2023

____________________

| 88-3590180 | |||||

| |||||

| |||||

|

|

| ||

|

| |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification | |||

55 Francisco Street, Suite

San Francisco, California |

|

| ||||

(Address of principal executive offices) |

| (Zip Code) | ||||

(707) 324-4219 (Registrant’s telephone number, including area code)

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

| |||||||||||||||

|

|

| ||||||||||||||

| PET | The Nasdaq | ||||||||||||||

|

|

| ||||||||||||||

| PETWW | The Nasdaq | ||||||||||||||

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||||||||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | ||||||||||

| Emerging growth company | ☒ |

|

| ||||||||||

As of June 30, 2021 (the last business day of the registrant’s second fiscal quarter), the registrant was not a public company and, therefore, cannot calculate the☒

As of March 8, 2022, there were 15,687,500 sharesJune 30, 2023, the last business day of the registrant’s ordinarymost recently completed second fiscal quarter, was $30.9 million based upon the last reported sales price for such date on the Nasdaq Global Market.

Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2023.

|

| |||||||||

| PART I | ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

Item 1C. | ||||||||||

| Item 2. |

| |||||||||

| ||||||||||

| ||||||||||

| PART II |

| |||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| PART III |

| |||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| PART IV |

| |||||||||

| ||||||||||

| ||||||||||

i

CERTAIN TERMS

Unless otherwise stated in this Annual Report (this “Annual Report”) on Form 10-K, references to:

The forward-looking statements contained in this Annual Report are based on our current expectationsForm 10-K. The results, events and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. Thesecircumstances reflected in the forward-looking statements involve a number of risks, uncertainties (some of which are beyondmay not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the controlforward-looking statements.

Company History

In January 2021, our sponsor purchased an aggregatesteady rise throughout the year, less than 50% of 3,162,500 ordinary shares (our “founder shares”) (after giving effect to a 1.1-for 1 share split we effected on August 30, 2021) for an aggregate purchase price of $25,000, or approximately $0.009 per share. The number of founder shares issued was determinedpeople were back in-office based on the expectation thatKastle “Back to Work Barometer” data study. Beyond the founder shares would represent 20%pet service sector of the issued and outstanding ordinary shares upon completionaddressable market, untapped potential coupled with the continued trend of the initial public offering.

On September 1, 2021, we consummated our initial public offeringhumanization of 12,500,000 units (the “units”), including 1,500,000 units issued pursuantpets may lead to the partial exercise of the underwriters’ over-allotment option. Each unit consists of one ordinary share, and one redeemable warrant of the Company (each, a “warrant”), with each warrant entitling the holder thereof to purchase one ordinary share for $11.50 per share. The units were sold at a price of $10.00 per unit, generating gross proceeds to the Company of $125,000,000.

Simultaneously with the closing of our initial public offering, we completed the private placement sale of 4,238,636 Warrants (the “private placement warrants”) to the Sponsor, generating total proceeds of $4,238,636. The private placement warrants are identical to the warrants sold in our initial public offering except as otherwise disclosed in our registration statement on Form S-1 (File Nos. 333-254422 and 333-259182). No underwriting discounts or commissions were paid with respect to the sale of the private placement warrants. The issuance of the private placement warrants was made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”).

Thirteen qualified institutional buyers or institutional accredited investors which are not affiliated with CHW, the Sponsor, our directors, or any member of our management (the “anchor investors”), each purchased unitsspike in the IPO at varying amounts not exceeding 9.9%pet insurance space. According to an industry report released by the North American Pet Health Insurance Association, there was an increase of the units subjectapproximately 22% from 2021 to the IPO. In conjunction with each anchor investor purchasing 100%2022 of the units allocated to it,insured pets in connection with the closing of the IPO the Sponsor sold 750,000 founder sharesNorth America. While this growth is exciting for Wag!, over 155 million pets in the aggregateUnited States still remain uninsured; leaving approximately 97% of pets in the United States as potential entrants into the market.

Furthermore, simultaneously with the closingquality of life for all pets. To give back to our initial public offering,communities, we completed the private placement sale of 62,500 ordinary shares (the “Representative Shares”) to Chardan Capital Markets, LLC for nominal consideration. We issued the Representative Shares pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act.

A total of $125,000,000 comprised of the proceeds from our initial public offering after offering expenses anddonate a portion of the proceeds from each walk to local shelters. From our inception through December 2023, we have donated over 17.7 million meals to pets in need through our partnership with the Greater Good Rescue Bank Program. We have also partnered with various pet rescue organizations both large and small across the United States, including pet adoption activation events.

Commencing September 24, 2021, holders. This is an increase of 11% from the previous year, driven largely by the COVID-19 pandemic spike in pet population. The APPA breaks down the pet industry into four categories: (1) Pet Food & Treats; (2) Supplies, Live Animals & OTC Medicine; (3) Vet Care & Product Sales; and (4) Other Services (inclusive of insurance). Wag! enters into 2024 with product offerings in three of the 12,500,000 units soldaforementioned four markets; anchored by our premium subscription service Wag! Premium, which spans across market lines.

1

Proposed Wag! Business Combination

Overview

On February 2, 2022, we entered into a business combination agreement (the “Business Combination Agreement”) with CHW Merger Sub Inc., a Delaware corporation and wholly owned direct subsidiary of CHW (“Merger Sub”), and Wag!, pursuant to which, and subjectAccording to the terms and conditions contained therein,2023-2024 APPA National Pet Owners Survey, 66% of U.S. households own a pet, which equates to 86.9 million homes. According to the business combinationAmerican Veterinary Medical Association, almost 90% of CHW, Merger Sub and Wag! (the “Business Combination”) will be effected. The termsPet Parents consider their pet a member of the Business Combination Agreement, which contain customary representationsfamily. This has led to increases in pet spending by necessity and warranties, covenants, closing conditions, termination provisions, anddesire to provide for their pet as any other terms relating to the Business Combination, are summarized below. The combined company’s business will continue to operate through Wag!. Unless otherwise defined herein, the capitalized terms used below are defined in the Business Combination Agreement.

The Business Combination will be effected in two steps: (i) on the Domestication Closing Date, CHW will domesticate as a Delaware corporation (the “Domestication” and following the Domestication, CHW is referred to herein as “New Wag!”); and (ii) on the Acquisition Closing Date, Merger Sub will merge with and into Wag!, with Wag! surviving the merger as a wholly owned subsidiary of New Wag! (the “Acquisition Merger”).

Concurrently with the Domestication, CHW will adopt and file a certificate of incorporation with the Secretary of Statemember of the Statefamily. In light of Delaware, pursuantthese trends, marketplaces, such as Dog Food Advisor and Petted.com, can provide Pet Parents with both knowledge and power to which CHW will change its nameexecute on that desire with a few simple clicks.

Conversion of Securities

Upon the Domestication Closing, by virtue of the Domestication and without any action on the part of CHW, Merger Sub, Wag!, or the holders of any of CHW’s or Wag!’s securities:

On the Acquisition Closing Date and immediately prior to the Acquisition Merger Effective Time, each then-outstanding share of Wag! preferred stock (excluding Series P Preferred Stock of Wag!) will convert automatically into a number of shares of Wag! common stock at the then-effective conversion rate in accordance with the terms of the existing Wag! charter. Each share of Wag! preferred stock (excluding Series P Preferred Stock of Wag!) is expected to convert in connection with the Conversion on a one-for-one basis into a share of Wag! common stock.

At the Acquisition Merger Effective Time, by virtue of the Acquisition Merger and without any action on the part of New Wag!, Merger Sub, Wag!, or the holders of the following securities:

2

The “Exchange Ratio” means the following ratio (rounded to ten decimal places): (i) the Company Merger Shares divided by (ii) the Company Outstanding Shares.

The consummation of the proposed Wag! Business Combination is subject to certain conditions as further described in the Business Combination Agreement.

In connection with entering into the Business Combination Agreement, on February 2, 2022, CHW and certain stockholders of Wag!! (the “Key Wag! Stockholders”) entered into a Lock-Up Agreement (the “Lock-Up Agreement”). Pursuant to the Lock-Up Agreement, approximately 70% of the aggregate issued and outstanding securities of New Wag! will be subject to the restrictions described below from the Acquisition Closing until the termination of applicable lock-up periods.

At the closing of the Business Combination, New Wag!, the Sponsor, certain other shareholders of CHW and certain stockholders of Wag will enter into an Amended and Restated Registration Rights Agreement (the “Amended and Restated Registration Rights Agreement”). Pursuant to the Amended and Restated Registration Rights Agreement, New Wag! will agree that, within 30 calendar days after the consummation of the Business Combination, it will file with the SEC a registration statement registering the resale of certain securities held by or issuable to the other parties thereto (the “Resale Registration Statement”), and New Wag! will use its commercially reasonable efforts to have such Resale Registration Statement declared effective as soon as reasonably practicable after the filing thereof. In certain circumstances, certain holders can demand up to three underwritten offerings, and certain holders will be entitled to piggyback registration rights.

3

In connection with entering into the Business Combination Agreement, on February 2, 2022, CHW entered into Subscription Agreements (the “Subscription Agreements”) with qualified institutional buyers (the “PIPE and Backstop Investors”), pursuant toservice, which among other things, the PIPE and Backstop Investors agreed to purchase an aggregate of 500,000 shares of common stock of CHW following the Domestication and immediately prior to the Acquisition Merger at a cash purchase price of $10.00 per share, resulting in aggregate proceeds of $5,000,000 million; provided, however, if the PIPE and Backstop Investors acquire shares of common stock of CHW in the open market between the date of the Subscription Agreements and the close of business on the third trading day prior to the special meeting of CHW’s shareholders called in connection with the Business Combination, then the required purchase amount shall be reduced on a share-for-share basis by the number of shares of common stock of CHW so acquired in the open market (the “PIPE and Backstop Investment”).

In connection with the execution of the Business Combination Agreement, on February 2, 2022, the Sponsor, Mark Grundman and Jonah Raskas (collectively, the “CHW Founder Shareholders”) entered into that certain letter agreement (the “CHW Founders Stock Letter”) with CHW and Wag!, pursuant to which, among other things, CHW, Wag!, and the CHW Founder Shareholders agreed, with respect to 360,750 Founder Shares (as defined below) (the “Forfeiture Shares”), during the period commencing on the date of the Business Combination Agreement and ending on the earlier of (A) the date that is three years after the Acquisition Closing, (B) the date on which the Forfeiture Shares are no longer subject to forfeiture, (C) subsequent to the Acquisition Closing, the consummation of a liquidation, merger, share exchange or other similar transaction that results in all of the New Wag! stockholders having the right to exchange their sharescreates potential for cash, securities or other property, and (D) the valid termination of the Business Combination Agreement, the Sponsor will not to (i) sell, offer to sell, contract or agree to sell, hypothecate, pledge, grant any option to purchase, or otherwise dispose of or agree to dispose of, directly or indirectly, or establish or increase a put equivalent position or liquidate or decrease a call equivalent position within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations of the SEC promulgated thereunder with respect to, any Forfeiture Shares, (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any Forfeiture Shares, whether any such transaction is to be settled by delivery of such securities, in cash or otherwise or (iii) publicly announce any intention to effect any transaction specified in clauses (i) or (ii), subject to certain exceptions.

Wag! has delivered to CHW the Stockholder Support Agreement, dated February 2, 2022 (the “Stockholder Support Agreement”), pursuant to which, among other things, the Key Wag! Stockholders, whose ownership interests collectively represent the outstanding Wag! common stock and Wag! preferred stock (voting on an as-converted basis) sufficient to approve the Business Combination on behalf of Wag!, will agree to support the approval and adoption of the transactions contemplated by the Business Combination Agreement, including agreeing to execute and deliver the requisite consent of Wag!’s stockholders holding shares of Wag! common stock and Wag! preferred stock sufficient under the Delaware General Corporation Law and Wag!’s certificate of incorporation and bylaws to approve the Business Combination Agreement and the Business Combination, in the form of a written consent executed by the Key Wag! Stockholders, within 48 hours of the Registration Statement on Form S-4 filed with the SEC in connection with the Business Combination becoming effective. The Stockholder Support Agreement will terminate upon the earliest to occur of (a) the Acquisition Merger Effective Time, (b) the date of the termination of the Business Combination Agreement, and (c) the effective date of a written agreement of CHW, Wag!, and the Wag! stockholders party thereto terminating the Stockholder Support Agreement (the “Expiration Time”). The Key Wag! Stockholders also agreed, until the Expiration Time, to certain transfer restrictions (excluding the Conversion).

In connection with entering into the Business Combination Agreement, on February 2, 2022, CHW entered into a definitive commitment letter (the “Commitment Letter”) with Blue Torch Capital LP (together with its affiliated funds and any other parties providing a commitment thereunder, including any additional lenders, agents, arrangers or other parties joined thereto after the date thereof, collectively, the “Debt Financing Sources”), pursuant to which, among other things, the Debt Financing Sources agreed to fund a $30 million senior secured term loan credit facility (the “Credit Facility”). The closing and funding of the Credit Facility will occur in connection with the closing of the transactions contemplated by the Business Combination Agreement, subject to the satisfaction or waiver of the conditions to funding set forth in the Commitment Letter. Upon closing, Wag! will be the primary borrower under the Credit Facility, New Wag! will be a parent guarantor and substantially all of Wag!’s existing and future subsidiaries will be subsidiary guarantors (subject to certain customary exceptions). The Credit Facility will be secured by a first priority security interest in substantially all assets of Wag! and the guarantors (subject to certain customary exceptions).

4

The foregoing description of the Business Combination Agreement, Lock-Up Agreement, Amended and Restated Registration Rights Agreement, PIPE and Backstop Subscription Agreements, CHW Founders Stock Letter, Stockholder Support Agreement and Commitment Letter do not purport to be complete and are qualified in its entirety by the reference to the full text of such documents, copies of which are attached as Exhibits 2.1, 10.1, 10.2, 10.3, 10.4, 10.5, 10.6, 10.7 and 10.8 to our Current Report on Form 8-K filed with the SEC on February 3, 2022, and are incorporated herein by reference.

The Business Combination Agreement, Lock-Up Agreement, Amended and Restated Registration Rights Agreement, Subscription Agreement, CHW Founders Stock Letter, Stockholder Support Agreement and Commitment Letter (the “Included Agreements”) have been included to provide investors with information regarding their terms. They are not intended to provide any other factual information about CHW, Wag! or their affiliates. The representations, warranties, covenants and agreements contained in each Included Agreement and the other documents related thereto were made only for purposes of such Included Agreement as of the specific dates therein, were solely for the benefit of the parties to such Included Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Included Agreements instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors are not third-party beneficiaries under the Included Agreements and should not rely on the representations, warranties, covenants and agreements or any descriptions thereof as characterizations of the actual state of facts or condition of the parties thereto or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of representations and warranties may change after the date of the Included Agreements, as applicable, which subsequent information may or may not be fully reflected in the our public disclosures.

For more information about the Business Combination Agreement and the proposed Wag! Business Combination, see our Current Report on Form 8-K filed with the SEC on February 3, 2022 and the Wag! Disclosure Statement that we will file with the SEC. Unless specifically stated, this Annual Report does not give effect to the proposed Wag! Business Combination and does not contain the risks associated with the proposed Wag! Business Combination. Such risks and effects relating to the proposed Wag! Business Combination will be included in a Registration Statement on Form S-4 that we will file with the SEC relating to our proposed business combination with Wag!

Additional Disclosures

Initial Business Combination

Nasdaq listing rules require that our initial business combination must be with one or more operating businesses or assets with a fair market value equal to at least 80% of the assets held in the Trust Account (net of amounts disbursed to management for working capital purposes, if permitted, and excluding the amount of any deferred underwriting fees and taxes payable on the income earned on the Trust Account). We refer to this as the 80% fair market value test. If our board of directors is not able to independently determine the fair market value of the target business or businesses, we will obtain an opinion from an independent investment banking firm or another independent entity that commonly renders valuation opinions with respect to the satisfaction of such criteria. We do not currently intend to purchase multiple businesses in unrelated industries in conjunction with our initial business combination, although there is no assurance that will be the case.

5

We anticipate structuring our initial business combination so that the post-transaction company in which our Public Shareholders own shares will own or acquire 100% of the issued and outstanding equity interests or assets of the target business or businesses. We may, however, structure our initial business combination such that the post-transaction company owns or acquires less than 100% of such interests or assets of the target business in order to meet certain objectives of the target management team or shareholders or for other reasons, but we will only complete such business combination if the post-transaction company owns or acquires 50% or more of the issued and outstanding voting securities of the target or otherwise acquires a controlling interest in the target business sufficient for it not to be required to register as an investment company under the Investment Company Act. Even if the post-transaction company owns or acquires 50% or more of the voting securities of the target, our shareholders prior to our initial business combination may collectively own a minority interest in the post-transaction company, depending on valuations ascribed to the target and us in our initial business combination transaction. For example, we could pursue a transaction in which we issue a substantial number of new shares in exchange for all of the issued and outstanding capital stock, shares or other equity securities of a target business or issue a substantial number of new shares to third-parties in connection with financing our initial business combination. In this case, we would acquire a 100% controlling interest in the target. However, as a result of the issuance of a substantial number of new shares, our shareholders immediately prior to our initial business combination could own less than a majority of our issued and outstanding shares subsequent to our initial business combination. If less than 100% of the equity interests or assets of a target business or businesses are owned or acquired by the post-transaction company, the portion of such business or businesses that is owned or acquired is what will be valued for purposes of the 80% fair market value test. If our initial business combination involves more than one target business, the 80% fair market value test will be based on the aggregate value of all of the target businesses. Notwithstanding the foregoing, if we are not then listed on Nasdaq for whatever reason, we would no longer be required to meet the foregoing 80% fair market value test.

We have filed a Registration Statement on Form 8-A with the SEC to voluntarily register our securities under Section 12 of the Exchange Act. As a result, we are subject to the rules and regulations promulgated under the Exchange Act. We have no current intention of filing a Form 15 to suspend our reporting or other obligations under the Exchange Act prior or subsequent to the consummation of our initial business combination.

Corporate Information

Our executive offices are located at 2 Manhattanville Road, Suite 403, Purchase, NY 10577, and our telephone number is (914) 603-5016.

We are a Cayman Islands exempted company. Exempted companies are Cayman Islands companies conducting business mainly outside the Cayman Islands and, as such, are exempted from complying with certain provisions of the Companies Law. As an exempted company, we have received a tax exemption undertaking from the Cayman Islands government that, in accordance with Section 6 of the Tax Concessions Law (2018 Revision) of the Cayman Islands, for a period of 20 years from the date of the undertaking, no law which is enacted in the Cayman Islands imposing any tax to be levied on profits, income, gains or appreciations will apply to us or our operations and, in addition, that no tax to be levied on profits, income, gains or appreciations or which is in the nature of estate duty or inheritance tax will be payable (i) on or in respect of our shares, debentures or other obligations or (ii) by way of the withholding in whole or in part of a payment of dividend or other distribution of income or capital by us to our shareholders or a payment of principal or interest or other sums due under a debenture or other obligation of us.

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies”personalized pet recommendations including but not limited to age, breed, average walk distance and photos.

6

Travel and Local (Google Play) and Travel (iOS) categories for key search terms through App Store optimization and strong consumer rankings and reviews. In addition, Section 107our website saw more than five million visitors per month from direct or unpaid traffic sources in 2023, the majority of which came from our search engine optimization efforts. In 2023, we saw an average of 80% organic customer acquisition.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering, (b)discount trials, partnerships, display advertising, billboards, radio, video, television, direct mail, social media, email, podcasts, hiring and classified advertisement websites, mobile “push” communications, search engine optimization, and paid keyword search campaigns.

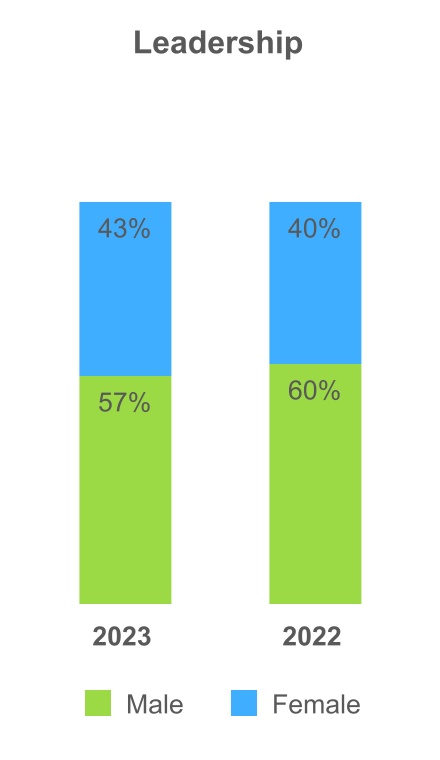

Additionally, we arediverse backgrounds and experiences;

Evaluation of a Target Business and Structuring of Our Initial Business Combination

In evaluating a prospective target business, we expect to conduct a due diligence review which may encompass, among other things, (i) meetings with incumbent management and their advisors (if applicable); (ii) document reviews; (iii) interviews with various stakeholders,procedures, including but not limited to reviewing job descriptions for inclusive language, sourcing from wide talent pools and a structured interview process; and

| Board | Leadership | Non-Leadership | ||||||||||||||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||||||||||||

| American Indian or Alaska Native | — | % | — | % | — | % | — | % | 2 | % | 2 | % | ||||||||||||||||||||||||||

| Asian | 33 | % | 33 | % | 9 | % | 5 | % | 14 | % | 16 | % | ||||||||||||||||||||||||||

| Black or African American | 17 | % | 17 | % | 5 | % | 5 | % | 8 | % | 6 | % | ||||||||||||||||||||||||||

| Hispanic or Latino | — | % | — | % | — | % | — | % | 19 | % | 16 | % | ||||||||||||||||||||||||||

| Two or More Races | — | % | — | % | 5 | % | 5 | % | 8 | % | 8 | % | ||||||||||||||||||||||||||

| White | 50 | % | 50 | % | 81 | % | 85 | % | 49 | % | 52 | % | ||||||||||||||||||||||||||

| 2023 | 2022 | |||||||||||||

| 24 years and younger | 1 | % | 4 | % | ||||||||||

| 25-29 years | 15 | % | 24 | % | ||||||||||

| 30-34 years | 37 | % | 32 | % | ||||||||||

| 35-39 years | 11 | % | 8 | % | ||||||||||

| 40-49 years | 25 | % | 22 | % | ||||||||||

| 50+ years | 11 | % | 10 | % | ||||||||||

Theus relating to privacy, data protection, and cybersecurity may evolve in a manner that relates to our practices or the features of our mobile applications or website. We may need to take additional measures to comply with new and evolving legal obligations and to maintain and improve our cybersecurity posture in an effort to reduce cybersecurity incidents or avoid breaches affecting personal information or other sensitive or proprietary data. For additional information, see “

Lack of Business Diversification

For an indefinite period of time after the completion ofbusiness.

7

Limited Ability to Evaluate the Target’s Management Team

Although we intend to closely scrutinize the management of a prospective target business when evaluating the desirability of effecting our initial business combination with that business, our assessment of the target business’s managementintellectual property rights, they may not prove to be correct. In addition, the future management may not have the necessary skills, qualifications or abilities to manage a public company. Furthermore, the future role of members of our management team, if any, in the target business cannot presently be stated with any certainty. The determination as to whether any of the members of our management team will remain with the combined company will be made at the time of our initial business combination. While it is possible that one or more of our directors will remain associated in some capacity with us following our initial business combination, it is unlikely that any of them will devote their full efforts to our affairs subsequent to our initial business combination. Moreover, we cannot assure you that members of our management team will have significant experience or knowledge relating to the operations of the particular target business.

We cannot assure you that any of our key personnel will remain in senior management or advisory positions with the combined company. The determination as to whether any of our key personnel will remain with the combined company will be made at the time of our initial business combination.

Following a business combination, we may seek to recruit additional managers to supplement the incumbent management of the target business. We cannot assure you that we will have the ability to recruit additional managers, or that additional managers will have the requisite skills, knowledge or experience necessary to enhance the incumbent management.

Conflicts of Interest

Certain of our officers and directors presently have, andrespected in the future anyor may be invalidated, circumvented, or challenged.

Human Capital Management

We currently have four executive officers and we do not intend to have any full time employees prior to the completion of our initial business combination. Members of our management team are not obligated to devote any specific number of hours to our matters but they intend to devote as much of their time as they deem necessary to our affairs until we have completed our initial business combination. The amount of time they will devote in any time period will vary based on the status of the proposed Wag! business combination and, if the proposed Wag! business combination is not consummated, whether a different target business has been selected for our initial business combination and the current stage of the business combination process.

Factors

8

For the complete list of risks relating to our operations, see the section titled “Risk Factors” contained in our prospectus dated August 30, 2021. See also the Risk Factors that will be set forth in our preliminary prospectus/proxy statement to be included in a Registration Statement on Form S-4 that we will file with the SEC relating to our proposed business combination with Wag!

Comments

will be available as needed.

ToProceedings

9

10

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Securities

On March 9, 2022,13, 2024, there was 1 holder of record of our units, 24were 126 holders of record of our ordinary sharescommon stock and 26 holders of record of our public warrants.

The actual number of stockholders is greater than this number of record holders and includes stockholders who are beneficial owners but whose shares are held in street name by brokers or other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust by other entities.

None.

On September 1, 2021, simultaneously with the closing of the initial public offering, and in accordance with the Private Placement Warrants Purchase Agreement, the Company completed the private placement sale of 4,238,636 warrants (the “private placement warrants”) to the Sponsor, generating total proceeds of $4,238,636. The private placement warrants are identical to the warrants sold in the initial public offering, except as otherwise disclosed in the registration statement on Form S-1 (File Nos. 333-254422 and 333-259182). No underwriting discounts or commissions were paid with respect to the sale of the private placement warrants. The issuance of the private placement warrants was made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act.

On September 1, 2021, simultaneously with the closing of the initial public offering, and in accordance with the Underwriting Agreement, the Company completed the private placement sale of 62,500 ordinary shares (the “representative shares”) to Chardan for nominal consideration. The Company issued the representative shares pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act.

None.

11

On September 1, 2021, we consummated our initial public offering of 12,500,000 units, including 1,500,000 units issued pursuant to the partial exercise of the underwriters’ over-allotment option. Each unit consists of one ordinary share and one redeemable warrant, with each warrant entitling the holder thereof to purchase one ordinary share for $11.50 per share. The units were sold at a price of $10.00 per unit, generating gross proceeds to the Company of $125,000,000.

A total of $125,000,000 of the proceeds from the initial public offering (which amount includes $4,375,000 of the underwriters’ deferred discount) and the sale of the Private Placement Warrants, was placed in a U.S.-based trust account maintained by Wilmington, acting as trustee. The proceeds held in the trust account may be invested by the trustee only in U.S. government securities with a maturity of 185 days or less or in money market funds investing solely in U.S. government treasury obligations and meeting certain conditions under Rule 2a-7 under the Investment Company Act of 1940, as amended.

Item 6. [RESERVED.]

[Reserved.]

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion and analysis of our financial condition and results of operations, should be read in conjunction withcash requirements, financial condition, contractual restrictions and other factors that our audited financial statementsBoard may deem relevant.

All statements other than statements of historical fact included in this Annual Report including, without limitation, statements under “Management’sAffiliated Purchasers

| Year Ended December 31, | Change | |||||||||||||||||||||||||

| 2023 | 2022 | $ | % | |||||||||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||||||||

| Platform Participants (as of period end) | 600 | 434 | 166 | 38.2 | % | |||||||||||||||||||||

| Revenues | $ | 83,916 | $ | 54,865 | 29,051 | 52.9 | % | |||||||||||||||||||

| Net loss | $ | (13,317) | $ | (38,567) | 25,250 | (65.5) | % | |||||||||||||||||||

| Net loss margin | (15.9) | % | (70.3) | % | ||||||||||||||||||||||

| Net cash provided by (used in) operating activities | $ | (6,465) | $ | (2,803) | (3,662) | 130.6 | % | |||||||||||||||||||

| Adjusted EBITDA (loss)(1) | $ | 722 | $ | (3,872) | 4,594 | * | ||||||||||||||||||||

| Adjusted EBITDA (loss) margin(1) | 0.9 | % | (7.1) | % | ||||||||||||||||||||||

Overview

the quarter. Services include dog walking, sitting, boarding, drop-ins, training, premium telehealth services, wellness plans, and pet insurance plan comparison.

| Year Ended December 31, | ||||||||||||||

| 2023 | 2022 | |||||||||||||

| (in thousands, except percentages) | ||||||||||||||

| Net loss | $ | (13,317) | $ | (38,567) | ||||||||||

| Interest expense, net | 6,510 | 2,470 | ||||||||||||

| Income taxes | 93 | 13 | ||||||||||||

| Depreciation and amortization | 1,673 | 571 | ||||||||||||

| Stock-based compensation | 4,712 | 24,492 | ||||||||||||

| Integration and transaction costs associated with acquired business | 189 | 220 | ||||||||||||

| Severance costs | 199 | — | ||||||||||||

| Legal settlements | 663 | — | ||||||||||||

| Change in fair value of derivative liability | — | 4,958 | ||||||||||||

| Issuance of Community Shares | — | 1,971 | ||||||||||||

| Adjusted EBITDA (loss) | $ | 722 | $ | (3,872) | ||||||||||

| Revenues | $ | 83,916 | $ | 54,865 | ||||||||||

| Adjusted EBITDA (loss) margin | 0.9 | % | (7.1) | % | ||||||||||

| Year Ended December 31, | Change | |||||||||||||||||||||||||

| 2023 | 2022 | $ | % | |||||||||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||||||||

| Revenues | $ | 83,916 | $ | 54,865 | 29,051 | 52.9 | % | |||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||

| Cost of revenues (exclusive of depreciation and amortization shown separately below) | 5,477 | 4,024 | 1,453 | 36.1 | % | |||||||||||||||||||||

| Platform operations and support | 12,475 | 13,825 | (1,350) | (9.8) | % | |||||||||||||||||||||

| Sales and marketing | 50,523 | 35,156 | 15,367 | 43.7 | % | |||||||||||||||||||||

| Royalty | 1,791 | — | 1,791 | 100.0 | % | |||||||||||||||||||||

| General and administrative | 19,223 | 32,415 | (13,192) | (40.7) | % | |||||||||||||||||||||

| Depreciation and amortization | 1,673 | 571 | 1,102 | 193.0 | % | |||||||||||||||||||||

| Total costs and expenses | 91,162 | 85,991 | 5,171 | 6.0 | % | |||||||||||||||||||||

| Interest expense | 7,417 | 2,886 | 4,531 | 157.0 | % | |||||||||||||||||||||

| Interest income | (907) | (416) | (491) | 118.0 | % | |||||||||||||||||||||

| Other expense, net | 21 | 4,958 | (4,937) | (99.6) | % | |||||||||||||||||||||

| Loss before income taxes and equity in net earnings of affiliate | (13,777) | (38,554) | 24,777 | (64.3) | % | |||||||||||||||||||||

| Income taxes | 93 | 13 | 80 | 615.4 | % | |||||||||||||||||||||

| Equity in net earnings of equity method investment | 553 | — | 553 | 100.0 | % | |||||||||||||||||||||

| Net loss | $ | (13,317) | $ | (38,567) | 25,250 | (65.5) | % | |||||||||||||||||||

We expect to continue to incur significant costs in the pursuit of our acquisition plans. We cannot assure you that our plans to complete a business combination will be successful.

Results of Operations

We have neither engaged in any operations nor generated any operating revenues to date. Our only activities from inception throughyear ended December 31, 2021 were organizational activities and those necessary2022 to prepare$83.9 million for the IPO, described below, and since the IPO, the search and initiation ofyear ended December 31, 2023. The increase was primarily attributable to a Business Combination. We do not expect to generate any operating revenues until after the completion of our initial Business Combination, at the earliest. We expect to generate non-operating income$19.9 million increase in the form of interest income from the proceeds of the IPO placed in the Trust Account. We expect that we will incur increased expensesWellness revenue as a result of increased activity and a $6.6 million increase in Pet Food & Treats revenue as a result of our acquisition of Dog Food Advisor in the first quarter of 2023 and launch of Cat Food Advisor in the third quarter of 2023. The increase also includes a $2.6 million increase in Services revenue from increased Pet Parents’ engagement of Pet Caregivers to provide pet care services as a result of increased return-to-office, and growth in ancillary services such as Wag! Premium subscriptions and Wag! products.

For the period January 12,2021 (inception) toyear ended December 31, 2021, we had a net loss2022 to $1.7 million for the year ended December 31, 2023. The increase was primarily attributable to the acquisitions of $829,563, which primarily consistsDog Food Advisor and Maxbone in 2023 and the related amortization of operating expenses of $832,564, partially offset by Income on investments held in Trust Account of $3,001.

12

LiquidityInterest expense, net was as follows:

| Year Ended December 31, | Change | |||||||||||||||||||||||||

| 2023 | 2022 | $ | % | |||||||||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||||||||

| Interest expense | $ | 7,417 | $ | 2,886 | 4,531 | 157.0 | % | |||||||||||||||||||

| Interest income | (907) | (416) | (491) | 118.0 | % | |||||||||||||||||||||

| Interest expense, net | $ | 6,510 | $ | 2,470 | 4,040 | 163.6 | % | |||||||||||||||||||

On September 1, 2021, we consummated our IPO of 12,500,000 Units, which includes 1,500,000 Units from the underwriters’ partial exercise of their over-allotment option, at $10.00 per Unit, generating gross proceeds of $125,000,000. SimultaneouslyWarrant Agreement entered into in connection with the closing of the IPOBusiness Combination with CHW, partially offset by an increase in interest income on our cash and cash equivalents due to a higher interest rate environment.

Forfactors described in Part I, Item 1A,

| Year Ended December 31, | Change | |||||||||||||||||||||||||

| 2023 | 2022 | $ | % | |||||||||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||||||||

| Net cash provided by (used in): | ||||||||||||||||||||||||||

| Operating activities | $ | (6,465) | $ | (2,803) | (3,662) | 130.6 | % | |||||||||||||||||||

| Investing activities | (12,261) | 1,835 | (14,096) | (768.2) | % | |||||||||||||||||||||

| Financing activities | (1,917) | 37,089 | (39,006) | (105.2) | % | |||||||||||||||||||||

| Net change in cash and cash equivalents | $ | (20,643) | $ | 36,121 | (56,764) | (157.1) | % | |||||||||||||||||||

AtEconomic Security Act, of which $3.5 million was subsequently forgiven. The PPP Loan matures on August 5, 2025 and bears interest at a fixed rate of 1.00%. Principal and interest payments are payable monthly, and as of December 31, 2021, we had cash2023, the amount outstanding under the PPP Loan was $0.8 million.

At December 31, 2021, we had cash of $687,581 outside of the trust account. We intend to use the funds held outside the trust account primarily to identify and evaluate target businesses, perform business due diligencethis Annual Report on prospective target businesses, travel to and from the offices, plants or similar locations of prospective target businesses or their representatives or owners, review corporate documents and material agreements of prospective target businesses, and structure, negotiate and complete a business combination.

Until the consummation of a Business Combination, the Company will be using the funds not held in the Trust Account for identifying and evaluating prospective acquisition candidates, performing due diligence on prospective target businesses, paying for travel expenditures, selecting the target business to acquire, and structuring, negotiating and consummating the Business Combination. The Company will need to raise additional capital through loans or additional investments from its Sponsor, shareholders, officers, directors, or third parties. The Company’s officers, directors and Sponsor may, but are not obligated to, loan the Company funds, from time to time or at any time, in whatever amount they deem reasonable in their sole discretion, to meet the Company’s working capital needs. Accordingly, the Company may not be able to obtain additional financing.

If the Company is unable to raise additional capital, it may be required to take additional measures to conserve liquidity, which could include, but not necessarily be limited to, curtailing operations, suspending the pursuit of a potential transaction, and reducing overhead expenses. The Company cannot provide any assurance that new financing will be available to it on commercially acceptable terms, if at all. These conditions raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time, which is considered to be one year from the issuance date of the financial statements. These financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

Form 10-K.

We have no obligations, assets or liabilities, which would be considered off-balance sheet arrangements as of December 31, 2021. We do not participate in transactions that create relationships with entities or financial partnerships, often referred to as variable interest entities, which would have been established for the purpose of facilitating off-balance sheet arrangements. We have not entered into any off-balance sheet financing arrangements, established any special purpose entities, guaranteed any debt or commitments of other entities, or purchased any non-financial assets.

Contractual obligations

13

The underwriters were paid a cash underwriting discount of $0.175 per unit, or $2,187,500 in the aggregate at the closing of the IPO (which includes amounts related to the partial exercise of the over-allotment option). In addition, the underwriters are entitled to a deferred underwriting commissions of $0.35 per unit, or $4,375,000 in the aggregate from the closing of the IPO (which includes amounts related to the partial exercise of the over-allotment option).

JOBS Act

On April 5, 2012, the JOBS Act was signed into law. The JOBS Act contains provisions that, among other things, relax certain reporting requirements for qualifying public companies. We will qualify as an “emerging growth company” and under the JOBS Act will be allowed to comply with new or revised accounting pronouncements based on the effective date for private (not publicly traded) companies. We are electing to delay the adoption of new or revised accounting standards, and as a result, we may not comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. As such, our financial statements may not be comparable to companies that comply with public company effective dates.

Additionally, we are in the process of evaluating the benefits of relying on the other reduced reporting requirements provided by the JOBS Act. Subject to certain conditions set forth in the JOBS Act, if, as an “emerging growth company,” we choose to rely on such exemptions we may not be required to, among other things, (i) provide an auditor’s attestation report on our system of internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act, (ii) provide all of the compensation disclosure that may be required of non-emerging growth public companies under the Dodd-Frank Wall Street Reform and Consumer Protection Act, (iii) comply with any requirement that may be adopted by the PCAOB regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (auditor discussion and analysis) and (iv) disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of executive compensation to median employee compensation. These exemptions will apply for a period of five years following the completion of our IPO or until we are no longer an “emerging growth company,” whichever is earlier.

Critical Accounting Policies

The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted in the United States of AmericaEstimates

Warrant Liabilities

For issued or modified warrants that meet all of the criteria for equity classification, the warrants are required to be recorded as a component of additional paid-in-capital at the time of issuance. For issued or modified warrants that do not meet all the criteria for equity classification, the warrants are required to be recorded at their initial fair valuestock price on the date of issuance,grant. The fair values of equity awards are recognized as compensation expense over the requisite service period or over the period in which the related services are received (generally the vesting period) using the straight-line method. We account for forfeitures as they occur.

14

Ordinary Shares Subject to Possible Redemption

The Company accounts for its Ordinary Shares subject to possible redemptionincome taxes using an asset and liability approach, which requires the recognition of taxes payable or refundable for the current year and deferred tax liabilities and assets for the future tax consequences of events that have been recognized in accordance with the guidance in ASC Topic 480, “Distinguishing Liabilities from Equity”. Ordinary shares subject to mandatory redemption, if any, are classified as a liability instrument and is measured at fair value. Conditionally redeemable Ordinary Shares (including Ordinary Shares that features redemption rights that are either within the controlfinancial statements or tax returns. The measurement of the holderdeferred items is based on enacted tax laws. In the event the future consequences of differences between financial reporting basis and the tax basis of assets and liabilities result in a deferred tax asset, the Company evaluates the probability of being able to realize the future benefits indicated by such asset. A valuation allowance related to a deferred tax asset is recorded when it is more likely than not that either some portion or subjectthe entire deferred tax asset will not be realized. The Company records a valuation allowance to redemption uponreduce the occurrencedeferred tax assets to the amount of uncertain eventsfuture tax benefit that is more likely than not solely within the Company’s control) are classified as temporary equity. At all other times, Ordinary Shares are classified as shareholders’ equity. The Company’s Public Shares features certain redemption rights that are considered to be outsiderealized. We regularly review the deferred tax assets for recoverability based on historical taxable income or loss, projected future taxable income or loss, the expected timing of the Company’s controlreversals of existing temporary differences and subjecttax planning strategies. Our judgment regarding future profitability may change due to occurrence ofmany factors, including future market conditions and the ability to successfully execute the business plans and/or tax planning strategies. Should there be a change in the ability to recover deferred tax assets, our income tax provision would increase or decrease in the period in which the assessment is changed.

Net Loss per Ordinary Share

Net loss per share is computed by dividing net loss by the weighted average number of shares of ordinary share outstanding during the period, excluding shares of ordinary share subject to forfeiture by the Sponsor. At December 31, 2021, thebeing recognized upon settlement. The Company did not haverecognize any dilutive securities and/or other contracts that could, potentially, be exercised or converted into shares of ordinary sharetax benefits from uncertain tax positions during the years ended December 31, 2023 and then share2022.

Recent Accounting Standards

In August 2020, the FASB issued Accounting Standard Update (“ASU”) No. 2020-06, Debt -Debtextended transition period. Accordingly, our consolidated financial statements may not be comparable to companies that comply with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging -Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity, which simplifies accounting for convertible instruments by removing major separation models required under current GAAP. The ASU removes certain settlement conditions that are required for equity contracts to qualify for the derivative scope exception, and it also simplifies the diluted earnings per share calculation in certain areas. The Company adopted ASU 2020-06 on January 12, 2021, with no impact upon adoption. The Company’s management does not believe that any other recently issued, but not yet effective,new or revised accounting pronouncements if currently adopted, would have a material effect on the Company’s financial statement.

Management does not believe that any other recently issued, but not yetas of public company effective accounting standards, if currently adopted, would have a material effect on our financial statements

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

Through December 31, 2021, our efforts have been limited to organizational activities, activities relating to our initial public offering and since the initial public, the search for a target business with which to consummate an initial business combination. We have engaged in limited operations and have not generated any revenues. We have not engaged in any hedging activities since our inception on January 12, 2021. We do not expect to engage in any hedging activities with respectdates.

The net proceeds of the initial public offering and the sale of the private placement warrants heldConsolidated Financial Statements included in the trust account have been invested in U.S. government treasury bills with a maturity of 185 days or less or in money market funds meeting certain conditions under Rule 2a-7 under the Investment Company Act which invest only in direct U.S. government treasury obligations. Due to the short-term nature of these investments, we believe there will be no associated material exposure to interest rate risk.

Part II, Item 8. 8,

Reference is made to pages F-1 through F-18 comprising a portionData

Item 9. Changes in and Disagreements with Accountants10-K for information on Accounting and Financial Disclosure.

None.

15

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Disclosure controls are procedures that are designed with the objective of ensuring that information required to be disclosed in our reports filed under the Exchange Act, such as this Annual Report, is recorded, processed, summarized, and reported within the time period specified in the SEC’s rules and forms. Disclosure controls are also designed with the objective of ensuring that such information is accumulated and communicated to our management, including the chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding required disclosure. Our management evaluated, with the participation of our current chief executive officer and chief financial officer (our “Certifying Officers”), the effectiveness of our disclosure controls and procedures as of December 31, 2021, pursuant to Rule 13a-15(b) under the Exchange Act.

Based upon that evaluation, our Certifying Officers concluded that, as of December 31, 2021, our disclosure controls and procedures were not effective due toAs a material weakness in internal controls over financialsmaller reporting related to the lack of ability to account for complex financial instruments. Management identified errors in its historical financial statements related to the accounting for the public shares and other reclassification adjustments on the balance sheet. Because the public shares issued in the IPO can be redeemed or become redeemable subject to the occurrence of future events considered outside of the company’s control, the company, should have classified all of these redeemable shares in temporary equity and remeasured these redeemable shares to their redemption value (i.e., $10.00 per share) as of the end of the first reporting period after the date of the company’s IPO. This material weakness resulted in the restatement of our previously filed balance sheet as of July 20, 2021 included in exhibit 99.1 to our Current Report on Form 8-K filed on September 8, 2021. See Note 2 of the notes to the financial statements included in our Quarterly Report on Form 10-Q filed on November 24, 2021.

To address this material weakness, management has devoted, and plans to continue to devote, significant effort and resources to the remediation and improvement of its internal control over financial reporting and to provide processes and controls over the internal communications within the company, financial advisors and independent registered public accounting firm. While we have processes to identify and appropriately apply applicable accounting requirements, we plan to enhance these processes to better evaluate our research and understanding of the nuances of the complex accounting standards that apply to our financial statements. We plan to include providing enhanced access to accounting literature, research materials and documents and increased communication among our personnel and third-party professionals with whom we consult regarding complex accounting applications. The elements of our remediation plan can only be accomplished over time, and we can offer no assurance that these initiatives will ultimately have the intended effects. Other than this issue, our disclosure controls and procedures were effective at a reasonable assurance level and, accordingly, provided reasonable assurance that the information required to be disclosed by us in reports filed under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms.

We do not expect that our disclosure controls and procedures will prevent all errors and all instances of fraud. Disclosure controls and procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the disclosure controls and procedures are met. Further, the design of disclosure controls and procedures must reflect the fact that there are resource constraints, and the benefits must be considered relative to their costs. Because of the inherent limitations in all disclosure controls and procedures, no evaluation of disclosure controls and procedures can provide absolute assurance that we have detected all our control deficiencies and instances of fraud, if any. The design of disclosure controls and procedures also is based partly on certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

Management’s Report on Internal Controls over Financial Reporting

This Annual Report does not include a report of management’s assessment regarding internal control over financial reporting or an attestation report of our registered public accounting firm due to a transition period established by the rules of the SEC for newly public companies.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act) during the most recent fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

16

Item 9B. Other Information.

None.

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections.

None.

17

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Directors and Executive Officers

As of the date of this Annual Report, our directors and officers are as follows:

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The experience of our directors and executive officers is as follows:

Paul Norman has served as our President since February 2021. Mr. Norman is a global consumer products leader with over 30 years of experience creating brand and shareholder value. He currently serves on the boards of directors of Hearthside Food Solutions, a contract food manufacturer, Jones Soda Company (OTC:JSDA), a beverage company, and PureK Holdings (TSX-V: PKAN), a CBD retail products company. From 2019 to 2020, he served as chairman and CEO of HeavenlyRx, a privately held CBD wellness company. Prior to HeavenlyRx, Mr. Norman spent three decades at Kellogg, the $11 billion multinational food-manufacturing company, where his tenure was defined by transformation, profitable growth and shareholder value creation through strategic portfolio management, innovation and diverse talent development and leadership. He has deep experience in building brands while successfully navigating complex regulatory environments where challenges around marketing and nutrition/ ingredient labeling restrictions are constantly evolving. As president of Kellogg’s $9 billion North American business from 2015 to 2018, Mr. Norman led initiatives such as the exit of Direct Store Delivery, which transformed US Snacks to a warehouse pull model. He was instrumental in accelerating mergers and acquisitions activity at Kellogg, including Kellogg’s acquisition of RX bar in 2017 for $600 million. In his role, Mr. Norman interacted regularly with the Kellogg board of directors, attending all board meetings and collaborating closely with several sub-committees. He also participated in analyst and investor calls for the company. Prior to serving as president of Kellogg’s North American business in 2015, Mr. Norman served as the company’s chief growth officer from 2013 to 2015, where he developed the Kellogg global category operating model. In that role he focused on long-term innovation, building sales and marketing capability, and long-term strategy for the company’s breakfast and snacks categories. Concurrent with the chief growth officer role, Mr. Norman served as interim president of the U.S. Morning Foods business, which generated approximately $3 billion in revenues. In 2008, he was promoted to president of Kellogg International, where he built a team and platform to support international growth, a key pillar of the company’s growth plan. As part of that team, Mr. Norman helped to facilitate the acquisition of Pringles® in 2012, which was key to the company’s plans for global expansion and growth. In 2012, he led the integration of Pringles® and the restructuring of Kellogg’s European business to implement the new “Wired to Win” operating model, which resulted in significantly improved European top and bottom line performance. From 2004 to 2008, Mr. Norman led U.S. Morning Foods, which included cereal, PopTarts®, the Kashi Company, and the frozen foods division, to five years of sequential profitable sales and share growth. He was named managing director of Kellogg’s U.K./ Republic of Ireland business in 2002, where he successfully led a turnaround in sales performance and helped to grow the company’s cereal market share for the first time in 11 years. In 2000, Mr. Norman became president of Kellogg Canada Inc. and from 1989 to 2000, he held progressively more senior marketing roles at U.S. Morning Foods across France, Canada, Latin America and the U.S. In addition to his time at Kellogg, from 2016 to 2018 Mr. Norman served as a member of the Grocery Manufacturers Association board of directors, where he served on the executive committee. He also served as a Trustee of the Food Marketing Institute Foundation board, from 2016 to 2018. Mr. Norman received a bachelor’s degree with honors in French from Portsmouth Polytechnic.

Jonah Raskas has served as our Co-Chief Executive Officer and a member of our board of directors since January 2021. Since 2016, Mr. Raskas has worked in the consumer industry, as brand manager at GlaxoSmithKline plc, or GSK, and has led several business lines for the company. All business lines he has led sell millions of products on an annual basis. At GSK, Mr. Raskas has focused on

18

digital, e-commerce, innovation profit and loss management, and overall strategy. Most recently, he led all e-commerce and digital for the first prescription to over-the-counter in the pain category in more than 20 years. There are, on average, only one to two prescription switches annually in the consumer industry and Mr. Raskas led one of them in 2020. He is also part of the US Consumer Healthcare Emerging Leaders Program at GSK. In March 2021, Mr. Raskas was appointed as a member of the Innovation Advisory Council of Brand Innovators, a brand marketing organization that provides programming and networking opportunities. From 2008 to 2010, he was an investment banker at Rodman and Renshaw, a mid-tier investment bank. Mr. Raskas was primarily focused on initial public offerings and secondary offerings, giving him capital market and public market exposure. Mr. Raskas started his career in 2007 working in the White House in the Speechwriting Office for President George W. Bush. There, he focused on market research and reviewing speeches that were written for President Bush and Vice President Dick Cheney. Mr. Raskas also graduated summa cum laude with a MBA from the Gabelli School of Business at Fordham University with a focus on Accounting and Marketing.

Mark Grundman has served as our Co-Chief Executive Officer and a member of our board of directors since January 2021. Mr. Grundman brings direct experience within a range of businesses, such as helipads, chemical plants, packaged consumer goods, and janitorial services. In early 2020, he established his own firm, MJG Partners, LLC, which focuses on small business investing and investment advising. From 2018 to 2019, he served as president of VPG International, LLC, a newly-acquired framed art business within a portfolio of investor-owned companies. From 2006 to 2016, Mr. Grundman worked at GAMCO Investors, Inc. (NYSE: GBL), a leading institutional asset management firm. From 2013 to 2014, he took a leave of absence to attend Columbia Business School, where he received his MBA. After graduating from Columbia, he rejoined the company to focus on building out a sell-side special situations department. During his tenure at GAMCO, Mr. Grundman held various roles including trading desk analyst, focusing on special situation investing, including merger arbitrage, spinoffs, special purpose acquisition companies, liquidations, and other arbitrage opportunities, ultimately reporting directly to Mario Gabelli, Chairman and Chief Investment Officer of GAMCO. In addition to his investing focus, Mr. Grundman was responsible for presenting and reviewing the portfolio strategy and performance to the board of directors and major investors of GAMCO’s publicly traded mutual funds as well as the separately managed accounts and sub accounts of the firm. Mr. Grundman brings a unique and valuable perspective to our strategic approach, in terms of public market reception, operational excellence, and sustainability.

Stephen Katchur has served as our Chief Financial Officer since March 2021. Mr. Katchur has also served as President of Blue Ribbon CFOs, a Delaware Limited Liability Company providing outsourced CFO solutions and business consulting since 2019. Mr. Katchur has also served as Chief Financial Officer of Advanced Merger Partners, Inc., a special purpose acquisition corporation, since January 2021. Previously, Mr. Katchur was Chief Financial Officer and Chief Compliance Officer for Land & Buildings Investment Management LLC, an activist real estate-focused manager where he was responsible for all non-investment operations including, accounting, finance, investor relations, marketing, and regulatory compliance. From 2011 to 2014, Mr. Katchur was Chief Financial Officer of Wolfacre Global Management LLC and later for North Oak Capital Advisors LLC, both investment managers affiliated with Tiger Management LP. In these positions, Mr. Katchur oversaw all day-to-day non-investment functions. Mr. Katchur began his career in Hedge Fund Administration where he led teams supporting several large investment managers. Mr. Katchur holds an undergraduate degree in Finance from the University of Central Florida and an MBA from New York University, Stern School of Business with specializations in Finance and Financial Instruments & Markets.

Victor Herrero has served as the chairman of our board of directors since August 30, 2021. Mr. Herrero has extensive experience in corporate management and business operations in the consumables industry. From 2015 to 2019, Mr. Herrero served as the chief executive officer and director of Guess Inc., which is principally engaged in designing, marketing, distributing and licensing a lifestyle collection of contemporary apparel, denim, handbags, watches, footwear and other related consumer products around the world. Prior to joining Guess Inc., Mr. Herrero served as the head of Asia Pacific and managing director of Greater China of Industria de Diseño Textil, S.A. (Inditex Group), an international fashion retailer with brands including Zara, Massimo Dutti, Pull & Bear, Bershka and Stradivarius. In addition to Active International, Mr. Herrero is a board member of Global Fashion Group S.A., (e-commerce fashion site operator and owner of Zalora and The Iconic among others, the shares of which are listed on the Frankfurt stock exchange), G-III Apparel Group, Ltd (U.S. manufacturer and distributor operating through a portfolio of brands, the shares of which are listed on NASDAQ) and Gruppo Coppel (Mexican consumer finance and retail conglomerate) and Clarks (British based international shoe manufacturer and retailer). Mr. Herrero graduated with a Master of Business Administration from Kellogg School of Management at Northwestern University. He obtained a Bachelor’s Degree in Business Administration from ESCP Europe in Paris, France in 1992 and a Bachelor of Law Degree from the University of Zaragoza in Spain in 1993. He was also awarded “Best CEO in the Sustainable Apparel Industry” in 2018 by European CEO Magazine.

19

M. Carl Johnson, III has served as a member of our board of directors since August 30, 2021. Mr. Johnson is currently Chairman of the Board of Nautilus, Inc. (NYSE:NLS), a fitness solutions company, and has served in this capacity since 2010. He also served as interim chief executive officer of Nautilus from March 2019 through July 2019. From 2011 to 2015, he served as group executive vice president/brands and chief growth officer of Del Monte Foods (2011-2014) and chief growth officer and executive vice president, marketing, for Big Heart Pet Brands, the successor company to Del Monte Foods (2014- 2015), and senior advisor, J. M. Smucker Co., following its acquisition of Big Heart Pet Brands (2015). From 2001 to 2011, Mr. Johnson served as senior vice president and chief strategy officer for Campbell Soup Company. From 1992-2001, he served in various roles at Kraft Food Group, Inc.: Vice President, Strategy, Kraft USA (1992-93); EVP & General Manager, Specialty Products Division, Kraft USA (1993-94); EVP & General Manager, Meals Division, Kraft Foods, N.A.; EVP & President, New Meals Division, Kraft Foods, N.A. (1997-2001). Prior to that, Mr. Johnson held roles at Marketing Corp. of America, Polaroid Corp., and Colgate-Palmolive. Mr. Johnson brings a broad set of skills to our board of directors, which he developed through helping lead iconic American companies such as Campbell Soup Company, Kraft, Polaroid, Colgate-Palmolive, managing multi-billion dollar businesses, and serving on c-suite leadership teams.

Gary Tickle has served as a member of our board of directors since August 30, 2021. Mr. Tickle is an industry leader with 30 years of global experience successfully driving growth and transformation in consumer packaged goods, or CPG, businesses. He held leadership roles across various functions including supply chain, manufacturing, finance, sales and marketing. Mr. Tickle has had twenty years of c-suite responsibility, including turnaround assignments, innovation and global strategy development, particularly focused on nutrition, health and wellness. His broad category experience includes coffee, confectionery, snacks, dairy, infant nutrition, milk modifiers, cereals, foodservice, personal care, tea, soups and cooking aids. In January 2021, Mr. Tickle joined Sustainable Beverage Technologies (SBT) as its Global CEO. From 2019 to 2020, Mr. Tickle served as chief executive officer at Shiftlineup, a software as a service human capital management company. From 2016 to 2019 Mr. Tickle was the chief executive officer of Hain Celestial North America, a NASDAQ-listed natural and organic food company. Prior to that, he had an extensive international career with Nestle spanning over 25 years, starting in 1987. Mr. Tickle was the global strategic business unit head of infant nutrition where led the successful global acquisition and integration of Wyeth Nutrition, before coming to the United States to serve as president and chief executive officer of Nestle Nutrition North America. Mr. Tickle was also regional business head of South Asia, based in New Delhi, India, and chief executive officer of Nestle New Zealand for five years. He has held a number of industry leadership roles, including chairman of the infant Nutrition Council of America and vice chairman of the Food and Grocery Council in New Zealand. He also served as a Board Member of Buckley Country Day School in New York and today is an external advisor on the AT Kearney Consumer Industries and Retail Panel. Mr. Tickle also serves as a mentor on the Denver Small Business Development Council. Mr. Tickle holds an MBA with Distinction from Deakin University in Australia, a Bachelor of Business in Operations Management/Human Resource Management and Post Graduate Degree in Finance.

Deb Benovitz has served as a member of our board of directors since August 30, 2021. Ms. Benovitz has more than 30 years of consumer experience in leading consumer-focused companies. Her particular area of expertise is in brand transformation. She has played a key role in the transformation of major brands such as LEGO, Dove (via the Campaign for Real Beauty) and Pepsi. Ms. Benovitz currently serves as senior vice president, global marketing/competitive intelligence and human truths for WW (formerly Weight Watchers), a position she has held since September 2014. She sits on the executive committee at WW, reporting to the chief executive officer. In her role, she delivers strategic consumer insights to drive business growth, manages the global consumer insights department, and spearheads WW’s goal of democratizing wellness and making it accessible to all. In addition, Ms. Benovitz is responsible for ensuring that all innovation, brand, science and tech design work, begins with a consumer need, and stays true to the consumer throughout the process. She led WW’s wellness agenda and was part of a small team that crafted the company’s wellness vision and mission. From 2009 to 2014, she was vice president of global consumer insights at PepsiCo, where she led their cutting-edge, future-focused insights department serving 30 markets around the world. Ms. Benovitz has extensive experience in brand, consumer, competitive intelligence, shopper and tech user experience research among adults and children, including innovation, trend tracking, new product and concept research, advertising assessment, segmentation research, brand equity and tracking research, usage and attitude work, needs identification, consumer journey mapping, creative insight generation, and analytics. Ms. Benovitz holds a B.A. from Barnard College, Columbia University, and an MBA from the University of Wisconsin.

20