SECURITIES AND EXCHANGE COMMISSION

| x | |

[X]

| ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended November 30, 20132014 |

| |

[ ]

o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT |

| |

| For the transition period from _______________________ to ________ ______________ |

| |

| Commission file number: 333-190265 |

| |

MASCOTA RESOURCES CORP. |

(Exact name of registrant as specified in its charter) |

|

Nevada | 36-4752858 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

PO Box 64, Calle Columbia 1014

Colonia 5 de Diciembre

Puerto Vallarta, CP48351

Jalisco, México

29409 232nd Ave. SE Black Diamond, WA 98010 |

(Address of principal executive offices) |

|

Registrant’s telephone number: (702) 997-2546(206) 818-4799 |

|

Securities registered under Section 12(b) of the Exchange Act: |

|

Title of each class | Name of each exchange on which registered |

none | not applicable |

|

Securities registered under Section 12(g) of the Exchange Act: |

|

Title of class | |

none | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[X]x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

| Large accelerated filer | o | Accelerated filer | o |

| | | | |

| Non-accelerated filer | o | Smaller reporting company | x |

| (Do note check if a smaller reporting company) | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Not available Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 3,100,000

As of July 22, 2016, the Company had 3,890,750 shares as of February 5, 2014its common stock, par value $0.001, issued and outstanding.

| | |

| TABLE OF CONTENTS

| |

| | Page

|

| PART I

| |

Item 1.

| Business

| 4

Page |

Item 2.

| | 7

|

| | 11

|

| | |

| | |

| | 11

|

| | |

| | 12

|

| | 13

|

| | 13

|

| | 16

|

| | 16

|

| | 18

|

| | 18

|

| | 18

|

| | |

| | 19

|

| | 20

|

| | 22

|

| | 22

|

| | 23

|

| | |

| | 24

|

We are an exploration stage mineral exploration company incorporated in Nevada on November 3, 2011. On November 10, 2011, we incorporated a wholly-owned subsidiary, MRC Exploration LLC in the state of Nevada, for the purposes of mineral exploration. company.

On May 3, 2013, our consulting geologist acquired a 100% legal and beneficial ownership interest in the MC00000266 mining claim (hereafter the

“Mineral Claim”“Claim”) which

he holdsheld in trust for us. The

Mineral Claim

iswas located in the Northeast Athabasca Basin, in the Province of Saskatchewan, Canada. It

iswas located on provincial lands administered by the Province of Saskatchewan. The legal and ownership rights on the claim

arewere limited to the exploration and extraction of mineral deposits subject to applicable regulations. The

Mineral Claim

totalstotaled roughly 2,014 acres or 3.15 square miles in size and

iswas located approximately 25 miles north of the community of Points North, Saskatchewan.

The

Mineral Claim

comprisescomprised an irregular shaped block approximately 3 miles long and

1one mile wide located approximately 6 miles east of a significant uranium occurrence known as Laroque Lake. Historic exploration work

showsshowed that the

claims areClaim was located within an area that has potential for uranium mineralization.

Exploration of our

Mineral Claim

iswas required before a determination as to its viability

cancould be made. We

intendintended to conduct the first phase of our exploration program commencing in the

early summerlate fall of 2014. Upon the completion of the first phase and any additional exploration phase, we

intendintended to request that our geological consultant

reviewsreview the results of each exploration program and report back to us with recommendations, if any, with regard to further exploration programs. Each exploration phase of our exploration program

willwould be dependent upon a number of factors such as our geological consultant’s recommendations and our available funds. We

currently planplanned to have our consulting geologist, Carl von Einsiedel, and his firm, Ram Explorations Ltd., perform Phase I of our exploration program. Ram Explorations

iswas in the business of doing geological explorations and

hashad capable staff on-board, or available through sub-contracting.

Our consulting geologist

hashad recommended that Phase I of exploration work on our

Mineral Claim

which consistsshould consist of prospecting to determine if samples of the Athabasca sandstone exposed on the ground within our mineral claim area,

exhibitexhibited alterations typical of those associated with known uranium deposits in the Athabasca Basin. The total estimated cost of the proposed Phase I program

iswas $15,000. The initial prospecting

will be collectingwould collect and

assayingassay "grab

samples".samples." This

iswas a process whereby the prospector (in our case Carl von Einsiedel, P Geol and owner of Ram Explorations Ltd.)

willwould reconnoiter the property, making maps of areas of interest taking samples and recording each sample on his sketched map. He

willwould chip away at sandstone outcroppings with his geological hand pick and visually analyze samples through a magnifying eyepiece looking for alterations in the sandstone typical of those associated with known uranium deposits in the Athabasca Basin. This type of alteration is known as the “Illite” alteration. He

willwould take the best 50 or so samples and send them to an assay laboratory for geochemical analysis to determine the extent of Illite alteration, if any, in each of the samples. In the event that our geological consultant

recommendsrecommended a further exploration program and if approved by our management, we

shallwould embark upon a Phase II mineral exploration program. The estimated cost of this Phase II exploration program

iswas $140,000.

We

havehad no proven, possible

andor implied reserves on our mineral

claim.Claim. Depending upon the outcome of our mineral exploration programs, an economic feasibility study would be undertaken to determine proven, possible and implied reserves prior to making any production decisions. We could expend many millions of dollars on exploration activities prior to determining if a feasibility study

iswas warranted or not.

Our

claim will remainClaim remained in good standing until

after the commencement of our Phase I exploration program in 2014.May 2015. The expenditure of $15,000 on that program

shall extendwould have extended the good standing date by one year. The minimum amount of exploration expenditure required to keep the

mineral claimClaim in good standing

iswas either the payment of $15,000 annually to the Province of Saskatchewan for the first eight years or incurring at least $15,000 of exploration work on our

claimClaim each year for the first eight years. Amounts expended over $15,000 per year in the first eight years

shallwould count as a credit for expenditures required in subsequent years.

Our proposed Phase I

We were unable to raise the necessary annual funding of $15,000 to keep the mineral Claim in good standing and Phase IIin May 2015, the Company forfeited its legal and beneficial ownership interest in the MC00000266 mining Claim, which was held in trust for the Company, for non-payment. As of the date of filing this Form 10K, the Company no longer holds a beneficial interest in the Claim.

The Company’s business plan is to proceed with the acquisition and exploration

programs will cause minimal ground disruption and consequently shall not require exploration permits.

In orderof feasible mineral claims to carry out an exploration program within the Province of Saskatchewan wheredetermine whether there is substantial ground disruption such as in line cutting, trenching, drilling, tunneling, and surface or underground bulk sampling, a provincial permit is required. A period of two to three months should be allowed between filing an application and the granting of a permit.

Proposed Phase 1 Exploration Program

| |

Engineering and supervision, geology

| $5,000

|

| |

Crew mobilization

| 2,500

|

| |

Camp and technical support

| 2,500

|

| |

Aircraft support

| 2,500

|

| |

Geochemical analysis(soil and rock)

| |

- 100 samples @ $25

| 2,500

|

| |

Total estimated costs:

| $15,000

|

Proposed Stage 2 Exploration Program

| |

Engineering and project supervision, reports

| $20,000

|

| |

Helicopter / aircraft support

| |

- allow approx. 20 hours @ $1,500

| 30,000

|

| |

Ground geophysical surveys (EM and magnetics)

| 75,000

|

| |

Contingency @ 10%

| 15,000

|

| |

Total estimated cost of Stage 2

| $140,000

|

Our planned additional exploration activities will be designed to explore for additional indications that our Mineral Claim may contain commercially viable quantities of uranium. We have not identifiedare commercially exploitable reserves of uranium on our Mineral Claimgold, silver and uranium. Our geological consulting firm is well experienced in the mineral exploration business and will provide us with the expected costs of exploration to date. We are an exploration stage company and there is no assurance that commercially viable uranium quantities exist on our Mineral Claim. In addition, our sole officer and director, Ms. Ponce, has not yet visiteddetermine the property. As a result, we may face an enhanced risk that, upon management’s physical examinationcommercial viability of our Mineral Claim, no commercially viable deposits of uranium will be located.

Our Mineral Claim is without known reserves and our proposed program is exploratory in nature.

the prospect.

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims.

We were incorporated on November 3, 2011 and ourOur operations are not

well-established. Ouryet well-established and our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of

ourany Mineral Claim. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and enter into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital.

Provincial Mining Regulations

In the view of our consulting geologist there are no environmental liabilities associated with our phase I mineral exploration program on our Mineral Claim. The early exploration nature of our exploration activities on the property does not lend itself to creating significant environmental hazards.

In order to carry out exploration in Saskatchewan, a permit is required from the Saskatchewan Environment Ministry (the “SEM”). Permit applications are required to go into substantial detail about the location, nature and possible environmental impact of a proposed exploration project, plus measures that will be taken to minimize the risk of fuel spills, forest fires etc., in addition to proposed remediation and rehabilitation procedures to be taken when the project is closed down. Notice must be given to other users of the land, which normally means trap line operators in the vicinity, and they are given the opportunity to comment.

Applications are reviewed by SEM, which notifies the potentially affected first nation community or communities. SEM facilitates consultation with potentially affected first nations by arranging meetings and by having a representative present to mediate if necessary. In the case of early-stage exploration projects, the local representative of the first nations typically requests that employment in the field be given to one or more of its members, on a scale proportionate to the size and scope of the project. The Athabasca Basin has seen a great deal of uranium focused exploration, and band management is well informed and (in the author’s experience) relatively sophisticated and businesslike in their dealings with exploration companies. Most importantly, they do not appear to be encumbered with a priori prejudice against mining, mining companies, mining exploration, uranium itself, uranium exploration or uranium mining. They have seen first-hand that uranium extraction can be done without major damage to the environment because they have a modern uranium mine and mill in their territory.

A period of two to three months should be allowed between filing an application for an exploration permit, and the granting of a permit by SEM. Permits are usually granted for a period of 18 months.

Our proposed Phase 1 Exploration Program will consist of surface sampling and reconnoitering and consequently will not require an exploration permit.

All of the claims comprising the Mineral Claim were staked pursuant to the Saskatchewan online tenure system (MARS). Title to the claims is maintained through the performance of annual assessment filings and payment of required fees. In order to maintain a mineral claim in good standing the holder must meet the minimum exploration expenditure requirements set out in the Mineral Tenure Registry Regulations. According to Section 44(1) (a) nil expenditures are required during the first assessment work period; (b) $6.07 per acre per assessment work period, from the second to tenth assessment work periods with a minimum of $240.00 per claim per assessment work period; and, (c) $10.12 per acre per assessment work period, for the eleventh assessment work period and all subsequent assessment work periods with a minimum of $400.00 per claim per assessment work period.

Employees

Exploration work completed to meet the assessment work requirements must meet certain requirements and the regulations further stipulate that (1) No mineral disposition lapses by reason of a delay that occurs due to the consideration by the minister of any evidence of assessment work submitted for registration as assessment work that was submitted within the time set out in these regulations. (2) If, on consideration of the evidence submitted, the minister disallows all or part of the expenditures claimed, the holder may, within 10 business days after notification by the minister: (a) make a deferred deficiency cash deposit or a deferred non-refundable cash payment in accordance with the regulations; and (b) revise the grouping of any dispositions affected by the disallowed expenditures in accordance with the regulations (3) Any deferred deficiency cash deposit or deferred non-refundable cash payment made or grouping of dispositions revised pursuant to subsection (2) shall have the same force and effect as if it were submitted at the time or within the periods specified in the regulations. (4) Notwithstanding any grouping of dispositions requested by the holder pursuant to the, the holder fails to revise the grouping of dispositions affected by the disallowed expenditures, the minister shall register all of the approved expenditures against the mineral dispositions where the expenditures were incurred.

Employees

We have no employees as of the date of this prospectus other than

our presidentDale Rasmussen who serves as the Company’s President, CEO and

CEO, Ms. Ponce. We conduct our business largely through agreements with consultantsCFO, and

other independent third party vendors.Mark Rodenbeck who serves as the Company’s Secretary. Our Officers receive no compensation for their services to the Company.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

On November 10, 2011, we incorporated a wholly-owned subsidiary, MRC Exploration LLC, in the State of Nevada for the purpose of conducting our planned mineral exploration.

We do not own, either legally or beneficially, any patent or trademark.

ITEM 1A. RISK FACTOItem 2. Properties

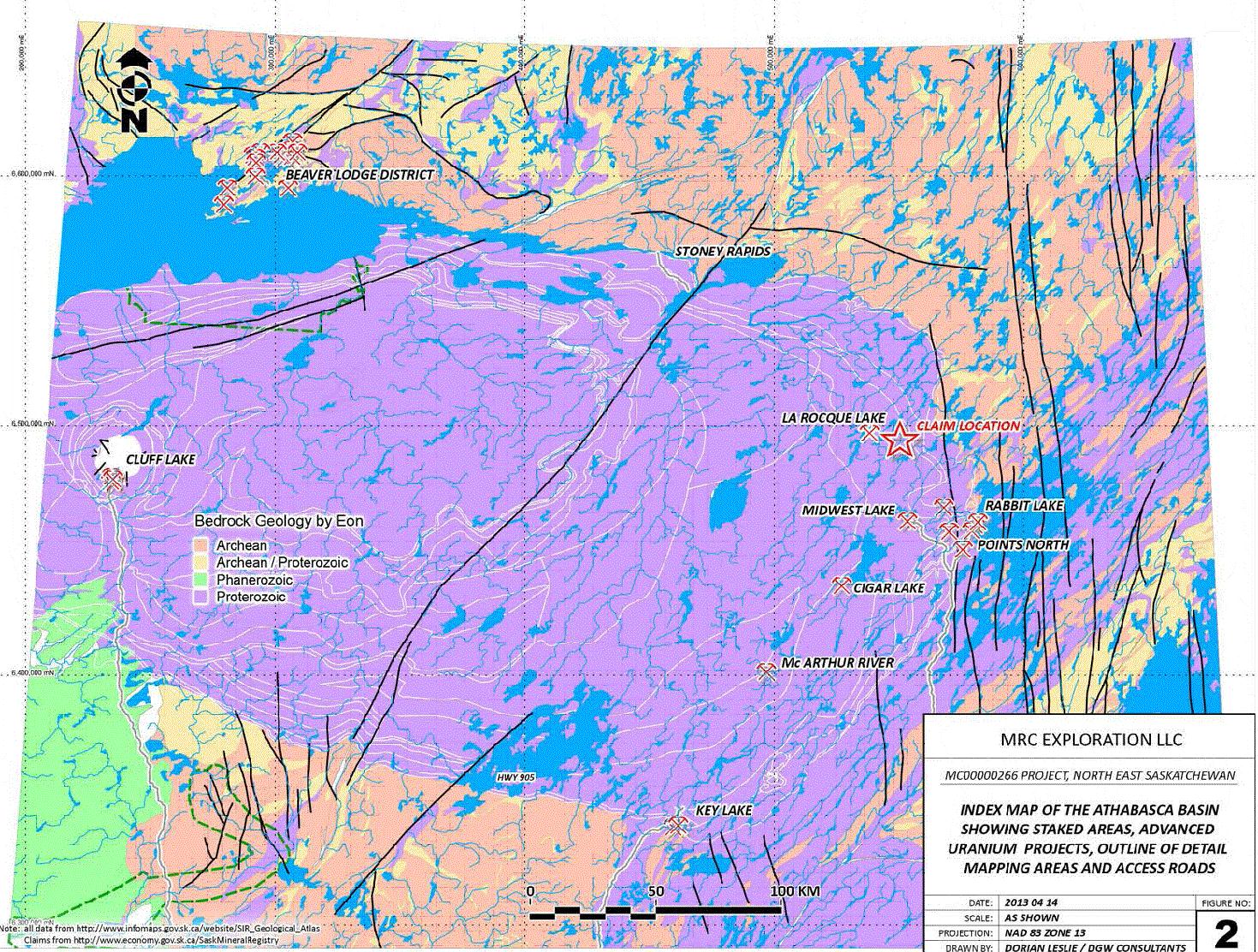

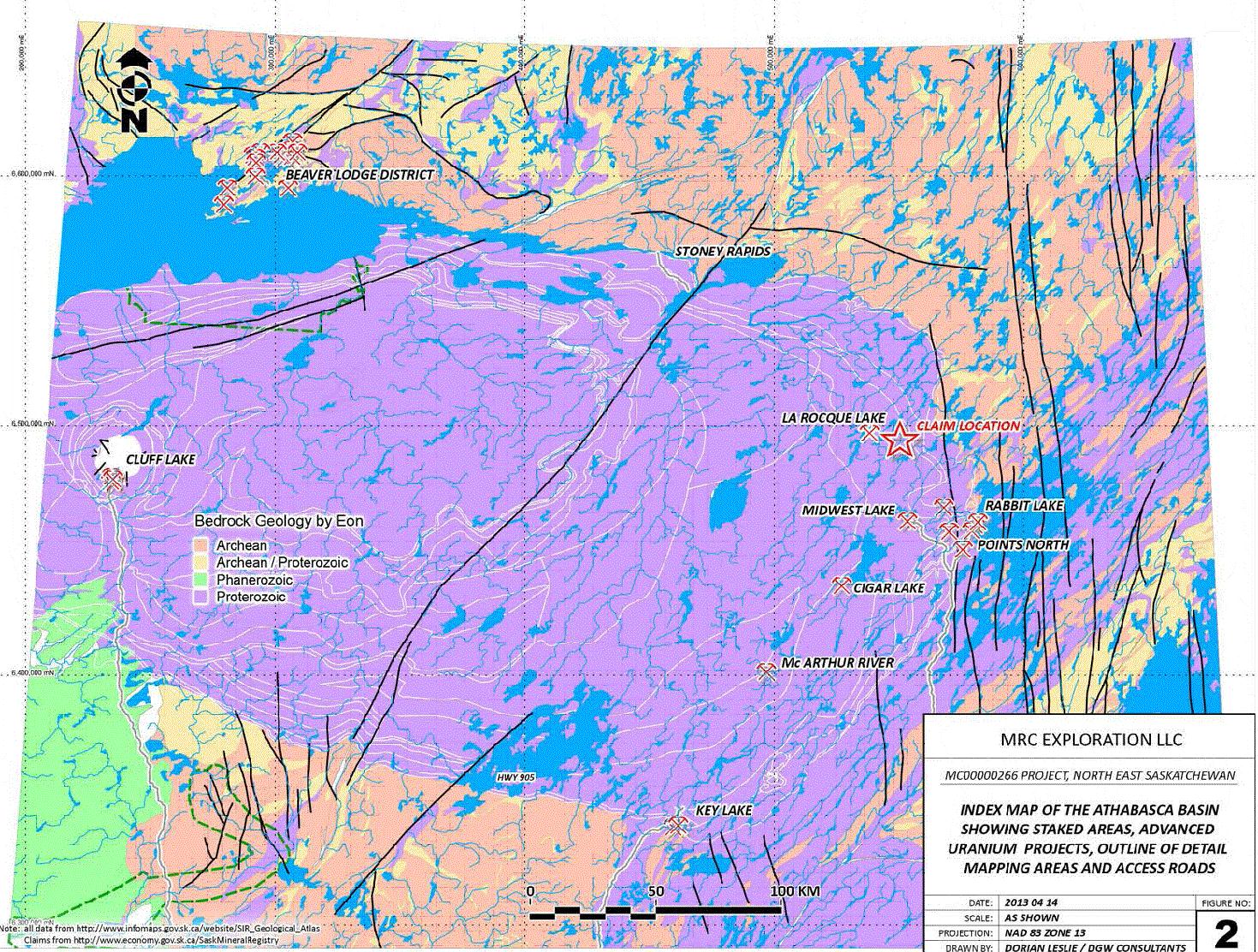

Location and Means of Access to our Mineral Claim; Infrastructure

The Mineral Claim is located in the Athabasca Basin of Northern Saskatchewan on lands owned by the Province of Saskatchewan, inRS

As a

remote area approximately 245 miles north of the city of La Ronge, Saskatchewan. All of the property comprising the Mineral Claim was staked pursuant to the Saskatchewan online tenure system. There is a government maintained highway 905 that connects La Ronge to the community of Points North which is approximately 24 miles south of the Property. There“smaller reporting company” we are

no existing access roads to the Property and the only way to access the Property is by helicopter or float equipped aircraft from Points North approximately 24 miles the south. The nearest electrical power transmission line terminates at the community of Points North, 24 miles to the south, hence during the exploration phase, any electrical powernot required

on the property would be supplied from a portable engine driven electrical generator. Water can be supplied from any of the numerous lakes on the mineral claim. There is no infrastructure of any kind on the property. A gravel access road that passes within 12 miles of the Property which connects Points North to the community of Stony Rapids approximately 122 miles northwest of the Property. Alternatively the Property can be accessed by helicopter from Fort McMurray in northern Alberta approximately 153 miles to the south west. The geographical coordinates of the property are NTS 74109, UTM Zone 13, NAD 83, 6493550N 549500E.

Figure 1 shows the general project location and Figure 2 shows access and the location of the subject claim relative to known uranium mines and prospects.

Geology and Potential Uranium Sources on Our Mineral Claim

The Athabasca Basin has been a focus for uranium exploration since the 1960’s and has seen three periods of intense uranium exploration. The first was in the late 1960s, when uranium deposits were discovered at Rabbit Lake in the eastern part of the basin and at Cluff Lake in the west central part of the basin. Most of the known uranium occurrences and operating uranium mines are located in the eastern part of the Athabasca Basin. The second began in 1975 when the Key lake deposit was discovered in the eastern part of the basin and continued into the 1980s. The third began in 2004 after the McArthur River deposit was discovered and uranium prices began to rise again.

The Athabasca Basin is a flat-lying sedimentary basin dominated by unmetamorphised sandstone of Helikian (mid-Proterozoic) age, which occupies a large part of northern Saskatchewan. It rests unconformably on earlier crystalline rocks, in the area of the property these belong to the Wollaston Domain and the Mudjatik Domain, a subdivision of the Churchill Province of the Canadian Shield, which comprises Aphebian (early Proterozoic) metasediments, interfolded with granitoid Archean “domes”. The unconformity at the base of the Athabasca Basin is directly associated with high grade uranium deposits. In the general vicinity of our Mineral Claim, the unconformity has been intersected at depths approximately 200 - 300 meters.

Our Mineral Claims comprises an irregular shaped block approximately 3 miles long and 1 mile wide. Historic exploration work shows that the claim is located within an area where extensive uranium mineralization has been discovered.

Unconformity-related uranium deposits are a specific type with well-defined characteristics. They occur at and/or above and/or below the unconformity at the base of sandstone-dominated basins, usually of mid to late-Proterozoic age. Deposits at or above the unconformity tend to be flat-lying, often have a complex mineralogy with pitchblende, coffinite and cobalt-nickel arsenides, and may have very high grades. Deposits hosted in basement rocks tend to be steeply dipping, have simpler mineralogy with pitchblende and coffinite only, and have lower grades. They are often associated closely with graphitic metasediments in the basement rocks (hence the use of electromagnetic surveys to locate buried deposits has been very successful), as well as faults and especially the intersections of faults, thought to provide channelways for mineralizing solutions.

information required by this item.

Alteration in the form of anomalous clay and

We do not own any real estate or other

minerals (illite, kaolinite, chlorite, dravite), and geochemical enrichment in uranium and pathfinder elements, tend to form haloes in the overlying sandstones, which are useful in exploring for buried deposits. In the eastern Athabasca Basin where the basement rocks belong to the Wollaston Domain, uranium deposits often lie close to the “triple unconformity” where the basin rocks overlie basement Aphebian metasediments close to their own unconformable contact with the Archean “domes”.properties.

Regional work in the southeastern Athabasca Basin has partially defined regional-scale illite alteration anomalies within Athabasca sandstone, which include various other uranium occurrences to the southeast of the subject Property. According to the online exploration database maintained by the Saskatchewan government, alteration and uranium mineralization has been identified by various mining exploration companies on mineral claims adjoining our Mineral Claim.

Field visits on exploration-level uranium properties in the Athabasca Basin seldom yield any direct information that has a use in exploration programs, other than assessing access routes, camp sites, terrain types etc., that may assist the logistics of a such programs. Outcrops are very scarce in the Athabasca Basin, due to the generally friable nature of the Athabasca sandstones, and locally derived boulders in glacial till are usually the only medium by which rocks on the property can be examined.

Even if outcrops are present, the target of exploration is uranium mineralization at or close to the unconformity where the Athabasca sandstone rests on older basement rocks. In the case of our Mineral Claim, the unconformity lies about 200 to 300 yards below the surface. Unconformity-related uranium deposits often have alteration haloes that extend upwards through the overlying sandstone for hundreds of metres, and may be detected at surface by geochemical and/or mineralogical analysis. However, such alteration is usually not evident to a visual inspection.

Compilation of the historic exploration work completed in the northeastern part of the Athabasca Basin indicates that known uranium occurrences are associated with faulting in basement rocks and alteration in the overlying sandstones. Based on published technical data available from the Saskatchewan government there appear to be untested structural lineaments within our Mineral Claim and several lake and rock samples that exhibit elevated uranium and pathfinder elements located in the general area of our claim, however, no surface work or sampling appears to have been completed within the subject claim area.

It is recommended that the next stage of exploration work (Stage 1) on our Mineral Claim consist of sandstone sampling to determine if samples of the Athabasca sandstone exposed within the claim area exhibits the characteristic alterations associated with the presents of economic deposits of uranium in the area as documented by Earle and Sopuck, in 1989.

History of Mineral Exploration on our Mineral Claim

To our knowledge there has been no prior mineral exploration programs carried out on our claim.

Ownership of our Mineral Claim

Our consulting geologist, Mr. Carl von Einsiedel, is the registered owner of a 100% interest in our Mineral Claim, mineral claim MC00000266, which he holds in trust for us pursuant to a Mineral Claim Trust Agreement, dated May 3, 2013. The claim was issued to our consulting geologist by the Government of the Province of Saskatchewan. The claim consists of 1 block consisting of 2,014 acres or approximately 3.15 square miles.

10

Current Condition of our Mineral Claim

Our mineral claim is unimproved.

Item

ITEM 3. Legal ProceedingsLEGAL PROCEEDINGS

We are not a party to any pending legal proceeding. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Item

ITEM 4. Mine Safety DisclosuresMINE SAFETY DISCLOSURES

ITEM 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity SecuritiesMARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES Our common stock is quoted under the symbol “MACR” on the

OTCBB operated by the Financial Industry Regulatory Authority, Inc. (“FINRA”) and the OTCQBOTC Pink tier operated by OTC Markets Group, Inc.

The criteria for listing on either the OTCBB or OTCQB are similar and include that we remain current in our SEC reporting. Our reporting is presently current and, since inception, we have filed our SEC reports on time.The following tables set forth the range of high and low prices for our common stock for the each of the periods indicated as reported by

the OTCQB.OTC Markets Group, Inc. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| | | | |

Fiscal Year Ending November 30, 2013

|

Quarter Ended

| | High $

| | Low $

|

November 30, 2013

| | N/A

| | N/A

|

August 31, 2013

| | N/A

| | N/A

|

May 31, 2013

| | N/A

| | N/A

|

February 28, 2013

| | N/A

| | N/A

|

| Fiscal Year Ending November 30, 2014 | |

| Quarter Ended | | High $ | | | Low $ | |

| November 30, 2014 | | | 6.00 | | | | 6.00 | |

| August 31, 2014 | | | 6.00 | | | | 6.00 | |

| May 31, 2014 | | | 10.00 | | | | 6.00 | |

| February 28, 2014 | | | N/A | | | | N/A | |

To date, an active trading market for our securities has not developed.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of

February 5, 2014,July 22, 2016, we had

3,100,0003,890,750 shares of our common stock issued and outstanding, held by

thirty-one (31)thirty-two (32) shareholders of record.

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

1.

| 1. | we would not be able to pay our debts as they become due in the usual course of business, or; |

| 2. | our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Item

ITEM 6. Selected Financial DataSELECTED FINANCIAL DATA

A smaller reporting company is not required to provide the information required by this Item.

Item

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of OperationsMANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse

affecteffect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

The Company’s business plan is to proceed with the

acquisition and exploration of

our Mineral Claimfeasible mineral claims to determine whether there are commercially exploitable reserves of

gold, silver and uranium.

We intend to proceed with an initial (Phase I) exploration program as recommended by our consulting geologist.

Our geological consulting firm is well experienced in the mineral exploration business and providedwill provide us with the expected costs of exploration to determine the Phase Icommercial viability of the prospect.

Once we identify and

Phase II exploration programs. Theypurchase a mineral claim, our geological consulting firm can either provide all of the geological services which we will require or sub-contract out these services to others.

We have a written agreement with our consulting geologist’s firm that requires them to review all of the results from the exploration work performed upon our mineral claim, to make recommendations based upon those results, and to conduct any exploration programs on the mineral claim that we may require. The principal of our geological consulting firm will be in charge of our exploration programs and shall visit the property in order to conduct our Phase I exploration project which is expected to commence in the early summer of 2014.

Additional exploration activities are expected to commence in the Spring of 2015 and are estimated to cost approximately $140,000. We rely on outside contractors to assist us in the operation of our business. These arrangements are either verbal or contractual. We currently do not have any arrangements for financing and we may not be able to obtain financing when required.

Sampling for sandstone alteration zones and other data acquired during our initial exploration of our Mineral Claim will ultimately determine whether the project will proceed to the second phase of our exploration program.

Operating Budget for the Calendar Year Beginning June 1, 2013

The operating budget for the calendar year commencing June 1, 2013 consists of planned expenditures for Phase I of our mineral exploration program, as described above, and for necessary legal and accounting expenses. Management’s estimate of our planned expenditures by category for the first half of our current fiscal year is set forth below:

| | | |

| Fiscal year beginning December 1, 2013 | |

| Q1 | Q2 | |

Expense Category | | | Category Totals |

Mining Exploration | $15,000 | $0 | $15,000 |

Legal, Accounting | $2,000 | $2,000 | $4,000 |

Totals | $17,000 | $2,000 | $19,000 |

Results of Operations

for the Years Ended November 30, 2013 and 2012, the Period from Inception (November 3, 2011) to November 30, 2013.We are currently in the exploration stage of our business and have generated no revenue to date. For the fiscal year ended November 30,

2013,2014, we incurred

operating expenses

of $35,491 and a net loss of

$38,953.$(36,902), compared to $45,595 and $(48,953) for the fiscal year ended November 30, 2013. Our

expenses consisted of accounting and audit fees of $19,113, legal fees of $10,252, other general and administrative expenses of $6,126, mineral property acquisition costs of $0, and interest expense of $1,411. In comparison, for the fiscal year ended November 30, 2013, our expenses consisted of accounting and audit fees of $17,578, legal fees of $8,200, general and administrative expenses of $9,817,

mineral property acquisition costs of $10,000, and interest expense of $3,358.

During the fiscal year ended November 30, 2012, we incurred in expenses and a net loss of $27,912. Our expenses consisted of accounting and audit fees of $6,276, legal fees of $2,110, general and administrative expenses of $7,271, mineral property pre-acquisition costs of $10,150, and interest expense of $2,105. For the period from Inception(November 3, 2011) through November 30, 2013, we incurred total expenses and a net loss of $69,693.We expect that our expenses and our net losses will continue to increase as we

undertake the planned exploration ofcontinue with our

Mineral Claim.business plan.

Liquidity and Capital Resources

As of November 30,

2013,2014, we had total current assets of

$2,682, consisting of cash$0 and

prepaid expenses. We had current liabilities of

$6,900 as of November 30, 2013.$32,163. Accordingly, we had working capital deficit of

$4,218$(32,163) as of November 30,

2013.2014.

In support of the Company’s efforts and cash requirements, it has relied on advances from related parties until such time that the Company can support its operations or attains adequate financing through sales of its equity or traditional debt financing. There is no formal written commitment for continued support by shareholders or officer and

director has loaned us a total of $58,500 under to following termsdirectors. The advances are considered temporary in nature and

conditions:

1.

On November 28, 2011 Ms. Ponce loaned us $35,000 which is evidencedhave not been formalized by a Promissory Note inpromissory note.

The Company’s sole officers and directors, Dale Rasmussen and Mark Rodenbeck, have loaned the amountCompany the following amounts:

| Date | | Amount | |

| March 19, 2014 | | $ | 12,935 | |

| June 24, 2014 | | | 2,375 | |

| August 29, 2014 | | | 1,102 | |

| November 30, 2014 | | | 24 | |

| April 2015 | | | 14,977 | |

| September 2015 | | | 19,688 | |

| January 2016 | | | 20,150 | |

| Total | | $ | 71,251 | |

The amounts are unsecured, bear 6% interest

accruing on the principal amount of 6% per annum, and

are due on

December 31, 2013.

2.

On April 24, 3013, we entered into a Debt Refinancing Agreement with Ms. Ponce whereby the $35,000 Promissory note due on December 31, 2013 was marked paiddemand. Accrued interest and a new Promissory Note in the amountinterest expense totaled $604 as of $38,500 was issued with interest accruing on the principal amount of 6% per annum and due on December 31, 2016.

3.

On May 8, 2013 Ms. Ponce loaned us $5,000 which is evidenced by a Promissory Note in the amount of $5,000 plus interest accruing on the principal amount of 6% per annum and due on December 31, 2016.

4.

On June 4, 2013 Ms. Ponce loaned us $10,000 which is evidenced by a Promissory Note in the amount of $10,000 plus interest accruing on the principal amount of 6% per annum and due on December 31, 2016.

5.

On September 19, 2013 Ms. Ponce loaned us $5,000 which is evidenced by a Promissory Note in the amount of $5,000 plus interest accruing on the principal amount of 6% per annum and due on December 31, 2016.

Our sole officer and Director, Ms. Ponce, has offered to fund our basic legal and accounting compliance expenses through additional infusions of equity or debt capital on an as-needed basis, although she is under no legal obligation to provide funding. This offer is not the subject of a formal written agreement with us, and there are no specific limits as to time or dollar amount.

As outlined above, we expect to spend approximately $19,000 toward the initial implementation of our business during the first half of the current fiscal year. We will therefore require some additional financing in order to pursue the exploration activities we have planned for the immediate future. In addition, we will require significant additional capital in order to undertake commercial uranium production on our mineral claims following completion of our planned exploration activities. We do not have any formal commitments or arrangements for the sales of stock or the advancement or loan of funds at this time. There can be no assurance that such additional financing will be available to us on acceptable terms, or at all.

year ended November 30, 2014.

Off Balance Sheet Arrangements

As of November 30,

2013,2014, there were no off balance sheet arrangements.

We have yet to achieve profitable operations, have accumulated losses of

$69,693$116,595 since our inception and expect to incur further losses in the development of our business, all of which casts substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our ability to generate future profitable operations and/or to obtain the necessary financing from shareholders or other sources to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has no formal plan in place to address this concern but considers that we will be able to obtain additional funds by equity financing and/or related party advances, however there is no assurance of additional funding being available or on acceptable terms, if at all.

Critical Accounting Policies

In December 2001, the SEC requested that all registrants list their most “critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical accounting policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. At this time, management does not believe that any of our accounting policies fit this definition.

Recently Issued Accounting Pronouncements

The Company has reviewed issued accounting pronouncements and plans to adopt those that are applicable to it. The Company does not expect the adoption of any other pronouncements to have an impact on its results of operations or financial position.

Item

ITEM 7A. Quantitative and Qualitative Disclosures About Market RiskQUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

A smaller reporting company is not required to provide the information required by this Item.

Item

ITEM 8. Financial Statements and Supplementary DataFINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Index to Financial Statements Required by Article 8 of Regulation S-X:

| |

Audited Financial Statements: |

| |

| |

| |

| |

| |

| |

(An Exploration Stage Company)

CONSOLIDATED FINANCIAL STATEMENTS

November 30,

20132014 and

20122013

PRITCHETT, SILER & HARDY, P.C. CERTIFIED PUBLIC ACCOUNTANTS

A PROFESSIONAL CORPORATION

1438 N. HIGHWAY 89 STE. 130

FARMINGTON, UTAH 84025

_______________

(801) 447-9572 FAX (801) 447-9578

17

Office Locations

Las Vegas, NV

New York, NY

Pune, India

Beijing, China

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the

Board of Directors and Stockholders

Ogden Utah

We have audited the accompanying

consolidated balance

sheetssheet of Mascota Resources Corp.

and subsidiary (the

“Company”)Company) as of November 30,

2013 and 20122014 and the related

consolidated statements of operations,

stockholders’stockholders' equity (deficit) and cash flows for

each of the

yearsyear then

ended and for the period from inception (November 3, 2011) through November 30, 2013. Mascota Resources Corp. and subsidiary’sended. The Company’s management is responsible for these

consolidated financial statements. Our responsibility is to express an opinion on these financial statements based on our

audits.audit.

We conducted our

auditsaudit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The

companyCompany is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the

company’sCompany’s internal control over financial reporting. Accordingly, we express no such opinion. An audit

also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our

audits provideaudit provides a reasonable basis for our opinion.

In our opinion, the

consolidated financial statements referred to above present fairly, in all material respects, the financial position of

Mascota Resources Corp. and subsidiarythe Company as of November 30,

2013 and 20122014 and the results of its operations and its cash flows for

each of the

yearsyear then ended,

and for the period from inception (November 3, 2011) through November 30, 2013 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming

the CompanyMascota Resources Corp. will continue as a going concern. As discussed in Note

12 to the financial statements, the Company has

sufferedincurred losses

from operations, whichsince its inception, has a working capital deficit and has not yet established profitable operations. These factors raise substantial doubt about

itsthe ability

of the Company to continue as a going concern. Management’s plans in

regardregards to these matters are also described in Note

1. The consolidated2. These financial statements do not include any adjustments that might result from the outcome of

this uncertainty.these uncertainties.

/s/

De Joya Griffith, LLCHenderson, NevadaFebruary 11, 2014____________________________________________________________________________________

De Joya Griffith, LLC ● 2580 Anthem Village Dr. ● Henderson, NV ● 89052

Telephone (702) 563-1600 ● Facsimile (702) 920-8049

www.dejoyagriffith.com

Pritchett, Siler & Hardy, P.C.

MASCOTA RESOURCES CORP.

(An Exploration Stage Company)

PRITCHETT, SILER & HARDY, P.C.

Farmington, Utah

July 20, 2016

| | | | | |

| November 30, |

ASSETS | 2013 | | 2012 |

| | | |

Current assets | | | |

Cash | $ | 1,504 | | $ | 19,877 |

Prepaid expenses | | 1,178 | | | 2,000 |

| | | | | |

Total current assets | | 2,682 | | | 21,877 |

| | | | | |

Mineral property - Note 4 | | 10,000 | | | - |

| | | | | |

Total assets | $ | 12,682 | | $ | 21,877 |

| | | | | |

LIABILITIES | | | | | |

| | | | | |

Current liabilities | | | | | |

Accounts payable and accrued liabilities | $ | 6,900 | | $ | 500 |

Total current liabilities | | 6,900 | | | 500 |

| | | | | |

| | | | | |

Long term liabilities | | | | | |

Accrued interest, related party - Note 5 | | 1,975 | | | 2,117 |

Note payable, related party - Note 5 | | 58,500 | | | 35,000 |

Total long term liabilities | | 60,475 | | | 37,117 |

| | | | | |

Total liabilities | $ | 67,375 | | $ | 37,617 |

| | | | | |

STOCKHOLDERS’ DEFICIT | | | | | |

| | | | | |

Preferred stock, $0.001 par value | | | | | |

10,000,000 shares authorized, none outstanding | | - | | | - |

Common stock, $0.001 par value | | | | | |

90,000,000 shares authorized | | | | | |

2,000,000 shares issued and outstanding- Notes 5 and 6 | | 2,000 | | | 2,000 |

Additional paid-in capital | | 13,000 | | | 13,000 |

Deficit accumulated during the exploration stage | | (69,693) | | | (30,740) |

| | | | | |

Total stockholders’ deficit | | (54,693) | | | (15,740) |

| | | | | |

Total liabilities & stockholders’ deficit | $ | 12,682 | | $ | 21,877 |

| |

| CONSOLIDATED BALANCE SHEETS | |

| | |

| | November 30, | | November 30, | |

| | 2014 | | 2013 | |

| | | | | | (Restated, Unaudited) | |

| ASSETS | |

| Current Assets | | | | | | |

| Cash | | $ | - | | | $ | 1,504 | |

| Prepaid Expenses | | | - | | | | 1,178 | |

| Total Current Assets | | | - | | | | 2,682 | |

| | | | | | | | | |

| Total Assets | | $ | - | | | $ | 2,682 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| LIABILITIES | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Accounts Payable | | | 15,123 | | | | 6,900 | |

| Accrued Interest, Related Parties | | | 604 | | | | 1,975 | |

| Note Payable, Related Parties | | | 16,436 | | | | 58,500 | |

| Total Current Liabilities | | | 32,163 | | | | 67,375 | |

| | | | | | | | | |

| Total Liabilities | | | 32,163 | | | | 67,375 | |

| | | | | | | | | |

| STOCKHOLDERS' DEFICIT | | | | | | | | |

| Common Stock, $0.001 par value, 90,000,000 shares authorized, | | | | | | | | |

| 3,100,000 and 2,000,000 shares issued and outstanding, as of | | | | | | | | |

| November 30, 2014 and November 30, 2013, respectively | | | 3,100 | | | | 2,000 | |

| Additional Paid-in Capital | | | 81,332 | | | | 13,000 | |

| Accumulated Deficit | | | (116,595 | ) | | | (79,693 | ) |

| Total Stockholders' Deficit | | | (32,163 | ) | | | (64,693 | ) |

| | | | | | | | | |

| Total Liabilities and Stockholders' Deficit | | $ | - | | | $ | 2,682 | |

SEE ACCOMPANYING NOTES THAT ARE

AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

MASCOTA RESOURCES CORP.

(An Exploration Stage Company)

Table of ContentsCONSOLIDATED STATEMENTS OF OPERATIONS

(Stated in US Dollars)

(Audited)

| |

| CONSOLIDATED STATEMENTS OF OPERATIONS | |

| | |

| | | Years Ended | |

| | | November 30, | |

| | | 2014 | | | 2013 | |

| | | | | | (Restated, Unaudited) | |

| Revenue | | $ | - | | | $ | - | |

| | | | | | | | | |

| Operating Expenses | | | | | | | | |

| General and administrative | | | 35,491 | | | | 35,595 | |

| Mineral property expense | | | - | | | | 10,000 | |

| Total Expenses | | | 35,491 | | | | 45,595 | |

| | | | | | | | | |

| Operating loss | | | (35,491 | ) | | | (45,595 | ) |

| | | | | | | | | |

| Interest expense | | | 1,411 | | | | 3,358 | |

| | | | | | | | | |

| Net loss | | | (36,902 | ) | | | (48,953 | ) |

| | | | | | | | | |

| Basic and Diluted loss per share | | | (0.01 | ) | | | (0.02 | ) |

| | | | | | | | | |

| | | | | | | | | |

Weighted average number of shares outstanding - basic | | | 3,081,918 | | | | 2,000,000 | |

| | | | | | | | |

| | | From |

| | | Inception |

| | | (November 3, |

| Years Ended | | 2011) to |

| November 30, | | November 30, |

| 2013 | | 2012 | | 2013 |

| | | | | |

Expenses | | | | | |

Accounting and audit | $ | 17,578 | | $ | 6,276 | | $ | 23,854 |

Legal fees | | 8,200 | | | 2,110 | | | 12,783 |

Mineral property - pre acquisition cost | | - | | | 10,150 | | | 10,150 |

General and administrative | | 9,817 | | | 7,271 | | | 17,431 |

| | | | | | | | |

Operating loss | | (35,595) | | | (25,807) | | | (64,218) |

| | | | | | | | |

Interest expense - Note 5 | | (3,358) | | | (2,105) | | | (5,475) |

| | | | | | | | |

Net loss | $ | (38,953) | | $ | (27,912) | | $ | (69,693) |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Basic loss per share | $ | (0.02) | | $ | (0.01) | | | |

| | | | | | | | |

Weighted average number of shares outstanding - basic | | 2,000,000 | | | 2,000,000 | | | |

SEE ACCOMPANYING NOTES THAT ARE

AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

MASCOTA RESOURCES CORP.

(An Exploration Stage Company)

Table of ContentsCONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY (DEFICIT)

For the Period from Inception (November 3, 2011) to November 30, 2013

(Stated in US Dollars)

(Audited)

| | | | | | | | | | | | | | | | | |

| | | | | | Deficit | | |

| | | | Additional | | Accumulated | | |

| | (Note 6) | | Paid-in | | During the | | |

| Preferred Shares | Common Shares | | Capital | | Exploration Stage | | Total |

| Number | | Amount | Number | | Amount | | | | | | |

Balance, inception (November 3, 2011) | - | | $ | - | - | | $ | - | | $ | - | | $ | - | | $ | - |

| | | | | | | | | | | | | | | | | |

Capital stock issued to founder for cash | - | | | - | 2,000,000 | | | 2,000 | | | 13,000 | | | - | | | 15,000 |

Net loss for the period | - | | | - | - | | | - | | | - | | | (2,828) | | | (2,828) |

| | | | | | | | | | | | | | | | | |

Balance, November 30, 2011 | - | | | - | 2,000,000 | | | 2,000 | | | 13,000 | | | (2,828) | | | 12,172 |

| | | | | | | | | | | | | | | | | |

Net loss for the year | - | | | - | - | | | - | | | - | | | (27,912) | | | (27,912) |

| | | | | | | | | | | | | | | | | |

Balance, November 30, 2012 | - | | | - | 2,000,000 | | | 2,000 | | | 13,000 | | | (30,740) | | | (15,740) |

| | | | | | | | | | | | | | | | | |

Net loss for the period | - | | | - | - | | | - | | | - | | | (38,953) | | | (38,953) |

| | | | | | | | | | | | | | | | | |

Balance, November 30, 2013 | - | | $ | - | 2,000,000 | | $ | 2,000 | | $ | 13,000 | | $ | (69,693) | | $ | (54,693) |

| |

| CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' DEFICIT | |

| For the Years Ended November 30, 2014 and 2013 | |

| | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | Additional | | | | | | Stockholders' | |

| | | Common Stock | | | Paid-in | | | Accumulated | | | Deficit | |

| | | Shares | | | Amount | | | Capital | | | Deficit | | | Total | |

| Balances at November 30, 2012 (unaudited) | | | 2,000,000 | | | $ | 2,000 | | | $ | 13,000 | | | $ | (30,740 | ) | | $ | (15,740 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net loss for the year (Restated, Unaudited) | | | - | | | | - | | | | - | | | | (48,953 | ) | | | (48,953 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Balances at November 30, 2013(Restated, Unaudited) | | | 2,000,000 | | | | 2,000 | | | | 13,000 | | | | (79,693 | ) | | | (64,693 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Shares issued for cash, net of commission | | | 1,100,000 | | | | 1,100 | | | | 7,050 | | | | - | | | | 8,150 | |

| | | | | | | | | | | | | | | | | | | | | |

| Forgiveness of shareholder’s notes and interest | | | - | | | | - | | | | 61,282 | | | | - | | | | 61,282 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss for the year | | | - | | | | - | | | | - | | | | (36,902 | ) | | | (36,902 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Balances at November 30, 2014 | | | 3,100,000 | | | $ | 3,100 | | | $ | 81,332 | | | $ | (116,595 | ) | | $ | (32,163 | ) |

SEE ACCOMPANYING NOTES THAT ARE

AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

MASCOTA RESOURCES CORP.

(An Exploration Stage Company)

Table of ContentsCONSOLIDATED STATEMENTS OF CASH FLOWS

(Stated in US Dollars)

(Audited)

| |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | |

| | |

| | | Year Ended | |

| | | November 30, | |

| | | 2014 | | | 2013 | |

| | | | | | (Restated, Unaudited) | |

| | | | | | | | | |

| Cash Flows from Operating Activities | | | | | | | | |

| Net loss | | $ | (36,902 | ) | | $ | (48,953 | ) |

| Change in operating assets and liabilities: | | | | | | | | |

| Decrease in prepaid expenses | | | 1,178 | | | | 822 | |

| Increase in accounts payable | | | 8,223 | | | | 6,400 | |

| Increase in accrued interest, related parties | | | 1,411 | | | | 3,358 | |

| Net Cash provided by Operating Activities | | | (26,090 | ) | | | (38,373 | ) |

| | | | | | | | | |

| Cash Flows from Investing Activities | | | - | | | | - | |

| | | | | | | | | |

| Cash Flows from Financing Activities | | | | | | | | |

| Shares sold for cash, net of commission | | | 8,150 | | | | - | |

| Notes payable, related parties | | | 16,436 | | | | 20,000 | |

| Net Cash provided by Financing Activities | | | 24,586 | | | | 20,000 | |

| | | | | | | | | |

| Net Increase (decrease) in cash | | | (1,504 | ) | | | (18,373 | ) |

| | | | | | | | | |

| Cash at beginning of period | | | 1,504 | | | | 19,877 | |

| | | | | | | | | |

| Cash at end of period | | $ | - | | | $ | 1,504 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | | |

| | | | | | | | | |

| Cash paid for: | | | | | | | | |

| Interest | | $ | - | | | $ | - | |

| Income taxes | | $ | - | | | $ | - | |

| | | | | | | | | |

| Non-Cash Investing and Financing Activities | | | | | | | | |

| Forgiveness of related party notes and interest | | $ | 61,282 | | | $ | - | |

| Refinancing of note payable to related party | | $ | - | | | $ | 35,000 | |

| Refinancing of accrued interest on note payable to related party | | $ | - | | | $ | 3,500 | |

| | | | | | | | |

| | | From |

| | | Inception |

| | | (November 3, |

| Years Ended | | 2011) to |

| November 30, | | November 30, |

| 2013 | | 2012 | | 2013 |

| | | | | |

Cash flows used in operating activities | | | | | |

Net loss | $ | (38,953) | | $ | (27,912) | | $ | (69,693) |

Changes in non-cash working capital items: | | | | | | | | |

Prepaid expenses | | 822 | | | (2,000) | | | (1,178) |

Accounts payable and accrued liabilities | | 6,400 | | | (2,240) | | | 6,900 |

Accrued interest, related party | | 3,358 | | | 2,105 | | | 5,475 |

| | | | | | | | |

Net cash used in operating activities | | (28,373) | | | (30,047) | | | (58,496) |

| | | | | | | | |

Cash flows from investing activities | | | | | | | | |

Acquisition of mineral property | | (10,000) | | | - | | | (10,000) |

| | | | | | | | |

Net cash used by investing activities | | (10,000) | | | - | | | (10,000) |

| | | | | | | | |

Cash flows from financing activities | | | | | | | | |

Capital stock issued | | - | | | - | | | 15,000 |

Notes payable, related party | | 20,000 | | | - | | | 55,000 |

| | | | | | | | |

Net cash provided by financing activities | | 20,000 | | | - | | | 70,000 |

| | | | | | | | |

Net increase (decrease) in cash during the year | | (18,373) | | | (30,047) | | | 1,504 |

| | | | | | | | |

Cash, beginning of the year | | 19,877 | | | 49,924 | | | - |

| | | | | | | | |

Cash, end of the year | $ | 1,504 | | $ | 19,877 | | $ | 1,504 |

| | | | | | | | |

Supplemental information | | | | | | | | |

| | | | | | | | |

Non cash refinancing of debt | $ | 3,500 | | $ | - | | $ | 3,500 |

Interest and taxes paid in cash | $ | - | | $ | - | | $ | - |

SEE ACCOMPANYING NOTES THAT ARE

AN INTEGRAL PART OF THESE CONSOLIDATED FINANCIAL STATEMENTS.

MASCOTA RESOURCES CORP.(An Exploration Stage Company)

CORP.

Notes to Consolidated Financial Statements

For the Years Ended November 30, 2014 and 2013

(Disclosures pertaining to the year ended November 30, 2013

and 2012(Stated in US Dollars)

(Audited)

are unuaudited.)

Note 1

Nature of Operations and Ability to Continue as a Going Concern

TheBasis of Presentation

Mascota Resources Corp. (“the Company,

” “we,” “us,” or “our”) was incorporated in the state of Nevada

United States of America on November 3, 2011. The Company is an exploration stage company and was formed for the purpose of acquiring exploration and development stage mineral properties.

The Company’s year-end is November 30.

On November 10,9, 2011, the Company incorporated a wholly-owned subsidiary, MRC Exploration LLC (“MRC”), in the State of Nevada United States of America (“USA”) for the purpose of mineral exploration.

During May 2013, MRC acquired a Uranium mineral claim located in the Athabasca Basin, within the

ProvenceProvince of Saskatchewan,

Canada.Canada (the “Claim”). Subsequently, the required exploration and development expenditures were not made and the ownership interest in the Claim lapsed on May 3, 2015 and as of the date of filing this Form 10K, the Company no longer holds a beneficial interest in the Claim.

The Company’s business plan is to proceed with the acquisition and exploration of feasible mineral claims to determine whether there are commercially exploitable reserves of gold, silver and uranium. Our geological consulting firm is well experienced in the mineral exploration business and will provide us with the expected costs of exploration to determine the commercial viability of the prospect.

The Company’s prior registered public accounting firm, which issued an unqualified opinion with going concern explanatory paragraph on the Company’s financial statements as of and for the year ended November 30, 2013 previously included in the Company’s 2013 Form 10-K, is currently under sanction by the SEC and thus cannot re-issue their opinion on the 2013 financial statements shown comparatively with the accompanying 2014 financial statements. Rather than having its new registered public accounting firm re-audit prior years, the Company has elected to present its 2013 financial statements as unaudited.

Note 2 Going Concern

These financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which assumes that the Company will be able to meet its obligations and continue its operations

for its next fiscal year.in the ordinary course of business. Realization values may be substantially different from carrying values as shown and these financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Company be unable to continue as a going concern. The Company has yet to achieve profitable operations, has accumulated losses of

$69,693$116,595 since its inception

through November 30, 2014 and expects to incur further losses in the development of its business, all of which casts substantial doubt about the Company’s ability to continue as a going concern.

The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or to obtain the necessary financing from shareholders or other sources to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has no formal plan in place to address this concern but considers that the Company willmay be able to obtain additional funds by equity financing and/or related party advances, however there is no assurance of additional funding being available or on acceptable terms, if at all.

The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the company cannot continue in existence.

Note

2 3 Summary of Significant Accounting Policies

Basis of Presentation

The consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and are stated in US dollars. The

preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expense during the reporting period. Actual results could differ from those estimates.

The financial statements have, in management’s opinion, been properly prepared within the framework of the significant accounting policies summarized below:

F-6

MASCOTA RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

Company has adopted a November 30 2013 and 2012

(Stated in US Dollars)

(Audited)

year end.

Note 2 Summary of Significant Accounting Policies - (continued)

Principles of Consolidation

Consolidated Statements

These consolidated financial statements include the accounts of the Company and MRC Exploration LLC., a wholly owned subsidiary incorporated in Nevada, USA on November 9, 2011. All significant inter-company transactions and balances have been eliminated.

Exploration Stage Company

The Company is an exploration stage company as defined by ASC 915. All losses accumulated since inception are considered part of the Company’s exploration stage activities.

Cash and cash equivalents

The Company considers all highly liquid instruments purchased with a maturity of three months or less to be cash equivalents. There were no cash equivalents at November 30, 2013 and 2012.

Mineral Property

The Company is primarily engaged in the acquisition, exploration and development of mineral properties.

Mineral property acquisition costs are capitalized in accordance with FASB ASC 930, “Extractive Activities-Mining,” when management has determined that probable future benefits consisting of a contribution to future cash inflows have been identified and adequate financial resources are available or are expected to be available as required to meet the terms of property acquisition and budgeted exploration and development expenditures. Mineral property acquisition costs are expensed as incurred if the criteria for capitalization are not met.

In the event that mineral property acquisition costs are paid with Company shares, those shares are recorded at the estimated fair value at the time the shares are due in accordance with the terms of the property agreements.

Mineral property exploration costs are expensed as incurred.

When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves and pre-feasibility, the costs incurred to develop such property are capitalized.

F-7

MASCOTA RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

November 30, 2013 and 2012

(Stated in US Dollars)

(Audited)

Note 2 Summary of Significant Accounting Policies - (continued)

Mineral Property - (continued)

Estimated future removal and site restoration costs, when determinable are provided over the life of proven reserves on a units-of-production basis. Costs, which include production equipment removal and environmental remediation, are estimated each period by management based on current regulations, actual expenses incurred, and technology and industry standards. Any charge is included in exploration expense or the provision for depletion and depreciation during the period and the actual restoration expenditures are charged to the accumulated provision amounts as incurred.

To date the Company has not established any proven or probable reserves on its mineral properties.

Asset Retirement Obligations

Asset retirement obligations (“ARO”) associated with the retirement of a tangible long-lived asset, are recognized as liabilities in the period in which it is incurred and becomes determinable, with an offsetting increase in the carrying amount of the associated assets. The cost of tangible long-lived assets, including the initially recognized ARO, is amortized, such that the cost of the ARO is recognized over the useful life of the assets. The ARO is recorded at fair value, and accretion expense is recognized over time as the discounted fair value is accreted to the expected settlement value.

The fair value of the ARO is measured using expected future cash flow, discounted at the Company’s credit-adjusted risk-free interest rate. As of November 30, 2013 and November 30, 2012, the Company has determined no provision for ARO’s is required.

Impairment of Long- Lived Assets

The Company reviews and evaluates long-lived assets for impairment when events or changes in circumstances indicate that the related carrying amounts may not be recoverable. The assets are subject to impairment consideration under FASB ASC 360-10-35-17 if events or circumstances indicate that their carrying amount might not be recoverable. When the Company determines that an impairment analysis should be done, the analysis will be performed using the rules of FASB ASC 930-360-35, Asset Impairment, and 360- 0 through 15-5, Impairment or Disposal of Long- Lived Assets.

Foreign Currency Translation

The Company’s functional currency is the United States dollar as substantially all of the Company’s operations are in the USA. The Company uses the United States dollar as its reporting currency for consistency with registrants of the Securities and Exchange Commission (“SEC”).

F-8

15

MASCOTA RESOURCES CORP.

(An Exploration Stage Company)

Notes to Consolidated Financial Statements

November 30, 2013 and 2012

(Stated in US Dollars)

(Audited)

Note 2 Summary

Assets and liabilities denominated in a foreign currency are translated at the exchange rate in effect at the balance sheet date and capital accounts are translated at historical rates. Income statement accounts are translated at the average rates of exchange prevailing during the

period.

period, if applicable.

Translation adjustments from the use of different exchange rates from period to period are included in the Accumulated Other Comprehensive Income account in Stockholders’ Equity, if applicable.

Transactions undertaken in currencies other than the functional currency of the entity are translated using the exchange rate in effect as of the transaction date. Any exchange gains and losses are included in the Statement of Operations and Comprehensive Loss.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect certain reported amounts and disclosures of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimated.

Exploration Stage Accounting

The Company is an exploration stage company, as defined in pronouncements of the Financial Accounting Standards Board (FASB) and Industry Guide #7 of the Securities and Exchange Commission. Generally accepted accounting principles govern the recognition of revenue by an exploration stage enterprise and the accounting for costs and expenses. As an exploration stage company is also required to make additional disclosures as defined under the then current Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 915, "Development-Stage Entities." Additional disclosures required are that our financial statements be identified as those of an exploration stage company, and that the statements of operations, changes in changes in stockholders' deficit and cash flows disclosed activity since the date of its Inception (November 3, 2011). Effective June 10, 2014, the FASB changed its regulations with respect to development stage entities and these additional disclosures are no longer required for annual reporting periods beginning after December 15, 2015, with the option for entities to early adopt these new provisions. The Company has elected to early adopt these provisions and consequently these additional disclosures are not included in its financial statements.

Proven and Probable Reserves

The definition of proven and probable reserves is set forth in SEC Industry Guide 7. Proven reserves are reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; (b) grade and/or quality are computed from the results of detailed sampling; and (c) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. Probable reserves are reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

In addition, reserves cannot be considered proven and probable until they are supported by a feasibility study, indicating that the reserves have had the requisite geologic, technical and economic work performed and are economically and legally extractable at the time of the reserve determination. As of November 30, 2014, none of our mineralized material met the definition of proven or probable reserves.

Cash Equivalents

The Company considers all short term investments purchased with an original maturity of three months or less to be cash equivalents.

Investments in Mining Rights

Mining rights held for development are recorded at the cost of the rights, plus related acquisition costs. These costs will be amortized when extraction begins. Mining rights the Company acquired in 2013 and held briefly but never developed further were expensed upon acquisition (Note 9).

Mine Development Costs

Mine development costs include engineering and metallurgical studies, drilling and other related costs to delineate an ore body, the removal of overburden to initially expose an ore body at open pit surface mines and the building of access ways, shafts, lateral access, drifts, ramps and other infrastructure at underground mines. Costs incurred at a mine site before proven reserves have been established are expensed as mine development costs. At the point proven reserves have been established at a mine site, such costs will be capitalized and will be written off as depletion expense as the minerals are extracted. As of November 30, 2014, none of the Company’s mine concessions met the requirements for qualification as having proven reserves, and no mine development costs had been incurred.

Income Taxes