by an NCATS employee(s) and our employee(s), the CRADA grants to us an exclusive option to elect an exclusive or nonexclusive commercialization license. For inventions owned solely by NCATS or jointly by NCATS and us, and licensed pursuant to our option, we must grant to NCATS a nonexclusive, nontransferable, irrevocable, paid-up license to practice the invention or have the invention practiced throughout the world by or on behalf of the United States government. For inventions made solely by an employee of ours, we grant to the United States government a nonexclusive, nontransferable, irrevocable, paid-up license to practice the invention or have the invention practiced throughout the world by or on behalf of the United States government for research or other government purposes.

6

We believe Envelta and PES200 could support the current effort amongmay provide prescribers, regulators, and patients to seekalternative non-addictive treatment options for pain.to control severe pain, including post cancer pain and potentially manage symptoms related to PTSD. We plan to utilize these delivery technologies to selectively develop a portfolio of patented 505(b)(2) and NCE candidates for commercialization. We intend to use these studies as a source for INDs for two additional potential indications, cancer pain and post-traumatic stress disorder. To date, all fourFour planned in vitro studies have beenwere successfully completed as well as the in vivo acute efficacy studies. In February 2022, we completed a 14-day intranasal dose range finding toxicity study of Envelta in rats with a 14-day recovery period which showed no adverse related findings in hematology, coagulation and serum chemistry data, with no treatment related toxicology findings or mortality noted. A 14-day intranasal dose range finding toxicity study of Envelta in dogs with a 14-day recovery period was also conducted and showed no adverse toxicologic findings. Bioavailability studies are anticipated to be completed by end of March 2023 and the in vivo chronic efficacy studies are being planned and are estimated to be completed sometime during the second half of 2023.

The preclinical manufacturing work being performedstudies under the CRADA necessaryare expected to filecontinue over the IND is ongoing. NCATS is working with its manufacturer on scaling up production of Envelta and anticipates completion of this task in the second half of 2023.next nine months. We currently anticipate filing an IND with Envelta duringin 2024. However, the second quarterIND timing is subject to risks in manufacturing of 2024.the MET/LENK, COA for GMP material and filling of cartridges for a 28-day dog bridging study and may be extended into 2025.

NobrXiol

Cannabidiol Nanoparticles with Molecular Envelope Technology (NobrXiol™)

NobrXiol

NobrXiol™ is being developed by Nanomerics Ltd. (‘Nanomerics”) as an investigational formulation delivered via the nasal route that uses MET as its delivery system to enhance Cannabidiol (“CBD”) transport to the brain. CBD acts on CB receptors of the endocannabinoid system in the brain, which regulates neuronal excitability response relevant to the pathophysiology of epilepsy. NobrXiol uses a proprietary preassembled delivery device that holds single-use cartridges that are sealed in inert gas and pressurized for easy activation that can be self-administered. Activation of the cartridge system to propelpropels the CBD powder formulation into the nose and to the brain via the olfactory nerve/bulb. This product candidate will be formulated to potentially treat epileptic seizures associated with Lennox-Gastaut syndrome (LGS) and Dravet syndrome (DS) in pediatric patients two years of age and older. Lennox-Gastaut syndrome (LGS) and Dravet syndrome (DS) are rare central nervous system diseases considered serious epileptic encephalopathies that cause different types of epileptic seizures, as well as cognitive and behavioral changes, and are generally resistant to treatment. The FDA previously granted Orphan Drug Designation for another drug for the treatment of the same diseases. Therefore, NobrXiol may also be able to receive Orphan Drug Designation for the treatment of Lennox-Gastaut syndrome (LGS) and Dravet syndrome (DS) in pediatric patients. NobrXiol has many potential competitive advantages including fast onset of action, reduced peripheral side effects, no liver first-pass metabolism, avoidance of drug to drug interactions, no gastrointestinal interaction, and the potential to eliminate enzymatic deactivation. On September 17, 2021, we entered into a collaboration and license agreement with Nanomerics (the “Nanomerics License Agreement – NobrXiol”) for the exclusive worldwide license to develop and commercialize the product candidate. We plan to target our marketing and selling efforts to healthcare practitioners specializing in pediatric epilepsy within the $16.5$16.915 billion market for managing epilepsy in pediatrics and adults.pediatrics. We have engaged Destum Partners to search for a Global Animal Healthcare sublicensing partner.

On April 21, 2022, we notified Nanomerics that the study aim of demonstrating the ability of Nanomerics platform technology delivering CBD to the brain via nasal administration in an animal model was met. Pursuant to the Nanomerics License Agreement - NobrXiol, we paid a milestone payment of $500,000 upon meeting this study aim in April 2022. We submitted the pre-IND Briefing Book with the FDA in October 2022 and received comments back from the FDA in December 2022. Upon our review of the FDA response letter,minutes, we now believe we have the appropriate guidance from the FDA to move forward with our overall development plan for this new product candidate and the ability to identify any need for further data prior to submitting the IND. Our current plan is to utilize potential grant awards to fund the development of NobrXiol through to an IND filing whilefiling. In April 2023, we focusentered into a participation agreement with the National Institute of Neurological Disorders and Stroke (“NINDS”), a part of NIH, to supply our cash resources on more immediate needs with regardproduct candidate compounds to the NINDS’s Epilepsy Therapy Screening Program (“ETSP”). NINDS ETSP will test our other product candidates.compounds in epilepsy animal models to determine whether our compounds have activity against resistant epilepsy and related disorders.

Current Development Status

An acute seizure model study, Maximal Electroshock Seizures (MES) in rats, is currently ongoing at NINDS ETSP. Once that study is complete, NINDS plans to explore behavioral tolerability screens, and chronic seizure models. There are also plans to examine the differentiation with various models for acute and sub-chronic dosing and to explore ancillary drug resistant epilepsy models.

Diclofenac Epolamine Spray Film (Epoladerm)(Epoladerm™)

We believe the Topical Spray Film Delivery Technology, which we refer to as Epoladerm,Epoladerm™, could provide a pathway for additional proprietary spray formulations with strong adhesion and accessibility properties upon application, especially around active joints and curvedcontoured body surfaces to manage pain associated with osteoarthritis. Our belief is based on, in part, research done to assess the effectiveness and safety of different preparations and doses of non-steroidal anti-inflammatory drugs (“NSAIDs”), opioids, and paracetamol for knee and hip osteoarthritis pain and physical function to enable effective and safe use of these drugs at their lowest possible dose. Osteoarthritis, which we believe to be a bettersignificant global market opportunity for us, is a painful condition that results in reduced physical function and quality of life and increased risk of all-cause mortality. A recent large meta-analysisOn June 6, 2017, the Company entered into a license agreement, as amended on pharmacologic treatmentsSeptember 2, 2017 and October 31, 2017 (the “MedPharm License Agreement”), with MedPharm Limited (“MedPharm”) for kneethe exclusive global rights to discover, develop, make, sell, market, and hip osteoarthritis indicatedotherwise commercialize any pharmaceutical composition or preparation (in any and all dosage forms) in final form containing one or more compounds, including Diclofenac Epolamine (“Epoladerm”), that topical diclofenac had the largest effect on painwas developed, manufactured or commercialized utilizing MedPharm’s spray formulation technology (“MedPharm Product”), to be used for any and physical function with a better safety profile than oral diclofenac. We believe these agents should be considered as a first-line pharmacological treatment for osteoarthritis.all uses in humans (including all diagnostic, therapeutic and preventative uses).

7

We believe Epoladerm’s proprietary spray film technology may lead to adhesion capabilities superior to those of currently available transdermal patches (e.g. Epoladerm does not require any tape reinforcement), while maintaining comparable skin absorption capabilities to transdermal patches currently on the market. Specifically, because the Epoladerm technology does not require a patch to deliver the drug through the skin, we believe Epoladerm may have better adhesion to the skin and may have better accessibility, particularly around joints and other curved body surfaces. Additionally, because Epoladerm is a spray, we believe it will be more aesthetically appealing to patients than transdermal patches. As a spray, Epoladerm was studied in ex-vivo skin studies (skin from abdominoplasty) and recent studies indicate drying times of approximately 120 seconds for chronic osteoarthritis of the knee. Unlike other topical NSAIDs, Epoladerm does not require physical handling of the actual drug and enables dosing that provides an accurate amount of active ingredient per spray application.

Pursuant to a Research and Option Agreement with MedPharm Limited (the “MedPharm Research and Option Agreement”), MedPharm will conduct certain research and development activities of proprietary formulations incorporating certain MedPharm technologies and certain of our proprietary molecules. Under the agreement, we were granted an option to obtain an exclusive, world-wide, sub-licensable, royalty bearing, irrevocable license to research, develop, market, use, commercialize, and sell any product utilizing MedPharm’s spray formulation technology.

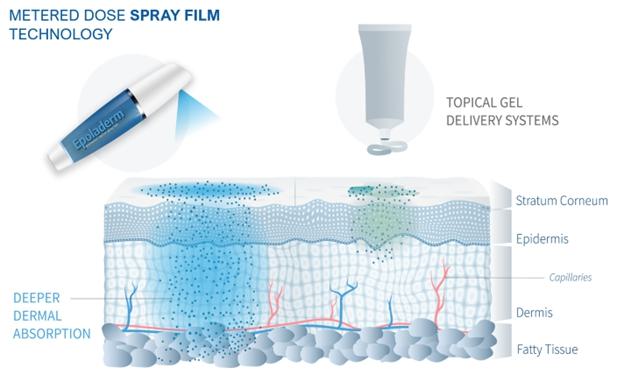

Image 1,7, below, displays the expected delivery system of Epoladerm for the treatment of chronic osteoarthritis:

Image 1

Image 7

When discussing nonopioid treatments for chronic pain, the Centers for Disease Control (“CDC”) notes clinicians should consider topical agents as alternative first-line analgesics, thought to be safer than systemic medications. In an August 18, 2020 article appearing in the Annals of Internal Medicine, the American College of Physicians and the American Academy of Family Physicians announced a joint clinical guideline, “Nonpharmacologic and Pharmacologic Management of Acute Pain from Non-Low Back, Musculoskeletal Injuries in Adults,” whereby they recommend topical NSAIDs as first-line therapy for patients experiencing pain from non-low back, musculoskeletal injuries. The clinical guideline also recommends that clinicians not prescribe opioids for these injuries except in cases of severe injury or if patients cannot tolerate first-line therapeutic options. A recent large meta-analysis research report published in October 2021 on pharmacologic treatments for knee and hip osteoarthritis indicated that topical diclofenac had the largest effect on pain and physical function with a better safety profile than oral diclofenac. Based on this meta-analysis it was recommended that topical diclofenac should be considered as a first-line pharmacological treatment for knee osteoarthritis.

8

As a result of our pre-investigational new drug (“IND”) review,meeting, we believe it is reasonable for us to pursue a 505(b)(2) or OTC accelerated new drug application (“NDA”) for Epoladerm. There can be no assurance that we will be successful in securing regulatory approval under the 505(b)(2) pathway or that we will be successful in mitigating risks associated with the clinical development of this product candidate.

Current Development Status

In December 2021, we completed a single dose pharmacokinetic study of dermal administration of Epoladerm in minipigs as part of the required IND enabling trials. Single-dose transdermal delivery of Epoladerm was well-tolerated in all minipigs and no treatment-related clinical observations, changes in body weight, or dermal irritation were observed. All Epoladerm treated animals had plasma levels of Epoladerm confirming transdermal absorption. The maximum plasma concentration (“Cmax”) was reached at 4 hours post-dose, and plasma Epoladerm remained at 24-hour post-dose for all animals.

In January 2022, we reported positive results of four preclinical dermal safety studies for Epoladerm. Researchers concluded that once daily dermal administration of Epoladerm for 28 days was well-tolerated with no serious adverse findings. The studies were performed by Charles River Laboratories, a well-known clinical research organization. The studies included a skin irritation study in rabbits; a dermal sensitization assessment in guinea pigs; and a phototoxicity assay in mouse fibroblasts. Epoladerm was well tolerated in each of the studies and no reportable dermal irritation, dermal sensitization or phototoxicity was observed.

In June 2022, we announced our intention to pursue a direct to Over-the-Counter (“OTC”) regulatory pathway for Epoladerm. The direct to OTC, non-prescription regulatory pathway is expected to provide a faster drug development timeline and faster global approval track than the prescription pathway we had originally pursued for Epoladerm. To support the OTC application, we plan to submit Epoladerm’s completed dermal toxicity, sensitization, irritation, phototoxicity studies and its pharmacokinetic characteristics will need to be submitted to the FDA. In addition, we anticipate that we will have to complete a consumer preference assessment and a pivotal study required by the FDA’s Office of Non-prescription Drugs. The originally scheduled preclinical toxicology studies for an osteoarthritis of the knee indication that were to run in parallel with our anticipated pilot study for Epoladerm will not be required for our direct to OTC regulatory pathway.

We made the determination to delay our First-in-Human study investigating Epoladerm for pain associated with chronic osteoarthritis oduedue to: (i) a delay in procuring the active pharmaceutical ingredient necessary for the drug product candidate, (ii) delays related to supply chain disruptions, and (iii) an extensive review of the formulation and potential degradants resulting in MedPharm replacing the potential degradant. This additionalAdditional formulation work and in-vitro permeation testing may enable the patent coverage of this asset to be extended until at least 2042.2042 and provide an Over the Counter (“OTC”) pathway. MedPharm is anticipated to complete the formulation work and permeation testing at the end of third quarter 2023. If this nonclinical testing is successful, we plan to file an IND with Epoladerm in the fourth quarter 2023. In addition, MedPharm will initiate manufacturing batches that will be utilized for the First-in-Human study that is anticipated to begin first quarterhalf of 2024.

We may seekare seeking to license out or partner this asset as we continue to focus our efforts on our prescription drug pipeline.

High-Density Molecular Masking Spray Formulation for the Prevention of Respiratory Viruses (AnQlar)(AnQlar™)

AnQlar is a high-density molecular masking spray we plan to develop as an anti-viral barrier to potentially prevent, or reduce the risk or the intensity of, viral infections in humans. We intend for this formulation to be delivered using a preassembled device and cartridgemetered dose nasal spray to propel the high-density molecular spray formulation into the nose. We intend for AnQlar to be used as a nasal powder spray tonose and potentially prevent viral binding to epithelial cells in the nasal cavity and the upper respiratory tract, potentially reducing respiratory related infections.

9

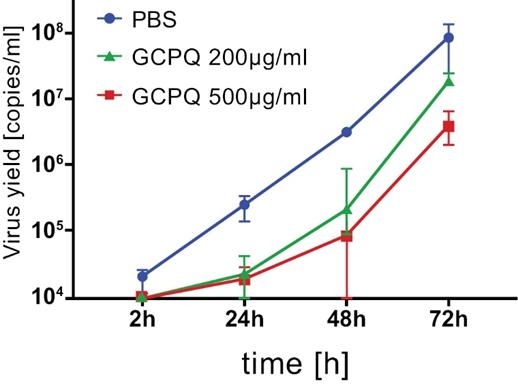

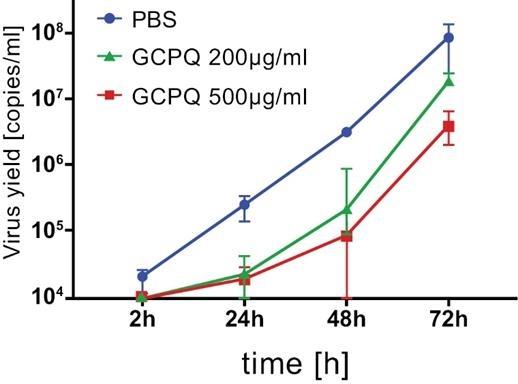

As an addition to standard personal protective equipment, we believe AnQlar may offer an additional layer of protection, in the form of a molecular mask, to protect healthcare workers and those at risk of serious disease from viral infections. AnQlar has completed IND-enabling toxicology studies and ex-vivo studies which demonstrated a reduction in infectivity from respiratory viruses like influenza and SARS-CoV-2. During the ex-vivo study, in the presence of AnQlar, SARS-CoV-2 viral replication inhibition was observed in a bronchial epithelial model reconstituted from healthy human donor cells. Virus replication was evaluated using RT-qPCR. The data was presented as a number of viral copies per ml. A lower viral yield was detected in the cultures treated with AnQlar than in the control with phosphate buffered saline (“PBS”) after 72 hours of infection. AnQlar could potentially be marketed to first responders, healthcare workers, clinics, military forces, transplant and other immune compromised or at risk patients within the $13 billion (as of 2019) anti-viral market.

Image 78 below illustrates the results of the AnQlar IND-enabling toxicology studies ex-vivo:

Image 78

A lower viral yield was detected in the cultures treated with AnQlar than in the control with Phosphate Buffered Saline (“PBS”) after 72 hours of infection.

Current Development Status

We submitted and received a written pre-investigational new drug (“pre-IND”) response from the FDA for AnQlar. In its pre-IND response, the FDA provided guidance on our pathway to pursue prophylactic treatment against SARS-CoV-2 and influenza for daily use as an OTC product. We believe the results of the pre-IND response support further research on AnQlar as a once daily intranasal prophylactic treatment of viral infections. The FDA has indicated that, upon successful completion of all necessary preclinical and clinical trials, we may pursue an NDA drug approval with the Office of Non-Prescription Drugs.

In August 2021, we engaged Syneos Health to assist with the design of the optimal clinical trial to facilitate an efficient regulatory and development timeline for AnQlar.

On August 25, 2021, we entered into a commercial manufacturing and supply agreement with Seqens, an integrated global leader in pharmaceutical solutions with 24 manufacturing sites worldwide and seven research and development facilities throughout the U.S. and Europe. The agreement with Seqens provides for both the supply material for our clinical studies as well as the long-term commercial supply of AnQlar. Seqens has initiated and is conducting process development and validation of additional large scale commercial quantities of AnQlar at its facilities in Devens and Newburyport, Massachusetts.

10

On September 29, 2021, we engaged a research and development firm to conduct a series of IND enabling toxicity studies for AnQlar which are expected to beAnQlar. These studies have been completed by the fourth quarter 2023. This was slightly delayed due to certain issues with finalizing the bioanalytical method developmentwithout an analysis of the product candidate. Upon successful completion of these studies, we intend to run a process using an investment banker to assist with sublicensing AnQlar to a global commercial partner in the respiratory space.pharmacokinetics (PK) data.

On July 5, 2022, we announced our intention to pursue an OTC Intranasal Medical Device Consumer regulatory pathway for AnQlar. To supportThe FDA has indicated that, upon successful completion of all necessary preclinical and clinical trials, we may pursue an NDA drug approval with the OTC Medical Device application, we plan to submit AnQlar’s completed in-vitro study, ex-vivo study using human mucosal cells, in-vivo study in rats, toxicology study and its pharmacokinetics (PK) characteristics studies to the FDA. Additionally, we will include AnQlar’s completed safety-pharmacology studies, drug-drug interaction studies and its virology studies evaluating AnQlar’s viral barrier properties against two variantsOffice of SARS-CoV-2 in a SARS-CoV-2 mouse model to the FDA. For the OTC medical device application, we anticipate that we will have to complete stability testing, human factors testing for medical devices, safety studies and supplementary in-vitro studies.Non-Prescription Drugs.

We recentlyOn July 27, 2022, Virpax conducted an initial review of the results from a preclinical virology study conducted by one of our CROs where we were evaluating the viral barrier properties of AnQlar™ versus two variants of the SARS CoV-2 virus. This review conducted by our external consultants indicates that the test article (AnQlar) shows an appropriate level of virus deactivation for a prophylactic viral barrier product candidate which was the outcome we were expecting. We have completed a validated bioanalytical method for the samples on February 12, 2024.

We are seeking to license out or partner this asset as we continue to seek opportunities to exploitfocus our product portfolio through licensing and other strategic transactions to further developefforts on our prescription drug product candidates. This includes seeking potential partners in further developing our drug product candidates and responding to inquiries of interest we have received concerning our product portfolio.pipeline.

Intellectual Property

We strive to protect and enhance the proprietary technologies, inventions and improvements that we believe are important to our business, including seeking, maintaining and defending patent rights, whether developed internally or licensed from third parties. Our policy is to seek to protect our proprietary position by, among other methods, pursuing and obtaining patent protection in the United States and in jurisdictions outside of the United States related to our proprietary technology, inventions, improvements, platforms and our product candidates that are important to the development and implementation of our business.

As of February 10, 2023March 15, 2024 our portfolio of owned and licensed patents and pending patent applications consisting of 1027 issued patents of which 11 are issued U.S. patents, 213 pending patent applications, of which 3 are pending U.S. patent applications, 1 pending Patent Cooperation Treaty (“PCT”) application, 26 issued patents 4 pending foreign applications and 12 provisional patent application.applications. These patent rights include issued US Patent Nos. 7,741,474, 8,470,371, 10,213,474, 8,278,277, 8,920,819, 9,713,591, 8,349,297 8,695,592, 10.213.474, 10,842,745 and 10,842,74511,839685 as well as patents and patent applications in Europe (Germany, France, UK), Canada, Japan, China, Israel, Australia, New Zealand, and South Korea. Below is a breakdown of patents by product:product, with unextended patent expiration dates indicated:

Epoladerm

The product candidate is covered by US Patent No. 8,349,297 (expires December 4, 2028) as well as issued patents in South Africa, Russian Federation, New Zealand, Norway, Mexico, Republic of Korea, Japan, China, Canada, Australia, Turkey, Slovakia, Slovenia, Sweden, Portugal, Poland, Netherlands, Latvia, Luxembourg, Lithuania, Italy, Ireland, Hungary, Greece, United Kingdom, France, Finland, Spain, Denmark, Germany, Czech Republic, Switzerland, Belgium and Austria (all of which expire September 14, 2026). The patents contain broad composition claims to a platform of pharmaceutical formulations which form a film on spray administration where the active agent is present at least 80% saturation and there is no undissolved active agent in the formulation. The claims also include a method of treatment and an aerosol dispenser containing the formulation. There is one pending provisional patent application that relates to specific spray formulations of diclofenac.

11

Probudur

The product candidate is covered by US Patent No. 9,713,591 (expires July 24, 2030) and US Patent No. 10,842,745 and 11,839685 (expires October 10, 2029) as well as a European patent (expires October 11, 2029) and a Chinese patent (expires October 11, 2029). There is also a pending US application which is a continuation of US Patent No. 10,842,745..11,839685. The patents containscontain composition claims to pharmaceutical compositions having an external storage solution containing an active pharmaceutical ingredient and particles of liposomes embedded in a polymeric matrix contained within the storage solution.

Envelta

The product candidate is covered by the following patent families which protect the chemistry of the MET polymer and its use in pharmaceutical products: Patent Family 1 includes US Patent No. 7,741,474 (expires March 18, 2026), and a Japanese Patent, Canadian Patent and European Patent (all which expire September 22, 2023). This patent family covers carbohydrate polymers with hydrophobic and hydrophilic side-groups suitable for solubilizing, for example, hydrophobic drugs.