| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) | ||||||||||

| OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) | |||||||||||

| OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||

(State or jurisdiction of incorporation or organization) | 26-1219283 (I.R.S. Employer Identification No.) | |||||||

333 South Grand Avenue, 28th Floor Los Angeles, CA (Address of principal executive office) | 90071 (Zip Code) | |||||||

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||||||||

Common Stock, par value $0.01 per share | OCSL | The | ||||||||||||

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||||||||||||||||

Emerging growth company ¨ | |||||||||||||||||||

| PART I | |||||||||

| PART II | |||||||||

| PART III | |||||||||

| PART IV | |||||||||

| Investment A | Investment B | Investment C | Investment D | Investment E | Cumulative Unrealized Capital Depreciation | Cumulative Realized Capital Losses | Cumulative Realized Capital Gains | |||||||||||||||||||

| Year 1 | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | -- | -- | -- | ||||||||||||||||||

| Year 2 | $20 million (sale price) | $8 million FMV | $12 million FMV | $10 million FMV | $10 million FMV | $2 million | -- | $10 million | ||||||||||||||||||

| Year 3 | -- | $8 million FMV | $14 million FMV | $14 million FMV | $16 million FMV | $2 million | -- | $10 million | ||||||||||||||||||

| Year 4 | -- | $10 million FMV | $16 million FMV | $12 million (sale price) | $14 million FMV | -- | -- | $12 million | ||||||||||||||||||

| Year 5 | -- | $14 million FMV | $20 million (sale price) | -- | $10 million FMV | -- | -- | $22 million | ||||||||||||||||||

| Year 6 | -- | $16 million (sale price) | -- | -- | $8 million FMV | $2 million | -- | $28 million | ||||||||||||||||||

| Year 7 | -- | -- | -- | -- | $8 million (sale price) | -- | $2 million | $28 million | ||||||||||||||||||

| Investment A | Investment B | Investment C | Investment D | Investment E | Cumulative Unrealized Capital Depreciation | Cumulative Realized Capital Losses | Cumulative Realized Capital Gains | |||||||||||||||||||

| Year 1 | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | -- | -- | -- | ||||||||||||||||||

| Year 2 | $20 million (sale price) | $8 million FMV | $12 million FMV | $10 million FMV | $10 million FMV | $2 million | -- | $10 million | ||||||||||||||||||

| Year 3 | -- | $8 million FMV | $14 million FMV | $14 million FMV | $16 million FMV | $2 million | -- | $10 million | ||||||||||||||||||

| Year 4 | -- | $10 million FMV | $16 million FMV | $12 million (sale price) | $14 million FMV | -- | -- | $12 million | ||||||||||||||||||

| Year 5 | -- | $14 million FMV | $20 million (sale price) | -- | $10 million FMV | -- | -- | $22 million | ||||||||||||||||||

| Year 6 | -- | $16 million (sale price) | -- | -- | $8 million FMV | $2 million | -- | $28 million | ||||||||||||||||||

| Year 7 | -- | -- | -- | -- | $8 million (sale price) | -- | $2 million | $28 million | ||||||||||||||||||

| Investment A | Investment B | Investment C | Investment D | Investment E | Cumulative Unrealized Capital Depreciation | Cumulative Realized Capital Losses | Cumulative Realized Capital Gains | |||||||||||||||||||

| Year 1 | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | -- | -- | -- | ||||||||||||||||||

| Year 2 | $20 million (sale price) | $8 million FMV | $12 million FMV | $10 million FMV | $10 million FMV | $2 million | -- | $10 million | ||||||||||||||||||

| Year 3 | -- | $8 million FMV | $14 million FMV | $14 million FMV | $16 million FMV | $2 million | -- | $10 million | ||||||||||||||||||

| Year 4 | -- | $10 million FMV | $16 million FMV | $12 million (sale price) | $14 million FMV | -- | -- | $12 million | ||||||||||||||||||

| Year 5 | -- | $14 million FMV | $20 million (sale price) | -- | $10 million FMV | -- | -- | $22 million | ||||||||||||||||||

| Year 6 | -- | $16 million (sale price) | -- | -- | $8 million FMV | $2 million | -- | $28 million | ||||||||||||||||||

| Year 7 | -- | -- | -- | -- | $8 million (sale price) | -- | $2 million | $28 million | ||||||||||||||||||

| Assumed Return on Portfolio (Net of Expenses) | - 10% | - 5% | 0% | 5% | 10% | ||||||||||

| Corresponding net return to common stockholder | -22.31% | -13.00% | -3.69% | 5.62% | 14.94% | ||||||||||

| Assumed Return on Portfolio (Net of Expenses) | - 10% | - 5% | 0% | 5% | 10% | ||||||||||||

| Corresponding net return to common stockholder | -25.21% | -14.99% | -4.77% | 5.45% | 15.68% | ||||||||||||

| Subscription Rights Exercise Price | Net Asset Value Per Share Prior To Exercise | Net Asset Value Per Share After Exercise | ||||||||||||

| 10% premium to net asset value per common share | $ | 10.00 | $ | 10.20 | ||||||||||

| Net asset value per common share | $ | 10.00 | $ | 10.00 | ||||||||||

| 10% discount to net asset value per common share | $ | 10.00 | $ | 9.80 | ||||||||||

| Sale Price | |||||||||||||||||||||||||||||||||||

| NAV (1) | High | Low | Premium (Discount) of High Sales Price to NAV (2) | Premium (Discount) of Low Sales Price to NAV (2) | Cash Distribution per Share (3) | ||||||||||||||||||||||||||||||

| Year ended September 30, 2021 | |||||||||||||||||||||||||||||||||||

| First quarter | $ | 6.85 | $ | 5.66 | $ | 4.52 | (17.4) | % | (34.0) | % | $ | 0.110 | |||||||||||||||||||||||

| Second quarter | $ | 7.09 | $ | 6.36 | $ | 5.47 | (10.3) | % | (22.8) | % | $ | 0.120 | |||||||||||||||||||||||

| Third quarter | $ | 7.22 | $ | 6.92 | $ | 6.19 | (4.2) | % | (14.3) | % | $ | 0.130 | |||||||||||||||||||||||

| Fourth quarter | $ | 7.28 | $ | 7.40 | $ | 6.58 | 1.6 | % | (9.6) | % | $ | 0.145 | |||||||||||||||||||||||

| Year ended September 30, 2022 | |||||||||||||||||||||||||||||||||||

| First quarter | $ | 7.34 | $ | 7.62 | $ | 7.03 | 3.8 | % | (4.2) | % | $ | 0.155 | |||||||||||||||||||||||

| Second quarter | $ | 7.26 | $ | 7.81 | $ | 7.13 | 7.6 | % | (1.8) | % | $ | 0.016 | |||||||||||||||||||||||

| Third quarter | $ | 6.89 | $ | 7.61 | $ | 6.20 | 10.4 | % | (10.0) | % | $ | 0.165 | |||||||||||||||||||||||

| Fourth quarter | $ | 6.79 | $ | 7.25 | $ | 5.87 | 6.8 | % | (13.5) | % | $ | 0.170 | |||||||||||||||||||||||

| Year ending September 30, 2023 | |||||||||||||||||||||||||||||||||||

| First quarter (through November 11, 2022) | * | $ | 6.89 | $ | 5.86 | * | * | $0.32 (4) | |||||||||||||||||||||||||||

| High | Low | |||||||

| Fiscal year ended September 30, 2017 | ||||||||

| First quarter | $ | 5.95 | $ | 5.10 | ||||

| Second quarter | $ | 5.71 | $ | 4.31 | ||||

| Third quarter | $ | 5.00 | $ | 3.90 | ||||

| Fourth quarter | $ | 5.72 | $ | 4.51 | ||||

| Fiscal year ended September 30, 2016 | ||||||||

| First quarter | $ | 6.53 | $ | 5.53 | ||||

| Second quarter | $ | 6.52 | $ | 4.40 | ||||

| Third quarter | $ | 5.53 | $ | 4.71 | ||||

| Fourth quarter | $ | 6.32 | $ | 4.86 | ||||

| Date Declared | Record Date | Payment Date | Amount per Share | Cash Distribution | DRIP Shares Issued | DRIP Shares Value | |||||||||||

| August 4, 2015 | October 15, 2015 | October 30, 2015 | $ | 0.06 | $ 8.4 million | 106,185 | (1) | $ 0.6 million | |||||||||

| August 4, 2015 | November 16, 2015 | November 30, 2015 | 0.06 | 8.4 million | 91,335 | (1) | 0.6 million | ||||||||||

| November 30, 2015 | December 15, 2015 | December 30, 2015 | 0.06 | 8.4 million | 99,673 | (1) | 0.6 million | ||||||||||

| November 30, 2015 | January 15, 2016 | January 28, 2016 | 0.06 | 8.4 million | 113,905 | (1) | 0.7 million | ||||||||||

| November 30, 2015 | February 12, 2016 | February 26, 2016 | 0.06 | 8.4 million | 123,342 | (1) | 0.6 million | ||||||||||

| February 8, 2016 | March 15, 2016 | March 31, 2016 | 0.06 | 8.6 million | 86,806 | (1) | 0.4 million | ||||||||||

| February 8, 2016 | April 15, 2016 | April 29, 2016 | 0.06 | 8.2 million | 112,569 | (1) | 0.6 million | ||||||||||

| February 8, 2016 | May 13, 2016 | May 31, 2016 | 0.06 | 8.4 million | 76,432 | (1) | 0.4 million | ||||||||||

| May 5, 2016 | June 15, 2016 | June 30, 2016 | 0.06 | 8.2 million | 108,629 | (1) | 0.5 million | ||||||||||

| May 5, 2016 | July 15, 2016 | July 29, 2016 | 0.06 | 8.2 million | 100,268 | (1) | 0.6 million | ||||||||||

| May 5, 2016 | August 15, 2016 | August 31, 2016 | 0.06 | 8.3 million | 59,026 | (1) | 0.4 million | ||||||||||

| August 3, 2016 | September 15, 2016 | September 30, 2016 | 0.06 | 8.3 million | 65,170 | (1) | 0.4 million | ||||||||||

| August 3, 2016 | October 14, 2016 | October 31, 2016 | 0.06 | 8.2 million | 81,391 | (1) | 0.4 million | ||||||||||

| August 3, 2016 | November 15, 2016 | November 30, 2016 | 0.06 | 8.2 million | 80,962 | (1) | 0.4 million | ||||||||||

| October 18, 2016 | December 15, 2016 | December 30, 2016 | 0.06 | 7.7 million | 70,316 | (1) | 0.4 million | ||||||||||

| October 18, 2016 | January 13, 2017 | January 31, 2017 | 0.06 | 8.0 million | 73,940 | (1) | 0.4 million | ||||||||||

| October 18, 2016 | February 15, 2017 | February 28, 2017 | 0.06 | 8.0 million | 86,120 | (1) | 0.4 million | ||||||||||

| February 6, 2017 | March 15, 2017 | March 31, 2017 | 0.02 | 2.7 million | 27,891 | (1) | 0.1 million | ||||||||||

| February 6, 2017 | June 15, 2017 | June 30, 2017 | 0.02 | 2.7 million | 20,502 | (1) | 0.1 million | ||||||||||

| February 6, 2017 | September 15, 2017 | September 29, 2017 | 0.125 | 17.0 million | 118,992 | (1) | 0.7 million | ||||||||||

| August 7, 2017 | December 15, 2017 | December 29, 2017 | 0.125 | ||||||||||||||

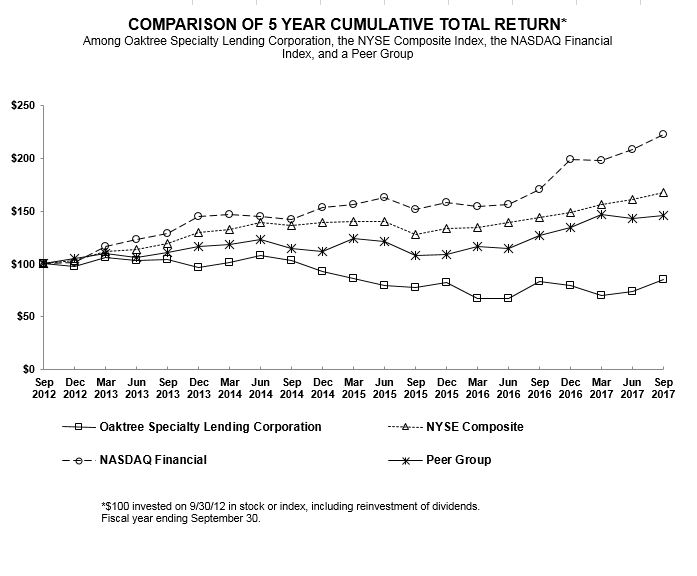

| Sep 2012 | Dec 2012 | Mar 2013 | Jun 2013 | Sep 2013 | Dec 2013 | Mar 2014 | Jun 2014 | Sep 2014 | Dec 2014 | ||||||||||||

| Oaktree Specialty Lending Corporation | 100.00 | 97.52 | 105.90 | 103.19 | 104.32 | 96.13 | 100.93 | 107.72 | 103.27 | 93.02 | |||||||||||

| NYSE Composite | 100.00 | 102.95 | 111.75 | 113.23 | 119.62 | 130.01 | 132.40 | 138.99 | 136.26 | 138.78 | |||||||||||

| NASDAQ Financial | 100.00 | 101.10 | 116.33 | 123.33 | 129.19 | 144.60 | 146.42 | 145.11 | 141.78 | 153.14 | |||||||||||

| Peer Group | 100.00 | 105.20 | 110.14 | 106.29 | 110.83 | 116.78 | 118.39 | 122.82 | 114.86 | 111.82 | |||||||||||

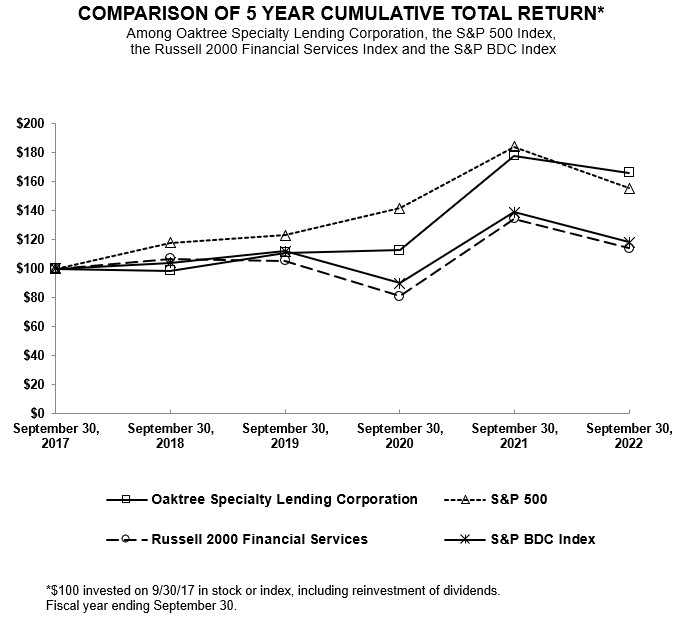

| September 30, 2017 | September 30, 2018 | September 30, 2019 | September 30, 2020 | September 30, 2021 | September 30, 2022 | ||||||||||||||||||

| Oaktree Specialty Lending Corporation | $ | 100.00 | $ | 98.62 | $ | 111.04 | $ | 112.83 | $ | 177.97 | $ | 166.19 | |||||||||||

| S&P 500 | $ | 100.00 | $ | 117.91 | $ | 122.93 | $ | 141.55 | $ | 184.02 | $ | 155.55 | |||||||||||

| Russell 2000 Financial Services | $ | 100.00 | $ | 106.79 | $ | 105.34 | $ | 81.07 | $ | 134.44 | $ | 113.96 | |||||||||||

| S&P BDC Index | $ | 100.00 | $ | 104.06 | $ | 112.05 | $ | 89.94 | $ | 138.81 | $ | 118.23 | |||||||||||

| Mar 2015 | Jun 2015 | Sep 2015 | Dec 2015 | Mar 2016 | Jun 2016 | Sep 2016 | Dec 2016 | Mar 2017 | Jun 2017 | Sep 2017 | |||||||||||||

Oaktree Specialty Lending Corporation (cont.) | 86.49 | 79.62 | 77.10 | 82.07 | 66.93 | 66.97 | 82.83 | 79.03 | 69.95 | 73.95 | 85.17 | ||||||||||||

| NYSE Composite (cont.) | 140.37 | 140.10 | 127.85 | 133.11 | 134.88 | 139.62 | 143.64 | 149.00 | 155.83 | 160.59 | 167.69 | ||||||||||||

| NASDAQ Financial (cont.) | 156.01 | 162.51 | 151.30 | 158.00 | 154.11 | 156.68 | 170.11 | 199.15 | 198.43 | 208.84 | 223.04 | ||||||||||||

| Peer Group (cont.) | 123.87 | 121.31 | 107.83 | 108.86 | 116.36 | 114.26 | 126.45 | 134.32 | 146.31 | 143.00 | 145.47 | ||||||||||||

| For the three months ended | ||||||||||||||||||||||||||||||||||||

(dollars in thousands, except per share amounts) | September 30, 2017 | June 30, 2017 | March 31, 2017 | December 31, 2016 | September 30, 2016 | June 30, 2016 | March 31, 2016 | December 31, 2015 | September 30, 2015 | June 30, 2015 | March 31, 2015 | December 31, 2014 | ||||||||||||||||||||||||

| Total investment income | $ | 35,732 | $ | 44,917 | $ | 45,555 | $ | 51,760 | $ | 59,160 | $ | 64,026 | $ | 59,563 | $ | 65,122 | $ | 63,770 | $ | 69,900 | $ | 66,467 | $ | 65,338 | ||||||||||||

| Net investment income | 11,464 | 19,390 | 18,504 | 23,294 | 25,695 | 29,106 | 25,343 | 26,582 | 28,159 | 32,251 | 28,123 | 26,407 | ||||||||||||||||||||||||

| Net realized and unrealized loss | (136,935 | ) | (25,447 | ) | (9,703 | ) | (97,536 | ) | (29,128 | ) | (34,324 | ) | (20,363 | ) | (89,468 | ) | (30,548 | ) | (11,740 | ) | (2,380 | ) | (54,877 | ) | ||||||||||||

| Net increase (decrease) in net assets resulting from operations | (125,471 | ) | (6,057 | ) | 8,801 | (74,242 | ) | (3,433 | ) | (5,218 | ) | 4,980 | (62,886 | ) | (2,389 | ) | 20,511 | 25,743 | (28,470 | ) | ||||||||||||||||

| Net assets | 867,657 | 1,010,750 | 1,019,626 | 1,030,272 | 1,142,288 | 1,184,376 | 1,225,974 | 1,263,113 | 1,353,094 | 1,403,213 | 1,410,302 | 1,407,822 | ||||||||||||||||||||||||

| Total investment income per common share | $ | 0.25 | $ | 0.32 | $ | 0.32 | $ | 0.36 | $ | 0.41 | $ | 0.44 | $ | 0.40 | $ | 0.43 | $ | 0.42 | $ | 0.46 | $ | 0.43 | $ | 0.43 | ||||||||||||

| Net investment income per common share | 0.08 | 0.14 | 0.13 | 0.16 | 0.18 | 0.20 | 0.17 | 0.18 | 0.18 | 0.21 | 0.18 | 0.17 | ||||||||||||||||||||||||

| Earnings (loss) per common share | (0.89 | ) | (0.04 | ) | 0.06 | (0.52 | ) | (0.02 | ) | (0.04 | ) | 0.03 | (0.42 | ) | (0.02 | ) | 0.13 | 0.17 | (0.19 | ) | ||||||||||||||||

| Net asset value per common share at period end | 6.16 | 7.17 | 7.23 | 7.31 | 7.97 | 8.15 | 8.33 | 8.41 | 9.00 | 9.15 | 9.20 | 9.18 | ||||||||||||||||||||||||

| Stockholder transaction expenses: | ||||||||||||||||||||||||||||||||||||||

| Sales load (as a percentage of offering price) | —% | (1) | ||||||||||||||||||||||||||||||||||||

| Offering expenses (as a percentage of offering price) | —% | (2) | ||||||||||||||||||||||||||||||||||||

| Dividend reinvestment plan fees | Up to $15 | (3) | ||||||||||||||||||||||||||||||||||||

| Total stockholder transaction expenses (as a percentage of offering price) | —% | (4) | ||||||||||||||||||||||||||||||||||||

| Annual expenses (as a percentage of net assets attributable to common stock): | ||||||||||||||||||||||||||||||||||||||

| Base management fees | 3.10% | (5) | ||||||||||||||||||||||||||||||||||||

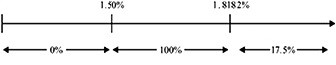

| Incentive fees (17.5%) | 2.24% | (6) | ||||||||||||||||||||||||||||||||||||

| Interest payments on borrowed funds (including other costs of servicing and offering debt securities) | 5.28% | (7) | ||||||||||||||||||||||||||||||||||||

| Other expenses | 0.74% | (8) | ||||||||||||||||||||||||||||||||||||

| Acquired fund fees and expenses | 1.36% | (9) | ||||||||||||||||||||||||||||||||||||

| Total annual expenses | 12.72% | (10) | ||||||||||||||||||||||||||||||||||||

| An investor would pay the following expenses on a $1,000 investment | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||

| Assuming a 5% annual return (assumes no return from net realized capital gains) | $ | 100 | $ | 292 | $ | 474 | $ | 885 | |||||||||||||||

| Assuming a 5% annual return (assumes return entirely from net realized capital gains) | $ | 108 | $ | 314 | $ | 507 | $ | 929 | |||||||||||||||

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Programs | Dollar Value of Shares That May Yet be Purchased Under the Plans or Programs | ||||||||||||||

| October 1 - October 31 | — | $ | — | — | ||||||||||||||

| November 1 - November 30 | — | — | — | |||||||||||||||

| December 1 - December 31 | 2,298,247 | 5.44 | 2,298,247 | |||||||||||||||

| January 1 - January 31 | — | — | — | |||||||||||||||

| February 1 - February 29 | — | — | — | |||||||||||||||

| March 1- March 31 | — | — | — | |||||||||||||||

| April 1 - April 30 | — | — | — | |||||||||||||||

| May 1 - May 31 | — | — | — | |||||||||||||||

| June 1- June 30 | — | — | — | |||||||||||||||

| July 1 - July 31 | — | — | — | |||||||||||||||

| August 1 - August 31 | — | — | — | |||||||||||||||

| September 1 - September 30 | — | — | — | |||||||||||||||

| Total | 2,298,247 | $ | 5.44 | 2,298,247 | $ | — | ||||||||||||

| As of and for the Years Ended | ||||||||||||

| (dollars in thousands, except per share amounts) | September 30, 2017 | September 30, 2016 | September 30, 2015 | September 30, 2014 | September 30, 2013 | |||||||

| Statement of Operations data: | ||||||||||||

| Total investment income | $177,964 | $247,872 | $265,475 | $293,954 | $221,612 | |||||||

| Base management fee, net | 31,129 | 41,145 | 51,069 | 51,048 | 33,427 | |||||||

| Incentive fee | 10,713 | 22,091 | 28,575 | 35,472 | 28,158 | |||||||

| All other expenses | 64,729 | 97,338 | 70,891 | 64,860 | 45,074 | |||||||

| Gain on extinguishment of unsecured convertible notes | — | — | — | — | — | |||||||

| Insurance recoveries | 1,259 | 19,429 | — | — | — | |||||||

| Net investment income | 72,652 | 106,727 | 114,940 | 142,574 | 114,953 | |||||||

| Net unrealized appreciation (depreciation) on investments | (97,543) | (47,924) | (71,674) | (32,164) | 13,397 | |||||||

| Net unrealized (appreciation) depreciation on secured borrowings | (296) | (76) | 658 | (53) | — | |||||||

| Realized gain (loss) on investments | (171,782) | (125,283) | (28,529) | 2,175 | (26,529) | |||||||

| Net increase (decrease) in net assets resulting from operations | (196,969) | (66,556) | 15,395 | 112,532 | 101,821 | |||||||

| Per share data: | ||||||||||||

| Net asset value per common share at period end | $6.16 | $7.97 | $9.00 | $9.64 | $9.85 | |||||||

| Market price at period end | 5.47 | 5.81 | 6.17 | 9.18 | 10.29 | |||||||

| Net investment income | 0.51 | 0.72 | 0.75 | 1.00 | 1.04 | |||||||

| Net realized and unrealized loss on investments and secured borrowings | (1.90) | (1.17) | (0.65) | (0.21) | (0.12) | |||||||

| Net increase (decrease) in net assets resulting from operations | (1.39) | (0.45) | 0.10 | 0.79 | 0.92 | |||||||

| Distributions per common share | 0.465 | 0.72 | 0.79 | 1.00 | 1.15 | |||||||

| Balance Sheet data at period end: | ||||||||||||

| Total investments at fair value | $1,541,755 | $2,165,491 | $2,402,495 | $2,495,914 | $1,893,046 | |||||||

| Cash, cash equivalents and restricted cash | 59,913 | 130,362 | 143,484 | 109,046 | 147,359 | |||||||

| Other assets | 14,380 | 47,432 | 39,678 | 63,258 | 31,928 | |||||||

| Total assets | 1,616,048 | 2,343,285 | 2,585,657 | 2,668,218 | 2,072,333 | |||||||

| Total liabilities | 748,391 | 1,200,997 | 1,232,563 | 1,189,743 | 703,461 | |||||||

| Total net assets | 867,657 | 1,142,288 | 1,353,094 | 1,478,475 | 1,368,872 | |||||||

| Other data: | ||||||||||||

| Weighted average yield on debt investments (1) | 9.6% | 10.4% | 10.8% | 11.1% | 11.1% | |||||||

| Number of portfolio companies at period end | 125 | 129 | 135 | 124 | 99 | |||||||

| (Share amounts in thousands) | Year ended September 30, 2022 | Year ended September 30, 2021 | Year ended September 30, 2020 | Year ended September 30, 2019 | Year ended September 30, 2018 (1) | |||||||||||||||||||||||||||

| Net asset value per share at beginning of period | $7.28 | $6.49 | $6.60 | $6.09 | $6.16 | |||||||||||||||||||||||||||

| Net investment income (2) | 0.82 | 0.60 | 0.51 | 0.48 | 0.43 | |||||||||||||||||||||||||||

| Net unrealized appreciation (depreciation) (2)(5) | (0.75) | 0.73 | (0.14) | 0.27 | 0.73 | |||||||||||||||||||||||||||

| Net realized gains (losses) (2) | 0.09 | 0.16 | (0.10) | 0.14 | (0.83) | |||||||||||||||||||||||||||

| (Provision) benefit for taxes on realized and unrealized gains (losses) (2) | — | — | 0.01 | — | — | |||||||||||||||||||||||||||

| Distributions of net investment income to stockholders | (0.65) | (0.51) | (0.39) | (0.38) | (0.27) | |||||||||||||||||||||||||||

| Tax return of capital | — | — | — | — | (0.13) | |||||||||||||||||||||||||||

| Issuance of common stock | — | (0.19) | — | — | — | |||||||||||||||||||||||||||

| Net asset value per share at end of period | $6.79 | $7.28 | $6.49 | $6.60 | $6.09 | |||||||||||||||||||||||||||

| Per share market value at beginning of period | $7.06 | $4.84 | $5.18 | $4.96 | $5.47 | |||||||||||||||||||||||||||

| Per share market value at end of period | $6.00 | $7.06 | $4.84 | $5.18 | $4.96 | |||||||||||||||||||||||||||

| Total return (3) | (6.71)% | 57.61% | 2.10% | 12.56% | (1.49)% | |||||||||||||||||||||||||||

| Common shares outstanding at beginning of period | 180,361 | 140,961 | 140,961 | 140,961 | 140,961 | |||||||||||||||||||||||||||

| Common shares outstanding at end of period | 183,374 | 180,361 | 140,961 | 140,961 | 140,961 | |||||||||||||||||||||||||||

| Net assets at beginning of period | $1,312,823 | $914,879 | $930,630 | $858,035 | $867,657 | |||||||||||||||||||||||||||

| Net assets at end of period | $1,245,563 | $1,312,823 | $914,879 | $930,630 | $858,035 | |||||||||||||||||||||||||||

| Average net assets (4) | $1,308,518 | $1,150,662 | $871,305 | $909,264 | $841,583 | |||||||||||||||||||||||||||

| Ratio of net investment income to average net assets (4) | 11.36% | 8.44% | 8.26% | 7.47% | 7.13% | |||||||||||||||||||||||||||

| Ratio of total expenses to average net assets (4) | 8.68% | 9.65% | 7.57% | 9.65% | 9.51% | |||||||||||||||||||||||||||

| Ratio of net expenses to average net assets (4) | 8.45% | 9.51% | 8.16% | 8.78% | 9.35% | |||||||||||||||||||||||||||

| Ratio of portfolio turnover to average investments at fair value | 26.99% | 39.66% | 38.99% | 32.50% | 67.66% | |||||||||||||||||||||||||||

| Weighted average outstanding debt (6) | $1,361,151 | $964,390 | $647,080 | $573,891 | $608,553 | |||||||||||||||||||||||||||

| Average debt per share (2) | $7.47 | $5.95 | $4.59 | $4.07 | $4.32 | |||||||||||||||||||||||||||

| Asset coverage ratio at end of period (7) | 188.64% | 201.68% | 227.22% | 294.91% | 232.98% | |||||||||||||||||||||||||||

| (1) | |||||

| (2) | Calculated based upon | ||||

| (3) | Total return | ||||

| (4) | Calculated based upon the weighted average net assets for the period. | ||||

| (5) | For the year ended September 30, 2021, the amount shown for net unrealized appreciation (depreciation) includes the effect of the timing of common stock issuances in connection with the OCSI Merger. | ||||

| (6) | Calculated based upon the weighted average of principal debt outstanding for the period. | ||||

| (7) | Based on outstanding senior securities of $1,350.0 million, $1,280.0 million, $714.8 million, $476.1 million and $643.4 million as of September 30, 2022, 2021, 2020, 2019 and 2018, respectively. | ||||

| Year ended September 30, 2017 | Year ended September 30, 2016 | Year Ended September 30, 2015 | Year Ended September 30, 2014 | Year Ended September 30, 2013 | ||||||||||||||||||||||||||||

| Net asset value at beginning of period | $7.97 | $9.00 | $9.64 | $9.85 | $9.92 | |||||||||||||||||||||||||||

| Net investment income (4) | 0.51 | 0.72 | 0.75 | 1.00 | 1.04 | |||||||||||||||||||||||||||

| Net unrealized appreciation (depreciation) (4) | (0.69) | (0.33) | (0.46) | (0.23) | 0.12 | |||||||||||||||||||||||||||

| Net realized gains (losses) (4) | (1.21) | (0.84) | (0.19) | 0.02 | (0.24) | |||||||||||||||||||||||||||

| Distributions of net investment income to stockholders | (0.47) | (0.67) | (0.79) | (0.94) | (0.90) | |||||||||||||||||||||||||||

| Tax return of capital | — | (0.05) | — | (0.06) | (0.25) | |||||||||||||||||||||||||||

| Net issuance/repurchase of common stock | 0.05 | 0.14 | 0.05 | — | 0.16 | |||||||||||||||||||||||||||

| Net asset value at end of period | $6.16 | $7.97 | $9.00 | $9.64 | $9.85 | |||||||||||||||||||||||||||

| Per share market value at beginning of period | $5.81 | $6.17 | $9.18 | $10.29 | $10.98 | |||||||||||||||||||||||||||

| Per share market value at end of period | $5.47 | $5.81 | $6.17 | $9.18 | $10.29 | |||||||||||||||||||||||||||

| Total return (1) | 2.84% | 7.02% | (27.18)% | (0.97)% | 4.89% | |||||||||||||||||||||||||||

| Common shares outstanding at beginning of period | 143,259 | 150,263 | 153,340 | 139,041 | 91,048 | |||||||||||||||||||||||||||

| Common shares outstanding at end of period | 140,961 | 143,259 | 150,263 | 153,340 | 139,041 | |||||||||||||||||||||||||||

| Net assets at beginning of period | $1,142,288 | $1,353,094 | $1,478,475 | $1,368,872 | $903,570 | |||||||||||||||||||||||||||

| Net assets at end of period | $867,657 | $1,142,288 | $1,353,094 | $1,478,475 | $1,368,872 | |||||||||||||||||||||||||||

| Average net assets (2) | $1,018,498 | $1,229,639 | $1,413,357 | $1,393,635 | $1,095,225 | |||||||||||||||||||||||||||

| Ratio of net investment income to average net assets (2) | 7.13% | 8.68% | 8.13% | 10.23% | 10.50% | |||||||||||||||||||||||||||

| Ratio of total expenses to average net assets (2) | 10.49% | 13.09% | 10.69% | 10.91% | 9.95% | |||||||||||||||||||||||||||

| Ratio of net expenses to average net assets (2) | 10.35% | 11.48% | 10.65% | 10.86% | 9.74% | |||||||||||||||||||||||||||

| Ratio of portfolio turnover to average investments at fair value | 39.06% | 23.39% | 23.02% | 25.50% | 38.22% | |||||||||||||||||||||||||||

| Weighted average outstanding debt (3) | $982,372 | $1,190,105 | $1,228,413 | $1,110,021 | $597,596 | |||||||||||||||||||||||||||

| Average debt per share (4) | $6.95 | $8.07 | $8.02 | $7.82 | $5.42 | |||||||||||||||||||||||||||

| Asset coverage ratio at end of period (5) | 227.40% | 220.84% | 238.95% | 259.50% | 394.86% | |||||||||||||||||||||||||||

| (1) | Total return equals the increase or decrease of ending market value over beginning market value, plus distributions, divided by the beginning market value, assuming dividend reinvestment prices obtained under the Company's DRIP. Total return does not include sales load. | ||||

| (2) | Calculated based upon the weighted average net assets for the period. | ||||

| (3) | Calculated based upon the weighted average of principal debt outstanding for the period. | ||||

| (4) | Calculated based upon weighted average shares outstanding for the period. | ||||

| (5) | Based on outstanding senior securities of $680.7 million, $946.5 million, $975.3 million, $928.4 million and $464.3 million as of September 30, 2017, 2016, 2015, 2014 and 2013, respectively. | ||||

| September 30, 2022 | September 30, 2021 | |||||||||||||

| Cost: | ||||||||||||||

| Senior secured debt | 85.08 | % | 85.85 | % | ||||||||||

| Debt investments in the JVs | 5.59 | 5.79 | ||||||||||||

| Preferred equity | 3.26 | 2.60 | ||||||||||||

| Subordinated debt | 2.57 | 1.67 | ||||||||||||

| LLC equity interests of the JVs | 1.88 | 1.94 | ||||||||||||

| Common equity and warrants | 1.62 | 2.15 | ||||||||||||

| Total | 100.00 | % | 100.00 | % | ||||||||||

| September 30, 2022 | September 30, 2021 | |||||||||||||

| Fair value: | ||||||||||||||

| Senior secured debt | 86.86 | % | 86.72 | % | ||||||||||

| Debt investments in the JVs | 5.88 | 5.94 | ||||||||||||

| Preferred equity | 3.19 | 2.49 | ||||||||||||

| Subordinated debt | 2.28 | 1.67 | ||||||||||||

| Common equity and warrants | 0.96 | 1.71 | ||||||||||||

| LLC equity interests of the JVs | 0.83 | 1.47 | ||||||||||||

| Total | 100.00 | % | 100.00 | % | ||||||||||

| September 30, 2017 | September 30, 2016 | |||||

| Cost: | ||||||

| Senior secured debt | 74.73 | % | 78.36 | % | ||

| Subordinated debt | 6.42 | 7.49 | ||||

| Debt investments in SLF JV I | 7.32 | 6.34 | ||||

| LLC equity interests of SLF JV I | 0.92 | 0.70 | ||||

| Purchased equity | 6.40 | 3.61 | ||||

| Equity grants | 2.78 | 2.40 | ||||

| Limited partnership interests | 1.43 | 1.10 | ||||

| Total | 100.00 | % | 100.00 | % | ||

| September 30, 2017 | September 30, 2016 | |||||

| Fair value: | ||||||

| Senior secured debt | 78.01 | % | 78.02 | % | ||

| Subordinated debt | 6.06 | 7.22 | ||||

| Debt investments in SLF JV I | 8.35 | 5.96 | ||||

| LLC equity interests of SLF JV I | 0.36 | 0.63 | ||||

| Purchased equity | 5.10 | 5.27 | ||||

| Equity grants | 0.45 | 1.86 | ||||

| Limited partnership interests | 1.67 | 1.04 | ||||

| Total | 100.00 | % | 100.00 | % | ||

| September 30, 2022 | September 30, 2021 | |||||||||||||

| Cost: | ||||||||||||||

| Application Software | 14.98 | % | 14.49 | % | ||||||||||

| Multi-Sector Holdings (1) | 7.48 | 7.73 | ||||||||||||

| Pharmaceuticals | 4.83 | 5.44 | ||||||||||||

| Data Processing & Outsourced Services | 4.60 | 4.74 | ||||||||||||

| Biotechnology | 4.20 | 4.41 | ||||||||||||

| Health Care Technology | 3.82 | 0.55 | ||||||||||||

| Industrial Machinery | 3.12 | 3.47 | ||||||||||||

| Specialized Finance | 3.09 | 2.70 | ||||||||||||

| Internet & Direct Marketing Retail | 2.59 | 2.45 | ||||||||||||

| Aerospace & Defense | 2.37 | 2.66 | ||||||||||||

| Construction & Engineering | 2.33 | 2.44 | ||||||||||||

| Automotive Retail | 2.26 | 1.65 | ||||||||||||

| Health Care Services | 2.24 | 3.34 | ||||||||||||

| Health Care Distributors | 2.18 | 0.78 | ||||||||||||

| Internet Services & Infrastructure | 2.07 | 1.85 | ||||||||||||

| Personal Products | 2.03 | 4.08 | ||||||||||||

| Fertilizers & Agricultural Chemicals | 1.88 | 2.63 | ||||||||||||

| Metal & Glass Containers | 1.82 | 0.69 | ||||||||||||

| Real Estate Operating Companies | 1.82 | 1.08 | ||||||||||||

| Home Improvement Retail | 1.75 | 1.83 | ||||||||||||

| Airport Services | 1.65 | 1.64 | ||||||||||||

| Real Estate Services | 1.54 | 1.59 | ||||||||||||

| Leisure Facilities | 1.52 | 0.99 | ||||||||||||

| Diversified Support Services | 1.45 | 1.60 | ||||||||||||

| Specialty Chemicals | 1.43 | 1.84 | ||||||||||||

| Health Care Supplies | 1.39 | 1.17 | ||||||||||||

| Insurance Brokers | 1.36 | 1.00 | ||||||||||||

| Integrated Telecommunication Services | 1.32 | 1.85 | ||||||||||||

| Soft Drinks | 1.31 | 1.32 | ||||||||||||

| Electrical Components & Equipment | 1.29 | 1.27 | ||||||||||||

| Other Diversified Financial Services | 1.12 | 0.63 | ||||||||||||

| Advertising | 1.08 | 1.13 | ||||||||||||

| Movies & Entertainment | 1.00 | 1.02 | ||||||||||||

| Distributors | 0.97 | — | ||||||||||||

| Health Care Equipment | 0.93 | 0.93 | ||||||||||||

| Oil & Gas Storage & Transportation | 0.85 | 1.44 | ||||||||||||

| Environmental & Facilities Services | 0.80 | — | ||||||||||||

| Cable & Satellite | 0.79 | 1.05 | ||||||||||||

| Home Furnishings | 0.75 | 0.77 | ||||||||||||

| Systems Software | 0.57 | 0.26 | ||||||||||||

| Consumer Finance | 0.55 | — | ||||||||||||

| Hotels, Resorts & Cruise Lines | 0.53 | — | ||||||||||||

| Auto Parts & Equipment | 0.48 | 0.49 | ||||||||||||

| IT Consulting & Other Services | 0.45 | 0.30 | ||||||||||||

| Restaurants | 0.36 | 0.37 | ||||||||||||

| Research & Consulting Services | 0.35 | 0.29 | ||||||||||||

| Education Services | 0.35 | 0.04 | ||||||||||||

| Oil & Gas Refining & Marketing | 0.33 | 1.42 | ||||||||||||

| Trading Companies & Distributors | 0.29 | — | ||||||||||||

| Air Freight & Logistics | 0.28 | 0.19 | ||||||||||||

| Apparel Retail | 0.20 | — | ||||||||||||

| Apparel, Accessories & Luxury Goods | 0.20 | 0.20 | ||||||||||||

| Integrated Oil & Gas | 0.19 | 0.19 | ||||||||||||

| Food Distributors | 0.18 | 0.18 | ||||||||||||

| Specialized REITs | 0.16 | — | ||||||||||||

| Diversified Banks | 0.13 | 0.14 | ||||||||||||

| Technology Distributors | 0.12 | 0.12 | ||||||||||||

| Construction Materials | 0.09 | 0.09 | ||||||||||||

| Housewares & Specialties | 0.09 | 0.07 | ||||||||||||

| Electronic Components | 0.08 | 0.40 | ||||||||||||

| Alternative Carriers | 0.01 | 0.26 | ||||||||||||

| Independent Power Producers & Energy Traders | — | 0.92 | ||||||||||||

| Airlines | — | 0.88 | ||||||||||||

| Commercial Printing | — | 0.78 | ||||||||||||

| Managed Health Care | — | 0.73 | ||||||||||||

| Thrifts & Mortgage Finance | — | 0.63 | ||||||||||||

| Property & Casualty Insurance | — | 0.39 | ||||||||||||

| Leisure Products | — | 0.26 | ||||||||||||

| Food Retail | — | 0.15 | ||||||||||||

| Total | 100.00 | % | 100.00 | % | ||||||||||

| September 30, 2017 | September 30, 2016 | |||||

| Cost: | ||||||

| Internet software & services | 15.37 | % | 15.80 | % | ||

| Healthcare services | 11.98 | 16.60 | ||||

| Multi-sector holdings (1) | 9.87 | 7.80 | ||||

| Healthcare equipment | 5.67 | 5.24 | ||||

| Advertising | 4.82 | 7.47 | ||||

| Data processing & outsourced services | 4.42 | 3.68 | ||||

| Construction & engineering | 3.86 | 2.90 | ||||

| Pharmaceuticals | 3.46 | 2.61 | ||||

| Specialty stores | 3.33 | 2.04 | ||||

| Airlines | 3.28 | 3.11 | ||||

| Application software | 2.93 | 2.13 | ||||

| Education services | 2.85 | 1.03 | ||||

| Environmental & facilities services | 2.84 | 4.34 | ||||

| Research & consulting services | 2.16 | 2.76 | ||||

| Air freight and logistics | 1.85 | 1.39 | ||||

| Leisure facilities | 1.76 | 1.49 | ||||

| Integrated telecommunication services | 1.75 | 2.47 | ||||

| Housewares & specialties | 1.70 | — | ||||

| Oil & gas equipment services | 1.57 | 2.00 | ||||

| Casinos & gaming | 1.33 | — | ||||

| Consumer electronics | 1.32 | 1.09 | ||||

| Home improvement retail | 1.31 | 1.07 | ||||

| Diversified support services | 1.29 | 3.73 | ||||

| Auto parts & equipment | 1.21 | 0.73 | ||||

| Industrial machinery | 0.86 | 2.04 | ||||

| Distributors | 0.85 | — | ||||

| Security & alarm services | 0.75 | 0.59 | ||||

| Real Estate Services | 0.74 | — | ||||

| Other diversified financial services | 0.69 | 0.65 | ||||

| Hypermarkets & super centers | 0.68 | — | ||||

| Precious metals & minerals | 0.42 | — | ||||

| Thrift & mortgage finance | 0.41 | 0.35 | ||||

| Trucking | 0.40 | — | ||||

| Computer & electronics retail | 0.36 | — | ||||

| Multi-utilities | 0.35 | — | ||||

| Commercial printing | 0.34 | 0.27 | ||||

| Apparel, accessories & luxury goods | 0.29 | 0.69 | ||||

| Restaurants | 0.28 | 0.22 | ||||

| Food retail | 0.24 | 0.18 | ||||

| IT consulting & other services | 0.23 | 2.27 | ||||

| Specialized finance | 0.18 | — | ||||

| Food distributors | — | 0.52 | ||||

| Specialized consumer services | — | 0.39 | ||||

| Healthcare technology | — | 0.35 | ||||

| Total | 100.00 | % | 100.00 | % | ||

| September 30, 2017 | September 30, 2016 | |||||

| Fair value: | ||||||

| Internet software & services | 17.20 | % | 15.09 | % | ||

| Multi-sector holdings (1) | 10.67 | 7.37 | ||||

| Healthcare services | 6.09 | 16.64 | ||||

| Advertising | 5.43 | 6.90 | ||||

| Healthcare equipment | 4.73 | 5.58 | ||||

| Data processing & outsourced services | 4.43 | 3.71 | ||||

| Pharmaceuticals | 4.07 | 2.79 | ||||

| Airlines | 3.86 | 3.56 | ||||

| Specialty stores | 3.69 | 2.09 | ||||

| Application software | 3.50 | 2.35 | ||||

| Environmental & facilities services | 3.29 | 4.66 | ||||

| Construction & engineering | 3.26 | 2.90 | ||||

| Research & consulting services | 2.50 | 2.93 | ||||

| Education services | 2.48 | 0.91 | ||||

| Leisure facilities | 2.11 | 1.59 | ||||

| Integrated telecommunication services | 2.03 | 2.45 | ||||

| Housewares & specialties | 1.93 | — | ||||

| Oil & gas equipment services | 1.84 | 0.78 | ||||

| Home improvement retail | 1.61 | 1.21 | ||||

| Consumer electronics | 1.56 | 1.16 | ||||

| Casinos & gaming | 1.52 | — | ||||

| Diversified support services | 1.46 | 3.50 | ||||

| Auto parts & equipment | 1.41 | 0.86 | ||||

| Industrial machinery | 0.97 | 2.38 | ||||

| Distributors | 0.96 | — | ||||

| Security & alarm services | 0.85 | 0.64 | ||||

| Real Estate Services | 0.84 | — | ||||

| Other diversified financial services | 0.76 | 0.68 | ||||

| Hypermarkets & super centers | 0.75 | — | ||||

| Precious metals & minerals | 0.48 | — | ||||

| Trucking | 0.46 | — | ||||

| Computer & electronics retail | 0.42 | — | ||||

| Multi-utilities | 0.41 | — | ||||

| Thrift & mortgage finance | 0.40 | 0.27 | ||||

| Commercial printing | 0.39 | 0.28 | ||||

| Leisure products | 0.38 | 1.62 | ||||

| Restaurants | 0.32 | 0.23 | ||||

| Food retail | 0.28 | 0.19 | ||||

| IT consulting & other services | 0.25 | 2.38 | ||||

| Specialized finance | 0.21 | — | ||||

| Air freight and logistics | 0.12 | 0.33 | ||||

| Apparel, accessories & luxury goods | 0.08 | 0.68 | ||||

| Food distributors | — | 0.53 | ||||

| Specialized consumer services | — | 0.42 | ||||

| Healthcare technology | — | 0.34 | ||||

| Total | 100.00 | % | 100.00 | % | ||

| September 30, 2022 | September 30, 2021 | |||||||||||||

| Fair value: | ||||||||||||||

| Application Software | 15.43 | % | 14.58 | % | ||||||||||

| Multi-Sector Holdings (1) | 6.71 | 7.41 | ||||||||||||

| Pharmaceuticals | 4.79 | 5.56 | ||||||||||||

| Data Processing & Outsourced Services | 4.46 | 4.46 | ||||||||||||

| Biotechnology | 4.35 | 4.44 | ||||||||||||

| Health Care Technology | 3.90 | 0.55 | ||||||||||||

| Industrial Machinery | 3.25 | 3.53 | ||||||||||||

| Specialized Finance | 2.93 | 2.69 | ||||||||||||

| Internet & Direct Marketing Retail | 2.82 | 2.68 | ||||||||||||

| Aerospace & Defense | 2.48 | 2.72 | ||||||||||||

| Construction & Engineering | 2.45 | 2.47 | ||||||||||||

| Automotive Retail | 2.31 | 1.65 | ||||||||||||

| Health Care Distributors | 2.19 | 0.77 | ||||||||||||

| Internet Services & Infrastructure | 2.16 | 1.87 | ||||||||||||

| Fertilizers & Agricultural Chemicals | 2.08 | 2.64 | ||||||||||||

| Personal Products | 2.01 | 4.13 | ||||||||||||

| Real Estate Operating Companies | 1.93 | 1.11 | ||||||||||||

| Metal & Glass Containers | 1.91 | 0.68 | ||||||||||||

| Health Care Services | 1.84 | 3.31 | ||||||||||||

| Home Improvement Retail | 1.82 | 1.82 | ||||||||||||

| Airport Services | 1.72 | 1.59 | ||||||||||||

| Real Estate Services | 1.59 | 1.61 | ||||||||||||

| Leisure Facilities | 1.57 | 0.90 | ||||||||||||

| Diversified Support Services | 1.47 | 1.60 | ||||||||||||

| Health Care Supplies | 1.47 | 1.18 | ||||||||||||

| Specialty Chemicals | 1.36 | 1.82 | ||||||||||||

| Soft Drinks | 1.35 | 1.31 | ||||||||||||

| Insurance Brokers | 1.33 | 1.08 | ||||||||||||

| Electrical Components & Equipment | 1.32 | 1.26 | ||||||||||||

| Integrated Telecommunication Services | 1.29 | 1.94 | ||||||||||||

| Advertising | 1.08 | 1.19 | ||||||||||||

| Movies & Entertainment | 1.07 | 1.06 | ||||||||||||

| Distributors | 0.98 | — | ||||||||||||

| Other Diversified Financial Services | 0.98 | 0.62 | ||||||||||||

| Health Care Equipment | 0.97 | 0.93 | ||||||||||||

| Oil & Gas Storage & Transportation | 0.84 | 1.35 | ||||||||||||

| Environmental & Facilities Services | 0.83 | — | ||||||||||||

| Cable & Satellite | 0.78 | 1.06 | ||||||||||||

| Home Furnishings | 0.73 | 0.77 | ||||||||||||

| Hotels, Resorts & Cruise Lines | 0.56 | — | ||||||||||||

| Consumer Finance | 0.53 | — | ||||||||||||

| Systems Software | 0.51 | 0.26 | ||||||||||||

| Auto Parts & Equipment | 0.46 | 0.48 | ||||||||||||

| Restaurants | 0.35 | 0.37 | ||||||||||||

| Oil & Gas Refining & Marketing | 0.34 | 1.43 | ||||||||||||

| IT Consulting & Other Services | 0.34 | 0.29 | ||||||||||||

| Education Services | 0.34 | 0.04 | ||||||||||||

| Research & Consulting Services | 0.34 | 0.30 | ||||||||||||

| Air Freight & Logistics | 0.26 | 0.19 | ||||||||||||

| Trading Companies & Distributors | 0.22 | — | ||||||||||||

| Apparel Retail | 0.21 | — | ||||||||||||

| Integrated Oil & Gas | 0.20 | 0.19 | ||||||||||||

| Diversified Banks | 0.14 | 0.14 | ||||||||||||

| Food Distributors | 0.13 | 0.18 | ||||||||||||

| Specialized REITs | 0.13 | — | ||||||||||||

| Technology Distributors | 0.12 | 0.12 | ||||||||||||

| Housewares & Specialties | 0.10 | 0.08 | ||||||||||||

| Construction Materials | 0.08 | 0.09 | ||||||||||||

| Electronic Components | 0.08 | 0.40 | ||||||||||||

| Alternative Carriers | 0.01 | 0.27 | ||||||||||||

| Airlines | — | 0.96 | ||||||||||||

| Independent Power Producers & Energy Traders | — | 0.92 | ||||||||||||

| Commercial Printing | — | 0.79 | ||||||||||||

| Managed Health Care | — | 0.74 | ||||||||||||

| Thrifts & Mortgage Finance | — | 0.62 | ||||||||||||

| Property & Casualty Insurance | — | 0.39 | ||||||||||||

| Leisure Products | — | 0.26 | ||||||||||||

| Food Retail | — | 0.15 | ||||||||||||

| Total | 100.00 | % | 100.00 | % | ||||||||||

| September 30, 2017 | September 30, 2016 | September 30, 2015 | ||||||||||||||||||||||||||||||||||||||||

| Cost | % of Debt Portfolio | Fair Value | % of Debt Portfolio | Cost | % of Debt Portfolio | Fair Value | % of Debt Portfolio | Cost | % of Debt Portfolio | Fair Value | % of Debt Portfolio | |||||||||||||||||||||||||||||||

| Accrual | $ | 1,299,793 | 83.59 | % | $ | 1,357,794 | 95.29 | % | $ | 1,890,606 | 89.80 | % | $ | 1,854,228 | 93.89 | % | $ | 2,226,334 | 95.08 | % | $ | 2,206,418 | 97.97 | % | ||||||||||||||||||

| PIK non-accrual (1) | 10,227 | 0.66 | 379 | 0.03 | 40,187 | 1.91 | 31,548 | 1.60 | 66,579 | 2.84 | 28,145 | 1.25 | ||||||||||||||||||||||||||||||

| Cash non-accrual (2) | 244,952 | 15.75 | 66,636 | 4.68 | 174,629 | 8.29 | 89,036 | 4.51 | 48,694 | 2.08 | 17,600 | 0.78 | ||||||||||||||||||||||||||||||

| Total | $ | 1,554,972 | 100.00 | % | $ | 1,424,809 | 100.00 | % | $ | 2,105,422 | 100.00 | % | $ | 1,974,812 | 100.00 | % | $ | 2,341,607 | 100.00 | % | $ | 2,252,163 | 100.00 | % | ||||||||||||||||||

| Year ended September 30, 2017 | Year ended September 30, 2016 | Year ended September 30, 2015 | ||||||||||

| Cash interest income | $ | 18,327 | $ | 13,737 | $ | 5,179 | ||||||

| PIK interest income | 7,801 | 7,225 | 8,423 | |||||||||

| OID income | 154 | 27,886 | 4,627 | |||||||||

| Total | $ | 26,282 | $ | 48,848 | $ | 18,229 | ||||||

| September 30, 2017 | September 30, 2016 | |||

| Senior secured loans (1) | $245,063 | $324,406 | ||

| Weighted average interest rate on senior secured loans (2) | 7.70% | 7.84% | ||

| Number of borrowers in SLF JV I | 32 | 37 | ||

| Largest exposure to a single borrower (1) | $18,374 | $19,775 | ||

| Total of five largest loan exposures to borrowers (1) | $82,728 | $93,926 | ||

| Portfolio Company | Industry | Investment Type | Maturity Date | Current Interest Rate(1)(4) | Cash Interest Rate | Principal | Cost | Fair Value (2) | |||||||||||||||

| AdVenture Interactive, Corp. (3) | Advertising | 927 Common Stock Shares | $ | 1,088 | $ | 1,412 | |||||||||||||||||

| Allied Universal Holdco LLC (3) | Security & alarm services | First Lien | 7/28/2022 | LIBOR+3.75% (1% floor) | 5.08 | % | $ | 6,982 | 7,040 | 6,976 | |||||||||||||

| Ameritox Ltd. (3)(5) | Healthcare services | First Lien | 4/11/2021 | LIBOR+5% (1% floor) 3% PIK | 6.33 | % | 5,759 | 5,638 | 668 | ||||||||||||||

| 301,913.06 Class B Preferred Units | 302 | — | |||||||||||||||||||||

| 928.96 Class A Common Units | 5,474 | — | |||||||||||||||||||||

| Total Ameritox, Ltd. | 5,759 | 11,414 | 668 | ||||||||||||||||||||

| BeyondTrust Software, Inc. (3) | Application software | First Lien | 9/25/2019 | LIBOR+7% (1% floor) | 8.33 | % | 15,330 | 15,231 | 15,329 | ||||||||||||||

| BJ's Wholesale Club, Inc. (3) | Hypermarkets & super centers | First Lien | 1/26/2024 | LIBOR+3.75% (1% floor) | 4.99 | % | 4,988 | 4,993 | 4,793 | ||||||||||||||

| Compuware Corporation | Internet software & services | First Lien B3 | 12/15/2021 | LIBOR+4.25% (1% floor) | 5.49 | % | 11,154 | 11,041 | 11,293 | ||||||||||||||

| DFT Intermediate LLC (3) | Specialized finance | First Lien | 3/1/2023 | LIBOR+5.5% (1% floor) | 6.74 | % | 10,723 | 10,474 | 10,652 | ||||||||||||||

| Digital River, Inc. | Internet software & services | First Lien | 2/12/2021 | LIBOR+6.5% (1% floor) | 7.82 | % | 4,524 | 4,541 | 4,546 | ||||||||||||||

| Dodge Data & Analytics LLC (3) | Data processing & outsourced services | First Lien | 10/31/2019 | LIBOR+8.75% (1% floor) | 10.13 | % | 9,339 | 9,372 | 8,744 | ||||||||||||||

| DTZ U.S. Borrower, LLC (3) | Real estate services | First Lien | 11/4/2021 | LIBOR+3.25% (1% floor) | 4.57 | % | 6,964 | 6,998 | 6,990 | ||||||||||||||

| Edge Fitness, LLC | Leisure facilities | First Lien | 12/31/2019 | LIBOR+7.75% (1% floor) | 9.05 | % | 10,600 | 10,602 | 10,600 | ||||||||||||||

| EOS Fitness Opco Holdings, LLC (3) | Leisure facilities | First Lien | 12/30/2019 | LIBOR+8.75% (0.75% floor) | 9.99 | % | 18,374 | 18,182 | 18,557 | ||||||||||||||

| Everi Payments Inc.(3) | Casinos & gaming | First Lien | 5/9/2024 | LIBOR+4.5% (1% floor) | 5.74 | % | 4,988 | 4,964 | 5,039 | ||||||||||||||

| Falmouth Group Holdings Corp. | Specialty chemicals | First Lien | 12/13/2021 | LIBOR+6.75% (1% floor) | 8.08 | % | 4,610 | 4,578 | 4,610 | ||||||||||||||

| Garretson Resolution Group, Inc. | Diversified support services | First Lien | 5/22/2021 | LIBOR+6.5% (1% floor) | 7.83 | % | 5,836 | 5,818 | 5,766 | ||||||||||||||

| Portfolio Company | Industry | Investment Type | Maturity Date | Current Interest Rate (1)(4) | Cash Interest Rate | Principal | Cost | Fair Value (2) | |||||||||||||||

| InMotion Entertainment Group, LLC (3) | Consumer electronics | First Lien | 10/1/2018 | LIBOR+7.75% (1.25% floor) | 9.09 | % | 8,875 | 8,884 | 8,875 | ||||||||||||||

| First Lien B | 10/1/2018 | LIBOR+7.75% (1.25% floor) | 9.09 | % | 8,875 | 8,828 | 8,871 | ||||||||||||||||

| Total InMotion Entertainment Group, LLC | 17,750 | 17,712 | 17,746 | ||||||||||||||||||||

| Keypath Education, Inc. (3) | Advertising | First Lien | 4/3/2022 | LIBOR+7% (1.00% floor) | 8.33 | % | 2,040 | 2,040 | 2,039 | ||||||||||||||

| 927 shares Common Stock | 1,391 | 809 | |||||||||||||||||||||

| 2,040 | 3,431 | 2,848 | |||||||||||||||||||||

| Lift Brands, Inc. (3) | Leisure facilities | First Lien | 12/23/2019 | LIBOR+7.5% (1% floor) | 8.83 | % | 18,276 | 18,257 | 18,275 | ||||||||||||||

| Metamorph US 3, LLC (3)(5) | Internet software & services | First Lien | 12/1/2020 | LIBOR+5.5% (1% floor) 2% PIK | 6.74 | % | 9,969 | 9,481 | 3,786 | ||||||||||||||

| Motion Recruitment Partners LLC | Human resources & employment services | First Lien | 2/13/2020 | LIBOR+6% (1% floor) | 7.24 | % | 4,330 | 4,281 | 4,330 | ||||||||||||||

| NAVEX Global, Inc. | Internet software & services | First Lien | 11/19/2021 | LIBOR+4.75% (1% floor) | 5.49 | % | 5,959 | 5,925 | 5,982 | ||||||||||||||

| New IPT, Inc. (3) | Oil & gas equipment & services | First Lien | 3/17/2021 | LIBOR+5% (1% floor) | 6.33 | % | 1,794 | 1,794 | 1,794 | ||||||||||||||

| Second Lien | 9/17/2021 | LIBOR+5.1% (1% floor) | 6.43 | % | 1,094 | 1,094 | 1,094 | ||||||||||||||||

| 21.876 Class A Common Units | — | 321 | |||||||||||||||||||||

| Total New IPT, Inc. | 2,888 | 2,888 | 3,209 | ||||||||||||||||||||

| Novetta Solutions, LLC | Internet software & services | First Lien | 9/30/2022 | LIBOR+5% (1% floor) | 6.34 | % | 6,118 | 6,066 | 5,950 | ||||||||||||||

| OmniSYS Acquisition Corporation (3) | Diversified support services | First Lien | 11/21/2018 | LIBOR+7.5% (1% floor) | 8.83 | % | 10,896 | 10,900 | 10,833 | ||||||||||||||

| Refac Optical Group (3) | Specialty stores | First Lien A | 9/30/2018 | LIBOR+8% | 9.23 | % | 4,623 | 4,605 | 4,623 | ||||||||||||||

| Salient CRGT, Inc. (3) | IT consulting & other services | First Lien | 2/28/2022 | LIBOR+5.75% (1% floor) | 6.99 | % | 2,457 | 2,412 | 2,440 | ||||||||||||||

| Scientific Games International, Inc. (3) | Casinos & gaming | First Lien | 8/14/2024 | LIBOR+3.25% (1% floor) | 4.58 | % | 6,632 | 6,598 | 6,651 | ||||||||||||||

| SHO Holding I Corporation | Footwear | First Lien | 10/27/2022 | LIBOR+5% (1% floor) | 6.24 | % | 8,594 | 8,566 | 8,487 | ||||||||||||||

| TravelClick, Inc. (3) | Internet software & services | Second Lien | 11/6/2021 | LIBOR+7.75% (1% floor) | 8.99 | % | 5,127 | 5,127 | 5,153 | ||||||||||||||

| TV Borrower US, LLC | Integrated telecommunications services | First Lien | 2/22/2024 | LIBOR+4.75% (1% floor) | 6.08 | % | 3,582 | 3,565 | 3,607 | ||||||||||||||

| Valet Merger Sub, Inc. (3) | Environmental & facilities services | First Lien | 9/24/2021 | LIBOR+7% (1% floor) | 8.24 | % | 12,998 | 12,862 | 12,998 | ||||||||||||||

| Vubiquity, Inc. | Application software | First Lien | 8/12/2021 | LIBOR+5.5% (1% floor) | 6.83 | % | 2,653 | 2,636 | 2,633 | ||||||||||||||

| $ | 245,063 | $ | 251,648 | $ | 235,526 | ||||||||||||||||||

| Portfolio Company | Industry | Investment Type | Maturity Date | Current Interest Rate (1)(4) | Cash Interest Rate | Principal | Cost | Fair Value (2) | |||||||||||||||

| AccentCare, Inc. | Healthcare services | First Lien | 9/3/2021 | LIBOR+5.75% (1% floor) | 6.75 | % | $ | 4,906 | $ | 4,837 | $ | 4,830 | |||||||||||

| AdVenture Interactive, Corp. (3) (5) | Advertising | First Lien | 3/22/2018 | LIBOR+7.75% (1% floor) | 8.75 | % | 9,178 | 9,150 | 7,066 | ||||||||||||||

| AF Borrower, LLC | IT consulting & other services | First Lien | 1/28/2022 | LIBOR+5.25% (1% floor) | 6.25 | % | 8,083 | 8,105 | 8,121 | ||||||||||||||

| Ameritox Ltd. (3) | Healthcare services | First Lien | 4/11/2021 | LIBOR+5% (1% floor) 3% PIK | 6.00 | % | 5,890 | 5,884 | 5,848 | ||||||||||||||

| 301,913.06 Class B Preferred Units | 302 | 331 | |||||||||||||||||||||

| 928.96 Class A Common Units | 5,474 | 2,471 | |||||||||||||||||||||

| Total Ameritox, Ltd. | 5,890 | 11,660 | 8,650 | ||||||||||||||||||||

| BeyondTrust Software, Inc. (3) | Application software | First Lien | 9/25/2019 | LIBOR+7% (1% floor) | 8.00 | % | 17,198 | 17,038 | 17,059 | ||||||||||||||

| Compuware Corporation | Internet software & services | First Lien B1 | 12/15/2019 | LIBOR+5.25% (1% floor) | 6.25 | % | 3,194 | 3,164 | 3,206 | ||||||||||||||

| First Lien B2 | 12/15/2021 | LIBOR+5.25% (1% floor) | 6.25 | % | 9,825 | 9,689 | 9,806 | ||||||||||||||||

| Total Compuware Corporation | 13,019 | 12,853 | 13,012 | ||||||||||||||||||||

| CRGT, Inc. | IT consulting & other services | First Lien | 12/21/2020 | LIBOR+6.5% (1% floor) | 7.50 | % | 2,294 | 2,289 | 2,300 | ||||||||||||||

| Digital River, Inc. | Internet software & services | First Lien | 2/12/2021 | LIBOR+6.5% (1% floor) | 7.50 | % | 4,524 | 4,563 | 4,515 | ||||||||||||||

| Dodge Data & Analytics LLC (3) | Data processing & outsourced services | First Lien | 10/31/2019 | LIBOR+8.75% (1% floor) | 9.75 | % | 9,688 | 9,740 | 9,810 | ||||||||||||||

| Edge Fitness, LLC | Leisure facilities | First Lien | 12/31/2019 | LIBOR+8.75% (1% floor) | 9.75 | % | 10,600 | 10,602 | 10,565 | ||||||||||||||

| EOS Fitness Opco Holdings, LLC (3) | Leisure facilities | First Lien | 12/30/2019 | LIBOR+8.75% (0.75% floor) | 9.50 | % | 19,160 | 18,869 | 18,672 | ||||||||||||||

| Falmouth Group Holdings Corp. | Specialty chemicals | First Lien | 12/13/2021 | LIBOR+6.75% (1% floor) | 7.75 | % | 4,963 | 4,920 | 4,968 | ||||||||||||||

| Garretson Resolution Group, Inc. | Diversified support services | First Lien | 5/22/2021 | LIBOR+6.5% (1% floor) | 7.50 | % | 5,991 | 5,966 | 5,946 | ||||||||||||||

| InMotion Entertainment Group, LLC (3) | Consumer electronics | First Lien | 10/1/2018 | LIBOR+7.75% (1.25% floor) | 9.00 | % | 9,375 | 9,394 | 9,252 | ||||||||||||||

| First Lien B | 10/1/2018 | LIBOR+7.75% (1.25% floor) | 9.00 | % | 9,375 | 9,270 | 9,252 | ||||||||||||||||

| Total InMotion Entertainment Group, LLC | 18,750 | 18,664 | 18,504 | ||||||||||||||||||||

| Integrated Petroleum Technologies, Inc. (3) | Oil & gas equipment services | First Lien | 3/31/2019 | LIBOR+7.5% (1% floor) | 8.50 | % | 8,267 | 8,267 | 2,839 | ||||||||||||||

| Legalzoom.com, Inc. (3) | Specialized consumer services | First Lien | 5/13/2020 | LIBOR+7% (1% floor) | 8.00 | % | 19,775 | 19,410 | 19,660 | ||||||||||||||

| Lift Brands, Inc. (3) | Leisure facilities | First Lien | 12/23/2019 | LIBOR+7.5% (1% floor) | 9.00 | % | 19,043 | 19,015 | 18,858 | ||||||||||||||

| Lytx, Inc. (3) | Research & consulting services | First Lien | 3/15/2023 | LIBOR+8.5% (1% floor) | 9.50 | % | 7,981 | 7,981 | 7,981 | ||||||||||||||

| MedTech Group, Inc. | Healthcare equipment | First Lien | 1/1/2019 | LIBOR+5.25% (1% floor) | 6.25 | % | 11,910 | 11,910 | 11,696 | ||||||||||||||

| Metamorph US 3, LLC (3) | Internet software & services | First Lien | 12/1/2020 | LIBOR+6.5% (1% floor) | 7.50 | % | 10,078 | 9,945 | 8,390 | ||||||||||||||

| Motion Recruitment Partners LLC | Human resources & employment services | First Lien | 2/13/2020 | LIBOR+6% (1% floor) | 7.00 | % | 4,563 | 4,487 | 4,550 | ||||||||||||||

| My Alarm Center, LLC | Security & alarm services | First Lien A | 1/9/2019 | LIBOR+8% (1% floor) | 9.00 | % | 3,000 | 2,993 | 3,005 | ||||||||||||||

| First Lien B | 1/9/2019 | LIBOR+8% (1% floor) | 9.00 | % | 4,506 | 4,493 | 4,514 | ||||||||||||||||

| First Lien C | 1/9/2019 | LIBOR+8% (1% floor) | 9.00 | % | 1,136 | 1,128 | 1,133 | ||||||||||||||||

| Total My Alarm Center, LLC | 8,642 | 8,614 | 8,652 | ||||||||||||||||||||

| Portfolio Company | Industry | Investment Type | Maturity Date | Current Interest Rate (1)(4) | Cash Interest Rate | Principal | Cost | Fair Value (2) | |||||||||||||||

| NAVEX Global, Inc. | Internet software & services | First Lien | 11/19/2021 | LIBOR+4.75% (1% floor) | 5.75 | % | 995 | 943 | 990 | ||||||||||||||

| Novetta Solutions, LLC | Internet software & services | First Lien | 9/30/2022 | LIBOR+5% (1% floor) | 6.00 | % | 6,614 | 6,528 | 6,357 | ||||||||||||||

| OmniSYS Acquisition Corporation (3) | Diversified support services | First Lien | 11/21/2018 | LIBOR+7.5% (1% floor) | 8.50 | % | 10,896 | 10,903 | 10,743 | ||||||||||||||

| Refac Optical Group (3) | Specialty stores | First Lien A | 9/30/2018 | LIBOR+7.5% | 8.02 | % | 7,116 | 7,049 | 7,107 | ||||||||||||||

| SHO Holding I Corporation | Footwear | First Lien | 10/27/2022 | LIBOR+5% (1% floor) | 6.00 | % | 4,466 | 4,426 | 4,461 | ||||||||||||||

| TIBCO Software, Inc. | Internet software & services | First Lien | 12/4/2020 | LIBOR+5.5% (1% floor) | 6.50 | % | 4,748 | 4,548 | 4,691 | ||||||||||||||

| Too Faced Cosmetics, LLC | Personal products | First Lien | 7/7/2021 | LIBOR+5% (1% floor) | 6.00 | % | 1,135 | 1,028 | 1,140 | ||||||||||||||

| TravelClick, Inc. (3) | Internet software & services | Second Lien | 11/8/2021 | LIBOR+7.75% (1% floor) | 8.75 | % | 8,460 | 8,460 | 7,576 | ||||||||||||||

| TrialCard Incorporated | Healthcare services | First Lien | 12/31/2019 | LIBOR+4.5% (1% floor) | 5.50 | % | 13,319 | 13,222 | 13,255 | ||||||||||||||

| TV Borrower US, LLC | Integrated telecommunications services | First Lien | 1/8/2021 | LIBOR+5% (1% floor) | 6.00 | % | 9,800 | 9,633 | 9,763 | ||||||||||||||

| Valet Merger Sub, Inc. (3) | Environmental & facilities services | First Lien | 9/24/2021 | LIBOR+7% (1% floor) | 8.00 | % | 14,887 | 14,692 | 15,138 | ||||||||||||||

| Vitera Healthcare Solutions, LLC | Healthcare technology | First Lien | 11/4/2020 | LIBOR+5% (1% floor) | 6.00 | % | 4,863 | 4,863 | 4,747 | ||||||||||||||

| Vubiquity, Inc. | Application software | First Lien | 8/12/2021 | LIBOR+5.5% (1% floor) | 6.50 | % | 2,680 | 2,658 | 2,666 | ||||||||||||||

| Worley Claims Services, LLC (3) | Internet software & services | First Lien | 10/31/2020 | LIBOR+8% (1% floor) | 9.00 | % | 9,924 | 9,882 | 9,875 | ||||||||||||||

| $ | 324,406 | $ | 327,720 | $ | 315,153 | ||||||||||||||||||

| September 30, 2017 | September 30, 2016 | |||||||

| Selected Balance Sheet Information: | ||||||||

| Investments in loans at fair value (cost September 30, 2017: $251,648; cost September 30, 2016: $327,720) | $ | 235,526 | $ | 315,153 | ||||

| Receivables from secured financing arrangements at fair value (cost September 30, 2017: $9,783; cost September 30, 2016: $10,014) | 8,305 | 9,672 | ||||||

| Cash and cash equivalents | 24,389 | 1,878 | ||||||

| Restricted cash | 5,097 | 7,080 | ||||||

| Other assets | 3,485 | 4,700 | ||||||

| Total assets | $ | 276,802 | $ | 338,483 | ||||

| Senior credit facilities payable | $ | 113,053 | $ | 167,012 | ||||

| Debt securities payable at fair value (proceeds September 30, 2017: $147,052; proceeds September 30, 2016: $165,533) | 147,052 | 147,433 | ||||||

| Other liabilities | 10,383 | 8,371 | ||||||

| Total liabilities | $ | 270,488 | $ | 322,816 | ||||

| Members' equity | 6,314 | 15,667 | ||||||

| Total liabilities and members' equity | $ | 276,802 | $ | 338,483 | ||||

| Year ended September 30, 2017 | Year ended September 30, 2016 | |||||||

| Selected Statements of Operations Information: | ||||||||

| Interest income | $ | 23,222 | $ | 30,156 | ||||

| Other income | 869 | 840 | ||||||

| Total investment income | 24,091 | 30,996 | ||||||

| Interest expense | 22,195 | 23,262 | ||||||

| Other expenses | 700 | 501 | ||||||

| Total expenses (1) | 22,895 | 23,763 | ||||||

| Net unrealized appreciation (depreciation) | (22,789 | ) | 7,438 | |||||

| Net realized gain (loss) | 13,350 | (7,771 | ) | |||||

| Net income (loss) | $ | (8,243 | ) | $ | 6,900 | |||

| September 30, 2022 | September 30, 2021 | |||||||

| Senior secured loans (1) | $383,194 | $344,196 | ||||||

| Weighted average interest rate on senior secured loans (2) | 8.33% | 5.60% | ||||||

| Number of borrowers in SLF JV I | 60 | 55 | ||||||

| Largest exposure to a single borrower (1) | $10,093 | $9,875 | ||||||

| Total of five largest loan exposures to borrowers (1) | $48,139 | $46,984 | ||||||

| September 30, 2022 | September 30, 2021 | ||||||||||

| Senior secured loans (1) | $143,225 | $126,512 | |||||||||

| Weighted average current interest rate on senior secured loans (2) | 8.52% | 5.86% | |||||||||

| Number of borrowers in the Glick JV | 43 | 37 | |||||||||

| Largest loan exposure to a single borrower (1) | $6,562 | $6,907 | |||||||||

| Total of five largest loan exposures to borrowers (1) | $28,973 | $28,324 | |||||||||

| Debt Outstanding as of September 30, 2021 | Debt Outstanding as of September 30, 2022 | Weighted average debt outstanding for the year ended September 30, 2022 | Maximum debt outstanding for the year ended September 30, 2022 | |||||||||||||||||||||||

| Syndicated Facility | $ | 495,000 | $ | 540,000 | $ | 550,165 | $ | 620,000 | ||||||||||||||||||

| Citibank Facility | 135,000 | 160,000 | 160,986 | 185,000 | ||||||||||||||||||||||

| 2025 Notes | 300,000 | 300,000 | 300,000 | 300,000 | ||||||||||||||||||||||

| 2027 Notes | 350,000 | 350,000 | 350,000 | 350,000 | ||||||||||||||||||||||

| Total debt | $ | 1,280,000 | $ | 1,350,000 | $ | 1,361,151 | ||||||||||||||||||||

| Payments due by period as of September 30, 2022 | ||||||||||||||||||||||||||

| Contractual Obligations | Total | Less than 1 year | 1-3 years | 3-5 years | ||||||||||||||||||||||

| Syndicated Facility | $ | 540,000 | $ | — | $ | — | $ | 540,000 | ||||||||||||||||||

| Interest due on Syndicated Facility | 90,986 | 25,313 | 50,626 | 15,047 | ||||||||||||||||||||||

| Citibank Facility | 160,000 | — | 160,000 | — | ||||||||||||||||||||||

| Interest due on Citibank Facility | 19,225 | 8,996 | 10,229 | — | ||||||||||||||||||||||

| 2025 Notes | 300,000 | — | 300,000 | — | ||||||||||||||||||||||

| Interest due on 2025 Notes | 25,286 | 10,500 | 14,786 | — | ||||||||||||||||||||||

| 2027 Notes | 350,000 | — | — | 350,000 | ||||||||||||||||||||||

| Interest due on 2027 Notes (a) | 62,699 | 14,595 | 29,190 | 18,914 | ||||||||||||||||||||||

| Total | $ | 1,548,196 | $ | 59,404 | $ | 564,831 | $ | 923,961 | ||||||||||||||||||

| Number of Shares Issued | Gross Proceeds | Placement Agent Fees | Net Proceeds (1) | Average Sales Price per Share (2) | ||||||||||||||||||||||||||||

| "At the market" offering | 2,801,206 | $ | 21,049 | $ | 210 | $ | 20,839 | $ | 7.51 | |||||||||||||||||||||||

| Date Declared | Record Date | Payment Date | Amount per Share | Cash Distribution | DRIP Shares Issued (1) | DRIP Shares Value | |||||||||

| August 4, 2015 | October 15, 2015 | October 30, 2015 | $ | 0.06 | $ 8.4 million | 106,185 | $ 0.6 million | ||||||||

| August 4, 2015 | November 16, 2015 | November 30, 2015 | 0.06 | 8.4 million | 91,335 | 0.6 million | |||||||||

| November 30, 2015 | December 15, 2015 | December 30, 2015 | 0.06 | 8.4 million | 99,673 | 0.6 million | |||||||||

| November 30, 2015 | January 15, 2016 | January 28, 2016 | 0.06 | 8.4 million | 113,905 | 0.7 million | |||||||||

| November 30, 2015 | February 12, 2016 | February 26, 2016 | 0.06 | 8.4 million | 123,342 | 0.6 million | |||||||||

| February 8, 2016 | March 15, 2016 | March 31, 2016 | 0.06 | 8.6 million | 86,806 | 0.4 million | |||||||||

| February 8, 2016 | April 15, 2016 | April 29, 2016 | 0.06 | 8.2 million | 112,569 | 0.6 million | |||||||||

| February 8, 2016 | May 13, 2016 | May 31, 2016 | 0.06 | 8.4 million | 76,432 | 0.4 million | |||||||||

| May 5, 2016 | June 15, 2016 | June 30, 2016 | 0.06 | 8.2 million | 108,629 | 0.5 million | |||||||||

| May 5, 2016 | July 15, 2016 | July 29, 2016 | 0.06 | 8.2 million | 100,268 | 0.6 million | |||||||||

| May 5, 2016 | August 15, 2016 | August 31, 2016 | 0.06 | 8.3 million | 59,026 | 0.4 million | |||||||||

| August 3, 2016 | September 15, 2016 | September 30, 2016 | 0.06 | 8.3 million | 65,170 | 0.4 million | |||||||||

| August 3, 2016 | October 14, 2016 | October 31, 2016 | 0.06 | 8.2 million | 81,391 | 0.4 million | |||||||||

| August 3, 2016 | November 15, 2016 | November 30, 2016 | 0.06 | 8.2 million | 80,962 | 0.4 million | |||||||||

| October 18, 2016 | December 15, 2016 | December 30, 2016 | 0.06 | 7.7 million | 70,316 | 0.4 million | |||||||||

| October 18, 2016 | January 13, 2017 | January 31, 2017 | 0.06 | 8.0 million | 73,940 | 0.4 million | |||||||||

| October 18, 2016 | February 15, 2017 | February 28, 2017 | 0.06 | 8.0 million | 86,120 | 0.4 million | |||||||||

| February 6, 2017 | March 15, 2017 | March 31, 2017 | 0.02 | 2.7 million | 27,891 | 0.1 million | |||||||||

| February 6, 2017 | June 15, 2017 | June 30, 2017 | 0.02 | 2.7 million | 20,502 | 0.1 million | |||||||||

| February 6, 2017 | September 15, 2017 | September 29, 2017 | 0.125 | 17.0 million | 118,992 | 0.7 million | |||||||||

| August 7, 2017 | December 15, 2017 | December 29, 2017 | 0.125 | ||||||||||||

| Date Declared | Record Date | Payment Date | Amount per Share | Cash Distribution | DRIP Shares Issued (1) | DRIP Shares Value | ||||||||||||||||||||||||||||||||||||||

| November 13, 2020 | December 15, 2020 | December 31, 2020 | $ | 0.11 | $ 15.0 million | 93,964 | $ 0.5 million | |||||||||||||||||||||||||||||||||||||

| January 29, 2021 | March 15, 2021 | March 31, 2021 | 0.12 | 16.4 million | 81,702 | 0.5 million | ||||||||||||||||||||||||||||||||||||||

| April 30, 2021 | June 15, 2021 | June 30, 2021 | 0.13 | 22.9 million | 76,979 | 0.5 million | ||||||||||||||||||||||||||||||||||||||

| July 30, 2021 | September 15, 2021 | September 30, 2021 | 0.145 | 25.5 million | 85,075 | 0.6 million | ||||||||||||||||||||||||||||||||||||||

| October 13, 2021 | December 15, 2021 | December 31, 2021 | 0.155 | 27.2 million | 107,971 | 0.8 million | ||||||||||||||||||||||||||||||||||||||

| January 28, 2022 | March 15, 2022 | March 31, 2022 | 0.16 | 28.5 million | 104,411 | 0.8 million | ||||||||||||||||||||||||||||||||||||||

| April 29, 2022 | June 15, 2022 | June 30, 2022 | 0.165 | 29.4 million | 131,028 | 0.9 million | ||||||||||||||||||||||||||||||||||||||

| July 29, 2022 | September 15, 2022 | September 30, 2022 | 0.17 | 30.2 million | 153,544 | 1.0 million | ||||||||||||||||||||||||||||||||||||||

(1)Shares were purchased on |

| Financial Covenant | Description | Target Value | June 30, | |||||||||||||||||

| Minimum shareholders' equity | Net assets shall not be less than the | $ | $ | |||||||||||||||||

| Asset coverage ratio | Asset coverage ratio shall not be less than | |||||||||||||||||||

| Interest coverage ratio | Interest coverage ratio shall not be less than 2.25:1 | 2.25:1 | ||||||||||||||||||

| Minimum net worth | Net worth shall not be less than | $ | $ | |||||||||||||||||

| As of September 30, 2022 | As of September 30, 2021 | |||||||||||||||||||||||||

| ($ in millions) | 2025 Notes | 2027 Notes | 2025 Notes | 2027 Notes | ||||||||||||||||||||||

| Principal | $ | 300.0 | $ | 350.0 | $ | 300.0 | $ | 350.0 | ||||||||||||||||||

| Unamortized financing costs | (1.8) | (3.2) | (2.6) | (4.0) | ||||||||||||||||||||||

| Unaccreted discount | (1.2) | (0.7) | (1.7) | (0.9) | ||||||||||||||||||||||

| Interest rate swap fair value adjustment | — | (42.0) | — | (2.1) | ||||||||||||||||||||||

| Net carrying value | $ | 297.0 | $ | 304.1 | $ | 295.7 | $ | 343.0 | ||||||||||||||||||

| Fair Value | $ | 283.1 | $ | 294.0 | $ | 314.5 | $ | 351.1 | ||||||||||||||||||

| ($ in millions) | 2025 Notes | 2027 Notes | ||||||||||||

| Coupon interest | $ | 10.5 | $ | 9.5 | ||||||||||

| Amortization of financing costs and discount | 1.3 | 0.9 | ||||||||||||

| Effect of interest rate swap | — | (0.4) | ||||||||||||

| Total interest expense | $ | 11.8 | $ | 10.0 | ||||||||||

| Coupon interest rate (net of effect of interest rate swap for 2027 Notes) | 3.500 | % | 2.585 | % | ||||||||||

| ($ in millions) | 2025 Notes | 2027 Notes | ||||||||||||

| Coupon interest | $ | 10.5 | $ | 3.5 | ||||||||||

| Amortization of financing costs and discount | 1.3 | 0.3 | ||||||||||||

| Effect of interest rate swap | — | (1.1) | ||||||||||||

| Total interest expense | $ | 11.8 | $ | 2.7 | ||||||||||

| Coupon interest rate (net of effect of interest rate swap for 2027 Notes) | 3.500 | % | 1.813 | % | ||||||||||

| ($ in millions) | 2025 Notes | |||||||

| Coupon interest | $ | 6.3 | ||||||

| Amortization of financing costs and discount | 0.7 | |||||||

| Total interest expense | $ | 7.0 | ||||||

| Coupon interest rate | 3.500 | % | ||||||

| September 30, 2017 | September 30, 2016 | |||||||

| Lift Brands Holdings, Inc. | $ | 15,000 | $ | 13,000 | ||||

| P2 Upstream Acquisition Co. | 10,000 | 10,000 | ||||||

| Valet Merger Sub, Inc. | 9,326 | 5,596 | ||||||

| Edge Fitness, LLC | 8,353 | 8,353 | ||||||

| InMotion Entertainment Group, LLC | 7,544 | 6,856 | ||||||

| BeyondTrust Software, Inc. | 5,995 | 5,995 | ||||||

| EOS Fitness Opco Holdings, LLC | 5,000 | 5,000 | ||||||

| Dominion Diagnostics, LLC (1)(2) | 4,180 | — | ||||||

| Impact Sales, LLC | 3,234 | — | ||||||

| Systems, Inc. | 3,030 | — | ||||||

| Thing5, LLC | 3,000 | 5,000 | ||||||

| WeddingWire, Inc. | 3,000 | 3,000 | ||||||

| Keypath Education, Inc. | 3,000 | — | ||||||

| Traffic Solutions Holdings, Inc. | 2,998 | 2,682 | ||||||

| Motion Recruitment Partners LLC | 2,900 | 2,900 | ||||||

| Pingora MSR Opportunity Fund I, LP (limited partnership interest) | 2,760 | 2,054 | ||||||

| Edmentum, Inc.(1) | 2,664 | 2,664 | ||||||

| OmniSYS Acquisition Corporation | 2,500 | 2,500 | ||||||

| Ping Identity Corporation | 2,500 | 2,500 | ||||||

| 4 Over International, LLC | 2,232 | 2,232 | ||||||

| New IPT, Inc. | 2,229 | — | ||||||

| Refac Optical Group | 2,080 | 6,400 | ||||||

| SPC Partners VI, L.P. (limited partnership interest) | 2,000 | — | ||||||

| Ministry Brands, LLC | 1,708 | 15,000 | ||||||

| Sailpoint Technologies, Inc. | 1,500 | — | ||||||

| Metamorph US 3, LLC (1) | 1,470 | 3,675 | ||||||

| Senior Loan Fund JV 1, LLC | 1,328 | 14,065 | ||||||

| TransTrade Operators, Inc. (1)(3) | 1,052 | 424 | ||||||

| Webster Capital III, L.P. (limited partnership) | 736 | 1,013 | ||||||

| Riverside Fund V, LP (limited partnership interest) | 539 | 853 | ||||||

| Garretson Firm Resolution Group, Inc. | 508 | 1,066 | ||||||

| Sterling Capital Partners IV, L.P. (limited partnership interest) | 490 | 485 | ||||||

| Beecken Petty O'Keefe Fund IV, L.P. (limited partnership interest) | 472 | 813 | ||||||

| Tailwind Capital Partners II, L.P. (limited partnership interest) | 391 | 1,005 | ||||||

| Moelis Capital Partners Opportunity Fund I-B, L.P. (limited partnership interest) | 365 | 476 | ||||||

| RCP Direct II, LP (limited partnership interest) | 364 | 654 | ||||||

| Cenegenics, LLC (1)(3) | 297 | 1,001 | ||||||

| Riverside Fund IV, LP (limited partnership interest) | 254 | 544 | ||||||

| ACON Equity Partners III, LP (limited partnership interest) | 239 | 204 | ||||||

| RCP Direct, LP (limited partnership interest) | 184 | 236 | ||||||

| Bunker Hill Capital II (QP), LP (limited partnership interest) | 183 | 190 | ||||||

| Milestone Partners IV, LP (limited partnership interest) | 180 | 261 | ||||||

| SPC Partners V, L.P. (limited partnership interest) | 159 | 602 | ||||||

| Riverlake Equity Partners II, LP (limited partnership interest) | 129 | 177 | ||||||

| L Squared Capital Partners (limited partnership interest) | — | 308 | ||||||

| Legalzoom.com, Inc. | — | 15,427 | ||||||

| TigerText, Inc. | — | 10,000 | ||||||

| RP Crown Parent, LLC | — | 9,414 | ||||||

| TIBCO Software, Inc. | — | 5,800 | ||||||

| Integrated Petroleum Technologies, Inc. | — | 5,397 | ||||||

| Trialcard Incorporated | — | 4,900 | ||||||

| Adventure Interactive, Corp. (2) | — | 4,846 | ||||||

| Baart Programs, Inc. | — | 4,762 | ||||||

| Discovery Practice Management, Inc. | — | 3,958 | ||||||

| OBHG Management Services, LLC | — | 3,836 | ||||||

| First American Payment Systems, LP | — | 3,000 | ||||||

| My Alarm Center, LLC | — | 2,940 | ||||||

| Eagle Hospital Physicians, Inc. | — | 2,753 | ||||||

| HealthDrive Corporation | — | 2,534 | ||||||

| Teaching Strategies, LLC | — | 2,400 | ||||||

| ExamSoft Worldwide, Inc. | — | 2,000 | ||||||

| Accruent, LLC | — | 1,900 | ||||||

| Total | $ | 118,073 | $ | 215,651 | ||||

| Debt Outstanding as of September 30, 2016 | Debt Outstanding as of September 30, 2017 | Weighted average debt outstanding for the year ended September 30, 2017 | Maximum debt outstanding for the year ended September 30, 2017 | |||||||||||||

| SBA debentures | $ | 213,300 | $ | — | $ | 159,201 | $ | 213,300 | ||||||||

| ING facility | 472,495 | 226,495 | 356,961 | 530,495 | ||||||||||||

| Sumitomo facility | 43,800 | 29,500 | 40,379 | 44,000 | ||||||||||||

| 2019 Notes | 250,000 | 250,000 | 250,000 | 250,000 | ||||||||||||

| 2024 Notes | 75,000 | 75,000 | 75,000 | 75,000 | ||||||||||||

| 2028 Notes | 86,250 | 86,250 | 86,250 | 86,250 | ||||||||||||

| Secured borrowings | 18,929 | 13,489 | 14,581 | 18,929 | ||||||||||||

| Total debt | $ | 1,159,774 | $ | 680,734 | $ | 982,372 | ||||||||||

| Payments due by period as of September 30, 2017 | ||||||||||||||||||||

| Contractual Obligations | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||

| ING facility | $ | 226,495 | $ | 226,495 | $ | — | $ | — | $ | — | ||||||||||

| Interest due on ING facility | 6,733 | 6,733 | — | — | — | |||||||||||||||

| Sumitomo facility | 29,500 | 29,500 | — | — | — | |||||||||||||||

| Interest due on Sumitomo facility | 886 | 886 | — | — | — | |||||||||||||||

| Secured borrowings | 13,489 | — | 13,489 | — | — | |||||||||||||||

| Interest due on secured borrowings | 1,857 | 612 | 1,245 | — | — | |||||||||||||||

| 2019 Notes | 250,000 | — | 250,000 | — | — | |||||||||||||||

| Interest due on 2019 Notes | 17,263 | 12,188 | 5,075 | — | — | |||||||||||||||

| 2024 Notes | 75,000 | — | — | — | 75,000 | |||||||||||||||

| Interest due on 2024 Notes | 31,230 | 4,406 | 8,813 | 8,813 | 9,198 | |||||||||||||||

| 2028 Notes | 86,250 | — | — | — | 86,250 | |||||||||||||||

| Interest due on 2028 Notes | 55,940 | 5,283 | 10,566 | 10,566 | 29,525 | |||||||||||||||

| Total | $ | 794,643 | $ | 286,103 | $ | 289,188 | $ | 19,379 | $ | 199,973 | ||||||||||

| Year Ended | Qualified Net Interest Income | Qualified Short-Term Capital Gains | |||||||||

| September 30, | % | — | |||||||||

| September 30, 2022 | September 30, 2021 | |||||||||||||||||||||||||||||||||||||

| ($ in thousands) | Fair Value | % of Floating Rate Portfolio | Fair Value | % of Floating Rate Portfolio | ||||||||||||||||||||||||||||||||||

| 0% | $ | 228,186 | 11.1 | % | $ | 322,222 | 14.6 | % | ||||||||||||||||||||||||||||||

| >0% and <1% | 388,458 | 19.0 | % | 283,065 | 12.8 | % | ||||||||||||||||||||||||||||||||

| 1% | 1,364,668 | 66.6 | % | 1,507,977 | 68.4 | % | ||||||||||||||||||||||||||||||||

| >1% | 68,332 | 3.3 | % | 92,384 | 4.2 | % | ||||||||||||||||||||||||||||||||

| Total Floating Rate Investments | $ | 2,049,644 | 100.0 | % | $ | 2,205,648 | 100.0 | % | ||||||||||||||||||||||||||||||

| September 30, 2017 | September 30, 2016 | |||||||||||||

| ($ in thousands) | Fair Value | % of Floating Rate Portfolio | Fair Value | % of Floating Rate Portfolio | ||||||||||

| Under 1% | $ | 201,365 | 16.91 | % | $ | 271,484 | 16.98 | % | ||||||

| 1% to under 2% | 989,575 | 83.09 | 1,324,121 | 82.83 | ||||||||||

| 2% to under 3% | — | — | — | — | ||||||||||

| 3% and over | — | — | 3,000 | 0.19 | ||||||||||

| Total | $ | 1,190,940 | 100.00 | % | $ | 1,598,605 | 100.00 | % | ||||||

| ($ in thousands) Basis point increase | Increase in Interest Income | (Increase) in Interest Expense | Net increase in net assets resulting from operations | |||||||||||||||||

| 250 | $ | 53,484 | $ | (26,250) | $ | 27,234 | ||||||||||||||

| 200 | 42,767 | (21,000) | 21,767 | |||||||||||||||||

| 150 | 32,051 | (15,750) | 16,301 | |||||||||||||||||

| 100 | 21,334 | (10,500) | 10,834 | |||||||||||||||||

| 50 | 10,622 | (5,250) | 5,372 | |||||||||||||||||

| ($ in thousands) | ||||||||||||

| Basis point increase(1) | Interest income | Interest expense | Net increase (decrease) | |||||||||

| 500 | $ | 61,700 | $ | (13,100 | ) | $ | 48,600 | |||||

| 400 | 50,300 | (10,400 | ) | 39,900 | ||||||||

| 300 | 39,000 | (7,700 | ) | 31,300 | ||||||||

| 200 | 27,600 | (5,000 | ) | 22,600 | ||||||||

| 100 | 16,200 | (2,300 | ) | 13,900 | ||||||||

| ($ in thousands) Basis point decrease | (Decrease) in Interest Income | Decrease in Interest Expense | Net (decrease) in net assets resulting from operations | |||||||||||||||||

| 50 | $ | (10,611) | $ | 5,250 | $ | (5,361) | ||||||||||||||

| 100 | (21,062) | 10,500 | (10,562) | |||||||||||||||||

| 150 | (31,456) | 15,750 | (15,706) | |||||||||||||||||

| 200 | (41,787) | 21,000 | (20,787) | |||||||||||||||||

| 250 | (49,943) | 26,250 | (23,693) | |||||||||||||||||

| September 30, 2022 | September 30, 2021 | |||||||||||||||||||||||||

| ($ in thousands) | Interest Bearing Cash and Investments | Borrowings | Interest Bearing Cash and Investments | Borrowings | ||||||||||||||||||||||

| Money market rate | $ | 5,262 | $ | — | $ | 23,600 | $ | — | ||||||||||||||||||

| Prime rate | 2,618 | — | 305 | 10,000 | ||||||||||||||||||||||

| LIBOR | ||||||||||||||||||||||||||

| 30 day | 669,273 | 540,000 | 674,613 | 485,000 | ||||||||||||||||||||||

| 90 day (a) | 928,978 | 510,000 | 1,037,019 | 485,000 | ||||||||||||||||||||||

| 180 day | 199,301 | — | 323,869 | — | ||||||||||||||||||||||

| 360 day | — | — | 96,095 | — | ||||||||||||||||||||||

| EURIBOR | ||||||||||||||||||||||||||

| 30 day | € | 24,838 | — | € | 24,838 | — | ||||||||||||||||||||

| 90 day | 16,911 | — | 13,980 | — | ||||||||||||||||||||||

| 180 day | 1,964 | — | 18,203 | — | ||||||||||||||||||||||

| SOFR | ||||||||||||||||||||||||||

| 30 day | $ | 50,099 | — | — | — | |||||||||||||||||||||

| 90 day | 190,799 | — | — | — | ||||||||||||||||||||||