strong chemical resistance. Rubber flooring is extremely durable compared to other flooring alternatives.

Marketing and Sales

We have traditionally focused our carpet marketing strategy on major accounts, seeking to build lasting relationships with national and multinational end-users, and on architects, engineers, interior designers, contracting firms, and other specifiers who often make or significantly influence purchasing decisions. While most of our sales are in the corporate office segment, both new construction and renovation, we also emphasize sales in other segments, including retail space, government institutions, schools, healthcare facilities, tenant improvement space, hospitality centers, residences and home office space. Our marketing efforts are enhanced by the established and well-known brand names of our carpet products, including Interface andFLOR.

An important part of our marketing and sales efforts involves the preparation of custom-made samples of requested carpet designs, in conjunction with the development of innovative product designs and styles to meet the customer’s particular needs. In most cases, we can produce samples to customer specifications in less than five days, which significantly enhances our marketing and sales efforts and has increased our volume of higher margin custom or made-to-order sales. In addition, through our websites, we have made it easy to view and request samples of our products. We also use technology which allows us to provide digital, simulated samples of our products, which helps reduce raw material and energy consumption associated with our samples.

We primarily use our internal marketing and sales force to market our carpet products. In order to implement our global marketing efforts, we have product showrooms or design studios in the United States, Canada, Mexico, Brazil, Denmark, England, France, Germany, Spain, the Netherlands, India, Australia, Norway, United Arab Emirates, Russia, Singapore, Hong Kong, Thailand, China and elsewhere. We expect to open offices in other locations around the world as necessary to capitalize on emerging marketing opportunities.

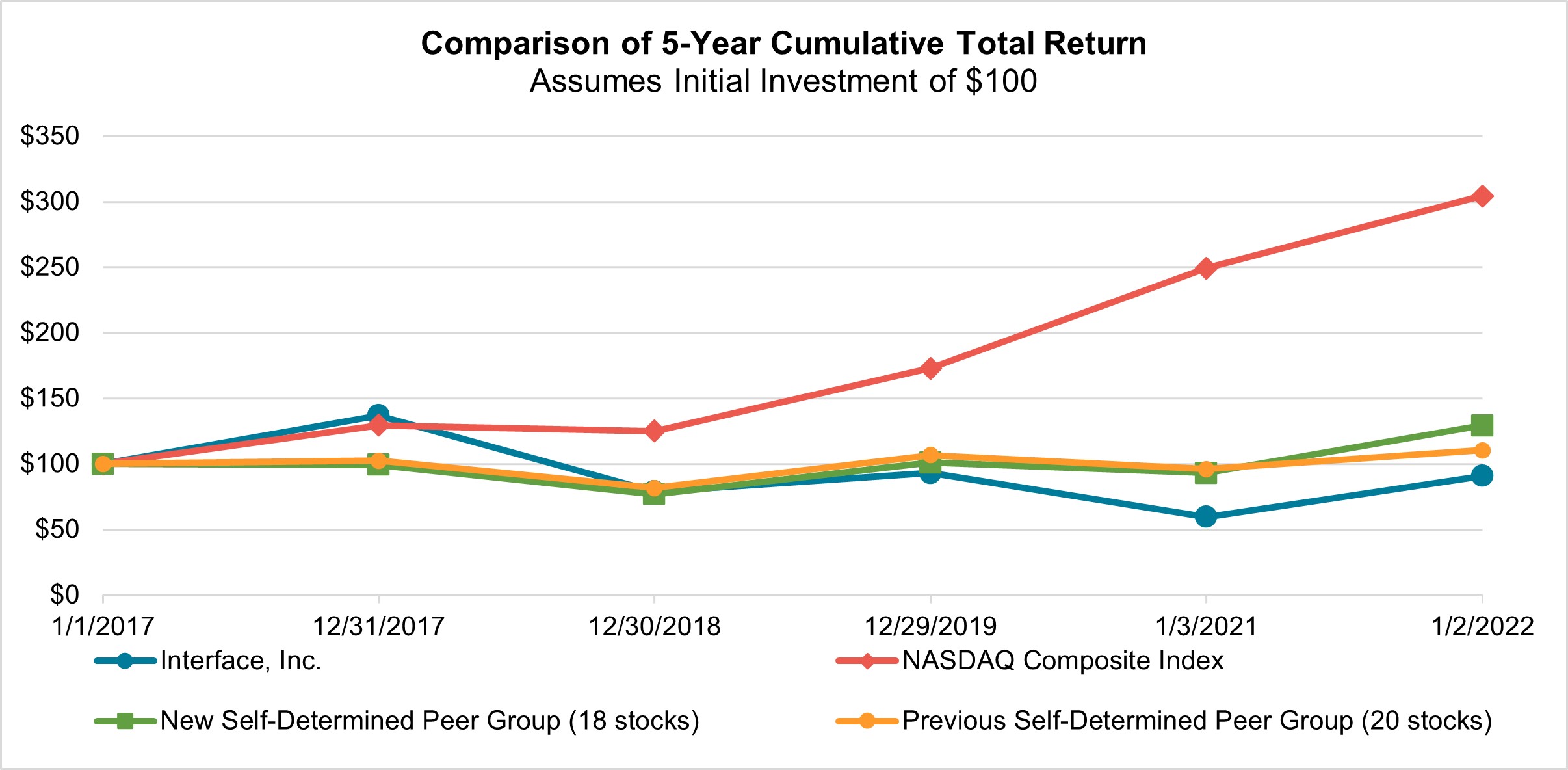

Raw Materials Germany. the COVID-19 pandemic over the course of the year. We believe the principal competitive factors in our primary floorcovering markets are brand recognition, quality, design, service, broad product lines, product performance, marketing strategy, pricing and development. Innovation and increased customization in product design and styling are the principal focus of our product development efforts, the lowest carbon footprint possible and products that help maintain a climate fit for life. Our carbon negative carpet tile features carbon negative materials in the With our new COVID-19 have resulted in delays of construction projects and flooring installations in many regions worldwide, which also have caused fluctuations in our backlog. January 2, 2022. Information About Our Executive Officers Principal Position(s) David B. Foshee Vice President, General Counsel and Secretary Bruce A. Hausmann Vice President and Chief Financial Officer Vice President (President - Americas) Nigel Stansfield Vice President (President - 2001. He was elected to the Board in October 1996 and has served on the Executive Committee of the Board since July 2001. In October 2011, Mr. Hendrix was elected as Chairman of the Board of Directors. Mr. Hendrix retired from the positions of President and Chief Executive Officer in March 2017 (while remaining Chairman of the Board), and subsequently was re-elected as President and Chief Executive Officer in January 2020. companies and is a certified public accountant (inactive status) in the State of California. Africa, and in January 2019 he assumed responsibility for the Asia-Pacific region as well. market. weakened by negative cycles or other factors, including as a result of the continuing COVID-19 pandemic. and manufacturing personnel. us. The market price of our common stock has been volatile and the value of your investment may decline. We are also making significant investments and modifications to our manufacturing facilities, results of operations. These types of events could also affect our suppliers, installers, and customers, which could have a material adverse impact on our business. West Point, Georgia Annual Report on Form 10-K is incorporated by reference herein. High Low Dividends Per Share 2018 First Quarter (through February 16, 2018) 2017 Fourth Quarter Third Quarter Second Quarter First Quarter 2016 Fourth Quarter Third Quarter Second Quarter First Quarter Stock Performance 12/30/12 12/29/13 12/28/14 1/3/16 1/1/17 12/31/17 Interface, Inc. $100 $137 $107 $124 $122 $167 NASDAQ Composite Index $100 $142 $166 $175 $191 $248 Self-Determined Peer Group (14 Stocks) $100 $150 $166 $178 $205 $229 Issuer Purchases of Equity Securities Period(1) Total Number of Shares Purchased Average Price Paid Per Share Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(2) Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs(2) October 2 - 31, 2017 November 1 – 30, 2017 (3) December 1 – 31, 2017 Total 2017 2016 2015 2014 2013 Net sales Cost of sales Operating income(1) Net income(2) Income from continuing operations per common share attributable to Interface, Inc. Basic Diluted Average Shares Outstanding Basic Diluted Cash dividends per common share Property additions Depreciation and amortization(3) Working capital Total assets Total long-term debt Shareholders’ equity Current ratio(4) market segments for the last three fiscal years by reportable segment. 2020. 2017 2016 2015 (in millions) Impact of changes in foreign currency on net sales Impact of changes in foreign currency on operating income Fiscal Year 2017 2016 2015 Net sales Cost of sales Gross profit on sales Selling, general and administrative expenses Restructuring and asset impairment charges Operating income Interest/Other expense Income before income tax expense Income tax expense Net income Fiscal Year Percentage Change 2017 2016 2015 2017 compared 2016 compared (in thousands) with 2016 with 2015 Net Sales 2020 Consolidated Cost and Expenses Cost and Expenses Fiscal Year Percentage Change 2017 2016 2015 2017 compared with 2016 2016 compared with 2015 (in thousands) Cost of Sales Selling, General and Administrative Expenses Total net sales was partially offset by productivity efficiencies during the year. Management believes it is reasonably likely the inflationary pressures experienced in 2021 will continue to some degree in 2022, particularly in the first half of 2022. COVID-19. AOI for 2020. We anticipate that our liquidity is sufficient to meet our obligations for the next 12 months and we expect to generate sufficient cash to meet our long-term obligations. 2022 to be approximately $30 million, although we are not committed to these amounts. of Senior Notes outstanding. and (2) a decrease in dividends paid of $9.8 million. cost of borrowing cash overnight collateralized by U.S. Treasury securities. We have exposure to LIBOR-based financial instruments under the Facility, which has variable (or floating) interest rates based on LIBOR. The Facility allows for the use of an alternative benchmark rate if LIBOR is no longer available. As of January 2, 2022, the weighted average interest rate on borrowings outstanding under the Facility was 1.91%. Payments Due by Period Total Payments Due Less than 1 year 1-3 years 3-5 years More than 5 years (in thousands) Long-Term Debt Obligations Operating Lease Obligations(1) Expected Interest Payments(2) Unconditional Purchase Obligations(3) Pension Cash Obligations(4) Total Contractual Cash Obligations(5) (6) and Estimates Impairment of Long-Lived Assets.Long-lived assets are reviewed for impairment at the asset group level whenever events or changes in circumstances indicate that the carrying value may not be recoverable. If the sum of the expected future undiscounted cash flow is less than the carrying amount of the asset, an impairment is indicated. A loss is then recognized for the difference, if any, between the fair value of the asset (as estimated by management using its best judgment) and the carrying value of the asset. Management’s judgement in estimating the undiscounted cash flows based on market conditions and trends, and other industry specific metrics used in determining the fair value is subject to uncertainty. If actual market value is less favorable than that estimated by management, additional write-downs may be required. impacted. used in the fair value determination are subject to judgement. During the fourth quarters of However, the full extent of the future impact of COVID-19 on the Company’s operations is uncertain, and a prolonged COVID-19 pandemic could result in additional impairment of goodwill. If the actual fair value of the goodwill is determined to be less than that estimated, an additional write-down may be required. Pension Benefits.Net pension expense recorded is based on, among other things, assumptions about the discount rate, estimated return on plan assets and salary increases. While management believes these assumptions are reasonable, changes in these and other factors and differences between actual and assumed changes in the present value of liabilities or assets of our plans above certain thresholds could cause net annual expense to increase or decrease materially from year to year. The actuarial assumptions used in our salary continuation plan and our foreign defined benefit plans reporting are reviewed periodically and compared with external benchmarks to ensure that they appropriately account for our future pension benefit obligation. The expected long-term rate of return on plan assets assumption is based on weighted average expected returns for each asset class. Expected returns reflect a combination of historical performance analysis and the forward-looking views of the financial markets, and include input from actuaries, investment service firms and investment managers. The table below represents the changes to the projected benefit obligation as a result of changes in discount rate assumptions: Foreign Defined Benefit Plans Increase (Decrease) in Projected Benefit Obligation (in millions) 1% increase in actuarial assumption for discount rate 1% decrease in actuarial assumption for discount rate Domestic Salary Continuation Plan Increase (Decrease) in Projected Benefit Obligation (in millions) 1% increase in actuarial assumption for discount rate 1% decrease in actuarial assumption for discount rate Contents Recent Accounting Pronouncements There were no active derivative instruments as of January 2, 2022. 2020. in 2021. 2018 2019 2020 2021 Thereafter Total Fair Value (in thousands) Rate-Sensitive Liabilities Long-term Debt: Variable Rate Variable Interest Rate January 2, 2022 and January 3, 2021 was 1.91% and 1.89%, respectively. The carrying value of the Company’s borrowings under our Syndicated Credit Facility approximates fair value as the Facility bears variable interest rates that are similar to existing market rates. Based on a hypothetical immediate 100 basis point increase in interest rates, with all other variables held constant, the fair value of our fixed rate long-term debt would be impacted by a net decrease of $10.8 million. Conversely, a 100 basis point decrease in interest rates would result in a net increase in the fair value of our fixed rate long-term debt of $6.0 million. ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA FISCAL YEAR 2017 2016 2015 (in thousands, except per share data) Net sales Cost of sales Gross profit on sales Selling, general and administrative expenses Restructuring and asset impairment charges Operating income Interest expense Other expense (income) Income before income tax expense Income tax expense Net income Net income per share – basic Net income per share – diluted Basic weighted average common shares outstanding Diluted weighted average common shares outstanding INTERFACE, INC. AND SUBSIDIARIES FISCAL YEAR 2017 2016 2015 (in thousands) Net income Other comprehensive income (loss), after tax Foreign currency translation adjustment Cash flow hedge change in net unrealized gains (losses) Pension liability adjustment Comprehensive income INTERFACE, INC. AND SUBSIDIARIES END OF FISCAL YEAR 2017 2016 (in thousands) ASSETS Current Cash and cash equivalents Accounts receivable, net Inventories, net Prepaid expenses and other current assets Total current assets Property and equipment, net Deferred tax asset Goodwill, net Other assets LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities Accounts payable Accrued expenses Current portion of long-term debt Total current liabilities Long term debt Deferred income taxes Other Total liabilities Commitments and contingencies Shareholders’ equity Preferred stock Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive loss – foreign currency translation Accumulated other comprehensive income – cash flow hedge Accumulated other comprehensive loss – pension liability Total shareholders’ equity Total liabilities and shareholders’ equity INTERFACE, INC. AND SUBSIDIARIES FISCAL YEAR 2017 2016 2015 (in thousands) Net income Adjustments to reconcile income to cash provided by operating activities Depreciation and amortization Stock compensation amortization expense Enactment of U.S. Tax Cuts and Jobs Act expenses Bad debt expense Deferred income taxes and other Working capital changes: Accounts receivable Inventories Prepaid expenses and other current assets Accounts payable and accrued expenses Cash provided by operating activities INVESTING ACTIVITIES: Capital expenditures Other Cash used in investing activities FINANCING ACTIVITIES: Credit facility borrowing Credit facility repayments Term loan repayments Repurchase of common stock Dividends paid Tax Withholding Payments for Share-Based Compensation Debt issuance costs Proceeds from issuance of common stock Cash provided by (used in) financing activities Net cash provided by (used in) operating, investing and financing activities Effect of exchange rate changes on cash CASH AND CASH EQUIVALENTS: Net increase (decrease) Balance, beginning of year Balance, end of year the nora acquisition, and integration of its European and Asia-Pacific commercial areas, and determined that it has 2 operating and reportable segments – namely Americas (“AMS”) and Europe, Africa, Asia and Australia (collectively “EAAA”). The AMS operating segment is unchanged from prior year and continues to include the United States, Canada and Latin America geographic areas. See Note 20 entitled “Segment Information” for additional information. Handling Cash, Cash Equivalents and Short-Term Investments 3, 2021. Property and Equipment and Long-Lived Assets amount. During the fourth quarters of BALANCE JANUARY 1, 2017 ACQUISITIONS IMPAIRMENT FOREIGN CURRENCY TRANSLATION BALANCE DECEMBER 31, 2017 (in thousands) rates and classified as level 2 within the fair value hierarchy. See Note 5 entitled “Fair Value of Financial Instruments” for further information. Stock-Based Compensation “Shareholders' Equity.” 2019. the same category as the cash flows from the items being hedged. follows: COVID-19 pandemic under the NOW program enacted in the Netherlands. Revenue from sales of carpet, modular resilient flooring, rubber flooring, and other flooring-related material was approximately 98% of total revenue for 2021, 2020 and 2019. The remaining 2% of revenue was generated from the installation of carpet and other flooring-related material in 2021, 2020 and 2019. Inventories are summarized as END OF FISCAL YEAR 2017 2016 (in thousands) Finished goods Work-in-process Raw materials Property, plant and equipment consisted of the following: END OF FISCAL YEAR 2017 2016 (in thousands) Land Buildings Equipment Accumulated depreciation END OF FISCAL YEAR 2017 2016 (in thousands) Compensation Interest Restructuring Taxes Accrued purchases Warranty and sales allowances Other Long-term debt consisted of the following: the Company is required to make quarterly amortization payments of the term loan borrowings. The amortization payments are due on the last day of the calendar quarter. principal amount plus accrued and unpaid interest, if any, to (but excluding) the redemption date, plus a make-whole premium. If the Company experiences a change of control, the Company will be required to offer to purchase the Senior Notes at 101% of their principal amount, plus accrued and unpaid interest to (but excluding) the date of repurchase. payable. $0.4 million, and $0.4 million, respectively. FISCAL YEAR AMOUNT (in thousands) 2018 2019 2020 2021 2022 Thereafter NOTE The program. The following tables depict the activity in the accounts which make up SHARES AMOUNT ADDITIONAL PAID-IN CAPITAL RETAINED EARNINGS (DEFICIT) PENSION LIABILITY FOREIGN CURRENCY TRANSLATION ADJUSTMENT (in thousands) Balance, at December 28, 2014 Net income Stock issuances under employee option plans Other issuances of common stock Unamortized stock compensation expense related to restricted stock awards Cash dividends paid Forfeitures and compensation expense related to stock awards Share repurchases Pension liability adjustment Foreign currency translation adjustment Other Balance, at January 3, 2016 SHARES AMOUNT ADDITIONAL PAID-IN CAPITAL RETAINED EARNINGS (DEFICIT) PENSION LIABILITY FOREIGN CURRENCY TRANSLATION ADJUSTMENT (in thousands) Balance, at January 3, 2016 Net income Stock issuances under employee plans Other issuances of common stock Unamortized stock compensation expense related to restricted stock awards Cash dividends paid Forfeitures and compensation expense related to stock awards Share Repurchases Pension liability adjustment Foreign currency translation adjustment Windfall tax benefit - share-based payment awards Other Balance, at January 1, 2017 SHARES AMOUNT ADDITIONAL PAID-IN CAPITAL RETAINED EARNINGS (DEFICIT) PENSION LIABILITY FOREIGN CURRENCY TRANSLATION ADJUSTMENT CASH FLOW HEDGE (in thousands) Balance, at January 1, 2017 Net income Stock issuances under employee plans Other issuances of common stock Unamortized stock compensation expense related to restricted stock awards Cash dividends paid Forfeitures and compensation expense related to stock awards Share Repurchases Pension liability adjustment Foreign currency translation adjustment Cash flow hedge unrealized gain (loss) Adoption of new accounting standard - share-based payment awards Balance, at December 31, 2017 Shares Weighted Average Exercise Price Outstanding at January 1, 2017 Granted Exercised Forfeited or cancelled Outstanding at December 31, 2017 (a) Exercisable at December 31, 2017 (b) forfeited during the period. The expense related to awards of restricted stock is captured in SG&A expenses on the consolidated statements of operations. Shares Weighted Average Grant Date Fair Value Outstanding at January 1, 2017 Granted Vested Forfeited or cancelled Outstanding at December 31, 2017 Performance Share Awards The Company evaluates the probability of achieving the performance-based goals as of the end of each reporting period and adjusts compensation expense based on this assessment. Performance Shares Weighted Average Grant Date Fair Value Outstanding at January 1, 2017 Granted Vested Forfeited or canceled Outstanding at December 31, 2017 will be recognized by the end of 2024. Fiscal Year 2017 2016 2015 Earnings per share: Basic earnings per share Distributed earnings Undistributed earnings Diluted earnings per share Distributed earnings Undistributed earnings The following table Fiscal Year 2017 2016 2015 (in millions) Net income attributable to participating securities Total Restructuring Charge Costs Incurred in 2016 Costs Incurred in 2017 Balance at Dec. 31, 2017 (in thousands) Workforce Reduction Asset Impairment Lease Exit Costs FISCAL YEAR 2017 2016 2015 (in thousands) Current expense/(benefit): Federal Foreign State Deferred expense/(benefit): Federal Foreign State FISCAL YEAR 2017 2016 2015 (in thousands) U.S. operations Foreign operations 2017 2016 ASSETS LIABILITIES ASSETS LIABILITIES (in thousands) Basis differences of property and equipment Basis difference of intangible assets Foreign currency Net operating loss carryforwards Valuation allowances on net operating loss carryforwards Federal tax credits Deferred compensation Basis difference of inventory Basis difference of prepaids, accruals and reserves Pensions Foreign withholding taxes on unremitted earnings Undistributed earnings from foreign subsidiaries not deemed to be indefinitely reinvested Basis difference of other assets and liabilities FISCAL YEAR 2017 2016 (in thousands) Deferred tax asset (non-current asset) Deferred income taxes (non-current liabilities) As of FISCAL YEAR 2017 2016 2015 (in thousands) Income taxes at U.S. federal statutory rate Increase (decrease) in taxes resulting from: State income taxes, net of federal tax effect Non-deductible business expenses Non-deductible employee compensation Tax effects of Company owned life insurance One-time transition tax on foreign earnings Remeasurement of net Deferred Tax Asset Tax effects of undistributed earnings from foreign subsidiaries not deemed to be indefinitely reinvested Foreign and U.S. tax effects attributable to foreign operations Valuation allowance effect – State NOL Federal tax credits Other Income tax expense FISCAL YEAR 2017 2016 2015 (in thousands) Balance at beginning of year Increases related to tax positions taken during the current year Decreases related to tax positions taken during the prior years Decreases related to settlements with taxing authorities Decreases related to lapse of applicable statute of limitations Changes due to foreign currency translation Balance at end of year FISCAL YEAR AMOUNT (in thousands) 2018 2019 2020 2021 2022 Thereafter Defined Contribution and Deferred Compensation Plans Under the 2019, a plan amendment was executed to eliminate future service accruals in our defined benefit pension plan in the Netherlands (the “Dutch Plan”), which resulted in a curtailment of the plan. The Dutch Plan remains in existence and continues to pay vested benefits. Active participants no longer accrue benefits after December 31, 2019, and instead participate in the Industry-Wide Pension Fund (the “IWPF”) multi-employer plan beginning in fiscal year 2020. During 2021 and 2020, the Company recorded multi-employer pension expense related to multi-employer contributions of $2.6 million and $2.5 million, respectively. The Company’s contributions into the IWPF are less than 5% of total plan contributions. The IWPF is more than 95% funded at the end of 2020, which is the latest date plan information is available. The IWPF multi-employer plan is not considered to be significant based on the funded status of the plan and our contributions. In the next fiscal year, approximately $1.4 million will be reclassified from accumulated other comprehensive loss into net periodic benefit cost. FISCAL YEAR 2017 2016 (in thousands) Change in benefit obligation Benefit obligation, beginning of year Service cost Interest cost Benefits and expenses paid Actuarial loss (gain) Member contributions Currency translation adjustment Benefit obligation, end of year FISCAL YEAR 2017 2016 (in thousands) Change in plan assets Plan assets, beginning of year Actual return on assets Company contributions Benefits paid Currency translation adjustment Plan assets, end of year Reconciliation to balance sheet Funded status benefit asset/(liability) Amounts recognized in accumulated other comprehensive income (after tax) Unrecognized actuarial loss Unamortized prior service costs Total amount recognized Accumulated Benefit Obligation The above disclosure represents the aggregation of information related to the END OF FISCAL YEAR 2017 2016 (in thousands) Projected Benefit Obligation Accumulated Benefit Obligation Plan Assets Dutch Plan Projected Benefit Obligation Accumulated Benefit Obligation Plan Assets FISCAL YEAR 2017 2016 2015 (in thousands) Components of net periodic benefit cost Service cost Interest cost Expected return on plan assets Amortization of prior service cost Recognized net actuarial (gains)/losses Net periodic benefit cost 3, 2021. Under the express terms of the Contract, contract value is the greater of (i) the value of the discounted vested benefits of the Dutch Plan 2021 and 2020 is not significant. FISCAL YEAR 2018 2017 2016 Target Allocation Percentage of Plan Assets at Year End Asset Category: Equity Securities Debt and Debt Securities Other Pension Plan Assets by Category as of December 31, 2017 Dutch Plan UK Plan Total (in thousands) Level 1 Level 2 Level 3 Total Pension Plan Assets by Category as of January 1, 2017 Dutch Plan UK Plan Total (in thousands) Level 1 Level 2 Level 3 Total 2017 Level 1 Level 2 Level 3 (in thousands) Asset Class Equity Securities Debt and Debt Securities Other (including cash) 2016 Level 1 Level 2 Level 3 (in thousands) Asset Class Equity Securities Debt and Debt Securities Other (including cash) 2021 and 2020: 2017 (in thousands) Balance of level 3 assets, beginning of year Interest cost Benefits paid Assets transferred in to (out of) Level 3 Actuarial gain (loss) Translation adjustment Ending Balance of level 3 assets FISCAL YEAR EXPECTED PAYMENTS (in thousands) 2018 2019 2020 2021 2022 FISCAL YEAR 2017 2016 (in thousands) Change in benefit obligation Benefit obligation, beginning of year Service cost Interest cost Benefits paid Actuarial loss (gain) Benefit obligation, end of year The amounts recognized in the consolidated balance sheets are as follows: 2017 2016 (in thousands) Current liabilities Non-current liabilities 2017 2016 (in thousands) Unrecognized actuarial loss 2017 2016 2015 (in thousands, except for assumptions) Assumptions used to determine net periodic benefit cost Discount rate Rate of compensation Assumptions used to determine benefit obligations Discount rate Rate of compensation Components of net periodic benefit cost Service cost Interest cost Amortizations Net periodic benefit cost FISCAL YEAR EXPECTED PAYMENTS (in thousands) 2018 2019 2020 2021 2022 AMERICAS EUROPE ASIA- PACIFIC TOTAL (in thousands) 2017 Net Sales Depreciation and amortization Total assets 2016 Net Sales Depreciation and amortization Total assets 2015 Net Sales Depreciation and amortization FISCAL YEAR ENDED 2017 2016 2015 (in thousands) DEPRECIATION AND AMORTIZATION Total segment depreciation and amortization Corporate depreciation and amortization Reported depreciation and amortization ASSETS Total segment assets Corporate assets and eliminations Reported total assets FISCAL YEAR 2017 2016 2015 (in thousands) SALES TO UNAFFILIATED CUSTOMERS(1) United States United Kingdom Australia Other foreign countries Net sales LONG-LIVED ASSETS(2) United States United Kingdom Netherlands Australia Thailand China Other foreign countries Total long-lived assets NOTE FISCAL YEAR 2017 FIRST QUARTER(1) SECOND QUARTER THIRD QUARTER FOURTH QUARTER(2) (in thousands, except per share data) Net sales Gross profit Net income Basic income per share Diluted income per share Share prices High Low FISCAL YEAR 2016 FIRST QUARTER SECOND QUARTER THIRD QUARTER FOURTH QUARTER(1) (in thousands, except per share data) Net sales Gross profit Net income Basic income per share Diluted income per share Share prices High Low Report of Independent Registered Public Accounting Firm 2021. Notes to Consolidated Financial Statements (BDO USA, LLP, Atlanta, Georgia, PCAOB ID: 243) 23 24 31.1 31.2 32.1 32.2 101.INS XBRL Instance Document 101.SCH XBRL Taxonomy Extension Schema 101.CAL XBRL Taxonomy Extension Calculation Linkbase 101.LAB XBRL Taxonomy Extension Label Linkbase 101.PRE XBRL Taxonomy Presentation Linkbase 101.DEF XBRL Taxonomy Definition Linkbase COLUMN A BALANCE, AT BEGINNING OF YEAR COLUMN B CHARGED TO COSTS AND EXPENSES (A) COLUMN C CHARGED TO OTHER ACCOUNTS COLUMN D DEDUCTIONS (DESCRIBE) (B) COLUMN E BALANCE, AT END OF YEAR (in thousands) Allowance for Doubtful Accounts: Year Ended: December 31, 2017 January 1, 2017 January 3, 2016 COLUMN A BALANCE, AT BEGINNING OF YEAR COLUMN B CHARGED TO COSTS AND EXPENSES (A) COLUMN C CHARGED TO OTHER ACCOUNTS(B) COLUMN D DEDUCTIONS (DESCRIBE) (C) COLUMN E BALANCE, AT END OF YEAR (in thousands) Restructuring Reserve: Year Ended: December 31, 2017 January 1, 2017 January 3, 2016 COLUMN A BALANCE, AT BEGINNING OF YEAR COLUMN B CHARGED TO COSTS AND EXPENSES (A) COLUMN C CHARGED TO OTHER ACCOUNTS COLUMN D DEDUCTIONS (DESCRIBE) (B) COLUMN E BALANCE, AT END OF YEAR (in thousands) Warranty and Sales Allowances Reserves : Year ended: December 31, 2017 January 1, 2017 January 3, 2016 Daniel T. Hendrix President, Chief Executive Officer and Chairman of the Board and Director March /s/ BRUCE A. HAUSMANN March Bruce A. Hausmann /s/ March /s/ JOHN P. BURKE John P. Burke /s/ /s/ CHRISTOPHER G. KENNEDY Christopher G. Kennedy /s/ JOSEPH KEOUGH K. David Kohler /s/ Sheryl D. PalmerWe distribute our products through two primary channels: (1) direct sales to end users;(2) indirect sales through independent contractors or distributors. In each case, we may also call upon architects, engineers, interior designers, contracting firms and other specifiers who often make or substantially influence purchasing decisions.Manufacturingtwotwo locations in the United States and at facilities in the Netherlands, the United Kingdom, Thailand, China and Australia.Having foreign manufacturing operations enables us to supply our customers with We also have manufactured carpet fromtile at a location in Thailand for many years, but in 2021 we announced that we are closing the location offeringThailand plant (anticipated closure at the most advantageous delivery times, duties and tariffs, exchange rates, and freight expense, and enhances our ability to develop a strong local presence in foreign markets. We believe that the ability to offer consistent products and services on a worldwide basis at attractive prices is an important competitive advantage in servicing multinational customers seeking global supply relationships. We will consider additional locations for manufacturing operations in other partsend of the world as necessary to meet the demandsfirst quarter of customers2022). We manufacture rubber flooring in international markets.–— both regionally and globally –— with the exception of synthetic fiber (nylon yarn). For yarn, we principally rely upon two major global suppliers, but we also have significant relationships with at least two other suppliers. Although our number of principal yarn suppliers is limited, we do have the capability to manufacture carpet using face fiber produced from two separate polymer feedstocks –— nylon 6 and nylon 6,6 –— which provides additional flexibility with respect to yarn supply inputs, if needed. Our global sourcing strategy, including with respect to our principal yarn suppliers and dual polymer manufacturing capability, allows us to help guard against any potential shortages of raw materials or raw material suppliers in a specific polymer supply chain.We have a flexible-inputs carpet backing line, which For rubber flooring, the key polymer raw materials are available from multiple sources, and we call “Cool Blue™”, at our modular carpet manufacturing facility in LaGrange, Georgia. Using next generation thermoplastic technology, the custom-designed backing line dramatically improves our ability to keep reclaimedcan source both synthetic and waste carpet in the production “technical loop,”natural rubber depending on product specification and further permits us to explore other plastics and polymers as inputs. material availability.the Cool Blue process.our CQuestGB carpet backing. This technology, which is part of our ReEntry®2.0 carpet reclamation program, allows us to send some of the reclaimed face fiber back to our fiber supplier to be blended with virgin or other post-industrial materials and extruded into new fiber., Georgia, West Point, Georgia, Northern Ireland, the Netherlands, Thailand (anticipated closure at the end of the first quarter of 2022), China and Australia are certified under International Standards Organization (ISO) Standard No. 14001.Our significant international operations are subject Nora’s manufacturing facility, which is located in Weinheim, Germany, is ISO14001 certified as well and sells the majority of its products with the Blauer Engel label. Blauer Engel is the leading German institute that recognizes products that have environmentally friendly aspects.various political, economicend users; and (2) indirect sales through independent contractors, installers and distributors. We have traditionally focused our carpet marketing strategy on major accounts, seeking to build lasting relationships with national and multinational end-users, and on architects, interior designers, engineers, contracting firms, and other uncertainties,specifiers who often make or significantly influence purchasing decisions. While the corporate office market segment, including risksnew construction and renovation, is our largest, we also emphasize sales in other market segments, including schools and educational facilities, government institutions, retail space, healthcare facilities, tenant improvement space, hospitality centers, residences and home office space. Our marketing efforts are enhanced by the established and well-known brand names of restrictive taxation policies, foreign exchange restrictions, changing political conditionsour carpet products, including Interface and governmental regulations.FLOR, as well as the strength of the nora rubber flooring brands of noraplan and norament.receive a substantial portionuse technology which allows us to provide digital, simulated samples of our products, which helps reduce raw material and energy consumption associated with our samples.in currencies other than U.S. dollars, which makes us subjectand profitability by pursuing the following key initiatives:risks inherenteconomic cyclicality of the corporate office segment, and it has become a principal strategy generally for growing our business and enhancing profitability. currency translations. Althoughthe high growth LVT market, we plan to expand our LVT product offerings while also seeking to introduce new products in the resilient flooring category, such as rigid core LVT that was launched in early 2022. We believe our ability to manufactureoffer and shipsell our soft and hard surfaces in an integrated flooring design helps meet the needs of our customers by complementing and enhancing our carpet tile portfolio with true modular installation, no transition strips between surfaces, carpet tile and resilient products that are in some cases the same size and shape, and favorable acoustic properties. Our acquisition of nora, with its rubber flooring products, is also a key component of our strategy in this area.facilities in several foreign countries reduces the riskseconomic impacts of foreign currency fluctuations we might otherwise experience, we also engage from time to time in hedging programs intended to further reduce those risks.We believe we are the largest manufacturer of modular carpet in the world. However, aA number of domestic and foreign competitors manufacture modular carpet as one segment of their business, and some of these competitors have financial resources greater than ours. In addition, some of the competing carpet manufacturers have the ability to extrude at least some of their requirements for fiber used in carpet products, which decreases their dependence on third party suppliers of fiber.8pricing.sustainability. In the corporate office market segment, modular carpet competes with various floorcoverings of whichincluding broadloom carpet, is the most common. LVT and polished concrete. We believe the quality, service, design, better and longer average product performance, flexibility (design options, selective rotation or replacement, use in combination with our LVT or roll goods)resilient products), environmental footprint and convenience of our modular carpet are our principal competitive advantages.LVTresilient products to our customers. Additionally, we believe that our global carpet tile manufacturing capabilities are an important competitive advantage in serving the needs of multinational corporate customers. We believe that the incorporation of theIntersept antimicrobial chemical agent into the backing of some modular carpet products enhances our ability to compete successfully across allsome of our market segments generally, and specifically with resilient tile in the healthcare market.In addition, we believe that our environmentalsegments.and commitment to eliminate our negative impact on the environment by 2020 isare a brand-enhancing, competitive strength as well as a strategic initiative. Our customers are increasingly concerned about the environmental and broader ecological implications of their operations and the products they use in them. Our leadership, knowledge and expertise in the area, especially in the “green building” movement and related environmental certification programs, resonate deeply with many of our customers and prospects around the globe. Our modular carpet products historically have had inherent installation and maintenance advantages that have translated into greater efficiency and waste reduction. We are using raw materials and production technologies, such as our Cool Blue backing line and our ReEntry 2.0 reclaimed carpet separation process and our new CQuest backings, that directly reduce the adverse impact of those operations on the environment and limit our dependence on petrochemicals.80150 people and also draw on the research and development efforts of our suppliers, particularly in the areas of fibers, yarns and modular carpet backing materials. Our research and development costs were $14.0 million, $14.3 million, and $14.5 million in 2017, 2016, and 2015, respectively.OurThe research and development team provides us with technical support and advanced materials research and development for us. The team assisted in the development of ourpost-consumer recycled content, polyvinyl chloride, or PVC, extruded sheet process that has been incorporated into our GlasBacRE modular carpet backing. Our post-consumer recycled content PVC extruded sheet exemplifies our commitment to “closing-the-loop” in recycling. More recently, this team developed our TacTiles carpet tile installation system, which uses small squares of adhesive plastic film to connect intersecting carpet tiles. The team also helped implement our Cool Blue flexible inputs backing line and our ReEntry 2.0 reclaimed carpet separation technology and post-consumer recycling technology for nylon face fibers. With a goal of supporting sustainable product designs in floorcoverings applications, we continue to evaluate bio-based and renewable polymers for use in our products. Our research and development team also supports the dissemination, consultancies and technical communication of our global sustainability endeavors. This team also provides all biochemical and technical support to Intersept antimicrobial chemical product initiatives., and this focus has led to several design breakthroughs such as our Skinny PlankSkinny Plank products, as well as our i2 product line. Our carpet design and development team is recognized as an industry leader in carpet design and product engineering for the commercial and institutional markets. David Oakey Designs also contributedour ability to efficiently produce many products from a single yarn system. Our mass customization production approach evolved, in major part, from this concept and increases the number and variety of product designs, which in turn enables us to offer products with competitive margins.In the latter part of 1994, we commenced a within our business that we now call Mission Zero,began more than 25 years ago with initiatives aimed at reducing waste, environmental footprint and costs. Mission Zero, which includesWith our QUEST waste reduction initiative, is directed towards the elimination of energy and raw materials waste in our businesses, and, on a broader and more long-term scale, the practical reclamation — and ultimate restoration — of shared environmental resources. The initiative involves a commitment by us:We have engaged some of the world’s leading authorities on global ecology as environmental advisors. The list of advisors includes: Paul Hawken, author of The Ecology of Commerce: A Declaration of Sustainability and The Next Economy, and co-author of Natural Capitalism: Creating the Next Industrial Revolution; Amory Lovins, energy consultant and co-founder of the Rocky Mountain Institute; Bill Browning, fellow and former director of the Rocky Mountain Institute’s Green Development Services; Janine M. Benyus, author of Biomimicry; and Bob Fox, renowned architect.As more customers in our target markets share our view that sustainability is an important factor in making purchasing and design decisions, and not just good deeds, our acknowledged leadership position should strengthen our brands and provide a differentiated advantage in competing for business. To further raise awareness of our goal of becoming sustainable, we launched our Mission Zero global branding initiative, which represents our mission to eliminate any negative impact our companies may have on the environment by the year 2020. In 2016, we launched the recent in which we seek to lead industry in designing and making products in ways that will maintain a climate fit for life. Our Mission Zeroand Climate Take Back logos appear logo appears on many of our marketing and merchandising materials distributed throughout the world.high pointhighlight in our pursuit of sustainability has beenwas our creation with the Zoological Society of London of a program called Net-Works®Net-Works® in which we’vewe worked with communities in the Philippines to collect discarded fishing nets that are damaging a large coral reef, and divert them to our yarn supplier where they are recycled into new carpet fiber. Net-Works provides a source of income for members of these communities in the Philippines, while also cleaning up the beaches and waters where they live and work. Our Net Effect Collection of carpet tile products, among others, contains yarn that is partly made from the recycled fishing nets collected through the Net-Works program. Through 2017, this program has collected more than 142 tons of discarded fishing nets. Net-Works is a big step in redesigning our supply chain from a linear take-make-waste process toward a closed loop system, and it advances our ultimate goal of becoming a restorative enterprise. $122.9 $215.6 million at February 11, 2018,6, 2022, compared with approximately $107.8$177.7 million at February 12, 2017.7, 2021. Historically, backlog is subject to significant fluctuations due to the timing of orders for individual large projects and currency fluctuations. AllDisruptions in supply and distribution chains, global travel restrictions and government shelter in place orders due to the impact of the backlog orders at February 11, 2018 are expected to be shipped during the succeeding six to nine months.Intersept, GlasBac, Mission Zero, CQuest, Climate Take Back, nora, norament, noraplan, nTX solution, noraplan unita, noraplan valua, and Net-Works.TacTiles.Trademark registrations in the United States are valid for a period of 10 years and are renewable for additional 10-year periods as long as the mark remains in actual use. The duration of trademarks registered in other jurisdictions varies.Financial InformationOperating Segmentsliving our values. Our core values represent who we are, how we see the world, how we treat each other and Geographic AreasThe Notes to Consolidated Financial Statements appearing in Item 8our external customers and stakeholders, and how we approach our work every day. These core values are:December 31, 2017,January 2, 2022, we employed a total of 3,0923,646 employees worldwide. Of such employees, 1,781total, 1,463 were clerical, staff, sales, supervisory and management personnel and 1,3112,183 were manufacturing personnel. We also utilized the services of 227251 temporary personnel as of December 31, 2017.production employees in Australia, and the United Kingdom and China are represented by unions. In the Netherlands, a Works Council, the members of which are Interface employees, is required to be consulted by management with respect to certain matters relating to our operations in that country, such as a change in control of Interface Europe B.V. (our modular carpet subsidiary based in the Netherlands), and the approval of the Works Council is required for some of our actions, including changes in compensation scales or employee benefits. The majority of our employees in Germany are represented by a Works Council as well. Our management believes that its relations with the Works Council,Councils, the unions and all of our employees are good.10Environmental Mattersoperations are subject to laws and regulations relating to the generation, storage, handling, emission, transportation and discharge of materials into the environment. The costs of complying with environmental protection laws and regulations have not had a material adverse impact on our financial condition or results of operations in the past and are not expected to have a material adverse impact in the future. The environmental management systems of our floorcovering manufacturing facilities in LaGrange, Georgia, West Point, Georgia, Northern Ireland, the Netherlands, Thailand, China and Australia are certified under ISO Standard No. 14001.of the RegistrantDecember 31, 2017,January 2, 2022, and their principal positions with us are set forth below. Executive officers serve at the pleasure of the Board of Directors.NameAgePrincipal Position(s)Jay D. Gould58Daniel T. Hendrix 67 President and Chief Executive Officer Robert A. Coombs59Senior Vice President (President - Asia-Pacific)4748Matthew J. Miller49Kathleen R. Owen54Vice President and Chief Human Resources OfficerJ. Chadwick Scales54Vice President and Chief Marketing, Innovation & Design Officer50Europe)Gould Hendrixjoined us as Executive Vice President and Chief Operating Officer in January 2015, was promoted to President and Chief Operating Officer in January 2016, and was promoted to Chief Executive Officer effective March 3, 2017. From 2012 to January 2015, Mr. Gould was the Chief Executive Officer of American Standard Brands,1983 after having worked previously for a kitchen and bath products company. Prior to his employment with American Standard Brands, Mr. Gould held senior executive roles at Newell Rubbermaid Inc., a global marketer of consumer and commercial products, serving as President of its Home & Family business group from 2008 to 2012 and President of its Parenting Essentials business group from 2006 to 2008. He also previously held executive level positions at The Campbell Soup Company (2002-2006) and The Coca-Cola Company (1995-2002).Mr. Coombs originally worked for us from 1988 to 1993 as a marketing manager for our Heuga carpet tile operations in the United Kingdom and later for all of our European floorcovering operations. In 1996, Mr. Coombs returned to us as Managing Director of our Australian operations. He was promoted in 1998 to Vice President-Sales and Marketing, Asia-Pacific, with responsibility for Australian operations and sales and marketing in Asia, which was followed by a promotion to Senior Vice President, Asia-Pacific.national accounting firm. He was promoted to Treasurer in 1984, Chief Financial Officer in 1985, Vice President-Finance in 1986, Senior Vice President European Sales, in May 1999 and SeniorOctober 1995, Executive Vice President European Salesin October 2000, and Marketing, in April 2000. In February 2001, he was promoted to President of Interface Overseas Holdings, Inc. with responsibility for all of our floorcoverings operations in both Europe and the Asia-Pacific region, and he became a Vice President of Interface. In September 2002, Mr. Coombs relocated back to Australia, retaining responsibility for our floorcovering operations in the Asia-Pacific region while another executive assumed responsibility for floorcovering operations in Europe. Mr. Coombs was promoted to Senior Vice President of InterfaceChief Executive Officer in July 2008.Refreshment Services business unitDirect Store Delivery segment since 2014. Prior to joining Aramark, he served as Vice President and Segment Controller for the Interactive Media Group of The Walt Disney Company, which he joined in 2002. He has also previously held finance and controller positions with several software and internet companies.Miller Poppensjoined us in June 2015 as Vice President and Chief Strategy Officer, and became President2017 to lead the restructuring of our AmericasFLOR business in June 2016. He came to Interface from American Standard Brands, where he was Senior Vice President of Innovation and Strategy from April 2013 to May 2015. Mr. Miller also was an independent consultant to American Standard Brands from February 2012 to April 2013. Previously, he served as Global Vice President-Finance of the Juvenile Products Segment of Newell Rubbermaid Inc. from 2008 to 2011, and as Director of Strategy and Corporate Development for Newell Rubbermaid from 2006-2008. He also has worked with a number of other global organizations, including Kraft Foods and Zyman Group.Ms. Owen joined us in June 2015 as Vice President and Chief Human Resources Officer. Ms. Owen is responsible for the development and oversight of human resources strategies and initiatives for talent management, organization development, learning, compensation, culture and diversity for Interface associates, globally. She came to Interface from Taylor Morrison Home Corporation, a publicly traded North American real estate developer and home builder, where shethen served as Vice President of Human Resources from June 2005 to December 2014. Prior to that, she held several human resources positions with experience across the U.S.Corporate Marketing and Europe with companies including McKesson Technology Solutions, Check-Free Corporation and Lanier Worldwide.Mr. Scales joined us in April 2016 as Vice President and Chief Innovation Officer with responsibility for the Company’s innovation strategy and platforms globally. In August 2016, he also becamewas responsible for the Company’s marketing and designglobal andglobal product commercialization planning as well as leading the FLOR business. He was named Chief Marketing, Innovation and Design Officer. Prior to Interface, Mr. Scales served as Senior Vice President and General Manager for the Consumer Packaged Goods division of FOCUS Brands Inc.our Americas business in February 2020. Prior to joining FOCUS Brands,us, Mr. Scales was Global Vice PresidentPoppens held leadership roles at Newell Rubbermaid, Kellogg Company, REI, and Coca-Cola. MRP manufacturing software systems at seven of our manufacturing plants. In 1999, he returned to Firth Carpets as Operations Director. In 2002, he became a member of our European research and development team focusing on our sustainability initiatives, and in 2004, he became Product and Innovations Director for all of our European Operations. In 2010, he joined our European management team as Senior Vice President of Product, Design and Innovation, before being named Vice President and Chief Innovations Officer for the Company in March 2012. In December 2016, he became President of our business serving Europe, the Middle East and Africa. annual reportAnnual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our Internet address is http://www.interface.com. The SEC maintains a website that contains annual, quarterly and current reports, proxy statements and other information that issuers (including the Company) file electronically with the SEC. The SEC’s website is http://www.sec.gov.Factors”.Factors.”12stock.stock.Any or all of the following risk factors could have a material adverse effecton our business, financial condition, results of operations and prospects.Salesand construction of commercial and institutional buildings.country’scountry’s or region’s general economy, prevailing interest rates and other factors that lead to cost control measures, or reduction in the use of space, by businesses and other users of commercial or institutional space. TheFor example, the COVID-19 pandemic may have cyclical and structural impacts on this activity resulting from job losses for office workers, reductions in the use of coworking spaces, and increases in the number of people working from home. As the COVID-19 pandemic continues, the future of the office, and what the office of the future might look like, is being highly debated by senior executives, commercial real estate firms, architects, designers and other global experts which could adversely affect the amount of money that customers spend on our products. In addition, the effects of cyclicality uponand other factors affecting the corporate office segment tendhave traditionally tended to be more pronounced than the effects upon the institutional segment.on other market segments. Historically, we have generated more sales in the corporate office segment than in any other market.segment. The effects of cyclicality uponand other factors on the new construction segment of the market have also tendtended in the past to be more pronounced than the effects uponon the renovation segment. These effects may recur and could be more pronounced if global economic conditions do not improve or are weakened.manufacturersmanufacturers and manufacturers of other types of floorcovering. Although the industry has experienced significant consolidation, a large number of manufacturers remain in the industry. Moreover, some of our competitors are adding manufacturing capacity into the industry throughout the globe which could increase the amount of supply in the market. Increased capacity at our competitors could result in pricing pressure on our products (including products, like LVT, which may currently carry attractive margins) and less demand for our products, thus adversely affecting both revenues and profitability.havehave greater financial resources than we do. Competing effectively may require us to make additional investments in our product development efforts, manufacturing facilities, distribution network and sales and marketing activities. (including(including experienced sales personnel)and manufacturing personnel), and our lossof any of them could affect us adversely.strongexperienced sales leaders.carpetflooring industry –— particularly in the areas of sales, marketing, operations, product design and management –— could have an adverse impact on our business. We may not be able to easily replace such personnel, particularly if the underlying reasons for the loss make the Company relatively unattractive as an employer.are implementingcontinue to implement a multi-year transformation of our sales organization, including the implementation of standardized processes in whichand systems that our sales force goesuses to go to market, interactsinteract with customers, workswork with architects and the architect and design community and, in general, operatesgeneral, operate day-to-day. We are also implementingcontinue to improve and change the technology tools that the sales force will beis required to use as part of their day-to-day jobs, and new managementmonitor managerial positions that are designed to actively manage and coach the sales force. All of these changes are disruptive, which may create challenges for our sales force to adapt, particularly for long tenured employees, which comprise a large portion of our sales force. There are no guarantees that these efforts will increase sales or improve profitability of the business, or that they will not instead adversely disrupt the business, decrease sales, and decrease overall profitability.Our substantial international operations are subject to various political, economicand other uncertainties that could adversely affect our business results, includingby restrictive taxation or other government regulation and by foreign currencyfluctuations.We have substantial international operations. In 2017, approximately half of our net sales and a significant portion of our production were outside the United States, primarily in Europe and Asia-Pacific. Our corporate strategy includes the expansion and growth of our international business on a worldwide basis. As a result, our operations are subject to various political, economic and other uncertainties, including risks of restrictive taxation policies, changing political conditions and governmental regulations. This includes, for example, the uncertainty surrounding the implementation and effect of the United Kingdom’s June 2016 referendum in which voters approved the United Kingdom’s exit from the European Union, including changes to the legal and regulatory framework that apply to the United Kingdom and its relationship with the European Union. We also make a substantial portion of our net sales in currencies other than U.S. dollars (approximately half of 2017 net sales), which subjects us to the risks inherent in currency translations. The scope and volume of our global operations make it impossible to eliminate completely all foreign currency translation risks as an influence on our financial results. In addition, political unrest, terrorist acts, military conflict and disease outbreaks have increased the risks of doing business abroad generally.13Concerns regardingEuropean sovereign debtand market perceptions about the instability of the euro, the potential re-introduction of individual currencies within the Eurozone, the potential dissolution of the euro entirely, or the U.K. exiting the European Union, could adversely affect our business, results of operations or financial condition.Following the European sovereign debt crisis that began in 2011, concerns still persist regarding the debt burden of certain countries using the euro as their currency (the “Eurozone”) and their ability to meet future financial obligations, the overall stability of the euro and the suitability of the euro as a single currency given the diverse economic and political circumstances in individual Eurozone countries. Despite remedial efforts undertaken by the European Commission and others, these concerns have caused instability in the euro and could lead to the re-introduction of individual currencies in one or more Eurozone countries, or, in more extreme circumstances, the possible dissolution of the euro currency entirely. Should the euro dissolve entirely, the legal and contractual consequences for holders of euro-denominated obligations would be determined by laws in effect at such time. These potential developments, or market perceptions concerning these and related issues, could adversely affect the value of our euro-denominated assets and obligations or increase the risks of foreign currency fluctuations or cause the failure of hedging programs intended to reduce those risks. In addition, concerns over these effects on financial institutions in Europe and globally could have an adverse impact on the capital markets generally, and more specifically on our ability and the ability of our customers, suppliers and lenders to finance our and their respective businesses, to access liquidity at acceptable financing costs, if at all, on the availability of supplies and materials, and on the demand for our products.In addition, the results of a June 2016 referendum vote in the U.K. were in favor of the U.K. exiting the European Union (the “Brexit Vote”). On March 29, 2017, the U.K. notified the European Union of its intention to withdraw pursuant to Article 50 of the Lisbon Treaty. The terms of the withdrawal are subject to a negotiation period that could last at least two years from the withdrawal notification date. The uncertainty leading up to and following the Brexit Vote has had a negative impact on our business and demand for our products in Europe, and particularly in the U.K. In addition, the Brexit Vote has had a detrimental effect, and could have further detrimental effects, on the value of either or both of the euro and the British Pound Sterling, which could negatively impact our business (principally from the translation of sales and earnings in those foreign currencies into our reporting currency of U.S. dollars). Such a development could have other unpredictable adverse effects, including a material adverse effect on demand for office space and our carpet products in the U.K. and in Europe if a U.K. exit leads to economic difficulties in Europe.petroleum-basedour raw materials, shipping costs, duties or tariffs could adversely affectus if we are unable to pass these cost increases through to our customers.manufacturing.manufacturing carpet. Synthetic rubber uses petroleum-based products as feedstock as well. We also incur significant shipping and transport costs to move our products around the globe, and those costs have increased dramatically due to recent global supply chain challenges. While we attempt to match cost increases with corresponding price increases, continued inflation and volatility in the cost of petroleum-based raw materials, transportation and shipping costs could adversely affect our financial results if we are unable to pass through such pricecost increases to our customers.third partythird-party suppliers of synthetic fiber or our sole third partyprimary third-party supplier for luxury vinyl tile (“LVT”) or other key raw materials could have a material adverse effect on us.third partythird-party suppliers of synthetic fiber and a single supplierare largely dependent upon two primary suppliers for our LVT products. The unanticipated termination or interruption of any of our supply arrangements with our current suppliers of synthetic fiber (nylon), our primary suppliers of LVT, or sole supplier of LVT,other key raw material suppliers, including failure by any third party supplier to meet our product specifications, could have a material adverse effect on us because we do not have the capability to manufacture our own fiber for use in our carpet products or our own LVT. Our suppliers may not be able to meet our demand for a variety of reasons, including our inability to forecast our future needs accurately or a shortfall in production by the supplier for reasons unrelated to us, such as work stoppages, acts of war, terrorism, pandemics, epidemics, fire, earthquake, energy shortages, flooding or other natural disasters. The primary manufacturing facility of our largest supplier of LVT is located in South Korea. If any of our supply arrangements with our primary suppliers of synthetic fiber, or our sole supplierprimary suppliers of LVT, isor suppliers of other key raw materials are terminated or interrupted, we likely would incur increased manufacturing costs and experience delays in our manufacturing process (thus resulting in decreased sales and profitability) associated with shifting more of our synthetic fiber purchasing to another synthetic fiber supplier or developing new supply chain sources for LVT. A prolonged inability on our part to source synthetic fiber included in our products, LVT, or LVTother key raw materials on a cost-effective basis could adversely impact our ability to deliver products on a timely basis, which could harm our sales and customer relationships.We have a significant amount of indebtedness, which could have important negativeconsequences to us.Our significant indebtedness could have important negative consequences to us, including:making it more difficult for us to satisfy our obligations with respect to such indebtedness;increasing our vulnerability to adverse general economic and industry conditions;limiting our ability to obtain additional financing to fund capital expenditures, acquisitions or other growth initiatives, and other general corporate requirements;requiring us to dedicate a substantial portion of our cash flow from operations to interest and principal payments on our indebtedness, thereby reducing the availability of our cash flow to fund capital expenditures, acquisitions or other growth initiatives, and other general corporate requirements;limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;placing us at a competitive disadvantage compared to our less leveraged competitors; andlimiting our ability to refinance our existing indebtedness as it matures.As a consequence of our level of indebtedness, a substantial portion of our cash flow from operations must be dedicated to debt service requirements. In addition, borrowings under our Syndicated Credit Facility have variable interest rates, and therefore our interest expenses will increase if the underlying market rates (upon which the variable interest rates are based) increase. The terms of our Syndicated Credit Facility also limit our ability and the ability of our subsidiaries to, among other things, incur additional indebtedness, pay dividends or make certain other restricted payments or investments in certain situations, consummate certain asset sales, enter into certain transactions with affiliates, create liens, merge or consolidate with any other person, or sell, assign, transfer, lease, convey or otherwise dispose of all or substantially all of our assets. They also require us to comply with certain other reporting, affirmative and negative covenants and meet certain financial tests. If we fail to satisfy these tests or comply with these covenants, a default may occur, in which case the lenders could accelerate the debt as well as any other debt to which cross-acceleration or cross-default provisions apply. Our Syndicated Credit Facility matures in August 2022. We cannot assure you that we would be able to renegotiate, refinance or otherwise obtain the necessary funds to satisfy these obligations.It is important for you to consider that we have a significant amount of indebtedness. We cannot assure you that we will be able to renegotiate or refinance any of our debt on commercially reasonable terms, or at all. If we are unable to refinance our debt or obtain new financing, we would have to consider other options, such as selling assets to meet our debt service obligations and other liquidity needs, or using cash, if available, that would have been used for other business purposes.Thethus cannot predict the market price for our common stock going forward.Our earnings in a future period could be adversely affected by non-cash adjustmentsto goodwill, if a future test of goodwill assets indicates a material impairment ofthose assets.As prescribed by accounting standards governing goodwill and other intangible assets, we undertake an annual review of the goodwill asset balance reflected in our financial statements. Our review is conducted during the fourth quarter of the year, unless there has been a triggering event prescribed by applicable accounting rules that warrants an earlier interim testing for possible goodwill impairment. In the past, we have had non-cash adjustments for goodwill impairment as a result of such testings ($61.2 million in 2008 and $44.5 million in 2007). A future goodwill impairment test may result in a future non-cash adjustment, which could adversely affect our earnings for any such future period.or move operations to new ones.other sites, and change our manufacturing processes. We are also in the process of closing our carpet tile manufacturing facility in Thailand. Large scale changes or moves could disrupt our normal operations, leading to possible loss of productivity, which may adversely affect our results.The company will be moving its corporate headquarters in 2018. The transition and relocation of the company’s headquarters could be disruptive and could create a distraction to management in running day-to-day operations which could adversely affect the business.in LaGrange Georgia. At times this processprocesses, product compositions, and product construction including but not limited to the production of our new disruptive, and theredisruptive. There is also no guarantee that theseour CQuest™ backings will not fail to perform as expected and will not increase warranty claims or customer complaints. These efforts willmay also not yield the financial returns and improvements in the business that we hope to achieve from them. In addition, whileWhile these changes are intended to yield stronger financial results, they could potentially adversely affectimpact our financial results in negative ways due to project delays, business disruption as new facilities and equipment come online, increase customer complaints, or increase warranty claims; all of which could negatively affect our operations, reputation, financial condition and general disruption as we make changes and modifications to our manufacturing facilities and processes. For example, in July 2012, a fire occurred at our manufacturing facility in Picton, Australia, causing extensive damage and rendering the facility inoperable. In January 2014, we commenced operations at a new manufacturing facility in Minto, Australia. We could incur uninsured losses and liabilities arising from such events, including damage to our reputation, and/orand suffer material losses in operational capacity, which could have a material adverse impact on our business, financial condition and results of operations.effect onaffect our business.systems—systems—both software and computer hardware—to operate our business. We rely on these systems to, among other things:● plan the purchase, management and distribution of, and payment for, inventory and raw materials;●Control our production processes;●manage and monitor our distribution network and logistics;●receive, process and ship orders;●manage billing, collections and payables;●manage financial reporting; and●manage payroll and human resources information.15Table of, Contentsand payment for, inventory and raw materials;●natural disasters, like fires;●power loss;●software “bugs”, hardware defects or human error; or●hacking, computer viruses, malware, ransomware or other cyber attacks.Our Rights Agreement could discourage tender offersother transactions for our stock that couldformer employees, or claims relating to intellectual property matters. Litigation might result in shareholders receiving a premium oversubstantial costs and may divert management’s attention and resources, which may adversely affect our business, results of operations and financial condition. An unfavorable judgment against us in any legal proceeding or claim could require us to pay monetary damages. Insurance might not cover such claims, might not provide sufficient payments to cover all the market price for our stock.Our Board of Directors has adopted a Rights Agreement pursuantcosts to which holders of our common stock will be entitled to purchase from us a fraction of a share of our Series B Participating Cumulative Preferred Stock if a third party acquires beneficial ownership of 15%resolve one or more of our common stock without our consent.such claims, and might not continue to be available on terms acceptable to us. In addition, an unfavorable judgment in which the holderscounterparty is awarded equitable relief, such as an injunction, could harm our business, results of our common stock will be entitledoperations and financial condition.purchase the stockItem 3, “Legal Proceedings,” within this Report for additional information related to litigation and claims.an Acquiring Person (as defined in the Rights Agreement) at a discount upon the occurrence of triggering events. These provisions of the Rights Agreement could have the effect of discouraging tender offers or other transactions that could result in shareholders receiving a premium over the market price for our common stock.20,00042,000 square feet of leased space. The following table lists our principal manufacturing facilities and other material physical locations (some locations are comprised of multiple buildings), by reportable segment, all of which we own except as otherwise noted:LocationLocation Floor

Space

(Sq. Ft.)Bangkok, Thailand275,946Craigavon, N. Ireland(1)669,145 80,986717,205 539,545LaGrange, Georgia(1)370,000 322,096Union City, Georgia(1)370,000Valley, Alabama(1)338,086Minto, Australia259,356Scherpenzeel, the Netherlands360,800250,000 299,600109,129 EAAA 275,946 72,200 Minto, Australia 240,000 Scherpenzeel, Netherlands 1,250,960 831,113 China(1)China(1)142,500 142,500__________(1)Leased.7050 locations in over 30more than 25 countries and a number of other distribution facilities in several countries. Most of our sales and marketing locations and many of our distribution facilities are leased.expanding global market demands. Substantially all of our owned properties in the United States are subject to mortgages, which secure borrowings under our Syndicated Credit Facility.16Wesubjecta party to various legal proceedings, whether arising in the ordinary course of business noneor otherwise. The disclosure set forth in Note 18 to the consolidated financial statements included in Item 8 of which we believe are required to be disclosed under this Item 3.MINEMINE SAFETY DISCLOSURES2018,2022, we had 624643 holders of record of our Common Stock. We estimate that there are in excess of 10,0009,000 beneficial holders of our Common Stock. The following table sets forth, for the periods indicated, the high and low sale prices of the Company’s Common Stock on the Nasdaq Global Select Market as well as dividends paid during such periods. $ 26.25 $ 22.10 $ 0.00 $ 25.70 $ 21.21 $ 0.065 22.60 18.30 0.065 21.05 18.15 0.06 19.93 17.18 0.06 $ 19.10 $ 14.59 $ 0.06 18.45 15.02 0.06 18.71 14.56 0.05 18.99 13.70 0.05 On February 21, 2018, our Board also declared a regular quarterly cash dividend of $0.065 per share, payable March 23, 2018 to shareholders of record as of March 9, 2018. specifiesspecify conditions as to when any dividend payments may be made. As such, we may discontinue our dividend payments in the future if our Board determines that a cessation of dividend payments is proper in light of the factors indicated above.17five-year period comprised of the Company’s five preceding fiscal years ended December 31, 2017,January 2, 2022, the Company’s total returns to shareholders (stock price plus(assuming all dividends divided by beginning stock price)were reinvested) with that of (i) all companies listed on the Nasdaq Composite Index, and (ii) aour previous self-determined peer group, comprised primarily of companies in the commercial interiors industry,and (iii) our new self-determined peer group, assuming an initial investment of $100 in each on December 30, 2012January 1, 2017 (the last day of the fiscal year 2012)2016). In 2021, the Company updated its self-determined peer group to exclude FLIR Systems, Inc. and Knoll, Inc. as both of these companies were acquired in 2021 and no longer trade publicly. In determining its peer group companies, the Company considered various factors, including the potential peer’s industry, business model, size and complexity. The Company chose a peer group that it believes provides a robust sample size with minimal revenue dispersion, with companies in similar industries or lines of business or subject to similar economic and business cycles, including companies with a significant international presence that are also focused on sustainability.