UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

FORM 10-K

|

|

| |

| |

|

|

| |

☒Annual Report under Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2023

or

☐Transitional Report under Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission File Number 333-184948001-39531

Heatwurx,Processa Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | ||

| 45-1539785 | |

(State or other jurisdiction of

| (IRS Employer Identification No.) |

530 S Lake Avenue #615, Pasadena, CA 911017380 Coca Cola Drive, Suite 106,

(Address of principal executive offices and Zip Code)Hanover, Maryland21076

(443) 776-3133

(626) 364-5342

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:None

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.0001 par value per share | PCSA | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whetherif the registrant is a well-known seasoned issuer, as defined byin Rule 405 of the Securities Act. YES [ ] NO [X]Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act YES [ ] NO [X]Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [ ] NO [X]Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [ ] NO [X]Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or emerging growth company. See the definitionsdefinition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]☐

Indicate by check mark whether the registrant has filed a report on and attestation to its managements’ assessment of the effectiveness of its internal controls over financial reporting under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES [ ] NO [X]Yes ☐ No ☒

The aggregate market value of the voting and non-voting common unitsequity held by non-affiliates of the registrant on June 30, 20162023, the last business day of the most recently completed second quarter, based upon the closing price of Common Stock on such date as reported on Nasdaq Capital Market, was approximately $1,447,232. As$10.2 million.

The number of September 10, 2017, the numberoutstanding shares of the registrant’s common shares outstandingstock as of March 21, 2024 was 11,017,388..

DOCUMENTS INCORPORATED BY REFERENCE:REFERENCE

None.

Heatwurx, Inc.

Portions of the Proxy Statement for the registrant’s 2024 Annual Meeting of Stockholders (the “Proxy Statement”) to be filed within 120 days of the end of the fiscal year ended December 31, 2023 are incorporated by reference into Part III hereof. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as a part hereof.

Table of Contents

| 2 |

GLOSSARY OF CERTAIN SCIENTIFIC TERMS

The medical and scientific terms used in this Annual Report on Form 10-K have the following meanings:

“Active metabolite” means a drug that is processed by the body into an altered form which effects the body.

“Agonist” means a chemical/drug that binds to a receptor in the body and activates that receptor to produce a biological response.

“Analog” means a compound having a structure similar to that of an approved drug but differing from it with respect to a certain component of the molecule which may cause it to have similar or different effects on the body.

“cGCP” means current Good Clinical Practices. The FDA and other regulatory agencies promulgate regulations and standards, commonly referred to as current Good Clinical Practices, for designing, conducting, monitoring, auditing and reporting the results of clinical trials to ensure that the data and results are accurate and that the rights and welfare of trial participants are adequately protected.

“cGMP” means current Good Manufacturing Practices. The FDA and other regulatory agencies promulgate regulations and standards, commonly referred to as current Good Manufacturing Practices, which include requirements relating to quality control and quality assurance, as well as the corresponding maintenance of records and documentation.

“CMO” means Contract Manufacturing Organization.

“CRO” means Contract Research Organization.

“Deuterated analog” means a small molecule in which one or more of the hydrogen atoms are replaced by deuterium.

“EMA” means the European Medicines Agency.

“FDA” means the Food and Drug Administration.

“IND” means an Investigational New Drug Application. Before testing a new drug on human subjects, the company must file an IND with the FDA. Information must be produced on the absorption, distribution, metabolism, and excretion properties of the drug and detailed protocols for testing on human subjects must be submitted.

“Indication” means a condition which makes a particular treatment or procedure advisable.

“Moiety” means an active or functional part of a molecule.

“NDA” means a New Drug Application submitted to the FDA. Under the Food, Drug, and Cosmetic Act of 1938, an NDA is submitted to the FDA enumerating the uses of the drug and providing evidence of its safety.

“NGC” means Next Generation Chemotherapy, referring to the drugs in our pipeline that have active cancer killing metabolites that are the same or have very similar chemical structure to existing FDA-approved chemotherapy treatments, resulting in our NGCs killing cancer cells following the same mechanism as the FDA-approved treatments.

“NL” means Necrobiosis Lipoidica, a rare chronic and granulomatous disorder.

| 3 |

CAUTIONARY

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This reportAnnual Report on Form 10-K contains forward lookingforward-looking statements that involve risks and uncertainties, principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”uncertainties. All statements other than statements of historical factfacts contained in this report, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations,Form 10-K are forward-looking statements. We have attempted toIn some cases, you can identify forward-looking statements by terminology including “anticipates,words such as “anticipate,” “believes,“believe,” “can,“contemplate,” “continue,“continue,” “could,“could,” “estimates,“estimate,” “expects,“expect,” “intends,“intend,” “may,“may,” “plans,“plan,” “potential,“potential,” “predicts,“predict,” or “should,“project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these termswords or other comparable terminology. Although we do not make forward lookingWe have based these forward-looking statements unlesson our current expectations and projections about future events and trends that we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy.may affect our financial condition, results of operations, strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking statements are only predictions and involve known and unknownsubject to a number of risks, uncertainties and other factors,assumptions, including the risks outlined under “Risk Factors” orthose described in “Risk Factors” and elsewhere in this report, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment. Newenvironment, and new risks emerge from time to time and ittime. It is not possible for usour management to predict all risk factors,risks, nor can we addressassess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Form 10-K may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. AllGiven these uncertainties, you should not place undue reliance on these forward-looking statements. These risks are discussed more fully in the “Risk Factors” section of this Annual Report on Form 10-K and are summarized below under the “Summary Risk Factors” section. These risks include, but are not limited to, the following:

| ● | our ability to obtain funding for our future clinical trials, preclinical activities and our operations; | |

| ● | our ability to obtain and maintain regulatory approval of our product candidates; | |

| ● | our ability to contract with third-party suppliers, manufacturers and other service providers and their ability to perform adequately; | |

| ● | our ability to meet obligations under our license agreements; | |

| ● | the potential market size, opportunity and growth potential for our product candidates, if approved; | |

| ● | our ability to build our own sales and marketing capabilities, or seek collaborative partners, to commercialize our product candidates, if approved; | |

| ● | our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; | |

| ● | our ability to advance product candidates into, and successfully complete, clinical trials; | |

| ● | our ability to recruit and enroll suitable patients in our clinical trials; | |

| ● | the initiation, timing, progress and results of clinical trials and pre-clinical studies for our NGC drugs; | |

| ● | the timing or likelihood of the accomplishment of various scientific, clinical, regulatory filings and approvals and other product development objectives; | |

| ● | the pricing and reimbursement of our product candidates, if approved; | |

| ● | the rate and degree of market acceptance of our product candidates by physicians, patients, third-party payors and others in the medical community, if approved; | |

| ● | the implementation of our business model, strategic plans for our business, product candidates and technology; | |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology; | |

| ● | developments relating to our competitors and our industry; | |

| ● | the accuracy of our estimates regarding expenses, capital requirements and needs for additional financing; | |

| ● | our financial performance; and | |

| ● | other risks and uncertainties, including those described under part I, Item 1A. Risk Factors of this Annual Report. |

You should not rely upon forward-looking statements includedas predictions of future events. Although we believe that the expectations reflected in this documentthe forward-looking statements are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements.

Undue reliance should not be placed on any forward-looking statement, each of which applies onlyreasonable as of the date of this report. Before investing in our securities, investors should be awareForm 10-K, we cannot guarantee that the occurrencefuture results, levels of theactivity, performance or events describedand circumstances reflected in the section entitled “Risk Factors” and elsewhere in this report could negatively affect our business, operating results, financial condition and stock price. Except as required by law, weforward-looking statements will be achieved or occur. We undertake no obligation to update or revise publicly any of the forward-looking statements for any reason after the date of this reportForm 10-K to conform ourthese statements to new information, actual results or changed expectations.to changes in our expectations, except as required by law.

PART I

You should read this Form 10-K and the documents that we reference in this Form 10-K and have filed with the SEC as exhibits with the understanding that our actual future results, levels of activity, performance, and events and circumstances may be materially different from what we expect.

ITEM

In this Form 10-K, “we,” “us”, “our”, “Processa” and “the Company” refer to Processa Pharmaceuticals, Inc. and its subsidiary.

| 4 |

SUMMARY RISK FACTORS

We are providing the following summary of the risk factors contained in our Form 10-K to enhance the readability and accessibility of our risk factor disclosures. We encourage our stockholders to carefully review the full risk factors contained in this Form 10-K in their entirety for additional information regarding the risks and uncertainties that could cause our actual results to vary materially from our recent results or from our anticipated future results.

Risks Related to Our Financial Position and Need for Additional Capital

| ● | We have a history of losses and we may never become profitable. | |

| ● | We have limited cash resources and will require additional financing. | |

| ● | Our financial statements contain a statement regarding a substantial doubt about our ability to continue as a going concern. | |

| ● | Our ability to use our net operating loss carryforwards and other tax attributes may be limited. |

Risks Relating to Clinical Development and Commercialization of Our Product Candidates

| ● | We currently do not have, and may never develop, any FDA-approved, licensed or commercialized products. | |

| ● | Our licenses are subject to termination by the licensor in certain circumstances. | |

| ● | If we fail to comply with our obligations contained in the agreements under which we license intellectual property rights from third parties, we could lose important license rights. | |

| ● | We depend entirely on the successful development of our product candidates, which have not yet demonstrated efficacy for their target indications in clinical trials. We may never be able to demonstrate efficacy for our product candidates, thus preventing us from licensing, obtaining marketing approval by any regulatory agency, and/or commercializing our product(s). | |

| ● | We must successfully complete clinical trials for our product candidates before we can apply for marketing approval. | |

| ● | We have little corporate history of conducting clinical trials. Our planned clinical trials or those of our collaborators may reveal significant adverse events, toxicities or other side effects not seen in our preclinical studies and may result in a safety profile that could inhibit regulatory approval or market acceptance of any of our product candidates. | |

| ● | Even if we receive regulatory approval for any of our product candidates, we may not be able to successfully license or commercialize the product and the revenue that we generate from its sales, if any, may be limited. | |

| ● | We are completely dependent on third parties to manufacture our product candidates, and our commercialization of our product candidates could be halted, delayed or made less profitable if those third parties fail to obtain manufacturing approval from the FDA or comparable foreign regulatory authorities, fail to provide us with sufficient quantities of our product candidates or fail to do so at acceptable quality levels or prices. | |

| ● | Even if we obtain marketing approval for any of our product candidates, we will be subject to ongoing obligations and continued regulatory review, which may result in significant additional expenses. | |

| ● | Obtaining and maintaining regulatory approval of our product candidates in one jurisdiction does not mean that we will be successful in obtaining regulatory approval of our product candidates in other jurisdictions. | |

| ● | Recently enacted and future legislation may increase the difficulty and cost for us to obtain marketing approval of and commercialize our product candidates and affect the prices we may obtain. | |

| ● | We could face competition from other biotechnology and pharmaceutical companies, and our operating results would suffer if we fail to innovate and compete effectively. | |

| ● | We rely on third parties to conduct clinical trials for our product candidates. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may not be able to obtain regulatory approval for or commercialize any of our product candidates and our business would be substantially harmed. | |

| ● | Clinical drug development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results. | |

| ● | Even though we may apply for orphan drug designation for a product candidate, we may not be able to obtain orphan drug marketing exclusivity. | |

| ● | Although we may pursue expedited regulatory approval pathways for a product candidate, it may not qualify for expedited development or, if it does qualify for expedited development, it may not actually lead to a faster development, regulatory review or approval process. | |

| ● | Third-party coverage and reimbursement, health care cost containment initiatives and treatment guidelines may constrain our future revenues. | |

| ● | Legal, regulatory and legislative changes with respect to reimbursement, pricing and contracting may adversely affect our business and future prospects. | |

| ● | We may face product liability exposure, and if successful claims are brought against us, we may incur substantial liability if our insurance coverage for those claims is inadequate. | |

| ● | If any of our product candidates are approved for marketing and we are found to have improperly promoted off-label uses, or if physicians misuse our products or use our products off-label, we may become subject to prohibitions on the sale or marketing of our products, product liability claims and significant fines, penalties and sanctions, and our brand and reputation could be harmed. | |

| ● | We may choose not to continue developing or commercializing any of our product candidates at any time during development or after approval, which would reduce or eliminate our potential return on investment for those product candidates. |

Risks Relating to Our Intellectual Property Rights

| ● | We depend on rights to certain pharmaceutical compounds that are or will be licensed to us. We do not own the intellectual property rights to these pharmaceutical compounds and any loss of our rights to them could prevent us from selling our products. | |

| ● | We cannot ensure protection of our licensed intellectual property rights. | |

| ● | Our product candidates may infringe the intellectual property rights of others, which could increase our costs and delay or prevent our development and commercialization efforts. | |

| ● | Obtaining and maintaining our patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements. |

General Company-Related Risks

| ● | We will need to grow the size of our organization, and we may experience difficulties in managing this growth. | |

| ● | If we lose key management personnel, or if we fail to recruit additional highly skilled personnel, our ability to identify and develop new or next generation product candidates will be impaired, could result in loss of markets or market share and could make us less competitive. | |

| ● | If our information technology systems or data, or those of third parties upon which we rely, are or were compromised, we could experience adverse consequences resulting from such compromise, including but not limited to regulatory investigations or actions, interruptions or disruptions to operations or clinical trials, reputational harm, litigation, fines and penalties. | |

| ● | We are exposed to cyber-attacks and data breaches, including the risks and costs associated with protecting our systems and maintaining integrity and security of our business information, as well as personal data of our guests, employees and business partners. |

Risks Related to Ownership of Our Common Stock

| ● | Our failure to maintain compliance with Nasdaq’s continued listing requirements could result in the delisting of our common stock. | |

| ● | Future equity offerings, license transactions or acquisitions may dilute our existing stockholders’ ownership and/or have other adverse effects on our operations. | |

| ● | Our common stock price is expected to be volatile. | |

| ● | We are a “smaller reporting company,” and the reduced disclosure requirements applicable to us as such may make our common stock less attractive to our stockholders and investors. | |

| ● | We do not currently intend to pay dividends to our stockholders in the foreseeable future, and consequently, your ability to achieve a return on your investment will depend on appreciation in our value. | |

| ● | If securities or industry analysts do not publish research or reports about our business, or if they publish negative evaluations of our stock or negative reports about our business, our stock price and trading volume could decline. | |

| ● | Provisions in our corporate documents and Delaware law could have the effect of delaying, deferring, or preventing a change in control of us, even if that change may be considered beneficial by some of our stockholders. | |

| ● | Provisions in our bylaws provide for indemnification of officers and directors, which could require us to direct funds away from our business and the development of our product candidates. |

| 5 |

Part I

Item 1. Business

Overview

Heatwurx,We are a clinical-stage biopharmaceutical company focused on utilizing our “regulatory science” approach, including the principles associated with FDA’s Project Optimus Oncology initiative and the related FDA Draft Guidance, in the development of Next Generation Chemotherapy (“NGC”) oncology drug products. Our mission is to provide better treatment options than those that presently exist by extending a patient’s survival and/or improving a patient’s quality of life. This is achieved by improving upon FDA-approved, widely used oncology drugs or the cancer-killing metabolites of these drugs by altering how they are metabolized and/or distributed in the body, including how they are distributed to the actual cancer cells.

Our regulatory science approach was conceived in the early 1990s when the founders of Processa and other faculty at the University of Maryland worked with the FDA to develop multiple FDA Guidances. Regulatory science is the science of developing new tools, standards, and approaches to assess the safety, efficacy, quality, and performance of all FDA-regulated products. Over the last 30 years, two of our founders, Dr. David Young and Dr. Sian Bigora, have expanded the original regulatory science concept by including the pre-clinical and clinical studies to justify the benefit-risk assessment required for FDA approval when designing the development programs of new drug products.

Our regulatory science approach defines the scientific information that the FDA requires to determine if the benefit outweighs the risk of a drug in a specific population of patients and at a specific dosage regimen for a specific drug product. The studies are designed to obtain the necessary scientific information to support the regulatory decision.

Recently, the FDA has taken steps to define some of the regulatory science required for the FDA approval of oncology products. Through the FDA’s Project Optimus Oncology Initiative and the related Draft Guidance on determining the “optimal” dosage regimen for an oncology drug, the FDA has chosen to make the development of oncology drugs more science-based than in the past. Since the principles of the FDA’s Project Optimus and the related Draft Guidance have been used by our regulatory science approach in a number of non-oncology drugs, our experience with the principles of Project Optimus differentiates us from other biotechnology companies by focusing us not only on the clinical science, but also on the equally important regulatory process. We believe utilizing our regulatory science approach provides us with three distinct advantages:

| ● | greater efficiencies (e.g., the right trial design and trial readouts); | |

| ● | greater possibility of drug approval by the FDA or other regulatory authorities; and | |

| ● | greater ability to evaluate the benefit-risk of a drug compared to existing therapy, which allows prescribers to provide better treatment options for each patient. |

Our strategic prioritization is to advance our pipeline of NGC proprietary small molecule oncology drugs. The NGC products are new chemical entities, but they work by changing the metabolism, distribution and/or elimination of already FDA-approved cancer drugs or their active metabolites while maintaining the mechanism of how the drug kills cancer cells. We believe our NGC treatments will provide improved safety-efficacy profiles when compared to their currently marketed counterparts – capecitabine, gemcitabine, and irinotecan. All future studies of these drugs are subject to availability of capital to conduct the trials.

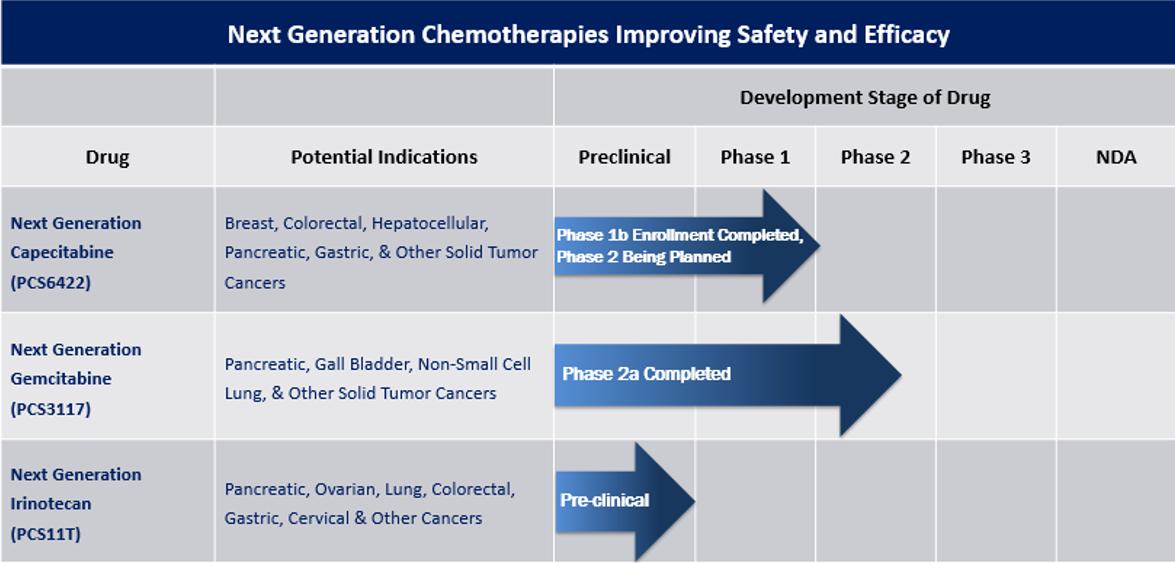

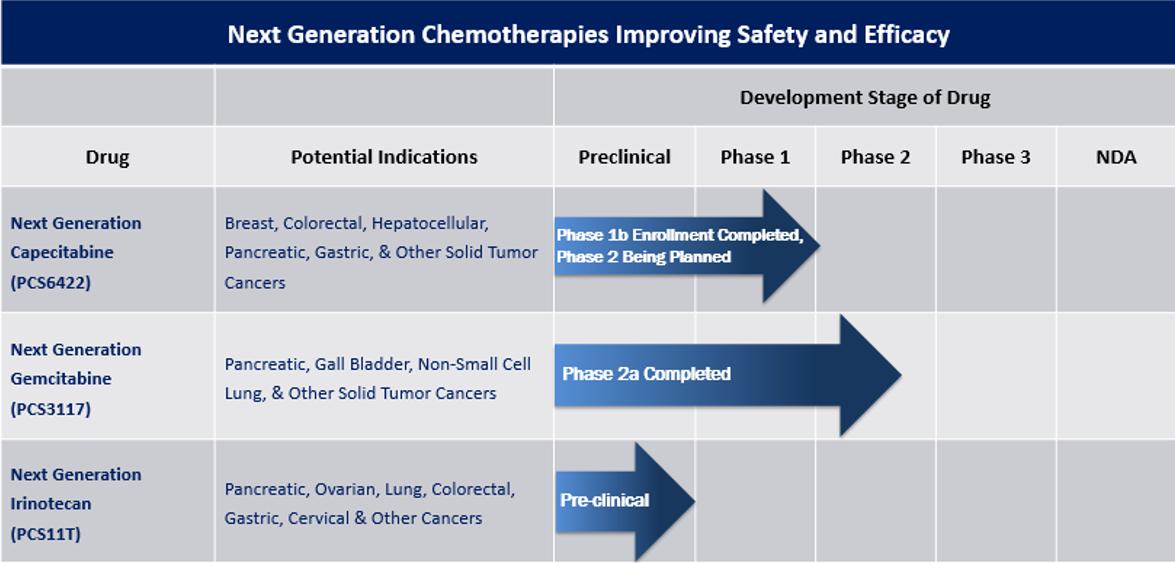

The three NGC treatments in our pipeline are as follows:

| ● | NGC-Capecitabine (also referred to as NGC-Cap) is a combination of PCS6422 and capecitabine, capecitabine being the oral prodrug of the cancer drug 5-fluorouracil (5-FU). PCS6422, without having any clinically meaningful biological effect itself, alters the metabolism of 5-FU, resulting in more 5-FU distribution to the cancer cells. In clinical trials, NGC-Cap has shown a safety profile different than capecitabine when administered alone. Side effects such as Hand-Foot Syndrome (HFS) and cardiotoxicity typically occur in up to 50-70% of patients treated with capecitabine and are caused by specific capecitabine metabolites. These types of toxicities frequently result in decreased doses, interrupted doses, or discontinuation of treatment with capecitabine. Since a much smaller amount of these metabolites are formed with NGC-Cap, these side effects appear in less patients and are less severe when they do occur. In addition, NGC-Cap has been found to be up to 50 times more potent than capecitabine based on the systemic exposure of the capecitabine metabolite 5-FU, which is metabolized to the cancer-killing metabolites. Like capecitabine, NGC-Cap could potentially be used to treat patients with various cancers, such as metastatic breast, colorectal, gastrointestinal, and pancreatic. On December 11, 2023, we had a successful meeting with the FDA regarding the next Phase 2 study supporting the advancement of NGC-Cap for cancer patients. The meeting with the FDA was supported by the interim results from the ongoing Phase 1B study that was fully enrolled in the first quarter of 2024. Following the meeting with the FDA, we decided the next NGC-Cap trial would be a Phase 2 trial in breast cancer. This decision was supported through discussions with the FDA where we agreed with the FDA that the development of NGC-Cap in breast cancer would be a more efficient development program than metastatic colorectal cancer and improve the likelihood of FDA approval. The FDA has agreed that the data from past and existing studies could be used to directly support the Phase 2 trial in breast cancer. Breast cancer is the most diagnosed cancer, representing approximately 15% of all new cancer patients in 2023. It has a prevalence of more than 3.8 million patients, with nearly 300,000 new diagnoses last year. Over 150,000 women are currently living with advanced or metastatic breast cancer. The NGC-Cap annual newly diagnosed incidence rate for breast, colorectal and other cancers is greater than 250,000 patients per year. |

| 6 |

| ● | PCS3117, also referred to as NGC-Gemcitabine (NGC-Gem), is an oral analog of gemcitabine that is converted to its active metabolite by a different enzyme system than gemcitabine resulting in a positive response in gemcitabine patients as well as some gemcitabine treatment-resistant patients. Like gemcitabine, NGC-Gem could be used to treat patients with various cancers such as pancreatic, biliary tract, lung, ovarian, and breast. We estimate more than 275,000 patients in the United States were newly diagnosed in 2022 with pancreatic, biliary tract, lung, ovarian, and breast cancer. We plan to meet with the FDA to discuss potential study designs including implementation of the Project Optimus initiative as part of the design in 2024. | |

| ● | PCS11T, also referred to as NGC-Irinotecan (NGC-Iri), is a prodrug of the active metabolite of irinotecan (SN-38). The chemical structure of NGC-Iri influences the uptake of the drug into cancer cells, resulting in more NGC-Iri entering cancer cells than normal cells in mice. These levels were significantly greater than those seen with irinotecan, resulting in lower doses of NGC-Iri having greater efficacy than irinotecan and improved safety in animal models. Like irinotecan, NGC-Iri could be used to treat patients with various cancers such as lung, colorectal, gastrointestinal, and pancreatic cancer. We estimate at least 200,000 patients in the United States were newly diagnosed in 2022 with lung, colorectal, gastrointestinal, and pancreatic cancer. We plan to conduct IND-enabling and toxicology studies in 2024-2025. |

We have completed our Phase 2A trial for PCS12852 in gastroparesis patients with positive results. Additionally, in February 2023, due primarily to the inability to identify and enroll patients in our rare disease Phase 2 trial for PCS499 in ulcerative Necrobiosis Lipoidica (uNL), we decided to cease further enrollment in the PCS499 trial and terminated the trial. We did not experience any safety concerns during the conduct of either the PCS12852 or PCS499 trial. We are currently evaluating options to monetize these non-core drug assets, which may include out-licensing or partnering these assets with one or more third parties.

Our shift in prioritization to NGC oncology drugs does not change our mission. We continue to be focused on drug products that improve the survival and/or quality of life for patients by improving the safety and/or efficacy of the drug in a targeted patient population, while providing a more efficient and probable path to FDA approval and differentiating our drugs from those on the market or are currently being developed.

Historically, much of oncology drug development has searched for novel or different ways to treat cancer. Our approach is to take three current FDA-approved cancer drugs and modify and improve how the human body metabolizes and/or distributes these NGC treatments compared to their presently approved counterpart chemotherapy drugs while maintaining the cancer-killing mechanism of action; thus, our reason for calling our drugs Next Generation Chemotherapy (or NGC) treatments. Part of the development includes determining the optimal dosage regimen based on the dose-response relationship as described in the FDA’s Project Optimus Initiative and Draft Optimal Dosage Regimen Oncology Guidance. To date, we have data that we believe suggests our NGC treatments are likely to have a better safety-efficacy profile than the current widely used marketed counterpart drugs, not only potentially making the development and approval process more efficient, but also clearly differentiating our NGC treatments from the existing treatment. We believe our NGC treatments have the potential to extend the survival and/or quality of life for more patients diagnosed with cancer while decreasing the number of patients who are required to dose-adjust or discontinue treatment because of side effects or lack of response.

| 7 |

Our Strategy

Our strategy is to develop our pipeline of NGC proprietary small molecule oncology drugs using our regulatory science approach to determine the optimal dosage regimen of our oncology drugs. By changing either the metabolism, distribution, and/or elimination of already FDA-approved cancer drugs (e.g., capecitabine, gemcitabine, and irinotecan) or their active metabolites, we believe that our three new oncology drugs represent the next generation of chemotherapy with an improved safety profile, improved efficacy profile and/or potentially benefiting more patients while maintaining the mechanism of how the drug kills cancer cells. By combining these modified approved cancer treatments with our regulatory science approach and our experience using the principles of FDA’s Project Optimus initiative, we anticipate that we will be able to increase the probability of FDA approval, improve the safety-efficacy profile over the existing counterparts of our NGC drugs, and more efficiently develop each drug.

Our pipeline of NGCs (i) already has data demonstrating the desired pharmacological activity in humans or appropriate animal models and is able to provide improved safety and/or efficacy by some modification in the formation and/or distribution of the active moieties associated with the drug and (ii) targets cancers for which a single positive pivotal trial demonstrating efficacy might provide enough evidence that the clinical benefits of the drug and its approval outweighs the risks associated with the drug.

Our Team

Our drug development efforts are guided by our knowledge and experience in applying our regulatory science approach to decrease manageable risks, costs, and time toward achieving marketing authorization from regulatory authorities including the FDA. We have assembled a seasoned management team and development team with extensive experience in developing therapies, including advancing product candidates from preclinical research through clinical development and ultimately regulatory approval and commercialization. Our team is led by our President of Research and Development and Founder David Young, Pharm.D., Ph.D. who has extensive experience in research, regulatory approval and business development and who served at Questcor Pharmaceuticals for eight years, initially as an independent director on its Board of Directors and, subsequently, as its Chief Scientific Officer.

To execute our strategy, we assembled an experienced and development team with a successful track record of drug approvals and successful exits. Our team is experienced in developing drug products through all principal regulatory tiers from IND-enabling studies to New Drug Application (NDA) submission. Throughout their careers, the combined scientific, development and regulatory experiences of our team members have resulted in more than 30 drug approvals in indications reviewed by almost every division of the FDA including the oncology divisions, over 100 meetings with the FDA and involvement with more than 50 drug development programs, including drug products targeted to patients who have an unmet medical need and cancer patients. In addition, the FDA Project Optimus Oncology initiative and recent FDA Oncology Guidance applies our regulatory science approach and principles used and refined by our Founders over the last 30 years.

| 8 |

Our Drug Pipeline

Our pipeline currently consists of NGC-Cap, NGC-Gem and NGC-Iri (also identified as PCS6422, PCS3117 and PCS11T, respectively) and two non-oncology drugs (PCS12852 and PCS499). The non-oncology drugs are not included in the pipeline chart above, as we are exploring our options for those drugs, which may include out-licensing or partnership opportunities. A summary of each drug is provided below.

Next Generation Chemotherapy Pipeline

| ● | Next Generation Capecitabine (NGC-Cap) is a combination of PCS6422 and a lower dose of the FDA-approved cancer drug capecitabine. PCS6422 is an orally administered irreversible inhibitor of the enzyme dihydropyrimidine dehydrogenase (DPD). DPD metabolizes 5-Fluorouracil (5-FU), the major metabolite of capecitabine and widely used itself as an intravenous chemotherapeutic agent in many types of cancer, to multiple metabolites classified as catabolites. These catabolites do not have any cancer-killing properties but frequently cause dose-limiting side effects that may require dose adjustments or discontinuation of therapy. |

Capecitabine, as presently prescribed and FDA-approved, forms the cancer drug 5-FU which is then further metabolized to anabolites (which kill both cancer cells and normal duplicating cells) and catabolites (which cause side effects and have no cancer killing properties). When capecitabine is given in combination with PCS6422 in NGC-Cap, PCS6422 significantly changes the metabolism of 5-FU, which results in a change in the distribution of 5-FU within the body. Due to this change in metabolism and the overall metabolite profile of anabolites and catabolites, the side effect and efficacy profile of NGC-Cap has been found to be different from capecitabine given without PCS6422. Since the potency of NGC-Cap is also greater than FDA-approved capecitabine based on the 5-FU systemic exposure per mg of capecitabine administered, the amount of capecitabine anabolites formed from 1 mg of capecitabine administered in NGC-Cap will, therefore, be much greater than formed from the administration of 1 mg of existing capecitabine.

On August 2, 2021, we enrolled the first patient in our Phase 1B dose-escalation maximum tolerated dose trial in patients with advanced refractory gastrointestinal (GI) tract tumors. Our interim analysis of Cohorts 1 and 2A of the ongoing clinical trial found no dose-limiting toxicities (DLTs), no drug-related adverse events greater than Grade 1, and no adverse events associated with the catabolites of 5-FU such as HFS. In this Phase 1B trial, it was demonstrated that the irreversible inhibition of DPD by PCS6422 could alter the metabolism, distribution and elimination of 5-FU, making NGC-Cap significantly (up to 50 times) more potent than capecitabine alone and potentially leading to higher levels of anabolites which can kill replicating cancer and normal cells. By administering NGC-Cap to cancer patients, the balance between anabolites and catabolites changes depending on the dosage regimens of PCS6422 and capecitabine used, making the efficacy-safety profile of NGC-Cap different than that of FDA-approved capecitabine and requiring further evaluation of the PCS6422 and capecitabine regimens to determine the optimal NGC-Cap regimens for patients.

| 9 |

In order for NGC-Cap to provide a safer and more efficacious profile for cancer patients compared to existing chemotherapy, understanding how the different regimens of PCS6422 and capecitabine may affect the systemic and tumor exposure to the anabolites, as well as the systemic exposure to the catabolites, is required. This can be achieved by following the timeline of DPD irreversible inhibition and the formation of new DPD using the plasma concentrations of 5-FU and its catabolites.

In an effort to better estimate the timeline of DPD inhibition and formation of new DPD, we modified the protocol for the Phase 1B trial and began enrolling patients in the amended Phase 1B trial in April 2022. On November 1, 2022, we announced that data from the Phase 1B trial identified multiple dosage regimens with potentially better safety and efficacy profiles than currently existing chemotherapy regimens. Since 5-FU exposure is dependent on both the PCS6422 regimen and the capecitabine regimen, safe regimens were identified as well as regimens that cause DLTs. One of the regimens in the Phase 1B trial did cause DLTs in two patients, one of whom died. The Phase 1B trial is continuing to enroll patients and is expected to complete enrollment in early 2024. The next trial will be a Phase 2 trial to determine which regimens provide an improved efficacy-safety profile over present therapy using the principles of the FDA’s Project Optimus initiative to help guide the design of the trial. This FDA initiative requires us to consider NGC regimens that are not at the maximum tolerated dose or exposure level.

Discussions with the FDA in April 2023 have clarified that the major goal for the next Phase 2 trial will be to evaluate and understand the dose- and exposure-response relationship for anti-tumor activity and safety. The specific dosage regimens for the trial will be defined following the determination of the MTD from our ongoing Phase 1B trial. Cohort 3 in the Phase 1B trial, which dosed patients with PCS6422 in combination with capecitabine at 150 mg BID (twice a day), completed with no dose-limiting toxicities. Enrollment in Cohort 4 was expanded to include six patients to further evaluate the safety at this dose. Enrollment in this cohort is now complete and to date, no DLTs have been observed in this cohort, but safety evaluation for this cohort is still ongoing. Once the cohort and the safety evaluation is complete, the need for any additional cohorts will be further evaluated. Following the FDA meeting on December 11, 2023, we have decided the next NGC-Cap trial would be a Phase 2 trial in breast cancer. This decision was supported through discussions with the FDA where we agreed with the FDA that the development of NGC-Cap in breast cancer would be a more efficient development program than metastatic colorectal cancer and improve the likelihood of FDA approval. The FDA has agreed that the data generated from past and existing studies could be used to directly support the Phase 2 trial in breast cancer. Capecitabine is already approved as both monotherapy and combination therapy in breast cancer, which contributes to the logic and efficiency of our current direction. In addition, the FDA’s agreement that our present data would support a Phase 2 trial in breast cancer makes the expansion seamless. The objective for the Phase 2 trial will be to provide safety-efficacy data to preliminarily demonstrate the benefit of NGC-Cap over capecitabine and other treatment options. Based on this expansion to breast cancer, we expanded our Oncology Advisory Board to include key breast cancer oncologists. We have already determined the Phase 2 study design, which we expect to share with the FDA soon, and plan to use the funding from our January 2024 public offering to begin enrolling patients in the third quarter of 2024.

Our license agreement with Elion Oncology, Inc. (“Elion”) for NGC-Cap requires us to use commercially reasonable efforts, at our sole cost and expense, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that include dosing a first patient with a product in a Phase 2 or 3 clinical trial on or before October 2, 2024. We are currently conducting pre-trial activities and planning to dose the first patient in our Phase 2 trial in the third quarter of 2024.

| 10 |

| ● | NGC-Gem is a cytidine analog similar to gemcitabine (Gemzar®), but different enough in chemical structure that some patients are more likely to respond to PCS3117 than gemcitabine. In addition, we believe those patients inherently resistant or who acquire resistance to gemcitabine are likely not to be resistant to NGC-Gem. The difference in response occurs because NGC-Gem is metabolized to its active metabolite through a different enzyme system than gemcitabine. We continue to evaluate the potential use of NGC-Gem in patients with pancreatic and other potential cancers and to evaluate ways to identify patients who are more likely to respond to NGC-Gem than gemcitabine. We plan to meet with the FDA in 2024 to discuss potential trial designs including implementation of the Project Optimus initiative as part of the design. Similar to NGC-Cap, we will need to obtain additional funding before we can begin the Phase 2 trial for NGC-Gem. |

Our license agreement with Ocuphire Pharma, Inc. (“Ocuphire”) for NGC-Gem requires us to use commercially reasonable efforts, at our sole cost and expense to oversee such commercialization efforts, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that consist of: (i) dosing a patient in a clinical trial prior to June 16, 2024; and (ii) dosing a patient in a pivotal clinical trial or in a clinical trial for a second indication of the drug prior to June 16, 2026. We are currently in discussions with Ocuphire to extend these deadlines.

| ● | NGC-Iri is an analog of SN38 (SN38 is the active metabolite of irinotecan) and should have an improved safety/efficacy profile in every type of cancer that irinotecan is presently used. The manufacturing process and sites for drug substance and drug product are presently being evaluated and IND-enabling toxicology studies will then be initiated. In addition, we are defining the potential paths to approval, which include defining the targeted patient population and the type of cancer. We plan to conduct IND enabling and toxicology studies in 2024, subject to available funding. |

Non-Oncology Pipeline for Out-licensing or Partnership

| ● | PCS12852 is a highly specific and potent 5HT4 agonist that has already been evaluated in clinical studies in South Korea for gastric emptying and gastrointestinal motility in healthy volunteers and volunteers with a history of constipation. In October 2021, the FDA cleared our IND application to proceed with a Phase 2A trial for the treatment of gastroparesis. We enrolled our first patient on April 5, 2022 and completed enrollment of the trial on September 2, 2022. Results from this Phase 2A trial, which included 25 patients with moderate to severe gastroparesis, demonstrated improvements in gastric emptying in patients receiving 0.5 mg of PCS12852 as compared to placebo. The results indicated that for the patients in the PCS12852 group, the mean time for 50% of the gastric contents to empty (t50) compared to their baseline value (±SD) decreased by -31.90 min (±50.53) (compared to the change seen in the placebo group of only -9.36 min (±42.43). Significant gastric emptying differences were not observed between the placebo and the 0.1 mg dose. Adverse events associated with the administration of PCS12852 were generally mild to moderate as expected, limited in duration, and quickly resolved without any sequelae. There were no cardiovascular safety events or serious adverse events reported during the trial. Additionally, the 0.5 mg of PCS12852 showed a greater improvement than placebo in the gastroparesis symptomology scales used in the trial, including both total scores in the scales, as well as sub-scores such as nausea, vomiting and abdominal pain. With the trial now complete, we have the data necessary to finalize the development plan for the treatment of diabetic gastroparesis patients. We are exploring options for PCS12852, which may include licensing, partnering and/or collaborating opportunities. |

| ● | PCS499 is an oral tablet of the deuterated analog of one of the major metabolites of pentoxifylline (PTX or Trental®). PCS499 is a drug that can be used to treat unmet medical need conditions caused by multiple pathophysiological changes. We completed a Phase 2A trial for PCS499 in patients with ulcerative and non-ulcerative necrobiosis lipoidica (uNL and NL, respectively) in late 2020, and in May 2021, we enrolled the first patient in our Phase 2B trial for the treatment of uNL. Although we initiated several recruitment programs to enroll patients in this trial, we were only able to recruit four patients. We experienced extremely slow enrollment in the trial given the extreme rarity of the condition (rarer than reported in the literature), the impact of COVID-19, and the reluctance of patients to be in a clinical trial. We completed the Phase 2B uNL trial for those currently enrolled but halted further efforts to enroll new patients in the trial and have terminated the trial. There were no safety concerns during the conduct of the trial. Although we believe that PCS499 can be effective in treating uNL, preliminary data indicated that the placebo response was likely to be much greater than the literature and clinical experts believe; thus, a much larger sample size would be required in a pivotal trial for an indication where it was extremely difficult to enroll even four patients. We are exploring options for PCS499 in other indications, which may include licensing, partnering and/or collaborating opportunities. |

| 11 |

Manufacturing and Clinical Supplies

We do not own or operate, and currently have no plans to establish, any manufacturing facilities. We currently rely, and expect to continue to rely, on multiple third-party contract manufacturing organizations (CMOs) for the supply of current Good Manufacturing Practices (cGMP)-grade clinical trial materials and commercial quantities of our product candidates and products, if approved. We require all our CMOs to conduct manufacturing activities in compliance with cGMP. We have assembled a team of experienced employees and consultants to provide the necessary technical, quality and regulatory oversight of our CMOs.

We anticipate that these CMOs will have the capacity to support both clinical supply and commercial-scale production, but we do not have any formal agreements at this time with any of these CMOs to cover commercial production. We also may elect to pursue additional CMOs for manufacturing supplies of drug substance and finished drug product in the future. We believe that our standardized manufacturing process can be transferred to a number of other CMOs for the production of clinical and commercial supplies of our product candidates in the ordinary course of business.

Competition

Many of our potential competitors may have significantly greater financial resources, a more established presence in the market, and more expertise in research and development, manufacturing, pre-clinical and clinical testing, obtaining regulatory approvals and reimbursement, and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical, biotechnology and diagnostic industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These potential competitors may also compete with us in recruiting and retaining top qualified scientific, sales, marketing and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs.

The key competitive factors affecting each of our products, if approved, are likely to include the efficacy, safety, convenience and price of the products relative to other approved products used on- or off-label for each unmet medical need condition. Although preliminary clinical data exists to support the possibility of improved efficacy and safety profiles for our drugs, more in-depth randomized, controlled studies are required for our products to determine if our preliminary findings will support the approval in the designated unmet medical need indication.

For NGC-Cap, the competitive factors will be related to the efficacy and safety of the product when compared to capecitabine. The market penetration will depend on how much improvement will occur in the efficacy and/or safety profiles when administered in combination with PCS6422. Currently, there are no other reversible or irreversible enzyme inhibitor products approved in the US and no irreversible enzyme inhibitors approved ex-US, which may make PCS6422 the first DPD irreversible inhibitor available.

For NGC-Gem, the competitive factors will include establishing market penetration against other cytidine analogues, such as gemcitabine, which is currently used as first or second line chemotherapy either alone or in combination with other chemotherapy agents. The market penetration will depend on the potential for an improved efficacy profile in patients who have developed tolerance to other agents.

For NGC-Iri, the competitive factors will include establishing marketing penetration against the existing irinotecan product (Camptosar®) and the newer liposomal irinotecan product (Onivyde®). The establishment of that market will be based upon improved efficacy and/or safety of NGC-Iri.

For PCS12852, the competitive factors will include establishing marketing penetration against the metoclopramide products (the only approved drug to treat gastroparesis) and other 5-HT4 receptor agonists used off label. The market penetration will depend on the potential for an improved safety profile due to the very selective 5-HT4 receptor binding by PCS12852 and similar or greater efficacy in the treatment of gastroparesis.

For PCS499, there are currently no FDA-approved drugs for the treatment of patients with NL, and few drugs are used off-label for NL given the lack of efficacy and/or side effect concerns.

| 12 |

Our commercial opportunity for any of our product candidates could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, less expensive, more convenient or easier to administer, or have fewer or less severe side effects, than any products that we may develop. Our competitors also may obtain FDA, EMA or other regulatory approval for their products more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market.

Intellectual Property

Our success will depend in large part on our ability and that of our licensors to:

| ● | obtain and maintain international and domestic patent and other legal protections for the proprietary technology, inventions and improvements we consider important to our business; | |

| ● | prosecute and defend our existing and future patents, once obtained; | |

| ● | preserve confidentiality of our own and our licensed methods, processes and know-how; and | |

| ● | operate without infringing the patents and proprietary rights of other parties. |

Although we rely extensively on licensing patents from third parties, we intend to seek appropriate patent protection for product candidates in our research and development programs, where applicable, and their uses by filing patent applications in the United States and other selected countries. We intend for these patent applications to cover, where possible, claims for compositions of matter, medical uses, processes for preparation and formulations.

Our current patent portfolio consists of the number of patents related to our drug candidates licensed from each third-party licensor. In addition to the international patents and/or international and U.S. patent applications licensed from our third-party licensors, we have licensed at least the following number of U.S. patents:

| CoNCERT | Yuhan | Aposense | Elion | Ocuphire | Total | ||||||||

| U.S. patents | 9 | 5 | 3 | 2 | 6 | 25 |

A provisional patent for NGC-Cap has been filed.

Besides relying on patents, we may also rely on trade secrets, proprietary know-how and continuing innovation to develop and maintain our competitive position, especially when we do not believe that patent protection is appropriate or can be obtained. In addition, we continuously evaluate opportunities to obtain exclusivity through our regulatory filings with the FDA. We seek protection of these trade secrets, proprietary know-how and any continuing innovation, in part, through confidentiality and proprietary information agreements. However, these agreements may not provide meaningful protection for, or adequate remedies to protect, our technology in the event of unauthorized use or disclosure of information. Furthermore, our trade secrets may otherwise become known to, or be independently developed by, our competitors.

| 13 |

License Agreements

The following descriptions of our license agreements are only summaries. You should also refer to the copies of such agreements which have been filed as exhibits to this Annual Report.

License Agreement with Elion Oncology, Inc.

On August 23, 2020, we entered into a condition precedent License Agreement with Elion Oncology (“Elion License Agreement”), pursuant to which we acquired an exclusive license to develop, manufacture and commercialize PCS6422 globally. The license grant was conditioned on the following being satisfied by October 30, 2020: (i) our closing on an equity financing of at least $15 million in gross proceeds and (ii) successful up-listing to Nasdaq.

On October 6, 2020, all conditions were satisfied, resulting in the addition of PCS6422 to our portfolio, and we paid $100,000 cash and issued 41,250 shares of our common stock to Elion. As part of the Elion License Agreement, we agreed to issue to Elion 5,000 shares of our common stock on each of the first and second anniversary dates of the Elion License Agreement.

As additional consideration, we will pay Elion development and regulatory milestone payments (a portion of which are payable in shares of our common stock and a portion of which are payable in cash) upon the achievement of certain milestones, which include FDA or other regulatory approval and dosing a patient. In addition, we must pay Elion one-time sales milestone payments based on the achievement during a calendar year of one or more thresholds for annual sales for products made and pay royalties based on annual licensing sales. We are also required to split any milestone payments received with Elion based on any sub-license agreement we may enter.

On May 17, 2022, we amended the third Milestone Event of Section 6.4 of our License Agreement with Elion Oncology, Inc. changing the third Milestone Event from “1st Patient in Dose Confirmation Study” to (a) determination of the maximum tolerated dose (MTD) or (b) determination of the recommended Phase 2 Dose. Prior to this amendment, the third milestone was not considered probable since it was unknown when, or if a dose confirmation study was going to be conducted. As a result of the modification, we consider it probable that the recommended Phase 2 dosage regimen could be determined in connection with our current Phase 1B trial for NGC-Cap. We recorded an expense and related liability of $189,000 representing the value of the shares we anticipate issuing to Elion at the fair value on the date of modification. No other terms or conditions of the License Agreement were modified. We determined the dosage for our Phase 2 study on January 25, 2024 and issued 5,000 shares of common stock to Elion for meeting this milestone.

We are required to use commercially reasonable efforts, at our sole cost and expense to research, develop and commercialize products in one or more countries, including dosing a first patient with a product in a Phase 2 or 3 clinical trial by October 2, 2024. We are currently on track to dose our first patient in a Phase 2 clinical trial by the deadline. Either party may terminate the agreement in the event of a material breach of the agreement that has not been cured following written notice and a 90-day opportunity to cure such breach (which is shortened to 15 days for a payment breach).

| 14 |

License Agreement with Ocuphire Pharma, Inc.

On June 16, 2021, we executed a License Agreement with Ocuphire Pharma, Inc. (“Ocuphire Agreement”) under which we received a license to research, develop and commercialize PCS3117 globally, excluding the Republic of Singapore, China, Hong Kong, Macau and Taiwan.

As consideration for the Ocuphire Agreement, we issued 2,235 shares of our common stock to Ocuphire, a cash payment of $200,000 and assumed $66,583 in certain liabilities. Additional consideration includes future development and regulatory milestones payments to Ocuphire upon our achievement of certain defined clinical milestones, such as dosing a patient in pivotal trials and receiving marketing authorization by a regulatory authority in the United States or another country. In addition, we are required to pay Ocuphire one-time sales milestone payments based on the achievement during a calendar year of the highest annual Net Sales for products made and pay royalties based on annual Net Sales, as defined in the Ocuphire Agreement.

We are required to use commercially reasonable efforts, at our sole cost and expense to oversee such commercialization efforts, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that consist of: (i) first patient administered drug in a Clinical Trial of a Product prior to June 16, 2024 and (ii) first patient administered drug in a Pivotal Clinical Trial of a Product or first patient administered drug in a Clinical Trial for a Second Indication of a Product prior to June 16, 2026. We are currently in discussions with Ocuphire to extend these deadlines. Although we do not anticipate having any issues in extending the deadlines, there can be no assurance that such negotiations will be successful. Either party may terminate the agreement in the event of a material breach of the agreement that has not been cured following written notice and a 120-day opportunity to cure such breach.

License Agreement with Aposense, Ltd.

On May 24, 2020, we entered into a condition precedent License Agreement with Aposense, Ltd. (“Aposense License Agreement”), pursuant to which we were granted Aposense’s patent rights and Know-How to develop and commercialize their next generation irinotecan cancer drug, PCS11T. The Aposense License Agreement provides us with an exclusive worldwide license (excluding China), to research, develop and commercialize products comprising or containing PCS11T. The license grant was conditioned on the following being satisfied within nine months of May 24, 2020 (or the Aposense License Agreement shall terminate): (i) our closing of an equity financing and successful up-listing to Nasdaq and (ii) Aposense obtaining the approval of the Israel Innovation Authority for the consummation of the transactions contemplated by the Aposense License Agreement.

On October 6, 2020, all conditions were satisfied, resulting in the addition of PCS11T to our portfolio, and we issued 31,250 shares of our common stock to Aposense. As additional consideration, we will pay Aposense development and regulatory milestone payments (up to $3.0 million per milestone) upon the achievement of certain milestones, which primarily consist of having a drug indication approved by a regulatory authority in the United States or another country. In addition, we will pay Aposense one-time sales milestone payments based on the achievement during a calendar year of one or more thresholds for annual sales for products made and pay royalties based on annual licensing sales. We are also required to split any sales milestone payments or royalties we receive with Aposense based on any sub-license agreement we may enter.

License Agreement with Yuhan Corporation

On August 19, 2020, we entered into a License Agreement with Yuhan Corporation (“Yuhan License Agreement”), pursuant to which we acquired an exclusive license to develop, manufacture and commercialize PCS12852 globally, excluding South Korea.

As consideration for the Yuhan License Agreement and related Share Issuance Agreement, we issued to Yuhan 25,000 shares of common stock. As additional consideration, we will pay Yuhan development and regulatory milestone payments (a portion of which are payable in shares of our common stock based on the volume weighted average trading price during the period prior to such achievement and a portion of which are payable in cash) upon the achievement of certain milestones, based on a Yuhan affiliate purchasing 37,500 shares of common stock for $3,000,000 in our October 2020 underwritten public offering. The milestones primarily consist of dosing a patient in pivotal trials or having a drug indication approved by a regulatory authority in the United States or another country. In addition, we must pay Yuhan one-time sales milestone payments based on the achievement during a calendar year of one or more thresholds for annual sales for products made and pay royalties based on annual licensing sales. We are also required to split any milestone payments received with Yuhan based on any sub-license agreement we may enter.

We are required to use commercially reasonable efforts, at our sole cost and expense, in conjunction with a joint Processa-Yuhan Board to oversee such commercialization efforts, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that consist of: (i) preparing a first draft of the product development plan within 90 days; (ii) requesting an FDA pre-IND meeting for a product within 6 months; (iii) dosing a first patient in a Phase 2A clinical trial with a product within 24 months; and (iv) dosing a first patient with a product in a Phase 2B clinical trial, Phase 3 clinical trial or other pivotal clinical trial with a product by August 19, 2024. Either party may terminate the agreement in the event of a material breach of the agreement that has not been cured following written notice and a 60-day opportunity to cure such breach (which is shortened to 15 days for a payment breach).

| 15 |

License Agreement with CoNCERT Pharmaceuticals, Inc.

On October 4, 2017, Promet entered into a License Agreement with CoNCERT (“CoNCERT License Agreement”). On March 19, 2018, we, Promet, and CoNCERT entered into an Amended Option Licensing Agreement (“March Amendment”) that, among other things, assigned the CoNCERT Agreement from Promet to us and we exercised the exclusive commercial license option for the PCS499 compound from CoNCERT.

The CoNCERT License Agreement provides us with an exclusive (including as to CoNCERT) royalty-bearing license to CoNCERT’s patent rights and Know-How to develop, manufacture, use, sub-license and commercialize compounds (PCS499 and each metabolite thereof) and pharmaceutical products with such compounds worldwide. We are required to pay CoNCERT royalties, on a product–by-product basis, on future worldwide net sales, or pay a percentage of any sublicense revenue.

We will incur royalty obligations to CoNCERT on a country-by-country and product-by-product basis that expire on a country-by-country and product-by-product basis on the later of (i) expiration or invalidation of the last patent rights covering such product in such country or (ii) the tenth anniversary of the date of the first commercial sale to a non-sublicensee third party of such product in such country.

We are required to use commercially reasonable efforts, at our sole cost and expense, to develop and obtain regulatory approval for one product in the U.S. and at least one other major market and, subject to obtaining regulatory approval in the applicable major market, commercialize one product in the U.S. and at least one other major market. CoNCERT may terminate the agreement if, following written notice and a 60-day opportunity to demonstrate a plan to cure, it believes that we are not using commercially reasonable efforts to develop and obtain regulatory approval for one product in the U.S. and in at least one other major market for any consecutive nine-month period.

The term of the CoNCERT License Agreement continues in full force and effect until the expiration of the last royalty term. On a country-by-country and product-by-product basis, upon the expiration of the royalty term in such country with respect to such product, we shall have a fully paid-up, perpetual, irrevocable license to such intellectual property with respect to such product in such country. In the event of a material breach of the CoNCERT Agreement, either party may terminate the agreement provided such breach is not cured in the 90 days following written notice of the breach (which is shortened to 15 days for a payment breach). In addition, either party may terminate the agreement upon an assignment for the benefit of creditors or the filing of an insolvency proceeding by or against the other party that is not dismissed within 90 days of such filing.

| 16 |

Government Regulation

The FDA and comparable regulatory authorities in state and local jurisdictions and in other countries impose substantial and burdensome requirements upon companies involved in the clinical development, manufacture, marketing and distribution of drugs, such as those we are developing. These agencies and other federal, state and local entities regulate, among other things, the research and development, testing, manufacture, quality control, safety, effectiveness, labeling, storage, record keeping, approval, advertising and promotion, distribution, post-approval monitoring and reporting, sampling and export and import of our product candidates.

U.S. Government Regulation

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, or FDCA, and its implementing regulations. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval, may subject an applicant to a variety of administrative or judicial sanctions, such as the FDA’s refusal to approve pending NDAs, withdrawal of an approval, imposition of a clinical hold, issuance of warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement or civil or criminal penalties.

The process required by the FDA before a drug may be marketed in the United States generally involves the following:

| ● | completion of pre-clinical laboratory tests, animal studies and formulation studies in compliance with the FDA’s good laboratory practice (GLP) regulations; | |

| ● | submission to the FDA of an IND application, which must become effective before human clinical trials may begin; |

| ● | approval by an independent Institutional Review Board (IRB), at each clinical site before each trial may be initiated; | |

| ● | performance of adequate and well-controlled human clinical trials in accordance with good clinical practices (GCP) requirements to establish the safety and efficacy of the proposed drug product for each indication; | |

| ● | submission to the FDA of an NDA; | |

| ● | satisfactory completion of an FDA advisory committee review, if applicable; | |

| ● | satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with cGMP requirements and to assure that the facilities, methods and controls are adequate to preserve the drug’s identity, strength, quality and purity; | |

| ● | FDA review and approval of the NDA, including consideration of the views of any FDA advisory committee, prior to commercial marketing or sale of the drug in the United States; and | |

| ● | compliance with any post-approval requirements, including the potential requirement to implement a Risk Evaluation and Mitigation Strategy (REMS) or to conduct a post-approval study. |

Pre-clinical studies

Before testing any biological product candidate in humans, including our product candidates, the product candidate must undergo rigorous pre-clinical testing. The pre-clinical developmental stage generally involves laboratory evaluations of drug chemistry, formulation and stability, as well as studies to evaluate toxicity in animals, to assess the potential for adverse events and, in some cases, to establish a rationale for therapeutic use. The conduct of pre-clinical studies is subject to federal regulations and requirements, including GLP regulations for safety/toxicology studies. An IND sponsor must submit the results of the pre-clinical studies, together with manufacturing information, analytical data, any available clinical data or literature and a proposed clinical protocol, to the FDA as part of the IND.

An IND is a request for authorization from the FDA to administer an investigational product to humans and must become effective before human clinical trials may begin. Some long-term pre-clinical testing, such as animal tests of reproductive adverse events and carcinogenicity, may continue after the IND is submitted. An IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA raises concerns or questions before that time related to one or more proposed clinical trials and places the trial on clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. As a result, submission of an IND may not result in the FDA allowing clinical trials to commence.

| 17 |

Clinical trials

The clinical stage of development involves the administration of the investigational product to healthy volunteers or patients under the supervision of qualified investigators, generally physicians not employed by, or under control of, the trial sponsor, in accordance with GCPs, which include the requirement that all research patients provide their informed consent for their participation in any clinical trial. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria and the parameters to be used to monitor subject safety and assess efficacy. Each protocol, and any subsequent amendments to the protocol, must be submitted to the FDA as part of the IND. Furthermore, each clinical trial must be reviewed and approved by an IRB for each institution at which the clinical trial will be conducted to ensure that the risks to individuals participating in the clinical trials are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the informed consent form that must be provided to each clinical trial subject or his or her legal representative and must monitor the clinical trial until completed. There also are requirements governing the reporting of ongoing clinical trials and completed clinical trial results to public registries. Information about most clinical trials must be submitted within specific timeframes for publication on www.clinicaltrials.gov. Information related to the product, patient population, phase of investigation, study sites and investigators and other aspects of the clinical trial is made public as part of the registration of the clinical trial. Sponsors are also obligated to disclose the results of their clinical trials after completion. Disclosure of the results of these trials can be delayed in some cases for up to two years after the date of completion of the trial. Competitors may use the publicly available information to gain knowledge regarding the progress of development programs.

Human clinical trials are typically conducted in three sequential phases, which may overlap or be combined: