| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| |

| Delaware | 74-1335253 | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) | |

| Title of Each Class | Name of Each Exchange onwhich registered | |

Common Stock ($0.32 par value per share) | New York Stock Exchange | |

| Common Stock Purchase Rights | New York Stock Exchange | |

x

x

x

| Large accelerated filer ☐ | Accelerated filer |

Non-accelerated filer ☐ | Smaller reporting company x |

| Emerging growth company ☐ | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ | |

x

26, 201529, 2018PagePart IPage Item 1Business6Risk Factors102020434479797980808080808185

Additional Information

We file reports with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. The public may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We are an electronic filer, and the SEC maintains an Internet site athttp://www.sec.gov that contains the reports, proxy and information statements, and other information that we file electronically. Our website address iswww.lubysinc.com. Please note that our website address is provided as an inactive textual reference only. We make available free of charge through our website the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The information provided on our website is not part of this report, and is therefore not incorporated by reference unless such information is specifically referenced elsewhere in this report.

FORWARD-LOOKING STATEMENTS

This Annual Report on “Form(this "Form 10-K”) contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this Form 10-K, other than statements of historical facts, are “forward-looking statements” for purposes of these provisions, including any statements regarding:

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

PART I

San Antonio Metro Rio Grande Valley Dallas/Fort Worth Metro Austin Arizona orders which comprise approximately 13% of our Luby's Cafeteria restaurant sales. the area supervised. Food-to-go sales comprise approximately 8% of Fuddruckers restaurant sales. governmental facility, one medical office building, one senior living facility, and one freestanding coffee venue located inside an office building. We have the unique ability to deliver quality services that include facility design and procurement as well as nutrition and branded food services to our clients. 2017. Luby’s, Inc. owns or is licensed to use valuable intellectual property including trademarks, service marks, patents, copyrights, trade secrets and other proprietary information, including the Luby’s and Fuddruckers logos, trade names and trademarks, which are of material importance to our business. Depending on the jurisdiction, trademarks, and service marks generally are valid as long as they are used and/or registered. Patents, copyrights, and licenses are of varying durations. The success of our business depends on the continued ability to use existing trademarks, service marks, and other components of our brands in order to increase brand awareness and further develop branded products. We take prudent actions to protect our intellectual property. event our cost estimates differ from actual costs, we could incur additional unplanned costs, which could adversely impact our financial condition. In addition, we have previously been the victim of a cyber attack by hackers who deployed a version of the SamSam ransomware that encrypted electronic files, locking us out of many of our point-of-sale and other systems. These hackers requested a “ransom” payment in exchange for restoring access to these encrypted files. Such attacks, while they did not provide the hackers with access to confidential customer and employee information, did adversely affect our profits due to our temporary inability to operate our restaurants and increased costs associated further protecting and restoring our computer systems. While we have taken preventative measures, no assurances can be provided that we will not be the subject of cyber attacks again in the future. December 2021. Fiscal Quarter Ended High Low November 20, 2013 February 12, 2014 May 7, 2014 August 27, 2014 November 19, 2014 February 11, 2015 May 6, 2015 August 26, 2015 $1.41. (a) (b) (c) Plan Category Number of Securitiesto be Issued Upon Exercise of Outstanding Options, Rights Weighted- Average Options, Rights Number of Securities Available for Future Issuance Under Equity Compensation Plans Excluding Securities Reflected in Column (a) Equity compensation plans previously approved by security holders Equity compensation plans not previously approved by security holders(1) Total 2010 2011 2012 2013 2014 2015 Luby’s, Inc. S&P 500 Index—Total Return S&P 500 Restaurant Index New Peer Group Index Only New Peer Group Index + Luby’s Inc. Old Peer Group Index Only Old Peer Group Index + Luby’s Inc. Fiscal Year Ended August 26, August 27, August 28, August29, August31, (364 days) (364 days) (364 days) (364 days) (371days) (In thousands, except per share data) Sales Restaurant sales Culinary contract services Franchise revenue Vending revenue Total sales Income (loss) from continuing operations ) ) Income (loss) from discontinued operations (a) ) ) ) ) Net income (loss) ) ) Income (loss) per share from continuing operations: Basic ) ) Assuming dilution ) ) Income (loss) per share from discontinued operation: Basic ) ) ) ) Assuming dilution ) ) ) ) Net income (loss) per share: Basic ) ) Assuming dilution ) ) Weighted-average shares outstanding: Basic Assuming dilution Total assets Total debt Number of restaurants at fiscal year end Number of franchised restaurants at fiscal year end Number of Culinary Contract Services contracts at fiscal year end Costs and Expenses (As a percentage of restaurant sales) Cost of food % % % % % Payroll and related costs % % % % % Other operating expenses % % % % % Occupancy costs % % % % % FiscalYear Ended August 26, August 27, August 28, (52 weeks) (52 weeks) (52 weeks) Restaurant sales % % % Culinary contract services % % % Franchise revenue % % % Vending revenue % % % TOTAL SALES % % % STORE COSTS AND EXPENSES: (As a percentage of restaurant sales) Cost of food % % % Payroll and related costs % % % Other operating expenses % % % Occupancy costs % % % Vending revenue )% )% )% Store level profit % % % COMPANY COSTS AND EXPENSES: (As a percentage of total sales) Opening costs % % % Depreciation and amortization % % % Selling, general and administrative expenses % % % Provision for asset impairments % % % Net gain on disposition of property and equipment )% )% )% Culinary Contract Services Costs (As a percentage ofculinary contract servicessales) Cost of culinary contract services % % % Culinary income % % % Franchise Operations Costs (As a percentage offranchise operations) Cost of franchise operations % % % Franchise income % % % (As a percentage of total sales) INCOME (LOSS) FROM OPERATIONS )% )% % Interest income % % % Interest expense )% )% )% Other income, net % % % Income (loss) before income taxes and discontinued operations )% )% % Provision (benefit) for income taxes )% )% % Income (loss) from continuing operations )% )% % Loss from discontinued operations, net of income taxes )% )% )% NET INCOME (LOSS) )% )% % FiscalYear Ended August 26, August 27, August 28, (52 weeks) (52 weeks) (52 weeks) Store level profit Plus: Sales from culinary contract services Sales from franchise revenue Less: Opening costs Cost of culinary contract services Cost of franchise operations Depreciation and amortization Selling, general and administrative expenses Provision for asset impairments Net gain on disposition of property and equipment ) ) ) Interest income ) ) ) Interest expense Other income, net ) ) ) Provision (benefit) for income taxes ) ) Income (loss) from continuing operations ) ) 30, 2017. Fiscal2015 Year Begin Fiscal 2015 Openings Fiscal 2015 Closings Fiscal2015 Year End Luby’s Cafeterias(1) ) Fuddruckers Restaurants(1) ) Cheeseburger in Paradise Other restaurants(2) Total ) Description of the business sales through retail grocery outlets. associated other overhead costs. 2016. % )% % )% )% % % )% % )% )% % Fiscal Year 2015 Ended Fiscal Year 2014 Ended Fiscal 2015 vs Fiscal 2014 Fiscal Year 2013 Ended Fiscal 2014 vs Fiscal 2013 ($000s) August 26, 2015 August 27, 2014 Increase/ (Decrease) August 28, 2013 Increase/ (Decrease) (52 weeks) (52 vs 52 weeks) Restaurant sales % % Culinary contract services )% % Franchise revenue )% % Vending revenue )% )% Total )% % were generated. Restaurant Brand Fiscal 2015 ($000s) Fiscal 2014 ($000s) Fiscal 2015 H/(L) Than Fiscal 2014 $ Amount % Change Luby’s Cafeterias ) )% Fuddruckers % Combo locations % Cheeseburger in Paradise ) )% Koo Koo Roo ) )% Total Restaurant Sales % 2017. Fiscal Year 2015Ended Fiscal Year 2014 Ended Fiscal 2015 vs Fiscal 2014 Fiscal Year 2013 Ended Fiscal 2014 vs Fiscal 2013 ($000s) August 26, 2015 August 27, 2014 Increase/ (Decrease) August 28, 2013 Increase/ (Decrease) (52 weeks) (52 vs 52 weeks) (52 weeks) (52 vs 52 weeks) Cost of food % % As a percent of restaurant sales % % % % % Payroll and Related Costs Fiscal Year 2015 Ended Fiscal Year 2014 Ended Fiscal 2015 vs Fiscal 2014 Fiscal Year 2013 Ended Fiscal 2014 vs Fiscal 2013 ($000s) August 26, 2015 August 27, 2014 Increase/ (Decrease) August 28, 2013 Increase/ (Decrease) (52 weeks) (52 vs 52 weeks) (52 weeks) (52 vs 52 weeks) Payroll and related costs % % As a percent of restaurant sales % % % % % hourly wage rates reflective of market pressures; and (3) an approximate $1.0 million increase in workers' compensation expense. (mainly management labor) with lower same-store sales levels; (2) higher average hourly wage rates reflective of market pressures; (3) higher average restaurant management compensation; partially offset by (4) lower workers' compensation insurance expense. Fiscal Year 2015 Ended Fiscal Year 2014 Ended Fiscal 2015 vs Fiscal 2014 Fiscal Year 2013 Ended Fiscal 2014 vs Fiscal 2013 August 26, 2015 August 27, 2014 Increase/ (Decrease) August 28, 2013 Increase/ (Decrease) Other operating expenses % % As a percent of restaurant sales % % % % % supplies expense with typical inflationary cost increases on lower same-store sales volumes. Fiscal Year 2015 Ended Fiscal Year 2014 Ended Fiscal 2015 vs Fiscal 2014 Fiscal Year 2013 Ended Fiscal 2014 vs Fiscal 2013 August 26, 2015 August 27, 2014 Increase/ (Decrease) August 28, 2013 Increase/ (Decrease) Occupancy cost )% % As a percent of restaurant sales % % )% % )% Franchise Operations Segment Profit Fiscal Year 2015 Ended Fiscal Year 2014 Ended Fiscal 2015 vs Fiscal 2014 Fiscal Year 2013 Ended Fiscal 2014 vs Fiscal 2013 August 26, 2015 August 27, 2014 Increase/ (Decrease) August 28, 2013 Increase/ (Decrease) Franchise revenue )% % Cost of franchise revenue )% % Franchise profit )% )% Franchise profit as percent of franchise revenue % % % % )% Fiscal Year 2015 Ended Fiscal Year 2014 Ended Fiscal 2015 vs Fiscal 2014 Fiscal Year 2013 Ended Fiscal 2014 vs Fiscal 2013 ($000s) August 26, 2015 August 27, 2014 Increase/ (Decrease) August 28, 2013 Increase/ (Decrease) Culinary contract services sales % Cost of culinary contract services % Culinary contract profit % Culinary contract profit as percent of culinary contract sales % % % % (3) the closure of nine locations which reduced sales by $3.1 million. Cost of 2016. Fiscal Year 2015 Ended Fiscal Year 2014 Ended Fiscal 2015 vs Fiscal 2014 Fiscal Year 2013 Ended Fiscal 2014 vs Fiscal 2013 August 26, 2015 August 27, 2014 Increase/ (Decrease) August 28, 2013 Increase/ (Decrease) Depreciation and amortization % % As a percent of total sales % % % % % lives. Fiscal Year 2015 Ended Fiscal Year 2014 Ended Fiscal 2015 vs Fiscal 2014 Fiscal Year 2013 Ended Fiscal 2014 vs Fiscal 2013 August 26, 2015 August 27, 2014 Increase/ (Decrease) August 28, 2013 Increase/ (Decrease) Selling, general and administrative expenses Marketing and advertising expenses Selling, general and administrative expenses As percent of total sales approximately $0.5 million. the lease terms. at operating locations and costs associated with disposal of assets at one leased property we operated up until the time of lease termination. 2016. balances and higher average interest rates. 2017 compared to fiscal 2016 primarily related to (1) recording a net reduction in the fair value of our interest rate swap agreement; (2) lower rental net income; and (3) a decrease in sales tax discounts as we did not participate in state tax prepayment programs to the full extent in fiscal 2017. FiscalYear Ended August 26, August 27, August 28, (52 weeks) (52 weeks) (52 weeks) Discontinued operating losses ) ) ) Impairments ) ) ) Net gains (losses) ) Pretax loss ) ) ) Income tax benefit from discontinued operations Loss from discontinued operations ) ) ) properties. Based upon our level of past and projected capital requirements, we expect that proceeds from the sale of assets and cash flows from operations, combined with other financing alternatives in place or available, will be sufficient to meet our capital expenditures and working capital requirements during the next twelve months. Fiscal Year Ended August 26, August 27, August 27, (In thousands) Total cash provided by (used in): Operating activities Investing activities ) ) ) Financing activities ) Increase (decrease) in cash and cash equivalents ) the fair value of our interest rate swap. 2017. costs. November 8, 2021. For this section of the form 10-K, capitalized terms that are used but not otherwise defined shall have the meanings given to such terms in the 2016 Credit Agreement. Agreement, initial extensions of credit under the 2016 Credit Agreement, and (iii) for working capital and general corporate purposes of the Company. our subsidiaries. The other indebtedness. Payments due by Period Contractual Obligations Total Less than 1 Year 1-3 Years 3-5 Years After (In thousands) Long-term debt(a) Capital lease and other obligations(b) Operating lease obligations(c) Uncertain tax positions liability(d) Total Amount of Commitment by Expiration Period Other Commercial Commitments Total Fiscal Fiscal Fiscal Thereafter (In thousands) Letters of credit Capital lease obligations contain leases FiscalYear Ended August 26, August 27, August 28, (364 days) (364 days) (364 days) (In thousands) AFFILIATED COSTS INCURRED: Selling, general and administrative expenses—professional and other costs Capital expenditures—custom-fabricated and refurbished equipment Other operating expenses, occupancy costs and opening costs, including property leases Total RELATIVE TOTAL COMPANY COSTS: Selling, general and administrative expenses Capital expenditures Other operating expenses, occupancy costs and opening costs Total AFFILIATED COSTS INCURRED AS A PERCENTAGE OF RELATIVE TOTAL COMPANY COSTS % % % one dollar. the Company. the Company. Our income tax expense, deferred tax assets and liabilities, and liabilities for unrecognized tax benefits reflect management’s best estimate of current and future taxes to be paid. We are subject to income taxes in the United States and a limited number of foreign jurisdictions, involving franchised locations in South America, Mexico, Dominican Republic, Canada, Poland and Italy. Significant judgments and estimates are required in the determination of the consolidated income tax expense. On December 22, 2017, President Donald J. Trump signed into law U.S. tax reform legislation that is commonly referred to as the Tax Cuts and Jobs Act (the “Tax Act”). The enactment date occurred during the second quarter of fiscal 2018 and the impact on our income tax accounts of the Tax Act are accounted for in the period of enactment, in accordance with ASC 740. The Tax Act makes broad and complex changes to the U.S. tax code and most notably to the Company, the Tax Act lowered the federal statutory tax rate from 35% to 21% effective January 1, 2018. In accordance with the application of IRC Section 15, the Company's federal statutory tax rate for fiscal 2018 was 25 percent, representing a blended tax rate for the current fiscal year based on the number of days in the fiscal year before and after the effective date. For subsequent years, the Company's federal statutory tax rate is anticipated to be 21%. The Company was also required to remeasure its deferred tax assets and liabilities using the new federal statutory tax rate in the second quarter of fiscal year 2018, upon enactment of the Tax Act. At that time, the Company's net deferred tax asset balance was $7.8 million, and the Tax Act reduction in the federal statutory tax rate resulted in a one-time non-cash reduction to the Company's net deferred tax balance of approximately $3.2 million with a corresponding income tax provision increase in the second quarter of fiscal 2018. Deferred income taxes arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in the financial statements, which will result in taxable or deductible amounts in the future, as well as from tax Net Operating Losses ("NOL") and tax credit carryovers. We establish a valuation allowance when we no longer consider it more likely than not that a deferred tax asset will be realized. In evaluating our ability to recover our deferred tax assets, we consider available positive and negative evidence, including scheduled reversals of deferred tax liabilities, tax-planning strategies rd party insurance carriers. Our self-insurance expense is accrued based upon the aggregate of the expected liability for reported claims and the estimated liability for claims incurred but not reported, based on historical claims experience provided by our 3rd party insurance advisors, adjusted as necessary based upon management’s reasoned judgment. Actual employee medical claims expense may differ from estimated loss provisions based on historical experience. The liabilities for these claims are included as a component of Accrued expenses and other liabilities on our consolidated balance sheets. It is generally our policy to maintain stable menu prices without regard to seasonal variations in food costs. Certain increases in costs of food, wages, supplies, transportation and services may require us to increase our menu prices from time to time. To the extent prevailing market conditions allow, we intend to adjust menu prices to maintain profit margins. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. 2013 Internal Control-Integrated Framework issued by COSO. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. August 26, August 27, (In thousands, except share data) ASSETS Current Assets: Cash and cash equivalents Trade accounts and other receivables, net Food and supply inventories Prepaid expenses Assets related to discontinued operations Deferred income taxes Total current assets Property held for sale Assets related to discontinued operations Property and equipment, net Intangible assets, net Goodwill Deferred income taxes Other assets Total assets LIABILITIES AND SHAREHOLDERS’ EQUITY Current Liabilities: Accounts payable Liabilities related to discontinued operations Accrued expenses and other liabilities Total current liabilities Credit facility debt Liabilities related to discontinued operations Other liabilities Total liabilities Commitments and Contingencies SHAREHOLDERS’ EQUITY Common stock, $0.32 par value; 100,000,000 shares authorized; Shares issued were 29,134,603 and 28,949,523, respectively; Shares outstanding were 28,634,603 and 28,449,523, respectively Paid-in capital Retained earnings Less cost of treasury stock, 500,000 shares ) ) Total shareholders’ equity Total liabilities and shareholders’ equity Year Ended August 26, August 27, August 28, (In thousands, except per share data) SALES: Restaurant sales Culinary contract services Franchise revenue Vending revenue TOTAL SALES COSTS AND EXPENSES: Cost of food Payroll and related costs Other operating expenses Occupancy costs Opening costs Cost of culinary contract services Cost of franchise operations Depreciation and amortization Selling, general and administrative expenses Provision for asset impairments Net gain on disposition of property and equipment ) ) ) Total costs and expenses INCOME (LOSS) FROM OPERATIONS ) ) Interest income Interest expense ) ) ) Other income, net Income (loss) before income taxes and discontinued operations ) ) Provision (benefit) for income taxes, net ) ) Income (loss) from continuing operations ) ) Loss from discontinued operations, net of income taxes ) ) ) NET INCOME (LOSS) ) ) Income (loss) per share from continuing operations: Basic ) ) Assuming dilution ) ) Loss per share from discontinued operations: Basic ) ) ) Assuming dilution ) ) ) Net income (loss) per share: Basic ) ) Assuming dilution ) ) Weighted-average shares outstanding: Basic Assuming dilution Common Stock Issued Treasury Shares Amount Shares Amount Paid-In Retained Total Balance at August 29, 2012 ) ) Net income for the year Common stock issued under nonemployee director benefit plans Common stock issued under employee benefit plans Increase in excess tax benefits from share-based compensation Share-based compensation expense Balance at August 28, 2013 ) ) Net loss for the year ) ) Common stock issued under nonemployee director benefit plans Common stock issued under employee benefit plans Increase in excess tax benefits from share-based compensation Share-based compensation expense Balance at August 27, 2014 ) ) Net loss for the year ) ) Common stock issued under nonemployee director benefit plans ) Common stock issued under employee benefit plans Increase in excess tax benefits from share-based compensation Share-based compensation expense Balance at August 26, 2015 ) ) Year Ended August 26, August 27, August 28, (In thousands) CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) ) ) Adjustments to reconcile net income to net cash provided by operating activities: Provision for asset impairments and gains on property sales ) ) Depreciation and amortization Amortization of debt issuance cost Non-cash compensation expense Share-based compensation expense Tax benefit on share-based compensation ) ) ) Deferred tax expense (benefit) ) ) Cash provided by operating activities before changes in operating asset and liabilities Changes in operating assets and liabilities: Decrease (increase) in trade accounts and other receivables ) ) Decrease (increase) in food and supply inventories ) ) Decrease (increase) in prepaid expenses and other assets ) Increase (decrease) in accounts payable, accrued expenses and other liabilities ) Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Repayment of note receivable Acquisition of Cheeseburger in Paradise – ) Proceeds from disposal of assets and property held for sale Purchases of property and equipment ) ) ) Net cash used in investing activities ) ) ) CASH FLOWS FROM FINANCING ACTIVITIES: Credit facility borrowings Credit facility repayments ) ) ) Debt issuance costs ) ) ) Tax benefit on share-based compensation Proceeds received on the exercise of employee stock options Net cash provided by (used in) financing activities ) Net increase (decrease) in cash and cash equivalents ) Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Year Ended August 27, August 28, (364 days) (364 days) (In thousands) Payroll and related costs Payroll and related costs (previous classification) Management training reclassification ) ) Payroll and related costs (as reported) Other operating expenses Other operating expenses (previous classification) Restaurant level marketing expense reclassification ) ) Non-store specific travel and insurance expense reclassification1 ) ) Other operating expenses (as reported) Occupancy costs Occupancy costs (previous classification) Property insurance expense reclassification Centralized Bakery and Facility Service Center occupancy reclassification ) ) Occupancy costs Selling, general and administrative General and administrative costs (previous classification) Restaurant level marketing expense reclassification Management training reclassification Centralized bakery and Facility Service Center occupancy reclassification Non-store specific travel and insurance expense reclassification Culinary services administration costs reclassification ) ) Franchise administration costs reclassification ) ) Selling, general and administrative (as reported) Cost of culinary contract services Cost of culinary contract services (previous classification) Culinary services administration costs reclassification2 Cost of culinary contract services (as reported) Cost of franchise operations Cost of franchise operations (previous reclassification) Franchise administration costs reclassification3 Cost of franchise operations (as reported) Principles of Consolidation net realizable value. During fiscal 2018, management concluded to increase their valuation allowance to reduce fully the Company’s net deferred tax asset balances, net of deferred tax liabilities, including through the fiscal year ended August 29, 2018. Share-based compensation expense is estimated for equity awards at fair value at the grant date. The Company determines fair value of restricted stock awards based on the average of the high and low price of its common stock on the date awarded by the Board of Directors. The Company determines the fair value of stock option awards using a consolidated financial statements. Management's Assessment of Going Concern Cash and cash equivalents Accounts receivable Inventories Other current assets Property and equipment Liquor licenses and permits Favorable leases License agreement and trade name Goodwill Accrued liabilities ) Net acquisition cost Fiscal Year Ended August 31, August 30, August 29, August 28, August 26, (In thousands) Favorable Year Ended August 28, 2013 August 29, 2012 (Unaudited) (Unaudited) (In thousands, except per share data) Pro forma total sales Pro forma income from continuing operations Pro forma net income Pro forma income from continuing operations per share Basic Diluted Pro forma net income per share Basic Diluted The total number of Fisal Year Ended August 26, August 27, August 28, (In thousands) Sales: Company-owned restaurants(1) Culinary contract services Franchise operations Total Segment level profit: Company-owned restaurants Culinary contract services Franchise operations Total Depreciation and amortization: Company-owned restaurants Culinary contract services Franchise operations Corporate Total Total assets: Company-owned restaurants(2) Culinary contract services Franchise operations (3) Corporate(4) Total Capital expenditures: Company-owned restaurants Culinary contract services Franchise operations Corporate Total Income (loss) before income taxes and discontinued operations: Segment level profit Opening costs ) ) ) Depreciation and amortization ) ) ) Selling, general and administrative expenses ) ) ) Provision for asset impairments ) ) ) Net gain on disposition of property and equipment Interest income Interest expense ) ) ) Other income, net Total ) ) Fair Value FiscalYear Ended August 26, 2015 Quoted Significant Significant Total (In thousands) Continuing Operations Property and equipment related to company-owned restaurants ) Discontinued Operations Property and equipment related to corporateassets ) Fair Value FiscalYear Ended August 27, 2014 Quoted Significant Significant Total (In thousands) Continuing Operations Property and equipment related to company-owned restaurants ) ) Discontinued Operations Property and equipment related to corporate assets ) Fair Value FiscalYear Ended August 28, 2013 Quoted Significant Significant Total (In thousands) Continuing Operations Property and equipment related to company-owned restaurants ) Property and equipment related to corporate assets ) ) Discontinued Operations Property and equipment related to corporate assets ) August 26, August 27, (In thousands) Trade and other receivables Franchise royalties and marketing and advertising receivables Trade receivables, unbilled Allowance for doubtful accounts ) ) Total, net Unbilled revenue, was approximately $1.6 million at August 29, 2018 and approximately $1.6 million at August 30, 2017. CCS contracts are billed on a calendar month end basis and represent the total balance of Unbilled revenue. FiscalYear Ended August 26, August 27, August 28, (In thousands) Beginning balance Provisions for doubtful accounts ) Write-offs ) ) ) Ending balance August 26, August 27, (In thousands) Deferred income tax assets: Workers’ compensation, employee injury, and general liability claims Deferred compensation Net operating losses General business and foreign tax credits Depreciation, amortization and impairments Straight-line rent, dining cards, accruals, and other Total deferred income tax assets Deferred income tax liabilities: Property taxes and other Total deferred income tax liabilities Net deferred income tax asset ended August 29, 2018. August 26, August 27, August 28, (In thousands) Current federal and state income tax expense Current foreign income tax expense Deferred income tax expense (benefit) ) ) Total income tax expense (benefit) ) ) FiscalYear Ended August 26, August 27, August 28, Amount % Amount % Amount % (In thousands and as a percent of pretax income from continuing operations) Income tax expense (benefit) from continuing operations at the federal rate ) % ) % % Permanent and other differences: Federal jobs tax credits (wage deductions) ) ) Stock options and restricted stock ) ) Other permanent differences ) ) State income tax, net of federal benefit ) ) General Business Tax Credits ) ) ) ) Other ) ) ) ) Income tax expense (benefit) from continuing operations ) % ) % % 2016, respectively. Balance at August 29, 2012 Decrease based on prior year tax positions ) Interest Expense Balance as of August 28, 2013 Decrease based on prior year tax positions ) Interest Expense Balance as of August 27, 2014 Interest Expense Balance as of August 26, 2015 expense. 29, 2018. August 26, August 27, Estimated (In thousands) Land Restaurant equipment and furnishings Buildings Leasehold and leasehold improvements Lesser of lease term or estimated useful life Office furniture and equipment Construction in progress Less accumulated depreciation and amortization ) ) Property and equipment, net Intangible assets, net Goodwill August 26, 2015 August 27, 2014 (In thousands) (In thousands) Gross Carrying Amount Accumulated Amortization Net Carrying Amount Gross Carrying Amount Accumulated Amortization Net Carrying Amount Intangible Assets Subject to Amortization: Fuddruckers trade name and franchise agreements ) ) Cheeseburger in Paradise trade name and license agreements ) ) Intangible assets, net ) ) the goodwill from the Fuddruckers acquisition in 2010. The Company performs a goodwill impairment test annually as of the end of the second quarter of each year and more frequently when negative conditions or a triggering event arise. August 26, August 27, (In thousands) Salaries, compensated absences, incentives, and bonuses Operating expenses Unredeemed gift cards and certificates Taxes, other than income Accrued claims and insurance Income taxes, legal and other Total August 26, August 27, (In thousands) Workers’ compensation and general liability insurance reserve Capital leases Deferred rent and unfavorable leases Deferred compensation Other Total 30, 2017: The the Company’s personal property, including without limitation the equity interest in each subsidiary of the Company. The Agreement. other indebtedness. FiscalYear Ended August 26, August 27, August 28, (In thousands, except per share data) Provision for asset impairments Net gain on disposition of property and equipment ) ) ) ) ) Effect on EPS: Basic Assuming dilution property locations, ten properties held for sale written down to their fair value, and a reserve for 15 restaurant closings of approximately $1.3 million. fiscal approximately $1.0 million partially offset by routine asset retirements. operations in this plan. August 26, August 27, (In thousands) Prepaid expenses Assets related to discontinued operations—current Property and equipment Other assets Assets related to discontinued operations—non-current Deferred income taxes Accrued expenses and other liabilities Liabilities related to discontinued operations—current Other liabilities Liabilities related to discontinued operations—non-current FiscalYear Ended August 26, August 27, August 28, (In thousands, except locations) Sales Pretax loss ) ) ) Income tax benefit on discontinued operations Loss on discontinued operations ) ) ) Discontinued locations closed during the period FiscalYear Ended August 26, August 27, August 28, (In thousands, except per share data) Discontinued operating losses ) ) ) Impairments ) ) ) Gains (losses) ) Net loss ) ) ) Income tax benefit from discontinued operations Loss from discontinued operations ) ) ) Effect on EPS from discontinued operations—decrease—basic ) ) ) 2016: Balance as of August 29, 2012 Disposals Net impairment charges ) Balance as of August 28, 2013 Disposals ) Net transfers to property held for sale Balance as of August 27, 2014 Disposals ) Net transfers to property held for sale Balance as of August 26, 2015 From time to time, the Company enters into non-cancelable contracts for the construction of its new Year Ending: (In thousands) August 31, 2016 August 30, 2017 August 29, 2018 August 28, 2019 August 26, 2020 Thereafter Total minimum lease payments As of August 29, 2018, aggregate future minimum rentals to be received under non-cancelable subleases was approximately $3.9 million. Year Ended August 26, August 27, August 28, (In thousands, except percentages) Minimum rent-facilities Contingent rentals Minimum rent-equipment Total rent expense (including amounts in discontinued operations) Percent of sales % % % Included in these costs for fiscal 2016 was approximately $252 thousand, which represented accelerated share-based compensation expense as a result of the rescission of 312,663 stock options. 29, 2018. 29, 2018. The fair value of each option award is estimated on the date of the grant using the Black-Scholes option pricing model which determine inputs as shown in the following table for options granted under the Employee Stock Plan: FiscalYear Ended August 26, August 27, August 28, (In thousands, except percentages) Dividend yield % % Volatility % % Risk-free interest rate % % Expected life (in years) Shares Under Options Weighted- Average Price Weighted- Average Term Aggregate Intrinsic (Years) (In thousands) Outstanding at August 29, 2012 Granted Exercised ) Forfeited/Expired ) Outstanding at August 28, 2013 Exercised ) Forfeited/Expired ) Outstanding at August 27, 2014 Granted Exercised ) Forfeited/Expired ) Outstanding at August 26, 2015 Exercisable at August 26, 2015 $82 thousand. Restricted Stock Weighted Weighted- (Per share) (In years) Unvested at August 29, 2012 Granted – Vested ) – Unvested at August 28, 2013 Granted – Vested ) – Forfeited ) – Unvested at August 27, 2014 Granted – Vested ) – Forfeited – – Unvested at August 26, 2015 The Company has a voluntary 401(k) employee savings plan to provide substantially all employees of the Company an opportunity to accumulate personal funds for their retirement. The Company matches 25% of participants’ contributions made to the plan up to 6% of their salary. The net expense recognized in connection with the employer match feature of the voluntary 401(k) employee savings plan for the years ended August This facility matured and was refunded on November 8, 2016, through the entering of the 2016 Credit Agreement, and there were no amounts outstanding under the 2013 Credit Facility at August 30, 2017. FiscalYear Ended August 26, August 27, August 28, (In thousands, except per share data) Numerator: Income (loss) from continuing operations ) ) Net income (loss) ) ) Denominator: Denominator for basic earnings per share—weighted-average shares Effect of potentially dilutive securities: Employee and non-employee stock options Denominator for earnings per share assuming dilution Income (loss) from continuing operations: Basic ) ) Assuming dilution(a) ) ) Net income (loss) per share: Basic ) ) Assuming dilution(a) ) ) Quarter Ended(a) August 26, May6, February 11, November19, (112 days) (84 days) (84 days) (84 days) (In thousands, except per share data) Restaurant sales Franchise revenue Culinary contract services Vending revenue Total sales Income (loss) from continuing operations ) ) Loss from discontinued operations ) ) ) ) Net income (loss) ) ) ) Net income (loss) per share: Basic ) ) Assuming dilution ) ) Costs and Expenses (As a percentage of restaurant sales) Cost of food % % % % Payroll and related costs % % % % Other operating expenses % % % % Occupancy costs % % % % Quarter Ended(a) August 27, May 7, February 12, November 20, (112 days) (84 days) (84 days) (84 days) (In thousands, except per share data) Restaurant sales Franchise revenue Culinary contract services Vending revenue Total sales Income (loss) from continuing operations ) ) ) Loss from discontinued operations ) ) ) ) Net income (loss) ) ) ) Net income (loss) per share: Basic ) ) ) Assuming dilution ) ) ) Costs and Expenses (As a percentage of restaurant sales) Cost of food % % % % Payroll and related costs % % % % Other operating expenses % % % % Occupancy costs % % % % 29, 2018. Financial Statements Financial Statement Schedules Exhibits 3(b) 3(c) 14(b) 21 23.1 31.1 31.2 32.1 32.2 99(a) 101.SCH XBRL Schema Document 101.CAL XBRL Calculation Linkbase Document 101.DEF XBRL Definition Linkbase Document 101.LAB XBRL Label Linkbase Document 101.PRE XBRL Presentation Linkbase Document Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. LUBY’S, INC. Christopher J. Pappas President and Chief Executive Officer /S/ GASPER MIR, III November Gasper Mir, III, Director and Chairman of the Board /S/ CHRISTOPHER J. PAPPAS November /S/ K. SCOTT GRAY November Other brands weWe also operate includeanother brand named Cheeseburger in Paradise and Bob Luby’s Seafood.Paradise.LFRLuby's Fuddruckers Restaurants, LLC, a Texas Limited Liability Company ("LFR") and the consolidated subsidiaries of Luby’s, Inc. References to “Luby’s Cafeteria” refer specifically to the Luby’s Cafeteria brand restaurant.are extremelystay loyal to our restaurant brands and value them as a significant part of their lives. We want our company’s performance to make it a leader wherever it operates and in its sector of our industry.3, 2015,7, 2018, we operated 179142 restaurants located throughout the United States, as set forth in the table below. These establishments are located in close proximity to retail centers, business developments and residential areas. Of the 179142 restaurants, 9377 are located on property that we own and 8665 are located on property that we lease. Six locations consist of a side-by-side Luby’s Cafeteria and Fuddruckers restaurant, to which we refer herein to as a “Combo location”. Total Total Texas:47 Houston Metro5416 1712 1312 149 Other Texas Markets 16 California 10 Other Texas Markets20California10Maryland65Illinois4 Virginia4GeorgiaIllinois 3 Indiana3 Mississippi 2 Mississippi8 2Wisconsin142 2Other States13Total1793, 2015,7, 2018, we operated 2530 locations through our Culinary Contract Services (“CCS”). Of the 25 locations, 18 are in Texas: 15 in Houston, 2 in Austin and 1 in Dallas. For the remaining 7 CCS locations, we operate 2 in Louisiana and 1 each in Florida, Massachusetts, Missouri, North Carolina and Oklahoma. CCS provides food service management to healthcare, educational and corporate dining facilities.Total Texas: Houston Metro 22 San Antonio Metro 2 Rio Grande Valley 3 Dallas/Fort Worth Metro 2 Greensboro, NC 1 Total 30 3, 2015,7, 2018, we had 5141 franchisees operating 107104 Fuddruckers restaurants in locations as set forth in the table below. Our largest fivesix franchisees own five to eleven12 restaurants each. ThirteenFourteen franchise owners each own two to four restaurants. The thirty-threetwenty-one remaining franchise owners each own one restaurant. FuddruckersFranchises Texas:8 Other Texas Markets 10 California 7 Connecticut 1 Delaware 1 Florida 10 Georgia 3 Iowa 1 Louisiana 3 Maryland 1 Massachusetts 4 Michigan 4 Missouri 3 Montana 4 Nebraska 1 Nevada 3 New Jersey 2 New Mexico 4 North Carolina 1 North Dakota 1 Oklahoma 1 Oregon 1 Pennsylvania 5 South Carolina 8 South Dakota 1 Tennessee 2 Virginia 3 International: Dallas/Fort Worth Metro2 10Other Texas Markets2 10California8Florida7GeorgiaMexico 3 LouisianaPanama 3 Maryland2Massachusetts4Michigan4Missouri3Montana4NebraskaPuerto Rico 1 Nevada104 2New Jersey2New Mexico4North Carolina2North Dakota2Oregon1Pennsylvania4South Carolina7South Dakota2Tennessee3Virginia2Wisconsin2Other States4International:Canada1Chile1Colombia1Dominican Republic1Italy3Mexico1Panama1Poland1Puerto Rico1Total1073, 2015,7, 2018, this licensee operates 3533 restaurants that are licensed to use the Fuddruckers Proprietary Marksproprietary marks in Saudi Arabia, Egypt, Lebanon, United Arab Emirates, Qatar, Jordan, Bahrain, Kuwait, Morocco and Malaysia.Kuwait. The Company does not receive revenue or royalties from these restaurants.New York Stock ExchangeNYSE in 1982.Luby’s Fuddruckers Restaurants, LLC, a Texas limited liability company (“LFR”).LFR. All restaurant operations are conducted by LFR.(“Koo Koo Roo”) locations with franchisees operating an additional 130 Fuddruckers locations.to orderin small batches from scratch using real food, real ingredients prepared fresh daily, and our employees and our company get involved and support the fabric of our local communities. We buy local produce as much as possible. We promise to breathe life into the experience of dining out and make every meal meaningful. We were founded in San Antonio, Texas in 1947.Americana-themed home-style classic made-from-scratch favorites priced to appeal to a broad range of customers, including those customers that focus on fast wholesome choices, quality, variety, and affordability. We have had particular success among families with children, shoppers, travelers, seniors, and business people looking for a quick, freshly prepared meal at a fair price. All of our restaurants sell food-to-go orders.of oneled by a general manager, onean associate manager and one to two assistant managers including wait staff.managers. We grant authority to our restaurant managers to direct the daily operations of their stores and, in turn, we compensate them on the basis of their performance. We believe this strategy is a significant factor contributing to the profitability of our restaurants. Each general manager is supervised by an area leader. Each area leader is responsible for approximately 7 to 10 units, depending on location.restaurants, which includes one Bob Luby’s Seafood restaurant,Cafeterias was 9484 at fiscal year-end 2015.New Luby’s RestaurantsIn 2007, we developed and opened an updated prototype ground-up new construction Luby's Cafeteria. Since then we have rebuilt three locations and newly developed four locations according to this prototype.In 2012, we opened a prototype ground-up new construction combination Luby’s and Fuddruckers restaurant location featuring a Luby’s Cafeteria and a Fuddruckers Restaurant on the same property with a common wall but separate kitchens and dining areas (“Combo location”). Since 2012, we have built five more Combo locations; four in fiscal year 2014 and one in fiscal year 2015.

FuddruckersWe anticipate using and further modifying both of these prototype designs as we execute our strategy to build new restaurants in markets where we believe we can achieve superior restaurant cash flows.Fuddruckersburgerburgers and fries accountsaccount for the majority of its restaurant sales, its menu also includes exotic burgers, such as buffalo and elk, steak sandwiches, various grilled and breaded chicken breast sandwiches, hot dogs, a variety of salads, chicken tenders, fish sandwiches, hand breaded onion rings, soft drinks, handmade milkshakes, and bakery items. BeerA variety of over 100 carbonated soft drinks including our own unique Sweet Cherry Cream Soda, which is exclusively offered at Fuddruckers restaurants, along with other varieties such as Powerade®, and flavored waters are offered through Coke Freestyle® self-service dispensers. Additionally, beer and wine are served and, generally, account for less than 2% of restaurant sales.a total staff of one general manager with two or three assistant managers and 25 to 45 other associates, includinga number of full-time and part-time associates working in overlapping shifts. Since Fuddruckers generally utilizes a self-service concept, similar to fast casual, it typically does not employ waiters or waitresses. Fuddruckers restaurant operations are currently divided into a total of ten geographic areas, each supervised by an area leader. On average, each area leader supervises five to nine restaurants.year 2015,2018, we opened nine newclosed 11 Company-owned Fuddruckers restaurants. The number of Fuddruckers restaurants was 60 at fiscal year-end 2015, was 75.In 2014,2018.openedoperated two of the original Cheeseburger in Paradise locations.prototype ground-up new construction Fuddruckers Restaurant in Houston, Texas.106105 at fiscal year-end 20152018 and 110113 at fiscal year-end 2014.Cheeseburger in ParadiseAt fiscal year-end 2015, we operated eight of the original Cheeseburger in Paradise locations, completed six conversions to Fuddruckers restaurants, have selected four additional locations expected to be converted into Fuddruckers, two locations sub-leased to franchisees and another three locations which we expect to dispose. Cheeseburger in Paradise is known for its inviting beach-party atmosphere, its big, juicy burgers, salads, coastal fare and other tasty and unique items. Cheeseburger in Paradise is a full-service island-themed restaurant and bar developed ten years ago in collaboration with legendary entertainer Jimmy Buffet based on one of his most popular songs. The restaurants also feature a unique tropical-themed island bar with many televisions and tasty “boat drinks.”24 to the consolidated financial statements included in Part II, Item 8 of this Form 10-K.1. Consistently successful execution: Every day, with every guest, at every restaurant we operate. 2. Growing our human capital: Our team members are the most critical factor in ensuring our Company’s success. Our relentless focus as a company must be inspiring and developing our team members to delight our guests. 3. Raising awareness of our brand: Our restaurants provide guests in our local communities with memories of family, friends, childhood, a great date, a memorable birthday, or a significant accomplishment. The most reliable ways to grow and sustain our business is to perpetuate word of mouth and remain involved in the community. We must share our story with our guests in our restaurants. This allows new guests to learn our brand story and also reaffirms it with legacy and loyal guests. Loyal guests spread and preach the word about our brand. Our most loyal guests typically agree to be in our E-club so we can communicate with them and reward them. 4. Improving restaurant appearances: We recognize the importance of remodeling our legacy restaurants to remain relevant and appealing to keep loyal guests coming back and draw in new guests. 5. Effective cost management: We evaluate each area of our business to assess that we are spending and investing at appropriate levels. This includes restaurant operating costs and corporate overhead costs. Within our restaurants, we seek opportunities with our food and supplies purchasing, menu offerings, labor productivity, and contracts with restaurant service providers to maintain an appropriate restaurant level cost structure. Within our corporate overhead, we seek opportunities to leverage technology and efficient work processes to maintain a stream-lined corporate overhead. Intellectual PropertyCulinary Contract ServicesOur Culinary Contract Services segment consists of a business line servicing healthcare, higher education and corporate dining clients. The healthcare accounts are full service and typically include in-room delivery, catering, vending, coffee service and retail dining. Our mission is to re-define the contract food industry by providing tasty and healthy menus with customized solutions for healthcare, senior living, business and industry and higher education facilities. We seek to provide the quality of a restaurant dining experience in an institutional setting. 3, 2015, we had contracts with 16 long-term acute care hospitals, three acute care hospitals, one behavioral hospital, one children’s hospital, two business and industry clients, one medical office building and one freestanding coffee venue located inside an office building. We have the unique ability to deliver quality services that include facility design and procurement as well as nutrition and branded food services to our clients. We anticipate allocating capital expenditures as needed to further develop our CCS business in fiscal year 2016.EmployeesAs of November 3, 2015,7, 2018, we had an active workforce of 8,3526,589 employees consisting of restaurant management employees, non-management restaurantsrestaurant employees, CCS management employees, CCS non-management employees, and office and facility service employees. Employee relations are considered to be good. We have never had a strike or work stoppage, and we are not subject to collective bargaining agreements.General economicOur ability to service our debt obligations is primarily dependent upon our future financial performance.As of August 26, 2015, we had shareholders’ equity of approximately $175 million compared to approximately:●$37.5 million of long-term debt;●$63.4 million of minimum operating and capital lease commitments; and●$1.1 million of standby letters of credit.Our ability to meet our debt service obligations depends on our ability to generate positive cash flows from operations and proceeds for assets held for sale.If we are unable to service our debt obligations, we may have to:●delay spending on maintenance projects and other capital projects, including new restaurant development;●sell assets;●restructure or refinance our debt; or●sell equity securities.Our debt, and the covenants contained in the instruments governing our debt, could:●result in a reduction of our credit rating, which would make it more difficult for us to obtain additional financing on acceptable terms;●require us to dedicate a substantial portion of our cash flows from operating activities to the repayment of our debt and the interest associated with our debt;●limit our operating flexibility due to financial and other restrictive covenants, including restrictions on incurring additional debt and creating liens on our properties;●place us at a competitive disadvantage compared with our competitors that have relatively less debt;●expose us to interest rate risk because certain of our borrowings are at variable rates of interest; and●make us more vulnerable to downturns in our business.If we are unable to service our debt obligations, we may not be able to sell equity securities, sell additional assets or restructure or refinance our debt. Our ability to generate sufficient cash flow from operating activities to pay the principal of and interest on our indebtedness is subject to market conditions and other factors which are beyond our control.Healthcoverage is provided through fully-insured contracts with insurance carriers. Insurance premiumspremiums. Self-insurance costs are a shared cost betweenaccrued based upon the Company and covered employees. Theaggregate of the expected liability for covered healthreported claims is borneand the estimated liability for claims incurred but not reported, based on information on historical claims experience provided by our third party insurance advisors, adjusted as necessary based upon management’s reasoned judgment. Actual employee medical claims expense may differ from estimated loss provisions based on historical experience. In the insurance carriers per the terms of each policy contract.Compensationcompensation coverage is provided through “self-insurance” by Luby’s Fuddruckers Restaurants, LLC.LFR. We record expenses under the plan based on estimates of the costs of expected claims, administrative costs, stop-loss insurance premiums, and expected trends. These estimates are then adjusted each year to reflect actual costs incurred. Actual costs under these plans are subject to variability that is dependent upon demographics and the actual costs of claims made. In the event our cost estimates differ from actual costs, we could incur additional unplanned costs, which could adversely impact our financial condition.( the(the "Affordable Care Act") and Healthcare Education and Affordability Reconciliation Act was passed and signed into law. Among other things, the healthcare reform legislation includes mandated coverage requirements, eliminates pre-existing condition exclusions and annual and lifetime maximum limits, restricts the extent to which policies can be rescinded, and imposes new and significant taxes on health insurers and healthcare benefits. Although requirements were phased in over a period of time, the most impactful provisions began in the third quarter of fiscal 2015.and Fuddruckers brandsbrand offer a large variety of entrées, side dishes and desserts and our continued success depends, in part, on the popularity of our cuisine and cafeteria-style dining. A change away from this cuisine or dining style could have a material adverse effect on our results of operations. Our Fuddruckers brand offers grilled-to-order burgers that feature always fresh and never frozen, 100% premium-cut beef with no fillers or additives and sesame-topped buns baked from scratch on-site throughout the day. While burgers are the signature, the engaging menu offers variety for many tastes with an array of sandwiches, and salads. Changing customer preferences, tastes and dietary habits can adversely affect our business and financial performance. We compete on quality, variety, value, service, concept, price, and location with well-established national and regional chains, as well as with locally owned and operated restaurants. We face significant competition from family-style restaurants, fast-casual restaurants, and buffets as well as fast food restaurants. In addition, we also face growing competition as a result of the trend toward convergence in grocery, delicatessen, and restaurant services, particularly in the supermarket industry, which offers “convenient meals” in the form of improved entrées and side dishes from the delicatessen section. Many of our competitors have significantly greater financial resources than we do. We also compete with other restaurants and retail establishments for restaurant sites and personnel. We anticipate that intense competition will continue. If we are unable to compete effectively, our business, financial condition, and results of operations may be adversely affected.Non-performance under the debt covenants in our revolving credit facility could adversely affect our ability to respond to changes in our business.As of August 26, 2015, we had outstanding long-term debt of $37.5 million. Our debt covenants require certain minimum levels of financial performance as well as certain financial ratios, which can limit our credit availability. To provide for our reduced credit requirements going forward, we amended our credit agreement on October 2, 2015, to, among other things, reduce the facility size to $60.0 million. For a more detailed discussion of our credit facility please review the footnotes to our financial statements located in Part II, Item 8 of this Form 10-K. Our failure to comply with these covenants could result in an event of default that, if not cured or waived, could result in the acceleration of our loans outstanding and affect our ability to refinance by the termination date of September 1, 2017.We may not be able to realize our deferred tax assets.Our ability to realize our deferred tax assets is dependent on our ability to generate taxable income in the future. If we are unable to generate enough taxable income in the future, we may be required to establish a valuation allowance related to our net deferred tax assets which would reduce expected earnings for the periods in which they are recorded.2015,fiscal 2018, approximately 70%73% of our restaurant sales were attributable to credit and debit card transactions, and credit and debit card usage could continue to increase. A number of retailers have experienced actual or potential security breaches in which credit and debit card information may have been stolen, including a number of highly publicized incidents with well-known retailers in recent years.We might not fully realize the benefits from the acquisition of Cheeseburger in Paradise.On December 6, 2012, we completed the acquisition of all the Membership Units of Paradise Restaurants Group, LLC and certain of their affiliates, collectively known as Cheeseburger in Paradise. The integration of the Cheeseburger in Paradise restaurants into our operations has presented significant difficulties and has not resulted in realization of the full benefits of synergies, cost savings and operational efficiencies that we expected. We closed 15 locations in fiscal 2014. Additionally, we converted three locations in each fiscal year, 2014 and 2015, to Fuddruckers restaurants and plan to convert four more locations into Fuddruckers restaurants.Several factors could result in not realizing the benefits from the acquisition of Cheeseburger in Paradise: (1) the remaining eight Cheeseburger in Paradise locations that we continue to operate do not achieve sufficient cash flows; (2) the locations that we select to convert from Cheeseburger in Paradise restaurants to Fuddruckers restaurants do not realize cash flows sufficient to justify the additional investment of capital necessary to renovate the restaurants and if the cash flows operating as Fuddruckers restaurants do not achieve cash flows commensurate with other company-operated Fuddruckers restaurants; and (3) locations that we select for disposal result in “carrying costs” (generally lease, property, tax, and maintenance expenses) for a significant period of time prior to disposal, or we are not able to dispose the locations on favorable terms.Peter Tropoli,Benjamin T. Coutee, our Chief Operating Officer. The loss of the services of any key management personnel could have a material adverse effect upon our business.Our existing revolvingfacilityagreement. The 2016 Credit Agreement, as amended, matures in September 2017 and weMay 1, 2019. We may not be able to amend or renew the new facility with terms and conditions consistent with the existing facility.3, 2015,7, 2018, we operated 179142 restaurants at 173136 property locations. Six of the operating locations are Combo locations and are considered two restaurants. Two operating locations are primarily Luby’s Cafeterias, but also serve Fuddruckers hamburgers. One operating location is a Bob Luby’s Seafood Grill. Luby’s Cafeterias have seating capacity for 250 to 300 customers at each location while Fuddruckers locations generally seat 125 to 200 customers and Cheeseburger in Paradise locations generally seat 180 to 220.7059 of our Luby’s Cafeteria and 2318 of our Fuddruckers restaurants are located. FiveTwo of these restaurant properties contain excess building space or an extra building on the property which have 127 tenants unaffiliated with Luby’s, Inc.2423 Luby’s Cafeteria restaurants, 5441 Fuddruckers restaurants, and 81 Cheeseburger in Paradise restaurants are held under 8564 leases. One of the 64 leases includes two restaurants at one Combo location: one Luby's Cafeteria and one Fuddruckers restaurant. The majority of the leases are fixed-dollar rentals, which require us to pay additional amounts related to property taxes, hazard insurance, and maintenance of common areas. Of the 8564 restaurant leases, the current terms of 26thirteen expire in less than one year, 35 expire between 2015one and 2017,five years, and 5916 expire thereafter. Additionally, 6847 leases can be extended beyond their current terms at our option. One of the leased properties has extra building space and currently has one tenant that offsets approximately $99,895 of lease and other expenses annually.3, 2015, we have 3 leased properties we plan to develop for future use.As of November 3, 2015,7, 2018, we had threefour owned non-operating properties with a carrying value of approximately $3.1$3.9 million and 11 operating properties with a carrying value of approximately $15.6 million related to continuing operations recorded in property held for sale. In addition, we havehad one owned and two leased propertiesproperty with a carrying value of approximately $1.9$1.8 million that are included in assets related to discontinued operations. Leased properties in discontinued operations have a carrying value of zero.twoone owned other-use properties; oneproperty which is used as a bake shop that supports the baked products forcentral bakery supporting our operating restaurants. The other owned property is leased to a Fuddruckers franchisee.threefour leased locations that have twothree third party tenants and twothree Fuddruckers franchisees.In addition to the two owned other-use properties, we have31,00026,000 square feet of corporate office space under leaseruns through 2016. The space is located on the Northwest Freeway in Houston, Texas in close proximity to many of our Houston restaurant locations.3,200630 square feet of warehouse and office space in Arlington, Texas.We also leaseFarmers Branch, Texas and an executive suite in North Andover, MA forwhere we have additional legal personnel.Not applicable. 8.23 6.49 9.15 6.00 6.91 4.93 6.01 4.83 5.58 4.75 5.33 4.37 5.93 4.78 5.30 4.52 Fiscal Quarter Ended High Low December 21, 2016 4.50 4.03 March 15, 2017 4.33 3.30 June 7, 2017 3.41 2.46 August 30, 2017 3.12 2.63 December 20, 2017 2.87 2.36 March 14, 2018 3.20 2.60 June 6, 2018 3.06 2.35 August 29, 2018 2.89 2.00 3, 2015,7, 2018, there were 2,2011,975 holders of record of our common stock. No cash dividends have been paid on our common stock since fiscal year 2000, and we currently have no intention to pay a cash dividend on our common stock. On November 3, 2015,7, 2018, the closing price of our common stock on the NYSE was $4.91.26, 2015,29, 2018, were as follows:

Warrants and

Exercise Price of

Outstanding

Warrants and

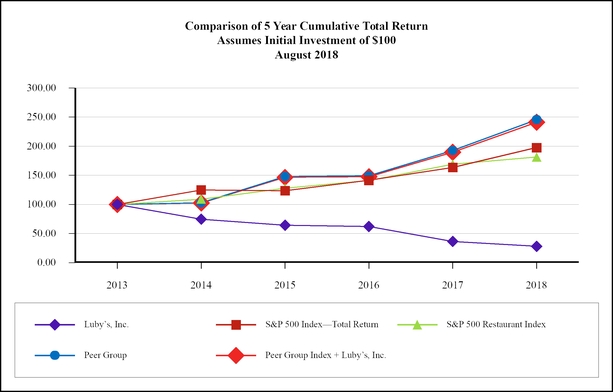

Remaining 594,549 $ 4.94 789,952 29,627 0 0 624,176 $ 4.71 789,952 (a) (b) (c) Plan Category Equity compensation plans previously approved by security holders 1,066,103 $ 4.53 1,612,652 17,801 0 0 Total 1,083,904 $ 4.47 1,612,652 Non-employeeNonemployee Director Phantom Stock Plan.14,16, “Share-Based Compensation,” to our Consolidated Financial Statements included in Item 8 of Part II of this report.26, 2015,29, 2018, with the cumulative total return on the S&P SmallCap 600 Index and an industry peer group index. The old peer group index consists of Bob Evans Farms, Inc., CBRL Group, Inc., Darden Restaurants, Inc., Denny’s Corporation, FrischDiversified Restaurant Group,Holdings, Inc., and Red Robin Gourmet Burgers and Ruby Tuesday Inc. The new peer group index consists of Bob Evans Farms, Inc., CBRL Group, Inc., Denny’s Corporation, Frisch Restaurant Group, Red Robin Gourmet Burgers, Ruby Tuesday Inc. as well as Darden Restaurants, Inc.Burgers. These companies are multi-unit family and casual dining restaurant operators in the mid-price range.25, 2010,29, 2013, and the reinvestment of all dividends. The returns of each company in the peer group index have been weighed according to that company’s stock market capitalization.

100.00 92.87 128.79 147.97 110.62 95.11 100.00 118.50 140.20 166.15 207.51 205.46 100.00 134.54 146.65 175.32 191.32 223.83 100.00 119.15 139.86 155.90 160.34 229.81 100.00 118.69 139.65 155.74 159.45 227.34 100.00 115.38 145.42 207.55 204.13 280.64 100.00 114.28 144.55 204.65 199.66 271.60

2013 2014 2015 2016 2017 2018 Luby’s, Inc. 100.00 74.76 64.28 62.07 36.41 28.14 S&P 500 Index—Total Return 100.00 124.89 123.66 141.50 163.53 197.61 S&P 500 Restaurant Index 100.00 109.12 127.67 141.05 169.16 181.31 Peer Group Index Only 100.00 102.87 148.01 149.08 192.47 245.57 Peer Group Index + Luby’s, Inc. 100.00 102.39 146.51 147.52 189.49 241.33 Five-Year Summary of Operations

2015

2014

2013

2012

2011 $ 370,192 $ 368,267 $ 360,001 $ 324,536 $ 325,383 16,401 18,555 16,693 17,711 15,619 6,961 7,027 6,937 7,232 7,092 531 532 565 618 654 394,085 394,381 384,196 350,097 348,748 (1,372 (1,613 4,547 7,398 2,572 (702 (1,834 (1,386 (645 301 $ (2,074 $ (3,447 $ 3,161 $ 6,753 $ 2,873 $ (0.05 $ (0.06 $ 0.16 $ 0.26 $ 0.09 $ (0.05 $ (0.06 $ 0.16 $ 0.26 $ 0.09 $ (0.02 $ (0.06 $ (0.05 $ (0.02 $ 0.01 $ (0.02 $ (0.06 $ (0.05 $ (0.02 $ 0.01 $ (0.07 $ (0.12 $ 0.11 $ 0.24 $ 0.10 $ (0.07 $ (0.12 $ 0.11 $ 0.24 $ 0.10 28,974 28,812 28,618 28,351 28,237 28,974 28,812 28,866 28,429 28,297 $ 264,258 $ 275,435 $ 250,645 $ 230,889 $ 228,102 $ 37,500 $ 42,000 $ 19,200 $ 13,000 $ 21,500 177 174 180 154 156 106 110 116 125 122 23 25 21 18 22 28.9 28.9 28.6 27.9 28.9 34.5 34.2 34.1 34.3 35.2 17.0 16.8 16.4 15.4 16.1 5.7 5.9 6.0 5.9 5.9 (a)For comparison purposes, fiscal 2013 and 2012 results have been adjusted to reflect the reclassification of certain Cheeseburger in Paradise leasehold locations to discontinued operations. See Note 11 to our consolidated financial statements in Part II, Item 8 in this Form 10-K for further discussion of discontinued operations. Fiscal Year Ended August 29, 2018 August 30, 2017 August 31, 2016 August 26, 2015 August 27, 2014 (364 days) (364 days) (371 days) (364 days) (364 days) (In thousands, except per share data) Sales Restaurant sales $ 332,518 $ 350,818 $ 378,111 $ 370,192 $ 369,808 Culinary contract services 25,782 17,943 16,695 16,401 18,555 Franchise revenue 6,365 6,723 7,250 6,961 7,027 Vending revenue 531 547 583 531 532 Total sales 365,196 376,031 402,639 394,085 395,922 Provision for asset impairments and restaurant closings 8,917 10,567 1,442 636 2,717 Loss from continuing operations (32,954 ) (22,796 ) (10,256 ) (1,616 ) (2,011 ) Loss from discontinued operations (614 ) (466 ) (90 ) (458 ) (1,436 ) Net Loss $ (33,568 ) $ (23,262 ) $ (10,346 ) $ (2,074 ) $ (3,447 ) Loss per share from continuing operations: Basic $ (1.10 ) $ (0.77 ) $ (0.35 ) $ (0.05 ) $ (0.06 ) Assuming dilution $ (1.10 ) $ (0.77 ) $ (0.35 ) $ (0.05 ) $ (0.06 ) Loss per share from discontinued operation: Basic $ (0.02 ) $ (0.02 ) $ (0.00 ) $ (0.02 ) $ (0.06 ) Assuming dilution $ (0.02 ) $ (0.02 ) $ (0.00 ) $ (0.02 ) $ (0.06 ) Loss per share: Basic $ (1.12 ) $ (0.79 ) $ (0.35 ) $ (0.07 ) $ (0.12 ) Assuming dilution $ (1.12 ) $ (0.79 ) $ (0.35 ) $ (0.07 ) $ (0.12 ) Weighted-average shares outstanding: Basic 29,901 29,476 29,226 28,974 28,812 Assuming dilution 29,901 29,476 29,226 28,974 28,812 Total assets $ 199,989 $ 226,457 $ 252,225 $ 264,258 $ 275,435 Total debt $ 39,506 $ 30,985 $ 37,000 $ 37,500 $ 42,000 Number of restaurants at fiscal year end 146 167 175 177 174 Number of franchised restaurants at fiscal year end 105 113 113 106 110 Number of Culinary Contract Services contracts at fiscal year end 28 25 24 23 25 Costs and Expenses (As a percentage of restaurant sales) Cost of food 28.3 % 28.1 % 28.3 % 28.9 % 28.9 % Payroll and related costs 37.4 % 35.9 % 35.2 % 34.5 % 34.3 % Other operating expenses 18.7 % 17.7 % 16.1 % 17.1 % 16.8 % Occupancy costs 6.1 % 6.2 % 5.9 % 5.7 % 6.0 % 26, 201529, 2018 (“fiscal 2015”2018”), August 27, 2014,30, 2017, (“fiscal 2014”2017”), and August 28, 201331, 2016 (“fiscal 2013”2016”) included in Part II, Item 8 of this Form 10-K.tablepage sets forth selected operating data as a percentage of total revenues (unless otherwise noted) for the periods indicated. All information is derived from the accompanying Consolidated Statements of Operations. Percentages may not add due to rounding.

2015

2014

2013 93.9 93.4 93.7 4.2 4.7 4.3 1.8 1.8 1.8 0.1 0.1 0.1 100 100 100 28.9 28.9 28.6 34.5 34.2 34.1 17.0 16.8 16.4 5.7 5.9 6.0 (0.1 (0.1 (0.2 14.0 14.4 15.0 0.7 0.5 0.2 5.4 5.1 4.8 9.8 10.3 9.4 0.2 0.6 0.2 (1.0 (0.6 (0.4 90.1 90.8 93.5 9.9 9.2 6.5 24.0 24.7 23.5 76.0 75.3 76.5 (0.1 (0.8 1.6 0.0 0.0 0.0 (0.6 (0.3 (0.2 0.1 0.3 0.3 (0.6 (0.8 1.6 (0.3 (0.4 0.5 (0.3 (0.4 1.2 (0.2 (0.5 (0.4 (0.5 (0.9 0.8 August 29,

2018 August 30,

2017 August 31,

2016 (52 weeks) (52 weeks) (53 weeks) Restaurant sales 91.1 % 93.3 % 93.9 % Culinary contract services 7.1 % 4.8 % 4.1 % Franchise revenue 1.7 % 1.8 % 1.8 % Vending revenue 0.1 % 0.1 % 0.1 % TOTAL SALES 100.0 % 100.0 % 100.0 % STORE COSTS AND EXPENSES: (As a percentage of restaurant sales) Cost of food 28.3 % 28.1 % 28.3 % Payroll and related costs 37.4 % 35.9 % 35.2 % Other operating expenses 18.7 % 17.7 % 16.1 % Occupancy costs 6.1 % 6.2 % 5.9 % Vending revenue (0.2 )% (0.2 )% (0.2 )% Store level profit 9.5 % 12.2 % 14.7 % Opening costs 0.2 % 0.1 % 0.2 % Depreciation and amortization 4.8 % 5.4 % 5.4 % Selling, general and administrative expenses 10.6 % 10.1 % 10.5 % Provision for asset impairments and restaurant closings 2.7 % 3.0 % 0.4 % Net Gain on disposition of property and equipment (1.6 )% (0.5 )% (0.2 )% Cost of culinary contract services 93.7 % 87.9 % 89.6 % Culinary income 6.3 % 12.1 % 10.4 % Cost of franchise operations 24.0 % 25.8 % 25.9 % Franchise income 76.0 % 74.2 % 74.1 % (As a percentage of total sales) LOSS FROM OPERATIONS (6.1 )% (4.6 )% (0.8 )% Interest income 0.0 % 0.0 % 0.0 % Interest expense (0.9 )% (0.6 )% (0.6 )% Other income (expense), net 0.1 % (0.1 )% 0.0 % Loss before income taxes and discontinued operations (6.9 )% (5.3 )% (1.4 )% Provision for income taxes 2.1 % 0.6 % 1.2 % Loss from continuing operations (9.0 )% (5.9 )% (2.6 )% Loss from discontinued operations, net of income taxes (0.2 )% (0.1 )% 0.0 % NET LOSS (9.2 )% (6.0 )% (2.6 )% incomeloss from continuing operations, a GAAP measure:

2015

2014