The Company has a limited public float, which adversely affects trading volume and liquidity, and may adversely affect the price of Merger Sub shall automatically be converted into an equal numberthe Common Stock and access to additional capital.

As of March 28, 2024, ETI and Cantor own approximately 72.3% and 20.1% of our outstanding shares of common stockCommon Stock. All of XBP Europe, (ii) each shareETI’s shares, and the majority of stock of XBP Europe will be cancelled and exchanged for the right to receive a number ofCantor’s shares of Class A common stock equal to (a) the quotient of (1) (A) the sum of $220,000,000 minus (B) the Company Closing Indebtedness of XBP Europe (as contemplated by the Merger Agreement) divided by (2) $10.00 plus (b) 1,330,650, and (iii) the Company will amend the Charter to, among other matters, change its name to XBP Europe Holdings, Inc.

Concurrently with the execution of the Merger Agreement, the Company entered into an Ultimate Parent Support Agreement with ETI-XCV Holdings, LLC (the “Ultimate Parent”), an indirect parent of Parent and wholly owned subsidiary of Exela Technologies, Inc., pursuant to which, among other things, the Ultimate Parent agreed (i) to cause its direct and indirect subsidiaries to vote their shares of Parent in favor of the Merger Agreement and other resolutions needed to consummate the Merger and the XBP Europe Business Combination, and to not transfer such shares, and (ii) not to take any action that would hinder or prevent the consummation of the Merger and the XBP Europe Business Combination.

Contemporaneously with the execution of the Merger Agreement, the Company entered into a Sponsor Support Agreement with the sponsor, Parent and XBP Europe, pursuant to which, among other things, the sponsor agreed (i) to vote its shares of common stock in favor of the Merger Agreement and each of the transaction proposals, and to not transfer such shares, (ii) to subject certain of its shares of common stock to additional transfer restrictions after closing, (iii) not to redeem any of its shares of common stock in connection with the XBP Europe Business Combination, (iv) to waive the anti-dilution rights with respect to the shares of Class B common stock under the Charter, (v) upon closing, to forfeit for cancellation 733,400 of its shares of Class B common stock, and (vi) to convert its right to repayment under any outstanding loans due to the sponsor by the Company upon closing to be repaid in shares of Class A common stock at a value of $10.00 per share, except as otherwise set forth in the Merger Agreement.

Concurrently with the execution of the Merger Agreement, the Company entered into a Lock-Up Agreement with XBP Europe and the Parent, pursuant to which the Parent agreed that securities of the Company held by it immediately following the closing will be locked-up andCommon Stock are subject to transfer restrictions as described below, subject to certain exceptions. The securities held by the Parent will be locked-upon resale until the earlier of: (i) the oneof (1) year anniversary of the date of the closing,November 29, 2024 and (ii)(2) the date on which the Company consummates a liquidation, merger, capital stock exchange, reorganization, or other similar transaction after the closing which results in all of the Company’s stockholders having the right to exchange their shares of common stockCommon Stock for cash, securities or other property.

Certain existing agreementsproperty, unless such restrictions are earlier waived. The aggregate number of the Company, included but not limited to the BCMA, have been or will be amended or amended and restated in connection with the XBP Europe Business Combination, all as further described in the XBP Europe Proxy Statement.

For more information on the XBP Europe Business Combination and the agreements described above, please see the Form 8-K filed by the Company with the SEC on October 11, 2022 and the XBP Europe Proxy Statement.

Business Strategy

Our acquisition and value creation strategy is to identify and acquire a company in an industry that complements the experience and expertiseshares of our management team. Our acquisition selection process leverages the network of contacts developedCommon Stock owned by our management team and those of the sponsor and its affiliates, including relationships in the financial services, healthcare, real estate services, technology and software industries, comprising management teams of public and private companies, investment bankers, private equity sponsors, venture capital investors, advisers, attorneys and accountants that we believe should provide us with a number of business combination opportunities. We have deployed a proactive sourcing strategy and have focused on companies where we believe the combination of our operating experience, relationships, capital and capital markets expertise can help accelerate the target’s growth and performance.

Our management team and Cantor and its affiliates have experience in:

| ● | sourcing, structuring, acquiring and selling businesses; |

| ● | fostering relationships with sellers, capital providers and target management teams; |

| ● | negotiating transactions favorable to investors; |

| ● | executing transactions in multiple geographies and under varying economic and financial market conditions; |

| ● | accessing the capital markets, including financing businesses and helping companies transition to public ownership; |

| ● | operating companies, setting and changing strategies, and identifying, monitoring and recruiting world-class talent; |

| ● | acquiring and integrating companies; and |

| ● | developing and growing companies, both organically and through acquisitions and strategic transactions and expanding the product range and geographic footprint of a number of target businesses. |

Investment Criteria

While we initially sought to acquire one or more businesses with an aggregate enterprise value ofBTC International represent approximately $500 million to $1.25 billion or more, following the Extensions, and in light of the reductions of the amount held in the trust account resulting from redemptions in connection with the Extensions, we entered into the Merger Agreement to effect the XBP Europe Business Combination, which provided for an enterprise value below that range. At the time of the initial public offering, we developed the following high level, non-exclusive investment criteria that we use to screen for and evaluate target businesses. We sought to acquire a business that (1) has sustainable competitive advantages, (2) generates, or has the near-term potential to generate, predicable free cash flows, (3) would benefit from the capabilities of the sponsor and management team to improve its operations and market position, (4) has an experienced and capable management team, (5) has the potential to grow both organically and through additional acquisitions and (6) can be acquired at an attractive valuation to maximize potential returns to our stockholders.

While we may pursue an acquisition opportunity in any business, industry, sector or geographical location, we focused on industries that complement our management team’s background. We therefore focused on potential target companies in the financial services, healthcare, real estate services, technology and software industries.

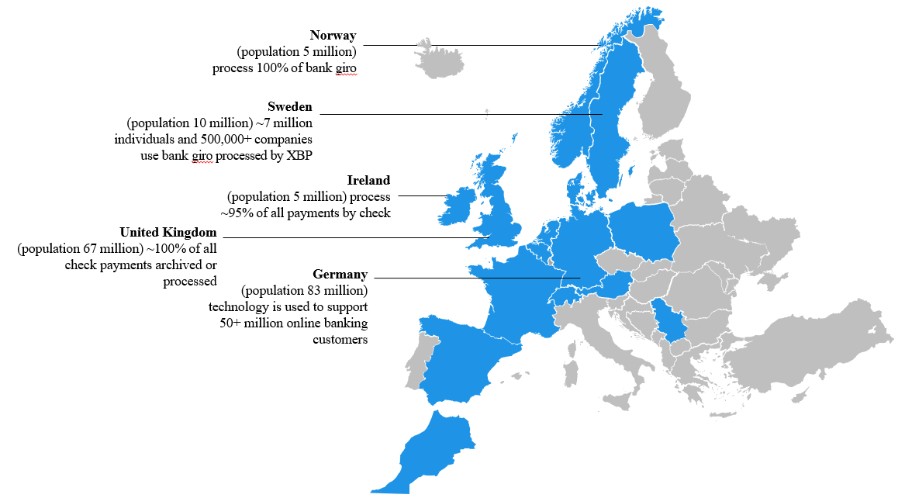

These criteria are not intended to be exhaustive. Any evaluation relating to the merits of a particular initial business combination may be based, to the extent relevant, on these general guidelines as well as other considerations, factors and criteria that our management may deem relevant. The board determined that pursuing a potential business combination with XBP Europe would be an attractive opportunity for us and our stockholders for a number of reasons, including, but not limited to, (1) that XBP Europe had an existing pan-European business with over 2,000 clients, many of whom have been long term clients with long term relationships, (2) that XBP Europe has plans to increase its financial performance and cash flows, (3) that Exela agreed to continue to provide services to XBP Europe after the closing of the XBP Europe Business Combination, (4) that if XBP Europe is successful in executing its strategy, we will have acquired XBP Europe at an attractive valuation. For more information, please see the XBP Europe Proxy Statement.

Initial Business Combination

So long as we maintain a listing for our securities on Nasdaq, we must complete one or more business combinations having an aggregate fair market value of at least 80% of the value of the assets held in the trust account (excluding taxes payable on the interest earned on the trust account) at the time of our signing a definitive agreement in connection with our initial business combination. Our board of directors will make the determination as to the fair market value of our initial business combination. If our board of directors is not able to independently determine the fair market value of our initial business combination, we will obtain an opinion from an independent investment banking firm or another independent firm that commonly renders valuation opinions with respect to the satisfaction of such criteria. While we consider it unlikely that our board of directors will not be able to make an independent determination of the fair market value of our initial business combination, it may be unable to do so if it is less familiar or experienced with the business of a particular target or if there is a significant amount of uncertainty as to the value of a target’s assets or prospects. The XBP Europe Business Combination was, and, pursuant to Nasdaq rules, any initial business combination must be, approved by a majority of our independent directors. If we are no longer listed on Nasdaq, we would not be required to satisfy the above-referenced fair market value test.

Based on the valuation analysis of our management and board of directors, we have determined that the fair market value of XBP Europe was significantly in excess of 80% of the assets held in the trust account and the 80% test was therefore satisfied. For more information, see the XBP Europe Proxy Statement.

We may, at our option, pursue an Affiliated Joint Acquisition. We do not expect that we would pursue any such opportunity with another SPAC sponsored by Cantor. Any such parties would co-invest only if (i) permitted by applicable regulatory and other legal limitations; (ii) we and Cantor considered a transaction to be mutually beneficial to us as well as the affiliated entity; and (iii) other business reasons exist to do so, such as the strategic merits of including such co-investors, the need for additional capital beyond the amount held in our trust account to fund the initial business combination and/or the desire to obtain committed capital for closing the initial business combination.

An Affiliated Joint Acquisition may be effected through a co-investment with us in the target business at the time of our initial business combination, or we could raise additional proceeds to complete the initial business combination by issuing to such parties a specified future issuance. Any such Affiliated Joint Acquisition or specified future issuance would be in addition to, and would not include, the FPS. The amount and other terms and conditions of any such specified future issuance would be determined at the time thereof. We are not obligated to make any specified future issuance and may determine not to do so. This is not an offer for any specified future issuance. Pursuant to the anti-dilution provisions of our Class B common stock, any such specified future issuance would result in an adjustment to the conversion ratio such that our initial stockholders and their permitted transferees, if any, would retain their aggregate percentage ownership at 20% of the sum of the total number of all shares of common stock outstanding upon completion of the initial public offering (not including the private placement shares) plus all shares issued in the specified future issuance, unless the holders of a majority of the then-outstanding shares of Class B common stock agreed to waive such adjustment with respect to the specified future issuance at the time thereof. We cannot determine at this time whether a majority of the holders of our Class B common stock at the time of any such specified future issuance would agree to waive such adjustment to the conversion ratio. They may waive such adjustment due to (but not limited to) the following: (i) closing conditions which are part of the agreement for our initial business combination; (ii) negotiation with Class A stockholders on structuring an initial business combination; (iii) negotiation with parties providing financing which would trigger the anti-dilution provisions of the Class B common stock; or (iv) as part of the Affiliated Joint Acquisition. If such adjustment is not waived, the specified future issuance would not reduce the percentage ownership of holders of our Class B common stock, but would reduce the percentage ownership of holders of our Class A common stock. If such adjustment is waived, the specified future issuance would reduce the percentage ownership of holders of both classes of our common stock. The issuance of the FPS will not result in such an adjustment to the conversion ratio of our Class B common stock.

We anticipate structuring our initial business combination, such as the XBP Europe Business Combination, either (i) in such a way so that the post-transaction company in which our public stockholders own shares will own or acquire 100% of the equity interests or assets of the target business or businesses, or (ii) in such a way so that the post-transaction company owns or acquires less than 100% of such interests or assets of the target business in order to meet certain objectives of the target management team or stockholders, or for other reasons, including an Affiliated Joint Acquisition as described above. However, we will only complete an initial business combination if the post-transaction company owns or acquires 50% or more of the outstanding voting securities of the target or otherwise acquires a controlling interest in the target sufficient for it not to be required to register as an investment company under the Investment Company Act. Even if the post-transaction company owns or acquires 50% or more of the voting securities of the target, our stockholders prior to the initial business combination may collectively own a minority interest in the post-transaction company, depending on valuations ascribed to the target and us in the initial business combination. For example, we could pursue a transaction in which we issue a substantial number of new shares in exchange for all of the outstanding capital stock of a target. In this case, we would acquire a 100% controlling interest in the target. However, as a result of the issuance of a substantial number of new shares, our stockholders immediately prior to our initial business combination could own less than a majority91.3% of our outstanding shares subsequent to our initial business combination. If less than 100% of the equity interests or assets of a target business or businesses are owned or acquired by the post-transaction company, the portion of such business or businesses that is owned or acquired is what will be taken into account for purposes of Nasdaq’s 80% fair market value test. If the initial business combination involves more than one target business, the 80% fair market value test will be based on the aggregate value of all of the transactions and we will treat the target businesses together as the initial business combination for purposes of a tender offer or for seeking stockholder approval, as applicable. So long as we obtain and maintain a listing for our securities on Nasdaq, we would be required to comply with such 80% rule.Common Stock.

We do not believe we will need to raise additional funds in order to meet the expenditures required for operating our business. However, if our estimates of the costs of identifying a target business, undertaking in-depth due diligence and negotiating an initial business combination are less than the actual amount necessary to do so, we may have insufficient funds available to operate our business prior to our initial business combination. Moreover, we may need to obtain additional financing either to complete our initial business combination or because we become obligated to redeem a significant number of our public shares upon completion of our initial business combination, in which case we may issue additional securities or incur debt in connection with such business combination. In addition, if any cash portion of the purchase price exceeds the amount available from the trust account, net of amounts needed to satisfy redemptions by public stockholders, we may be required to seek additional financing to complete such proposed initial business combination. We may also obtain financing priorDue to the closinglimited public float, the trading price of our initial business combinationCommon Stock may fluctuate widely due to fund our working capital needs and transaction costs in connection with our search for and completionvarious factors, including the volume of our initial business combination. There is no limitation on our ability to raise funds through the issuancepurchase or sales of equity or equity-linked securities or through loans, advances or other indebtedness in connection with our initial business combination, including pursuant to forward purchase agreements or backstop arrangements into which we may enter. Subject to compliance with applicable securities laws, we would only complete such financing simultaneously with the completion of our business combination. If we are unable to complete our initial business combination because we do not have sufficient funds available to us, we will be forced to cease operations and liquidate the trust account. In addition, following our initial business combination, if cash on hand is insufficient, we may need to obtain additional financing in order to meet our obligations.

Our Business Combination Process

In evaluating prospective business combinations, we have conducted, and, if applicable, will conduct, a thorough due diligence review that encompasses, among other things, a review of historical and projected financial and operating data, meetings with management and their advisors (if applicable), on-site inspection of facilities and assetsCommon Stock relative to the extent possible, document reviews, as well as a review of financial, operational, legal and other information which has been and will be made available to us and which we deem appropriate. We have utilized our expertise and the sponsor’s expertise in analyzing companies and evaluating operating projections, financial projections and determining the appropriate return expectations.

We are not prohibited from pursuing an initial business combination with a business that is affiliated with Cantor or its affiliates or the sponsor, or our officers or directors, including an Affiliated Joint Acquisition. While XBP Europe is not affiliated with the sponsor or our officers or directors, in the event we do not consummate the XBP Europe Business Combination and we seek to complete our initial business combination with a business that is affiliated with Cantor or its affiliates or the sponsor, or our officers or directors, we, or a committee of independent directors, will obtain an opinion from an independent investment banking firm or another independent firm that commonly renders valuation opinions that our initial business combination is fair to our stockholders from a financial point of view.public float. The sponsor has committed, pursuant to the FPA, to purchase, in a private placement for gross proceeds of $10,000,000 to occur concurrently with the consummation of our initial business combination, 1,000,000 of our units on substantially the same terms as the sale of units in the initial public offering at $10.00 per unit, and 250,000 shares of Class A common stock. The funds from the sale of the FPS will be used as part of the consideration to the sellers in the initial business combination; any excess funds from this private placement will be used for working capital in the post-transaction company. This commitment is independent of the percentage of stockholders electing to redeem their public shares and provides us with a minimum funding level for the initial business combination.

Cantor is the beneficial owner of founder shares and/or private placement units by virtue of its ownership of the sponsor and members of our management team may indirectly own such securities. The sponsor has transferred founder shares and private placement shares to our independent directors and we have agreed to pay a cash fee to one of our independent directors, as further described herein. Because of such ownership and interests, Cantor and our officers and directors may have a conflict of interest in determining whether a particular target business is an appropriate business with which to effectuate our initial business combination. Further, each of our officers and directors may have a conflict of interest with respect to evaluating a particular business combination if the retention or resignation of any such officers and directors were to be included by a target business as a condition to any agreement with respect to our initial business combination.

All of our officers are employed by Cantor or its affiliates. Cantor is continuously made aware of potential business opportunities, one or more of which we may desire to pursue for an initial business combination. While Cantor does not have any duty to offer acquisition opportunities to us, Cantor may become aware of a potential transaction that is an attractive opportunity for us, which Cantor may decide to share with us.

The sponsor, our officers, our directors, Cantor and their affiliates may participate in the formation of, or become an officer or director of, any other blank check company prior to completion of our initial business combination. In particular, certain of our executive officers and directors also serve as executive officers or directors of other SPACs sponsored by Cantor as set forth below, each of which is focused on searching for businesses that may provide significant opportunities for attractive investor returns in industries similar to the industries in which our search is focused. As a result, the sponsor and our officers or directors could have conflicts of interest in determining whether to present business combination opportunities to us or to any other blank check company with which they may become involved.

Each of our officers and directors presently has, and any of them in the future may have additional, fiduciary, contractual or other obligations or duties to one or more other entities pursuant to which such officer or director is or will be required to present a business combination opportunity. The Charter provides that we renounce our interest in any corporate opportunity offered to any director or officer unless such opportunity is expressly offered to such person solely in his or her capacity as a director or officer of our company, such opportunity is one we are legally and contractually permitted to undertake and would otherwise be reasonable for us to pursue, and to the extent the director or officer is permitted to refer that opportunity to us without violating another legal obligation. Accordingly, if any of our officers or directors becomes aware of a business combination opportunity which is suitable for one or more entities to which he or she has fiduciary, contractual or other obligations or duties, he or she will honor these obligations and duties to present such business combination opportunity to such entities first, and only present it to us if such entities reject the opportunity and he or she determines to present the opportunity to us.

Our Management Team

Members of our management team are not obligated to devote any specific number of hours to our matters but they devote as much of their time as they deem necessary to our affairs until we have completed our initial business combination. The amount of time that any member of our management team devotes in any time period will vary based on the current stage of the business combination process we are in.

We believe our management team’s operating and transaction experience and relationships with companies will provide us with a substantial number of potential business combination targets, such as XBP Europe. Over the course of their careers, the members of our management team have developed a broad network of contacts and corporate relationships in various industries. This network has grown through the activities of our management team sourcing, acquiring and financing businesses, our management team’s relationships with sellers, financing sources and target management teams and the experience of our management team in executing transactions under varying economic and financial market conditions.

Status as a Public Company

We believe our structure makes us an attractive business combination partner to target businesses. As a public company, we offer a target business an alternative to the traditional initial public offering through a merger or other business combination with us. Following an initial business combination, we believe the target business would have greater access to capital and additional means of creating management incentives that are better aligned with stockholders’ interests than it would as a private company. A target business can further benefit by augmenting its profile among potential new customers and vendors and aid in attracting talented employees. In a business combination transaction with us, the owners of the target business may, for example, exchange their shares of stock in the target business for shares of Class A common stock (or shares of a new holding company) or for a combination of shares of Class A common stock and cash, allowing us to tailor the consideration to the specific needs of the sellers.

Although there are various costs and obligations associated with being a public company, we believe target businesses will find this method a more expeditious and cost effective method to becoming a public company than the typical initial public offering. The typical initial public offering process takes a significantly longer period of time than the typical business combination transaction process, and there are significant expenses in the initial public offering process, including underwriting discounts and commissions, marketing and road show efforts that may not be present to the same extent in connection with an initial business combination with us.

Furthermore, once a proposed initial business combination is completed, such as the XBP Europe Business Combination, the target business will have effectively become public, whereas an initial public offering is always subject to the underwriters’ ability to complete the offering, as well as general market conditions, which could delay or prevent the offering from occurring orCommon Stock registered hereunder could have a significant negative valuation consequences. Following an initialimpact on the public trading price of Common Stock. The limited public float could adversely affect the Company’s business combination, we believe the target business would then have greater accessand financing opportunities, and may make it difficult for you to capital and an additional means of providing management incentives consistent with stockholders’ interests and the abilitysell your Common Stock at a price that is attractive to use its shares as currency for acquisitions. Being a public company can offer further benefits by augmenting a company’s profile among potential new customers and vendors and aid in attracting talented employees.you.

While we believe that our structure and our management team’s backgrounds make us an attractive business partner, some potential target businesses may view our status as a blank check company, such as our lack of an operating history and our ability to seek stockholder approval of any proposed initial business combination, negatively.

We areThe Company is an “emerging growth company,” as defined in Section 2(a)company” within the meaning of the Securities Act and it has taken advantage of certain exemptions from disclosure requirements available to emerging growth companies; this could make the Company’s securities less attractive to investors and may make it more difficult to compare the Company’s performance with other public companies.

The Company is an “emerging growth company” within the meaning of the Securities Act, as modified by the JOBS Act. As such, we are eligibleAct and intends to elect to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emergingemerging growth companies”companies including, but not limited to, not being required to comply with the auditor internal controls attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation inAct. As a result, holders of our periodic reportssecurities and proxy statements, and exemptions frompotential investors may not have access to certain information they may deem important. There can be no assurances whether investors will find the requirementsCompany’s securities less attractive because of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.such exemptions. If some investors find ourthe securities less attractive as a result of reliance on these exemptions, the trading prices of the Company’s securities may be lower than they otherwise would be, there may be a less active trading market for ourthe Company’s securities and the trading prices of ourthe securities may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of the benefits of this extended transition period.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following March 16, 2026, (b) in which we have total annual gross revenue of at least $1.235 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our Class A common stock that is held by non-affiliates exceeds $700 million as of the prior June 30, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. References herein to “emerging growth company” will have the meaning associated with it in the JOBS Act.

Additionally, we are a “smaller reporting company” as defined in Rule 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited consolidated financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (1) the market value of our common stock held by non-affiliates exceeds $250 million as of the prior June 30, or (2) our annual revenues exceed $100 million during such completed fiscal year and the market value of our common stock held by non-affiliates exceeds $700 million as of the prior June 30.

In addition, only holders of our shares of Class B common stock have the right to vote on the election of directors prior to the consummation of our initial business combination. As a result, Nasdaq considers us to be a “controlled company” within the meaning of Nasdaq corporate governance standards. Under Nasdaq corporate governance standards, a company of which more than 50% of the voting power for the election of directors is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements. We have utilized, and will continue to utilize, these exemptions.

Effecting Our Initial Business Combination

We are not presently engaged in, and we will not engage in, any operations other than the pursuit of our business combination, at which point we will engage in the business of the target we acquire in our initial business combination. We intend to effectuate our initial business combination using cash from the proceeds of the (i) initial public offering remaining in the trust account at the time of the business combination, (ii) private placement of the private placement units, (iii) $10,000,000 FPA, (iv) sale of our securities in connection with our initial business combination (pursuant to forward purchase contracts or any backstop agreements we may enter into following the consummation of the initial public offering or otherwise), (v) shares issued to the owners of the target, (vi) debt issued to bank or other lenders or the owners of the target, or (vii) a combination of the foregoing. We may seek to complete our initial business combination with a company or business that may be financially unstable or in its early stages of development or growth, which would subject us to the numerous risks inherent in such companies and businesses.

If our initial business combination is paid for using equity or debt securities, or not all of the funds released from the trust account are used for payment of the consideration in connection with our initial business combination or used for redemptions of our Class A common stock, we may apply the balance of the cash released to us from the trust account, as well as the $10,000,000 from the FPA, for general corporate purposes, including for maintenance or expansion of operations of the post-transaction company, the payment of principal or interest due on indebtedness incurred in completing our initial business combination, to fund the purchase of other companies or for working capital.

In addition to the transactions contemplated by the FPA, we may seek to raise additional funds through a private offering of debt or equity securities in connection with the completion of our initial business combination (which may include a specified future issuance), and we may effectuate our initial business combination using the proceeds of such offering rather than using the amounts held in the trust account. In addition, we are targeting businesses larger than we could acquire with the remaining net proceeds of our initial public offering, the sale of the private placement units as well as the $10,000,000 from the FPA, and may as a result be required to seek additional financing to complete such proposed initial business combination. Subject to compliance with applicable securities laws, we would expect to complete such financing only simultaneously with the completion of our initial business combination. In the case of an initial business combination funded with assets other than the trust account assets, our proxy materials or tender offer documents disclosing the initial business combination would disclose the terms of the financing and, only if required by law, we would seek stockholder approval of such financing. There are no prohibitions on our ability to raise funds privately, including pursuant to any specified future issuance, or through loans in connection with our initial business combination. At this time, other than the FPA, we are not a party to any arrangement or understanding with any third party with respect to raising any additional funds through the sale of securities or otherwise.

Sources of Target Businesses

Target business candidates have been brought to our attention from various unaffiliated sources, including investment bankers and investment professionals. These sources introduce us to target businesses in which they think we may be interested on an unsolicited basis, since many of these sources will have read the prospectus of our initial public offering and know what types of businesses we are targeting. Our officers and directors, as well as the sponsor and its affiliates, have brought, and may bring, to our attention target business candidates that they become aware of through their business contacts as a result of formal or informal inquiries or discussions they may have. In addition, we have received a number of proprietary deal flow opportunities that would not otherwise necessarily be available to us as a result of the business relationships of our officers and directors and the sponsor and its affiliates.

If the XBP Europe Business Combination is not consummated, we may also contact targets that any of the other SPACs sponsored by Cantor had considered if we become aware that such targets are interested in a potential initial business combination with us and such transaction would be attractive to our stockholders.

While we have not and do not anticipate engaging the services of professional firms or other individuals that specialize in business acquisitions on any formal basis, we may engage these firms or other individuals in the future, in which event we may pay a finder’s fee, consulting fee, advisory fee or other compensation to be determined in an arm’s length negotiation based on the terms of the transaction. We will engage a finder only to the extent our management determines that the use of a finder may bring opportunities to us that may not otherwise be available to us or if finders approach us on an unsolicited basis with a potential transaction that our management determines is in our best interest to pursue. Payment of finder’s fees is customarily tied to completion of a transaction, in which case any such fee will be paid out of the funds held in the trust account. In no event, however, will the sponsor or any of our existing officers or directors, or any entity with which the sponsor or officers are affiliated, be paid any finder’s fee, reimbursement, consulting fee, monies in respect of any payment of a loan or other compensation by the company prior to, or in connection with any services rendered for any services they render in order to effectuate, the completion of our initial business combination (regardless of the type of transaction that it is) other than as described herein. If the XBP Europe Business Combination is not consummated, some of our officers and directors may enter into employment or consulting agreements with the post-transaction company following our initial business combination. The presence or absence of any such fees or arrangements will not be used as a criterion in our selection process of an initial business combination candidate.

We are not prohibited from pursuing an initial business combination with a business that is affiliated with Cantor or its affiliates or the sponsor, or our officers or directors, including an Affiliated Joint Acquisition. While XBP Europe is not affiliated with the sponsor or our officers or directors, in the event we do not consummate the XBP Europe Business Combination and we seek to complete our initial business combination with an initial business combination target that is affiliated with the sponsor, its affiliates, or our officers or directors, we, or a committee of independent directors, would obtain an opinion from an independent investment banking firm or another independent firm that commonly renders valuation opinions that such an initial business combination is fair to our stockholders from a financial point of view. We are not required to obtain such an opinion in any other context.

Each of our officers and directors presently has, and any of them in the future may have additional, fiduciary, contractual or other obligations or duties to one or more other entities pursuant to which such officer or director is or will be required to present a business combination opportunity to such entities. Our officers and directors also may become aware of business opportunities which may be appropriate for presentation to us and the other entities to which they owe certain fiduciary, contractual or other duties. Accordingly, if any of our officers or directors becomes aware of a business combination opportunity which is suitable for one or more entities to which he or she has fiduciary, contractual or other obligations or duties, he or she will honor these obligations and duties to present such business combination opportunity to such entities first, and only present it to us if such entities reject the opportunity and he or she determines to present the opportunity to us. These conflicts may not be resolved in our favor and a potential target business may be presented to another entity prior to its presentation to us. The Charter provides that we renounce our interest in any corporate opportunity offered to any director or officer unless (i) such opportunity is expressly offered to such person solely in his or her capacity as a director or officer of our company, (ii) such opportunity is one we are legally and contractually permitted to undertake and would otherwise be reasonable for us to pursue and (iii) the director or officer is permitted to refer the opportunity to us without violating another legal obligation.

Selection of a Target Business and Structuring of our Initial Business Combination

So long as we maintain a listing for our securities on Nasdaq, we must complete one or more business combinations having an aggregate fair market value of at least 80% of the value of the assets held in the trust account (excluding taxes payable on the interest earned on the trust account) at the time of our signing a definitive agreement in connection with our initial business combination. The XBP Europe Business Combination fulfilled such criteria, and if the XBP Europe Business Combination is not consummated, any business combination must fulfill such criteria. The fair market value of our initial business combination will be determined by our board of directors based upon one or more standards generally accepted by the financial community, such as discounted cash flow valuation, a valuation based on trading multiples of comparable public businesses or a valuation based on the financial metrics of merger and acquisition transactions of comparable businesses. If our board of directors is not able to independently determine the fair market value of our initial business combination, we will obtain an opinion from an independent investment banking firm or another independent firm that commonly renders valuation opinions with respect to the satisfaction of such criteria. While we consider it unlikely that our board of directors will not be able to make an independent determination of the fair market value of our initial business combination, it may be unable to do so if it is less familiar or experienced with the business of a particular target or if there is a significant amount of uncertainty as to the value of a target’s assets or prospects. We do not intend to purchase multiple businesses in unrelated industries in conjunction with our initial business combination. Subject to this requirement, our management will have virtually unrestricted flexibility in identifying and selecting one or more prospective target businesses, although we will not be permitted to effectuate our initial business combination with another blank check company or a similar company with nominal operations.

In any case, we will only complete an initial business combination in which we own or acquire 50% or more of the outstanding voting securities of the target or otherwise acquire a controlling interest in the target sufficient for it not to be required to register as an investment company under the Investment Company Act. If we own or acquire less than 100% of the equity interests or assets of a target business or businesses, the portion of such business or businesses that are owned or acquired by the post-transaction company is what will be taken into account for purposes of Nasdaq’s 80% fair market value test. There is no basis for our investors to evaluate the possible merits or risks of any target business with which we may ultimately complete our initial business combination.

To the extent we effect our initial business combination with a company or business that may be financially unstable or in its early stages of development or growth we may be affected by numerous risks inherent in such company or business. Although our management will endeavor to evaluate the risks inherent in a particular target business, we cannot assure you that we will properly ascertain or assess all significant risk factors.

In evaluating prospective business targets, we have conducted, and, if applicable, will conduct, a thorough due diligence review, which encompasses and may encompass, among other things, meetings with incumbent management and employees, document reviews, inspection of facilities, as well as a review of financial and other information that is made available to us.

We have engaged CF&Co., an affiliate of the sponsor, pursuant to the BCMA as an advisor in connection with our initial business combination to assist us in holding meetings with our stockholders to discuss any potential initial business combination and the target business’ attributes, introduce us to potential investors that are interested in purchasing our securities and assist us with our press releases and public filings in connection with our initial business combination. We will pay CF&Co. the Marketing Fee upon the consummation of the initial business combination except that CF&Co. has agreed to waive the Marketing Fee solely in connection with the XBP Europe Business Combination. We have also engaged CF&Co. as a financial advisor in connection with the XBP Europe Business Combination but CF&Co. has agreed not to receive an advisory fee for such services other than to receive reimbursement of actual expenses incurred and to be indemnified against certain liabilities arising out of its engagement. In the event the XBP Europe Business Combination is not consummated, we may engage CF&Co., or another affiliate of the sponsor, as a financial advisor in connection with our initial business combination and/or placement agent for any securities offering to occur concurrently with our initial business combination and pay such affiliate a customary financial advisory and/or placement agent fee in an amount that constitutes a market standard financial advisory or placement agent fee for comparable transactions. Furthermore, we may acquire a target company that has engaged CF&Co., or another affiliate of the sponsor, as a financial advisor, and such target company may pay such affiliate a financial advisory fee in connection with our initial business combination.

Any costs incurred with respect to the identification and evaluation of a prospective target business with which our initial business combination is not ultimately completed will result in our incurring losses and will reduce the funds we can use to complete another business combination.

Lack of Business Diversification

For an indefinite period of time after the completion of our initial business combination, the prospects for our success may depend entirely on the future performance of a single business. Unlike other entities that have the resources to complete business combinations with multiple entities in one or several industries, it is probable that we will not have the resources to diversify our operations and mitigate the risks of being in a single line of business. In addition, we have focused our search for an initial business combination in a single industry. By completing our initial business combination with only a single entity, our lack of diversification may:

| ● | subject us to negative economic, competitive and regulatory developments, any or all of which may have a substantial adverse impact on the particular industry in which we operate after our initial business combination, and |

| ● | cause us to depend on the marketing and sale of a single product or limited number of products or services. |

Limited Ability to Evaluate the Target’s Management Team

Although we closely scrutinize the management of a prospective target business, including the management of XBP Europe, when evaluating the desirability of effecting our initial business combination with such business and will continue to do so if the XBP Europe Business Combination is not consummated and we seek other business combination opportunities, our assessment of the target business’ management may not prove to be correct. In addition, the future management may not have the necessary skills, qualifications or abilities to manage a public company. Furthermore, other than with respect to the XBP Europe Business Combination, the future role of members of our management team, if any, in the target business cannot presently be stated with any certainty. The determination as to whether any of the members of our management team will remain with the combined company will be made at the time of our initial business combination. While it is possible that one or more of our directors will remain associated in some capacity with us following our initial business combination, it is unlikely that any of them will devote their full efforts to our affairs subsequent to our initial business combination. If the XBP Europe Business Combination is consummated, none of our directors are expected to remain with the Company after consummation of the XBP Europe Business Combination. Moreover, we cannot assure you that members of our management team will have significant experience or knowledge relating to the operations of the particular target business.

We cannot assure you that any of our key personnel will remain in senior management or advisory positions with the combined company. If the XBP Europe Business Combination is consummated, none of our key personnel are expected to remain with the Company after consummation of the XBP Europe Business Combination. The determination as to whether any of our key personnel will remain with any other potential combined company, if the XBP Europe Business Combination is not consummated, will be made at the time of our initial business combination.

Stockholders May Not Have the Ability to Approve Our Initial Business Combination

We may conduct redemptions without a stockholder vote pursuant to the tender offer rules of the SEC. However, we will seek stockholder approval if it is required by applicable law or stock exchange rule (as is the case with the XBP Europe Business Combination as currently contemplated), or, if the XBP Europe Business Combination is not consummated, we may decide to seek stockholder approval for business or other legal reasons. Presented in the table below is a graphic explanation of the types of initial business combinations we may consider and whether stockholder approval is currently required under Delaware law for each such transaction.

Type of Transaction | | | Whether

Stockholder

Approval is

Required | |

Purchase of assets | | | No | |

| | | | |

Purchase of stock of target not involving a merger with the company | | | No | |

| | | | |

Merger of target into a subsidiary of the company | | | No | |

| | | | |

Merger of the company with a target | | | Yes | |

So long as we maintain a listing for our securities on Nasdaq, stockholder approval would be required for our initial business combination if, for example:

| ● | we issue shares of Class A common stock that will be equal to or in excess of 20% of the number of shares of our Class A common stock then outstanding (other than in a public offering); |

| ● | any of our directors, officers or substantial stockholders (as defined by Nasdaq rules) has a 5% or greater interest (or such persons collectively have a 10% or greater interest), directly or indirectly, in the target business or assets to be acquired or otherwise and the present or potential issuance of common stock could result in an increase in outstanding shares of common stock or voting power of 5% or more; or |

| ● | the issuance or potential issuance of common stock will result in our undergoing a change of control. |

Permitted Purchases of our Securities

If we seek stockholder approval of our initial business combination and we do not conduct redemptions in connection with our initial business combination pursuant to the tender offer rules, our initial stockholders, directors, officers, advisors or any their respective affiliates may purchase shares or public warrants in privately negotiated transactions or in the open market either prior to or following the completion of our initial business combination. There is no limit on the number of shares our initial stockholders, directors, officers, advisors or any of their respective affiliates may purchase in such transactions, subject to compliance with applicable law and Nasdaq rules. However, they have no current commitments, plans or intentions to engage in such transactions and have not formulated any terms or conditions for any such transactions.

In the event our initial stockholders, directors, officers, advisors or any of their respective affiliates determine to make any such purchases at the time of a stockholder vote relating to our initial business combination, such purchases could have the effect of influencing the vote necessary to approve such transaction. If they engage in such transactions, they will be restricted from making any such purchases when they are in possession of any material non-public information not disclosed to the seller or if such purchases are prohibited by Regulation M under the Exchange Act. Such a purchase may include a contractual acknowledgement that such stockholder, although still the record holder of our shares, is no longer the beneficial owner thereof and therefore agrees not to exercise its redemption rights. We do not currently anticipate that such purchases, if any, would constitute a tender offer subject to the tender offer rules under the Exchange Act or a going-private transaction subject to the going-private rules under the Exchange Act; however, if the purchasers determine at the time of any such purchases that the purchases are subject to such rules, the purchasers will comply with such rules. Any such purchases will be reported pursuant to Section 13 and Section 16 of the Exchange Act to the extent such purchasers are subject to such reporting requirements. None of the funds held in the trust account will be used to purchase shares or public warrants in such transactions prior to completion of our initial business combination.

The purpose of any such purchases of shares could be to vote such shares in favor of the initial business combination and thereby increase the likelihood of obtaining stockholder approval of the initial business combination or to satisfy a closing condition in an agreement with a target that requires us to have a minimum net worth or a certain amount of cash at the closing of our initial business combination, where it appears that such requirement would otherwise not be met. The purpose of any such purchases of public warrants could be to reduce the number of public warrants outstanding or to vote such warrants on any matters submitted to the warrant holders for approval in connection with our initial business combination. Any such purchases of our securities may result in the completion of our initial business combination that may not otherwise have been possible. In addition, if such purchases are made, the public “float” of our shares of Class A common stock or warrants may be reduced and the number of beneficial holders of our securities may be reduced, which may make it difficult to maintain or obtain the quotation, listing or trading of our securities on a national securities exchange.

The sponsor, our officers, directors, advisors and/or any of their respective affiliates anticipate that they may identify the stockholders with whom the sponsor, our officers, directors, advisors or any of their respective affiliates may pursue privately negotiated purchases by either the stockholders contacting us directly or by our receipt of redemption requests submitted by stockholders following our mailing of proxy materials in connection with our initial business combination. To the extent that the sponsor, our officers, directors, advisors or any of their respective affiliates enter into a private purchase, they would identify and contact only potential selling stockholders who have expressed their election to redeem their shares for a pro rata share of the trust account or vote against our initial business combination, whether or not such stockholder has already submitted a proxy with respect to our initial business combination. Such persons would select the stockholders from whom to acquire shares based on the number of shares available, the negotiated price per share and such other factors as any such person may deem relevant at the time of purchase. The price per share paid in any such transaction may be different than the amount per share a public stockholder would receive if it elected to redeem its shares in connection with our initial business combination. The sponsor, our officers, directors, advisors or any of their respective affiliates will purchase shares only if such purchases comply with Regulation M under the Exchange Act and the other federal securities laws.

Any purchases by the sponsor, our officers, directors and/or any of their respective affiliates who are affiliated purchasers under Rule 10b-18 under the Exchange Act will only be made to the extent such purchases are able to be made in compliance with Rule 10b-18, which is a safe harbor from liability for manipulation under Section 9(a)(2) and Rule 10b-5 of the Exchange Act. Rule 10b-18 has certain technical requirements that must be complied with in order for the safe harbor to be available to the purchaser. The sponsor, our officers, directors, advisors and/or any of their respective affiliates will not make purchases of common stock if the purchases would violate Section 9(a)(2) or Rule 10b-5 of the Exchange Act. Any such purchases will be reported pursuant to Section 13 and Section 16 of the Exchange Act to the extent such purchases are subject to such reporting requirements.

As of the date of this Report, there have been no such discussions and no agreements to such effect have been entered into with any such investor or holder. If such arrangements or agreements are entered into, we will file a Current Report on Form 8-K to disclose any arrangements entered into or significant purchases made by any of the aforementioned persons. Any such report will include (i) the amount of shares of common stock purchased and the purchase price; (ii) the purpose of such purchases; (iii) the impact of such purchases on the likelihood that the business combination transaction will be approved; (iv) the identities or characteristics of security holders who sold shares if not purchased in the open market or the nature of the sellers; and (v) the number of shares of common stock for which we have received redemption requests.

Redemption Rights for Public Stockholders upon Completion of our Initial Business Combination

We will provide our public stockholders with the opportunity to redeem all or a portion of their shares of Class A common stock upon the completion of our initial business combination at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account as of two business days prior to the consummation of the initial business combination including interest earned on the funds held in the trust account and not previously released to us to pay our taxes, divided by the number of then outstanding public shares, subject to the limitations described herein. As of December 31, 2022, the amount in the trust account was approximately $10.53 and following the Third Extension, as of March 16, 2023, the amount in the Trust account was approximately $10.57 per public share (excluding interest that may be earned on funds in the Trust Account). The sponsor and our officers and directors have entered into a letter agreement with us, pursuant to which they have agreed to waive their redemption rights with respect to any founder shares and any public shares held by them in connection with the completion of our initial business combination.

Manner of Conducting Redemptions

We will provide our public stockholders with the opportunity to redeem all or a portion of their shares of Class A common stock upon the completion of our initial business combination either (i) in connection with a stockholder meeting called to approve the initial business combination, or (ii) by means of a tender offer. The decision as to whether we will seek stockholder approval of a proposed initial business combination or conduct a tender offer will be made by us, solely in our discretion, and will be based on a variety of factors such as the timing of the transaction and whether the terms of the transaction would require us to seek stockholder approval under applicable law or stock exchange listing requirement. Under Nasdaq rules, asset acquisitions and stock purchases would not typically require stockholder approval while direct mergers with our company where we do not survive and any transactions where we issue more than 20% of our outstanding common stock or seek to amend the Charter would require stockholder approval. If we structure an initial business combination with a target company in a manner that requires stockholder approval, we will not have discretion as to whether to seek a stockholder vote to approve the proposed initial business combination. We may conduct redemptions without a stockholder vote pursuant to the tender offer rules of the SEC unless stockholder approval is required by applicable law or stock exchange listing requirements or we choose to seek stockholder approval for business or other legal reasons. So long as we obtain and maintain a listing for our securities on Nasdaq, we will be required to comply with such rules.

If a stockholder vote is not required and we do not decide to hold a stockholder vote for business or other legal reasons, we will, pursuant to the Charter:

| ● | conduct the redemptions pursuant to Rule 13e-4 and Regulation 14E of the Exchange Act, which regulate issuer tender offers, and |

| ● | file tender offer documents with the SEC prior to completing our initial business combination which contain substantially the same financial and other information about the initial business combination and the redemption rights as is required under Regulation 14A of the Exchange Act, which regulates the solicitation of proxies. |

In the event we conduct redemptions pursuant to the tender offer rules, our offer to redeem will remain open for at least 20 business days, in accordance with Rule 14e-1(a) under the Exchange Act, and we will not be permitted to complete our initial business combination until the expiration of the tender offer period. In addition, the tender offer will be conditioned on public stockholders not tendering more than a specified number of public shares which are not purchased by the sponsor, which number will be based on the requirement that we may only redeem our public shares so long as our net tangible assets are at least $5,000,001 either immediately prior to or upon consummation of our initial business combination and after payment of underwriters’ fees and commissions (so that we are not subject to the SEC’s “penny stock” rules) or any greater net tangible asset or cash requirement which may be contained in the agreement relating to our initial business combination. If public stockholders tender more shares than we have offered to purchase, we will withdraw the tender offer and not complete the initial business combination.

If, however, stockholder approval of the transaction is required by applicable law or stock exchange listing requirement, or we decide to obtain stockholder approval for business or other legal reasons, we will, pursuant to the Charter:

| ● | conduct the redemptions in conjunction with a proxy solicitation pursuant to Regulation 14A of the Exchange Act, which regulates the solicitation of proxies, and not pursuant to the tender offer rules, and |

| ● | file proxy materials with the SEC. |

In the event that we seek stockholder approval of our initial business combination, we will distribute proxy materials and, in connection therewith, provide our public stockholders with the redemption rights described above upon completion of the initial business combination.

If we seek stockholder approval, we will complete our initial business combination only if a majority of the outstanding shares of common stock are voted in favor of the initial business combination. A quorum for such meeting will consist of the holders present in person or by proxy of shares of outstanding capital stock of the company representing a majority of the voting power of all outstanding shares of capital stock of the company entitled to vote at such meeting. Our initial stockholders will count toward this quorum and pursuant to the letter agreement, the sponsor and our officers and directors have agreed to vote their founder shares, private placement shares and any public shares purchased during or after our initial public offering (including in open market and privately negotiated transactions) in favor of our initial business combination. For purposes of seeking approval of the majority of our outstanding shares of common stock voted, non-votes will have no effect on the approval of our initial business combination once a quorum is obtained. As of December 31, 2022, after accounting for the redemption of public shares in connection with the First Extension and the Second Extension, the sponsor owns 69.4% of the issued and outstanding shares of common stock. Accordingly, the sponsor will have the ability, voting on its own, to satisfy quorum requirements and to approve an initial business combination, including the XBP Europe Business Combination, and none of our public shares will need to vote in favor of an initial business combination in order to have our initial business combination approved. We intend to give approximately 30 days (but not less than 10 days nor more than 60 days) prior written notice of any such meeting, if required, at which a vote shall be taken to approve our initial business combination. These quorum and voting thresholds, and the voting agreements of our initial stockholders, make it more likely that we will consummate our initial business combination. Each public stockholder may elect to redeem its public shares irrespective of whether they vote for or against a proposed business combination.

The Charter provides that we may only redeem our public shares so long as our net tangible assets are at least $5,000,001 either immediately prior to or upon consummation of our initial business combination and after payment of underwriters’ fees and commissions (so that we are not subject to the SEC’s “penny stock” rules) or any greater net tangible asset or cash requirement which may be contained in the agreement relating to our initial business combination. For example, the proposed initial business combination may require: (i) cash consideration to be paid to the target or its owners, (ii) cash to be transferred to the target for working capital or other general corporate purposes or (iii) the retention of cash to satisfy other conditions in accordance with the terms of the proposed initial business combination. In the event the aggregate cash consideration we would be required to pay for all shares of Class A common stock that are validly submitted for redemption plus any amount required to satisfy cash conditions pursuant to the terms of the proposed initial business combination exceed the aggregate amount of cash available to us, we will not complete the initial business combination or redeem any shares, and all shares of Class A common stock submitted for redemption will be returned to the holders thereof.

Limitation on Redemption upon Completion of our Initial Business Combination if we Seek Stockholder Approval

Notwithstanding the foregoing, if we seek stockholder approval of our initial business combination and we do not conduct redemptions in connection with our initial business combination pursuant to the tender offer rules, the Charter provides that a public stockholder, together with any affiliate of such stockholder or any other person with whom such stockholder is acting in concert or as a “group” (as defined under Section 13 of the Exchange Act), will be restricted from seeking redemption rights with respect to more than an aggregate of 15% of the shares sold in our initial public offering (the “Excess Shares”). We believe this restriction will discourage stockholders from accumulating large blocks of shares, and subsequent attempts by such holders to use their ability to exercise their redemption rights against a proposed initial business combination as a means to force us or our management to purchase their shares at a significant premium to the then-current market price or on other undesirable terms. Absent this provision, a public stockholder holding more than an aggregate of 15% of the shares sold in our initial public offering could threaten to exercise its redemption rights if such holder’s shares are not purchased by us or our management at a premium to the then-current market price or on other undesirable terms. By limiting our stockholders’ ability to redeem no more than 15% of the shares sold in our initial public offering without our prior consent, we believe we will limit the ability of a small group of stockholders to unreasonably attempt to block our ability to complete our initial business combination, particularly in connection with an initial business combination with a target that requires as a closing condition that we have a minimum net worth or a certain amount of cash. However, we would not be restricting our stockholders’ ability to vote all of their shares (including Excess Shares) for or against our initial business combination.

Tendering Stock Certificates in Connection with Redemption Rights

We may require our public stockholders seeking to exercise their redemption rights, whether they are record holders or hold their shares in “street name,” to either tender their certificates to our transfer agent prior to the date set forth in the tender offer materials mailed to such holders, or up to two business days prior to the vote on the proposal to approve the initial business combination in the event we distribute proxy materials, or to deliver their shares to the transfer agent electronically using the DWAC System, at the holder’s option. The proxy materials that we will furnish to holders of our public shares in connection with our initial business combination will indicate whether we are requiring public stockholders to satisfy such delivery requirements. Accordingly, a public stockholder would have up to two business days prior to the vote on the initial business combination if we distribute proxy materials to tender its shares if it wishes to seek to exercise its redemption rights. Given the relatively short exercise period, it is advisable for stockholders to use electronic delivery of their public shares.

There is a nominal cost associated with the above-referenced tendering process and the act of certificating the shares or delivering them through the DWAC System. The transfer agent will typically charge the tendering broker $100.00 and it would be up to the broker whether or not to pass this cost on to the redeeming holder. However, this fee would be incurred regardless of whether or not we require holders seeking to exercise redemption rights to tender their shares. The need to deliver shares is a requirement of exercising redemption rights regardless of the timing of when such delivery must be effectuated.

The foregoing is different from the procedures used by many blank check companies. In order to perfect redemption rights in connection with their business combinations, many blank check companies would distribute proxy materials for the stockholders’ vote on an initial business combination, and a holder could simply vote against a proposed initial business combination and check a box on the proxy card indicating such holder was seeking to exercise his or her redemption rights. After the initial business combination was approved, the company would contact such stockholder to arrange for him or her to deliver his or her certificate to verify ownership. As a result, the stockholder then had an “option window” after the completion of the initial business combination during which he or she could monitor the price of the company’s stock in the market. If the price rose above the redemption price, he or she could sell his or her shares in the open market before actually delivering his or her shares to the company for cancellation. As a result, the redemption rights, to which stockholders were aware they needed to commit before the stockholder meeting, would become “option” rights surviving past the completion of the initial business combination until the redeeming holder delivered its certificate. The requirement for physical or electronic delivery prior to the meeting ensures that a redeeming holder’s election to redeem is irrevocable once the initial business combination is approved.

Any request to redeem such shares, once made, may be withdrawn with our consent at any time up to the date of the stockholder meeting set forth in our proxy materials. Furthermore, if a holder of a public share delivered its certificate in connection with an election of redemption rights and subsequently decides prior to the applicable date not to elect to exercise such rights, such holder may simply request that the transfer agent return the certificate (physically or electronically). It is anticipated that the funds to be distributed to holders of our public shares electing to redeem their shares will be distributed promptly after the completion of our initial business combination.

If our initial business combination is not approved or completed for any reason, then our public stockholders who elected to exercise their redemption rights would not be entitled to redeem their shares for the applicable pro rata share of the trust account. In such case, we will promptly return any certificates delivered by public holders who elected to redeem their shares.

If the XBP Europe Business Combination is not completed, we may continue to try to complete an initial business combination with a different target during the Combination Period.

Redemption of Public Shares and Liquidation if no Initial Business Combination

The Charter provides that we will have until the end of the Combination Period to consummate a business combination. If we are unable to complete our initial business combination by the end of the Combination Period, we will: (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account including interest earned on the funds held in the trust account and not previously released to us to pay our taxes (less up to $100,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire worthless if we fail to complete our initial business combination within the allotted time period.

The sponsor and our officers and directors have entered into a letter agreement with us, pursuant to which they have waived their rights to liquidating distributions from the trust account with respect to any founder shares or private placement shares held by them if we fail to complete our initial business combination by the end of the Combination Period. However, if the sponsor or our officers or directors acquire public shares in or after our initial public offering, they will be entitled to liquidating distributions from the trust account with respect to such public shares if we fail to complete our initial business combination by the end of the Combination Period.

The sponsor and our officers and directors have agreed, pursuant to a written agreement with us, that they will not propose any amendment to the Charter (i) to modify the substance or timing of our obligation to allow redemption in connection with our initial business combination or to redeem 100% of our public shares if we do not complete our initial business combination by the end of the Combination Period or (ii) with respect to any other provision relating to stockholders’ rights or pre-initial business combination activity, unless we provide our public stockholders with the opportunity to redeem their shares of Class A common stock upon approval of any such amendment at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account including interest earned on the funds held in the trust account and not previously released to us to pay our taxes divided by the number of then outstanding public shares.