GlobalProtect Subscription.•GlobalProtect. This appliance-based subscription provides protection for mobile users of both traditional laptop devices and mobile devices. It expands the boundaries of the end-users’ physical network, effectively establishing a logical perimeter that encompasses remote laptop and mobile device users irrespective of their location. When a remote user logs into the device, GlobalProtect automatically determines the closest gateway available to the roaming device and establishes a secure connection. Windows and AppleRegardless of the operating systems, laptops, as well as mobile devices, such as Android phones and tablets, and Apple iPhones and iPads,phones will stay connected to the corporate network wheneverwhen they are on a network of any kind. Askind and, as a result, they are protected as if they never left the corporate campus. GlobalProtect ensures that the same secure application enablement policies that protect users at the corporate site are enforced for all users, independent of their location.

•Enterprise DLP.This cloud-delivered security service provides consistent, reliable protection of sensitive data, such as personally identifiable information (“PII”) and intellectual property, for all traffic types, applications, and users. Native integration with our products makes it simple to deploy, and advanced machine learning minimizes management complexity. Enterprise DLP allows organizations to consistently discover, classify, monitor, and protect sensitive data, wherever it may reside. It helps minimize the risk of a data breach both on-premises and in the cloud—such as in Office/Microsoft 365™, Salesforce®, and Box—and assists in meeting stringent data privacy and compliance regulations, including GDPR, CCPA, PCI DSS, HIPAA, and others.

VM-Series Subscription. VM-Series,•AIOps:AIOps is available in both free and licensed premium versions. AIOps redefines network operational experience by empowering security teams to proactively strengthen security posture and resolve network disruptions. AIOps provides continuous best practice recommendations powered by machine learning (“ML”) based on industry standards, security policy context, and advanced telemetry data collected from our network security customers to improve security posture. It also intelligently predicts health, performance, and capacity problems up to seven days in advance and provides actionable insights to resolve the software form factorpredicted disruptions.

Secure Access Service Edge:

•Prisma Access. Prisma Access is a cloud-delivered security offering that helps organizations deliver consistent security to remote networks and mobile users. Located in more than 100 locations around the world, Prisma Access consistently inspects all traffic across all ports and provides bidirectional networking to enable branch-to-branch and branch-to-headquarter traffic. Prisma Access consolidates point-products into a single converged cloud-delivered offering, transforming network security and allowing organizations to enable secure hybrid workforces. Prisma Access protects all application traffic with complete, best-in-class security while ensuring an exceptional user experience with industry-leading service-level agreements (“SLA”s).

•Prisma SD-WAN.Our Prisma SD-WAN solution is a next-generation SD-WAN solution that makes the secure cloud-delivered branch possible. Prisma SD-WAN enables organizations to replace traditional Multiprotocol Label Switching (“MPLS”) based WAN architectures with affordable broadband and internet transport types that promote improved bandwidth availability, redundancy and performance at a reduced cost. Prisma SD-WAN leverages real-time application performance SLAs and visibility to control and intelligently steer application traffic to deliver an exceptional user experience. Prisma SD-WAN also provides the flexibility of our Next-Generation Firewall,deploying with an on-premises controller to help businesses meet their industry-specific security compliance requirements and manage deployments with application-defined policies. Our Prisma SD-WAN simplifies network and security operations using machine learning and automation.

Cloud Security:

•Prisma Cloud. Prisma Cloud is offered asa comprehensive Cloud-Native Application Protection Platform (“CNAPP”), securing both cloud-native and lift-and-shift applications across multi- and hybrid-cloud environments. With broad security and compliance coverage and a perpetual licenseflexible agentless, as well as agent-based, architecture, Prisma Cloud protects cloud-native applications across their lifecycle from code to cloud. The platform helps developers prevent risks as they code and build the application, secures the software supply chain and the continuous integration and continuous development (“CI/CD”) pipeline, and provides complete visibility and real-time protection for applications in the cloud.

With its code-to-cloud security capabilities, Prisma Cloud uniquely stitches together a term-based subscription. The VM-Series provides allcomplete security picture by tracing back thousands of cloud risks and vulnerabilities that occur in the application runtime to their origin in the code-and-build phase of the sameapplication. The platform enables organizations to “shift security left” and fix issues at the source (in code) before they proliferate as a large number of risks in the cloud. The contextualized visibility to alerts, attack paths, and vulnerabilities delivered by Prisma Cloud facilitates collaboration between security and development teams to drive down risks and deliver better security outcomes. The context helps security teams block attacks in the cloud runtime and developers fix risks in source code.

A comprehensive library of compliance frameworks included in Prisma Cloud vastly simplifies the task of maintaining compliance. Seamless integration with security orchestration tools ensures rapid remediation of vulnerabilities and security issues.

With a flexible, integrated platform that enables customers to license and activate cloud security capabilities that match their need, Prisma Cloud helps secure organizations at every stage in their cloud adoption journey. The platform enables security teams to consolidate multiple products that address individual risks with an integrated solution that also delivers best-in-class capabilities. Including the recently launched CI/CD security module, Prisma Cloud’s code-to-cloud CNAPP delivers comprehensive protection for applications and their code, infrastructure (workloads, network, and storage), data, APIs, and associated identities.

Security Operations:

•Cortex XSIAM. This cloud-based subscription is the AI security automation platform for the modern SOC, harnessing the power of AI to radically improve security outcomes and transform security operations. Cortex XSIAM customers can consolidate multiple products into a single unified platform, including EDR, XDR, SOAR, ASM, user behavior analytics (“UBA”), threat intelligence platform (“TIP”), and security information and event management (“SIEM”). Using a security-specific data model and applying AI, Cortex XSIAM automates data integration, analysis, and triage to respond to most alerts, enabling analysts to focus on only the incidents that require human intervention.

•Cortex XDR. This cloud-based subscription enables organizations to collect telemetry from endpoint, network, identity and cloud data sources and apply advanced analytics and machine learning, to quickly find and stop targeted attacks, insider abuse, and compromised endpoints. Cortex XDR has two product tiers: XDR Prevent and XDR Pro. XDR Prevent delivers enterprise-class endpoint security focused on preventing attacks. XDR Pro extends endpoint detection and response (“EDR”) to include cross-data analytics, including network, cloud, and identity data. Going beyond EDR, Cortex XDR detects the most complex threats using analytics across key data sources and reveals the root cause, which can significantly reduce investigation time as compared to siloed tools and manual processes.

•Cortex XSOAR. Available as a cloud-based subscription or an on-premises appliance, Cortex XSOAR is a comprehensive security orchestration automation and response (“SOAR”) offering that unifies playbook automation, case management, real-time collaboration, and threat intelligence management to serve security teams across the incident lifecycle. With Cortex XSOAR, security teams can standardize processes, automate repeatable tasks, and manage incidents across their security product stack to improve response time and analyst productivity. It learns from the real-life analyst interactions and past investigations to help SOC teams with analyst assignment suggestions, playbook enhancements, and best next steps for investigations. Many of our hardware appliances, but is delivered ascustomers see significantly faster SOC response times and a software package that can be deployed on VMware’s NSX and ESXi, Microsoft’s Hyper-V, and Red Hat KVM hypervisors, as well as nativelysignificant reduction in Amazon Web Services cloud and Microsoft Azure cloud.

the number of SOC alerts which require human intervention.Traps Endpoint Protection Subscription. This subscription provides protection for endpoints against cyberattacks that aim to run malicious code or exploit software vulnerabilities. It prevents known and previously unknown attacks through its unique capability of stopping the underlying exploit techniques and can prevent cyberattacks without relying on prior knowledge of the attack. Through its integration with WildFire, it is also capable of preventing cyberattacks that rely on malware.

AutoFocus Subscription.•Cortex Xpanse. This cloud-based subscription provides threat intelligence capabilitiesattack surface management (“ASM”), which is the ability for an organization to our end-customers’ security operations teams. Indicatorsidentify what an attacker would see among all of compromiseits sanctioned and anomaliesunsanctioned Internet-facing assets. In addition, Cortex Xpanse detects risky or out-of-policy communications between Internet-connected assets that occur on an end-customer’s network can be correlatedexploited for data breaches or ransomware attacks. Cortex Xpanse continuously identifies Internet assets, risky services, or misconfigurations in third parties to help secure a supply chain or identify risks for mergers and acquisitions due diligence. Finally, compliance teams use Cortex Xpanse to improve their audit processes and stay in compliance by assessing their access controls against regulatory frameworks.

SUPPORT

Customer Support.Global customer support helps our customers achieve their security outcomes with similar data that has been centrally collected by us inservices and support capabilities covering the customer's entire journey with Palo Alto Networks. This post-sales, global organization advances our Threat Intelligence Cloud from among all our participating end-customers. This offers our end-customers priority alerts, deep attack context,customers’ security maturity, supporting them when, where, and high-fidelity threat intelligence across millions of malware samples and tens of billions of file artifacts.

Aperture Subscription. This cloud-based subscription provides content control for IT-sanctioned SaaS applications that are used to store and share end-customer’s data. It offers end-customers the capability to safely use these SaaS applications and avert risks associated with improper sharing of confidential data and risks associated with sharing of malicious content.

GlobalProtect Cloud Service Subscription. This cloud-based subscription, expected to be released in September 2017, enables our end-customers to utilize the preventive capabilities of our Next-Generation Security Platform to secure remote offices and mobile users, providing consistent protection across globally distributed network and cloud environments without thehow they need for firewall appliances or software in the remote locations. With this offering, our end-

customers can quickly and easily add or remove remote locations and users, and establish and adjust security policies as needed, using a multi-tenant, cloud-based security infrastructure that we operate on their behalf.

Logging Service Subscription. This cloud-based subscription, expected to be released in September 2017, allows our end-customers to collect large amounts of context-rich enhanced network logs generated by our security offerings, including those of our firewalls and GlobalProtect Cloud-Based Security subscription, without needing to plan for local compute and storage.

Support.it. We offer Standard Support, Premium Support, and four-hour PremiumPlatinum Support to our end-customers and channel partners. Our channel partners that operate a Palo Alto Networks Authorized Support Center (“ASC”) typically deliver level-one and level-two support. We provide level-three support 24 hours a day, seven days a week through regional support centers that are located worldwide. We also offer an annual subscription-based Technical Account Managementa service offering called Focused Services that includes Customer Success Managers (“TAM”CSM”) service that provides dedicatedto provide support for end-customers with unique or complex support requirements. We offer our end-customers ongoing support for both hardware, software, and software in order to receivecertain cloud offerings, which includes ongoing security updates, PAN-OS upgrades, bug fixes, and repair.repairs. End-customers typically purchase these services for a one-year or longer term at the time of the initial product sale and typically renew for successive one-year or longer periods. Additionally, we provide expedited replacement for any defective hardware. We use a third-party logistics provider to manage our worldwide deployment of spare appliances and other accessories.

Threat Intelligence, Incident Response and Security Consulting. Unit 42 brings together world-renowned threat researchers, incident responders, and security consultants to create an intelligence-driven, response-ready organization that is passionate about helping clients proactively manage cyber risk. We help security leaders assess and test their security controls, transform their security strategy with a threat-informed approach, and respond to incidents rapidly. The Unit 42 Threat Intelligence team provides threat research that enables security teams to understand adversary intent and attribution, while enhancing protections offered by our products and services to stop advanced attacks. Our security consultants serve as trusted partners with state-of-the-art cyber risk expertise and incident response capabilities, helping customers focus on their business before, during, and after a breach.

Professional Services.Professional services are primarily delivered directly by Palo Alto Networks and through oura global network of authorized channel partners to our end-customers and include on-location and remote, hands-on experts who plan, design, and deploy effective security solutions tailored to our end-customers’ specific requirements. These services include application traffic management, solutionarchitecture design and planning, implementation, configuration, and firewall migration.migrations for all our products, including Prisma and Cortex deployments. Customers can also purchase on-going technical experts to be part of customer’s security teams to aid in the implementation and operation of their Palo Alto Networks capabilities. Our education services provideinclude certifications, as well as free online technical courses and classroom-stylein-classroom training, andwhich are also primarily delivered through our authorized training partners.

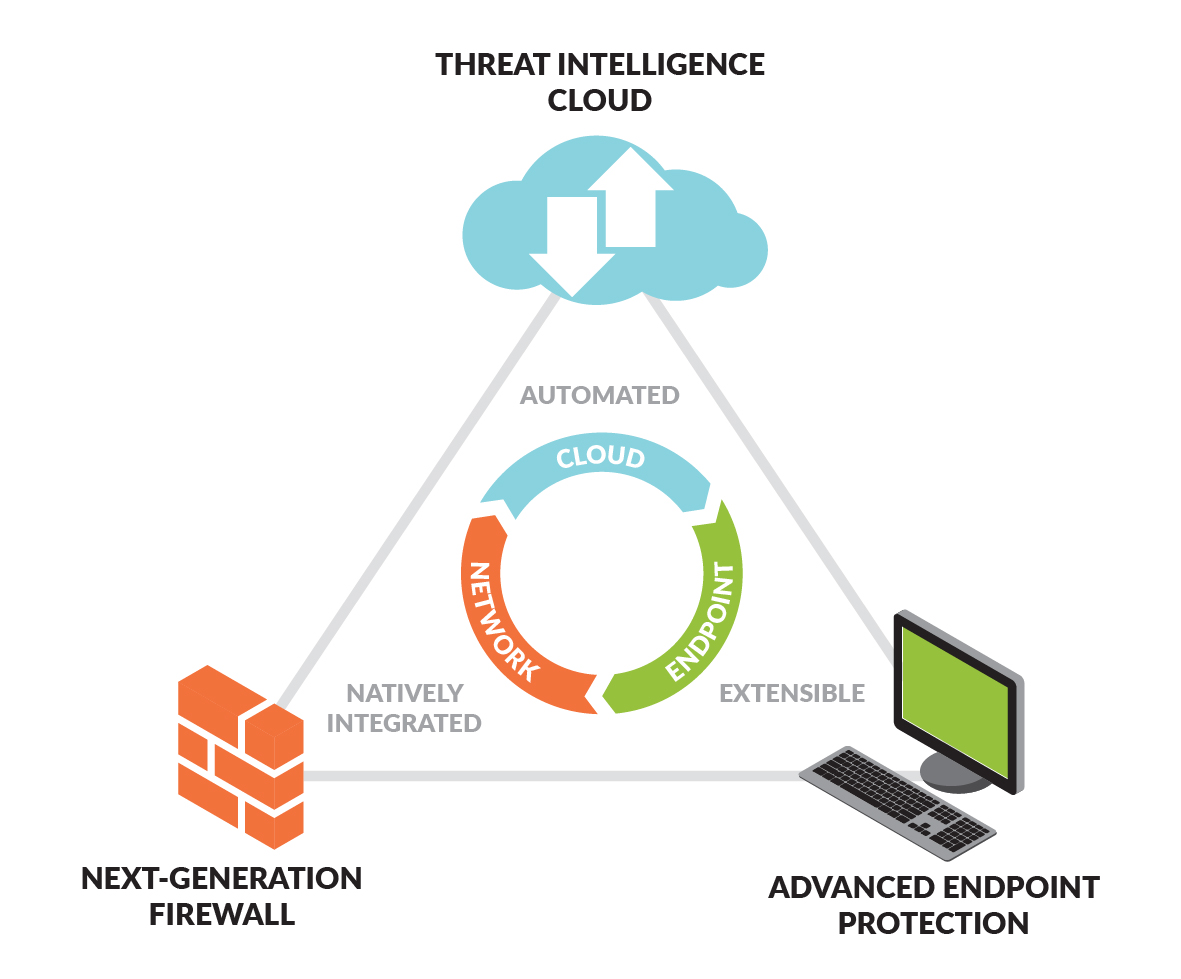

We combine our proprietary hardware and software architecture, PAN-OS operating system, Traps, and Threat Intelligence Cloud to provide a comprehensive security platform. Our Next-Generation Firewall integrates application visibility and control and is comprised

App-ID. App-ID is our application classification engine that uses multiple identification techniques to determine the exact identity of applications traversing the network. App-ID is the foundational classification engine that provides the core traffic classification to all other functions in our platform. The App-ID classification is used to invoke other security functions.

App-ID uses a series of classification techniques to accurately identify an application. When traffic first enters the network, App-ID applies an initial policy check based on Internet Protocol (“IP”) and port. Signatures are then applied to the traffic to identify the application based on application properties and related transaction characteristics. If the traffic is encrypted and a decryption policy is in place, the application is first decrypted, then application signatures are applied. Additional context-based signature analysis is then performed to identify known protocols that may be hiding other applications. Encrypted traffic that was decrypted is then re-encrypted before being sent back into the network. For evasive applications that cannot be identified through advanced signature and protocol analysis, heuristics or behavioral analysis are used to determine the identity of the application. When an application is accurately identified during this series of successive techniques, the policy check determines how to treat the application and associated functions. The policy check can block the application, allow it and scan for threats, inspect it for unauthorized file transfer and data patterns, or shape its use of network resources by applying a quality-of-service policy.

App-ID consistently classifies all network traffic, including business applications, consumer applications, and network protocols, across all ports. Consequently, there is no need to perform a series of signature checks to look for an application that is thought to be on the network. App-ID continually monitors the state of the application to determine if the application changes. Our platform allows only those applications within the policy to enter the network, while all other applications are blocked.

Internally developed or custom applications can be managed using either an application override or custom App-IDs. End-customers can use either of these mechanisms to apply the same level of control over their internal or custom applications that they apply to common applications. Because the application landscape is constantly changing, our research teams are constantly updating our App-ID classification engine. We deliver updated App-IDs automatically to our end-customers through our weekly update service.

User-ID.User-ID integrates our platform with a wide range of enterprise user directories and technologies, including Active Directory, eDirectory, Open LDAP, Citrix Terminal Server, Microsoft Exchange, Microsoft Terminal Server, and ZENworks. A network-based, User-ID agent communicates with the domain controllers, directories, or supported enterprise applications, mapping information such as user, role, and current IP address to the firewall, making the policy integration transparent. In cases

where user repository information does not include the current IP address of the user, a transparent, captive portal authentication or challenge/response mechanism can be used to tie users into the security policy. In cases where a user repository or application is in place that already has knowledge of users and their current IP address, a standards-based application programming interface (“API”) can be used to tie the repository to our platform.

Content-ID. Content-ID is a collection of technologies that enables many of our subscription services. Content-ID combines a real-time threat prevention engine, a cloud-based analysis service, and a comprehensive URL categorization database to limit unauthorized data and file transfers, detect and block a wide range of threats, and control non-work related web surfing.

The threat prevention engine blocks several common types of attacks, including vulnerability exploits, buffer overflows, and port scans from compromising and damaging enterprise information resources. It includes mechanisms such as protocol decoder-based analysis, protocol anomaly-based protection, stateful pattern matching, statistical anomaly detection, heuristic-based analysis, custom vulnerability, and spyware “phone home” signatures.

Our cloud-based threat analysis service, WildFire, provides a near real-time analysis engine for detecting previously unseen targeted malware. The core component of WildFire is a sandbox environment that can be deployed in a customer’s private cloud or on our cloud where files can be run and monitored for more than 100 behavioral characteristics that identify the file as malware. Once identified, signatures are automatically generated and delivered to all end-customers that subscribe to the WildFire service. By providing WildFire as a cloud-based service, all of our end-customers benefit from malware found on any network or endpoint. Refer to the “WildFire” section below for a more detailed discussion of our WildFire technology.

Our URL filtering database consists of millions of URLs across many categories and is designed to monitor and control employee web surfing activities. The on-appliance URL database can be augmented to suit the traffic patterns of the local user community with a custom URL database. URLs that are not categorized by the local URL database can be pulled into an on-appliance data cache from a very extensive, cloud-based URL database. The data filtering features in our platform enable policies that reduce the risks associated with the transfer of unauthorized files and data. This can be achieved by blocking files by type, by controlling sensitive data, such as credit card and social security numbers in application content or attachments, and by controlling file transfers within applications.

SP3. SP3 is our proprietary software and hardware architecture that is comprised of two elements: single-pass software and parallel processing hardware.

Our single-pass software accomplishes two key functions in our platform. First, it performs operations once per packet. As a packet is processed, the networking functions, the policy lookup, the application identification and decoding, and the signature matching for any and all threats and content are all performed simultaneously. This significantly reduces the amount of processing required to perform multiple functions in one security device. Second, the content scanning step is stream-based and uses uniform signature matching to detect and block threats. Instead of using multiple scanning passes and file proxies, which require download prior to scanning, our single-pass software scans content once in a stream-based fashion to minimize latency. This results in very high throughput and low latency, even with all security functions active. It also offers a single, fully integrated policy, thus enabling easier management of security.

Our parallel processing hardware is designed to optimize single-pass software performance through the use of separate data and control planes, which means that heavy utilization of one does not negatively impact the performance of the other. Our hardware also uses discrete, specialized processing groups to perform critical functions. On the data plane, this includes functions such as networking, policy enforcement, encryption and decryption, decompression, and content scanning. On the control plane, this includes configuration management, logging, and reporting.

We believe that the combination of single-pass software and parallel processing hardware is unique in the enterprise security industry and allows our platform to safely enable applications and prevent cyberthreats at very high levels of performance and throughput.

PAN-OS Operating System. Our PAN-OS operating system provides the foundation for our security platform and contains App-ID, User-ID, and Content-ID. PAN-OS performs the core functions of our platform while also providing the networking, security, and management functions needed for implementation. The PAN-OS networking functions include dynamic routing, switching, high availability, and VPN support, which enables deployment into a broad range of networking environments.

We have the ability to enable a series of virtual firewall instances or virtual systems. Each virtual system is an independent (virtual) firewall within the device that is managed separately and cannot be accessed or viewed by any other administrator of any other virtual system. This capability allows enterprises and service providers to separate firewall instances in departmental and multi-tenant managed services scenarios.

The security functions in PAN-OS are implemented in a single security policy and include application, application function, user, group, port, and service-based elements. Policy responses can range from open (allow but monitor for activity), to moderate

(enabling certain applications or functions), to closed (deny). The tight integration of application control, users, and groups, and the ability to scan the allowed traffic for a wide range of threats minimizes the number of policies.

PAN-OS also includes attack protection capabilities, such as blocking invalid or malformed packets, IP defragmentation, Transmission Control Protocol (“TCP”) reassembly, and network traffic normalization. PAN-OS eliminates invalid and malformed packets, while TCP reassembly and IP defragmentation is performed to ensure the utmost accuracy and protection despite any attack evasion techniques.

WildFire. WildFire is our cloud-based malware analysis environment that offers a completely new approach to cybersecurity. Through native integration with our Next-Generation Firewall, the service brings advanced threat detection and prevention to every system deployed throughout the network, automatically sharing protections with all WildFire subscribers globally.

The service offers a unified, hybrid cloud architecture deployed via either a Palo Alto Networks run cloud, a private cloud appliance that maintains all data on the local network, or a combination of the two. This allows us to perform dynamic analysis of suspicious content in a cloud-based virtual environment to discover unknown threats, automatic creation and enforcement of best-in-class, content-based malware protections, and link detection in email, proactively blocking access to malicious websites.

Advanced attacks are not point-in-time events. Adversaries deliver attacks persistently, often using non-standard ports, protocols or encryption for subsequent attack stages. Like our Next-Generation Firewall, WildFire provides complete visibility into unknown threats within all traffic across thousands of applications, including Web traffic, email protocols (SMTP, IMAP, POP), and FTP, regardless of ports or encryption (SSL).

Once WildFire discovers a new threat, the service automatically generates protections across the attack lifecycle, blocking malicious files and command-and-control traffic. Uniquely, many of these protections are content-based, not relying on easily changed attributes such as hash, filename or URL, allowing the service to block the initial malware and future variants without any additional action or analysis. WildFire informs the protection of our other security services, blocking threats in-line through Threat Prevention (anti-malware, DNS, command-and-control), Web Security (malicious URLs in PAN-DB), and GlobalProtect (anti-malware for mobile devices).

Traps. Traps is our Advanced Endpoint Protection product that prevents advanced attacks originating from either exploits or malicious executables before any malicious activity can successfully run, regardless of software patches in place. If an attack attempt is made, Traps will immediately block the technique or techniques, terminate the process, and notify both the user and the administrator that an attack was thwarted. Whenever a block does occur, Traps will collect detailed forensics, including the offending process, the memory state when it was prevented, and many other details that are reported to the Endpoint Security Manager (“ESM”).

The Traps agent injects itself into each process as it is started. When an attacker attempts to exploit a software vulnerability, the Traps protection modules cause the exploit attempt to fail because Traps has already made the process impervious to those techniques. When the attempt is prevented, the Traps agent kills the process and reports all of the details to the ESM.

Traps policy is configured to protect over 100 processes - each one with dozens of proprietary exploit prevention modules (“EPMs”). However, unlike other products, Traps is not limited to protecting only those processes or applications. Our end-customers use Traps to protect all manner of processes and applications by simply adding them to the policy configuration. Processes that have been run on the endpoint automatically show up in the ESM console, making it easy to protect those processes with the click of a button. This is especially useful for those end-customers running industry-specific applications. In addition to protecting workstations, laptops, and servers, Traps can protect point-of-sale (“POS”) systems, automated teller machines(“ATMs”), supervisory control and data acquisition (“SCADA”), and any other applications from exploitation.

Certifications. Many of our products have been awarded Federal Information Processing Standard(“FIPS”) 140-2 Level 2, Common Criteria/National Information Assurance Partnership (“NIAP”) Evaluation Assurance Level (“EAL”) 2, Common Criteria/NIAP EAL4+, Network Equipment-Building System (“NEBS”), and ICSA Firewall certifications.

Research and DevelopmentRESEARCH AND DEVELOPMENT

Our research and development effort isefforts are focused on developing new hardware and software and on enhancing and improving our existing product and subscription offerings. We believe that hardware and software are both critical to expanding our leadership in the enterprise security market.industry. Our engineering team has deep networking, endpoint, and security expertise and works closely with end-customers to identify their current and future needs. In additionOur scale and position in multiple areas of the security market enable us to our focus onleverage core competencies across hardware, software, and software, ourSaaS and also share expertise and research and development team is focused on research into applications andaround threats, which allows us to respond to the rapidly changing application and threat landscape. We supplement our own research and development effortefforts with technologies and products that we license from third parties. We test our products thoroughly to certify and ensure interoperability with third-party hardware and software products. Our research and development expense was $347.4 million, $284.2 million, and $185.8 million in fiscal 2017, 2016, and 2015, respectively.

We believe that innovation and timely development of new features and products is essential to meeting the needs of our end-customers and improving our competitive position. In February 2017,During fiscal 2023, we expanded our family of firewalls with the launch ofintroduced several new appliances: our PA-220, which is designed for small branch offices and remote locations; our PA-800 series, which are ideal for medium-sized networks and branch and remote office environments; our PA-5200 series, which deliver security for high throughput environments in a compact form factor; andofferings, including: Cortex XSIAM 1.0, major updates to Prisma Cloud (including three new VM-Series virtual firewall models,security modules), Prisma Access 4.0, PAN-OS 11.0, Cloud NGFW for AWS, and Cloud NGFW for Azure. Additionally, we acquired productive investments that fit well within our long-term strategy. For example, we acquired Cider Security Ltd. (“Cider”), which we expect will support cloud and virtualization initiatives ranging from virtualized branch officesour Prisma Cloud’s platform approach to data center and service provider deployments. We also delivered PAN-OS 8.0, an important software release that expands security for public and private clouds, provides new SaaSsecuring the entire application security functionality, and also provides the capabilitieslifecycle from code to prevent the theft and abuse of stolen credentials. Additionally, in February 2017 we acquired LightCyber Ltd. (“LightCyber”), a privately-held cybersecurity company. LightCyber’s technology expands the functionality of our platform through the addition of behavioral analytics, and will be the foundation for a new future subscription offering. We also expect to release two new cloud-based subscription offerings in September 2017: our GlobalProtect cloud service subscription, which provides our Next Generation Security Platform as a cloud-based service for remote offices and mobile users; and our Logging Service subscription, which functions as the central cloud-based repository for all application data and logs, and allows end-customers to collect data without needing to plan for local processing power and storage.cloud.

We plan to continue to significantly invest in our research and development effortefforts as we evolve and extend the capabilities of our platform. For example, in June 2017, we announced the next phase in the evolution of our Next-Generation Security Platform: our Palo Alto Networks Application Framework. Our cloud-based Application Framework will extend the capabilities of our Next-Generation Security Platform and will introduce a new SaaS consumption model that will allow our end-customers to evaluate and deploy new capabilities via security applications developed by our engineering team, as well as those built by third-party developers and other security industry vendors. Under this new model, our end-customers will be able to rapidly implement these cloud-based security applications without having to deploy or manage additional products. We expect our Application Framework to become generally available in the early 2018 calendar year, with continuous and ongoing introduction of new security applications.portfolio.

Intellectual Property

INTELLECTUAL PROPERTY

Our industry is characterized by the existence of a large number of patents and frequent claims and related litigation regarding patent and other intellectual property rights. In particular, leading companies in the enterprise security industry have extensive patent portfolios and are regularly involved in both offensive and defensive litigation. We continue to grow our patent portfolio and own intellectual property and related intellectual property rights around the world that relate to our products, services, research and development, and other activities, and our success depends in part upon our ability to protect our core technology and intellectual property. We file patent applications to protect our intellectual property and believe that the duration of our issued patents is sufficient when considering the expected lives of our products.

We actively seek to protect our global intellectual property rights and to deter unauthorized use of our intellectual property by controlling access to, and use of, our proprietary software and other confidential information through the use of internal and external controls, including contractual protections with employees, contractors, end-customers, and partners, and our software is protected by U.S. and international copyright laws. Despite our efforts to protect our intellectual property rights, our rights may not be successfully asserted in the future or may be invalidated, circumvented, or challenged. In addition, the laws of various foreign countries where our offerings are distributed may not protect our intellectual property rights to the same extent as laws in the United States. See “Risk Factors-Claims by others that we infringe their proprietary technology or otherintellectual property rights could harm our business,” “Risk Factors-Our proprietary rights may be difficult to enforce or protect, which could enable others to copy or use aspects of our products or subscriptions without compensating us,” and “Legal Proceedings” below for additional information.

Competition

GOVERNMENT REGULATION

We are subject to numerous U.S. federal, state, and foreign laws and regulations covering a wide variety of subject matters. Like other companies in the technology industry, we face scrutiny from both U.S. and foreign governments with respect to our compliance with laws and regulations. Our compliance with these laws and regulations may be onerous and could, individually or in the aggregate, increase our cost of doing business, impact our competitive position relative to our peers, and/or otherwise have an adverse impact on our business, reputation, financial condition, and operating results. For additional information about government regulation applicable to our business, see Part I, Item 1A “Risk Factors” in this Form 10-K.

COMPETITION

We operate in the intensely competitive enterprise security marketindustry that is characterized by constant change and innovation. Changes in the application, threat, and technology landscape result in evolving customer requirements for the protection from threats and the safe enablement of applications. Our main competitors fall into threefour categories:

•large networking vendorscompanies that incorporate security features in their products, such as Cisco Systems, Inc. (“Cisco”) and Juniper Networks, Inc. (“Juniper”), Microsoft, or those that have acquired, or may acquire, large network and endpoint security specialist vendors and have the technical and financial resources to bring competitive solutions to the market;

•independent security vendors, such as Symantec Corporation (“Symantec”), Check Point Software Technologies Ltd. (“Check Point”), Fortinet, Inc. (“Fortinet”), and FireEye,Crowdstrike, Inc. (“FireEye”Crowdstrike”), and Zscaler, Inc. (“Zscaler”), that offer a mix of networksecurity products;

•startups and endpoint security products; and

small and large companiespoint-product vendors that offer pointindependent or emerging solutions and/oracross various areas of security; and

•public cloud vendors and startups that offer solutions for cloud security services that compete with some of the features present in our platform.

(private, public, and hybrid cloud).

As our market grows, it will attract more highly specialized vendors, as well as larger vendors that may continue to acquire or bundle their products more effectively.

The principal competitive factors in our market include:

•product features, reliability, performance, and effectiveness;

•product line breadth, diversity, and applicability;

•product extensibility and ability to integrate with other technology infrastructures;

•price and total cost of ownership;

•adherence to industry standards and certifications;

•strength of sales and marketing efforts; and

•brand awareness and reputation.

We believe we generally compete favorably with our competitors on the basis of these factors as a result of the features and performance of our platform,portfolio, the ease of integration of our productssecurity solutions with technological infrastructures, and the relatively low total cost of ownership of our products. However, many of our competitors have substantially greater financial, technical, and other resources, greater name recognition, larger sales and marketing budgets, broader distribution, more diversified product lines, and larger and more mature intellectual property portfolios.

Sales, Customer Support and Marketing

SALES, MARKETING, SERVICES, AND SUPPORT

Customers.Our end-customers are predominantly medium to large enterprises, service providers, and government entities. Our end-customers operate in a variety of industries, including education, energy, financial services, government entities, healthcare, Internet and media, manufacturing, public sector, and telecommunications. Our end-customers deploy our platformportfolio of solutions for a variety of security functions across a variety of deployment scenarios. Typical deployment scenarios include the enterprise perimeter,network, the enterprise data center, cloud locations, and the distributed enterprise perimeter. Our end-customer deployments typically involve at least one pair of our products along with onebranch or more of our subscriptions, depending on size, security needs and requirements, and network complexity. As of July 31, 2017, we had more than 42,500 end-customers worldwide.remote locations. No single end-customer accounted for more than 10% of our total revenue in fiscal 2017, 2016,2023, 2022, or 2015.2021.

Distribution. We primarily sell our products and subscription and support offerings to end-customers through our channel partners utilizing a two-tier, indirect fulfillment model whereby we sell our products and subscription and support offerings to our distributors, which, in turn, sell to our resellers, which then sell to our end-customers. Sales are generally subject to our standard, non-exclusive distributor agreement, which provides for an initial term of one year, one-year renewal terms, termination by us with 30-9030 to 90 days written notice prior to the renewal date, and payment to us from the channel partner within 30-4530 to 45 calendar days of the date we issue an invoice for such sales. For fiscal 2017, 65.7%2023, 49.7% of our total revenue was derived from sales to three distributors.

We also sell our VM-Series virtual firewalls directly to end-customers through Amazon’s AWS Marketplace, and Microsoft’s Azure Marketplace, and Google’s Cloud Platform Marketplace under a usage-based licensing model.

Sales. Our sales organization is responsible for large-account acquisition and overall market development, which includes the management of the relationships with our channel partners, working with our channel partners in winning and supporting end-customers through a direct-touch approach, and acting as the liaison between our end-customers and our marketing and product development organizations. We pursue sales opportunities both through our direct sales force and as assisted by our channel partners, including leveraging cloud service provider marketplaces. We expect to continue to grow our sales headcount to expand our reach in all of our principal markets and expand our presence into countries where we currently do not have a direct sales presence.key growth sectors.

Our sales organization is supported by sales engineers with responsibility for pre-sales technical support, solutions engineering for our end-customers, and technical training for our channel partners.

Channel Program.Our NextWave Channel Partner program is focused on building in-depth relationships with solutions-oriented distributors and resellers that have strong security expertise. The program rewards these partners based on a number of attainment goals, as well as provides them access to marketing funds, technical and sales training, and support. To ensurepromote optimal productivity, we operate a formal accreditation program for our channel partners’ sales and technical professionals. As of July 31, 2017,2023, we had more than 4,4007,100 channel partners.

Global Customer Support.Success.Our customer supportGlobal Customer Success (“GCS”) organization is responsible for delivering support, professional, educational, and educationalsupport services directly to our channel partners and to end-customers. We leverage the capabilities of our channel partners and train them in the delivery of support, professional, educational, and educationalsupport services to ensureenable these services areto be locally delivered. We believe that a broad range of support services is essential to the successful customer deployment and ongoing support of our products, and we have hired support engineers with proven experience to provide those services.

Marketing. Our marketing is focused on building our brand reputation and the market awareness of our platformportfolio and driving pipeline and end-customer demand. Our marketing team consists primarily of product marketing, programs marketing,brand, demand generation, field marketing, channeldigital marketing, communications, analyst relations, and public relationsmarketing analytics functions. Marketing activities include pipeline development through demand generation, social media and advertising programs, managing the corporate web sitewebsite and partner portal, trade shows and conferences, press, analyst andrelationships, customer relations,advocacy, and customer awareness. Every year we organize multiple signature events, such as our end-customer conference “Ignite.“Ignite” and focused conferences such as “Cortex Symphony” and “SASE Converge.” We also publish major marketthreat intelligence research, papers such as the “Application UsageUnit 42 Cloud Threat Report and the Unit 42 Network Threat Trends Research Report,” which are based on the application and cyberthreat landscape ofdata from our end-customers.global threat intelligence team, Unit 42. These activities and tools benefit both our direct and indirect channels and are available at no cost to our channel partners.

Backlog.Orders for subscription and support offerings for multiple years are generally billed upfront shortly afterupon fulfillment of an order and are included in deferred revenue. Timing ofContract amounts that are not recorded in deferred revenue recognition foror revenue are considered backlog. We expect backlog related to subscription and support offerings may vary depending onwill change from period to period for various reasons, including the contractual period or when the subscriptiontiming and support offerings are rendered.duration of customer orders and varying billing cycles of those orders. Products are shipped and billed shortly after receiptupon hardware shipment or delivery of an order.software license. The majority of our product revenue comes from orders that are received and shipped in the same quarter. However, insufficient supply and inventory may delay our hardware product shipments. As such, we do not believe that our product backlog at any particular time is meaningful and it is not necessarily indicative of our future operating results.

Seasonality.Our business is affected by seasonal fluctuations in customer spending patterns. We have begun to see seasonal patterns in our business, which we expect to become more pronounced as we continue to grow, with our strongest sequential revenue growth generally occurring in our fiscal second and fourth quarters.

Manufacturing

MANUFACTURING

We outsource the manufacturing of our security products to various manufacturing partners, which include our electronics manufacturing services provider (“EMS provider”) and original design manufacturers. This approach allows us to reduce our costs as it reduces our manufacturing overhead and inventory and also allows us to adjust more quickly to changing end-customer demand. Our EMS provider is Flextronics International, Ltd. (“Flex”), who assembles our products using design specifications, quality assurance programs, and standards that we establish, and procures components and assembles our products based on our demand forecasts. These forecasts represent our estimates of future demand for our products based upon historical trends and analysis from our sales and product management functions as adjusted for overall market conditions.

The component parts within our products are either sourced by our manufacturing partners or by us from various component suppliers. WeOur manufacturing and supply contracts, generally, do not have any long-term manufacturing contracts that guarantee us anya certain level of supply or fixed capacity or pricing, which could increaseincreases our exposure to supply shortages or price fluctuations relatedincreases.

HUMAN CAPITAL

We believe our ongoing success depends on our employees. Development and investment in our people is central to raw materials.

Employees

Aswho we are, and will continue to be so. With a global workforce of 13,948 as of July 31, 2017,2023, our People Strategy is a critical element of our overall company strategy. Our People Strategy is a comprehensive approach to source, hire, onboard, develop, engage, and reward employees. Our approach is grounded on core tenants: respect each employee as an individual, demonstrate fairness and equity in all we had 4,562 employees. Competitiondo, facilitate flexibility, personalization, and choice whenever possible, and nurture a culture where employees are supported in doing the best work of their careers. Our values of disruption, execution, collaboration, inclusion, and integrity were co-created with employees and serve as the foundation of our culture.

Source & Hire.Sourcing diverse talent who possess the skills and capabilities to execute and add value to our culture form the cornerstone of our comprehensive approach to talent acquisition—a philosophy we call “The Way We Hire.” We utilize an array of methods to identify subject matter experts in their respective fields, emphasizing sourcing channels that connect us with underrepresented talents.

In an effort to foster career growth within Palo Alto Networks, we prioritize internal mobility. This allows current employees to progress either through a traditional career path or by exploring roles across various business functions, often culminating in promotions. We encourage existing employees to refer qualified individuals for qualified personnelour open positions, thus leveraging the collective networks of our team to attract a diverse range of expertise and perspectives.

We have made strides to understand job requirements and implement structured interviewing practices to identify candidates of the highest quality. By conducting thorough job analyses and creating success profiles, we have developed a deeper understanding of what is required for success in critical roles. We equip our hiring managers with essential training to identify and mitigate potential unconscious biases. Our interviewing process emphasizes values and competencies that we believe enhance our culture. This commitment extends to conducting interviews with diverse panelists and providing a balanced evaluation and quality interview experience for a diverse slate of candidates. We remain steadfast in our industrycommitment to fairness, bias reduction, and equal opportunities for all potential hires.

A key to our hiring process is intense,the Global Hiring Committees, introduced in fiscal 2023. These committees play a significant role in elevating our hiring standards by promoting shared understanding, reducing biases, enhancing objectivity, and ensuring the recruitment of diverse talent. The Committees foster effective collaboration using a common language and consensus-driven decision-making.

Onboard & Develop.We believe that each member of our workforce is unique, and that their integration into Palo Alto Networks and their career journey involve unique needs, interests, and goals. That is why our development programs are grounded on individualization, flexibility, and choice. From onboarding to ongoing development, our FLEXLearn philosophy offers multiple paths to assess, develop, and grow.

Our onboarding experience starts with “pre-boarding.” Before an employee’s start date, they are provided access to foundational tools to help them prepare to join Palo Alto Networks. We view pre-boarding as fundamental to introducing new employees to our culture, building trust, and facilitating rapid productivity. Welcome Day is a combination of in-person, virtual learning platforms and communication channels that provide new employees with inspirational, often personalized, onboarding experiences that carry on through the first year of employment. We have specialized learning tracks for interns and new graduates that have been recognized as best in class externally to support early-in-career individuals in acclimating to our culture as they progress on their career journey. As part of our merger and acquisition strategy, we have also established a robust integration program with the goal to enable individuals joining our teams to feel part of our culture at speed.

Following onboarding, there are a variety of ways that employees can assess their interests and skills, build a development plan specific to those insights, and continue to grow. Our development initiatives are delivered to employees through a comprehensive platform, FLEXLearn. The platform contains curated content and programs, such as assessment instruments, thousands of courses, workshops, and mentoring and coaching services. Leaders and executives also have access to specialized learning tracks that help them strategize, mobilize, and deliver maximum personal and team performance. Employees have full agency to direct their growth at their pace and choosing. Development information about core business elements, working in a distributed hybrid environment, as well as required company-wide compliance training, such as Code of Conduct, privacy and security, anti-discrimination, anti-harassment, and anti-bribery training, is also deployed through the FLEXLearn platform for all employees. In addition, FLEXLearn provides employees with events and activities that motivate and spark critical thinking, on topics ranging from inclusion to well-being and collaboration. On average, employees had completed 33 hours of development through the FLEXLearn platform during fiscal 2023.

Engage & Reward.We aim to foster engagement through a multifaceted approach to collect, understand, and act on employee feedback. Our comprehensive communication and listening strategy utilizes in-person and technology-enabled channels. We share and collect information through corporate and functional “All Hands” meetings, including several meetings specifically focused on employee-centered topics in an “Ask Me Anything” format. Digital Displays across our sites, our intranet platform, monthly and weekly email communications, and an active Slack platform provide a regular flow of information to and between employees and leadership. In addition to these channels that reach large audiences, we conduct regular executive listening sessions, including small group convenings with our CEO and other C-suite leaders, and ad-hoc pulse surveys to better understand employee engagement, sentiment, well-being, and the ability to transition to a hybrid work model.

Employee sentiment is also collected from external sources, such as web platforms that crowdsource feedback. Employees provide commentary to platforms such as Glassdoor, Comparably, and others and insights from those platforms are used to measure engagement. In addition, based on employee participation in an anonymous survey, the Best Practice Institute has certified Palo Alto Networks as a “most loved workplace” (2021, 2022, and 2023). Palo Alto Networks has been recognized by Glassdoor, Comparably, Human Rights Campaign, Disability Index, and others as an employer of choice. Our CEO has also earned a 92% employee approval rating on Glassdoor, a top percentile score.

In addition to a comprehensive compensation and diverse benefits program, we believe in an always-on feedback and rewards philosophy. From recurring 1:1 sessions, quarterly performance feedback, semi-annual performance reviews to use of our Cheers for Peers peer recognition program, employees get continuous input about the value they bring to the organization.

These engagement and recognition strategies have informed our holistic People Strategy, including our Inclusion and Diversity (“I&D”) initiatives and Internal Mobility program. Based on the outcomes from external sources, insights from internal sources, our modest attrition rate (compared to market trends), and strong participation in our Internal Mobility program, we believe employees at Palo Alto Networks feel engaged and rewarded.

Inclusion & Diversity. We are intentional about including diverse points of view, perspectives, experiences, backgrounds, and ideas in our decision-making processes. We deeply believe that true diversity exists when we have representation of all ethnicities, genders, orientations and identities, and cultures in our workforce. Our corporate I&D programs focus on five principles—our workforce should feel psychologically safe, they should understand, listen, and support one another, and they should elevate others. These principles are the foundation of our approach to I&D, which we call P.U.L.S.E.

We have eleven employee network groups (“ENG”s) that play a vital role in building understanding and awareness. Over 29% of our global workforce was involved in at least one ENG as of July 31, 2023. ENGs are also allocated funding to make charitable grants to organizations advancing their causes. We involve our ENGs in listening sessions with executive teams and we work in partnership to develop our annual I&D plans because we believe thatinvolvement is critical.

Our I&D philosophy is fully embedded in our future success depends in part ontalent acquisition, learning and development, performance elevation, and rewards and recognition programs. The diversity of our continued abilityboard of directors, with women representing 40% of our board as of July 31, 2023, is an example of our commitment to hire, motivate,inclusion and retain such personnel.diversity.

Segment and Geographic InformationENVIRONMENTAL, SOCIAL, AND GOVERNANCE

We recognize our duty to address environmental, social, and governance (“ESG”) practices. From our science-based approach to emissions reductions and our social impact programs to our Supplier Responsibility initiatives and Code of Business Conduct and Ethics, we value the opportunity to have meaningful outcomes that reinforce our intention to respect our planet, uplift our communities, and advance our industry.

Environmental. We recognize climate change is a global crisis and are organizedcommitted to doing our part to reduce environmental impacts. We remain committed to our goals of utilizing 100% renewable energy by 2030, reducing our greenhouse gas (“GHG”) emissions and operateworking across our value chain, and with coalitions, to address climate change. We made progress towards our goals in fiscal 2023 through several milestones. We engaged with a single reportable segment,local utility provider to power our Santa Clara, California headquarters with 70.2%100% renewable energy effective January 1, 2023. Our near-term scope 1, 2, and 3 emissions reduction goals, aligned to a warming scenario of 1.5° Celsius, were verified by the Science Based Targets initiative. We were recognized by Carbon Disclosure Project (“CDP”) as an “A-List” company and a “Supplier Engagement Leader.” We remain committed to being transparent about our progress over time through annual reporting.

Social. In addition to our People Strategy described in the section titled “Human Capital” above, we prioritized the health and safety of our total revenueglobal workforce. Through the deployment of our Global Supplier Code of Conduct, we continued to reach across our supply chain to communicate our expectations regarding labor standards, business practices, and workplace health and safety conditions. During fiscal 2023, we maintained our affiliate membership in the Responsible Business Alliance and maintained our commitment to Supplier Diversity. We value our role as a good corporate citizen and in fiscal 20172023 continued to execute our social impact programs. We made charitable grants to support organizations providing services in our core funding areas of education, including academic scholarships, diversity, and basic needs. We expanded our work to provide cybersecurity curriculum to schools, universities, and nonprofit organizations to help individuals of all ages protect their digital way of life and to prepare diverse adults for careers in cybersecurity. Employees continued to participate in our giving, matching, and volunteer programs to make impacts in their local communities.

Governance. Integrity is one of our core values. Our corporate behavior and leadership practices model ethical decision-making. All employees are informed about our governance expectations through our Codes of Conduct, compliance training programs, and ongoing communications. Our board of directors is governed by Corporate Governance Guidelines, which are amended from time to time to incorporate best practices in corporate governance. Reinforcing the Americas, 18.2% from Europe,importance of our ESG performance, the Middle East,charter of the ESG and Africa (“EMEA”), and 11.6% from Asia Pacific and Japan (“APAC”). Refer to Note 16. Segment InformationNominating Committee of Notes to Consolidated Financial Statements included in Part II, Item 8the board of this Annual Report on Form 10-K for more information about segments and revenue and assets by geographic region.directors includes the primary oversight of ESG.

Available Information

AVAILABLE INFORMATION

Our website is located at www.paloaltonetworks.com, and our investor relations website is located at investors.paloaltonetworks.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are available free of charge on the Investors portion of our web sitewebsite as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). We also provide a link to the section of the SEC’s website at www.sec.gov that has all of our public filings, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, all amendments to those reports, our Proxy Statements, and other ownership relatedownership-related filings. Further, a copy of this Annual Report on Form 10-K is located at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

We also use our investor relations website as a channel of distribution for important company information. For example, webcasts of our earnings calls and certain events we participate in or host with members of the investment community are on our investor relations website. Additionally, we announce investor information, including news and commentary about our business and financial performance, SEC filings, notices of investor events, and our press and earnings releases, on our investor relations

website. Investors and others can receive notifications of new information posted on our investor relations website in real time by signing up for email alerts and RSS feeds. Further corporate governance information, including our corporate governance guidelines, board committee charters, and code of conduct, is also available on our investor relations website under the heading “Governance.” The contents of our websites are not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only. All trademarks, trade names, or service marks used or mentioned herein belong to their respective owners.

Item 1A. Risk Factors

Our operations and financial results are subject to various risks and uncertainties including those described below. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, also may become important factors that affect us. If any of the following risks or others not specified below materialize, our business, financial condition, and operating results could be materially adversely affected, and the market price of our common stock could decline. In addition, the impacts of any worsening of the economic environment may exacerbate the risks described below, any of which could have a material impact on us.

Risk Factor Summary

Our business is subject to numerous risks and uncertainties. These risks include, but are not limited to, the following:

•Our operating results may be adversely affected by unfavorable economic and market conditions and the uncertain geopolitical environment.

•Our business and operations have experienced growth in recent periods, and if we do not effectively manage any future growth or are unable to improve our systems, processes, and controls, our operating results could be adversely affected.

•Our revenue growth rate in recent periods may not be indicative of our future performance, and we may not be able to maintain profitability, which could cause our business, financial condition, and operating results to suffer.

•Our operating results may vary significantly from period to period, which makes our results difficult to predict and could cause our results to fall short of expectations, and such results may not be indicative of future performance.

•Seasonality may cause fluctuations in our revenue.

•If we are unable to sell new and additional product, subscription, and support offerings to our end-customers, especially to large enterprise customers, our future revenue and operating results will be harmed.

•We rely on revenue from subscription and support offerings, and because we recognize revenue from subscription and support over the term of the relevant service period, downturns or upturns in sales or renewals of these subscription and support offerings are not immediately reflected in full in our operating results.

•The sales prices of our products, subscriptions, and support offerings may decrease, which may reduce our revenue and gross profits and adversely impact our financial results.

•We rely on our channel partners to sell substantially all of our products, including subscriptions and support, and if these channel partners fail to perform, our ability to sell and distribute our products and subscriptions will be limited and our operating results will be harmed.

•We are exposed to the credit and liquidity risk of our customers, and to credit exposure in weakened markets, which could result in material losses.

•A portion of our revenue is generated by sales to government entities, which are subject to a number of challenges and risks.

•We face intense competition in our market and we may lack sufficient financial or other resources to maintain or improve our competitive position.

•We may acquire other businesses, which could subject us to adverse claims or liabilities, require significant management attention, disrupt our business, adversely affect our operating results, may not result in the expected benefits of such acquisitions, and may dilute stockholder value.

•If we do not accurately predict, prepare for, and respond promptly to rapidly evolving technological and market developments and successfully manage product and subscription introductions and transitions to meet changing end-customer needs in the enterprise security industry, our competitive position and prospects will be harmed.

•Issues in the development and deployment of Artificial Intelligence (“AI”) may result in reputational harm and legal liability and could adversely affect our results of operations.

•A network or data security incident may allow unauthorized access to our network or data, harm our reputation, create additional liability, and adversely impact our financial results.

•Defects, errors, or vulnerabilities in our products, subscriptions, or support offerings, the failure of our products or subscriptions to block a virus or prevent a security breach or incident, misuse of our products, or risks of product liability claims could harm our reputation and adversely impact our operating results.

•Our ability to sell our products and subscriptions is dependent on the quality of our technical support services and those of our channel partners, and the failure to offer high-quality technical support services could have a material adverse effect on our end-customers’ satisfaction with our products and subscriptions, our sales, and our operating results.

•Claims by others that we infringe their intellectual property rights could harm our business.

•Our proprietary rights may be difficult to enforce or protect, which could enable others to copy or use aspects of our products or subscriptions without compensating us.

•Our use of open source software in our products and subscriptions could negatively affect our ability to sell our products and subscriptions and subject us to possible litigation.

•We license technology from third parties, and our inability to maintain those licenses could harm our business.

•Because we depend on manufacturing partners to build and ship our hardware products, we are susceptible to manufacturing and logistics delays and pricing fluctuations that could prevent us from shipping customer orders on time, if at all, or on a cost-effective basis, which may result in the loss of sales and end-customers.

•Managing the supply of our hardware products and product components is complex. Insufficient supply and inventory would result in lost sales opportunities or delayed revenue, while excess inventory would harm our gross margins.

•Because some of the key components in our hardware products come from limited sources of supply, we are susceptible to supply shortages or supply changes, which, in certain cases, have disrupted or delayed our scheduled product deliveries to our end-customers, increased our costs and may result in the loss of sales and end-customers.

•If we are unable to attract, retain, and motivate our key technical, sales, and management personnel, our business could suffer.

•We generate a significant amount of revenue from sales to distributors, resellers, and end-customers outside of the United States, and we are therefore subject to a number of risks associated with international sales and operations.

•We are exposed to fluctuations in foreign currency exchange rates, which could negatively affect our financial condition and operating results.

•We face risks associated with having operations and employees located in Israel.

•We are subject to governmental export and import controls that could subject us to liability or impair our ability to compete in international markets.

•Our actual or perceived failure to adequately protect personal data could have a material adverse effect on our business.

•We may have exposure to greater than anticipated tax liabilities.

•If our estimates or judgments relating to our critical accounting policies are based on assumptions that change or prove to be incorrect, our operating results could fall below our publicly announced guidance or the expectations of securities analysts and investors, resulting in a decline in the market price of our common stock.

•We are obligated to maintain proper and effective internal control over financial reporting. We may not complete our analysis of our internal control over financial reporting in a timely manner, or our internal control may not be determined to be effective, which may adversely affect investor confidence in our company and, as a result, the value of our common stock.

•Our reputation and/or business could be negatively impacted by environmental, social, and governance (“ESG”) matters and/or our reporting of such matters.

•Failure to comply with governmental laws and regulations could harm our business.

•We may not have the ability to raise the funds necessary to settle conversions of our Notes, repurchase our Notes upon a fundamental change, or repay our Notes in cash at their maturity, and our future debt may contain limitations on our ability to pay cash upon conversion or repurchase of our Notes.

•We may still incur substantially more debt or take other actions that would diminish our ability to make payments on our Notes when due.

•The market price of our common stock historically has been volatile, and the value of an investment in our common stock could decline.

•The convertible note hedge and warrant transactions may affect the value of our common stock.

•The issuance of additional stock in connection with financings, acquisitions, investments, our stock incentive plans, the conversion of our Notes or exercise of the related Warrants, or otherwise will dilute stock held by all other stockholders.

•We cannot guarantee that our share repurchase program will be fully consummated or that it will enhance shareholder value, and share repurchases could affect the price of our common stock.

•We do not intend to pay dividends for the foreseeable future.

•Our charter documents and Delaware law, as well as certain provisions contained in the indentures governing our Notes, could discourage takeover attempts and lead to management entrenchment, which could also reduce the market price of our common stock.

•Our business is subject to the risks of earthquakes, fire, power outages, floods, health risks, and other catastrophic events, and to interruption by man-made problems, such as terrorism.

•Our failure to raise additional capital or generate the significant capital necessary to expand our operations and invest in new products and subscriptions could reduce our ability to compete and could harm our business.

Risks Related to Global Economic and Geopolitical Conditions

Our operating results may be adversely affected by unfavorable economic and market conditions and the uncertain geopolitical environment.

We operate globally, and as a result, our business and revenues are impacted by global economic and geopolitical conditions. The instability in the global credit markets, inflation, changes in public policies such as domestic and international regulations, taxes, any increases in interest rates, fluctuations in foreign currency exchange rates, or international trade agreements, international trade disputes, geopolitical turmoil, and other disruptions to global and regional economies and markets continue to add uncertainty to global economic conditions. Military actions or armed conflict, including Russia’s invasion of Ukraine and any related political or economic responses and counter-responses, and uncertainty about, or changes in, government and trade relationships, policies, and treaties could also lead to worsening economic and market conditions and geopolitical environment. In response to Russia’s invasion of Ukraine, the United States, along with the European Union, has imposed restrictive sanctions on Russia, Russian entities, and Russian citizens (“Sanctions on Russia”). We are subject to these governmental sanctions and export controls, which may subject us to liability if we are not in full compliance with applicable laws. Any continued or further uncertainty, weakness or deterioration in economic and market conditions or the geopolitical environment could have a material and adverse impact on our business, financial condition, and results of operations, including reductions in sales of our products and subscriptions, longer sales cycles, reductions in subscription or contract duration and value, slower adoption of new technologies, alterations in the spending patterns or priorities of current and prospective customers (including delaying purchasing decisions), increased costs for the chips and components to manufacture our products, and increased price competition.

Risks Related to Our Business and Our Industry

RISKS RELATED TO OUR GROWTH

Our business and operations have experienced rapid growth in recent periods, and if we do not effectively manage any future growth or are unable to improve our systems, processes, and controls, our operating results could be adversely affected.

We have experienced rapid growth and increased demand for our products and subscriptions over the last few years. As a result, our employee headcount and number of end-customers havehas increased, significantly, and we expect bothit to continue to grow over the next year. For example, from the end of fiscal 20162022 to the end of fiscal 2017,2023, our headcount increased from 3,79512,561 to 4,562 employees, and our number of end-customers increased from approximately 34,000 to more than 42,500.13,948 employees. In addition, as we have grown, the number of end-customers has also increased, and we have increasingly managed more complex deployments of our products and subscriptions with larger end-customers. The growth and expansion of our business and product, subscription, and support offerings places a significant strain on our management, operational, and financial resources. To manage any future growth effectively, we must continue to improve and expand our information technology and financial infrastructure, our operating and administrative systems and controls, and our ability to manage headcount, capital, and processes in an efficient manner.

We may not be able to successfully implement, scale, or scalemanage improvements to our systems, processes, and controls in an efficient or timely manner.manner, which could result in material disruptions of our operations and business. In addition, our existing systems, processes, and controls may not prevent or detect all errors, omissions, or fraud. We may also experience difficulties in managing improvements to our systems, processes, and controls, or in connection with third-party software licensed to help us with such improvements. Any future growth would add complexity to our organization and require effective coordination throughout our organization. Failure to manage any future growth effectively could result in increased costs, disrupt our existing end-customer relationships, reduce demand for or limit us to smaller deployments of our platform,products, or materially harm our business performance and operating results.

Our operating results may vary significantly from period to period and be unpredictable, which could cause the market price of our common stock to decline.