UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended February 2, 2020January 30, 2022

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from to

Commission file number 001-33608

lululemon athletica inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-3842867 | |||||||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |||||||

1818 Cornwall Avenue,, Vancouver,, British ColumbiaV6J 1C7

(Address of principal executive offices)

Registrant's telephone number, including area code: (604) (604) 732-6124

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $0.005 per share | LULU | Nasdaq Global Select Market | ||||||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. Yes ☐No☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☑ | Accelerated filer | ☐ | |||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||||||||||||||||

| Emerging growth company | ☐ | |||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting stock held by non-affiliates of the registrant on August 2, 2019July 30, 2021 was approximately $20,011,000,000.$44,414,000,000. Such aggregate market value was computed by reference to the closing price of the common stock as reported on the Nasdaq Global Select Market on August 2, 2019.July 30, 2021. For purposes of determining this amount only, the registrant has defined affiliates as including the executive officers, directors, and owners of 10% or more of the outstanding voting stock of the registrant on August 2, 2019.July 30, 2021.

Common Stock:

At March 20, 202023, 2022 there were 124,115,144122,710,357 shares of the registrant's common stock, par value $0.005 per share, outstanding.

Exchangeable and Special Voting Shares:

At March 20, 2020,23, 2022, there were outstanding 6,049,9395,203,012 exchangeable shares of Lulu Canadian Holding, Inc., a wholly-owned subsidiary of the registrant. Exchangeable shares are exchangeable for an equal number of shares of the registrant's common stock.

In addition, at March 20, 2020,23, 2022, the registrant had outstanding 6,049,9395,203,012 shares of special voting stock, through which the holders of exchangeable shares of Lulu Canadian Holding, Inc. may exercise their voting rights with respect to the registrant. The special voting stock and the registrant's common stock generally vote together as a single class on all matters on which the common stock is entitled to vote.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 20202022 Annual Meeting of Stockholders have been incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

| Page | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

PART I

Special Note Regarding Forward-Looking Statements

This report and some documents incorporated herein by reference include estimates, projections, statements relating to our business plans, objectives, and expected operating results that are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We use words such as "anticipates," "believes," "estimates," "may," "intends," "expects," and similar expressions to identify forward-looking statements. Discussions containing forward-looking statements may be found in the material set forth under "Business", "Management's Discussion and Analysis of Financial Condition and Results of Operations", and in other sections of the report. All forward-looking statements are inherently uncertain as they are based on our expectations and assumptions concerning future events. Any or all of our forward-looking statements in this report may turn out to be inaccurate. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, and financial needs. They may be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including the risks, uncertainties and assumptions described in the section entitled "Item 1A. Risk Factors" and elsewhere in this report. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur as contemplated, and our actual results could differ materially from those anticipated or implied by the forward-looking statements. All forward-looking statements in this report are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement.

This annual report includes website addresses and references to additional materials found on those websites. These websites and materials are not incorporated by reference herein.

ITEM 1. BUSINESS

General

lululemon athletica inc. is principally a designer, distributor, and retailer of healthy lifestyle inspired athletic apparel and accessories. We have a vision to be the experiential brand that ignites a community of people through sweat, grow, and connect, which we call "living the sweatlife." Since our inception, we have fostered a distinctive corporate culture; we promote a set of core values in our business which include taking personal responsibility, nurturing entrepreneurial spirit, acting with honesty and courage, valuing connection and inclusion, and choosing to have fun. These core values attract passionate and motivated employees who are driven to achieve personal and professional goals, and share our purpose "to elevate the world by unleashingrealizing the full potential within every one of us."

In this Annual Report on Form 10-K ("10-K" or "Report") for the fiscal year ended February 2, 2020 ("fiscal 2019"),January 30, 2022, lululemon athletica inc. (together with its subsidiaries) is referred to as "lululemon," "the Company," "we," "us""us," or "our." We refer to the fiscal year ended January 30, 2022 as "2021" and the fiscal year ended January 31, 2021 as "2020."

Components of this discussion of our business include:

Our Products

Our healthy lifestyle inspired athletic apparel and accessories are marketed under the lululemon brand. We offer a comprehensive line of apparel and accessories for women and men.accessories. Our apparel assortment includes items such as pants, shorts, tops, and jackets

1

designed for a healthy lifestyle including athletic activities such as yoga, running, training, and most other sweaty pursuits. We also offer a range of products designed for being On the Move, fitness-related accessories.accessories, and footwear. We expect to continue to broaden our merchandise offerings through expansion across these product areas.

Our design and development team continues to source technically advanced fabrics, with new feel and fit, and craft innovative functional features for our products. Through our vertical retail strategy and direct connection with our customers, whom we refer to as guests, we are able to collect feedback and incorporate unique performance and fashion needs into our design process. In this way, we believe we solve problems forare better positioned to address the needs of our guests, helping us advance our product lines and differentiate us from the competition.

Our Market

Our guests seek a combination of performance, style, and sensation in their athletic apparel, choosing products that allow them to feel great however they exercise. Since consumer purchase decisions are driven by both an actual need for functional products and a desire to live a particular lifestyle, we believe the credibility of our brand and the authentic community experiences we offer expand our potential market beyond just athletes to those who pursue an active, mindful, and balanced life.

Although our primary and largest customer group is made up of women,guests who shop our women's range, representing 67% of our 2021 net revenue, we also design a comprehensive men's line and have a targeted strategy in place to serve our male guests. Our businessplace. Revenue from men's range is growing as more menguests discover the technical rigor and premium quality of our men's products, and are attracted by our distinctive brand.

North America is our largest market by geographical split, offering a mature health and wellness industry and sophisticated consumer. Additionally, werepresenting 85% of our 2021 net revenue. We are expanding internationally across Europe, the People's Republic of China ("PRC"), and the rest of Asia Pacific.Pacific, and Europe. We are expanding in these regions via a decentralized model, allowing for local community insight and consumer preference to inform our strategic expansion.

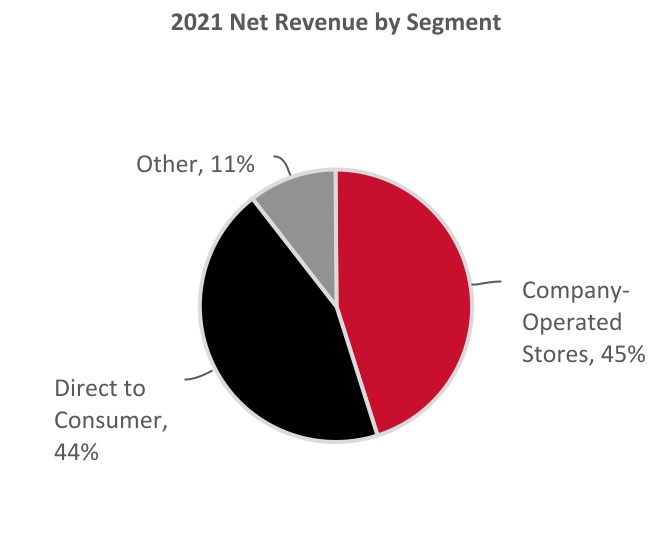

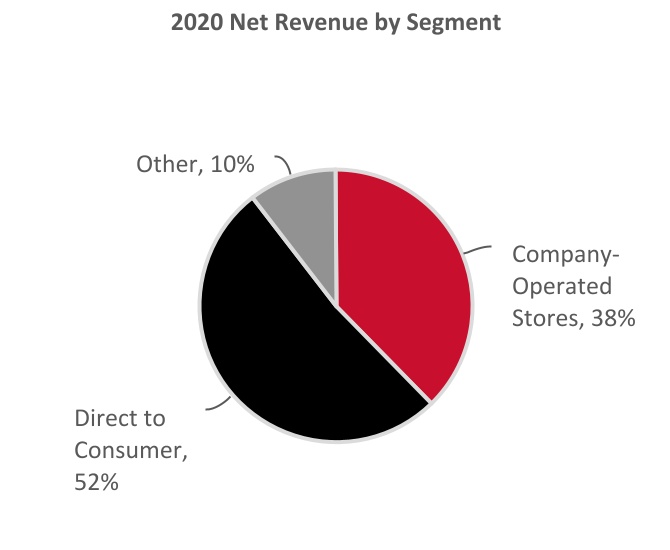

Our Segments

We primarily conduct our business through two channels: company-operated stores and direct to consumer.

We also generate net revenue fromoperate outlets sales fromand temporary locations, sales toconduct business through MIRROR, serve certain wholesale accounts, throughhave license and supply arrangements, and hold warehouse sales.sales from time to time. The net revenue we generate fromfinancial results of these sources is combinedoperations are disclosed in our other segment.Other.

2

Company-Operated Stores

At the end of fiscal 2019,2021, we had 491operated 574 stores in 17 countries across the globe. In addition to being a venue to sell product,our products, our stores give us a direct connection to our guest, which we view as a valuable tool in helping us build our brand and product line.

| Number of company-operated stores by country | January 30, 2022 | January 31, 2021 | ||||||||||||

| United States | 324 | 315 | ||||||||||||

People's Republic of China(1) | 86 | 55 | ||||||||||||

| Canada | 63 | 62 | ||||||||||||

| Australia | 31 | 31 | ||||||||||||

| United Kingdom | 17 | 16 | ||||||||||||

| South Korea | 12 | 7 | ||||||||||||

| Germany | 9 | 7 | ||||||||||||

| New Zealand | 7 | 7 | ||||||||||||

| Japan | 6 | 6 | ||||||||||||

| Singapore | 6 | 4 | ||||||||||||

| France | 3 | 3 | ||||||||||||

| Ireland | 3 | 1 | ||||||||||||

| Malaysia | 2 | 2 | ||||||||||||

| Sweden | 2 | 2 | ||||||||||||

| Netherlands | 1 | 1 | ||||||||||||

| Norway | 1 | 1 | ||||||||||||

| Switzerland | 1 | 1 | ||||||||||||

| Total company-operated stores | 574 | 521 | ||||||||||||

| February 2, 2020 | February 3, 2019 | |||||

| United States | 305 | 285 | ||||

| Canada | 63 | 64 | ||||

People's Republic of China(1) | 38 | 22 | ||||

| Australia | 31 | 29 | ||||

| United Kingdom | 14 | 12 | ||||

| Japan | 7 | 5 | ||||

| New Zealand | 7 | 7 | ||||

| Germany | 6 | 5 | ||||

| South Korea | 5 | 4 | ||||

| Singapore | 4 | 3 | ||||

| France | 3 | 1 | ||||

| Malaysia | 2 | — | ||||

| Sweden | 2 | 1 | ||||

| Ireland | 1 | 1 | ||||

| Netherlands | 1 | — | ||||

| Norway | 1 | — | ||||

| Switzerland | 1 | 1 | ||||

| Total company-operated stores | 491 | 440 | ||||

We opened 5153 net new company-operated stores in fiscal 2019,2021, including 3243 net new stores outside of North America.

We perform ongoing evaluations of our portfolio of company-operated store locations. During fiscal 2019,2021, we closed fourthree of our lululemon branded company-operated stores and two of our ivivva branded company-operated stores. As we continue our evaluations we may, in the future, periods, close or relocate additional company-operated stores.

In fiscal 2020,2022, our new store growth will come primarily from company-operated store openings in Asia and in the United States. Our real estate strategy over the next several years will not only consist of opening new company-operated stores, but also in overall square footage growth through store expansions and relocations.

We believe that our innovative retail concept and guest experience contribute to the success of our stores. We use sales per square foot to assess the performance of our company-operated stores relative to their square footage. We believe that sales per square foot is useful in evaluating the performance of our company-operated stores. During fiscal 2019, ourOur sales per square foot for 2021 was $1,657.$1,443. As a significant number of our stores were temporarily closed due to COVID-19 during the first two quarters of 2020, we do not believe sales per square foot for 2020 is useful to investors in understanding performance, therefore we have not included this metric.

Sales per square foot is calculated using total net revenue from all company-operated stores that opened, or opened in their significantly expanded space, prior to the current fiscal year. The total net revenue of these stores for the fiscal year is divided by the total square footage of these stores at the end of the year. The fiscal 2019 sales per square foot metric is based on an average square footage of 3,127 per store as of February 2, 2020.the stores during the year. In fiscal years with 53 weeks, the 53rd week of net revenue is excluded from the calculation of sales per square foot. The square footage of our company-operated stores includes all retail related space, storage areas, and administrative space used by the store employees. It excludes any space used for non-retail related activities. The sales per square foot metric we report may not be equivalent to similarly titled metrics reported by other companies.

3

Direct to Consumer

We serve our guests via our e-commerce website www.lululemon.com, other country and region-specific websites, and mobile apps, including mobile apps on in-store devices that allow demand to be fulfilled via our distribution centers or other retail locations.

We continue to evolve and integrate our digital and physical channels in order to enrich our interactions with our guests, and to provide an enhanced omni-channel experience.

Other Channels

•Outlets and warehouse sales - We utilize outlets as well as physical warehouse sales, which are held from time to time, to sell slow moving inventory and inventory from prior seasons at discounted prices. As of January 30, 2022, we operated 37 outlets, with the majority in North America.

•Temporary locations - Our temporary locations, including pop ups, are typically opened for 8.6%a short period of total net revenuetime. We believe these retail locations enable us to serve guests during peak shopping periods in fiscal 2019, comparedmarkets where we do not ordinarily have a physical location, or enable us to 9.2%better serve our guest in fiscal 2018,markets where we see high demand at our existing locations.

•MIRROR - We offer in-home fitness through an interactive workout platform that allows our guests to subscribe for live and 8.9%on-demand classes.

•Wholesale - Our wholesale accounts include premium yoga studios, health clubs, and fitness centers. We believe these premium wholesale locations offer an alternative distribution channel that is convenient for our core guest and enhances the image of total net revenue in fiscal 2017. Other net revenue includes sales made throughour brand. We do not intend wholesale to be a significant contributor to overall sales. Instead, we use the following channels:channel to build brand awareness, including outside of North America.

• |

License and supply arrangements - We enter into license and supply arrangements from time to time when we believe that it will be to our advantage to partner with companies and individuals with significant experience and proven success in certain target markets. |

We have entered into license and supply arrangements with partners in the Middle East and Mexico which grant them the right to operate lululemon branded retail locations in the United Arab Emirates, Kuwait, Qatar, Oman, Bahrain, and Mexico. We retain the rights to sell lululemon products through our e-commerce websites in these countries. Under these arrangements we supply the partners with lululemon products, training and other support. TheAn extension to the initial term of the agreement for the Middle East expiredwas signed in January 2020 and we currently intendit extends the arrangement to stay in the market.December 2024. The initial term of the agreement for Mexico expires in November 2026. As of February 2, 2020,January 30, 2022, there were four14 licensed retail locations, including six in Mexico, threesix in the United Arab Emirates, one in Kuwait, and one in Qatar, which are not included in the above company-operated stores table.

Community-Based Marketing

We utilize a community-based approach to build brand awareness and customerguest loyalty. We pursue a multi-faceted strategy which leverages our local teams and ambassadors, digital marketing and social media, in-store community boards, and a variety of grassroots initiatives. We also plan to continue to explore how we can complement and amplify our community-based initiatives with global brand-building activity.

Product Design and Development

Our product design and development efforts are led by a team of researchers, scientists, engineers, and designers. Our team is comprised of athletes and users of our products who embody our design philosophy and dedication to premium quality. Our design and development team identifies trends based on market intelligence and research, proactively seeks the input of our guests and our ambassadors, and broadly seeks inspiration consistent with our goals of function, style, and technical superiority.

4

As we strive to continue to provide our guests with technically advanced fabrics, our team works closely with our suppliers to incorporate the latest in technical innovation, bringing particular specifications to our products. We partner with independent inspection, verification, and testing companies, who conduct a variety of tests on our fabrics, testing performance characteristics including pilling, shrinkage, abrasion resistance, and colorfastness. We develop proprietary fabrics and collaborate with leading fabric and trims suppliers to manufacture fabrics and trims that we ultimately protect through agreements, trademarks, and trade-secrets.

Sourcing and Manufacturing

We do not own or operate any manufacturing facilities. We rely on a limited number of suppliers to provide fabrics for, and to produce, our products. The following statistics are based on cost.

We work with a group of approximately 3941 vendors that manufacture our products, five of which produced approximately 56%57% of our products in fiscal 2019. During fiscal 2019,2021, with the largest single manufacturer produced approximately 17% of our

We work with a group of approximately 7665 suppliers to provide the fabrics for our products. In fiscal 2019, approximately 59%2021, 56% of our fabrics were produced by our top five fabric suppliers, andwith the largest single manufacturer produced approximately 32% of fabric used.producing 27%. During fiscal 2019, approximately 46%2021, 48% of our fabrics originated from Taiwan, PRC, 14%19% from the rest of the PRC, 19%Mainland China, 11% from Sri Lanka, and the remainder from other regions.

We also source other raw materials which are used in our products, including items such as content labels, elastics, buttons, clasps, and drawcords from suppliers located predominantly in the Asia Pacific region.

We have developed long-standing relationships with a number of our vendors and take great care to ensure that they share our commitment to quality and ethics. We do not, however, have any long-term term contracts with the majority of our suppliers or manufacturing sources for the production and supply of our fabrics and garments, and we compete with other companies for fabrics, raw materials, and production. We require that all of our manufacturers adhere to our vendor code of ethics regarding social and environmental sustainability practices. Our product quality and sustainability teams partner with leading inspection and verification firms to closely monitor each supplier's compliance with applicable laws and our vendor code of ethics.

Distribution Facilities

We operate and distribute finished products from our distribution facilities in the United States, Canada, and Australia. We own our distribution center in Columbus, Ohio, and lease our other distribution facilities. We also utilize third-party logistics providers to warehouse and distribute finished products from their warehouse locations in the United Sates, the PRC, and the Netherlands. We regularly evaluate our distribution infrastructure and consolidate or expand our distribution capacity as we believe appropriate for our operations and to meet anticipated needs.

Competition

Competition in the athletic apparel industry is based principally on brand image and recognition as well as product quality, innovation, style, distribution, and price. We believe that we successfully compete on the basis of our premium brand image and our technical product innovation. We also believe our ability to introduce new product innovations, combine function and fashion, and connect through in-store, online, and community experiences sets us apart from our competition. In addition, we believe our vertical retail distribution strategy and community-based marketing differentiates us further, allowing us to more effectively control our brand image and connect with our guest.

The market for athletic apparel is highly competitive. It includes increasing competition from established companies that are expanding their production and marketing of performance products, as well as from frequent new entrants to the market. We are in direct competition with wholesalers and direct sellers of athletic apparel, such as Nike, Inc., adidas AG, and Under Armour, Inc.Inc, and Columbia Sportswear Company. We also compete with retailers who have expanded to include women's athletic apparel including The Gap, Inc. (including the Athleta brand) and, Victoria's Secret with its Sport collection.sport and lounge offering, and Urban Outfitters, Inc.

Seasonality

Our business is affected by the general seasonal trends common to the retail apparel industry. Our annual net revenue is weighted more heavily toward our fourth fiscal quarter, reflecting our historical strength in sales during the holiday season, while our operating expenses are more equally distributed throughout the year. As a result, a substantial portion of our operating profits are generated in the fourth quarter of our fiscal year. For example, we generated approximately 47%44% and

5

56% of our full year operating profit during each of the fourth quarters of fiscal 20192021 and fiscal 2018.2020, respectively. Due to a significant number of our company-operated stores being temporarily closed due to COVID-19 during the first two quarters of 2020, we earned a higher proportion of our operating profit during the last two quarters of 2020 compared to 2021.

Human Capital

Our EmployeesImpact Agenda sets out our social and environmental goals, commitments, and strategy across three pillars - Be Well, Be Planet, and Be Human. Details of our Impact Agenda and corresponding Impact Report can be found on our website (https://corporate.lululemon.com/our-impact).

The Be Human pillar of our Impact Agenda sets out our focus areas with respect to our human capital, including our employees and broader community:

•advancing a culture of Inclusion, Diversity, Equity, and Action (“IDEA”);

•empowering our employees through whole-person opportunities; and

•supporting the well-being of the people who make our products in our supply chain.

Advancing a culture of Inclusion, Diversity, Equity and Action

We continually endeavor to create an environment that is equitable, inclusive, and fosters personal growth.

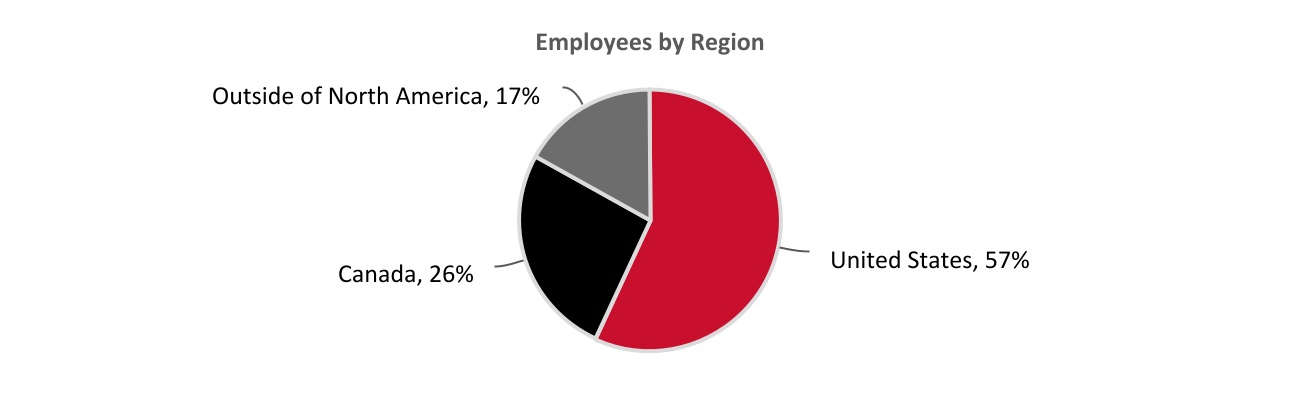

Diversity and inclusion are key components of our culture and are fundamental to achieving our strategic priorities and future vision. The diversity of our teams and working in an inclusive culture enables increased employee engagement, better decision making, greater adaptability, creativity, and a deeper understanding of the communities we serve. We are proud that as of January 30, 2022, approximately 55% of our board of directors, 65% of our senior executive leadership team, and 50% of our vice presidents and above are women, while approximately 75% of our overall workforce are women.(1)

We maintain 100% gender pay equity within our entire global employee population, meaning equal pay for equal work across genders. We have achieved pay equity across all areas of diversity in the United States and are seeking, to the extent permitted under local law and regulation, to collect the data necessary to confirm complete pay equity globally.

We expect to invest at least $5 million annually to fund our global IDEA activities. These funds can further support the career progress of our diverse talent and increase access to internal opportunities and professional development. We offer all employees IDEA education, training, and guided conversations on a variety of topics, including anti-racism, anti-discrimination, and inclusive leadership behaviors. We aim to foster a culture of inclusion by making IDEA part of our everyday conversation, and frequently review our policies, programs, and practices to identify ways to be more inclusive and equitable.

Inclusive in our Impact Agenda is a goal to invest a total of $75.0 million to advance equity in well-being by 2025.

(1) While we track male and female genders, we acknowledge this is not fully encompassing of all gender identities.

6

Empowering our employees through whole-person opportunities

We believe that each of our approximately 29,000 people are key to the success of our business, and webusiness. We strive to foster a distinctive corporate culture rooted in our core business values which attractthat attracts and retains passionate and motivated employees who are driven to achieve personal and professional goals. We believe our people succeed because we create an environment that fosters growth and is diverse and equitable.

We assess our performance and identify opportunities for improvement through an annual employee engagement survey. In 2021, the participation rate was approximately 85% and our employee engagement score exceeded the retail industry average.(2) Our engagement score suggests our people are proud to work for lululemon, they are motivated to contribute to work that aligns with their purpose, and they recommend lululemon as a great place to work.

We understand that health and wealth programs need to offer choice at all stages of February 2, 2020, we had approximately 19,000life. Our current offerings support our goal of becoming the number one place where people come to develop and grow as inclusive leaders. These offerings include, among other things:

•Competitive compensation which rewards exceptional performance;

•A parenthood program which is a gender-neutral benefit that provides all eligible employees up to six months of paid leave;

•An employee assistance program which approximately 11,000 were employed in the United States, approximately 5,200 were employed in Canada, and approximately 2,800 were employed outside of North America. None of our employees are currently covered by a collective bargaining agreement. We have had no labor-related work stoppages byprovides free, confidential, support to all our employees and their families in a variety of areas from mental well-being to financial services to advice for new parents;

•Personal resilience tools to employees, ambassadors, and suppliers;

•Reimbursement programs which reward physical activity; and

•A Fund your Future program for eligible employees which offers partial contribution matches to a pension plan and employee share purchase plan.

As part of the competitive compensation we believeoffer, we raised the minimum base pay for the majority of our relationsstore and Guest Education Center employees in North America during 2021.

Supporting the well-being of the people who make our products in our supply chain

We work with suppliers who share our employeesvalues and collaborate as partners to uphold robust standards, address systemic challenges, and improve the well-being of people who make our products.

Our Vendor Code of Ethics outlines our commitment to respect human and labor rights, and to promote safe and fair working conditions for people in our supply chain. The code is based on international standards for workers' rights with regard to their employment, wages and working hours, occupational health and safety, access to confidential grievance mechanisms without retaliation, and environmental protection. Our finished goods and mill suppliers are excellent.assessed against the Vendor Code of Ethics prior to forming a business relationship, and regularly thereafter; we work with factories that can uphold our strict requirements.

(2) Based on an industry benchmark provided by the third party that administers this survey to our employees.

7

Our COVID-19 response

We closely monitor the changing landscape of COVID-19 so that we can make appropriate decisions to support and keep our people safe. Over the last two years, we have responded to the pandemic with a variety of measures from temporarily closing our stores to committing to pay protection for employees during the COVID-19 related closures. During 2020 we launched a hardship fund for employees, the We Stand Together Fund, and launched an Ambassador Relief Fund, and these continued in 2021.

We created a wide range of resiliency and connection sessions and tools to support our people during the pandemic and we made these resources available to our guests and the broader community.

As we continue to navigate the COVID-19 pandemic, we continue to prioritize the safety of our people and our guests. We are closely monitoring the situation in the markets and communities that we serve. We will temporarily close stores and restrict operations as necessary, based upon information from government and health officials.

Intellectual Property

We have trademark rights on mostmany of our products and believe having distinctive marks that are readily identifiable is an important factor in building our brand image and in distinguishing our products from the products of others. We consider our lululemon and wave design trademarks to be among our most valuable assets. In addition, we own many other trademarks for names of several of our brands, slogans, fabrics and products. We own registered and pending U.S. and foreign utility and design patents, industrial designs in Canada, and registered community designs in Europe that protect our product innovations, distinctive apparel, and accessory designs.

Securities and Exchange Commission Filings

Our website address is www.lululemon.com. We provide free access to various reports that we file with, or furnish to, the United States Securities and Exchange Commission, or the SEC, through our website, as soon as reasonably practicable after they have been filed or furnished. These reports include, but are not limited to, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports. Our SEC reports can also be accessed through the SEC's website at www.sec.gov. Also available on our website are printable versions of our Code of Business Conduct and Ethics and charters of the Audit, Compensation, and Nominating and Governance Committeesstanding committees of our board of directors. Information on our website does not constitute part of this annual report on Form 10-K or any other report we file or furnish with the SEC.

ITEM 1A. RISK FACTORS

In addition to the other information contained in this Form 10-K, the following risk factors should be considered carefully in evaluating our business. Our business, financial condition, or results of operations could be materially adversely affected byas a result of any of these risks. Please note that additional risks not presently known

Risks related to us or that we currently deem immaterial could also impair our business and operations.industry

Our success depends on our ability to maintain the value and reputation of our brand.

8

intellectual property, if these efforts are not successful the value of our brand may be harmed. Any harm to our brand and reputation could have a material adverse effect on our financial condition.

The current COVID-19 coronavirus pandemic and related government, private sector, and individual consumer responsive actions have and could continue to affect our business operations, store traffic, employee availability, supply chain, financial condition, liquidity, and cash flow.

The COVID-19 pandemic has negatively impacted the global economy, disrupted consumer spending and global supply chains, and created significant volatility and disruption of financial markets. COVID-19 negatively impacted our business and operations in 2020. While conditions improved in 2021, the extent and duration of ongoing impacts remain uncertain.

The spread of COVID-19 has caused health officials to impose restrictions and recommend precautions to mitigate the spread of the virus, especially when congregating in heavily populated areas, such as malls and lifestyle centers. Our stores have experienced temporary closures, and we have implemented precautionary measures in line with guidance from local authorities in the stores that are open. These measures include restrictions such as limitations on the number of guests allowed in our stores at any single time, minimum physical distancing requirements, and limited operating hours. We do not know how the measures recommended by local authorities or implemented by us may change over time or what the duration of these restrictions will be.

Further resurgences in COVID-19 cases, including from variants, could cause additional restrictions, including temporarily closing all or some of our stores again. An outbreak at one of our locations, even if we follow appropriate precautionary measures, could negatively impact our employees, guests, and brand. There is uncertainty over the impact of COVID-19 on the U.S., Canadian, and global economies, consumer willingness to visit stores, malls, and lifestyle centers, and employee willingness to staff our stores as the pandemic continues and if there are future resurgences. There is also uncertainty regarding potential long-term changes to consumer shopping behavior and preferences and whether consumer demand will recover when restrictions are lifted.

The COVID-19 pandemic also has the potential to significantly impact our supply chain if the factories that manufacture our products, the distribution centers where we manage our inventory, or the operations of our logistics and other service providers are disrupted, temporarily closed, or experience worker shortages. In particular, we have seen disruptions and delays in shipments, and we may see negative impacts to pricing of certain components of our products as a result of the COVID-19 pandemic.

The COVID-19 situation is changing rapidly and the extent to which COVID-19 impacts our results will depend on future developments, which are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of COVID-19 and its variants and the actions taken to contain it or treat its impact, including vaccinations.

Changes in consumer shopping preferences, and shifts in distribution channels could materially impact our results of operations.

We sell our products through a variety of channels, with a significant portion through traditional brick-and-mortar retail channels. The COVID-19 pandemic has shifted guest shopping preferences away from brick-and-mortar and towards digital platforms. As strong e-commerce channels emerge and develop, we are evolving towards an omni-channel approach to support the shopping behavior of our guests. This involves country and region-specific websites, social media, product notification emails, mobile apps, including mobile apps on in-store devices that allow demand to be fulfilled via our distribution centers, and online order fulfillment through stores. The diversion of sales from our company-operated stores could adversely impact our return on investment and could lead to impairment charges and store closures, including lease exit costs. We could have difficulty in recreating the in-store experience through direct channels. Our failure to successfully integrate our digital and physical channels and respond to these risks might adversely impact our business and results of operations, as well as damage our reputation and brands.

If any of our products have manufacturing or design defects or are otherwise unacceptable to us or our guests, our business could be harmed.

We have occasionally received, and may in the future receive, shipments of products that fail to comply with our technical specifications or that fail to conform to our quality control standards. We have also received, and may in the future receive, products that are otherwise unacceptable to us or our guests. Under these circumstances, unless we are able to obtain replacement products in a timely manner, we risk the loss of net revenue resulting from the inability to sell those products and related increased administrative and shipping costs. Additionally, if the unacceptability of our products is not discovered until after such products are purchased by our guests,sold, our guests could lose confidence in our products or we could face a product recall and our results of operations could suffer and our business, reputation, and brand could be harmed.

9

Our MIRROR subsidiary offers complex hardware and software products and services that can be affected by design and manufacturing defects. Sophisticated operating system software and applications, such as those offered by MIRROR, often have issues that can unexpectedly interfere with the intended operation of hardware or software products. Defects may also exist in components and products that we source from third parties. Any defects could make our products and services unsafe and create a risk of environmental or property damage or personal injury and we may become subject to the hazards and uncertainties of product liability claims and related government, private sector, and individual consumer responsive actions may adversely affectlitigation. The occurrence of real or perceived defects in any of our business operations, store traffic, employee availability, financial condition, liquidity, and cash flow.

We operate in a highly competitive market and the size and resources of some of our competitors may allow them to compete more effectively than we can, resulting in a loss of our market share and a decrease in our net revenue and profitability.

The market for technical athletic apparel is highly competitive. Competition may result in pricing pressures, reduced profit margins or lost market share, or a failure to grow or maintain our market share, any of which could substantially harm our business and results of operations. We compete directly against wholesalers and direct retailers of athletic apparel, including large, diversified apparel companies with substantial market share, and established companies expanding their production and marketing of technical athletic apparel, as well as against retailers specifically focused on women's athletic apparel. We also face competition from wholesalers and direct retailers of traditional commodity athletic apparel, such as cotton T-shirts and sweatshirts. Many of our competitors are large apparel and sporting goods companies with strong worldwide brand recognition. Because of the fragmented nature of the industry, we also compete with other apparel sellers, including those specializing in yoga apparel and other activewear. Many of our competitors have significant competitive advantages, including longer operating histories, larger and broader customer bases, more established relationships with a broader set of suppliers, greater brand recognition and greater financial, research and development, store development, marketing, distribution, and other resources than we do.

Our competitors may be able to achieve and maintain brand awareness and market share more quickly and effectively than we can. In contrast to our grassroots community-based marketing approach, many of our competitors promote their brands through traditional forms of advertising, such as print media and television commercials, and through celebrity endorsements, and have substantial resources to devote to such efforts. Our competitors may also create and maintain brand awareness using traditional forms of advertising more quickly than we can. Our competitors may also be able to increase sales in their new and existing markets faster than we do by emphasizing different distribution channels than we do, such as catalog sales or an extensive franchise network.

In addition, because we hold limited patents and exclusive intellectual property rights in the technology, fabrics or processes underlying our products, our current and future competitors are able to manufacture and sell products with performance characteristics, fabrication techniques, and styling similar to our products.

Our reliance on suppliers to provide fabrics for and to produce our products could cause problems in our supply chain.

Our business is subject to significant pressure on costs and pricing caused by many factors, including intense competition, constrained sourcing capacity and related inflationary pressure, the availability of qualified labor and wage inflation, pressure from consumers to reduce the prices we charge for our products, and changes in consumer demand. These factors may cause us to experience increased costs, reduce our prices to consumers or experience reduced sales in response to increased prices, any of which could cause our operating margin to decline if we are unable to offset these factors with reductions in operating costs and could have a material adverse effect on our financial condition, operating results, and cash flows.

If we are unable to anticipate consumer preferences and successfully develop and introduce new, innovative, and updateddifferentiated products, we may not be able to maintain or increase our sales and profitability.

Our success depends on our ability to identify and originate product trends as well as to anticipate and react to changing consumer demands in a timely manner. All of our products are subject to changing consumer preferences that cannot be predicted with certainty. If we are unable to introduce new products or novel technologies in a timely manner or our new products or technologies are not accepted by our guests, our competitors may introduce similar products in a more timely fashion, which could hurt our goal to be viewed as a leader in technical athletic apparel innovation. Our new products may not receive consumer acceptance as consumer preferences could shift rapidly to different types of athletic apparel or away from these types of products altogether, and our future success depends in part on our ability to anticipate and respond to these changes. Our failure to anticipate and respond in a timely manner to changing consumer preferences could lead to, among other things, lower sales and excess inventory levels. Even if we are successful in anticipating consumer preferences,

10

our ability to adequately react to and address those preferences will in part depend upon our continued ability to develop and introduce innovative, high-quality products. Our failure to effectively introduce new products that are accepted by consumers could result in a decrease in net revenue and excess inventory levels, which could have a material adverse effect on our financial condition.

Our results of operations could be materially harmed if we are unable to accurately forecast guest demand for our products.

To ensure adequate inventory supply, we must forecast inventory needs and place orders with our manufacturers based on our estimates of future demand for particular products. Our ability to accurately forecast demand for our products could be affected by many factors, including an increase or decrease in guest demand for our products or for products of our competitors, our failure to accurately forecast guest acceptance of new products, product introductions by competitors, unanticipated changes in general market conditions (for example, because of unexpected effects on inventory supply and consumer demand caused by the current COVID-19 coronavirus pandemic), and weakening of economic conditions or consumer confidence in future economic conditions.conditions (for example, because of inflationary pressures, or because of sanctions, restrictions, and other responses related to geopolitical events). If we fail to accurately forecast guest demand, we may experience excess inventory levels or a shortage of products available for sale in our stores or for delivery to guests.

Inventory levels in excess of guest demand may result in inventory write-downs or write-offs and the sale of excess inventory at discounted prices, which would cause our gross margin to suffer and could impair the strength and exclusivity of our brand. Conversely, if we underestimate guest demand for our products, our manufacturers may not be able to deliver products to meet our requirements, and this could result in damage to our reputation and guest relationships.

Our inability to safeguard against security breaches or our failure to comply with data privacy laws could damage our customer relationships and result in significant legal and financial exposure.

Our future growth depends in part on our expansion efforts outside of North America. We have limited experience with regulatory environments and market practices internationally, and we may not be able to penetrate or successfully operate in any new market. In connection with our expansion efforts we may encounter obstacles we did not face in North America, including cultural and linguistic differences, differences in regulatory environments, labor practices and market practices, difficulties in keeping abreast of market, business and technical developments, and foreigninternational guests' tastes and preferences. We may also encounter difficulty expanding into new international markets because of limited brand recognition leading to delayed acceptance of our technical athletic apparel by guests in these new international markets. Our failure to develop our business in new international markets or disappointing growth outside of existing markets could harm our business and results of operations.

We may not realize the potential benefits and synergies sought with the acquisition of MIRROR.

During 2020, we acquired MIRROR as part of our growth plan, which includes driving business through omni-guest experiences. The potential benefits of enhancing our digital and interactive capabilities and deepening our roots in the sweatlife might not be realized fully, if at all, or take longer than anticipated to achieve. Further, the expected synergies between lululemon and MIRROR, such as health pandemics couldthose related to our connections with our guests and communities as well as our store and direct to consumer infrastructure, may not materialize. A significant portion of the purchase price was allocated to goodwill and if our acquisition does not yield expected returns, we may be required to record impairment charges, which would adversely impactaffect our results of operations.

11

internal control over financial reporting could impactbe adversely impacted. The acquisition may not be well received by the customers or employees of either company, and this could hurt our performance, including our abilitybrand and result in the loss of key employees. If we are unable to successfully expand internationally. Global economic conditions could impact levels of consumer spending in the markets in whichintegrate MIRROR, including its people and technologies, or if integration takes longer than planned, we operate,may not be able to manage operations efficiently, which could impactadversely affect our sales and profitability. Political unrest could negatively impact our guests and employees, reduce consumer spending, and adversely impact our business and results of operations. Health pandemics, such as the current COVID-19 coronavirus pandemic, and the related governmental, private sector and individual consumer responsive actions could reduce store traffic and consumer spending, result in temporary or permanent closuresThe acquisition of stores, offices, and factories, and could negatively impact the flow of goods.

In addition, we do, they may, from time to time, evaluate and pursue other strategic investments or acquisitions. These involve various inherent risks and the benefits sought may not be able to manufacturerealized. The acquisition of MIRROR or other strategic investments or acquisitions may not create value and sell products based on our fabrics and manufacturing technology at lower prices than we can. If our competitors do sell similar products to ours at lower prices, our net revenue and profitability could suffer.

We may not be able to grow the MIRROR business and have it achieve profitability.

We may be unable to attract and retain subscribers to MIRROR. If we do not provide the delivery and installation service that our guests expect, offer engaging and innovative classes, and support and continue to improve the technology used, we may not be able to maintain and grow the number of subscribers. This could adversely impact our results of operations.

We are dependent on international trade agreementstechnology systems to provide live and regulations. The countriesrecorded classes to our customers with MIRROR subscriptions, to maintain its software, and to manage subscriptions. If we experience issues such as cybersecurity threats or actions, or interruptions or delays in which we produceour technology systems, the data privacy and selloverall experience of subscribers could be negatively impacted and could therefore damage our products could impose or increase tariffs, duties, or other similar charges that could negativelybrand and adversely affect our results of operations, financial position, or cash flows.operations.

If we continue to grow at a rapid pace, we may not be able to effectively manage our growth and the increased complexity of our business and as a result our brand image and financial performance may suffer.

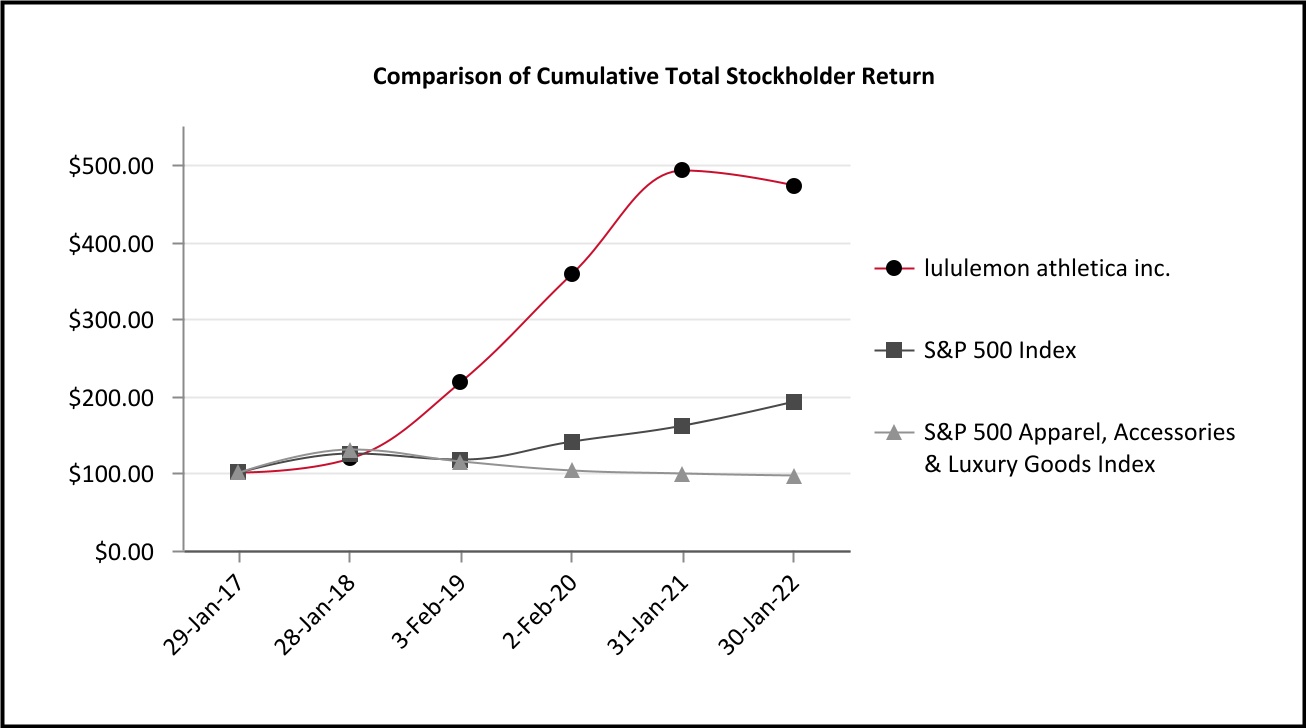

We have expanded our operations rapidly since our inception in 1998 and our net revenue has increased from $40.7 million in fiscal 2004 to $4.0$6.3 billion in fiscal 2019.2021. If our operations continue to grow at a rapid pace, we may experience difficulties in obtaining sufficient raw materials and manufacturing capacity to produce our products, as well as delays in production and shipments, as our products are subject to risks associated with overseas sourcing and manufacturing. We could be required to continue to expand our sales and marketing, product development and distribution functions, to upgrade our management information systems and other processes and technology, and to obtain more space for our expanding workforce. This expansion could increase the strain on our resources, and we could experience operating difficulties, including difficulties in hiring, training, and managing an increasing number of employees. These difficulties could result in the erosion of our brand image which could have a material adverse effect on our financial condition.

We are subject to risks associated with leasing retail and distribution space subject to long-term and non-cancelable leases.

We lease the majority of our stores under operating leases and our inability to secure appropriate real estate or lease terms could impact our ability to grow. Our leases generally have initial terms of between five and 15 years, and generally can be extended in five-year increments if at all. We generally cannot cancel these leases at our option. If an existing or new store is not profitable, and we decide to close it, as we have done in the past and may do in the future, we may nonetheless be committed to perform our obligations under the applicable lease including, among other things, paying the base rent for the balance of the lease term. Similarly, we may be committed to perform our obligations under the applicable leases even if current locations of our stores become unattractive as demographic patterns change. In addition, as each of our leases expire, we may fail to negotiate renewals, either on commercially acceptable terms or at all, which could require us to close stores in desirable locations.

We also lease the majority of our distribution centers and our inability to secure appropriate real estate or lease terms could impact our ability to deliver our products to the market.

12

We may not be able to successfully open new store locations in a timely manner, if at all, which could harm our results of operations.

Our growth will largely depend on our ability to successfully open and operate new stores. We may be unsuccessful in identifying new locations and markets where our technical athletic apparel and other products and brand image will be accepted. In addition, we may not be able to open or profitably operate new stores in existing, adjacent, or new markets due to the impact of COVID-19, political instability, inflationary pressures, or other economic conditions, which could have a material adverse effect on us.

Our future success is substantially dependent on the service of our senior management and other key employees.

In the last few years, we have had changes to our senior management team including new hires, departures, and role and responsibility changes. The performance of our senior management team and other key employees may not meet our needs and expectations. Also, the loss of services of any of these key employees, or any negative public perception with respect to these individuals, may be disruptive to, or cause uncertainty in, our business and could have a negative impact on our ability to manage and grow our business effectively. Such disruption could have a material adverse impact on our financial performance, financial condition, and the market price of our stock.

Our business is affected by seasonality, which could result in fluctuations in our operating results.

Our business is affected by the general seasonal trends common to the retail apparel industry. Our annual net revenue is weighted more heavily toward our fourth fiscal quarter, reflecting our historical strength in sales during the holiday season, while our operating expenses are more equally distributed throughout the year. This seasonality, along with other factors that are beyond our control, including weather conditions and the effects of climate change, could adversely affect our business and cause our results of operations to fluctuate.

Risks related to our supply chain

Disruptions of our supply chain could have a material adverse effect on our operating and financial results.

Disruption of our supply chain capabilities due to trade restrictions, political instability, severe weather, natural disasters, public health crises such as the ongoing COVID-19 pandemic, war, terrorism, product recalls, labor supply or stoppages, the financial or operational instability of key suppliers and carriers, changes in diplomatic or trade relationships (including any sanctions, restrictions, and other responses such as those related to current geopolitical events), or other reasons could impair our ability to distribute our products. To the extent we are unable to mitigate the likelihood or potential impact of such events, there could be a material adverse effect on our operating and financial results.

Our reliance on suppliers to provide fabrics for and to produce our products could cause problems if we experience a supply chain disruption and we are unable to secure additional suppliers of fabrics or other raw materials, or manufacturers of our end products.

The entire apparel industry, including our company, continues to face supply chain challenges as a result of economic uncertainty due to the impacts of COVID-19, political instability, inflationary pressures, and other factors, including reduced freight availability and increased costs, port disruption, manufacturing facility closures, and related labor shortages and other supply chain disruptions. We do not manufacture our products or the raw materials for them and rely instead on suppliers. Many of the specialty fabrics used in our products are technically advanced textile products developed and manufactured by third parties and may be available, in the short-term, from only one or a limited number of sources. We have no long-term contracts with any of our suppliers or manufacturers for the production and supply of our raw materials and products, and we compete with other companies for fabrics, other raw materials, and production. The following statistics are based on cost.

We work with a group of approximately 41 vendors that manufacture our products, five of which produced 57% of our products in 2021. During 2021, the largest single manufacturer produced approximately 15% of our products. During 2021, approximately 40% of our products were manufactured in Vietnam, 17% in Cambodia, 11% in Sri Lanka, 7% in the PRC, including 2% in Taiwan, and the remainder in other regions.

We work with a group of approximately 65 suppliers to provide the fabrics for our products. In 2021, 56% of our fabrics were produced by our top five fabric suppliers, and the largest single manufacturer produced approximately 27% of fabric used. During 2021, approximately 48% of our fabrics originated from Taiwan, 19% from Mainland China, 11% from Sri Lanka, and the remainder from other regions.

We also source other raw materials which are used in our products, including items such as content labels, elastics, buttons, clasps, and drawcords from suppliers located predominantly in the Asia Pacific region.

13

We have experienced, and may in the future experience, a significant disruption in the supply of fabrics or raw materials and may be unable to locate alternative suppliers of comparable quality at an acceptable price, or at all. In addition, if we experience significant increased demand, or if we need to replace an existing supplier or manufacturer, we may be unable to locate additional supplies of fabrics or raw materials or additional manufacturing capacity on terms that are acceptable to us, or at all, or we may be unable to locate any supplier or manufacturer with sufficient capacity to meet our requirements or fill our orders in a timely manner. Identifying a suitable supplier is an involved process that requires us to become satisfied with its quality control, responsiveness and service, financial stability, and labor and other ethical practices. Even if we are able to expand existing or find new manufacturing or fabric sources, we may encounter delays in production and added costs as a result of the time it takes to train our suppliers and manufacturers in our methods, products, and quality control standards.

Our supply of fabric or manufacture of our products could be disrupted or delayed by the impact of health pandemics, including the current COVID-19 pandemic, and the related government and private sector responsive actions such as border closures, restrictions on product shipments, and travel restrictions, as well as other economic or political conditions. Delays related to supplier changes could also arise due to an increase in shipping times if new suppliers are located farther away from our markets or from other participants in our supply chain. The receipt of inventory sourced from areas impacted by COVID-19 has been slowed or disrupted and our manufacturers may also face similar challenges in receiving fabric and fulfilling our orders. In addition, ocean freight capacity issues continue to persist worldwide as there is much greater demand for shipping and reduced capacity and equipment. Any delays, interruption, or increased costs in the supply of fabric or manufacture of our products could have an adverse effect on our ability to meet guest demand for our products and result in lower net revenue and income from operations both in the short and long term.

Our business could be harmed if our suppliers and manufacturers do not comply with our Vendor Code of Ethics or applicable laws.

While we require our suppliers and manufacturers to comply with our Vendor Code of Ethics, which includes labor, health and safety, and environment standards, we do not control their operations. If suppliers or contractors do not comply with these standards or applicable laws or there is negative publicity regarding the production methods of any of our suppliers or manufacturers, even if unfounded or not specific to our supply chain, our reputation and sales could be adversely affected, we could be subject to legal liability, or could cause us to contract with alternative suppliers or manufacturing sources.

The fluctuating cost of raw materials could increase our cost of goods sold.

The fabrics used to make our products include synthetic fabrics whose raw materials include petroleum-based products. Our products also include silver and natural fibers, including cotton. Our costs for raw materials are affected by, among other things, weather, consumer demand, speculation on the commodities market, the relative valuations and fluctuations of the currencies of producer versus consumer countries, and other factors that are generally unpredictable and beyond our control. Any and all of these factors may be exacerbated by global climate change. In addition, ongoing impacts of the pandemic, political instability, trade relations, sanctions, price inflationary pressure, or other geopolitical or economic conditions could cause raw material costs to increase and have an adverse effect on our future margins. Increases in the cost of raw materials, including petroleum or the prices we pay for silver and our cotton yarn and cotton-based textiles, could have a material adverse effect on our cost of goods sold, results of operations, financial condition, and cash flows.

If we encounter problems with our distribution system, our ability to deliver our products to the market and to meet guest expectations could be harmed.

We rely on our distribution facilities for substantially all of our product distribution. Our distribution facilities include computer controlled and automated equipment, which means their operations may be subject to a number of risks related to security or computer viruses, the proper operation of software and hardware, electronic or power interruptions, or other system failures. In addition, our operations could also be interrupted by labor difficulties, pandemics (such as the COVID-19 pandemic), the impacts of climate change, extreme or severe weather conditions or by floods, fires, or other natural disasters near our distribution centers. If we encounter problems with our distribution system, our ability to meet guest expectations, manage inventory, complete sales, and achieve objectives for operating efficiencies could be harmed.

Increasing labor costs and other factors associated with the production of our products in South Asia and South East Asia could increase the costs to produce our products.

A significant portion of our products are produced in South Asia and South East Asia and increases in the costs of labor and other costs of doing business in the countries in this area could significantly increase our costs to produce our products and could have a negative impact on our operations and earnings. Factors that could negatively affect our business include a potentiallabor shortages and increases in labor costs, labor disputes, pandemics, the impacts of climate change, difficulties and

14

additional costs in transporting products manufactured from these countries to our distribution centers and significant revaluation of the currencies used in these countries, which may result in an increase in the cost of producing products, labor shortage and increases in labor costs, and difficulties and additional costs in transporting products manufactured from these countries to our distribution centers.products. Also, the imposition of trade sanctions or other regulations against products imported by us from, or the loss of "normal trade relations" status with any country in which our products are manufactured, could significantly increase our cost of products and harm our business.

Risks related to information security and technology

We may be unable to safeguard against security breaches which could damage our customer relationships and result in significant legal and financial exposure.

As part of our normal operations, we receive confidential, proprietary, and personally identifiable information, including credit card information, and information about our customers, our employees, job applicants, and other third parties. Our business employs systems and websites that allow for the storage and transmission of this information. However, despite our safeguards and security processes and protections, security breaches could expose us to a risk of theft or misuse of this information, and could result in litigation and potential liability.

The retail industry, in particular, has been the target of many recent cyber-attacks. We may not have the resources or technical sophistication to be able to successfully openanticipate or prevent rapidly evolving types of cyber-attacks. Attacks may be targeted at us, our vendors or customers, or others who have entrusted us with information. In addition, despite taking measures to safeguard our information security and privacy environment from security breaches, our customers and our business could still be exposed to risk. Actual or anticipated attacks may cause us to incur increasing costs including costs to deploy additional personnel and protection technologies, train employees and engage third party experts and consultants. Advances in computer capabilities, new store locationstechnological discoveries or other developments may result in the technology used by us to protect transaction or other data being breached or compromised. Measures we implement to protect against cyber-attacks may also have the potential to impact our customers' shopping experience or decrease activity on our websites by making them more difficult to use.

Data and security breaches can also occur as a result of non-technical issues including intentional or inadvertent breach by employees or persons with whom we have commercial relationships that result in the unauthorized release of personal or confidential information. Any compromise or breach of our security could result in a violation of applicable privacy and other laws, significant legal and financial exposure, and damage to our brand and reputation or other harm to our business.

In addition, the increased use of employee-owned devices for communications as well as work-from-home arrangements, such as those implemented in response to the COVID-19 pandemic, present additional operational risks to our technology systems, including increased risks of cyber-attacks. Further, like other companies in the retail industry, we have in the past experienced, and we expect to continue to experience, cyber-attacks, including phishing, and other attempts to breach, or gain unauthorized access to, our systems. To date, these attacks have not had a material impact on our operations, but they may have an impact in the future.

Privacy and data protection laws increase our compliance burden.

We are subject to a variety of privacy and data protection laws and regulations that change frequently and have requirements that vary from jurisdiction to jurisdiction. For example, we are subject to significant compliance obligations under privacy laws such as the General Data Privacy Regulation ("GDPR") in the European Union, the Personal Information Protection and Electronic Documents Act (“PIPEDA”) in Canada, the California Consumer Privacy Act ("CCPA") modified by the California Privacy Rights Act (“CPRA”), and the Personal Information Protection Law (“PIPL”) in the PRC. Some privacy laws prohibit the transfer of personal information to certain other jurisdictions. We are subject to privacy and data protection audits or investigations by various government agencies. Our failure to comply with these laws subjects us to potential regulatory enforcement activity, fines, private litigation including class actions, and other costs. Our efforts to comply with privacy laws may complicate our operations and add to our compliance costs. A significant privacy breach or failure or perceived failure by us or our third-party service providers to comply with privacy or data protection laws, regulations, policies or regulatory guidance might have a materially adverse impact on our reputation, business operations and our financial condition or results of operations.

Disruption of our technology systems or unexpected network interruption could disrupt our business.

We are increasingly dependent on technology systems and third-parties to operate our e-commerce websites, process transactions, respond to guest inquiries, manage inventory, purchase, sell and ship goods on a timely manner,basis, and maintain cost-efficient operations. The failure of our technology systems to operate properly or effectively, problems with transitioning to upgraded or replacement systems, or difficulty in integrating new systems, could adversely affect our business. In addition, we have e-commerce websites in the United States, Canada, and internationally. Our technology systems, websites, and

15

operations of third parties on whom we rely, may encounter damage or disruption or slowdown caused by a failure to successfully upgrade systems, system failures, viruses, computer "hackers", natural disasters, or other causes. These could cause information, including data related to guest orders, to be lost or delayed which could, especially if the disruption or slowdown occurred during the holiday season, result in delays in the delivery of products to our stores and guests or lost sales, which could reduce demand for our products and cause our sales to decline. The concentration of our primary offices, two of our distribution centers, and a number of our stores along the west coast of North America could amplify the impact of a natural disaster occurring in that area to our business, including to our technology systems. In addition, if changes in technology cause our information systems to become obsolete, or if our information systems are inadequate to handle our growth, we could lose guests. We have limited back-up systems and redundancies, and our technology systems and websites have experienced system failures and electrical outages in the past which have disrupted our operations. Any significant disruption in our technology systems or websites could harm our reputation and credibility, and could have a material adverse effect on our business, financial condition, and results of operations.

Our technology-based systems that give our customers the ability to shop with us online may not function effectively.

Many of our customers shop with us through our e-commerce websites and mobile apps. Increasingly, customers are using tablets and smart phones to shop online with us and with our competitors and to do comparison shopping. We are increasingly using social media and proprietary mobile apps to interact with our customers and as a means to enhance their shopping experience. Any failure on our part to provide attractive, effective, reliable, user-friendly e-commerce platforms that offer a wide assortment of merchandise with rapid delivery options and that continually meet the changing expectations of online shoppers could place us at a competitive disadvantage, result in the loss of e-commerce and other sales, harm our reputation with customers, have a material adverse impact on the growth of our e-commerce business globally and could have a material adverse impact on our business and results of operations.

Risks related to environmental, social, and governance issues

Climate change, and related legislative and regulatory responses to climate change, may adversely impact our business.

There is increasing concern that a gradual rise in global average temperatures due to increased concentration of carbon dioxide and other greenhouse gases in the atmosphere will cause significant changes in weather patterns around the globe, an increase in the frequency, severity, and duration of extreme weather conditions and natural disasters, and water scarcity and poor water quality. These events could adversely impact the cultivation of cotton, which is a key resource in the production of our products, disrupt the operation of our supply chain and the productivity of our contract manufacturers, increase our production costs, impose capacity restraints and impact the types of apparel products that consumers purchase. These events could also compound adverse economic conditions and impact consumer confidence and discretionary spending. As a result, the effects of climate change could have a long-term adverse impact on our business and results of operations. In many countries, governmental bodies are enacting new or additional legislation and regulations to reduce or mitigate the potential impacts of climate change. If we, our suppliers, or our contract manufacturers are required to comply with these laws and regulations, or if we choose to take voluntary steps to reduce or mitigate our impact on climate change, we may experience increased costs for energy, production, transportation, and raw materials, increased capital expenditures, or increased insurance premiums and deductibles, which could adversely impact our operations. Inconsistency of legislation and regulations among jurisdictions may also affect the costs of compliance with such laws and regulations. Any assessment of the potential impact of future climate change legislation, regulations or industry standards, as well as any international treaties and accords, is uncertain given the wide scope of potential regulatory change in the countries in which we operate.

Increased scrutiny from investors and others regarding our environmental, social, governance, or sustainability, responsibilities could result in additional costs or risks and adversely impact our reputation, employee retention, and willingness of customers and suppliers to do business with us.