_________________________________

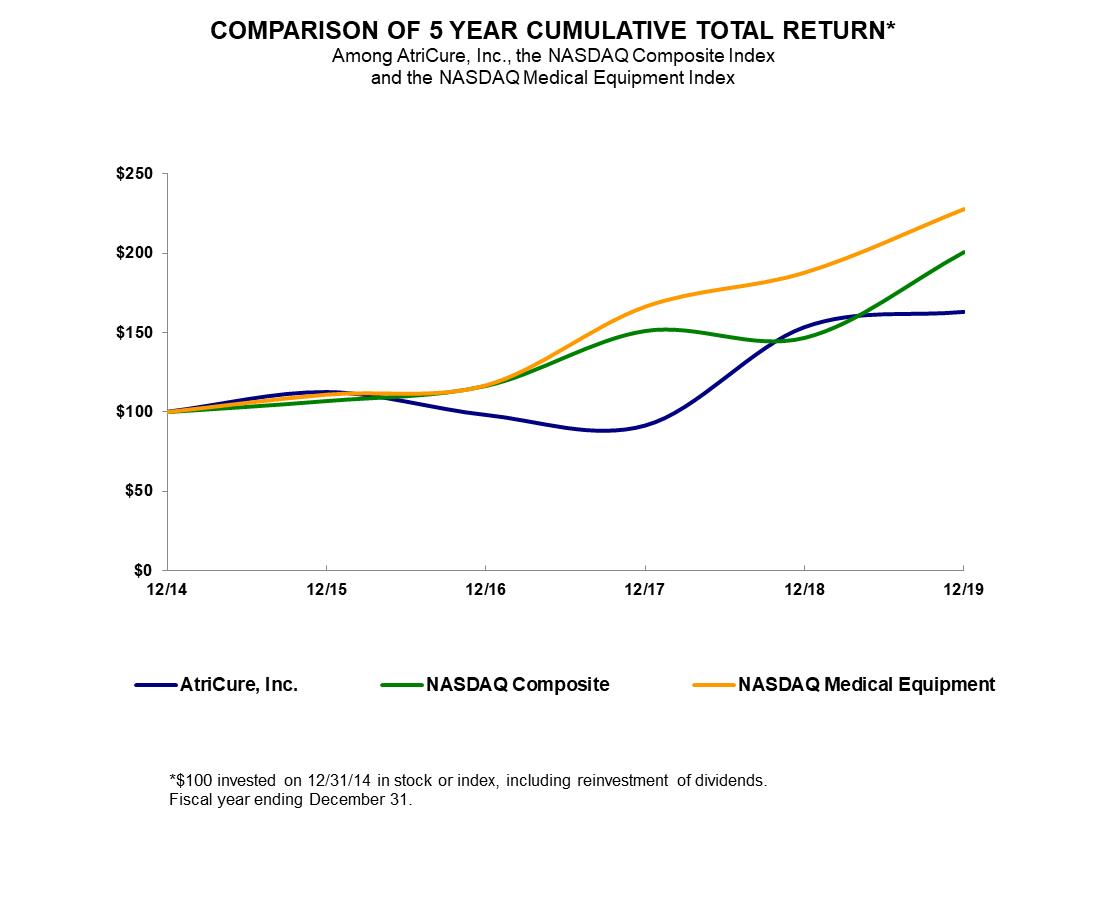

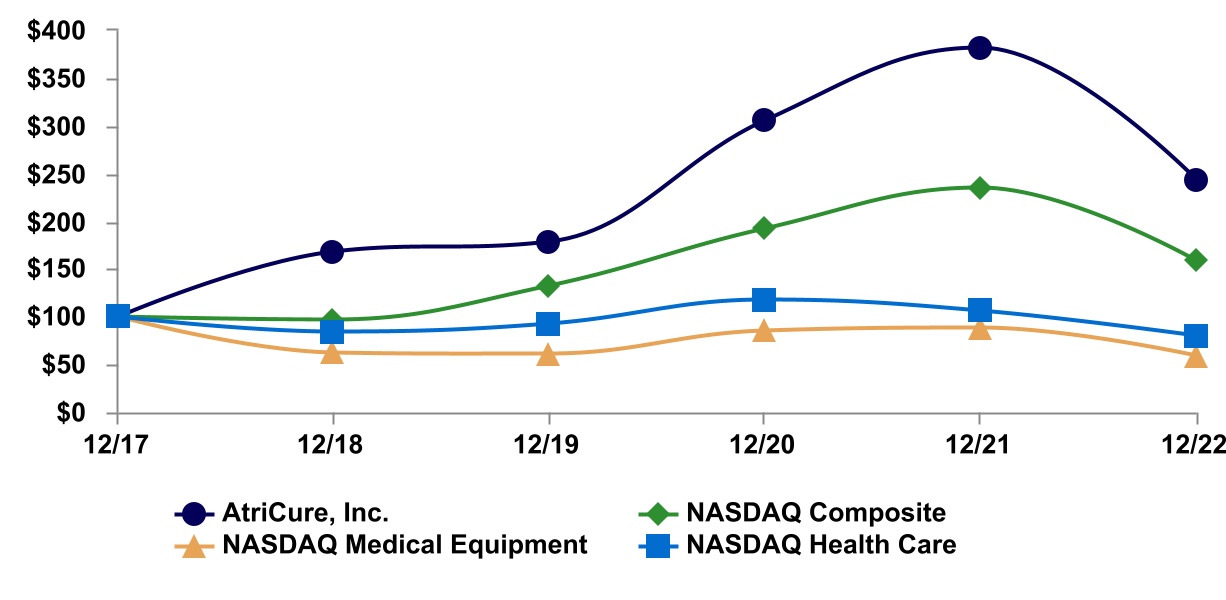

2022 Delaware 34-1940305 7555 Innovation Way, Mason, OH 45040 (Address of principal executive offices) (Zip Code) Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, $.001 par value ATRC NASDAQ Global Market Class Outstanding February 17, 2023 Common Stock, $.001 par value SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS globally. manner that will cure them. In addition, Afib is thought to be responsible for approximately 15% to 20% of the estimated 800,000 strokes that occur annually in the United States. According to the American Heart Association, the risk of stroke is five times higher in people with Afib. Studies have also suggested that 90% of clots that cause strokes in patients who have Afib originate from within the LAA. Recently, a very large independent international randomized trial, Left Atrial Appendage Occlusion Study (LAAOS) III, demonstrated a significant reduction in strokes when the LAA was managed during cardiac surgery. Afib accounts for billions of dollars in hospitalization-related and office visit costs in the United States each year. Indirect costs, such as the management of Afib-related strokes, are also believed to be significant. Because of the risk of stroke and the significant cost burden on the healthcare system, more and more surgeons are routinely addressing the LAA, both in patients who have Afib, but also in those who do not have Afib but may be at increased risk of developing the disease in the future. We believe that our AtriClip system is safer, more effective and easier to use than other products and techniques for excluding the LAA during cardiac surgery. Therefore, we believe that the market for our ablation products and the AtriClip system represent a significant growth opportunity. addiction to prescription narcotics, making alternative, non-opioid pain management modalities, such as other benefits. AtriClip System. The AtriClip® reusable cardiac surgery instruments. In the United States, a significant risk device requires the prior submission of an application for an Investigational Device Exemption (IDE) to FDA for approval before initiating a clinical trial. Clinical trials are required to support a pre-market approval (PMA) and are sometimes required for 510(k) clearance. Some trials require a feasibility study followed by a pivotal trial. In April 2022, FDA approved the protocol for the Left Atrial Appendage Exclusion for Prophylactic Stroke Reduction (LeAAPS) IDE clinical trial. The trial is designed to evaluate the effectiveness of prophylactic LAA exclusion using the AtriClip LAA Exclusion System for the prevention of ischemic stroke or systemic arterial embolism in cardiac surgery patients without pre-operative AF diagnosis who are at risk for these events. This prospective, multicenter, randomized trial evaluates safety at 30 days post-procedure to demonstrate no increased risk with LAA exclusion during cardiac surgery and effectiveness with a minimum follow-up of five years post procedure for all subjects. The trial provides for enrollment of up to 6,500 subjects at up to 250 sites worldwide. Site initiation and enrollment is ongoing. DEEP AF Pivotal clinical trials. Sales, Marketing and Medical Education a similar therapy. Physicians are reimbursed for their services separately under the Medicare Part B physician fee schedule. When performing a surgical cardiac ablation with and without a concomitant open-heart procedure, surgeons report Current Procedural Terminology (CPT) codes to receive a professional fee payment. Multiple CPT codes may be reported by a physician during a procedure if multiple procedures are performed. There are category one CPT codes for both concomitant and standalone surgical Afib Pervasive and Continuing Regulation. There are numerous regulatory requirements that apply after a product is cleared or approved by removals. Our manufacturing facilities and processes are also subject to FDA inspections to ensure compliance with QSR. professionals. Afib and other diseases and conditions. components, specific supplier requirements and current market demand for the components and subassemblies. To date, we have not experienced significant product availability or delay issues directly related to obtaining any of our components. harmed, and we may not achieve or sustain profitability. results. products to compete directly with ours. Companies also compete with us to attract qualified scientific and technical personnel as well as funding. Most of our competitors and potential competitors have greater financial, manufacturing, marketing and research and development capabilities than we have, and may obtain FDA approval or clearance for their Our clinical trials are expensive to conduct, typically products to be marketed specifically for those indications. Some payors may deny coverage or payment for the use of our products for indications not specifically approved or cleared by FDA. Often, these denials can be overcome through an appeals process, but there is no guarantee of success in these cases. We rely upon single and limited source third-party suppliers and third-party operations. materially adversely impacted. emission or disposal of hazardous substances that could cause us to incur substantial liabilities, including costs for investigation and remediation. 73. 2022. Effective December 31, 2022, we have ceased use of the NASDAQ Medical Equipment Index and transitioned to use of the NASDAQ Health Care Index for the comparison. We believe the NASDAQ Health Care Index to be a more appropriate index for this comparison, as it is more accessible to stockholders than the NASDAQ Medical Equipment Index and is widely recognized and used. 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 AtriCure, Inc. $ 112.42 $ 98.05 $ 91.38 $ 153.31 $ 162.88 NASDAQ Composite $ 106.96 $ 116.45 $ 150.96 $ 146.67 $ 200.49 NASDAQ Medical Equipment $ 111.06 $ 116.87 $ 166.41 $ 187.88 $ 227.84 Year Ended December 31, 2019 (1) 2018 (2) 2017 2016 2015 (3) (in thousands, except per share data) Operating Results: Revenue $ 230,807 $ 201,630 $ 174,716 $ 155,109 $ 129,755 Gross profit $ 170,335 $ 147,120 $ 126,163 $ 111,101 $ 92,875 Gross margin 73.8% 73.0% 72.2% 71.6% 71.6% Net loss $ (35,194) $ (21,137) $ (26,892) $ (33,338) $ (27,212) Basic and diluted net loss per share $ (0.94) $ (0.62) $ (0.83) $ (1.05) $ (0.97) Weighted average shares outstanding 37,589 34,087 32,387 31,609 28,058 Financial Position: Cash, cash equivalents and investments $ 94,476 $ 124,402 $ 34,451 $ 47,009 $ 42,284 Working capital 93,244 134,457 50,355 56,889 43,164 Total assets 557,880 356,759 267,704 276,421 273,092 Long-term debt and leases 74,204 47,743 36,861 37,205 13,710 Stockholders’ equity 247,343 249,381 161,166 168,442 186,685 2021 Year Ended December 31, 2019 2018 % of % of Amount Revenue Amount Revenue (dollars in thousands) Revenue $ 230,807 100.0 % $ 201,630 100.0 % Cost of revenue 60,472 26.2 54,510 27.0 Gross profit 170,335 73.8 147,120 73.0 Operating expenses: Research and development expenses 41,230 17.9 34,723 17.2 Selling, general and administrative expenses 162,227 70.3 129,524 64.2 Total operating expenses 203,457 88.2 164,247 81.5 Loss from operations (33,122) (14.4) (17,127) (8.5) Other income (expense): Interest expense (4,111) (1.8) (4,607) (2.3) Interest income 2,398 1.0 1,006 0.5 Other (160) (0.1) (183) (0.1) Other expense (1,873) (0.8) (3,784) (1.9) Loss before income tax expense (34,995) (15.2) (20,911) (10.4) Income tax expense 199 0.1 226 — Net loss $ (35,194) (15.2) % $ (21,137) (10.5) % Revenue. Selling, general and administrative expenses. Selling, general and administrative expenses increased The following table Less than More than Contractual Obligations Total 1 year 1-3 years 3-5 years 5 years Long-term debt(1) $ 60,000 $ — $ 32,195 $ 27,805 $ — Finance leases(2) 17,937 1,597 3,225 3,316 9,799 Operating leases(3) 4,688 1,465 2,515 708 — Royalty obligations(4) 2,895 2,895 — — — Restricted grants 726 726 — — — Total contractual obligations $ 86,246 $ 6,683 $ 37,935 $ 31,829 $ 9,799 Inflation has impacted our operating costs throughout 2022. Continued increases in our cost of revenue may effect our ability to maintain our gross margin if the selling prices of our products do not increase commensurately, while continued increases in our operating expenses may adversely effect our operating results and the ability to make discretionary investments. We will continue to monitor the impact of inflation on our cost of revenue and operating expenses. on historical experience, current conditions and other reasonable factors. Actual results could differ from those estimates under different assumptions or conditions. We account for revenue in accordance with FASB ASC 606, “Revenue from Contracts with Customers”. Significant judgments and estimates involved in the Company’s recognition of revenue include the Share-Based Employee Compensation— We estimate the fair value of future periods. more information regarding recent accounting pronouncements. Page Financial Statements: /s/ Deloitte & Touche LLP 22, 2023 2021 2019 2018 Assets Current assets: Cash and cash equivalents $ 28,483 $ 32,231 Short-term investments 53,318 92,171 Accounts receivable, less allowance for doubtful accounts of $1,124 and $547 28,046 25,195 Inventories 29,414 22,484 Prepaid and other current assets 3,899 2,592 Total current assets 143,160 174,673 Property and equipment, net 32,646 27,080 Operating lease right-of-use assets 4,032 — Long-term investments 12,675 — Intangible assets, net 129,881 49,254 Goodwill 234,781 105,257 Other noncurrent assets 705 495 Total Assets $ 557,880 $ 356,759 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable $ 14,948 $ 9,659 Accrued liabilities 32,750 25,840 Other current liabilities and current maturities of debt and leases 2,218 4,717 Total current liabilities 49,916 40,216 Long-term debt 59,634 35,571 Finance lease liabilities 11,774 12,172 Operating lease liabilities 2,796 — Contingent consideration and other noncurrent liabilities 186,417 19,419 Total Liabilities 310,537 107,378 Commitments and contingencies (Note 12) Stockholders’ Equity: Common stock, $0.001 par value, 90,000 shares authorized; 39,655 and 38,604 issued and outstanding 40 39 Additional paid-in capital 529,658 496,544 Accumulated other comprehensive loss (158) (199) Accumulated deficit (282,197) (247,003) Total Stockholders’ Equity 247,343 249,381 Total Liabilities and Stockholders’ Equity $ 557,880 $ 356,759 (LOSS) INCOME 2020 2019 2018 2017 Revenue $ 230,807 $ 201,630 $ 174,716 Cost of revenue 60,472 54,510 48,553 Gross profit 170,335 147,120 126,163 Operating expenses: Research and development expenses 41,230 34,723 34,144 Selling, general and administrative expenses 162,227 129,524 116,998 Total operating expenses 203,457 164,247 151,142 Loss from operations (33,122) (17,127) (24,979) Other income (expense): Interest expense (4,111) (4,607) (2,264) Interest income 2,398 1,006 227 Other (160) (183) 138 Loss before income tax expense (34,995) (20,911) (26,878) Income tax expense 199 226 14 Net loss $ (35,194) $ (21,137) $ (26,892) Basic and diluted net loss per share $ (0.94) $ (0.62) $ (0.83) Weighted average shares outstanding – basic and diluted 37,589 34,087 32,387 Comprehensive loss: Unrealized gain (loss) on investments $ 137 $ (31) $ 15 Foreign currency translation adjustment (96) (202) 487 Other comprehensive income (loss) 41 (233) 502 Net loss (35,194) (21,137) (26,892) Comprehensive loss, net of tax $ (35,153) $ (21,370) $ (26,390) 2020 Accumulated Additional Other Total Common Stock Paid-in Accumulated Comprehensive Stockholders’ Shares Amount Capital Deficit Income (Loss) Equity Balance—December 31, 2016 33,342 $ 33 $ 367,851 $ (198,974) $ (468) $ 168,442 Issuance of common stock under equity incentive plans 1,112 2 2,387 — — 2,389 Issuance of common stock under employee stock purchase plan 132 — 2,110 — — 2,110 Share-based employee compensation expense — — 14,615 — — 14,615 Other comprehensive income — — — — 502 502 Net loss — — — (26,892) — (26,892) Balance—December 31, 2017 34,586 $ 35 $ 386,963 $ (225,866) $ 34 $ 161,166 Issuance of common stock through public offering 2,875 3 82,870 — — 82,873 Issuance of common stock for settlement of contingent consideration 232 — 6,279 — — 6,279 Issuance of common stock under equity incentive plans 781 1 1,554 — — 1,555 Issuance of common stock under employee stock purchase plan 130 — 2,383 — — 2,383 Share-based employee compensation expense — — 16,495 — — 16,495 Other comprehensive loss — — — — (233) (233) Net loss — — — (21,137) — (21,137) Balance—December 31, 2018 38,604 $ 39 $ 496,544 $ (247,003) $ (199) $ 249,381 Issuance of common stock for SentreHEART acquisition 699 1 20,306 — — 20,307 Issuance of common stock under equity incentive plans 248 — (7,831) — — (7,831) Issuance of common stock under employee stock purchase plan 104 — 2,662 — — 2,662 Share-based employee compensation expense — — 17,977 — — 17,977 Other comprehensive income — — — — 41 41 Net loss — — — (35,194) — (35,194) Balance—December 31, 2019 39,655 $ 40 $ 529,658 $ (282,197) $ (158) $ 247,343 2020 2019 2018 2017 Cash flows from operating activities: Net loss $ (35,194) $ (21,137) $ (26,892) Adjustments to reconcile net loss to net cash used in operating activities: Share-based compensation expense 17,977 16,495 14,615 Depreciation 7,423 7,244 7,761 Amortization of intangible assets 1,943 1,510 1,367 Amortization of deferred financing costs 375 515 264 Non-cash lease expense 751 — — Loss on disposal of property and equipment and impairment of assets 604 323 336 Realized loss (gain) from foreign exchange on intercompany transactions 181 165 (173) (Accretion) amortization of investments (922) (362) 30 Provision for doubtful accounts 582 598 (172) Change in fair value of contingent consideration (4,916) (10,825) (4,078) Payment of contingent consideration in excess of purchase accounting amount — (96) — Changes in operating assets and liabilities, net of amounts acquired: Accounts receivable (3,201) (2,837) (1,464) Inventories (5,151) (146) (4,477) Other current assets (1,199) (367) 829 Accounts payable 2,790 (2,398) 1,290 Accrued liabilities 3,108 7,016 2,228 Other noncurrent assets and liabilities (962) 131 (408) Net cash used in operating activities (15,811) (4,171) (8,944) Cash flows from investing activities: Purchases of available-for-sale securities (73,249) (106,588) (16,455) Sales and maturities of available-for-sale securities 100,485 27,389 26,600 Purchases of property and equipment (12,182) (6,211) (6,384) Proceeds from sale of property and equipment 39 6 — Cash paid for business combination (17,240) — — Net cash (used in) provided by investing activities (2,147) (85,404) 3,761 Cash flows from financing activities: Proceeds from sale of stock, net of offering costs of $229 — 82,873 — Proceeds from debt borrowings 20,000 17,381 — Payments on debt and finance leases (629) (1,755) (1,689) Payment of debt fees (329) (1,136) (50) Proceeds from stock option exercises 1,202 6,012 4,402 Shares repurchased for payment of taxes on stock awards (9,033) (4,457) (2,013) Proceeds from issuance of common stock under employee stock purchase plan 2,662 2,383 2,110 Payment of contingent consideration liability previously established in purchase accounting — (1,125) — Proceeds from economic incentive loan 500 — — Net cash provided by financing activities 14,373 100,176 2,760 Effect of exchange rate changes on cash and cash equivalents (163) (179) 24 Net (decrease) increase in cash and cash equivalents (3,748) 10,422 (2,399) Cash and cash equivalents—beginning of period 32,231 21,809 24,208 Cash and cash equivalents—end of period $ 28,483 $ 32,231 $ 21,809 Supplemental cash flow information: Cash paid for interest $ 3,719 $ 3,870 $ 2,002 Cash paid for income taxes 259 65 37 Non-cash investing and financing activities: Contingent consideration in business combinations 171,300 — — Stock issuance in business combinations 20,307 — — Share-settled portion of contingent consideration — 6,279 — Accrued purchases of property and equipment 1,053 348 650 Assets obtained in exchange for finance lease obligations 270 24 2 Finance lease early termination — (6) — year ended December 31, 2021 excludes 404 shares because the effect would be anti-dilutive. 2019 2018 2017 Total accumulated other comprehensive (loss) income at beginning of period $ (199) $ 34 $ (468) Unrealized gains (losses) on investments Balance at beginning of period $ (37) $ (6) $ (21) Other comprehensive income (loss) before reclassifications 137 (31) 15 Amounts reclassified from accumulated other comprehensive (loss) income to other income — — — Balance at end of period $ 100 $ (37) $ (6) Foreign currency translation adjustment Balance at beginning of period $ (162) $ 40 $ (447) Other comprehensive (loss) income before reclassifications (277) (367) 660 Amounts reclassified from accumulated other comprehensive (loss) income to other income 181 165 (173) Balance at end of period $ (258) $ (162) $ 40 Total accumulated other comprehensive (loss) income at end of period $ (158) $ (199) $ 34 Research and Development Costs—Research and development If such targets are not met or service is not rendered for the requisite service period, no compensation cost is recognized, and any recognized compensation cost in prior periods will be reversed. For PSAs with a market condition, a Monte Carlo simulation is performed to estimate the fair value on the date of grant, and compensation cost is recognized over the requisite service period as the employee renders service, even if the market condition is not satisfied. The Company’s determination of the fair value is affected by the Company and market index stock performance, as defined by the award agreement, at the beginning of the service period and grant date; the expected volatility of the Company and market index stock performance over the performance period and the correlation coefficient of the daily returns for the Company and market index over the performance period. The Company’s long-lived assets are located in the United States, except for $1,616 as of December 31, 2022 and $1,399 as of December 31, 2021 located primarily in Europe. Quoted Prices in Active Significant Significant Markets for Other Other Identical Observable Unobservable Assets Inputs Inputs (Level 1) (Level 2) (Level 3) Total Assets: Money market funds $ — $ 14,502 $ — $ 14,502 Repurchase agreements — 10,000 — 10,000 Commercial paper — 13,755 — 13,755 U.S. government agencies and securities 8,539 — — 8,539 Corporate bonds — 24,852 — 24,852 Asset-backed securities — 18,847 — 18,847 Total assets $ 8,539 $ 81,956 $ — $ 90,495 Liabilities: Acquisition-related contingent consideration $ — $ — $ 185,157 $ 185,157 Total liabilities $ — $ — $ 185,157 $ 185,157 The following table represents the Company’s fair value hierarchy for its financial assets and liabilities measured at fair value on a recurring basis as of December 31, Quoted Prices in Active Significant Significant Markets for Other Other Identical Observable Unobservable Assets Inputs Inputs (Level 1) (Level 2) (Level 3) Total Assets: Money market funds $ — $ 16,193 $ — $ 16,193 Commercial paper — 40,731 — 40,731 U.S. government agencies and securities 6,734 — — 6,734 Corporate bonds — 30,195 — 30,195 Asset-backed securities — 14,511 — 14,511 Total assets $ 6,734 $ 101,630 $ — $ 108,364 Liabilities: Acquisition-related contingent consideration — — $ 18,773 $ 18,773 Total liabilities $ — $ — $ 18,773 $ 18,773 During 2021, the Company was informed that data from the aMAZE clinical trial did not achieve statistical superiority, and the Company assessed the projected probability of payment to be remote. The Weighted average Fair Value Valuation Technique Input Range by relative fair value Discount rate 5.56 % 5.56 % Regulatory & Commercialization-based milestones $ 185,157 Probability-weighted scenario approach Projected month and year of payment June 2020 - n/a Probability of payment 77.40 - 85.00 % 81.75 % 2019 2018 2017 Beginning Balance – January 1 $ 18,773 $ 37,098 $ 41,176 Amounts acquired 171,300 — — Settlement of trial enrollment milestone — (7,500) — Changes in fair value included in selling, general and administrative expenses (4,916) (10,825) (4,078) Ending Balance – December 31 $ 185,157 $ 18,773 $ 37,098 Unrealized Gains Cost Basis (Losses) Fair Value Corporate bonds $ 24,796 $ 56 $ 24,852 U.S. government agencies and securities 8,529 10 8,539 Commercial paper 13,755 — 13,755 Asset-backed securities 18,813 34 18,847 Total $ 65,893 $ 100 $ 65,993 Unrealized Gains Cost Basis (Losses) Fair Value Corporate bonds $ 30,223 $ (28) $ 30,195 U.S. government agencies and securities 6,734 — 6,734 Commercial paper 40,731 — 40,731 Asset-backed securities 14,520 (9) 14,511 Total $ 92,208 $ (37) $ 92,171 August 13, 2019 Inventories $ 1,848 Current assets 328 Operating lease right-of-use asset 2,929 Property and equipment 94 Intangible assets 82,570 Other assets 202 Total identifiable assets $ 87,971 Current liabilities $ 5,719 Operating lease liability 2,929 Total liabilities assumed $ 8,648 Net identifiable assets acquired $ 79,323 Goodwill 129,524 Total consideration $ 208,847 Amortization Term Valuation (in years) Developed technology $ 270 15 IPR&D 82,300 Indefinite Total $ 82,570 Year Ended December 31, (unaudited) 2019 2018 Revenue $ 232,768 $ 205,725 Net loss (40,970) (42,959) Basic and diluted net loss per share $ (1.09) $ (1.23) 2019 2018 Estimated Accumulated Accumulated Useful Life Cost Amortization Cost Amortization Technology 3-15 years $ 11,691 $ 8,131 $ 12,250 $ 7,017 IPR&D 126,321 — 44,021 — Total $ 138,012 $ 8,131 $ 56,271 $ 7,017 Future amortization expense is projected as follows: 2020 $ 1,822 2021 1,511 2022 18 2023 18 2024 18 2025 and thereafter 173 Total $ 3,560 2019 2018 Raw materials $ 11,126 $ 9,100 Work in process 1,260 1,232 Finished goods 17,028 12,152 Inventories $ 29,414 $ 22,484 Estimated Useful Life 2019 2018 Generators and other capital equipment 1-3 years $ 20,167 $ 18,158 Building under finance lease 15 years 14,250 14,250 Computer and other office equipment 3 years 7,606 6,360 Machinery, equipment and vehicles 3-7 years 5,905 4,859 Furniture and fixtures 3-7 years 5,009 4,702 Leasehold improvements 5-15 years 6,078 3,943 Construction in progress N/A 5,708 1,868 Land N/A 502 — Equipment under finance leases 3-5 years 483 213 Total 65,708 54,353 Less accumulated depreciation (33,062) (27,273) Property and equipment, net $ 32,646 $ 27,080 $3,637. 2019 2018 Accrued bonus $ 10,840 $ 9,100 Accrued commissions 8,734 8,065 Accrued payroll and employee-related expenses 6,748 4,512 Sales returns and allowances 3,979 1,410 Other accrued liabilities 59 1,205 Accrued taxes and value-added taxes payable 1,658 886 Accrued royalties 732 662 Total $ 32,750 $ 25,840 2020 $ — 2021 14,634 2022 17,561 2023 17,561 2024 10,244 Total long-term debt, of which $60,000 is noncurrent $ 60,000 2022. Twelve Months Ended December 31, 2019 Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows from operating leases $ 1,026 Operating cash flows from finance leases 872 Financing cash flows from finance leases 629 Right-of-use assets obtained in exchange for lease obligations: Operating Leases 1,884 Finance Leases 270 Operating lease right-of-use asset obtained in business combination 2,929 Supplemental balance sheet information related to leases Operating Leases Finance Leases 2020 $ 1,465 $ 1,597 2021 1,337 1,602 2022 1,178 1,623 2023 708 1,646 2024 — 1,670 2025 and thereafter — 9,799 Total payments $ 4,688 $ 17,937 Less imputed interest (427) (5,410) Total $ 4,261 $ 12,527 2019 2018 2017 Current Tax Expense Federal $ (26) $ (51) $ — State 34 28 44 Foreign 165 198 72 Total current tax expense 173 175 116 Deferred Tax Expense Federal $ (7,655) $ (3,048) $ 18,485 State (1,368) 178 (1,337) Foreign (1,690) 45 (2,241) Change in valuation allowance 10,739 2,876 (15,009) Total deferred tax expense 26 51 (102) Total tax expense $ 199 $ 226 $ 14 2019 2018 Deferred tax assets (liabilities): Net operating loss carryforward $ 111,000 $ 68,563 Research and development and AMT credit carryforwards, net 8,193 6,206 Deferred interest 909 774 Equity compensation 8,233 4,750 Accruals and reserves 3,513 802 Inventories 1,007 726 Intangible assets (30,996) (11,448) Property and equipment, net (1,482) (608) Finance and operating lease liabilities 4,016 — Right-of-use assets (3,476) — Other, net 287 135 Subtotal 101,204 69,900 Less valuation allowance (101,178) (69,849) Total $ 26 $ 51 or fifteen years, depending on where research is conducted. The Company has federal net operating loss carryforwards of 2019 2018 2017 Federal tax at statutory rate 21.00 % $ (6,950) 21.00 % $ (4,391) 34.00 % $ (9,139) Federal and Foreign tax rate change 1.40 (462) (6.84) 1,430 (109.68) 29,480 Federal R&D credit 2.53 (837) 4.39 (918) (0.40) 107 Federal deferred adjustment 3.28 (1,085) (10.77) 2,253 — — Federal NOL adjustment for ASU — — — — 10.48 (2,816) Valuation allowance (32.45) 10,739 (13.75) 2,876 55.84 (15,009) State income taxes 4.02 (1,334) (0.99) 206 4.81 (1,292) Foreign NOL rate change (1.17) 388 (1.22) 256 1.30 (348) Foreign tax rate differential (0.38) 126 (0.60) 125 (2.45) 658 Permanent differences and other 1.17 (386) 7.70 (1,611) 6.05 (1,627) Effective tax rate (0.60) % $ 199 (1.08) % $ 226 (0.05) % $ 14 2020. beginning in 2019 2018 2017 Balance at the beginning of the year $ 1,157 $ 1,157 $ 3,175 Increases (decreases) for prior year tax positions 620 — (2,018) Increases (decreases) for current year tax positions — — — Increases (decreases) related to settlements — — — Decreases related to statute lapse — — — Balance at the end of the year $ 1,777 $ 1,157 $ 1,157 Stock Incentive Plan Stock options, restricted stock awards and restricted stock units granted generally vest at a rate of 33.3% on the first, second and third anniversaries of the grant date. Stock options Weighted Weighted Average Number of Average Remaining Aggregate Shares Exercise Contractual Intrinsic Time-Based Stock Options Outstanding Price Term Value Outstanding at January 1, 2019 1,582 $ 13.83 Granted 42 28.77 Exercised (110) 10.91 Cancelled (7) 30.48 Outstanding at December 31, 2019 1,507 $ 14.38 4.25 $ 27,340 Vested and expected to vest 1,503 $ 14.35 4.24 $ 27,319 Exercisable at December 31, 2019 1,392 $ 13.55 3.90 $ 26,398 Weighted Weighted RSA Average PSA Average Shares Grant Date Shares Grant Date Restricted Stock Awards and Performance Share Awards Outstanding Fair Value Outstanding Fair Value Outstanding at January 1, 2019 1,746 $ 18.19 90 $ 17.71 Awarded 435 30.12 174 30.77 Released (776) 18.44 — — Forfeited (3) 18.02 — — Outstanding at December 31, 2019 1,402 $ 21.76 264 $ 26.34 PSAs provide that each PSA that vests represents the right to receive one share of the Company’s common stock at the end of the performance period. With respect to the PSAs, the number of shares that vest and are issued to the recipient is based upon the Company’s performance with respect to specified targets at the end of the three year performance period. PSAs granted in 2020 have performance targets based on the Company’s compound annual revenue growth rate (CAGR) over the three year performance period, and payout opportunities range from 0% to 100% of the target amount. PSAs awarded subsequent to 2020 have two weighted performance targets: (i) the Company’s CAGR and (ii) relative total shareholder return (TSR). TSR is measured against the Nasdaq Health Care Index constituents and the 20-trading-day average stock price prior to the start and end of the performance period. PSAs granted in 2021 have payout opportunities ranging from 0% to 200% of the target amount, based on equally weighting of the performance targets. Awards granted in 2022 have payout opportunities ranging from 0% to 300% of the target amount and are weighted 60% on the CAGR performance target and 40% on the TSR performance target. These ranges are used to determine the number of shares that will be issuable when the award vests. The performance and market condition payouts will be determined independently and accumulated to determine the total payout for the three year performance period, subject to the maximum payout defined in the PSA agreements. All or a portion of the PSAs may vest following a change of control or a termination of service by reason of death or disability. Weighted Weighted Average Number of Average Remaining Aggregate Shares Exercise Contractual Intrinsic Performance Stock Options Outstanding Price Term Value Outstanding at January 1, 2019 450 $ 13.48 Granted — — Exercised — — Cancelled — — Outstanding at December 31, 2019 450 $ 13.48 3.45 $ 8,566 Exercisable at December 31, 2019 350 $ 13.48 3.45 $ 6,662 Activity under the plans during Weighted Weighted Average Number of Average Remaining Aggregate Shares Exercise Contractual Intrinsic Time-Based Stock Options Outstanding Price Term Value Outstanding at January 1, 2018 2,026 $ 13.30 Granted 52 26.05 Exercised (474) 12.70 Cancelled (22) 18.14 Outstanding at December 31, 2018 1,582 $ 13.83 5.02 $ 26,587 Vested and expected to vest 1,574 $ 13.78 5.00 $ 26,525 Exercisable at December 31, 2018 1,419 $ 12.99 4.63 $ 24,991 Weighted Weighted RSA Average PSA Average Shares Grant Date Shares Grant Date Restricted Stock Awards and Performance Share Awards Outstanding Fair Value Outstanding Fair Value Outstanding at January 1, 2018 1,845 $ 18.22 — $ — Awarded 630 18.71 90 17.71 Released (638) 18.87 — — Forfeited (91) 17.97 — — Outstanding at December 31, 2018 1,746 $ 18.19 90 $ 17.71 Weighted Weighted Average Number of Average Remaining Aggregate Shares Exercise Contractual Intrinsic Performance Stock Options Outstanding Price Term Value Outstanding at January 1, 2018 450 $ 13.48 Granted — — Exercised — — Cancelled — — Outstanding at December 31, 2018 450 $ 13.48 4.45 $ 5,555 Exercisable at December 31, 2018 350 $ 13.48 4.45 $ 4,321 The total intrinsic value of options exercised during the years ended December 31, and restricted stock award grants. 2019 2018 2017 Cost of revenue $ 917 $ 1,545 $ 610 Research and development expenses 2,374 1,987 2,052 Selling, general and administrative expenses 14,686 12,963 11,953 Total $ 17,977 $ 16,495 $ 14,615 2019 2018 2017 Restricted Stock Awards & Time-Based Stock Options $ 13,922 $ 15,032 $ 13,908 Performance Share Awards 3,254 766 — Performance Stock Options — — 43 ESPP 801 697 664 Total $ 17,977 $ 16,495 $ 14,615 2019 2018 2017 Range of risk-free interest rate 1.43-2.64 % 2.31 - 3.01 % 1.75 - 2.12 % Range of expected life of stock options (years) 5.13 to 5.69 5.14 to 5.71 5.21 to 5.76 Range of expected volatility of stock 40.00 - 42.00 % 41.00 - 42.00 % 43.00 - 48.00 % Weighted-average volatility 40.87 % 41.51 % 44.50 % Dividend yield 0.00 % 0.00 % 0.00 % The fair value of performance share awards with a market condition is estimated on the grant date using a Monte Carlo simulation and includes the following assumptions: 2019 2018 2017 Stock options $ 11.56 $ 10.97 $ 8.60 Restricted stock awards 30.12 18.71 19.38 Performance share awards 30.77 17.71 — tax: 2019 2018 2017 United States $ 185,829 $ 162,146 $ 138,387 Europe 27,929 25,912 21,901 Asia 15,976 12,687 13,616 Other international 1,073 885 812 Total international 44,978 39,484 36,329 Total revenue $ 230,807 $ 201,630 $ 174,716 2019 2018 2017 Open ablation $ 80,205 $ 72,250 $ 64,517 Minimally invasive ablation 34,842 35,053 34,421 Appendage management 68,166 52,891 37,281 Total ablation and appendage management 183,213 160,194 136,219 Valve tools 2,616 1,952 2,168 Total United States $ 185,829 $ 162,146 $ 138,387 2019 2018 2017 Open ablation $ 24,945 $ 21,118 $ 20,718 Minimally invasive ablation 8,349 9,176 8,007 Appendage management 11,476 8,988 7,251 Total ablation and appendage management 44,770 39,282 35,976 Valve tools 208 202 353 Total international $ 44,978 $ 39,484 $ 36,329 For the Three Months Ended March 31, June 30, September 30, December 31, 2019 2018 2019 2018 2019 2018 2019 2018 Operating Results: Revenue $ 53,966 $ 46,994 $ 58,906 $ 51,802 $ 56,614 $ 49,941 $ 61,321 $ 52,893 Gross profit 39,871 34,503 43,893 38,079 41,797 35,948 44,774 38,590 Loss from operations (5,320) (9,430) (3,839) 958 (8,637) (6,048) (15,326) (2,607) Net loss (5,635) (10,134) (4,101) (338) (9,362) (7,235) (16,096) (3,430) Net loss per share (basic and diluted) $ (0.15) $ (0.31) $ (0.11) $ (0.01) $ (0.25) $ (0.22) $ (0.42) $ (0.09) Beginning Additions Ending Balance Expenses Other (1) Deductions Balance Reserve for sales returns and allowances Year ended December 31, 2019 $ 1,410 $ 369 $ 2,240 $ 40 $ 3,979 Year ended December 31, 2018 1,169 $ 312 $ — $ 71 $ 1,410 Year ended December 31, 2017 834 $ 441 $ — $ 106 $ 1,169 Allowance for inventory valuation Year ended December 31, 2019 $ 1,029 $ 848 $ — $ 360 $ 1,517 Year ended December 31, 2018 889 $ 718 $ — $ 578 $ 1,029 Year ended December 31, 2017 1,080 $ 1,004 $ — $ 1,195 $ 889 Valuation allowance for deferred tax assets Year ended December 31, 2019 $ 69,849 $ 10,739 $ 20,590 $ — $ 101,178 Year ended December 31, 2018 66,973 $ 2,876 $ — $ — $ 69,849 Year ended December 31, 2017 81,982 $ — $ — $ 15,009 $ 66,973 REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM is incorporated herein by reference. Number of securities Weighted-average Number of securities remaining Plan Category (a) (b) (c) Equity compensation plans approved by security holders (3) 3,623,588 $ 14 1,577,687 Equity compensation plans not approved by security holders — — — Total 3,623,588 $ 14 1,577,687 reference. Exhibit No. Description 3.1 3.2 4.1 10.1# 10.2# 10.3# 10.4# 10.5 10.6 10.7# 10.8# 10.9# 10.10# 10.11 10.16§ 23.1 31.1 31.2 32.1 32.2 101.INS XBRL Instance Document 101.SCH XBRL Taxonomy Extension Schema Document 101.CAL XBRL Taxonomy Extension Calculation Linkbase Document 101.DEF XBRL Taxonomy Definition Linkbase Document 101.LAB XBRL Taxonomy Extension Label Linkbase Document 101.PRE XBRL Taxonomy Extension Presentation Linkbase Document 104 Cover Page Interactive Data File _________________________ SIGNATURES AtriCure, Inc. (REGISTRANT) Date: February /s/ Michael H. Carrel Michael H. Carrel President and Chief Executive Officer (Principal Executive Officer) Date: February /s/ Chief Financial Officer (Principal Accounting and Financial Officer) Signature Title(s) /s/ /s/ Michael H. Carrel Michael H. Carrel Michael H. Carrel Director, President and Chief Executive Officer (Principal Executive Officer) /s/ Mark A. Collar Mark A. Collar Mark A. Collar Director /s/ Regina E. Groves Regina E. Groves Regina E. Groves Director /s/ Karen N. Prange Karen N. Prange Karen N. Prange Director /s/ Deborah H. Telman Sven A. Wehrwein Sven A. Wehrwein Director /s/ Robert S. White Robert S. White Robert S. White Director_________________________________ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 19342019 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Delaware34-1940305None_________________________________ No No No No ☐☐ No 2019,2022, the last business day of the registrant’s most recently completed second fiscal quarter as reported on the NASDAQ Global Market, was $1,110.6approximately $1,851.6 million.ClassOutstanding February 20, 202040,048,97246,568,044_________________________________