PART I

Diffusion Pharmaceuticals: Enhancing Oxygen, Fueling Life

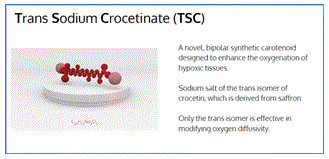

We are a clinical stage biotechnologybiopharmaceutical company developing novel therapies that enhance the body’s ability to deliver oxygen to the areas where it is needed most. Our lead product candidate, TSC, is being developed to enhance the diffusion of oxygen to tissues with low oxygen levels, also known as hypoxia, a serious complication of many of medicine’s most intractable and difficult-to-treat conditions.

Our Strategy

Our goal is to become a leading biopharmaceutical company focused on extending the life expectancydevelopment and commercialization of novel therapies that enhance the body’s ability to deliver oxygen to areas where it is needed most and improve treatment outcomes for patients suffering from conditions complicated by hypoxia. To achieve this strategy, we are focused on the following key objectives:

| • | Demonstrate the effects of TSC on the oxygenation pathway. The results of our Oxygenation Trials – a series of three short-term, pharmacodynamic studies to evaluate the effects of TSC on different components of the oxygenation pathway that we expect to complete by the middle of 2022 – will be used to further inform the identification of potential indications appropriate for TSC and will guide the design of clinical trials aimed at supporting the commercialization of TSC as a treatment for conditions complicated by hypoxia. For additional information, see "Business — Our Lead Product Candidate: Trans Sodium Crocetinate -- The TSC Oxygenation Trials: Demonstrating Proof of Concept, Dose Response Relationships, and Potential Indications for Future Development.” |

| • | Develop TSC as an adjunct treatment for hypoxic solid tumors. The prevalence of hypoxic regions across numerous primary solid tumor types is believed to directly contribute to treatment resistance, whether it be radiotherapy, chemotherapy, or immunotherapy, increasing the metastatic potential of these tumors and the probability of unsuccessful treatment. We believe TSC’s novel mechanism of action supports the objective of developing TSC as a treatment for hypoxic solid tumors because TSC’s ability to enhance the oxygenation of hypoxic tissues may increase the effectiveness of standard-of-care radiation therapy and chemotherapy. Accordingly, in November 2021, we announced our Hypoxic Solid Tumor Program and our intent to commence our Planned Phase 2 Hypoxic Solid Tumor Trial in the second half of 2022. The data obtained during 2021 and early 2022 from our Oxygenation Trials and COVID Trial regarding TSC’s effects on oxygenation, dose response characteristics, pharmacokinetics, and pharmacodynamics are being used to guide the design of this trial. Through the combination of this new data, our past experiences, and further analyses and discussions of all available data with our Scientific Advisory Board and other external advisors, we believe we now have the necessary information to design the Hypoxic Solid Tumor Program to be more efficient and increase our likelihood of success compared to the Company’s past efforts to develop TSC as a cancer treatment, which were terminated in 2019 due to financial constraints. For additional information, see "Business — Our Lead Product Candidate: Trans Sodium Crocetinate – Our Hypoxic Solid Tumor Program.” |

| • | Accelerate development of TSC as a treatment for non-cancer indications. Beyond cancer, hypoxia is a complicating factor in many other intractable and difficult-to-treat conditions, including cardiovascular diseases, cerebrovascular diseases, respiratory diseases, skin and soft tissue diseases, and neurodegenerative diseases. We have previously undertaken clinical studies of TSC in a variety of non-cancer indications, including interstitial lung disease, COVID-19, stroke, and peripheral artery disease, and have evaluated TSC in preclinical models in an even wider range of indications. Data that we expect to obtain from our ongoing Altitude and ILD-DLCO Trials may identify additional, non-oncology development opportunities. Although our primary near-term focus will be our Hypoxic Solid Tumor Program, we will continue to explore pathways to progress TSC’s development in non-oncology indications through our preclinical studies. For additional information, see "Business — Our Lead Product Candidate: Trans Sodium Crocetinate – TSC’s Potential to Treat Other Conditions Complicated by Hypoxia.” |

| • | Maximize the commercial value of our pipeline. We have invested, and plan to continue to invest, significant time, effort, and resources into the development and maintenance of our intellectual property portfolio as we seek to retain worldwide development and commercial rights to our product candidates. In parallel with advancing our development programs, we will evaluate the commercial landscape for TSC with the intent of improving patient access to maximize our chances of commercial success, should the product be approved. |

| • | Opportunistically acquire or in-license additional product candidates that complement TSC and our overall strategy. We believe we can leverage what we have learned from the development of TSC and the significant skills and experience of our team to opportunistically identify and acquire or in-license novel product candidates that complement TSC and further our efforts to improve patient outcomes by enhancing standard-of-care therapy for conditions complicated by hypoxia. We also believe diversifying our asset portfolio through an acquisition or in-licensing would reduce our Company’s overall risk profile as an investment. |

Our Lead Product Candidate: Trans Sodium Crocetinate

Our lead product candidate, TSC, is being developed to enhance the diffusion of oxygen to tissues with low oxygen levels, also known as hypoxia.

Hypoxia is a condition in which there is an insufficient supply of oxygen to meet the energy demands of the cells in a tissue (e.g., skeletal muscle). Hypoxia is associated with the pathophysiology of many of medicine’s most intractable and difficult-to-treat conditions, including cancers, cardiovascular diseases, cerebrovascular diseases, respiratory diseases, skin and soft tissue diseases, and neurodegenerative diseases.

All currently approved treatments for hypoxia work by augmenting or supplementing the systemic availability of oxygen. For example, respirators use pressure to push oxygen across the lungs into the blood to increase oxygen concentration, certain medications and devices such as external mechanical pumps are designed to improve cardiac output, and blood transfusions are used to increase the concentration of red blood cells and oxygen-carrying hemoglobin molecules.

While these treatments are effective in certain circumstances, there are significant associated risks such as lung damage resulting from the use of respirators, toxic side effects and drug-to-drug interactions of medications that increase cardiac output, infections related to blood transfusions, and the risk of creating excessive oxygen-related tissue toxicity, or hyperoxia, by providing a patient with excessive amounts of oxygen, among others. In addition, in certain other indications, these currently approved therapies are ineffective in treating the associated hypoxia. For example, in the treatment of cancer, re-oxygenating hypoxic, cancerous tissue cells cannot typically be accomplished simply by increasing the systemic availability of oxygen.

We believe TSC is the first therapy specifically designed to enhance the efficiency of the oxygen diffusion process. Furthermore, in animal models, TSC’s diffusion-enhancing mechanism of action has been observed to affect hypoxic tissue preferentially while avoiding excessive oxygen-related tissue toxicity.

By supporting normal, physiologic levels of oxygen diffusion at the uptake and delivery points of the circulatory system, we believe TSC presents a significant opportunity to improve the current standard-of-care treatment for conditions complicated by hypoxia.

TSC's Mechanism of Action

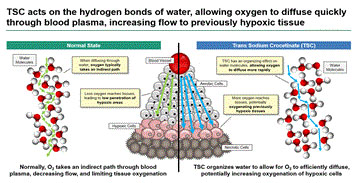

Blood plasma is approximately 90% water. The water molecules in the plasma are constantly moving, bound together in a loosely organized matrix by hydrogen bonds. TSC was designed to enhance the level of organization among the water molecules by increasing the amount of hydrogen bonding. This creates a less dense matrix of water molecules, reducing the resistance to oxygen diffusion across the concentration gradient.

Selected Preclinical Experiences

TSC has been evaluated in a variety of preclinical models intended to mimic relevant human conditions known to be complicated by hypoxia. In these studies, a variety of positive effects have been observed in connection with TSC administration, including:

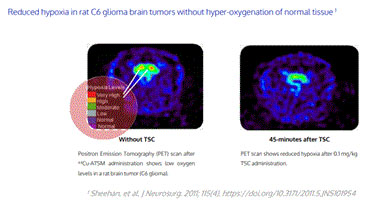

| • | Reducing hypoxia in rat brain tumors without hyper-oxygenation of normal tissue; |

| • | Improving survival in a rat brain tumor model when added to radiotherapy, whether alone or in combination with chemotherapy; |

| • | Improving tissue oxygenation without hyper-oxygenation of normal tissue and reducing infarct size in a rat ischemic stroke model; |

| • | Demonstrating a functional benefit in a rabbit ischemic stroke model, with or without tissue plasminogen activator at one-hour post-clot infection and with tissue plasminogen activator at three hours post-clot infection; and |

| • | Improving levels of arterial partial pressure of blood oxygen in a rat model of acute respiratory distress syndrome. |

Positron emission tomography scans showing reduction in hypoxia in a rat C6 glioma brain tumor model 45 min after TSC administration.

The TSC Oxygenation Trials: Demonstrating Proof of Concept, Dose Response Relationships, and Potential Indications for Future Development

While our clinical trials evaluating TSC conducted prior to 2021 provided certain preliminary signals regarding TSC’s mechanism of action and dose response characteristics, none of those studies were designed to demonstrate proof of concept by directly measuring TSC’s effects on tissue oxygenation and a variety of questions remained regarding TSC’s dose response characteristics, pharmacokinetics, and pharmacodynamics.

Given these identified gaps in our knowledge, in November 2020, we communicated our plan to design and execute our Oxygenation Trials, a series of short-term clinical studies using experimental models to evaluate the clinical effects of TSC on oxygenation, each designed to look at the effects of TSC on a different component of the oxygenation pathway. By quantifying the magnitude of effects of TSC on tissue oxygen levels and other direct clinical parameters assessing oxygen levels, and thereby demonstrating proof of concept of TSC’s effects on tissue oxygenation, as well as supplementing our knowledge of TSC’s dose response characteristics, pharmacokinetics and pharmacodynamics, we believe the data obtained from the Oxygenation Trials will allow us to significantly increase our clinical development strategy’s likelihood of success.

TCOM Trial: TSC's Effects on Peripheral Tissue Oxygenation

In March 2021, we initiated and completed enrollment in the first of the Oxygenation Trials, our TCOM Trial. In June 2021, we reported a positive trend in peripheral tissue oxygenation as compared to placebo among participants receiving TSC that persisted through the duration of the one-hour, post-dosing measurement period. Although the magnitude of this effect was not statistically significant due to limitations in the study design, the trends in the primary endpoint data indicated an improvement in peripheral oxygenation with TSC with no evidence of hyperoxygenation.

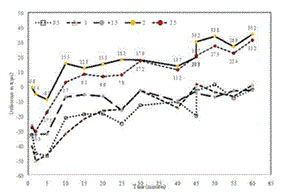

The figure below was created during a supplemental analysis of the TCOM Trial results by subtracting the median response observed in the TCOM Trial’s placebo group from the median response observed in each TSC dosage group at each of the measurement times during the one-hour period following dosing. These data highlight the persistent increase in peripheral tissue oxygenation relative to the placebo group through the duration of the one-hour measurement period following TSC administration, particularly at the two highest doses tested.

Effects of TSC on transcutaneous oxygen pressure.

We believe the TCOM Trial provides clinical evidence to support the hypothesis that TSC enhances the passive diffusion of oxygen from areas of high concentration to areas of low concentration without causing hyperoxygenation and that the data obtained from the study represent a positive and meaningful step towards the accomplishing of the Oxygenation Trials’ strategic objectives originally set forth in November 2020. These data have and will continue to guide the next steps of our development strategy, including the design of our Hypoxic Solid Tumor Program.

Altitude Trial: TSC's Effects Under Induced Hypoxic Conditions

On November 22, 2021, we announced dosing of the first participants in our second Oxygenation Trial, the Altitude Trial. This study is a double-blind, randomized, placebo-controlled crossover study designed to evaluate the effects of TSC on maximal oxygen consumption and partial pressure of blood oxygen in normal healthy volunteers subjected to incremental levels of physical exertion while exposed to “simulated altitude.” The study will enroll 30 healthy volunteers and give each volunteer a single dose of TSC at one of three different doses. Due to enrollment delays experienced during early 2022 related to the omicron variant wave of the COVID-19 pandemic, we now anticipate completing dosing in the Altitude Trial in the second quarter of 2022, with topline results reported within two months of study completion.

ILD-DLCO Trial: TSC's Effects on Oxygen Transfer Efficiency

On December 16, 2021, we announced dosing of the first patients in our third and final Oxygenation Trial, the ILD-DLCO Trial. This study is a double-blind, randomized, placebo-controlled, crossover study designed to evaluate the effects of TSC on the diffusion of carbon monoxide through the lungs, or DLCO, in patients with previously diagnosed ILD who have a baseline DLCO test result that is abnormal. DLCO is used in the study as a surrogate measure of oxygen transfer efficiency, or uptake, from the alveoli of the lungs through the plasma, and onto hemoglobin within red blood cells. The study will enroll 27 patients with confirmed ILD who will be randomized in a 2:1 ratio to a single dose of TSC or placebo via IV bolus. The study is statistically powered to evaluate the difference in effect of TSC versus placebo on improvement in DLCO measurements. In addition, patients will undergo a standard six-minute walk test intended to assess functional improvement in exercise capacity. Due to enrollment delays experienced during early 2022 related to the omicron variant wave of the COVID-19 pandemic, the effect of the omicron variant on patients with pulmonary diseases such as ILD, and staffing issues at the facilities where the ILD-DLCO Trial is being conducted, we now anticipate completing dosing in the ILD-DLCO Trial by improvingthe middle of 2022, with topline results reported within two months of study completion.

TSC's Demonstrated Clinical Safety Profile

TSC has been observed to be safe and well-tolerated at most doses tested in over 220 subjects included to-date in clinical studies at a variety of doses administered via intravenous infusion. Our clinical studies have included patients with a variety of medical conditions often complicated by hypoxia, including patients afflicted with GBM, peripheral artery disease with intermittent claudication, stroke, COVID-19, and interstitial lung disease. In each of these conditions and many others, hypoxia is a significant contributor to morbidity and mortality, and a considerable treatment obstacle for medical providers.

During 2021, we obtained additional data further demonstrating TSC's safety at higher doses and increased dosing frequencies from our COVID Trial and Oxygenation Trials. In the COVID Trial, completed in February 2021, TSC was administered on a different dosing regimen than any of our prior trials, with patients receiving an infusion multiple times per day for up to 15 days. In the TCOM Trial, based in part on a recommendation from the COVID Trial’s safety monitoring committee, arms evaluating even higher doses of TSC were included. No dose-limiting toxicities or serious adverse events were observed among any patients or participants in the either trial, including those who received the highest tested doses of TSC.

Our Hypoxic Solid Tumor Program

We believe TSC’s novel mechanism of action supports the objective of developing TSC as a treatment for hypoxic solid tumors because TSC’s ability to enhance the oxygenation of hypoxic tissues may increase the effectiveness of current standard-of-care treatments, including radiation therapy and chemotherapy. We are developing our lead product candidate,transcrocetinate sodium, also known astrans sodium crocetinate (“TSC”), for use in the many cancer types in which tumor oxygen deprivation (“hypoxia”) is known to diminish the effectiveness of current treatments. TSC is designed to target the cancer’s hypoxic micro-environment, re-oxygenating treatment-resistant tissue and making the cancer cells more susceptible to the therapeutic effects of standard-of-care radiation therapy and chemotherapy. Our lead development programs target TSC against cancers known to be inherently treatment-resistant, including brain

Solid tumors comprise approximately 90% of all adult cancers and, pancreatic cancer. A Phase 1/2 clinical trial of TSC combined with first-line radiation and chemotherapyaccording to the American Cancer Society, it was expected that roughly 1.9 million new cancer cases would be diagnosed in patients newly diagnosed with primary brain cancer (“glioblastoma” or “GBM”) was completed in 2015. This trial provided evidence of efficacy and safety in extending overall survival without the addition of toxicity. Based on these results, an End-of-Phase 2 meeting was held with the U.S. Food and Drug Administration (“FDA”) in August 2015, resulting in guidelines for the design of a single 400 patient pivotal Phase 3 registration study which, if successful, would be sufficient to support approval. The Companyduring 2021. It is also exploring the possibility of focusing on the subset of inoperable patientswell-documented in the GBM indication. Discussions withscientific literature that the FDA regarding extensionprevalence of the TSC development program from first line GBM into first-line pancreatic cancer treatment are currently underway. TSC has been granted Orphan Drug designation for the treatment of both GBM and brain metastases.

In addition to cancer, TSC also has potential applications in other indications involving hypoxia, such as hemorrhagic shock, stroke, peripheral artery disease, respiratory diseases and neurodegenerative diseases. In this regard, the Company is exploring the feasibility of testing TSC as a novel stroke treatment in an emergency medicine/ambulance setting.

Summary of Current Product Candidate Pipeline

The following table summarizes the targeted clinical indications for Diffusion’s lead molecule,trans sodium crocetinate:

In addition to the TSC programs depicted in the table, we are exploring alternatives regarding how best to capitalize upon our product candidate, RES-529, a novel PI3K/Akt/mTOR pathway inhibitor which has completed two Phase I clinical trials for age-related macular degeneration and is in preclinical development in oncology, specifically GBM.

Technology Overview

Our proprietary technology is targeted at overcoming treatment-resistance in solid cancerous tumors by combining our lead product candidate, TSC, with standard-of-care radiation and chemotherapy regimens, thus effecting a better patient survival outcome without the addition of harmful side effects.

Under normally oxygenated cellular conditions, radiation and chemotherapy generally have a powerful killing effect upon cancerous tumor tissue. However, in manyhypoxic regions across numerous primary solid tumor types cellular oxygen deprivation occurs asdirectly contributes to treatment resistance, whether it be radiotherapy, chemotherapy, or immunotherapy, increasing the resultmetastatic potential of rapid tumor growth, causing partsthese tumors and the probability of the tumor to outgrow its blood supply. When tumor tissue becomes hypoxic, it is up to three times more resistant to the cancer-killing power of the standard therapies (radiation and chemotherapy) currently used in the treatment of the vast majority of cancer patients. Cancerous tumor cells are known to thrive under hypoxic conditions, as the resultant changes in the tumor microenvironment confer “treatment-resistance” to radiation and chemotherapy within the cell.unsuccessful treatment.

Many solid cancerousof the challenges faced by practitioners in treating some of the most fatal and difficult-to-treat tumor types, are hypoxic and therefore subject to this treatment-resistance. TSC safely re-oxygenates treatment-resistant hypoxic tumor tissue via a novel mechanism of action, without affecting the oxygenation of normal tissue, thereby increasing therapeutic effectiveness. To date, no addition of serious harmful side effects, or exacerbation of the known side effects of standard-of-care treatments, has been observed in our clinical studies.

TSC’s distinctive re-oxygenation capabilities derive from its mechanism of action, which promotes enhanced diffusion of oxygen through blood plasma and into the hypoxic tumor microenvironment. Disruption of the treatment-resistance syndrome by re-oxygenation promotes enhanced cancer-killing power from radiation and chemotherapy, thereby safely extending patient survival. Because of the characteristics of this novel mechanism, oxygen levels of normal tissue remain unaffected, thereby avoiding side effects related to the syndrome referred to as “oxygen toxicity.” We believe this avoidance of oxygen toxicity confers a significant advantage to TSC’s diffusion-based approach over previous attempts to diminish treatment-resistance based on enhancing the oxygen concentration levels of the blood.

Our clinical development plan targets TSC at radiation and chemotherapy sensitization of hypoxic tumor types, with an initial focus on primary brain cancer,including GBM, pancreatic cancer, and brain metastases. We have been granted orphan drug designations by the FDA for the treatment of brain cancers based on the acknowledged unmet medical need and number of patients affected. Such orphan drug designations allow certain favorable treatments under FDA regulations in connection with exclusivity periods and the new drug approval process.

Tumor Hypoxia

We believe that our breakthrough small molecule approach to overcomingother solid tumor treatment-resistance by the reduction of cellular hypoxia may have significant implications for the improved treatment of cancer. Hypoxia is a deficiency in the supply of oxygen. It is well known that tumors, are especiallya product of those tumors’ highly hypoxic nature. Cancerous tumors are specifically susceptible to developing hypoxia driven bydue to a combination of rapid cellular growth, structural abnormalities of the tumor microvessels, and disturbed circulation within the tumor. There are a number of known treatment-resistanceHypoxic conditions within the tumor microenvironment have numerous negative consequences conferred by tumor hypoxia, including increases in:for patient outcomes and treatment, including:

| ●

• increased resistance to ionizing radiation, chemotherapy, immunotherapy and other treatment methods; • a more clinically aggressive phenotype; • increased potential for invasive growth and tumor progression; and • increased regional and distal tumor metastasis. | Resistance to ionizing radiation;

|

| ●

| Clinically aggressive phenotype;

|

| ●

| Potential for more invasive growth; and,

|

| ●

| Regional and distal tumor spreading.

|

In November 2021, based on the available preclinical and clinical data and the significant unmet medical need, we announced our intention to focus near-term efforts on developing TSC as an adjunct to standard of care therapy for hypoxic solid tumors. Through the combination of our past experiences, new knowledge gained from our Oxygenation Trials and COVID Trial regarding TSC’s effects on oxygenation, dose response characteristics, pharmacokinetics, and pharmacodynamics, and further analyses and discussions of all available data with our Scientific Advisory Board and other external advisors, we believe we now have the necessary information to design the Hypoxic Solid Tumor Program to be more efficient and increase our likelihood of success compared to the Company’s past efforts to develop TSC as a cancer treatment, which were terminated in 2019 due to financial constraints.

As part of the ongoing design of our Planned Phase 2 Hypoxic Tumor Trial – the first trial in our Hypoxic Solid Tumor Program which we currently expect to commence in the second half of 2022, subject to FDA feedback and the availability of clinical drug supply – we are currently drafting a trial protocol which we intend to file with the FDA. In parallel, we will continue our work to optimize the TSC manufacturing process and support the continued availability of high-quality drug product and undertake preclinical studies and other opportunities to continue developing data designed to demonstrate TSC’s potential uses in a broad spectrum of non-cancer indications.

TSC's Potential to Treat Other Conditions Complicated by Hypoxia

Beyond cancer, hypoxia is a complicating factor in many other intractable and difficult-to-treat conditions as well, including cardiovascular diseases, cerebrovascular diseases, respiratory diseases, skin and soft tissue diseases, and neurodegenerative diseases. In addition to our oncology programs past and present, we have previously conducted a variety of preclinical and clinical studies evaluating the effects of TSC in several of these other indications complicated by hypoxia, including COVID-19, stroke, and peripheral artery disease with intermittent claudication, and we intend to continue to pursue potential partnering opportunities in non-oncology indications.

Certain medical conditions complicated by hypoxia.

Our Phase 2 COVID-19 Trial

We believe TSC’s oxygen-enhancing mechanism of action could potentially provide benefit patients suffering from respiratory indications, such as COVID-19.

In September 2020, we announced the dosing of the first patients in our COVID Trial evaluating TSC in hospitalized COVID-19 patients at the National Institute of Infectious Diseases in Bucharest, Romania. The trial enrolled 24 patients divided into four sequential cohorts of six patients, with each patient in a cohort receiving the same intravenous doses of 0.25 mg/kg, 0.5 mg/kg, 1.0 mg/kg, or 1.5 mg/kg. All patients were administered intravenous doses of TSC every six hours for a minimum of five days and up to 15 days. On February 9, 2021, we completed dosing of the twenty-fourth and final patient in the trial.

The above-described phenomenon of hypoxia-related “treatment-resistance” has been known to the scientific and clinical communities for over half a century. The challenge has been to find an approach that can effectively mitigate treatment-resistance without the addition of toxic side effects or exacerbationprimary endpoint of the side effects associated with radiationCOVID Trial was to evaluate the safety and chemotherapy treatments. We believe thattolerability of TSC embodiesadministered every six hours for at least five and up to 15 days, a more frequent dosing regimen than had been used in our previous clinical studies. Secondary endpoints included pharmacokinetic measurement of TSC levels after dosing, relative improvements in blood oxygen levels, and certain other clinical parameters related to COVID-19, such an approach.as improvement in WHO ordinal scale by day 7 and through day 29, time on oxygen supplementation, and hospital length of stay.

Trans Sodium CrocetinateData from the trial, evaluated by the study’s independent safety monitoring committee, indicated TSC was safe and well-tolerated and that no dose-limiting toxicities or serious adverse events were observed among any patients in the study, including those who received the highest dose administered in the trial. Additionally, while the COVID Trial was not designed or powered to evaluate efficacy, the safety monitoring committee also observed that patients receiving the highest dose administered had improved outcomes in the trial’s secondary and exploratory endpoints compared to those receiving lower doses. Further, no patients that received TSC required dialysis or developed acute kidney injury, nor were there any reports of pulmonary embolism or deep vein thrombosis. Based on their observations, the safety monitoring committee also recommended the Company consider testing of higher TSC doses and a continuous intravenous infusion in future studies.

Product Development

Dr. John Gainer, our Chief Scientific Officer, one of our directorsResearch and Professor Emeritus of Chemical Engineering at the University of Virginia, was the first to propose the use of chemical compounds specifically to facilitate the diffusion of oxygen through blood plasma for the purpose of re-oxygenating hypoxic tissues. Dr. Gainer’s early laboratory work systematically examined various means to alter the diffusivity of oxygen through the use of small molecules that would affect the intermolecular forces existing in blood plasma. He originally identified crocetin, a natural carotenoid compound, as a molecule that could increase oxygen diffusion through the plasma, and crocetin was shown to be an effective treatment in a rabbit model of atherosclerosis and other indications. This work continued from the 1970s into the mid-1990s with various animal models, including radiation sensitization and hemorrhagic shock.

Because crocetin is an isomeric mixture, Dr. Gainer examined whether it was thetransDevelopment-isomer which was responsible for eliciting the therapeutic benefit. These experiments led to his development of a puretrans-isomer salt compound, which he namedtrans sodium crocetinate. (The USAN designated name istranscrocetinate sodium). TSC has been shown to be more effective than crocetin in a severe model of hemorrhagic shock in both rats and pigs. It also demonstrated safety and efficacy in animal models of stroke and myocardial infarction, as well as in enhancing the response of hypoxic tumors to the therapeutic effects of radiation and chemotherapy.

It is proposed that TSC works by altering the molecular arrangement of the water molecules in blood plasma (which is composed of 90% water), with the altered structure being less dense – and thus less resistant to oxygen diffusion – than untreated blood plasma. A water molecule is composed of two hydrogen atoms and one oxygen atom, with a net positive charge found on the hydrogen atoms and a net negative charge found on the oxygen atom. This results in the formation of hydrogen bonds, which are an attraction between the net-negatively charged oxygen of one water molecule and the net-positively charged hydrogen atoms of another water molecule. Theoretically, one water molecule can form four hydrogen bonds with neighboring water molecules. However, the literature on the subject indicates that a water molecule actually forms, on average, 2 to 3.6 hydrogen bonds. By promoting an increase in the average number of hydrogen bonds among the water molecules comprising the bulk of blood plasma, TSC enhances the ability of oxygen to diffuse more easily through the plasma and into hypoxic tissue.

In March 2017, we received a patent for bipolar trans carotenoid saltsrecent years, the majority of our research and their uses.This patent expands the coverage of the therapeutic use of TSC and other related compounds to five hypoxia-related conditions including congestive heart failure, chronic renal failure, acute lung injury (ALI), chronic obstructive pulmonary disease (COPD) and respiratory distress syndrome (RDS).

Trans Sodium Crocetinate Increases Oxygenation of Hypoxic Cancerous Tumors

While earlier studies focused on improved treatments for hemorrhagic shock, ischemia, and traumatic brain injury, the use of TSC as an agent to re-oxygenate hypoxic cancerous tumors became a central area of research for us following our founding in 2001. Because tumor hypoxia is a leading cause of solid tumor resistance to both radiation and chemotherapy, it was believed that an agent such as TSC – one that could safely increase the oxygenation of hypoxic tumor tissue – could prove effective in treatment-resistant cancers when combined with standard-of-care regimens of radiation and/or chemotherapy. This belief leddevelopment expenditures have been directed to the development of TSC. For example, during the year ended December 31, 2021, we incurred approximately $8.5 million in costs related to research and development of our products, a decrease of approximately $0.9 million compared to the year ended December 31, 2020. The majority of these costs were related to the development of TSC and related personnel, including costs associated with the Oxygenation Trials and the COVID Trial, which was completed in February 2021. We expect this trend to continue for the foreseeable future, including planned expenditures related to completion of the remaining Oxygenation Trials, the initiation of the Hypoxic Solid Tumor Program, and other costs associated with the conduct of additional, supportive preclinical studies and clinicalgeneral research and development programs targeted against treatment-resistanceactivities related to TSC and any other product candidates we may acquire or in-license in various cancers, withthe future.

As a focus on brain cancer types (both GBMdevelopment-stage company, we continuously evaluate opportunities to improve the value of our development pipeline, including potential acquisition and metastatic)in-licensing opportunities. Our efforts include ongoing evaluation and pancreatic cancer, allmodification of which are knownour development plans intended to maximize the probability of technical, developmental, and regulatory success while enhancing patient and stockholder value. These activities have, and we expect they will continue to be significantly hypoxic. The Company’s longer term goal isfor the foreseeable future, focused on opportunities that are synergistic with our overall corporate strategy to use TSC against treatment-resistance indevelop novel treatments for the entire rangetreatment of hypoxic cancers now treated with radiationhypoxia and chemotherapy.conditions complicated by hypoxia.

Glioblastoma ProgramIntellectual Property

Our lead programWe believe that a strong intellectual property portfolio is targetedcritical to our success. We are committed to obtaining and maintaining appropriate patent and other protections for our products candidates and other technologies, preserving and protecting our trade secrets and other confidential and proprietary information, and fiercely defending our intellectual property portfolio against newly diagnosed primary brain cancer, also known as glioblastoma (GBM). Glioblastoma is a grade IV brain tumor, characterizedany potential infringement by a heterogeneous cell population,third parties. We attempt to protect our intellectual property through among other things, the filing of applications for patent, trademark, and other appropriate intellectual property protections, the use of confidentiality agreements with a numberconsultants, contractors and other third parties, our employee policies regarding confidentiality, invention disclosure, and the assignment of negative attributes. GBM cells are typically genetically unstable (and thus prone to mutation), highly infiltrative, angiogenic, and resistant to radiation and chemotherapy. The mutations typically found in GBM allow the tumor to grow and thrive in a hypoxic environment. GBM is classified into two major subclasses, primary or secondary, depending upon the clinical propertiesinventions, as well as regular meetings of members of our internal development and legal teams, which contains key members of our management team. We are also committed to operating our business without infringing on the chromosomal and genetic alterations that are unique to each class. Primary GBM arisesde novo from normal glial cells and typically occurs in those over the ageintellectual property of 40, while secondary GBM arises from transformation of lower grade tumors and is usually seen in younger patients. Primary GBM is believed to account for approximately 95% of all GBM diagnoses.others.

While GBMIn general, patents extend for varying periods according to the date of patent filing or grant and the legal term of patents in various countries where patent protection is obtained, with term adjustments or extensions possible in certain cases based on patent office delays or pursuant to certain administrative and legislative exceptions. The actual protection afforded by a patent, which can vary from country to country, depends on the most common formtype of primary brain tumor involving glial cells it is still relatively rare, as approximately 12,000 peoplepatent, the scope of its coverage and the availability of legal remedies in the United States were diagnosed with GBM in 2014. The median age of GBM diagnosis is approximately 65 years, with the incidence of GBM in those over 65 increasing rapidly as shown by a doubling in incidence from 5.1 per 100,000 in the 1970s to 10.6 per 100,000 in the 1990s. Those diagnosed with the disease have a grim prognosis, with the median survival time of untreated patients being 4.5 months. Current standard-of-care treatment only provides 14-16 months of survival time after diagnosis.country.

Current Treatments for GBM

The standard-of-care for GBM tumors generally begins with surgical resection, unlessWe continue to invest significant time, effort, and resources into the tumor is deemed inoperable due to its location near vital centersdevelopment and maintenance of the brain. This surgery is performed both to alleviate the symptoms associated with the disease as well as to facilitate treatmentour patent portfolio. As of residual tumor cells. Even with advancesDecember 31, 2021, we owned 17 issued U.S. patents and more than 35 issued non-U.S. patents, and had numerous patent applications pending worldwide including issued patents and applications in surgical technique, complete removal of the tumor with clean margins is difficult to achieve,major markets such as the tumors are highly infiltrativeU.S., E.U., China, Japan, and typically extend intoIndia. The normal life (i.e. with no adjustments or extensions) of our key issued patents related to the composition of matter of TSC extends to 2026, with potential patent term extensions to 2031, and the normal brain parenchyma. Duelife of our patents related to this, almost all GBM patients have recurrencean oral formulation of the tumor,TSC extends to 2031, with 90%potential patent term extensions to 2036. The normal life of such recurrence occurring at the primary site.

Dueour key issued patents related to the invasive naturemethods of the tumors, surgical resection is promptly followed by radiotherapy coupled with the use of chemotherapeutic agents. Radiotherapy involves the administration of irradiationTSC extends to the whole brain. While nitrosoureas were historically a commonly used chemotherapeutic agent, temozolomide (“TMZ”) was approved in 20052037, not including potential patent term extensions. For additional information regarding patent term extensions, see "Business — Government Regulation— The Hatch-Waxman Amendments — Patent Term Restoration and is now a mainstay of the standard-of-care. This is based on a clinical trial that showed theMarketing Exclusivity. In addition, of TMZ to surgery and radiation increased median survival in newly diagnosed GBM patients to 14.6 months compared to 12.1 months for the surgery and radiation only group.

Most chemotherapeutic drugs have a limited ability to cross the blood brain barrier, thus a strategy to attempt to circumvent this was the development of Gliadel®, dissolvable chemotherapy wafers that could be placed in the tumor bed following surgical resection. Gliadel® contains the nitrosourea chemotherapeutic agent carmustine that is released for several weeks, in contrast to systemically administered carmustine that has a very short half-life. While Gliadel® wafers were shown to be safe, the drugs’ addition to radiation and TMZ did not result in a statistically significant increase in survival.

GBM tumors show increased expression of vascular endothelial growth factor (“VEGF”), and the anti-angiogenesis drug bevacizumabTSC has been approvedgranted Orphan Drug designation by the FDA for the treatment of recurrent GBM. A Phase 2 study found that bevacizumab treatment in patientsboth GBM and metastatic brain cancer, which may provide us with recurrent GBM increased six-month progression-free survival from a historical 9-15% to 25% with overall six-month survivalright of 54%. Another Phase 2 study showed that recurrent GBM patients treated with bevacizumab at a lower dose but a higher frequency had even higher six-month progression-free survival of 42.6%.

While bevacizumab has shown success in recurrent GBM, it is not utilized in newly diagnosed patients, our target patient population, as two separate clinical trials showed no difference in overall survival in patients treated with radiation, TMZ,exclusivity under certain FDA regulations. For additional information regarding orphan and bevacizumab compared to patients treated with only radiation and TMZ. Bevacizumab treatment did result in an increase in progression free survival in both studies; however, the reason why this increase in progression free survival did not translate to an increase in overall survival is unclear. In addition, certain studies have reported that patients treated with bevacizumab had an increased symptom burden, a worse quality of life, and a decline in neurocognitive function.

ultra-orphan designations, see "GBM Therapies Under DevelopmentBusiness

There are a number of companies developing GBM therapies. For example, a search on the website www.clinicaltrials.gov yields over 300 results for “glioblastoma multiforme” and “open trials.” Most of these trials focus on the recurrent patient population, whereas our target population is newly diagnosed patients. In addition to the therapeutics previously mentioned, current GBM trials include Northwest Therapeutics’ DCVax®-L, Bristol-Myers Squibb’s Nivolumab/Ipilimumab and AbbVie’s Veliparib. In addition, the medical device company Novocure has been developing a novel approach called Tumor Treating Fields (“TTFields”) using low intensity, alternating electric fields within the intermediate frequency range. TTFields are believed to disrupt cell division through physical interactions with key molecules during mitosis. This medical device approach has shown some success in the recurrent GBM patient population and more recently as an initial treatment.

—GBM is an Orphan Disease Government Regulation

GBM is diagnosed in approximately 12,000 individuals every year, making it an “orphan disease.”— Certain Other FDA Regulations — The Orphan Drug Act of 1983 was designed to provide financial incentives for, and to reduce the costs associated with, developing drugs for rare diseases and disorders. A “rare disease or disorder” is defined by the Orphan Drug Act of 1983 as affecting fewer than 200,000 Americans at the time of designation or one for which “there is no reasonable expectation that the cost of developing and making available in the United States…will be recovered from sales in the United States..” A sponsor must request that the FDA designate a drug currently under development for a “rare disease or condition” as an orphan drug, and if the FDA agrees that the drug and indication meet the criteria set forth in the Orphan Drug Act of 1983, certain financial and marketing incentives become available.

In July 2011, we announced that TSC was granted Orphan Drug Designation by the FDA for the treatment of GBM.Chemistry, Manufacturing, and Controls

Trans Sodium Crocetinate Phase 1/2 Clinical Trial in GBMTSC is currently formulated as a freeze-dried, injectable product, requiring a sophisticated manufacturing process.

We have evaluateddo not currently own or operate any facilities suitable for manufacturing TSC in 148 human subjects in various Phase 1or any of our other product candidates on a scale required to support either clinical development or commercialization. We currently use third-party CMOs to manufacture API, other starting materials, and Phase 2finished drug product for our preclinical studies and clinical trials and we intend to date,continue doing so for the foreseeable future. We anticipate this strategy will be scalable in a manner sufficient to support the production capacity required to support continued clinical development and ultimate commercialization. However, we do not have any formal agreements at this time with no serious adverse events attributableany CMO to TSC. Our Phase 1/2 clinical trialcover commercial production of TSC or any other product candidate. Although the use of third party CMOs to manufacture pharmaceutical products is common within the industry, this dependence on third-party CMOs exposes our business to certain risks, including those described under the heading, “Risk Factors – Risks Related to Our Dependence on Third Parties.”

Supply Chain Matters

Recently, many companies across a variety of sectors have reported disruptions, shortages, and other supply chain-related issues. In the biopharmaceutical sector, delays and interruptions in patients with newly diagnosed GBM completedthe supply chain were particularly pronounced as CMOs redirected resources under the Defense Production Act and to otherwise support the COVID-19 vaccine roll-out across the globe.

During 2021, we were able to effectively manage our supply of TSC and its component materials in 2015 is described in more detail below. TSC is targeted for testing against newly diagnosed GBM in an upcoming Phase 3a manner that avoided any significant interruptions to our clinical trial that, assumingprograms. We also took actions designed to increase the robustness of our drug supply and overall supply chain to mitigate risks related to the availability of funding resourcesour drug supply in the future. However, as constraints on the supply chain continue to impact the cost and general availability of manufacturing materials, related delays and shortages could affect the completioncost and timing of certain manufacturing and animal toxicology guidelines mandated by the FDA guidance, could begin within the next twelve (12) months.our available clinical study drug supply of TSC.

Our Phase 1/2 clinical trialCompetition

Currently, medical options to improve oxygenation without risk of hyper-oxygenation are limited and we believe that TSC's diffusion enhancing mechanism of action make it a first-in-class, novel, small molecule. However, there are several companies currently developing or marketing oxygen enhancing products, therapeutics, or devices that may nevertheless be competitive with TSC, if approved, including Hemoglobin Oxygen Therapeutics LLC, Hemotek Medical Inc., NuvOx Pharma LLC, Omniox, Inc., and VirTech Bio Inc. In addition, in GBM enrolled 59 newly diagnosed patients who received TSC in conjunctionthe first quarter of 2021, we became aware of a third party affiliated with radiation and TMZ. In the Phase I portiona former outside consultant of the trial, TSC was initially administered three times per week at half-dose to three patients prior to radiation. Subsequently, six additional patients received full-dose TSC for six weeks in combination with radiation. No dose-limiting toxicities were identified in the nine patients during the Phase I portion of the trial, nor were any serious adverse events relating to the drug observed. Fifty additional patients were enrolled in the Phase II trial and received full-dose TSC in combination with TMZ and radiation therapy. Four weeks after completion of radiation therapy, all patients underwent chemotherapy with higher doses of TMZ for five (5) days every four weeks, but no further TSC was administered.

We presented initial results from the trial at the 2015 American Society of Clinical Oncology (“ASCO”) Annual Meeting in June 2015,Company which discussed data from the 18 trial sites covering the first twenty-one months. Final results were published in the Journal of Neurosurgery online in May 2016. We compared results in relation to a historical control group from a 2005 study which showed that the addition of TMZ to standard-of-care (surgery plus radiation) increased overall survival from 12.1 months to 14.6 months. We reported that:

| ●

| TSC plus radiation and TMZ increased the patients’ chance of survival at two years by 37% compared to the historical control group. The overall survival at two years was 36.3% in the TSC group compared to 26.5% in the historical control group.

|

| ●

| In the subgroup of patients considered inoperable, the chance of survival at two years for those who received TSC was increased by 380%, (40% alive at two years for TSC group versus 10% for control).

|

| ●

| 71% of those treated with TSC were alive at one year compared to 61% of those in the historical control group. In 11 of 56 patients, tumors regressed to undetectable.

|

| ●

| No serious safety findings attributed to TSC were observed in the TSC study and adverse events were consistent with those seen in previous trials of GBM featuring radiation and TMZ.

|

End-of-Phase 2 FDA Meeting and Plans for TSC Phase 3 GBM Clinical Trial

Following the announcement of the results of the 2015 Phase 1/2 clinical trial in GBM, we held an end of Phase 2 meeting with the FDA in August 2015 to discuss planning for a Phase 3 clinical trial. At the meeting, guidance was received on a trial design for the Phase 3 study, including:

| ●

| A single, randomized trial of the agreed upon design, if successful, can serve as the basis for an application for approval.

|

| ●

| The trial will consist of 400 newly diagnosed GBM patients with half given TSC in conjunction with standard-of-care radiation and TMZ and half receiving standard-of-care radiation and TMZ only.

|

| ●

| Based on the Phase 1/2 safety results with supporting toxicology, TSC’s dosing exposure will be substantially increased, which means that TSC can now be used for both the radiation + chemotherapy and subsequent TMZ chemotherapy-only phase of GBM treatment, extending the TSC treatment duration from 6 weeks to 30 weeks.

|

| ●

| Diffusion will provide certain expanded information on animal toxicology, pharmacokinetics and manufacturing practices to the FDA before initiating the trial.

|

One of the major differences between the Phase 3 trial and the Phase 1/2 trial is the addition of TSC doses after the completion of the radiation/chemotherapy phase of treatment into the chemotherapy only phase. In the Phase 1/2 trial, TSC was only given prior to radiation (18 doses total over 6 weeks). In the Phase 3 study, we are planning to give the patients 36 total doses of TSC, 18 in conjunction with radiation/chemotherapy and 18 in conjunction with chemotherapy alone for a total TSC treatment duration of 30 weeks. The following figure gives a graphical representation of our planned Phase 3 trial, which, assuming the availability of financial resources and the completion of certain manufacturing and animal toxicology guidelines mandated by the FDA guidelines, we intend to commence enrollment in 2017, complete enrollment and potentially receive interim data in 2019 and complete conduct (enrollment and dosing) of the study in 2020. Data collection, analysis and regulatory interaction are projected to occur over the following 12 to 18 months.

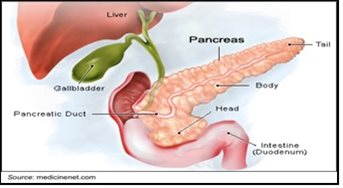

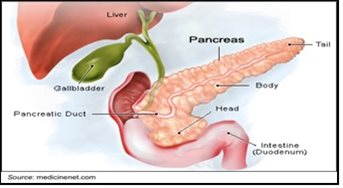

Pancreatic Cancer Program

One of the most hypoxic of all the solid cancers, and therefore one of the most treatment-resistant, is pancreatic cancer. According to the American Cancer Society, pancreatic cancer is responsible for 7% of all cancer deaths in both men and women, making it the fourth leading cause of cancer death in the U.S. Estimates are that 40% of pancreatic cancer cases are sporadic in nature, 30% are related to smoking and 20% may be associated with dietary factors, with only 5-10% of cases hereditary in nature.

Pancreatic cancer is difficult to diagnose in early stages because initial symptoms are often nonspecific and subtle in nature, and include anorexia, malaise, nausea, fatigue, and back pain. Approximately 75% of all pancreatic carcinomas occur within the head or neck of the pancreas, 15-20% occur in the body of the pancreas, and 5-10% occur in the tail.

The only potential curative therapy for pancreatic cancer is complete surgical resection. Unfortunately, this is only possible for approximately 20% of cases, and even of those patients whose cancer is surgically resected, 80% will develop metastatic disease within two to three years following surgery. Patients with unresectable pancreatic cancer have a median overall survival of 10 to 14 months while patients diagnosed with Stage IV disease (indicative of metastases) have a 5-year overall survival of just 1%.

Multiple studies have confirmed that pancreatic cancers are highly hypoxic. A study reporting the direct measurement of oxygenation in human pancreatic tumors prior to surgery showed dramatic differences between tumors and normal tissue. The partial pressure of oxygen (“pO2”) ranged between 0-5.3 mmHg in tumors but in adjacent normal tissue it ranged from 9.3-92.7 mmHg. Hypoxic areas are also frequently found when examining tissue from mouse models of pancreatic cancer.

Current Treatment Options for Pancreatic Cancer

Surgery remains the primary mode of treatment for patients with pancreatic cancer. However, there is an important role for chemotherapy and/or radiation in an adjuvant setting (given to prevent recurrence) or neoadjuvant setting (given before surgery to shrink the tumor to make complete resection more probable), as well as in patients with unresectable disease.

Since its approval in 1996, gemcitabine has been partnered with approximately 30 different agents in late-stage clinical trials in an attempt to improve upon the effectiveness of gemcitabine alone in treating patients with metastatic pancreatic cancer. Only two of these trials have demonstrated improved efficacy, leading to FDA approvals – erlotinib (Tarceva®) and nab-paclitaxel (Abraxane®).

In patients with metastatic disease, the use of erlotinib with gemcitabine led to a significantly higher one-year survival rate than with the use of gemcitabine alone (23% vs. 17%,P= 0.023) as well as an increased median overall survival (6.24 months vs. 5.91 months,P = 0.038). A more recent study showed that the addition of nanoparticle albumin-bound (nab)-paclitaxel to gemcitabine significantly improved overall survival in treatment naïve patients with metastatic cancer, as overall survival was approximately two (2) months longer in patients treated with combination therapy (8.5 vs. 6.7 months).

The Folfirinox (leucovorin + 5-fluorouracil + oxaliplatin + irinotecan) regimen was shown to significantly improve overall survival compared to treatment with gemcitabine (11.1 months vs. 6.8 months). While dramatically improving overall survival, the Folfirinox treatment was accompanied by serious adverse events and thus is only recommended for patients with good performance status.

Other combinations of gemcitabine with cisplatin, oxaliplatin, irinotecan or docetaxel tested in Phase 3 trials have not been of superior benefit to gemcitabine alone. The combination therapy nab-Paclitaxel and gemcitabine was recently approved by the FDA as an additional standard-of-care for the treatment of patients with untreated pancreatic adenocarcinoma. However, the improvements were modest, and treatment of pancreatic cancer remains an area of intense research, with 92 products in all stages of clinical development with 14 of them in Phase 3 at this time according to clinicaltrials.gov.

Just recently, the FDA approved Onivyde® (irinotecan liposome injection) in combination with fluorouracil and leucovorin, to treat patients with metastatic pancreatic cancer who were previously treated with gemcitabine-based chemotherapy. In the pivotal clinical trial, patients treated with Onivyde® plus fluorouracil/leucovorin lived an average of 6.1 months, compared to 4.2 months for those treated with only fluorouracil/leucovorin.

Pancreatic Cancer Market Analysis

It is estimated that every year approximately 49,000 people are diagnosed with pancreatic cancer in the United States. More than half of these patients will be diagnosed with metastatic disease. The five-year survival rates for patients with pancreatic cancer are dismal (<14%) and are particularly bad for those with metastatic disease (~1%).

The current standard-of-care for patients with metastatic pancreatic cancer includes gemcitabine combined with either erlotinib or nab-paclitaxel. Gemzar® (gemcitabine) is now available as a generic, however prior to losing patent protection the drug generated peak revenues of approximately $700 million in the United States for Eli Lilly. Tarceva®(erlotinib), which is approved for the treatment of metastatic non-small cell lung cancer and metastatic pancreatic cancer, is marketed by Roche and Astellas and sales of the drug generated $1.2 billion in revenue in 2015. Abraxane® (nab-paclitaxel), which was approved for the treatment of breast cancer in 2005 and non-small cell lung cancer in 2012, was approved by the FDA in 2013 for the treatment of metastatic pancreatic cancer. Sales of Abraxane® totaled $848 million in 2014 for all indications.

TSC in Pancreatic Cancer

We believe that targeting hypoxia in pancreatic cancer with TSC, especially in combination with standard-of-care therapies involving gemcitabine and nab-paclitaxel, may be beneficial in the treatment of pancreatic cancer. Pancreatic cancer is one of the most hypoxic malignant tumors, making it one of the most resistant tumors to therapy. Patients with advanced pancreatic cancer of exocrine origin have few therapeutic options and, for patients with advanced cancers, the overall survival rate of all stages is less than 1% at 5 years, with most patients dying within 1 year. Gemcitabine remains to-date, the backbone of treatment of pancreatic cancer.

The antitumor efficacy of gemcitabine is knownclaims to be hindered byin early-stage development of a numberproduct candidate that purportedly may operate through a similar mechanism of hypoxia-related factors including, but not limited to:

| ●

| Limited Delivery of Gemcitabine to Intracellular Tumor Microenvironment. Hypoxia has been associated with resistance to nucleoside analogs such as gemcitabine by decreasing the expression of the human cross-cell membrane equilibrative nucleoside transporter 1 (hENT1), thereby decreasing transport of gemcitabine and other nucleoside analogues into tumor cells.

|

| ●

| Gemcitabine Intratumor Cell Inhibition of Ribonucleotide Reductase Compromised. Hypoxia has been associated with a decrease in intracellular tumor ribonucleotide reductase, an enzyme required for the antitumor effect of gemcitabine. Indeed, this decrease leads to cell cycle arrest in G1 or G2 phase, thereby allowing DNA repair before progression to S or M phase.

|

| ●

| Increased Breakdown of Gemcitabine. It has been also observed that under hypoxic conditions, intratumor cell levels of cytidine deaminase are substantially increased. Cytidine Deaminase is the main enzyme responsible for the breakdown of gemcitabine and similar nucleosides. As a result of this, the gemcitabine antitumor effect is substantially decreased under hypoxic conditions.

|

| ●

| Nab-paclitaxel Potentiates Gemcitabine by Decreasing Cytidine Deaminase. One of the ways nab-paclitaxel decreases cytidine deaminase has been observed to be through increasing reactive oxygen species (“ROSs”) which has been shown to deactivate cytidine deaminase.

|

Taken together, the four factors above are believed to explain, at least in part, the limitations of gemcitabine in hypoxic conditions and the efficacy observed with the gemcitabine plus nab-paclitaxel combination regimen for the treatment of pancreatic cancer. They also suggest that correction of hypoxia with an anti-hypoxia agent such as TSC may significantly improve the efficacy of the gemcitabine plus nab-paclitaxel combination regimen for the treatment of pancreatic cancer, including for the following reasons:

| ●

| TSC has been shown to improve the cytotoxic effect of gemcitabine in a pre-clinical rat model.

|

| ●

| By correcting hypoxia, TSC may improve delivery of gemcitabine to intracellular tumor microenvironment by increasing levels of hENT-1.

|

| ●

| By reversing hypoxia-induced cell cycle arrest via reactivation of ribonucleotide reductase, TSC may restore gemcitabine’s antitumor effect.

|

| ●

| By reversing the hypoxia-induced increase of cytidine deaminase, TSC may increase intratumoral gemcitabine levels. Addition of TSC to the gemcitabine plus nab-paclitaxel regimen could further improve the efficacy of the combination by further decreasing cytidine deaminase. Of note, hypoxia has also been implicated in conferring tumor resistance to taxane-based therapies.

|

Proposed Plans for TSC Phase 2 Clinical Trial in Pancreatic Cancer

The planned Phase 2 clinical trial for TSC in pancreatic cancer is based on preclinical safety and efficacy data, and findings from the Phase 1/2 clinical trial in GBM, as well as the facts noted above. Global experts in the field agree that pancreatic cancer is an appropriate target for expansion of the use of TSC, and a clinical advisory committee of these key opinion leaders has been assembled to facilitate our pancreatic cancer clinical development program. We are currently in discussions with recognized pancreatic cancer experts and the FDA regarding trial design, end-points, and patient numbers. Assuming the availability of financial resources, we anticipate beginning enrollment in this trial during 2017 and completing conduct of the study (enrollment and dosing) in 2019. Data collection, analysis and regulatory interaction are projected to occur over the following 9 to 12 months.

Brain Metastases Program

In contrast to the relative rarity of primary brain cancers, life-threatening cancers that metastasize to the brain are much more common and represent a serious complication in the treatment of many cancer types. Up to 30% of adult cancer patients will suffer from brain metastases. There are approximately 170,000 cases of metastatic brain cancer every year in the United States. Incidence of brain metastases varies depending upon the primary tumor type, although lung cancer appears to carry the greatest risk. The prognosis for patients with brain metastases is very grim, with current treatment options only resulting in median overall survival times of less than one year.

Treatment for brain metastases involves both controlling the symptoms associated with the condition as well as attacking the cancer directly. Brain metastases typically result in edema that can be controlled with the use of steroids; however, long-term use of steroids typically results in side effects that diminish a patient’s quality of life. Approximately 25-45% of patients will experience seizures and require the use of anti-epileptic drugs. Surgery is only utilized in patients with a solitary brain metastatic lesion. Radiation therapy remains the standard-of-care for the vast majority of patients with brain metastases. There is very limited evidence for the use of chemotherapy, as few clinical trials have been conducted. There are no medications currently approved for the treatment of brain metastases.

Plans for TSC Phase 2/3 Clinical Trial in Metastatic Brain Cancer

We are planning to conduct a Phase 2/3 clinical trial in metastatic brain cancer after further discussions with experts and the FDA regarding trial design, end-points, and patient numbers.

In December 2012, the FDA granted us Orphan Drug Designation for the use of TSC in brain metastases.

Description of Other Indications/Products

We have rights to and own technologies and potential products beyond those described above, including analog molecules as backupsaction to TSC. It is our strategy to focus at the current time on our TSC for oncology, specifically GBM and pancreatic cancer, as described herein. Beyond those described herein, we also intend to continue to review our technologies and potential products on a regular basis and consider internal development in the future and the potential to out-license portions of our technology and potential products to other biopharmaceutical companies with greater focus and resources than ours, or potentially in-license late stage products which are in or ready for human clinical trials.

As a result of the Merger, we acquired product candidates for ophthalmology, oncology and dermatology. One suchunclear if this Company’s product candidate is RES-529, a novel PI3K/Akt/mTOR pathway inhibitor which has completed two Phase I clinical trials for age-related macular degenerationwould, if developed and is in preclinical development in oncology, specifically GBM. The novel inhibition of the PI3K/Akt/mTOR pathway and targeting of the androgen receptor have also shown potential in a number of additional indications.

We are exploring partnering opportunities for our product candidates, such as strategic partnerships, alliances or licensing arrangements.

Competitionapproved, actually be competitive with TSC.

Our industry is highly competitive and subject to rapid and significant change. Potential competitors in the United States are numerous and include major pharmaceutical and specialty pharmaceutical companies, smaller biopharmaceutical companies, research universities, and other institutions. We generally divide ourothers. The biopharmaceutical and pharmaceutical industries are characterized by rapidly advancing technologies, intense competition, and a strong emphasis on developing proprietary therapeutics. Numerous companies are engaged in the pharmaceutical industry into four categories: (1) corporationsdevelopment, patenting, manufacturing, and marketing of health care products competitive with large research and developmental departmentsthose that develop and market products in many therapeutic areas; (2) companies that have moderate research and development capabilities and focus their product strategy on a small number of therapeutic areas; (3) small companies with limited development capabilities and only a few product offerings; and (4) university and other research institutions.we are developing. Many of our competitors have longer operating histories, greater name recognition, substantially greater financial resources, and larger research and development staffs than we do, as well as substantially greater experience than us in developing products, obtaining regulatory approvals, and manufacturing and marketing pharmaceutical products. AIn addition, a significant amount of research is carried out at academic and government institutions. These institutions are aware of the commercial value of their findings and are aggressive in pursuing patent protection and negotiating licensing arrangements to collect royalties for use of technology that they have developed.

There are several firms currently marketing One or developingmore of these companies or other entities may have one or more products under development that maywould be competitive with our products, including therapeutics and devices. We believe TSC is a first-in-class novel small molecule that re-oxygenates hypoxic tissue, enhancing efficacy of radiation and chemotherapy without harmful side effects.TSC.

MergersSales and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated among a smaller number of our competitors. Our commercial opportunity could be reduced or eliminated if our competitors develop or market products or other novel therapies that are more effective, safer or less costly than our current or future product candidates, or obtain regulatory approval for their products more rapidly than we may obtain approval for our product candidates. In addition, the first product to reach the market in a therapeutic or preventative area is often at a significant competitive advantage relative to later entrants in the market and may result in certain marketing exclusivity as per federal legislation. Acceptance by physicians and other health care providers, including managed care groups, also is critical to the success of a product versus competitor products. Our success will be based in part on our ability to identify, develop and manage a portfolio of product candidates that are safer and more effective than competing products.

Research and Product Development

We incurred approximately $7.2 million in 2016 and $3.9 million in 2015 on research and product development activities that related primarily to activities associated with the synthesis and formulations of our products then in development, additional preclinical studies and planning for Phase I/Phase II studies. We anticipate that our research and development expenses during 2017 will increase compared to 2016 and will consist primarily of expenses associated with the initiation of our glioblastoma and pancreatic cancer human clinical trials.

Intellectual Property

Our success depends and will continue to depend in part upon our ability to maintain proprietary protection for our products and technologies, to preserve our proprietary information, trademarks and trade secrets and to operate without infringing the proprietary rights of others. Our policy is to attempt to protect our technology by, among other things, filing patent applications on inventions that are important to the development and conduct of our business with the U.S. Patent and Trademark Office (“USPTO”), and its foreign counterparts or obtaining license rights for technology that we consider important to the development of our business.

As of December 31, 2016, we owned approximately 14 issued U.S. patents and 46 issued foreign patents, which include granted European, Japanese, Chinese and Indian patent rights, and over 50 pending patent applications worldwide, covering the product candidates we currently intend to develop. Our current patents expire between 2026 and 2031. TSC has been granted Orphan Drug Designation for the treatment of both GBM and metastatic brain cancer and an application is pending for pancreatic cancer. A formulation patent provides protection for the TSC oral drug product until 2031 with extensions possible.

Patents extend for varying periods according to the date of patent filing or grant and the legal term of patents in various countries where patent protection is obtained. The actual protection afforded by a patent, which can vary from country to country, depends on the type of patent, the scope of its coverage and the availability of legal remedies in the country.

In addition to patents, we use other forms of protection, such as trademark, copyright and trade secret protection, to protect our intellectual property, particularly where we do not believe patent protection is appropriate or obtainable. We aim to take advantage of all of the intellectual property rights that are available to us and believe that this comprehensive approach will provide us with proprietary positions for our product candidates, where available.Marketing

We also protect our proprietary information by requiring our employees, consultants, contractorscurrently have no marketed products and, accordingly, currently have no sales or marketing personnel.

Government Regulation

Pharmaceuticals like TSC and other advisors to execute nondisclosure and assignment of invention agreements upon commencement of their respective employment or engagement. Agreements with our employees also prevent them from bringingproduct candidates we may develop are highly regulated by governmental authorities in the proprietary rights of third parties to us. In addition, we also require confidentiality or service agreements from third parties that receive our confidential information or materials.

Government Regulation

FDA Drug Approval Process

In the United States, pharmaceutical products are subject to extensive regulation by the FDA. The Federal Food, Drug, and Cosmetic Act (the “FDC Act”)U.S. and other countries at the federal, state, and state statuteslocal levels. These regulations are numerous and regulations, govern,extensive in their scope, relating to, among other things, the research and development, testing, manufacture, storage, recordkeeping,quality control and testing, approval, labeling and packaging, promotion, marketing, and marketing,advertising, distribution, post-approval monitoring and reporting, samplingexport and import, and exportrecord keeping of pharmaceutical products. Failure

The FDA Drug Approval Process

Generally, before a new pharmaceutical product can be marketed, considerable data demonstrating its quality, safety and efficacy must be obtained, organized into a format specific for each applicable regulatory authority, submitted for review, and approved by the competent regulatory authority. In the United States, the competent regulatory authority is the FDA, which, pursuant to the FDC Act, is responsible for the review and approval of all data required to support a license to commercially market pharmaceuticals such as TSC.

The process of obtaining regulatory approvals and the subsequent compliance with FDA regulations requires the expenditure of substantial time and financial resources and failure to comply with the applicable U.S. requirements at any time during the product development process, approval process, or, if approved, following approval may subject a companyan applicant to a variety of administrative or judicial sanctions. These sanctions such as FDAcould include, among other actions, the FDA’s refusal to approve pending new drug applications, (“NDAs”),withdrawal of an approval, license revocation, a clinical hold, untitled or warning letters, voluntary or untitled letters,mandatory product recalls, market withdrawals, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement and civil or criminal penalties, and criminal prosecution.any of which could have a material adverse effect on our business, financial position, or results of operations.

Pharmaceutical product development for a new product or certain changes to an approved product inProcess Overview

The FDA drug approval process generally involves the United States typically involves preclinical laboratory and animal tests, the submission to the FDA of an investigational new drugfollowing steps:

| • | completion of extensive preclinical laboratory studies , including studies conducted in accordance with GLP requirements; |

| • | submission to the FDA of an IND application, (“IND”) which must become effective before clinical trials involving human subjects or patients may begin; |

| • | performance of adequate and well-controlled human clinical trials in accordance with applicable IND regulations, GCP requirements, and other clinical trial-related regulations to establish the safety and efficacy of the investigational product for each proposed indication, including approval by an IRB or independent ethics committee before each trial may be initiated; |

| • | submission to the FDA of an NDA; |

| • | a determination by the FDA within 60 days of its receipt of an NDA as to whether it will accept the filing for review; |

| • | satisfactory completion of one or more FDA pre-approval inspections of the manufacturing facility or facilities where the drug will be produced to assess compliance with cGMP requirements and to assure that the facilities, methods and controls are adequate to preserve the drug’s identity, strength, quality and purity; |

| • | a potential FDA audit of the clinical trial sites that generated the data in support of the NDA; |

| • | payment of user fees for FDA review of the NDA; and |

| • | FDA review and approval of the NDA, including consideration of the views of any FDA advisory committee, prior to any commercial marketing or sale of the biologic or drug in the United States. |

The preclinical and clinical testing may commence, and adequateapproval process requires substantial time, effort, and well-controlled clinical trials to establish the safetyfinancial resources and effectiveness of the drug for each indication for which FDA approval is sought. Satisfactionsatisfaction of FDA pre-market approval requirements typically takes many years, andthough the actual time required may vary substantially based upon the type, complexity, and novelty of the applicable product or disease.indication to be treated. We cannot be certain that any approvals for TSC or any product candidates we attempt to develop in the future will be granted on a timely basis or at all.

Preclinical testsStudies