UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20222023

or

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-37507

IMMUNITYBIO, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 43-1979754 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| |

3530 John Hopkins Court San Diego, California | 92121 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (858) 633-0300(844) 696-5235

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | IBRX | | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ¨ | | Accelerated filer | ¨ |

| | | | |

| Non-accelerated filer | þ | | Smaller reporting company | þ |

| | | | |

| | | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ¨

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates, computed based on the closing price of shares of common stock on the Nasdaq Global Select Market on June 30, 20222023 was approximately $302.1$315.9 million.

The number of shares of the registrant’s common stock outstanding as of February 24, 2023March 14, 2024 was 435,835,583673,952,278 (excluding 163,800 shares held by a majority owned subsidiary of ours that are treated as treasury shares for accounting purposes).

DOCUMENTS INCORPORATED BY REFERENCE

As noted herein, the information called for by Part III of this Annual Report on Form 10-K is incorporated by reference to specified portions of the registrant’s definitive proxy statement to be filed in conjunction with the registrant’s 20232024 Annual Meeting of Stockholders, which is expected to be filed not later than 120 days after the registrant’s fiscal year ended December 31, 2022.2023.

IMMUNITYBIO, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 20222023

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| PART I |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| PART III |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| PART IV |

| | |

| Item 15. | | |

| Item 16. | | |

| |

Defined Terms

Unless expressly indicated or the context required otherwise, the terms “ImmunityBio,” “the company,” “the combined company,” “we,” “us,” and “our” in this Annual Report refer to ImmunityBio, Inc., a Delaware corporation, and, where appropriate, its subsidiaries. We have also used several other terms in this Report, the consolidated financial statements and accompanying notes included herein, most of which are defined below:

| | | | | | | | |

| Term | | Definition |

| | |

| 2014 Plan | | NantKwest, Inc. 2014 Equity Incentive Plan |

| 2015 Plan | | ImmunityBio, Inc. 2015 Equity Incentive Plan |

| 2015 Share Repurchase Program | | Board of Directors-approved share repurchase program |

| 3M IPC | | 3M Innovative Properties Company |

| 401(k) Plan | | 401(k) retirement and savings plan |

| AAHI | | Access to Advanced Health Institute |

| ACA | | Affordable Care Act |

| ADCC | | antibody-dependent cellular cytotoxicity |

| Altor | | Altor BioScience, LLC |

| America Invents Act | | Leahy-Smith America Invents Act |

| AML | | acute myeloid leukemia |

| Amyris | | Amyris, Inc. |

Anktiva® | | Proposed proprietary name for N-803, our novel antibody-cytokine fusion protein (nogapendekin alfa inbakicept-pmln) in the non-muscle invasive bladder cancer indication. The FDA has not yet approved this proposed proprietary name for such use, and this proposed proprietary name will be approved at the time the BLA is approved, if at all. |

| Annual Report | | Annual Report on Form 10-K |

| ART | | anti-retroviral therapy |

| ASC | | Accounting Standards Codification |

| ASCO | | American Society of Clinical Oncology |

| ASU | | Accounting Standards Update |

| Athenex | | Athenex, Inc. |

| ATM | | “at-the-market” sales agreement |

| ATRA | | American Taxpayer Relief Act of 2012 |

| BARDA | | Biomedical Advanced Research and Development Authority |

| BCG | | bacillus Calmette-Guérin |

| Beike | | Shenzhen Beike Biotechnology Co. Ltd. |

| BICR | | blinded independent central review |

| BLA | | Biologics License Application |

| BPCIA | | Biologics Price Competition and Innovation Act of 2009 |

| bNAbs | | broadly-neutralizing antibodies |

| Brink | | Brink Biologics, Inc. |

| Cambridge | | Cambridge Equities, LP |

| CAR | | chimeric antigen receptor |

| CCPA | | California Consumer Privacy Act of 2018 |

| CEO | | chief executive officer |

| CFO | | chief financial officer |

| cGMP | | current Good Manufacturing Practice |

| China | | when used in connection with the RIPA, People’s Republic of China, Hong Kong and any territories controlled by the People’s Republic of China |

| | | | | | | | |

| Term | | Definition |

| | |

| CI | | confidence interval |

| CIO | | chief information officer |

| CIS | | carcinoma in situ |

| Clinic | | Immuno-Oncology Clinic, Inc. |

| Closing Date | | when used in connection with the RIPA, December 29, 2023 |

| CMC | | Chemistry, Manufacturing and Controls |

| CMO | | contract manufacturing organization |

| CMS | | Centers for Medicare & Medicaid Services |

| Code | | Internal Revenue Code of 1986, as amended |

| Company Common Stock | | common stock, par value $0.0001 per share, of the company |

| CPRA | | California Privacy Rights Act of 2020 |

| CR | | complete response |

| CRADA | | Cooperative Research and Development Agreement |

| CRL | | complete response letter |

| CRO | | contract research organization |

| CVR | | contingent value right |

Cynviloq™ | | IG-101 (paclitaxel nanoparticle polymeric micelle) |

| | |

| DGCL | | Delaware General Corporation Law |

| DSCSA | | Drug Supply Chain Security Act |

| Duley Road | | Duley Road, LLC |

| Dunkirk Facility | | a leasehold interest in a cGMP ISO Class 5 pharmaceutical manufacturing space in

western New York |

| EGFR | | epidermal growth factor receptor |

| EMA | | European Medicines Agency |

| ERM | | Enterprise Risk Management |

| Etubics | | Etubics Corporation |

| EU | | European Union |

| EUA | | emergency use authorization |

| Exchange Act | | Securities Exchange Act of 1934, as amended |

| Exchange Ratio | | a right to receive 0.8190 newly issued shares of Company Common Stock |

| Exyte | | Exyte U.S., Inc. |

| FASB | | Financial Accounting Standards Board |

| FCA | | False Claims Act |

| FCPA | | U.S. Foreign Corrupt Practices Act |

| FD&C Act | | Federal Food, Drug, and Cosmetic Act |

| FDA | | U.S. Food and Drug Administration |

| FDASIA | | Food and Drug Administration Safety and Innovation Act of 2012 |

| FSMC | | Fort Schuyler Management Corporation, a not-for-profit corporation affiliated with the

state of New York |

| FTC | | Federal Trade Commission |

| FTO | | freedom-to-operate |

| FVO | | fair value option |

| GBM | | glioblastoma multiforme |

| | | | | | | | |

| Term | | Definition |

| | |

| GCP | | Good Clinical Practice |

| GDPR | | General Data Protection Regulation |

| GlobeImmune | | GlobeImmune, Inc. |

| GLP | | Good Laboratory Practice |

| GMP | | Good Manufacturing Practice |

| hAd5 | | human adenovirus serotype 5 |

| Hatch-Waxman Act | | Drug Price Competition and Patent Term Restoration Act of 1984 |

| HCW | | HCW Biologics, Inc. |

| HHS | | U.S. Department of Health and Human Services |

| HIPAA | | Health Insurance Portability and Accountability Act of 1996 |

| HITECH | | Health Information Technology for Economic and Clinical Health Act |

| HIV | | human immunodeficiency virus |

| ICB | | immune checkpoint blockade |

| IDE | | Investigational Device Exemption |

| IDRI | | Infectious Disease Research Institute |

| IgDraSol | | IgDraSol, Inc., a subsidiary of the company |

| IL-15 | | novel interleukin 15 |

| IND | | investigational new drug |

| Infinity | | Infinity SA LLC, as purchaser agent for affiliates of Oberland |

| IPR&D | | In-process research and development |

| IRA | | Inflation Reduction Act of 2022 |

| IRB | | Institutional review boards |

| IRS | | Internal Revenue Service |

| LadRx | | LadRx Corporation |

| LMIC | | low- and middle-income countries |

| Lung-MAP | | Lung Cancer Master Protocol |

| M-ceNK | | memory-like cytokine-enhanced NK cells |

| mAbs | | monoclonal antibodies |

| MDSC | | myeloid-derived suppressor cells |

| MHC | | majors histocompatability |

| MNC | | mononuclear cells |

| Nant Capital | | Nant Capital, LLC |

| NantBio | | NantBio, Inc. |

| NantCell | | NantCell, Inc., a subsidiary of the company |

| NANTibody | | Immunotherapy NANTibody, LLC, a subsidiary of the company |

| NantKwest | | NantKwest, Inc. |

| NantMobile | | NantMobile, LLC |

| NantPharma | | NantPharma, LLC |

| NantWorks | | NantWorks, LLC, a related-party |

| NC 2015 Plan | | NantCell, Inc. 2015 Stock Incentive Plan |

| NCI | | National Cancer Institute |

| NCSC | | NantCancerStemCell, LLC |

| NCTN | | National Clinical Trials Network |

| | | | | | | | |

| Term | | Definition |

| | |

| NDA | | New Drug Application |

| NEO | | named executive officer |

| NHP | | non-human primate |

| NIAID | | National Institute of Allergy and Infectious Diseases |

| NIDCD | | National Institute on Deafness and Other Communication Disorders |

| NIH | | National Institutes of Health |

| NIH Guidelines | | NIH Guidelines for Research Involving Recombinant DNA Molecules |

| NK | | natural killer |

| NLC | | nanostructured lipid carrier |

| NMIBC | | non-muscle invasive bladder cancer |

| NOL | | net operating loss |

| NSCLC | | non-small cell lung cancer |

| OBA | | NIH Office of Biotechnology Activities |

| Oberland | | Oberland Capital Management LLC and its affiliates (including Purchasers as

defined in the RIPA) |

| OFAC | | U.S. Treasury Department’s Office of Foreign Assets Control |

| OSHA | | Occupational Safety and Health Administration |

| OWS | | Operation Warp Speed |

| PCAOB | | Public Company Accounting Oversight Board (United States) |

| PDMA | | U.S. Prescription Drug Marketing Act |

| PDUFA date | | user fee goal date |

| PF | | physical function |

| PHI | | Protected Health Information |

| PHSA | | Public Health Service Act |

| PIK | | paid-in-kind |

| PMA | | premarket approval |

| PREA | | Pediatric Research Equity Act |

| PRO | | Patient Recorded Outcomes |

| Proxy Statement | | Schedule 14A in connection with our 2024 Annual Meeting of Stockholders |

| QMSR | | Quality Management System Regulation |

| QSR | | Quality System Regulation |

| R&D | | research and development |

| R&E | | research and experimental expenditures |

| RAC | | Recombinant DNA Advisory Committee |

| RECIST | | response evaluation criteria in solid tumors |

| REMS | | Risk Evaluation and Mitigation Strategy |

| RIPA | | Revenue Interest Purchase Agreement |

| Riptide | | Riptide Bioscience, Inc. |

| RSU | | restricted stock unit |

| Sarbanes-Oxley | | Sarbanes-Oxley Act of 2002 |

| saRNA | | self-amplifying RNA |

| SARS-CoV-2 | | novel strain of the coronavirus (COVID-19) |

| | | | | | | | |

| Term | | Definition |

| | |

| SBRT | | stereotactic body radiotherapy |

| SEC | | U.S. Securities and Exchange Commission |

| Section 404 | | Section 404 of the Sarbanes-Oxley Act of 2002 |

| Securities Act | | Securities Act of 1933, as amended |

| SCLC | | small cell lung cancer |

| Sorrento | | Sorrento Therapeutics, Inc. |

| SPOA | | Stock Purchase and Option Agreement |

| SRLY | | separate return limitation year |

| SWOG | | SWOG Cancer Research Network |

| TAA | | tumor-associated antigen |

| TCJA | | Tax Cuts and Jobs Act of 2017 |

| Term SOFR | | Term Secured Overnight Financing Rate |

| Test Date | | when used in connection with the RIPA, December 31, 2029 |

| TLR | | toll-like receptor |

| Treg | | Regulatory T cells |

| U.S. GAAP | | accounting principles generally accepted in the United States of America |

| USPTO | | U.S. Patent and Trademark Office |

| | |

| VBC Holdings | | VBC Holdings, LLC, a subsidiary of the company |

| VIE | | variable interest entity |

| Viracta | | Viracta Therapeutics, Inc. |

| VivaBioCell | | VivaBioCell, S.p.A., a wholly-owned subsidiary of VBC Holdings |

PART I

ITEM 1. BUSINESS.

Forward-Looking Statements

This Annual Report on Form 10-K (Annual Report) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act), that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements may include, but are not limited to:

•our ability to develop next-generation therapies and vaccines that complement, harness, and amplify the immune system to defeat cancers and infectious diseases;

•our ability to obtain funding foradditional financing to fund our operations including funding necessary toand complete furtherthe development and any commercialization of our various product candidates;

•whether or not the FDA will ultimately determine that the BLA resubmission and related actions successfully address and resolve the issues identified in the CRL;

•our ability, and the ability of our third-party CMOs, to adequately address the issues raised in the FDA’s CRL;

•whether the FDA approval milestone after which Oberland may purchase $100.0 million in Revenue Interests will be achieved;

•our ability to meet our payment obligations under the RIPA and to service the interest on our related-party promissory notes and repay such notes, to the extent required;

•our ability to comply with the terms, conditions, covenants, restrictions, and obligations set forth in the RIPA and related transaction documents;

•our expectations regarding the potential benefits of our strategy and technology;

•our ability to forecast operating results and make period-to-period comparisons predictive of future performance due to fluctuations in warrant values;

•our expectations regarding the operation and effectiveness of our product candidates and related benefits;

•our ability to utilize multiple modes to induce cell death;

•our beliefs regarding the benefits and perceived limitations of competing approaches, and the future of competing technologies and our industry;

•details regarding our strategic vision and planned product candidate pipeline, including that we eventually plan to advance vaccines and therapies for virally-induced infectious diseases;pipeline;

•our beliefs regarding the success, cost and timing of our product candidate development activities and current and future clinical trials and studies, including study design and the enrollment of patients;

•the timing of the development and commercialization of our product candidates;

•our expectations regarding our ability to utilize the Phase 1/2I/II aNK and haNK® clinical trials data to support the development of our product candidates, including our haNK, taNK, t‑haNK™, MSC, and M-ceNK™ product candidates;

•our expectations regarding the development, application, commercialization, marketing, prospects and use generally of our product candidates, including Anktiva,™ (N-803), saRNA, hAd5 and yeastsaRNA constructs, recombinant subunit proteins, toll-like receptor-activating adjuvants, and aldoxorubicin;PD-L1 t‑haNK and M-ceNK;

•the timing or likelihood of regulatory filings or other actions and related regulatory authority responses, including any planned investigational new drug (IND), Biologics License Application (BLA)IND, BLA or New Drug Application (NDA)NDA filings or pursuit of accelerated regulatory approval pathways or orphan drug status and Breakthrough Therapy designations;

•our ability to implement and support our SARS-CoV-2 (COVID‑19) vaccine and therapeutic programs;

•our ability to implement an integrated discovery ecosystem and the operation of that planned ecosystem, including being able to regularly add neoepitopes and subsequently formulate new product candidates;

•the ability and willingness of strategic collaborators to share our vision and effectively work with us to achieve our goals;

•the ability and willingness of various third parties to engage in research and developmentR&D activities involving our product candidates, and our ability to leverage those activities;

•our ability to attract additional third-party collaborators;

•our expectations regarding the ease of administration associated with our product candidates;

•our expectations regarding patient compatibility associated with our product candidates;

•our beliefs regarding the potential markets for our product candidates and our ability to serve those markets;

•our expectations regarding the timing of enrollment and submission of our clinical trials, and protocols related to such trials;

•our ability to produce an antibody cytokineantibody-cytokine fusion protein, a DNA, RNA, or recombinant protein vaccine, a toll-like receptor-activating adjuvant, an NK-cell or T-cell therapy, or a damage-associated molecular patterns (DAMP) inducercell therapy;

•our beliefs regarding the potential manufacturing and distribution benefits associated with our product candidates, and our abilitythird-party CMOs’ abilities to follow cGMP standards to scale up the production of our product candidates;

•our plans regarding our manufacturing facilities and our belief that our manufacturing is capable of being conducted in‑house;

•our belief in the potential of our antibody cytokineantibody-cytokine fusion proteins, DNA, RNA, or recombinant protein vaccines, toll-like receptor-activating adjuvants, NK-cellor cell therapies, or DAMP inducer platforms, and the fact that our business is based upon the success individually and collectively of these platforms;

•our belief regarding the magnitude or duration for additional clinical testing of our antibody cytokineantibody-cytokine fusion proteins, DNA, RNA or recombinant protein vaccines, toll-like receptor-activating adjuvants, NK-cellor cell therapies, or DAMP inducers along with other product candidate families;

•even if we successfully develop and commercialize specific product candidates like our N-803 or PD-L1 t‑haNK, our ability to develop and commercialize our other product candidates either alone or in combination with other therapeutic agents;

•the ability to obtain and maintain regulatory approval of any of our product candidates, and any related restrictions, limitations and/or warnings in the label of any approved product candidate;

•our ability to commercialize any approved products;

•the rate and degree of market acceptance of any approved products;

•our ability to attract and retain key personnel;

•the accuracy of our estimates regarding our future revenue, as well as our future operating expenses, capital requirements and needs for additional financing;

•our ability to obtain, maintain, protect, and enforce intellectual propertypatent protection and other proprietary rights for our product candidates and technology and not infringe upon, misappropriate or otherwise violate the intellectual property of others;technologies;

•the terms and conditions of licenses granted to us and our ability to license additional intellectual property relating to our product candidates and technology;

•any government shutdown, which could adversely affect the U.S. and global economies, and materially and adversely affect our business and/or our BLA submission;

•the impact on us, if any, if the contingent value rights (CVRs)CVRs held by former Altor BioScience Corporation (Altor) stockholders become due and payable in accordance with their terms; and

•regulatory developments in the United States (U.S.)U.S. and foreign countries; andcountries.

•Table ofContentsany impact of the coronavirus pandemic, or responses to the pandemic, on our business, clinical trials or personnel.Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “continues,” “goal,” “could,” “seeks,“estimates,” “estimates,“scheduled,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “indicate,” “projects,” “seeks,” “should,” “will,” “would,” “strategy,” and variations of such words or similar expressionsexpressions. and the negatives of those terms. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. Statements of past performance, efforts, or results of our preclinical and clinical trials, about which inferences or assumptions may be made, can also be forward-looking statements and are not indicative of future performance or results. These statements are based upon information available to us as of the date of this Annual Report, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

This Annual Report also contains estimates, projections and other information concerning our industry, our business, and the markets for certain diseases, including data regarding the estimated size of those markets, and the incidence and prevalence of certain medical conditions. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained this industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data, and similar sources.

Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. We discuss these risks in greater detail in Item 1A. “Risk Factors” of this Annual Report. Given these uncertainties, you should not place undue reliance on these forward-looking statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this Annual Report. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. You should read this Annual Report completely and with the understanding that our actual future results may be materially different from what we expect.

Anktiva, ceNK, Conkwest, GlobeImmune, GlobeImmune (logo), haNK, haNK (Chinese characters), ImmunityBio, NantKwest, Anktiva, VesAnktiva, ThAnktiva, NK-92, ceNK, M-ceNK, haNK, taNK, t-haNK, GlobeImmune, Tarmogen, VivaBioCell, Nant001, NantXL, Nant Cancer Vaccine, QUILT, IPRT, Outsmart your disease, taNK, Tarmogen, VesAnktiva,Your Disease, Smart Therapies for Difficult Diseases, and VivaBioCellNature’s First Responder are trademarks or registered trademarks of ImmunityBio, Inc., its subsidiaries, or its affiliates.

Our product candidates, including N-803, are investigational.investigational agents that are restricted by federal law to investigational use only. Safety and efficacy have not been established by any agency, including the U.S. Food and Drug Administration (FDA).FDA.

This Annual Report contains references to our trademarks and trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Annual Report, including logos, artwork, and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us, by any other companies.

In this Annual Report, “ImmunityBio,” “the company,” “the combined company,” “we,” “us,” and “our” refer to ImmunityBio, Inc. and its subsidiaries.

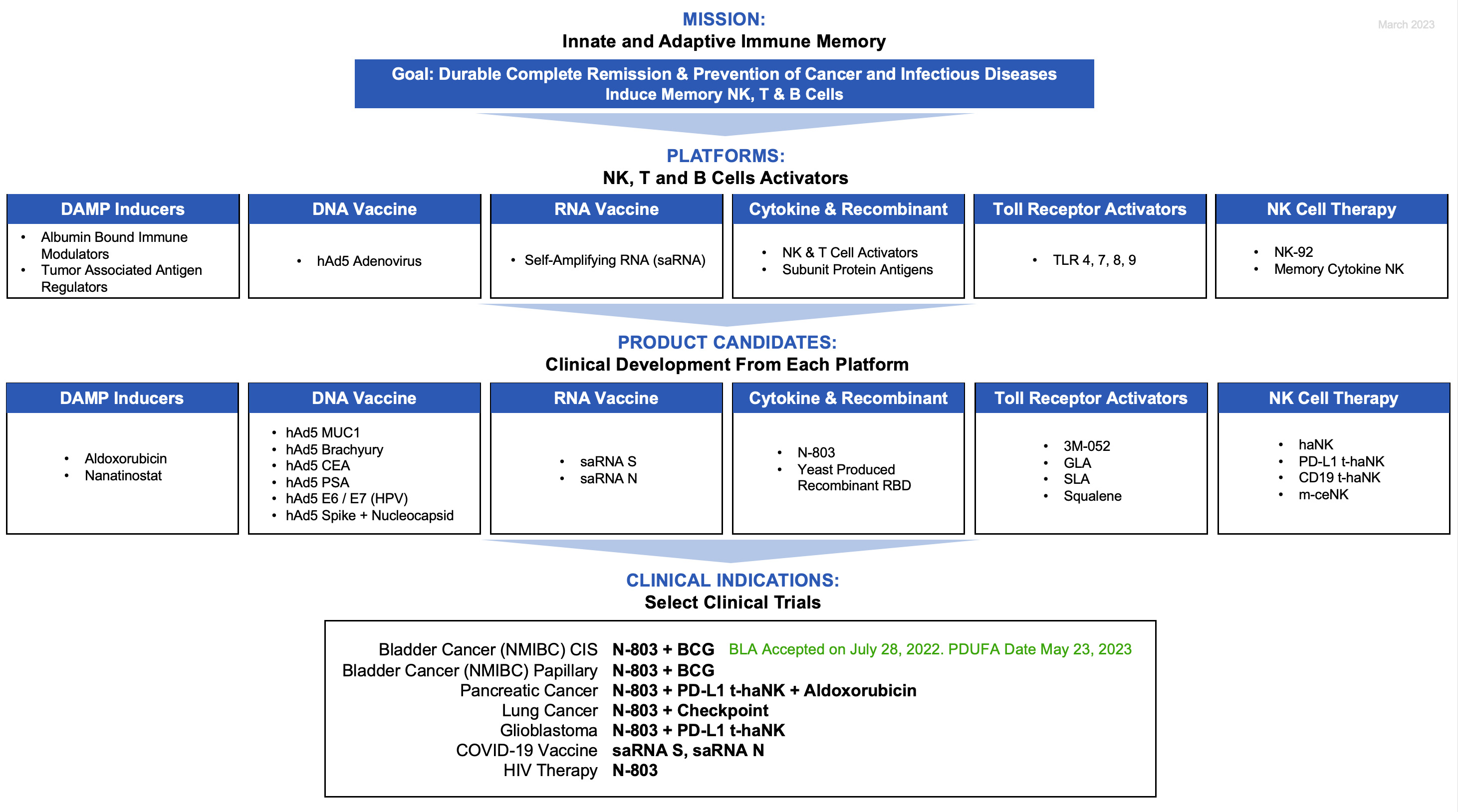

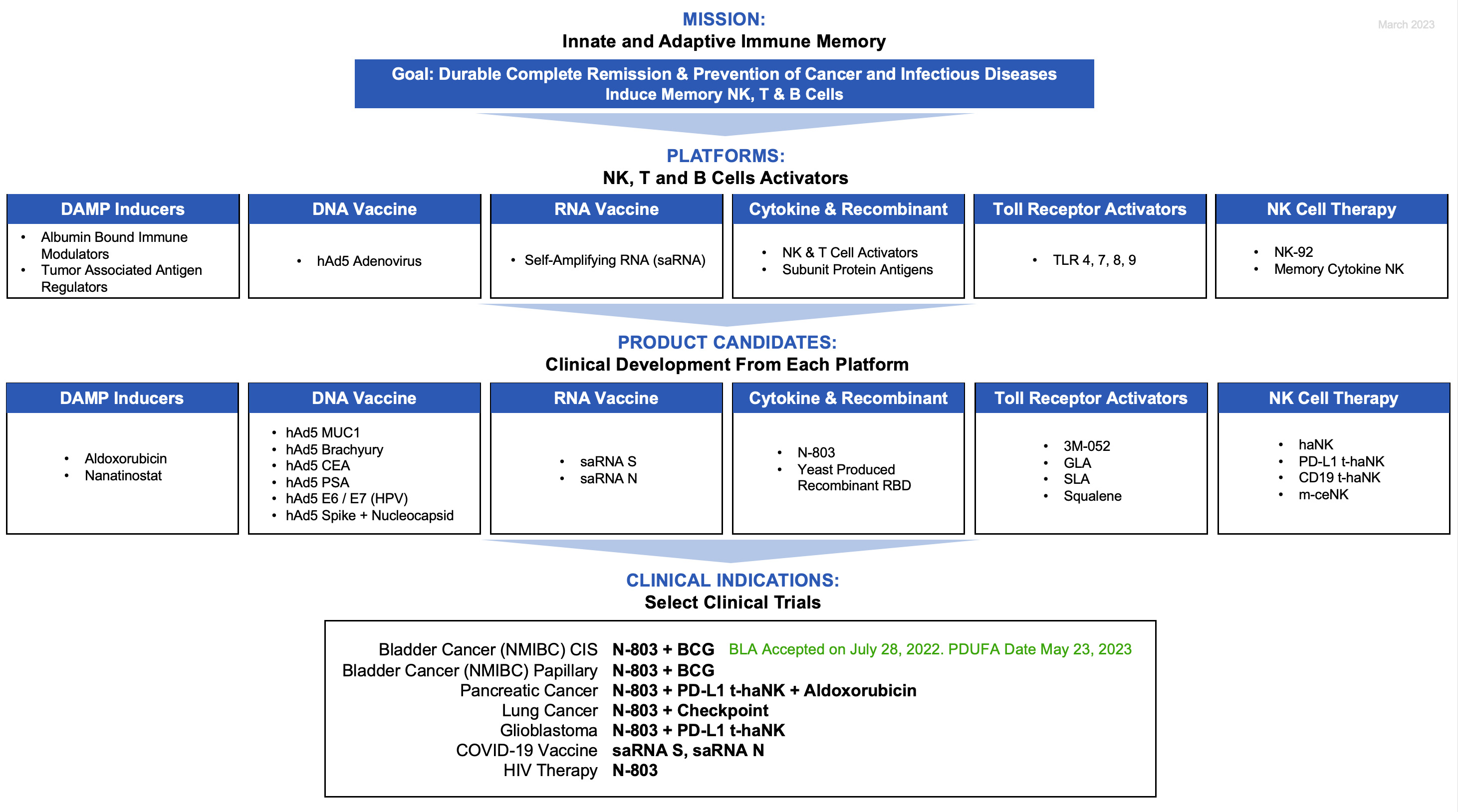

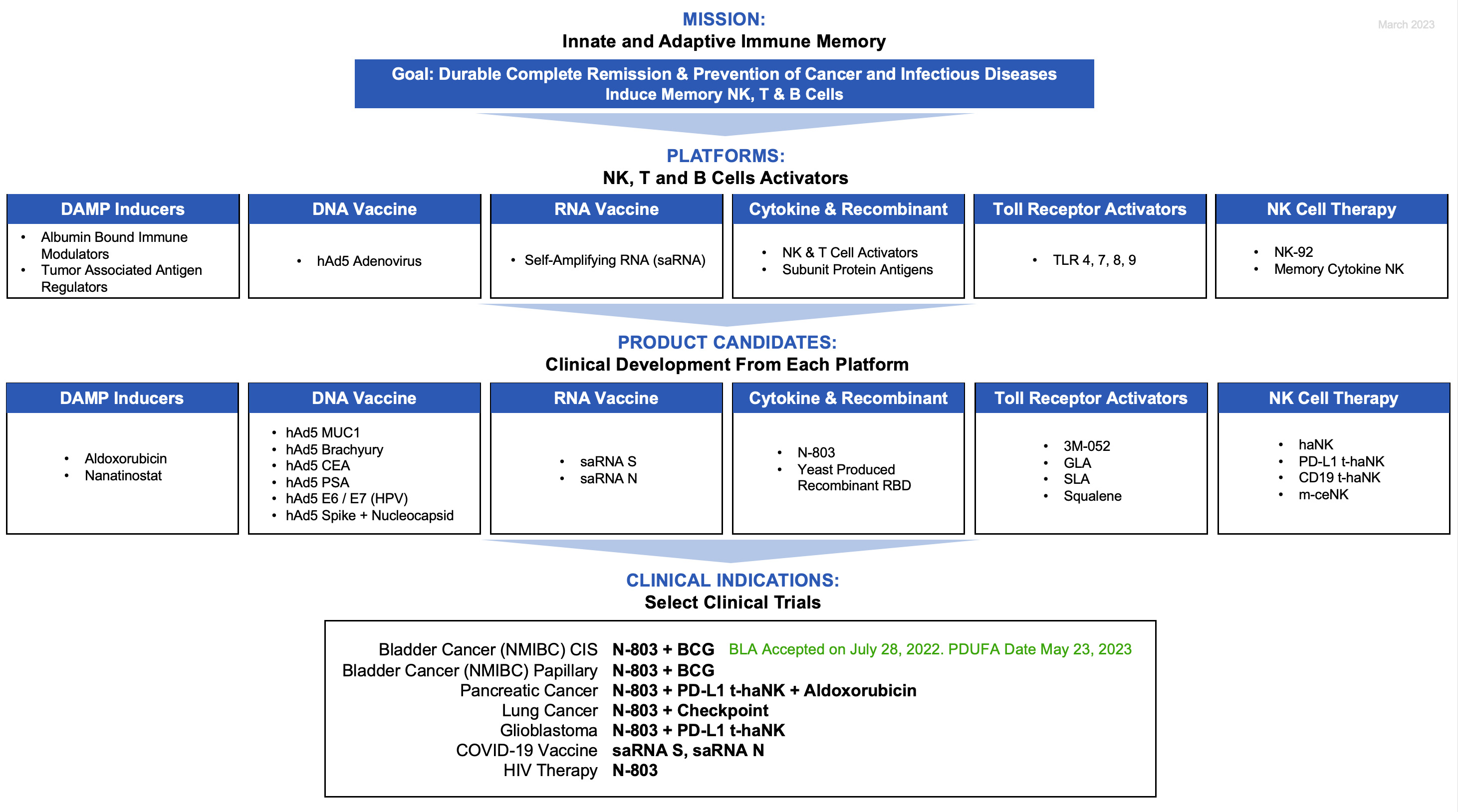

Our Business

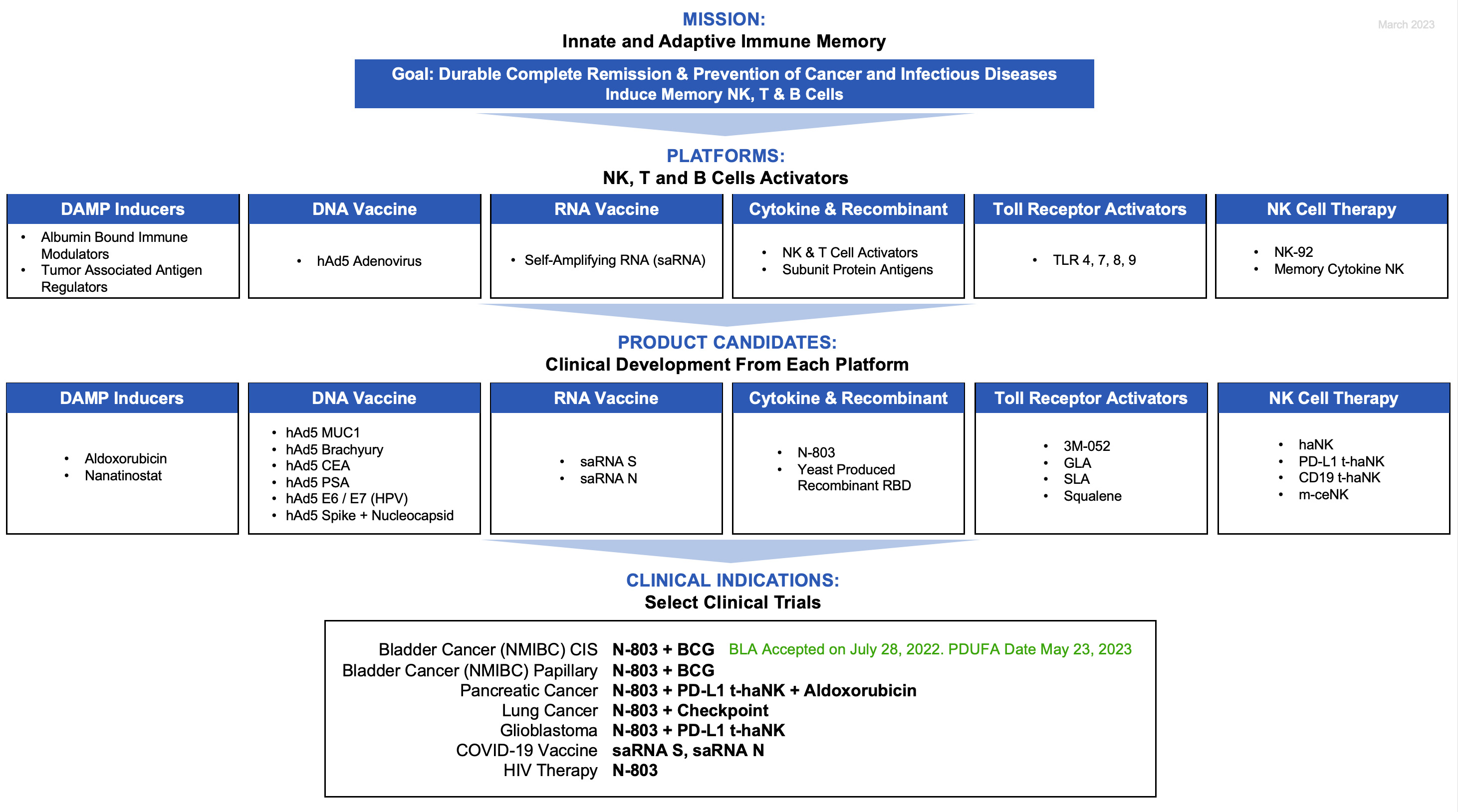

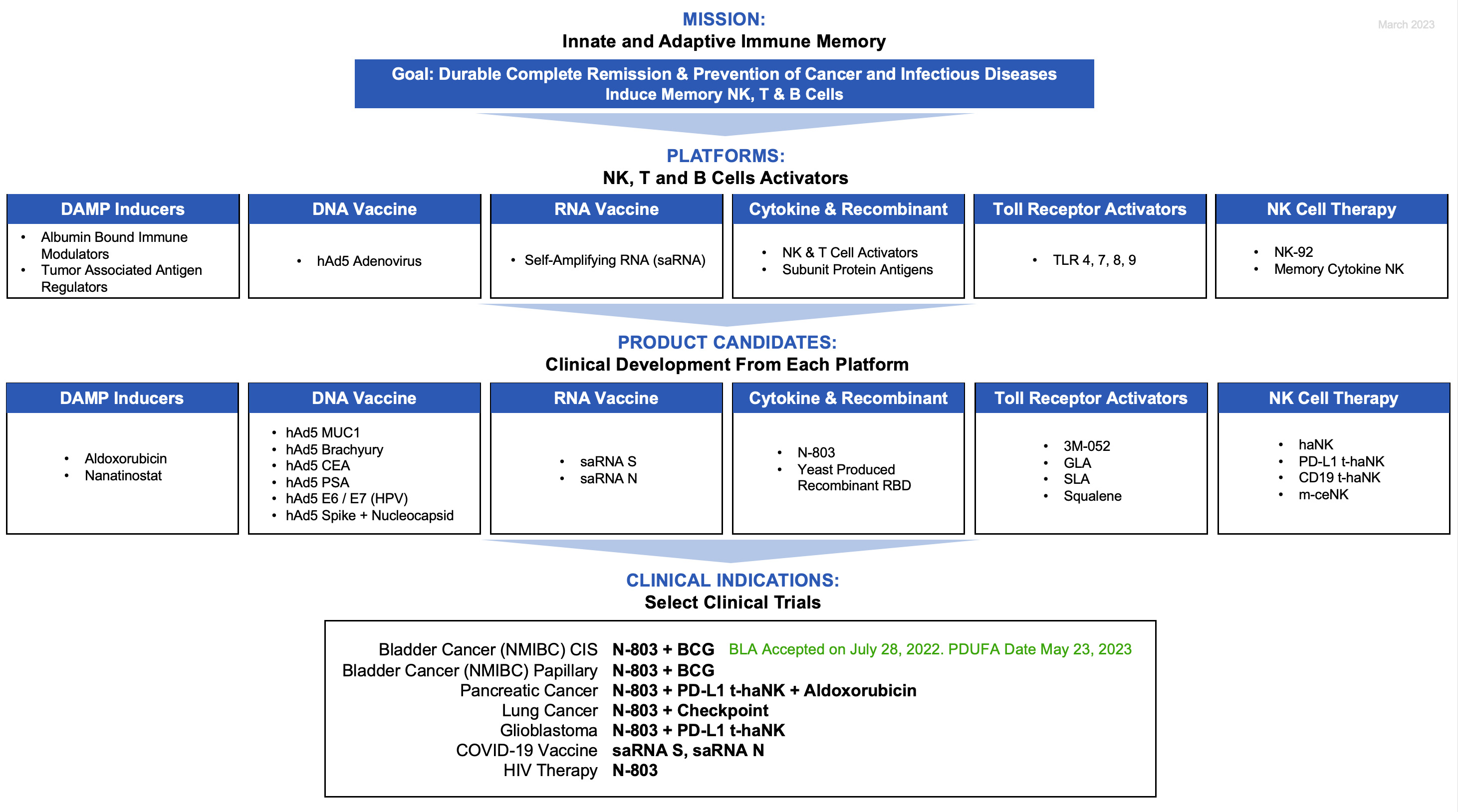

ImmunityBio, Inc. is aWe are an integrated clinical-stage biotechnology company discovering, developing, and commercializing next-generation immuno- and cellular therapies that bolster the natural immune system to drive and sustain an immune response. Using our proprietary platforms that amplify both the innate and adaptive branches of the immune system, our teams of clinical, scientific, and manufacturing experts, advance novel therapies and vaccines that complement, harness,aimed at defeating urologic and amplify the immune system to defeatother cancers, andas well as infectious diseases. We striveAlthough such designations may not lead to be a vertically-integrated immunotherapy company designingfaster development process or regulatory review and manufacturingmay not increase the likelihood that a product candidate will receive approval, N-803 (Anktiva), our products so they are more effective, accessible, more conveniently stored,lead biologic commercial product candidate, has received Breakthrough Therapy and more easily administered to patients.Fast Track designations and is currently under review by the FDA for treatment in combination with BCG of patients with BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease and has a new user fee goal date (PDUFA date) of April 23, 2024.

Our broad immunotherapyplatforms and cell therapy platformstheir associated product candidates are designed to attack cancer and infectious pathogens by activating both the innate immune system—natural killer (NK)system, including—NK cells, dendritic cells, and macrophages—and macrophages, as well as—the adaptive immune system—system comprising—B cells and T cells—cells,—in an orchestrated manner. The goal of this potentially best-in-class approach is to generate immunogenic cell death thereby eliminating rogue cells from the body whether they are cancerous or virally infected.virally-infected. Our ultimate goal is to employovercome the limitations of current treatments, such as checkpoint inhibitors, and/or reduce the need for standard high-dose chemotherapy in cancer by employing this coordinated approach to establish an “immunological memory” that confers long-term benefit for the patient.

Our business is based on the foundation of multiple platforms that collectively act on the entire immune response with the goal of targeted, durable, coordinated,biologic product candidates include: (i) antibody-cytokine fusion proteins, (ii) DNA, RNA, and safe immunity against disease.recombinant protein vaccines, and (iii) cell therapies. These platforms and their associated product candidates are designed to overcome the limitations of the current standards of care in oncology and infectious diseases, such as checkpoint inhibitors and antiretroviral therapies. Our portfolio includes:

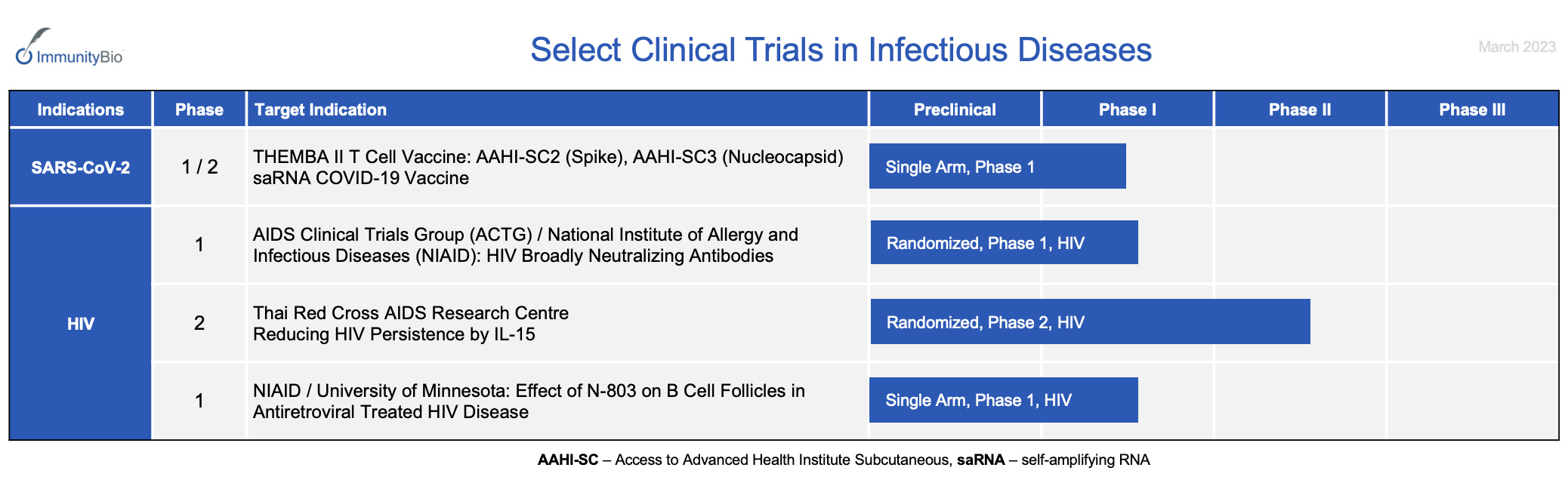

Our platforms includehave generated 9 first-in-humannovel therapeutic agents thatfor which clinical trials are currently being studiedeither underway or planned in 26solid and liquid tumors. Specifically, our clinical trials—17 offocus includes bladder, lung, and colorectal cancers and GBM, which are in Phase 2 or 3 development—across 12 indications in liquid and solid tumors, including bladder, pancreatic and lung cancers. These are among the most frequent and lethal cancer types, for whichand where there are high failure rates for existing standards of care or in some cases, no available effective treatment. In infectious diseases, our pipeline currently targets such pathogens as the novel strain of the coronavirus (SARS-CoV-2) and human immunodeficiency virus (HIV). We believe SARS-CoV-2 currently lacks a vaccine that provides long-term protection against the virus, particularly its variants, while HIV affects tens of millions of people globally and currently has no known cure.

We believe that our innovative approach to orchestrate and combine therapies for optimal immune system response will become a therapeutic foundation across multiple clinical indications. Additionally, we believe that data from multiple clinical trials indicates N-803 has broad potential to enhance the activity of therapeutic monoclonal antibodies (mAbs), including checkpoint inhibitors (e.g., Keytruda), across a wide range of tumor types. N-803 is currently being studied in 21 clinical trials (both ImmunityBio and investigator-sponsored) across 12 indications. Although such designations may notOur lead to a faster development process or regulatory review and may not increase the likelihood that abiologic commercial product candidate will receive approval, Anktiva ImmunityBio’s novel antibody cytokineis an IL-15 superagonist antibody-cytokine fusion protein, has received Breakthrough Therapy and Fast Track designations from the FDA in combination with bacillus Calmette-Guérin (BCG) for the treatment of patients with BCG-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ (CIS) with or without Ta or T1 disease.protein. In May 2022, we announced the submission of a Biologics License Application (BLA)BLA to the FDA for our product candidate, Anktiva in combination with BCG for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease. In JulyOn May 9, 2023, the FDA delivered a CRL to us regarding the BLA filed in May 2022, indicating that the FDA had determined that it could not approve the original BLA submission in its initial form, and the FDA made recommendations to address the issues raised. The deficiencies in the CRL related to the FDA’s pre-license inspection of the company’s third-party CMOs, among other items. Satisfactory resolution of the observations noted at the pre-license inspection would be required before the BLA could be approved. At the time, the FDA further provided recommendations specific to additional CMC issues and assays to be resolved. The CRL did not request new preclinical studies or Phase III clinical trials to evaluate safety or efficacy. The FDA requested that the company provide updated duration of response data for the efficacy population as identified by the FDA in the company’s resubmission, as well as a safety update.

On October 23, 2023, we announced that we had completed the resubmission of the BLA addressing the issues in the CRL. As part of our resubmission, we provided an update of the duration of response regarding the responders identified by the FDA in the efficacy population for BCG unresponsive subjects with high-risk CIS disease. On October 26, 2023, we announced that the FDA had accepted our BLA resubmission for review and considered it as a complete response to the CRL. The FDA has set a target Prescription Drug User Fee Act (PDUFA) actionnew user fee goal date (PDUFA date) of MayApril 23, 2023.2024. While we believe the BLA resubmission addresses the issues identified in the CRL, there is no guarantee that the FDA will ultimately agree that such issues have been successfully addressed and resolved. It is unclear when the FDA will approve our BLA, if at all.

Further late-stage efforts for Anktiva are in development within the broader bladder cancer space, including BCG-naïve NMIBC. In addition, data from multiple clinical trials suggest N-803 has potential to enhance the activity of therapeutic mAbs, including checkpoint inhibitors (e.g., pembrolizumab/Keytruda), across a wide range of tumor types. We believe there is potential for N-803 to become a therapeutic foundation across all phases of treatment, including in adjunctive therapy, to amplify, reactivate or extend the efficacy of standard of care. In addition to N-803, we have active clinical programs evaluating therapeutic candidates from our DNA and RNA vaccine technology platforms and our NK cell-based therapy platforms in oncology and infectious disease indications.

We have established Good Manufacturing Practice (GMP) manufacturing capacityOn December 29, 2023, we entered into the RIPA with Infinity and Oberland. Pursuant to the RIPA, Oberland acquired certain Revenue Interests (as defined in the RIPA) from us for a gross purchase price of $200.0 million paid on closing, less certain transaction expenses. In addition, Oberland may purchase additional Revenue Interests from us in exchange for the $100.0 million Second Payment upon satisfaction of certain conditions specified in the RIPA, including following the receipt of approval by the FDA of the company’s BLA for N-803 in combination with BCG for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease on or before June 30, 2024 (the Second Payment). Under the RIPA, Oberland has the right to receive quarterly payments from us based on, among other things, a certain percentage of our worldwide net sales, excluding those in China, during such quarter.

Also, on December 29, 2023 and in connection with the RIPA, we entered into an SPOA with Oberland pursuant to which we sold an aggregate of approximately $10.0 million of our common stock at scale with cutting-edge cell manufacturing expertise and ready-to-scale facilities, as well as extensive and seasoned research and development (R&D), clinical trial, and regulatory operations and development teams.$4.1103 per share in a private placement. Oberland also has an option to purchase up to an additional $10.0 million of our common stock, at a price per share to be determined by reference to the 30-day trailing volume weighted-average price of our common stock calculated from the date of exercise.

I.Our Strategy

We seek to become thea leading global immunological therapeutics company by creating the next generation of immunotherapiesnext-generation immuno- and cell therapies to address serious unmet needs within oncologyurologic and other cancers as well as infectious diseases. To achieve this goal, the key elements of our strategy include:

•advancing the approval and commercialization of our lead antibody cytokineIL-15 superagonist antibody-cytokine fusion protein, N-803, as an integral component of immunotherapy combinations, including those with checkpoint inhibitors;

•continuously scrutinizing our clinical pipeline and assessing our strategic priorities to maximize opportunities for regulatory approval and to meet unmet medical needs;pipeline;

•accelerating product candidates generated from our immunotherapy platform and product candidatesplatforms with registrational intent to address difficult-to-treat oncological and infectious disease indications;

•continuing to prospect, license, and acquire technologies to complement and strengthen our platforms and product candidates, both as single agent and combination therapies, in order to activate and coordinateoptimize responses of the innate and adaptive immune systemsystems to generate cellular memory against multiple tumor types and infectious diseases;

•optimizing investmentinvesting in our discovery, development, and manufacturing capabilities for our next-generation targeted antibody cytokine fusion and recombinant proteins and vaccine candidates, as well as for cell therapies;

•advancing our formulations and delivery mechanisms to make our promising biotechnology product candidates available to the broadest population possible;in both oncology and infectious disease; and

•cultivating new and expanding existing collaborations for our multi-stage pipeline to efficientlyreach global scale globally.efficiently.

II.Our Next-Generation Platforms

Antibody-Cytokine Fusion Proteins

1.Antibody Cytokine Fusion Proteins

Antibody cytokineAntibody-cytokine fusion proteins, such as N-803, are a novel class of biopharmaceuticalsbiologics that enhance the therapeutic potential of cytokines, and promote lymphocyte infiltration at a site of disease, improving immune response. N-803 is a novel interleukin-15 (IL-15)an IL-15 superagonist fusion protein consisting of high-affinity mutant IL-15N72D fused to the IL-15 receptor α sushi subunit and linked to the Fc portion of IgG1 Fc.Fc that exerts its effects via enhanced IL-2 receptor The novel antibody cytokine fusion proteinβ site binding. N-803 specifically increases the activityproliferation and activation of two critical aspectscell types of the immune system—system – NK cells and cytotoxic (tumor cell killing) CD8 T-cells—and exerts its effects via enhanced IL-2 receptor bindingCD8+T-cells – but not immunosuppressive T-reg cells, leading to the β site resulting in generationestablishment of Killer T cells and not the immunosuppressive regulatory T-cell (T-reg) cells. This superagonist IL-15 activity is the first in class to activate and proliferate NK cells, CD8+ Killer T cells, and Memorymemory T cells. Anktiva has received Breakthrough Therapy and Fast Track designations by the FDA for the treatment of BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease as well as Fast Track designation for BCG-unresponsive NMIBC papillary and BCG-naïve NMIBC with CIS. We believe this fusion protein combined with our natural killer cell therapy platform and our DNA/RNA vector delivery platforms places ImmunityBio at the leading edge to successfully deliver a cancer vaccine for durable complete responses across multiple tumor types. Althoughnote such designations may not lead to a faster development process or regulatory review and may not increase the likelihood that a product candidate will receive approval Anktiva has received Breakthrough Therapy and Fast Track designations by the FDA for the treatment of BCG-unresponsive NMIBC CIS with or without Ta or T1 disease as well as Fast Track designation for BCG-unresponsive NMIBC papillary and BCG-naïve NMIBC CIS..

In May 2022, we announced the submission of a BLA to the FDA for our product candidate, Anktiva in combination with BCG for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease. In July 2022,As described above, on October 26, 2023, we announced that the FDA had accepted our BLA resubmission for review and considered it as a complete response to the CRL. The FDA has set a target PDUFA actionnew user fee goal date (PDUFA date) of MayApril 23, 2023.2024. It is unclear when the FDA will approve our BLA, if at all.

We believe that other N-803 indications with registration potential include BCG-unresponsive papillary, bladder cancer,BCG-naïve CIS and BCG-naïve papillary, lung cancer, pancreatic cancer, and glioblastoma multiforme (GBM)colorectal cancers, and GBM in oncology and HIV in infectious diseases.

N-803

In addition to N-803, we are developing bi-specific fusion proteins targeting CD20, PD-L1, IL-12, and TGF-ß to further enhance NK and T-cell activation directed to the infectious disease or tumor microenvironment, and to modulate the systemic and local immune response to accelerate immunogenic cell death. Prioritized product candidates in preclinical development include antibody cytokineantibody-cytokine fusion proteins N-820 (targeting CD20), N-809 (targeting PD-L1), N-812 (delivering IL-12 to necrotic tumor cells), and N-830 (delivering a TGF-ß Trap to necrotic tumor cells).

2.DNA, RNA, and Recombinant Protein Vaccine TechnologiesVaccines

We have developed andand/or acquired rights to multiple vaccine delivery technologies for oncology to deliver common TAAs, and neoepitopes (expressed only by cancer cells) and for infectious diseases to target key viruses, including SARS-CoV-2, and for oncology to deliver common tumor-associated antigens (TAAs), and neoepitopes (expressed only by cancer cells).SARS-CoV-2. These technologies can deliver DNA, self-amplifying RNA (saRNA),saRNA, and subunit proteins to induce B- and T-cell memory due to the activation of both CD4+ and CD8+ T cells along with antibody (humoral) responses. In SARS-CoV-2, we believe

Our key vaccine delivery technologies include:

a.Second-generation hAd5 vector

Adenovirus is a well-established viral vector and can be utilized as a vaccine platform to stimulate the focus on targeting a highly mutable S-protein and the associated antigenic drift with limited memory T-cell response is leading to a potential for emergence of resistance to the current generation of vaccines. A booster vaccine targeting the N protein, which is highly conservedimmune system. Our hAd5 technology has unique deletions in the coronavirus genusearly 1, (E1), early 2 (E2b) and is oneearly 3 (E3) regions (hAd5 [E1-, E2b-, E3-]), which allows it to be effective in the presence of pre-existing adenovirus immunity and lowers the most abundant structural proteinsrisk of generating de novo vector-directed immunity. We have developed several hAd5 product candidates that have been studied in virus-infected cells, could provide maximal immune protection against currentmultiple clinical trials as potential vaccines for the treatment of infectious diseases and future COVID-19 variants such as Deltacertain cancers. Importantly, these product candidates have shown an ability to overcome previous adenovirus immunity in preclinical models and Omicron and their associated sub-lineage variants of concern.in cancer patients. In oncology, we are exploring the delivery of N-803 in combination with hAd5 TAAs like E6/E7, CEA, MUC1, Brachyury, [E6/E7] and PSA, which we believe could yield immunological memory.Our key vaccine delivery technologies include:

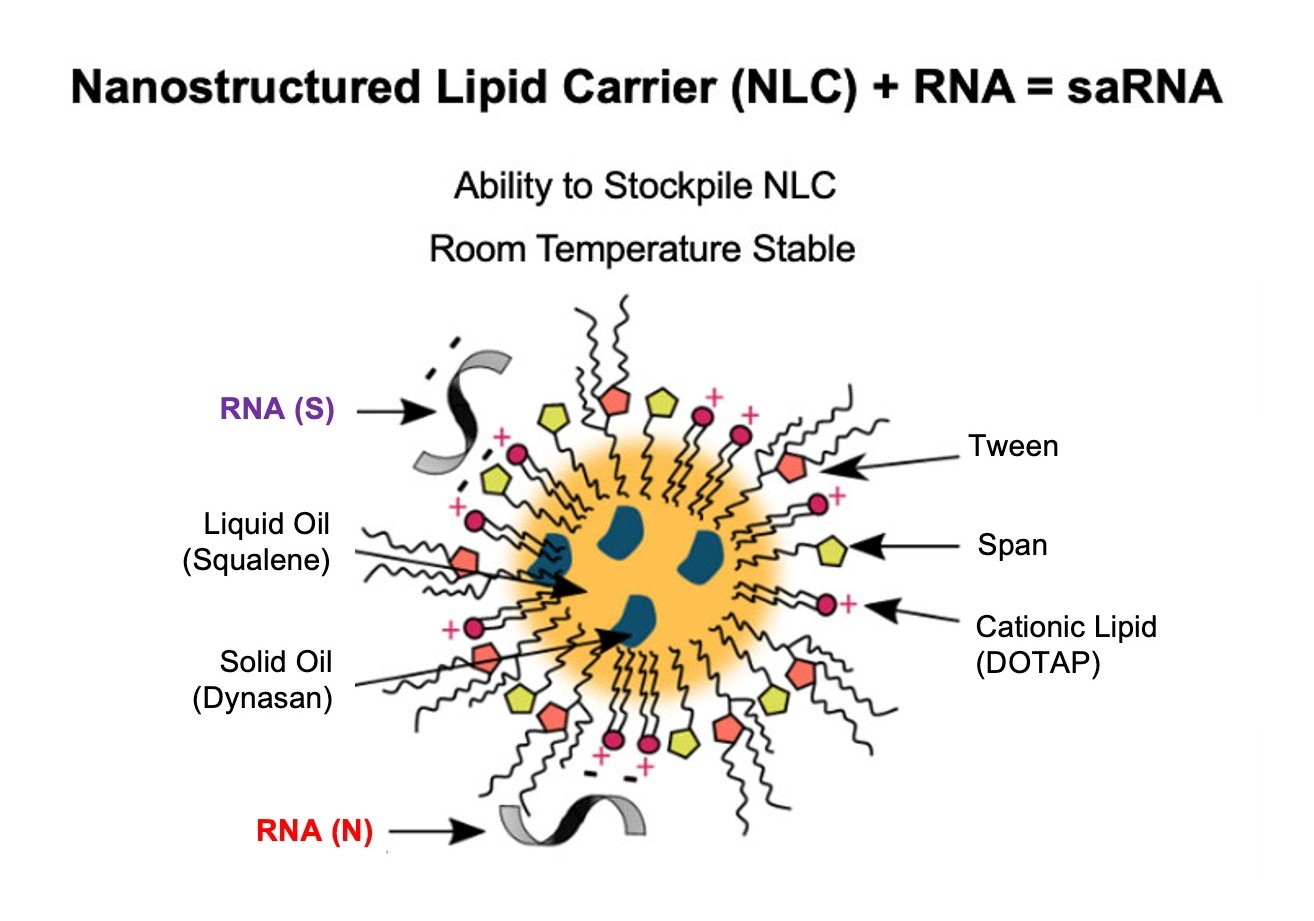

a.b.Self-amplifying RNAsaRNA in an NLC formulation

Synthetic RNA technology has quickly emergedcome to the forefront for use in prophylactic and therapeutic vaccines in part because it allows for rapid, scalable, and cell-free manufacturing as evidenced by the adoption of SARS-CoV-2 RNA vaccines. We believe ourOur saRNA technology (licensed from the Access to Advanced Health Institute (AAHI) (formerlyAAHI, formerly known as the Infectious Disease Research Institute, or IDRI), both directlyincludes an NLC formulation that protects the saRNA cargo and in the case of SARS-CoV-2, through our joint venture formed with Amyris, Inc. (Amyris) in December 2021) represents a significant improvement over existing RNA technologies. Our saRNA constructs include a nanostructured lipid carrier (NLC) formulationis important for thermal stability and facilitating thestability. The platform technology facilitates substitution of genetic sequences to generate novel vaccines and have demonstratedhas an ability to vaccinate with multivalent strains. The self-replicating capability allows for increased potency by maintaining auto-replicative activity derived from the RNA virus vector, while the self-amplifying capability may increase the duration and breadth of immunity. Preclinical studies in small animal and non-human primate (NHP)NHP models have shown that theNLC saRNA delivery vehicle results inelicits potent humoral and cell-based immunogenicity. Phase 1I first-in-human trials of saRNA for COVID-19 began in 2022 and continues in the first quarter of 2023.2022. Results to date have demonstrated limited adverse events of the saRNA S construct and the trial is currently evaluating the safety and immunogenicity of our saRNA N construct in a similar dose escalation manner. Once Phase 1 is complete, the results will be usedare being analyzed to inform the Phase 2 design for optimal immunogenicity.

b.Second-generation adenovirus hAd5 vector

Adenovirus is a well-established viral vectorfuture studies in oncology and can be utilized as a vaccine to stimulate the immune system. Our human adenovirus serotype 5 (hAd5) technology has unique deletions in the early 1, (E1), early 2 (E2b) and early 3 (E3) regions (hAd5 [E1-, E2b-, E3-]), which allows it to be effective in the presence of pre-existing adenovirus immunity and lowers the risk of generating de novo vector-directed immunity. We have developed several hAd5 product candidates, which have been studied in multiple clinical trials as potential vaccines for the treatment of infectious diseases and certain cancers. Importantly, these product candidates have shown an ability to overcome previous adenovirus immunity in preclinical models and in cancer patients.

In oncology, we are exploring the delivery of N-803 in combination with hAd5 TAAs like HPV E6/E7, CEA, MUC1, Brachyury, and PSA, which we believe could yield immunological memory.disease.

c.Recombinant protein vaccine platforms

Our yeast vaccine platforms have been studied in both oncology and infectious diseases:

(i)diseases, including our Tarmogen platform (licensed from our subsidiary GlobeImmune, Inc. (GlobeImmune))GlobeImmune), which has been administered to over 400 patients with cancer or infectious diseases in FDA-regulated clinical trials. This platform technology consists of a heat-killed, recombinant S cerevisiae yeast-based vaccine engineered to express immunogens such as TAAs, pathogen antigens, and tumor-specific neoepitopes. Immunization with this platform elicits CD4+ and CD8+ T cell responses capable of eliminating tumor cells or pathogen-infected cells.

(ii)our pichia platform was used to produce RBD antigens (licensed from Baylor College of Medicine (BCM) (which was developed at the Texas Children’s Hospital Center for Vaccine Development)), which, when combined with the 3M-052/Alum adjuvants and related technology (licensed from AAHI and 3M Company (3M) and affiliates), had been shown to provide protection against SARS-CoV-1, SARS-CoV-2 (and variants of concern), and animal coronaviruses in preclinical models.

3.Toll-Like Receptor Activating Adjuvants

Adjuvants are either synthetic or naturally occurring moleculesWe believe that activate toll-like receptors (TLRs) thereby enhancing the humoral and cell-mediated immune response of vaccines. There are 10 human TLRs expressed either on the inside or outside of the immune cell and their function is to recognize foreign substances expressed by pathogens. Once activated, these TLRs stimulate danger signals to the immune cells initiating an immune response. Wewe have licensed adjuvants and related technology from AAHI and 3M and its affiliates to incorporate with the vaccine delivery platforms described above and have access to multiple toll receptor activators, including TLR 4, TLR 7, and TLR 8. The synthetic imidazoquinolinone 3M-052 is structurally similar to resiquimod. The 3M-052/Alum adjuvant formulation is in Phase 1 trials in the U.S. with an HIV antigen and has been well-tolerated and immunogenic.

4.NK Cell Therapy

ImmunityBio has one of the most comprehensive clinical-stage natural killer cellcell-based platforms which hasin development. Our engineered NK cells have demonstrated the ability to induce cell death in cancers and virally-infected cells through a variety of concurrent mechanisms including innate killing, antibody-mediated killing, chimeric antigen receptor (CAR)-directedCAR-directed killing, and a combination of both antibody-mediated and CAR-directed killing.the latter.

a.Off-the-shelf natural killer (NK)NK cells

Natural killerNK cells (NK cells) are a type of cytotoxic lymphocyte critical to the innate immune system. NK cells show spontaneous cytolytic activity against cells under stress such as tumor cells and virally-infected cells. After activation, NK cells also secrete several cytokines such as interferon-γ (IFN-γ), tumor necrosis factor-α (TNF-α), granulocyte macrophage colony-stimulating factor (GM-CSF)(GM‑CSF), and chemokines that can modulate the function of other innate and adaptive immune cells. CytotoxicOur NK-92 cytotoxic cell lines (including our NK-92) have beenline was established from patientsa patient with clonal NK-cell lymphoma. ThoseThese NK cells can be expanded in culture in the presence of cytokines (IL-2, IL-15). Our “off-the-shelf” NKaNK cell platform has been molecularly engineered in a variety of ways to boost its killing capabilities against cancers and virally-infected cells. Unlike normal natural killerNK cells, our aNK cells do not express the key inhibitory receptors that diseased cells often exploit to turn off the killing function of NK cells and escape elimination. Further, wWee have genetically engineered our aNK cell platform to overexpress high-affinity CD16 receptors that bind to antibodies. These antibody-targeted haNK cells are designed to directly bind to IgG1-type antibodies, such as avelumab, trastuzumab, cetuximab, and rituximab, with the intention of enhancing the cancer-killing efficacy of these antibodies by boosting the population of competent natural killerNK cells that can kill cancer cells through antibody dependent cellular cytotoxicity (ADCC).ADCC.

Our most advanced line of off-the-shelf product candidatesNK cell, t-haNK, is an innovative, bioengineered combinationcell line that incorporates all the features of our haNK platform together with a CAR, (t-haNK).such as programmed PD-L1. Product candidates under this platform have three modes of killing: innate, antibody-mediated, and CAR-directed killing. These product candidates also include one or more additional expression elements such as functional cytokines, chemokines, and trafficking factors. These product candidates are intended to be combined with commercially availablecommercially-available therapeutic antibodies to effectively target either two different epitopes of the same cancer-specific protein or two entirely different cancer specificcancer-specific proteins. Trials studyingClinical trials to assess our t-haNKt‑haNK product candidates were initiated—PD-L1 t-haNK in a Phase 1I trial in triple negativetriple-negative breast cancer, (TNBC), and a Phase 2II trial in pancreatic cancer—and CD19 t-haNK has been cleared to commence Phase 1I testing.

InFindings from a preclinical study performed in collaboration with the National Cancer Institute (NCI),NCI demonstrated our PD-L1 t-haNK was reported to be acells exert potent cell therapy agentantitumor effects against myeloid-derived suppressor cells (MDSC)MDSC and overcome T cell escape in multiple types of resistant tumors (Fabian et al 2020). Resultstumors. The contribution of the QUILT 88 trial of patients with advanced pancreatic cancerPD-L1 t‑haNK to antitumor efficacy is further evidenced by data reported at the American Society of Clinical Oncology (ASCO)ASCO meeting in June 2022 and updated at ASCO GI in January 2023 showedfrom the QUILT 88 trial of patients with advanced pancreatic cancer who were administered PD-L1 t-haNK, aldoxorubicin and N-803. The multi-modal therapy resulted in a median overall survival of 6.3 months (95% CI: 5.0, 7.2 months) in patients who had progressed after two prior lines of therapy, more than doubling the historical survival.survival rate.

We believe we have aour pipeline ofthat includes t-haNK cells engineered to express other prominent CARs, for t-haNK, including epidermal growth factor receptor (those targeting EGFR),EGFR, which is advancing through clinical-enabling studies, which will enable usfacilitate our ability to potentially address an even broader range of cancers as part of a chemotherapy-free combination regimen.

b.Autologous and allogenic memory-like cytokine-enhanced NK cells (M-ceNK)allogeneic M-ceNK

Memory-like cytokine-enhanced NKM-ceNK cells are a unique set ofgenerated from lymphocytes collected from donors that differentiate after a brief pre-activation with interleukin-12are then pre-activated ex-vivo by exposure to interleukins-12 (IL-12), IL-15-15 and IL-18-18, which results in differentiation and exhibitacquisition of enhanced responses to cytokine re-stimulation that includere-stimulation. M-ceNK have increased antitumor characteristics, including enhanced IFN-γ production and cytotoxicity against leukemic cell lines. TheseM-ceNK cells have been isolated and characterizedare further distinguished by their unique cell-surface marker profile and their highly desirable feature of immune-memory, marked by their pronounced anti-cancer activity for weeks to months in duration, which has made these cells a research focus for more than a decade. We have developed a unique ability to generate a portfolio of distinct M-ceNK cell products through the application of our proprietary technology and cytokines and our proprietary methods and overall expertise in scale manufacturing of NK cell-based products. A Phase 1I first-in-human trial is open and actively enrolling patients in a first-in-human trial to study the M-ceNK platform in solid tumors (QUILT 3.076)3076).

5.Damage-Associated Molecular Patterns Inducers

DAMPs are releasedWe anticipate commencement of Phase II trials of M-ceNK plus N-803 in response to cell stresspatients with AML (QUILT 102) and death, and elicit potent sterile inflammation. Recent evidence suggests that DAMPs may also have a key roleplatinum-resistant ovarian cancer (QUILT 108) in the development of cancer as well as in the host response to cytotoxic anti-tumor therapy. DAMPs may play a protective role by alerting the immune system to the existence of dying tumor cells, thereby triggering immunogenic tumor cell death. Albumin-bound immune modulators and tumor associated antigen regulators target delivery of the chemotherapy agent to the tumor microenvironment, activate tumor killing macrophages and/or enable a tumor suppressive microenvironment.near term.

a.Aldoxorubicin

Aldoxorubicin is an albumin-associated anthracycline designed to target immune evasion in cancer. Aldoxorubicin has the same cytotoxic mechanism of action as doxorubicin, which is currently approved for use in 14 indications, including breast cancer, Hodgkin’s lymphoma and small-cell lung cancer (SCLC), but also has unique pharmacological properties resulting in lower cardiotoxicity as shown in Phase 2 and Phase 3 clinical trials for soft tissue sarcoma previously conducted by LadRx Corporation (LadRx, formerly CytRx Corporation). LadRx out-licensed global development, manufacturing, and commercialization rights for aldoxorubicin to us in 2017. The investigative therapeutic is currently in a Phase 2 trial in metastatic pancreatic cancer (QUILT 88) of DAMP inducers combined with N-803and PD-L1 t-haNK to evaluate the safety and efficacy of the combination.

b.Nanatinostat

VRx-3996 (nanatinostat), an orally available histone deacetylase (HDAC) inhibitor, is being developed by Viracta. Nanatinostat is selective for specific isoforms of Class I HDACs, which is key to inducing viral genes that are epigenetically silenced in Epstein-Barr virus-associated malignancies. In preclinical studies, nanatinostat has been shown to reactivate silenced transgenes in tumor cells thereby turning them into preferential targets for NK cell killing, while also serving to broadly stimulate a patient’s immune system, offering the potential for improved clinical responses in cancer patients. The activity of HDAC inhibitors are believed to be based on the upregulation of natural killer group 2D (NKG2D) ligand expression on cancer cells, which serve as “eat-me” signals for NK cells and can drive NK proliferation, activation and cancer cell killing. We entered into an agreement with Viracta under which we were granted exclusive worldwide rights in patents and know-how related to nanatinostat for use in combination with our platform of NK cell therapies.

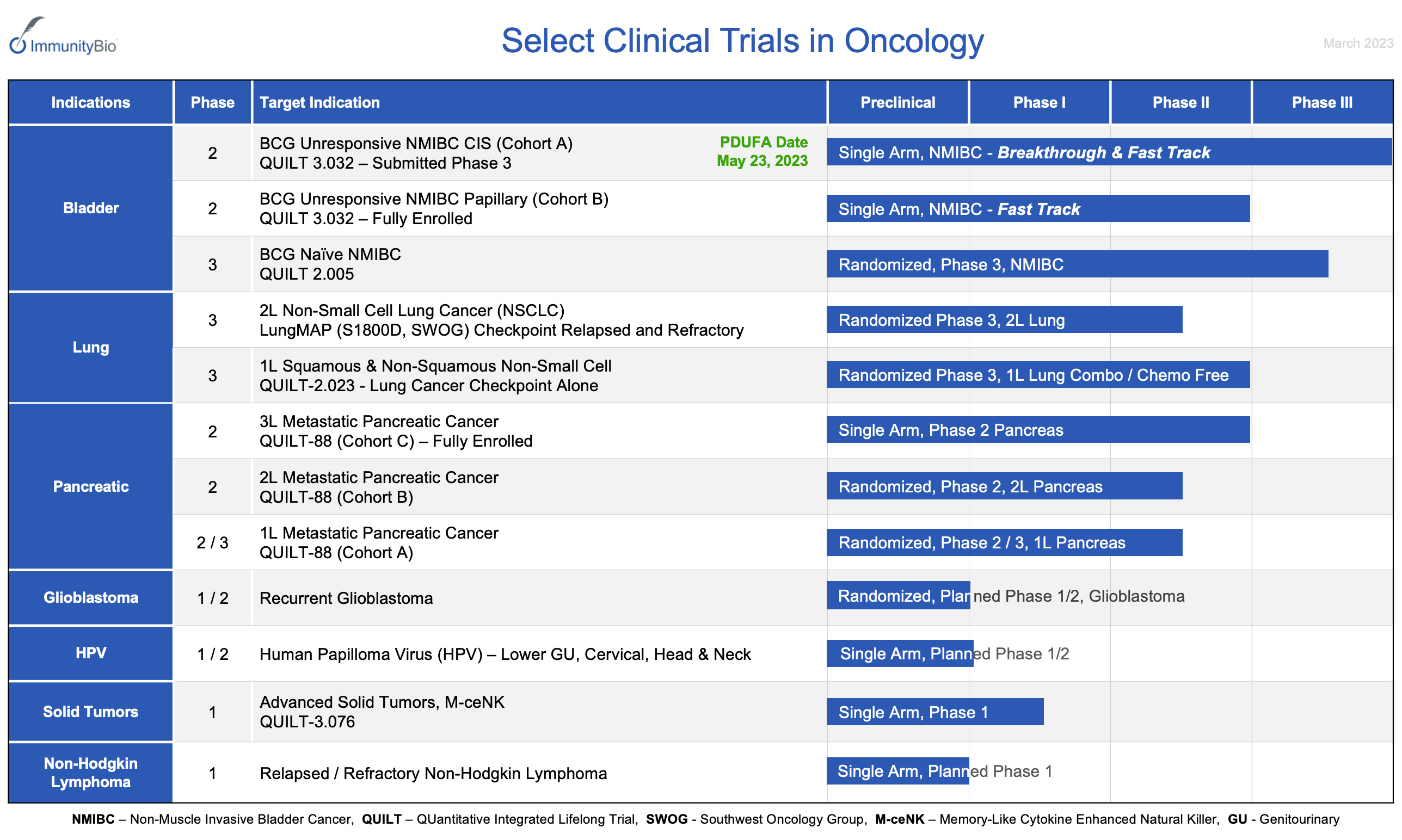

III.Our Pipeline

OurAs of March 2024, our platforms includehave generated 9 first-in-human therapeutic agents that are currently being or planned to be studied in 2624 clinical trials—17 of which are in Phase 2 or 3 development—trials across 12 indications in liquid and solid tumors, including bladder, pancreaticlung and lung cancers.colorectal cancers, and GBM. These indications are among the most frequent and lethal cancer types for which there are high failure rates for existing standards of care or, in some cases, no available effective treatment. We are constantly monitoring and deciding which trials to initiate or continueprioritizing clinical development based upon the availability of our resources and the efficacy and market developments of our and our competitors’, products and product candidates, among other factors.

1.Non-Muscle Invasive Bladder Cancer

In the U.S., bladder cancer is the fourth most commonly-diagnosed solid malignancy in men and twelfth in women.men. The American Cancer Society estimates there will be 82,29083,190 new cases and 16,71016,840 deaths from bladder cancer in 2023.2024. There is an urgent, unmet need to treat NMIBC and avoid radical cystectomy of the bladder in an attempt to control the disease. Although such designations may not lead to a faster development process or regulatory review and may not increase the likelihood that a product candidate will receive approval, Anktiva has received Breakthrough Therapy and Fast Track designations by the FDA for the treatment of BCG-unresponsive NMIBC with CIS (Cohort A) with or without Ta or T1 disease as well as Fast Track designation for BCG-unresponsive NMIBC papillary (Cohort B) and BCG-naïve NMIBC with CIS. In our QUILT 3.0323032 trial, the company reported in November 2022, as published in NEJM Evidence, that the primary end points were met for both BCG-unresponsive NMIBC with CIS with a complete response rate of 71%, and BCG-unresponsive NMIBC papillary with a 12-month disease-free rate of 55%. As presented at ASCO 2022, the combination of BCG plus AnktivaN-803 (as measured in BCG-unresponsive NMIBC patients, Cohorts A and B combined) was well-tolerated with 1% treatment-related serious adverse events, 0% immune-related serious adverse events, and 100% bladder cancer-specific overall survival at 24 months. Low-grade treatment-related adverse events include dysuria (22%), pollakiuria (20%), hematuria (17%), fatigue (16%), and urgency (12%), and all other treatment-related adverse events were seen at 7% or less. Seminal patents covering intravesical administration of BCG and AnktivaN-803 were issued providing term coverage until 2035.

BCG-UnresponsiveBCG Unresponsive NMIBC CIS (QUILT 3.032)(Cohort A) – QUILT 3032

In our Phase 2/3II/III open-label multi-center trial of BCG-unresponsive high grade NMIBC patients, the patients are receiving BCG plus AnktivaN-803 weekly for six consecutive weeks during induction. The patients also receive additional treatment including three weekly maintenance instillations every three months for up to 12 months and then at month 18. Patients with no disease or low-grade Ta disease at months 24, 30, and 36 are eligible for continued BCG plus AnktivaN-803 (Cohort A) or AnktivaN-803 alone (Cohort C) treatment (3 weekly instillations), at the principal investigators’ discretion.

The primary endpoint of the BCG-unresponsive NMIBC with CIS trial is a CRcomplete response rate at any time equal to or greater than 30% and the lower bound of the 95% confidence intervalCI must be greater than or equal to 20% for success. Complete response, or the disappearance of measurable disease in response to treatment, is evaluated at three months or six months following initial administration of BCG plus AnktivaN-803 (and every three months thereafter until 24 months). This endpoint would be achieved once at least 24 of the 80 patients in the trial achieve a complete response.

All patients enrolled in Cohort A have been treated with the recommended number of full-strength doses of BCG on study during our trial. We have enrolled patients who have received a lower dosage of BCG therapy before enrollment in our trial as a result of BCG shortages. The mean and median number of prior BCG doses in Cohort A is 16.5 and 12.0, respectively, which are consistent with the FDA definition of BCG-unresponsive CIS. The FDA allowed our modification of the study design to allow enrollment of such patients, and definition of these patients may require further discussions with the FDA upon review. A published meta-analysis (Zeng 2015) of six relevant randomized controlled trials and two quasi-randomized controlled trials in NMIBC concluded that low-dose BCG instillation significantly reduces the incidence of overall side effects, especially severe and systemic symptoms in patients with NMIBC, while the oncological control efficacy of low-dose BCG is not inferior to standard-dose BCG. There can be no assurance that the FDA will agree with this conclusion.

A data cutoff occurred in January 2022, which provided a median follow-up in Cohort A of approximately 24 months. Data as published in NEJM Evidence in November 2022 showed a complete response in 58 of 82 patients with a 71% CRcomplete response rate (95% CI: 59.6, 80.3) and a median duration of CR of 26.6 months (95% CI: 9.9, [upper bound not reached]). At 24 months in patients with a complete response, the probability of avoiding cystectomy and disease-specific survival was 91.4% and 100%, respectively. Also, at 24 months in all patients in Cohort A, the probability of avoiding cystectomy and of disease-specific survival was 84.1% and 100%, respectively.

As part of planned analyses, BCG-unresponsive patients in the QUILT 3032 trial of N-803 plus BCG completed PRO questionnaires, which revealed stability of both mean physical function and global health from baseline to 24 months on-study for those participants who had reached the 24-month assessment. Further, at month 6, Cohort A (CIS disease) patients that achieved a complete response reported higher physical function scores than those without a CR (P = 0.0659). Summary scores for the NMIBC-specific questionnaire also remained stable. These PROs, taken together with efficacy findings from both the NEJM Evidence report and subsequent follow-up, suggest a favorable risk-benefit ratio for the novel therapeutic combination.

In May 2022, we announced the submission ofsubmitted a BLA to the FDA for our product candidate, Anktiva in combination with BCG for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease. In July for which we received a target PDUFA action date of May 23, 2023. On May 9, 2023, the FDA delivered a CRL to us regarding the BLA filed in May 2022, indicating that the FDA had determined that it could not approve the original BLA submission in its initial form, and the FDA made recommendations to address the issues raised. The deficiencies in the CRL related to the FDA’s pre-license inspection of the company’s third-party CMOs, among other items. Satisfactory resolution of the observations noted at the pre-license inspection would be required before the BLA could be approved. At the time, the FDA further provided recommendations specific to additional CMC issues and assays to be resolved. The CRL did not request new preclinical studies or clinical trials to evaluate safety or efficacy. The FDA requested that the company provide updated duration of response data for the efficacy population as identified by the FDA in the company’s resubmission, as well as a safety update.

On October 23, 2023, we announced that we had completed the resubmission of the BLA addressing the issues in the CRL. As part of our resubmission, we provided an update of the duration of response regarding the responders identified by the FDA in the efficacy population for BCG-unresponsive subjects with high-risk CIS disease. On October 26, 2023, we announced that the FDA had accepted our BLA resubmission for review and considered it as a complete response to the CRL. The FDA has set a target PDUFA actionnew user fee goal date (PDUFA date) of MayApril 23, 2023.2024. While we believe the BLA resubmission addresses the issues identified in the CRL, there is no guarantee that the FDA will ultimately agree that such issues have been successfully addressed and resolved. It is unclear when the FDA will approve our BLA, if at all.

BCG-UnresponsiveBCG Unresponsive NMIBC Papillary (QUILT 3.032)(Cohort B) – QUILT 3032

In our Phase 2,II, open-label multi-center trial of BCG-unresponsive high grade NMIBC papillary patients (Cohort B), the patients are receiving BCG plus N-803 weekly for six consecutive weeks during induction. The patients also receive additional treatment including three weekly maintenance instillations every three months for up to 12 months and then every nine months for up to 24 months. The primary endpoint of the trial is a 12-month disease free rate greater than or equal to 30% and the lower bound of the 95% confidence intervalCI must be greater than or equal to 20% for success. To meet the primary endpoint, 24 out of 80 patients must be disease free at 12 months.

A data cutoff occurred in January 2022, which provided a median follow-up in Cohort B of approximately 21 months. Data as published in NEJM Evidence in November 2022 showed a 12-month disease-free survival rate of 55% (95% CI: 42.0, 66.8), with median disease-free survival of 19.3 months (95% CI: 7.4, [upper bound not reached]). At the cutoff date 67 of 72 patients, 93.1%, had not progressed to radical cystectomy and the 24 month24-month disease-free survival rate was 97.7%.

We met with the FDA in December 2022, and the FDA advised us to conductthat when there is a time-to-event endpoint a randomized trial in localizedis required. We are continuing to evaluate trial designs while we work with the FDA on BCG-unresponsive NMIBC papillary disease.

BCG-Naïve (QUILT 2.005)– QUILT 2005

As discussed above, N-803Anktiva has been awarded Fast Track designation by the FDA for the treatment of BCG-naïve NMIBC with CIS. We are currently enrolling patients in our Phase 2bIIb blinded, randomized, two-cohort, open-label, multi-center trial of intravesical BCG plus AnktivaN-803 versus BCG alone, in BCG naïBCG-naïve patients with high-grade NMIBC with CIS (Cohort A) and NMIBC papillary (Cohort B). Planned enrollment for Cohort A (CIS) and Cohort B (papillary) is 366 patients and 230 patients, respectively. As part of our October 2023 BLA resubmission for Anktiva in combination with BCG for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease, we provided an update on the long-term follow-up (QUILT 205) of BCG-naïve subjects in QUILT 2005 receiving N-803 plus BCG for CIS± Ta/T1 in the Phase Ib trial, examining the survival of the 9 subjects who entered the trial since 2014. As initially reported in 2021, all 9 subjects (100%) achieved a complete response, and in an 8-year follow up, the 6 evaluable patients remain disease-free (two were deceased from causes other than bladder cancer and one was lost to follow-up) with bladder preservation over a median survival period of 8.8 years.

2.Lung Cancer

According to the American Cancer Society, lung cancer is the second most common cancer in the U.S. In 2023,2024, it is estimated that 238,340234,580 new cases of lung cancer will be diagnosed in the U.S. and 127,070125,070 deaths will be attributed to the disease. Non-small cell lung cancer (NSCLC)NSCLC accounts for about 80% to 85% of all lung cancers diagnoses and there are very few successful treatment options for these patients once the cancer spreads beyond the lungs. The development of checkpoint inhibitors in NSCLC has been revolutionary, doubling the median overall survival in some settings; however, patient response may be short lived, due to late response and/or progression after achieving an initial response. As with bladder cancer, N-803 enhances the proliferation and activation of NK and T cells critical for targeting and killing lung cancer cells. There is therefore a strong rationale to evaluate N-803 in addition to an anti-PD-1 or anti-PD-L1 checkpoint inhibitor for patients with NSCLC who have relapsed after achieving an initial response to PD-1 or PD-L1 checkpoint inhibitor therapy. SCLC accounts for about 10% to 15% of all lung cancers. About two-thirds of patients with SCLC are diagnosed with extensive-stage disease, which is associated with especially poor prognosis, and a median survival of 10–13 months.

Analysis of pooled data from a Phase 1/2I/II trial conducted from January 2016 to June 2017 in 23 patients, and a subsequent investigator-initiated Phase 2II trial conducted by the Medical University of South Carolina, yielded confirmation of activity of the combination of checkpoint inhibitors and N-803 in relapsed NSCLC. In 15 patients with PD-L1 greater than 50%, the overall response rate was 38% and the median overall survival rate was 17.1 months. These preliminary findings were favorable relative to the historical response rate seen in this patient population in the first-line setting with checkpoint inhibitor therapy.

Non-Small Cell Lung Cancer – QUILT 3055

On the basis of these findings discussed above, we initiated a single-arm Phase 2bIIb multi-cohort basket trial (QUILT 3.055) of N-803 and checkpoint inhibitor combinations in patients who have previously received treatment with PD-1/PD-L1 immune checkpoint inhibitors per an FDA-approved indication. Patients enrolled in this trial were eligible if actively progressing on checkpoint inhibitor therapy. Upon enrollment, patients continued on the same checkpoint inhibitor but with the addition of N-803. Despite progressing on checkpoint inhibitor therapy upon entry into the trial, the majority of patients reverted to stable disease and demonstrated durability of stable disease, some extending as long as nine months. Data presented at the ASCO Annual Meeting in 2021 showed that despite the patients’ prior progression on checkpoint inhibitor therapy alone, upon entry into the trial the majority of patients experienced clinical benefit either as stable disease (49%) or a partial response (9%).

Among 140 patients enrolled in QUILT 3.055,3055, the common N-803 attributed grade 1 and 2 adverse events included: injection siteinjection-site reaction (71%), chills (34%), fatigue (27%), pyrexia (24%), flu-like illness (13%), and decreased appetite (10%). A total of 18 grade 3 and 4 adverse events attributed to N-803 have been reported among 16 patients (12%) in the trial as of February 2021. All reported grade 3 and 4 adverse events occurred at a frequency of 5% or less; two patients reported increased alanine amino transferase, increased aspartate amino transferase or increased blood alkaline phosphatase, anemia, injection-site reaction, or injection-site pain. All other occurrences of grade 3 or 4 adverse events that the clinical trial site investigators reported as suspected as being due to N-803 include: decreased lymphocyte count; weight loss; influenza-like illness; injection siteinjection-site pruritus; cellulitis; injection-site cellulitis; sepsis; deep vein thrombosis; hypovolemic shock; colitis; diarrhea; delirium; respiratory failure; and maculopapular rash. Although further studies are warranted, based on this relatively well-tolerated adverse event profile, coupled with NK and CD8+ T cell stimulatory effects, we believe that N-803 has the potential to become a standard in combination with other immunotherapies for multiple indications.

In March 2023, we reviewed the updated QUILT 3055 data, through February 5, 2023, from several cohorts of NSCLC patients who have progressed after check point inhibitor therapy. These cohorts are:

•Cohort 1a – NSCLC patients with initial response on single-agent checkpoint inhibitor therapy and subsequently progressed on or after that therapy.

•Cohort 2 – NSCLC patients having high PD-L1 expression (tumor proportion score ≥50%) and disease progression on a PD-1/PD-L1 checkpoint inhibitor after experiencing an initial response when received checkpoint inhibitor as a single-agent for first-line treatment.

•Cohort 3 – NSCLC patients with initial response but subsequently relapsed on maintenance PD-1/PD-L1 checkpoint inhibitor therapy when initially received checkpoint inhibitor therapy in combination with chemotherapy as first-line treatment.

•Cohort 4 – NSCLC patients currently receiving PD-1/PD-L1 checkpoint inhibitor therapy that progressed after experiencing stable disease for at least 6 months during previous treatment with PD-1/PD-L1 checkpoint inhibitor therapy.

The results are listed in the table below:

QUILT 3055: Overall Survival – NSCLC Subjects Safety Population

| | | | | | | | | | | | | | | | | |

| Variable | Cohort 1a

(N=19) | Cohort 2

(N=9) | Cohort 3

(N=20) | Cohort 4

(N=38) | All Subjects (N=86) |

| | | | | |

| Number of Deaths | 13 (68%) | 6 (67%) | 15 (75%) | 21 (55%) | 55 (64%) |

| Median Survival (months) | 14.1 | 18.5 | 15.8 | 12.6 | 13.9 |

| 95% CI for Median Survival | 11.7, 28.7 | 6.1, – | 7.5, 24.9 | 8.8, 25.5 | 11.7, 17.4 |

These results show a median overall survival of 13.9 months in the 86 patients in the pooled analysis. This is in contrast to the overall survival of 6.1 months reported by Freeman et al. for patients who received any therapy post-checkpoint inhibitor therapy progression or an overall survival of 7.5 months, as reported by Brueckl et al., for patients who received docetaxel plus ramucirumab after initial failure of first-line chemotherapy plus checkpoint inhibitor.

Small Cell Lung Cancer – QUILT 211