UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20202023

Commission File Number: 001-36771

| | |

| LendingClub Corporation |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | |

| Delaware | | | 51-0605731 |

(State or other jurisdiction of

incorporation or organization) | | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 595 Market Street, Suite 200, | |

| San Francisco, | CA | 94105 | |

| (Address of principal executive offices and zip code) |

(415) 632-5600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class: | Trading Symbol | Name of each exchange on which registered: |

| Common Stock, par value $0.01 per share | LC | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | ☐ | Accelerated filer | ☒☐ |

| Non-accelerated filer | | ☐ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2020,2023, the last business day of the registrant’s most recently completed second fiscal quarter, was $278,428,673$894,810,579 based on the closing price reported for such date on the New York Stock Exchange. Shares of the registrant’s common stock held by each executive officer, director and holder of 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This calculation does not reflect a determination that certain persons are affiliates of the registrant for any other purpose.

As of February 26, 2021,January 31, 2024, there were 93,550,219110,410,602 shares of the registrant’s common stock outstanding.

Documents Incorporated by Reference

Portions of the registrant’s Definitive Proxy Statement for the Registrant’s 20212024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2020.

Annual Report On Form 10-K

For Fiscal Year Ended December 31, 20202023

TABLE OF CONTENTS

Glossary

The following is a list of common acronyms and terms LendingClub Corporation regularly uses in its financial reporting:

| | | | | |

| |

| ACL | Allowance for Credit Losses (includes both the allowance for loan and lease losses and the reserve for unfunded lending commitments) |

| Acquisition | Acquisition of Radius Bancorp, Inc. |

| AFS | Available for Sale |

| ALLL | Allowance for Loan and Lease Losses |

| Annual Report | Annual Report on Form 10-K for the year ended December 31, 2023 |

| ASU | Accounting Standards Update |

| AUM | Assets Under Management (outstanding balances of Loan Originations serviced by the Company including loans sold to investors as well as loans held for investment and held for sale by the Company) |

| Balance Sheet | Consolidated Balance Sheets |

| CECL | Current Expected Credit Losses (Accounting Standards Update 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments) |

| CET1 | Common Equity Tier 1 |

| CET1 Capital Ratio | Common Equity Tier 1 capital divided by total risk-weighted assets as defined under the Basel III capital framework |

| DCF | Discounted Cash Flow |

| |

| EPS | Earnings Per Share |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| FRB or Federal Reserve | Board of Governors of the Federal Reserve System and, as applicable, Federal Reserve Bank(s) |

| GAAP | Accounting Principles Generally Accepted in the United States of America |

| HFI | Loans which are retained by the Company and held for investment |

| HFS | Held for sale loans expected to be sold to investors, including Marketplace Loans |

| Income Statement | Consolidated Statements of Income |

| LC Bank or LendingClub Bank | LendingClub Bank, National Association |

| LendingClub, LC, the Company, we, us, or our | LendingClub Corporation and its subsidiaries |

| Loan Originations | Unsecured personal loans and auto refinance loans originated by the Company or facilitated by third-party issuing banks |

| Marketplace Loans | Loan Originations designated as HFS and subsequently sold to investors |

| |

| N/M | Not meaningful |

| Parent | LendingClub Corporation (the Parent Company of LendingClub Bank, National Association and other subsidiaries) |

| PPNR or Pre-Provision Net Revenue | PPNR, or Pre-Provision Net Revenue, is a non-GAAP financial measure calculated by subtracting the provision for credit losses and income tax benefit/expense from net income. |

| |

| PPP loans | Loans originated pursuant to the U.S. Small Business Administration’s Paycheck Protection Program |

| |

| Radius | Radius Bancorp, Inc. |

| |

| |

| |

| |

| |

| SEC | United States Securities and Exchange Commission |

| Securities Act | Securities Act of 1933, as amended |

| |

| Structured Certificates | Asset-backed securitization transaction where the Company retains the senior note security and sells the residual certificate on a pool of loans to a marketplace investor at a predetermined price. |

| | | | | |

| Structured Program transactions | Asset-backed securitization transactions, including Structured Certificate transactions, where certain accredited investors and qualified institutional buyers have the opportunity to invest in securities backed by a pool of unsecured personal whole loans. |

| |

| Tier 1 Capital Ratio | Tier 1 capital, which includes Common Equity Tier 1 capital plus non-cumulative perpetual preferred equity that qualifies as additional tier 1 capital, divided by total risk-weighted assets as defined under the Basel III capital framework. |

| Tier 1 Leverage Ratio | Tier 1 capital, which includes Common Equity Tier 1 capital plus non-cumulative perpetual preferred equity that qualifies as additional tier 1 capital, divided by quarterly adjusted average assets as defined under the Basel III capital framework. |

| Total Capital Ratio | Total capital, which includes Common Equity Tier 1 capital, Tier 1 capital and allowance for credit losses and qualifying subordinated debt that qualifies as Tier 2 capital, divided by total risk-weighted assets as defined under the Basel III capital framework. |

| Unsecured personal loans | Unsecured personal loans originated on the Company’s platforms, including an online direct to consumer platform and a platform connected with a network of education and patient finance providers. |

| VIE | Variable Interest Entity |

Except as the context requires otherwise, as used herein, “LendingClub,” “Company,” “we,” “us,” and “our,” refer to LendingClub Corporation, a Delaware corporation, and, where appropriate, its consolidated subsidiaries and consolidated variable interest entities (VIEs), including:

•including LendingClub Bank, National Association (the(LC Bank)

•Various, and various entities established to facilitate loan sale transactions under LendingClub’s Structured Program, including sponsoring asset-backed securities transactions and Certificate Program transactions, where certain accredited investors and qualified institutional buyers have the opportunity to invest in senior and subordinated securities backed by a pool of unsecured personal whole loans.

•LC Trust I (the LC Trust), an independent Delaware business trust that acquires loans from LendingClub and holds them for the sole benefit of certain investors that have purchased trust certificates issued by the LC Trust and that are related to specific underlying loans for the benefit of the investor.Program.

Forward-LookingForward-looking Statements

This Annual Report on Form 10-K (Report)for the year ended December 31, 2023 (Annual Report) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934.1934, as amended (Exchange Act). Forward-looking statements in this Annual Report include, without limitation, statements regarding borrowers, credit scoring, our strategy, future operations, expected losses, future financial position, future revenue, projected costs, prospects, plans, objectives of management, expected market growth and the impact on our business. You can identify these forward-looking statements by words such as “anticipate,” “appear,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “intend,” “may,” “opportunity,” “plan,” “predict,” “project,” “should,” “strategy,” “target,” “will,” “would,” or similar expressions.

These forward-looking statements include, among other things, statements about:

•The impact of, and our ability to integratesuccessfully navigate, the Bankcurrent interest rate and economic climate, a potential recession and the timing and ability to realize the expected financial and strategic benefitsresumption of the acquisition;Federal student loan payments;

•our ability following to sustain the business under adverse circumstances;

•our acquisition of the Bank,ability to attract and retain new members, to expand our product offerings and services, to improve revenue and generate recurring earnings, to capture expense benefits, to increase resiliency, and to enhance regulatory clarity;

•our ability to address strictercompliance, and that of third-party partners or heightened regulatory or supervisory requirements and expectations;

•our complianceproviders, with applicable local, state and Federalfederal laws, regulations and regulatory developments or court decisions affecting our business;

•the impact of COVID-19 and our ability to effectuate and the effectiveness of certain operational and strategy initiatives in light of COVID-19;

•our ability to successfully navigate the current economic climate;

•our ability to sustain the business under adverse circumstances;

•the effects of natural disasters, public health crises,crisis, acts of war or terrorism and other external events on our customers and business;business, including the Ukrainian-Russian and Gaza Strip conflicts;

•the impact of changes in laws or the regulatory or supervisory environment, including as a result of legislation, regulation, policies or changes in government officials or other personnel;

•the impact of changes in monetary, fiscal, or trade laws or policies, including as a result of actions by governmental agencies, central banks, or supranational authorities;policies;

•the impact of new accounting standards or policies, including the Current Expected Credit LossLosses (CECL) standard;

•the results of examinations of us by regulatory authorities and the possibility that any such regulatory authority may, among other things, require us to limit our business activities, increase our allowance for loan losses, increase our capital levels, or affect our ability to borrow funds or maintain or increase deposits;

•our ability, and that of third-party partners or providers, to maintain an enterprise risk management framework that is effective in mitigating risk;

•our ability to effectively manage capital or liquidity to support our evolving business or operational needs, while remaining compliant with regulatory or supervisory requirements and appropriate risk-management standards;

•our ability to attract and retain loan borrowers;

•our ability to develop and maintain a strong core deposit base or other low cost funding sources necessary to fund our activities;

•the impact of changes in consumer spending, borrowing and saving habits;

•the impact of the continuation of or changes in the short-term and long-term interest rate environment;

•our expectations on the interplay among origination volume, underwriting standards and interest rates;

•the ability and willingness of borrowers to repay loans;

•our belief that certain loans and leases in our commercial loan portfolio will be fully repaid in accordance with the plans of borrowers;contractual loan terms;

•our ability to maintain investor confidence in the operation of our platform;

•our ability to retain existing sources and secure new or additional sources of investor commitments for our platform;

•our expectation that marketplace investor demand for our loans will remain depressed until interest rates and the macro environment stabilize;

•our expectation of pressure on net interest margin;

•the performance of our loan products and expected rates of return for investors;

•platform volume, pricing and balance;

•the effectiveness of our platform’s credit scoring models;

•our ability to innovate and the adoption and success of new products and services;

•the adequacy of our corporate governance, risk-management framework and compliance programs;

•the impact of, and our ability to resolve, pending litigation and governmental inquiries and investigations;

•the use of our own capital to purchase loans and the impact of holding loans on and our ability to sell loans off our balance sheet;

•our intention not to sell our available for sale (AFS) investment portfolio;

•our financial condition and performance, including the impact that management’s estimates have on our financial performance and the relationship between the interim period and full year results;

•our ability, and that of third-party vendors,partners and providers, to maintain service and quality expectations;

•the fair value estimates used in the valuation of our financial instruments;

•our estimate of our interest rate sensitivity;

•our calculation of expected credit losses for our collateral-dependent loans;

•our estimated maximum exposure to losses;

•our expectation of loan servicing fee revenue based on forecasted prepayments and estimated market rate of servicing at the time of loan sale;

•capital expenditures;

•our compliance with contractual obligations or restrictions;

•the potential impact of macro-economic developments, including recessions, inflation or other adverse circumstances;

•our ability to develop and maintain effective internal controls;

•our ability to recruit and retain quality employees to support current operations and future growth;

•our ability to continue to realize the financial and strategic benefits of our digital marketplace bank business model;

•changes in the effectiveness and reliability of our information technology and computer systems, including the impact of any security or privacy breach;

•the impact of expense initiatives and our ability to control our cost structure;

•our ability to manage and repay our indebtedness; and

•other risk factors listed from time to time in reports we file with the SEC.

We caution you that the foregoing list may not contain all of the forward-looking statements in this Annual Report. We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward-looking statements. We have included important factors in the “Risk Factors” section of this Annual Report, as well as in our consolidated financial statements, related notes, and other information appearing elsewhere in this Annual Report and our other filings with the Securities and Exchange Commission,SEC that could, among other things, cause actual results or events to differ materially from forward-looking statements contained in this Annual Report. Forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this Annual Report carefully and completely and with the understanding that actual future results may be materially different from what we expect. We do not assume any obligation to update or revise any forward-looking statements, whether as a result of new information, actual results, future events or otherwise, other than as required by law.

PART I

Item 1. Business

Introduction

LendingClub was founded in 2006 to transformand brought a traditional credit product – the banking industryinstallment loan – into the digital age by leveraging technology, data science, and a unique marketplace model. LendingClub now operates a leading digital marketplace bank and is one of a small number of fintech companies with a national bank charter. We startedare building a new of kind of bank, one that aims to advantage our members with the information, tools, and guidance they need to achieve their own version of financial success. We do this by bringing a traditional credit product, the installment loan, into the digital ageleveraging data and became the largest provider of unsecured personal loans in the United States. On February 1, 2021, LendingClub completed the acquisition of Radius Bancorp, Inc. (Radius), whereby LendingClub became a bank holding company and formed LendingClub Bank, National Association (the Bank) as its wholly-owned subsidiary, through which we will now operate the vast majority of our business. With the acquisition, we combined the complementary strengths of the Company’s digital lending capabilities with an award-winning digital bank. LendingClub’s customers, or our “members”, can gaintechnology to increase access to credit, lower borrowing costs, and improve the return on savings – all through a broader range of financial productssmart, simple, and services designed to help them digitally manage their lending, spending and savings.rewarding digital experience. Since 2007, more than 34.8 million individuals have become members and thereby joined the Club, to help reach their financial goals. With the capabilities Radius possesses, the Company intends to enhance consumer engagement by offering a broader range of products and services aimed at supporting our members and further improving their financial health. In addition to serving our members, the acquisition of Radius enables us to offer products and services to commercial customers, as well as to continue to serve the broad range of institutional investors for our unsecured personal loans and auto loans (Consumer Loans), and for our patient and education finance loans.

We anticipate that additional strategic and financial benefits of the Radius acquisition will include:

•Increased resiliency with access to stable, low-cost deposit funding replacing higher-cost and more volatile third-party warehouse funding;

•Increased and more stable revenue driven by increased net interest income from Consumer Loans held for investment;

•Expense benefits by capturing the fees that were historically paid to our third-party issuing banks; and

•Ability to attract new members and deepen relationships with existing members through the addition of banking services that leverage LendingClub’s marketing and brand strengths.Club.

Our business model and competitive advantages

LendingClub Bank offersAs a digital marketplace bank, we offer key business model and competitive advantages over both traditional banks and fintech marketplaces, whichmarketplaces. These include:

•DataFinancially attractive and resilient business model. As a bank, we save on fees from third-party issuing banks, which compares favorably to nonbank fintechs. We benefit from two distinct revenue streams: (i) marketplace revenue in the form of origination fees from borrowers and servicing fees on loans sold to investors, which provides attractive in-period income, and (ii) net interest income earned from retaining a portion of our prime loan originations or other loans acquired for investment and from retaining senior securities related to Structured Program transactions, which provide a recurring and resilient revenue source. We are able to adjust the relative percentage of loans held for investment and loans sold through the marketplace depending on market conditions. In addition to improving our loan-level economics, our banking capabilities also substantially increase the long-term resiliency of our business by providing access to deposit funding, instead of higher-cost and more volatile third-party warehouse funding. Finally, as a digital-first marketplace bank without the legacy branches and related infrastructure of traditional banks, we are better able to leverage technology to meet customers where they are and provide them with efficient and effective solutions.

•Unmatched data and analytics, that drive a superiorwhich power our customer experience and underwriting results. We believe that lending is essentially a data problem and that we have the technology and expertise to solve it. We serve members across a wide band of the credit spectrum and have facilitated more than $60$90 billion of loans to over 3more than 4.8 million members since the Company was founded. OurThrough our interactions with applicants and members, we have allowed us to capture billions ofcollected more than 150 billion cells of performance and behavioral data across thousands of attributes which we useand various economic cycles. That data informs our activities across the customer lifecycle in both lending and savings – from marketing to continually refine ourunderwriting, pricing, and underwriting algorithms. By leveraging vast amountsservicing – and informs our proprietary credit decisioning and machine learning models to rapidly adapt and adjust to changing environments. As a result of our data advantage and continually refining our underwriting models, we believeiterative credit modeling, third-party data shows that we are able to assess credit risk more effectively compared tothan traditional scoring models allowingand our peer set, which allows us to expand access to credit and generate savings for members andwhile also enabling us to approve more members for loans. In addition, wegenerating competitive risk-adjusted returns. We also believe our access to data and robust marketing analyticsthose advantages promote efficiency when we generate and convert demand, driving lower customer acquisition costs.costs and give us a deep understanding of our members, which helps us anticipate their needs, informs future product offerings, and enables us to effectively customize offers.

•Strong, growing, and engaged customer loyalty and engagement.base. Our efficient marketplace model enables us to generate savings for a broad range of borrowers across the credit spectrum by matching them with the lowest available cost of funding provided by our platform investors. Our scalable technology platform, customer servicemarketplace, customer-focused culture, and effective use of data and analytics enableshas enabled us to efficiently originate loans.provide loans and savings to our millions of members. Our typical member is among the industry’s most sought-after consumers: borrowers who have relatively high incomes ($100,000+ annual income on average), high FICO scores (above 700 on average) and between mid-30s to mid-50s in age. Many of them have accumulated higher-cost debt as a result of relying on a limited set of available credit options to bridge cash flow gaps or disruptions and they want better, lower-cost solutions. We are able to help members refinance their higher-cost, adjustable rate debt

into a lower-cost, fixed rate product, thereby providing our members both savings and a pathway toward an improved financial position. Our high net promoter score reflects the strong affinity our members have for our brand. Withbrand and the acquisition of Radius,value we are able to offer additional banking services designed to deliver even more savings, driving increased customer loyalty and engagement.

•Operating and funding efficiency. With LendingClub as the originating bank, we save on fees that we historically paid third-party issuing banks. With access to low-cost deposits and by retaining a portionprovide. In fact many of our members return to us for a subsequent personal loan originationsand/or to increase their savings through other loan products, like auto refinance, and/or checking and deposit products. These “repeat members” have very low acquisition costs, demonstrate better loan performance, and are avid proponents of LendingClub, which serves as a powerful foundation for investment, we expect to generate an attractive stream of recurring revenue. In addition to improving our loan-level economics, we expect our banking capabilities will also substantially increase the resiliency of our business with access to more stable deposit funding.extension into future products.

With respectOur marketplace not only allows us to investors, weserve a broad spectrum of members, it also enables a broad range of institutions ranging from banks to institutional funds and asset managers to invest in our asset class. Our marketplace products primarily compete with other investment vehicles and asset classes, such as equities, bonds, and short-term fixed income securities. LendingClub’s key competitive advantages for marketplace investors include:

•Competitive risk-adjusted returns and short duration. We have over a decade-and-a-half track record of generating competitive risk-adjusted returns for marketplace investors. Our loans compare favorably to other alternative investment options due to their higher yield and shorter duration. We dynamically price loans based on a variety of inputs, such as competitive insights, supply and demand, and prevailing interest rates.

•Portfolio diversification. Unsecured personal and auto loansLoans we sell through our marketplace can offer duration, geographic, and/or asset diversification to investors.

•Generating competitive risk-adjusted returns.Innovative and easy-to-use technology platform. The data analyticsinvestor marketplace brings the traditional loan trading model into the digital age with faster, more efficient transactions that enable borrowers and underwriting resultsinvestors alike to achieve better outcomes. The marketplace supports same-day automated settlements, flexible real-time market-based pricing, the ability to customize investor portfolios and trading activity and passive or active loan selection strategies.

•Regulated and resilient counterparty. As a national bank subject to regulatory oversight and an investor in our own loans, LendingClub is a trusted partner, which is especially important for banks participating on our marketplace.

LendingClub’s key competitive advantages also extend to our members, including:

•Easy access to affordable credit. We allow members to easily apply for a loan from a desktop or mobile device, presenting a variety of our marketplace platform enable usrate and term options with no impact to generate competitive risk-adjusted returns for investors. We believetheir credit score. Once an offer is selected, we run credit and identity verifications, relying on automation when possible to reduce friction, and typically deposit funds (less any fees due to us) to approved applicants within a matter of days.

•Improvements in their financial position. Members who use a LendingClub personal loan to pay off their existing debt not only reduce their cost of debt but also may increase their credit score.

•Access to other LendingClub products and services. Members have access to a growing set of financial products and services that the risk-adjusted returns generated by our loans compare favorablyare designed to alternative investment options.work well together to deliver value in new and rewarding ways.

Our loan origination and deposit gathering model

Our sales and marketing efforts are designed to efficiently attract and retain customersmembers and build brand awareness. We use an array of marketing channels and constantly seek to improve and optimize the borrowermember experience, both on-online and offline, to achieve efficiency and high levels of customermember satisfaction.

We attract and retain members directly through our website and through targeted online advertising, online aggregation partners, direct mail, and other channels, (includingincluding search engines, online display advertising, email, social media and strategic relationship referrals) and this continues to drive growth in our customer base.referrals. Our growing member base often returns directly to LendingClub if they need another loan or deposit product – at very low acquisition cost for us – which increases the lifetime value of our members while helpingproviding them additional avenues to improve their financial health.position.

Our primary loan products include unsecured personal loans, secured auto refinance loans, and patient and education finance loans (Consumer Loans). Once a loan application is received, our efficientmultivariable and automated processes enable us to assess risk and present the applicantapproved applicants with various loan options, including the term, rate, and amount for which the applicant qualifies. AfterAlthough approval of the applicant selects their personalized financing option and completes the application process,vast majority of our loans is automated, we may perform additional verifications on the applicant.applicant verifications. Once any verifications are completed, and athe loan has been funded, the Bank originatesis originated and issues proceeds of the loan are issued to the borrower, net of theany origination or transaction fee charged and retained by us.

ThroughWe currently offer borrowers multiple features to lower their cost of debt and enhance their financial position, including balance transfers (where a borrower’s existing credit card debt is directly paid down and the acquisitionloan is consolidated into a fixed-rate term loan) and joint applications (where borrowers may receive a better rate when they jointly apply for a personal loan). These loan products are underpinned by a scalable technology platform and capabilities targeted directly at our members’ core needs to either lower the cost of Radius, we obtained commercial and consumer lending and deposit relationships as well as Banking-as-a-Service (BaaS) capabilities, through which we can offer certain of our products and services to third-parties. For depositors, we offer an award-winning digital experience, customer friendly features such as ATM fee rebates, rewards and competitive interest rates. their debt and/or improve the returns on their savings.

Our commercial lending business includes commercialis primarily focused on small businesses, and industrial loans, commercial real estate loans, small business loans and equipment loans and leases.we participate in the U.S. Small Business Administration (SBA) lending programs. Commercial loans are originatedsourced through relationship managers who maintain and build relationships with businesses across the country. We underwrite loans based on the credit worthinesscreditworthiness of commercial clients,businesses, including an assessment of cash flows, orand on the underlying value of collateral such as equipment orany collateral. In the first quarter of 2023, we ceased originating commercial real estate. Consumer loans acquired from Radius included residential mortgageestate loans and yacht loans.equipment leases and currently intend to retain the existing loan portfolios to maturity.

Prior to acquiring RadiusOur deposit business includes sourcing deposits directly from consumer and establishing the Bank,commercial customers and from third-party marketing channels and deposit brokers. For consumer depositors, we offer high-yield savings accounts, checking accounts and certificates of deposit (CDs). With our issuing bank for Consumer Loans was WebBank, a Utah-chartered industrial bank, member Federal Deposit Insurance Corporation (FDIC).FDIC-insured high-yield savings account, members can enhance their savings by earning competitive interest on their entire balance. Our issuing banks for educationchecking accounts deliver an award-winning digital experience and patient finance loans will remain NBT Bankmember-friendly features, such as ATM fee rebates, no overdraft fees and Comenity Capital Bank, which originate and service such loans. For our role in facilitating loan originations, we recognize transaction fees paid by the issuing banks and education and patient service providers once the loan is issued and the proceeds are delivered to the borrower.

Our marketplace and our members

Borrowersearly direct deposits.

Our marketplace originates unsecured personal loans that are primarily used to refinance credit card balances, make major purchases (including home improvement, education and healthcare costs) or for other purposes. We also originate secured loans that are primarily used to refinance auto loans.

Borrowers applying for loans through our programs must meet certain minimum credit requirements, including a minimum FICO score, satisfactory debt-to-income ratios, satisfactory credit history and a limited number of credit inquiries in the previous six months. After an automated credit scoring and decisioning process, we offer loans to approved applicants. Our personal loans generally have loan amounts between $1,000 to $40,000, with maturities of three or five years, fixed interest rates, monthly amortizing payments, and no prepayment penalties. For auto loans, loan amounts are between $4,000 to $55,000, with maturities ranging between two to seven years, monthly amortizing payments, and no prepayment penalties. Loans originated through our platform do not have interest rates or annual percentage rates in excess of 36%, which is often regarded as a benchmark for responsible lending.

We offer borrowers multiple features to lower their cost of debt and enhance their financial health, including balance transfers where a borrower’s existing credit card debt is paid down and the loan is consolidated into a fixed-rate term loan, and joint applications where borrowers may receive a better rate when they jointly apply for a personal loan.

Loan Investors

Our Consumer Loans are either: (i) sold to marketplace investors or (ii) retained by theLC Bank. Our commercial loans are generally retained by theLC Bank.

Loan Sales (Marketplace Activity): CertainWe sell whole loans to institutional investors, such as banks, asset managers, insurance companies, hedgeinvestment funds, credit unions and other large non-bank investors, seekthrough our innovative and proprietary marketplace. Our marketplace loan sales are executed as either: (i) whole loan sales to invest in our Consumer Loans. To meet this need,investors or (ii) Structured Program transactions.

In the second quarter of 2023, we launched Structured Certificates – a new type of Structured Program transaction where we retain the senior security and sell the residual certificate on a pool of loans to thesea marketplace investor at a predetermined price. This structure, developed by LendingClub and enabled by our marketplace bank model, delivers a transaction that benefits both marketplace investors throughand LendingClub. Marketplace investors earn compelling levered returns on the residual certificate without the need for the financing typically required for a whole loan purchase and sale agreements.LendingClub earns an attractive yield with remote credit risk. We sold over $1.5 billion of loans under this program during its first year in 2023.

We also facilitate loans through LCX, our real-time electronic platform and settlement technology. This proprietary investor platform can easily be customized to meet the needs of individual investors, making transactions on our marketplace fast, easy, and repeatable. This platform has a variety of benefits derived from its unique features:

•A diverse, multifaceted investor market, which enables LendingClub to offer loans to a greater number of customers across a wider credit spectrum than what LC Bank retains on its balance sheet.

•A competitive, dynamically priced market that allows a broad array of investors to instantly buy loans at variable prices (at, below, or above par). It also provides us with real-time information on current market prices and demand for certain types of loans, which helps inform our credit models.

•A flexible and adaptable platform that enables LendingClub to test and launch new products, including structured products, or potential underwriting expansions with limited credit or market risk to LC Bank.

•Quick and efficient trading at scale, that allows investors to quickly deploy their strategies and change their approaches as conditions warrant.

LendingClub Bank: TheLC Bank holds high-quality prime loans and funds those loans directly with its own capital and deposits, which are typically stable and retains thelow cost. We retain these loans for investment.investment on LC Bank’s balance sheet and recognize this source of recurring revenue over the life of the loans.

PriorLoan Purchases: From time to time, we may opportunistically purchase loans. For example, in the acquisitionfourth quarter of Radius,2022, we acquired a $1.05 billion outstanding principal personal loan portfolio we previously facilitated and have since held those loans on our loan investors also purchased loans through:balance sheet to earn net interest income.

Retail Notes. Investors werehad historically been able to purchase LendingClub Member Payment Dependent Notes (Retail Notes), which wereare securities for which cash flows to investors were dependent upon principal and interest payments made by borrowers of certain unsecured personal loans. As of December 31, 2020, and in anticipation of the closing of the Acquisition, LendingClub ceased offering and selling Retail Notes. The total balance of outstanding Retail Notes and related loans will continue to decline as underlying borrower payments are made. The Company does not share in any interest rate or credit risk on the related loans.

Structured Program Transactions. Prior to the first quarter of 2020, we also sold loans through Structured Programs, which included asset-backed securitization transactions and Certificate Program transactions. The Company continues to be required to retain a portion of the securities from these transactions.

Seasonality

Historically, personal loan volume on our platformmarketplace is generally lower in the first quarterand fourth quarters of the year, primarily due to seasonality of borrower behavior. Additionally, in the fourth quarter of the year, we typically observe fluctuations in marketing effectiveness and borrower behavior, due to the holidays, which can impact volume. These seasonal

trends contribute to fluctuations in our operating results. Additionally, the current market environment could result in continued reduction in loan origination volume, which may impact our operating results and operating cash flow. However, we may not observe such trends due toin the impact of COVID-19.near term.

Revenue

Prior to the acquisition, we facilitated loan originations by connecting borrowers with investors through our online lending marketplace platform. However, we relied on third-party issuing banks toWe originate and fund loans initiated by borrowers, which were then sold to investors. Following the acquisition, the Bank became the originator and lender for our Consumer Loans. As discussed above, we fund our Consumer Loan originationsLoans through the Company’s marketplace by either selling loansthem directly to third-party purchasersinvestors, which generates a majority of related revenue immediately, or investingby using our own capital in originated loans and holding thoseto hold the loans for investment.investment, which generates revenue over the life of the loan.

As the originator of Consumer Loans, origination feesRevenue from loans held for sale (HFS) will beis recorded in “Marketplace revenue” and “Interest income” on our Consolidated Statements of Income (Income Statement). Marketplace revenue includes origination fees recorded at the time of loan origination and is monetized as a componentcash from loan investor sale proceeds. Marketplace revenue also includes the gain on sales of marketplace lending revenue. Marketplace lending revenue willloans (recognition of servicing asset), servicing fees received from investors over the life of the loan, and net fair value adjustments (gains or losses from sale prices in excess of or less than the loan principal amount). We also include servicing revenue associated withearn interest income on loans HFS between the time of origination and the settlement date of the loan sales. Origination fees and costssales to investors.

Revenue from loans held for investment (HFI) will beat amortized cost is recorded in “Interest income” on our Income Statement. Origination fees and applicable costs on loans HFI are deferred and are accreted through interest income, over the life of the loans and are accelerated when loans are paid in full before their maturity date. The CECL allowance for HFI loans at amortized cost is calculated using a discounted cash flow (DCF) approach and is an estimate of the net present value of lifetime expected credit losses, reflected as a charge through earnings. The lifetime estimated credit losses on HFI loans will bewhich is initially recognized through earnings when such loans are originated or otherwise acquired,(as “Provision for credit losses”) at the time of origination, while the loan interest received will beand the accretion of deferred fees and costs are recognized according to the loan’s contractual payment terms. Due to thisthe timing difference betweencaused by origination fee deferrals and upfront credit losses taken throughloss provisioning, earnings and actual charge-offs, we expect earnings to beare disproportionately impacted in

from the near term from thestrong expected organic growth in our HFI loan portfolio at amortized cost before benefiting from higher levels of interest income in later periods.

Prior toHFI loans are measured at fair value if the acquisition of Radius, our primary sources of revenue consisted of transaction fees that were paid to us by issuing banks to facilitate loan originations, netCompany elects the fair value option. We may elect the fair value option for certain HFI loans. Interest income is recorded under the effective interest income andmethod, which considers any purchase premium or discounts. In addition, purchase-related discounts absorb credit losses. We record fair value adjustments on loans investedthat are recorded at fair value in by the Company, investor fees that compensated us for the costs we incurred in servicing loans, and a gain or loss“Marketplace revenue” on sales of loans.

See “Part II – Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion of our revenue streams prior to the acquisition of Radius.Income Statement.

Competition

The financial services industry is highly competitive, rapidly changing, highly innovative, and subject to regulatory scrutiny and oversight. We compete with financial services providers such as banks, savings and loan associations, credit unions, finance companies, mortgage banking companies, insurance companies, investment banks and mutual fundfinance companies. We also face increased competition from non-bank institutions such as online and marketplace lending companies, as well as from financial services subsidiaries of commercial and manufacturing companies. Many of these competitors enjoyhave fewer regulatory constraints and some may have lower cost structures. The financial services industry is also likely to become more competitive as further technological advances enable more companies to provide financial services.

See “Item 1A. Risk Factors – Substantial and increasing competition in our industry may harm our business” for further discussion of the potential impact of competition on our business.

Regulation and Supervision

General

The U.S. financial services and banking industry is highly regulated. The bank regulatory regime is intended primarily for the protection of customers, the public, the financial system and the Deposit Insurance Fund (DIF) of the Federal Deposit Insurance Corporation (FDIC), rather than our shareholdersstockholders or creditors.

The legal and regulatory regime affects virtually all aspects of our operations. Statutes, regulations and regulatory and supervisory policies govern, among other things, the scope of activities that we may conduct and the manner in which we may conduct them; our business plan and growth; our board, management, and risk management infrastructure; the type, terms, and pricing of our products and services; our loan and investment portfolio; our capital and liquidity levels; our reserves against deposits; our ability to pay dividends, buy-back stock or distribute capital; and our ability to engage in mergers, acquisitions, strategic initiatives and other strategic initiatives.transactions between LC Bank and its affiliates. The legal and regulatory regime is continually under review by legislatures, regulators and other governmental bodies, and changes regularly occur through the enactment or amendment of laws and regulations or through shifts in policy, implementation or enforcement. Changes are difficult to predict and could have significant effects on our business.

The material regulatory requirements that are applicable to us and our subsidiaries are summarized below. The description below, as well as other descriptions of laws and regulations in this Annual Report, isare not intended to summarize all laws and regulations applicable to us and our subsidiaries, and isare based upon the statutes, regulations, policies, interpretive letters and other written guidance that are in effect as of the date of this Annual Report.

Regulatory Framework

We are subject to regulation and supervision by multiple regulatory bodies. As a bank holding company, the Company is subject to the Bank Holding Company Act of 1956 (BHCA) and is subject to ongoing and comprehensive supervision, regulation, examination and enforcement by the Board of Governors of the Federal Reserve System (FRB). The FRB’s jurisdiction also extends to any company that is directly or indirectly controlled by aFRB acts as the supervisor of the consolidated operations of bank holding company.companies.

As a national bank, theLC Bank is subject to ongoing and comprehensive supervision, regulation, examination and enforcement by the Office of the Comptroller of the Currency (OCC). The OCC charges fees to national banks, including theLC Bank, in connection with its supervisory activities.

TheLC Bank’s deposits are insured by the Deposit Insurance Fund (DIF)DIF of the FDIC up to applicable legal limits. As an FDIC-insured depository institution, theLC Bank is subject under certain circumstances to supervision, regulation and examination by the FDIC. The FDIC charges deposit insurance assessments to FDIC-insured institutions, including theLC Bank, to fund and support the DIF. The rate of these deposit insurance assessments is based on, among other things, the risk characteristics of theLC Bank. The FDIC has the power to terminate theLC Bank’s deposit insurance if it determines theLC Bank is engaging in unsafe or unsound practices. Federal banking laws provide for the appointment of the FDIC as receiver in the event theLC Bank were to fail, such as in connection with undercapitalization, insolvency, unsafe or unsound condition or other financial distress. In a receivership, the claims of the receiver for administrative expenses and the claims of LC Bank’s depositors (and those of the FDIC as subrogee of theLC Bank) would have priority over other general unsecured claims against theLC Bank.

The Company isWe are subject to the disclosure and regulatory requirements of the Securities Act of 1933, as amended, and the Securities Exchange Act, of 1934, as amended, both as administered by the SEC. The Company’sOur common stock is listed on the New York Stock Exchange (NYSE) under the trading symbol “LC” and therefore the Company iswe are also subject to the rules of the NYSE for listed companies.

Broad Powers to Ensure Safety and Soundness

A principal objective of the U.S. bank regulatory system is to ensure the safety and soundness of banking organizations. Safety and soundness is a broad concept that includes financial, operational, compliance and reputational considerations, including matters such as capital, asset quality, quality of board and management oversight, earnings, liquidity, and sensitivity to market and interest rate risk. As part of its commitment to maintain safety and soundness, at the time the Company acquired theLC Bank, theLC Bank entered into an Operating Agreement with the OCC (the Operating Agreement). The Operating Agreement setsset forth key parameters within which the

LC Bank mustwas required to operate within, such as with respect to its business plan, minimum capital, directors and senior executive officers, risk management and compliance. Per its original terms, the Operating Agreement expired on February 2, 2024.

The banking and financial regulators have broad examination and enforcement authority. The regulators require banking organizations to file detailed periodic reports and regularly examine the operations of banking organizations. Banking organizations that do not meet the regulators’ supervisory expectations can be subjected to increased scrutiny and supervisory criticism. The regulators have various remedies available, which may be public or of a confidential supervisory nature, if they determine that an institution’s condition, management, operations or risk profile is unsatisfactory. The regulators may also take action if they determine that the banking organization or its management is violating or has violated any law or regulation. The regulators have the power to, among other things:

•require affirmative actions to correct any violation or practice;

•issue administrative orders that can be judicially enforced;

•direct increases in capital;

•direct the sale of subsidiaries or other assets;

•limit dividends and distributions;

•restrict growth and activities;

•set forth parameters, obligations and/or limitations with respect to the operation of our business;

•assess civil monetary penalties;

•remove officers and directors; and

•terminate deposit insurance.

Engaging in unsafe or unsound practices or failing to comply with applicable laws, regulations and supervisory agreements could subject us and our subsidiaries or their officers, directors and institution-affiliated parties to thea broad variety of sanctions or remedies, including those described above and other sanctions.above.

Limits on Activities and Approval Requirements

The BHCA generally restricts the Company’s ability, directly or indirectly, to engage in, or acquire more than 5% of any class of voting securities of a company engaged in, activities other than those determined by the FRB to be so closely related to banking as to be a proper incident thereto. The Gramm-Leach-Bliley Act expanded the scope of permissible activities to include those that are financial in nature or incidental or complementary to a financial activity for a bank holding company that elects to be a financial holding company, which requires the satisfaction of certain conditions. We have not elected financial holding company status.

The bank regulatory regime including through the Operating Agreement, requires that we obtain prior approval of one or more regulators for various initiatives or corporate actions, including acquisitions or minority investments, the establishment, relocation or closure of branches, certain changes to our board or senior management, certain dividends or capital distributions, and significant deviations from the Bank’s previously approved business plan.distributions. Regulators take into account a range of factors in determining whether to grant a requested approval, including the supervisory status of the applicant and its affiliates. Thus, there is no guarantee that a particular proposal by us would receive the required regulatory approvals.

The Community Reinvestment Act (CRA) requires federal banking regulators, in their review of certain applications by banking organizations, to take into account the applicant’s record in helping meet the credit needs of its community, including low- and moderate-income neighborhoods. TheLC Bank is subject to periodic examination under the CRA by the OCC, which will assign ratings based on the methodologies set forth in its regulations and guidance. Less favorable CRA ratings, or concerns raised under the CRA, may adversely affectresult in negative regulatory consequences for LC Bank. The federal banking regulators have recently finalized reforms to the Bank’s abilityregulations implementing the CRA that, subject to obtain approval forthe outcome of related litigation, may impact how certain types of applications.activities may be considered, and how regulators may assess performance, under the CRA.

Company as Source of Strength for theLC Bank

Federal law and FRB policy require that a bank holding company serve as a source of financial and managerial strength for any FDIC-insured depository institution that it controls. Thus, if theLC Bank were to be in financial distress or to otherwise be viewed by the regulators as in an unsatisfactory condition, then the regulators couldFederal Reserve has the authority to require the Company to provideact as a source of strength for LC Bank, which could include providing additional capital or liquidity support, or take other action, in support of theLC Bank, even if doing so is not otherwise in the best interest of the Company.

Regulatory Capital and Liquidity Requirements and Prompt Corrective Action

The Company and LC Bank are expected to have established policies and practices for identifying, measuring, monitoring and controlling their funding and liquidity risks. The banking regulators view capital levels as important indicators of an institution’s financial soundness. As a general matter, FDIC-insured depository institutions and their holding companies are required to maintain a specified level of capital relative to the amount and types of assets they hold. While capital can serve as an important cushion against losses, higher capital requirements can also adversely affect an institution’s ability to grow and/or increase leverage through deposit-gathering or other sources of funding.

The Company and theLC Bank are each subject to generally similar capital requirements adopted by the FRB and the OCC, respectively. These requirements establish required minimum ratios for common equity Tiertier 1 (CET1) risk-based capital, Tier 1 risk-based capital, total risk-based capital and a Tier 1 leverage ratio; set risk-weighting for

assets and certain other items for purposes of the risk-based capital ratios; require an additional capital conservation buffer over the minimum required capital ratios in order to avoid certain limitations on paying dividends, engaging in share repurchases, and paying discretionary bonuses; and define what qualifies as capital for purposes of meeting the capital requirements. The U.S. capital requirements generally are modeled off the Capital Accords of the Basel Committee on Banking Supervision (BCBS). Specifically, the capital thresholds in order to be regarded as a well-capitalized institution under the Basel Committee on Banking SupervisionBCBS standardized approach for U.S. banking organizations are as follows: a CET1 risk-based capital ratio of 6.5%, a Tier 1 risk-based capital ratio of 8.0%, a total risk-based capital ratio of 10.0% and a Tier 1 leverage ratio of 5.0%.

The regulators assess any particular institution’s capital adequacy based on numerous factors and may require a particular banking organization to maintain capital at levels higher than the generally applicable minimums. In this regard, and unless otherwise directed by the OCC, we have made commitments for the Bank to maintain a common equity Tier 1 risk-based capital ratio of 11%, a Tier 1 risk-based capital ratio above 11%, a total risk-based capital ratio above 13% and a Tier 1 leverage ratio of 11% for a minimum of three years following its formation.

The Federal Deposit Insurance Act provides for a system of “prompt corrective action” (PCA). The PCA regime provides for capitalization categories ranging from “well-capitalized” to “critically undercapitalized.” An institution’s PCA category is determined primarily by its regulatory capital ratios. The PCA requires remedial actions and imposes limitations that become increasingly stringent as an institution’s condition deteriorates and its PCA capitalization category declines. Among other things, institutions that are less than well-capitalized become subject to increasingly stringent restrictions on their ability to accept and/or rollover brokered deposits.

In addition to capital requirements, depository institutions are required to maintain non-interest bearing reserves at specified levels against their transaction accounts and certain non-personal time deposits.

Regulatory Limits on Dividends and Distributions

The ability of the Company or theLC Bank to pay dividends, buy backrepurchase stock and make other capital distributions is limited by regulatory capital rules and other aspects of the regulatory regime. For example, a policy statement of the FRB provides that, among other things, a bank holding company generally should not pay dividends if its net income for the past year is not sufficient to cover both the cash dividends and a rate of earnings retention that is consistent with the company’s capital needs, asset quality, and overall financial condition.

Dividends and capital distributions by theLC Bank are also limited by the regulatory regimes. For example, the Operating Agreement requires the Bank to obtain a prior written determination of non-objection from the OCC

before declaring any dividend. Taking into account a wide range of factors, the OCC may object and therefore prevent the Bank from paying dividends to the Company. Other laws and regulations generally applicable to national banks also limit the amount of dividends and capital distributions that may be made by a national bank and/or require prior approval of the OCC. Because substantially all of our business activities, income and cash flow are expected to be generated by theLC Bank, an inability of theLC Bank to pay dividends or distribute capital to the Company would adversely affect the Company’s liquidity.

See“Part II – Item 8. Financial Statements and Supplementary Data– Notes to Consolidated Financial Statements – Note 21. Regulatory Requirements” and “Item 1A. Risk Factors – Risks Related to Regulation, Supervision and Compliance” for additional information.

Consumer Protection

We are subject to a broad array of federal, state and local laws and regulations that govern almost every aspect of our business relationships with consumers. These laws relate to, among other things, the content and adequacy of disclosures, pricing and fees, fair lending, anti-discrimination, privacy, cybersecurity, usury, mortgages and housing finance, lending to service members, escheatment, debt collection, loan servicing, collateral secured lending, availability of funds and unfair, deceptive or abusive acts or practices.

The Consumer Financial Protection Bureau (CFPB) is generally responsible for rulemaking with respect to certain federal laws related to the provision of financial products and services to consumers. In addition, the CFPB has examination and primary enforcement authority with respect to federal consumer financial protection laws with respect to banking organizations with assets of $10 billion or more. TheLC Bank has assets less than $10 billion; therefore, we are not currently subject to the examination and primary enforcement jurisdiction of the CFPB. However, many consumer protection rules adopted or amended by the CFPB do apply to us and are the subject of examination and enforcement with respect to us by the FRB and OCC.

If we fail to comply with these laws and regulations, we may be subject to significant penalties, judgments, other monetary or injunctive remedies, lawsuits (including putative class action lawsuits and actions by state and local attorneys general or other officials), customer rescission rights, supervisory or enforcement actions, and civil or criminal liability.

Anti-Money Laundering, Sanctions and Financial Crime

We are subject to a wide range of laws related to anti-money laundering (AML), anti-corruption, anti-bribery, economic sanctions and prevention of financial crime, including the Bank Secrecy Act, the USA PATRIOT Act and economic sanctions programs. We are required to, among other things, maintain an effective anti-money laundering and counter-terrorist compliance program, identify and file suspicious activity and currency transaction reports, and block or reject transactions with sanctioned persons or jurisdictions. Compliance with these laws requires significant investment of management attention and resources. These laws are enforced by a number of federal and state regulatory and enforcement authorities, including the FRB, OCC, Office of Foreign Assets Control, the Financial Crimes Enforcement Network, the U.S. Department of Justice, Drug Enforcement Administration, and Internal Revenue Service. Failure to comply with these laws, or to meet our regulators’ supervisory expectations in connection with these laws, could subject us to supervisory or enforcement action, significant financial penalties, criminal liability and/or reputational harm.

Third-Party Relationship Risk Management

We utilize third-party service providers to perform a wide range of operations and other functions, which may present various risks. Our regulators will expect us to maintain an effective program for managing risk arising from third-party relationships, which should be commensurate with the level of risk and complexity of our business and our third-party relationships. If not managed effectively, the use of third-party service providers may expose us to risks that could result in regulatory action, financial loss, litigation, and reputational harm.

Privacy, Information Technology and Cybersecurity

We are subject to various laws related to the privacy of consumer information. For example, the Company and its subsidiaries are required under federal law periodically to disclose to their retail clients the Company’s policies and

practices with respect to the sharing of nonpublic client information with their affiliates and others, and the confidentiality and security of that information. In some cases, theLC Bank must obtain a consumer’s consent before sharing information with an unaffiliated third party, and theLC Bank must allow a consumer to opt out of theLC Bank’s sharing of information with its affiliates for marketing and certain other purposes. We are also subject to laws and regulatory requirements related to information technology and cybersecurity. For example, the Federal Financial Institutions Examination Council (FFIEC), which is a council comprised of the primary federal banking regulators, has issued guidance and supervisory expectations for banking organizations with respect to information technology and cybersecurity. Our regulators regularly examine us for compliance with applicable laws and adherence to industry best practices with respect to these topics. For example, they will evaluate our security of user and customer credentials, business continuity planning, and the ability to identify and thwart cyber-attacks. The federal banking regulators have also implemented rules to require banks and their service providers to provide certain notification when certain cybersecurity incidents occur.

State regulators have also been increasingly active in implementing privacy and cybersecurity standards and regulations. Recently, several states have adopted regulations requiring certain financial institutions to implement cybersecurity programs and providing detailed requirements with respect to these programs, including data encryption requirements. Many states have also recently implemented or modified their data breach notification and data privacy requirements. For example, the California Consumer Privacy Rights Act of 2020 became effectivefully operative on January 1, 2020.2023. We expect this trend of state-level activity in those areas to continue, and are continually monitoring developments in the states in which our clients are located.

Limitations on Transactions with Affiliates and Loans to Insiders

Banks areLC Bank is subject to restrictions on theirits ability to conduct transactions with affiliates and other related parties under federal banking laws.parties. For example, federal banking laws impose quantitative limits, qualitative requirements, and collateral standards on certain extensions of credit and other transactions by an insured depository institution with, or for the benefit of, its affiliates. In addition, most types of transactions by an insured depository institution with, or for the benefit of, an affiliate must be on terms substantially the same or at least as favorable to the insured depository institution as if the transaction were conducted with an unaffiliated third party. Federal banking laws also impose restrictions and procedural requirements in connection with the extension of credit by an insured depository institution to directors, executive officers, principal shareholdersstockholders (including the Company) and their related interests. In addition, purchases and salesextensions of assetscredit between an insured depository institution and its executive officers, directors, principal stockholders, and principal shareholders maytheir related interests are also be limited under such laws.by federal law. The Sarbanes-Oxley Act generally prohibits loans by public companies to their executive officers and directors. However, there is a specific exception for loans by financial institutions, such as theLC Bank, to its executive officers and directors that are made in compliance with federal banking laws.

Acquisition of a Significant Interest in the Company

Banking laws impose various regulatory requirements on parties that may seek to acquire a significant interest in the Company. For example, the Change in Bank Control Act of 1978 would generally require that any party file a formal notice with, and obtain non-objection of, the FRB prior to acquiring (directly or indirectly, whether alone or acting in concert with any other party) 10% or more of any class of voting securities of the Company. Further approval requirements and significant ongoing regulatory consequences would apply to any company that (directly or indirectly, whether alone or as part of an association with another company) seeks to acquire “control” of the Company or theLC Bank for purposes of the BHCA. The determination whether a party “controls” a depository institution or its holding company for purposes of these laws is based on applicable regulations and all of the facts and circumstances surrounding the investment.

Certain Regulatory Developments Relating to the COVID-19 Pandemic CARES Act

On March 27, 2020, the Coronavirus Aid, Relief and Economic Security Act (CARES Act) was passed by Congress and signed into law by the President. Below is a brief overview of some of the provisions of the CARES Act and other regulations and supervisory guidance related to the COVID-19 pandemic that are applicable to the operations and activities of the Company and the Bank.

Paycheck Protection Program (PPP). A principal provision of the CARES Act amended the Small Business Administration’s (SBA) loan program to create a guaranteed, unsecured loan program, the PPP, to fund operational costs of eligible businesses, organizations, and self-employed persons during the COVID-19 pandemic. On June 5, 2020, the Paycheck Protection Program Flexibility Act (PPPFA) was signed into law, which among other things, gave borrowers additional time and flexibility to use PPP loan proceeds. Shortly thereafter, and due to the evolving impact of the COVID-19 pandemic, additional legislation authorizing the SBA to resume accepting PPP applications on July 6, 2020 and extending the PPP application deadline to August 8, 2020 was signed. It is anticipated that additional revisions to the SBA’s interim final rules on forgiveness and loan review procedures will be forthcoming to address these and related changes. As a participating lender in the PPP, the Bank continues to monitor legislative, regulatory, and supervisory developments related thereto.

Temporary Regulatory Capital Relief related to Impact of Current Expected Credit Loss (CECL). Concurrent with enactment of the CARES Act, federal bank regulatory authorities issued an interim final rule that delays the estimated impact on regulatory capital resulting from the adoption of CECL. The interim final rule provides banking organizations that implement CECL before the end of 2020 the option to delay for two years the estimated impact of CECL on regulatory capital relative to regulatory capital determined under the prior incurred loss methodology, followed by a three-year transition period to phase out the aggregate amount of capital benefit provided during the initial two-year delay.

Effect on Economic Environment

The policies of regulatory authorities, including the monetary policy of the FRB, have a significant effect on the operating results of bank holding companies and their subsidiaries. Among the means available to the FRB to affect the money supply are open market operations in U.S. government securities, changes in the discount rate on borrowings and changes in reserve requirements with respect to deposits. These means are used in varying combinations to influence overall growth and distribution of bank loans, investments and deposits, and their use may affect interest rates charged on loans or paid for deposits. The FRB monetary policies have materially affected the operating results of commercial banks in the past and are expected to continue to do so in the future. WeAlthough we conduct stress tests to measure and prepare for the impact of potential changes in monetary policy, we cannot predict with certainty the nature of future monetary policies and the effect of such policies on itsour business and earnings.

Issuing Bank Model

As disclosed above, priorPrior to acquiring Radius and establishing theLC Bank, our issuing bank for unsecured personal and auto refinance loans was WebBank, a Utah-chartered industrial bank. Our issuingpartner banks for education and patient finance loans will remainwere NBT Bank and Comenity Capital Bank, which originate and service such loans. NBT Bank is subject to oversight by the OCC and was phased out as a partner in 2021. Comenity Capital Bank is subject to oversight by the FDIC and the Utah Department of Financial Institutions.Institutions, and continues to be a partner. These authorities impose obligations and restrictions on our activities and the loans facilitated through our lending marketplace through issuing banks, and there haspartner banks.

There have been challenges to the ability of an FDIC-insured depository institutiona bank to "export"“export” interest rates permitted by the laws of the state where the bank is located, regardless oflocated. For example, the usury limitations imposed by the laws of the state of the borrower’s residence.

The Second Circuit’s 2015 decision in Madden v. Midland Funding, LLC has led to an

increase in inquiries, regulatory proceedings and litigation challenging or raising issues relating to the application of state usury restrictions and limitations and lending arrangements where a bank or other third party has made a loan and then sells and assigns it. In May 2020, the OCC issued a final rule clarifying that interest on a loan that is lawful under federal law for national banks and federal savings associations remains lawful upon the sale, assignment or other transfer of the loan.loan (the OCC Rule). The FDIC issued a similar final rule in June 2020 applicable to FDIC insured state-chartered banks. Additionally,banks (the FDIC Rule). Since these final rules, several federal district courts have declined to follow the Madden decision, including in October 2020,Colorado, Massachusetts and New York. On February 8, 2022, a federal district court granted summary judgment in favor of the OCC issuedand FDIC in lawsuits brought by multiple states seeking to invalidate the OCC Rule and FDIC Rule (California, et al. v. The Office of the Comptroller of the Currency, et al., No. 4:20-cv-05200-JSW (N.D. Cal.); California, et al. v. Federal Deposit Insurance Corporation, No. 4:20-cv-05860-JSW (N.D. Cal.)).

Regulatory Examinations and Actions Relating to the Company’s Pre-Acquisition Business

The Company is routinely subject to examination for compliance with applicable laws and regulations in the states in which it is licensed. Prior to the Acquisition, the Company conducted its business through nonbank entities, some of which maintain or maintained various financial services licenses in numerous jurisdictions. Since the Acquisition, the vast majority of the Company’s business is conducted through LC Bank pursuant to the laws applicable to national banks. Accordingly, many state level regulations and licensing requirements no longer apply to the Company post-Acquisition in part because: (i) it is a rule clarifying that whenbank holding company operating a national bank or federal savings association makes a loan it isand therefore subject to the “true lender” in the context of a partnership between the bank and a third party if, aspurview of the datefederal banking regulations and regulators, and (ii) post-Acquisition, the Company has ceased certain types of origination, it is namedoperations that were unique to its pre-Acquisition business model, such as the lender inRetail Notes program.

Therefore the loan agreementCompany’s nonbank entities have returned, and may continue to return, certain state financial services licenses that were used for pre-Acquisition business activities that have since been discontinued. Nevertheless, even after state financial services licenses are returned, the Company may continue to be subject to the regulation, supervision and enforcement of various state regulatory authorities with respect to legacy or fundsresidual activities. Furthermore, the loan. It is unclear what impactCompany’s nonbank entities continue to maintain certain state licenses, which continue to subject the positionCompany to the regulation, supervision and enforcement of the OCC or FDIC, or the rules they have promulgated, will have on existing or future litigation orsome state regulatory proceedings involving arguments of federal preemption of state usury laws.

LENDINGCLUB CORPORATION

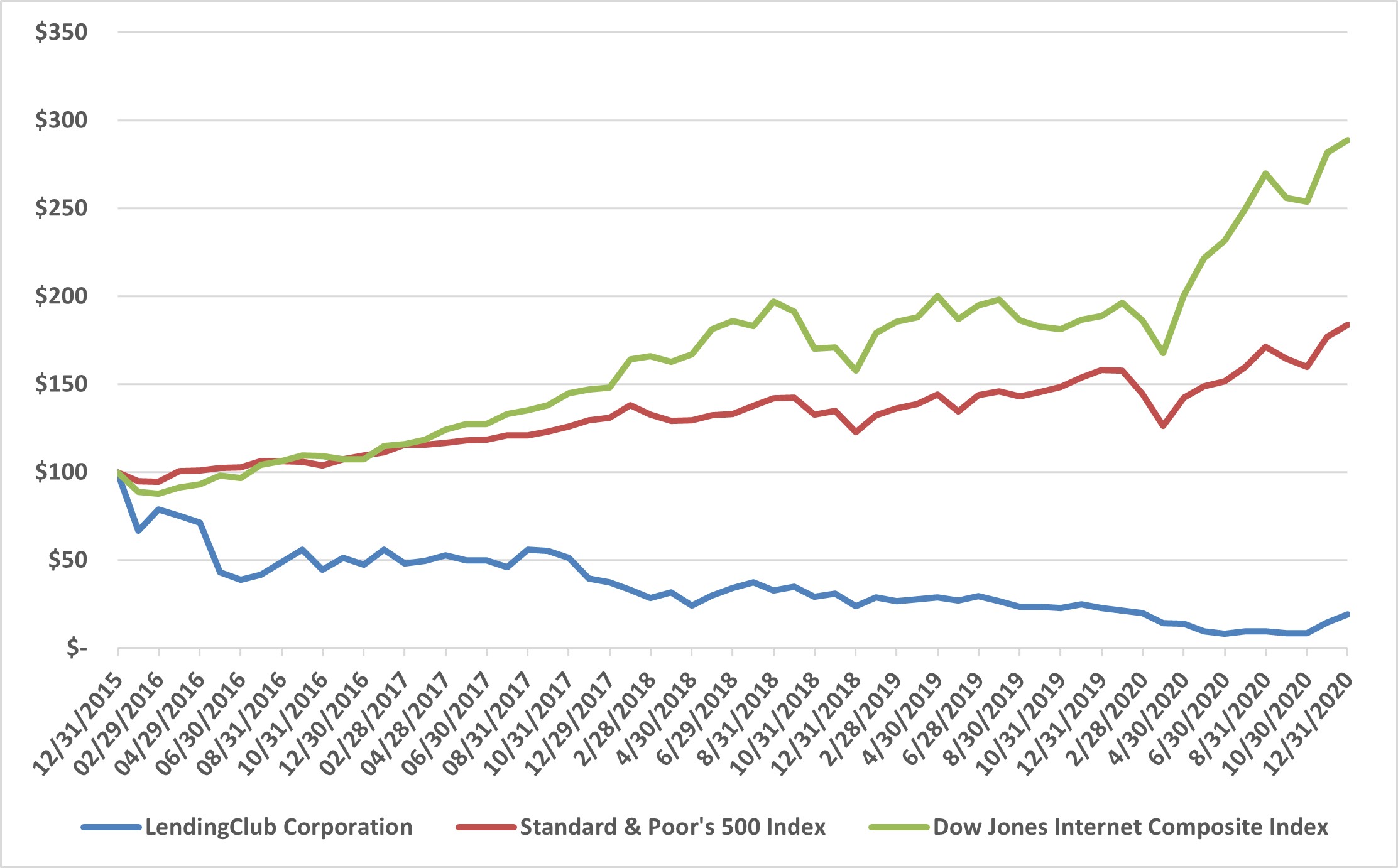

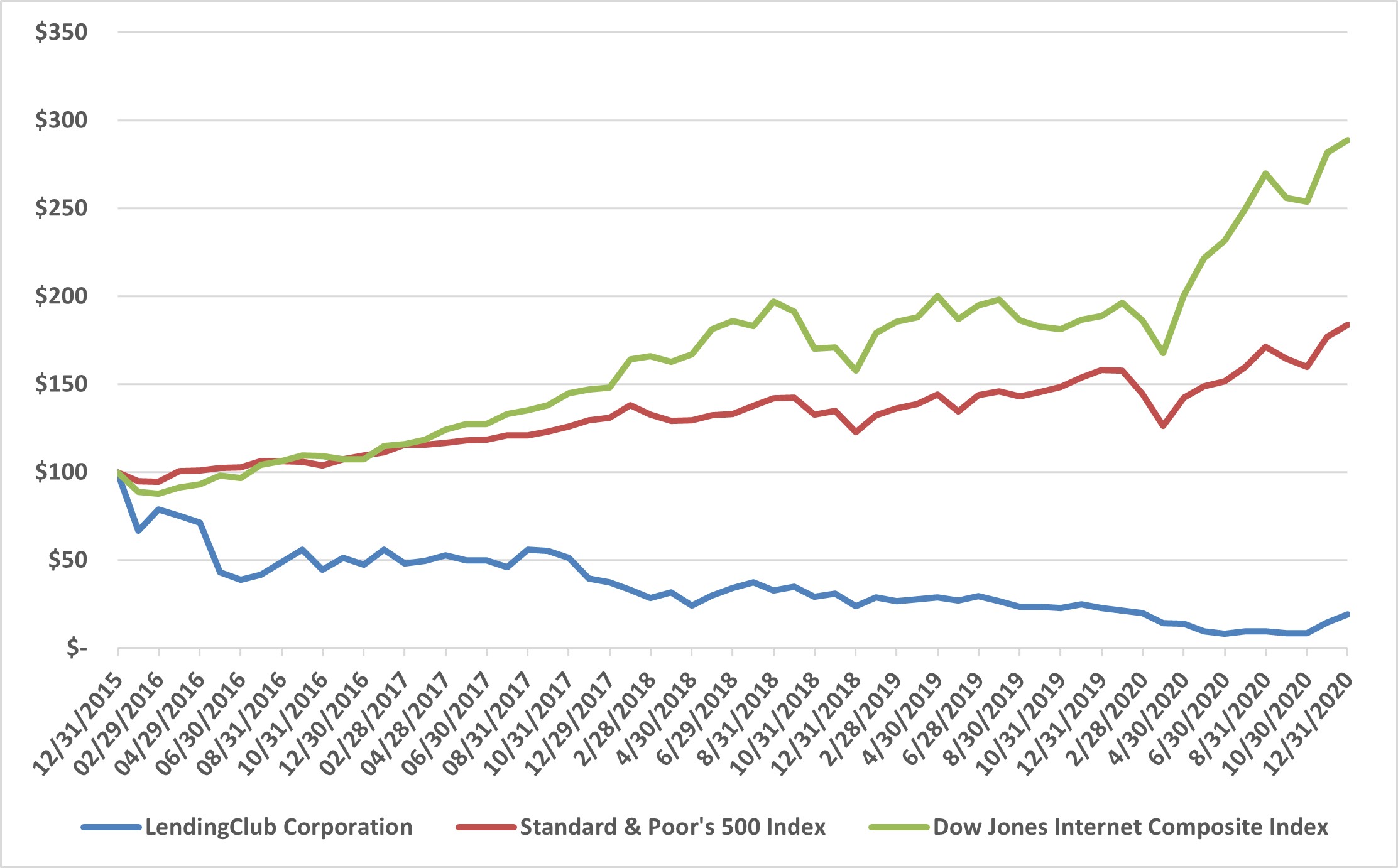

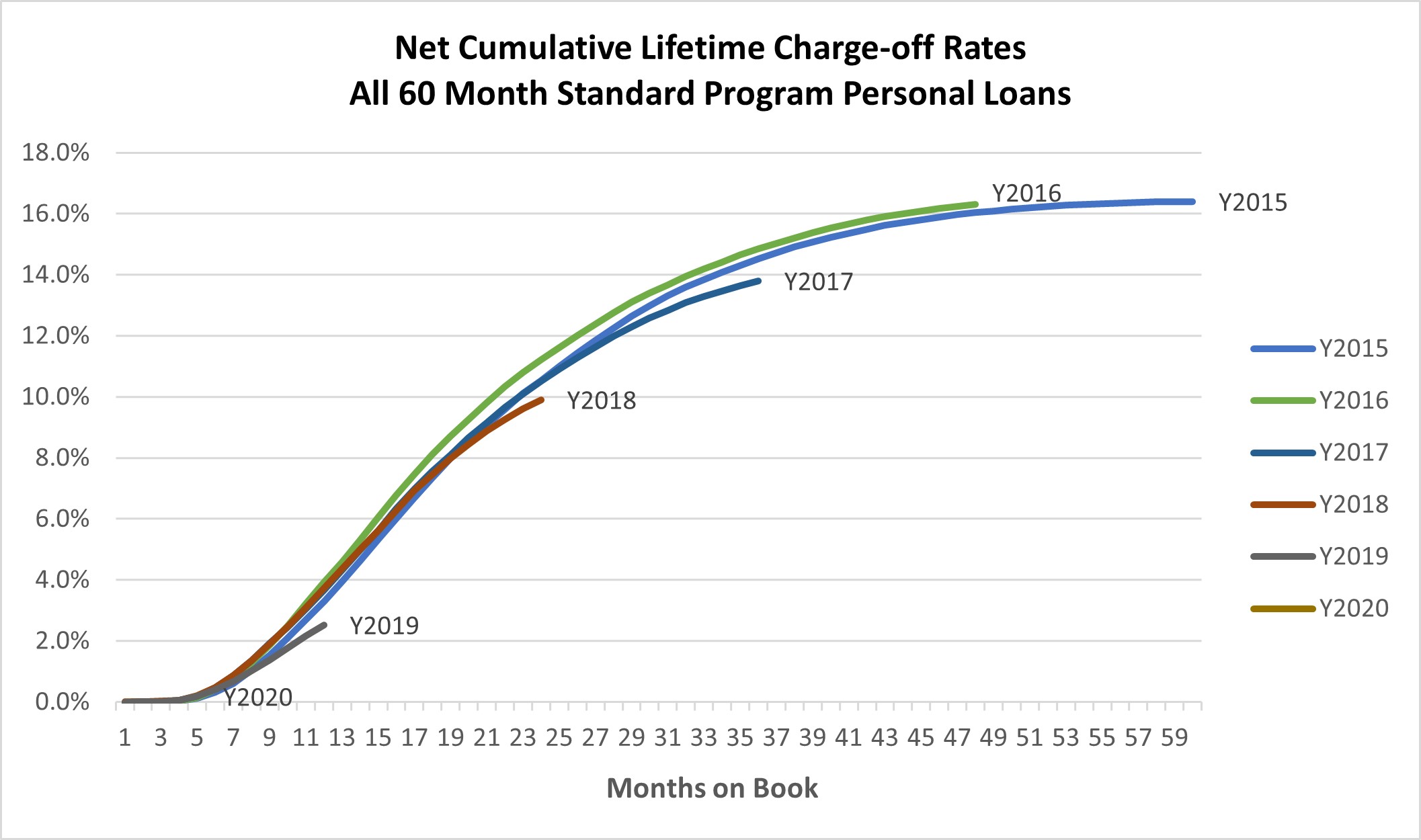

authorities.