Washington, D.C. 20549

GRAN TIERRA ENERGY INC.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. o☐

Gran Tierra Energy Inc.

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts included in this Annual Report on Form 10-K regarding our financial position, estimated quantities and net present values of reserves, business strategy, plans and objectives of our management for future operations, covenant compliance, capital spending plans and benefits of the changes in our capital program or expenditures, our liquidity and financial condition and those statements preceded by, followed by or that otherwise include the words “believe”, “expect”, “anticipate”, “intend”, “estimate”, “project”, “target”, “goal”, “plan”, “budget”, “objective”, “should”, or similar expressions or variations on these expressions are forward-looking statements. We can give no assurances that the assumptions upon which the forward-looking statements are based will prove to be correct or that, even if correct, intervening circumstances will not occur to cause actual results to be different than expected. Because forward-looking statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements, including, but not limited to, our operations are located in South America and unexpected problems can arise due to guerilla activity, strikes, local blockades or protests; technical difficulties and operational difficulties may arise which impact the production, transport or sale of our products; other disruptions to local operations; global health events; global and regional changes in the demand, supply, prices, differentials or other market conditions affecting oil and gas, including inflation and changes resulting from a global health crisis, geopolitical events, including the conflicts in Ukraine and the Gaza region, or from the imposition or lifting of crude oil production quotas or other actions that might be imposed by OPEC, such as its decision in June 2023 to cut production and other producing countries and the resulting company or third-party actions in response to such changes; changes in commodity prices, including volatility or a prolonged decline in these prices relative to historical or future expected levels; the risk that current global economic and credit conditions may impact oil prices and oil consumption more than we currently predict which could cause further modification of our strategy and capital spending program; prices and markets for oil and natural gas are unpredictable and volatile; the effect of hedges; the accuracy of productive capacity of any particular field; geographic, political and weather conditions can impact the production, transport or sale of our products; our ability to execute its business plan and realize expected benefits from current initiatives; the risk that unexpected delays and difficulties in developing currently owned properties may occur; the ability to replace reserves and production and develop and manage reserves on an economically viable basis; the accuracy of testing and production results and seismic data, pricing and cost estimates (including with respect to commodity pricing and exchange rates); the risk profile of planned exploration activities; the effects of drilling down-dip; the effects of waterflood and multi-stage fracture stimulation operations; the extent and effect of delivery disruptions, equipment performance and costs; actions by third parties; the timely receipt of regulatory or other required approvals for our operating activities; the failure of exploratory drilling to result in commercial wells; unexpected delays due to the limited availability of drilling equipment and personnel; volatility or declines in the trading price of our common stock or bonds; the risk that we do not receive the anticipated benefits of government programs, including government tax refunds; our ability comply with financial covenants in our indentures and make borrowings under any future credit agreement; and those factors set out in Part I, Item 1A.1A “Risk Factors” in this Annual Report on Form 10-K. The information included herein is given as of the filing date of this Annual Report on Form 10-K with the Securities and Exchange Commission (“SEC”) and, except as otherwise required by the federal securities laws, we disclaim any obligationsobligation or undertaking to publicly release any updates or revisions to, or to withdraw, any forward-looking statement contained in this Annual Report on Form 10-K to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

content of gas and oil. The rate is not necessarily indicative of the relationship between oil and gas prices. BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf:1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

Below are explanations of some commonly used terms in the oil and gas business and in this report.

if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty.

All dollar ($) amounts referred to in this Annual Report on Form 10-K are United States (U.S.) dollars, unless otherwise indicated.

Acquisitions and Dispositions

On April 27, 2017, we acquired an operated 100% working interest (“WI”) inMay 5, 2023, the Santana and Nancy-Burdine-Maxine Blocks inCompany completed a 1-for-10 reverse stock split of the Putumayo Basin in Colombia for cash considerationCompany’s Common Stock. As a result of $30.4 million.

On June 30, 2017, we completed the salereverse stock split, every ten of our Brazil business unit for a purchase pricethe Company’s issued shares of $35.0 million, which, after certain final closing adjustments, resulted in cash considerationCommon Stock were automatically combined into one issued share of approximately $36.8 million.

On December 18, 2017, we completed the sale of our Peru business unit. PursuantCommon Stock, without any change to the divestiture, Sterling Resources Ltd. (“Sterling”) acquired all ofpar value per share. All share and per share numbers in this Annual Report on Form 10-K have been adjusted to reflect the issued and outstanding shares in our indirect, wholly owned subsidiary that indirectly held all of our Peruvian assets for aggregate consideration of $33.5 million, comprising approximately 187.3 million common shares of Sterling and an estimated cash-settled working capital adjustment of $0.4 million. Additionally, in connection with the divestiture, we purchased $11.0 million of subscription receipts which were exchangeable for common shares of PetroTal Ltd. and subsequently exchanged them for approximately 58.9 million common shares of Sterling. After giving effect to the divestiture, we directly and indirectly hold approximately 246.2 million common shares representing approximately 46% of Sterling's issued and outstanding common shares.reverse stock split.

20172023 Operational Highlights

InDuring the year ended December 31, 2017,2023, we drilled 25 wells (17 development, and eight water injectors), all in Colombia and incurred capital expenditures of $251.0$218.9 million including $242.6 million, or 97%, the majority of which were incurred in Colombia. In Colombia, we drilled 4 exploration and 21 development wells, including 2 service wells.

We drilled explorationeight development and five water injector wells in the Putumayo-1 Block (Vonu-1), Putumayo-7 Block (Confianza-1), Putumayo-4 Block (Siriri-1) and Midas Block (Ayombero-1) Two of these wells are currently on production (Vonu-1 and Confianza-1) and we are currently evaluating Siriri and testing Ayombero.

Development wells were drilled in the Midas Block (Acordionero-9, 10i, 11, 12, 13, 14i, 15, 16, 17, 18, 20, 21 and Mochuelo), Suroriente Block (Cohembi-19, 20, 21, 22), Chaza Block (Costayaco-28, 29 and 30) and Guayuyaco Block (Juanambu-2). Two of these wells were water injection wells (Acordionero-10i and 14i).

We acquired and processed new 3-D seismic in the Cumplidor and Northwest areas in the Putumayo-7 Block. Two walkaway vertical seismic profiles were acquired and processed in the Acordionero Field. We re-processed 2-D and 3-D seismic in the Llanos Basin (Garibay-El Porton area), Middle Magdalena Basin (Acordionero, Los Angeles, Midas Norte areas) and Putumayo Basin (Cohembi, Moqueta, Costayaco). Minor re-processing was done for evaluations in Mexico.

We also continued facilities work at the Acordionero Field on the Midas Block and the Moqueta Field on thenine development and three water injector wells in Chaza Block. As at December 31, 2023, of the 17 development wells drilled during the year, two were in-progress and the remainder were producing.

20182024 Outlook

Colombia remainsOur Colombian development operation is expected to represent 93% of our focusproduction and represents 100%approximately 60% - 70% of our 2024 capital budget, with the 2018remainder allocated to exploration activities.

The table below shows the break-down of our 2024 capital program. In December 2017, we announced our 2018 capital budget. We expect the following ranges for our 2018 capital budget:program:

| | | | | | | | | | | | | | | | | |

| | | | | | |

| Number of Wells

(Gross) | | Number of Wells

(Net) | | 20182024 Capital Budget

($ million) |

| Development - Colombia | 13 - 17 | | 12 - 16 | | 130 - 140 |

DevelopmentExploration - Colombia and Ecuador | 19-216 - 9 | |

6 - 9 | | 18-20

| 100-105 |

80 - 100 |

| Exploration19 - 26 | | 8-1118 - 25 | |

7-10 |

| 80-90 |

|

Facilities | — |

| — |

| 50-55 |

|

Seismic and Studies | — |

| — |

| 20 |

|

| 27-32 |

| 25-30 |

| 250-270 |

210 - 240 |

Our base capital program for 2024 is $210 million to $240 million for exploration and development activities. Based on the midpointmid-point of the 2024 guidance, the capital budget is forecasted to be approximately 60% - 70% directed to development and 40% - 30% to exploration. Between 30% and 35%exploration activities. Approximately 20% of the 2018development activities included in the 2024 capital program isare expected to be directed to facilities with approximately 75% of this investment expected to be dedicated to the ongoing facilities expansion at the Acordionero Field.support future production growth and enhance recovery factors.

We expect our 20182024 capital program to be fully funded by cash flows from operations.

Senior Notes Offering

On February 15, 2018, through our indirect wholly owned subsidiary, Gran Tierra Energy International Holdings Ltd., we issued $300 million aggregate principal amount of 6.25% Senior Notes due 2025 in a private placement transaction. The notes bear interest at a rate of 6.25% per year, payable semi-annually in arrears on February 15 and August 15 of each year, beginning on August 15, 2018. The notes will mature on February 15, 2025, unless earlier redeemed or repurchased.

Business Strategy

Our strategy is to profitably grow our portfolio of exploration, development and production opportunities in Colombia. We are taking steps to grow cash flows Funding this program from existing assets by developing reserves and growing reserves through enhanced oil recovery (“EOR”) techniques. Starting in 2017, we have consolidated sufficient exploration opportunities to commence a three to five year continuous exploration program which we expect will be fully funded through the reinvestment of cash flows from operations relies in part on Brent oil prices being $70 per bbl for 2024.

Business Strategy

We are an international exploration and leverage ofproduction company focused on hydrocarbon development in proven, under-explored conventional basins which have access to established infrastructure and competitive fiscal regimes. Our mandate is to develop high-value resource opportunities to deliver top-quartile returns. We intend to continue to high-grade our financial strength.portfolio, with a continued focus on operational excellence, safety, and stakeholder returns. The senior management team has a proven track record in developing technically difficult reservoirs, enhanced oil recovery, and operating in remote locations in demanding jurisdictions. We aim to have a meaningful and sustainable impact through social investments within the communities we operate. Our “Beyond Compliance Policy” focuses on our commitments to environmental, social, and governance excellence.

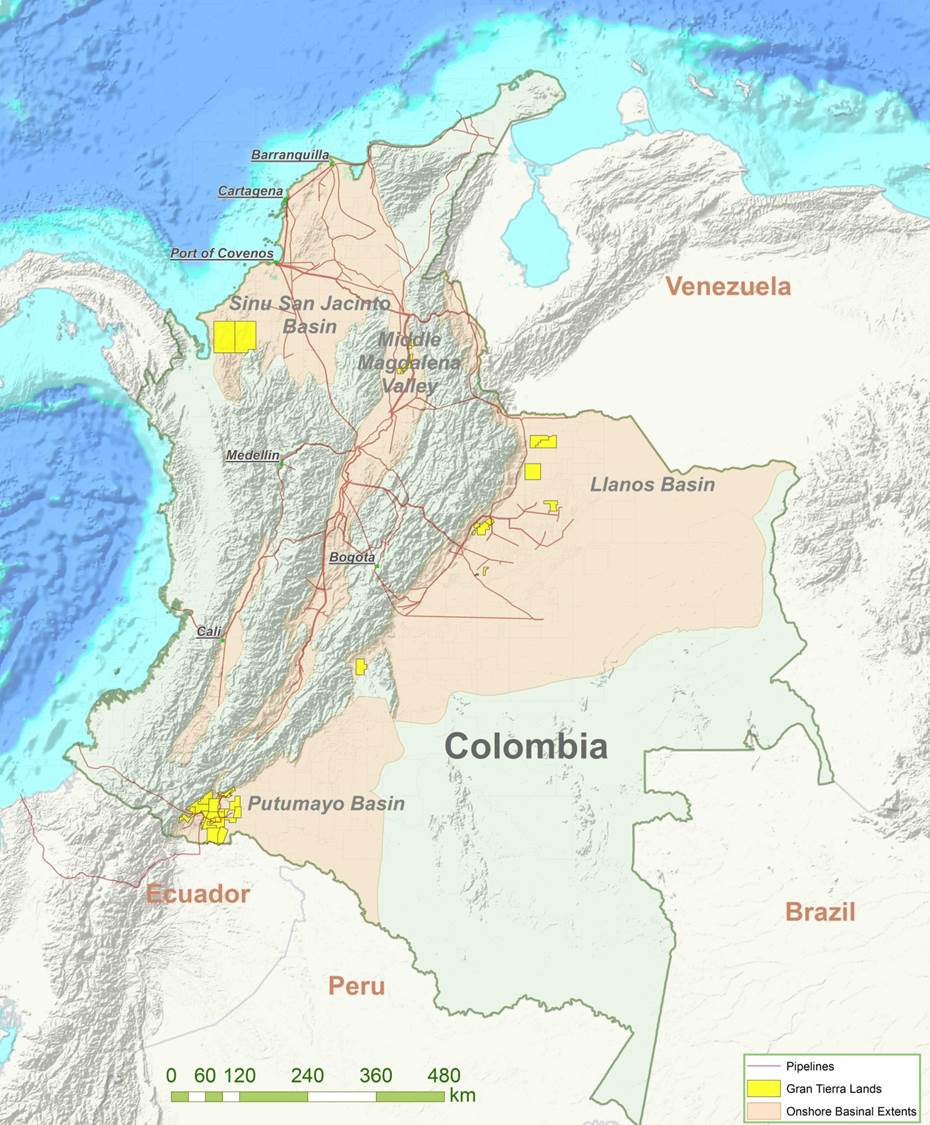

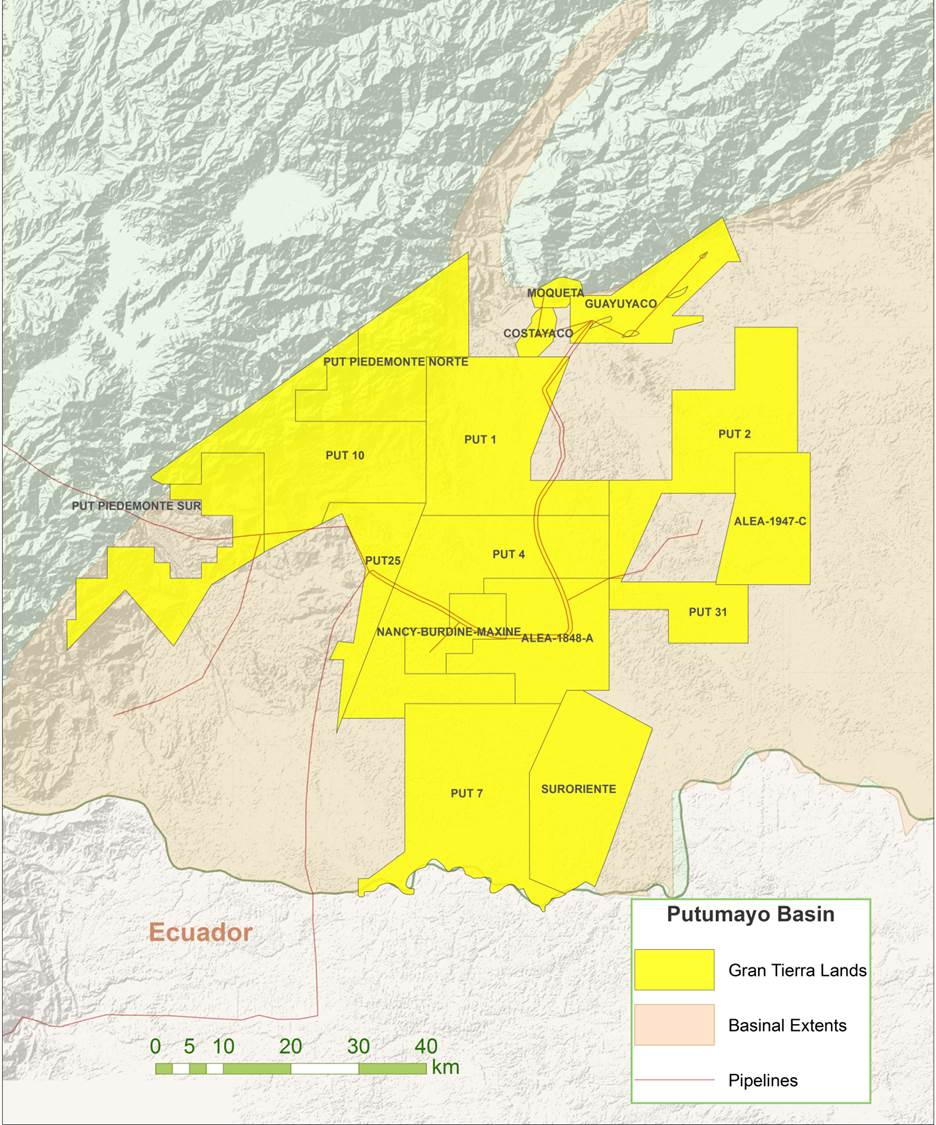

Oil and Gas Properties - Colombia and Ecuador

Acquisitions and Farm-ins

On April 27, 2017, we acquired an operated 100% WI in the Santana and Nancy-Burdine-Maxine Blocks in the Putumayo Basin for cash considerationAs of $30.4 million.

On November 27, 2017, we entered into two farm-in agreements to acquire, subject to approval from the Agencia Nacional de Hidrocarburos (National Hydrocarbons Agency) (“ANH”), additional WIs in the Alea 1848-A and 1947-C Blocks in the Putumayo Basin. Under the terms of the agreements, we will increase our position to 75% WI in each of these blocks and will carry the farmor on current contract phase obligations, to a combined maximum of $4.8 million. The applications for approval to be submitted to the ANH will include the appointment of Gran Tierra as operator of these blocks. During 2017, we relinquished our working interest in the Arjona Block.

ExcludingDecember 31, 2023, excluding blocks subject to relinquishment, we havehad interests in 3022 blocks in Colombia, three blocks in Ecuador, and are the operator on 23of 24 of these blocks.

Exploration Blocks & Commitments

The following table provides a summary of our exploration commitments for certain blocks as atof December 31, 2017:2023:

| | | | | | | | | | | |

| Basin | Block | | |

Basin | Block | Current Phase | Remaining Commitments, Current Phase |

| Colombia |

| Putumayo | Alea

1848-A | 3 & 4N/A** | 70 km 2D seismic, 1evaluation program |

| Putumayo | PUT-1 | 2* | two exploration wells |

| Putumayo | PUT-4 | 1* | one exploration well |

| Putumayo | Alea

1947-CPUT-7 | 2*2 | 1two exploration wellwells |

| Putumayo | PPNPUT-10 | 1* | 52 km 2D seismic |

Putumayo | PPS | 2 & 3* | 2 km of 2D seismic, 1 exploration well |

Putumayo | PUT-1 | 2 | 2 exploration wells |

Putumayo | PUT-2 | 2 | 3 exploration wells |

Putumayo | PUT-4 | 1 | 1 exploration well |

Putumayo | PUT-7 | 1 | 1 exploration well |

Putumayo | PUT-10 | 1* | 73 km 2D seismic, 2two exploration wells |

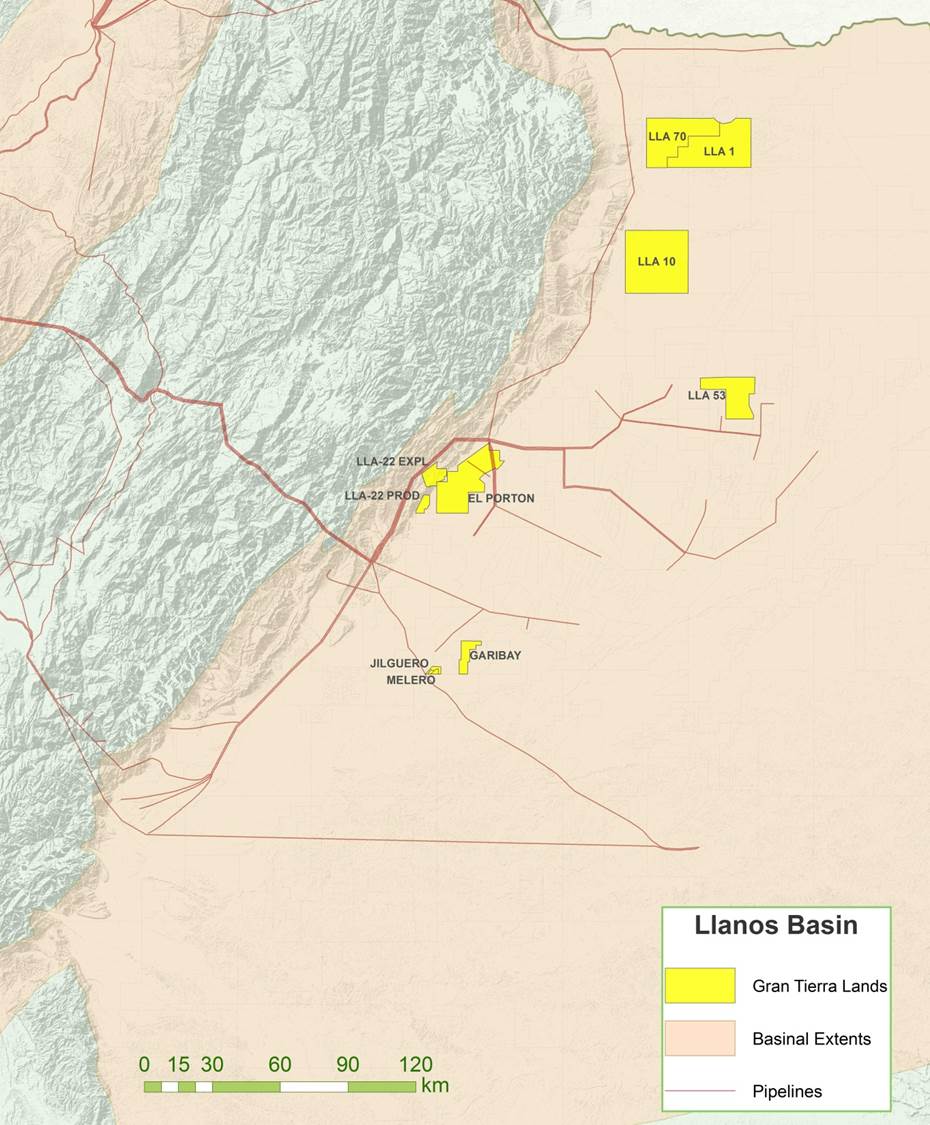

LlanosPutumayo | El PortonPUT-31 | 5*1* | 1201.9 km 2D seismic, one exploration well |

LlanosPutumayo | LLA-1NBM | N/A** | two exploration wells |

| Llanos | LLA-1 | 1** | 97.598 km2 3D seismic 1one exploration well

|

| Llanos | LLA-10LLA-22 | 1* | 1 exploration well |

Llanos | LLA-22 | 1 & 2* | 85 km2 3D seismic, 1one exploration well (45% working interest) |

| Llanos | LLA-53LLA-70 | 1* | 89163 km2 3D seismic, 2one exploration wells (approval requested to transfer commitments to PUT4- and PUT-7)well

|

| Llanos | LLA-70LLA-85 | 1**1 | one exploration well |

| MMV | VMM-24 | 1 | 16350 km23D seismic, 1100 km 2D seismic reprocessing, 100 km aerogeophysics, 100 km2 remote sensing, 80 km2 surface geochemistry, one exploration well

|

Caguan-Putumayo | Tinigua | 2* | 1 exploration wellEcuador |

SinúOriente | SN-1Charapa | N/A (currently a Technical Evaluation Area)1 | 1 stratigraphic well (pending approval to convert to20 km 2D seismic, 238 km2 3D seismic, five exploration well)wells |

SinúOriente | SN-3Chanangue | 1 | 1four exploration well, including vertical seismic program and biostratigraphy studieswells |

| Oriente | Iguana | 1 | two exploration wells |

*As of February 22, 2018,December 31, 2023, exploration has been suspended due to licensing restrictions, security issues or social reasons.

** As of February 22, 2018, suspended dueDecember 31, 2023, exploration commitments in the exploration block are not subject to security issuesphasing.

Royalties

Colombian royalties are regulated under Colombia Law 756 of 2002, as modified by Law 1530 of 2012. All discoveries made subsequent to the enactment of Law 756 of 2002 have the sliding scale royalty described below. Discoveries made before the

enactment of Law 756 of 2002 have a royalty of 20%, and in the case of such discoveries under association contracts reverted to the national government, an additional 12% applies for a total royalty of 32%.

The ANHAgencia Nacional de Hidrocarburos (National Hydrocarbons Agency) (“ANH”) contracts to which we are a party all have royalties that are based on a sliding scale described in Law 756 of 2002. This royalty worksThese royalties work on an individual oil field basis starting with a base royalty rate of 8% for gross production of less than 5,000 bopd. The royalty increasesBOPD, increasing in a linear fashion from 8% to 20% for gross production between 5,000 and 125,000 bopdBOPD and is stablefixed at 20% for gross production between 125,000 and 400,000 bopd.BOPD. For gross production between 400,000 and 600,000 bopdBOPD the rate increases in a linear fashion from 20% to 25%. For gross production in excess of 600,000 bopdBOPD the royalty rate is fixed at 25%. The Santana and Nancy-Burdine-Maxine Blocks have fixed rates for existing production of 32% and 20%, respectively. New discoveries and incremental production are subject to sliding scale royalties duly approved by the ANH. In addition to the sliding scale royalty, the following blocks havethere are additional x-factor royalties:economic rights of 1%

for Llanos-22, Putumayo-2, Putumayo-4, Putumayo-7, Putumayo-21 and Putumayo-7: 1%; Sinu-1VMM-24; 2% for Llanos-85; 3% for VMM-2, 5% for Putumayo-1; 12% for Putumayo-31; 31% for Llanos-1 and Llanos-10: 3%; Putumayo-31: 12%; Sinu-3:17%; Llanos-1: 31%; Llanos-53: 33%; Llanos-70: 31%; Putumayo 25: 19%; Santana: 32% and Nancy-Burdine-Maxine: 20% for existing production and sliding scale for new discoveries or incremental production duly approved by ANH.Llanos-70.

For gas fields, the royalty is based on an individual gas field basis starting with a base royalty rate of 6.4% for gross production of less than 28.5 MMcf of gas per day. The royalty increases in a linear fashion from 6.4% to 20%16% for gross production between 28.5 MMcf of gas per day and 3.42 Bcf712.5 MMcf of gas per day and is stable at 16% for gross production between 712.5 to 2,280 MMcf of gas per day. For gross production between 2.28 to 3.42 Bcf of gas per day, the rateand then increases in a linear fashion from 16% to 20%. for gross production between 2,280 to 3,420 MMcf of gas per day. For gross production in excess of 3.42 Bcf3,420 MMcf of gas per day the royalty rate is fixed at 20%.

An additional royalty (the “HPR royalty”Additional high price rights (“HPR”) applies onare applicable to exploration and production contracts signed under the new ANH oil regulatory regime in 2004 and onwards when cumulative gross production (net of royalty) from an Exploitation Area is greater than five MMbbl5 MMbbls of oil and WTI reference prices exceedprice exceeds the trigger price defined in the contract. For exploration andThe HPR is calculated using the associated production contracts awardedmultiplied by the Q factor, which is calculated as follows:

Q factor = (WTI price - Base Price (1))/WTI Price * S(2)

(1) Base Price is determined annually by the ANH, based on a formula defined in the 2010, 2012contract. For 2023 and 2014 Colombia Bid Rounds,2022, the HPR royalty will apply once the production from the area governed by the contract, rather than any particular Exploitation Area designated under the contract, exceeds five MMbbl of cumulative production. base price was set as follows:

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Quality (Oil API) | Base Price ($/bbl) |

< 10 o | Nil | | Nil |

10o to 15o | 64.54 | | 58.67 |

15o to 22o | 45.18 | | 41.07 |

22o to 29o | 43.56 | | 39.60 |

> 29o | 41.93 | | 38.12 |

At December 31, 2017,2023, HPR was applicable to our production from the Costayaco and Moqueta Exploitation Areas in the Chaza blockBlock and the Acordionero Exploitation Area in the Midas Block were subjectBlock. In January 2023, Llanos-22 reached accumulated production of 5 MMbbls which triggered its HPR.

(2) S percentage of HPR participation is 30% flat for Chaza and Midas Blocks. For Llanos-22, the percentage is variable compared to the HPR royalty. The HPR royalty is calculated based on the established percent (S) of the part of the average monthly reference WTI price (P) that exceeds a base price (Po), divided by the average monthly reference price (P).The Guayuyaco and Suroriente Blocks have the sliding scale royalty but do not have the additional royalty.as per below:

| | | | | |

| S percentage |

| Base Price ≤ WTI < 2x Base Price | 30% |

| 2x Base Price ≤ WTI < 3x Base Price | 35% |

| 3x Base Price ≤ WTI < 4x Base Price | 40% |

| 4x Base Price ≤ WTI < 5x Base Price | 45% |

| 5x Base Price ≤ WTI | 50% |

In addition to these government royalties and rights, our original interests in the Guayuyaco and Chaza Blocks acquired on our entry into Colombia in 2006 are subject to a third party royalty. The additional interests in Guayuyaco and Chaza that we acquired on the acquisition of Solana in 2008 are not subject to this third party royalty. The overriding royalty rights start with a 2% rate on working interest production less government royalties. For new commercial fields discovered within 10 years of the agreement date and after a prescribed threshold is reached, Crosby Capital, LLC (“Crosby”) reserves the right to convert the overriding royalty rights to a net profit interest (“NPI”). This NPI ranges from 7.5% to 10% of working interest production less sliding scale government royalties, as described above, and operating and overhead costs. No adjustment is made for the HPR royalty.HPR. On certain pre-existing fields, Crosby does not have the right to convert its overriding royalty rights to ana NPI. In addition, there are conditional overriding royalty rights that apply only to the pre-existing fields. Currently, we are subject to a 10% NPI on 50% of our working interest production from the Costayaco and Moqueta Fieldsfields in the Chaza Block and 35% of our working interest production from the Juanambu Fieldfield in the Guayuyaco Block and overriding royalties on our working interest production from the Guayuyaco Fieldfield in the Guayuyaco Block.

The Putumayo-7 Block isand Putumayo-1 Blocks are also subject to a third party royalty in addition to the government royalties.royalties and rights. Pursuant to the terms of the agreement by which the interests in the Putumayo-7 Block were acquired, a 10% royalty on production from the Putumayo-7 Block is payable to a third party. The terms of the royalty allow for transportation costs, marketing and handling fees, government royalties (including royalties payable to the ANH pursuant to Section 39 of the contract for the Putumayo-7 Block - the “Rights Due to High Prices”) and taxes, (otherother than taxes measured by the income of any party, and other than VATvalue-added tax (“VAT”) or any equivalent)equivalent, to be paid in cash or kind to the Government of Colombia (or any federal, state, regional or local government agency) and ANH, and a 1% ’X’‘X’ factor payment to be deducted from production revenue prior to the royalty being paid to a third party.

Oil and Gas Properties - Brazil and Peru

As noted above, during 2017, we completed Pursuant to the saleterms of our assets in Brazil and Peru.

Until June 30, 2017, we had a 100% WI in six blocks in Brazil and were the operator in all of these blocks. The Brazilian properties were locatedagreement by which the interests in the RecôncavoPutumayo-1 Block were acquired, a 3% royalty on production from the Putumayo-1 Block is payable to a third party. The terms of the royalty do not allow for any costs, royalties, and taxes to be deducted from production revenue.

We currently hold Participation Sharing Contracts (“PSC”) for the three Blocks (Charapa, Chanangue and Iguana) in the Oriente Basin in Eastern BrazilEcuador. Unlike traditional PSCs, these contracts do not include cost oil or royalties. Instead, the entire production is placed into a profit-sharing pool that is split between the Company and the government based on a percentage derived from a biddable price component and a production component. The biddable price component is a sliding scale that is based on the Oriente oil price ranging from $30 per bbl to $120 per bbl, with the Company’s production share varying between 87.5% and 40%, respectively. The Company’s share in production would only drop below 50% if the StateOriente oil prices exceed $100 per bbl. The production component is a tier-based mechanic increasing from 0% to 6% based on the PSC’s daily production. For the year ended December 31, 2023, the share of Bahia.production retained by the government of Ecuador was recorded as royalties in-kind.

Until December 18, 2017, we had a 100% WI in five blocks in Peru and were the operator in all of these blocks. Since that date, we have owned a minority equity interest in Sterling, which owns and operates assets in Peru. Please read “2017 Overview - Acquisitions and Dispositions” above.

Administrative Facilities

Our principal executive offices areoffice is located in Calgary, Alberta, Canada. The Calgary office lease will expire on November 29, 2022. We also have office space30, 2028. Office leases in Colombia.Colombia and Ecuador will expire on February 28, 2026, and June 30, 2025, respectively.

Estimated Reserves

Our 20172023 reserves werewere independently prepared by McDaniel International Inc.& Associates (“McDaniel”), a wholly owned subsidiary of. McDaniel & Associates. McDaniel & Associates was established in 1955 as an independent Canadian consulting firm and has been providing oil and gas reserves evaluation services to the world'sworld’s petroleum industry for the past 60 years. They have internationally recognized expertise in reserves evaluations, resource assessments, geological studies, and acquisition and disposition advisory services. McDaniel'sMcDaniel’s office is located in Calgary, Canada. The technical person primarily responsible for the preparation of our reserves estimates at McDaniel meets the requirements regarding qualifications, independence, objectivity, and confidentiality set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers.

The primary internal technical person in charge of overseeing the preparation of our reserve estimates is the Vice President, Asset Management. He has a B. Eng (Hons) degree in mechanical engineeringBachelor of Geological Engineering, graduating with Great Distinction, and is a professional engineer and memberMasters of the Association of Professional Engineers, Geologists and Geophysicists of Alberta.Chemical Engineering (petroleum). He is responsible for our engineering activities, including reserves reporting, asset evaluation, reservoir management, and field development. He has over 2030 years of experience working internationally in the oil and gas industry.industry with extensive experience in reservoir management, production, and operations.

We have developed internal controls for estimating and evaluating reserves. Our internal controls over reserve estimates include: 100%All of our reserves are evaluated by an independent reservoir engineering firm, at least annually;annually. We have developed internal controls over estimation and reviewevaluation of reserves. Our internal controls are followed, includingover reserve estimates include an independent internal review of assumptions used in thefor reserve estimates and presentation of the results of this internal review to our reserves committee. Calculations and data are reviewed at several levels of the organizationCompany to ensure consistent and appropriate standards and procedures. Our policies are applied byto all staff involved in generating and reporting reserve estimates including geological, engineering and finance personnel.

The process of estimating oil and gas reserves is complex and requires significant judgment, as discussed in Item 1A.1A “Risk Factors”. The reserve estimation process requires us to use significant decisions and assumptions in the evaluation of available geological, geophysical, engineering, and economic data for each property. Therefore, the accuracy of the reserve estimateestimates is dependent on the quality of the data, the accuracy of the assumptions based on the data, and the interpretations and judgment related to the data.

Proved reserves are reserves which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward from known reservoirs under existing economic conditions, operating methods, and government regulations prior to the time at which contracts providing the right to operate expires, unless evidence

indicates that renewal is reasonably certain. The term “reasonable certainty” implies a high degree of confidence that the quantities of oil or natural gas actually recovered will equal or exceed the estimate. To achieve reasonable certainty, we and the independent reserve engineers employed technologies that have been demonstrated to yield results with consistency and repeatability. Estimates of proved reserves are generated through the integration of relevant geological, engineering, and production data, utilizing technologies that have been demonstrated in the field to yield repeatable and consistent results as defined inby the SEC regulations. Data used in these integrated assessments included information obtained directly from the subsurface through wellbores, such as well logs, reservoir core samples, fluid samples, static and dynamic pressure information, production test data, and surveillance and performance information. The data utilized also included subsurface information obtained through indirect measurements, such as seismic data. The tools used to interpret the data included proprietary and commercially available seismic processing software and commercially available reservoir modeling and simulation software. Reservoir parameters from analogous reservoirs were used to increase the quality of and confidence in the reserves estimates when available. The method or combination of methods used to estimate the reserves of each reservoir was based on the unique circumstances of each reservoir and the dataset available at the time of the estimate. Probable reserves are reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered. Estimates of probable reserves which may potentially be recoverable through additional drilling or recovery techniques are by nature more uncertain than estimates of proved reserves and accordingly are subject to substantially greater risk of not actually being realized by us.

The probable reserves that have been assigned as of December 31, 2023, were based on both the greater percentage of recovery of the hydrocarbons in place than assumed for proved reserves, as well as the areas of a reservoir adjacent to proved reserves where data control or interpretations of available data are less certain. Possible reserves are reserves that are less certain to be recovered than probable reserves. Estimates of possible reserves are also inherently imprecise. Estimates of probable and possible reserves are also continually subject to revisions based on production history, results of additional exploration and development, price changes, and other factors. The possible reserves that have been assigned as of December 31, 2023, were based on both the greater percentage of recovery of the hydrocarbons in place than assumed for probable reserves as well as to areas of a reservoir adjacent to probable reserves where data control or interpretations of available data are less certain.

The following table sets forth our estimated reserves NAR located in Colombia and Ecuador which were 100% oil as of December 31, 2017.2023:

| | | | | | | | | |

| Oil | | | | |

| Reserves Category | (Mbbl) | | | | |

| Proved | | | | | |

| Total proved developed reserves | 39,599 | | | | | |

| Total proved undeveloped reserves | 34,697 | | | | | |

Total proved reserves (2) | 74,296 | | | | | |

| | | | | |

Probable (1) | | | | | |

| Total probable developed reserves | 12,139 | | | | | |

| Total probable undeveloped reserves | 34,109 | | | | | |

Total probable reserves (3) | 46,248 | | | | | |

| | | | | |

Possible (1) | | | | | |

| Total possible developed reserves | 11,362 | | | | | |

Total possible undeveloped reserves (4) | 37,144 | | | | | |

| Total possible reserves | 48,506 | | | | | |

|

| | | | | | | | | |

| | | Oil | | Natural Gas | | Oil and Natural Gas |

| Reserves Category | | (Mbbl) | | (MMcf) | | (MBOE) |

| Proved | | | | | | |

| Total proved developed reserves | | 39,487 |

| | 1,431 |

| | 39,726 |

|

| Total proved undeveloped reserves | | 19,467 |

| | 653 |

| | 19,576 |

|

| Total proved reserves | | 58,954 |

| | 2,084 |

| | 59,302 |

|

| | | | | | | |

| Probable | | | | | | |

| Total probable developed reserves | | 13,499 |

| | 307 |

| | 13,550 |

|

| Total probable undeveloped reserves | | 41,442 |

| | 1,311 |

| | 41,661 |

|

| Total probable reserves | | 54,941 |

| | 1,618 |

| | 55,211 |

|

| | | | | | | |

| Possible | | | | | | |

| Total possible developed reserves | | 16,893 |

| | 320 |

| | 16,946 |

|

| Total possible undeveloped reserves | | 40,955 |

| | 1,312 |

| | 41,174 |

|

| Total possible reserves | | 57,848 |

| | 1,632 |

| | 58,120 |

|

(1) Estimates of probable and possible reserves are more uncertain than proved reserves, but have not been adjusted for risk due to that uncertainty. Accordingly, estimates of probable and possible reserves are not comparable and have not been, or should not be, summed arithmetically with each other or with estimates of proved reserves.

(2) Includes proved developed oil reserves of 0.7 MMbbl and proved undeveloped oil reserves of 4.0 MMbbl related to Ecuador.

(3) Includes probable developed oil reserves of 0.1 MMbbl and probable undeveloped oil reserves of 5.9 MMbbl related to Ecuador.

(4) Includes possible developed oil reserves of 0.2 MMbbl and possible undeveloped oil reserves of 6.9 MMbbl related to Ecuador.

Product Prices Used Inin Reserves Estimates

The product prices that were used to determine the future gross revenue for each property reflect adjustments to the benchmark prices for gravity, quality, local conditions and/or distance from market. The average realized prices for reserves in the report are:

|

| | | | |

| Oil and NGLs ($/bbl) - Colombia | | $ | 43.00 |

|

| Natural Gas ($/Mcf) - Colombia | | $ | 3.67 |

|

| ICE Brent - average of the first day of each month price for the 12-month period | | $ | 54.19 |

|

| | | | | |

| Oil ($/bbl) - Colombia | $ | 69.91 | |

| |

| Oil ($/bbl) - Ecuador | $ | 77.44 | |

| ICE Brent - average of the first day of each month price for the 12-month period | $ | 82.51 | |

These prices should not be interpreted as a prediction of future prices, nor do they reflect the value of our commodity derivative instruments in place as of December 31, 2017.prices. We do not represent that this data is the fair value of our oil and gas properties or a fair estimate of the present value of cash flows to be obtained from their development and production.

Proved Undeveloped Reserves

At As at December 31, 2017,2023, we had total proved undeveloped reserves NAR of 19.634.7 MMBOE (December(December 31, 20162022 - 14.925.0 MMBOE), which were 100%89% in Colombia, (Decemberwith the remainder in Ecuador (December 31, 20162022 – 70%)92% in Colombia with the remainder in Ecuador). Approximately 64%33%, 13% 20%, 10% and 7%19% for a total of 72% of proved undeveloped reserves are located in our Acordionero, Costayaco Cumplidorfields and Moqueta Fields,Suroriente Block, respectively, in Colombia. None of our proved undeveloped reserves at December 31, 20172023, have remained undeveloped for five years or more since initial disclosure as proved reserves, and we have adopted a development plan which indicates that the proved undeveloped reserves are scheduled to be drilled within five years of initial disclosure as proved reserves.

Material changesChanges in proved undeveloped reserves during the year ended December 31, 2023 are summarizedshown in the table below: | | | | | |

| Total Company - Oil Equivalent (MMBOE) |

| Balance, December 31, 2022 | 25.0 | |

| |

| Converted to proved producing | (5.5) | |

| Technical revisions | 1.0 | |

| Extensions and discoveries | 14.2 | |

| |

| Balance, December 31, 2023 | 34.7 | |

Changes in proved undeveloped reserves during the year ended December 31, 2023, shown in the table above primarily resulted from the following significant factors:

We utilize existing technology, industry best practices and continual process improvement to execute our business plan. We have not expended any resources on pursuing research and development initiatives.

Marketing and Major Customers

Colombia

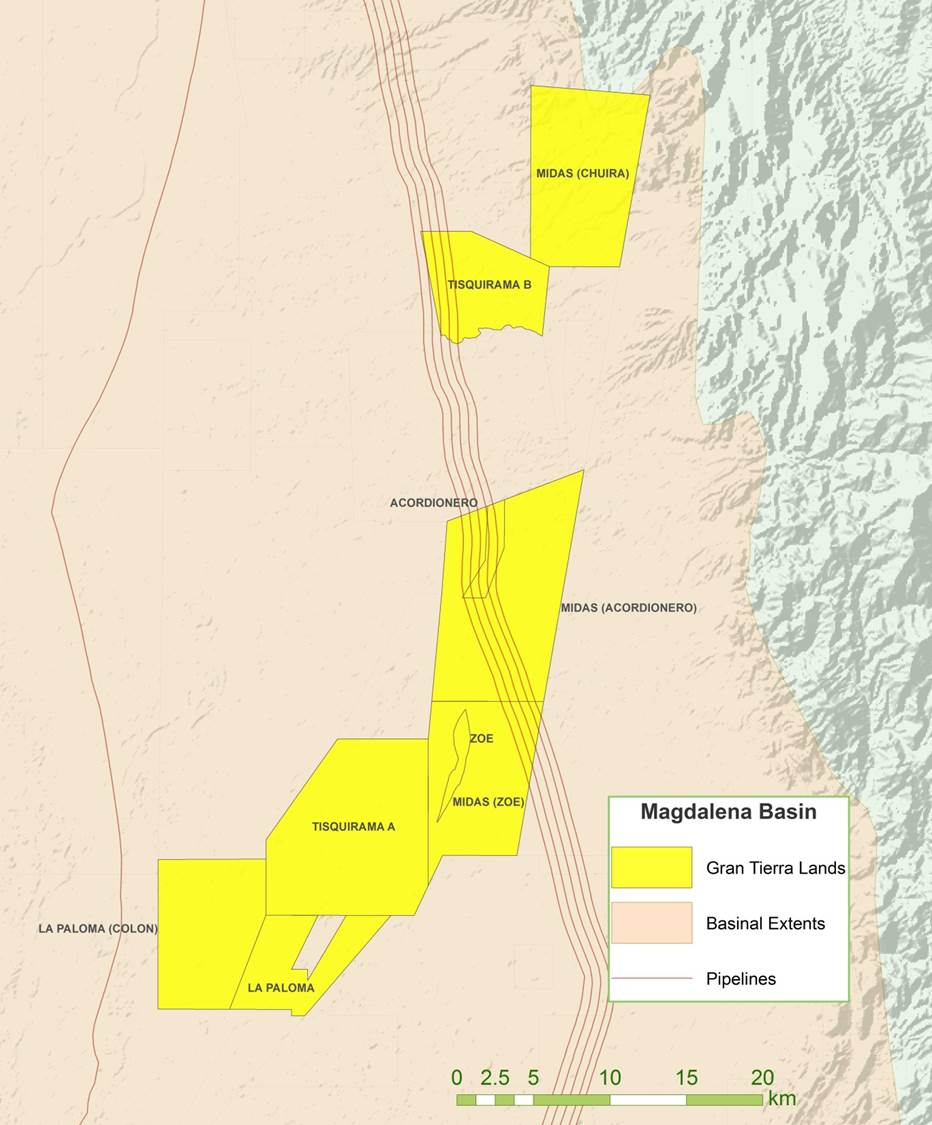

Our represents approximately 97% of our production with oil reserves and production in Colombia are mainly located in the Middle Magdalena Valley (“MMV”) and Putumayo Basin. In MMV, our focuslargest field is on the Acordionero Field,field, where we produce approximately 17° API oil, which represented 52% of total Company production for the year ended December 31, 2023. The Putumayo production is approximately 19°27° API for Chaza Block and represented 33%18° API for Suroriente Block, representing 25% and 13%, respectively, of ourthe total Company production in 2017. The Putumayo production (as defined below) is approximately 29° API and represented 59% of our production in 2017.for the year ended December 31, 2023.

We have entered into numerous sales agreements to sellfor our production from MMV and the Putumayo Basin with domestic customers selling crude oil produced in the Chaza and Guayuyaco Blocks (the “Putumayo production”).for export purposes. These agreements are subject to renegotiation for terms between three to twelve and thirty months and generally contain mutual termination provisions with 30 days'90 days’ notice. The volume of crude oil contemplated in these sales agreements does not include the volume of oil corresponding to royalties taken in kind, butin-kind and since October 2022 does include volumes relating to HPR royalties.

We may, but are not obligated to, sell up to 100%All of our Putumayo production to Ecopetrol. The Ecopetrol agreement will expire March 31, 2018. We deliver our oil to Ecopetrol through our transportation facilities which include pipelines, gathering systems and through the transportation and logistics assets of CENIT Transporte y Logistica de Hidrocarburos S.A.S (“CENIT”), a wholly-owned subsidiary of Ecopetrol. The point of sale of our Putumayo production to Ecopetrol is the Port of Tumaco on the Pacific coast of Colombia or at the Ecuador border, in the event of pipeline disruptions.

We have entered into ship and pay transportation agreements (the “Transportation Agreements”) with CENIT. These agreements will expire November 30, 2018. Pursuant to the Transportation Agreements we pay a transportation tariff and transportation tax for the transportation of the Putumayo production from the Putumayo Basin to the Port of Tumaco. Pursuant to the Transportation Agreements, Gran Tierra Energy Colombia Ltd. has the right to transport up to 10,000 bopd, subject to availability of capacity, (1) from Santana Station to CENIT’s facility at Orito through CENIT’s Mansoya – Orito Pipeline (“OMO”), and (2) from CENIT’s facility at Orito to the Port of Tumaco through CENIT’s Orito – Tumaco Pipeline (“OTA”). Generally, under these agreements, CENIT is liable (subject to specified limitations) for pollution clean up costs resulting from incidents during transportation. The cost of oil lost during transportation is shared by the parties that ship oil on the pipeline, in proportion to their share of total volumes shipped.

In addition to the ship and pay transportation agreements described above, we have Firm Capacity Transportation Agreements for 6,000 bopd, of which 3,000 bopd are under ship or pay agreements and 3,000 bopd are under ship and pay agreements. These agreements will expire October 31, 2020.

Putumayo production is also sold to multiple other parties, in addition to Ecopetrol. Other sales in Putumayo are generally delivered at the wellhead. Oil is delivered and sold at the Costayaco battery and Santana station and loaded into trucks. When oil is loaded into trucks there are multiple evacuation routes. When oil is delivered to facilities at Babillas Station, the sales point is the Port of Coveñas and it is sold as Vasconia 24 API. For oil delivered via truck to Amazonas, Oleoducto de Crudos Pesados (OCP) Ecuador S.A. Ecuador, the sales point is the Port of Esmeraldas and it is sold as Chaza blend 27.9 API. For oil delivered via pipeline to the Port of Esmeraldas, Ecuador, it is sold as NAPO 18 API.

Trucking options for Putumayo include: (1) from Santana Station to Ecopetrol’s storage terminal at Orito, a distance of approximately 47 kilometers; (2) from Santana Station to OCP’s Amazonas Station truck offloading facility, a distance of approximately 128 kilometers; (3) from the Costayaco Field to Hocol’s storage terminal at Babillas, approximately 363 kilometers north of the Chaza Block; and (4) from the Costayaco Field to Puerto Bahia, Cartagena approximately 1,589 kilometers.

In MMV, the Acordionero Field has a firm volumetric contract which will end by approximately the first quarter of 2018. A tender process is ongoing and will award in time for completion of present contract. Presently, we truck these volume 530 kilometers to the buyer at Puerto Bahia, Cartagena Bay. We are evaluating the construction of a pipeline tie in at the Acordionero Field, which is expected to provide us with access to the Port of Coveñas for future sales at the export terminal. Production from the minor fields in MMV is sold at the wellhead onwellhead. The oil is picked up by the customer at the Company-operated truck loading stations located at our Costayaco battery or Santana station facilities in Putumayo North and at our Cohembi and Cumplidor fields in Putumayo South. In order to capture the best market value and optimize our netback, our marketing strategy is to sell a short-term contract which will expire February 28, 2018. A tender process is ongoing.

Trucking options for Llanos include: (1)blend “Chaza Heavy” of the entire Putumayo production with an average quality of 25° API. Production from the Garibay Jilguero Field to facilitiesAcordionero field in MMV is trucked and sold at Cusiana Station, a distance of approximately 75 kilometers;various terminals or pipeline inlets and (2)various distances from the Llanos 22 Ramiriqui FieldAcordionero field, depending on our marketing strategy to facilitiesoptimize the value. Production from MMV minor fields is sold at Cusiana Station,wellhead.

In 2023, all of our MMV and Putumayo production was sold to one domestic marketer. The sales agreements for Putumayo and MMV production expire on March 31, 2025. The loss of any individual sales customer will not have a distancematerial adverse impact on our Company as customers can be substituted or we could market the crude directly ourselves.

During the fourth quarter of 2022, we commenced production in Ecuador, which contributed 3% of the total production for the year ended December 31, 2023. Bocachico produces approximately 35 kilometers.19° API oil and Charapa produces approximately 28° API oil. All of Ecuador production was sold to two international marketers and is sold at port of shipment.

We receive revenues for our Colombian and Ecuador oil sales in U.S. dollars. Oil prices for sales of our crude oil are defined by agreements with the purchasers of the oil andoil. They are based generally on an average price for crude oil, usingreferenced to ICE Brent, with adjustments for differences in quality, specified fees, transportation fees, and transportation tax. Pipeline tariffs are denominated in U.S. dollars, andwhile trucking costs are in Colombian Pesos.Pesos in Colombia and U.S. dollars in Ecuador.

Competition

The oil and gas industry is highly competitive. We face competition from both local and internationalmultinational companies. This competition impacts our ability to acquire properties, contract for drilling and other oil field equipment, and secure trained personnel. Many competitors, such as Ecopetrol, Colombia'sColombian and Ecuadorian national oil company,companies, have greater financial and technical resources. Our larger or more integrated competitors may be able to absorb the burden of existing, and any changes to, federal, state and local laws and regulations more easily than we can, which could adversely affect our competitive position. Our ability to acquire additional properties and to discover reserves in the future will depend on our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. There is substantial competition for land contracts, prospects, and resources in the oil and natural gas industry, and we compete to develop and produce those reserves cost effectively.cost-effectively. In addition, we compete to monetize our oil production: for transportation capacity and infrastructure for the delivery ofto deliver our products, to maintain a skilled workforce, and to obtain quality services and materials.

Geographic Information

We have one reportable segment basedBased on the geographic organization, Colombia. Prior toColombia is the sale of our Brazilonly reportable segment. We also have Participation Sharing Contracts (“PSCs”) for the three Blocks in Ecuador. For the years ended December 31, 2023, 2022 and 2021, the Ecuador business unit effective June 30, 2017was not significant and was included in our Peru business unit effective December 18, 2017, Brazil and Peru wereColombia reportable segments. Information regarding our geographic segment, including information on revenues, assets, expenses and net income, can be found in Note 3 to the Consolidated Financial Statements, Segment and Geographic Reporting, in Item 8. “Financial Statements and Supplementary Data”, which information is incorporated by reference here. Long livedsegment. Long-lived assets are Property, Plant and Equipment, which includesinclude all oil and gas assets, furniture and fixtures, automobiles, computer equipment, and computer equipment.capitalized leases. No long livedlong-lived assets are held in our country of domicile, which is the United States of America. “All Other” assets include assetsAssets held by our corporate head office in Calgary, Alberta, Canada.Canada, were not significant as of December 31, 2023, and 2022 and were included in the Colombia reportable segment under “other” category. Because all of our exploration and development operations are in Colombia and

Ecuador, we face many risks associated with these operations. See Item 1A.1A “Risk Factors” for risks associated with our foreign operations.

Regulation

The oil and gas industry in both Colombia and Ecuador is heavily regulated. Rights and obligations with regardrelating to exploration, development, and production activities are explicit for each project; economics areis governed by a royalty/royalty and tax regime. Various government approvals are required for property acquisitions and transfers, including, but not limited to, meeting financial and technical qualification criteria in order to be certified as an oil and gas company in the country. Oil and gas concessions are typically granted for fixed terms with an opportunity for extension.

Colombia Administration

We operate in Colombia through Colombian branches of the following entities: Gran Tierra Energy Colombia Ltd.,GmbH, Gran Tierra Operations Colombia Inc.GmbH, and Petrolifera Petroleum (Colombia) Limited. Gran Tierra Energy Colombia Ltd. and Gran Tierra ColombiaResources Inc. These entities are currently qualified as operators of oil and gas properties by the ANH. The entities operate under a special regime for hydrocarbon companies in Colombia that entitle them to collect proceeds from oil sales abroad in U.S. dollars.

In Colombia, the ANH is the administrator of the hydrocarbons in the country, as delegated by the Ministry of Mining and Energy, and therefore is responsible for regulating the administration of Colombian oil and gas industry, includingcontracts and managing all exploration lands. Since 2003, Ecopetrol, the Colombian national oil company, has beenis a public company listed in the Colombian and United States stock markets, owned in majority by the state with the main purpose of exploring and producing hydrocarbons similar to any other integrated oil company. In addition, Ecopetrol is a major purchaser and marketer of oil in Colombia and directly or through its subsidiaries operates the majoritymost of the oil pipeline transportation and refining infrastructure in the country. Ecopetrol Group also owns a majority stake in the Colombian energy transmission sector.

The ANH uses an exploration risk contract, or the Exploration and Production Contract,various forms of contracts, which providesprovide full risk/reward benefits for the contractor. Under the terms of this contract,these contracts, the successful operator retains the rightsright to produce all reserves, production, and income from any new exploration and evaluation block, subject to existing royalty and tax regulations. Each contract contains an exploration phase and a production phase.periods. The exploration phaseperiod contains a number of exploration periodsphases, and each periodphase has

an associated work commitment. The production phaseperiod usually lasts a number of24 years (usually 24) from the declaration of a commercial hydrocarbon discovery. Such contracts may be terminated at election of the ANH on the failure of the contract holder to comply with certain material terms of the contract, such as failure to perform committed exploration operations or investments in accordance with the contract. Ecopetrol uses various forms of contracts, which contain exploration and development phases. Duration of contracts can be life of field or up to a specific date and the terms of such contracts vary depending on the type of contract. Under the Ecopetrol contract, the partner retains its working interest rights to produce all reserves, production and income from any new exploration and evaluation block, subject to existing royalty and tax regulations during the duration of such contract.

When operating under athe ANH contract, the contractor is the owner of the hydrocarbons extracted from the contract area during the performance of operations, except for royalty volumes which are collected by the ANH (or its designee). The contractor can market the hydrocarbons in any manner whatsoever, subject to a limitation in the case of natural emergencies where the law specifies the manner of sale. Under the Ecopetrol contract, each party owns its working interest of the hydrocarbons extracted.

The contracts in place with ANH and Ecopetrol are agreements among both parties duly protected by regulation and, therefore, cannot be unilaterally adjusted at election of the Government. Contracts include the instances for remediation, arbitration and other protection measures. In addition, investment protection treaties and Colombian regulation protect the sanctity of the existing contract.

Ecuador Administration

We operate in Ecuador through the Ecuadorian branch of Gran Tierra Energy Colombia, GmbH.

In Ecuador, the Ministry of Energy and Mines (“MEM”) is responsible for signing oil and gas contracts and regulating the Ecuadorian oil and gas industry through the Agency for Regulation and Control of Energy and Non-Renewable Natural Resources.

The MEM uses service and participation contracts for the exploration and/or exploitation of hydrocarbons (“Participation Contracts”). We currently hold three Participation Contracts which provide for full risk for the contractor and production sharing with the MEM and contain an exploration and exploitation periods. The exploration period has an associated work

commitment and lasts typically 4 years. The participation contracts include a provision to extend the exploration period for up to two years, on the grounds of, among others, delays caused by the Ecuadorian government in the environmental licensing procedures. In the second quarter of 2021, we received a two-year extension of the exploration period for all three Participation Contracts, under the aforementioned provision.The exploitation period usually lasts 20 years from the approval of the development plan for one of several commercial hydrocarbon discoveries. Such contracts may be terminated at the election of the MEM on the failure of the contract holder to comply with certain material terms of the contract, such as failure to perform committed exploration operations in accordance with the contract.

When operating under a participation contract, the contractor is the owner of the hydrocarbons extracted from the contract area during the performance of operations, except for the share of volumes owned by the MEM agreed under each contract.

Environmental Compliance

Our activities are subject to laws and regulations governing environmental compliance quality, waste and pollution control in the countries where we maintain operations. Our activities with respect to exploration, drilling, production and facilities, including the operation and construction of pipelines, plants and other facilities for transporting, processing, treating or storing oil and other products, are subject to stringent environmental regulation by regional and federal authorities in Colombia.Colombia and Ecuador. Such regulations relate to mandatory environmental impact studies, the discharge of pollutants into air and water, water use and management, the management of non-hazardous and hazardous waste, including its transportation, storage and disposal permitting for the construction of facilities, recycling requirements and reclamation standards, and the protection of certain plants and animal species as well as cultural resources and areas inhabited by indigenous peoples,people, among others. Risks are inherent in oil and gas exploration, development and production operations. These risks include blowouts, fires, or spills. Significant costs and liabilities may be incurred in connection with environmental compliance issues. Licenses and permits required for our exploration and production activities may not be obtainable on reasonable terms or onin a timely basis, which could result in delays and have an adverse effect on our operations. Spills and releases of petroleum products into the environment of petroleum products can result in remediation costs and liability for damages. The costs of remedying such conditions may be significant, and remediation obligations could adversely affect our financial condition, results of operations and prospects. Moreover, violations of environmental laws and regulations can result in the issuance of administrative, civil or criminal fines and penalties, as well as orders or injunctions prohibiting some or all of our operations in affected areas. In addition, indigenous groups or other local organizations could oppose our operations in their communities, potentially resulting in delays which could adversely affect our operations.new developments. Governmental or judicial actions may influence the interpretation and enforcement of environmental laws and regulations and may thereby increase licensing and compliance costs. We do not expect that the cost of compliance with regional and federal provisions, which have been enacted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment or natural resources, will be material to us.

We have implemented a company wide web-based reporting system which allows us to track incidents and respective corrective actions and associated costs. We have a Corporate Health, Safety, and Environmental Management SystemPolicy and Plan as well as a Corporate Environmental Management Plan (EMP)(“EMP”). The EMP is based on the environmental performance standards of the World Bank/IFCBank International Finance Corporation and reflects best industry practices. We have an Environmental Management System which is ISO14001:2015 certified representing compliance with internationally recognized industry best practice, as well as the environmental risk management program in place as well asand robust waste management procedures. Air, soil and water testing occuroccurs regularly and environmental contingency plans have been prepared for all sites and ground transportation of oil. We have a regular quarterly comprehensive reporting system, reporting to executive management as well as a committeethe Health Safety and Environment Committee of the Board.Board of Directors. We have a schedule of internal and external audits and routine checking of practices and procedures and conduct emergency response exercises.

EmployeesHuman Capital Management

At December 31, 2017,2023, we had 324351 full-time employees (December 31, 20162022 - 387)336): 8194 located in the Calgary corporate office, and 243234 in Colombia (171(166 staff in Bogota and 7268 field personnel). During 2017, we completed the sale of our assets, 23 in BrazilEcuador (three staff in Quito and Peru.20 field personnel). None of our employees are represented by labor unions, and we consider our employee relations to be good.

Safety is our top priority, and we have implemented safety management systems, procedures, and tools to protect our employees and contractors. As part of our Health and Safety Management System, we identify potential risks associated with the workplace and develop measures to mitigate possible hazards. We support our employees with general safety training and

implement specific programs for those working in all our operations, such as equipment and machinery safety, chemical management, and electrical safety.

Workplace Practices and Policies

Gran Tierra is an equal opportunity employer committed to equality and sourcing local employees, contractors, and suppliers. We have a program to increase gender and diversity representation, including guidelines to prevent gender discrimination in selection and recruitment by contractors, incentives to promote the recruitment of women throughout the supply chain, training to increase the competitiveness of female employees and candidates, and guarantees of fair working conditions including schedules and salaries.

We are committed to enabling employees and contractors to grow within their roles to advance by offering coaching and mentoring programs. An example of this is our Te Enseña (Learn with Gran Tierra) program. It involves independent training sessions across several departments, where participants improve internal knowledge and further develop their skill sets. We also offer employee-led virtual training sessions that promote individual growth and create a space to learn from their peers. These programs have fostered interdepartmental connections between employees and contractors providing ability to work remotely.

Compensation

We believe that all employees deserve competitive compensation and standard short and long-term incentives that enable employees to share success of the Company.

Engagement

We believe that open, honest, and transparent communication among the team members, managers, and senior management promotes company engagement and offers a strong understanding of our business’s big picture. We regularly encourage employees to learn about the organization’s strategic objectives and understand company’s decisions and how those decisions impact them specifically. We undertake quarterly reviews to inform our team about the Company’s performance and future goals. We believe these key strategies have led to strategic alignment across the organization.

Available Information

We file or furnish annual, quarterly and current reports, proxy statements and other documents with the SEC. We make available free of charge through our website at www.grantierra.com our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed or furnished with the SecuritiesSEC. Our Code of Business Conduct and Exchange Commission (“SEC”).Ethics, our Corporate Governance Guidelines, our Audit Committee Charter, our Compensation Committee Charter and our Nominating and Corporate Governance Committee Charter are also posted to the governance section of our website. Our website address is provided solely for informational purposes. Information on our website is not incorporated into this Annual Report or otherwise made part of this Annual Report. We intend to use our website as a means for distributing information to the public for purposes of compliance with Regulation FD.Fair Disclosure.

In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding us. Any materials we have filedissuers that file electronically with the SEC, may be read or copied at the SEC’s Public Reference Roomincluding us.

at 100 F Street N.E. Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Item 1A. Risk Factors

Risks Related to our Business

Prices and markets for oil and natural gas are unpredictable and tend to fluctuate significantly, which could cause temporary suspension of production and reduce our profitability, growth and value.value

Substantially all of our revenues are derived from the sale of oil. The current and forward contract oil which price is based on world demand, supply, weather, pipeline capacity constraints, inventory storage levels, geopolitical unrest, world health events and other factors, geopolitical unrest, all of which are beyond our control. Historically, the market for oil has been volatile and the market is likelyexpected to continue to be volatile in the future.remain so. Furthermore, prices which we receive for our oil sales, while based on international oil prices, are established by contracts with purchasers with prescribedand include the deductions for quality differentials and transportation. The differentials and transportation and quality differentials. These differentialscosts can change over time and have a detrimental impact on realized prices.

Future decreases in the prices of oil, or sustained low prices, periods of extended pricing volatility, and increasing borrowing costs may have a material adverse effect on our financial condition, the future results of our operations (including rendering existing projects unprofitable)unprofitable or requiring temporary suspension of fields), financing available to us, and quantities of reserves recoverable on an economic basis, as well as the market price for our securities.

We may be adversely affected by global epidemics or public health crises

Global epidemics and public health crises and fear of such events may adversely impact our operations and the global economy, including the worldwide demand for oil and natural gas. The extent to which our business, results of operations and financial condition will be affected by such events depend on future developments, many of which are outside of our control, such as the duration, severity, and sustained geographic spread of the virus, and the impact and effectiveness of governmental actions to contain and treat outbreaks, including government policies and restrictions; vaccine hesitancy, vaccine mandates, and voluntary or mandatory quarantines; and the global response surrounding such uncertainties. To the extent any global epidemic or public health crisis may adversely affect our business, operations, financial condition and operating results, it may also have the effect of heightening the other risks described herein.

Estimates of oil and natural gas reserves may be inaccurate and our actual revenues may be lower than estimated.estimated

We make estimates of oil and natural gas reserves, upon which we base our financial projections and capital expenditure plans. We make these reserve estimates using various assumptions, including assumptions as to oil and natural gas prices, drilling and operating expenses, capital expenditures, taxes and availability of funds. Some of these assumptions are inherently subjective, and the accuracy of our reserve estimates relies in part on the ability of our management team, engineers and other advisors to make accurate assumptions. Wells that are drilled may not achieve the results expected. Economic factors beyond our control, such as world oil prices, interest rates, inflation, and exchange rates, will also impact the quantity and value of our reserves.

The process of estimating oil and natural gas reserves is complex and requires us to use significant decisions and assumptions in the evaluation of available geological, geophysical, engineering and economic data for each property. As a result, our reserves estimates are inherently imprecise. All categories of reserves are continually subject to revisions based on production history, results of additional exploration and development, price changes and other factors. When producing an estimate of the amount of oil that is recoverable from a particular reservoir, probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered. Possible reserves are even less certain and generally require only a 10% or greater probability of being recovered. Estimates of probable and possible reserves are by their nature much more speculative than estimates of proved reserves and are subject to greater uncertainties, and accordingly the likelihood of recovering those reserves is subject to substantially greater risk.

Actual future production, oil and natural gas prices, revenues, taxes, exploration and development expenditures, operating expenses and quantities of recoverable oil and natural gas reserves may vary substantially from those we estimate. suchSuch changes could require us to materially reduce our revenues and result in the impairment of our oil and natural gas interests.

Unless we are able to replace our reserves and production, and develop and manage oil and natural gas reserves and production on an economically viable basis, our financial condition and results of operations will be adversely impacted.impacted

Our future success depends on our ability to find, develop and acquire additional oil and natural gas reserves that are economically recoverable. Producing oil and natural gas reservoirs generally are characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Our future oil and natural gas reserves and production, and therefore our cash flowflows and results of operations, are highly dependent on our success in efficiently developing and exploiting our current reserves and economically finding or acquiring additional recoverable reserves. The value of our securities and our ability to raise capital will be adversely impacted if we are not able to replace our reserves that are depleted by production. We may not be able to develop, exploit, find or acquire sufficient additional reserves to replace our current and future production.

Exploration, development and production costs (including transportationoperating and workovertransportation costs), marketing costs (including distribution costs) and regulatory compliance costs (including taxes) will substantially impact the net revenues we derive from the oil and natural gas that we produce. These costs are subject to fluctuations and variations in different localesthe areas in which we operate, and we may not be able to predict or control these costs. If these costs exceed our expectations, this may adversely affect our results of operations.

Our future reserves will depend not only on our ability to develop and effectively manage then-existing properties, but also on our ability to identify and acquire additional suitable producing properties or prospects, to identify and retain responsible service providers and contractors to efficiently drill and complete our wells and to find markets for the oil and natural gas we develop and to effectively distribute our production into our markets.

Exploration for oil and natural gas, and development of new formations, is risky.risky

Oil and natural gas exploration involves a high degree of operational and financial risk. These risks are more acute in the early stages of exploration, appraisal and development. It is difficult to predict the results and to project the costs of implementing an exploratory drilling program due to the inherent uncertainties and costs of drilling in unknown formations the costs associated withand encountering various drilling conditions, such as over-pressured zones andunexpected formations or pressures, premature decline of reservoirs, the invasion of water into producing formations, tools lost in the hole, and changes in drilling plans and locations as a result of prior exploratory wells or additional seismic data and interpretations thereof.

Future oil and gas exploration may involve unprofitable efforts, not only from dry wells, but from wells that are productive but do not produce sufficient net revenues to return a profit after drilling, operating and other costs.

Our business requires significant capital expenditures,Oil and we maynatural gas exploration, development and production operations are subject to the risks and hazards typically associated with such operations, including, but not have the resources necessarylimited to, fund these expenditures.

Our capital program for 2018 is $265 to $285 million for exploration and development. This does not include the cost of any acquisitions. We expect to finance our 2018 capital program primarily through cash flows from operations. Funding this program from cash flow from operations relies in part on oil prices being greater than $50 per barrel, or higher.

If cash flows from operations, cash on hand (including proceeds of the offering of senior unsecured notes completed in February 2018) and available capacity under our credit facility are not sufficient to fund our capital program, we may be required to seek external financing or to delay or reduce our exploration and development activities, which could impact production and reserve growth.

If we require additional capital, we may pursue sources of capital through various financing transactions or arrangements, including joint venturing of projects, debt financing, equity financing or other means. We may not be able to access capital on favorable terms or at all. If we do succeed in raising additional capital, future financings may be dilutive to our shareholders, as we could issue additional shares of Common Stock or other equity to investors. In addition, debtfire, explosion, blowouts, cratering, sour gas releases, spills and other mezzanine financing may involve a pledge of assets, involve covenants that would restrict our business activities,environmental hazards. Such risks and may be seniorhazards could result in substantial damage to interests of equity holders. We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertibles and warrants, which would adversely impact our financial results.

Our ability to obtain needed financing may be impaired by factors such as weak capital markets (both generally and for the oil and gas industry in particular), the location of our oil and natural gas properties in South America, lowwells, production facilities, other property or declining prices of oil and natural gas on the commodities markets, and the loss of key management. Further, if oilenvironment, as well as personal injury to our employees, contractors or natural gas prices on the commodities markets decrease, then our revenues will likely decrease, and such decreased revenues may increase our requirements for capital. Somemembers of the contractual arrangements governingpublic.

Losses resulting from the occurrence of any of these risks may have a material adverse effect on our exploration activity may require us to commit to certain capital expenditures,business, financial condition, results of operations and prospects.

Although we may lose our contract rights if we do not have the required capital to fulfill these commitments. If themaintain well control and liability insurance in an amount of capital we are able to raise from financing activities, together with our cash flow from operations, is not sufficient to satisfy our capital needs (even to the extent that we reduce our activities), we mayconsider prudent and consistent with industry practice, liabilities associated with certain risks could exceed policy limits or not be required to curtail our operations.

The borrowing base under our revolving credit facility may be reduced by the lenders, which could prevent us from meeting our future capital needs.

The borrowing base under our revolving credit facility is currently $300 million. Our borrowing base is redetermined by the lenders twice per year, and will be re-determined no later than May 2018. Our borrowing base may decrease as a result of a decline in oil or natural gas prices, operating difficulties, declines in reserves, lending requirements or regulations, the issuance of new indebtedness or for any other reason. We cannot be certain that funding will be available if needed, and to the extent required, on acceptable terms.covered. In theeither event of a decrease in our borrowing base, we could be required to repay any indebtedness in excess of the redetermined borrowing base, which could deplete cash flow from operations or require additional financing. Further, our borrowing base is made available to us subject to the terms and covenants of our revolving credit facility, including compliance with the ratios and other financial covenants of such facility, and a failure to comply with such ratios or covenants could force us to repay a portion of our borrowings and suffer adverse financial impacts.incur significant costs.

Our business is subject to local legal, social, security, political and economic factors that are beyond our control, which could impair or delay our ability to expand our operations or operate profitably.profitably

We operate our business in Colombia, where allAll of our proved reserves and production are currently located in Colombia and Ecuador; however, we may eventually expand to other countries. Exploration and production operations are subject to legal, social, security, political and economic uncertainties, including terrorism, military repression, social unrest and activism, illegal blockades, strikes by local or national labor groups, interference with private contract rights, , extreme fluctuations in currency exchange rates, high rates of inflation, exchange controls, changes in tax rates, changes in laws or policies affecting environmental issues (including land use and water use), workplace safety, foreign investment, foreign trade, investment or taxation, as well as restrictions imposed on the oil and natural gas industry, such as restrictions on production, price controls and export controls. When such disruptions occur, they may adversely impact our operations and threaten the economic viability of our projects or our ability to meet our production targets.