Most of our manufacturing partners are located in China. In addition, we have established a facilitymanufacturing and testing facilities in China, initially for the testing of our ICs.China. The Chinese government has broad discretion and authority to regulate the technology industry in China. China’s government has implemented policies from time to timetime-to-time to regulate economic expansion in China. It also exercises significant control over China’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. New regulations or the readjustment of previously implemented regulations could require us and our manufacturing partners to change our business plans, increase our costs, or limit our ability to sell products and conduct activities in China, which could adversely affect our business and operating results.

In addition, the Chinese government and provincial and local governments have provided, and continue to provide, various incentives to encourage the development of the semiconductor industry in China. Such incentives include tax rebates, reduced tax rates, favorable lending policies and other measures, some or all of which may be available to our manufacturing partners and to us with respect to our facilityfacilities in China. Any of these incentives could be reduced or eliminated by governmental authorities at any time. Any such reduction or elimination of incentives currently provided to our manufacturing partners could adversely affect our business and operating results.

There are inherent risks associated with the operation of our manufacturing and testing facilityfacilities in China, which could increase product costs or cause a delay in product shipments.

We have amanufacturing and testing facilityfacilities in China that began operations in 2006. In addition to the risks discussed elsewhere in this annual report on Form 10-K, weWe face the following risks, among others, with respect to our testing facilityoperations in China:

inability to hire and maintain a qualified workforce;

inability to maintain appropriate and acceptable manufacturing controls; and.and

higher than anticipated overhead and other costs of operation.

If we are unable to maintain our testing facilityfacilities in China at fully operational status with qualified workers, appropriate manufacturing controls and reasonable cost levels, we may incur higher costs than our current expense levels, which would affect our gross margins. In addition, if capacity restraints result in significant delays in product shipments, our business and results of operations would be adversely affected.

The average selling prices of products in our markets have historically decreased over time and will likely do so in the future, which could harm our revenuesrevenue and gross profits.

Average selling prices of semiconductor products in the markets we serve have historically decreased over time. Our gross profits and financial results will suffer if we are unable to offset any reductions in our average selling prices by reducing our costs, developing new or enhanced products on a timely basis with higher selling prices or gross profits, or increasing our sales volumes. Additionally, because we do not operate our own wafer manufacturing or assembly facilities, we may not be able to reduce our costs as rapidly as companies that operate their own facilities, and our costs may even increase, which could also reduce our profit margins.

Because of the lengthy sales cycles for our products and the fixed nature of a significant portion of our expenses, we may incur substantial expenses before we earn associated revenue and may not ultimately achieve our forecasted sales for our products.

The introduction of new products presents significant business challenges because product development plans and expenditures mustmay be made up to two years or more in advance of any sales. It generally takes us up to 12 months or more to design and manufacture a new product prototype. Only after we have a prototype do we introduce the product to the market and begin selling efforts in an attempt to achieve design wins. This sales process requires us to expend significant sales and marketing resources without any assurance of success. Volume production of products that use our ICs, if any, may not be achieved for an additional period of time after an initial sale. Sales cycles for our products are lengthy for a number of reasons, including:

our customers usually complete an in-depth technical evaluation of our products before they place a purchase order;

the commercial adoption of our products by OEMs and ODMs is typically limited during the initial release of their producttheirproduct to evaluate product performance and consumer demand;

our products must be designed into a customer’s productour customers’ products or system;systems; and

the development and commercial introduction of our customers’ products incorporating new technologies frequently arefrequentlyare delayed.

As a result of our lengthy sales cycles, we may incur substantial expenses before we earn associated revenue because a significant portion of our operating expenses is relatively fixed and based on expected revenue. The lengthy sales cycles of our products also make forecasting the volume and timing of orders difficult. In addition, the delays inherent in lengthy sales cycles raise additional risks that customers may cancel or change their orders. Our sales are made by purchase orders. Because industry practice allows customers to reschedule or cancel orders on relatively short notice, backlog is not always a good indicator of our future sales. If customer cancellations or product changes occur, we could lose anticipated sales and not have sufficient time to reduce our inventory and operating expenses.

Our success depends on our investment of significant amount of resources in research and development. We may have to invest more resources in research and development than anticipated, which could increase our operating expenses and negatively impact our operating results.

Our success depends on us investing significant amounts of resources into research and development. Our research and development expenses as a percent of our total revenue were 22.8% and 22.7% for the year ended December 31, 2012 and 2011, respectively. We expect to have to continue to invest heavily in research and development in the future in order to continue to innovate and come to market with new products in a timely manner and increase our revenue and profitability. If we have to invest more resources in research and development than we anticipate, we could see an increase in our operating expenses which may negatively impact our operating results. Also, if we are unable to properly manage and effectively utilize our research and development resources, we could see material adverse effects on our business, financial condition and operating results.

In addition, if new competitors, technological advances by existing competitors, our entry into new markets, or other competitive factors require us to invest significantly greater resources than anticipated in our research and development efforts, our operating expenses would increase. If we are required to invest significantly greater resources than anticipated in research and development efforts without a corresponding increase in revenue, our operating results could decline. Research and development expenses are likely to fluctuate from time to time to the extent we make periodic incremental investments in research and development and these investments may be independent of our level of revenue, which could negatively impact our financial results. In order to remain competitive, we anticipate that we will continue to devote substantial resources to research and development, and we expect these expenses to increase in absolute dollars in the foreseeable future due to the increased complexity and the greater number of products under development.

The loss of any of our key personnel or the failure to attract or retain specialized technical and management personnel couldaffect our operations orimpair our ability to grow our business.

Our future success depends upon our ability to attract and retain highly qualified technical and managerial personnel. We are particularly dependent on the continued services of our key executives, including Michael Hsing, our President and Chief Executive Officer, who founded our company and developed our proprietary process technology. In addition, personnel with highly skilled analog and mixed-signal design engineering expertise are scarce and competition for personnel with these skills is intense. There can be no assurance that we will be able to retain existing key employees or that we will be successful in attracting, integrating or retaining other highly qualified personnel with critical capabilities in the future. If we are unable to retain the services of existing key employees or are unsuccessful in attracting new highly qualified employees quickly enough to meet the demands orof our business, including design cycles, our business could be harmed.

If we fail to retain key employees in our sales, applications, finance and legal staff or to make continued improvements to our internal systems, particularly in the accounting and finance area, our business may suffer.

If we fail to continue to adequately staff our sales, applications, financial and legal staff, maintain or upgrade our business systems and maintain internal controlscontrol that meet the demands of our business, our ability to operate effectively will suffer. The operation of our business also depends upon our ability to retain these employees, as these employees hold a significant amount of institutional knowledge about us and our products, and, if they were to terminate their employment, our sales and internal control over financial reporting could be adversely affected.

We intend to continue to expand our operations, which may strain our resources and increase our operating expenses.

We plan to continue to expand our domestic and foreign operations through internal growth, strategic relationships, and/or acquisitions. We expect that any such expansion will strain our systems and operational and financial controls. In addition, we are likely to incur significantly higher operating costs. To manage our growth effectively, we must continue to improve and expand our systems and controls, as well as hire experienced administrative and financial personnel. If we fail to do so, our growth will be limited. If we fail to effectively manage our planned expansion of operations, our business and operating results may be harmed.

We may engagenot realize the anticipated benefits of any company or business that we acquire. In addition,acquisitionscould result in future acquisitions that dilute dilutingthe ownership interests of our stockholders, reduce our cash balances,and cause us to incur debt or to assume contingent liabilities, and we may be unable to successfully integrate these companies into our operations, which wouldcould adversely affect our business.

As a part of our business strategy, from time to time we review acquisition prospects that would complement our current product offerings, enhance our design capability or offer other competitive opportunities. In the eventFor example, we completed our acquisition of futureSensima Technology SA in July 2014 to further our diversification strategy and create new opportunities with key customers. As a result of completing acquisitions, we could use a significant portion of our available cash, cash equivalents and short-term investments, issue equity securities whichthat would dilute current stockholders’ percentage ownership, incur substantial debt or contingent liabilities, and/orand incur impairment charges related to goodwill or other acquisition-related intangibles. Such actions by us could impact our operating results and/orand the price of our common stock.

In addition, we may be unable to identify or complete prospective acquisitionacquisitions for various reasons, including competition from other companies in the semiconductor industry, the valuation expectations of acquisition candidates and applicable antitrust laws or related regulations. If we are unable to identify and complete acquisitions, we may not be able to successfully expand our business and product offerings.

We cannot guarantee that the extentSensima acquisition or any future acquisitions will improve our results of operations or that we are successful in completing strategic acquisitions,will otherwise realize the anticipated benefits of any acquisitions. In addition, if we are unsuccessful in integrating any acquired company or business into our operations or if integration is more difficult than anticipated, we may experience disruptions that could harm our business and notresult in our failure to realize the anticipated benefits of the acquisitions. Some of the risks that may adversely affect our ability to integrate or realize any anticipated benefits from the acquired companies, businesses or assets include those associated with:

unexpected losses of key employees or customers of the acquired companies or businesses;

conforming the acquired company’s standards, processes, procedures and controls with our operations;

coordinating new product and process development;

hiring additional management and other critical personnel;

increasing the scope, geographic diversity and complexity of our operations;

difficulties in consolidating facilities and transferring processes and know-how;

difficulties in the assimilation of acquired operations, technologies or products;

the risk of undisclosed liabilities of the acquired businesses and potential legal disputes with founders or stockholders ofstockholdersof acquired companies;

our inability to commercialize acquired technologies;

the risk that the future business potential as projected is not realized and as a result, we may be required to take a chargeacharge to earnings that would impact our profitability;

• | the need to take impairment charges or write-downs with respect to acquired assets and technologies; | |

• | difficulties in assessing the fair value of earn-out arrangements; |

diversion of management’s attention from other business concerns; and

adverse effects on existing business relationships with customers.

We compete against many companies with substantially greater financial and other resources, and our market share may be reduced if we are unable to respond to our competitors effectively.

The analog and mixed-signal semiconductor industry is highly competitive, and we expect competitive pressures to continue. Our ability to compete effectively and to expand our business will depend on our ability to continue to recruit applications and design talent, our ability to introduce new products, and our ability to maintain the rate at which we introduce these new products. We compete with domestic and non-domestic semiconductor companies, many of which have substantially greater financial and other resources with which to pursue engineering, manufacturing, marketing, and distribution of their products. We are in direct and active competition, with respect to one or more of our product lines, with at least 10many manufacturers of such products, of varying size and financial strength. The number of our competitors has grown due to the expansion of the market segments in which we participate. We consider our competitors to include, but not be limited to: Fairchild Semiconductor, Intersil, Linear, Maxim Integrated Products, Micrel, Microsemi, National Semiconductor, O2Micro, RichTek, Rohm, Semtech, STMicroelectronic, Texas Instruments and Volterra. We expect continued competition from existing competitors as well as competition from new entrants in the semiconductor market.

We cannot assure you that our products will continue to compete favorably, or that we will be successful in the face of increasing competition from new products and enhancements introduced by existing competitors or new companies entering this market, which would materially and adversely affect our results of operations and our financial condition.

If securities or industry analysts downgrade our stock or do not continue to publish research or reports about our business, our stock price and trading volume could decline.

The trading market for our common stock will depend, in part, on the research and reports that industry or securities analysts publish about us or our business. We do not have any control over these analysts. If one or more of the analysts who cover us downgrade our stock, our stock price would likely decline. If one or more of these analysts cease coverage of us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

Major earthquakes or other natural disasters and resulting systems outages may cause us significant losses.

Our corporate headquarters, the production facilities of our third-party wafer suppliers, our IC testing facility,and manufacturing facilities, a portion of our assembly and research and development activities, and certain other critical business operations are located in or near seismically active regions and are subject to periodic earthquakes. We do not maintain earthquake insurance and could be materially and adversely affected in the event of a major earthquake. Much of our revenue, as well as our manufacturers and assemblers, are concentrated in Asia.Asia, particularly in China. Such concentration increases the risk that other natural disasters, labor strikes, terrorism, war, political unrest, epidemics, and/or health advisories could disrupt our operations. In addition, we rely heavily on our internal information and communications systems and on systems or support services from third parties to manage our operations efficiently and effectively. Any of these are subject to failure due to a natural disaster or other disruption. System-wide or local failures that affect our information processing could have material adverse effects on our business, financial condition, operating results and cash flows.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our primary operating locationsoperations are currentlylocated in San Jose, California and Chengdu, China. Up until May 2012, we were leasing approximately 55,110 square feet in San Jose, which served as our corporate headquarters, as well as our sales and research and development center. Certain test procedures and manufacturing also took place in our San Jose facility. The landlord exercised their right to terminate the lease which required us to seek new headquartersWe occupy an owned facility before May 1, 2012 deadline.

We lease a facility with approximately 56,00060,000 square feet in Chengdu, China, which serves as our test facility and manufacturing hubhub. In September 2015, we exercised our option to purchase this facility and expect to close the transaction in the first half of 2016. In addition, we constructed a 150,000 square footsquare-foot research and development facility in Chengdu, China, which was put into operation in October 2010.

In November 2015, we entered into an agreement to purchase three units of an office building with approximately 6,600 square feet in Shanghai, China. The space is primarily used for sales and marketing and research and development functions. The transaction was closed in January 2016.

We also lease other sales and research and development offices in China, Europe, Japan, Korea, Singapore, Taiwan and the United States, Japan, China, Taiwan and Korea.States. We believe that our existing facilities are adequate for our current operations.

ITEM 3. LEGAL PROCEEDINGS

We are partiesa party to actions and proceedings incident to the Company's business in the ordinary course of business, including litigation regarding itsour shareholders a former employee and itsour intellectual property, challenges to the enforceability or validity of itsour intellectual property, and claims that the Company’sour products infringe on the intellectual property rights of others.others, and employment matters. These proceedings often involve complex questions of fact and law and may require the expenditure of significant funds and the diversion of other resources to prosecute and defend. The Company defends itselfWe defend ourselves vigorously against any such claims.

O2 Micro

As of California issued an order finding O2 Micro International, Ltd. (“O2 Micro”) liable for approximately $9.1 million in attorneys’ fees and non-taxable costs, plus interest, in connection with the patent litigation that the Company won in 2010. This award is in addition to the approximately $0.3 million in taxable costs that the Court had earlier ordered O2 Micro to pay to the Company in connection with the same lawsuit. The Court then entered judgment for the Company. In October 2012, O2 Micro filed an appeal against this judgment.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. Market for the Registrant’s CommonCommon Equity, Related StockholdersStockholder Matters and Issuer Purchases of Equity Securities.

Market Price of Our Common Stock

Our common stock is traded on the Nasdaq Global Select Market under the symbol “MPWR”.“MPWR.” The following table sets forth for the periods indicated, the high and low closing sales price per share of our common stock on the Nasdaq Global Select Market. These prices represent quotations among dealers without adjustments for retail mark-ups, markdowns or commissions, and may not represent prices of actual transactions.

| 2012 | High | Low | ||||||

| Fourth quarter ended December 31, 2012 | $ | 22.38 | $ | 17.17 | ||||

| Third quarter ended September 30, 2012 | $ | 23.07 | $ | 17.07 | ||||

| Second quarter ended June 30, 2012 | $ | 22.40 | $ | 17.70 | ||||

| First quarter ended March 31, 2012 | $ | 19.91 | $ | 14.58 | ||||

| 2011 | ||||||||

| Fourth quarter ended December 31, 2011 | $ | 15.61 | $ | 9.49 | ||||

| Third quarter ended September 30, 2011 | $ | 15.64 | $ | 10.16 | ||||

| Second quarter ended June 30, 2011 | $ | 18.56 | $ | 13.41 | ||||

| First quarter ended March 31, 2011 | $ | 17.12 | $ | 12.95 |

High | Low | |||||||

2015 | ||||||||

First quarter | $ | 56.12 | $ | 45.80 | ||||

Second quarter | $ | 54.95 | $ | 49.96 | ||||

Third quarter | $ | 52.12 | $ | 45.28 | ||||

Fourth quarter | $ | 68.88 | $ | 50.42 | ||||

2014: | ||||||||

First quarter | $ | 38.86 | $ | 31.36 | ||||

Second quarter | $ | 42.48 | $ | 35.14 | ||||

Third quarter | $ | 47.78 | $ | 40.77 | ||||

Fourth quarter | $ | 50.44 | $ | 34.47 | ||||

Holders of Our Common Stock

As of February 20, 2013, 22, 2016, there were 16

Dividend Policy

In June 2014, our Board declared MPS’s first ever cashof Directors approved a dividend of $1.00 per shareprogram pursuant to stockholders of record as of December 21, 2012. The cash dividend was paid on December 28, 2012 and totaled approximately $35.7 million. Other than this dividend,which we have not paidintend to pay quarterly cash dividends on our common stock since our inception. We currently do not anticipate paying any furtherstock. Stockholders of record as of the last day of the quarter are entitled to receive the quarterly cash dividends when and if declared by our Board of Directors, which are generally payable on the 15th of the following month. Our Board of Directors declared the following cash dividends (in thousands, except per-share amounts):

Dividend Declared per Share | Total Amount | |||||||

2015: | ||||||||

First quarter | $ | 0.20 | $ | 7,854 | ||||

Second quarter | $ | 0.20 | $ | 7,925 | ||||

Third quarter | $ | 0.20 | $ | 7,901 | ||||

Fourth quarter | $ | 0.20 | $ | 7,938 | ||||

2014: | ||||||||

Second quarter | $ | 0.15 | $ | 5,817 | ||||

Third quarter | $ | 0.15 | $ | 5,823 | ||||

Fourth quarter | $ | 0.15 | $ | 5,826 | ||||

The declaration of any future cash dividends is at the discretion of our Board of Directors and will depend on, among other things, our financial condition, results of operations, capital requirements, business conditions, statutory requirements of Delaware law, compliance with the terms of future indebtedness and credit facilities and other factors that our Board of Directors may deem relevant, as well as a determination that cash dividends are in the future.

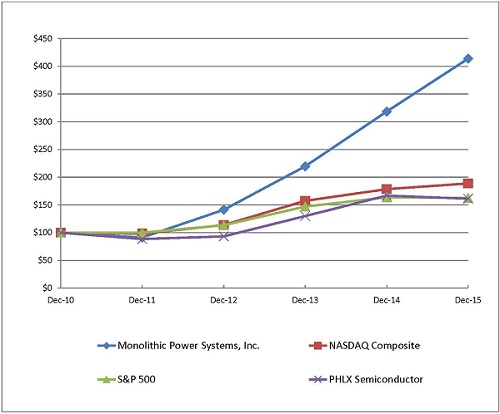

Performance of Our Common Stock

The following graph compares the cumulative 60-monthfive-year total return provided shareholders on our common stock relative to the cumulative total returns of the Nasdaq Composite Index, the S & P&P 500 Index and the Philadelphia Semiconductor Index. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock on December 31, 20072010 and its relative performance is tracked through December 31, 2012.

|

The information contained in the Stock Performance Graphstock performance graph section shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Recent SalesPurchases of UnregisteredEquity Securities by the Issuer and Affiliated Purchasers

Stock repurchase activity during the yearthree months ended December 31, 2012.

Total Number of Shares Purchased (a) | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Program | Dollar Value of Shares That May Yet Be Purchased Under the Program (b) | |||||||||||||

October 1 - October 31 | �� | 11 | $ | 52.14 | 11 | |||||||||||

November 1 - November 30 | - | $ | - | - | ||||||||||||

December 1 - December 31 | - | $ | - | - | ||||||||||||

Total | 11 | $ | - | 11 | $ | - | ||||||||||

(a) | In July 2013, the Board of Directors approved a stock repurchase program that authorized us to repurchase up to $100 million in the aggregate of our common stock through June 30, 2015. In April 2015, the Board of Directors approved an extension of the program through December 31, 2015. Under the program, shares may be repurchased in privately negotiated or open market transactions, including undera Rule 10b5-1 plan. Shares were retired upon repurchase. |

(b) | The stock repurchase program expired on December 31, 2015, with a remaining balance of $5.9 million. In February 2016, the Board of Directors approved a new stock repurchase program that authorizes us to repurchase up to $50 million in the aggregate of our common stock through December 31, 2016. |

ITEM 6. SELECTED FINANCIAL DATA

The following selected consolidated financial data is derived from our audited annualshould be read in conjunction with ''Management's Discussion and Analysis of Financial Condition and Results of Operations'' and the consolidated financial statements and the notes thereto included elsewhere in this Annual Report on Form 10-K to fully understand factors that may affect the comparability of the information presented below. We derived the selected consolidated balance sheet data as of December 31, 2015 and 2014, and the consolidated statement of operations data for the years ended December 31, 2012, 2011, 2010, 20092015, 2014 and 2008. You should read the following table in conjunction with the2013 from our audited consolidated financial statements and the relatedaccompanying notes contained elsewhereincluded in this reportAnnual Report on Form 10-K. OperatingThe consolidated balance sheet data as of December 31, 2013, 2012 and 2011, and the consolidated statement of operations data for each of the years ended December 31, 2012 and 2011 are derived from our audited consolidated financial statements which are not included in this report.Operating results for any year are not necessarily indicative of results to be expected for any future periods.

Consolidated Statement of Operations Data:

| Year ended December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| (in thousands, except per share amounts) | ||||||||||||||||||||

| Revenue | $ | 213,813 | $ | 196,519 | $ | 218,840 | $ | 165,008 | $ | 160,511 | ||||||||||

| Cost of revenue (1) | 100,665 | 94,925 | 97,383 | 67,330 | 61,184 | |||||||||||||||

| Gross profit | 113,148 | 101,594 | 121,457 | 97,678 | 99,327 | |||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Research and development (2) | 48,796 | 44,518 | 44,372 | 38,295 | 34,850 | |||||||||||||||

| Selling, general and administrative (3) | 50,018 | 40,280 | 41,169 | 36,752 | 35,256 | |||||||||||||||

| Litigation expense (benefit), net | (2,945 | ) | 3,379 | 5,418 | 9,457 | 6,714 | ||||||||||||||

| Patent litigation settlement (provision reversal) | - | - | - | (6,356 | ) | - | ||||||||||||||

| Total operating expenses | 95,869 | 88,177 | 90,959 | 78,148 | 76,820 | |||||||||||||||

| Income from operations | 17,279 | 13,417 | 30,498 | 19,530 | 22,507 | |||||||||||||||

| Interest income and other, net | 611 | 309 | 922 | 618 | 2,935 | |||||||||||||||

| Income before income taxes | 17,890 | 13,726 | 31,420 | 20,148 | 25,442 | |||||||||||||||

| Income tax provision | 2,134 | 425 | 1,857 | 474 | 1,216 | |||||||||||||||

| Net income | $ | 15,756 | $ | 13,301 | $ | 29,563 | $ | 19,674 | $ | 24,226 | ||||||||||

| Basic net income per share | $ | 0.45 | $ | 0.39 | $ | 0.83 | $ | 0.57 | $ | 0.72 | ||||||||||

| Diluted net income per share | $ | 0.43 | $ | 0.38 | $ | 0.78 | $ | 0.54 | $ | 0.67 | ||||||||||

| Weighted average common shares outstanding: | ||||||||||||||||||||

| Basic | 34,871 | 34,050 | 35,830 | 34,310 | 33,509 | |||||||||||||||

| Diluted | 36,247 | 35,160 | 37,826 | 36,634 | 36,120 | |||||||||||||||

| (1) Includes stock-based compensation expense | $ | 510 | $ | 312 | $ | 393 | $ | 246 | $ | 344 | ||||||||||

| (2) Includes stock-based compensation expense | 6,922 | 5,909 | 6,742 | 6,408 | 5,821 | |||||||||||||||

| (3) Includes stock-based compensation expense | 11,220 | 6,905 | 9,675 | 7,957 | 6,993 | |||||||||||||||

| Total stock-based compensation expense | $ | 18,652 | $ | 13,126 | $ | 16,810 | $ | 14,611 | $ | 13,158 | ||||||||||

Year Ended December 31, | ||||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

(in thousands, except per share amounts) | ||||||||||||||||||||

Revenue | $ | 333,067 | $ | 282,535 | $ | 238,091 | $ | 213,813 | $ | 196,519 | ||||||||||

Cost of revenue | 152,898 | 129,917 | 110,190 | 100,665 | 94,925 | |||||||||||||||

Gross profit | 180,169 | 152,618 | 127,901 | 113,148 | 101,594 | |||||||||||||||

Operating expenses: | ||||||||||||||||||||

Research and development | 65,787 | 58,590 | 49,733 | 48,796 | 44,518 | |||||||||||||||

Selling, general and administrative | 72,312 | 66,755 | 54,624 | 50,018 | 40,280 | |||||||||||||||

Litigation expense (benefit), net | 1,000 | (8,027 | ) | (371 | ) | (2,945 | ) | 3,379 | ||||||||||||

Total operating expenses | 139,099 | 117,318 | 103,986 | 95,869 | 88,177 | |||||||||||||||

Income from operations | 41,070 | 35,300 | 23,915 | 17,279 | 13,417 | |||||||||||||||

Interest and other income, net | 1,421 | 1,092 | 92 | 611 | 309 | |||||||||||||||

Income before income taxes | 42,491 | 36,392 | 24,007 | 17,890 | 13,726 | |||||||||||||||

Income tax provision | 7,319 | 897 | 1,109 | 2,134 | 425 | |||||||||||||||

Net income | $ | 35,172 | $ | 35,495 | $ | 22,898 | $ | 15,756 | $ | 13,301 | ||||||||||

Net income per share: | ||||||||||||||||||||

Basic | $ | 0.89 | $ | 0.92 | $ | 0.61 | $ | 0.45 | $ | 0.39 | ||||||||||

Diluted | $ | 0.86 | $ | 0.89 | $ | 0.59 | $ | 0.43 | $ | 0.38 | ||||||||||

Weighted-average shares outstanding: | ||||||||||||||||||||

Basic | 39,470 | 38,686 | 37,387 | 34,871 | 34,050 | |||||||||||||||

Diluted | 40,869 | 39,793 | 38,620 | 36,247 | 35,160 | |||||||||||||||

Cash dividends declared per common share | $ | 0.80 | $ | 0.45 | $ | - | $ | 1.00 | $ | - | ||||||||||

Consolidated Balance Sheet Data:

| As of December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Cash and cash equivalents | $ | 75,104 | $ | 96,371 | $ | 48,010 | $ | 46,717 | $ | 83,266 | ||||||||||

| Short-term investments | 85,521 | 77,827 | 129,709 | 118,914 | 21,922 | |||||||||||||||

| Long-term investments | 11,755 | 13,675 | 19,180 | 19,445 | 37,425 | |||||||||||||||

| Restricted cash | - | - | - | - | 7,360 | |||||||||||||||

| Working capital | 190,841 | 185,435 | 195,403 | 179,577 | 117,365 | |||||||||||||||

| Total assets | 287,162 | 273,867 | 281,603 | 241,821 | 195,299 | |||||||||||||||

| Long-term tax liabilities | 5,408 | 4,920 | 5,015 | 4,915 | 4,762 | |||||||||||||||

| Common stock | 194,079 | 159,336 | 178,269 | 175,518 | 147,298 | |||||||||||||||

| Total stockholders' equity | 258,294 | 242,877 | 246,895 | 212,957 | 164,645 | |||||||||||||||

| Cash dividend per common share: | ||||||||||||||||||||

| Declared | $ | 1.00 | $ | - | $ | - | $ | - | $ | - | ||||||||||

| Paid | $ | 1.00 | $ | - | $ | - | $ | - | $ | - | ||||||||||

December 31, | ||||||||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

(in thousands) | ||||||||||||||||||||

Cash and cash equivalents | $ | 90,860 | $ | 126,266 | $ | 101,213 | $ | 75,104 | $ | 96,371 | ||||||||||

Short-term investments | $ | 144,103 | $ | 112,452 | $ | 125,126 | $ | 85,521 | $ | 77,827 | ||||||||||

Long-term investments | $ | 5,361 | $ | 5,389 | $ | 9,860 | $ | 11,755 | $ | 13,675 | ||||||||||

Total assets | $ | 431,285 | $ | 399,366 | $ | 368,908 | $ | 287,162 | $ | 273,867 | ||||||||||

Common stock | $ | 265,763 | $ | 240,500 | $ | 234,201 | $ | 194,079 | $ | 159,336 | ||||||||||

Total stockholders' equity | $ | 368,516 | $ | 346,425 | $ | 323,399 | $ | 258,294 | $ | 242,877 | ||||||||||

Working capital (1) | $ | 288,645 | $ | 271,051 | $ | 253,304 | $ | 190,840 | $ | 185,014 | ||||||||||

(1) | In November 2015, the Financial Accounting Standards Board issued Accounting Standards Update No. 2015-17, Balance Sheet Classification of Deferred Taxes, whichrequires that all deferred tax assets and liabilities, including related valuation allowance, be classified as non-current on the balance sheets. We early adopted this standard retrospectively and reclassified the current deferred tax assets to non-current deferred tax assets on our consolidated balance sheets data for all periods presented. |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the consolidated financial statements and related notes which appear elsewhereunder Item 8 in this annual reportAnnual Report on Form 10-K.

Overview

We are a fabless semiconductorleading company that designs, develops,in high performance power solutions. Founded in 1997, we design and markets proprietary, advanced analogprovide small, highly energy efficient, easy-to-use power solutions for systems found in industrial applications, telecommunication infrastructures, cloud computing, automotive, and mixed-signal semiconductors. We currently offer products that serve multiple markets, including consumer electronics, communications, computing (which includes storage) and industrial markets.applications. Our mission is to reduce total energy consumption in our customers' systems with green, practical, compact solutions. We believe that we differentiate ourselves by offering solutions that are more highly integrated, smaller in size, more energy efficient, more accurate with respect to performance specifications and, consequently, more cost-effective than many competing solutions. We plan to continue to introduce additional new products within our existing product families, as well as in new innovative product categories.

We operate in the cyclical semiconductor industry where there is seasonal demand for certain of our products. We are not and will not be immune from current and future industry downturns, but we have targeted product and market areas that we believe have the ability to offer above average industry performance over the long term.

We work with third parties to manufacture and assemble our integrated circuits (“ICs”). This has enabled us to limit our capital expenditures and fixed costs, while focusing our engineering and design resources on our core strengths.

Following the introduction of a product, our sales cycle generally takes a number of quarters to achieve revenue and volume production is usually achieved several months after we receive an initial customer order for a new product.product to ramp up. Typical lead time for orders is fewer than 90 days. These factors, combined with the fact that orders in the semiconductor industry can typically be cancelled or rescheduled without significant penalty to the customer, make the forecasting of our orders and revenue difficult.

We derive most of our revenue from sales through distribution arrangements orand direct sales to customers in Asia, where the componentsproducts we produce are incorporated into an end-user product. For the years ended December 31, 2012 and 2011, 89% and 90%, respectively, of ourproducts. Our revenue was attributable tofrom direct or indirect sales to customers in Asia.Asia was 91%, 91% and 90% for the years ended December 31, 2015, 2014 and 2013, respectively. We derive a majority of our revenue from the sales of our DC to DC converter product family which servicesserves the consumer electronics, communications, storage and computing, (which includes storage)consumer and industrial markets. We believe our ability to achieve revenue growth will depend, in part, on our ability to develop new products, enter new market segments, gain market share, manage litigation risk, diversify our customer base and successfully secure manufacturing capacity.

In July 2014, we completed the acquisition of Sensima Technology SA (“Sensima”), a company located in Switzerland that develops magnetic sensors for angle measurements as well as three-dimensional magnetic field sensing.Sensima became a subsidiary of MPS and changed its name to MPS Tech Switzerland Sarl. The acquisition creates new opportunities with customers by offering enhanced solutions in power management for key industries such as automotive, industrial and cloud computing. The purchase consideration consisted of an upfront cash payment of $11.7 million and additional consideration that is contingent upon Sensima achieving a new product introduction and certain revenue and direct margin goals in 2016, with a fair value of $2.5 million at the date of acquisition. In addition, key employees received $1.7 million of time-based restricted stock units and up to $8.0 million of performance-based restricted stock units in connection with the transaction. These equity awards are considered arrangements for post-acquisition services and the related compensation expense is recognized over the requisite service period if it is probable that the performance goals will be met. The results of operations of Sensima have been included in our consolidated financial statements subsequent to the acquisition date.

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with generally accepted accounting principles in the U.S. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amount of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. We evaluate our estimates on an on-going basis, including those related to revenue recognition, stock-based compensation, long-term investments, short-term investments, inventories, income taxes, warranty obligationsvaluation of goodwill and intangible assets, and contingencies. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making the judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Estimates and judgments used in the preparation of our financial statements are, by their nature, uncertain and unpredictable, and depend upon, among other things, many factors outside of our control, such as demand for our products and economic conditions. Accordingly, our estimates and judgments may prove to be incorrect and actual results may differ, perhaps significantly, from these estimates.

We believe the following critical accounting policies reflect our more significant judgments used in the preparation of our consolidated financial statements.

Revenue Recognition. Recognition

We recognize revenue in accordance with Financial Accounting Standards Board (“FASB”) – Accounting Standards Codification (“ASC”) 605-10-S25 Revenue Recognition – Overall – Recognition. ASC 605-10-S25 requires thatwhen the following four basic criteria must be met before revenue can be recognized:are met: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred or services have been rendered; (3) the fee is fixed or determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management’s judgment regarding the fixed nature of the feefees charged for products delivered and the collectability of those fees. The application of these criteria has resulted in ourus generally recognizing revenue upon shipment (when title passes)and risk of loss have transferred to customers. Should changescustomers), including distributors, original equipment manufacturers and electronic manufacturing service providers.

Our revenue consists primarily of sales of assembled and tested finished goods. We also sell die in conditions cause managementwafer form to determine these criteria are not met for certain future transactions,our customers and value-added resellers, and we receive royalty revenue recognized for any reporting period could be adversely impacted.

For the years ended December 31, 2015, 2014 and 2013, approximately 96%, 92% and 91% of our distributor sales, respectively, including sales to our value-added resellers, for the year ended December 31, 2012 were made through distribution arrangements with third parties. These arrangements generally do not include any special payment terms (our normal payment terms are 30-45 days for our distributors), price protection or exchange rights. Returns are limited to our standard product warranty. Certain of our large distributors have contracts that include limited stock rotation rights that permit the return of a small percentage of the previous six months’ purchases.

For the years ended December 31, 2015, 2014 and 2013, approximately 4%, 8% and 9% of our distributor sales, for the year ended December 31, 2012respectively, were made through small distributors primarily based on purchase orders. These distributors alsotypically have limited or no stock rotation rights.

We generally recognize revenue consists primarilyupon shipment of sales of assembled and tested finished goods. We also sell die in wafer formproducts to our customers and value-added resellers, and we receive royalty revenue from third parties and value-added resellers.

(1) | The price is fixed or determinable at the date of sale. We do not offer special payment terms, price protection orprice adjustments to distributors when we recognize revenue upon shipment. | |

(2) | The distributors are obligated to pay us and this obligation is not contingent on the resale of our products. | |

(3) | The distributors’ obligation is unchanged in the event of theft or physical destruction or damage to the products. | |

(4) | The distributors have stand-alone economic substance apart from our relationship. | |

(5) | We do not have any obligations for future performance to directly bring about the resale of our productsby the distributors. | |

(6) | The amount of future returns can be reasonably estimated. We have the ability and the information necessary totrack inventory sold to and held at our distributors. We maintain a history of returns and have the ability to estimatethe stock rotation returns on a quarterly basis. |

We maintain a sales reserve for stock rotation rights, which is based on historical experience of actual stock rotation returns on a per distributor basis, where available, and information related to products in the distribution channel. This reserve is recorded at the time of sale. Historically, these returns were not material to our consolidated financial statements. In the future, if we are unable to estimate our stock rotation returns accurately, we may not be able to recognize revenue from sales to our distributors based on when we sell inventory to our distributors. Instead, we may have to recognize revenue when the distributor sells through such inventory to an end-customer.

If we enter into arrangements that have rights of return that are not estimable, we recognize revenue under such arrangements only after the distributor hasdistributors have sold ourthe products to an end customer.

Inventory Valuation.Valuation

We value our inventory at the lower of the standard cost (which approximates actual cost on a first-in, first-out basis) or its current estimated market value. We write down inventory for obsolescence or lack of demand, based on assumptions about future demand and market conditions. If actual market conditions are less favorable than those projected by management, additional inventory write-downs may be required. Conversely, if market conditions are more favorable, inventory may be sold that was previously reserved.

Valuation of Goodwill and Acquisition-Related Intangible Assets

We evaluate intangible assets with finite lives for impairment whenever events or changes in circumstances indicate that an impairment may exist. We perform an annual impairment assessment for goodwill and intangible assets with indefinite lives in the fourth quarter, or more frequently if indicators of potential impairment exist. Impairment of intangible assets is recognized based on the difference between the fair value of the assets and their carrying value. Impairment for goodwill occurs if the fair value of a reporting unit including goodwill is less than its carrying value and is recognized based on the difference between the implied fair value of the reporting unit’s goodwill and the carrying value of the goodwill. The assumptions and estimates used to determine future value of goodwill and intangible assets are complex and subjective. They can be affected by various factors, including external factors such as industry and economic trends, and internal factors such as changes in our business strategy and revenue forecasts. If there is a significant adverse change in our business in the future, including macroeconomic and market conditions, we may be required to record impairment charges on our goodwill and acquisition-related intangible assets.

Accounting for Income Taxes.Taxes ASC 740-10 Income Taxes – Overall prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This interpretation also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods and disclosure. In accordance with ASC 740-10, we

We recognize federal, state and foreign current tax liabilities or assets based on our estimate of taxes payable or refundable in the current fiscal year by tax jurisdiction. We also recognize federal, state and foreign deferred tax assets or liabilities for our estimate of future tax effects attributable to temporary differences and carryforwards. We record a valuation allowance to reduce any deferred tax assets by the amount of any tax benefits that, based on available evidence and judgment, are not expected to be realized.

Our calculation of current and deferred tax assets and liabilities is based on certain estimates and judgments and involves dealing with uncertainties in the application of complex tax laws. Our estimates of current and deferred tax assets and liabilities may change based, in part, on added certainty or finality or uncertainty to an anticipated outcome, changes in accounting or tax laws in the U.S., or foreign jurisdictions where we operate, or changes in other facts or circumstances. In addition, we recognize liabilities for potential U.S. and foreign income tax for uncertain income tax positions taken on our tax returns if it has less than a 50% likelihood of being sustained. If we determine that payment of these amounts is unnecessary or if the recorded tax liability is less than our current assessment, we may be required to recognize an income tax benefit or additional income tax expense in our financial statements in the period such determination is made. We have calculated our uncertain tax positions which were attributable to certain estimates and judgments primarily related to transfer pricing, cost sharing and our international tax structure exposure.

As of December 31, 20122015 and 2011,2014, we had a valuation allowance of $12.5$18.6 million and $14.6$19.1 million, respectively, attributable to management’s determination that it is more likely than not that most of the deferred tax assets in the United StatesU.S. will not be realized. Should it be determined that additional amounts of the net deferred tax asset will not be realized in the future, an adjustment to increase the deferred tax asset valuation allowance will be charged to income in the period such determination is made. Likewise, in the event we were to determine that it is more likely than not that we would be able to realize our deferred tax assets in the future in excess of our net recorded amount, an adjustment to the valuation allowance for the deferred tax asset would increase income in the period such determination was made.

As a result of the cost sharing arrangements with the Company’sour international subsidiaries (cost share arrangements), relatively small changes in costs that are not subject to sharing under the cost share arrangements can significantly impact the overall profitability of the U.S. entity. Because of the U.S. entity’s inconsistent earnings history and uncertainty of future earnings, the Company haswe have determined that it is more likely than not that the U.S. deferred tax benefits will not be realized.

Contingencies

We are a single sales factor for California state apportionment, effective for tax years beginning on or after January 1, 2012. As a result of this law change that happened, our California deferred tax assets were revalued down. As we have a valuation allowance against our U.S. deferred tax assets, this revaluation of our California deferred tax assets did not impact income tax expense.

Accounting for Stock-Based Compensation.Compensation

We account for stock-based compensation under the provisions of ASC 718-10-30 Compensation – Stock Compensation – Overall – Initial Measurement. This standard requires us to measure the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award. We currently use the Black-Scholes option-pricing model to estimate theThe fair value of our share-based payments. The Black-Scholes option-pricing model is based on a number of assumptions, including historical volatility, expected life, risk-free interest rate and expected dividends. The fair value for time-basedrestricted stock awards and stock awards that are contingent upon the achievement of financialunits with service conditions or performance metricsconditions is based on the grant date share price. The fair value of restricted stock units with market conditions, as well as restricted stock units with both market conditions and performance conditions, is estimated using a Monte Carlo simulation model. The fair value of options and shares issued under the employee stock purchase plan is estimated using the Black-Scholes model.

We recognize compensation expense equal to the grant-date fair value for all share-based payment awards that are expected to vest. This expense is recorded on a straight-line basis over the requisite service period of the entire award,awards, unless the awards are subject to market conditions or performance conditions, in which case we recognize compensation expense over the requisite service period offor each separateseparately vesting tranche. WeFor awards with performance conditions, as well as awards with both market conditions and performance conditions, we recognize compensation expense for our performance share units when it becomes probable that the performance criteria specifiedset by the Board of Directors will be achieved.This assessment is performed on a quarterly basis and requires significant assumptions and estimates made by management related to the projected achievement of the performance goals, which can be affected by external factors, such as macroeconomic conditions and the analog industry forecasts, and internal factors, such as our business and operations strategy, product roadmaps and revenue forecasts.Changes in the plan willprobability assessment of achieving the performance conditions are accounted for in the period of change by recording a cumulative catch-up adjustment as if the new estimate had been applied since the service inception date.If the actual performance targets achieved differ significantly from those projected by management, additional compensation expense may be achieved. Therecorded for the performance-based awards due to the cumulative catch-up adjustment, which could have an adverse impact on our results of operations. Furthermore, the amount of stock-based compensation expense that the Company recognizeswe recognize is also based on an expected forfeiture rate. If there is a difference between the forfeiture assumptions used in determining stock-based compensation costs and the actual forfeitures which become known over time, we may change the forfeiture rate, which could have a significant impact on our stock-based compensation expense.

Fair Value of Financial Instruments. ASC 820-10 Fair Value Measurements and Disclosures – Overall defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles in the United States of America, and requires that assets and liabilities carried at fair value be classified and disclosed in one of the three categories, as follows:

In February 2013,May 2014, the Financial Accounting Standards Board (“FASB”("FASB") issued Accounting Standards Update (“ASU”) No. 2013-02, Reporting2014-09, Revenue from Contracts with Customers,which outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers. The standard’s core principle is that an entity will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. In July 2015, the FASB approved a one-year deferral of Amounts Reclassified Out of Accumulated Other Comprehensive Income. This ASU adds new disclosure requirement for items reclassified out of accumulated other comprehensive income (“AOCI”).the effective date. The ASU isstandard will be effective for fiscal years, and interimannual reporting periods within those years, beginning on or after December 15, 2012 and must2017. Early adoption is permitted for reporting periods beginning after December 15, 2016. The standard may be applied prospectively. The Company isretrospectively to each prior period presented or retrospectively with the cumulative effect recognized as of the date of adoption. We are evaluating the impact of the standardadoption on itsour consolidated financial statementsposition, results of operations, cash flows and related disclosures.

In June 2011,November 2015, the FASB issued ASU No. 2011-05 relating to Comprehensive Income (Topic 220) – Presentation2015-17,Balance Sheet Classification of Comprehensive Income (ASU 2011-05)Deferred Taxes,which requires an entitythat all deferred tax assets and liabilities, including related valuation allowance, be classified as non-current on the balance sheets.We have elected to presentearly adopt the totalstandard as of comprehensive income,December 31, 2015 on a retrospective basis. As of December 31, 2014, we reclassified $0.2 million of current deferred tax assets to non-current deferred tax assets on the components of net income, and the components of other comprehensive income either in a single continuous statement ofConsolidated Balance Sheet. The adoption did not affect our operating results, comprehensive income or in two separate but consecutive statements. The ASU is effectivecash flows for fiscal years, and interimthe periods within those years, beginning on or after December 15, 2011 and must be applied retrospectively. The Company adopted this standard effective January 1, 2012.presented.

Results of Operations

| Year ended December 31, | ||||||||||||||||||||||||

| 2012 | 2011 | 2010 | ||||||||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||||||

| Revenue | $ | 213,813 | 100.0 | % | $ | 196,519 | 100.0 | % | $ | 218,840 | 100.0 | % | ||||||||||||

| Cost of revenue | 100,665 | 47.1 | 94,925 | 48.3 | 97,383 | 44.5 | ||||||||||||||||||

| Gross profit | 113,148 | 52.9 | 101,594 | 51.7 | 121,457 | 55.5 | ||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||

| Research and development | 48,796 | 22.8 | 44,518 | 22.7 | 44,372 | 20.3 | ||||||||||||||||||

| Selling, general and administrative | 50,018 | 23.4 | 40,280 | 20.5 | 41,169 | 18.8 | ||||||||||||||||||

| Litigation expense (benefit), net | (2,945 | ) | (1.4 | ) | 3,379 | 1.7 | 5,418 | 2.5 | ||||||||||||||||

| Total operating expenses | 95,869 | 44.8 | 88,177 | 44.9 | 90,959 | 41.6 | ||||||||||||||||||

| Income from operations | 17,279 | 8.1 | 13,417 | 6.8 | 30,498 | 13.9 | ||||||||||||||||||

| Interest income and other, net | 611 | 0.3 | 309 | 0.2 | 922 | 0.5 | ||||||||||||||||||

| Income before income taxes | 17,890 | 8.4 | 13,726 | 7.0 | 31,420 | 14.4 | ||||||||||||||||||

| Income tax provision | 2,134 | 1.0 | 425 | 0.2 | 1,857 | 0.9 | ||||||||||||||||||

| Net income | $ | 15,756 | 7.4 | % | $ | 13,301 | 6.8 | % | $ | 29,563 | 13.5 | % | ||||||||||||

The following table showssummarizes our results of operations:

Year Ended December 31, | ||||||||||||||||||||||||

2015 | 2014 | 2013 | ||||||||||||||||||||||

(in thousands, except percentages) | ||||||||||||||||||||||||

Revenue | $ | 333,067 | 100.0 | % | $ | 282,535 | 100.0 | % | $ | 238,091 | 100.0 | % | ||||||||||||

Cost of revenue | 152,898 | 45.9 | 129,917 | 46.0 | 110,190 | 46.3 | ||||||||||||||||||

Gross profit | 180,169 | 54.1 | 152,618 | 54.0 | 127,901 | 53.7 | ||||||||||||||||||

Operating expenses: | ||||||||||||||||||||||||

Research and development | 65,787 | 19.8 | 58,590 | 20.7 | 49,733 | 20.9 | ||||||||||||||||||

Selling, general and administrative | 72,312 | 21.7 | 66,755 | 23.6 | 54,624 | 22.9 | ||||||||||||||||||

Litigation expense (benefit), net | 1,000 | 0.3 | (8,027 | ) | (2.8 | ) | (371 | ) | (0.2 | ) | ||||||||||||||

Total operating expenses | 139,099 | 41.8 | 117,318 | 41.5 | 103,986 | 43.6 | ||||||||||||||||||

Income from operations | 41,070 | 12.3 | 35,300 | 12.5 | 23,915 | 10.1 | ||||||||||||||||||

Interest and other income, net | 1,421 | 0.5 | 1,092 | 0.4 | 92 | 0.0 | ||||||||||||||||||

Income before income taxes | 42,491 | 12.8 | 36,392 | 12.9 | 24,007 | 10.1 | ||||||||||||||||||

Income tax provision | 7,319 | 2.2 | 897 | 0.3 | 1,109 | 0.5 | ||||||||||||||||||

Net income | $ | 35,172 | 10.6 | % | $ | 35,495 | 12.6 | % | $ | 22,898 | 9.6 | % | ||||||||||||

Revenue

The following table summarizes our revenue by product family (amounts in thousands, except percentages):

| Year ended December 31, | Percent Change | |||||||||||||||||||||||||||||||

| Product Family | 2012 | % of Revenue | 2011* | % of Revenue | 2010* | % of Revenue | 2012 to 2011 Change | 2011 to 2010 Change | ||||||||||||||||||||||||

| DC to DC Converters | $ | 188,736 | 88.3 | % | $ | 170,032 | 86.5 | % | $ | 190,286 | 87.0 | % | 11.0 | % | (10.6 | %) | ||||||||||||||||

| Lighting Control Products | 25,077 | 11.7 | % | 26,487 | 13.5 | % | 28,554 | 13.0 | % | (5.3 | %) | (7.2 | %) | |||||||||||||||||||

| Total | $ | 213,813 | 100.0 | % | $ | 196,519 | 100.0 | % | $ | 218,840 | 100.0 | % | 8.8 | % | (10.2 | %) | ||||||||||||||||

Year Ended December 31, | Change | |||||||||||||||||||||||||||||||

Product Family | 2015 | % of Revenue | 2014 | % of Revenue | 2013 | % of Revenue | From 2014 to 2015 | From 2013 to 2014 | ||||||||||||||||||||||||

(In thousands, except percentages) | ||||||||||||||||||||||||||||||||

DC to DC products | $ | 299,726 | 90.0 | % | $ | 253,083 | 89.6 | % | $ | 211,337 | 88.8 | % | 18.4 | % | 19.8 | % | ||||||||||||||||

Lighting control products | 33,341 | 10.0 | % | 29,452 | 10.4 | % | 26,754 | 11.2 | % | 13.2 | % | 10.1 | % | |||||||||||||||||||

Total | $ | 333,067 | 100.0 | % | $ | 282,535 | 100.0 | % | $ | 238,091 | 100.0 | % | 17.9 | % | 18.7 | % | ||||||||||||||||

Revenue for the year ended December 31, 20122015 was $213.8$333.1 million, an increase of $17.3$50.6 million, or 8.8%17.9%, from $196.5$282.5 million for the year ended December 31, 2011.2014. This increase was due to higher sales of both DC to DC and lighting control products, as unit shipments increased 17% due to higher market demand with current customers and additional design wins with new customers, coupled with an increase of 1% in average sales prices. Revenue from our DC to DC products was $299.7 million for the year ended December 31, 2015, an increase of $46.6 million, or 18.4%, from the same period in 2014. This increase was primarily due to increased demand for our DC to DC converters. Revenue fromhigher sales of our DC to DC converters was $188.7 million, an increaseand battery chargers, which were offset in part by lower sales of $18.7 million, or 11.0%, over the same period in 2011 primarily due to increased demand for our DC to DC converters, Mini-Monster and CLSMini-Monsters products. Sales ofRevenue from our lighting control products was $33.3 million for the year ended December 31, 2012 were down by 5.3%2015, an increase of $3.9 million, or 13.2%, compared towith the same period in 2011 primarily due to reductions in demand for our CCFL and WLED products.

Revenue for the year ended December 31, 20112014 was $196.5$282.5 million, a decreasean increase of $22.3$44.4 million, or 10.2%18.7%, from $218.8$238.1 million for the year ended December 31, 2010. For the year ended December 31, 2011, the decrease in revenue from the same period last year2013. This increase was largely attributabledue to having lost certainhigher sales of both DC to DC converters productand lighting control products, as unit shipments increased 37% due to higher market demand with current customers and additional design wins with new customers, which were offset in Korea aspart by a lack of production capacity resulted13% decrease in product shortages during 2010. Audioaverage sales which are reported inprices. Revenue from our DC to DC converters beginning in 2012, were $4.4products was $253.1 million for the year ended December 31, 2011, a decrease2014, an increase of $2.8$41.7 million, or 19.8%, from the same period in 20102013. This increase was primarily due to a changehigher sales of our DC to DC converters, offset in product mix. Thepart by lower sales of our Mini-Monsters products. Revenue from our lighting control products were downwas $29.5 million for the year ended December 31, 2011 from2014, an increase of $2.7 million, or 10.1%, compared with the similarsame period in 2010 because of a reduction in the demand for our CCFL products, which was partially offset by increased sales of our WLED products.

Cost of Revenue and Gross Margin

| Year ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| (in thousands, except percentages) | ||||||||||||

| Cost of Revenue (1) | $ | 100,665 | $ | 94,925 | $ | 97,383 | ||||||

| Cost of revenue as a percentage of revenue | 47.1 | % | 48.3 | % | 44.5 | % | ||||||

| Gross Profit | $ | 113,148 | $ | 101,594 | $ | 121,457 | ||||||

| Gross Margin | 52.9 | % | 51.7 | % | 55.5 | % | ||||||

| (1) Includes stock-based compensation expense | $ | 510 | $ | 312 | $ | 393 | ||||||

Cost of revenue primarily consists primarily of costs incurred to manufacture, assemble and test our products, as well as warranty costs, inventory-related and other overhead costs, relating to the aforementioned costs includingand stock-based compensation expense. Gross profit as a percentageexpenses. In addition, cost of revenue includes amortization of intangible assets from the Sensima acquisition beginning in the third quarter of 2014.

Year Ended December 31, | Change | |||||||||||||||||||

2015 | 2014 | 2013 | From 2014 to 2015 | From 2013 to 2014 | ||||||||||||||||

(in thousands, except percentages) | ||||||||||||||||||||

Cost of revenue | $ | 152,898 | $ | 129,917 | $ | 110,190 | 17.7 | % | 17.9 | % | ||||||||||

Cost of revenue as a percentage of revenue | 45.9 | % | 46.0 | % | 46.3 | % | ||||||||||||||

Gross profit | $ | 180,169 | $ | 152,618 | $ | 127,901 | 18.1 | % | 19.3 | % | ||||||||||

Gross margin | 54.1 | % | 54.0 | % | 53.7 | % | ||||||||||||||

Cost of revenue was $152.9 million, or gross margin, was 52.9%45.9% of revenue, for the year ended December 31, 2012, compared to 51.7%2015, and $129.9 million, or 46.0% of revenue, for the year ended December 31, 2011.2014. The $23.0 million increase in gross profit margin year-over-yearcost of revenue was primarily due to a 17% increase in unit shipments, coupled with a 4% increase in the average direct cost of units shipped. The increase in cost of revenue was also driven by additional amortization of intangible assets of $1.1 million.

Gross margin was 54.1% for the year ended December 31, 2015, compared with 54.0% for the year ended December 31, 2014. For the year ended December 31, 2015, gross margin was favorably impacted by lower inventory reserveslabor and improved product mixoverhead costs as a percentage of revenue, partially offset by increased sales of lower margin products and higher amortization of intangible assets compared to the same period in 2011.

Cost of revenue was 51.7%$129.9 million, or 46.0% of revenue, for the year ended December 31, 20112014, and 55.5%$110.2 million, or 46.3% of revenue, for the year ended December 31, 2010. For2013. The $19.7 million increase in cost of revenue was primarily due to a 37% increase in unit shipments, which was partially offset by a 14% decrease in the average direct cost of units shipped. The increase in cost of revenue was also driven by an increase of $0.8 million in the provision for inventory reserve and additional amortization of intangible assets of $0.7 million.

Gross margin was 54.0% for the year ended December 31, 2011,2014, compared to 53.7% for the year ended December 31, 2013. The increase in gross margin declined between yearswas primarily due to lower labor and overhead costs as a resultpercentage of declining average selling prices for certain of our products, unabsorbed test manufacturing costs andrevenue compared to the same period in 2013. This increase was partially offset by an increase in the provision for inventory reserves.

Research and Development

Research and development (“R&D”) expenses primarily consist of salary and benefit expenses, bonuses and stock-based compensation expenses for design and product engineers, expenses related to new product development and relatedsupplies, and facility costs.

| Year ended December 31, | Percentage Change | |||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 to 2011 | 2011 to 2010 | ||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||

| Research and development (“R&D”) (1) | $ | 48,796 | $ | 44,518 | $ | 44,372 | 9.6 | % | 0.3 | % | ||||||||||

| R&D as a percentage of revenue | 22.8 | % | 22.7 | % | 20.3 | % | ||||||||||||||

| (1) Includes stock-based compensation expense | $ | 6,922 | $ | 5,909 | $ | 6,742 | ||||||||||||||

Year Ended December 31, | Change | |||||||||||||||||||

2015 | 2014 | 2013 | From 2014 to 2015 | From 2013 to 2014 | ||||||||||||||||

(in thousands, except percentages) | ||||||||||||||||||||

R&D expenses | $ | 65,787 | $ | 58,590 | $ | 49,733 | 12.3 | % | 17.8 | % | ||||||||||

As a percentage of revenue | 19.8 | % | 20.7 | % | 20.9 | % | ||||||||||||||

R&D expenses were $48.8$65.8 million, or 22.8%19.8% of revenue, for the year ended December 31, 20122015 and $44.5$58.6 million, or 22.7%20.7% of revenue, for the year ended December 31, 2011.2014. The $7.2 million increase in R&D expenses increased year-over-yearwas primarily due to an increase of $3.7 million in cash compensation expenses, which include salary, benefits and bonuses, an increase of $2.1 million in stock-based compensation expenses primarily associated with the performance-based equity awards, an increase of $0.5 million in new product development expenses, and an increase of $0.3 million in expenses associated with increased new product development.manufacturing and laboratory supplies. These increases were partially offset by a decrease of $0.2 million related to the changes in the value of the employee deferred compensation plan liabilities. Our R&D headcount as of December 31, 2012 was 388 employees, compared to 374506 employees as of December 31, 2011.2015, compared with 476 employees as of December 31, 2014.

R&D expenses were $44.5$58.6 million, or 22.7%20.7% of revenue, for the year ended December 31, 20112014 and $44.4$49.7 million, or 20.3%20.9% of revenue, for the year ended December 31, 2010. For the year ended December 31, 2011,2013. The $8.9 million increase in R&D expenses remained flatwas primarily due to an increase of $2.8 million in stock-based compensation expenses primarily associated with the same periodperformance-based and market-based equity awards, an increase of $2.4 million in 2010 due to lower stock-based compensation expenses. These were partially offset bynew product development expenses, an increase of $2.0 million in cash compensation expenses, which include salary, benefits and new product development expenses.

Selling, General and Administrative

Selling, general and administrative (“SG&A”) expenses primarily include salary and benefit expenses, bonuses and stock-based compensation expenses for sales, marketing and administrative personnel, sales commissions, travel expenses, related facilities costs, outside legal and accounting fees, and fees associated with Sarbanes-Oxley compliance requirements.

| Year ended December 31, | Percentage Change | |||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 to 2011 | 2011 to 2010 | ||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||

| Selling, general and administrative (“SG&A”) (1) | $ | 50,018 | $ | 40,280 | $ | 41,169 | 24.2 | % | (2.2 | %) | ||||||||||

| SG&A as a percentage of net revenue | 23.4 | % | 20.5 | % | 18.8 | % | ||||||||||||||

| (1) Includes stock-based compensation expense | $ | 11,220 | $ | 6,905 | $ | 9,675 | ||||||||||||||

Year Ended December 31, | Change | |||||||||||||||||||

2015 | 2014 | 2013 | From 2014 to 2015 | From 2013 to 2014 | ||||||||||||||||

(in thousands, except percentages) | ||||||||||||||||||||

SG&A expenses | $ | 72,312 | $ | 66,755 | $ | 54,624 | 8.3 | % | 22.2 | % | ||||||||||

As a percentage of revenue | 21.7 | % | 23.6 | % | 22.9 | % | ||||||||||||||

SG&A expenses were $50.0$72.3 million, or 23.4%21.7% of revenue, for the year ended December 31, 20122015 and $40.3$66.8 million, or 20.5%23.6% of revenue, for the year ended December 31, 2011.2014. The $5.5 million increase in SG&A expenses increased year-over-yearwas primarily due to an increase of $5.7 million in cash and stock-based compensation expenses professional services feesprimarily associated with the performance-based equity awards, an increase of $2.0 million in cash compensation expenses, which include salary, benefits and salesbonuses, and an increase of $0.6 million in commission onexpenses due to higher revenue comparedrevenue. These increases were partially offset by a credit of $2.5 million related to the same periodrelease of a contingent consideration liability (see below), a decrease of $0.6 million in 2011.professional service fees due to the transaction costs incurred in the Sensima acquisition in 2014 but not in 2015, and a gain of $0.3 million from sales of certain operating equipment. Our SG&A headcount as of December 31, 2012 was 250 employees, compared to 238306 employees as of December 31, 2011.

Our acquisition of Senisma in July 2014 included a contingent consideration arrangement which requires us to pay up to $8.9 million to certain former Sensima shareholders if Sensima achieves a new product introduction as well as certain product revenue and direct margin targets in 2016. The fair value of the contingent consideration at the acquisition date was $2.5 million, which was estimated based on a probability-weighted analysis of possible future revenue outcomes. As part of the quarterly assessment in the fourth quarter of 2015, management reviewed the sales forecast for the products and concluded that the projected product revenue in 2016 will not likely meet the minimum target required to earn the contingent consideration, primarily because the product adoption process by customers will take longer than we had originally anticipated. Accordingly, the fair value of the contingent consideration was deemed to be $0 as of December 31, 2015, and we recorded the release of the liability of $2.5 million as a credit to SG&A expenses. We will continue to assess the probability of former Sensima shareholders earning the contingent consideration in 2016 and may record additional adjustment to the fair value.

SG&A expenses were $40.3$66.8 million, or 20.5%23.6% of revenue, for the year ended December 31, 20112014 and $41.2$54.6 million, or 18.8%22.9% of revenue, for the year ended December 31, 2010. For the year ended December 31, 2011,2013. The $12.2 million increase in SG&A expenses decreased from the same period in 2010was primarily due to loweran increase of $9.7 million in stock-based compensation expenses. These were partially offset byexpenses primarily associated with the performance-based and market-based equity awards, an increase of $0.9 million in professional service fees primarily due to the transaction costs of $0.6 million incurred in the Sensima acquisition, an increase of $0.5 million in cash compensation expenses. expenses, which include salary, benefits and bonuses, and an increase of $0.3 million in commission expenses due to higher revenue. Our SG&A headcount was 274 employees as of December 31, 2014, compared to 249 employees as of December 31, 2013.

Litigation Expense (Benefit), Net

Litigation expense (benefit), net

| Year ended December 31, | Percentage Change | |||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 to 2011 | 2011 to 2010 | ||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||

| Litigation expense (benefit), net | $ | (2,945 | ) | $ | 3,379 | $ | 5,418 | (187.2 | %) | (37.6 | %) | |||||||||

| Litigation expense (benefit), net, as a percentage of revenue | (1.4 | %) | 1.7 | % | 2.5 | % | ||||||||||||||

Litigation benefit, net, was $(8.0) million for the year ended December 31, 2010. During2014, compared with a litigation benefit, net, of $(0.4) million for the year ended December 31, 2011, we incurred legal expenses primarily to recover attorneys’ fees from O2Micro relating to our earlier lawsuits with them, which were resolved in the second quarter of 2010. During2013. The net litigation benefit for the year ended December 31, 2010,2014 included the recognition of a $9.5 million award from the O2 Micro litigation, partially offset by $0.5 million of additional legal fees incurred in connection with the final resolution of the litigation. The net litigation benefit for the year ended December 31, 2013 included $0.8 million of proceeds received in connection with the legal settlement with Silergy Corporation. The increase in net litigation benefit for the year ended December 31, 2014 was partially offset by higher expenses we incurred legal expenses primarily forin other litigation matters, compared to the defense of those lawsuits. Overall, our litigation expense decreased as a result of us being party to fewer material legal actions.

For a more complete description of our current material litigation matters, please see Part I, Item 3 “Legal Proceedings” and Note 1013 “Litigation” of the Notes to Consolidated Financial Statements.

Interest Income and Other Income, Net