You should carefully consider the following risk factors. Our future performance is subject to a variety of risks and uncertainties that could materially and adversely affect our business, financial condition, and results of operations, and the trading price of our common stock. We may be subject to other risks and uncertainties not presently known to us. See "Cautionary Note Regarding Forward-Looking Statements."

Part of our strategy is to continue to expand our sales of Trio® both domestically and internationally. Our expansion efforts may not be successful, which would temper any Trio® sales growth. In addition, it is difficult to determine if or how any expanded international demand and pricing for Trio® will develop. Our international sales often result in lower gross margins than domestic sales due to higher costs. These costs could include higher transportation costs, importation costs, and costs associated with duties, trade requirements, or other import or export control laws and regulations. Also, we could face increased price pressure and competition in some international markets where substitutes are more prevalent. Any of these items could negatively impact our results of operations. In addition, as we expand our international sales program, these sales may occur on an irregular basis, which could cause volatility in our inventories and our results of operations.

International sales could present risks to our business.

As discussed above, we are working to grow our international sales of Trio®.Participating in international markets requires significant resources and management attention and may subject us to economic, regulatory, and political risks that are different from those in the United States. These risks include accounts receivable collection; the need to adapt marketing and sales efforts for specific countries; new and different sources of competition; disputes and losses associated with overseas shipping; tariffs, export controls, and trade duties; additional time and effort to obtain product certifications; adverse tax consequences; restrictions on the transfer of funds; changes in legal and regulatory requirements or import policies; compliance with potentially unfamiliar local laws and customs; and political and economic instability. International sales may also be subject to fluctuations in currency exchange rates, which could increase the price of our products outside the United States and expose us to foreign currency exchange rate risk. Certain international markets require significant time and effort on the part of management to develop relationships and gain market acceptance for our products. Overall, there are additional logistical requirements associated with international sales, which may increase the time between production and our ability to recognize related revenue. Our failure to manage any of these risks successfully could harm our future international operations and our overall business.

Current and future indebtedness could adversely affect our financial condition and impair our ability to operate our business.

We have outstanding $60 million aggregate principal amount of senior notes. We also have an asset-based revolving credit facility that allows us to borrow up to an additional $35 million. We may incur additional indebtedness in the future. The agreements governing the senior notes and credit facility restrict, but do not prohibit, us from incurring additional indebtedness.

Current and future indebtedness could have important consequences, including the following:

it could limit our ability to borrow additional money or sell additional shares of common stock to fund our working capital, capital expenditures, and debt service requirements

it could limit our flexibility in planning for, or reacting to, changes in our business

we could be more highly leveraged than some of our competitors, which could place us at a competitive disadvantage

it could make us more vulnerable to a downturn in our business or the economy

it could require us to dedicate a substantial portion of our cash flows from operations to the repayment of our indebtedness, thereby reducing the availability of our cash flows for other purposes

it could adversely affect our business and financial condition if we default on or are unable to service our indebtedness or are unable to obtain additional financing, as needed

Our debt agreements contain financial and other restrictive covenants. For example, the agreements include financial covenants that require us to maintain a minimum level of adjusted EBITDA (earnings before interest, income taxes, depreciation, amortization, and certain other expenses, as defined under the agreements) and require us to meet specified financial covenants. Also, the interest rates under the notes are adjusted quarterly, and we may be subject to additional interest in the future based on our financial performance and certain financial covenant levels. For more information about these financial covenants, see "Management's Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources."

These covenants could limit our ability to engage in activities that are in our long-term best interests. Our failure to comply with these covenants would result in an event of default that, if not waived, could result in the acceleration of all outstanding indebtedness. The senior notes and credit facility are variously secured by substantially all of our assets. As such, an event of default could also result in our lenders foreclosing on some or all of our assets.

The credit facility expires in 2019 and the senior notes are due in 2020, 2023, and 2025. In June 2017, we entered into an agreement with the holders of the Notes that requires us to prepay $10 million of the Notes, together with accrued interest and a make-whole amount, on or before December 31, 2018. In the future, we may be unable to obtain new financing or refinancing on acceptable terms.

We may not be successful in our efforts to sustain or expand water sales due to the status of our water rights, challenges to our water rights, changes in the demand for water in the areas around our facilities, restrictions on water use, or other events, which could adversely impact our financial condition and results of operations.

We have permitted, licensed, declared and partially adjudicated water rights in New Mexico and Utah under which we sell water primarily for industrial uses such as in the oil and gas services industry. We continue to work to expand sales of water, especially to support oil and gas development in the Permian Basin near our New Mexico facilities. If there are changes in state or federal regulations regarding oil and gas production or water usage, this could materially impact our ability to monetize our water rights. Third parties regularly challenge our applications to the OSE to change our water rights permits so that we are authorized to sell water to oil and gas producers. We may not be successful in these efforts.our efforts to obtain the requisite permit changes. In many cases, sales of water require governmental permits or approvals. A decision to deny, delay, revoke, or modify a permit or approval could prevent us from selling water, or increase the cost to provide water. Third parties may also challengewater, or result in our having to refund prepayments that we have received for future water rights or sales. If oil or gas prices decline, or if oil and gas development in the Permian Basin decreases, or if demand for fresh water in the Permian Basin declines for other reasons, the demand for water under our water rights could be adversely affected. In addition, although we currently expect to incur minimal expenditures associated with water sales, we could be required to expend capital to meet customer needs. Any of these events could adversely impact our financial condition and results of operations.

Water rights in New Mexico are subject to a stated place of withdrawal, purpose and place of use. Some of our water right permits, declarations and licenses were originally issued for uses relating to our mining operations. To sell water under these rights for oil and gas development, we must apply for a permit from the OSE to change the point of diversion, purpose and/or place of use of the underlying water rights. The OSE reviews such applications and makes a determination as to the validity of the right and, will approve the proposed change if it determines the requested change will not impair existing water rights, will not be contrary to the conservation of water within the state, and will not be detrimental to the public welfare of the state. In some situations, the OSE can issue a preliminary authorization for the change, which allows for the proposed change to go into effect immediately while pending further administrative review. Such authorizations for water sales are often subject to repayment if the underlying water rights were ultimately found to be invalid. Third parties may protest an application to change a point of diversion, purpose or place of use or a preliminary authorization at minimal cost and frequently do so. Once protested, an administrative process begins, whereby the OSE will ultimately determine if the subject application or preliminary authorization will impair existing water rights, will be contrary to the conservation of water within the state or will be detrimental to the public welfare of the state. The OSE’s findings can be appealed to a New Mexico district court. A significant portion of our water sales are being made under leases issued by the OSE. Additionally, some of our water rights are permitted water rights for which we still need to provide proof of completion of works and proof of beneficial use to the OSE. Please see Note 14 of the Notes to Consolidated Financial Statements for an update on challenges to our water rights.

We may face political and regulatory issues relating to the potential use of the maximum amount of our rights. Any decrease in our water rights could materially impact our ability to monetize our water rights.

A decline in oil and gas drilling could decrease our revenue.

A portion of our revenue comes from the sale of water, brines, and potassium chloride for use in oil and gas development. We also generate revenue from the sale of caliche, a produced water royalty, and various surface use agreements with operators. A decline in oil and gas drilling, especially in the Permian Basin, could reduce our sales of water, brines, and potassium chloride and result in reduced revenue from our other oilfield related offerings. For example, the decline in oil and gas drilling in 2020 due to restrictions implemented by local, state and federal authorities in response to the COVID-19 pandemic and the resulting impacts of these restrictions on the global economy as a whole, reduced our sales of water, brine, and potassium chloride and revenue for other oilfield related offerings into industrial markets in 2020 and the first quarter of 2021. In addition, oil and gas developers are regularly looking for ways to use more produced water instead of fresh water in oil and gas development and operations. Also, there are other products available that have some of the same clay-inhibiting properties as our potassium chloride. These alternative products could temporarily or permanently replace some of our sales of water or potassium chloride. We also have other oilfield product and service offerings, such as caliche and brine products, the sales of which were negatively impacted by the decline in oil and gas development in 2020, and may be further impacted in the future by declines in oil and gas development.

We may alter or expand our operations or continue to pursue acquisitions, which could adversely affect our business if we are unable to manage any expansion or acquisition effectively.

We are in the process of implementing or considering initiativescontinue to look for opportunities designed to maximize the value of our existing assets, such as through increased production and sales of water, salt, and brine. For example, in 2019 we purchased water and real property assets in southeastern New Mexico, which we refer to as Intrepid South, in an effort to expand our water sales and other revenue from the oil and gas industry. We aremay also exploring ways to potentially monetize the known but small lithium resource in our Wendover ponds. In addition, we may enter into new or complementary businesses that expand our product offerings beyond our existing assets. For example, weassets, which may include leveraging our existing oil and gas businesses in southeast New Mexico and expand into additional

oil naturaland gas or other commodities ormidstream and upstream activities. For instance, as part of this strategy, in May 2020, we acquired an 11% equity stake in the W.D. Von Gonten Laboratories, a global industry leader in drilling and completion chemistry and a strong supporter of the use of potassium chloride in oil and gas drilling and completion activities. We may also expand into new products or services up or down the supply chain in our current industry or newother industries. WeUltimately, we may not be able to successfully implementunsuccessful in implementing any alteration of our activities or expansion initiatives. Further, we may not be able to fully realize any anticipated benefits of these initiatives. Any expansion initiatives may require significant capital investments and those investments may not produce theour expected benefits.returns.

As part of thisour growth strategy, we may consider the acquisition of other companies or assets that complement or expand our business. We may not be able to successfully identify suitable acquisition opportunities, prevail against competing potential acquirers, negotiate appropriate acquisition terms, obtain necessary financing, complete proposed acquisitions, successfully integrate acquired businesses or assets into our existing operations, or expand into new markets. An acquisition may require us to use a significant portion of available cash or may result in significant dilution to our stockholders. We may be required to assume unanticipated liabilities or contingencies as part of an acquisition, or we may face substantial costs, delays, or other problems as part of the integration process. In addition, acquired businesses or assets may not achieve the desired effects or otherwise perform as we expect. We may not realize the synergies that we expect to achieve. Additionally, while we execute these acquisitions and related integration activities, our attention may be diverted from our ongoing operations, which could have a negative impact on our business.

Any of these items could negatively impact our financial condition and results of operations.

AggressiveCompetitors' aggressive pricing or operating strategies by our competitors could adversely affect our sales and results of operations.

The potassium-fertilizer industry is concentrated, with a small number of producers accounting for the majority of global production. Many of these producers have significantly larger operations and more resources than we do. These larger producers may have greater leverage in pricing negotiations with customers and transportation providers. They also have a broader product portfolio, which may allow them to offer rebates or bundle products to offer discounts or incentives to gain a competitive advantage. TheyCompetitors may also be able to mine their potash or langbeinite at a lower cost due to economies of scale or other competitive advantages. In addition, they may decide to pursue aggressive pricing or operating strategies that disrupt the global and U.S. markets. These disruptions could cause lower prices or demand for our product, which would adversely affect our sales and results of operations.

Changes in the agricultural industry could exacerbate the cyclical nature of the prices and demand for our products or adversely affect the markets for our products.

Farmers attempt to apply the optimum amounts of fertilizer to maximize their economic returns. A farmer's decision about the application rate for each fertilizer, or the decision to forgo the application of a fertilizer, particularly potash and Trio®, varies from year to year depending on a number of factors. These factors include crop types, crop prices, weather patterns, fertilizer and other crop input costs, and the level of crop nutrients remaining in the soil following the previous harvest. Farmers are more likely to increase application rates of fertilizers when crop prices are relatively high, fertilizer and other crop input costs are relatively low, or the level of crop nutrients remaining in the soil is relatively low. Conversely, farmers are likely to reduce application of fertilizers when farm economics are weak or declining or the level of crop nutrients remaining in the soil is relatively high. This variability in application rates can impact the cyclical nature of the prices and demand for our products. In addition, farmers may buy and apply potash or Trio® in excess of current crop needs, which results in a build-up of potassium in the soil that can be used by crops in subsequent crop years. If this occurs, demand for our products could be delayed to future periods.

State and federal governmental policies, including farm and ethanol subsidies and commodity support programs, may also influence the number of acres planted, the mix of crops planted, and the use of fertilizers. In addition, there are various city, county, and state initiatives to regulate the use and application of fertilizers due to various environmental concerns. If U.S. agricultural production or fertilizer use decreased significantly due to one or more of these factors, our results of operations could be adversely affected.

The seasonal demand for our products, and the resulting variations in our cash flows from quarter to quarter, could have an adverse effect on our results of operations and working capital requirements.

The fertilizer business is seasonal. With respect to domestic sales, we typically experience increased sales during the North American spring and fall application seasons. The degree of seasonality can change significantly from one year to the next due to weather-related shifts in planting schedules and purchasing patterns. We and our customers generally build inventories during low-demand periods of the year to ensure timely product availability during high-demand periods, resulting in increased working capital requirements just before the start of these seasons. If we are unable to accurately predict the timing of demand for our products due to variations in seasonality from year to year, our results of operations and working capital could be adversely affected. Similarly, if we do not have adequate storage capacity to manage varying inventory needs, we may need to reduce production or lower the price at which we sell product, either of which would adversely affect our results of operations.

In mid-2016, we transitioned our East mine to Trio®-only, resulting in an increased supply of Trio®.Previously, Trio® was supply-constrained, which meant that we did not see as much seasonality with respect to purchases as we did for potash. As purchasers have gained increased confidence in our ability to supply this product closer to the traditional spring application season in the U.S., these purchasers have moved to more of a just-in-time purchasing model. As a result, we now experience more traditional seasonality with respect to our domestic Trio® sales. sales, which exposes us to inventory and demand risks similar to those with respect to our potash.

As noted above, part of our strategy is to expand international sales of We market Trio®.We are currently marketing Trio® into many different parts of in various countries around the world, all of which have different climates and fertilizer-application patterns. As a result, seasonality in our international Trio® sales may develop, which could cause volatility in our results of operations.

Our Trio® profitability could be affected by market entrants or the introduction of langbeinite alternatives.

Langbeinite is produced by us and one other company from a single resource located in Carlsbad, New Mexico. Additional competition in the market for langbeinite and comparable products exists and could increase in the future. Other companies could seek to create and market chemically similar alternatives to langbeinite, some of which could be superior to langbeinite, or less costly to produce. In addition, companies sometimes blend several nutrients to obtain a product with similar

agronomic benefits as langbeinite. The market for langbeinite and our Trio® sales could be affected by the success of these and other products that are competitive with langbeinite, which could adversely affect the viability of our Trio® business and our results of operations and

financial condition. Further, recent increases in the supply of langbeinite by us and the other producer may continue to pressure the sales price of Trio®.

International sales could present risks to our business.

Sales of Trio® into international markets often require more resources and management attention than domestic sales and may subject us to economic, regulatory, and political risks that are different from those in the U.S. These risks include accounts receivable collection; the need to adapt marketing and sales efforts for specific countries; new and different sources of competition; disputes and losses associated with overseas shipping; tariffs, export controls, and trade duties; additional time and effort to obtain product certifications; adverse tax consequences; restrictions on the transfer of funds; changes in legal and regulatory requirements or import policies including sanctions; compliance with potentially unfamiliar local laws and customs; and political and economic instability. International sales may also be subject to fluctuations in currency exchange rates, which could increase the price of our products outside the U.S. and expose us to foreign currency exchange rate risk. Certain international markets require significant time and effort on the part of management to develop relationships and gain market acceptance for our products. Overall, there are additional logistical requirements associated with international sales, which may increase the time between production and our ability to recognize related revenue. Our failure to manage any of these risks successfully could harm our future international operations and our overall business.

If potash or Trio® prices decline, or oil and gas activity declines, we could be required to record additional write-downs of our long-lived and indefinite-lived assets, which could adversely affect our results of operations and financial condition.

We evaluate our long-lived assets for impairment when events or changes in circumstances indicate that the related carrying amount may not be recoverable. Impairment is considered to exist if an asset's total estimated future cash flows on an undiscounted basis are less than the carrying amount of the related asset. An impairment loss is measured and recorded based on the discounted estimated future cash flows. For example,

In 2023, we recorded total impairment charges to our long-lived assets and mineral properties of $43.3 million. We recorded impairment charges of $31.9 million related to our long-lived assets and mineral property assets at our East mine. We determined that sufficient indicators of potential impairment existed because higher Trio® production costs and lower realized Trio® prices led to negative gross margins for our Trio® segment. We also recorded impairment charges of $9.9 million related to our long-lived assets that are in care and maintenance at our West mine, and $1.5 million related to certain assets in our oilfield solutions segment.

We also have certain indefinite-lived intangible assets that we evaluate for impairment at least annually or more frequently when events or changes in circumstances indicate the fair value may have changed. An impairment loss is measured and recorded based on the current fair value of the asset.

After recording impairment charges to our long-lived assets in the fourth quarter of 2015, we recorded impairment charges of approximately $324 million related to our East and West conventional mining facilities, and our North facility in Carlsbad, New Mexico, due to declining potash prices at the time.

Although2023, we believe the carrying values of our long-lived assets and our indefinite-lived intangible assets were realizable as of the balance sheet dates,dates. However, future events could cause us to conclude otherwise. These future events could include further significant and sustained declines in potash or Trio® prices, further significant or sustained declines in water prices and demand, or higher production and operating costs. Further, based on our analysis of the profitability of any of our facilities, we may decide to terminate or suspend operations at additional facilities. These events could require a further write-down of the carrying value of our assets, which would adversely affect our results of operations and financial condition.

If we are required to write down the value of our inventories, our financial condition and results of operations would be adversely affected.

We carry our inventories at the lower of cost or market.net realizable value. In periods when the market prices for our products fall below our cost to produce them and the lower prices are not expected to be temporary, we are required to write down the value of our inventories. Any write-down of our inventory would adversely affect our financial condition and results of operations, possibly materially. We recorded $6.5 million of lower of cost or net realizable value adjustments in 2023, $3.8 million in our Trio® segment, and $2.7 million in our potash segment.

Weakening of foreign currencies against the U.S. dollar could lead to lower domestic potash prices, which would adversely affect our results of operations. Currency fluctuations could cause our results of operations to fluctuate.

The U.S. imports the majority of its potash, including from Canada, Russia and other countries. If the local currencies for foreign suppliers strengthen in comparison to the U.S. dollar, foreign suppliers realize a smaller margin in their local currencies unless they increase their nominal U.S. dollar prices. Strengthening of these local currencies therefore tends to support higher U.S. potash prices as the foreign suppliers attempt to maintain their margins. However, if these local currencies

weaken in comparison to the U.S. dollar, foreign suppliers may lower prices to increase sales volume while again maintaining a margin in their local currency. Changes in the strength of the U.S. dollar compared to other currencies could cause our sales prices and results of operations to decrease or fluctuate significantly.

Our business depends on skilled and experienced workers, and our inability to find and retain quality workers could have an adverse effect on our development and results of operations.

The success of our business depends on our ability to attract and retain skilled managers, engineers, and other workers. At times, we may not be able to find or retain qualified workers. In particular, the labor market around Carlsbad, New Mexico, is competitive and employee turnover is generally high. In that market, we compete for experienced workers with several other employers, including natural resource and hazardous waste facilities, oil and gas producers, and another producer of langbeinite. If we are unable to attract and retain quality workers, the development and growth of our business could suffer, or we could be required to raise wages to keep our employees, hire less qualified workers, or incur higher training costs. These risks may be exacerbated in times when we need to reduce our workforce due to economic conditions. The occurrence of any of these events could have an adverse effect on our results of operations. For example, in mid-2016, we idled our West mine and transitioned our East mine to Trio®-only, resulting in our laying off a significant number of skilled employees in New Mexico. This may make it more difficult for us to re-hire skilled employees in the future.

Increases in the prices of energy and other important materials used in our business, or disruptions to their supply, could adversely impact our sales, results of operations, or financial condition.

Natural gas, electricity, chemicals, diesel, and gasoline are key materials that we purchase and use in the production of our products. The prices of these commodities are volatile.

Our sales and profitability are impacted by the price and availability of these materials. A significant increase in the price of these materials that is not recovered through an increase in the price of our products, or an extended interruption in the supply of these materials to our production facilities, could adversely affect our results of operations or financial condition. In addition, high natural gas or other fuel costs could increase input costs for end-users of our products, which could cause them to spend less on our products.

Increased costs could affect our per-ton profitability.

A substantial portion of our operating costs is comprised of fixed costs that do not vary based on production levels. These fixed costs include labor and benefits, base energy usage, property taxes, insurance, maintenance expenditures, and depreciation. Any increase in fixed costs or decrease in production generally increases our per-ton costs and correspondingly decreases our per-ton operating margin. We operate our East Plant at less than full capacity in order to curtail our Trio® production to match expected demand and manage inventory levels. A significant increase in costs at any of our facilities could have an adverse effect on our profitability and cash flows, particularly during periods of lower potash and Trio® prices.

A shortage of railcars or trucks for transporting our products, increased transit times, or interruptions in railcar or truck transportation could result in customer dissatisfaction, loss of sales, higher transportation or equipment costs, or disruptions in production.

We rely heavily upon truck and rail transportation to deliver our products to our customers. In addition, the cost of transportation is an important component of the price of our products. A shortage of trucks or railcars for carrying product or increased transit times due to accidents, highway or railway disruptions, congestion, high or compressed demand, labor disputes, adverse weather, natural disasters, changes to transportation systems, or other events could prevent us from making timely delivery to our customers or lead to higher transportation costs. As a result, we could experience customer dissatisfaction or a loss of sales. Similarly, disruption within the steady decreases intransportation systems could negatively affect our average net realized sales price per ton duringability to obtain the year ended December 31, 2017, we recorded lower-of-cost-or-market adjustments totaling $7.3 million.supplies and equipment necessary to produce our products. We may also have difficulty obtaining access to vessels to deliver our products to overseas customers.

TheWe rely on our management personnel for the development and execution of strategic projectsour business strategy, and the loss of one or more members of our management team could requireharm our business.

Our management personnel have significant relevant industry and company-specific experience. Our senior management team has developed and implemented first-of-their-kind processes and other innovative ideas that are important to our business. If we are unable to retain these individuals, our operations could be disrupted and we may be unable to achieve our business strategies and grow effectively. We do not currently maintain "key person" life insurance on any of our management personnel.

We have less product diversification than nearly all of our competitors, which could have an adverse effect on our financial condition and results of operations.

A significant portion of our revenue comes from the sale of potash and langbeinite, whereas nearly all of our competitors are diversified, primarily into nitrogen- or phosphate-based fertilizer businesses or other chemical or industrial businesses. In addition, a majority of our sales are to customers in the U.S., and generally these customers are concentrated in key geographies where we have a freight advantage. As a result, we could be impacted more time and moneyacutely by factors affecting our industry or the regions in which we operate than we expect,would if our business was more diversified and our sales more global. A decrease in the demand for potash and langbeinite would have an adverse effect on our financial condition and results of operations. Similarly, in periods when production exceeds demand, the price at which couldwe sell our potash and langbeinite and our sales volumes would likely fall, which would adversely affect our results of operations and financial condition.condition more than our diversified competitors.

Heavy precipitation or low evaporation rates at our solar solution mines could impact our potash production at those facilities, which could adversely affect our sales and results of operations.

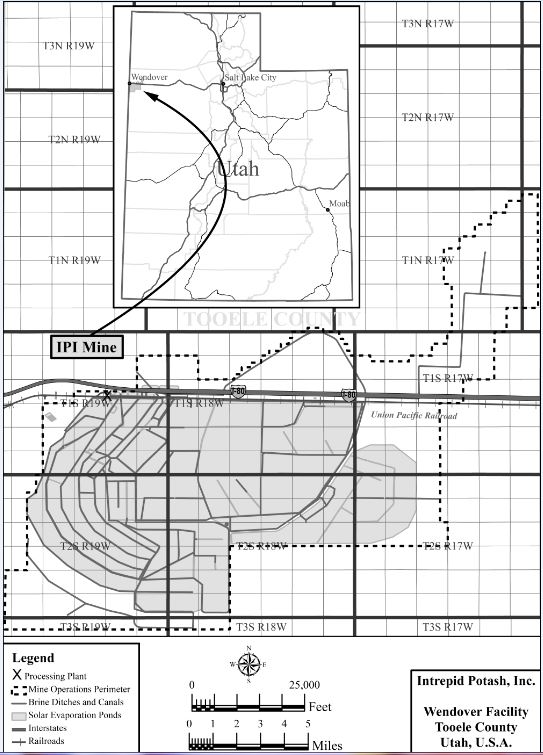

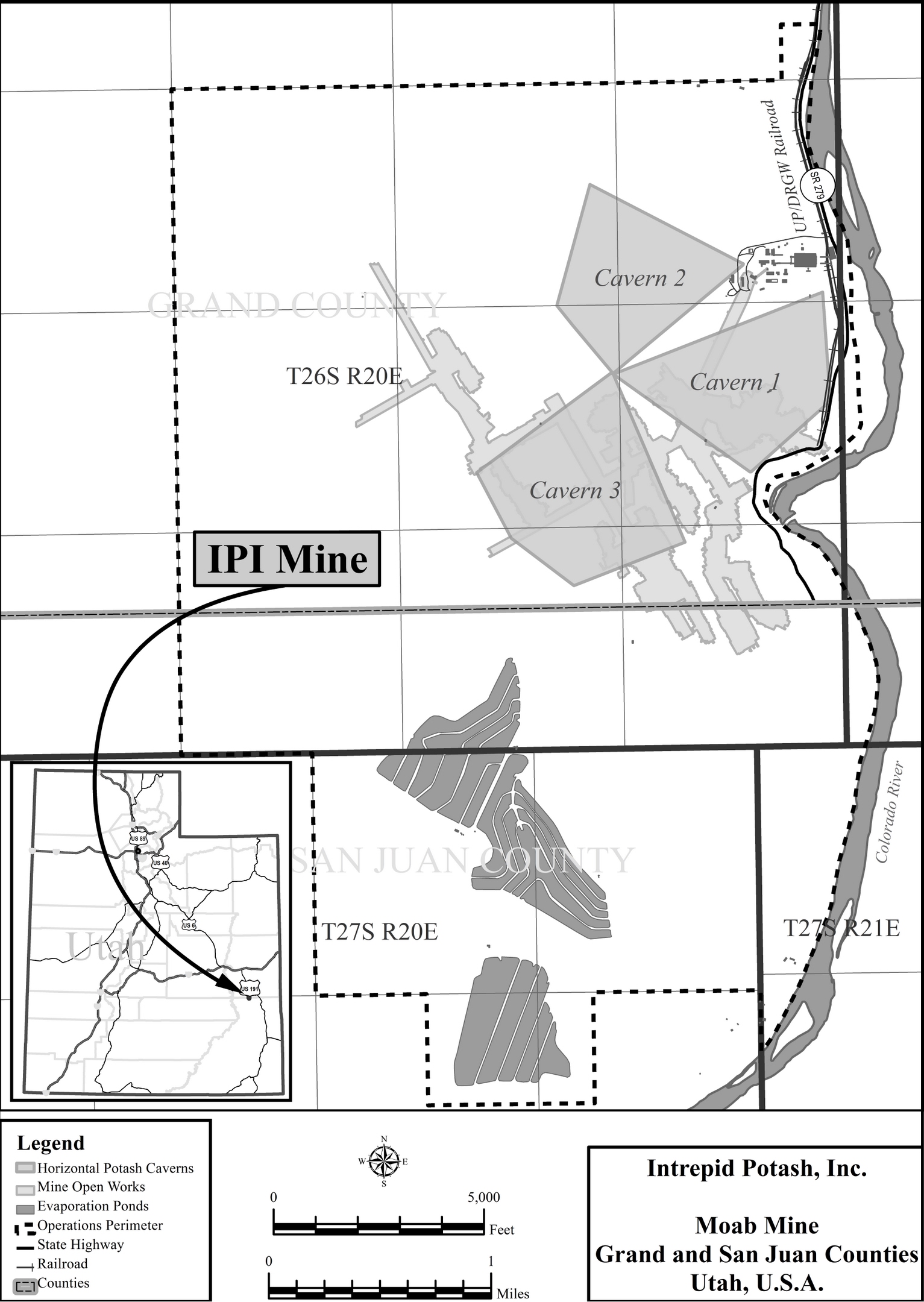

All of our potash production comes from our solar solution mines. These facilities use solar evaporation ponds to form potash crystals from brines. Weather conditions at these facilities could negatively impact potash production. For example, heavy rainfall in September and October, just after the evaporation season ends, can reduce the amount of potash we produce in that year or the following year by causing the potash crystals to dissolve and consume pond capacity. Similarly, lower‑than‑average temperatures or higher-than-average seasonal rainfall would reduce evaporation rates and therefore impact production. We experienced significant rainfall in the summer of 2019 at our Wendover facility which reduced the product available for sale in 2020. Similarly, our HB facility experienced a higher-than-average seasonal rainfall in the summer of 2021, which led to fewer tons available for sale in the second half of 2021 and in the spring of 2022. If we experience heavy rainfall or low evaporation rates at any of our solar solution mines, we would have less potash available for sale, and our sales and results of operations would be adversely affected. Reduced potash available for sale could also affect our ability to produce and sell byproducts such as salt and magnesium chloride.

Inflows of water into our langbeinite mine from heavy rainfall or groundwater could result in increased costs and production downtime and could require us to abandon the mine, any of which could adversely affect our results of operations.

Major weather events such as heavy rainfall can result in water inflows into our underground, langbeinite mine. The presence of water-bearing strata in many underground mines carries the risk of water inflows into the mines. If we experience water inflows at our langbeinite mine, our employees could be injured and our equipment and mine shafts could be seriously damaged. We could be forced to shut down the mine temporarily, potentially resulting in significant production delays, and we could spend substantial funds to repair or replace damaged equipment. Inflows may also destabilize the mine shafts over time, resulting in safety hazards for employees and potentially leading to the permanent abandonment of the mine.

A significant disruption to our information technology systems could adversely affect our business and operating results.

We rely on a variety of information technology and automated operating systems to manage or support our operations. We depend on our information technology systems for a variety of functions, including, but not limited to, financial reporting, inventory management, procurement, invoicing and email. We also have access to, and we create and store, sensitive data, including our proprietary business information and that of our customers, and personally identifiable information of our employees. The proper functioning of these systems and the security of this data is critical to the efficient operation and management of our business. In addition, these systems could require modifications or upgrades as a result of technological changes or growth in our business. These changes could be costly and disruptive to our operations and could impose substantial demands on management time. Our systems, and those of third-party providers, also could be vulnerable to damage or disruption caused by catastrophic events, power outages, natural disasters, computer system or network failures, viruses or malware, physical or electronic break-ins, unauthorized access, and cyber-attacks. Although we take steps to secure our systems and electronic information, these cybersecurity measures may not be adequate. Any security breaches could compromise our networks and the information stored on them could be improperly accessed, disclosed, lost or stolen. Any such access, disclosure or other loss of information could disrupt our operations and the services we provide to customers, damage our reputation or our relationships with our customers or result in legal claims or proceedings, any of which could adversely affect our business, reputation, and operating results.

Our business may be adversely affected by union activities.

Hourly employees at our Wendover facility are represented by a labor union. These employees represent approximately 9% of our total workforce. Our current collective bargaining agreement with the union, which became effective on June 1, 2023, expires on May 31, 2026. Although we believe that our relations with our unionized employees are good, we may not be successful in negotiating a new collective bargaining agreement as a result of general economic, financial,

competitive, legislative, political, and other factors beyond our control. Any new agreement could result in a significant increase in our labor costs. In addition, a breakdown in negotiations or failure to timely enter into a new collective bargaining agreement could materially disrupt our Wendover operations.

From time to time, we invest in strategic projects. The completion of these projectsefforts have been made to unionize employees at our other facilities. Additional unionization efforts could require significantly more time and money than we expect. In some cases, the constructiondisrupt our business, consume management attention, or commissioning processes could force us to slow or shut down normal operations at the affected facility for a period of time, which would cause lower production volume and higher production costs per ton.increase our operating costs. In addition, if these efforts were successful, we could experience increased labor costs, an increased risk of work stoppages, and limits on our management teamflexibility to run our business in the most efficient manner to remain competitive.

Risks Related to Our Industry

Changes in the agricultural industry could exacerbate the cyclical nature of the prices and demand for our products or adversely affect the markets for our products.

Farmers attempt to apply the optimum amounts of fertilizer to maximize their economic returns. A farmer's decision about the application rate for each fertilizer, or the decision to forgo the application of a fertilizer, particularly potash and Trio®, varies from year to year depending on several factors. These factors include crop types, crop prices, weather patterns, fertilizer and other employeescrop input costs, and the level of crop nutrients remaining in the soil following the previous harvest. Farmers are more likely to increase application rates of fertilizers when crop prices are relatively high, fertilizer and other crop input costs are relatively low, or the level of crop nutrients remaining in the soil is relatively low. Conversely, farmers are likely to reduce application of fertilizers when farm economics are weak or declining or the level of crop nutrients remaining in the soil is relatively high. This variability in application rates can impact the cyclical nature of the prices and demand for our products. In addition, farmers may buy and apply potash or Trio® in excess of current crop needs, which results in a build-up of potassium in the soil that can be requiredused by crops in subsequent crop years. If this occurs, demand for our products could be delayed to spend a significant amountfuture periods.

State and federal governmental policies, including farm and ethanol subsidies and commodity support programs, may also influence the number of time addressing strategic projects, which could mean that our normal operations receive less timeacres planted, the mix of crops planted, and attention.

Wethe use of fertilizers. In addition, there are considering potential long-term opportunities for revenuevarious city, county, and strategic growth, including additional solution mining relatedstate initiatives to our HB mine. These potential projects are at an early stage,regulate the use and we may not proceed with anyapplication of them. Even if we proceed withfertilizers due to various environmental concerns. If U.S. agricultural production or fertilizer use decreases significantly due to one or more of these or other strategic projects, we may not realize the expected benefits despite substantial investments, they may cost significantly more than we expect, or we may encounter additional risks that we did not initially expect.factors, our results of operations could be adversely affected.

Mining is a complex process that frequently experiences production disruptions, which could adversely affect our results of operations.

The process of mining is complex. Production delays can occur due to equipment failures, unusual or unexpected geological conditions, environmental hazards, acts of nature, and other unexpected events or problems. Furthermore, production is dependent upon the maintenance and geotechnical structural integrity of our tailings and storage ponds. The amounts that we are required to spend on maintenance and repairs may be significant.

Our East mine, surface, and support facilities are greater thanover 50 years old. As mining progresses at an underground mine, operations typically move further away from the shafts and, despite modernization through sustaining capital, fixed assets may require increased repair or refurbishment. These conditions increase the exposure to higher operating costs or the increased probability of incidents.

Mining is aan inherently hazardous process,industry, and accidents could result in significant costs or production delays.

The process of miningMining is hazardous and involves various risks and hazards that can result in serious accidents. If accidents or unforeseen events occur, or if our safety procedures are not effective,followed or are ineffective, we could be subject to liabilities arising out of personal injuries or death, our operations could be interrupted, or we could be required to shut down or abandon affected facilities. Accidents could cause us to expend significant amounts to remediate safety issues or repair damaged facilities.

Existing or expanded oil and gas development near our mines could result in methane gas leaking from an oil and gas well into our mines. We test our mines regularly for methane gas. However, unlikeUnlike coal mines, our mines are not constructed or equipped to deal with methane gas. Any intrusion of methane gas into our mines could cause a fire or an explosion resulting in loss of life or significant property damage or could require the suspension of all mining operations until the completion of extensive modifications and re-equipping of the mine. The costs of modifying our mines and equipment could make it uneconomical to reopen our mines. You can find more information about the co-development of potash and oil and gas resources near our New Mexico facilities under the risk factor below entitled "Existing-Existing and further oil and gas development in the Designated Potash Area could impair our potash reserves, which could adversely affect our financial condition or results of operations."

The grade of ore that we mine could vary from our projections due to the complex geology and mineralogy of our reserves, which could adversely affect our production and our results of operations.

Ore bodies have complex geology. Our production is affected by the mineral content and other mineralogy of the ore. Our projections of ore grade may not be accurate. There are numerous uncertainties inherent in estimating ore grade, including many factors beyond our control. As the grade of our remaining ore reserves decreases over time, we need to process more ore to produce the same amount of saleable-grade product, increasing our costs and slowing our production. In addition, there are few opportunities to acquire more reserves in the areas around our current operations. If we are unable to process more ore to maintain current production levels, if the processing of more ore materially increases our costs, or if our ore grade projections are not accurate, our results of operations would be adversely affected.

If the assumptions underlying our reserve estimates are inaccurate or if future events cause us to negatively adjust our previous assumptions, the quantities and value of our reserves, and in turn our financial condition and results of operations, could be adversely affected.

There are numerous uncertainties inherent in estimating our potash and langbeinite reserves. As a result, our reserve estimates necessarily depend upon a number ofseveral assumptions, including the following:

•geologic and mining conditions, which may not be fully identified by available exploration data and may differ from our experiences in areas where we currently mine or operateoperate;

| |

• | future potash and Trio® prices, operating costs, capital expenditures, royalties, severance and excise taxes, and development and reclamation costs

|

•future potash and Trio® prices, operating costs, capital expenditures, royalties, severance and excise taxes, and development and reclamation costs;

•future mining technology improvementsimprovements;

•the effects of governmental regulationregulation; and

•variations in mineralogymineralogy.

In addition, because reserves are estimates built on various assumptions, they cannot be audited for the purpose of verifying exactness. It is only after extraction that reserve estimates can be compared to actual values to adjust estimates of the remaining reserves. If any of the assumptions that we make in connection with our reserve estimates are incorrect, the amounts of potash and langbeinite that we are able tocan economically recover from our mines could be significantly lower than our reserve estimates. In addition, we periodically review the assumptions underlying our reserve estimates. If future events cause us to negatively adjust our previous assumptions, our reserve estimates could be adversely affected. In any of these events, our financial condition and results of operations could be adversely affected.

WeakeningWe updated our mineral reserves and resources as of foreign currencies againstDecember 31, 2023, and we determined we do not have any mineral reserves at our East facility because the U.S. dollarmineral deposit could lead to lower domestic potash prices, which would adversely affect our results of operations. Currency fluctuations could cause our results of operations to fluctuate.

The U.S. imports the majority of its potash, including from Canada, Russia, and Belarus. If the local currencies for foreign suppliers strengthen in comparison to the U.S. dollar, foreign suppliers realize a smaller margin in their local currencies unless they increase their nominal U.S. dollar prices. Strengthening of these local currencies therefore tends to support higher U.S. potash prices as the foreign suppliers attempt to maintain their margins. However, if these local currencies weaken in comparison to the U.S. dollar, foreign suppliers may lower prices to increase sales volume while again maintaining a margin in their local currency. Currently, the U.S. dollar is still relatively strong in comparison to many foreign currencies, which has led to increased imports into the U.S. These activities could cause our sales prices and results of operations to decrease or fluctuate significantly.

Adverse conditions in the global economy and disruptions in the financial markets could negatively affect our results of operations and financial condition.

Global economic volatility and uncertainty can create uncertainty for farmers and customers in the geographic areas where we sell our products. If farmers reduce, delay, or forgo their potash and Trio® purchases due to this uncertainty, our results of operations would be adversely affected. Moreover, volatility and disruptions in the financial markets could limit our

customers' ability to obtain adequate financing or credit to purchase and pay for our products, which would decrease our sales volume. Changes in governmental banking, monetary, and fiscal policies to restore liquidity and increase credit availability may not be effective. It is difficult to determine the extent of economic and financial market problems and the many ways in which they could negatively affect our customers and business. In addition, if we are required to raise additional capital or obtain additional credit during an economic downturn, we could be unable to do so on favorable terms or at all.

Changes in laws and regulations affecting our business, or changes in enforcement practices, could have an adverse effect on our financial condition or results of operations.

We are subject to numerous federal and state laws and regulations covering a wide variety of business practices. Changes in these laws or regulations could require us to modify our operations, objectives, or reporting practices in ways that adversely impact our financial condition or results of operations. In addition, new laws and regulations, or new interpretations of or enforcement practices with respect to existing laws and regulations, could similarly impact our business.

For example, we are subject to significant regulation under MSHA and OSHA. High-profile mining accidents could prompt governmental authorities to enact new laws and regulations that apply to our operations or to more strictly enforce existing laws and regulations.

Physical effects of climate change, and climate change legislation, could have a negative effect on our operations and results of operations.

The physical effects of climate change could have an adverse effect on us and our customers. These effects could include changes in weather patterns including drought and rainfall levels, water availability, storm patterns and intensities, and temperature levels. These changes could have an adverse effect on our costs, production, or sales, especially with respect to our solar operations. These changes could also have an adverse effect on our agricultural customers, which in turn could reduce the demand or price for our products.

In addition, federal and state legislators and regulators regularly consider ways to mitigate climate change. Any new rules could have a significant impact on our operations and products and could result in substantial additional costs for us.

Our business depends on skilled and experienced workers, and our inability to find and retain quality workers could have an adverse effect on our development and results of operations.

The success of our business depends on our ability to attract and retain skilled managers, engineers, and other workers. At times, we may not be able to find or retain qualified workers. In particular, the labor market around Carlsbad, New Mexico, is competitive and employee turnover is generally high. In that market, we compete for experienced workers with several other employers, including natural resource and hazardous waste facilities, oil fields, and another producer of langbeinite. If we are not able to attract and retain quality workers, the development of our business could suffer or we could be required to raise wages to keep our employees, hire less qualified workers, or incur higher training costs. These risks may be exacerbated in times when we need to reduce our workforce due to economic conditions, such as in 2016. The occurrence of any of these events could have an adverse effect on our results of operations. For example, in mid-2016, we idled our West mine and transitioned it into care-and-maintenance mode and transitioned our East mine to Trio®-only, resulting in our laying off a significant number of skilled employees in New Mexico. This may make it more difficult for us to re-hire skilled employees in the future.

Changes in the prices of energy and other important materials used in our business, or disruptions to their supply, could adversely impact our sales, results of operations, or financial condition.

Natural gas, electricity, chemicals, diesel, and gasoline are key materials that we purchase and use in the production of our products. The prices of these commodities are volatile.

Our sales and profitability are impacted by the price and availability of these materials. A significant increase in the price of these materials that is not recovered through an increase in the price of our products, or an extended interruption in the supply of these materials to our production facilities, could adversely affect our results of operations or financial condition. In addition, high natural gas or other fuel costs could increase input costs for end-users of our products, which could cause them to spend less on our products.

A decline in oil and gas drilling or a reduction in the use of potash in drilling fluids could increase our operating costs and decrease our revenue.

A portion of our revenue comes from the sale of potassium chloride for use in oil and gas drilling fluids. A decline in oil and gas drilling, especially in the areas around our production facilities, could reduce our sales into this industrial market. In addition, alternative products that have some of the same clay-inhibiting properties as potash are commercially available. These alternative products could temporarily or permanently replace some of our sales into the industrial market, where our average

net realized sales price per ton is higher than it is for the agricultural market. If a significant amount of our sales shift from the industrial market to the agricultural market due to any of these factors, our revenue could decline and shipping costs could increase to reach these markets.

Increased costs could affect our per-ton profitability.

A substantial portion of our operating costs is comprised of fixed costs that do not vary based on production levels. These fixed costs include labor and benefits, base energy usage, property taxes, insurance, maintenance expenditures, and depreciation. Any increase in fixed costs or decrease in production generally increases our per-ton costs and correspondingly decreases our per-ton operating margin. Beginning in December 2016, we curtailed our Trio® production to match expected demand and manage inventory levels. A significant increase in costs at any of our facilities could have an adverse effect on our profitability and cash flows, particularly during periods of lower potash and Trio® prices.

A shortage of railcars or trucks for transporting our products, increased transit times, or interruptions in railcar or truck transportation could result in customer dissatisfaction, loss of sales, higher transportation or equipment costs, or disruptions in production.

We rely heavily upon truck and rail transportation to deliver our products to our customers. In addition, the cost of transportation is an important component of the price of our products. A shortage of trucks or railcars for carrying product or increased transit times due to accidents, highway or railway disruptions, congestion, high or compressed demand, labor disputes, adverse weather, natural disasters, changes to transportation systems, or other events could prevent us from making timely delivery to our customers or lead to higher transportation costs. As a result, we could experience customer dissatisfaction or a loss of sales. Similarly, disruption within the transportation systems could negatively affect our ability to obtain the supplies and equipment necessary to produce our products. We may also have difficulty obtaining access to ships to deliver our products to overseas customers.

We rely on our management personnel for the development and execution of our business strategy, and the loss of one or more members of our management team could harm our business.

Our management personnel have significant relevant industry and company-specific experience. Our senior management team has developed and implemented first-of-their-kind processes and other innovative ideas that are important to our business. If we are unable to retain these individuals, our operations could be disrupted and we may be unable to achieve our business strategies and grow effectively. We do not currently maintain "key person" life insurance on any of our management personnel.economically extracted.

Existing and further oil and gas development in the Designated Potash Area could impair our potash reserves, which could adversely affect our financial condition or results of operations.

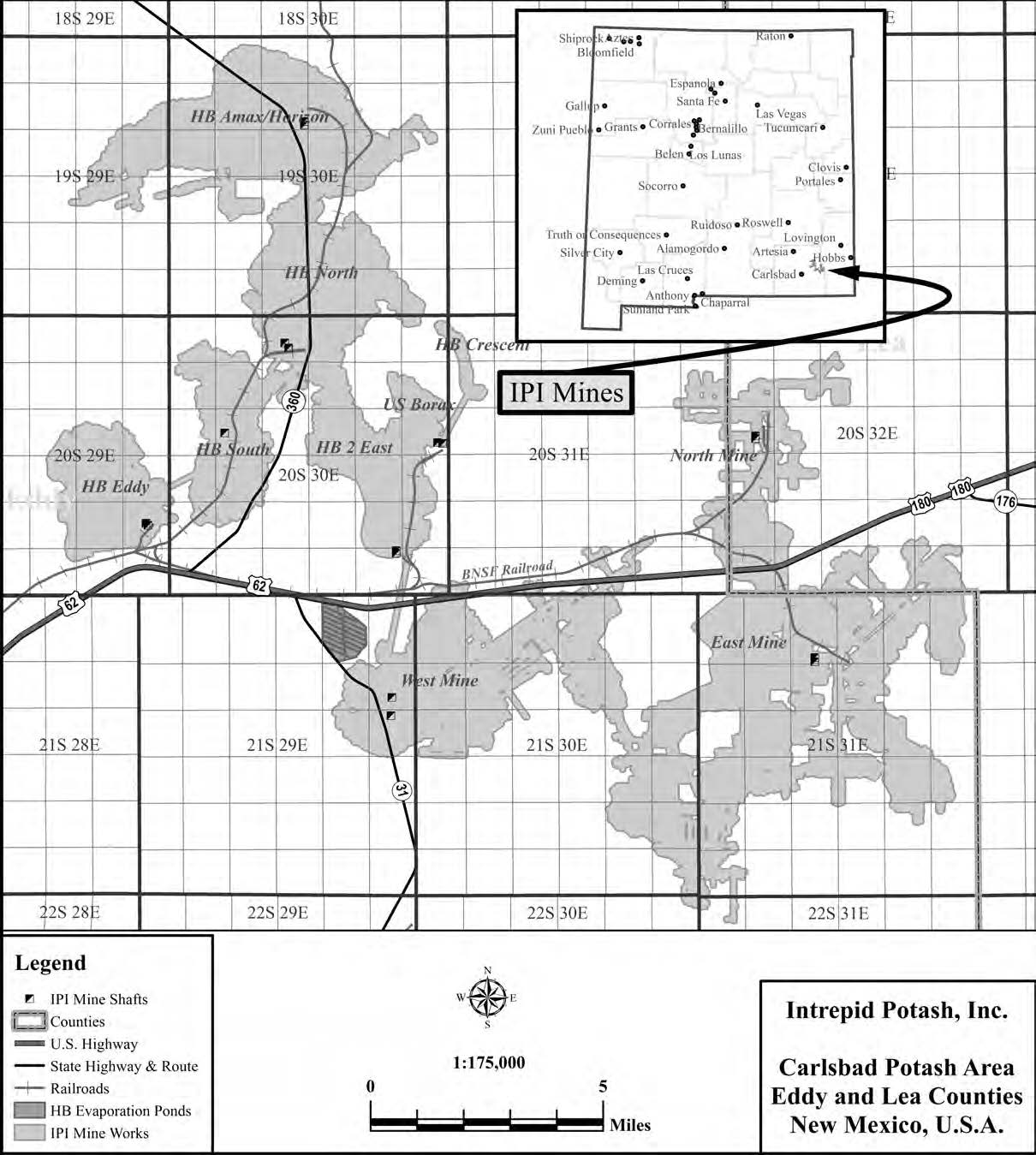

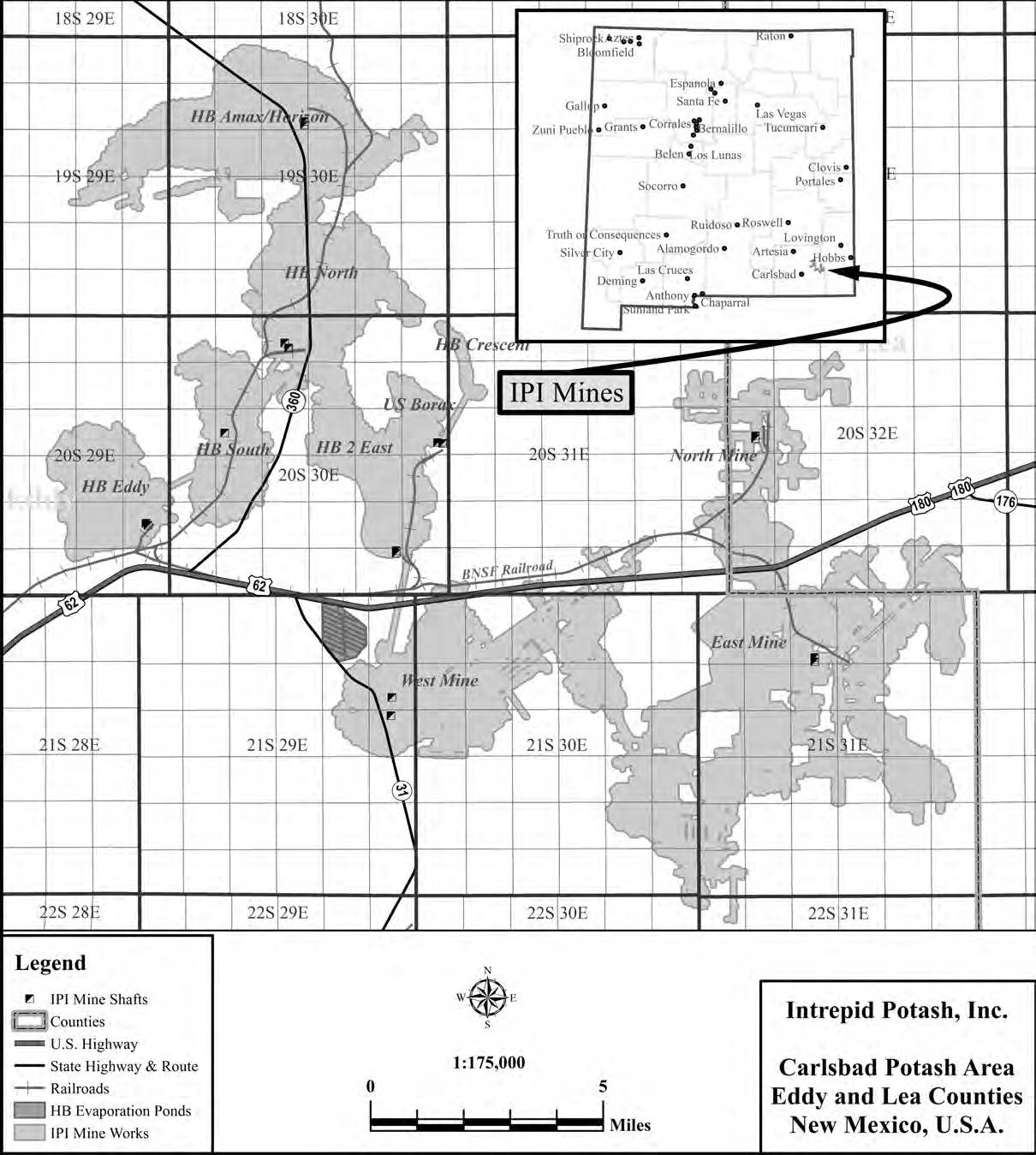

The U.S. Department of the Interior ("DOI") regulates the developmentco-development of federal mineral resources-both potash and oil and gas-on federal lands in what the DOI has designated as the Designated Potash Area. This 497,000-acre region outside of Carlsbad, New Mexico, includes all of our New Mexico operations and facilities. In 2012, the U.S. Department of the InteriorDOI issued an updated order that provides guidance to the U.S. Bureau of Land Management ("BLM")BLM and industry on the co-development of these resources. See Order 3324 issued by the Secretary of the Interior on December 4, 2012 ("2012 Secretary's Order").

It is possible that oil and gas drilling in this areathe Designated Potash Area could limit our ability to mine valuable potash and langbeinite reserves or mineralized deposits because of setbacks from oil and gas wells and the establishment of unminable buffer areas around oil or gas wells. It is also possible that the BLM could determine that the size of these unminable buffer areas should be larger than they are currently, which could impact our ability to mine our reserves. We review applications for permits to drill oil and gas wells as they are publicly disclosed by the BLM and the State of New Mexico. When appropriate, we protest applications for drilling permits that we believe should not be drilled consistent with the operative federal and state rules and that could impair our ability to mine our reserves or put at risk the safety of our employees. We may not prevail in these protests or be able to prevent wells from being drilled in the vicinity of our reserves. If, notwithstanding our protests and appeals, a sufficient number of wells are drilled through or near our reserves, our reserves could be significantly impaired, which could adversely affect our financial condition or results of operations.

The mining business is capital intensive and our inability to fund necessary or desirable capital expenditures could have an adverse effect on our growth and profitability.

The mining business is capital intensive. We may find it necessary or desirable to make significant capital expenditures in the future to sustain or expand our existing operations and may not have, or have access to, the financial resources to pursue these expenditures. If costs associated with capital expenditures increase or if our earnings decrease significantly or we do not have access to the capital markets, we could have difficulty funding any necessary or desirable capital expenditures at an acceptable rate or at all. This could limit the expansion of our production or make it difficult for us to sustain

our existing operations at optimal levels. Increased costs for capital expenditures could also have an adverse effect on the profitability of our existing operations and returns from our most recent strategic projects.

Risks Related to Financial Position, Indebtedness and Additional Capital Needs

The execution of strategic projects could require more time and money than we expect, which could adversely affect our results of operations and financial condition.

From time to time, we invest in strategic projects. The completion of these projects could require significantly more time and money than we expect. In some cases, the construction or commissioning processes could force us to slow or shut down normal operations at the affected facility for a period of time, which would cause lower production volume and higher production costs per ton. In addition, our management team and other employees may be required to spend a significant amount of time addressing strategic projects, which could mean that our normal operations receive less time and attention. As we proceed with one or more of these strategic projects, we may not realize the expected benefits despite substantial investments, they may cost significantly more than we expect, or we may encounter additional risks that we did not initially anticipate.

Future indebtedness could adversely affect our financial condition and impair our ability to operate our business.

As of December 31, 2023, we had $4 million in outstanding borrowings under a revolving credit facility that allows us to borrow up to $150 million. This credit facility expires in 2027. In the future, we may be unable to obtain new financing or refinancing on acceptable terms, or at all. In addition, we may incur additional indebtedness in the future. The agreements governing the credit facility restrict, but do not prohibit, us from incurring additional indebtedness.

Future indebtedness could have important consequences, including the following:

•limiting our ability to borrow additional money or sell additional shares of common stock to fund our working capital, capital expenditures, and debt service requirements;

•limiting our flexibility in planning for, or reacting to, changes in our business;

•being more highly leveraged than some of our competitors, which could place us at a competitive disadvantage;

•being vulnerable to a downturn in our business or the economy;

•requiring us to dedicate a substantial portion of our cash flows from operations to the repayment of our indebtedness, thereby reducing the availability of our cash flows for other purposes; and

•adversely affecting our business and financial condition if we default on or are unable to service our indebtedness, are unable to refinance such indebtedness on favorable terms or are unable to obtain additional financing, as needed.

Our debt agreement contains financial and other restrictive covenants. For example, the agreement includes financial covenants that require us to maintain a maximum leverage ratio (as these ratios are defined under the agreement). For more information about financial covenants, see Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources."

These covenants could limit our ability to engage in activities that are in our long-term best interests. Our failure to comply with these covenants would result in an event of default that, if not waived, could result in the acceleration of all outstanding indebtedness. The credit facility is secured by substantially all of our assets. As such, an event of default could also result in our lenders foreclosing on some or all of our assets.

Adverse conditions in the domestic and global economy and disruptions in the financial markets could negatively affect our results of operations and financial condition.

Global and domestic economic volatility and uncertainty, for example, as a result of rising interest rates, a recession or fear of a recession, global trade uncertainties, international conflicts, epidemics or other significant health concerns, and inflation, can create uncertainty for farmers and customers in the geographic areas where we sell our products. If farmers reduce, delay, or forgo their potash and Trio® purchases because of economic volatility or uncertainties the results of our operations would be adversely affected. Moreover, volatility and disruptions in the financial markets could limit our customers' ability to obtain adequate financing or credit to purchase and pay for our products, which would decrease our sales volume and increase our risk of non-payment by customers. Changes in governmental banking, monetary, and fiscal policies to restore liquidity and increase credit availability may not be effective. It is difficult to determine the extent of economic and financial market problems and the many ways in which they could negatively affect our customers and business. In addition, if we are required to raise additional capital or obtain additional credit during an economic downturn, we could be unable to do so on favorable terms or at all.

Market upheavals due to military actions, pandemics, terrorist attacks, other catastrophic events, or economic repercussions from those events could reduce our sales or increase our costs.

Actual or threatened armed conflicts, terrorist attacks, military or trade disruptions, or other catastrophic events, including pandemics and other public health crises, affecting the areas where we or our competitors do business could disrupt the global market for potassium-based products. As a result, our competitors may increase their sales efforts in our geographic markets and pricing of our products could suffer. If this occurs, we could lose sales to our competitors or be forced to lower our prices. In addition, due to concerns related to terrorism or the potential use of certain fertilizers as explosives, local, state, and federal governments could implement new regulations impacting the production, transportation, sale, or use of potassium-based products. These new regulations could result in lower sales or higher costs.

The loss or substantial decline in revenue from larger customers or certain industries could have a material adverse effect on our revenues, profitability, and liquidity.

Despite diversification across multiple industries, including agricultural, industrial, and feed, larger customers, at times, comprise a significant portion of our sales revenue. For example, in 2023, one customer in our potash and Trio® segments accounted for approximately 12%, or $33.4 million, of our total consolidated revenues. In 2022, this same customer accounted for approximately 10%, or $35.0 million of our total consolidated revenues. If we experience a significant decline in sales from our larger customers or in certain industries, it may be difficult to replace those sales which could have a material effect on our results of operations.

Risks Related to Compliance, Regulatory and Legal Issues

Changes in laws and regulations affecting our business, or changes in enforcement practices, could adversely affect our financial condition or results of operations.

We are subject to numerous federal, state and local laws and regulations covering a wide variety of business practices. Changes in these laws or regulations could require us to modify our operations, objectives, or reporting practices in ways that adversely impact our financial condition or results of operations. In addition, new laws and regulations, including economic sanctions, or new interpretations of or enforcement practices with respect to existing laws and regulations, could similarly impact our business.

For example, we are subject to significant regulation under MSHA and OSHA. High-profile mining accidents could prompt governmental authorities to enact new laws and regulations that apply to our operations or to more strictly enforce existing laws and regulations. See also “Environmental laws and regulations could subject us to significant liability and require us to incur additional costs.”

If we are unable to obtain and maintain the required permits, governmental approvals, and leases necessary for our operations, our business could be adversely affected.

We hold numerous environmental, mining, safety, and other permits and governmental approvals authorizing and regulating the operations at each of our facilities. AAn agency's decision by a governmental agency to deny or delay a new or renewed permit or approval, or to revoke or substantially modify an existing permit or approval, could prevent or limit us from continuing our operations at the affected facility, which could have an adverse effect on our business, financial condition, and results of operations. In addition, we could be required to expend significant amounts to obtain, or come into compliance with, these permits, approvals, and leases, or we could be required to make significant capital investments to modify or suspend our operations at one or more of our facilities.

Any expansion of our existing operations would require us to secure the necessary environmental and other permits and approvals. We may not be able to obtain these permits and approvals in a timely manner or at all. In addition, under certain circumstances, the federal government must consider and study a project's likely environmental impacts. Based on the federal government's conclusion,evaluation, it could require an environmental assessment or an environmental impact statement as a condition of approvingin order to approve a project or permit, which could result in significant time delays and costs. Furthermore, many of our operations take placeoccur on land that is leased from federal and state governmentalgovernment authorities. Expansion of our existing operations could require securing additional federal and state leases. We may not be able to obtain or renew these leases on favorable terms or at all. In addition, our existing leases generally require us to commence mining operations within a specified time frame and to continue mining in order to retain the lease. The loss or non-renewal of a lease could adversely affect our ability to mine the associated reserves.

Also, certain of our existing leases require us to make royalty payments based on the revenue generated by the potash, langbeinite, water, or by-productsbyproducts that we produceextract from the leased land. The royalty rates are subject to change whenever we renew our leases, which could lead to significant increases in these rates. As of December 31, 2017,2023 approximately 22%17% of our state, federal and federalprivate lease acres at our New Mexico facilities (including leases at the HB and North mines) and 0.2%22% of our state and federal lease acres at our Utah operations will be up for renewal within the next five years. Increases in royalty rates would reduce our profit margins and, if the increases were significant, would adversely affect our results of operations.

We have less product diversification than nearly all Reporting of our competitors, which could have an adverse effect on our financial condition and results of operations.

A significant portion of our revenue comes from the sale of potash and langbeinite, whereas nearly all of our competitors are diversified, primarily into nitrogen- or phosphate-based fertilizer businesses or other chemical or industrial businesses. In addition, a majority of our sales are to customers in the U.S., and generally these customers are concentrated in key geographies where we have a freight advantage. As a result, we could be impacted more acutely by factors affecting our industry or the regions in which we operate than we would if our business was more diversified and our sales more global. A decrease in the demand for potash and langbeinite would have an adverse effect on our financial condition and results of operations. Similarly, in periods when production exceeds demand, the price at which we sell our potash and langbeinite and our sales volumes would likely fall, which would adversely affect our results of operations and financial condition more than our diversified competitors.

Heavy precipitation or low evaporation rates at our solar solution mines could impact our potash production at those facilities, which could adversely affect our sales and results of operations.

All of our potash production comes from our solar solution mines. These facilities use solar evaporation ponds to form potash crystals from brines. Weather conditions at these facilities could negatively impact potash production. For example, heavy rainfall in September and October, just after the evaporation season ends, can reduce the amount of potash we produce in that year or the following year by causing the potash crystals to dissolve and consume pond capacity. Similarly, lower‑than‑average temperatures or higher-than-average seasonal rainfall would reduce evaporation rates and therefore impact production. If we experience heavy rainfall or low evaporation rates at any of our solar solution mines, we would have less potash available for sale, and our sales and results of operations would be adversely affected.

Inflows of water into our langbeinite mine from heavy rainfall or groundwater could result in increased costs and production downtime and could require us to abandon the mine, any of which could adversely affect our results of operations.

Major weather events such as heavy rainfall can result in water inflows into our underground, langbeinite mine. The presence of water-bearing strata in many underground mines carries the risk of water inflows into the mines. If we experience water inflows at our langbeinite mine, our employees could be injured and our equipment and mine shafts could be seriously damaged. We could be forced to shut down the mine temporarily, potentially resulting in significant production delays, and spend substantial funds to repair or replace damaged equipment. Inflows may also destabilize the mine shafts over time, resulting in safety hazards for employees and potentially leading to the permanent abandonment of the mine.

Environmental laws and regulations could subject us to significant liability and require us to incur additional costs.

We areroyalties is subject to many environmental, safety, and health laws and regulations, including laws and regulations relating to mine safety, mine land reclamation, remediation of hazardous substance releases, and discharges into the soil, air, and water.

Our operations, as well as those of our predecessors, have involved the use and handling of regulated substances, hydrocarbons, potash, salt, related potash and salt by-products, and process tailings. These operations resulted, or may have resulted, in soil, surface water, and groundwater contamination. At some locations, salt-processing waste, building materials (including asbestos-containing material), and ordinary trash may have been disposed of or buried in areas that have since been closed and covered with soil and other materials.

We could incur significant liabilities under environmental remediation laws such as CERCLA with regard to our current or former facilities, adjacent or nearby third-party facilities, or off-site disposal locations. Under CERCLA and similar state laws, in some circumstances liability may be imposed without regard to fault or legality of conduct and one party may be required to bear more than its proportional share of cleanup costs at a site. Liability under these laws involves inherent uncertainties.

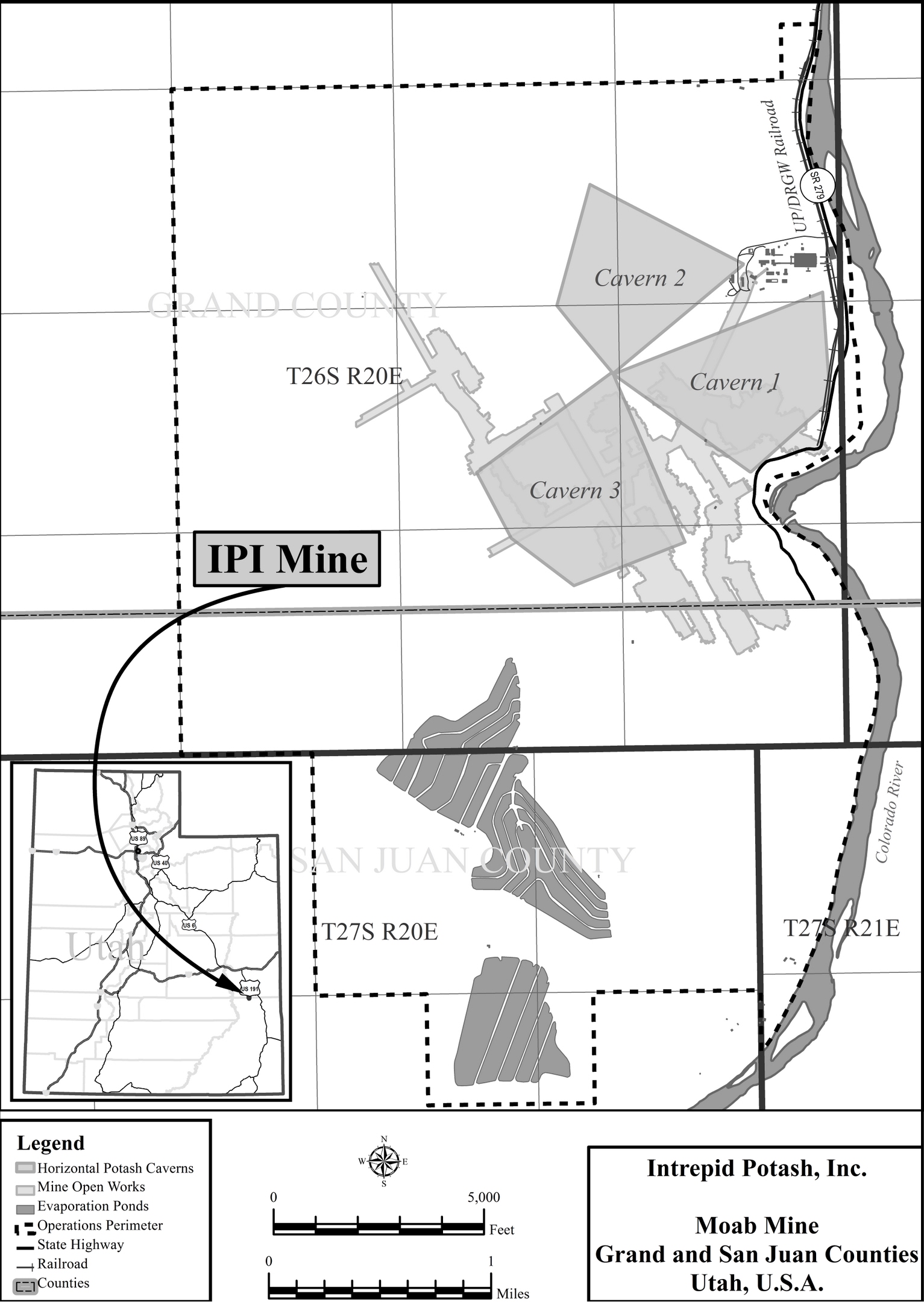

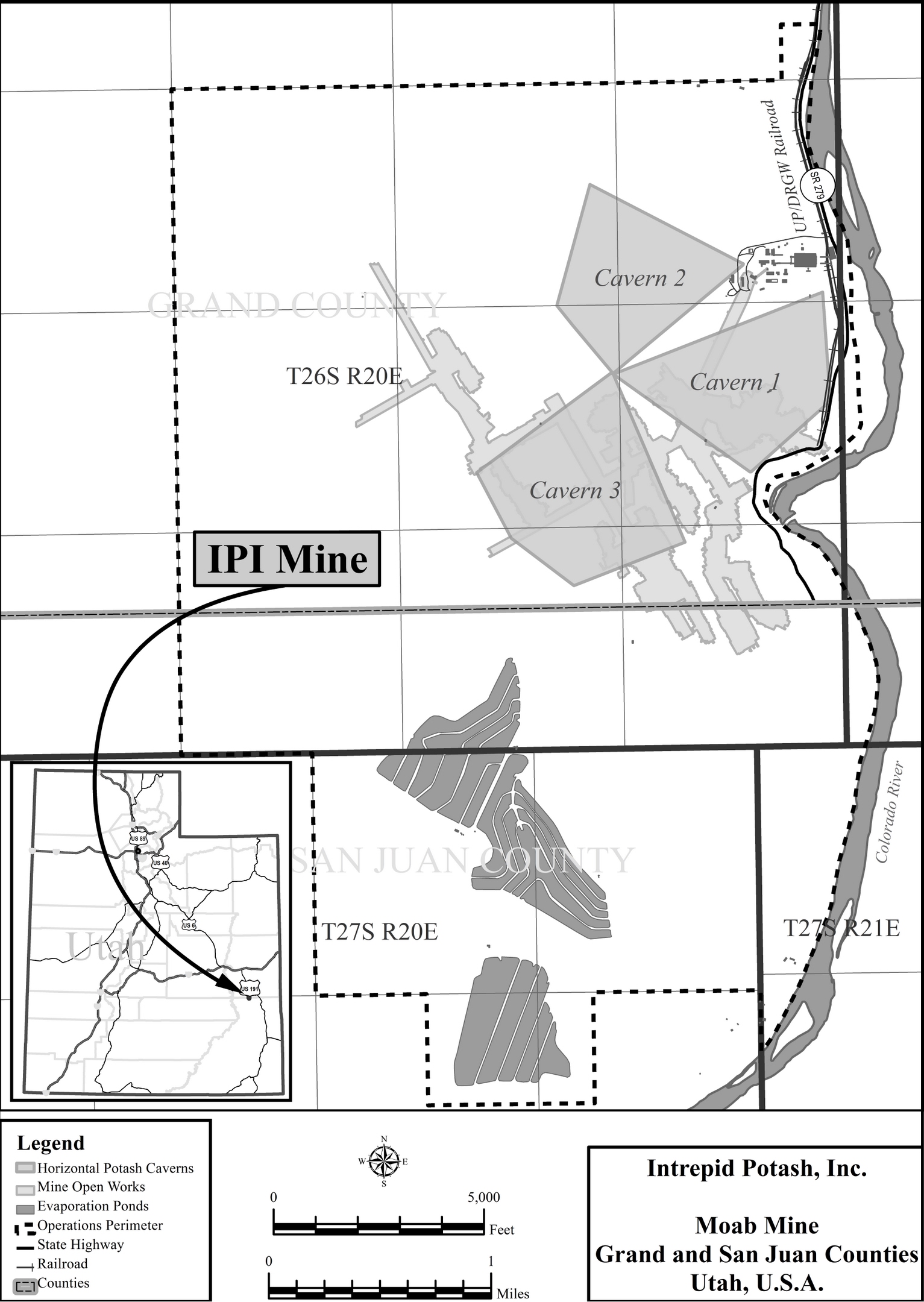

We are also subject toperiodic audits by federal and state environmental laws that regulate dischargesofficials. The Office of pollutants and contaminants into the environment, such as the U.S. Clean Water Act and the U.S. Clean Air Act. For example, our water disposal processes rely on dikes and reclamation ponds that could breach or leak, resulting in a possible prohibited release into the environment. Moreover, although the North and East mines in New Mexico and the Moab mine in Utah are designated as zero discharge facilities under the applicable water quality laws and regulations, these mines could experience some water discharges during significant rainfall events.Natural Resources Revenue

We expect that we will be required to continue to invest in environmental controls at our facilities and that these expenses could be significant. In addition, violations

changes in the interpretation of environmental laws

modifications to current environmental laws

the issuance of more stringent environmental laws

malfunctioning process or pollution control equipment

The mining and processing of potash and langbeinite also generate residual materials that must be managed both during the operation of the facility and upon facility closure. For example, potash tailings, consisting primarily of salt, iron, and clay, are stored in surface disposal sites and require management. At least one("ONRR") completed their draft audit report of our New Mexico facilities,royalty reporting in September 2019. As of February 2024, we are continuing to progress on the HB mine, may have issues regarding leadaudit in the tailings pile as a result of operations conducted by previous owners. During the life of the tailings management areas, we have incurred and will continue to incur significant costs to manage potash residual materials in accordancecooperation with environmental laws and regulations and permit requirements.

As a potash producer, we currently are exempt from certain State of New Mexico mining laws related to reclamation obligations. If this exemption were to be eliminated or restricted, we could be required to incur significant expenses related to reclamation at our New Mexico facilities.