SECURITIES AND EXCHANGE COMMISSION

FORM

10-K(Mark One)

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year

ended ended: December 31,, 2021☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

2023

or

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the

transition periodTransition Period from

toto.Commission File Number 001-40427

|

NKGen Biotech, Inc. |

GRAF ACQUISITION CORP. IV

|

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | | 001-40427

| | 86-2191918 |

(State or other jurisdiction of incorporation or organization) | |

(Commission

File Number)

| | Identification Number) |

3001 Daimler Street Santa Ana, CA, 92705 (Address of Principal Executive Offices) (Zip Code) (949) 396-6830 | | |

1790 Hughes Landing Blvd., Suite 400

The Woodlands, Texas

| |

77380

|

(Address of principal executive offices) | | (Zip Code)

|

Registrant’s telephone number, including area code: (346) 442-0819

Telephone Number, Including Area Code)

(Former

name or former address,Name, Former Address and Former Fiscal Year, if

changed since last report)Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

Act:

| | | | | | | | |

Title of Each Class:each class | Trading Symbol(s) | Trading Symbols

| | Name of Each Exchange on Which Registered: the principal U.S. market |

Common Stock, $0.0001 par value $0.0001 per share | NKGN | GFOR

| | New York Stock Exchange

Nasdaq Global Market |

Warrants, to purchaseeach whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | NKGNW | GFOR WS

| | New York Stock Exchange

|

Units, each consisting of one share of Common Stock and one-fifth Warrant

| | GFOR.U

| | New York Stock Exchange

Nasdaq Capital Market |

Securities registered pursuant to

Sectionsection 12(g) of the Act:

Nonenone.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes ☐o No ☒x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐o No ☒x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐x No ☒o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒x No ☐o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer,

a smaller reporting company, or an emerging growth company. See

definitionthe definitions of “large accelerated filer,” “accelerated

filer,”filer”, “smaller reporting company”

, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer | ☐o

| Accelerated filer | ☐o

|

Non-accelerated filer Filer | ☒x

| Smaller reporting company | ☒x

|

Emerging growth company | x☒ | |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐o Indicate by check mark whether the registrant has filed a report on and attestation to its management’smanagement’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐o If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ⌧o No ☐x.

As of June 30, 2021,April 16, 2024 there were 22,805,643 shares of common stock issued and outstanding, par value $0.0001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this report incorporates information by reference from the last business dayCompany's definitive proxy statement, which proxy statement is due to be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2023.

INTRODUCTORY NOTE

Merger

On September 29, 2023 (the “Closing Date”), NKGen Biotech, Inc. (formerly known as Graf Acquisition Corp. IV (“Graf”)), a Delaware corporation (“NKGen” or the “Company”), consummated its previously announced merger transaction in accordance with the terms and conditions of the registrant’s most recently completed second fiscal quarter,Agreement and Plan of Merger, dated as of April 14, 2023 (the “Merger Agreement”), with Austria Merger Sub, Inc., a Delaware corporation and former wholly-owned subsidiary of Graf (“Merger Sub”) and NKGen Operating Biotech, Inc. (formerly known as NKGen Biotech, Inc.), a Delaware corporation (“Legacy NKGen”), whereby such Merger Agreement contemplated Merger Sub merging with and into Legacy NKGen with the aggregate market valueseparate corporate existence of Merger Sub ceasing and Legacy NKGen becoming a wholly-owned subsidiary of ours at the Closing (as defined below) (the “Merger” and, together with the other transactions contemplated by the Merger Agreement, the “Business Combination”). In connection with the consummation of the Merger on the Closing Date, Graf changed its name from Graf Acquisition Corp. IV to NKGen Biotech, Inc. and Legacy NKGen changed its name from NKGen Biotech, Inc. to NKGen Operating Biotech, Inc. The closing of the Business Combination is herein referred to as “Closing.”

In connection with the Business Combination, Graf filed a registration statement on Form S-4 (File No. 333-271929) (as amended, the “Registration Statement”) with the U.S. Securities and Exchange Commission (the “SEC”). On August 14, 2023, the Registration Statement was declared effective by the SEC and on August 14, 2023, Graf filed a Definitive Proxy Statement/Prospectus, which was amended and supplemented by the Supplement No.1 and Supplement No.2 to the Definitive Proxy Statement/Prospectus dated September 21, 2023 and September 22, 2023, respectively (as amended and supplemented, the “Definitive Proxy Statement/Prospectus”).

As a result of the Merger and upon the Closing, among other things, (i) all outstanding shares of Legacy NKGen common stock outstanding, other than shares held by persons who may be deemed affiliatesas of the registrant, computed by referenceimmediately prior to the closing sales price for theClosing, including outstanding Legacy NKGen convertible notes converted into Legacy NKGen common stock on June 30, 2021, as reported onimmediately prior to the New York Stock Closing, were exchanged at an exchange ratio of 0.408 (the “Exchange was $170.76 million.Ratio

As”) for an aggregate of March 30, 2022, there were 21,451,87515,595,260 shares of our common stock, par value $0.0001 per share (“our Common Stock” or “NKGen Common Stock”) and (2) each option to purchase shares of Legacy NKGen common stock, whether vested or unvested, were assumed and converted into an option to purchase shares of our Common Stock (“Assumed Option”), with each Assumed Option subject to the same terms and conditions as were applicable to the original Legacy NKGen option and with the resulting exercise price and number of shares of our Common Stock purchasable based on the Exchange Ratio and other terms contained in the Merger Agreement.

Unless the context otherwise requires, “we,” “us,” “our” and the “Company” refer to our and its consolidated subsidiaries following the Closing and references to “Graf” refer to Graf Acquisition Corp. IV at or prior to the Closing. All references herein to the “NKGen Board” refer to the board of directors of the registrantCompany after giving effect to the Business Combination.

In connection with the special meeting of stockholders of Graf, held on September 25, 2023, and the Business Combination, the holders of 3,386,528 shares of Graf’s common stock, par value $0.0001 per share, exercised their right to redeem their shares for cash at a redemption price of approximately $10.4415 per share, for an aggregate redemption amount of approximately $35.4 million. Upon the Closing, the Company received approximately $21.9 million in gross proceeds, comprising approximately $1.7 million from the Graf trust account and approximately $20.2 million from the transactions in relation to the Warrant Subscription Agreements and Securities Purchase Agreement (each as defined below). In addition, in accordance with the Private Placement Agreements (as defined below), approximately $32.9 million in funds were deposited into escrow accounts, which were not received by the Company in connection with the Closing of the Business Combination. The escrowed funds may be released to the Company, the investors, or a combination of both as set forth in Note 4, Private Placement, of the consolidated financial statements.

At the Closing, Graf instructed its transfer agent to separate Graf’s public units into their component securities and, as a result, following the Closing, Graf’s public units are no longer tradeable as a separate security and were delisted from The New York Stock Exchange. On the business day following the Closing, there were 21,888,976 issued and outstanding.outstanding shares of our Common Stock.

Documents Incorporated

The foregoing description of the Merger Agreement is a summary only and is qualified in its entirety by

Reference: None.the full text of the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1, which is incorporated herein by reference.

Capitalized terms used in this Annual Report on Form 10-K but not otherwise defined herein shall have the meanings ascribed to those terms in the Definitive Proxy Statement/Prospectus.

This report contains references to trademarks belonging to other entities, which are the property of their respective holders. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

CERTAIN DEFINED TERMS

“BusinessCombination”meansthetransactionscontemplatedbytheBusinessCombinationAgreement.

“Closing” means the closing of the BusinessCombination.

“Closing Date” means the date of the Closing.

“Charter”meanstheamendedandrestatedcertificateofincorporationofNKGen,filedwiththe Secretary of State of the State of Delaware on May 20, 2021 and amended on May 20, 2023 and September 29,2023.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“ForwardPurchaseAgreements”meansthosecertainforwardpurchaseagreementsdatedSeptember22, 2023, September 26, 2023 and September 29, 2023, by and among Graf and certaininvestors, as amended on January 19, 2024, January 11, 2024, January 2, 2024 and December 26, 2023.

“GAAP” means U.S. generally accepted accounting principles.

“Graf” means Graf Acquisition Corp. IV, a Delaware corporation (which, after the Closing, became NKGen Biotech, Inc.).

“Graf IPO” means Graf’s initial public offering, consummated on May 25, 2021, through the sale of 17,161,500 Units at $10.00 per Unit.

“Legacy NKGen” means NKGen Operating Biotech, Inc., a Delaware corporation which, pursuant to the Business Combination, became a direct, wholly owned subsidiary of NKGen Biotech, Inc., and unless the context otherwise requires, its consolidated subsidiaries.

“Merger Agreement” means that Agreement and Plan of Merger, dated as of April 14, 2023, by and among Graf, Merger Sub and Legacy NKGen.

“Nasdaq” means the Nasdaq Stock Market LLC.

“NKGen”meanstheDelawarecorporationwhich,priortoconsummationoftheBusinessCombination, was known as Graf Acquisition Corp.IV.

“NKGen Board” means the board of directors of NKGen.

“NKGen Bylaws” or “Bylaws” means the amended and restated bylaws to be adopted by NKGen immediately after the Closing.

“NKGenCommonStock”or“ourCommonStock”meansanissuedandoutstandingshareofcommon stock, par value $0.0001 per share, ofNKGen.

“NKGen Options” means options to acquire NKGen Common Stock.

“NKMAX” means NKMAX Co., Ltd., the largest stockholder of NKGen, a company formed under the laws of the Republic of Korea.

“PIPE Warrants” means the aggregate 10,209,994 Warrants purchased by those warrant subscribers pursuant to the Warrant Subscription Agreements, each of which is exercisable for cash or cashless exercise under certain circumstances in accordance with the respective Warrant Subscription Agreement.

“PrivateWarrants”meansthe4,721,533WarrantspurchasedbytheSponsorconcurrentlywithGraf IPO,eachofwhichisexercisableforcashatanexercisepriceof$11.50orcashlessexerciseundercertain circumstances for one share of NKGen Common Stock.

“Public Warrants” means the 3,432,286 warrants included as a component of the units of Graf sold in the Graf IPO, each of which is exercisable, at an exercise price of $11.50, for one share of NKGen Common Stock, in accordance with its terms.

“SEC” means the U.S. Securities and Exchange Commission.

“SecuritiesPurchaseAgreement”meansthesecuritiespurchaseagreementinrelationtotheSenior Convertible Notes and 1,000,000 Warrants issued in connection with the Senior Convertible Notes, each of which was exercisable, at an exercise price of $11.50, for one share of NKGen Common Stock,by and among Graf and NKMAX, dated September 15,2023.

“SeniorConvertibleNotes”meansthe$10,000,000aggregateprincipalamountof5.0%/8.0%convertible senior notes due 2027 issued to NKMAX in a private placement pursuant to the Securities Purchase Agreement.

“Sponsor” means Graf Acquisition Partners IV LLC, a Delaware limited liability company.

“Warrant Subscription Agreements” means those certain warrant subscription agreements, dated September 26, 2023 and September 27, 2023, by and among Graf and the warrant investors pursuant to, and on the terms and subject to the conditions of which, the warrant investors have collectively subscribed for and agreed to purchase in private placements an aggregate of 10,209,994 shares of common stock at a purchase price of $1.00 per warrant, resulting in an aggregate purchase price of$10,209,994.

“Warrants” means the Private Warrants, the Public Warrants and the Working Capital Warrants.

“WorkingCapitalNote”meanstheconvertiblepromissorynoteissuedbyGraftotheSponsorwithaprincipal amount up to $1.5 million on May 15, 2023.

“Working Capital Warrants” means the 523,140 Warrants issued upon conversion of the then outstanding amount under the Working Capital Note upon the Closing, each of which is exercisable, for cash at an exercise price of $11.50, for one share of NKGen Common Stock, or on cashless exercise, in accordance with its terms.

NKGen Biotech, Inc.

FORM 10-K

December 31, 2023

INDEX

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTSCertain statements in this

This Annual Report on Form 10-K

(this “Form 10-K”) may

constitutecontain “forward-looking statements”

for purposeswithin the meaning of Section 27A of the

federal securities laws. OurSecurities Act and Section 21E of the Securities Exchange Act of 1934, as amended. The Company’s forward-looking statements include, but are not limited to, statements regarding

ourthe Company’s or

ourits management team’s expectations, hopes, beliefs, intentions or strategies regarding the

future.future, including the Company’s expectations regarding the plans and strategy for our business, future financial performance, expense levels and liquidity sources. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,“intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,”

“would”“would,” “goal” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements in this Form 10-K may include, for example, statements about: | ● | our ability to select an appropriate target business or businesses; |

| ● | our ability to complete our initial business combination; |

| ● | our expectations around the performance of the prospective target business or businesses; |

| ● | our success in retaining or recruiting, or changes required in, our officers, key employees or directors following our initial business combination; |

| ● | our officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business or in approving our initial business combination; |

| ● | our potential ability to obtain additional financing to complete our initial business combination; |

| ● | our pool of prospective target businesses; |

| ● | the adverse impacts of the COVID-19 outbreak and other events (such as terrorist attacks, natural disasters or a significant outbreak of other infectious diseases) on our ability to consummate an initial business combination; |

| ● | the ability of our officers and directors to generate a number of potential acquisition opportunities; |

| ● | our public securities’ potential liquidity and trading; |

| ● | the lack of a market for our securities; |

| ● | the use of proceeds not held in the trust account (as defined below) or available to us from interest income on the trust account balance; |

| ● | the trust account not being subject to claims of third parties; or |

| ● | our financial performance. |

The forward-looking statements contained in this Annual Report on Form 10-K and in documents incorporated herein are based on ourthe Company’s current expectations and beliefs concerning future developments and their potential effects on us.us taking into account information currently available to the Company. There can be no assurance that future developments affecting usthe Company will be those that we havethe Company has anticipated. These forward-looking statements involve a number of risks, uncertainties (some(many of which are difficult to predict and beyond ourthe Company’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These

As a result of a number of known and unknown risks and uncertainties, include, but are not limited to, those factors described under the section of this Form 10-K entitled “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect,Company’s actual results or performance may vary in material respectsbe materially different from those projected inexpressed or implied by these forward-looking statements. WeSome factors that could cause actual results to differ include:

•the Company’s ability to raise financing in the future;

•the Company’s ability to service its operations and expenses and other liquidity needs and to address its ability to continue as a going concern;

•the ability to recognize the anticipated benefits of the Business Combination;

•the ability to maintain the listing of the NKGen Common Stock on the Nasdaq Global Market and its warrants on the Nasdaq Capital Market, and the potential liquidity and trading of such securities;

•theriskthattheconsummationoftheBusinessCombinationdisruptscurrentplansandoperations of theCompany;

•costs related to the Business Combination and expenses and/or payments due to third parties;

•changes in applicable laws or regulations;

•the Company’s success in retaining or recruiting, or changes required in, our officers, key employees or directors after the Business Combination;

•the Company’s ability to successfully commercialize any product candidates that it successfully develops and that are approved by applicable regulatory authorities;

•the Company’s expectations for the timing and results of data from clinical trials and regulatory approval applications;

•the Company’s business, operations and financial performance including:

othe Company’s history of operating losses and expectations of significant expenses and continuing losses for the foreseeable future;

othe Company’s ability to execute its business strategy;

othe Company’s ability to develop and maintain its brand and reputation;

•the Company’s ability to partner with other companies;

•the size of the addressable markets for the Company’s product candidates;

•the Company’s expectations regarding its ability to obtain and maintain intellectual property protection and not infringe on the rights of others;

•the outcome of any legal proceedings that may be instituted against the Company; and

•unfavorable conditions in the Company’s industry, the global economy or global supply chain, including financial and credit market fluctuations, international trade relations, pandemics, political turmoil, natural catastrophes, warfare (such as the war between Russia and Ukraine and the armed conflict in Israel and the Gaza Strip and Israel’s declaration of war against Hamas), and terrorist attacks.

These forward-looking statements are based on information available as of the date of this Annual Report on Form 10-K, and current expectations, forecasts and assumptions, and involve a number of risks and uncertainties. Accordingly, forward-looking statements in this Annual Report on Form 10-K and in any document incorporated herein by reference should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake

noany obligation to update

or revise any forward-looking statements

to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

2

You should read this Annual Report on Form 10-K and the documents incorporated herein, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

Item 1. Business

Our Mission and Vision

Our mission is to improve patient outcomes in this reportthe areas of neurodegenerative and oncological diseases by developing safe and effective cellular therapies that leverage the power of a patient’s immune system. Our vision is to “we,” “us,” “our” orbecome the “Company” refer to Graf Acquisition Corp. IV. References to our “management” or our “management team” refer to our officers and directors.Introduction

global leader in CAR-natural killer (“

NK”) cell therapies.

Overview

We are a blank checkbiotechnology company incorporateddeveloping cell therapies for neurodegenerative and oncological diseases based on January 28, 2021 as a Delaware corporation for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses (the “business combination”). We have reviewed, and continue to review, a number of opportunities to enter into a business combination, but weactivated NK cells. NK cells are not able to determine at this time whether we will complete a business combination with anypart of the target businesseshuman innate immune response system that wecan selectively identify and destroy abnormal or diseased cells. Our product candidates are based on a proprietary manufacturing and cryopreservation process which produces SuperNKTM (“SNK”) cells that have reviewed or with any other target business. We also have neither engaged in any operations nor generated any revenue to date. Based on our business activities, the Company is a “shell company”shown increased activity as defined under the Exchange Act of 1934 (the “Exchange Act”) because we have no operations and nominal assets consisting almost entirely of cash.Our registration statement for our initial public offering (the “IPO”) was declared effective on May 20, 2021. On May 25, 2021, we consummated our IPO of 15,000,000 units (the “units” and, with respectcompared to the common stock included in the units being offered, the “common stock” or the “public shares”), at $10.00 per unit, with each unit containing one public share and one-fifthstarting population of one redeemable warrant (the “public warrants”), generating gross proceeds of $150.0 million, and incurring offering costs of approximately $8.8 million, of which approximately $5.3 million was for deferred underwriting commissions. We granted the underwriter a 45-day option to purchase up to an additional 2,250,000 units at the IPO price to cover over-allotments. On June 2, 2021, the underwriters partially exercised their over-allotment option and purchased 2,161,500 additional units (the “additional units”), generating gross proceeds of approximately $21.6 million (the “over-allotment”). The Company incurred additional offering costs of approximately $1.2 million in connection with the over-allotment (of which approximately $757,000 was for deferred underwriting fees).

Prior to the consummation of the IPO, on February 13, 2021, Graf Acquisition Partners LLC (“Graf LLC”) paid an aggregate of $25,000 for certain expenses on our behalf in exchange for issuance of 4,312,500 shares of common stock, or approximately $0.006 per share (the “founder shares”). On April 2, 2021, Graf LLC transferred all of its founder shares to Graf Acquisition Partners IV LLC (the “sponsor”). On April 8, 2021, our sponsor transferred 20,000 founder shares to each of our independent directors, resulting in our sponsor holding 4,252,500 founder shares. The number of founder shares issued was determinedNK cells, based on the expectationresults of in vitro experiments performed by NKMAX, as defined by parameters such as cytotoxicity, cytokine production and activating receptor expression. SNK cells can be produced in large quantities and cryopreserved, while maintaining high levels of cytotoxicity and activating receptor expression after thawing and reconstitution. We believe that SNK cells have the potential to deliver transformational benefits to patients with both neurodegenerative diseases, such founder shares would represent 20%as Alzheimer’s Disease (“

AD”) and Parkinson’s disease (“PD”), and oncological diseases. Our initial insights into the potential of SNK01, an autologous cell therapy candidate, in neurodegenerative disease is derived from compassionate use data from three patients with AD and two patients with PD. Compassionate use refers to the outstanding shares afteruse outside of a clinical trial of an investigational, or unapproved, medical product (drug, biologic or medical device) in patients with a chronically or seriously debilitating disease who cannot be treated satisfactorily by an authorized medicinal product. Treatment of these five patients with SNK01 was associated with marked improvement in certain clinical symptoms typically associated with AD and PD, such as cognitive, vocal and motor impairments. Although the IPO. The founder sharesresults from these compassionate use case studies provide no assurance or guarantee that SNK01 will be worthless ifdeemed to be safe or effective for the treatment of AD or PD, and extensive clinical testing and regulatory approval will be required for SNK01, such results led NKGen to initiate formal clinical development of SNK01 as a potential treatment for neurodegenerative diseases. Accordingly, we do not completeare conducting a Phase I trial in Mexico (MX04) to assess the safety and tolerability of SNK01 in AD patients, received clearance in October 2023 of an initial business combination. In addition, as discussed in more detail below, our sponsor purchased an aggregate of 4,433,333 private placement warrants (as defined below)investigational new drug (“IND”) by the FDA, for a purchase price of $6,650,000, or $1.50 per warrant, that will also be worthless if we do not complete an initial business combination.Simultaneously with the closing of the IPO, we consummated the private placement (the “private placement”) of 4,433,333 warrants (each, a “private placement warrant” and collectively, the “private placement warrants”), at a price of $1.50 per private placement warrant to our sponsor, generating proceeds of approximately $6.7 million. Simultaneously with the closing of the over-allotment on June 2, 2021, we consummated the second closing of the private placement, resulting in the purchase of an aggregate of an additional 288,200 private placement warrants at $1.50 per private placement warrant (the “additional private placement warrants”), generating additional gross proceeds of approximately $432,000.

Upon the closing of the IPO, the over-allotment, and private placement, $171.6 million ($10.00 per unit) of the net proceeds of the sale of the units in the IPO, the over-allotment and of the private placement warrants in the private placement were placed in a trust account (the “trust account”)Phase I/IIa trial in the United States, maintainedreceived clearance in December 2023 by Continental Stock Transfer & Trust Company,Health Canada of a CTA for the same trial, and initiated the first patient in the US for this trial in December 2023.

In oncology, SNK01 treatment in Phase I trials has demonstrated certain antitumor activity, tumor shrinkage and stabilization of disease in solid tumors as trustee,monotherapy, in combination with checkpoint inhibitors, and will be invested onlywith targeted therapies. In the monotherapy treatment group with SNK01, six out of nine heavily pre-treated and refractory patients had stopped tumor progression for a period of time. At the highest dose level (which was 4x109 cells in U.S. “government securities” within the meaningPhase I trial), there was a trend towards tumor reduction, but it did not meet response evaluation criteria in solid tumors. In the combination treatment group of Section 2(a)(16)SNK01 and an immune checkpoint inhibitor, which consisted of heavily pre-treated and refractory patients, some patients achieved a partial response or were able to maintain a state of stabilized disease. This Phase I trial was not designed to support statistical significance testing.

The clinical readouts of the Investment Company Actstudies initiated in 2023 for SNK01 (Phase I/IIa trial in the United States for AD) and SNK02 (in solid tumors) are expected to serve as the basis for subsequent combination trials. In 2024 and beyond, if funding permits, we intend to submit an IND to the FDA to conduct a Phase I trial in PD, to evaluate the expansion into other neurodegenerative diseases, accelerate development in oncology through strategic collaborations, and continue investment in our manufacturing technology.

NK cells are components of 1940,the innate immune system, comprising approximately five to fifteen percent of circulating lymphoid cells, or lymphocytes. NK cells have the broad ability to recognize and destroy many types of cells that express markers associated with cellular damage or infection. Target cells for NK cell destruction include, without limitation, cancer cells, damaged neurons and infected cells. Although hundreds of clinical trials have been initiated with NK cells, there have been no FDA approvals of NK cell therapies to date. We believe that a key barrier to improving clinical outcomes is related to how potential NK cell therapies are prepared, and that our proprietary process has the potential to produce NK cells that may be transformational in the treatment of neurodegenerative and oncological diseases.

Our Solution

We have developed an innovative manufacturing process for SNK cells that addresses several factors that we believe have limited the potential of NK cell therapy to date.

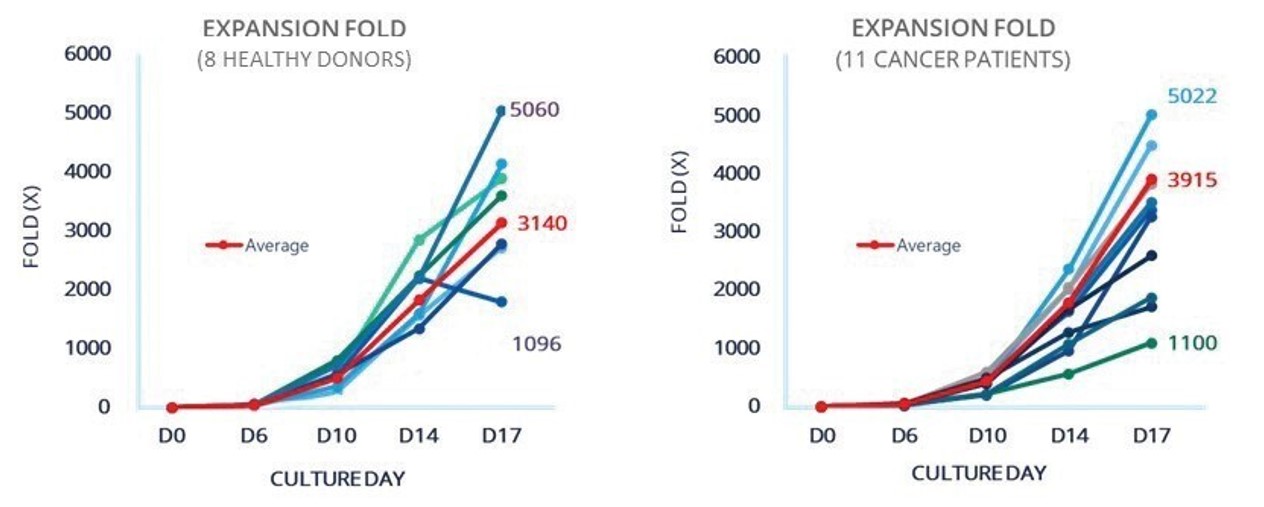

•Expandability. We have demonstrated the ability to generate NK cells from both healthy donors and cancer patients, minimizing manufacturing failures that can leave patients without therapy.

•Activity. SNK cells have shown the ability to deliver increased NK cell activity per dose as amended (the ”Investment Company Act”), havingcompared to the starting populations of NK cells, based on the results of in vitro experiments performed by NKMAX, as defined by parameters such as cytotoxicity, cytokine production, and activating receptor expression.

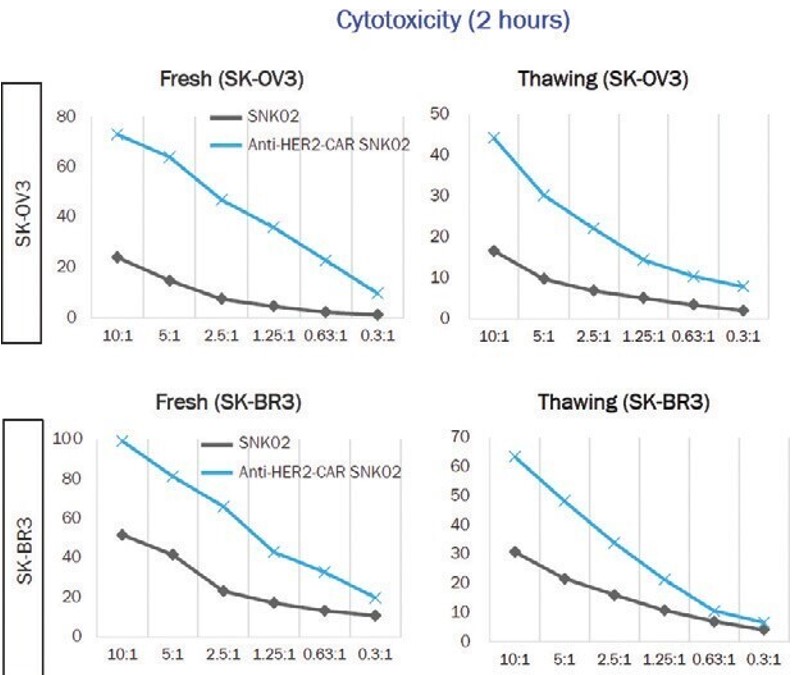

•Cryopreservation. We have developed technologies that facilitate the cryopreservation of NK cells that retain the majority of their cell activity. Because of this capability, we believe we are able to generate product candidates that can be made readily available as off-the-shelf therapies.

•Scalability. We have invested in developing the technology to enable the generation of hundreds of thousands of doses of SNK cells while maintaining high cellular activity and viability. This capability is critical as we seek to address highly prevalent diseases. We own and operate a maturity25,000 sq. ft. drug manufacturing facility in Santa Ana, California, of 185 days or lesswhich approximately half is equipped for good manufacturing practice (“GMP”) production of NK cells.

We have treated approximately 64 oncology patients and 13 patients with AD in clinical trials with SNK01 either as monotherapy or in

money market funds meeting certain conditions under Rule 2a-7 promulgated under the Investment Company Act which invest only in direct U.S. government treasury obligations, until the earlier of: (i) the completion of a business combination

with other agents, including chemotherapy, cetuximab, avelumab, pembrolizumab and

(ii) the distribution of the trust account, as described below.AFM24. As of December 31, 2021, there was approximately $1.7 million2023, these patients account for more than 530 infusions of fresh SNK01. The median number of doses administered per patient across all studies is six infusions, with a minimum of one infusion and a maximum of 38 infusions. Five additional patients have been treated for either AD or PD on a compassionate use basis. There have been no reported significant adverse events deemed related to SNK01 and no immune-related AE ≥ Grade 2 attributed to SNK01. These factors have given us confidence to pursue treatment in ourneurodegenerative diseases, where we are assessing the therapeutic potential of SNK01 directly in human patients, rather than in animal models.

For clinical trials sponsored by NKGen initiated after September 30, 2023, SNK01 have/will be using the cryopreserved SNK01. All allogeneic studies will use cryopreserved SNK02.

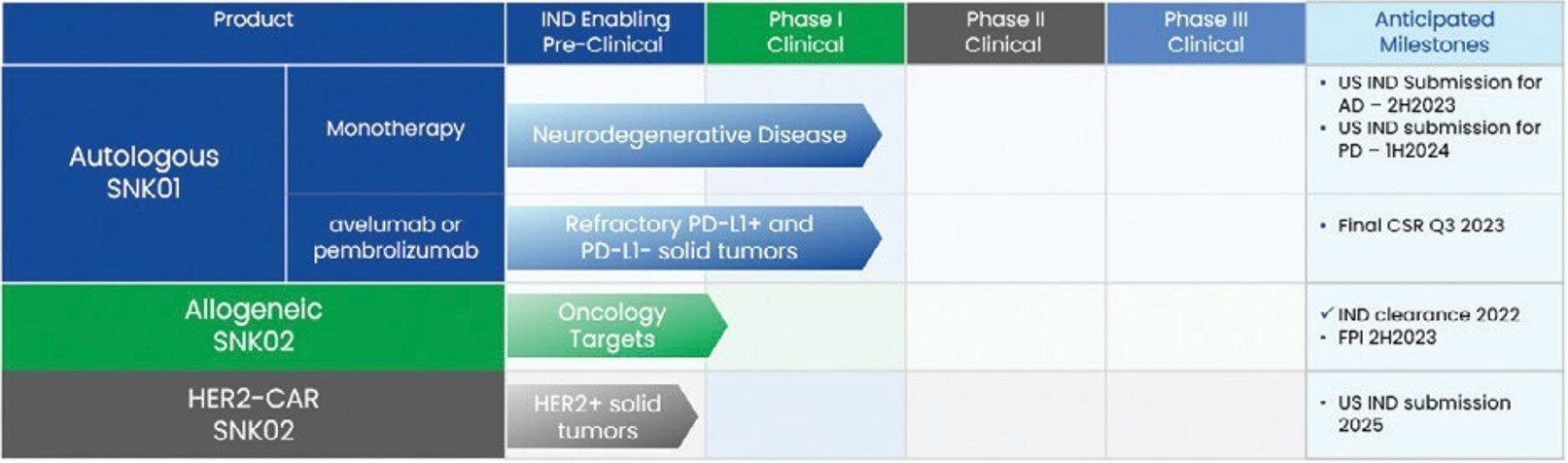

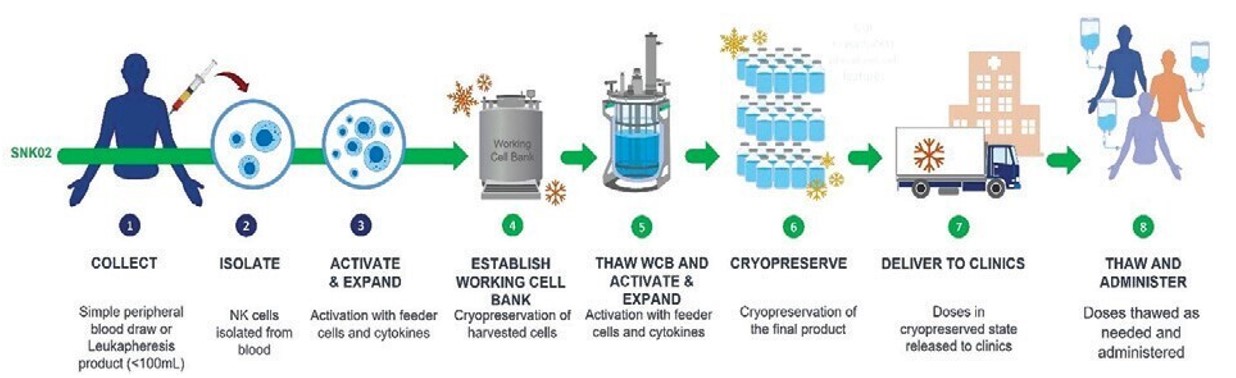

Autologous vs. Allogeneic SNK

Our novel manufacturing technology allows the production of SNK cells for use in either autologous (SNK01) or allogeneic (SNK02) cell therapy. Autologous SNK01 is manufactured using an individual patient’s own NK cells and the generated product is infused back into the same patient. The patient’s NK cells are purified and culture-expanded for up to 18 days, and the harvested cells are washed, packaged, and stored as a cryopreserved product at ≤-130°C. Allogeneic SNK02, on the other hand, is an “off the shelf” product generated from a healthy donor’s NK cells. The donor-derived NK cells are purified and used to establish a working cell bank account(“WCB”). The WCBs are further processed by subjecting the NK cells to long- term culture and working capitalmultiple passages which allow the production of approximately $642,000.

multiple doses of the allogeneic cell therapy product. The manufactured SNK02 are cryopreserved at ≤-130°C and can be used by any patient.

Effecting our initial business combination

SNK01

GeneralWe are not presently engageddeveloping SNK01 for the potential treatment of neurodegenerative diseases, such as AD and PD, based on data from compassionate use cases in five patients. Based on the reported observations from these cases, and despite the caveats associated with limited data from uncontrolled case studies, we believe that SNK01 has the potential to transform the treatment of such neurodegenerative diseases. Patients with severe AD, who could no longer walk, talk or feed themselves, partially regained these abilities after treatment. AD is often assessed using the Mini-Mental State Examination (“MMSE”) score. Patients with early-stage disease typically have MMSE scores between 20 and 25. As patients develop moderate symptoms and exhibit clear impairment, their MMSE scores typically range from 13 to 20. One AD patient who was treated by NKGen on a compassionate use basis and exhibited severe dementia, had a documented pre- treatment MMSE score of 12, but improved to an MMSE score of 23 after six doses of SNK01.

We have opened an IND with the FDA to initiate Phase I/II clinical trials to assess the potential of SNK01, in AD (study initiated in December 2023). In preparation for this trial, we conducted a dose escalation Phase I safety and tolerability trial of SNK01 that, as of the date of this annual report, has been dosed in 11 AD patients in Mexico (MX04) under the hospital’s research ethics committee and Mexico regulatory body’s approval. As part of this trial, we are conducting cognitive function testing collecting exploratory biomarker data to help assess the effects of SNK01 on disease severity in AD. Data that we have obtained to date indicates that intravenously administered SNK01 was well- tolerated by patients and led to stable or improved cognitive functions. Patients were evaluated using the Clinical Dementia Rating Sum of Boxes, the Alzheimer’s Disease Assessment Scale - Cognitive Subscale and the MMSE, each of which are widely used and clinically validated general cognitive measures in clinical trials for AD. The data also indicated that SNK01 dosing was associated with stable or reduced levels of amyloid protein, tau, and neuroinflammation biomarkers in cerebrospinal fluid that are suggestive of altering disease pathology.

We and NKMAX have also conducted several trials with fresh SNK01 that we believe demonstrates the tolerability and therapeutic potential of SNK cells in oncological diseases. These trials fall into three categories: (1) as a monotherapy, SNK01 treatment in highly advanced progressive cancer patients led to a stabilization of disease in six out of nine evaluated patients for at least nine weeks; (2) in combination with checkpoint inhibitors, the addition of SNK01 led to improved overall survival and an increase in progression free survival in refractory lung cancer patients; and (3) NKMAX’s collaboration with Merck KGaA, NKMAX is also conducting a Phase I/IIa trial investigating the combination of SNK01 with a therapeutic antibody, cetuximab, marketed as Erbitux® in advanced epidermal growth factor receptor mutated NSCLC that is refractory to tyrosine kinase inhibitors. Preliminary results from this collaborative trial presented at the annual American Society of Clinical Oncology (“ASCO”) 2023 meeting in June 2023 showed that three of six patients treated with SNK01 in combination with cetuximab achieved partial responses. All other patients treated with SNK01 had stable disease at the time of analysis for the ASCO meeting.

SNK02

Based on the proof-of-concept data generated with SNK01 in oncological diseases, the preference to use an off-the-shelf product and evidence suggesting there may be an improved antitumor response using allogeneic NK cells compared to autologous NK cells, we are transitioning our oncological diseases development program from SNK01, an autologous product, to cryopreserved SNK02, an allogeneic product. As a result, we believe that SNK02 may have greater potential in human clinical trials. Because of our manufacturing expertise, we anticipate that we will not engage in, any operations for an indefinite periodbe able to create hundreds of time. We intendthousands of doses of cryogenically preserved SNK02 which can be made readily available to effectuate our initial business combination using cashpatients, improving upon the current time and resource-intensive process of generating fresh NK cell products on demand. On October 14, 2022, we received IND clearance from the proceedsFDA for SNK02 allogenic NK cell therapy for solid tumors. We have begun dosing in Phase I of the SNK01 clinical trial in refractory solid tumors. Our allogeneic NK cell therapy product candidate will undergo clinical testing without the need for lymphodepletion. We believe this may provide an advantage in terms of antitumor response.

Background

We were founded in the United States in 2017 as a majority-owned subsidiary of NKMAX, a leading biotechnology company in South Korea that specializes in NK cell therapy and the development and manufacture of diagnostic assays, antibodies, and proteins. NKMAX became a publicly traded company on the KOSDAQ in 2015. Shortly thereafter, NKMAX began developing a unique NK cell therapy leading to the creation of a subsidiary in Japan via a collaboration with a Japanese clinic. Through this collaboration, NKMAX obtained early data on its autologous NK cell therapy treatment in human patients. This data served as the basis for NKMAX’s clinical strategy development and provided the basis in 2019 for starting, together with a leading hospital in South Korea, its first clinical trial in non-small cell lung cancer patients using an autologous NK cell therapy, SNK01, combined with an immune checkpoint inhibitor, pembrolizumab. We were founded to further develop SNK01 in oncological and neurodegenerative diseases, such as AD and PD.

After SNK01 was developed, NKMAX proceeded to develop an off-the-shelf cryopreserved allogeneic NK cell therapy, SNK02, to expand its clinical program in oncology. NKMAX plans to initiate its Phase I SNK02 trial in South Korea, received clearance in October 2023 of an IND by the FDA by the South Korean regulatory body, MFDS. We have begun the dosing in Phase I of the clinical trials for SNK02 in the United States in August 2023.

In accordance with the terms of the Intercompany License, we have a license to use all data (non- clinical, clinical, and any other data) that NKMAX controls that would be reasonably useful to develop, manufacture, have manufactured, use or commercialize NK cell pharmaceutical products, processes, services, or therapies in the Licensed Territory. As such, NKMAX’s clinical development in South Korea is expected to continue to provide insight into the potential uses for SNK cells for years to come, for which we will have the right to use the data. See the section titled “Business — Licensing Agreements — NKMAX License” for additional details.

Our goal is to bring transformative NK cell therapies to patients with both neurodegenerative and oncological diseases and thereby to realize the potential of our

IPO, the sale of the private placement warrants, the proceeds of the sale ofteam’s extensive NK cell expertise. We believe our

shares in connection with our initial business combination (including pursuant to forward purchase agreements or backstop agreements we may enter into following the consummation of the IPO or otherwise), shares issued to the owners of the target, debt issued to bank or other lenders or the owners of the target, or a combination of the foregoing. We may seek to complete our initial business combination with a company or business that may be financially unstable or in its early stages of development or growth, which would subjectdifferentiated strategy enables us to

the numerous risks inherent in such companiesleverage our highly integrated platform to develop and

businesses.If our initial business combination is paid for using equity or debt securities, or not all of the funds released from the trust account are used for payment of the consideration in connection with our initial business combination or used for redemptions of our common stock, we may apply the balance of the cash released to us from the trust account for general corporate purposes, including for maintenance ormanufacture NK cell therapies. Our expansion of operations of the post-transaction company, the payment of principal or interest due on indebtedness incurred in completing our initial business combination, to fund the purchase of other companies or for working capital.

Sources of Target Businesses

We anticipate that target business candidates will be brought to our attention from various unaffiliated sources, including investment bankers and investment professionals. Target businesses may be brought to our attention by such unaffiliated sources as a result of being solicited by us by calls or mailings. These sources may also introduce us to target businesses in which they think we may be interested on an unsolicited basis, since many of these sources will have read the registration statement relating to the IPO and know what types of businesses we are targeting. Our officers and directors,into neurodegenerative diseases as well as our sponsorsolid tumor oncology strategy serve as pillars for our unique NK cell therapies. Key highlights of our strategy include, but are not limited to:

•Advance clinical development of SNK01 in AD. The results obtained thus far with SNK01 in advanced AD patients have revealed the possibility of bringing transformational therapeutic benefits to patients. On October 20, 2023, we received IND clearance from the FDA for SNK01 in AD. On December 21, 2023, we received the No Objection Letter from Health Canada for our clinical trial application of SNK01 in AD. On December 28, 2023, we dosed our first participant in the US on the SNK01-AD01 clinical trial. During 2024 and their affiliates, may also bringbeyond, we intend to (i) advance the clinical development of SNK01 and continue enrolling the Phase I/IIa trial in the United States and Canada for AD, and (ii) continue the Phase I trial with SNK02 in refractory solid tumors.

•Advance clinical development of SNK01 in PD. Preliminary results from patients treated with SNK01 in a compassionate use basis suggests that SNK01 is well-tolerated and has the potential to be a disease-modifying agent in PD. In Q1 2024, we submitted an IND to the FDA to conduct a Phase I trial in PD, and if funding permits, we will continue to evaluate the expansion into other neurodegenerative diseases and accelerate development in oncology through strategic collaborations.

•Develop SNK02 as the backbone for multiple oncology therapies. Based on data generated with SNK02, which shows similar characteristics to SNK01, we believe that our SNK02 allogeneic product candidate presents the opportunity for a scalable off-the-shelf alternative to our attentionautologous SNK01 product. We obtained an IND clearance from the FDA in October 2022 for SNK02 in solid tumors and have begun dosing in Phase I of the clinical trial for SNK02 in August 2023. We are also developing chimeric antigen receptor (“CAR”), derivatives of SNK02 to target business candidatescertain high-prevalence solid tumors.

•Accelerate development in oncology through collaboration. We have identified potential opportunities for SNK cell therapy to significantly enhance the antitumor potential of leading cancer therapeutics such as immune checkpoint inhibitors and therapeutic antibodies. We established a collaboration with Merck KGaA (through AresTrading) to evaluate combinations of SNK01 with avelumab, and anticipate establishing similar partnerships with other biotechnology companies in the future.

•Continue to invest in manufacturing technology. Our SNK manufacturing technology has demonstrated the ability to address certain key limitations of other NK cell manufacturing approaches. We believe we are capable of producing hundreds of thousands of potential doses of NK cell therapies from material collected from a single donor. We believe this is critical in unlocking the therapeutic potential of NK cell therapies. We continue to optimize the industrialization of our processes that they become awarewill be required to address the market opportunities presented by our clinical development activities. Finally, we plan to invest in optimizing and developing the automation of through their business contacts asour processes. We own and operate a result25,000 sq. ft. drug manufacturing facility in Santa Ana, California, of formal or informal inquiries or discussions they maywhich approximately half is equipped for GMP production of NK cells.

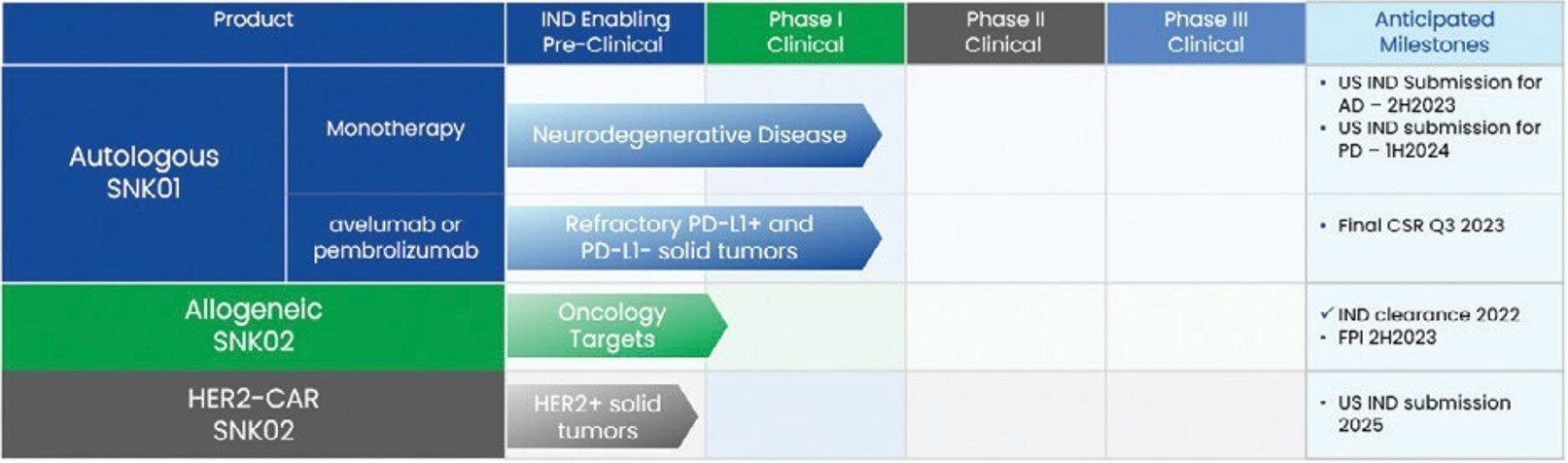

Pipeline

Challenges in developing NK cell therapies

Although literature and clinical experience have as well as attending trade shows or conventions. We expect to receiveprovided a rationale for the therapeutic use of NK cells, there have been a number of proprietary deal flow opportunitieschallenges that wouldhave limited NK cells’ clinical potential including, but not otherwise necessarily be availablelimited to.

•Expansion limitations. Existing manufacturing processes have not been optimized for robust production of NK cells from all patients or donors and this unpredictable expansion capability often represents a major hurdle in developing a therapeutic product.

•Low activity during expansion. Extended periods of cell culture, intended to usincrease cell numbers, can lead to loss of cell activity as a resultcompared to the starting population of NK cells and induce senescence.

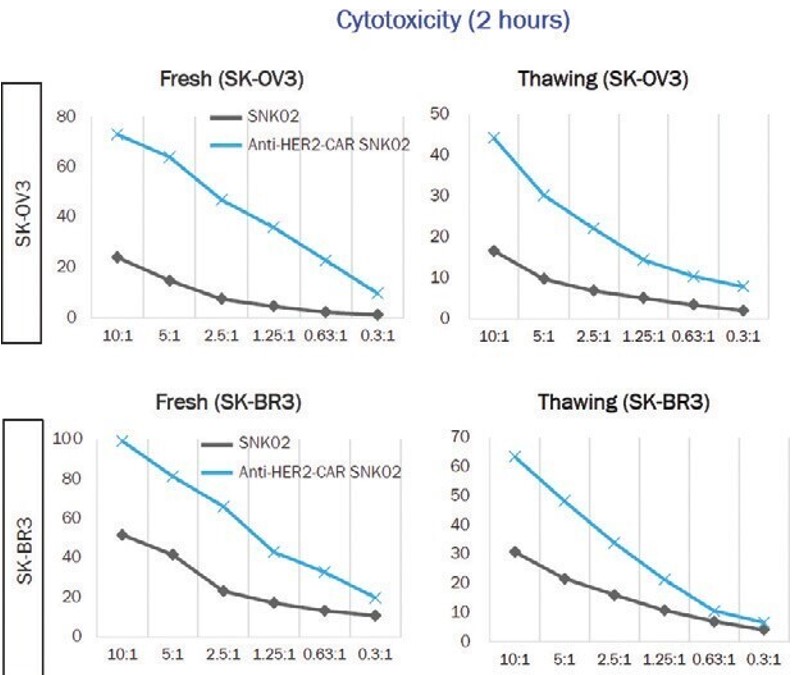

•Loss of activity following cryopreservation. Cryopreserved NK cells have been reported at an effector to target (E:T) ratio of 10:1 to have about 50 percent decrease in cell-killing activity compared to freshly prepared NK cells.

•Difficult to scale commercially. Because of the business relationshipsrelatively short half-life of NK cells, therapy often requires multiple doses, which is difficult to achieve with existing manufacturing processes.

To date, these limitations have often restricted the ability of other NK cell therapy companies to timely generate truly off-the-shelf allogeneic products where hundreds of thousands of doses may be required to meet clinical needs.

NKGen believes that these factors have led to the treatment of patients with NK cells that fail to demonstrate the full potential of NK cell therapy because of the low activity (as compared to the starting population of NK cells) based on in vitro experiments performed by NKMAX and the low numbers of NK cells that can be delivered with each dose. The combination of low activity (as compared to the starting population of NK cells) and low cell numbers also typically imposes the requirement that patients undergo lymphodepletion to enable NK cell therapy to survive due to competition for cytokine support from other immune cells. NKGen believes that lymphodepletion is counterproductive for a therapy that is intended to stimulate an immune response to disease. Lymphodepletion also often limits the ability to administer repeat doses to patients, especially for NK cell product candidates that must be freshly prepared rather than cryopreserved and prepared for use as needed.

Our Solution — SNK cells

We aim to develop NK cell therapies that address the limitations described by others, by focusing on the optimization of parameters that we believe are critical for NK cell therapy to drive clinical and commercial success. These optimization parameters include, but are not limited to:

•improved cell expansion capabilities;

•production of highly active cells compared to the starting population of NK cells;

•process improvements to enable cryopreservation with minimal loss of NK cell activity pre- and post- freezing; and

•the ability to generate cells using GMP processes at a commercial scale.

NK cells typically comprise between approximately five and fifteen percent of circulating lymphocytes. We isolate NK cells from these blood samples and expands them using a proprietary process generating what refer to as “SNK cells”. SNK cells are then delivered to the patient without the need for preconditioning through lymphodepletion.

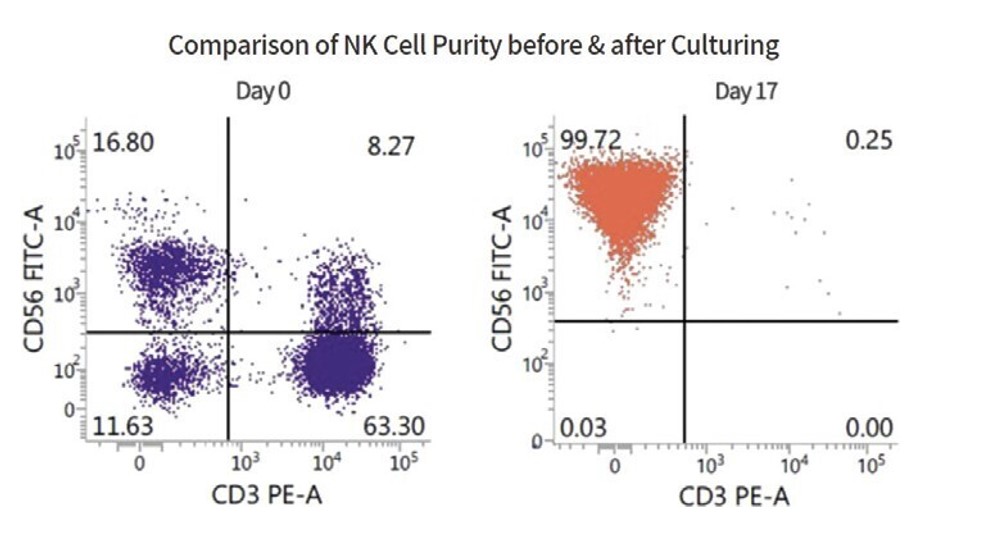

Figure 1. Overview of SNK01 autologous process of isolating, expanding, and treating patients with cell therapy.

We refer to our officers and directorsautologous NK cell product candidate as SNK01 and our sponsorallogeneic NK cell product candidate as SNK02.

Our Manufacturing Process

Processes for isolating and their affiliates. While we do not presently anticipate engaging the services of professional firms or other individuals that specialize in business acquisitions on any formal basis, we may engage these firms or other individuals in the future, in which event we may pay a finder’s fee, consulting fee, advisory fee or other compensation to be determined in an arm’s length negotiation based on the terms of the transaction. We will engage a finder only to the extent our management determines thatexpanding NK cells involve the use of cytokines such as interleukin-2, or IL-2; interleukin-15, or IL-15; and interleukin-21, or IL-21; often used in combinations. In some cases, other cells, referred to as feeder cells, are used to provide signaling stimuli to NK cells to increase their activation and proliferation. The reported cell expansion efficiencies of these processes vary widely from approximately five-fold in two weeks to over a finder may bring opportunitiesthousand-fold in the same time period.

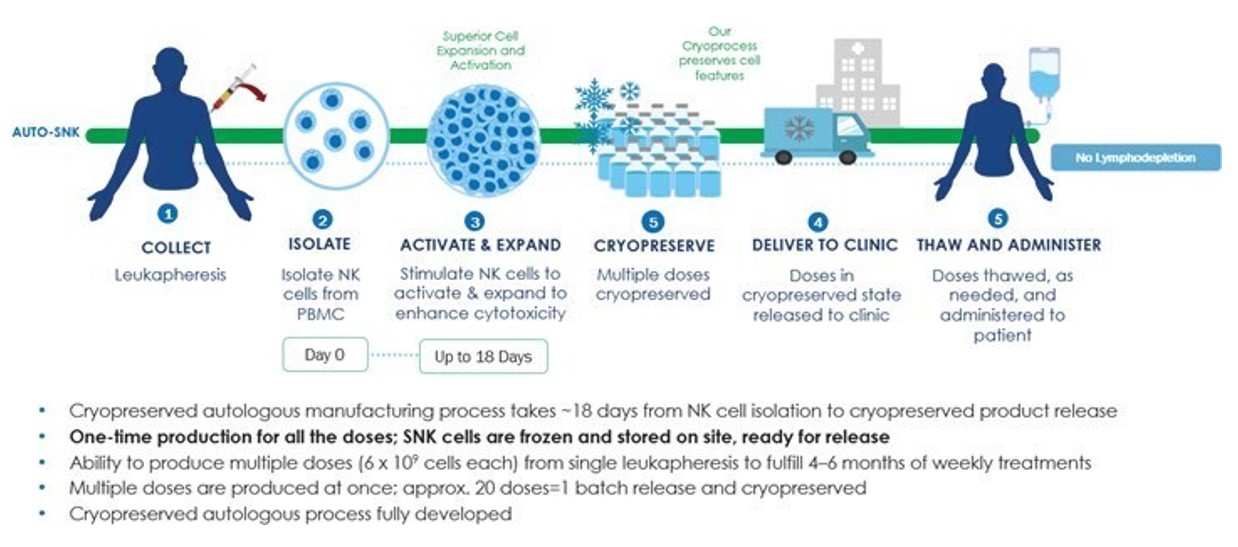

We have developed a proprietary process that combines cytokine stimulation and feeder cell culture that routinely results in expansions over a period of seventeen to useighteen days of several thousand-fold. This process typically yields a population of cells that may not otherwise be available to us or if finders approach us onare greater than 99 percent NK cells as measured by high levels of expression of an unsolicited basis with a potential transaction that our management determines is in our best interest to pursue. Payment of finder’s fees is customarily tied to completionNK cell marker, CD56, and low expression of a transaction,CD3,aT cell marker.

Figure 2. The NKGen manufacturing process results in a highly enriched population of NK cells.

Expandability

Our process is highly reproducible from patient to patient which is critical for autologous therapies.

Ideally, the goal is for every patient who is recommended for treatment to have access to NK cell therapy on a timely basis, rather than add to their risk of disease progression due to manufacturing failures or delays. We have demonstrated our ability to generate large quantities of SNK01 cells from both healthy donors and cancer patients, the latter being essential for the development of autologous cell therapy for these individuals. This contrasts with traditional methods of autologous NK cell expansion from cancer patients, for which prior cancer treatments negatively affected both the ability to expand NK cells and their activity as compared to the starting population of NK cells, based on in vitro experiments performed by NKMAX.

Figure 3. In vitro experiments performed by NKMAX show NKGen manufacturing process is reproducible in both healthy donors and heavily pretreated cancer patients.

Activity

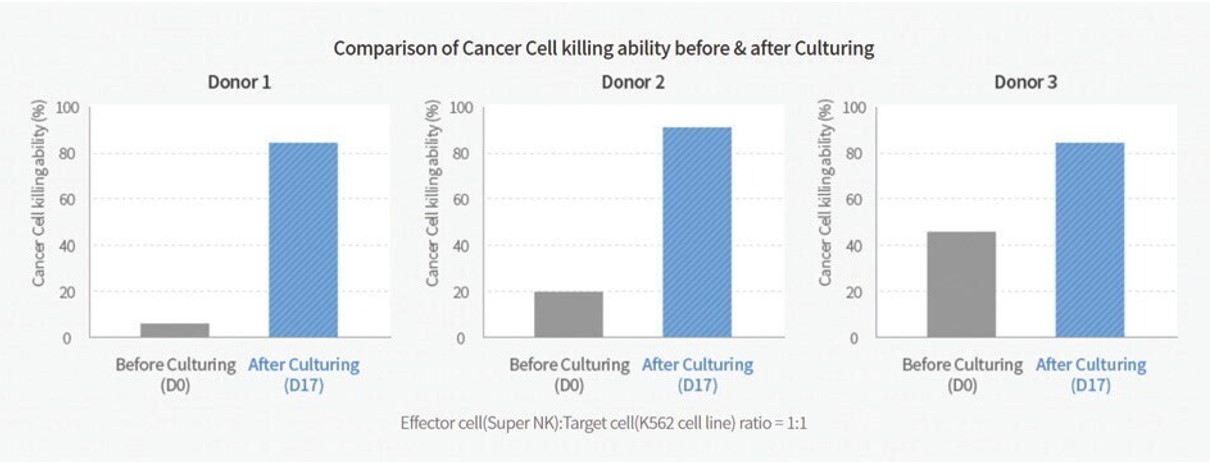

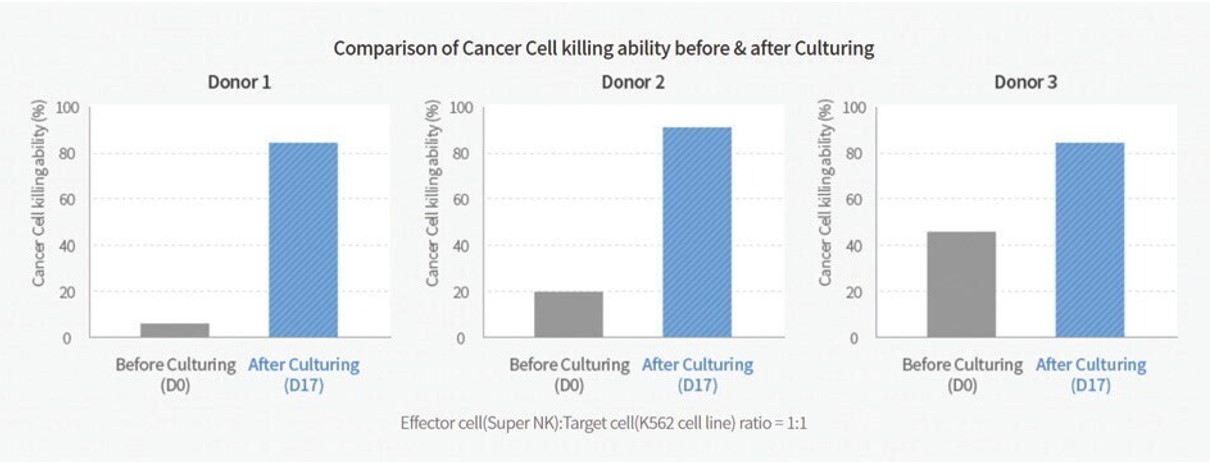

We designed our manufacturing process to generate NK cells that have increased activity compared to the activity of the initial and expanded NK cells obtained from donors. Importantly for their intended use as therapeutics, our manufacturing process generates SNK01 cells that have similar potencies across donors regardless of the activity of the original donor’s NK cells. The NK cell activity of expanded SNK01 cells from the initial NK cells of three donors was shown in vitro experiments performed by NKMAX to have increased relative to the NK cell activity of donor-matched initial and unexpanded NK cells. This was demonstrated by an increase of cytotoxicity, cytokine expression of IFN-γ and TNF-α, and expression of activating NK cell receptors as described below.

To characterize the cytokine released by expanded NK cells upon short incubations with K562 target cells, expanded NK cells were incubated with target cells and their supernatants that were harvested, and the concentration of 36 different human cytokines and chemokines were determined by a proteome profiler human cytokine array kit by NKMAX. The stimulation of NK cells with K562 cells induced IFN-γ and TNF-α secretion. Moreover, to investigate the ability of cytokine secretion by NK cells, the number of NK cells producing TNF-α and IFN-γ in response to K562 stimulation was analyzed by intracellular staining with initial and unexpanded and expanded NK cells. After stimulation with K562, the expression levels of TNF-α and IFN-γ were increased 68.5-fold and 8.2-fold, respectively, in the expanded NK cells (expressed 7.54% ± 0.10% of TNF-α and 55.30% ± 1.10% of IFN-γ), compared to the initial and unexpanded NK cells (expressed 0.11% ± 0.01% of TNF-α and 6.75% ± 0.60% of IFN-γ). In addition, the expression levels of TNF-α and INF-γ upon stimulation with K562 cells were increased 2.9-fold and 1.6-fold, respectively, in the simulated expanded NK cells (expressed 7.54 ± 0.10% of TNF-α and 55.30 ± 1.10% of IFN-γ), compared to the unstimulated expanded NK cells (expressed 2.60 ± 0.10% of TNF-α and 33.80 ± 0.50% of IFN-γ).

To characterize cytotoxicity of expanded NK cells toward K562 target cells, a comparison of cancer cell killing ability was done before and after culturing of SNK01. The cytotoxicity of SNK01 was shown to have increased several folds (i.e., 2.0- to 10.9-fold) higher than before NK Cell expansion from the same donor sample. Refer to Figure 4 in which

case any such fee will be paid outdonor 1 cytotoxicity went from less than 8.4% to approximately 91.8%, donor 2 cytotoxicity went from approximately 21.60% to approximately 90.1%, and donor 3 cytotoxicity went from approximately 44.70% to approximately 91.0%. In an NK cell cytotoxicity assay, the cancer cell killing ability percentage represents the proportion of

the funds held in the trust account. In no event, however, will our sponsor or any of our existing officers or directors, or any entity with which our sponsor or officers are affiliated, be paid any finder’s fee, reimbursement, consulting fee, monies in respect of any payment of a loan or other compensationtarget (cancer) cells that have been killed by the

company for services rendered prior to, or for any services rendered in order to effectuate, the completion of our initial business combination (regardless of the type of transaction that it is). Some of our officers and directors may enter into employment or consulting agreements with the post-transaction company following our initial business combination. The presence or absence of any such fees or arrangements will not be used as a criterion in our selection process of an initial business combination candidate.We are not prohibited from pursuing an initial business combination with an initial business combination target that is affiliated with our sponsor, officers or directors or making the initial business combination through a joint venture or other form of shared ownership with our sponsor, officers or directors. In the event we seek to complete our initial business combination with an initial business combination target that is affiliated with our sponsor, officers or directors, we, or a committee of independent directors, would obtain an opinion from an independent investment banking firm or another independent valuation or appraisal firm that regularly prepares fairness opinions that such an initial business combination is fair to our company from a financial point of view. We are not required to obtain such an opinion in any other context.

Selection of a target business and structuring of our initial business combination

We may pursue an initial business combination target in any business or industry or geographic region, which may include, without limitation, targets in industries such as mobility, technology, transportation, new energy, software, infrastructure, consumer,

defense and cybersecurity, business and real estate services, financial and data services, healthcare, diversified industrial manufacturing, technology, distribution and services, as well as companies that help to address evolving environmental, social and governance (“ESG”) related issues.

New York Stock Exchange (the “NYSE”) rules require that we must consummate an initial business combination with one or more operating businesses or assets with a fair market value equal to at least 80% of the net assets held in the trust account (net of amounts disbursed to management for working capital purposes, if permitted, and excluding the amount of any deferred underwriting commissions). Our board of directors will make the determination as to the fair market value of our initial business combination. If our board of directors is not able to independently determine the fair market value of our initial business combination, we will obtain an opinion from an independent investment banking firm or another independent valuation or appraisal firm that regularly provides fairness opinions solely with respect to the satisfaction of such criteria. While we consider it unlikely that our board will not be able to make such independent determination of fair market value, it may be unable to do soNK cells. For example, if the board is less familiar or experienced with the target company’s business, there isassay in Figure 4 below shows a significant amount of uncertainty as to the value of the company’s assets or prospects, including if such company is at an early stage of development, operations or growth, or if the anticipated transaction involves a complex financial analysis or other specialized skills and the board determines90% cytotoxicity, it means that outside expertise would be helpful or necessary in conducting such analysis. Since any opinion, if obtained, would merely state that the fair market value meets the 80% of net assets test, unless such opinion includes material information regarding the valuation of a target business or the consideration to be provided, it is not anticipated that copies of such opinion would be distributed to our stockholders. However, if required under applicable law, any proxy statement that we deliver to stockholders and file with the SEC in connection with a proposed transaction will include such opinion.

We anticipate structuring our initial business combination so that the post-transaction company in which our public stockholders own shares will own or acquire 100% of the equity interests or assetsapproximately 90% of the target business or businesses. We may, however, structure our(cancer) cells have been killed by the NK cells, while the remaining 10% are still alive. Higher percentages indicate greater cytotoxic activity and a more effective response by the NK cells.

Figure 4. In in vitro experiments performed by NKMAX, SNK01 cells have demonstrated increased activity as compared to the NK cells from which they were derived.

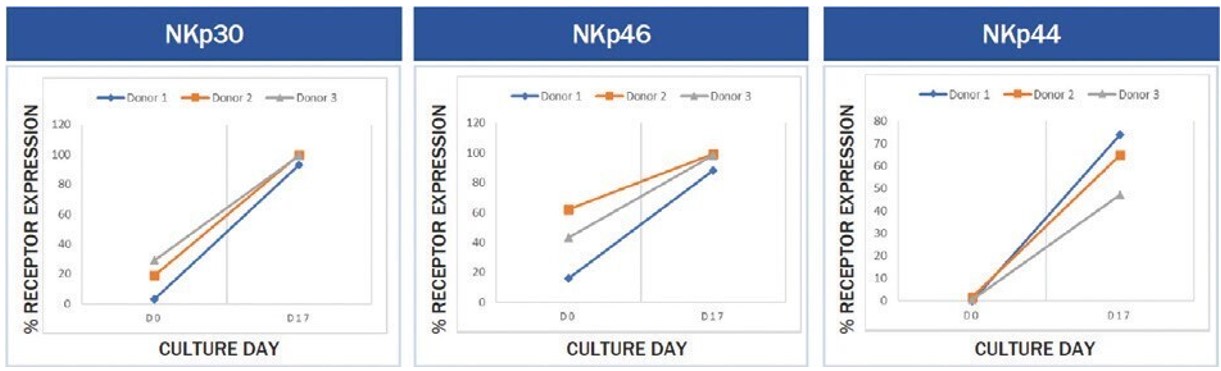

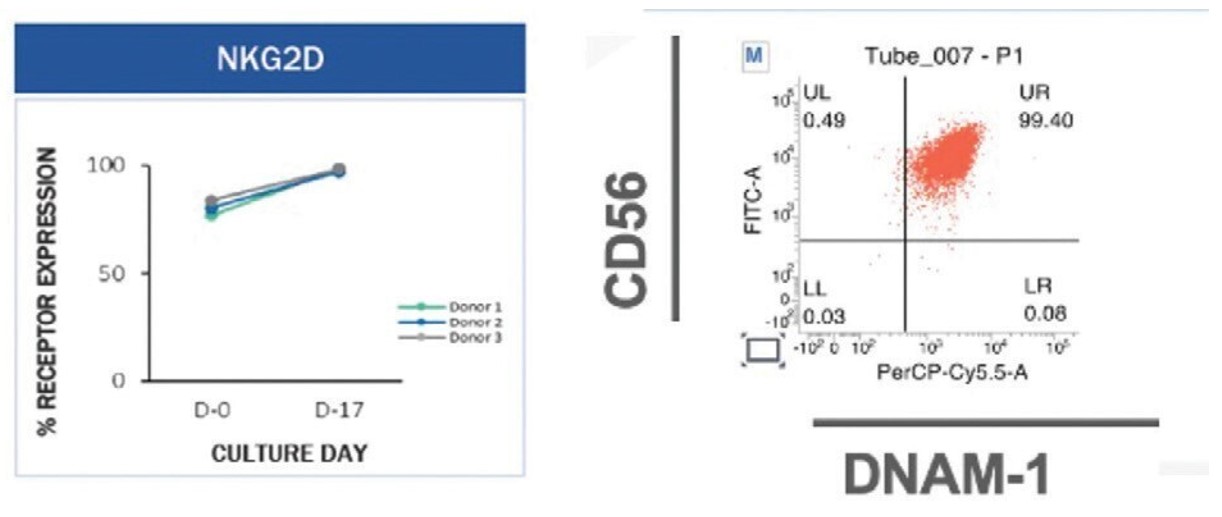

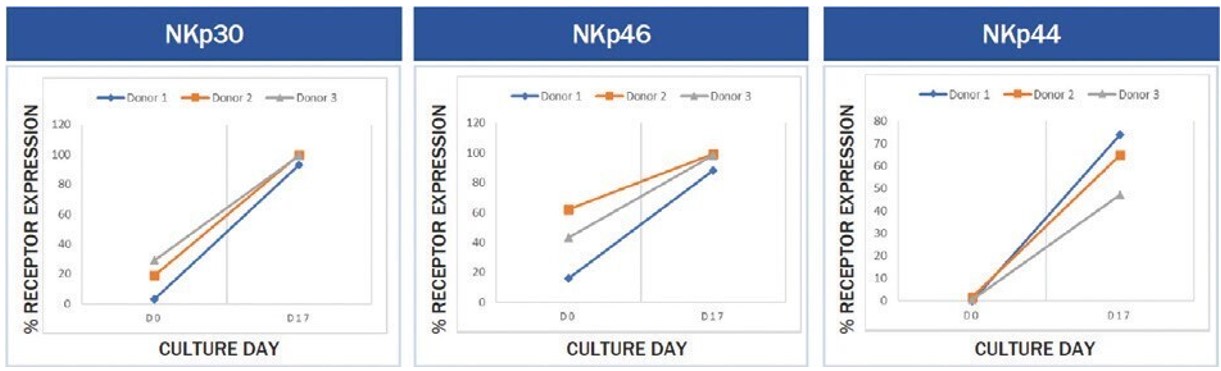

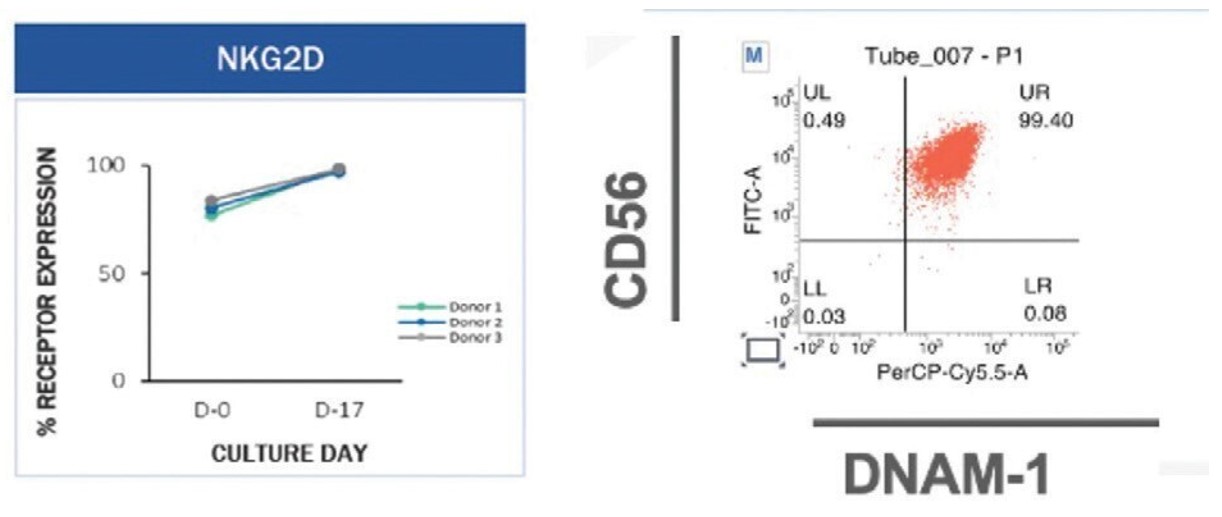

To investigate the change in the percentage expression level of NK cell activating receptor on expanded NK cells, both expanded and initial business combination suchNK cells were stained with antibodies for NK cell activating receptors of CD16, NKp30, NKp46, NKp44, and NKG2D, and then analyzed by flow cytometry. There was an increase of 1.2-fold for CD16 (expressed 97.21 ± 1.76%), 5.8-fold for NKp30 (expressed 97.32 ± 3.58%), 135.1-fold for NKp44 (expressed 62.15 ± 14.88%), 2.3-fold for NKp46 (expressed 93.98 ± 6.59%), and 1.1-fold for NKG2D (expressed 99.88 ± 0.10%) in the expanded NK cells, compared to initial unexpanded NK cells (expressed 80.83 ± 14.63% for CD16, 16.81 ± 13.06% for NKp30, 0.46 ± 0.38% for NKp44, 40.32 ± 23.07 for NKp46, and 91.29 ± 8.18% for NKG2D). Please see Figure 7 and Figure 8 below for more details.

The results of these in vitro experiments show significant increases with p values below 0.05 from the three donors. However, no statistical analyses were performed in a larger population of donors. Accordingly, we cannot guarantee that the post- transaction company ownsresults for every donor or acquires less than 100%the median donor would have been statistically significant in a larger population.

Cryopreservation

We have developed a cryopreservation method that preserves not only the viability of such interests or assetsSNK cells but, more importantly, an increased level of their activity. We have shown that the target business in order to meet certain objectivescell-killing activity of both unmodified SNK cells and genetically modified CAR NK cells are largely preserved after thawing. We believe that the target management team or stockholders or for other reasons, but we will only complete such business combination if the post-transaction company owns or acquires 50% or morehigh activity of the outstanding voting securities of the target or otherwise acquires a controlling interest in the target sufficient for it not to be required to registerSNK cells, as an investment company under the Investment Company Act. Even if the post-transaction company owns or acquires 50% or more of the voting securities of the target, our stockholders priorcompared to the business combination may collectively own a minority intereststarting population of NK cells, combined with the slightly decreased activity observed during cryopreservation enables the company to generate off-the-shelf NK cell product candidates that are more active than many freshly prepared NK cells generated by other methods.

Figure 5. In in vitro experiments performed by NKMAX, our cryopreservation method preserves the post-transaction company, depending on valuations ascribedincreased activity of SNK product candidates (as compared to the target and us in the business combination transaction. For example, we could pursue a transaction in which we issue a substantial numberstarting population of new shares in exchange for allNK cells).

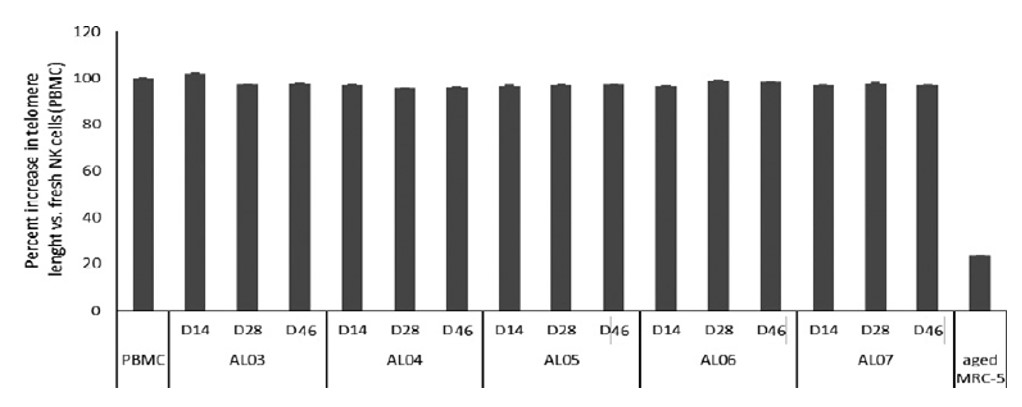

Scaling

We believe our manufacturing process is highly scalable. Cells that are produced show little loss of

the outstanding capital stock of a target. In this case, we would acquire a 100% controlling interest in the target. However,activity as

a result of the issuance of a substantial number of new shares, our stockholders immediately prior to our initial business combination could own less than a majority of our outstanding shares subsequent to our initial business combination. If less than 100% of the equity interests or assets of a target business or businesses are owned or acquired by the post-transaction company, the portion of such business or businesses that is owned or acquired is what will be taken into account for purposes of NYSE’s 80% of net assets test. If the business combination involves more than one target business, the 80% of net assets test will be based on the aggregate value of all of the target businesses.To the extent we effect our initial business combination with a company or business that may be financially unstable or in its early stages of development or growth we may be affected by numerous risks inherent in such company or business. Although our management will endeavor to evaluate the risks inherent in a particular target business, we cannot assure you that we will properly ascertain or assess all significant risk factors.

In evaluating a prospective target business, we expect to conduct a due diligence review which may encompass, among other things, meetings with incumbent management and employees, document reviews, interviews of customers and suppliers, inspections of facilities, as well as reviewing financial and other information made available to us and other reviews as we deem appropriate. We may also retain consultants with expertise relating to a prospective target business.

The time required to select and evaluate a target business and to structure and complete our initial business combination, and the costs associated with this process, are not currently ascertainable with any degree of certainty. Any costs incurred with respectcompared to the identification and evaluationstarting population of a prospective target business with which our initial business combinationNK cells, nor is not ultimately completedthere evidence of senescence even after extended periods of cell culture. This potential scalability will result in our incurring losses and will reduceenable the funds we can usecompany to complete another business combination.

Lackthousands of Business Diversification

For an indefinite perioddoses of time after the completion of our initial business combination, the prospects for our success may depend entirely on the future performance ofallogeneic SNK cells from a single business. Unlike other entities that have the resources to complete business combinations with multiple entities in one or several industries, it is probable that we will not have the resources to diversify our operations and mitigate the risks of being in a single line of business in a single industry. By completing our initial business combination with only a single entity, our lack of diversification may:

| ● | subject us to negative economic, competitive and regulatory developments, any or all of which may have a substantial adverse impact on the particular industry in which we operate after our initial business combination, and |

| ● | cause us to depend on the marketing and sale of a single product or limited number of products or services. |

Limited Ability to Evaluate the Target’s Management Team

Although we intend to closely scrutinize the management of a prospective target business when evaluating the desirability of effecting our initial business combination with that business, our assessment of the target business’ management may not prove to be correct. In addition, the future management may not have the necessary skills, qualifications or abilities to manage a public company. Furthermore, the future role of members of our management team, if any, in the target business cannot presently be stated with any certainty. The determination as to whether any of the members of our management team will remaindonor. Combined with the combined company will be made at the time of our initial business combination. While it is possible that one or more of our directors will remain associated in some capacity with us following our initial business combination, it is unlikely that any of them will devote their full effortsability to our affairs subsequent to our initial business combination.

Moreover,cryopreserve these cells, we cannot assure you that members of our management team will have significant experience or knowledge relating to the operations of the particular target business.

We cannot assure you that any of our key personnel will remain in senior management or advisory positions with the combined company. The determination as to whether any of our key personnel will remain with the combined company will be made at the time of our initial business combination.

Following an initial business combination, we may seek to recruit additional managers to supplement the incumbent management of the target business. We cannot assure youbelieve that we will have the abilitycapacity to recruit additional managers, or that additional managers willoffer off-the-shelf cell therapy solutions to patients. However, we have not yet developed a validated method of manufacturing our product candidates for long- term storage, in large quantities without damage, in a cost-efficient manner and without degradation beyond two years. We own and operate a 25,000-square-foot drug manufacturing facility in Santa Ana, California, of which approximately half is equipped for GMP production of NK cells.

Figure 6. No evidence of senescence, measured by telomere length, with extended expansion of SNK02 cells from multiple donors.

Molecular characteristics of SNK01

The levels of a group of natural cytotoxicity receptors (“NCRs”), including NKp30, NKp46 and NKp44, typically increase during the requisite skills, knowledge or experience necessarymanufacturing of SNK01. These receptors have been shown to enhancebe critical for the incumbent management.Stockholders May Not Haverecognition and elimination of tumor cells. One of the Abilityligands for NKp30, for example, is B7-H6, a common tumor antigen. The binding of NKp30 to Approve Our Initial Business Combination

We may conduct redemptions without a stockholder vote pursuantB7-H6 leads to the tender offer rulessecretion of cytokines such as TNF-alpha and IFN-gamma, and cell lysis perforins and granzymes. Expression of NKp30 has also been shown to correlate with overall improved survival and better prognosis in gastrointestinal stromal tumors. Whereas resting NK cells routinely express low levels of NKp30 and NKp46, NKp44 is only found on activated NK cells. Cell surface receptor expression between the starting (primary) NK cells and the expanded SNK cells have also been shown to increase several fold. In Figures 7 and 8, the cell receptor NKp30 went from approximately 0% to 95%, approximately 20% to 100%, and approximately 30% to 100% in donors 1, 2 and 3, respectively. The cell receptor NKp46 went from approximately 10% to 80%, approximately 40% to 100%, and approximately 60% to 100% in donors 1, 2 and 3, respectively. The cell receptor NKp44 went from approximately 0% to 45%, approximately 0% to 65%, and approximately 0% to 75%, in donors 1, 2 and 3, respectively. The cell receptor NKG2D went from approximately 70% to 100%, approximately 75% to 100%, and approximately 75% to 100% in donors 1, 2 and 3, respectively. Its high level of expression on SNK01 along with the elevated levels of NKp30, NKp44 and NKp46 serves as a confirmation of the SEC. However, we will seek stockholder approval if it is required by law or applicable stock exchange rule, or we may decide to seek stockholder approval for business or other legal reasons. Presented in the table below is a graphic explanationactivation state of the types of initial business combinations we may consider and whether stockholder approval is currently required under Delaware law for each such transaction.

| | |

TYPE OF TRANSACTION

|

| WHETHER STOCKHOLDER APPROVAL IS REQUIRED

|

Purchase of assets

| SNK01.

| No

|

Purchase of stock of target not involving a merger with the company

|

| No

|

Merger of target into a subsidiary of the company

|

| No

|

Merger of the company with a target

|

| Yes

|

UnderFigure 7. In in vitro experiments performed by NKMAX, increased expression of NCRs during the NYSE’s listing rules, stockholder approval would be requiredmanufacturing of SNK01 was observed across donors.

SNK01 cells also typically have high expression of NKG2D, a master regulator of immune response, and DNAM-1, a receptor that is essential for our initial business combination if,NK-cell mediated lysis of damaged cells such as tumor cells.

Figure 8. SNK01 cells have high expression of NKG2D and DNAM-1. SNK01 for

example: | ● | we issue (other than in a public offering for cash) shares of common stock that will either (a) be equal to or in excess of 20% of the number of shares of common stock then outstanding or (b) have voting power equal to or in excess of 20% of the voting power then outstanding; |

| ● | any of our directors, officers or substantial security holders (as defined by the NYSE rules) has a 5% or greater interest, directly or indirectly, in the target business or assets to be acquired and if the number of shares of common stock to be issued, or if the number of shares of common stock into which the securities may be convertible or exercisable, exceeds either (a) 1% of the number of shares of common stock or 1% of the voting power outstanding before the issuance in the case of any of our directors and officers or (b) 5% of the number of shares of common stock or 5% of the voting power outstanding before the issuance in the case of any substantial security holders; or |

| ● | the issuance or potential issuance of common stock will result in our undergoing a change of control. |

Permitted Purchasesthe treatment of our Securities

If we seek stockholder approvalneurodegenerative diseases