Proposed Wag! Business Combination

Overview

On February 2, 2022, we entered into a business combination agreement (the “Business"Business Combination Agreement”Agreement") with, CHW Merger Sub, Inc., a Delaware corporation and a direct, wholly owned direct subsidiary of CHW (“merged with and into Legacy Wag! (the "Merger"), with Legacy Wag! surviving the Merger Sub”as a wholly owned subsidiary of CHW. The Merger was approved by CHW’s stockholders at a meeting held on July 28, 2022. At the closing of the Merger, CHW changed its name to Wag! Group, Co.

Our Business

Our BusinessOur company was founded in 2015, born from a passion for the well-being of pets and an entrepreneurial spirit focused on making pet parenthood easier so that pets and their humans can share a fulfilling life full of joyful moments. Wag! develops and supports a proprietary marketplace technology platform available as a website and mobile app that enables independent Pet Caregivers and vendors to connect with Pet Parents. We built a platform where Pet Parents can find Pet Caregivers who want to earn extra income, together with a marketplace of services providers and vendors who are able to provide support for pets. We believe that these connections not only enable better care for pets, but also create joy for both parties, and so we sought to radically simplify the logistics of pet care. Beyond providing unrivaled services to premium Pet Parents, Wag! has expanded its reach to become the "button on the phone for the paw". Wag! is a key player in the pet wellness market via the management and operation of Petted.com, a pet insurance comparison service, as well as through the acquisition of Furmacy, Inc. ("Furmacy") which delivers pet health products directly to the door of loving Pet Parents. We have experienced consistent strong growth year over year, increasing annual revenue

by over 170% from 2021 to 2022. Additionally, in 2023, Wag! expanded into the $50 billion pet food and treat market by acquiring from Clicks and Traffic LLC the assets of Dog Food Advisor, one of the most visited and trusted dog food marketplaces in the US ("Dog Food Advisor"). Wag! believes that the addition of Dog Food Advisor will unlock tremendous value and insights for recurring and new customers alike; those to whom we already provide an unparalleled marketplace experience in the wellness space and longtime customers who rely on Dog Food Advisor for expert advice. Wag! exists to make pet ownership possible and bring joy to pets and those who love them.

For Pet Caregivers, we built tools to easily create a listing in the Wag! platform, along with simple tools for promoting their profile online, scheduling and booking service opportunities, communicating with Pet Parents, and receiving payment. To assist both Pet Parents and Pet Caregivers, we invested in a customer service team available 24/7 to support them along the way. To be a brand dedicated to trust and safety, we thoroughly vet and screen all Pet Caregivers, and provide up to $1 million property damage protection, subject to certain terms and conditions.

With over 450,000 Pet Caregivers approved through 2022, our network of caregivers enables us to facilitate connections between pet, parent, and caregiver to best meet the unique needs and preferences of all members of the community. Our results speak for themselves — Pet Parents love Wag!. Based on internal reporting, from inception through December 2022, Pet Parents have written over 11 million reviews, more than 96% of which have earned five stars. As a Company which understands the walking business, having provided over 14 million miles on foot since inception, we know that the experience is a two-way street. Our engineers work to optimize the experience for Pet Caregivers just as they do for our Pet Parents, and in 2022 launched the ability to leave notes on furry friends for future Pet Caregivers to ensure a seamless experience.

We believe the demand for high-quality, personalized pet care far exceeds the existing market due to the increases in pet adoption and return to office policies being implemented. As of the end of December 2022, although we saw a steady rise throughout the year, less than 50% of people were back in-office based on the Kastle "Back to Work Barometer" data study. According to a study performed by Adzuna research in November 2022, this number is expected to rise as employers openly state firmer in-office policies in 2023. Additionally, the proportion of open roles specifying an “office-based” requirement has risen to a 19-month high of 4.2%. Beyond the pet service sector of the addressable market, untapped potential coupled with the continued trend of the humanization of pets may lead to a spike in the pet insurance space. According to an industry report released by the North American Pet Health Insurance Association, there was an increase of approximately 30% from 2020 to 2021 of insured pets in North America. While this growth is exciting for Wag!, over 155 million pets in the United States still remain uninsured; leaving approximately 97% of pets in the United States as potential entrants into the market.

We are committed to improving the quality of life for all pets. To give back to our communities, we donate a portion of the proceeds from each walk to local shelters. From our inception through December 2022, we have donated over 16.5 million meals to pets in need through our partnership with the Greater Good Rescue Bank Program. We have also partnered with the Humane Society of the United States.

In 2022, we derived revenue from four distinct streams: (1) service fees charged to Pet Caregivers; (2) subscription and other fees paid by Pet Parents for Wag! Premium; (3) registration fees paid by Pet Caregivers to join and be listed on our platform, and (4) wellness revenue through affiliate fees, prescription and over-the-counter sales. Beginning in 2023, we expect to recognize additional revenue in the pet food and treat category via affiliate fees paid by third-party service partners based on ‘revenue-per-action’ or conversion activity due to the acquisition of Dog Food Advisor.

Our Strategy

Our StrategyDuring 2022 and 2021, we continued to grow and innovate our pet service and wellness offerings. When we look to the future, we believe that there are numerous opportunities to expand our Premium pet platform. As mentioned previously, we are excited about our entrance into the pet food and treat market through the digital presence that Dog Food Advisor provides. By accelerating growth in existing markets, expanding subscription services, and expanding our platform into new markets, we believe we can continue to grow and progress towards being the premier pet wellness platform. We remain committed to our long-term strategic initiatives of measured expansion, opportunistic mergers and acquisitions, and becoming an all-inclusive, trusted partner for Pet Parents.

As a leading supporter of Pet Parents and the health and well-being of their pets it is our mission to continue to find ways to help Pet Parents and Pet Caregivers holistically. We aim to continue to help Pet Parents provide for their pet more efficiently and effectively, while making better and more informed decisions as quickly as they desire; the "button on the phone for the paw". For Pet Caregivers, we want to continue to provide them with an opportunity to earn income on their own schedule. Within our marketplace and platform, we leverage proprietary technology and data to empower both Pet Parents and Pet Caregivers to reach these goals.

To achieve these goals, we intend to continue to grow our business by pursuing the following key strategies:

•Accelerate growth in existing markets.We believe that immense growth remains within our existing offerings and geographies. With over 95% of the U.S. population having access to Wag!, as of December 2022, approximately 434,234 platform participants transacted on the Wag! platform for at least one service in the fourth quarter of 2022. One of the main drivers of our brand is word-of-mouth growth in local markets. With over 450,000 Pet Caregivers approved throughout North America, we want to continue to increase bookings and services.

•Expand subscription offerings.Wag! Premium is an annual or monthly subscription that offers 10% off all services booked as well as waived booking fees, free advice from licensed pet experts, priority access to top-rated Pet Caregivers, and VIP Pet Parent support. We plan to introduce additional service offerings in the Wag! marketplace to further support pets, parents, and Pet Caregivers and to drive significant revenue growth.

•Platform expansion.We aim to service Pet Parents with the #1 on-demand mobile first platform, including through introducing additional services unique to the Wag! platform. In addition to digitizing the facilitation of on demand pet services end-to-end, we also reimagined the pet wellness model by consolidating facets of the market such as finding insurance coverage to ordering prescription medicine into once place. For example, in the third quarter of 2021, we acquired Compare Pet Insurance Services, Inc. ("CPI") and expanded our platform into the wellness market via a pet insurance comparison marketplace. We now operate Petted.com, the nation's largest pet insurance comparison marketplace, to allow Pet Parents to compare the top insurance providers for the best deal and perfect plan for their beloved pet. Additionally, in the fourth quarter of 2022, we acquired Furmacy, Inc. ("Furmacy") a concierge prescription and compounding service that delivers pet health directly to the Pet Parent's door.

•Opportunistic mergers and acquisitions.We believe that, over time, we can extend the value of Wag! with strategic acquisitions in the pet industry and others, including pet products, vet care, and technology to improve the efficiency and efficacy of the Wag! platform. In the first quarter of 2023, Wag! entered the pet food and treat category with the acquisition of Dog Food Advisor which helps Pet Parents make informed decisions about dog food. This is a key example of merger and acquisition activity that allows us to expand into other areas of the industry, while still remaining true to the core of what we do: bettering the pet ownership experience in a digital and data driven manner.

Our Market Opportunity

The total U.S. market for pet spending was $123.6 billion in 2021, including pet food and treats, veterinary care and product sales, pet supplies, and other non-medical services, according to the APPA. This is an increase of over 19% from the previous year, driven largely by the COVID-19 pandemic spike in pet population. The industry is generally viewed via the APPA breakdown of four categories: 1) Pet Food & Treats; 2) Supplies, Live Animals & OTC Medicine; 3) Vet Care & Product Sales; and 4) Other Services (inclusive of insurance). Wag! enters into 2023 with product offerings in three of the aforementioned four markets; anchored by our premium subscription service which spans across market lines.

| | | | | |

| [1] | Source: American Pet Products Association (“APPA”) – Actual Sales within the U.S. Market in 2021. |

| [2] | The “Wellness” category equates to the APPA “Vet Care & Product Sales” market category. |

We believe that the commercial market for pet care represents an enormous expansion opportunity because the existing commercial market for pet care is limited due to the challenges of traditional pet care service and wellness offerings.

Key Products and Services

Key Products and ServicesWag! Services

Through the Wag! platform, Pet Parents can connect with Pet Caregivers to schedule an appointment of a desired pet service from a Pet Caregiver. Our platform allows Pet Parents to request from Pet Caregivers a multitude of preset services, including pre-scheduled and on-demand dog walking, drop-in visits at the Pet Parent’s home, pet boarding at a caregiver’s home, in-home pet sitting, and in-home one-on-one dog training and digital dog training. Our platform allows Pet Parents to specify required parameters, such as length of walk or specific pet needs, and then receive real-time updates, photos or videos, and a complete report card from the Pet Caregiver. Following the service, Pet Parents have the ability to provide written review of the Pet Caregivers, helping Pet Caregivers build their profile and business with the Wag! platform.

Wag! Premium, available to all Pet Parents, is an annual or monthly subscription that offers 10% off all services booked as well as other features, such as waived booking fees, free advice from licensed pet experts, priority access to top-rated Pet Caregivers, and VIP Pet Parent support.

In 2022, there were over 90 million pets in U.S. households, according to the APPA. In April 2020, the national pet adoption rate jumped 34% as compared to the same period a year earlier, according to Shelter Animals Count. In addition, the ASPCA estimated in May 2021 that 23 million households adopted a pet during the pandemic. With this increase in pet ownership and more people returning to the office in upcoming year, we believe there are increased opportunities to help busy Pet Parents find pet care services.

Wag! Wellness

Our suite of wellness services include Vet Chat, wellness plans, pet insurance comparison, and pet prescription Rx. Vet Chat enables Pet Parents to connect with a licensed pet expert around the clock through our platform for real-time advice on their pets’ behavior, health and other needs. Pet wellness plans enable Pet Parents to take out coverage for their pets to cover every day items. Pet insurance comparison enables Pet Parents to instantly compare insurance quotes and coverage from top-rated pet insurance providers, including Lemonade, Pets Best, Embrace, Trupanion, Petplan, and Prudent Pet. Prescription Rx, through Furmacy, enables vets and Pet Parents to quickly and efficiently obtain prescriptions.

By offering Pet Parents the opportunity to consult a licensed pet expert 24/7, pet wellness plans, and the ability to compare pet insurance plans, Wag! has proven its ability to diversify the total addressable market ("TAM") and unlock new spending in pet wellness.

Our Customers

Our CustomersPets and Pet Parents

According to the 2021-2022 APPA National Pet Owners Survey, 70% of U.S. households own a pet, which equates to 90.5 million homes. This is an increase of 3% from 2021. For example, one-in-five households in the United States adopted a pet during the pandemic, based on a poll conducted in May 2021 by ASPCA. Led by Millennials and Generation Z, many Pet Parents increasingly consider the needs of their pets, not just equally important to those of the rest of the family, but more important. According to the American Veterinary Medical Association, almost 90% of Pet Parents consider their pet a member of the family. This has led to increases in pet spending by necessity and desire to provide for their pet as any other member of the family. In light of these trends, marketplaces, such as Dog Food Advisor and Petted.com, can provide Pet Parents with both knowledge and power to execute on that desire with a few simple clicks.

Pet Parent’s Wants and Needs

Wag! was founded to make pet ownership possible because we believe that being busy should not prevent an individual from owning or taking care of his or her pet. We believed a platform like ours could better address

Pet Parents’ basic pet care needs — and that doing so represented an enormous business opportunity. We wanted to offer exceptional quality, ease of use, and affordability. In short, Pet Parents are seeking:

•A positive stress-free experience for their pets.Pet Parents want regular reassurance that their pets feel as comfortable as they would at home. While some commercial providers try to address this need with innovations like pet webcams, Pet Parents often desire more peace of mind.

•Quality personalized care for their pets.Pet Parents want assurances that their pets’ care is personalized to their needs and expectations. They also want to know that there are resources in place to handle problems that arise while they are away from their pets. Wag! platform pet data is frequently updated through the natural course of a service, which creates potential for personalized pet recommendations including but not limited to age, breed, average walk distance and photos.

•The availability of personalized on-demand pet services.Pet Parents want the ability to care and provide for their pets as soon as a need arises.

•Technology-enabled ease of access and management to pet services.Pet Parents expect to be able to use their mobile devices or computers to find available providers who will meet their pet’s needs. They want to effortlessly contact and communicate, book and pay for a service, and stay connected so they can feel confident their pet is safe and happy in their absence.

•Pet care that suits their budget and their lifestyle.While many Pet Parents may find commercial solutions too expensive, they are willing to pay the right price for the right care. For other parents whose pets often have specific needs or requirements, cost is not a barrier in exchange for safe, trusted, loving care.

Pet Caregivers

Our success is built on the foundation of dedicated Pet Caregivers who have chosen to provide their services through us. Wag! provides Pet Caregivers with flexibility and empowerment, enabling their passion for pets to become a way to make money, exercise, and participate in their local community. Through our platform, Pet Caregivers can connect with a nationwide community of Pet Parents. Some Pet Caregivers view the provision of pet care services as their full-time job. We support them by providing an additional avenue to build their pet care business and achieve meaningful income. Other Pet Caregivers simply love and enjoy caring for pets in addition to other avenues of employment. We support these more casual Pet Caregivers by providing them access to Pet Parents looking for pet care services, a means to earn some additional supplemental income, an enjoyable gig involving time outdoors and healthy habits, and flexibility in when and how they perform services. We give both full-time and casual Pet Caregivers the ability to share their love of pets with the Wag! pet community.

Similar to Pet Parents, when prospective Pet Caregivers encounter Wag! for the first time, we aim to anticipate and address many of their needs in advance. We added features to allow caregivers the opportunity to view notes before a service so they can make a more informed decision before requesting that service, the freedom to set their own prices, the option to withdraw earnings instantly for a small fee, ability to expand their reach to new Pet Parents and grow their business with social links to their profile and custom HTML Craigslist links, and the opportunity to access advice from seasoned veterans on the mobile app and tips to help them grow a successful pet care business.

Pet Caregivers who establish a presence on Wag! discover that the process to be approved as a caregiver is straightforward and simple, which helps them build trust and transparency with Pet Parents. Specifically, applicants are screened and required to pass a background check and a pet care test before they can be approved to offer services on the Wag! platform. All new Pet Caregivers also have the opportunity to complete a “test walk,” which is a simulated service that allows the Pet Caregiver to become familiar with the Wag! platform. We also provide built-in community safety features, such as the ability for a Pet Caregiver to flag chat conversations with a Pet Parent, block a Pet Parent’s service requests, and leave a review of a pet for other caregivers to consider. These measures reassure Pet Caregivers that they are joining a platform that cares about trust and reliability.

Wag! provides flexible, straightforward booking management tools. Our platform offers tools that allow Pet Caregivers to manage bookings and safely communicate to share photos, videos, and GPS mapping. Pet Caregivers receive safe, secure, and convenient online payments, set their availability with our calendar feature,

and only book care that’s a fit for their preferences and schedule. Our around the clock dedicated support team provides peace of mind for Pet Caregivers.

Wellness service providers

Through digitalization of the pet wellness market, we have integrated subject matter experts from all corners of the wellness industry, such as veterinarians and insurance providers, into the Wag! community. Our insurance marketplace facilitates the ability for Pet Parents to connect with top insurance providers in order to select the best plan for their pet. Wag! acts as the trusted liaison between the two parties. Additionally, via the Furmacy business, we provide the linkage between the Pet Parent and their veterinarian to provide Rx, over-the-counter and custom medication (compounds) directly to their home. The facilitation of pet wellness services places Wag! in a unique position of capturing both sides of the market: the business of either or both the Pet Parent and pet professional depending on the wellness need.

Wag! is also positioning itself to provide routine and anticipated healthcare needs to pets. Through our wellness plan offerings, we facilitate connections between Pet Parents and providers who furnish customized packages of routine care that every pet needs such as wellness exams, routine blood work and other diagnostics, vaccines and boosters, flea and tick meds, dental cleaning and even spay/neuter procedures.

During the year ended December 31, 2022, two customers accounted for in aggregate approximately 27% of total revenue, versus zero in the year ended December 31, 2021. For a discussion of risks related to customer concentration, see Part I, Item 1A, - Risk Factors: "The Company is substantially dependent on revenues from a small number of customers utilizing Wag! Wellness services and products. The loss of or decrease in revenue from any one of these customers could adversely affect Wag!’s business, results of operations, and financial condition" and Note 2 — Summary of Significant Accounting Policies of the Notes to Consolidated Financial Statements included herein.  Competitive Strengths

Competitive StrengthsAs we grow our online pet service, wellness, and dog food and treat platform, our competitive strengths relative to other online competitors include:

•Proprietary and innovative technology platform. Our technology platform was built to enable us to connect Pet Parents with Pet Caregivers, wellness providers, and dog food and treat providers. We own and operate all meaningful technology utilized in our business.

•Service offerings. Our platform offers access to pet services across the spectrum of the pet services categories including (1) Pet Food & Treats, (2) Supplies, Live Animals & Over-the-Counter Medicine, (3) Vet Care & Product Sales, and (4) Other Services.

•Large number of high-quality Pet Caregivers.Pet Caregivers are attracted to the Wag! platform. With the ability to make money on their own time, Pet Caregivers enjoy the flexibility of choosing how and when they want to work — claiming a last minute appointment or planning out an appointment weeks in advance. We currently have over 450,000 Pet Caregivers approved to provide services on Wag!.

•Industry best insurance comparison tool. Our proprietary insurance comparison tool allows Pet Parents to quickly and efficiently obtain and compare pet insurance coverage and fee quotes from leading pet insurance providers.

•High-quality pet service.With over 11 million Pet Parent reviews, more than 96% of which have earned five stars, we lead the industry in quality.

•Strong Pet Parent loyalty and word-of-mouth. Our continuous excellence in facilitating connections between pet, parent, and Pet Caregiver translates directly into advantages in our ability to retain Pet Parents.

•Premier online destination for pet services.According to recent industry surveys conducted by Similarweb.com, Wag! was one of the top three online pets and animals websites in the United States in the fourth quarter of 2022 with more than 4,700,000 monthly visitors.

Foundation of Trust and Safety

Foundation of Trust and SafetySafety on every booking is important to us, and we are committed to reducing the number of incidents in the Wag! community. If an incident occurs, we are committed to improving our effectiveness in responding. To bring peace of mind for Pet Parents, all Pet Caregivers are screened, background checked, and approved prior to being approved to provide services on the Wag! platform. We also have a dedicated 24/7 support team to assist pets and their parents around the clock, and convenient tools for Pet Parents to obtain real-time information about their pets during a service. In the event there is damage to a Pet Parent’s property, they may be protected with up to $1 million property damage protection (subject to applicable policy limitations and exclusions). We move quickly to correct behaviors that are not consistent with our Community Guidelines and do not hesitate to remove both Pet Parents and Pet Caregivers from our platform when they behave in ways that violate our standards.

Technology and Infrastructure

Technology and InfrastructureOur technology platform is designed to provide an efficient marketplace experience across our website and mobile apps. Our technology vision is to build and deliver secure, flexible, scalable systems, tools, and products that exceed expectations for Pet Parents, Pet Caregivers, and pet service providers, as well as accelerate growth and improve productivity.

Our booking platform connects to the front-end customer web and mobile clients, as well as to our support operations team. This platform also connects to our data science platform. We collect and secure information generated from user activity and use machine learning to continuously improve our booking systems. We have a common platform that allows us to seamlessly internationalize our product, integrate images and videos, use experiments to optimize user experience and test product improvements in real time, monitor our site reliability, and rapidly respond to incidents. Finally, our core booking platform connects to leading third-party vendors for communications, payment processing, IT operations management, as well as background checks.

We focus on user experience, quality, consistency, reliability, and efficiency when developing our software. We are also investing in continuously improving our data privacy, data protection, and security foundations, and we continually review and update our related policies and practices.

Support Operations

Support OperationsOur support team assists Pet Parents and Pet Caregivers with bookings, safety issues, and questions concerning any pet service. Because we are committed to the safety and happiness of all dogs in our care, and peace of mind for Pet Parents, we offer 24/7 assistance to our entire community.

Marketing

MarketingOur marketing strategy is focused on attracting Pet Parents, Pet Caregivers, and pet service providers, to our marketplace. We depend on paid marketing, organic marketing and brand marketing strategies, along with creating virality and word-of-mouth acquisition through our product experience. Through our blog, "The Daily Wag!", we attract new users to our marketplace. Wag! is top-ranking in both the Travel and Local (Google Play) and Travel (iOS) categories for key search terms through App Store optimization and strong consumer rankings and reviews. In addition, our website saw more than six million visitors per month from direct or unpaid traffic sources in 2022, the majority of which came from our search engine optimization efforts. In 2022, we saw an average of 70% organic customer acquisition.

While we rely significantly on word-of-mouth, organic search, and other unpaid channels, we believe that a significant amount of the growth in the number of Pet Parents and Pet Caregivers that use the platform is also attributable to our paid marketing initiatives. Our marketing efforts include referrals, affiliate programs, free or discount trials, partnerships, display advertising, billboards, radio, video, television, direct mail, social media, email, podcasts, hiring and classified advertisement websites, mobile “push” communications, search engine optimization, and paid keyword search campaigns.

Competitors

CompetitorsThe markets in which we operate are highly fragmented. We face multiple competitors across different categories, and our competitors vary in both size and breadth of services. We expect competition to continue, both from current competitors, who may be well-established and enjoy greater resources or other strategic advantages, as well as new entrants into the market, some of which may become significant competitors in the future. Our main competitors include:

•Family, friends, and neighbors.Our largest competitive dynamic remains the people to whom Pet Parents go for pet care within their personal networks. This typically includes veterinarians, neighbors, family, and friends with whom the Pet Parent and pet are familiar and comfortable.

•Local independent professionals.Local small businesses and independent professionals often operate at small scale with little to no online presence, primarily relying on word of mouth and marketing solutions such as flyers and local ads. As a Pet Parent, it is difficult to know where to find reliable information, who to call, and who to trust.

•Large, commercial providers.Large commercial providers, such as kennels and daycares, often struggle to meet the individual needs of Pet Parents and their pets. Such providers can be expensive, and their facilities are often crowded, inducing stress in some pets and leading Pet Parents to question the quality of care their pets receive.

•Online aggregators and directories.Pet Parents can also access general purpose online aggregators and directories, such as Google, Wirecutter, Craigslist, Nextdoor, or Yelp, to find pet care providers and ratings and rankings for similar marketplace offerings. However, Pet Parents may lack trust in these directories, or find it difficult to find an available and appropriate pet care provider.

•Other digital marketplaces.We compete with companies such as Rover and the pet care offering on Care.com. We differentiate ourselves with the breadth of our pet service options and simplicity in booking. For example, Wag! is the only marketplace to offer on-demand booking for dog walking and drop-in visits at the Pet Parent’s home, enabling Pet Parents to find a local Pet Caregiver in less than 15 minutes. In addition, our monthly subscription, Wag! Premium, enables Pet Parents to a suite of platform features including discounts on additional services, such as boarding, sitting, and training. Finally, through our Wag! wellness suite of services, Pet Parents can chat with a licensed pet expert 24/7.

Human Capital Resources

Human Capital ResourcesAs of December 31, 2022, we had 82 employees, including the business leaders of Furmacy, Inc who are currently included in the "Executive" department below . The breakout of employees by department is as follows as of December 31, 2022:

Run, Dig, Play & Catch

In 2022, as Wag!'s technology platform and overall business grew, we leaned on our values of "Run, Dig, Play and Catch" to help support employees and the Wag! Community. We continued our remote-first hybrid workplace strategy to provide employees with the flexibility for any caregiving responsibilities including, for dependents or other family members. This meant creating and fostering an open and accepting work environment where leaders and managers supported flexible work schedules, paid family leave and/or paid time off. For those employees seeking community and social engagement, we hosted virtual and in-person events. Wag! also provides 360 feedback and role growth opportunities as part of our twice-a-year performance management program to assist employees with development. We integrate the aforementioned Wag! values into the performance management and feedback process to help recognize not only those who perform, but also to recognize and celebrate those who exhibit our values and contribute to the culture.

Diversity, Equity & Inclusion

Diversity, equity, and inclusion ("DEI") are core to Wag!'s culture. We are committed to building a workplace where people of all backgrounds and walks of life can thrive. We know that diverse and inclusive teams build more creative and innovative solutions that strengthen our business and reinforce our values. In 2022, we donated to several organizations that align with our values, including the Center of Policing Equity, which measures bias in policing and has goals to help stop such biases, and one•n•ten which serves LGBTQ youth and young adults ages 11-24 by providing empowering social and service programs that promote self-expression, self-acceptance, leadership development, and healthy life choices. Wag! also celebrates diversity events, for example LGBT Pride Month internally and externally on our social media channels each year, and recognizes Juneteenth as a company holiday. Wag! intends to maintain, iterate and add to our DEI initiatives and programs to broaden their impacts, as Wag! continues to grow.

Safety

Safety will always be Wag!'s top priority, and in 2022 we maintained a fully optional in-person work policy. We believe that our employees can excel and be productive wherever they choose to work, but recognize that

certain employees seek to be around their co-workers and spend some time in the office. In order to attract and retain high performing employees while also being as inclusive as we can, we believe a remote-first hybrid approach to work is the best fit for our business, culture, and team. Our hybrid work policy allows employees and teams to select the work mode that best fits their personal needs. We do not anticipate any full-time in-person work requirements for our employees. In 2022, the sustainability of our working environment and employee well-being also remained a key priority. We retained our expanded sick and leave policies that were established in 2020, as well as periodic company-wide half-day Fridays to supplement Wag!'s paid time off policies.

Priorities

We are committed to:

•Attracting and retaining world-class talent with diverse backgrounds and experiences;

•Offering equitable and inclusive pay, benefits and policies;

•Fostering a safe workspace and requiring anti-discrimination and anti-harassment training;

•Fine-tuning our recruiting efforts and procedures, including but not limited to reviewing job descriptions for inclusive language, sourcing from wide talent pools and a structured interview process; and

•Creating an inclusive environment where employees feel welcome, valued, respected, supported, heard, and appreciated.

Furthermore, we are focused on employee engagement, which studies have shown is linked with high performance, retention, innovation, and growth. We also believe this helps us evaluate the effectiveness and inclusivity of our Employment Programs, Practices and Policies. Our employees have chosen to work at Wag! because they believe in our action-oriented, values-based, and purpose-driven work culture. In March 2022, Wag! conducted an engagement survey of all employees. 83% of employees submitted a response, and 81% of respondents reported favorable employee engagement, ahead of industry peers in the New Tech category according to research done by Culture Amp.

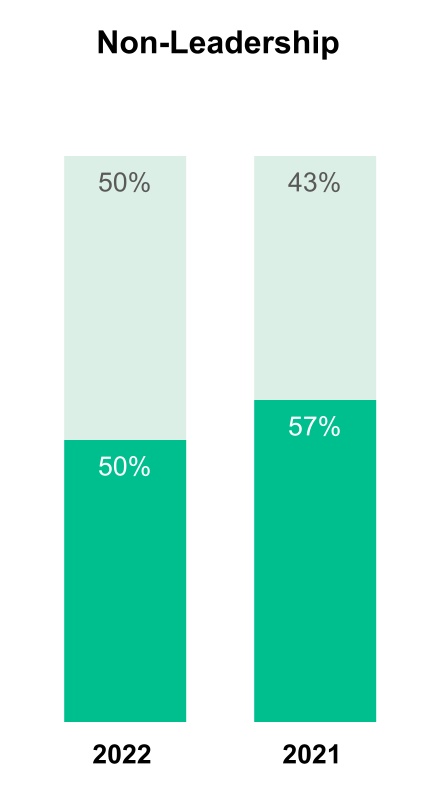

Workforce Diversity Metrics

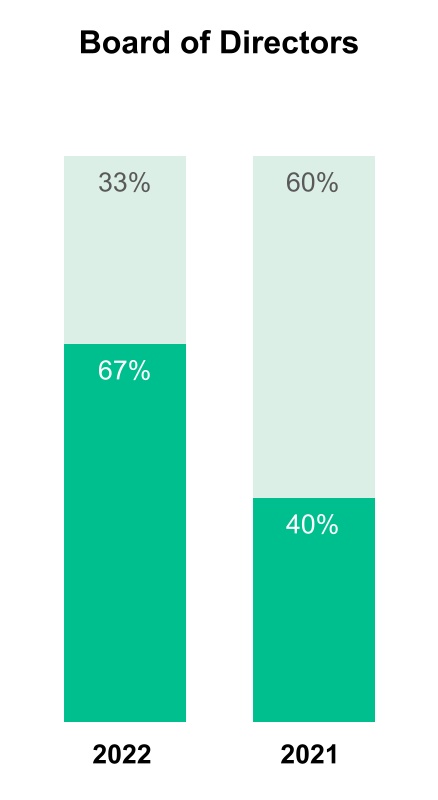

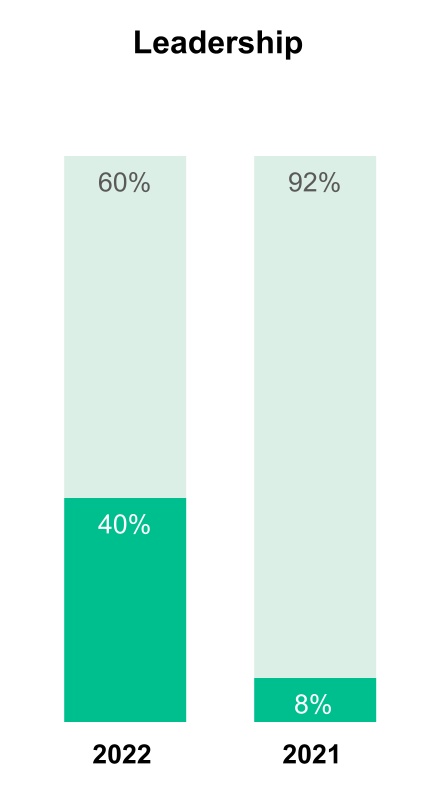

We aim for our marketplace, products and services to be enjoyed by the diverse community of Pet Parents and Pet Caregivers. We are committed to transparent reporting on workforce diversity. All metrics below are as of December 31 of the stated year. Overall metrics include all employees. Leadership is defined as Director level and above.

Our Board of Directors also affirmed its dedication to diversity in 2021, when we began adding Independent Board Members. The Board of Directors and Management committed to actively seek out diverse director candidates to include in the pool from which nominees are chosen.

Race and Ethnicity Metrics

| | | | | | | | | | | | | | | | | | | | |

| Board | Leadership | Non-Leadership |

| 2022 | 2021 | 2022 | 2021 | 2022 | 2021 |

| American Indian or Alaska Native | — | % | — | % | — | % | — | % | 2 | % | — | % |

| Asian | 33 | % | 20 | % | 5 | % | 8 | % | 16 | % | 15 | % |

| Black or African American | 17 | % | — | % | 5 | % | 8 | % | 6 | % | 8 | % |

| Hispanic or Latino | — | % | — | % | — | % | — | % | 16 | % | 14 | % |

| Two or More Races | | — | % | 5 | % | — | % | 8 | % | 6 | % |

| White | 50 | % | 80 | % | 85 | % | 84 | % | 52 | % | 57 | % |

Age Metrics (excluding Board Members)

| | | | | | | | |

| 2022 | 2021 |

| 24 years and younger | 4 | % | 8 | % |

| 25-29 years | 24 | % | 28 | % |

| 30-34 years | 32 | % | 19 | % |

| 35-39 years | 8 | % | 11 | % |

| 40-49 years | 22 | % | 21 | % |

| 50+ years | 10 | % | 13 | % |

Data Privacy, Data Protection and Security

Our privacy and information security program is designed and implemented, both within our internal systems and on our platform, to address the security and compliance requirements of personal or other regulated data related to Pet Parents, Pet Caregivers, and our employees.

We have a team of professionals that focuses on technical measures such as application, network, and system security, as well as policy measures related to privacy compliance, internal training and education, business continuity, and documented incident response protocols. Our information security protocols include periodic scans designed to identify security vulnerabilities on our servers, workstations, network equipment, production equipment, and applications, and we address remediation of any discovered vulnerabilities according to severity. We use various technical safeguards throughout our network, including but not limited to multi-factor authentication, permissioning software, audit logs, and other security controls to control access to internal systems that contain personal or other confidential information.

We design and implement our platform, offerings, and policies to facilitate compliance with evolving privacy, data protection, and data security laws and regulations, as well as to demonstrate respect for the privacy and data protection rights of our users and employees. We publish our user-related privacy practices on our website, and we further maintain certain additional internal policies and practices relating to the collection, use, storage, and disclosure of personal information.

Publication of our Privacy Statement and other policies and notices regarding privacy, data protection, and data security may subject us to investigation or enforcement actions by state and federal regulators if those statements, notices, or policies are found to be deficient, lacking transparency, deceptive, unfair, or misrepresentative of our practices. We also may be bound from time to time by contractual obligations related to privacy, data protection, or data security. The laws and regulations to which we are subject relating to privacy, data protection, and data security, as well as their interpretation and enforcement, are evolving and we expect them to continue to change. For example, the California Privacy Rights Act of 2020, which came into effect on January 1, 2023 and amends the California Consumer Privacy Act of 2018 (the “CCPA” and together with the California Privacy Right Act of 2020, collectively, the “CPRA”), among other things, requires covered companies to provide specified disclosures to California consumers about such companies’ collection, use and sharing of their personal information, gives California residents expanded rights to access, correct and delete their personal information, and affords such consumers abilities to opt out of certain “sales” or transfers of personal information, the processing of sensitive personal information for certain purposes and the use of personal information for cross context behavioral advertising. Guidance related to the CPRA continues to evolve and these acts have lead some states, namely Virginia, Colorado, Utah and Connecticut, and will likely lead other states to pass comparable legislation. Other privacy and data security laws and regulations to which we may be subject include, for example, the California Online Privacy Protection Act, the Personal Information Protection and Electronic Documents Act, the Controlling the Assault of Non-Solicited Pornography and Marketing Act, the Telephone Consumer Protection Act, and Section 5 of the Federal Trade Commission Act. More generally, the various legal obligations that apply to us relating to privacy and data security may evolve in a manner that relates to our practices or the features of our mobile applications or website. We may need to take additional measures to comply with new and evolving legal obligations and to maintain and improve our information security posture in an effort to reduce information security incidents or avoid breaches affecting personal information or other sensitive or proprietary data. For additional information, see “Risk Factors — Risks Related to Privacy and Technology — Changes in laws, regulations, or industry standards relating to privacy, data protection, or the protection or transfer of data relating to individuals, or any actual or perceived failure by Wag! to comply with such laws and regulations or any other obligations, including contractual obligations, relating to privacy, data protection, or the protection or transfer of data relating to individuals, could adversely affect Wag!’s business.”

Government Regulation

We are subject to a wide variety of laws, regulations, and standards in the United States and other jurisdictions. These laws, regulations, and standards govern issues such as worker classification, labor and employment, anti-discrimination, payments, pricing, whistleblowing and worker confidentiality obligations, animal and human health and safety, text messaging, subscription services, intellectual property, insurance producer licensing and market conduct, consumer protection and warnings, marketing, product liability,

environmental protection, taxation, privacy, data protection, data security, competition, unionizing and collective action, arbitration agreements and class action waiver provisions, terms of service, e-commerce, mobile application and website accessibility, money transmittal, and background checks. These laws, regulations, and standards are often complex and subject to varying interpretations, in many cases due to their lack of specificity or unclear applicability, and as a result, their application in practice may change or develop over time through judicial decisions or as new guidance or interpretations are provided by regulatory and governing bodies, such as federal, state, and local administrative agencies. Noncompliance with state insurance statutes or regulations may subject Wag! to regulatory action by the relevant state insurance regulator, and, in certain states, private litigation.

National, state, and local governmental authorities have enacted or pursued, and may in the future enact and pursue, measures designed to regulate the “gig economy.” For example, in 2019, the California Assembly passed AB-5, which codified a narrow worker classification test that has had the effect of treating many “gig economy” workers as employees. AB-5 includes a referral agency exemption that specifically applies to animal services and dog walking and grooming, and we believe that Wag! falls within this exemption.

In addition, other jurisdictions could adopt similar laws that do not include such carve outs and which, if applied to Wag!’s platform, could adversely impact its availability and our business.

On October 13, 2022, the United States Department of Labor published a Notice of Proposed Rulemaking regarding the classification of workers as independent contractors or employees. The comment period closed on December 13, 2022. We are monitoring the development of the proposed rule and will evaluate any potential impact of the final rule on our operations.

Other types of new laws and regulations, and changes to existing laws and regulations, continue to be adopted, implemented, and interpreted in response to our business and related technologies. For instance, state and local governments have in the past pursued, or may in the future pursue or enact, licensing, zoning, or other regulation that impacts the ability of individuals to provide home-based pet care.

One of our subsidiaries operates pet insurance comparison engine webpages. This subsidiary is not an underwriter of insurance risk nor does it act in the capacity of an insurance company. Rather, it is licensed and regulated as an insurance producer. On its website, the subsidiary may refer its customers to options for pet insurance plans provided and sold through unaffiliated third parties, including through unaffiliated insurance carriers. The subsidiary’s insurance comparison search feature provides hyperlinks by which consumers are connected with a pet insurance provider’s website to purchase an insurance plan. Each state has its own insurance statutes and regulations and applicable regulatory agency. Generally, each state requires insurers and insurance producers to be licensed in that state. Our subsidiary maintains insurance producer licenses in each state in which it operates. All insurance plans referred to by the subsidiary through its insurance comparison search feature are provided by third-party insurance companies. The subsidiary accepts neither premium payments from consumers nor responsibility for paying any amounts on claims.

For more information, see “Risk Factors — Risks Related to Regulation and Taxation — Wag!’s business is subject to a variety of U.S. laws and regulations, many of which are unsettled and still developing and failure to comply with such laws and regulations could subject Wag! to claims or otherwise adversely affect Wag!’s business, financial condition, or operating results; Government regulation of the Internet, mobile devices and e-commerce is evolving and unfavorable changes could substantially adversely affect Wag!’s business, financial condition, and operating results”; and “Risk Factors — Risks Related to Privacy and Technology — Changes in laws, regulations, or industry standards relating to privacy, data protection, or the protection or transfer of data relating to individuals, or any actual or perceived failure by Wag! to comply with such laws and regulations or any other obligations, including contractual obligations, relating to privacy, data protection, or the protection or transfer of data relating to individuals, could adversely affect Wag!’s business.”

We are subject to audits by taxing authorities and other forms of investigation, audit, or inquiry conducted by federal, state, or local governmental agencies, none of which have resulted in a material assessment.

On May 13, 2022, Legacy Wag! settled a claim with a Texas state tax authority related to the collection of sales and use taxes in Texas. Legacy Wag! was required to pay $1.2 million to the state of Texas, the amount of

the claim, as a prerequisite to the court challenge, but under the settlement agreement received those funds back.

Employment and Labor

In August 2018, the New York State Department of Labor (“DOL”) issued an Investigation Report assessing Legacy Wag! with approximately $250,000 in unemployment insurance contributions for our independent contractors. In May 2021, the Unemployment Insurance Appeal Board affirmed its decision sustaining the Department’s assessment. Interest continues to accrue on this assessment.

Intellectual Property

We rely on a combination of state, federal, and common-law rights and trade secret, trademark, and copyright laws in the United States and other jurisdictions together with confidentiality agreements, contractual restrictions, and technical measures to protect the confidentiality of our proprietary rights. To protect our trade secrets, we control access to our proprietary systems and technology and enter into confidentiality and invention assignment agreements with our employees and consultants and confidentiality agreements with other third-parties in order to limit access to, and disclosure and use of, our confidential and proprietary technology and to preserve our rights thereto. We also have registered and unregistered trademarks for the names of many of our products and services, and we are the registrant of the domain registrations for all of our material websites.

As of December 31, 2022, we hold 7 registered trademarks in the United States. In addition, we have registered domain names for websites that we use in our business, such as www.wagwalking.com and other variations. We intend to pursue additional intellectual property protection to the extent we believe it would be beneficial and cost-effective. We also utilize third-party content, software, technology and intellectual property in connection with our business.

We are presently involved in intellectual property lawsuits and may continue to face allegations from third parties, including our competitors, that we have infringed or otherwise violated their intellectual property rights. Despite our efforts to protect our intellectual property rights, they may not be respected in the future or may be invalidated, circumvented, or challenged.

In June 2015, a lawsuit against Wag! was filed in the United States District Court for the Eastern District of California by Wag Hotels, Inc. alleging trademark infringement. In exchange for dismissing all claims, we agreed to use certain branding going forward and we reached a settlement agreement in June 2016. In December 2019, Wag Hotels filed suit again claiming that the branding currently being used (“Wag”) violates the 2016 settlement agreement and infringes their trademark. In October 2021, we filed a Second Amended Answer and Counterclaim, and in November 2021, Wag Hotels moved to dismiss. In April 2022, the Court dismissed some of our affirmative defenses and counterclaim with leave to amend. Trial for this case is set for August 2023 and we intend to defend ourselves vigorously against all claims.

For additional information on risks relating to intellectual property, see the sections titled “Risk Factors — Risks Related to Wag!’s Intellectual Property”; “Risk Factors — Risk Related to Regulation and Taxation”; and “Information About Wag! — Legal Proceedings — IP and Trademark”.

Available Information

The Company’s internet address is www.wag.co. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are available, without charge, on the investor relations section of our website, investors.wag.co, as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. Reports filed with the SEC may be viewed at www.sec.gov. References in this report to our website address are provided only as a convenience and do not constitute, and should not be viewed as, an incorporation by reference of the information contained on, or available through, the website. Therefore, such information should not be considered part of this report.

Item 1A Risk Factors

Our business, prospects, operating results and financial condition could suffer materially, if any of the events or developments described below were to occur. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Summary of Principal Risk Factors

•The COVID-19 pandemic has materially adversely impacted and will continue to materially adversely impact our business, operating results and financial condition;

•Our operating and financial results forecast relies in large part upon assumptions and analyses we developed. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from our forecasted results;

•We have incurred net losses in each year since inception and experienced significant fluctuations in our operating results, which make it difficult to forecast future results, such as our ability to achieve profitability;

•If we fail to retain existing Pet Caregivers and Pet Parents or attract new Pet Caregivers and Pet Parents, our business, operating results and financial condition would be materially adversely affected;

•Any further and continued decline or disruption in the travel and pet care services industries or economic downturn would materially adversely affect our business, results of operations and financial condition;

•We face increasing competition in many aspects of our business;

•The business and industry in which we participate are highly competitive and we may be unable to compete successfully with our current or future competitors;

•Actions by Pet Caregivers or Pet Parents that are criminal, violent, inappropriate, or dangerous, or fraudulent activity, may undermine the safety or the perception of safety of our platform and materially adversely affect our reputation, business, operating results and financial conditions;

•If Pet Caregivers are reclassified as employees under applicable law or new laws are passed causing the reclassification of Pet Caregivers as employees, our business would be materially adversely affected;

•Our businesses are subject to extensive domestic and foreign regulations that may subject us to significant costs and compliance requirements;

•We may be subject to litigation risks and may face liabilities and damage to our professional reputation as a result;

•We are subject to cybersecurity risks and changes to data protection regulation;

•We rely on third-party payment service providers to process payments made by Pet Parents and payments made to Pet Caregivers on our platform. If these third-party payment service providers become unavailable or we are subject to increased fees, our business, operating results and financial condition could be materially adversely affected;

•We are subject to risks related to our dependency on our key management members and other key personnel, as well as attracting, retaining and developing qualified personnel in a highly competitive talent market;

•We may not realize the anticipated benefits of our business acquisitions, and any acquisition, strategic relationship, joint venture or investment could disrupt our business and harm our operating results and financial condition;

•If we are unable to manage our growth and expand our operations successfully, our reputation, brands, business and results of operations may be harmed;

•Failure to achieve and maintain effective internal control over financial reporting could result in our failure to accurately or timely report our financial condition or results of operations which could have a material adverse effect on our business and stock price;

•The compliance obligations under the Sarbanes-Oxley Act require substantial financial and management resources;

•We may be subject to risks related to our status as an emerging growth company within the meaning of the Securities Act;

•Insiders currently have and may continue to possess substantial influence over us, which could limit our ability to affect the outcome of key transactions, including a change of control;

•The grant of registration rights to certain of our investors and the future exercise of such rights may adversely affect the market price of our common stock;

•Our management has limited experience in operating a public company;

•Because we have become a publicly traded company by means other than a traditional underwritten initial public offering, our stockholders may face additional risks and uncertainties; and

•If we cannot continue to satisfy listing requirements and other rules of Nasdaq, our securities may be delisted, which could negatively impact the price of our securities and your ability to sell them.

Risks Related to Our Business

The COVID-19 pandemic and the impact of actions to mitigate the COVID-19 pandemic have materially adversely impacted and will continue to materially adversely impact our business, operating results, and financial condition.

The COVID-19 pandemic has materially adversely affected our operating results, business operations, results of operations, financial position, liquidity, and cash flows and may continue to materially adversely impact our financial condition and prospects. The extent of the impact of the pandemic on our business and financial results will depend largely on future developments, including the emergence of new variants both globally and within the United States, vaccination rates in various regions, the impact on capital, foreign currencies exchange and financial markets, governmental or regulatory orders that impact our business, and whether the impacts may result in permanent changes to our end users' behavior, all of which are highly uncertain and cannot be predicted. Any of the foregoing factors, or other cascading effects of the COVID-19 pandemic that are not currently foreseeable, will materially adversely impact our business, operating results, financial condition and prospects.

In response to the economic challenges and uncertainty resulting from the COVID-19 pandemic and its impact on our business, we have moved to a hybrid workplace setup in which employees have the voluntary option to go to the office. However there is no requirement for employees to go to the office at this time nor any plans for such a requirement in the immediate future. We are positioned to leverage technology for employees and teams to work from home and accomplish their work without going into the office.

Our business could be adversely affected by natural disasters, public health crises, political crises, economic downturns or other unexpected events.

A significant natural disaster, such as an earthquake, fire, hurricane, tornado, flood or significant power outage, could disrupt our operations, mobile networks, the Internet or the operations of our third-party technology providers. In particular, our corporate headquarters are located in the San Francisco Bay Area, a region known for seismic activity. In addition, any public health crises, such as the COVID-19 pandemic, other epidemics, political crises, such as terrorist attacks, war and other political or social instability and other geopolitical developments, or other catastrophic events, whether in the United States or abroad, could

adversely affect our operations or the economy as a whole. The impact of any natural disaster, act of terrorism or other disruption to us or our third-party providers’ abilities could result in decreased demand for our offerings, those of our third-party providers’, or a delay in the provision of such offerings, which could adversely affect our business, financial condition and results of operations. All of the aforementioned risks may be further increased if our disaster recovery plans prove to be inadequate.

Our business and results of operations are also subject to global economic conditions, including any resulting effect on spending by us or our customers. If general economic conditions deteriorate in the United States, discretionary spending may decline and demand for premium pet offerings may be reduced. An economic downturn resulting in a prolonged recessionary period may have a further adverse effect on our revenue.

Wag! has incurred net losses in each year since inception and experienced significant fluctuations in its operating results, which make it difficult to forecast future results, such as its ability to achieve profitability.

We incurred net losses of $18.8 million, $6.3 million, and $39 million in 2020, 2021 and 2022, respectively. As of December 31, 2022 and 2021, we had an accumulated deficit of $148.4 million and $109.9 million, respectively. As a result of the COVID-19 pandemic, our monthly revenues declined rapidly after March 2020. Historically, we have invested significantly in efforts to grow our Pet Parent and Pet Caregiver network, introduced new or enhanced offerings and features, increased marketing spend, expanded operations, hired additional employees, and enhanced the platform. This focus may not be consistent with our short-term expectations and may not produce the long-term benefits expected.

Our operating results have varied significantly and may continue to vary significantly and are not necessarily an indication of future performance. We experience seasonality in bookings based on numerous factors including holidays where we have experienced lower walking services requests on the platform, offset by higher sitting and boarding requests during these periods. In addition, our operating results may fluctuate as a result of a variety of other factors, some of which are beyond our control. As a result, we may not accurately forecast operating results. Moreover, we base our expense levels and investment plans on estimates for revenues that may turn out to be inaccurate and we may not be able to adjust our spending quickly enough if our revenue is less than expected, resulting in losses that exceed our expectations. If our assumptions regarding the risks and uncertainties that we use to plan our business are incorrect or change, or if we do not address these risks successfully, our operating results could differ materially from our expectations and our business, operating results, and financial condition could be materially adversely affected.

Online marketplaces for pet care are still in relatively early stages of growth and if demand for them does not continue to grow, grows slower than expected, or fails to grow as large as expected, our business, financial condition, and operating results could be materially adversely affected.

Demand for booking pet care through online marketplaces has grown rapidly since the 2015 launch of our platform, but such platforms are still relatively new and it is uncertain to what extent market acceptance will continue to grow, if at all. Our success will depend on the willingness of people to obtain pet care through platforms like our platform. If the public does not perceive these services as beneficial, or chooses not to adopt them, or instead adopts alternative solutions based on changes in our reputation for trust and safety, offering prices, availability of services, or other factors outside of our control, then the market for our platform may not further develop, may develop slower than we expect, or may not achieve the growth potential we expect, any of which could adversely affect our business, financial condition, and operating results.

We are substantially dependent on revenues from a small number of customers utilizing Wag! Wellness services and products. The loss of or decrease in revenue from any one of these customers could adversely affect our business, results of operations, and financial condition.

A small number of customers account for a significant portion of our revenue, and dependence on revenue from a relatively small number of customers makes relationships with each customer critically important to our business. For example, for the fiscal year ended December 31, 2022, two customers accounted for an aggregate of 27% of total consolidated revenues. Revenue from any major customer may decline or fluctuate significantly in the future. We may not be able to offset any decline in revenue from existing major customers,

with revenue from new customers or other existing customers. Because of our reliance on a limited number of customers, any decrease in revenue from, or loss of, one or more of these customers could harm our business, operating results, financial condition, and cash flows.

Our marketing efforts to help grow the business may not be effective.

Promoting awareness of our platform is important to our ability to grow the business and to attract new Pet Parents and Pet Caregivers. Since inception, our user base has grown in large part as a result of word-of-mouth, complemented by paid and organic search, social media, and other online advertising and infrequent television advertising. Many of our marketing efforts to date have focused on amplifying and accelerating this word-of-mouth momentum and such efforts may not continue to be effective. Although we continue to rely significantly on word-of-mouth, organic search, and other unpaid channels, we believe that a significant amount of the growth in the number of Pet Parents and Pet Caregivers that use the platform also is attributable to our paid marketing initiatives. Marketing efforts include or have previously included referrals, affiliate programs, free or discount trials, partnerships, display advertising, billboards, radio, video, television, direct mail, social media, email, podcasts, hiring and classified advertisement websites, mobile “push” communications, search engine optimization, and paid keyword search campaigns. Even if we successfully increase revenues as a result of paid marketing efforts, we may not offset the additional marketing expenses incurred. If marketing efforts to help grow the business are not effective, we expect that our business, financial condition, and operating results may be materially adversely affected.

If we fail to retain existing Pet Caregivers or attract new Pet Caregivers, or if Pet Caregivers fail to provide high-quality offerings, our business, operating results, and financial condition would be materially adversely affected.

Our business depends on Pet Caregivers maintaining their use of our platform and engaging in practices that encourage Pet Parents to book their services. If Pet Caregivers do not establish or maintain enough availability, the number of bookings declines for a particular period, or Pet Caregiver pricing is unattractive or insufficient, revenues will decline and our business, operating results, and financial condition would be materially adversely affected.

Pet Caregivers have a range of options for offering their services. They may advertise their offerings in multiple ways that may or may not include our platform. Some of our Pet Caregivers have chosen to cross-list their offerings, which reduces the availability of such offerings on our platform. When offerings are cross-listed, the price paid by Pet Parents on our platform may be or may appear to be less competitive for many reasons, including differences in fee structure and policies, which may cause Pet Parents to book through other platforms or with other competitors, which could materially adversely affect our business, operating results and financial condition. Additionally, certain Pet Parents reach out to our Pet Caregivers (and vice versa) and incentivize them to list or book directly with them and bypass our platform, which reduces the use of our platform. Some Pet Caregivers may choose to stop offering services all together for a variety of reasons, including work obligations or health concerns.

While we plan to continue to invest in our Pet Caregiver community and in tools to assist Pet Caregivers, including our technology and algorithms, these investments may not be successful in retaining existing Pet Caregivers or growing the number of Pet Caregivers and listings on our platform. In addition, Pet Caregivers may not establish or wish to maintain listings if we cannot attract prospective Pet Parents to our platform and generate bookings from a large number of Pet Parents. If we are unable to retain existing Pet Caregivers or add new Pet Caregivers, or if Pet Caregivers elect to market their offerings directly, exclusively with a competitor, or cross-list with a competitor, our platform may be unable to offer a sufficient supply of on-demand services to attract Pet Parents to use our platform. If we are unable to attract and retain individual Pet Caregivers in a cost-effective manner, or at all, our business, operating results, and financial condition would be materially adversely affected. In addition, the number of bookings on our platform may decline as a result of a number of other factors affecting pet care providers, including: the COVID-19 pandemic; Pet Caregivers booking on other third-party platforms as an alternative to offering on our platform; economic, social and political factors; Pet Caregivers not receiving timely and adequate support from us; perceptions of trust and safety on and off our platform; negative experiences with pets and Pet Parents, including pets who damage pet care provider property; our efforts or failure or perceived failure to comply with regulatory requirements; and our decision to

remove Pet Caregivers from our platform for not adhering to our Community Guidelines or other factors we deem detrimental to our community.

If we fail to retain existing Pet Parents or add new Pet Parents, or if Pet Parents fail to receive high-quality offerings, our business, operating results, and financial condition would be materially adversely affected.

Our success depends significantly on retaining existing Pet Parents and attracting new Pet Parents to use our platform, increasing the number of repeat bookings that Pet Parents make, and attracting them to different types of service offerings on our platform. Pet Parents have a range of options for meeting their pet care needs, including neighbors, family and friends, local independent operators, large, commercial providers such as kennels and day cares, other online aggregators and directories, and other digital marketplaces.

Our ability to attract and retain Pet Parents could be materially adversely affected by a number of factors, such as: Pet Caregivers failing to provide differentiated, high-quality and adequately available pet services at competitive prices; the fees we charge to Pet Parents for booking services; taxes; our failure to facilitate new or enhanced offerings or features that Pet Parents value; the performance of our platform; Pet Parents not receiving timely and adequate support from us; negative perceptions of the trust and safety of our platform; negative associations with, or reduced awareness of, our brand; declines and inefficiencies in our marketing efforts; our efforts or failure or perceived failure to comply with regulatory requirements; and our decision to remove Pet Parents from our platform for not adhering to our Community Guidelines or other factors we deem detrimental to our community. For incidents that occur during services booked through our platform, liable Pet Parents may be protected with up to $1 million property damage protection, subject to applicable policy limitations and exclusions. While we intend to continue this property damage protection, if it discontinues this policy, whether because payouts under these policies or insurance premiums become cost prohibitive or for any other reason, then the number of Pet Parents who list with us may decline.

Events beyond our control also may materially adversely impact our ability to attract and retain Pet Parents, including: the COVID-19 pandemic or other pandemics or health concerns; increased or continuing restrictions on travel and immigration; the impact of climate change on travel and seasonal destinations (such as fires, floods and other natural disasters); and macroeconomic and other conditions outside of our control affecting travel or business activities generally.

In addition, if our platform is not easy to navigate, Pet Parents have an unsatisfactory sign-up, search, booking, or payment experience on our platform, the content provided on our platform is not displayed effectively, we are not effective in engaging Pet Parents, or fail to provide a user experience in a manner that meets rapidly changing demand, we could fail to attract and retain new Pet Parents and engage with existing Pet Parents, which could materially adversely affect our business, results of operations, and financial condition.

Our fee structure is impacted by a number of factors and ultimately may not be successful in attracting and retaining Pet Parents and Pet Caregivers.

Demand for our platform is highly sensitive to a range of factors, including the availability of services at times and prices appealing to Pet Parents, prices that Pet Caregivers set for their services, the level of potential earnings required to attract and retain Pet Caregivers, incentives paid to Pet Caregivers and the fees, and commissions we charge Pet Caregivers and Pet Parents. Many factors, including operating costs, legal and regulatory requirements, constraints or changes, and our current and future competitors’ pricing and marketing strategies, could significantly affect our pricing strategies. Existing or future competitors offer, or may in the future offer, lower-priced or a broader range of offerings. Similarly, certain competitors may use marketing strategies that enable them to attract or retain Pet Parents or Pet Caregivers at a lower cost than us. There can be no assurance that we will not be forced, through competition, regulation, or otherwise, to increase the incentives paid to Pet Parents that use the platform, reduce the fees and commissions charged Pet Caregivers and Pet Parents, or to increase marketing and other expenses to attract and retain Pet Parents and Pet Caregivers in response to competitive pressures. We have launched and may in the future launch, new fee or pricing strategies and initiatives or modify existing fee strategies, any of which may not ultimately be successful in attracting and retaining Pet Parents and Pet Caregivers. Further, Pet Parents’ price sensitivity may vary by geographic location, and as we expand, our fee structure may not enable us to compete effectively in these locations.

Any further and continued decline or disruption in the travel and pet care services industries or economic downturn would materially adversely affect our business, results of operations, and financial condition.

Our financial performance is partially dependent on the strength of the travel and pet services industries. The COVID-19 pandemic caused many governments to implement quarantines and significant restrictions on travel or to advise that people remain at home where possible and avoid crowds, which has had a particularly negative impact on bookings for pet services. Global or regional health considerations, including the outbreak of another pandemic or contagious disease, such as COVID-19, have impacted and could continue to materially adversely impact our bookings and business. The extent and duration of such impact remains uncertain and is dependent on future developments that are difficult to predict accurately, such as the severity, transmission, and resurgence rate of COVID-19, vaccination rates and its effectiveness, the extent and effectiveness of containment actions taken, including mobility restrictions and the impact of these and other factors on travel or work behavior in general and on our business in particular.

Other events beyond our control can result in declines in travel or continued hybrid work arrangements. Because these events or concerns and the full impact of their effects, are largely unpredictable, they can dramatically and suddenly affect travel and work behavior by consumers and therefore demand for our platform and pet services, which would materially adversely affect our business, operating results, and financial condition.

Our financial performance is also subject to global economic conditions and their impact on levels of discretionary consumer spending. Downturns in worldwide or regional economic conditions, such as the downturn resulting from the COVID-19 pandemic or volatility due to geopolitical instability, have led or could lead to a general decrease in travel and spending on pet care services and such downturns in the future may materially adversely impact demand for our platform. Such a shift in Pet Parent behavior would materially adversely affect our business, operating results, and financial condition.

The business and industry in which we participate are highly competitive and we may be unable to compete successfully with our current or future competitors.

We operate in a highly competitive environment and face significant competition in attracting Pet Caregivers and Pet Parents. Pet Parents have a range of options to find and book pet care offerings, both online and offline. We believe that our competitors include:

•friends, family, and neighbors that Pet Parents go to for pet care within their personal networks;

•local independent operators;

•large, commercial providers such as kennels and daycares;

•online aggregators and directories, such as Craigslist, Nextdoor, and Yelp; and

•other digital marketplaces, such as Rover and the pet care offerings on Care.com.

We believe that our ability to compete effectively depends upon many factors both within and beyond our control, including:

•the popularity and adoption of online marketplaces to obtain services from individual pet care providers;

•the popularity, utility, ease of use, performance, and reliability of our offerings compared to those of our competitors;

•our reputation and brand strength relative to our competitors;

•the prices of offerings and the fees we charge pet care providers and Pet Parents on our platform;

•our ability to attract and retain high quality Pet Caregivers;

•the perceived safety of offerings on our platform

•cancellation policies, and other health-related disruptions;

•our ability, and the ability of our competitors, to develop new offerings;

•our ability to establish and maintain relationships with partners;

•changes mandated by, or that we elect to make, to address, legislation, regulatory authorities or litigation, including settlements, judgments, injunctions, and consent decrees;

•our ability to attract, retain, and motivate talented employees;