UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20202023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-36127

COOPER-STANDARD HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 20-1945088 |

(State or other jurisdiction of

| | (I.R.S. Employer

|

40300 Traditions Drive

Northville, Michigan 48168

(Address of principal executive offices) (Zip Code)Code)

Registrant’s telephone number, including area code: (248) 596-5900

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of Each Classeach class | | Trading Symbol(s) | | Name of Exchangeeach exchange on Which Registeredwhich registered |

| Common Stock, par value $0.001 per share | | CPS | | New York Stock Exchange |

| Preferred Stock Purchase Rights | | - | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

IndicateIndicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒☐ No ☐☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting and non-voting common stock held by non-affiliates as of June 30, 20202023 was $187,153,693.$192,207,617.

The number of the registrant’s shares of common stock, $0.001 par value per share, outstanding as of February 10, 20219, 2024 was 16,897,08517,197,479 shares.

Documents Incorporated by Reference

Certain portions, as expressly described in this report, of the Registrant’s Proxy Statement for the 20212024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| PART I |

| | |

| Item 1. | Business | |

| Item 1A. | Risk Factors | |

| Item 1B. | Unresolved Staff Comments | |

| Item 1C. | Cybersecurity | |

| Item 2. | Properties | |

| Item 3. | Legal Proceedings | |

| Item 4. | Mine Safety Disclosures | |

|

| PART II |

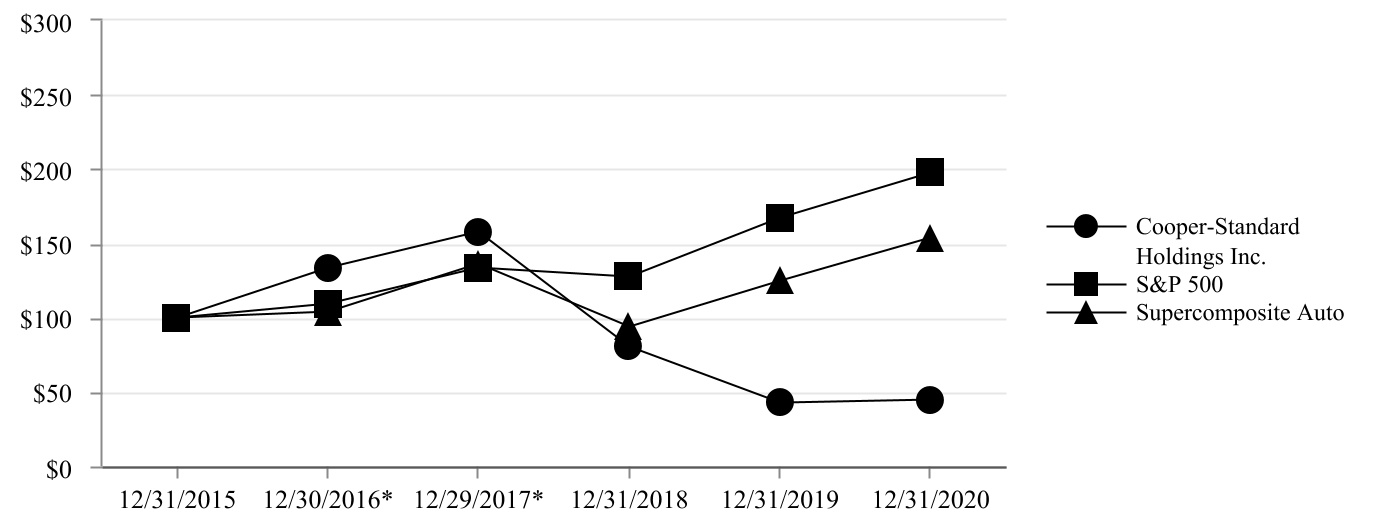

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| Item 6. | Selected Financial Data[Reserved] | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 8. | Financial Statements and Supplementary Data | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| Item 9A. | Controls and Procedures | |

| Item 9B. | Other Information | |

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

|

| PART III |

| Item 10. | Directors, Executive Officers and Corporate Governance | |

| Item 11. | Executive Compensation | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| Item 14. | Principal Accounting Fees and Services | |

|

| PART IV |

| Item 15. | Exhibits and Financial Statement Schedules | |

| Signatures | |

PART I

Item 1. Business

Cooper-Standard Holdings Inc. (together with its consolidated subsidiaries, the “Company,” “Cooper Standard,” “we,” “our” or “us”) is a leading manufacturer of sealing and fluid handling systems (consisting of fuel and brake delivery and fluid transfer systems.systems). Our products are primarily for use in passenger vehicles and light trucks that are manufactured by global automotive original equipment manufacturers (“OEMs”) and replacement markets. We conduct substantially all of our activities through our subsidiaries.

Cooper Standard is listed on the New York Stock Exchange (“NYSE”) under the ticker symbol “CPS.” The Company has approximately 25,00023,000 employees, including 3,1003,000 contingent workers, with 121128 facilities in 21 countries. We believe that we are the largest global producer of sealing systems, the second largest global producer of the types of fuel and brake delivery products that we manufacture and the third largest global producer of the types of fluid transfer systems.systems that we manufacture. We design and manufacture our products in each major region of the world through a disciplined and sustained approach to engineering and operational excellence. We operate in 7278 manufacturing locations and 4950 design, engineering, administrative and logistics locations.

On January 1, 2020, we changedApproximately 84% of our sales in 2023 were to OEMs, including Ford Motor Company (“Ford”), General Motors Company (“GM”), Stellantis, Volkswagen Group, Daimler, Renault-Nissan, BMW, Toyota, Volvo, Jaguar/Land Rover, Honda and various other OEMs based in China. The remaining 16% of our 2023 sales were primarily to Tier I and Tier II automotive suppliers, non-automotive customers, and replacement market distributors. The Company’s products can be found on over 440 nameplates globally.

Our organizational structure and createdprimarily consists of a global automotive business (“Automotive”) and Advanced Technologythe Industrial and Specialty Group (“ATG”ISG”). OurFor the periods presented herein, our business is nowwas organized in the following reportable segments: North America, Europe, Asia Pacific and South America. ATGISG and all other business activities arewere reported in Corporate, eliminations and other. This operating structure allowsallowed us to offer our full portfolio of products and support our global and regional customers with complete engineering and manufacturing expertise in all major regions of the world. We haveOn an ongoing basis, we undertake restructuring, expansion and cost reduction initiatives to improve competitiveness.

Approximately 83%Consistent with our strategy to drive future profitable growth, the Company has increased and intensified management focus on its two global automotive product line businesses. Effective January 1, 2024, the Company appointed a senior executive to lead each of our salessealing and fluid handling systems businesses, and the chief operating decision maker will prospectively begin to assess operating performance by product line rather than geography. As a result, beginning with the first quarter of 2024, the Company expects to report its financial results in 2020 were to OEMs, including Ford Motor Company (“Ford”), General Motors Company (“GM”), Fiat Chrysler Automobiles (“FCA”), PSA Peugeot Citroën, Volkswagen Group, Daimler, Renault-Nissan, BMW, Toyota, Volvo, Jaguar/Land Rover, Hondatwo reportable segments based on product line: Sealing Systems and various other OEMs based in China. The remaining 17% of our 2020 sales were primarily to Tier I and Tier II automotive suppliers, non-automotive customers, and replacement market distributors. The Company’s products can be found on over 500 nameplates globally.Fluid Handling Systems.

Corporate History and Business Developments

Cooper-Standard Holdings Inc. was established in 2004 as a Delaware corporation and began operating on December 23, 2004 when it acquired the automotive segment of Cooper Tire & Rubber Company. Cooper-Standard Holdings Inc. operates the business primarily through its principal operating subsidiary, Cooper-Standard Automotive Inc. (“CSA U.S.”). Since the 2004 acquisition, the Company has expanded and diversified its customer base through a combination of organic growth and strategic acquisitions.

In 2018, we established ATG, which incorporated our IndustrialOur ISG business accelerates and Specialty Group, to accelerate and maximizemaximizes the value stream of Cooper Standard’s materials science technologyand manufacturing expertise in industrial and specialty markets. We furthered the expansion of our Industrial and Specialty GroupISG business through the acquisition of Lauren Manufacturing and Lauren Plastics andin 2018.

Cooper Standard signed multiple joint development agreements for our Fortrex™ chemistry platform throughout 2018 to 2020.2021. In 2021, the Company reached a long-term commercial agreement to license its Fortrex™ technology to NIKE, Inc., with the footwear manufacturer launching the first related mass production programs in 2023.

In 2019,2023, we finalized the divestiture of our anti-vibration systemsEuropean technical rubber products business (“AVS”) product line within our North America, Europe and sold the Company’s entire controlling equity interest in a joint venture in the Asia Pacific segments. In 2020, we completed the divestiture of our European rubber fluid transfer and specialty sealing businesses, as well as our Indian operations.region.

We have set a clear vision for achieving profitable growth with a defined, focused plan to return to double-digit return on invested capital (“ROIC”). Our visionCooper Standard’s Purpose statement - Driving Value Through Culture, Innovation and ResultsCreating Sustainable Solutions Together - represents the evolutionCompany’s focus on creating solutions for the long-term health of the Company’s innovation culture providingbusiness as a whole and the basis for delivering even greater value.sustained value that we work each day to deliver to our stakeholders (customers, investors, employees, suppliers and communities). Our key strategic pillarsimperatives are defined as:

| | | | | |

| Financial Strength: | | | | | Execute our business plans achieving and sustaining double-digit EBITDA margins, ROIC and strong free cash flow generation. |

| Voice of the Customer: | We design and develop our products to meet the current and future needs of our customers. We listen intently and adjust to customer feedback to ensure we are consistently providing customer-focused products to meet their evolving needs. Customers support and trust us.

| |

Superior Products: | With a focus on our core products, we provide customers with market-leading solutions with predicable quality that meet or exceed their expectations. |

| |

World-Class Operations:Execution: | Attain world-class results across all our business allowing the Company to Be the First Choice of the Stakeholders We are committed to driving sustained excellence through the Cooper Standard Operating System (“CSOS”), our customized set of global best business practices. It is how we will continue to optimize performance on a global scale.Serve. |

| |

| Profitable Growth Driven by Innovation: | Leverage our materials science and product knowledge, innovation and manufacturing expertise across our product groups in the pursuit of organic and inorganic growth. |

| |

Engaged Employees:Corporate Responsibility: | Our employees areDeliver value to all our stakeholders through our environmental, social and governance initiatives to ensure the foundationlong-term sustainability of the Company and the key factor to our success. Committed to excellence and driven to succeed, our employees are focused on the Company’s overall vision and strategy.Company. |

Cooper Standard’s global alignment around these strategic pillarsimperatives continues to drive further value in many areas of the business, including:business.

Operational and Strategic Initiatives

As part of Cooper Standard’s world-class operations, the Company implementedrelies upon its CSOS (Cooper Standard Operating System) to fully position the Company for growth and ensure global consistency in engineering design, program management, manufacturing process, purchasing and IT systems. Standardization across all regions is especially critical in support of customers’ global platforms that require the same design, quality and delivery standards everywhere across the world. Cooper Standard operates Global Councils focused on technology, customer and manufacturing initiatives to better leverage the scale of the Company, identify best practices and transfer them around the world. As a result of these initiatives, the Company has leveraged CSOS to drive an average savings from improved operating efficiency of approximately $75$60 million each of the past five years.

In addition, as part of our continued focus on sustainability and corporate responsibility, the Company’s Global Sustainability Council provides executive level oversight for the Company’s sustainability strategy to help ensure alignment and integration with business goals and stakeholder priorities. The council maintains a holistic look at the Company’s ESG (environmental, social and governance) initiatives, tracks rapidly-evolving best practices and further develops long-term goals as the Company strives for ESG excellence.

Cooper Standard continues to progress its diversification strategy through its Advanced Technology GroupISG business, which is charged with accelerating and maximizing expertise in the Company’s core processproduct types for applications in the industrial and specialty markets. This businessCooper Standard also drives growth and diversification through the Company’s applied materials science offerings, which include the Fortrex™ chemistry platform that provides performance advantages over many other materials.materials, as well as a significantly reduced carbon footprint.

Leveraging Technology and Materials Science for Innovative Solutions

We use our technical and materials science expertise to provide customers with innovative and sustainable product solutions. Our engineers use the results of advanced computational simulations and incorporate a broad understanding of materials science to design products which meet or exceed our customers’ stringent requirements. We believe our reputation for successful innovation in product design and materials is the reason our customers consult us early in the development and design process of their next-generation vehicles or products.

The Company’s CS Open Innovation is an initiative that aims to position Cooper Standard as the partner of choice for start-ups, universities and other suppliers through a proactive outreach program. The initiative is focused in the areas of materials science, manufacturing and process technology, digital/artificial intelligence and advanced product technology.

In addition, the Company has recently implemented a defined, focused plan to return to double-digit ROIC to help deliver sustained value for all of our stakeholders.

Leverage Technology and Materials Science for Innovative Solutions

We utilize our technical and materials science expertise to provide customers with innovative solutions. Our engineers combine product design with a broad understanding of materials science for enhanced vehicle performance. We believe our reputation for successful innovation in product design and materials is the reason our customers consult us early in their vehicle development and design process of their next generation vehicles.

Cooper Standard utilizesuses its i3 Innovation Process (Imagine, Initiate and Innovate) and CS Open Innovation as mechanisms to capture novel ideas while promoting a culture of innovation. Ideas are carefully evaluated by our global technology council,product line teams and Global Technology Council, and those that are selected are put on an accelerated development cycle. We are developing innovative technologies based on materials expertise, process know-how, and application vision, which may drive future product direction. An example is Fortrex™, the

Company’s synthetic elastomer chemistry platform, offersoffering reduced weight while delivering superior material performance and aesthetics. We have also developed several other significant technologies,

especially related to advanced materials, processing and weight reduction. These include: FlushSeal™, an advanced integrated solution for frame under glass static sealing systems offering better appearance, improved aerodynamics, quieter ride and reduced weight; TPV body seal, a next generation body seal that replaces traditionally less sustainable EPDM and metal with recyclable thermoplastic materials which save significant component weight; MagAlloy™, a processing technology for brake lines that increases long term durability through superior corrosion resistanceresistance; and Easy-Lock™, a small package coolant and fuel vapor quick connect. Given the trajectory and anticipated future growth of electric vehicles, Cooper Standard has developed innovations to provide lightweight plastic tubing with our PC2000PlastiCool® 2000 multilayer tubing, smooth and CVT mid temperatureclear vinyl tubing (“CVT”) mid-temperature multilayer tubing, and our next generation ErgoLock™next-generation Ergo-Lock™ and Ergo-Lock™ + VDA quick connectors for glycol thermal management needs.

Cooper Standard is strategically integrating digital tools and advanced analysis to help deliver the best solutions. We offer advanced computer-aided engineering and digital simulations for engineered solutions. In addition, our team of experts has developed digital tools that enable them to conduct prototype testing without the need for physical samples, resulting in sustainability benefits. We can provide up to 100% virtual testing for certain products.

Among our newer technologies is Cooper Standard’s artificial intelligence (A.I.)-enhanced development cycle for polymer compounds that has shortened material development times while realizing rapid discovery of new compounds that offer superior performance properties, which yield superior products. We have also developed proprietary technology for A.I.-enhanced continuousA.I. automated processes controls.control improvements, called Liveline Technologies, a wholly owned subsidiary of Cooper Standard. This technology enables full automation of polymer extrusion and other complex continuous processes, reducing process variation (a top driver of scrap), increasing product quality, improving operational metrics and reducing our carbon footprint. In addition, the Company is piloting multiple A.I. applications to help drive efficiencies in various functions.

Our innovations are receiving industry recognition. Cooper Standard earned an Environment + Energy Leader Award in 2022 for our Fortrex™ chemistry platform, in addition to being named a General Motors Overdrive Award winner in the category of ‘Sustainability’ in 2021, a 2018 Automotive News PACE Award winner, and a 2018, 2019, and 2023 Society of Plastics Engineers Innovation Award finalist. Also, Cooper Standard’s artificial intelligence-enhanced development cycle for polymer compound development was named a finalist for the 2019 Automotive News PACE Awards. In addition, Fortrex™ was named a 2018 PACE Award winner and a 2018 and 2019

Cooper Standard’s fluid handling products were selected as the Society of Plastics Engineers 2022 Automotive Innovation Award finalist.winner for the Material category for our innovative battery electric vehicle thermoplastic thermal management solution utilizing PlastiCool

Pursue Acquisitions® 2000 multilayer tube and Alliances to Enhance Capabilities and Accelerate Growth

Our strong balance sheet allows us to selectively pursue complementary acquisitions and joint ventures to enhance our customer base, geographic penetration, scale and technology. Consolidation is an industry trend, which has been encouraged by the OEMs’ desire for global automotive suppliers. We believe we have a strong platform for growth through acquisitions based on our past integration successes, experienced management team, global presence and operational excellence.Ergo-Lock® connectors.

Industry

The automotive industry is one of the world’s largest and most competitive.competitive markets. Consumer demand for new vehicles largely determines sales and production volumes of global OEMs. The business and commercial environment in each region also plays a role in vehicle demand as it relates to fleet vehicle sales and industrial useindustrial-use vehicles such as light and heavy trucks.

OEMs compete for market share in a variety of ways including pricing and incentives, the development of new, more attractive models, branding and advertising, and the ability to customize vehicle features and options to meet specific customerconsumer needs or demands. They rely heavily on thousands of specialized suppliers to provide the many distinct components and systems that comprise the modern vehicle. They also rely on these automotive suppliers to develop technological innovations that will help them meet internal and consumer demands as well as regulatory requirements.

The supplier industry is a highly competitive industry and is generally characterized by high barriers to entry, significant start-up costs and long-standing customer relationships. The criteria by which OEMs judge automotive suppliers include quality, price, service, launch performance, design and engineering capabilities, innovation, timely delivery, financial stability and global footprint. Over the last decade, suppliers that have been able to achieve manufacturing scale globally, reduce structural costs, diversify their customer base and provide innovative, value-added technologies have been the most successful.

The technology of today’s vehicles is evolving rapidly. This evolution is being driven by many factors including consumer preferences and social behaviors, a competitive drive for differentiation, regulatory requirements and environmental impact and safety. Cooper Standard supports these trends by providing innovations that reduce weight, increase life-cycle and durability, reduce interior noise, enhance exterior appearance, and simplify the manufacturing and assembly process.process, and help reduce a vehicle’s environmental impact. These are innovations that can be applicable and valuable to virtually any vehicle (including fuel,internal combustion, hybrid or electric-poweredbattery electric powertrains) or vehicle manufacturer and, in many cases, can also be transferred to non-automotive applications in adjacent markets. Cooper Standard remains closely aligned with our customers and is prepared to meet their evolving needs as they shift their fleets and offer more electric vehicle (“EV”) options. We are focused on growing

our business in thisthe EV segment by leveraging our technology and innovation to provide value-add solutions for increasingly specialized technical requirements.

Markets Served

Our automotive business is focused on the passenger car and light truck market, up to and including Class 3 full-size, full-frame trucks, better known as the global light vehicle market. This is our largest market and accounts for approximately 92%94% of our global sales.

Customers

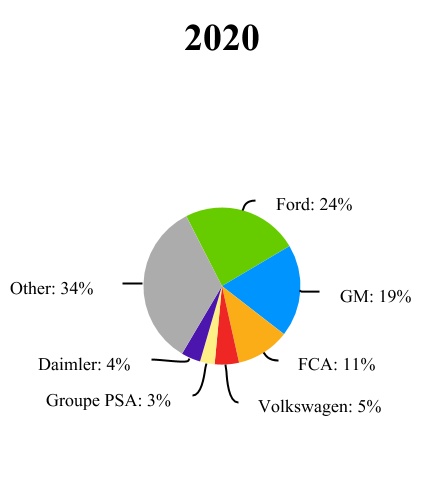

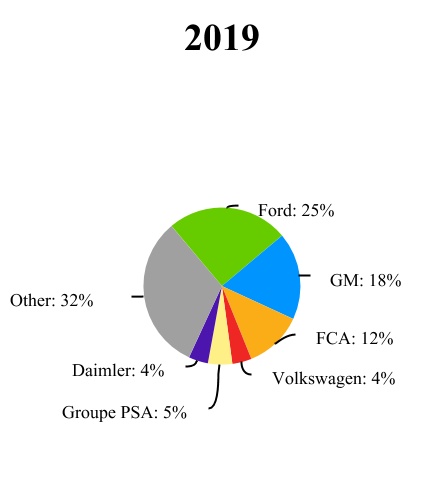

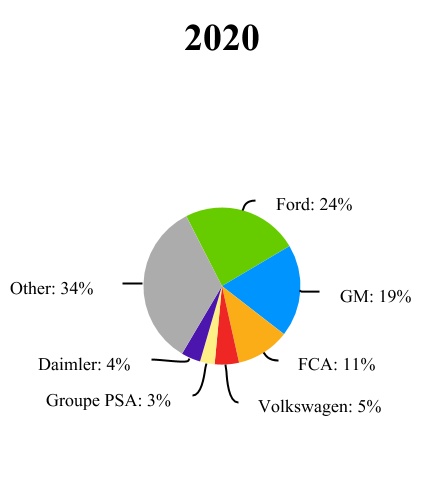

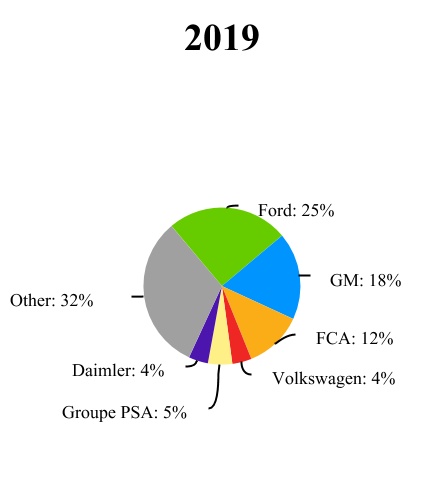

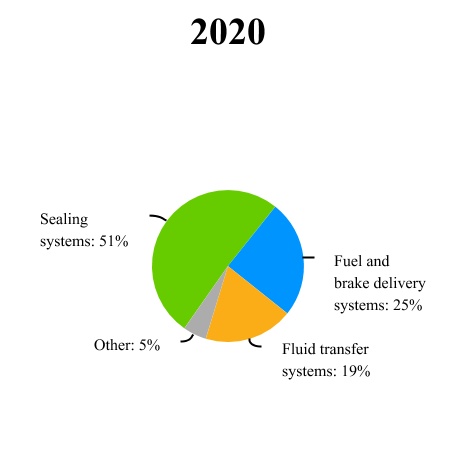

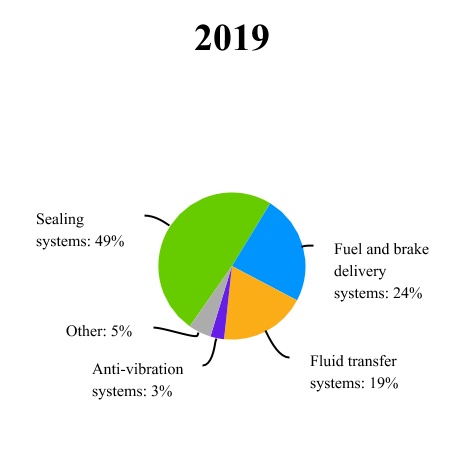

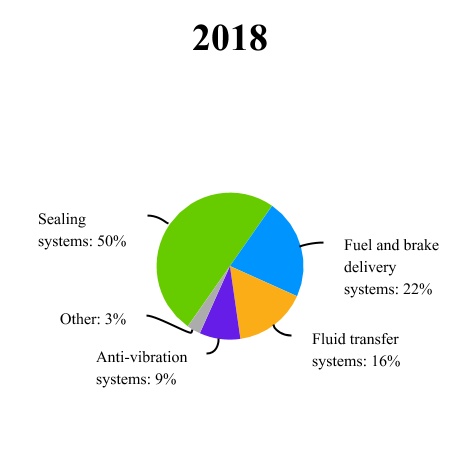

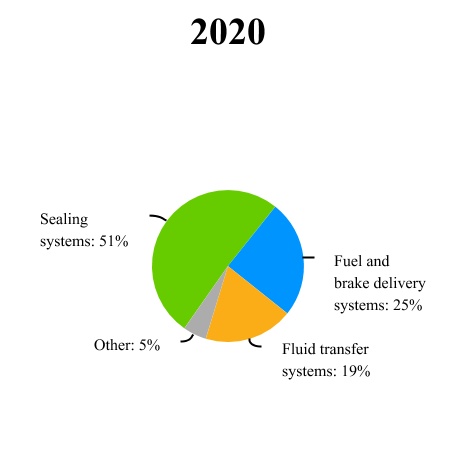

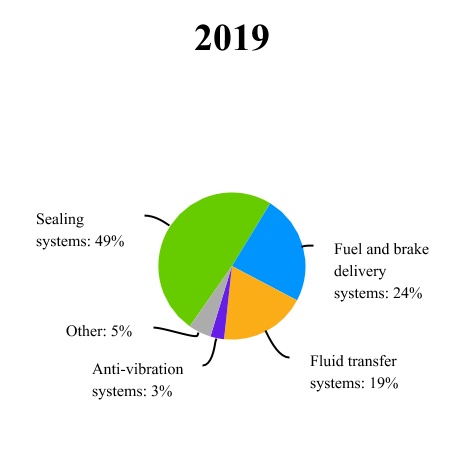

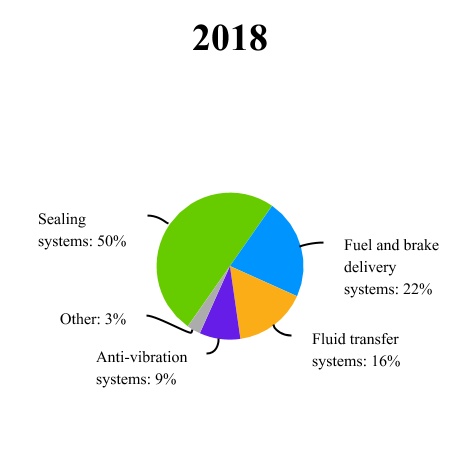

We are a leading supplier to the following OEMs and are increasing our presence with major OEMs throughout the world. The following charts show the percentage of sales to our top customers for the years ended December 31, 2020, 20192023, 2022 and 2018:2021:

Our other customers include OEMs such as Renault-Nissan, BMW, Toyota, Volvo, Jaguar/Land Rover, Honda and various other OEMs based in China. Our business with any given customer is typically split among several contracts for different parts on a number of platforms.

Subsequent Events

In January 2021, one of the Company’s top customers announced restructuring activities in South America including their intention to cease manufacturing operations in Brazil. As a result, Cooper Standard’s Brazil manufacturing operations and sales attributable to that customer will be significantly impacted. The Company is assessing the impact of this announcement on our 2021 financial results, but does not expect the action to have a material impact on the business, results of operations, financial condition or cash flows.

In January 2021, two of the Company’s top customers, FCA and Groupe PSA, completed a merger. The combined business was renamed Stellantis. The Company does not expect this merger to have a material impact on the business, results of operations, financial condition or cash flows.

Products

We currently have three distinctOur product lines:lines include sealing systems;systems and fluid handling systems (consisting of fuel and brake delivery systems; and fluid transfer systems.systems). These products are produced and supplied globally to a broad range of customers in multiple markets. On April 1, 2019, we completed the divestiture of the AVS product line within our North America, Europe and Asia Pacific segments. On July 1, 2020, we completed the divestiture of the European rubber fluid transfer and specialty sealing businesses, as well as our Indian operations.

In addition to these product lines, we also have sales tosell our core products into other adjacent markets. The percentage of sales by product line and other markets for the years ended December 31, 2020, 20192023, 2022 and 20182021 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Product Lines | | | | | | | Market Position* |

| SEALING SYSTEMS | | Protect vehicle interiors from weather, dust and noise intrusion for improved driving experience; provide aesthetic and functional class-A exterior surface treatment | | Global leader |

| | Products: | – | Obstacle detection sensor system | | |

| | – | Fortrex™ | – | Flush glass systems | | |

| | – | Dynamic seals | – | Variable extrusion | | |

| | – | Static seals | – | Specialty sealing products | | |

| | – | Encapsulated glass | – | Tex-A-Fib (Textured Surface with Cloth Appearance) | | |

| | – | Stainless steel trim | | | | |

| | | | | |

| FUEL & BRAKE DELIVERY SYSTEMS | | Sense, deliver and control fluids to fuel and brake systems | | Top 2 globally |

| Products: | | | | |

| | – | Chassis and tank fuel lines and bundles (fuel lines, vapor lines and bundles) | – | Direct injection & port fuel rails (fuel rails and fuel charging assemblies) | | |

| | – | Metallic brake lines and bundles | – | MagAlloy™ tube coatings | | |

| | – | Quick connects | – | Gen III Posi-Lock™ quick connects | | |

| | – | Low Oligomer MLT CVT | – | Series 300 S300LT | | |

| | – | Brake jounce lines | | | | |

| | | | | |

| FLUID TRANSFER SYSTEMS | | Sense, deliver, connect and control fluid and vapors for optimal thermal management, powertrain & HVAC operation | | Top 3 globally |

| | Products: | | | | |

| | – | Heater/coolant hoses | – | Turbo charger hoses | | |

| | – | Quick connects (SAE and VDA) | – | Charged air cooler ducts/assemblies | | |

| | – | DPF and SCR emission lines | – | Secondary air hoses | | |

| | – | Degas tanks | – | Brake and clutch hoses | | |

| | – | Air intake and charge | – | ArmorHose™ family of products | | |

| | – | Transmission Oil Cooling Hoses | – | Easy-Lock™ quick connect | | |

| | – | Multilayer tubing for glycol thermal management | – | Ergo-Lock™ VDA quick connect | | |

| | – | PC5000 high temperature MLT | – | PC2000 | | |

| | | | | |

*Market position data from PwC (2019) and company estimates | | | | | | | | | | | | | | | | | | | | | | | |

| Product Lines | | | | | | | Market Position |

| SEALING SYSTEMS | | Protect vehicle interiors from weather, dust and noise intrusion for improved driving experience; provide aesthetic and functional class-A exterior surface treatment | | Global leader |

| | Products: | | | | |

| | – | Fortrex® | – | FlushSeal™ systems | | |

| | – | Dynamic seals | – | Variable extrusion | | |

| | – | Static seals | – | Specialty sealing products | | |

| | – | Encapsulated glass | – | Stainless steel trim | | |

| | – | Tex-A-Fib (Textured Surface with Cloth Appearance) | – | Frameless Systems | | |

| | – | Obstacle detection sensor system | | | | |

| | | | | |

| FUEL & BRAKE DELIVERY SYSTEMS | | Sense, deliver and control fluid and fluid vapors for fuel and brake systems | | Top 2 globally |

| | Products: | | | | |

| | – | Chassis and tank fuel lines and bundles (fuel lines, vapor lines and bundles) | – | Direct injection & port fuel rails (fuel rails and fuel charging assemblies) | | |

| | – | Metallic brake lines and bundles | – | MagAlloy™ break tube coating | | |

| | – | Quick connects | – | ArmorTube™ brake tube coating | | |

| | – | Low oligomer multi-layer convoluted tube | – | Series 300 and S300LT (low temperature) quick connects | | |

| | – | Brake jounce lines | – | Gen III Posi-Lock® quick connects | | |

| | | | | |

| FLUID TRANSFER SYSTEMS | | Sense, deliver, connect and control fluid delivery for optimal thermal management, powertrain & HVAC operation | | Top 3 globally |

| | Products: | | | | |

| | – | Heater/coolant hoses | – | Turbo charger hoses | | |

| | – | Quick connects (SAE and VDA) | – | Charged air cooler ducts/assemblies | | |

| | – | Diesel particulate filter (DPF) lines | – | Secondary air hoses | | |

| | – | Degas tanks and deaerators | – | Brake and clutch hoses | | |

| | – | Charged air cooling (air intake and discharge) | – | Easy-Lock™ quick connect | | |

| | – | Transmission oil cooling hoses | – | Ergo-Lock™ VDA quick connect | | |

| | – | Multilayer tubing for glycol thermal management | – | Ergo-Lock™ + VDA quick connect | | |

| | – | PlastiCool® 5000 high temperature MLT | – | PlastiCool® 2000 multi-layer tubing for glycol thermal management | | |

| | | | | |

Competition

We believe that the principal competitive factors in our industry are quality, price, service, launch performance, design and engineering capabilities, innovation, timely delivery, financial stability and global footprint. We believe that our capabilities in these core competencies are integral to our position as a market leader in each of our product lines. Our sealing systems products compete with Toyoda Gosei, Henniges, Hutchinson Standard Profil, HSR&A, SaarGummi and JianXin, among others. Our fuel and brake delivery products compete with TI Automotive, Sanoh, Martinrea, Maruyasu and SeAH, among others. Our fluid transfer products compete with Conti-Tech, Hutchinson, Teklas, Tristone, Akwel and Fränkische, among others.

Joint Ventures and Strategic Alliances

Joint ventures represent an important part of our business, both operationally and strategically. We have utilized joint ventures to enter into and expand in geographic markets such as China, India and Thailand, to acquire new customers and to develop new technologies. When entering new geographic markets, teaming with a local partner can reduce capital investment

by leveraging pre-existing infrastructure. In addition, local partners in these markets can provide knowledge and insight into local practices and access to local suppliers of raw materials and components.

The following table shows our significant unconsolidated joint ventures:ventures as of December 31, 2023:

| | | | | | | | | | | | | | |

| Country | | Name | Product Line | Ownership Percentage |

United States | Thailand | Nishikawa Tachaplalert Cooper LLCLtd. | Sealing systems | 40%20% |

| India | | Polyrub Cooper Standard FTS Private Limited | Fluid transfer systems | 35% |

Thailand | United States | Nishikawa Tachaplalert Cooper Ltd.LLC | Sealing systems | 20%40% |

| China | | Yantai Leading Solutions Auto Parts Co., Ltd. | Fuel and brake delivery systems | 50% |

| China | Shenya Sealing (Guangzhou) Company Limited | Sealing and fluid transfer systems | 51% |

On April 1, 2019, the Company sold its equity interest in Sujan Cooper Standard AVS Private Limited in connection with the divestiture of its AVS product line.

Research and Development

We have a dedicated team of technical and engineering resources for each product line, some of which are located at our customers’ facilities. We utilize simulation, digital tools, best practices, standardization and track key process indicators to drive efficiency in execution with an emphasis on manufacturability and quality. Our development teams work closely with our customers to design and deliver innovative solutions, unique for their applications. Amounts spent on engineering, research and development, and program management were as follows:

| | | | | | | | | | | | | | |

| Year | | Amount | | Percentage of Sales |

| (Dollar amounts in millions) |

| 2020 | | $ | 101.6 | | | 4.3 | % |

| 2019 | | $ | 114.9 | | | 3.7 | % |

| 2018 | | $ | 122.5 | | | 3.4 | % |

| | | | | | | | | | | | | | |

| Year | | Amount | | Percentage of Sales |

| (Dollar amounts in millions) |

| 2023 | | $84.1 | | 3.0% |

| 2022 | | $80.5 | | 3.2% |

| 2021 | | $90.0 | | 3.9% |

Intellectual Property

We believe that one of our key competitive advantages is our ability to translate customer needs and our ideas into innovation through the development of intellectual property. We hold a significant number of patents and trademarks worldwide.

Our patents are grouped into two major categories: (1) specific product invention claims and (2) specific manufacturing processes that are used for producing products. The vast majority of our patents fall within the product invention category. We consider these patents to be of value and seek to protect our rights throughout the world against infringement. While in the aggregate these patents are important to our business, we do not believe that the loss or expiration of any one patent would materially affect our Company. We continue to seek patent protection for our new products and we develop significant technologies that we treat as trade secrets and choose not to disclose to the public through the patent process. These technologies nonetheless provide significant competitive advantages and contribute to our global leadership position in various markets. We believe that our trademarks, including FlushSeal™, Gen III Posi-Lock™Posi-Lock®, Easy-Lock™Easy-Lock®, MagAlloy™MagAlloy®, Ergo-Lock™, PC2000Ergo-Lock® +, PlastiCool® and Fortrex™, help differentiate us and lead customers to seek our partnership.

We also have technology sharing and licensing agreements with various third parties, including Nishikawa Rubber Company, one of our joint venture partners in sealing products. We have mutual agreements with Nishikawa Rubber Company for sales, marketing and engineering services on certain sealing products. Under those agreements, each party pays for services provided by the other and royalties on certain products for which the other party provides design or development services. We also have licensing and joint development agreements for commercial applications of our Fortrex™ chemistry platform in non-automotive industries. A joint development agreement has also been put in place for the collaborative creation of novel dynamic fluid control products and systems.

Innovation, Materials, and Product Lifecycle

The international response to risks and opportunities of climate change is transforming our global economy. Our most significant opportunity to contribute to this low-carbon and circular economy is through reducing the environmental impact of our products and manufacturing processes. We purposefully apply sustainable principles in the design and production of our

products, reducing the environmental impact from sourcing through end-of-life. These efforts also enable our customers to reduce their environmental impacts.

When obtaining or innovating materials for our products, we seek to sustainably source raw materials, increase the use of recycled content or recyclable material where feasible, decrease our use of hazardous chemicals where possible, and properly disclose restricted materials to customers and regulators. We believe our culture of innovation is a key differentiator, allowing us to compete and succeed within our dynamic global markets.

Supplies and Raw Materials

Cooper Standard is committed to building strong relationships with our supply partners. We recognize the importance of engaging with suppliers to create value for our customers.

The principleprincipal raw materials for our business include synthetic and natural rubber, carbon black, process oils, and plastic resins. PrinciplePrincipal procured components are primarily made from plastic, carbon steel, aluminum and stainless steel. We manage the procurement of our direct and indirect materials to assure supply continuity and to obtain the most favorable total cost.

Procurement arrangements include short-term and long-term supply agreements that may contain formula-based pricing based on commodity indices. These arrangements provide quantities needed to satisfy normal manufacturing demands. We believe we have adequate sources for the supply of raw materials and components for our products with suppliers located around the world, although we continue to manage, with our supplier partners, short-term disruptions in production and logistics throughout our supply chain caused by the COVID-19 pandemic.world.

Raw material prices are susceptible to fluctuations which may place operational and profitability burdens on the entire supply chain. Costs related toFollowing the pandemic, market prices for key raw materials, such as steel, aluminum, and oiloil-derived

commodities, experienced a period of extreme volatility, which led to significant cost increases for our business in 2021 and oil-derived commodities, continue to be volatile. As such,

2022. In response, we have implemented strategiesworked with both our suppliers and our customers throughout 2022 and 2023 to help manage these fluctuations. These actions include material substitutions and leveraging global purchases. Our global supply chain optimization efforts include using benchmarks and selective sourcing from strategic suppliers. Weimplement or expand index-based commercial

agreements that have also made process improvementsenabled us to ensure the efficient use of materials through scrap reduction, as well as standardization of material specifications to maximize leverage over higher volume purchases. With some customers, on certain raw materials, we have implemented indices that allow price changes as underlyingpartially recover incremental material costs fluctuate.incurred and significantly reduced our exposure

and risk related to commodity price fluctuations going forward. Global commodity markets and pricing have stabilized to a

large degree in 2023 and into the beginning of 2024.

Seasonality

Our principal operations are directly related toWithin the automotive industry. Salesindustry, sales to OEMs are lowest during the months prior to model changeovers or during assembly plant shutdowns. Automotive production is traditionally reduced during July, August and year-end holidays, and our quarterly results may reflect these trends. However, economic conditions and consumer demand may change the traditional seasonality of the industry. In recent years, for example, global light vehicle production, inventory and consumer demand all experienced extreme dislocations from historic norms due to the global COVID-19 pandemic and related restrictions on production and consumer activity. Post-pandemic, global light vehicle production continued to be negatively impacted by widespread supply chain disruptions, limiting the global automotive OEM’s ability to rebuild inventory and meet pent-up consumer demand.

Backlog

Our OEM sales are generally based upon purchase orders issued by the OEMs, with updated releases for volume adjustments. As such, we typically do not have a firm and definitive backlog of orders at any point in time. Once selected to supply products for a particular platform, we typically supply those products for the platform life, which is normally sixfive to seveneight years, although there is no guarantee that this will occur. In addition, when we are the incumbent supplier to a given platform, we believe we have a competitive advantage in winning the redesign or replacement platform, although there is no guarantee that this will occur.

Human Capital and Safety

As of December 31, 2020,2023, we had approximately 25,00023,000 employees, including 3,1003,000 contingent workers. We maintain good relations with both our union and non-union employees and, in the past ten years, have not experienced any major work stoppages.

Our people have always been the driving force of value at Cooper Standard. We renegotiated somecontinue to embrace new ways of working, a growing international movement for civil rights, and our domestic and non-domestic union agreements in 2020, and have several contracts setunwavering dedication to expire in the next twelve months.

The attraction, retention and development ofkeeping our employees ishealthy and safe has only made them more critical to our success. We accomplish this by developing the capabilities of our employees through continuous learning and performance management processes. Additionally, building an internal talent pipeline supports the achievement of this priority. In 2020,2023, our internal fill rate was approximately 56%36%. This metric, which is based on salaried, director leveldirector-level positions and above, helps us to understand where employees are advancing in their careercareers and the effectiveness of our internal development programs. OurFor 2023, our voluntary employee turnover rate was approximately 13%15%. We believe that our culture and continued effort to provide our employees with growth opportunities contributes to retaining our strong talent.

In addition, we aim to diversify our workforce because we recognize the value of engaging different opinions and backgrounds in a global company. We are committed to recruiting, developing and retaining a high-performing and diverse workforce. A global measurement for our diversity is women in the company and women in leadership. In 2020,2023, women made up approximately 36%40% of our workforce. Of our leadership positions, defined as vice president positions and above, women held approximately 20%24% of such roles.

Safety continues to be a top priority and primary focus of management. An emphasis on reducing workplace incidents helps Cooper Standard to maintain a safe workforce and continue to deliver world class results for product quality. In 2020,2023, our total incident rate (“TIR”) was 0.32, which represents an Occupational Safety and Health Administration measurement of on-the-job injuries in relation to total hours worked. Based on our review of industry peer sustainability reports, we have a lower TIR relative to our peer group. Additionally, throughout the COVID-19 pandemic, we have remained focused on protecting the health and safety of our employees while meeting the needs of our customers. After the onset of COVID-19, we adopted enhanced safety measures and practices across our facilities to protect employee health and safety and ensure a reliable supply of products to our customers. We monitor and track the impact of the pandemic on our employees and within our operations and proactively modify or adopt new practices to promote their health and safety.

Also in 2020, the Company was named to Newsweek’s list of America’s Most Responsible Companies for the second consecutive year and was recognized as one of the 2020 World’s Most Ethical Companies by Ethisphere. These awards are further testament to Cooper Standard’s commitment to ESG (environmental, social and governance) topics, including our core value of integrity.

Community Involvement

Supported by the Cooper Standard Foundation, our employees are highly engaged in their local communities. The Foundation’s mission is to strengthen the communities where Cooper Standard employees work and live through the passionate support of children’s charities, education, health and wellness, and community revitalization. The Cooper Standard Foundation is a 501(c)(3) organization with oversight by our Philanthropic Committee andits Board of Trustees.Directors, Board of Trustees and Philanthropic Committee. For more information on the Company’s community involvement, please visit our Corporate Responsibility Report located on the Cooper Standard website.

Environmental, Social and Governance (ESG)

In 2023, the Company was named to Newsweek’s list of America’s Most Responsible Companies for the fifth consecutive year and achieved Ecovadis Silver Status for sustainability efforts that also earned the Company recognition from Nissan for sustainability and social responsible practices. These awards are a further testament to Cooper Standard’s commitment to ESG topics, including our core value of integrity.

Cooper Standard considers itself a steward of the environment, and we monitor the environmental impact of our business and products. We prioritize our environmental management as a means of driving and sustaining excellence. We are subject to a broad range of federal, state, and local environmental and occupational safety and health laws and regulations in the United States and other countries, including regulations governing: emissions to air, discharges to water, noise and odor emissions; the generation, handling, storage, transportation, treatment, reclamation and disposal of chemicals and waste materials; the cleanup of contaminated properties; and human health and safety. We have made, and will continue to make, expenditures to comply with environmental requirements. While our costs to defend and settle known claims arising under environmental laws have not been material in the past and are not currently estimated to have a material adverse effect on our financial condition, such costs could be material to our financial statements in the future. Further details regarding our commitments and contingencies are provided in Note 23.20. “Contingent Liabilities” to the consolidated financial statements included in Item 8. “Financial Statements and Supplementary Data” of this Annual Report on Form 10-K (the “Report”).

Market Data

SomeCertain market data and other statistical information used throughout this Annual Report on Form 10-K is based on data from independent firms such as IHS Markit and PwC.S&P Global. Other data is based on good faith estimates, which are derived from our review of internal analyses, as well as third partythird-party sources. Although we believe these third partythird-party sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. To the extent that we have been unable to obtain information from third partythird-party sources, we have expressed our belief on the basis of our own internal analyses of our products and capabilities in comparison to our competitors.

Available Information

We make available free of charge on our website (www.cooperstandard.com) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (“SEC”). Our reports filed with the SEC also may be found on the SEC’s website at www.sec.gov. We may also use our website as a distribution channel of material company information. Neither the information on our website nor the information on the SEC’s website is incorporated by reference into this Report unless expressly noted.

Forward-Looking Statements

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of U.S. federal securities laws, and we intend that such forward-looking statements be subject to the safe harbor created thereby. Our use of words “estimate,” “expect,” “anticipate,” “project,” “plan,” “intend,” “believe,” “outlook,” “guidance,” “forecast,” or future or conditional verbs, such as “will,” “should,” “could,” “would,” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements are based upon our current expectations and various assumptions. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, we cannot assure you that these expectations, beliefs and projections will be achieved. Forward-looking statements are not guarantees of future performance and are subject to significant risks and uncertainties that may cause actual results or achievements to be materially different from the future results or achievements expressed or implied by the forward-looking statements. Among other items, such factors may include: volatility or decline of the impact,Company’s stock price, or absence of stock price appreciation; impacts and expected continueddisruptions related to the wars in Ukraine and the Middle East; our ability to achieve commercial recoveries and to offset the adverse impact of the recent COVID-19 outbreak onhigher commodity and other costs through pricing and other negotiations with our financial condition and results of operations; significant risks tocustomers; work stoppages or other labor disruptions with our liquidity presented by the COVID-19 pandemic risk;employees or our customers’ employees; prolonged or material contractions in automotive sales and production volumes; our inability to realize sales represented by awarded business; escalating pricing pressures; loss of large customers or significant platforms; our ability to successfully compete in the automotive parts industry; availability and increasing volatility in costs of manufactured

components and raw materials; disruption in our supply base; competitive threats and commercial risks associated with our diversification strategy through Advanced Technology Group;strategy; possible variability of our working capital requirements; risks associated with our international operations, including changes in laws, regulations, and policies governing the terms of foreign trade such as increased trade restrictions and tariffs; foreign currency exchange rate fluctuations; our ability to control the operations of our joint ventures for our sole benefit; our substantial amount of indebtedness and variable rates of interest; our ability to obtain adequate financing sources in the future; operating and financial restrictions imposed on us under our debt instruments; the underfunding of our pension plans; significant changes in discount rates and the actual return on pension assets; effectiveness of continuous improvement programs and other cost savings plans; significant costs related to manufacturing facility closings or consolidation; our ability to execute new program launches; our ability to meet customers’ needs for new and improved products; the possibility that our acquisitions and divestitures may not be successful; product liability, warranty and recall claims brought against us; laws and regulations, including environmental, health and safety laws and regulations; legal and regulatory proceedings, claims or investigations against us; work stoppages or other labor disruptions;the potential impact of any future public health events on our financial condition and results of operations; the ability of our intellectual property to withstand legal challenges; cyber-attacks, data privacy concerns, other disruptions in, or the inability to implement upgrades to, our information technology systems; the possible volatility of our annual effective tax rate; changes in our assumptions as a result of IRS issuing guidance on the Tax Cuts and Jobs Act; the possibility of a failure to maintain effective controls and procedures; the possibility of future impairment charges to our goodwill and long-lived assets; our ability to identify, attract, develop and retain a skilled, engaged and diverse workforce; our ability to procure insurance at reasonable rates; and our dependence on our subsidiaries for cash to satisfy our obligations.

You should not place undue reliance on these forward-looking statements. Our forward-looking statements speak only as of the date of this Annual Report on Form 10-K and we undertake no obligation to publicly update or otherwise revise any forward-looking statement, whether as a result of new information, future events or otherwise, except where we are expressly required to do so by law.

This Annual Report on Form 10-K also contains estimates and other information that is based on industry publications, surveys and forecasts. This information involves a number of assumptions and limitations, and we have not independently verified the accuracy or completeness of the information.

Item 1A. Risk Factors

We have listed below (not necessarily in order of importance or probability of occurrence) the most significant risk factors that could cause our actual results to vary materially from recent or anticipated results and could materially and adversely affect our business, results of operations, financial condition and cash flows.

Operational Risks

Our business, financial condition and results of operations have been, and are expected to continue tomay be adversely affectedimpacted by the recent COVID-19 outbreak.effects of inflation.

We face risks relatedInflation has the potential to public health issues, including epidemics and pandemics such as the global outbreak of COVID-19. The COVID-19 outbreak and preventative measures taken to contain or mitigate the COVID-19 outbreak have caused, and are continuing to cause,adversely affect our business, slowdowns or shutdowns and significant disruption in the financial markets both in the United States and globally. The continued spread of COVID-19 and efforts to contain the virus (including, but not limited to, vaccination, social distancing policies, restrictions on travel and reduced operations and extended closures of many businesses and institutions) may materially impact our financial condition and results of operations.

•Facilities. For example, beginning inoperations by increasing our overall cost structure. Other inflationary pressures could affect wages, the first quartercost and availability of 2020, we experienced the shutdown of effectively all of our facilities in Asia Pacific, North America, Europecomponents and South America, coinciding with the shutdown of our customer facilities in those regions. While facilities gradually reopenedraw materials and production resumed over the course of 2020, reopening was gradualother inputs and at times, at lower capacities. A resurgence of the virus could cause another shutdown of our and our customers’ facilities. Although our automotive operations generally do not realize revenue while our facilities are shut down, we continue to incur significant operating and non-operating expenses associated with these facilities. In addition, government regulations and safety and social distancing procedures that we have implemented in our facilities have increased our operating costs, and we may not be able to pass along these increased costs to our customers.

•Supply chain. Our business relies on a number of third parties, including suppliers and distribution and logistics providers. One or more of these third parties may experience financial distress, staffing shortages or liquidity challenges, file for bankruptcy protection, go out of business, or suffer disruptions in their business due to the COVID-19 pandemic. These supply chain effects may have an adverse effect on our ability to meet customer demanddemand. Inflation may further exacerbate other risk factors, including supply chain disruptions, risks related to international operations and may result in an increase in our coststhe recruitment and retention of production and distribution, including increased freight and logistics costs and other expenses. A continued significant disruption to our production schedule will have an adverse effect on our financial condition, liquidity and results of operations.qualified employees. If we are

•Workforce. If a significant percentageunsuccessful in negotiating pricing adjustments with our customers to raise the prices of our workforce, orproducts sufficiently to keep up with the workforcesrate of inflation, our suppliersprofit margins and other third-party partners, is unable to work, whether because of illness, quarantine, limitations on travel or other government restrictions in connection with COVID-19, our operationscash flows may be negatively impacted. We also depend on senior management and other key personnel and consultants, and the illness of certain personnel or consultants could resultadversely affected.

Increases in the losscosts, or reduced availability, of expertiseraw materials and negatively affect our operations.

•Demand. The economic slowdown attributable to COVID-19 has also led to a global decrease in vehicle sales in markets around the world. Based on current weak consumer confidence, rising unemployment levels, risks to small businesses and overall economic uncertainty, it is likely that global demand for light vehicles will be significantly lower than both historical and previously projected levels for an extended period, even as the COVID-19 pandemic begins to abate. As described in more detail under the risk factor entitled “We are highly dependent on the automotive industry. A prolonged or material contraction in automotive sales and production volumes couldmanufactured components may adversely affect our business,profitability.

Raw material costs can be volatile. The principal raw materials to produce our products include synthetic and natural rubber, carbon black, process oils, and plastic resins. Principal procured components are primarily made from plastic, carbon steel, aluminum and stainless steel. Material costs represented approximately 51% of our total cost of products sold in 2023. The costs and availability of raw materials and manufactured components can fluctuate due to factors beyond our control, including as a result of existing and potential changes to U.S. policies related to global trade and tariffs. Further, climate change may have an adverse impact on global temperatures, weather patterns, and the frequency and severity of extreme weather and natural disasters, which may adversely affect the availability or pricing for certain raw materials including natural rubber. A significant increase in the price of raw materials, or a restriction in their availability, could materially increase our operating costs and adversely affect our profitability because it is generally difficult to pass through these increased costs to our customers. While we entered into index pricing agreements with some of our customers which provide for a price adjustment based on quoted market prices to attempt to address some of these risks (notably with respect to steel and rubber), there can be no assurance that commodity price fluctuations will not adversely affect our results of operations and financial condition”, a sustained declinecash flows. In addition, while the use of index pricing adjustments may provide us with some protection from adverse fluctuations in vehicle sales would adversely affect our business, results of operations and financial condition.

•Liquidity. The COVID-19 pandemic has also caused significant disruptions to global financial markets. Such disruptions, together withcommodity prices, by utilizing these instruments, we potentially forego the impact of COVID-19 on the automotive industry, may have a negative impact on our ability to access capitalbenefits that might result from favorable fluctuations in the future on favorable terms or at all.

The full impact of the COVID-19 pandemic on our financial condition and results of operations will depend on future developments, such as the ultimate duration and scope of the outbreak, its impact on our customers, suppliers and logistics partners, how quickly normal operations can resume and the duration and magnitude of the economic downturn caused by the pandemic in our key markets. In particular, a delay in wide distribution of a vaccine, or a lack of public acceptance of a vaccine, could lead people to continue to self-isolate and not participate in the economy at pre-pandemic levels for a prolonged period of time. Further, even if a vaccine is widely distributed and accepted, the vaccine may not be successful in limiting or stopping the spread of COVID-19. Government-sponsored liquidity or stimulus programs in response to the COVID-19 pandemic may not be available to our customers, suppliers or us and, if available, may nevertheless be insufficient to address the impacts of COVID-19. Therefore, it remains difficult to predict the extent or nature of these impacts at this time. The COVID-19 pandemic may also exacerbate the other risks disclosed in this Item 1A. Risk Factors.

A disruption in, or the inability to successfully implement upgrades to, our information technology systems, including disruptions relating to cybersecurity as well as data privacy concerns, could adversely affect our business and financial performance.

We rely upon information technology networks, systems and processes, including the information technology networks of third parties such as suppliers and joint venture partners, to manage and support our business. We have implemented a number of procedures and practices designed to protect against breaches or failures of our systems. Despite the security measures that we have implemented, including those measures to prevent cyber-attacks, our systems could be breached or damaged by computer viruses or unauthorized physical or electronic access. A breach of our information technology systems, or those of the third parties on whom we rely, could result in theft of our intellectual property, disruption to business or unauthorized access to customer or personal information. Such a breach could adversely impact our operations and/or our reputation and may cause us to incur significant time and expense to cure or remediate the breach.

Further, we continually update and expand our information technology systems to enable us to more efficiently run our business. If these systems are not implemented successfully, our operations and business could be disrupted and our ability to report accurate and timely financial results could be adversely affected.price.

Disruptions in the supply chain could have an adverse effect on our business, financial condition, results of operations and cash flows.

We obtain components and other products and services from numerous suppliers and other vendors throughout the world. We are responsible for managing our supply chain, including suppliers that may be the sole sources of products that we require, that our customers direct us to use or that have unique capabilities that would make it difficult and/or expensive to re-source. In certain instances, entire industries may experience short-term capacity constraints. Any significant disruptiondisruptions in the automotive industry due to industry-wide parts shortages and global supply chain constraints could adversely affect our operations and financial performance. Furthermore, unfavorableUncertain economic or industry conditions resulting from such supply chain constraints could result in financial distress within our supply base, thereby further increasing the risk of supply disruption. Although market conditions generally have improved in recent years, uncertainty remains, and anFurthermore, any economic downturn or other unfavorable conditions in one or more of the regions in which we operate could cause a supply disruptiondisruptions and thereby adversely affect our financial condition, operating results and cash flows.

Work stoppages orother disruptions to our operations could negatively affect our operations and financial performance.

We may experience work stoppages caused by labor disputes under existing collective bargaining agreements or in connection with the negotiation of new agreements given that we have a number of agreements that expire in any given year. Further, there is no certainty that we will be successful in negotiating new collective bargaining agreements that extend beyond the current expiration dates or that new agreements will be on terms as favorable to us as past labor agreements. In addition, it is possible that our workforce will become more unionized in the future. Unionization activities could increase our costs, which could negatively affect our results of operations.

Our operations may also be disrupted by other labor issues, including absenteeism, public health events and government restrictions; major equipment failure with prolonged downtime or a complete loss of critical equipment where either no other comparable equipment exists or the remaining equipment does not have enough capacity to pick up the demand; or natural disaster-related plant closures or disruptions. In particular, natural disasters and adverse weather conditions can be caused or exacerbated by climate change.

Regardless of the cause, any significant disruption to our production could negatively affect our operations, customer relationships and financial performance. Similar disruptions at one or more of our suppliers or our customers’ suppliers could adversely affect our operations if an alternative source of supply were not readily available. Additionally, similar disruptions at our customers’ facilities could result in reduced demand for our products causing us to delay or cancel production and could have an adverse effect on our business.

A disruption in, or the inability to successfully implement upgrades to, our information technology systems, including disruptions relating to cybersecurity as well as data privacy concerns, could adversely affect our business and financial performance.

We rely upon information technology networks, systems and processes, including the information technology networks of third parties such as suppliers and joint venture partners, to manage and support our business. We have implemented a number

If a customer experiences a material supply shortage, either directlyof procedures and practices designed to protect against breaches or as a result of a supply shortage at another supplier, that customer may halt or limit the purchasefailures of our products,systems. Despite the security measures that we have implemented, including those measures to prevent cyber-attacks, our systems could be breached or damaged by computer viruses or unauthorized physical or electronic access. Like other public companies, our computer systems and those of our third-party vendors, partners and service providers are regularly subject to, and will continue to be the target of, computer viruses, malware or other malicious codes (including ransomware), unauthorized access, cyber-attacks or other computer-related penetrations which may cause disruptions to our operations. While we have experienced threats to our data and systems, to date, we are not aware that we have experienced a cybersecurity incident that has materially affected our business strategy, results of operations, or financial condition. Over time, however, the sophistication of these threats continues to increase. The preventative actions we take to reduce the risk of cyber incidents and protect our information may be insufficient. A breach of our information technology systems, or those of the third parties on whom we rely, could result in theft of our intellectual property, disruption to business or unauthorized access to customer or personal information. Such a breach could adversely affectimpact our operations and/or our reputation and may cause us to incur significant time and expense to cure or remediate the breach.

Further, we continually update and expand our information technology systems to enable us to run our business more efficiently, including the potential incorporation of traditional and generative A.I. solutions into our information systems and processes. The increasing use and evolution of this technology creates potential risks for loss or misuse of sensitive Company data that forms part of any data set that was collected, used, stored, or transferred to run our business, and unintentional dissemination or intentional destruction of confidential information stored in our or our third party providers' systems, portable media or storage devices, which may result in significantly increased business and security costs, a damaged reputation, administrative penalties, or costs related to defending legal claims. In addition, if the content, analyses, or recommendations that A.I. programs assist in producing are or are alleged to be deficient, inaccurate, or biased, our business, financial condition, and results of operations and financial condition.

Increases in the costs, or reduced availability, of raw materials and manufactured components may adversely affect our profitability.

Raw material costs can be volatile. The principle raw materials to produce our products include synthetic and natural rubber, carbon black, process oils, and plastic resins. Principal procured components are primarily made from plastic, carbon steel, aluminum and stainless steel. Material costs represented approximately 46% of our total cost of products sold in 2020. The costs and availability of raw materials and manufactured components can fluctuate due to factors beyond our control, including as a result of existing and potential changes to U.S. policies related to global trade and tariffs. A significant increase in the price of raw materials, or a restriction in their availability, could materially increase our operating costs and adversely affect our profitability because it is generally difficult to pass through these increased costs to our customers.

Our diversification strategy through the Advanced Technology Group poses new competitive threats and commercial risks.

Our diversification strategy through the Advanced Technology Group is to leverage our core products in adjacent markets and license our innovation technology in non-automotive markets. Wereputation may be unsuccessfuladversely affected. If these systems are not implemented successfully and in leveraginga timely, cost-effective, compliant and responsible manner, our existing productsoperations and technology into new marketsbusiness could be disrupted and thus in meeting the needs of these new customersour ability to report accurate and competing favorably in these new markets.timely financial results could be adversely affected.

OurAn inability to effectively manage the timing, quality and costs of new program launches could adversely affect our financial performance.

In connection with the award of new business, we may obligate ourselves to deliver new products that are subject to our customers’ timing, performance and quality standards. Given the number and complexity of new program launches, we may experience difficulties managing product quality, timeliness and associated costs. In addition, new program launches require a significant ramp up of costs. However, ourOur sales related to these new programs generally are dependent upon the timing and success of our customers’ introduction of new vehicles. OurAn inability to effectively manage the timing, quality and costs of these new program launches could adversely affect our financial condition, operating results and cash flows.

Our success depends in part on our development of improved products, and our efforts may fail to meet the needs of customers on a timely or cost-effective basis.

Our continued success depends on our ability to maintain advanced technological capabilities and knowledge necessary to adapt to changing market demands, as well as to develop and commercialize innovative products. We may be unable to develop new products successfully or to keep pace with technological developments by our competitors and the industry in general.general, which in recent years includes the rapid development and rising use of digital, A.I. and machine learning technologies. In addition, we may develop specific technologies and capabilities in anticipation of customers’ demands for new innovations and technologies. If such demand does not materialize, we may be unable to recover the costs incurred in the development of such technologies and capabilities. If we are unable to recover these costs or if any such programs do not progress as expected, our business, results of operations and financial condition could be adversely affected.

We may incur material losses and costs as a result of product liability and warranty and recall claims that may be brought against us.

We may be exposed to product liability and warranty claims in the event that our products actually or allegedly fail to perform as specified or expected or the use of our products results, or is alleged to result, in bodily injury and/or property damage. Accordingly, we could experience material warranty or product liability expenses in the future and incur significant costs to defend against these claims. In addition, if any of our products are, or are alleged to be, defective, we may be required to participate in a recall of that product if the defect or the alleged defect relates to automotive safety. Product recalls could cause us to incur material costs and could harm our reputation or cause us to lose customers, particularly if any such recall causes customers to question the safety or reliability of our products. Also, while we possess considerable historical warranty and recall data with respect to the products we currently produce, we do not have such data relating to new products, assembly programs or

technologies, including any new fuel and emissions technology and systems being brought into production, to allow us to accurately estimate future warranty or recall costs.

In addition, the increased focus on systems integration platforms utilizing fuel and emissions technology with more sophisticated components from multiple sources could result in an increased risk of component warranty costs over which we have little or no control and for which we may be subject to an increasing share of liability to the extent any of the other component suppliers are in financial distress or are otherwise incapable of fulfilling their warranty or product recall

obligations. Our costs associated with providing product warranties and responding to product recall claims could be material. Product liability, warranty and recall costs may adversely affect our business, results of operations and financial condition.

Work stoppages or similar difficulties could disrupt our operations and negatively affect our operations and financial performance.