UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

x ANNUAL REPORT PURSUANT TO

SECTION 13, 15(d), OR 37 OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 20172021

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 000-52313

TENNESSEE VALLEY AUTHORITY

(Exact name of registrant as specified in its charter)

|

| | | | | | | | | | |

A corporate agency of the United States created by an act of Congress (State or other jurisdiction of incorporation or organization) | | 62-0474417 (IRS Employer Identification No.) |

|

400 W. Summit Hill Drive Knoxville, Tennessee (Address of principal executive offices) | | 37902 (Zip Code) |

(865) 632-2101

(Registrant’sRegistrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13, 15(d), or 37 of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large"large accelerated filer,” “accelerated" "accelerated filer,” “smaller" "smaller reporting company,”" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer Emerging growth company o

Non-accelerated filer x(Do not check if a smaller reporting company) Smaller reporting company oEmerging growth company o

Non-accelerated filer xAccelerated filer o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

|

| | |

| Table of Contents |

GLOSSARY OF COMMON ACRONYMS....................................................................................................................................................................................................... ACRONYMS....................................................................................................................................................................................................... | |

FORWARD-LOOKING INFORMATION......................................................................................................................................................................................................... INFORMATION......................................................................................................................................................................................................... | |

GENERAL INFORMATION............................................................................................................................................................................................................................ INFORMATION............................................................................................................................................................................................................................ | |

| |

| |

| |

| ITEM 1. BUSINESS...................................................................................................................................................................................................................................... | |

The Corporation................................................................................................................................................................................................................................. Corporation................................................................................................................................................................................................................................. | |

Service Area....................................................................................................................................................................................................................................... Area....................................................................................................................................................................................................................................... | |

Customers.......................................................................................................................................................................................................................................... | |

Rates.................................................................................................................................................................................................................................................. | |

| Rates.................................................................................................................................................................................................................................................. | |

| Power Supply and Load Management Resources............................................................................................................................................................................. | |

Fuel Supply......................................................................................................................................................................................................................................... Supply......................................................................................................................................................................................................................................... | |

Transmission...................................................................................................................................................................................................................................... | |

Weather and Seasonality.................................................................................................................................................................................................................... Seasonality.................................................................................................................................................................................................................... | |

Competition........................................................................................................................................................................................................................................ | |

Research and Development............................................................................................................................................................................................................... Development............................................................................................................................................................................................................... | |

Flood Control Activities....................................................................................................................................................................................................................... Activities....................................................................................................................................................................................................................... | |

Environmental Stewardship Activities................................................................................................................................................................................................. Activities................................................................................................................................................................................................. | |

Economic Development Activities...................................................................................................................................................................................................... Activities...................................................................................................................................................................................................... | |

Regulation.......................................................................................................................................................................................................................................... | |

Taxation and Tax Equivalents............................................................................................................................................................................................................. Equivalents............................................................................................................................................................................................................. | |

Environmental Matters....................................................................................................................................................................................................................... Matters....................................................................................................................................................................................................................... | |

Employees.......................................................................................................................................................................................................................................... | |

| |

ITEM 1A. RISK FACTORS............................................................................................................................................................................................................................ FACTORS............................................................................................................................................................................................................................ | |

| |

ITEM 1B. UNRESOLVED STAFF COMMENTS............................................................................................................................................................................................ COMMENTS............................................................................................................................................................................................ | |

| |

ITEM 2. PROPERTIES.................................................................................................................................................................................................................................. PROPERTIES.................................................................................................................................................................................................................................. | |

Generating Properties........................................................................................................................................................................................................................ Properties........................................................................................................................................................................................................................ | |

Transmission Properties..................................................................................................................................................................................................................... Properties..................................................................................................................................................................................................................... | |

Natural Resource Stewardship Properties......................................................................................................................................................................................... Properties......................................................................................................................................................................................... | |

Buildings............................................................................................................................................................................................................................................. | |

Disposal of Property........................................................................................................................................................................................................................... Property........................................................................................................................................................................................................................... | |

| |

ITEM 3. LEGAL PROCEEDINGS.................................................................................................................................................................................................................. PROCEEDINGS.................................................................................................................................................................................................................. | |

| |

ITEM 4. MINE SAFETY DISCLOSURES...................................................................................................................................................................................................... | |

| |

| |

| |

| SECURITIES............ | |

| |

ITEM 6. SELECTED FINANCIAL DATA........................................................................................................................................................................................................ | |

| |

| OPERATIONS................................................................... | |

| Business and Mission......................................................................................................................................................................................................................... | |

Executive Overview............................................................................................................................................................................................................................ | |

| Results of Operations......................................................................................................................................................................................................................... | |

| Liquidity and Capital Resources......................................................................................................................................................................................................... | |

| Off-Balance Sheet Arrangements....................................................................................................................................................................................................... | |

| Key Initiatives and Challenges........................................................................................................................................................................................................... | |

Critical Accounting Policies and Estimates......................................................................................................................................................................................... Estimates......................................................................................................................................................................................... | |

Fair Value Measurements................................................................................................................................................................................................................... | |

New Accounting Standards and Interpretations................................................................................................................................................................................. Interpretations................................................................................................................................................................................. | |

Legislative and Regulatory Matters.................................................................................................................................................................................................... Matters.................................................................................................................................................................................................... | |

| Environmental Matters....................................................................................................................................................................................................................... | |

| Legal Proceedings.............................................................................................................................................................................................................................. | |

Risk Management Activities............................................................................................................................................................................................................... Activities............................................................................................................................................................................................................... | |

| |

| RISK........................................................................................................................... | |

| |

| DATA.......................................................................................................................................................... | |

Consolidated Statements of Operations............................................................................................................................................................................................. | |

Consolidated Statements of Comprehensive Income (Loss)............................................................................................................................................................. | |

Consolidated Balance Sheets............................................................................................................................................................................................................Statements of Operations............................................................................................................................................................................................. |

|

| |

| Consolidated Statements of Comprehensive Income (Loss)............................................................................................................................................................. | |

Consolidated Statements of Cash Flows...........................................................................................................................................................................................Flows........................................................................................................................................................................................... | |

| Capital............................................................................................................................................................. | |

|

| |

| Notes to Consolidated Financial Statements..................................................................................................................................................................................... | |

| Firm............................................................................................................................................................... | |

| |

| DISCLOSURE............................................................... | |

| | | | | |

| |

ITEM 9A. CONTROLS AND PROCEDURES............................................................................................................................................................................................... PROCEDURES............................................................................................................................................................................................... | |

Disclosure Controls and Procedures.................................................................................................................................................................................................. Procedures.................................................................................................................................................................................................. | |

Internal Control over Financial Reporting........................................................................................................................................................................................... Reporting........................................................................................................................................................................................... | |

| Firm................................................................................................................................................................ | |

| |

ITEM 9B. OTHER INFORMATION................................................................................................................................................................................................................ INFORMATION................................................................................................................................................................................................................ | |

| |

| |

| |

| GOVERNANCE............................................................................................................................. | |

| Directors.............................................................................................................................................................................................................................................. | |

| Executive Officers............................................................................................................................................................................................................................... | |

| Disclosure and Financial Code of Ethics............................................................................................................................................................................................ | |

| Committees of the TVA Board............................................................................................................................................................................................................ | |

| |

ITEM 11. EXECUTIVE COMPENSATION..................................................................................................................................................................................................... COMPENSATION..................................................................................................................................................................................................... | |

| Compensation Discussion and Analysis............................................................................................................................................................................................. | |

| CEO Pay Ratio Disclosure................................................................................................................................................................................................................. | |

| Executive Compensation Tables and Narrative Disclosures.............................................................................................................................................................. | |

| Retirement and Pension Plans........................................................................................................................................................................................................... | |

| Nonqualified Deferred Compensation................................................................................................................................................................................................ | |

Potential Payments on Account of Retirement/Resignation, Retirement, Termination without Cause, Termination with Cause, Death, or Disability........................................... | |

| Other Agreements.............................................................................................................................................................................................................................. | |

| Director Compensation....................................................................................................................................................................................................................... | |

| Compensation Committee Interlocks and Insider Participation.......................................................................................................................................................... | |

| Compensation Committee Report...................................................................................................................................................................................................... | |

| |

| MATTERS...................................... | |

| |

| INDEPENDENCE......................................................................................... | |

| Director Independence....................................................................................................................................................................................................................... | |

| Related Party Transactions................................................................................................................................................................................................................ | |

| |

| SERVICES...................................................................................................................................................................... | |

| |

| |

| |

| SCHEDULES..................................................................................................................................................................... | |

| |

SIGNATURES................................................................................................................................................................................................................................................ | |

EXHIBIT INDEX............................................................................................................................................................................................................................................. | |

| SIGNATURES................................................................................................................................................................................................................................................ | |

|

| | | | | | | |

| GLOSSARY OF COMMON ACRONYMS |

Following are definitions of some of the terms or acronyms that may be used in this Annual Report on Form 10-K for the fiscal year ended September 30, 20172021 (the “Annual Report”"Annual Report"): |

|

| Term or Acronym | | Definition |

AFUDCACE | | Allowance for funds used during constructionAffordable Clean Energy |

AOCIACPA | | Anti-Cherrypicking Amendment |

| ANI | | American Nuclear Insurers |

| AOCI | | Accumulated other comprehensive income (loss) |

| ARO | | Asset retirement obligation |

| ART | | Asset Retirement Trust |

ASLBBonds | | Atomic Safety and Licensing Board |

BLEU | | Blended low-enriched uranium |

Bonds | | Bonds, notes, or other evidences of indebtedness |

BSERCAA | | Best system of emission reduction |

CAA | | Clean Air Act |

CAIRCCR | | Clean Air Interstate Rule |

CCR | | Coal combustion residuals |

| CERCLA | | Comprehensive Environmental Response, Compensation, and Liability Act |

CME | | Chicago Mercantile Exchange |

CO2 | | Carbon dioxide |

COLCOVID-19 | | Combined construction and operating license applicationCoronavirus Disease 2019 |

COLACOLA(s) | | Cost-of-living adjustmentadjustment(s) |

| CSAPR | | Cross-State Air Pollution Rule |

| CTs | | Combustion turbine unit(s) |

| CVA | | Credit valuation adjustment |

| CY | | Calendar year |

DCPDBOT | | Down-blend offering for Tritium |

| DCP | | Deferred Compensation Plan |

| DER | | Distributed Energy Resources |

| DOE | | Department of Energy |

| EIS | | Environmental Impact Statement |

EPAELGs | | Effluent Limitation Guidelines |

| EMPs | | Electromagnetic pulses |

| EO(s) | | Executive Order(s) |

| EPA | | Environmental Protection Agency |

| EPRI | | Electric Power Research Institute |

ERSERC | | EnergyRight® Solutions programs

Enterprise Risk Council |

ESPAFASB | | Early Site Permit Application |

FASB | | Financial Accounting Standards Board |

FCMFERC | | Futures Commission Merchant |

FERC | | Federal Energy Regulatory Commission |

| FPA | | Federal Power Act |

| FTP | | Financial Trading Program |

| GAAP | | Accounting principles generally accepted in the United States of America |

| GHG | | Greenhouse gas |

GPHAP | | Generation PartnersHazardous Air Pollutants |

GPPIRP | | Green Power Providers |

GPS | | Green Power Switch®

|

GWh | | Gigawatt hour(s) |

IRP | | Integrated Resource Plan |

IRUsIwD | | Indefeasible rights of useInclusion with Diversity |

| JSCCG | | John Sevier Combined Cycle Generation LLC |

kWKOC | | KilowattsKnoxville Office Complex |

kWhkW | | Kilowatt hour(s)Kilowatts |

LPCkWh | | Kilowatt hours |

| LPCs | | Local power company customer of TVAcustomers |

LTDCPLTA | | Long-Term Agreement |

| LTDCP | | Long-Term Deferred Compensation Plan |

| MATS | | Mercury and Air Toxics Standards |

| | | | | | | | |

| MD&A | | Management’sManagement's Discussion and Analysis of Financial Condition and Results of Operations |

| MLGW | | Memphis Light, Gas and Water Division |

MLPsmmBtu | | Master Limited Partnerships |

mmBtu | | Million British thermal unit(s) |

MOXMtM | | Mixed oxideMark-to-market |

MtMMW | | Mark-to-market |

| Megawatts |

| NAAQS | | |

MW | | Megawatt |

NAAQS | | National Ambient Air Quality Standards |

| NAV | | Net asset value |

| NDT | | Nuclear Decommissioning Trust |

| NEIL | | Nuclear Electric Insurance Limited |

| NEPA | | National Environmental Policy Act |

| NERC | | North American Electric Reliability Corporation |

| NES | | Nashville Electric Service |

NO2x | | Nitrogen dioxideoxides |

NOx

NPDES | | Nitrogen oxides |

NPDES | | National Pollutant Discharge Elimination System |

| NRC | | Nuclear Regulatory Commission |

| NSR | | New Source Review |

NYSENuclear Development | | Nuclear Development, LLC |

| NWP | | Nationwide Permit |

| NYSE | | New York Stock Exchange |

| OCI | | Other comprehensive income (loss) |

| OMB | | Office of Management and Budget |

| PARRS | | Putable Automatic Rate Reset Securities |

| PM | | Particulate matter |

QERQTE | | Quadrennial Energy Review |

QTE | | Qualified technological equipment and software |

RECsRCRA | | Resource Conservation and Recovery Act |

| RECs | | Renewable Energy Certificates |

| REIT | | Real Estate Investment Trust |

| RSO | | Renewable Standard Offer |

| SCCG | | Southaven Combined Cycle Generation LLC |

| SCRs | | Selective catalytic reduction systems |

| SEC | | Securities and Exchange Commission |

SERPSELC | | Southern Environmental Law Center |

| SERP | | Supplemental Executive Retirement Plan |

| SHLLC | | Southaven Holdco LLC |

SMRSIPs | | State implementation plans |

| SMR | | Small modular reactor(s) |

SO2 | | Sulfur dioxide |

SOASPC | | Summer Place Complex |

| SOA | | Society of Actuaries |

| SSSL | | Seven States Southaven, LLC |

TCWNTDEC | | Tennessee Clean Water Network |

TDEC | | Tennessee Department of Environment & Conservation |

| TIPS | | Treasury Inflation-Protected Securities |

TOU | | Time-of-use |

| TVA Act | | The Tennessee Valley Authority Act of 1933, as amended 16 U.S.C. §§ 831-831ee |

TVARSTVA Board | | TVA Board of Directors |

| TVARS | | Tennessee Valley Authority Retirement System |

| U.S. Treasury | | United States Department of the Treasury |

| USACE | | U.S. Army Corps of Engineers |

| VIE | | Variable interest entity |

| XBRL | | eXtensible Business Reporting Language |

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K for the fiscal year ended September 30, 2021 ("Annual Report") contains forward-looking statements relating to future events and future performance. All statements other than those that are purely historical may be forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as "may," "will," "should," "expect," "anticipate," "believe," "intend," "project," "plan," "predict," "assume," "forecast," "estimate," "objective," "possible," "probably," "likely," "potential," "speculate," the negative of such words, or other similar expressions.

Although the Tennessee Valley Authority ("TVA") believes that the assumptions underlying theany forward-looking statements are reasonable, TVA does not guarantee the accuracy of these statements. Numerous factors could cause actual results to differ materially from those in theany forward-looking statements. These factors include, among other things:

•The continuing impact of the Coronavirus Disease 2019 ("COVID-19") pandemic on TVA's operating results, financial condition, and cash flows, the demand for electricity, TVA's workforce and operations, the availability of fuel and critical parts, supplies, and services, the financial markets, and the business and financial condition of TVA's customers and counterparties;

•The duration and severity of the COVID-19 pandemic, actions taken to contain its spread and mitigate its effects, and broader impacts of the COVID-19 pandemic on economic and market conditions, including impacts on interest rates, commodity prices, investment performance, and foreign currency exchange rates;

•New, amended, or existing laws, regulations, executive orders ("EOs"), or administrative orders or interpretations, including those related to climate change and other environmental matters, and the costs of complying with these laws, regulations, EOs, or administrative orders;orders or interpretations;

•The cost of complying with known, anticipated, or new emissions reduction requirements, some of which could render continued operation of many of TVA's aging coal-fired generation units not cost-effective andor result in their removal from service, perhaps permanently;

•Significant reductions in demand for electricity produced through non-renewable or centrally located generation sources whichthat may result from, among other things, economic downturns, increased energy efficiency and conservation, increased utilization of distributed generation and microgrids, and improvements in alternative generation and energy storage technologies;

•Changes in customer preferences for energy produced from cleaner generation sources;

•Changes in technology;

•Actions taken, or inaction, by the United States ("U.S.") government relating to the national or TVA debt ceiling or automatic spending cuts in government programs;

•Costs andor liabilities that are not anticipated in TVA’sTVA's financial statements for third-party claims, natural resource damages, environmental clean-upcleanup activities, or fines or penalties associated with unexpected events such as failures of a facility or infrastructure;

•Addition or loss of customers by TVA or theTVA's local power company customers of TVA ("LPCs");

•Significant delays, cost increases, or cost overruns associated with the construction and maintenance of generation, transmission, navigation, flood control, or related assets;

Changes in•Requirements or decisions changing the amount or timing or amount of funding obligations associated with TVA's pension andplans, other post-retirement benefit plans, or health care obligations and related funding;plans;

•Increases in TVA's financial liabilities for decommissioning its nuclear facilities or retiring other assets;

•Risks associated with the operation of nuclear facilities or other generation and related facilities, including coal combustion residualresiduals ("CCR") facilities;

•Physical attacks on TVA's assets;

•Cyber attacks on TVA's assets or the assets of third parties upon which TVA relies;

•The outcome of legal or administrative proceedings, including the CCR proceedings involving the Gallatin Fossil Plant as well as any other CCR proceedings that may be brought in the future;proceedings;

•The failure of TVA's generation, transmission, navigation, flood control, and related assets and infrastructure, including CCR facilities and spent nuclear fuel storage facilities, to operate as anticipated, resulting in lost revenues, damages, andor other costs that are not reflected in TVA’sTVA's financial statements or projections;

•Differences between estimates of revenues and expenses and actual revenues earned and expenses incurred;

•Weather conditions;conditions including changing weather patterns, extreme weather conditions, and other events such as flooding, droughts, wildfires, and snow or ice storms that may result from climate change;

•Catastrophic events such as fires, earthquakes, explosions, solar events, electromagnetic pulses ("EMPs"), geomagnetic disturbances, droughts, floods, hurricanes, tornadoes, or other casualty events or pandemics, wars, national emergencies, terrorist activities, andor other similar events, especially if these events occur in or near TVA's service area;

•Events at a TVA facility, which, among other things, could result in loss of life, damage to the environment, damage to or loss of the facility, and damage to the property of others;

•Events or changes involving transmission lines, dams, and other facilities not operated by TVA, including those that affect the reliability of the interstate transmission grid of which TVA's transmission system is a part and those that increase flows across TVA's transmission grid;

•Disruption of fuel supplies, which may result from, among other things, economic conditions, weather conditions, production or transportation difficulties, labor challenges, cyber attacks, mine closures or reduced mine production, an increase in fuel exports, or environmental laws or regulations affecting TVA's fuel suppliers or transporters;

•Purchased power price volatility and disruption of purchased power supplies;

•Events which affect the supply of water for TVA's generation facilities;

•Changes in TVA's determinations of the appropriate mix of generation assets;

•Ineffectiveness of TVA's efforts at adapting its organization to an evolving marketplace and remaining cost competitive;

•Inability to use regulatory accounting or loss of regulatory accounting approval for certain costs;

•Inability to obtain, or loss of, regulatory approval for the construction or operation of assets;

•The requirement or decision to make additional contributions to TVA's pension or other post-retirement benefit plans or to TVA's Nuclear Decommissioning Trust ("NDT") or Asset Retirement Trust ("ART");

•Limitations on TVA's ability to borrow money which may result from, among other things, TVA's approaching or substantially reaching the limit on bonds, notes, and other evidences of indebtedness (collectively, "Bonds") specified in the Tennessee Valley Authority Act of 1933, as amended 16 U.S.C. §§ 831-831ee (the “TVA Act”("TVA Act");

•An increase in TVA's cost of capital whichthat may result from, among other things, changes in the market for TVA's debt securities, changes in the credit rating of TVA or the U.S. government, or, potentially, an increased reliance by TVA on alternative financing should TVA approach its debt limit;

•Changes in the economy and volatility in financial markets;

•Reliability andor creditworthiness of counterparties;

•Changes in the market price of commodities such as coal, uranium, natural gas, fuel oil, crude oil, construction materials, reagents, electricity, andor emission allowances;

•Changes in the market price of equity securities, debt securities, andor other investments;

•Changes in interest rates, currency exchange rates, andor inflation rates;

•Ineffectiveness of TVA's disclosure controls and procedures or its internal controlscontrol over financial reporting;

•Inability to eliminate identified deficiencies in TVA's systems, standards, controls, or corporate culture;

•Inability to attract or retain a skilled workforce;

•Inability to respond quickly enough to current or potential customer demands or needs;

•Events at a nuclear facility, whether or not operated by or licensed to TVA, which, among other things, could lead to increased regulation or restriction on the construction, ownership, operation, andor decommissioning of nuclear facilities or on the storage of spent fuel, obligate TVA to pay retrospective insurance premiums, reduce the availability and affordability of insurance, increase the costs of operating TVA's existing nuclear units, andor cause TVA to forego future construction at these or other facilities;

•Loss of quorum of the TVA Board of Directors (the "TVA("TVA Board");

•Changes in the membershippriorities of the TVA Board or TVA senior management; andor

•Other unforeseeable events.

See also Item 1A, Risk Factors, and Item 7, Management’sManagement's Discussion and Analysis of Financial Condition and Results of Operations. New factors emerge from time to time, and it is not possible for managementTVA to predict all such factors or to assess the extent to which any factor, or combination of factors, may impact TVA’sTVA's business or cause results to differ materially from those contained in any forward-looking statement. TVA undertakes no obligation to update any forward-looking statement to reflect developments that occur after the statement is made.

GENERAL INFORMATION

Fiscal Year

References to years (2017, 2016,(2021, 2020, etc.) in this Annual Report on Form 10-K for the fiscal year ended September 30, 2021are to TVA’sTVA's fiscal years ending September 30 except for references to years in the biographical information about directors and executive officers in Item 10, Directors, Executive Officers and Corporate Governance, as well as to years that are preceded by “CY,”"CY," which references are to calendar years.

Notes

References to “Notes”"Notes" are to the Notes to Consolidated Financial Statements contained in Item 8, Financial Statements and Supplementary Data in this Annual Report.

Property

TVA does not own real property.property and real property interests (collectively, "real property"). TVA acquires real property in the name of the United States ("U.S."), and such legal title in real property is entrusted to TVA as the agent of the United StatesU.S. to accomplish the purposes of the TVA Act. TVA acquires personal property in the name of TVA. Accordingly, unless the context indicates the reference is to TVA’sTVA's personal property, any statement in this Annual Report referring to TVA property shall be read as referring to the real property of the United States whichU.S. that has been entrusted to TVA as its agent.

Available Information

TVA files annual, quarterly, and current reports with the Securities and Exchange Commission ("SEC") under Section 37 of the Securities Exchange Act of 1934. TVA’s1934 (the "Exchange Act"). TVA's SEC filings are available to the public over the internet on the SEC’sSEC's website at www.sec.gov or on TVA's website at www.tva.gov. Information contained on or accessible through TVA's website shall not be deemed to be incorporated into, or to be a part of, this Annual Report.Report or any other report or document that TVA files with the SEC.

PART I

ITEM 1. BUSINESS

The Corporation

General

The Tennessee Valley Authority ("TVA") is a corporate agency and instrumentality of the United States ("U.S.") that was created in 1933 by federal legislation enacted by the U.S. Congress in response to a requestproposal by President Franklin D. Roosevelt. TVA was created to, among other things, improve navigation on the Tennessee River, reduce the damage from destructive flood waters within the Tennessee River system and downstream on the lower Ohio and Mississippi Rivers, further the economic development of TVA’sTVA's service area in the southeastern United States,U.S., and sell the electricity generated at the facilities TVA operates. Today, TVA operates the nation’snation's largest public power system and supplies power to a population of over nineapproximately 10 million people.

TVA also manages the Tennessee River, its tributaries, and certain shorelines to provide, among other things, year-round navigation, flood damage reduction, and affordable and reliable electricity. Consistent with these primary purposes, TVA also manages the river system to provide recreational opportunities, adequate water supply, improved water quality, cultural and natural resource protection, and economic development. TVA performs these management duties in cooperation with other federal and state agencies whichthat have jurisdiction and authority over certain aspects of the river system. In addition, the TVA Board of Directors (the "TVA("TVA Board") has established two councils — the Regional Resource Stewardship Council and the Regional Energy Resource Council — under the Federal Advisory Committee Act to advise TVA on its stewardship activities in the Tennessee Valley and its energy resource activities.

Initially, all TVA operations were funded by federal appropriations. Direct appropriations for the TVA power program ended in 1959, and appropriations for TVA’sTVA's stewardship, economic development, and multipurpose activities ended in 1999. Since 1999, TVA has funded all of its operations almost entirely from the sale of electricity and power system financings. TVA’sTVA's power system financings consist primarily of the sale of debt securitiesbonds, notes, or other evidences of indebtedness (collectively, "Bonds") and secondarily of alternative forms of financing, such as lease arrangements. As a wholly-owned government corporation, TVA is not authorized to issue equity securities.

TVA's Mission of Service

TVA was built for the people, created by federal legislation, and charged with a unique mission - to improve the quality of life in a seven-state region through the integrated management of the region's resources. TVA's mission focuses on three key areas:

•Energy — Delivering reliable, low cost, clean energy;

•Environment — Caring for the region's natural resources; and

•Economic Development — Creating sustainable economic growth.

TVA's Strategic Priorities

While TVA's mission has not changed since it was established in 1933, the climate in which TVA operates continues to evolve. To continue to deliver its mission of service while evolving for future success, TVA must realize five strategic priorities:

•Powerful Partnerships — Promoting progress through the shared success of TVA's customers and stakeholders;

•People Advantage — Amplifying the energy, passion, and creativity within each TVA employee;

•Operational Excellence — Building on TVA's best-in-class reputation for reliable service and competitively priced power;

•Igniting Innovation — Pursuing innovative solutions for TVA and its customers and communities; and

•Financial Strength — Investing in the future, while keeping energy costs as low as possible.

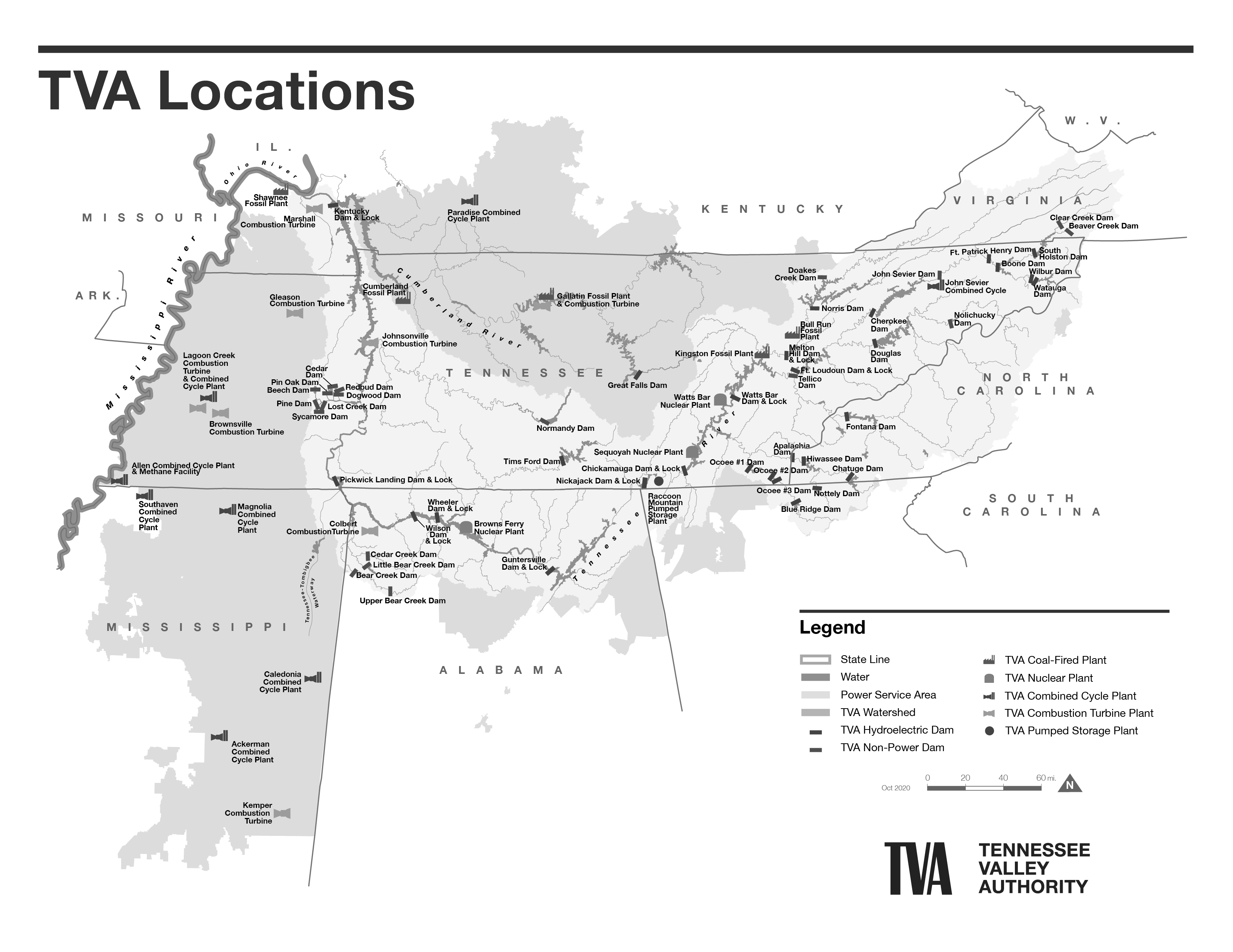

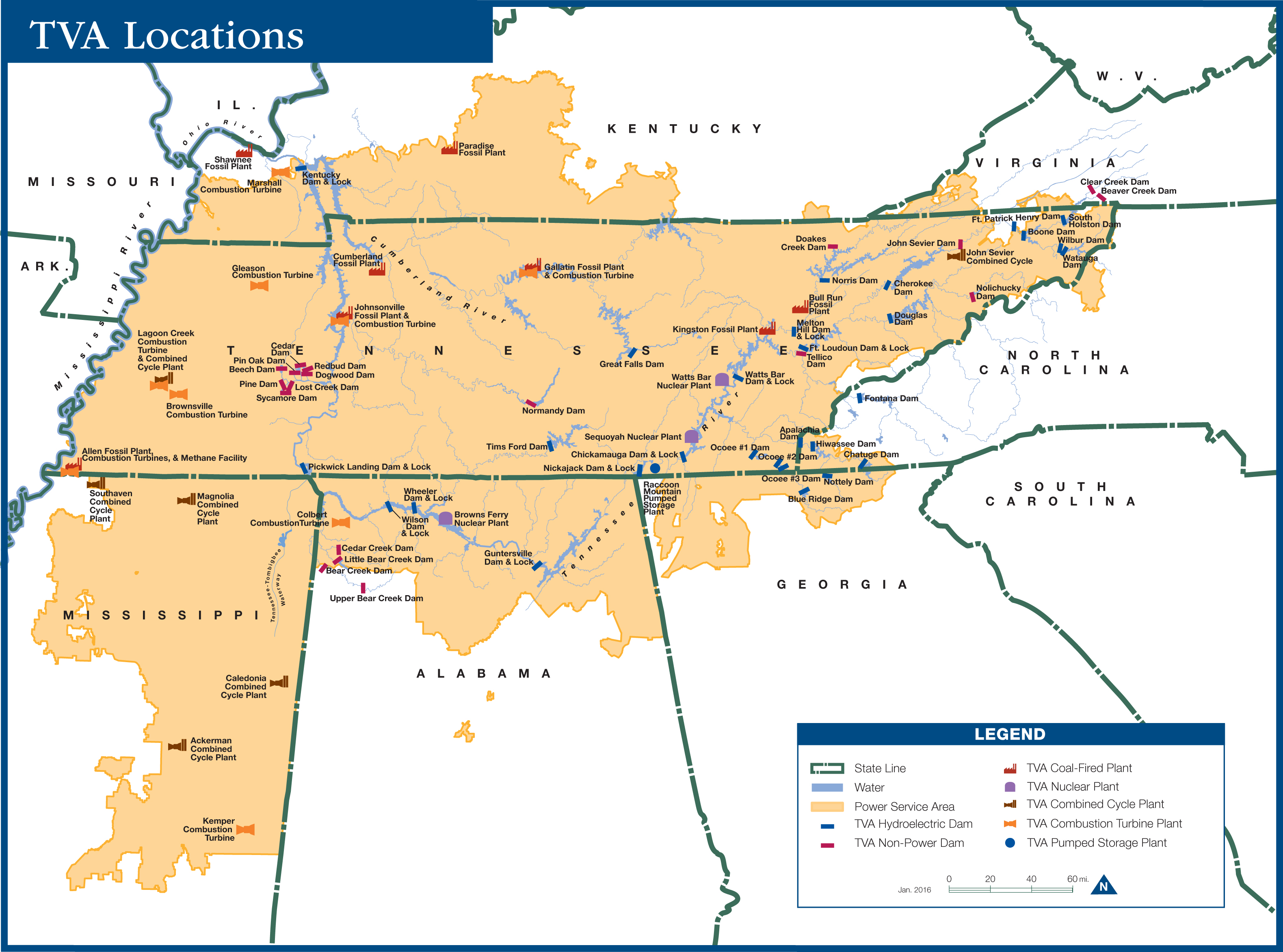

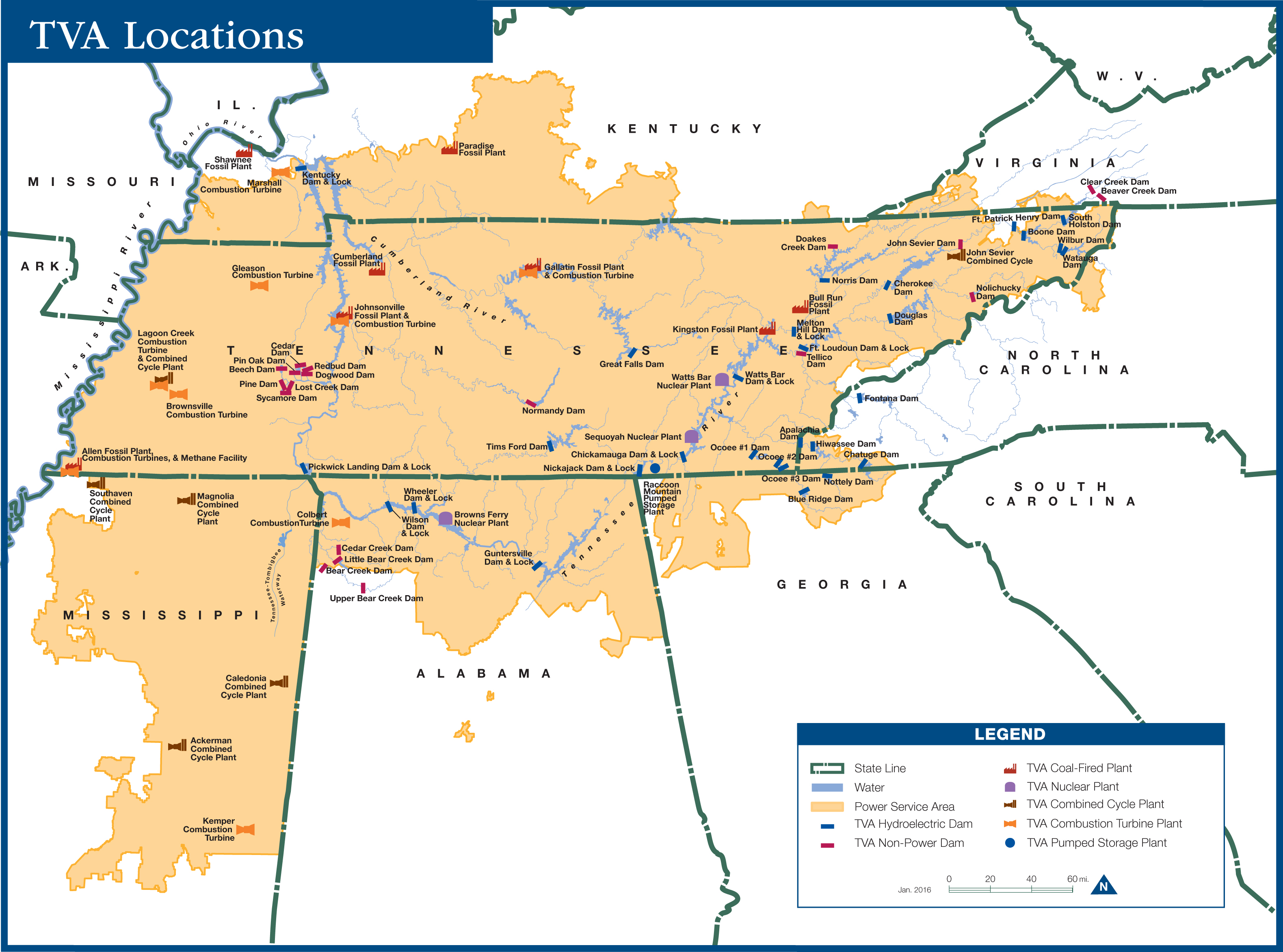

Service Area

TVA's service area, the area in which it sells power, is defined by the Tennessee Valley Authority Act of 1933, as amended ("TVA Act.Act"). TVA supplies power in most of Tennessee, northern Alabama, northeastern Mississippi, and southwestern Kentucky, and in portions of northern Georgia, western North Carolina, and southwestern Virginia. Under the TVA Act, subject to certain minor exceptions, TVA may not, without specific authorization from the U.S. Congress,enactment of authorizing federal legislation, enter into contracts that would have the effect of making it, or the wholesale customers ofthat distribute TVA power ("local power company customers" or "LPCs") that distribute TVA power,, a source of power supply outside the area for which TVA or its LPCs were the primary source of power supply on July 1, 1957. This provision is referred to as the “fence”"fence" because it bounds TVA’sTVA's sales activities, essentially limiting TVA to power sales within a defined service area.

See Power Supply and Load Management Resources— Coal-Fired for a discussion of coal-fired units.Resources.

In addition, the Federal Power Act ("FPA") includes a provision that helps protect TVA’sTVA's ability to sell power within its service area. This provision, called the "anti-cherrypicking" provision, prevents the Federal Energy Regulatory Commission ("FERC") from ordering TVA to provide access to its transmission lines to others to deliver power to customers within TVA’sTVA's defined service area. As a result, the anti-cherrypicking provision reduces TVA’sTVA's exposure to loss of its customers. However, there have been some efforts to circumvent the anti-cherrypicking provision, and the protection of the provision could be limited and perhaps eliminated by federal legislation at some time in the future. See Competition, Item 1A, Risk Factors — Regulatory, Legislative, and Legal Risks— TVA may lose its protected service territory, and Note 23 — Commitments and Contingencies — Legal Proceedings — Challenge to Anti-Cherrypicking Amendment.

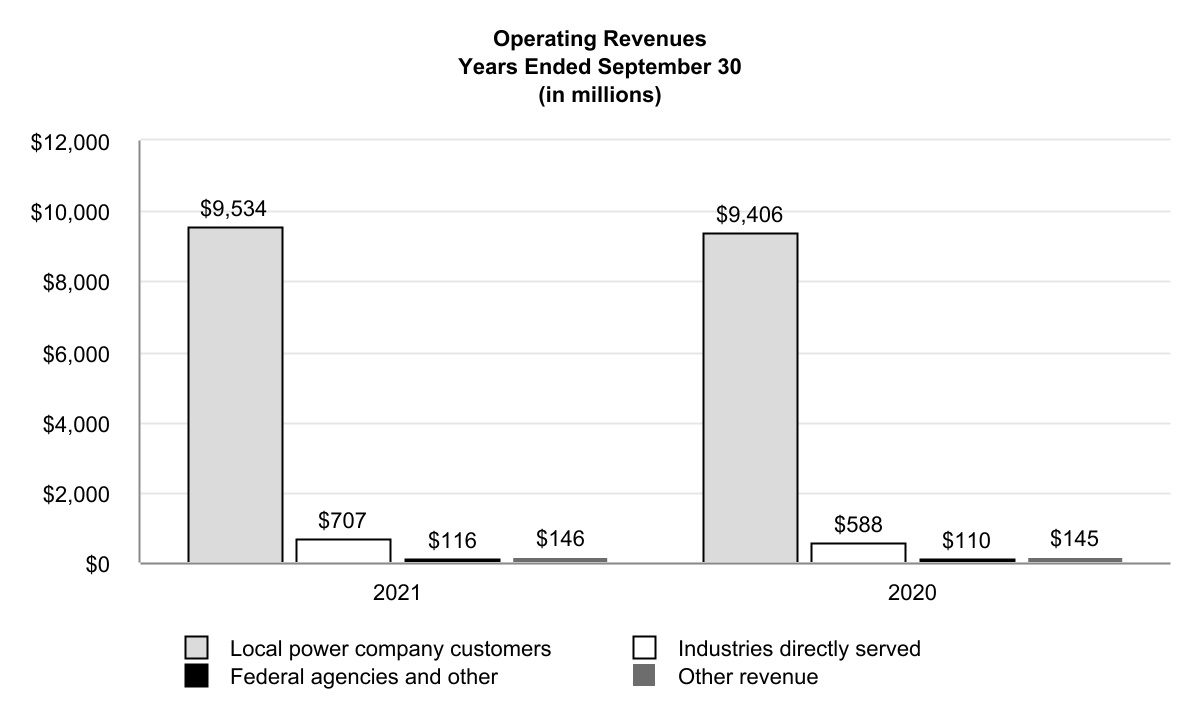

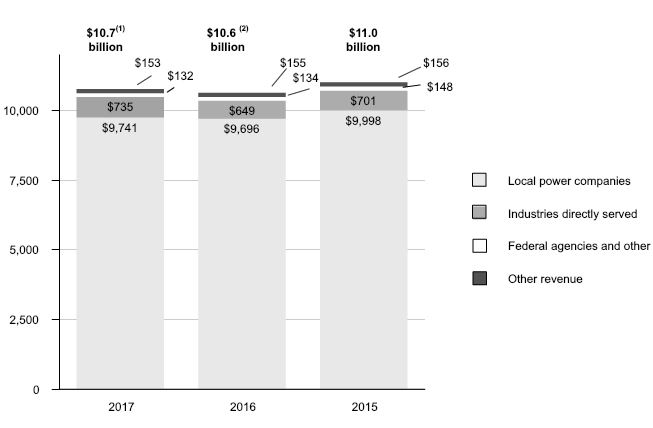

In 2017,2021, the revenues generated from TVA’sTVA's electricity sales were $10.6$10.4 billion and accounted for virtually all of TVA’sTVA's revenues. TVA’sSee Note 18 — Revenue for details regarding revenues by state for each of the last three yearsyears.

COVID-19 Pandemic

In March 2020, the World Health Organization declared the outbreak of the Coronavirus Disease 2019 ("COVID-19") to be a pandemic, which continues to be a serious challenge throughout the U.S. TVA implemented a company-wide pandemic plan to address specific aspects of the COVID-19 pandemic, including impacts from variants. TVA's pandemic plan continually evolves based on medical guidance and federal, regional, and local requirements and guidelines.

TVA has put in place measures to protect its workforce, stakeholders, and critical operations, such as extending the timeframe for workforce reintegration and continuing to implement strong physical and cybersecurity measures. Generation, transmission, and distribution functions are detailedactively monitored, and TVA's operations and delivery of energy to customers have not been materially impacted by the COVID-19 pandemic at this time. While TVA experienced a reduction in revenue for the table below.year ended September 30, 2020, based on current internal models, TVA estimates that the COVID-19 pandemic had little impact on TVA's sales volume for the year ended September 30, 2021. TVA continues to assess potential supplier risk, and through September 30, 2021, TVA has seen an increase in supplier impacts as a result of COVID-19, such as delays and price fluctuations, but has not experienced significant business disruptions at this time.

|

| | | | | | | | | | | |

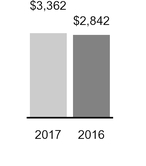

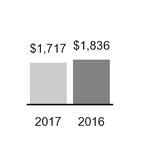

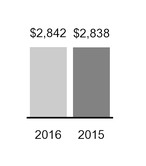

Operating Revenues By State For the years ended September 30 (in millions) |

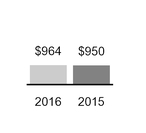

| | 2017 | | 2016 | | 2015 |

| Alabama | $ | 1,524 |

| | $ | 1,504 |

| | $ | 1,582 |

|

| Georgia | 252 |

| | 255 |

| | 267 |

|

| Kentucky | 665 |

| | 640 |

| | 660 |

|

| Mississippi | 1,016 |

| | 999 |

| | 1,023 |

|

| North Carolina | 57 |

| | 58 |

| | 58 |

|

| Tennessee | 7,041 |

| | 6,968 |

| | 7,189 |

|

| Virginia | 47 |

| | 48 |

| | 50 |

|

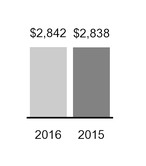

| Subtotal | 10,602 |

| | 10,472 |

| | 10,829 |

|

| Off-system sales | 6 |

| | 7 |

| | 18 |

|

Revenue capitalized during pre-commercial plant operations(1) | (22 | ) | | (18 | ) | | — |

|

| Revenue from sales of electricity | 10,586 |

| | 10,461 |

| | 10,847 |

|

| Other revenues | 153 |

| | 155 |

| | 156 |

|

| Total operating revenues | $ | 10,739 |

| | $ | 10,616 |

| | $ | 11,003 |

|

Note

(1) Represents revenue capitalized during pre-commercial operationsThe COVID-19 pandemic is an evolving situation, and TVA will continue to monitor and adjust its response as necessary to ensure reliable service while protecting the safety and health of $22 million at Watts Bar Nuclear Plant ("Watts Bar") Unit 2, Paradise Combined Cycle Plant,its workforce. See Item 7, Management's Discussion and Allen Combined Cycle Plant in 2017Analysis of Financial Condition and $18 million at Watts Bar Unit 2 in 2016. See Note 1Results of Operations — Pre-Commercial Plant Operations.Key Initiatives — COVID-19 Pandemic for an expanded discussion of the impact to TVA and related initiatives.

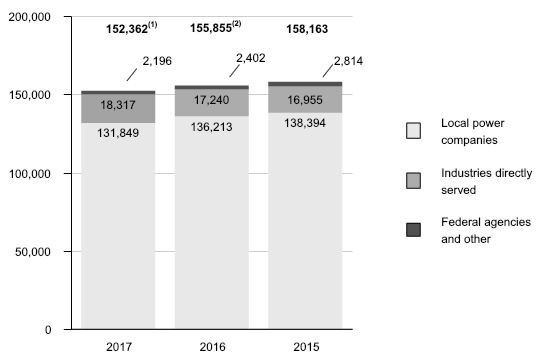

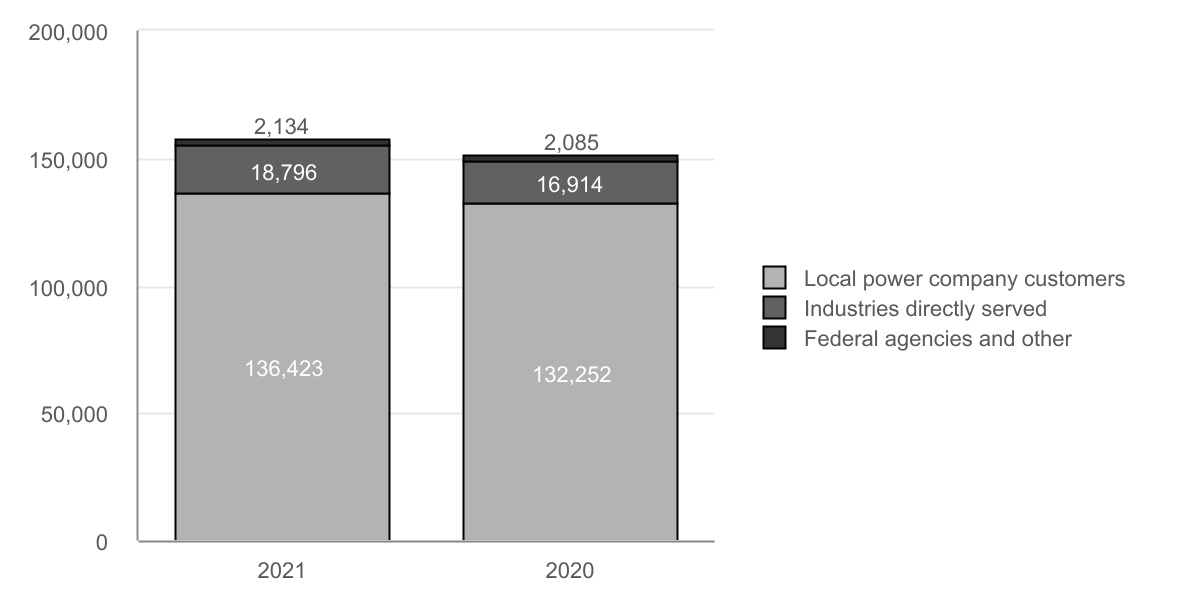

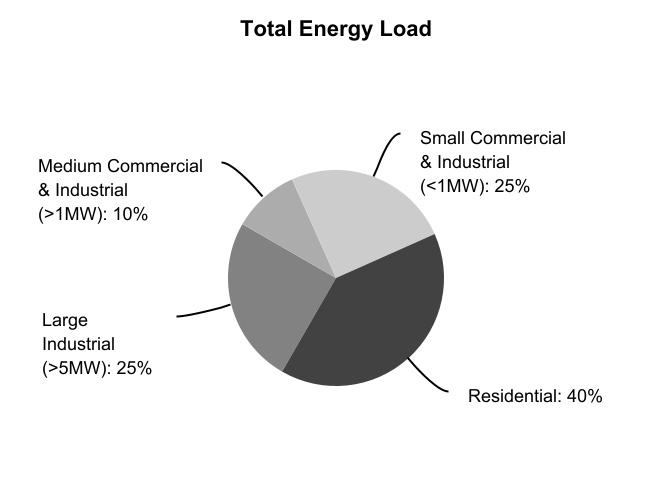

Customers

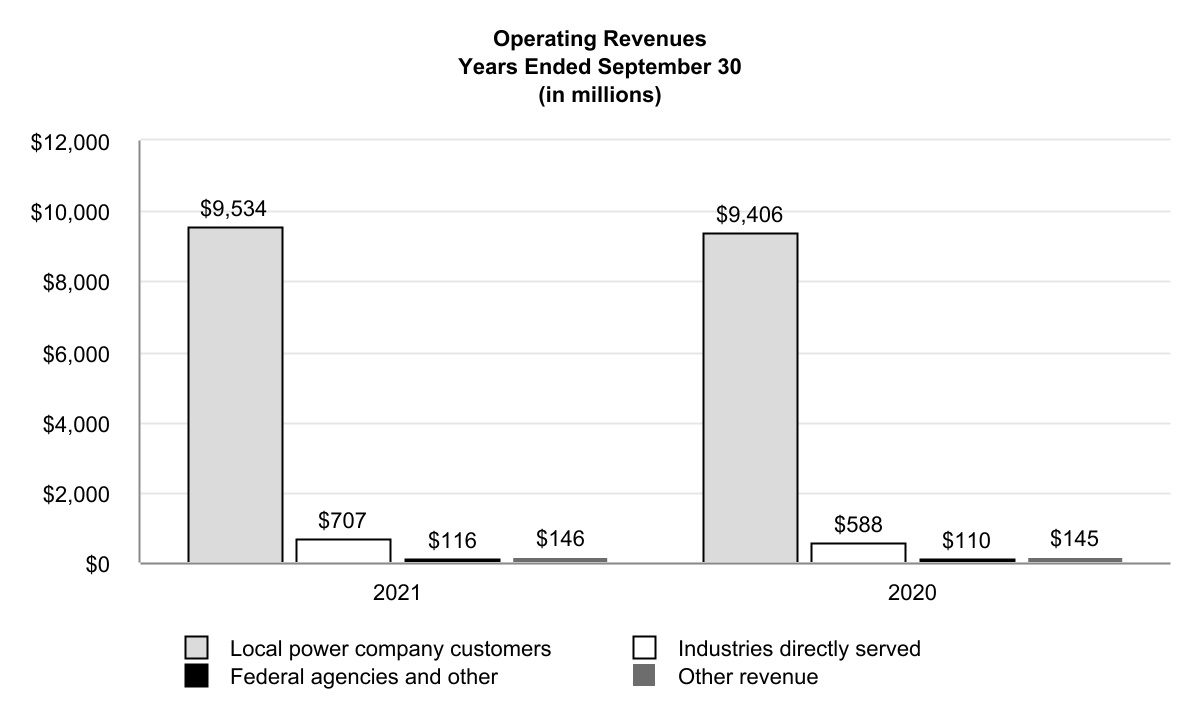

TVA is primarily a wholesaler of power, selling power to LPCs whichthat then resell power to their customers at retail rates. TVA’sTVA's LPCs consist of (1) municipalities and other local government entities ("municipalities") and (2) customer-owned entities ("cooperatives"). These municipalities and cooperatives operate public power electric systems whose primary purpose is not to make a profit but to supply electricity to the general public or the cooperative'scooperatives' members. TVA also sells power directly to certain end-use customers, primarily large commercial and industrial loads and federal agencies with loads larger than 5,000 kilowatts ("kW"). Whether TVA or aan LPC serves a new power customer is determined by reference to the applicable TVA-LPC wholesale power contract. TheEach contract contains a formula that balances the size of the LPC and the amount of any TVA infrastructure investment to determine which party is entitled to serve the new customer. In addition, power in excess of the needs of the TVA system may, where consistent with the provisions of the TVA Act, be sold under exchange power arrangements with other specific electric systems. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations — Results of Operations — Financial Results — Operating Revenues.and Note 18 — Revenue for details regarding operating revenues for each of the last three years.

|

| | | | | | | | | | | |

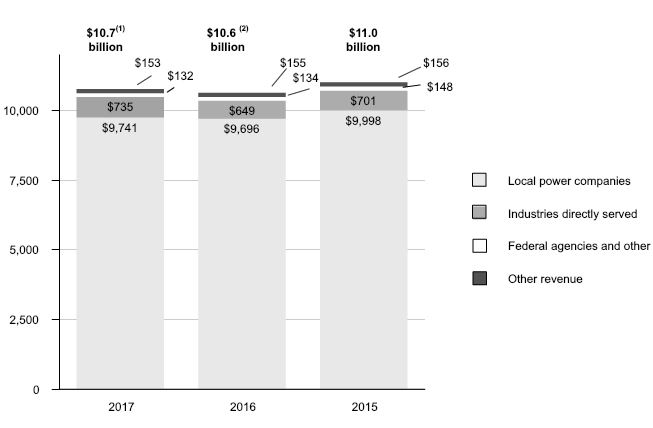

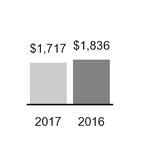

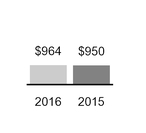

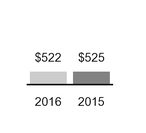

Operating Revenues by Customer Type For the years ended September 30 (in millions) |

| | 2017 | | 2016 | | 2015 |

| Revenue from sales of electricity | | | | | |

| Local power companies | $ | 9,741 |

| | $ | 9,696 |

| | $ | 9,998 |

|

| Industries directly served | 735 |

| | 649 |

| | 701 |

|

| Federal agencies and other | 132 |

| | 134 |

| | 148 |

|

Revenue capitalized during pre-commercial plant operations(1) | (22 | ) | | (18 | ) | | — |

|

| Revenue from sales of electricity | 10,586 |

| | 10,461 |

| | 10,847 |

|

| Other revenues | 153 |

| | 155 |

| | 156 |

|

| Total operating revenues | $ | 10,739 |

| | $ | 10,616 |

| | $ | 11,003 |

|

Note

(1) Represents revenue capitalized during pre-commercial operations of $22 million at Watts Bar Unit 2, Paradise Combined Cycle Plant, and Allen Combined Cycle Plant in 2017 and $18 million at Watts Bar Unit 2 in 2016. See Note 1 — Pre-Commercial Plant Operations.

Local Power CompaniesCompany Customers

Revenues from LPCs accounted for approximately 91 percent of TVA’sTVA's total operating revenues in 2017. At September 30, 2017,for 2021. TVA had wholesale power contracts with 154 LPCs.153 LPCs at September 30, 2021. Each of these contracts requires the LPC to purchase from TVA all of itsthe electric power andrequired for service to the LPC's customers; however, flexibility agreements available to LPCs that have executed long-term contracts with TVA allow LPCs to locally generate or purchase up to approximately five percent of average total hourly energy consumed within the TVA service area. Nearly allsales over 2015 - 2019 in order to meet their individual customers' needs. LPCs purchase power under contracts that requirewith terms of five ten, or fifteen20 years notice to terminate.

The number of LPCs with the contract arrangements described below, the revenues derived from such arrangements in 2017, and the percentage of TVA’s 2017 total operating revenues represented by these revenues are summarized in the table below.

|

| | | | | | | | | |

TVA Local Power Company Customer Contracts At September 30, 2017 |

Contract Arrangements(1) | Number of LPCs | | Sales to LPCs in 2017 (in millions) | | Percentage of Total Operating Revenues in 2017 |

| 20-year termination notice | 2 |

| | $ | 36 |

| | 0.3 | % |

| 15-year termination notice | 10 |

| | 351 |

| | 3.3 | % |

| 12-year termination notice | 1 |

| | 24 |

| | 0.2 | % |

| 10-year termination notice | 53 |

| | 3,554 |

| | 33.1 | % |

| 6-year termination notice | 1 |

| | 46 |

| | 0.4 | % |

| 5-year termination notice | 87 |

| | 5,730 |

| | 53.3 | % |

| Total | 154 |

| | $ | 9,741 |

| | 90.6 | % |

Note

(1) Ordinarily, the LPCs and TVA have the same termination notice period; however, in contracts with five of the LPCs with five-year termination notices, TVA has a 10-year termination notice (which becomes a five-year termination notice if TVA loses its discretionary wholesale rate-setting authority). Two of the LPCs have five-year termination notices or a shorter period if any act of Congress, court decision, or regulatory change requires or permits that election. Also, under TVA’s contract with Bristol Virginia Utilities, a five-year termination notice may not be given by the LPC until January 2018.

TVA’sTVA's two largest LPCs — Memphis Light, Gas and Water Division ("MLGW") and Nashville Electric Service ("NES") — have contracts with a five-year and 10-yeara 20-year termination notice periods,period, respectively. Sales to MLGW and NES accounted for 10nine percent and nineeight percent, respectively, of TVA’sTVA's total operating revenues for 2021. Certain LPCs, including MLGW, are evaluating options for future energy choices. In addition, in 2017.January 2021, four LPCs filed a complaint and petition with FERC asking FERC to order TVA to provide transmission and interconnection service to the LPCs or other suppliers that want to serve them. In August 2021, one of the LPCs notified FERC of its withdrawal from the complaint and petition. The remaining three LPCs accounted for three percent of TVA's total operating revenues for the year ended September 30, 2021. See Note 23 — Commitments and Contingencies — Legal Proceedings — Challenge to Anti-Cherrypicking Amendment for updates to this legal proceeding.

TVA and LPCs continue to work together to meet the changing needs of consumers around the Tennessee Valley. In 2019, the TVA Board approved a Partnership Agreement option that better aligns the length of LPC power contracts with TVA's long-term commitments. Under the partnership arrangement, the LPC power contracts automatically renew each year and have a 20-year termination notice. The partnership arrangements can be terminated under certain circumstances, including TVA's failure to limit rate increases as provided for in the agreements going forward. Participating LPCs receive benefits including a 3.1

percent wholesale bill credit in exchange for their long-term commitment, which enables TVA to recover its long-term financial commitments over a commensurate period. In June 2020, TVA provided participating LPCs a flexibility option that allows them to locally generate or purchase up to approximately five percent of average total hourly energy sales over 2015 - 2019 in order to meet their individual customers' needs. As of November 12, 2021, 145 LPCs had signed the 20-year Partnership Agreement with TVA, and 74 LPCs had signed a Flexibility Agreement.

The power contracts between TVA and LPCs provide for the purchase of power by LPCs at the wholesale rates established by the TVA Board. Under Section 10 of the TVA Act, the TVA Board is authorized to regulate LPCs to carry out the purposes of the TVA Act through contract terms and conditions as well as through rules and regulations. TVA regulates LPCs primarily through the provisions of TVA’sTVA's wholesale power contracts. All of the power contracts between TVA and the LPCs require that power purchased from TVA be sold and distributed to the ultimate consumer without discrimination among consumers of the same class and prohibit directlydirect or indirectlyindirect discriminatory rates, rebates, or other special concessions. In addition, there are a number of wholesale power contract provisions through which TVA seeks to ensure that the electric system revenues of the LPCs are used only for electric system purposes. Furthermore, almost all of these contracts specify the resale rates and charges at which the LPC must resell TVA power to its customers. These rates are revised from time to time, subject to TVA approval, to reflect changes in costs, including changes in the wholesale cost of power.

TVA also regulates LPC policies for customer deposits, termination of service for nonpayment,non-payment, information to consumers, and billing through a service practice policy framework. TVA’sTVA's regulatory framework provides for consistent regulatory policy for ratepayers across the Tennessee Valley, while recognizing local considerations. The regulatory provisions in TVA’sTVA's wholesale power contracts are designed to carry out the objectives of the TVA Act, including the objective of providing for an adequate supply of power at the lowest feasible rates. See Rates — Rate Methodology below.

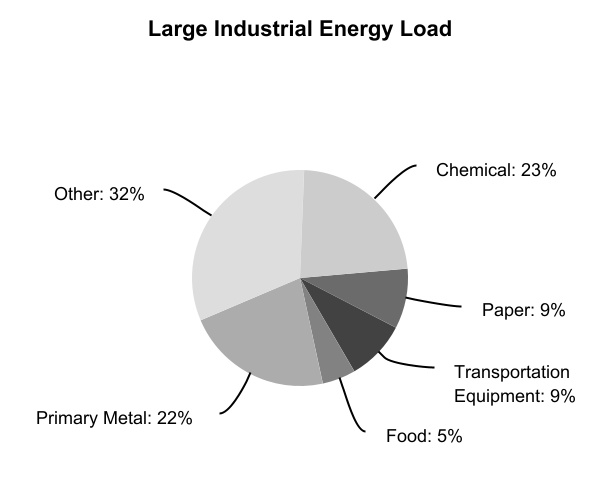

Other Customers

Revenues from directly served industrial customers accounted for approximately seven percent of TVA’sTVA's total operating revenues in 2017.2021. Contracts with these customers are subject to termination by the customer or TVA upon a minimum notice period that varies according to a number of factors, including the customer’scustomer's contract demand and the period of time service has been provided. TVA also serves seven federal customers, includingincluding U.S. Department of Energy ("DOE") facilities and military installations, which accounted for approximately one percent of TVA’sTVA's total operating revenues in 2017.2021.

Other revenue consists primarily of wheeling and network transmission charges, sales of excess steam that is a by-product of power production, delivery point charges for interconnection points between TVA and the customer, and certain other minor items. Other revenue accounted for approximately one percent of TVA's total operating revenues in 2021.

Rates

Rate Authority

The TVA Act gives the TVA Board sole responsibility for establishing the rates TVA charges for power. These rates are not subject to judicial review or to review or approval by any state or other federal regulatory body. Under the TVA Act, TVA is required to charge rates for power that will produce gross revenues sufficient to provide funds for:

•Operation, maintenance, and administration of its power system;

•Payments to states and counties in lieu of taxes ("tax equivalents");

•Debt service on outstanding indebtedness;

•Payments to the U.S. Treasury in repayment of and as a return on the government's appropriation investment in TVA's power facilities (the "Power Program Appropriation Investment"); and

•Such additional margin as the TVA Board may consider desirable for investment in power system assets, retirement of outstanding bonds, notes, or other evidences of indebtedness ("Bonds")Bonds in advance of their maturity, additional reduction of the Power Program Appropriation Investment, and other purposes connected with TVA’sTVA's power business.

In setting TVA’s rates, the TVA Board is charged by the TVA Act to havebusiness, having due regard for the primary objectives of the TVA Act, including the objective that power shall be sold at rates as low as are feasible. See Note 19 — Proprietary Capital.

TVA fulfilled its requirement to repay $1.0 billion of the Power Program Appropriation Investment in 2014; therefore, the repayment of this amount is no longer a component of rate setting.

Rate Methodology

In view of demand for electricity, the level of competition, and other relevant factors, TVA believes it is reasonable to assume that rates, set at levels that will recover TVA's costs, can be charged and collected from customers. Further, the TVA Board has the discretion to determine when costs will be recovered in rates. As a result of these factors, TVA records certain assets and liabilities that result from the self-regulated ratemaking process that could not otherwise be so recorded under accounting principles generally accepted in the United States. See Note 1 — Cost-Based Regulation and Note 7.

TVA uses a seasonal time of use wholesale rate structure that is comprised of base demand and energy rates, a basefuel rate, and a fuel rate that is automatically determined each month by the operation of the fuel cost adjustment formula.grid access charge ("GAC"). In setting the base rates, TVA uses a debt-service coverage ("DSC") methodology to derive annual revenue requirements in a manner similar to that used by other public power entities that also use the DSC rate methodology. Under the DSC methodology, rates are calculated so that an entity will be able to cover its operating costs and to

satisfy its obligations to pay principal and interest on debt.debt, plus an additional margin. This ratemaking approach is particularly suitable for use by entities financed primarily, if not entirely, by debt, such as TVA.

TVA's revenue requirements for costs or projected costs (other than the fuel, purchased power,TVA, and related costs

covered by the fuel rate) are calculated under the DSC methodology in order to producehelps ensure that TVA produces gross revenues sufficient to fund requirements specified in the TVA Act listed under Rate Authority above. above.

The DSC methodology reflects the cause-and-effect relationship between TVA's costs and the corresponding rates it

charges for power. Once the revenue requirements (or projected costs) are determined, they are compared to the projected revenues for the year in question, at existing rates, to arrive at the shortfall or surplus of revenues as compared to the projected costs. Power rates are adjusted by the TVA Board to a level deemed to be sufficient to produce revenues approximately equal to projected costs (exclusive of the costs collected through the fuel rate).

A comprehensive rate restructuring was approved by the TVA Board on August 21, 2015, and implemented on October 1, 2015. The rate restructuring resulted in structural changes to base rates to improve cost alignment with capacity-related on-peak demand charges and seasonal time-of-use ("TOU") energy rates that differ by on-peak and off-peak periods to better reflect how TVA incurs generation costs. Minor changes in revenue allocation were made to improve alignment with cost-of-service, to keep industrial rates competitive, and to keep residential rates affordable. The 2015 TOU rate was unanimously adopted by TVA’s LPCs and by nearly all of TVA’s directly served customers.

TVA recovers fuel costs and tax equivalentsequivalent payments associated with fuel cost adjustments through a monthly rate adjustment reflecting the forecasted costs paid by TVA forof fuel. PriorFuel costs are allocated to fiscal year 2016, all customers paid the same monthly base fuel rate. On August 21, 2015, the TVA Board approved a new methodology to more accurately allocate fuel costs to twothree groups of customers: Standard Service (residential and small commercial customers), large manufacturing customers with contract demands greater than 5 megawatts ("MW"), and Non-Standard Service (large commercial and industrial customers), eachlarge general service customers with a different monthly fuel rate better reflecting their group’s contribution to total fuel costs. contract demands greater than 5 MW. Fuel costs are now allocated to these customer groupsthree classes of customers in relation to their average hourly loads and TVA's hourly incremental dispatch costs.cost. Total monthly fuel costs include costs for natural gas, fuel oil, coal, purchased power, emission allowances, nuclear fuel, and other fuel-related commodities as well as realized gains and losses on derivatives purchased to hedge the costs of such commodities.

In 2013,prior years, TVA, LPCs, and directly served industries developed changes to TVA's rate structures that focus on TVA's long-term pricing efforts. These changes improved pricing by better aligning rates with underlying cost drivers and by sending improved pricing signals, while maintaining competitive industrial rates and keeping residential rates affordable. The rate structures also reduced wholesale energy rates for Standard Service and introduced a GAC at an offsetting rate to better recover fixed costs. This approach more accurately reflects the wholesale cost of energy and recognizes the value of the grid's reliability and associated fixed costs. TVA's modernized approach to pricing provides bill stability while maintaining reliability and fairness for all TVA's customers. TVA Board approved continuing the collection of Environmental Adjustment ("EA") chargeswill continue to fund investment in environmental projects. TVA’s EA was modified in 2015 to conform to the new wholesale and large-customer base rate designs. While revised slightly, the EA was designed to collect approximately the same revenue as before the rate structuring, approximately $415 million and $421 million in 2017 and 2016, respectively.

Subsequent to discussionscollaborate with LPCs over the past two years, TVA made a rate change proposal to LPCs around the need for further improvements to wholesale and retail pricing during the fourth quarter of 2017. It is intended that changes keep rates low, ensure fairness in rates, and bring more stability in bills while being more responsive to customer choices. The proposed changes account for reliable grid servicedirectly served industries as necessary to ensure 24/7 on-demand energy when distributed energy resources mayalignment with this approach.

not be available. In addition, it is anticipated that the proposed changes would allow consumers to make more informed investment decisions and stimulate economic growth.

On August 23, 2017, the TVA Board approved an annual base rate adjustment with the goal of increasing 2018 revenues by approximately $195 million. This adjustment equates to an approximately 2.4 percent wholesale rate increase (excluding fuel).

Power Supply and Load Management Resources

General

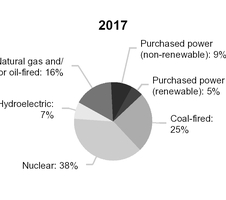

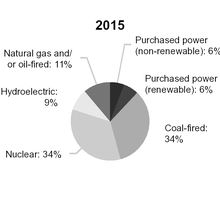

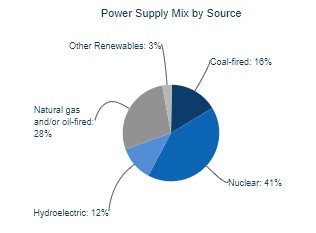

TVA seeks to balance production capabilities with power supply requirements by promoting the conservation and efficient use of electricity and, when necessary, buying, building, or leasing assets or entering into power purchase agreements.agreements ("PPAs"). TVA also intendsseeks to employ a diverse mix of energy generating sources and is workingworks toward obtaining greater amounts of its power supply from clean (low or zero carbon emitting) resources.

TVA is making investments in its generating portfolio to modernize the fleet while also allowing TVA to maintain competitive rates and high reliability and work toward carbon emission reductions. As TVA continues to evaluate the impact of retiring its coal-fired fleet by 2035, it is also evaluating adding flexible lower carbon-emitting gas plants as a bridging strategy to maintain reliability, such as the ongoing projects at TVA’s Paradise and Colbert sites. In addition, TVA is committed to investing in the future of nuclear with the evaluation of emerging advanced nuclear technologies, such as small modular reactors ("SMRs"), and has uprated the existing Browns Ferry units to generate more low-cost, reliable, and carbon-free energy. TVA is also implementing the Hydro Life Extension Program with a focus on improving the availability and flexibility of the hydroelectric fleet. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations — Key Initiatives — Generation Resources — Extended Power Uprate, Natural Gas-Fired Units, and Small Modular Reactors, in addition to Renewable Energy Resources — Hydro Modernization Program below.

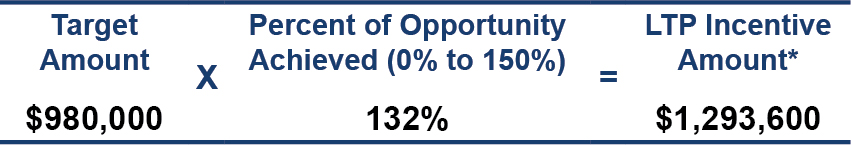

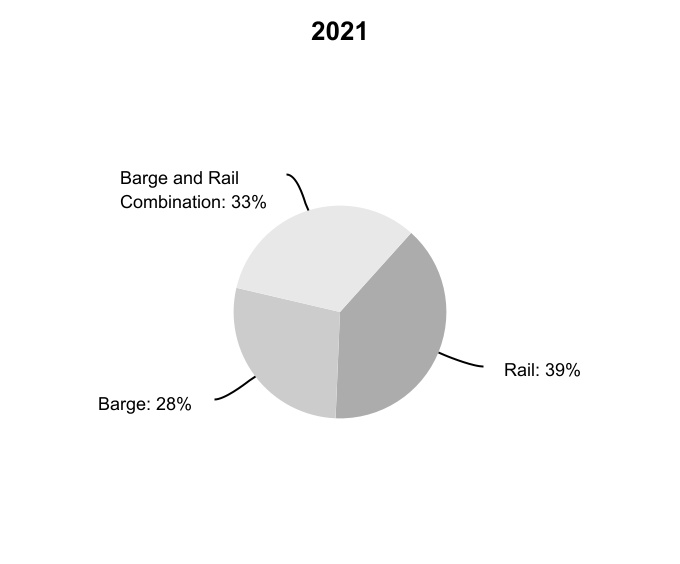

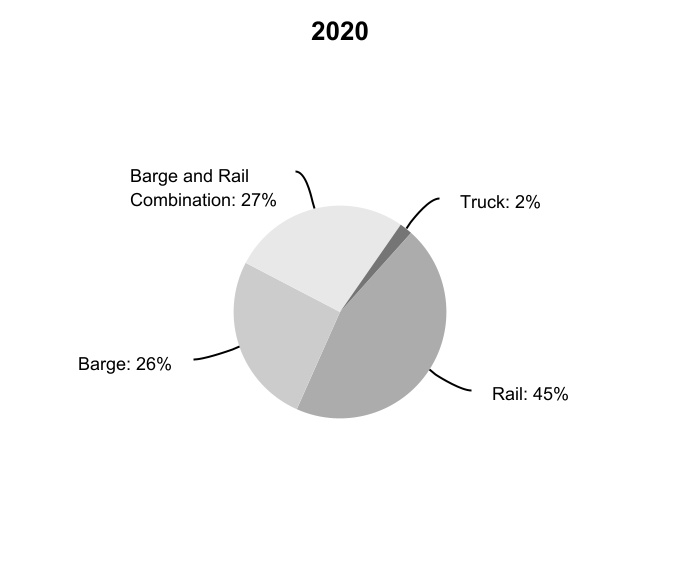

In addition, TVA and other utilities across the southeastern United States are exploring the creation of an automated energy exchange platform across the region to facilitate more short-term power exchanges. The energy exchange would be an enhancement to the existing market. See Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations — Key Initiatives — Automated Energy Exchange Platform.