UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| ☑ | |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 28, 20182024

| | | | | |

| ☐ | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33608

lululemon athletica inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 20-3842867 |

| | |

Delaware | | 20-3842867 |

(State or other jurisdiction of

incorporation or organization)

| | (I.R.S. Employer

Identification Number)

|

| |

|

1818 Cornwall Avenue, Vancouver, British Columbia V6J 1C7

Vancouver, British Columbia

| V6J 1C7 | | (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (604) 732-6124

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.005 per share | | LULU | | Nasdaq Global Select Market |

_______________________________________Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ☑ No o☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 ofor Section 15(d) of the Act. Yes o☐ No þ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ☑ No o☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ☑ No o☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one): | | | | | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | | ☑ | | Accelerated filer | | ☐ |

| | | | | | |

Large accelerated filer | | þ | | Accelerated filer | | o |

| Non-accelerated filer | | ☐ | | o (Do not check if a smaller reporting company)

| Smaller reporting company | | o☐ |

| Emerging growth company | | ☐ | | o | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Act). Yes o☐ No þ☑

The aggregate market value of the voting stock held by non-affiliates of the registrant on July 28, 20172023 was approximately $4,703,000,000.$40,905,000,000. Such aggregate market value was computed by reference to the closing price of the common stock as reported on the Nasdaq Global Select Market on July 28, 2017.2023. For purposes of determining this amount only, the registrant has defined affiliates as including the executive officers, directors, and owners of 10% or more of the outstanding voting stock of the registrant on July 28, 2017.2023.

Common Stock:

At March 21, 201815, 2024 there were 125,679,588120,892,132 shares of the registrant's common stock, par value $0.005 per share, outstanding.

Exchangeable and Special Voting Shares:

At March 21, 2018,15, 2024, there were outstanding 9,776,4215,115,961 exchangeable shares of Lulu Canadian Holding, Inc., a wholly-owned subsidiary of the registrant. Exchangeable shares are exchangeable for an equal number of shares of the registrant's common stock.

In addition, at March 21, 2018,15, 2024, the registrant had outstanding 9,776,4215,115,961 shares of special voting stock, through which the holders of exchangeable shares of Lulu Canadian Holding, Inc. may exercise their voting rights with respect to the registrant. The special voting stock and the registrant's common stock generally vote together as a single class on all matters on which the common stock is entitled to vote.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 20182024 Annual Meeting of Stockholders have been incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | Page |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| | |

| Item 15. | | |

| Item 16. | | |

| |

PART I

Special Note Regarding Forward-Looking Statements

This report and some documents incorporated herein by reference include estimates, projections, statements relating to our business plans, objectives, and expected operating results that are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We use words such as "anticipates," "believes," "estimates," "may," "intends," "expects," and similar expressions to identify forward-looking statements. Discussions containing forward-looking statements may be found in the material set forth under "Business", "Management's Discussion and Analysis of Financial Condition and Results of Operations", and in other sections of the report. All forward-looking statements are inherently uncertain as they are based on our expectations and assumptions concerning future events. Any or all of our forward-looking statements in this report may turn out to be inaccurate. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, and financial needs. They may be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including the risks, uncertainties and assumptions described in the section entitled "Item 1A. Risk Factors" and elsewhere in this report. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur as contemplated, and our actual results could differ materially from those anticipated or implied by the forward-looking statements. All forward-looking statements in this report are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement.

This annual report includes website addresses and references to additional materials found on those websites. These websites and information contained on or accessible through these websites are not incorporated by reference into, and do not form a part of, this Annual Report or any other report or document we file with the SEC, and any references to any websites are intended to be inactive textual references only. ITEM 1. BUSINESS

General

lululemon athletica inc. is principally a designer, distributor, and retailer of healthy lifestyle inspiredtechnical athletic apparel, footwear, and accessories. We have a missionvision to create transformationaltransformative products and experiences which enable people to live a life they love,that build meaningful connections, unlocking greater possibility and have developed a brandwellbeing for those pursuing an active, mindful lifestyle.all. Since our inception, we have fostered a distinctive corporate culture; we promote a set of core values in our business which include taking personal responsibility, nurturing entrepreneurial spirit, acting with honesty and courage, valuing connection and inclusion, and choosing to have fun. These core values attract passionate and motivated employees who are driven to achieve personal and professional goals, and share our purpose of "elevating the world through the power of practice."to elevate human potential by helping people feel their best."

In this Annual Report on Form 10-K ("10-K" or "Report") for the fiscal year ended January 28, 2018 ("fiscal 2017"),2024, lululemon athletica inc. (together with its subsidiaries) is referred to as "lululemon," "the Company," "we," "us""us," or "our." We refer to the fiscal year ended January 28, 2024 as "2023," the fiscal year ended January 29, 2023 as "2022," and the fiscal year ended January 30, 2022 as "2021." Our next fiscal year ends on February 2, 2025 and is referred to as "2024."

Components of this discussion of our business include:

Our Products

Our healthy lifestyle inspired athletic apparel and accessories are marketed under the lululemon and ivivva brand names. We offer a comprehensive line of performance apparel, footwear, and accessories for women, men and female youth.marketed under the lululemon brand. Our apparel assortment includes items such as pants, shorts, tops, and jackets designed for a healthy lifestyle and including

athletic activities such as yoga, running, training, and most other sweaty pursuits.activities. We also offer fitness-related accessories, including items such as bags, socks, underwear, yoga matsapparel designed for being on the move and equipment, and water bottles.fitness-inspired accessories. We expect to continue to broaden our merchandise offerings through expansion across these product areas.

Our design and development team continues to source technically advanced fabrics, with new feel and fit, and craft innovative functional features for our products. Through our vertical retail strategy and direct connection with our customers, whom we refer to as guests, we are able to collect feedback and incorporate unique performance and fashion needs into our design process. In this way, we believe we solve problems forare better positioned to address the needs of our guests, helping us advance our product lines and differentiate us from the competition.our competitors.

Although we benefit from the growing numberDuring 2023, our women's range represented 64% of people that participate in yoga, we believe the percentagenet revenue and our men's range represented 23% of our products sold for other activities will continue to increase as we broaden our product range.

net revenue. Our Market

Our guests seek a combination of performance, style, and sensation in their athletic apparel, choosing products that allow them to feel great however they exercise. Since consumer purchase decisions are driven by both an actual need for functional products and a desire to live a particular lifestyle, we believe the credibility of our brand and the authentic community experiences we offer expand our potential market beyond just athletes to those who pursue an active, mindful, and balanced life.

Although our primary and largest customer group is made up of women, we also design a comprehensive men's line and haveis a targeted strategy in place to servekey pillar of our male guests. Our businessstrategic growth plans. We believe net revenue from our men's range is growing as more menguests discover the technical rigor and premium quality of our men's products, and are attracted by our distinctive brand.

North AmericaWe continue to innovate and introduce new products for our guests. This includes introducing new product categories and expanding our accessories assortment. We believe this is another way in which we can attract new guests and enable them to experience our largest market by geographical split, offering a mature health and wellness industry and sophisticated consumer. Additionally, we are expanding internationally across Europe (including the United Kingdom and Germany) and Asia Pacific (including China, South Korea, and Japan). We are expandingproducts. Net revenue from our other product categories represented 13% of net revenue in these regions via a decentralized model, allowing for local community insight and consumer preference to inform our strategic expansion.2023.

Our Segments

We primarily conduct our business through two channels: company-operated storesMarkets and direct to consumer.

We also generate net revenue from outlets, sales from temporary locations, sales to wholesale accounts, showrooms, warehouse sales, and license and supply arrangements. The net revenue we generate from these sources is combined in our other segment.Segments

We operate in bothover 25 countries around the physicalworld and digital spaceorganize our operations into four regional markets: Americas, China Mainland, Asia Pacific ("APAC"), and Europe and the Middle East ("EMEA").

We report three segments, Americas, China Mainland, and Rest of World, which is comprised of the APAC and EMEA regions on a combined basis.

During the fourth quarter of 2023, we revised the financial information which our Chief Executive Officer, who is our chief operating decision maker ("CODM"), uses to better caterevaluate performance and allocate resources. This resulted in a change in our identified operating segments. As we have further executed on our omni-channel retail strategy, and continued to the shopping desires ofexpand our guest. At the end of fiscal 2017, we had 404 storesoperations in 12 countries across the globe. In addition to being a venue to sell product,international markets, our stores give us a direct connection to our guest, which we view as a valuable tool in helping us build our brandperformance reviews and product line.

Our direct to consumer segment includes the net revenue which we generate from our e-commerce website www.lululemon.com, other country and region specific websites, and mobile apps, including mobile apps on in-store devices that allow demandresource allocation decisions have evolved to be fulfilled viamade on a regional market basis. Our segment results have been recast to reflect our distribution centers.regional market-based structure. Historically, our segments were based on selling channel. We continue to monitor our revenue performance by our selling channels which are further described below.

Segment information is included in Note 19We operate an omni-channel retail model and aim to efficiently and effectively serve our audited consolidated financial statements included in Item 8 of Part II of this report.

Company-Operated Stores

As of January 28, 2018, our retail footprint included 404 company-operated stores. While most of our company-operated stores are branded lululemon, seven of our company-operated stores are branded ivivva and specialize in athletic wear for female youth. Our retail stores are located primarily on street locations, in lifestyle centers, and in malls.

Our company-operated stores by brand, and by country, as of January 28, 2018 and January 29, 2017, are summarizedguests in the table below:

|

| | | | | | |

| | | January 28,

2018 | | January 29,

2017 |

| lululemon | | | | |

United States(1) | | 270 |

| | 246 |

|

| Canada | | 57 |

| | 51 |

|

| Australia | | 28 |

| | 27 |

|

China(2) | | 15 |

| | 6 |

|

| United Kingdom | | 9 |

| | 9 |

|

| New Zealand | | 6 |

| | 5 |

|

| Singapore | | 3 |

| | 3 |

|

| South Korea | | 3 |

| | 2 |

|

| Germany | | 2 |

| | 1 |

|

| Japan | | 2 |

| | — |

|

| Ireland | | 1 |

| | — |

|

| Switzerland | | 1 |

| | 1 |

|

| | | 397 |

| | 351 |

|

| ivivva | | | | |

| United States | | 4 |

| | 42 |

|

| Canada | | 3 |

| | 13 |

|

| | | 7 |

| | 55 |

|

| Total | | 404 |

| | 406 |

|

__________

| |

(1)

| Included within the United States as of January 28, 2018 and January 29, 2017, was one company-operated store in the Commonwealth of Puerto Rico. |

| |

(2)

| Included within China as of January 28, 2018, were three company-operated stores in the Hong Kong Special Administrative Region and one company-operated store in the Taiwan Province. As of January 29, 2017, there were three company-operated stores in the Hong Kong Special Administrative Region and no company-operated stores in the Taiwan Province. |

We opened 46 net new lululemon branded company-operated stores in fiscal 2017, including 16 net new stores outside of North America.

We perform ongoing evaluations of our portfolio of company-operated store locations. In fiscal 2017, we closed three of our lululemon branded company-operated stores, and on August 20, 2017, as part of the restructuring of our ivivva operations, we closed 48 of our 55 ivivva branded company-operated stores. The seven remaining ivivva branded stores remain in operation and are not expectedways most convenient to close. As we continue our evaluation we may, in future periods, close or relocate additional company-operated stores.

In fiscal 2018, our new store growth will come primarily from new company-operated stores in the United States and an acceleration in our company-operated store openings in Asia. Our real estate strategy over the next several years will not only consist of opening new company-operated stores, but also in overall square footage growth through store expansions and relocations.

We believe that our innovative retail concept and guest experience contribute to the success of our stores. During fiscal 2017, our company-operated stores open at least one year, which average approximately 3,012 square feet, averaged sales of $1,554 per square foot. The square footage of our company-operated stores excludes space used for non-retail activities such as yoga studios and office space.

Direct to Consumer

Direct to consumer is a substantial part of our business, representing approximately 21.8% of our net revenue in fiscal 2017. We believe that e-commerce is convenient for our core customer and enhances the image of our brand. Our direct to consumer channel makes our product accessible to more markets than our company-operated store channel alone. We believe this channel is effective in building brand awareness, especially in new markets.

them. We continue to evolve and integrate our digital and physical channels in order to enrich our interactions with our guests, and to provide an enhanceda seamless omni-channel experience. We have invested in technologies which enable our omni-channel retailing model. Our capabilities differ by market and include:

Other Channels•Buy online pick-up in store - guests can purchase our products via our website or digital app and then collect that product from a retail location;

Other•Back-back room - our store educators can access inventory located at our other locations and have product shipped directly to a guest's address or a store;

•Ship from store – we are able to fulfill e-commerce orders by accessing inventory at both our distribution centers and at our retail locations, expanding the pool of accessible inventory;

•Returns processing – e-commerce guests are able to return products either online or in-store; and

•One inventory pool – we are able to view and allocate the product held at our distribution centers to either our physical retail locations, or make it available to fulfill online demand.

We operate a combination of physical retail locations and e-commerce services via our websites, other region-specific websites, digital marketplaces, and mobile apps. Our physical retail locations remain a key part of our growth strategy and we view them as a valuable tool in helping us build our brand and product line as well as enabling our omni-channel capabilities. We plan to continue to expand square footage and open new company-operated stores to support our growth objectives.

Americas

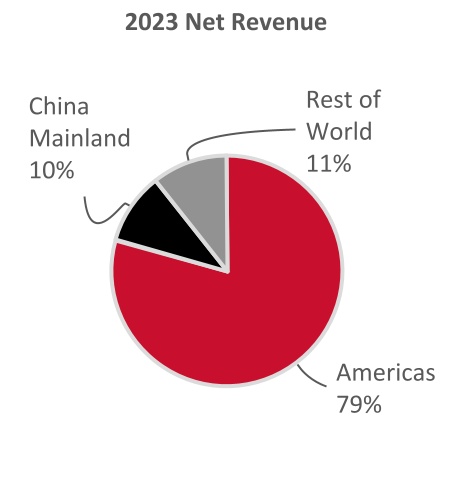

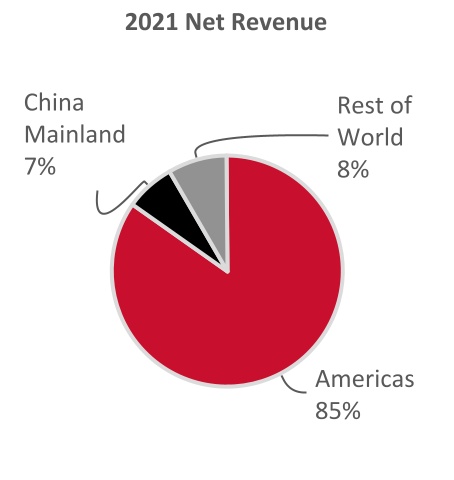

We have operated in the Americas for over 25 years. We opened our first ever store in Vancouver, Canada in 1998. In 2023, the net revenue accounted for 8.9%we generated in the Americas represented 79% of our total net revenue.

| | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2022 | | 2021 |

| | (In thousands) |

| Net revenue | | $ | 7,631,647 | | | $ | 6,817,454 | | | $ | 5,299,906 | |

| | | | | | |

| Net revenue growth | | 11.9 | % | | 28.6 | % | | 40.3 | % |

Our operations in the Americas are core to our business and we aim to continue to grow our net revenue in fiscal 2017, comparedthis market through ongoing product innovation and by building brand awareness. We also plan to 8.0%continue to invest in fiscal 2016,our omni-channel capabilities, to open new retail locations, and 6.9% of totalto relocate, optimize, and renovate our existing locations as needed.

We generate net revenue in the Americas through our lululemon branded retail locations which include different sizes of company-operated stores, outlets, pop-ups, other temporary locations, and stores operated by a third-party under a supply and license agreement in Mexico. We also serve our guests via our e-commerce website www.lululemon.com, our mobile app, our “Like New” re-commerce program, and through certain wholesale arrangements including certain yoga and fitness studios, university campus retailers, and other select partners.

China Mainland

We opened our first store in China Mainland in fiscal 2015. Other2014. In 2023, the net revenue we generated in China Mainland represented 10% of our total net revenue.

| | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2022 | | 2021 |

| | (In thousands) |

| Net revenue | | $ | 963,760 | | | $ | 576,503 | | | $ | 434,261 | |

| | | | | | |

| Net revenue growth | | 67.2 | % | | 32.8 | % | | 80.3 | % |

We have experienced significant net revenue growth in China Mainland and believe that as we continue to expand our operations and build our brand awareness, net revenue will continue to increase in this market. We believe China Mainland net revenue growth will drive an increase in our overall international net revenue. We plan to continue to invest in China Mainland and expect that the majority of our company-operated store openings in 2024 will be in this market.

We operate lululemon branded retail locations in China Mainland in a variety of different formats including different sizes of company-operated stores, outlets, pop-ups, and other temporary locations. We also serve our guests via our WeChat store and on third party marketplaces such as T-Mall and JD.com.

Rest of World

In 2023, the net revenue we generated in APAC and EMEA represented 11% of our total net revenue.

| | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2022 | | 2021 |

| | (In thousands) |

| Net revenue | | $ | 1,023,871 | | | $ | 716,561 | | | $ | 522,450 | |

| | | | | | |

| Net revenue growth | | 42.9 | % | | 37.2 | % | | 36.3 | % |

We have experienced significant net revenue growth in APAC and EMEA and intend to continue to invest in these markets to build brand awareness. Where we identify growth opportunities, we plan to open new retail locations, including in new markets across the EMEA and APAC regions.

We operate lululemon branded retail locations in these markets in a variety of different formats including different sizes of company-operated stores, outlets, pop-ups, and stores operated by third-parties under supply and license agreements in the Middle East and Israel. We also serve our guests via our country specific websites, our mobile app, and through third party regional marketplaces, such as Zalando, Lazada, and SSG.

Our Selling Channels

We conduct our business through a number of different channels in each market:

Company-operated stores: In addition to serving as a venue to sell our products, our stores give us a direct connection to our guests, which we view as a valuable tool in helping us build our brand and product lines as well as enabling our omni-channel capabilities. Our retail stores are located primarily on street locations, in lifestyle centers, and in malls. Our sales per square foot was $1,609, $1,580, and $1,443 for 2023, 2022, and 2021 respectively.

| | | | | | | | | | | | | | |

| Number of company-operated stores by market | | January 28, 2024 | | January 29, 2023 |

| United States | | 367 | | | 350 | |

| Canada | | 71 | | | 69 | |

| Americas | | 438 | | | 419 | |

| | | | |

| China Mainland | | 127 | | | 99 | |

| | | | |

| Australia | | 33 | | | 32 | |

| South Korea | | 19 | | | 16 | |

| Hong Kong SAR | | 9 | | | 9 | |

| Japan | | 8 | | | 7 | |

| New Zealand | | 8 | | | 8 | |

| Taiwan | | 8 | | | 7 | |

| Singapore | | 7 | | | 8 | |

| Malaysia | | 3 | | | 2 | |

| Macau SAR | | 2 | | | 2 | |

| Thailand | | 1 | | | — | |

| APAC | | 98 | | | 91 | |

| | | | |

| | | | | | | | | | | | | | |

| Number of company-operated stores by market | | January 28, 2024 | | January 29, 2023 |

| United Kingdom | | 20 | | | 20 | |

| Germany | | 9 | | | 10 | |

| France | | 6 | | | 4 | |

| Ireland | | 4 | | | 4 | |

| Spain | | 3 | | | 3 | |

| Netherlands | | 2 | | | 1 | |

| Sweden | | 2 | | | 2 | |

| Norway | | 1 | | | 1 | |

| Switzerland | | 1 | | | 1 | |

| EMEA | | 48 | | | 46 | |

| | | | |

| Total company-operated stores | | 711 | | | 655 | |

E-commerce: We believe e-commerce is convenient for our guests and also allows us to reach and serve guests in markets beyond where our physical retail locations are based. We believe this channel is effective in building brand awareness, especially in new markets. We serve our guests via our e-commerce websites, other country and region-specific websites, digital marketplaces, and mobile apps. E-commerce net revenue includes sales made throughour buy online pick-up in store, back-back room, and ship from store omni-channel retailing capabilities.

Other channels: We also use certain other distribution channels, generally with the following channels:goal of building brand awareness and providing broader access to our products. These other channels include:

Outlets and warehouse sales - We utilize outlets as well as physical warehouse sales, which are held from time to time, to sell slow moving inventory and inventory from prior seasons to retail customers at discounted prices.

•Temporary locations- Our temporary locations, including seasonal stores and pop-ups are typically opened for a short period of time enabling us to serve guests during peak shopping periods in markets in whichwhere we maydo not alreadyordinarily have a presence.

physical location, or to expand access in markets where we see high demand at our existing locations.•Wholesale - We sell to partners that offer convenient access for both core and new guests, including yoga and fitness studios, university campus retailers, and other select partners.

Wholesale•Outlets - We utilize outlets to sell slower moving inventory and inventory from prior seasons at discounted prices. As of January 28, 2024, we operated 47 outlets, the majority of which were in the Americas.

•Like New - Our wholesale accounts include premium yoga studios, health clubs,re-commerce program allows guests to exchange their gently used lululemon products for merchandise credit. Those products are then verified and fitness centers.quality checked before being resold online at likenew.lululemon.com. We believe these premium wholesale locations offer an alternative distribution channel thatthis program is convenient fora step towards a circular eco-system and helps reduce our core consumer and enhances the image of our brand. We do not intend wholesale to be a significant contributor to overall sales. Instead, we use the channel to build brand awareness, especially in new markets, including those outside of North America.

environmental footprint.Showrooms - Our showrooms are typically small locations that we open when we enter new markets and feature a limited selection of our product offering.

•License and supply arrangements- We enter into license and supply arrangements from time to time when we believe that it will be to our advantage to partner with companies and individualsthird parties with significant experience and proven success in certain target markets.

We Under these arrangements we have entered into license and supply arrangements with partners in the Middle East and Mexico which grant themgranted certain third parties the right to operate lululemon branded retail locations in the United Arab Emirates, Kuwait, Qatar, Oman, Bahrain, and Mexico. We retain the rights to sell lululemon products through our e-commerceon websites in thesespecific countries. Under these arrangements we supply the partners with lululemon products, training and other support. The initial term

| | | | | | | | | | | | | | |

| Number of retail locations operated by third parties by market | | January 28, 2024 | | January 29, 2023 |

| Mexico | | 15 | | | 12 | |

| United Arab Emirates | | 8 | | | 7 | |

| Saudi Arabia | | 6 | | | 3 | |

| Israel | | 3 | | | — | |

| Kuwait | | 3 | | | 1 | |

| Qatar | | 3 | | | 3 | |

| Bahrain | | 1 | | | — | |

| Total locations operated by third parties under license and supply arrangements | | 39 | | | 26 | |

Integrated Marketing

We believe that our brand awareness is relatively low, especially outside of the agreementAmericas, and also with our male guests. This represents an opportunity for the Middle East expires in January 2020,us and the initial term of the agreement for Mexico expires in November 2026. As of January 28, 2018, there were three licensed retail locations in the United Arab Emirates, one in Qatar, and one in Mexico, which are not included in the above company-operated stores table.

Community-Based Marketing

We utilizewe have a community-based approachmulti-faceted strategy to build brand awareness, affinity, and customerguest loyalty. We pursue a multi-facetedThis strategy which leveragesis designed to leverage owned and paid channels, our ambassador network, brand partners, events, and content – to drive awareness, consideration, engagement, conversion, and ultimately loyalty and engagement at the global, regional, and local teams and ambassadors, digital marketing and social media, in-store community boards, and a variety of grassroots initiatives. Our first global marketing campaign launched in fiscal 2017, and we plan to continue to explore how we complement and amplify our community-based initiatives with global brand-building activity.levels.

Product Design and Development

Our product design and development efforts are led by a team of researchers, scientists, engineers, and designers based in Vancouver, British Columbia, partnering with international designers. Our team is comprised of athletes and users of our products who embody our design philosophy and dedication to premium quality. Our design and development team identifies trends based on market intelligence and research, proactively seeks the input of our guests and our ambassadors, and broadly seeks inspiration consistent with our goals of function, style, and technical superiority.

As we strive to continue to provide our guests with technically advanced fabrics, our team works closely with our suppliers to incorporate the latest in technical innovation, bringing particular specifications to our products. We partner with independent inspection, verification, and testing companies, who conduct a variety of tests on our fabrics, testing performance characteristics including pilling, shrinkage, abrasion resistance, and colorfastness. We develop proprietary fabrics and collaborate with leading fabric and trims suppliers to manufacture fabrics and trims that we ultimatelygenerally seek to protect through agreements, trademarks, and as trade-secrets.

Sourcing and Manufacturing

We do not own or operate any manufacturing facilities. We rely on a limited number of suppliers to provide fabrics for, and to produce, our products. The following statistics are based on cost.

We work with a group of approximately 65 suppliers to provide the fabrics for our products. We work with a group of approximately 4749 vendors that manufacture our products, five of which produced approximately 64%55% of

our products in fiscal 2017.2023, with the largest manufacturer producing 17%. During fiscal 2017, no single manufacturer produced more than 25% of our product offerings. During fiscal 2017, approximately 53%2023, 42% of our products were manufactured in South East Asia, approximately 25%Vietnam, 16% in South Asia, approximatelyCambodia, 11% in Sri Lanka, 10% in China, approximatelyIndonesia, and 8% in the Americas,Bangladesh, and the remainder in other regions.

We work with a group of approximately 67 suppliers to provide the fabrics for our products. In 2023, 52% of our fabrics were produced by our top five fabric suppliers, with the largest manufacturer producing 19%. During 2023, 40% of our fabrics originated from Taiwan, 26% from China Mainland, and 12% from Sri Lanka, and the remainder from other regions.

We also source other raw materials which are used in our products, including items such as content labels, elastics, buttons, clasps, and drawcords from suppliers located predominantly in APAC and China Mainland.

We have developed long-standing relationships with a number of our vendors and take great care to ensure that they share our commitment to quality and ethics. We do not, however, have any long-term term contracts with the majority of our suppliers or manufacturing sources for the production and supply of our fabrics and garments, and we compete with other companies for fabrics, raw materials, and production. We require that all of our suppliers and manufacturers adhere to a vendor codeour Vendor Code of ethicsEthics regarding social and environmental sustainability practices. Our product quality and sustainability teams partner with leading inspectionclosely assess and verification firms to closely monitor each supplier's compliance with applicable laws and our vendor codeVendor Code of ethics.Ethics, including by partnering with leading inspection and verification firms.

Distribution Facilities

We operate and distribute finished products from our distribution facilities in the United States, Canada, and Australia. We own our distribution center in Columbus,Groveport, Ohio, and lease our other distribution facilities. The approximate square footage of each facility is included in Item 2 of Part I of this report. We also utilize third-party logistics providers in a number of countries in which we operate to warehouse and distribute finished products from their warehouse locations in Hong Kong, Rotterdam,locations. We regularly evaluate our distribution infrastructure and Shanghai.consolidate or expand our distribution capacity as we believe appropriate for our operations and to meet anticipated needs.

Competition

Competition in the athletic apparel industry is based principally on brand image and recognition as well as product quality, innovation, style, distribution, and price. We believe that we successfully compete on the basis of our premium brand image and our technical product innovation. We also believe our ability to introduce new product innovations, and combine function and fashion, and connect through in-store, online, and community experiences sets us apart from our competition. In

addition, we believe our vertical retail distribution strategy and community-based marketing differentiates us further, allowing us to more effectively control our brand image and connect with our guest.guests.

The market for athletic apparel is highly competitive. It includes increasing competition from established companies that are expanding their production and marketing of performance products, as well as from frequent new entrants to the market. We are in direct competition with wholesalers and direct sellers of athletic apparel and footwear, such as Nike, Inc., adidas AG, andPUMA, Under Armour, Inc., and Columbia Sportswear Company. We also compete with retailers specifically focused onwho have expanded to include women's athletic apparel including The Gap, Inc. (including the Athleta brand), Victoria's Secret with its sport and L Brands,lounge offering, and Urban Outfitters, Inc. (including the Victoria Sport assortment at Victoria's Secret).

Seasonality

Our business is affected by the general seasonal trends common to the retail apparel industry. Our annual net revenue is typically weighted more heavily toward our fourth fiscal quarter, reflecting our historical strength in sales during the holiday season in the Americas, while our operating expenses are generally more equally distributed throughout the year. As a result, a substantial portion of our operating profits are typically generated in the fourth quarter of our fiscal year. For example, we generated approximately 56%, 47%, and 45%43% of our full year operating profit during the fourth quartersquarter of fiscal 2017, fiscal 2016,2023.

Human Capital

Our Impact Agenda sets out our social and fiscal 2015, respectively. Excludingenvironmental goals and strategy across three pillars - Be Human, Be Well, and Be Planet. Details can be found in our Impact Report on our website (https://corporate.lululemon.com/our-impact).

Included within our Impact Agenda is a goal to invest a total of $75.0 million to advance equity in well-being by the costsend of 2025. As of January 28, 2024, we incurred in connection with the ivivva restructuring, we generated approximately 51%have invested a total of $44.8 million(1) towards this goal.

The Be Human pillar of our operating profit duringImpact Agenda sets out our focus areas with respect to human capital, including:

•Inclusion, Diversity, Equity, and Action (“IDEA”);

•Employee empowerment; and

•Fair labor practices and the fourth quarterwell-being of fiscal 2017.the people who make our products.

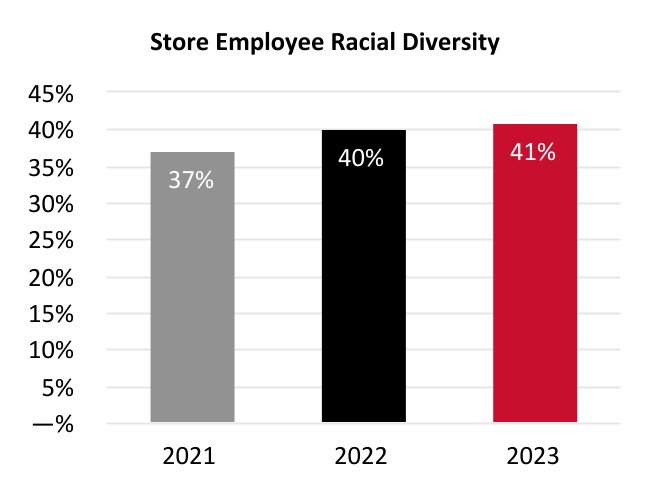

Inclusion, Diversity, Equity and Action

We believe IDEA is fundamental for shaping and building our company, industry, and communities, and for creating a shared sense of respect and belonging. By continuously striving to be an inclusive, diverse, and equitable organization, we aim to reflect a variety of perspectives and meet the needs of the global communities we serve. We are proud that as of January 28, 2024, approximately 50% of our board of directors, 70% of our senior executive leadership team, and 50% of our vice presidents and above are women, while approximately 75% of our overall workforce are women.(2)

(1) We have contributed $44.8 million to lululemon's Centre for Social Impact, $32.4 million of which has been contributed directly to social impact organizations. The remaining $12.4 million primarily consists of contributions toward a donor-advised fund for future grant making.

(2) While we track male and female genders, we acknowledge this is not fully encompassing of all gender identities.

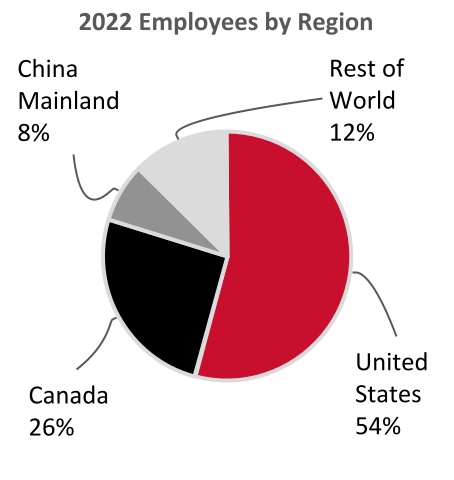

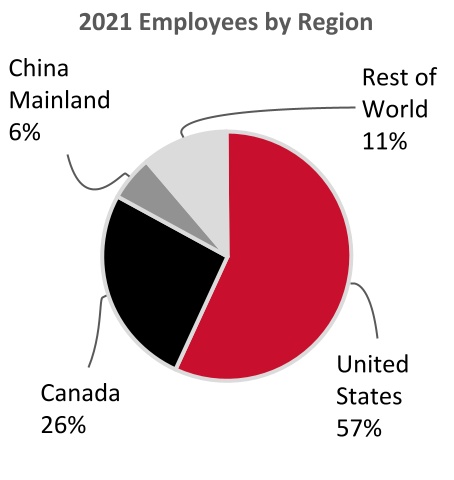

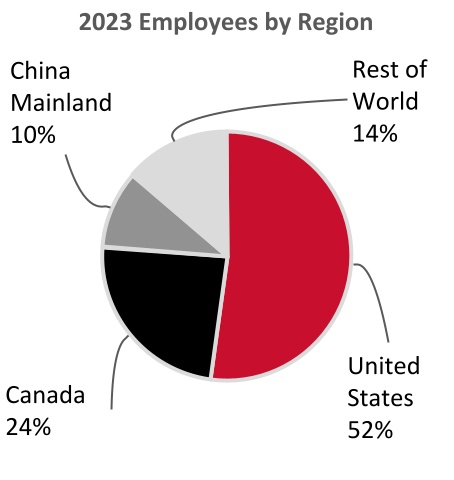

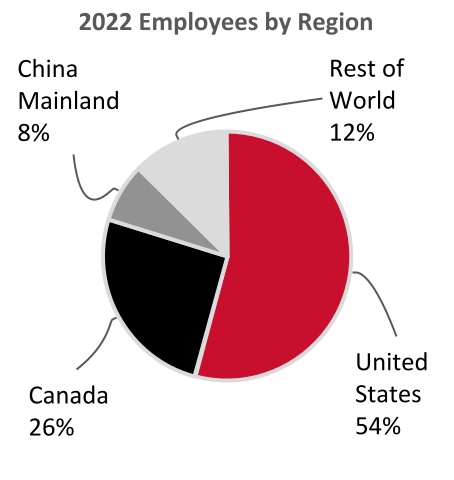

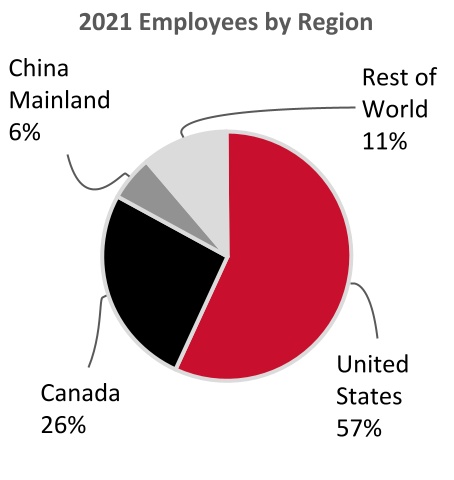

We use an annual voluntary global survey to help us understand the demographics of our employee base and provide us with access to tangible metrics to help us understand our employees’ sense of inclusion and belonging.(3) In 2023, the participation rate was approximately 85%. Our Employeesoverall goal is to reflect the racial diversity(4) of the communities we serve and in which we operate.

We seek to maintain 100% gender pay equity within our entire global employee population, meaning equal pay for equal work across genders, by geography. We have achieved full pay equity, including gender and race, in the United States, which is the only country where we currently collect individually attributable race data.

We offer all employees IDEA education, training, and guided conversations on a variety of topics, including anti-racism, anti-discrimination, and inclusive leadership behaviors. We have established People Networks, which are employee resource groups for employees who have marginalized and historically underrepresented identities. We see significant engagement in IDEA education and training across our global employee base. We aim to foster a culture of inclusion by making IDEA part of our everyday conversation, and frequently review our policies, programs, and practices to identify ways to be more inclusive and equitable.

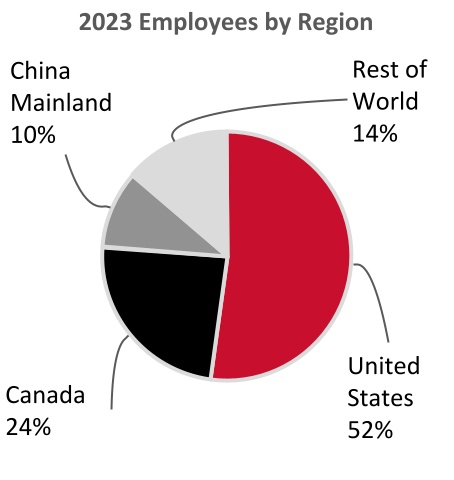

Employee Empowerment

We believe that our people are key to the success of our business, andbusiness. As of January 28, 2024 we employed approximately 38,000 people worldwide. We strive to foster a distinctive corporate culture rooted in our core business values which attractthat attracts and retains passionate and motivated employees who are driven to achieve personal and professional goals. We believe our people succeed because we create an environment that fosters growth and is diverse and equitable.

As of January 28, 2018, we had approximately 13,400 employees, of which approximately 7,900 were employed in the United States, approximately 3,800 were employed in Canada, and approximately 1,700 were employed outside of North America. None

(3) The voluntary demographic survey results presented above relate to all of our employees in the Americas, Europe, Australia, and New Zealand.

(4) "Racial diversity" is used to measure the non-white population.

We assess our performance and identify opportunities for improvement through an annual employee engagement survey. In 2023, the participation rate was approximately 85% and our employee engagement score exceeded the retail industry average.(5) Our engagement score suggests our people are currently covered byproud to work for lululemon, they are motivated to contribute to work that aligns with their purpose, and they recommend lululemon as a great place to work.

We understand that health and wealth programs need to offer choice at all stages of life. Our current offerings support our goal of becoming the number one place where people come to develop and grow as inclusive leaders, and we regularly use feedback to inform opportunities to support this goal. These offerings include, among other things:

•Competitive compensation which rewards exceptional performance;

•A Fund your Future program for eligible employees which offers partial contribution matches to a pension plan and employee share purchase plan;

•An annual paid VALUES (Volunteer, Awareness, Life, Unity, Empowerment, Support) Day, competitive paid time off, and sick leave;

•An employee discount program, which includes a lifetime discount to celebrate the contribution of our long-tenured employees to keep them within our collective, bargaining agreement. Weeven when they have had no labor-related work stoppages bymoved on to pursue goals outside of lululemon;

•Reimbursement programs which reward physical activity;

•A parenthood program which is a gender-neutral benefit that provides all eligible employees up to six months of paid leave;

•An employee assistance program which provides free confidential support to all our employees and their families in a variety of areas from mental well-being to financial services to advice for new parents; and

•Training and development of all of our employees including, but not limited to, mentorship programs, IDEA internships, leadership development, vision and goals, and coaching.

Fair Labor Practices and the Well-Being of the People who Make our Products

We work with suppliers who we believe share our relationsvalues and collaborate with us to uphold robust standards, address systemic challenges, and support the well-being of people who make our employeesproducts. Our Responsible Supply Chain program is built on three pillars:

•Monitoring - Assessing and improving working conditions in factories.

•Integration - Integrating responsible purchasing practices across enterprise strategies, processes, and tools.

•Collaboration - Working with multi-stakeholder organizations, industry, suppliers, and brands to support systemic change and impact.

Our Vendor Code of Ethics outlines our commitment to respect human and labor rights, and promote safe and fair working conditions for people in our supply chain. The code, which is based on international standards, sets the minimum standards for our supplier partners and is a component of our supplier and manufacturer agreements. Our finished goods and fabric suppliers are excellent.assessed against the Vendor Code of Ethics prior to forming a business relationship, and regularly thereafter; we work with factories that can uphold our strict requirements.

Our Foreign Migrant Worker Standard sets out our minimum requirements for what we believe are the appropriate and ethical recruitment, employment, and repatriation of foreign migrant workers.

Intellectual Property

We have trademark rights on mostmany of our products and believe having distinctive marks that are readily identifiable is an important factor in building our brand image and in distinguishing our products from the products of others. We consider our lululemon and wave design trademarks to be among our most valuable assets. In addition, we own many other trademarks for

the names of several of our brands, slogans, fabrics and products. We own registered and pending U.S. and foreign utility and design patents, industrial designs in Canada, and registered community designs in Europe that protect our product innovations, distinctive apparel, and accessory designs.

(5) Based on an industry benchmark provided by the third party that administers this survey to our employees.

Securities and Exchange Commission Filings

Our website address is www.lululemon.com. We provide free access to various reports that we file with, or furnish to, the United States Securities and Exchange Commission, or the SEC, through our website, as soon as reasonably practicable after they have been filed or furnished. These reports include, but are not limited to, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports. Our SEC reports can also be accessed through the SEC's website at www.sec.gov. The public may read and copy any materials filed by us with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also available on our website are printable versions of our Global Code of Business Conduct and Ethics and charters of the Audit, Compensation, and Nominating and Governance Committeesstanding committees of our board of directors. Information contained on or accessible through our websitewebsites is not incorporated into, and does not constituteform a part of, this annual report on Form 10-KAnnual Report or any other report or document we file or furnish with the SEC.SEC, and any references to our websites are intended to be inactive textual references only.

ITEM 1A. RISK FACTORS

In addition to the other information contained in this Form 10-K, the following risk factors should be considered carefully in evaluating our business. Our business, financial condition, or results of operations could be materially adversely affected byas a result of any of these risks. Please note that additional risks not presently known

Risks related to us or that we currently deem immaterial could also impair our business and operations.industry

Our success depends on our ability to maintain the value and reputation of our brand.

Our success depends on the value and reputation of the lululemon brand. The lululemon name is integral to our business as well as to the implementation of our strategies for expanding our business.expansion strategies. Maintaining, promoting, and positioning our brand will depend largely on the success of our marketing and merchandising efforts and our ability to provide a consistent, high quality product, and guest experience. We rely on social media, as one of our marketing strategies, to have a positive impact on both our brand value and reputation. Our brand and reputation could be adversely affected if we fail to achieve these objectives, if our public image was to be tarnished by negative publicity, which could be amplified by social media, if we fail to deliver innovative and high quality products acceptable to our guests, or if we face or mishandle a product recall. NegativeOur reputation could also be impacted by adverse publicity, whether or not valid, regarding allegations that we, or persons associated with us or formerly associated with us, have violated applicable laws or regulations, including but not limited to those related to safety, employment, discrimination, harassment, whistle-blowing, privacy, corporate citizenship, improper business practices, or cybersecurity. Certain activities on the production methodspart of any ofstakeholders, including nongovernmental organizations and governmental institutions, could cause reputational damage, distract senior management, and disrupt our suppliers or manufacturers could adversely affect our reputation and sales and force us to locate alternative suppliers or manufacturing sources.business. Additionally, while we devote considerable effortseffort and resources to protecting our intellectual property, if these efforts are not successful the value of our brand may be harmed. Any harm to our brand and reputation could have a material adverse effect on our financial condition.

Changes in consumer shopping preferences, and shifts in distribution channels could materially impact our results of operations.

We operate an omni-channel retail model and aim to efficiently and effectively serve our guests in the ways most convenient to them. We operate a combination of physical retail locations and e-commerce services via our websites, other region-specific websites, digital marketplaces, and mobile apps. Our physical retail locations remain a key part of our growth strategy and we view them as a valuable tool in helping us build our brand and product line as well as enabling our omni-channel capabilities. We plan to continue to expand square footage and open new company-operated stores to support our growth objectives. The diversion of sales from our company-operated stores could adversely impact our return on investment and could lead to impairment charges and store closures, including lease exit costs. We could have difficulty in recreating the in-store experience through direct channels. Our failure to successfully integrate our digital and physical channels and respond to these risks might adversely impact our business and results of operations, as well as damage our reputation and brand.

If any of our products have manufacturing or design defects or are otherwise unacceptable to us or our guests, our business could be harmed.

We have occasionally received, and may in the future receive, shipments of products that fail to comply with our technical specifications or that fail to conform to our quality control standards. We have also received, and may in the future receive, products that are otherwise unacceptable to us or our guests. Under these circumstances, unless we are able to obtain replacement products in a timely manner, we risk the loss of net revenue resulting from the inability to sell those products and related increased administrative and shipping costs. Additionally, if the unacceptability of our products is not discovered until after such products are purchased by our guests,sold, our guests could lose confidence in our products or we could face a product recall and our results of operations could suffer and our business, reputation, and brand could be harmed.

Our lululemon Studio subsidiary offers complex hardware and software products and services that can be affected by design and manufacturing defects. Sophisticated operating system software and applications, such as those offered by lululemon Studio, often have issues that can unexpectedly interfere with the intended operation of hardware or software products. Defects may also exist in components and products that we source from third parties. Any defects could make our products and services unsafe and create a risk of environmental or property damage or personal injury and we may become subject to the hazards and uncertainties of product liability claims and related litigation. The occurrence of real or perceived defects in any of our products, now or in the future, could result in additional negative publicity, regulatory investigations, or lawsuits filed against us, particularly if guests or others who use or purchase our lululemon Studio products are injured. Even if injuries are not the result of any defects, if they are perceived to be, we may incur expenses to defend or settle any claims and our brand and reputation may be harmed.

We operate in a highly competitive market and the size and resources of some of our competitors may allow them to compete more effectively than we can, resulting in a loss of our market share and a decrease in our net revenue and profitability.

The market for technical athletic apparel is highly competitive. Competition may result in pricing pressures, reduced profit margins or lost market share, or a failure to grow or maintain our market share, any of which could substantially harm our business and results of operations. We compete directly against wholesalers and direct retailers of athletic apparel, including large, diversified apparel companies with substantial market share, and established companies expanding their production and marketing of technical athletic apparel, as well as against retailers specifically focused on women's athletic apparel. We also face competition from wholesalers and direct retailers of traditional commodity athletic apparel, such as cotton T-shirts and sweatshirts. Many of our competitors are large apparel and sporting goods companies with strong worldwide brand recognition. Because of the fragmented nature of the industry, we also compete with other apparel sellers, including those

specializing in yoga apparel and other activewear. Many of our competitors have significant competitive advantages, including longer operating histories, larger and broader customer bases, more established relationships with a broader set of suppliers, greater brand recognition and greater financial, research and development, store development, marketing, distribution, and other resources than we do.

Our competitors may be able to achieve and maintain brand awareness and market share more quickly and effectively than we can. In contrast

We may fail to our "grassroots" marketing approach, manyacknowledge or react appropriately to the entry or growth of a viable competitor or disruptive force, and could struggle to continue to innovate, differentiate, and sustain the growth of our competitors promote their brands through traditional formsbrand. The increasing dominance and presence of advertising, such as print media and television commercials, and through celebrity endorsements, and have substantial resources to devote to such efforts. Our competitorsour brand may also create and maintain brand awareness using traditional forms of advertising more quickly than we can. Our competitors may also be able to increase sales in their new and existing markets faster than we do by emphasizing different distribution channels than we do, such as catalog sales or an extensive franchise network.drive guests towards alternative emerging competitors.

In addition, because we hold limited patents and exclusive intellectual property rights in the technology, fabrics or processes underlying our products, our current and future competitors are able to manufacture and sell products with performance characteristics, fabrication techniques, and styling similar to our products.

Our reliance on suppliers to provide fabrics for and to produce our products could cause problems in our supply chain.

We do not manufacture our products or the raw materials for them and rely instead on suppliers. Many of the specialty fabrics used in our products are technically advanced textile products developed and manufactured by third parties and may be available, in the short-term, from only one or a very limited number of sources. We work with a group of approximately 65 suppliers to provide the fabrics for our products. In fiscal 2017, approximately 59% of our fabrics were produced by our top five fabric suppliers, and no single manufacturer produced more than 35% of raw materials used. We work with a group of approximately 47 vendors that manufacture our products, five of which produced approximately 64% of our products in fiscal 2017. During fiscal 2017, no single manufacturer produced more than 25% of our product offerings. We have no long-term contracts with any of our suppliers or manufacturing sources for the production and supply of our fabrics and garments, and we compete with other companies for fabrics, raw materials, and production.

We have experienced, and may in the future experience, a significant disruption in the supply of fabrics or raw materials from current sources and we may be unable to locate alternative materials suppliers of comparable quality at an acceptable price, or at all. In addition, if we experience significant increased demand, or if we need to replace an existing supplier or manufacturer, we may be unable to locate additional supplies of fabrics or raw materials or additional manufacturing capacity on terms that are acceptable to us, or at all, or we may be unable to locate any supplier or manufacturer with sufficient capacity to meet our requirements or to fill our orders in a timely manner. Identifying a suitable supplier is an involved process that requires us to become satisfied with its quality control, responsiveness and service, financial stability, and labor and other ethical practices. Even if we are able to expand existing or find new manufacturing or fabric sources, we may encounter delays in production and added costs as a result of the time it takes to train our suppliers and manufacturers in our methods, products, and quality control standards. Delays related to supplier changes could also arise due to an increase in shipping times if new suppliers are located farther away from our markets or from other participants in our supply chain. Any delays, interruption or increased costs in the supply of fabric or manufacture of our products could have an adverse effect on our ability to meet guest demand for our products and result in lower net revenue and income from operations both in the short and long term.

An economic downturn or economic uncertainty in our key markets may adversely affect consumer discretionary spending and demand for our products.

Many of our products may be considered discretionary items for consumers. Factors affecting the level of consumer spending for such discretionary items include general economic conditions, particularly those in North America, and other factors such as consumer confidence in future economic conditions, fears of recession, the availability and cost of consumer credit, levels of unemployment, and tax rates. As global economic conditions continue to be volatile or economic uncertainty remains, trends in consumer discretionary spending also remain unpredictable and subject to reductions due to credit constraints and uncertainties about the future. Unfavorable economic conditions may lead consumers to delay or reduce purchases of our products. Consumer demand for our products may not reach our targets, or may decline, when there is an economic downturn or economic uncertainty in our key markets, particularly in North America. Our sensitivity to economic cycles and any related fluctuation in consumer demand may have a material adverse effect on our financial condition.

Our sales and profitability may decline as a result of increasing product costs and decreasing selling prices.

Our business is subject to significant pressure on costs and pricing caused by many factors, including intense competition, constrained sourcing capacity and related inflationary pressure, the availability of qualified labor and wage inflation, pressure from consumers to reduce the prices we charge for our products, and changes in consumer demand. These and other factors have, and may in the future, cause us to experience increased costs, reduce

our prices to consumers or experience reduced sales in response to increased prices, any of which could cause our operating margin to decline if we are unable to offset these factors with reductions in operating costs and could have a material adverse effect on our financial conditions,condition, operating results, and cash flows.

If we are unable to anticipate consumer preferences and successfully develop and introduce new, innovative, and updateddifferentiated products, we may not be able to maintain or increase our sales and profitability.

Our success depends on our ability to identify and originate product trends as well as to anticipate and react to changing consumer demands in a timely manner. All of our products are subject to changing consumer preferences that cannot be predicted with certainty. If we are unable to introduce new products or novel technologies in a timely manner or our new products or technologies are not accepted by our guests, our competitors may introduce similar products in a more timely fashion, which could hurt our goal to be viewed as a leader in technical athletic apparel innovation. Our new products may not receive consumer acceptance as consumer preferences could shift rapidly to different types of athletic apparel or away from these types of products altogether, and our future success depends in part on our ability to anticipate and respond to these changes. Our failure to anticipate and respond in a timely manner to changing consumer preferences could lead to, among other things, lower sales and excess inventory levels. We may not have relevant data to effectively understand and react to consumer preferences and expectations. Even if we are successful in anticipating consumer preferences, our ability to adequately react to and address those preferences will in part depend upon our continued ability to develop and introduce innovative, high-quality products. Our failure to effectively introduce new products that are accepted by consumers could

result in a decrease in net revenue and excess inventory levels, which could have a material adverse effect on our financial condition.

Our results of operations could be materially harmed if we are unable to accurately forecast guest demand for our products.

To ensure adequate inventory supply, we must forecast inventory needs and place orders with our manufacturers based on our estimates of future demand for particular products. Our ability to accurately forecast demand for our products could be affected by many factors, including an increase or decrease in guest demand for our products or for products of our competitors, our failure to accurately forecast guest acceptance of new products, product introductions by competitors, unanticipated changes in general market conditions (for example, because of global economic concerns such as inflation, an economic downturn, or delays and disruptions resulting from local and international shipping delays and labor shortages), and weakening of economic conditions or consumer confidence in future economic conditions.conditions (for example, because of inflationary pressures, or because of sanctions, restrictions, and other responses related to geopolitical events). If we fail to accurately forecast guest demand, we may experience excess inventory levels or a shortage of products available for sale in our stores or for delivery to guests.

Inventory levels in excess of guest demand may result in inventory write-downs or write-offs and the sale of excess inventory at discounted prices, which would cause our gross margin to suffer and could impair the strength and exclusivity of our brand. Conversely, if we underestimate guest demand for our products, our manufacturers may not be able to deliver products to meet our requirements, and this could result in damage to our reputation and guest relationships.

Our inability to safeguard against security breaches with respect to our information technology systems could disrupt our operations.

Our business employs systems and websites that allow for the storage and transmission of proprietary or confidential information regarding our business, guests and employees including credit card information. Security breaches could expose us to a risk of loss or misuse of this information and potential liability. We may not have the resources or technical sophistication to be able to anticipate or prevent rapidly evolving types of cyber-attacks. Actual or anticipated attacks may cause us to incur increasing costs including costs to deploy additional personnel and protection technologies, train employees and engage third party experts and consultants. Advances in computer capabilities, new technological discoveries or other developments may result in the technology used by us to protect transaction or other data being breached or compromised. Data and security breaches can also occur as a result of non-technical issues including intentional or inadvertent breach by employees or persons with whom we have commercial relationships that result in the unauthorized release of personal or confidential information. Any compromise or breach of our security could result in a violation of applicable privacy and other laws, significant litigation and potential liability and damage to our brand and reputation or other harm to our business.

Any material disruption of our information technology systems or unexpected network interruption could disrupt our business and reduce our sales.

We are increasingly dependent on information technology systems and third-parties to operate our e-commerce websites, process transactions, respond to guest inquiries, manage inventory, purchase, sell and ship goods on a timely basis, and maintain cost-efficient operations. The failure of our information technology systems to operate properly or effectively, problems with transitioning to upgraded or replacement systems, or difficulty in integrating new systems, could adversely affect our business. In addition, we have e-commerce websites in the United States, Canada, and internationally. Our information technology systems, websites, and operations of third parties on whom we rely, may encounter damage or disruption or slowdown caused by a failure to successfully upgrade systems, system failures, viruses, computer "hackers" or

other causes, could cause information, including data related to guest orders, to be lost or delayed which could, especially if the disruption or slowdown occurred during the holiday season, result in delays in the delivery of products to our stores and guests or lost sales, which could reduce demand for our products and cause our sales to decline. In addition, if changes in technology cause our information systems to become obsolete, or if our information systems are inadequate to handle our growth, we could lose guests. We have limited back-up systems and redundancies, and our information technology systems and websites have experienced system failures and electrical outages in the past which have disrupted our operations. Any significant disruption in our information technology systems or websites could harm our reputation and credibility, and could have a material adverse effect on our business, financial condition and results of operations.

If the technology-based systems that give our customers the ability to shop with us online do not function effectively, our operating results, as well as our ability to grow our e-commerce business globally, could be materially adversely affected.

Many of our customers shop with us through our e-commerce websites and mobile apps. Increasingly, customers are using tablets and smart phones to shop online with us and with our competitors and to do comparison shopping. We are increasingly using social media and proprietary mobile apps to interact with our customers and as a means to enhance their shopping experience. Any failure on our part to provide attractive, effective, reliable, user-friendly e-commerce platforms that offer a wide assortment of merchandise with rapid delivery options and that continually meet the changing expectations of online shoppers could place us at a competitive disadvantage, result in the loss of e-commerce and other sales, harm our reputation with customers, have a material adverse impact on the growth of our e-commerce business globally and could have a material adverse impact on our business and results of operations.

Risks specific to our e-commerce business also include diversion of sales from our company-operated stores, difficulty in recreating the in-store experience through direct channels and liability for online content. Our failure to successfully respond to these risks might adversely affect sales in our e-commerce business, as well as damage our reputation and brands.

The fluctuating cost of raw materials could increase our cost of goods sold and cause our results of operations and financial condition to suffer.

The fabrics used by our suppliers and manufacturers include synthetic fabrics whose raw materials include petroleum-based products. Our products also include silver and natural fibers, including cotton. Our costs for raw materials are affected by, among other things, weather, consumer demand, speculation on the commodities market, the relative valuations and fluctuations of the currencies of producer versus consumer countries, and other factors that are generally unpredictable and beyond our control. Increases in the cost of raw materials, including petroleum or the prices we pay for silver and our cotton yarn and cotton-based textiles, could have a material adverse effect on our cost of goods sold, results of operations, financial condition, and cash flows.

Our limited operating experience and limited brand recognition in new international markets and new product categories may limit our expansion and cause our business and growth to suffer.

Our future growth depends in part on our expansion efforts outside of North America.the Americas. We have limited experience with regulatory environments and market practices internationally, and we may not be able to penetrate or successfully operate in any new market. In connection with our expansion efforts we may encounter obstacles we did not face in North America,the Americas, including cultural and linguistic differences, differences in regulatory environments, labor practices and market practices, difficulties in keeping abreast of market, business and technical developments, and foreigninternational guests' tastes and preferences. We may also encounter difficulty expanding into new international markets because of limited brand recognition leading to delayed acceptance of our technical athletic apparel by guests in these new international markets. Our failure to develop our business in new international markets or disappointing growth outside of existing markets could harm our business and results of operations.

If we encounter problems with our distribution system, our ability to deliver our products to the market and to meet guest expectations could be harmed.

We rely on our distribution facilities for substantially all of our product distribution. Our distribution facilities include computer controlled and automated equipment, which means their operations may be subject to a number of risks related to security or computer viruses, the proper operation of software and hardware, electronic or power interruptions, or other system failures. In addition, because substantially all of our products are distributed from four locations, our operations could also be interrupted by labor difficulties, extreme or severe weather conditions or by floods, fires or other natural disasters near our distribution centers. If we encounter problems with our distribution system, our ability to meet guest expectations, manage inventory, complete sales, and achieve objectives for operating efficiencies could be harmed.

Our fabrics and manufacturing technology generally are not patented and can be imitated by our competitors.

The intellectual property rightscontinued growth depends in the technology, fabrics, and processes used to manufacture our products generally are owned or controlled by our suppliers and are generally not unique to us. Our ability to obtain intellectual property protection for our products is therefore limited and we do not generally own patents or hold exclusive intellectual property rights in the technology, fabrics or processes underlying our products. As a result, our current and future competitors are able to manufacture and sell products with performance characteristics, fabrics and styling similar to our products. Because many of our competitors have significantly greater financial, distribution, marketing, and other resources than we do, they may be able to manufacture and sell products based on our fabrics and manufacturing technology at lower prices than we can. If our competitors do sell similar products to ours at lower prices, our net revenue and profitability could suffer.

Our failure or inability to protect our intellectual property rights could diminish the value of our brand and weaken our competitive position.

We currently rely on a combination of copyright, trademark, trade dress, and unfair competition laws, as well as confidentiality procedures and licensing arrangements, to establish and protect our intellectual property rights. The steps we take to protect our intellectual property rights may not be adequate to prevent infringement of these rights by others, including imitation of our products and misappropriation of our brand. In addition, intellectual property protection may be unavailable or limited in some foreign countries where laws or law enforcement practices may not protect our intellectual property rights as fully as in the United States or Canada, and it may be more difficult for us to successfully challenge the use of our intellectual property rights by other parties in these countries. If we fail to protect and maintain our intellectual property rights, the value of our brand could be diminished and our competitive position may suffer.

Our future success is substantially dependent on the continued service of our senior management and identifying and attracting our next Chief Executive Officer.

On February 2, 2018, our Chief Executive Officer resigned. In addition to this change, a number of members of our senior management team have left the Company in the last several years. These changes, or the loss of services of any of our other key executive officers or other members of our senior management team, or any negative public perception with respect to these individuals, may be disruptive to, or cause uncertainty in, our business and could have a negative impactpart on our ability to manageexpand our product categories and grow our business effectively. Such disruption could have a material adverse impact on our financial performance, financial condition, and the market price of our stock.