2023

| Delaware | 34-1940305 | ||||

|

| ||||

State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification Number) | ||||

7555 Innovation Way, Mason, OH | 45040 | ||||

(Address of principal executive offices) | (Zip Code) | ||||

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Common Stock, $.001 | ATRC | NASDAQ Global Market | ||||||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

| Accelerated Filer ☐ | Non-Accelerated Filer ☐ |

| Emerging Growth Company ☐ | ||||||||||||||||||||||

As of February 23, 2018, there were 34,560,275 shares of Common Stock, $.001 par value per share, outstanding.

| Class | Outstanding February 13, 2024 | ||||

| Common Stock, $.001 par value | 47,587,966 | ||||

(Dollar

Physicians have adopted our radiofrequency (RF) ablation and cryoablation systems to treat Afib in over 250,000 patients since 2004, and we believe that we are currently the market leader in the surgical treatment of Afib. Our products are used by physicians during both open-heart and minimally invasive surgical procedures, either on a concomitant or standalone basis. During a concomitant procedure, the physician ablates cardiac tissue and/or occludes the LAA, secondary, or concomitant, to a primary structural heart procedure such as a valve repair or replacement or coronary artery bypass graft (CABG). Our Isolator Synergy System is approved by FDA for the treatment of persistent and long-standing persistent Afib concomitant to other open-heart surgical procedures. Our other ablation devices are all cleared for sale under FDA 510(k) clearances, including our other RF and cryoablation products, which are indicated for the ablation of cardiac tissue and/or the treatment of cardiac arrhythmias. In addition, our cryoICE probe is cleared for managing pain by temporarily ablating peripheral nerves. Our AtriClip products are 510(k)-cleared with an indication for the occlusion of the heart’s LAA, in conjunction with other cardiac surgical procedures. We also have a line of reusable surgical instruments typically used in cardiac valve replacement or repair. We anticipate that substantially all of our revenue for the foreseeable future will relate to products we currently sell, or are in the process of developing, which are used to ablate cardiac tissue, to occlude the left atrial appendage, to support mitral and aortic valve replacement and repair and/or to ablate peripheral nerves during cardiothoracic surgery.

Afib affects approximately 1% of the population in the United States.epidemic. It is the most common cardiac arrhythmia or irregular heartbeat, encountered in clinical practice and accountsresults in high utilization of healthcare services and significant cost burden. Patients often progress from being in Afib intermittently (paroxysmal) to being in Afib continuously. The continuous Afib patient population includes early persistent Afib, which lasts seven days to 6 months, persistent Afib, which lasts 6 months to one year, and long-standing persistent Afib, which lasts longer than one year. It is estimated that over 3.5 million people in the United States currently suffer from long-standing persistent Afib. Afib often occurs in conjunction with other cardiovascular diseases, including hypertension, congestive heart failure, left ventricular dysfunction, coronary artery disease and valvular disease.

In the United States, we sell our products to medical centers through our direct sales force. In certain international markets, such as Germany, France, the United Kingdom and the Benelux region, sales are also made directly to medical centers, while other international sales are made to distributors who in turn sell our products to end users. Our business is primarily transacted in U.S. Dollars with the exception of transactions with our European subsidiaries, which are transacted in Euros or British Pounds.

1

Market Overview

Afib is the most commonly diagnosed sustained cardiac arrhythmia, and affects more than 30 million people worldwide, including more than five millionin the United States. It is estimated that the incidence of Afib doubles with each decade of an adult’s life. At age 40, remaining lifetime risk for Afib is 26% for men and 23% for women. Afib is an under-diagnosed condition due in large part to the fact that patients with Afib, often have mild or no symptoms and their Afib is only diagnosed when they seek treatment for an associated condition, such as a structural heart disease or stroke.significant percentage of those clots can form inside of the LAA. We believe that increasing awareness of Afib and improved diagnostic screening will result in an increased number of patients diagnosed with Afib. Recently, there have been several new diagnostic technologies introduced in the United States that allow for less invasive screening options, which should assist patients with more compliant and proactive identification of Afib.Afib over time. Also, since the prevalence of Afib increases with age, there will likely be an increase in the number of diagnosed Afib patients in the United Statesglobally as the world population ages. We believe that the same trends in the United States apply globally, as in many geographies the incidence of Afib is increasing as the population ages.

surgical ablation. In addition, Afib is thought to be responsible for approximately 15% to 20% of the estimated 700,000800,000 strokes that occur annually in the United States. According to the American Heart Association, the risk of stroke is five times higher in people with Afib. Studies have also suggested that 90% of clots that cause strokes in patients who have Afib originate from within the LAA. Recently, a large independent international randomized trial, Left Atrial Appendage Occlusion Study (LAAOS) III, demonstrated a significant reduction in strokes when the LAA was managed during cardiac surgery. Afib accounts for billions of dollars in hospitalization-related and office visit costs in the United States each year. Indirect costs, such as the management of Afib-related strokes, are also believed to be significant. Because of the risk of stroke and the significant cost burden on the healthcare system, more and more surgeons are routinely addressing the LAA.LAA, both in patients who have Afib and in those who do not have Afib but may be at increased risk of developing the disease in the future. We believe that our AtriClip system is safer, more effective and easier to use than other products and techniques for occludingexcluding the LAA and, because of this,during cardiac surgery. Therefore, we believe that the market for our ablation products and the AtriClip system represent significant growth opportunities.

Cardiothoracicopportunity for the Company.

2

Clinicalapproaches. We have completed, and continue to invest in, clinical studies for the use of our ablation and LAAM products to treat Afib are ongoing.and reduce stroke. Leading cardiothoracic surgeons and electrophysiologists, including those who serve or who have served as consultants to us, have published results of initialpreclinical and clinical studies utilizing our Isolator Synergy System.devices. The results of these studies are to evaluatehave assessed efficacy, ease of use and safety.

We have two primary product linessafety endpoints.

Product linesthe treatment of persistent and long-standing persistent Afib concomitant to other open-heart surgical procedures. Certain products of our Isolator Synergy clamps bear the CE mark and may be commercially distributed throughout the member states of the European Union and other countries that comply with or mirror the Medical Device Directive. These products are available for sale in a number of other countries globally.

|

|

| •Multifunctional Pens and Linear Ablation Devices. These devices are single-use disposable RF products that come in multiple configurations. The MAX Pen devices enable surgeons to evaluate cardiac arrhythmias, perform temporary cardiac pacing, sensing and stimulation and ablate cardiac tissue with the same device. Surgeons can readily toggle back and forth between these functions. The device comes in multiple configurations that have unique tissue contacting and shaft lengths. The Coolrail® device enables the user to make longer linear lines of ablation. Surgeons generally use one or more of our pen and linear devices in combination with Isolator Synergy clamps. |

|

|

|

|

|

|

Our linear ablation devices are cleared for sale in the United States under FDA 510(k) clearances, with indications for the ablation of cardiac tissue and/or the treatment of cardiac arrhythmias. Our Isolator Synergy pens bear the CE mark, and most configurations may be commercially distributed throughout the member states of the European Union and other countries that comply with or mirror the Medical Device Directive. These products are available for sale in a number of other countries globally.

|

|

Product line for left atrial appendage management:

|

|

3

Product line

|

|

In addition to the above product lines we also sell enabling technologies including ourthat hold 510(k) approvals and/or bear the CE mark. The LARIAT® System is a solution for soft-tissue closure that includes a suture loop coupled to a single-use disposable applier. The Lumitip™ dissectors, the Fusion Magnetic Retriever System and a line of reusable cardiac surgery (valve) instruments. The Lumitip dissector is used by surgeons to separate tissues to provide access to key anatomical structures that are targeted for ablation. The Fusion Magnetic Retriever System™ allowsOther enabling technologies include our Glidepath™ guides for placement of our clamps, Subtle™ Cannula’s to support access around key anatomical structuresfor our EPi-Sense catheters and facilitates positioninga line of reusable cardiac surgery instruments.

Current Afib Treatment Alternatives

Physicians usually begin treating Afib patients with a variety of drugs intended to prevent blood clots, control heart rate or restore the heart to normal sinus rhythm. If a patient’s Afib cannot be adequately controlled with drug therapy, doctors may perform one of several procedures that vary depending on the severity of the Afib symptoms and whether or not the patient suffers from other forms of heart disease.

Alternative treatments to open-heart and minimally invasive procedures include:

|

|

|

|

|

|

With the exception of the Isolator Synergy System, which may be promoted according to its FDA-approved indication for patients with persistent and long-standing persistent Afib undergoing certain open-heart procedures, we do not promote our products specifically for Afib treatment in the United States. Nevertheless, some physicians have adopted our products for use in open-heart and minimally invasive procedures for the treatment of Afib. During elective open-heart surgical procedures, such as bypass or valve surgery, cardiothoracic surgeons use our ablation systems to treat patients with a pre-existing history of Afib. Surgeons use our products to perform cardiac procedures that may vary depending on the length of time a patient has been diagnosed with Afib and whether the patient’s Afib is intermittent, known as paroxysmal, or more continuous (non-paroxysmal), which is typically further classified as persistent, long-standing persistent or permanent. Patients who have been diagnosed with Afib for a longer duration and have non-paroxysmal forms of Afib generally receive more extensive ablation procedures than patients who have been diagnosed with Afib for a shorter duration or who have paroxysmal Afib. Additionally, during an open-heart procedure, physicians may use our AtriClip system to occlude the left atrial appendage.

For those patients with Afib who do not require a concomitant open-heart surgical procedure, surgeons have used our products for minimally invasive Afib treatment procedures. These procedures have generally been performed through minimally invasive incisions without the need to place patients on a heart-lung bypass machine.

Additionally, some physicians are performing various minimally invasive stand-alone procedures which combine epicardial (surgical) ablation (ablation on the outside of the heart) with endocardial ablation and mapping techniques (from the inside of the heart). These combination procedures are often referred to as “hybrid” or “multi-disciplinary” approaches, in that both surgical ablation and catheter ablations are performed. Sometimes, both procedures are performed on the same day or in the same hospital stay, where other times they are performed days or weeks apart. Physician preference as well as hospital logistics and procedural room availability plays into the decision whether to perform hybrid ablations in a single or a staged setting. Physicians are reporting that they are performing these procedures utilizing certain of our products to primarily treat patients who have non-paroxysmal forms of Afib.

4

Business Strategy

pain after surgery. Our missionstrategy is to expand the treatment options for patients who suffer from Afib, or have a high risk of stroke, or who suffer from post-operative pain, through the continued development of our technologies and expansion of our product offerings, clinical science investments and global commercial expansion and clinical science investments.expansion. The key elements of our strategy include:

Invest

efforts and expand the body of clinical evidence. We believe publication of additional scientific evidence, in addition to robust ongoing research activities, will ultimately create an increased demand for our products.

In addition, we

Expand Adoption of Our Minimally Invasive Products. We believe that the catalysts for expanded adoption of our minimally invasive products include procedural advancements, such as the hybrid or multi-disciplinary procedure, and the publication of peer-reviewed articles, which we believe will help validate the successful, long-term use of our products for patients with Afib. We believe that ongoing research activities, including prospective clinical trials, new procedural techniques and anticipated presentations and publications will create an increased demand for our minimally invasive products.

Clinical Trials

criteria.

CONVERGE. We

2023, results from our CEASE-AF trial were presented at the European Heart Rhythm Association meeting and subsequently published in July 2023. CEASE-AF is a prospective, multi-center randomized control trial that demonstrated superior freedom from atrial arrhythmias for staged hybrid ablation compared to endocardial catheter ablation. During the fourth quarter of 2023, the 12-month follow-up results of enrolled patients from the DEEP AF Pivotal Study.study were presented at the American Heart Association meeting. The DEEP AF IDE pivotal trial evaluatesevaluated the safety and efficacy of the Isolator SynergyAtriCure Bipolar System when used in a staged approach where a minimally invasive surgical ablation procedure is first performed and theperformed. The patient undergoes the intracardiacendocardial catheter procedure approximately 90-12091-120 days later. We have FDA approvalThe results from this single arm study demonstrated superior freedom from atrial arrhythmias for staged hybrid ablation compared to enroll up to 220 patients at 23 domestic medical centers and two international medical centers. Enrollment was temporarily suspended beginninga pre-specified performance goal. The Company is in May 2016 while we

5

evaluated changes to the trial protocol with FDA. We received FDA approval on the updated trial protocol during the third quarter of 2017. Six domestic medical centers have resumed participation in the study and five patients have been enrolled. Total enrollment in the trial is currently 47 patients.

ATLAS. The ATLAS study is a non-IDE randomized pilot study evaluating outcomes of patients with risk factors for developing postoperative Afib as well as risk of bleeding on oral anticoagulation. There are two types of patients subject to this study: those with a postoperative Afib diagnosis and receiving prophylactic exclusion of the left atrial appendage with the AtriClip device concomitant to cardiac surgery and those with a postoperative Afib diagnosis who are medically managed. The study provides for enrollment up to 2,000 patients at up to 40 medical centers. Enrollment began in February 2016, and there are currently 517 patients enrolled and twenty-three medical centers initiated. Enrollment is expected to end in 2018.

FROST. We are conducting a cryoanalgesia study, which is a non-IDE randomized pilot study evaluating whether intraoperative intercostal cryoanalgesia in conjunction with standard of care provides improved analgesic efficacy in patients undergoing unilateral thoracotomy cardiac procedures as compared to the current standard of care. The study involves treatment arm patients who receive intercostal cryoanalgesia in conjunction with standard post-operative pain management and control arm patients who receive standard post-operative pain management only. The study provides for enrollment of up to 100 patients at five medical centers. We began enrollment in June 2016, and there are currently 61 patients enrolled and four medical centers initiated.

CEASE AF. We are also pursuing a non-IDE trial in Europe to compare staged hybrid ablation treatment (minimally invasive surgical ablation procedure is first performed and the patient undergoes the intracardiac catheter procedure approximately 91-180 days later) versus catheter ablation alone. We expect the study to have an enrollment of approximately 210 patients at twelve sites. There are currently 90 patients enrolled and eleven medical centers initiated.

Our

To compete effectively, we strive to demonstrate that our products are an attractive alternative to other treatments by differentiating our products on the basis of safety, efficacy, performance, ease of use, reputation, service and price. We have encountered and expect to continue to encounter potential customersUnited States who prefer products offered by our competitors.

market their devices for a similar therapy.

Payment

6

may follow the coverage and payment policies for Medicare, Medicare’s coding, coverage and payment policies for cardiothoracic surgical procedures are significant to our business.

products even when multiple procedures are performed. Similar to surgical ablation for Afib or surgical LAAM, cryoablation performed for post-operative pain

post operative pain control.

used or pursuing specific reimbursement for utilization of our devices.

countries worldwide.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

total product lifecycle from early design, development and testing, to manufacturing and commercialization activities, as well as post-market surveillance and reporting, including corrective actions, removals and recalls. Unless an exemption applies, most medical devices distributed commercially in the United States require either 510(k) clearance or PMA from FDA.

7

510(k) Clearance Pathway.Pathway. To obtain 510(k) clearance, we must submit a notification to FDA demonstrating that our proposed device is substantially equivalent to a predicate device, i.e., a previously cleared and legally marketed 510(k) device or a device that was in commercial distribution before May 28, 1976, for which FDA has not yet called for the submission of a PMA. Any modification to a 510(k)-cleared device that would constitute a major change in its intended use, or a change in its design or manufacture that could significantly affect the safety or effectiveness of the device, requires a new 510(k) clearance or, possibly, in connection with safety and effectiveness, approval of a PMA. FDA requires every manufacturer to make the determination regarding a new 510(k) submission in the first instance, but FDA may review any manufacturer’s decision.

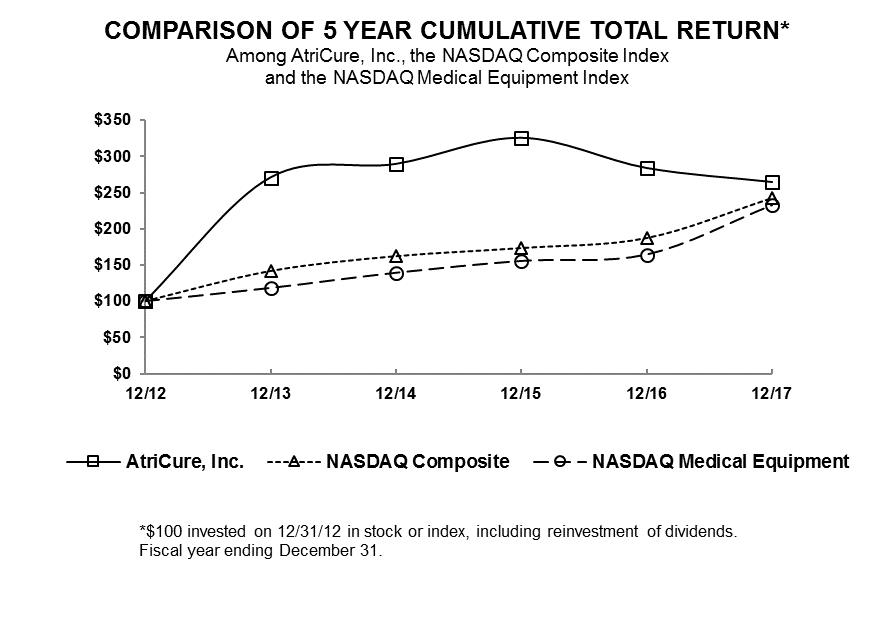

clearance. device. Accountability Act (HIPAA). In addition to FDA regulation, the advertising and promotion of certain medical devices are also regulated by the Federal Trade Commission and by state regulatory and enforcement authorities. health care program. The different, but the general trend is toward increasing regulation and greater requirements for the manufacturer to provide more bench testing and clinical evidence. In addition, regulatory agencies and authorities can halt distribution within the country or otherwise take action in accordance with local laws. payments are made. equipment on an ongoing basis. Order quantities and lead times for components purchased from outside suppliers are based on our forecasts derived from historical demand and anticipated future demand. Lead times may vary significantly depending on the size of the order, time required to fabricate and test the components, specific supplier requirements and current market demand for the components and Our attrition rate is historically lower than the industry average. AtriCure has a strong company culture, which is reflected in our employee engagement and overall success. manufacturing operations are highly centralized and disruption could harm our business. develop competing products, procedures and/or clinical solutions. There are few barriers to prevent new entrants or existing competitors from developing products to compete directly with ours. Companies also compete with us to attract qualified scientific, technical and business. We may experience unfavorable publicity relating to our business We rely upon single and limited source third-party suppliers and third-party Identifying and qualifying additional or replacement suppliers or sterilizers for any of the components used in our products or business, customer relations and financial condition. We spend considerable time and money complying with federal, state and foreign regulations in addition to FDA regulations, and, if we attention. We Due to the global nature of our business, we may be exposed to liabilities under the Foreign Corrupt Practices Act and various other anti-corruption laws, and any allegation or determination that we violated these laws could have a material adverse effect on our business. Credit Agreement. harm our ability to grow our business. threats. The The Company believes that its existing facilities are adequate to meet its immediate needs and that suitable additional space will be available in the future on commercially reasonable terms as needed. Price Range High Low 2017 First Quarter $ $ Second Quarter $ $ Third Quarter $ $ Fourth Quarter $ $ Price Range High Low 2016 First Quarter $ $ Second Quarter $ $ Third Quarter $ $ Fourth Quarter $ $ As of February Performance Graph 2023. 12/31/2013 12/31/2014 12/31/2015 12/31/2016 12/31/2017 AtriCure, Inc. $ $ $ $ $ NASDAQ Composite $ $ $ $ $ NASDAQ Medical Equipment $ $ $ $ $ Year Ended December 31, 2017 2016 2015 (1) 2014 2013 (2) (in thousands, except per share data) Operating Results: Revenue $ $ $ $ $ Gross profit Gross margin Net loss Basic and diluted net loss per share Weighted average shares outstanding Financial Position: Cash, cash equivalents and investments $ $ $ $ $ Working capital Total assets Long-term debt and capital leases Stockholders’ equity 2022 Year Ended December 31, 2017 2016 % of % of Amount Revenue Amount Revenue (dollars in thousands) Revenue $ % $ % Cost of revenue Gross profit Operating expenses: Research and development expenses Selling, general and administrative expenses Total operating expenses Loss from operations Other income (expense): Interest expense Interest income Other Other expense Loss before income tax expense Income tax expense — — Net loss $ % $ % major geographic regions. mix. domestic and international regulatory submissions drove a $2,389 increase in spending. second quarter of 2023. See Note 10 – Commitments and Contingencies for further information. Year Ended December 31, 2016 2015 % of % of Amount Revenue Amount Revenue (dollars in thousands) Revenue $ % $ % Cost of revenue Gross profit Operating expenses: Research and development expenses Selling, general and administrative expenses Total operating expenses Loss from operations Other income (expense): Interest expense Interest income Other Other income (expense) Loss before income tax expense Income tax expense — — Net loss $ % $ % Uses of liquidity and capital resources. Our executive officers and Board of Directors review our funding sources and future capital requirements in connection with our annual operating plan and periodic updates to the plan. Our principal cash requirements include costs of operations, capital expenditures, debt service costs and other contractual obligations. Our future capital requirements depend on a number of factors, including, SentreHEART acquisition. Subject to the terms and conditions of the SentreHEART merger agreement, such contingent consideration would be paid in AtriCure common stock and cash, up to a specified maximum number of shares. As of December 31, 2023, we believe the likelihood of payment is remote, and the estimated fair value of the contingent consideration is $0. See Note 2 – Fair Value. foreseeable future. Historical Cash Flow Activity.The following table Less than More than Contractual Obligations Total 1 year 1-3 years 3-5 years 5 years Long-term debt(1) $ $ — $ $ $ Capital leases(2) Operating leases(3) — Royalty obligations(4) — — — Restricted grants — — — Total contractual obligations $ $ $ $ $ Inflation has impacted our operating costs throughout 2023 and 2022. Continued increases in our cost of revenue may affect our ability to maintain our gross margin if the selling prices of our products do not increase commensurately, while continued increases in our operating expenses may adversely affect our operating results and the on historical experience, current conditions and other reasonable factors. Actual results could differ from those estimates under different assumptions or conditions. customers. We account for revenue in accordance with FASB ASC physically disposed. prior periods will be reversed. future periods. 16, 2024 2022 2017 2016 Assets Current assets: Cash and cash equivalents $ $ Short-term investments Accounts receivable, less allowance for doubtful accounts of $32 and $246 Inventories Other current assets Total current assets Property and equipment, net Long-term investments — Intangible assets, net Goodwill Other noncurrent assets Total Assets $ $ Liabilities and Stockholders’ Equity Current liabilities: Accounts payable $ $ Accrued liabilities Other current liabilities and current maturities of capital leases and long-term debt Total current liabilities Capital leases Long-term debt Other noncurrent liabilities Total Liabilities Commitments and contingencies (Note 10) Stockholders’ Equity: Common stock, $0.001 par value, 90,000 shares authorized and 34,586 and 33,342 issued and Additional paid-in capital Accumulated other comprehensive income (loss) Accumulated deficit Total Stockholders’ Equity Total Liabilities and Stockholders’ Equity $ $ (LOSS) INCOME 2021 2017 2016 2015 Revenue $ $ $ Cost of revenue Gross profit Operating expenses: Research and development expenses Selling, general and administrative expenses Total operating expenses Loss from operations Other income (expense): Interest expense Interest income Other Loss before income tax expense Income tax expense Net loss $ $ $ Basic and diluted net loss per share $ $ $ Weighted average shares outstanding – basic and diluted Comprehensive loss: Unrealized gain on investments $ $ $ Foreign currency translation adjustment Other comprehensive income (loss) Net loss Comprehensive loss, net of tax $ $ $ 2021 Accumulated Additional Other Total Common Stock Paid-in Accumulated Comprehensive Stockholders’ Shares Amount Capital Deficit Income (Loss) Equity Balance—December 31, 2014 Issuance of common stock through public offering — — Issuance of common stock under equity incentive �� — — Issuance of common stock under employee stock — — — Reclassification of non-employee option liability — — — — Share-based employee compensation expense — — — — Other comprehensive loss — — — — Net loss — — — — Balance—December 31, 2015 $ $ $ $ $ Issuance of common stock under equity incentive — — Issuance of common stock under employee stock — — — Share-based employee compensation expense — — — — Other comprehensive income — — — — Net loss — — — — Balance—December 31, 2016 $ $ $ $ $ Issuance of common stock under equity incentive — — Issuance of common stock under employee stock — — — Share-based employee compensation expense — — — — Other comprehensive income — — — — Net loss — — — — Balance—December 31, 2017 $ $ $ $ $ 2021 2017 2016 2015 Cash flows from operating activities: Net loss $ $ $ Adjustments to reconcile net loss to net cash used in operating activities: Share-based compensation expense Depreciation Amortization of intangible assets Amortization of deferred financing costs Loss on disposal of property and equipment and impairment of assets Realized (gain) loss from foreign exchange on intercompany transactions Amortization/accretion on investments Change in allowance for doubtful accounts Change in fair value of contingent consideration — Changes in operating assets and liabilities, net of amounts acquired: Accounts receivable Inventories Other current assets Accounts payable Accrued liabilities Other noncurrent assets and liabilities Net cash used in operating activities Cash flows from investing activities: Purchases of available-for-sale securities Sales and maturities of available-for-sale securities Purchases of property and equipment Proceeds from sale of property and equipment — — Increases in property under build-to-suit obligation — — Cash paid for nContact business combination — — Net cash provided by (used in) investing activities Cash flows from financing activities: Proceeds from debt borrowings — — Payments on debt and capital leases Proceeds from build-to-suit obligation — — Proceeds from economic incentive loan — — Payment of debt fees Proceeds from stock option exercises Shares repurchased for payment of taxes on stock awards Proceeds from issuance of common stock under employee stock purchase plan Payment of stock issuance fees — — Net cash provided by financing activities Effect of exchange rate changes on cash and cash equivalents Net (decrease) increase in cash and cash equivalents Cash and cash equivalents—beginning of period Cash and cash equivalents—end of period $ $ $ Supplemental cash flow information: Cash paid for interest $ $ $ Cash paid for income taxes Non-cash investing and financing activities: Accrued purchases of property and equipment Assets acquired through capital lease Capital lease asset early termination — — Stock issuance in business combinations — — Contingent consideration in business combinations — — STATEMENTS—(Continued) include demand deposits and money market funds with financial institutions. products. Revenue includes shipping and handling revenue of The Company does not maintain any post-shipping obligations to customers; no installation, calibration or testing of products is performed subsequent to shipment in order to render products operational. The Company expects to be entitled to the total consideration for the products ordered as product pricing is fixed, and there are no adjustments for a significant financing component as payment terms fall within one year. The Company excludes taxes assessed by governmental authorities on revenue-producing transactions from the measurement of the transaction price. liabilities. Recoveries are recognized when received as a reduction to the allowance for credit losses by decreasing bad debt expense. The following depreciated from three to seven years. The Company’s repair costs are expensed as incurred. The Company retires assets no longer in use. revenue. The Company reviews intangible assets for impairment at least annually or more often if impairment indicators are present using its best estimates based on reasonable and supportable assumptions and projections. lease term. See Note 9 – Leases for further discussion. Pounds, Australian Dollars and Canadian Dollars. 2017 2016 2015 Total accumulated other comprehensive loss at beginning of period $ $ $ Unrealized losses on investments Balance at beginning of period $ $ $ Other comprehensive income before reclassifications Amounts reclassified from accumulated other comprehensive income (loss) — — — Balance at end of period $ $ $ Foreign currency translation adjustment Balance at beginning of period $ $ $ Other comprehensive income before reclassifications Amounts reclassified from accumulated other comprehensive income (loss) Balance at end of period $ $ $ Total accumulated other comprehensive income (loss) at end of period $ $ $ Research and Development Costs—Research and development activities, as well as amortization of technology assets. Research and development costs are expensed as incurred. Clinical trial costs and other development costs incurred by third parties are expensed as contracted work is performed or over the expected service period. 2021. Effective January 1, 2023, the Company's policy was amended to account for forfeitures as they occur rather than estimating at the time of grant, and the effect on income from continuing operations and retained earnings is not significant. statements. Quoted Prices in Active Significant Significant Markets for Other Other Identical Observable Unobservable Assets Inputs Inputs (Level 1) (Level 2) (Level 3) Total Assets: Money market funds $ — $ $ — $ Commercial paper — — U.S. government agencies and securities — — Corporate bonds — — Total assets $ $ $ — $ Liabilities: Acquisition-related contingent consideration $ — $ — $ $ Total liabilities $ — $ — $ $ The following table represents the Company’s fair value hierarchy for its financial assets and liabilities measured at fair value on a recurring basis as of December 31, Quoted Prices in Active Significant Significant Markets for Other Other Identical Observable Unobservable Assets Inputs Inputs (Level 1) (Level 2) (Level 3) Total Assets: Money market funds $ — $ $ — $ Commercial paper — — U.S. government agencies and securities — Corporate bonds — — Total assets $ $ $ — $ Liabilities: Acquisition-related contingent consideration $ — $ — $ $ Total liabilities $ — $ — $ $ 2017 2016 2015 Beginning Balance $ — $ — $ Total loss included in earnings — — Exercises — — Ending Balance $ — $ — $ — 2022. 2017 2016 2015 Beginning Balance $ $ $ — Amounts acquired — — Changes in fair value included in earnings — Ending Balance $ $ $ Unrealized Gains Cost Basis (Losses) Fair Value Corporate bonds $ $ $ U.S. government agencies and securities Commercial paper — Total $ $ $ Unrealized Gains Cost Basis (Losses) Fair Value Corporate bonds $ $ $ U.S. government agencies and securities Commercial paper — Total $ $ $ 2017 2016 Estimated Accumulated Accumulated Useful Life Cost Amortization Cost Amortization Fusion technology 10 years $ $ $ $ Clamp & probe technology 3 years SUBTLE access technology 5 years IPR&D — — Total $ $ $ $ 2021. The following table summarizes the allocation of amortization expense of intangible assets: 2018 $ 2019 2020 2021 2022 2023 and thereafter Total $ 2017 2016 Raw materials $ $ Work in process Finished goods Inventories $ $ Estimated Useful Life 2017 2016 Generators and other capital equipment 1 - 3 years $ $ Building under capital lease 15 years Computer and other office equipment 3 years Machinery, equipment and vehicles 3 - 7 years Furniture and fixtures 3 - 7 years Leasehold improvements 5 - 15 years Construction in progress N/A Equipment under capital leases 3 - 5 years Total Less accumulated depreciation Property and equipment, net $ $ 2017 2016 Accrued commissions $ $ Accrued bonus Accrued payroll and employee-related expenses Sales returns and allowances Other accrued liabilities Accrued taxes and value-added taxes payable Accrued royalties Total $ $ approximately $28,750. 2018 $ 2019 2020 2021 2022 2023 and thereafter Total payments $ Imputed interest on capital lease obligations Net debt obligations, of which $561 is current and $36,861 is noncurrent $ 2018 $ 2019 2020 2021 2022 2023 and thereafter — Total $ Purchase Agreements. The Company enters into standard purchase agreements with business, generally with terms that allow cancellation. License Agreement, and that the Company did not provide related notices required under the License Agreement. The Company filed its Answering Statement and Counterclaims to the allegations in September 2022, denying each claim and counterclaiming for breach of contract, correction of inventorship, declaratory judgment, patent prosecution and legal fees. In May 2023, the Company entered into an Assignment and Agreement Regarding IDx and CCF Intellectual Property (Assignment Agreement) with Clinic and IDx. Pursuant to the Assignment Agreement, during the second quarter of 2023, the Company made a one-time payment of $33,400 to Clinic and IDx for the acquisition of patents and other intellectual property. The Assignment Agreement also required dismissal of the arbitration and release of payment for royalty obligations due to Clinic and IDx under the License Agreement after March 31, 2023. The amount paid, together with transaction costs, was allocated between the acquired intangible asset, the release of payment for royalty obligations and the settlement of the dispute. The intangible asset was assigned a value of $30,000 and is being amortized over an estimated useful life of 5 years. The release of the royalty obligations was valued at $432. The remaining $3,088 was allocated to the settlement and is included in selling, general and administrative expenses for the twelve months ended December 31, 2023. 2017 2016 Deferred tax assets (liabilities): Net operating loss carryforward $ $ Research and development and AMT credit carryforwards, net Equity compensation Accruals and reserves Inventories Intangible assets Property and equipment, net Other, net Subtotal Less valuation allowance Total $ $ — The Company’s provision for income taxes for each of the years ended December 31 is as follows: 2017 2016 2015 Current Tax Expense Federal $ — $ — $ State Foreign — Total current tax expense Deferred Tax Expense Federal $ $ $ State Foreign Change in valuation allowance Total deferred tax expense — — Total tax expense $ $ $ 2017 2016 2015 Federal tax at statutory rate % $ % $ % $ Federal tax rate change Federal R&D credit Federal NOL adjustment for ASU Valuation allowance State income taxes Foreign NOL rate change Foreign tax rate differential Permanent differences and other Effective tax rate % $ % $ % $ 2017 2016 2015 Balance at the beginning of the year $ $ $ Increases (decreases) for prior year tax positions — Increases (decreases) for current year tax positions — — — Increases (decreases) related to settlements — — — Decreases related to statute lapse — — — Balance at the end of the year $ $ $ 13. EMPLOYEE BENEFIT PLANS 2021. Stockholders approved the 2023 Plan at the 2023 Annual Meeting of Stockholders. Pursuant to its terms, the 2023 Plan supersedes and replaces the 2014 Stock Incentive Plan (Prior Plan). Activity under the plans during Weighted Weighted Average Number of Average Remaining Aggregate Shares Exercise Contractual Intrinsic Time-Based Stock Options Outstanding Price Term Value Outstanding at January 1, 2017 $ Granted Exercised Cancelled Outstanding at December 31, 2017 $ $ Vested and expected to vest $ $ Exercisable at December 31, 2017 $ $ Weighted Number of Average Shares Grant Date Restricted Stock Outstanding Fair Value Outstanding at January 1, 2017 $ Awarded Released Forfeited Outstanding at December 31, 2017 $ Weighted Weighted Average Number of Average Remaining Aggregate Shares Exercise Contractual Intrinsic Performance Stock Options Outstanding Price Term Value Outstanding at January 1, 2017 $ Granted — — Exercised — — Cancelled — — Outstanding at December 31, 2017 $ $ Exercisable at December 31, 2017 $ $ Weighted Weighted Average Number of Average Remaining Aggregate Shares Exercise Contractual Intrinsic Time-Based Stock Options Outstanding Price Term Value Outstanding at January 1, 2016 $ Granted Exercised Cancelled Outstanding at December 31, 2016 $ $ Vested and expected to vest $ $ Exercisable at December 31, 2016 $ $ Weighted Number of Average Shares Grant Date Restricted Stock Outstanding Fair Value Outstanding at January 1, 2016 $ Awarded Forfeited Released Outstanding at December 31, 2016 $ Weighted Weighted Average Number of Average Remaining Aggregate Shares Exercise Contractual Intrinsic Performance Stock Options Outstanding Price Term Value Outstanding at January 1, 2016 $ Granted — — Exercised — — Cancelled — — Outstanding at December 31, 2016 $ $ Exercisable at December 31, 2016 $ $ The total intrinsic value of options exercised during the years ended December 31, Employee Stock Purchase Plan 2017 2016 2015 Cost of revenue $ $ $ Research and development expenses Selling, general and administrative expenses Total $ $ $ 2017 2016 2015 Risk-free interest rate 1.75 - 2.12 % 1.06 - 2.02 % 1.30 - 1.96 % Expected life of option (years) 5.21 to 5.76 5.27 to 7.10 5.20 to 6.89 Expected volatility of stock 43.00 - 48.00 % 46.00 - 51.00 % 46.00 - 67.00 % Weighted-average volatility % % % Dividend yield % % % 2017 2016 2015 Stock options $ $ $ Restricted stock Price Fair Value of Fair Value of Target 2012 Grant 2014 Grant Tranche 1 $ $ $ Tranche 2 Tranche 3 Tranche 4 Tranche 5 Tranche 6 Tranche 7 Tranche 8 Tranche 9 2017 2016 2015 United States $ $ $ Europe Asia Other international Total international Total revenue $ $ $ 2017 2016 2015 Open-heart ablation $ $ $ Minimally invasive ablation AtriClip devices Total ablation and AtriClip devices Valve tools Total United States $ $ $ 2017 2016 2015 Open-heart ablation $ $ $ Minimally invasive ablation AtriClip devices Total ablation and AtriClip devices Valve tools Total international $ $ $ For the Three Months Ended March 31, June 30, September 30, December 31, 2017 2016 2017 2016 2017 2016 2017 2016 Operating Results: Revenue $ $ $ $ $ $ $ $ Gross profit Loss from operations Net loss Net loss per share (basic and diluted) $ $ $ $ $ $ $ $ Beginning Ending Balance Additions Deductions Balance Reserve for sales returns and allowances Year ended December 31, 2017 $ $ $ $ Year ended December 31, 2016 Year ended December 31, 2015 Allowance for inventory valuation Year ended December 31, 2017 $ $ $ $ Year ended December 31, 2016 Year ended December 31, 2015 Valuation allowance for deferred tax assets Year ended December 31, 2017 $ $ — $ $ Year ended December 31, 2016 — Year ended December 31, 2015 — 2023. is incorporated herein by reference. Statement under the heading “Corporate Governance Guidelines—Code of Conduct” and is incorporated herein by reference. Number of securities Weighted-average Number of securities remaining Plan Category (a) (b) (c) Equity compensation plans approved by $ Equity compensation plans not approved by — — — Total $ 3.2 4.1 23.1 31.1 31.2 32.1 32.2 101.INS XBRL Instance Document 101.SCH XBRL Taxonomy Extension Schema Document 101.CAL XBRL Taxonomy Extension Calculation Linkbase Document 101.DEF XBRL Taxonomy Definition Linkbase Document 101.LAB XBRL Taxonomy Extension Label Linkbase Document 101.PRE XBRL Taxonomy Extension Presentation Linkbase Document Date: February /s/ Michael H. Carrel Michael H. Carrel President and Chief Executive Officer (Principal Executive Officer) Date: February /s/ (Principal Accounting and Financial Officer) /s/ Michael H. Carrel Michael H. Carrel Michael H. Carrel Director, President and Chief Executive Officer (Principal Executive Officer) /s/ Regina E. Groves Regina E. Groves Regina E. Groves Director Director /s/ Sven A. Wehrwein Sven A. Wehrwein Sven A. Wehrwein Director /s/ Robert S. White Robert S. White Robert S. White DirectorPathway.Pathway. A PMA must be submitted to FDA if the device cannot be cleared through the 510(k) process and is not otherwise exempt. A PMA must be supported by extensive data, including but not limited to technical, preclinical, clinical, real-world data, manufacturing and labeling, to demonstrate the safety and effectiveness of the device for its intended use. AfterA PMA supplement is required for changes affecting the safety or effectiveness of a PMA is submitted and FDA has determined that the application is sufficiently completePMA-approved device, including but not limited to permitnew indications for use, a substantive review, FDA will accept the application for filing. During the review period, FDA may request additional information or clarification of the information already provided. Also, an advisory panel of experts from outside FDA may be convened to review and evaluate the application and provide recommendations to FDA as to the approvability of the device. In addition, FDA will conduct a preapproval inspection of thedifferent manufacturing facility, to ensure compliance with quality system regulations. Any approvals we receive may be limitedor changes in scope or may be contingent upon further post-approval study commitments or other conditions. New PMAs or PMA supplements are required for significant modification to the device, including indicated use, manufacturing process, labeling, andor design of a device that is approved through the premarket approval process. PMA supplements often require submissionspecifications or components of the same type of information as a PMA, except that the supplement is limited to information needed to support any changes from the device covered by the original PMA and may not require as extensive clinical data or the convening of an advisory panel.Trials.Trials. Clinical trials are required to support a PMA and are sometimes required for 510(k) clearance. Clinical trials are subject to extensive recordkeeping and reporting requirements. Our clinical trials must be conducted under the oversight of an Institutional Review Board (IRB) for the relevant clinical trial sites and must comply with FDA regulations, including, but not limited to, those relating to current good clinical practices. We are also required to obtain the written informed consent of patients in form and substance that complies with both FDA requirements and other humanhuman subject protection regulations. Similarly, in Europe, the clinical study must be approved by a local ethics committee and, in some cases, including studies with high-risk devices, by the ministry of health in the applicable country.Grants.Grants. FDA regulates manufacturers of medical devices and, in particular, the promotion of medical devices by manufacturers.manufacturers and prohibits the promotion by manufacturers of uses that are not within the approved or cleared labeling of the device. FDA does not regulate the practice of medicine or the conduct or content of medical education conducted by third parties.parties, which may include uses that are not within approved or cleared device labeling. Manufacturers may provide unrestricted financial support for suchindependent third-party medical education programs in the form of educational grants intended to offset the cost of such programs. If the manufacturer controls or unduly influences the content of such programs, FDA considers those programs to be promotional activities by the manufacturer and thus subject to FDA regulation including promotional restrictions. We seek to ensure that the activities we support pursuant to our educational grants program areis conducted in accordance with FDA criteria for independent educational activities. However, we cannot provide an assurance that FDA or other government authorities would view the third-party programs we have supported as being independent.Regulation.Regulation. There are numerous regulatory requirements that apply after a product is cleared or approved. These include:·FDA’s Quality System Regulation (QSR) which requires manufacturers, including third-party manufacturers,approved by FDA, including, but not limited to: annual establishment registration and product listing; current good manufacturing practice for devices (GMP); labeling requirements and advertising and promotion guidelines; assessing the significance of any changes to follow stringent design, testing, control, documentation and other quality assurance procedures during all aspects of the manufacturing process;·labeling regulations and FDA prohibitions against the false or misleading promotion or the promotion of products for uncleared, unapproved or off-label use or indication;·requirements to obtain clearance or approval of product modifications that could significantly affect safety or efficacy or that would constitute a major change in intended use;·medical device reporting regulations which require that manufacturers comply with reporting requirements of FDA and report if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if the malfunction were to recur;·post-approval restrictions or conditions, including post-approval study commitments;·post-market surveillance regulations which apply when necessary to protect the public health or to provide additional safety and effectiveness data for the device; and·requirements to issue notices of correction or removal, or conduct market withdrawals or recalls where quality or other issues arise.Under FDA’s MedWatch regulation, we must submit a Medical Device Report (MDR)device; monitoring and reporting serious and adverse events and certain device malfunctions; and reporting certain device corrections and removals. Our manufacturing facilities and processes are also subject to FDA within 30 days whenever we receive information that reasonably suggests that one of our products may have caused or contributedinspections to a death or serious injury, or that one of our products malfunctioned in a manner which, if the malfunction were to recur, could cause or contribute to a death or8serious injury. Our products are often used to treat very ill patients in highly complex surgeries, only a small portion of which may involve our products, and it is frequently difficult to determine whether our products caused or contributed to a patient injury or death that occurred during or after the procedure. If we are able to determine that our product caused or potentially contributed to a death or serious injury in the particular case, or that a malfunction of the type reported would cause death or serious injury, we submit an MDR on the case. Other incidents, including serious injuries or deaths, which occurred during procedures utilizing our products and that are not the subject of MDRs, may occur either because we are not aware of those incidents or because our investigation determined that the incident did not involve a malfunction of an AtriCure device and/or that an AtriCure device did not cause or contribute to a serious injury or death.Recently, someOn occasion, promotional activities for FDA-regulated products have beencan be the subject of enforcement action brought under healthcare reimbursement laws and consumer protection statutes. In addition, under the Federal Lanham Act and similar state laws, competitors and others can initiate litigation relating to advertising claims.We have registered with FDA as a medical device manufacturer and listed our devices. FDA has broad post-market and regulatory enforcement powers. We are subject to unannounced inspections by FDA and our Notified Body to determine our compliance with the QSR, the European Union’s Medical Device Directive (MDD) and other regulations. Such inspections may include the manufacturing facilities of our suppliers.Claims.Claims. We are directly and indirectly subject to various federal and state laws governing our relationship with healthcare providers and pertaining to healthcare fraud and abuse, including anti-kickback laws.providers. In particular, the federal healthcare program Anti-Kickback Statute is a federal criminal law that applies broadly and prohibits persons from knowinglythe knowing and willfully soliciting, offering, receivingwillful offer or providingpayment of remuneration directly or indirectly, in exchange for or to induce either the referral of an individual,or reward patient referrals or the furnishing, arranging for or recommending a goodgeneration of business involving any item or service for which payment may be made in whole or part underpayable by a federal healthcare programs, such as the Medicare and Medicaid programs.Federalfederal False Claims Act (FCA) imposes civil liability on any person or entity that submits, or causes the submission of, a false or fraudulent claim to the United States Government.government. Damages under the FCA consist of the imposition of fines and penalties and can be significant. The FCA also allows a private individual or entity with knowledge of past or present fraud against the federal government to sue on behalf of the government to recover the civil penalties and treble damages. The U.S. DepartmentJustice (DOJ), on behalf of the government, has previously alleged that the marketing and promotional practices of pharmaceutical and medical device manufacturers included the off-label promotion of products or the payment of prohibited kickbacks to doctors violated the FCA resulting in the submission of improper claims to federal and state healthcare entitlement programs such as Medicaid. In certain cases, manufacturers have entered into criminal and civil settlements with the federal government under which they entered into plea agreements, paid substantial monetary amounts and entered into corporate integrity agreements that require, among other things, substantial reporting and remedial actions going forward.The Advanced Medical Technology Association (AdvaMed) is one of the primary, a voluntary United States trade associationsassociation for medical device manufacturers. This association has established guidelines and protocols for medical device manufacturers in their relationships with healthcare professionals on matters including research and development, product training and education, grants and charitable contributions, support of third-party educational conferences and consulting arrangements. Adoption of the AdvaMed Code of Ethics for Interactions with Healthcare Professionals (the “AdvaMed Code”) by a medical device manufacturer is voluntary, and while the Office of the Inspector General and other federal and state healthcare regulatory agencies encourage its adoption and may look to the AdvaMed Code, they do not view adoption of the AdvaMed Code as proof of compliance with applicable laws. We have adopted the AdvaMed Code and incorporated its principles in our standard operating procedures, sales forceemployee training programs and relationships with medical professionals. In addition, we have conducted training sessions for employees on these principles.States.States:different. and voluntary standards regulate the design, manufacture and labeling of medical devices. Devices may only be placed on the marketdevices, and more stringent conformity assessment requirements have been put in the European Union if they complyplace with the essential requirements of a relevant directive and bear the CE mark. Manufacturers must demonstrate that their devices comply with the relevant essential requirements through a conformity assessment procedure.2017 Medical Device Regulation, effective May 26, 2021. The method for assessing conformity varies depending on the type and class of the product, but normallytypically involves a combination of self-assessment by the manufacturerquality system assessment and a third-party product conformitywill includeincludes a review of documentation relatingrelated to the device andthat may consist of an audit ofbe as extensive as the documentation requirements that the United States FDA requires for higher risk products. The notified body also audits the manufacturer’s quality system and specificperforms a detailed review of the testing of the manufacturer’s device. Successful completion of a conformity assessment procedure allows a manufacturer to issue a declaration of conformity with the requirements of the relevant directive and affix the CE mark to the device. Devices that bear the CE mark may be commercially distributed throughout the member states of the European Union and other countries that comply with or mirror the medical device directives. Aregulations.has granted us a certificatefor CE marking, including, but not limited to: labeling, advertising and promotion, reporting of device modifications, monitoring the safety of the product and performing corrections and removals when necessary, maintaining “state of the art” requirements for the devices through compliance with the International Organization for9Standardization, (ISO) 13485:2003 Quality Management System. Compliance with this standard establishes the presumption that our quality system conformsand individual device certificates on a periodic basis.essential requirementslaws of the jurisdictions where those physicians reside or practice, or where the relevant directive. We have successfully completed the conformity assessment procedure and affixed the CE mark to our Isolator Synergy clamps, Isolator Synergy pens, Coolrail linear pen, cryosurgery devices, AtriClip LAA Exclusion System, COBRA Fusion Ablation System, Numeris System and the EPi-Sense Guided Coagulation System with VisiTrax technology.patentsknow-how and related technology of importance to the commercialization of our products. For example, toTo continue developing and commercializing our current and future products, we may license intellectual property from commercial or academic entities to obtain the rights to technology that is required for our research, development and commercialization activities.facilityfacilities in Ohio, and our products are sterilized by third parties. Purchased components are generallyoften sourced from a single supplier, but alternatives to critical suppliers are available from more than one supplier. However, some products, such as our RF generatorsin the event this would be needed.Fusionraw materials specific to the respective part or device. We assess tooling and EPi-Sense products, are critical components of our RF ablation lines and there are relatively few alternative sources of supply available.subassemblies.raw materials. To date, we have not experienced significant delays inproduct availability or delay issues directly related to obtaining any of our components.ISOInternational Organization of Standardization (ISO) standards. We are an FDA-registered medical device manufacturer and certified to ISO 13485:2003.2016. We routinely conduct internal audits of our quality systems in accordance with various international standards. In addition, we have successfully participated in the Medical Device Single Audit Program (MDSAP) and have been certified accordingly. The MDSAP program is recognized in Australia, Brazil, Canada, Europe, Japan and the United States.Consulting Relationshipshave developed consulting relationships with scientistscontinuously evaluate, modify and physicians throughout the worldenhance our internal processes to increase employee engagement, productivity and efficiency, as well as to recruit new employees to support our growth. Recognizing the significance of our employees to our success, in 2022 we introduced a “people objective” to our annual incentive plan focused on attraction, development and retention of talent, in addition to strategic Diversity, Equity and Inclusion (DE&I) initiatives.development, clinical trials through healthcare partnershipstrainingethnically diverse groups, while collaborating with our partners to engage communities to promote heart health awarenesseducation programs.programs by fostering employee understanding, intentionality and measurable processes. This commitment is also reflected in the current makeup of our Board of Directors, which helps to set the “tone at the top” for our DE&I initiatives.work closely with these thought leadersare committed to understand unmet needsregularly analyzing and emerging applications forevaluating the treatmenteffectiveness of Afib. Our physician consulting agreementsour compensation and benefit programs and benchmarking our programs against the market and our industry peers. Annual pay increases and other forms of incentive compensation are intendedbased on performance and market evaluation. Performance expectations are communicated to satisfyemployees at the requirementstime of the personal services “Safe Harbor” regulationhiring, as well as the AdvaMedupon internal transfer or promotion, and Eucomed Codes. As such, they providedocumented through our annual performance management process.payment ofeligible U.S.-based employees include medical, dental and vision insurance; paid leave for vacation, illness and volunteer time; parental leave, fertility and adoption assistance; a fair market value fee only for legitimate services rendered401(k) retirement plan that includes a company matching contribution; a stock purchase plan enabling employees to us.purchase AtriCure stock at a reduced price; and life and disability insurance. Our international employee benefits vary due to local regulations and offerings. We do not expect or require the consultant to utilize or promote our products,ensure compliance with all statutory and consultants are required to disclose their relationship with us as appropriate,mandatory benefits which vary by country, such as when publishing an article in which onemedical, disability, retirement/pension, workers compensation, accident, social benefits and paid leave. None of our products is discussed. Amounts paid to physicians in the United Statesemployees are disclosed by us in annual reports submitted to CMS under the federal “Open Payments” law.10EmployeesWe had approximately 570 full-time employees as of January 31, 2018. None of the employees were represented by a labor union, or covered by a collective bargaining agreement. Weand we have never experienced any employment-related work stoppages andstoppages. We consider our employee relations to be in good standing. Relating To Businesswill depend,depends in large part on the medical community’s acceptance of our principal products in the United States, which is the largest revenue market in the world for medical devices. Our ablation and LAAM product sales in the United States generate the majority of our revenue. We expect that sales of these products will continue to account for a majority of our revenue for the foreseeable future and that our future revenue will depend on the increasing acceptance by the medical community of our products as standard of care for treating Afib, managing the LAA and managing pain with Cryo Nerve Block therapy. The U.S. medical community’s acceptance of our products will depend upon our ability to demonstrate the safety and efficacy, advantages, long-term clinical performance and cost-effectiveness of our products as compared to other products. In addition, acceptance of products for the treatment of Afib is dependent upon, among other factors, the level of screening for Afib general awareness and education of the medical community about the surgical treatment of Afib and the existence, effectiveness and safety of our products. Market acceptance and adoption of our products for the treatment of Afib also depends on the level of health insurer (including Medicare) reimbursement to physicians and hospitals for the use ofprocedures using our products.We cannot predict whether the U.S. medical community will accept our products or, if accepted, the extent of their use. Negative publicity resulting from incidents involving our products, otheror similar products related to those we sell or products or procedures subject to our clinical trials could have a significant adverse effect on the overall acceptance of our products. If we encounter difficulties growing the market for our products in the U.S., we may not be able to increase our revenue enough to achieve or sustain profitability, and our business and operating results will be seriously harmed.We rely onablation-related andimplantable devices, other surgical ablation devices, other products or techniques to occlude the left atrial appendage managementor other products as our primary sources of revenue. If we are not successful in selling these products, or if these products become obsolete, our operating results will be harmed.Our ablation and ablation-related products, along with our left atrial appendage management products, generate a large majority of our revenue. We expect that sales of these products will continuetechniques to account for a majority of our revenue for the foreseeable future and that our future revenue will depend on the increasing acceptance by the medical community of our products as a standard surgical treatment of Afib. We may not be able to maintain or increase market acceptance of our products for a number of additional reasons, including those set forth elsewhere in this “Risk Factors” section. In addition, ourmanage post-operative pain. Our products may become obsolete prior to the end of their anticipated useful lives, or we may introduce new products or next-generation products prior to the end of the useful life of a prior generation,our current products, either of which may require us to dispose of existing inventory and related capital equipment and/or write off their value or accelerate their depreciation. Since we believe that physicians are using our ablation and ablation-related products largely for the surgical treatment of Afib, if physicians do not use our products to treat Afib, we would lose substantially all of our revenue.Competition from existing and new products and procedures may decrease our market share and cause our revenue to decline.The medical device industry, including the market for the treatment of Afib, is highly competitive, subject to rapid technological change and significantly affected by new product introductions and promotional activities of its participants. There is no assurance that our products will compete effectively against drugs, catheter-based ablation, implantable devices, other ablation systems,In addition, other products or techniques to exclude the left atrial appendage, or other surgical Afib treatments, which may be more well-established among doctors and hospitals. In addition, such other products or techniques may be sold or implemented at lower prices. Due to the size of the Afib and LAA exclusionour markets, and the unmet need for an Afib cure, we anticipate that new or existing competitors may11technicalcommercial personnel as well as funding. SomeMost of our competitors and potential competitors have greater financial, manufacturing, marketing and research and development capabilities than we have, and may obtain FDA approval or clearance for their products before we do.products. In 2023, Medtronic announced the FDA clearance of the Penditureof our competitors obtaining FDA approvals or clearances, such as Medtronic's Penditure device, may result in price reductions, reduced margins, loss of market share, or may render our products obsolete, which could adversely affect our revenue and future profitability.Worldwide economic conditionsreduce demand for procedures usingnot be positive, and our current and planned clinical trials may not satisfy the requirements of the FDA or other regulatory authorities.otherwise result in the failure of the clinical trial. Conducting successful clinical studies may require the enrollment of large numbers of clinical sites and patients, and suitable patients may be difficult to identify and recruit. Patient enrollment in clinical trials and completion of patient participation and follow-up depends on many factors, including the size of the patient population; the nature of the trial protocol; the attractiveness of, or the discomforts and risks associated with, the treatments received by enrolled subjects; the availability of appropriate clinical trial investigators, support staff, and proximity of patients to clinical sites; and the ability to comply with the eligibility and exclusion criteria for participation in the clinical trial and patient compliance.implicationseffect on our business, operatingoperations. Turnover among our independent distributors, even if replaced, may adversely affect our short-term financial results while we transition to new independent distributors or direct sales personnel. The ability of these independent distributors to market and sell our products could also be adversely affected by unexpected events, including, but not limited to, power failures, nuclear events, local economic and political conditions, natural or other disasters and war or terrorist activities. In addition, the ability of our independent distributors to borrow money from their existing lenders or to obtain credit from other sources to purchase our products may be impaired or our independent distributors could experience a significant change in their liquidity or financial condition.General worldwidecondition, all of which could impair their ability to distribute our products and eventually lead to distributor turnover, and may adversely impact our sales.conditions may deteriorate due todownturn as a result of the collateral effects of among other developments, general credit market crises, collateral effects on the finance and banking industries, concerns about inflation,inflationary pressures, increases in interest rates, slower economic activity, whicha future outbreak of COVID-19 or a similar infectious disease, among other factors, may be caused by many factors, including natural disasters or other catastrophes, decreased consumer confidence, reduced corporate profits and capital spending, adverse business conditions and liquidity concerns. We are unable to predict the extent to which current or future worldwide economic conditions mayadversely impact our business. Specifically, because many procedures usingimpacts to procedure volumes and hospital staffing may result in reductions of our revenue and materially and adversely affect our results of operations and cash flows. Geopolitical issues around the world have impacted the global supply chain and could materially adversely affect global economic growth, disrupt discretionary spending habits and generally decrease demand for our products are elective, they can be deferred by patients. In addition, patients may not be as willing under current or future economic conditions to take time off from work or spend their money on deductibles and co-payments often required in connection with the procedures that use our products.Beyond patient demand, any current or future deterioration in worldwide economic conditions, including in particular their effects on the credit and capital markets, may have other adverse implications for our business. For example, ourservices. Our customers’ ability to borrow money from their existing lenders or to obtain credit from other sources to purchase our products may be impaired,Although we maintain allowances for estimated losses resultingWe may experience diversion of healthcare resources away from the inabilityconduct of clinical trials, including the diversion of hospitals serving as our customersclinical trial sites. We may also encounter interruption or delays in the operations of FDA or other regulatory authorities, which may impact review and approval timelines. We are unable to make required payments, we cannot guarantee that we will accurately predict the loss rates we will experience, especially given any continuing turmoil in theextent to which current or future worldwide economy. A significant change in the liquidity or financial condition ofeconomic conditions may impact our customers could cause unfavorable trends in our receivable collections and additional allowances may be required, which could adversely affect our operating results. Further, given the economic and political challenges facing Eurozone countries, concerns have been raised regarding the stability and suitability of the Euro as a single currency. The failure of the Euro as a single currency could adversely affect our operating results.We face significant uncertaintythe industry duegovernmental and third-party payors’ policies toward coverage and reimbursement for surgical procedures would harm our ability to government healthcare reform. The U.S. Patient Protectionpromote and Affordable Care Act (PPACA), as amended, and other healthcare reform have a significant impact onsell our business. The impact of the PPACA on the healthcare industry is extensive and includes, among other things, the federal government assuming a larger role in the healthcare system, expanding healthcare coverage of United States citizens and mandating basic healthcare benefits. The PPACA impacted our business by requiring an excise tax on all U.S. medical device sales beginning in January 2013. In December 2015, the U.S. government approved the suspension of the excise taxproducts.sales beginning January 1, 2016 through December 31, 2017. Then,companies to reduce their prices. Even to the extent that the use of our products is reimbursed by private payors and governmental payors, adverse changes in January 2018,payors’ policies toward coverage and reimbursement for surgical procedures would also harm our ability to promote and sell our products. Payors continue to review their policies and can, without notice, deny coverage for treatments that include the U.S. government approved an additional suspensionuse of the excise tax on medical device sales from January 1, 2018 to December 31, 2019. When in effect, the increased tax burden from the PPACA significantly impacts our results of operationsproducts. Because each third-party payor individually approves coverage and cash flows.It is possible that legislation willreimbursement, obtaining these approvals may be introducedtime-consuming and passed by the Republican-controlled Congress repealing the PPACA in whole or in part and signed into law. Because of the continued uncertainty about the implementation or continued effectiveness of the PPACA, including the potential for further legal challenges or repeal of that legislation, we cannot quantify or predict with any certainty the likely impact of the PPACA or its repeal on our business model, prospects, financial condition or results of operations.Any healthcare reforms enacted in the futurecostly. In addition, third-party payors may like the PPACA, be phased in over a number of years but, if enacted, could reduce our revenue, increase our costs or require us to reviseprovide scientific and clinical support for the waysuse of our products. Adverse changes in coverage and reimbursement for surgical procedures could harm our business and reduce our revenue.conduct business or put us at risk for losssell our products, and these efforts are expected to continue. To the extent that the use of12business. In addition, our results of operations, financial position and cash flows could be materially adversely affected by changesdevices has historically received reimbursement under a foreign healthcare payment system, such reimbursement, if any, has typically been significantly less than the PPACA and changes under any federal or state legislation adoptedreimbursement provided in the future. We sellUnited States. If coverage and adequate levels of reimbursement from governmental and third-party payors outside of the United States are not obtained and maintained, sales of our products outside of the United States may decrease, and we are subjectmay fail to various regulatory and other risks relating to international operations, which could harm our revenue and profitability.Doing businessachieve or maintain significant sales outside of the United States exposes us to risks distinct from those we face in our domestic operations. For example, our operations outside of the United States are subject to different regulatory requirements in each jurisdiction where we operate or have sales. Our failure, or the failure of our distributors, to comply with current or future foreign regulatory requirements, or the assertion by foreign authorities that we or our distributors have failed to comply, could result in adverse consequences, including enforcement actions, fines and penalties, recalls, cessation of sales, civil and criminal prosecution, and the consequences could be disproportionate to the relative contribution of our international operations to our results of operations. Moreover, if political or economic conditions deteriorate in these countries, or if any of these countries are affected by a natural disaster or other catastrophe, our ability to conduct our international operations or collect on international accounts receivable could be limited and our costs could be increased, which could negatively affect our operating results. Engaging in business outside of the United States inherently involves a number of other difficulties and risks, including, but not limited to:

States.·export restrictions and controls relating to technology;