UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20202023

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-38244

Genprex, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 90-0772347 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

|

|

|

|

Austin, Texas |

|

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (877) 774-4679

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock, par value $0.001 per share |

| GNPX |

| The Nasdaq Capital Market |

Securities registered pursuant to 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer: |

| ☐ |

| Accelerated filer |

| ☐ |

Non-accelerated filer: |

| ☒ |

| Smaller reporting company |

| ☒ |

|

|

|

| Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 20202023 was approximately $114$48.5 million, computed by reference to the closing price of the registrant’s common stock on June 30, 20202023 (the last business day of the registrant'sregistrant’s most recently completed second fiscal quarter) of $3.14 per share,, as reported by The Nasdaq Capital Market.

As of March 15, 2021,25, 2024, there were 43,276,7641,910,441 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission, or SEC, subsequent to the date hereof pursuant to Regulation 14A in connection with the registrant’s 20212024 annual meeting of stockholders, are incorporated by reference into Part III of this Annual Report on Form 10-K. Such proxy statement will be filed with the SEC not later than 120 days after the conclusion of the registrant’s fiscal year ended December 31, 2020.2023.

|

| Page |

| ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

| Item 1C. | Cybersecurity | 76 |

Item 2. | ||

Item 3. | ||

Item 4. | ||

|

|

|

| ||

Item 5. | ||

Item 6. | ||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | ||

Item 8. | ||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |

Item 9A. | ||

Item 9B. | ||

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 87 |

|

|

|

| ||

Item 10. | ||

Item 11. | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | ||

|

|

|

| ||

Item 15. | ||

Item 16. | ||

|

|

|

|

| |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report on Form 10-K” or this “Annual Report”) contains forward-looking statements that involve substantial risks and uncertainties. Unless the context requires otherwise, references to “Genprex,” the “Company,” “we,” “us” or “our” in this Annual Report refer to Genprex, Inc. Any statements in this Annual Report about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan” and “would.” For example, statements concerning financial condition, possible or assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our common stock and future management and organizational structure are all forward-looking statements. Forward-looking statements are not guarantees of performance. They involve known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to differ materially from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement.

Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout this Annual Report. Some of the risks, uncertainties and assumptions that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include but are not limited to:

Market conditions;

• | Market conditions; |

Our capital position;

• | Our capital position; |

Our ability to compete with larger better financed pharmaceutical companies;

• | Our ability to compete effectively and with larger and/or better-financed biotechnology and pharmaceutical companies; |

Our uncertainty of developing marketable products;

• | Our uncertainty of developing marketable products; |

Our ability to develop and commercialize our products;

• | Our ability to develop and commercialize our products; |

Our ability to obtain regulatory approvals;

• | Our ability to obtain regulatory approvals; |

Our ability and third parties’ ability to maintain and protect intellectual property rights;

• | Our ability and third parties’ ability to maintain and protect intellectual property rights; |

Our ability to raise additional future financing and possible lack of financial and other resources;

• | Our ability to raise additional future financing and possible lack of financial and other resources, our ability to maintain compliance with the continued listing requirements of The Nasdaq Capital Market, our ability to continue as a going concern, and to continue to support and fund our preclinical and clinical development programs and growth of our business; |

The success of our clinical trials through all phases of clinical development;

• | The effects and ultimate impact of public health crises such as the coronavirus pandemic, or any other health epidemic, on our business, our clinical trials, our research programs, healthcare systems or the global economy as a whole; |

Any delays in regulatory review and approval of our current and future product candidates;

• | The success of our clinical trials through all phases of clinical development, including the ability of our third-party suppliers or manufacturers to supply or manufacture our products on a timely, consistent basis in a manner sufficient and appropriate as is commensurate to meet our clinical trial timing, courses of treatment, and other requisite fulfillment considerations necessary to adequately advance our development programs; |

Our dependence on third-party manufacturers to supply or manufacture our products;

• | Our ability to conduct and complete our clinical trials in accordance with projected timelines; |

Our ability to control product development costs;

• | Any delays in regulatory review and approval of our current and future product candidates; |

Our ability to attract and retain key employees;

• | Our dependence on third-party suppliers or manufacturers to supply or manufacture our key ingredients and/or raw materials, products and/or product components and successfully carry out a sustainable, reproducible and scalable manufacturing process in accordance with specifications or applicable regulations; |

Our ability to compete effectively;

• | Our ability to control product development costs; |

Our ability to enter into new strategic collaborations, licensing or other arrangements;

• | Our ability to attract and retain key employees; |

Changes in government regulation affecting product candidates could increase our development costs;

• | Our ability to enter into new strategic collaborations, licensing or other arrangements; |

Our involvement in patent and other intellectual property litigation could be expensive and could divert management’s attention;

• | Changes in government regulation affecting product candidates that could increase our development costs; |

The possibility that there may be no market acceptance for our products; and

• | Our involvement in patent, trademark, and other intellectual property litigation that could be expensive and divert management’s attention; |

• | The possibility that there may be no market acceptance for our products; and |

Changes in third-party reimbursement policies which could adversely affect potential future sales of any of our products that are approved for marketing.

• | Changes in third-party reimbursement policies which could adversely affect potential future sales of any of our products that are approved for marketing. |

The foregoing list sets forth some, but not all, of the factors that could affect our ability to achieve results described in any forward-looking statements, which speak only as of the date of this Annual Report. Except as required by law, we assume no obligation and expressly disclaim any duty to update any forward-looking statement to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements contained in this Annual Report. All forward-looking statements are expressly qualified in their entirety by the cautionary statements contained in this section.

RISK FACTOR SUMMARY

Our business is subject to significant risks and uncertainties that make an investment in us speculative and risky. Below we summarize what we believe are the principal risk factors but these risks are not the only ones we face, and you should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors,” together with the other information in this Annual Report on Form 10-K. If any of the following risks actually occurs (or if any of those listed elsewhere in this Annual Report on Form 10-K occur), our business, reputation, financial condition, results of operations, revenue, and future prospects could be seriously harmed. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business.

Risks Related to Our Financial Position and Need for Additional Capital

|

|

|

|

|

|

Risks Related to Development and Commercialization of Our Current and Future Product Candidates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risks Related to Regulatory Approval and Marketing of Our Current and Future Product Candidates and Other Legal Compliance Matters

|

|

|

|

|

|

|

|

|

|

Risks Related to Our Dependence on Third Parties

|

|

|

|

|

|

Risks Related to Our Intellectual Property

|

|

|

|

|

|

|

|

Risks Related to Employee Matters and Managing Growth

|

|

|

|

General Risk Factors

|

|

|

|

|

|

|

|

Overview

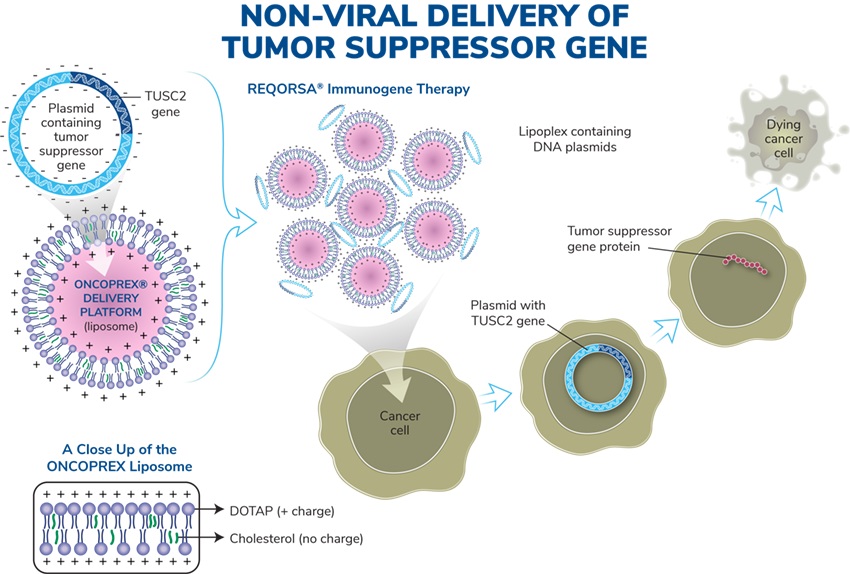

We are a clinical stage gene therapy company focused on developing life-changing treatmentspioneering the development of gene-based therapies for cancer and diabetes.large patient populations with unmet medical needs. Our lead cancer drug candidate, REQORSA™ Immunogene therapy drug (sometimes referred to as GPX-001), is being developed to treat non-small cell lung cancer ("NSCLC"). The active agent in REQORSA is a TUSC2 gene expressing plasmid that is encapsulatedoncology platform utilizes our systemic, non-viral ONCOPREX® Delivery System which uses lipid-based nanoparticles in a DOTAP cholesterol nanoparticle. TUSC2 is alipoplex form to deliver tumor suppressor gene which has both tumor killing (via apoptosis) and immunomodulatory effects. We utilize our novel proprietary ONCOPREX® Nanoparticle Delivery System to deliver the TUSC2 gene expressing plasmidgene-expressing plasmids to cancer cells. The TUSC2 geneproduct is one of a series of genes whose therapeutic useadministered intravenously, where it is coveredtaken up by our exclusive worldwide licenses from The University of Texas MD Anderson Cancer Center ("MD Anderson").

We are planning to initiate our Acclaim-1 and Acclaim-2 clinical trialstumor cells that then express tumor suppressor proteins that were deficient in 2021. Acclaim-1 is a Phase 1/2 clinical trial using a combination of REQORSA with AstraZeneca PLC’s Tagrisso® in patients with late-stage NSCLC with mutated epidermal growth factor receptors ("EGFRs") whose disease progressed after treatment with Tagrisso. In January 2020, we received Food and Drug Administration ("FDA") Fast Track Designation for the Acclaim-1 patient population. Acclaim-2 is a Phase 1/2 clinical trial using a combination of REQORSA with Merck & Co.’s Keytruda® in late-stage NSCLC patients who are low expressors (1% to 49%) of the protein programmed death-ligand 1 ("PD-L1").

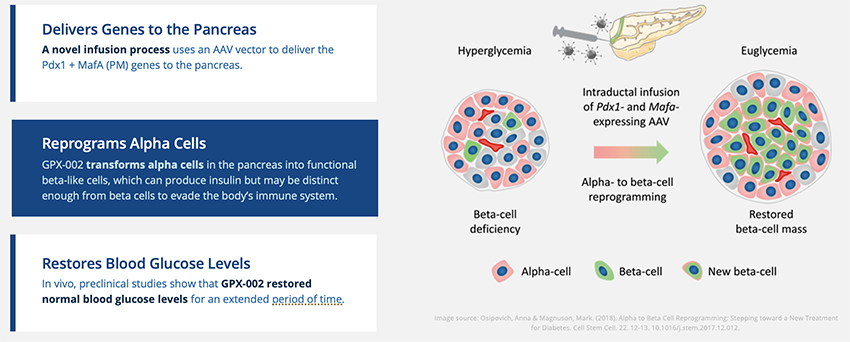

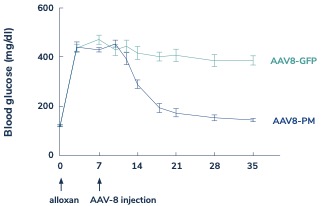

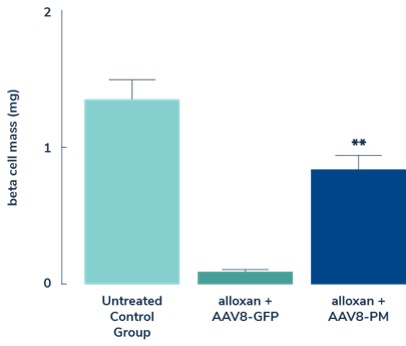

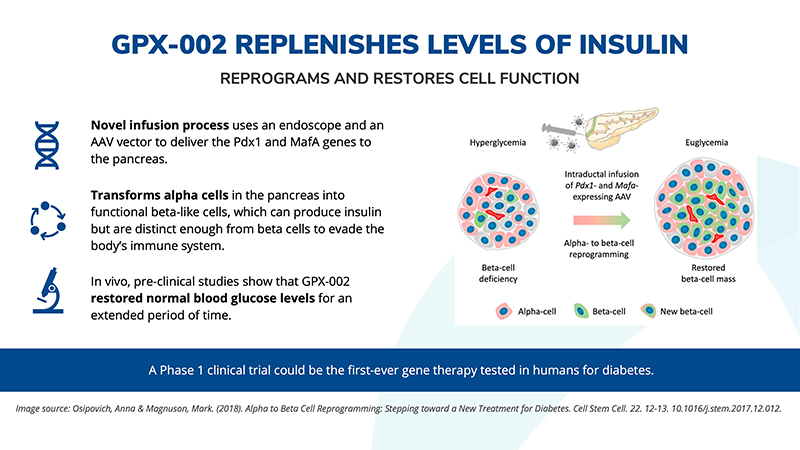

Intumor. Our diabetes we are developing a gene therapy that is exclusively licensed from the University of Pittsburgh of the Commonwealth System of Higher Education ("University of Pittsburgh") for the treatment of Type 1 and Type 2 diabetes. This potential treatmenttechnology is designed to work in Type 1 diabetes by transforming alpha cells in the pancreas into functional beta-like cells, which can produce insulin but aremay be distinct enough from beta cells to evade the body’s immune system. OurIn Type 2 diabetes, product candidateour technology is currently being evaluated in preclinical studies.believed to work by replenishing and rejuvenating exhausted beta cells that make insulin.

Oncology Platform

Utilizing our non-viral ONCOPREX Nanoparticle Delivery System, we are developing cancer treatments that are designed to administer cancer fighting genes. We encapsulate the gene-expressing plasmids using ONCOPREX lipid nanoparticles, and administer them intravenously, where they are then taken up by tumor cells and express proteins that are missing or found in low quantities in the tumor cells. With ourOur lead oncology drug candidate, REQORSA® Immunogene Therapy (generic name: quaratusugene ozeplasmid), previously referred to as GPX-001, is initially being developed in combination with prominent, approved cancer drugs to treat Non-Small Cell Lung Cancer (“NSCLC”) and Small Cell Lung Cancer (“SCLC”). REQORSA there ishas a multimodal mechanism of action whereby REQORSAit interrupts cell signaling pathways that cause replication and proliferation of cancer cells, re-establishes pathways for apoptosis, or programmed cell death, in cancer cells, and modulates the immune response against cancer cells. In early studies, REQORSA has also been shown to block mechanismsbe complementary with targeted drugs and immunotherapies. Our strategy is to develop REQORSA in combination with current approved therapies and we believe REQORSA’s unique attributes position it to provide treatments that create drug resistance.improve on these current therapies for patients with NSCLC, SCLC, and possibly other cancers.

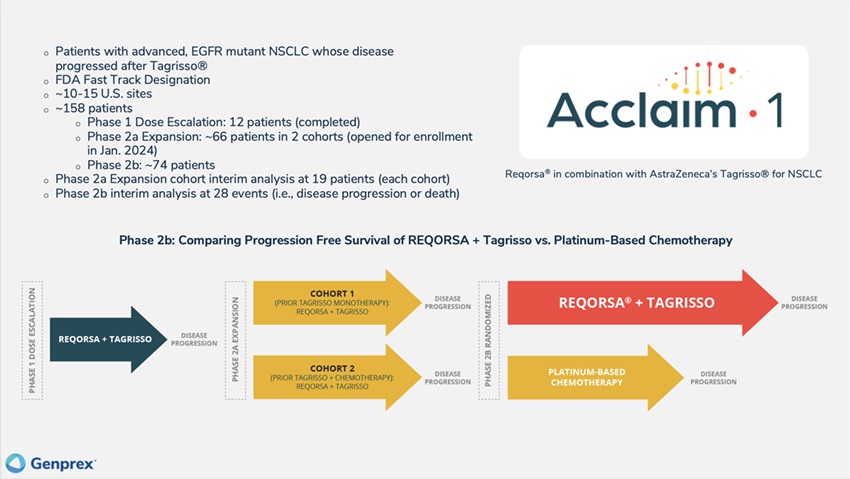

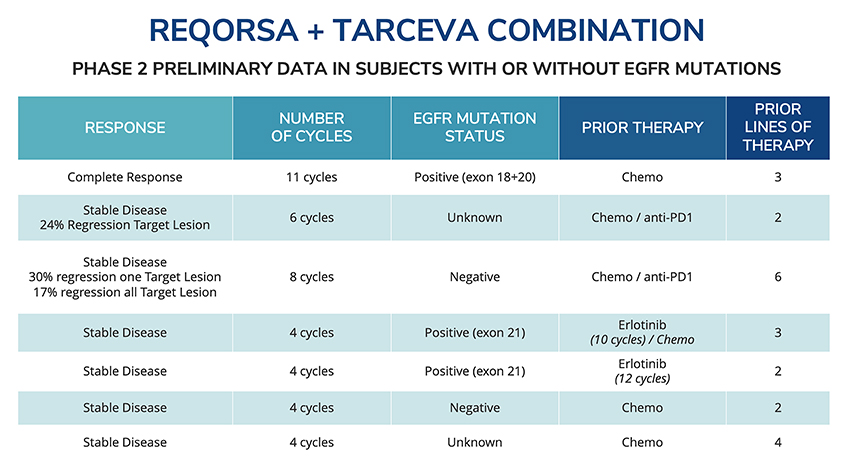

Acclaim – 1: We currently are enrolling and treating patients in the Phase 2a expansion portion of our Phase 1/2 Acclaim-1 clinical trial. The Acclaim-1 trial uses a combination of REQORSA and AstraZeneca’s Tagrisso® in patients with late-stage NSCLC that has activating epidermal growth factor receptor (“EGFR”) mutations and progression after treatment with Tagrisso. Following the May 2023 completion of the Phase 1 dose escalation portion of the study, the Acclaim-1 Safety Review Committee (“Acclaim-1 SRC”) approved advancement from the Phase 1 dose escalation portion to the Phase 2a expansion portion of the study. Based on a review of safety data which showed no dose limiting toxicities (“DLTs”), the Acclaim-1 SRC determined that the recommended Phase 2 dose (“RP2D”) of REQORSA will be 0.12 mg/kg. This was the highest dose level delivered in the Phase 1 portion of the study and is twice the highest dose level delivered in the Company’s prior clinical trial combining REQORSA with Tarceva® for the treatment of late-stage lung cancer. We opened the Phase 2a expansion portion of the study and enrolled and dosed the first patient in January 2024. The Phase 2a expansion portion of the trial is expected to enroll approximately 66 patients; half will be patients who received only prior Tagrisso treatment and the other half will be patients who received prior Tagrisso treatment and chemotherapy. The aim is to determine toxicity and efficacy profiles of patients with different eligibility criteria. There will be an interim analysis following the treatment of 19 patients in each cohort. We expect to complete the enrollment of 19 patients in each cohort of the Phase 2a expansion portion of the study by the end of 2024, and thus we expect the interim analyses in early 2025. The Food and Drug Administration (“FDA”) has granted Fast Track Designation for the Acclaim-1 treatment combination of REQORSA and Tagrisso in NSCLC patients who have progressed after Tagrisso treatment.

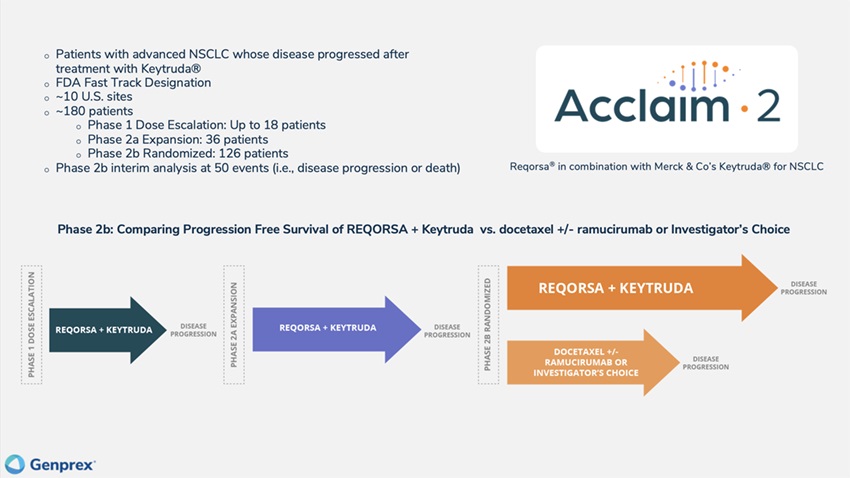

Acclaim – 2: We currently are enrolling and treating patients in the Phase 1 dose escalation portion of our Phase 1/2 Acclaim-2 clinical trial. The Acclaim-2 trial uses a combination of REQORSA and Merck & Co.’s Keytruda® in patients with late-stage NSCLC whose disease has progressed after treatment with Keytruda. Patients are currently being treated at the 0.06 mg/kg dose level in the first cohort of patients and, subject to Acclaim-2 Safety Review Committee (“Acclaim-2 SRC”) approval, will be treated at successive dose levels of 0.09 mg/kg and 0.12 mg/kg. In March 2023, we amended the Acclaim-2 protocol to include additional treatments in the control group with the goal of accelerating enrollment in the study by making the trial more attractive to a wider variety of investigators. We expect enrollment in the dose escalation portion of the study to be completed in the second half of 2024. We will then initiate and evaluate patients in the Phase 2a expansion portion of the study at the maximum tolerated dose (the “MTD”) or RP2D. The FDA has granted Fast Track Designation for the Acclaim-2 treatment combination of REQORSA and Keytruda in NSCLC patients who have progressed after Keytruda treatment.

The expansion portion of both the Acclaim-1 and Acclaim-2 trials are Phase 2 studies. The expansion portion of these studies provides us the advantage of early insight into drug effectiveness in defined and distinct patient populations at the MTD or RP2D in order to better evaluate efficacy and increase the likelihood of a successful randomized Phase 2 trial which will follow the expansion portion of each study.

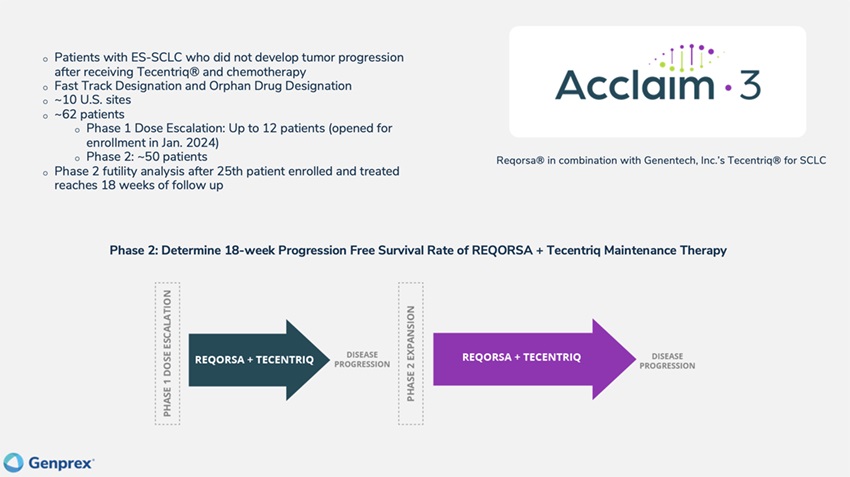

Acclaim – 3: We currently are enrolling patients in the Phase 1 dose escalation portion of our Phase 1/2 Acclaim-3 clinical trial. The Acclaim-3 clinical trial uses a combination of REQORSA and Genentech, Inc.’s Tecentriq® as maintenance therapy in patients with extensive stage small cell lung cancer (“ES-SCLC”) who did not develop tumor progression after receiving Tecentriq and chemotherapy as initial standard treatment. Patients are treated with REQORSA and Tecentriq until disease progression or unacceptable toxicity is experienced. In January 2024, we opened the Phase 1 portion of the Acclaim-3 study for enrollment. We expect to complete the Phase 1 dose escalation portion of the study during the second half of 2024 and we expect to start the Phase 2 expansion portion of our Acclaim-3 study in the second half of 2024. In June 2023, the FDA granted Fast Track Designation for the Acclaim-3 treatment combination of REQORSA and Tecentriq as maintenance therapy in patients with ES-SCLC who did not develop tumor progression after receiving Tecentriq and chemotherapy as initial standard treatment. In August 2023, the FDA granted Orphan Drug Designation to REQORSA for the treatment of SCLC.

The TUSC2 gene, which is the key component of REQORSA and plays a vital role in cancer suppression and normal cell regulation, is one of a series of genes on the short arm of Chromosome 3 whose therapeutic use is covered by our exclusive worldwide licenses from The University of Texas MD Anderson Cancer Center (“MD Anderson”). We believe that our ONCOPREX Nanoparticle Delivery System could allowallows for delivery of a number of cancer-fighting genes, alone or in combination with other cancer therapies, to combat multiple types of cancer. We believe that REQORSA’s combinationcancer and we are in early stages of pan-kinase inhibition, direct inductiondiscovery programs to identify other cancer candidates. In August 2022, we entered into a three-year sponsored research agreement with MD Anderson to support further preclinical studies of apoptosis, anti-cancer immune modulationTUSC2 and complementary action with targeted drugs and immunotherapies is unique, and positions REQORSA to provide treatment for patients with NSCLC and possibly other cancers, who are not benefitting from current therapies.tumor suppressor genes.

Diabetes Gene Therapy

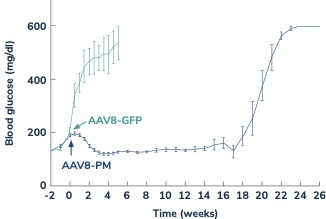

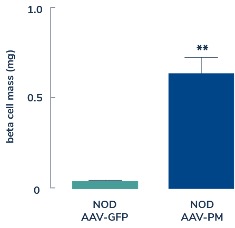

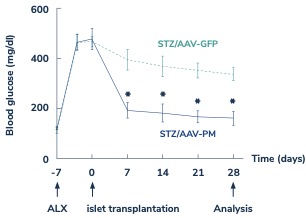

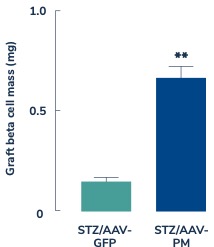

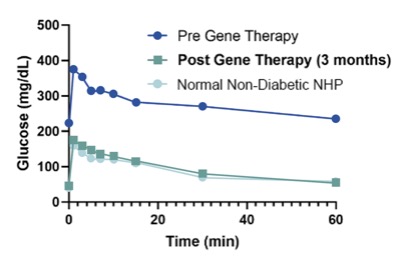

In diabetes, we have exclusively licensed from the University of Pittsburgh of the Commonwealth System of Higher Education (“University of Pittsburgh”) multiple technologies relating to the development of a gene therapy product for each of Type 1 and Type 2 diabetes. The same general novel approach is used in each of Type 1 and Type 2 diabetes whereby an adeno-associated virus (“AAV”) vector containing the Pdx1 and MafA genes is administered directly into the pancreatic duct. In humans, this can be done with a routine endoscopy procedure. Our diabetes gene therapy, also referred to as GPX-002, was developed by lead researcher Dr. George Gittes, at the Rangos Research Centerproduct candidates are currently being evaluated and optimized in preclinical studies at the University of Pittsburgh Medical Center ("UPMC") Children’s Hospital. This potentialPittsburgh. GPX-002 is being developed using the same construct for the treatment of both Type 1 diabetes and Type 2 diabetes. GPX-002 for Type 1 diabetes is designed to work by transforming alpha cells in the pancreas into functional beta-like cells, which can produce insulin but aremay be distinct enough from beta cells to evade the body’s immune system. In a similar approach, GPX-002 for Type 2 diabetes (formerly known as GPX-003), where autoimmunity is not at play, is believed to work by replenishing and rejuvenating exhausted beta cells that make insulin. We finalized the components of the diabetes construct to take forward for nonclinical studies and in December 2023, we submitted a request to meet with the FDA to obtain their guidance on the nonclinical studies needed to file an Investigational New Drug (“IND”) application and initiate first-in-human studies. As a result of the FDA’s response, the Company will continue with its planned additional nonclinical studies before requesting regulatory guidance in 2024 for the IND-enabling studies. In October 2023, we entered into a one-year extension to our August 2022 sponsored research agreement with the University of Pittsburgh for the use of GPX-002 in a non-human primate (“NHP”) model in Type 2 diabetes. The therapy utilizesextension includes a procedurerevised research plan to encompass our most recent technologies to which we acquired exclusive rights from the University of Pittsburgh in which an adeno-associated virus vector deliversJuly 2023. These include a MafB promoter to drive expression of the Pdx1 and MafA genestranscription factors that can potentially be used for both Type 1 and Type 2 diabetes. See also “Note 7 – Commitments and Contingencies” to our financial statements included in this Annual Report on Form 10-K. In February 2023, the pancreas.Company’s research collaborators at the University of Pittsburgh presented preclinical data in a NHP model of Type 1 diabetes highlighting the therapeutic potential of GPX-002 at the 16th International Conference on Advanced Technologies & Treatments for Diabetes (ATTD 2023) in Berlin, Germany. The statistically significant study results showed the treated animals had decreased insulin requirements, increased c-peptide levels, and improved glucose tolerance compared to baseline. In April 2023, the Company hosted a Key Opinion Leader virtual event entitled “Novel Gene Therapy to Treat Type 1 Diabetes,” which discussed preclinical data reported at ATTD 2023 supporting gene therapy to treat Type 1 diabetes.

Recent Developments

License Amendment with MD AndersonAt-the-Market Offering Program

On March 3, 2021,December 13, 2023, we entered into an amendmentAt The Market (“ATM”) Offering Agreement (the “MD License Amendment”“Agreement”) to the Patent and Technology License Agreement dated May 4, 2020 with MD Anderson. The MD License Amendment grants us a worldwide, exclusive, sublicensable licenseH.C. Wainwright & Co., LLC, serving as agent (the “Agent”) with respect to an additional portfolioATM offering program under which we may offer and sell through the Agent, from time to time at our sole discretion, up to such number or dollar amount of six patents and one patent application and related technology for methods for treating cancer by administrationshares (the “Shares”) of a TUSC2 therapy in conjunction with EGFR inhibitorsour common stock, par value $0.001 per share (the “Common Stock”), as registered on the prospectus supplement covering the ATM offering, as may be amended or other anti-cancer therapies in patients predictedsupplemented from time to be responsive to TUSC2 therapy. Pursuant to the MD License Amendment, wetime. We have agreed to (i) pay annual maintenance fees ranging from the mid five figuresAgent a commission equal to three percent (3%) of the low six figures, (ii) total milestone paymentsgross sales proceeds of $6,150,000, (iii) a one-time fee inany Shares sold through the mid five figuresAgent under the Agreement, and (iv) certain patent related expenses.

Financings

On February 11, 2021,also have provided the Agent with customary indemnification and contribution rights. As of December 31, 2023, we had not sold an aggregateany Shares through the Agent under the Agreement. From January 1, 2024 through the date of 4,000,000filing of this Annual Report on Form 10-K, we have sold 158,474 shares of our common stock for net proceeds to us totaling $881,946 through the Agent under the Agreement.

Reverse Stock Split

At our special meeting of stockholders held on December 14, 2023, the Company’s stockholders adopted and approved an amendment to our Amended and Restated Certificate of Incorporation to effect a purchase pricereverse stock split of $6.25our issued and outstanding shares of Common Stock, at a specific ratio, ranging from one-for-ten (1:10) to one-for-fifty (1:50), with such ratio to be determined by our Board in its discretion.

On January 31, 2024, we filed the amendment to our Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware to effect a reverse stock split of our Common Stock at a ratio of one-for-forty (1:40) (the “Reverse Stock Split”). The Reverse Stock Split became effective in accordance with the terms of the amendment at 12:01 AM Eastern Time on February 2, 2024 under a new CUSIP number, 372446-203. All share and per share amounts in this Annual Report on Form 10-K have been adjusted to reflect the Reverse Stock Split.

March 2024 Registered Direct Offering

On March 21, 2024, we completed a registered direct offering.offering, in which we sold to an institutional investor an aggregate of (i) 165,000 shares of our common stock, (ii) pre-funded warrants (the “March 2024 Pre-Funded Warrants”) exercisable for up to an aggregate of 1,377,112 shares of our common stock, and (iii) warrants (the “March 2024 Common Warrants”) exercisable for up to an aggregate of 1,542,112 shares of our common stock. The offering price for each share of common stock and accompanying March 2024 Common Warrant was $4.215, and the offering price for each March 2024 Pre-Funded Warrant and accompanying March 2024 Common Warrant was $4.2149. The March 2024 Pre-Funded Warrants are exercisable immediately upon issuance at an exercise price of $0.0001 per share and will expire when exercised in full. The March 2024 Common Warrants are exercisable immediately upon issuance at an exercise price of $4.09 per share and will expire in five years from the date of issuance. We received net proceeds of approximately $23.2$5.8 million after deducting estimatedcommissions and expenses, excluding any proceeds that may be received in the future from any exercise of the March 2024 Common Warrants. In connection with the offering, expenses.

we also amended certain existing warrants to purchase up to an aggregate of 194,248 shares of our common stock that were previously issued to investors in March 2023 and July 2023, with exercise prices of $44.00 and $35.40 per share and expiration dates of March 1, 2028 and July 21, 2028 for $0.125 per amended warrant, such that the amended warrants have a reduced exercise price of $4.09 per share and an expiration date of five years from the closing of this offering.

Our Pipeline

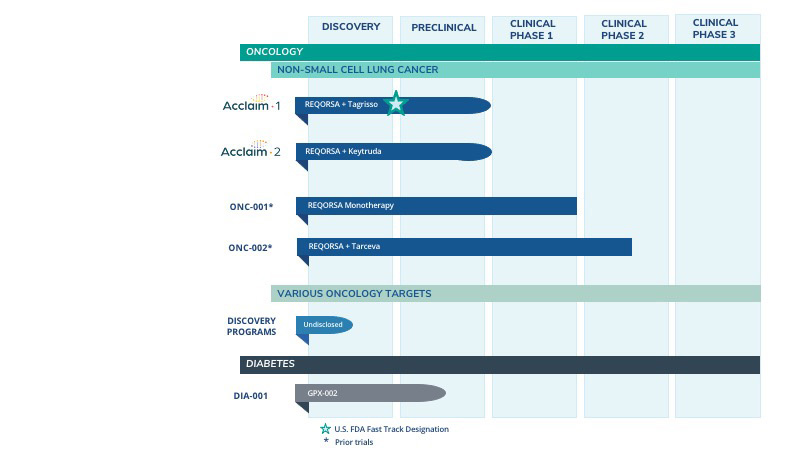

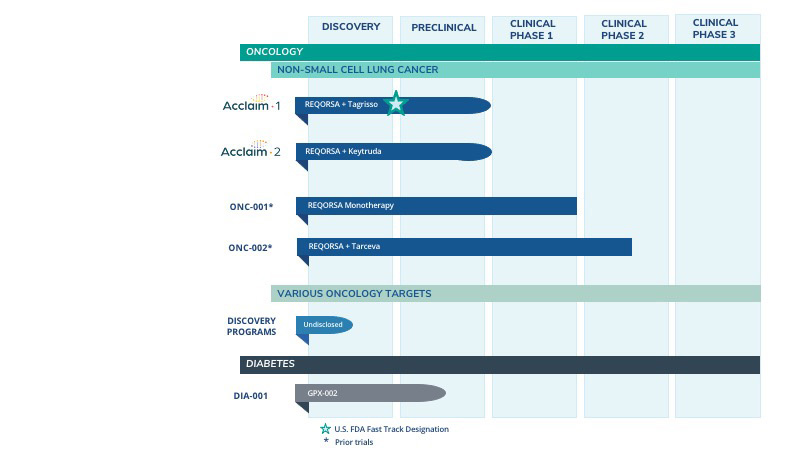

Our technologies are designed to administer disease-fighting genes to provide new treatment optionstherapies for large patient populations with cancer and diabetes who currently have limited treatment options. We are developing our lead oncology product candidate REQORSA to be administered with targeted therapies and with immunotherapies for NSCLC.NSCLC and SCLC. We continue to conduct preclinical research to explore how REQORSA may be administered with targeted therapies and immunotherapies in other solid tumors, such as ALK-positive NSCLC, and we are researching how other cancer fighting genes, such as NPRL2, can be appliedenhance our portfolio using our systemic, non-viral gene therapy platform, the ONCOPREX Nanoparticle Delivery System. WeDeliverySystem. Using a different gene therapy delivery system, we are also are developing our pre-clinicalpreclinical diabetes candidate GPX-002.GPX-002 using the same construct for both Type 1 diabetes and Type 2 diabetes (formerly known as GPX-003 when a different construct was being considered for Type 2 diabetes). The following table summarizes our product development pipeline.

Introduction – Cancer

Cancer and Genetic Mutations. Cancer results from genetic mutations. Mutations that lead to cancer are usually present in two major classes of genes: oncogenes, which are involved in functions such as signal transduction and transcription; and tumor suppressor genes, which play a rolemultiple roles in governing cell proliferation by regulating transcription.growth and proliferation. Transduction is the process by which chemical and physical signals are transmitted throughinto cells. Transcription is the process by which a cell’s DNA sequence is copied to make RNA molecules, which then play a role in protein expression. In normal cells, mutations in oncogenes are discovered and targeted for elimination by tumor suppressor genes. In cancer cells, the oncogene mutations may overwhelm the natural tumor suppression processes, or those tumor suppression processes may be impaired or absent. Functional alterations due to mutations in oncogenes or tumor suppressor genes may result in the abnormal and uncontrolled growth patterns characteristic of cancer. These genetic alterations facilitate such malignant growth by affecting signal transduction pathways and transcription, thussuch as inhibiting normal growth signaling in the cell, circumventing the natural process of apoptosis, evading the immune system’s response to cancer, and inducing angiogenesis, which is the formation of new blood vessels that supply cancer cells.

The most common genetic alterations present in NSCLClung cancer are in tumor suppressor genes, against which fewgenes. No targeted small molecule drugs historically considered the backbone of traditional medicine, have successfully been developed.developed against tumor suppressor gene mutations in NSCLC or SCLC.

Another genetic condition often associated with lung cancer is the overexpressionpresence of EGFRs and mutations of tyrosine kinases. KinasesTyrosine kinases are enzymes that play an important role in signal transduction through the modification of proteins by adding or taking away phosphate groups a process called dephosphorylation,(phosphorylation) onto the amino acid tyrosine, to change the proteins’ function. When an EGFR ligand binds to the EGFR, two EGFR transmembrane proteins are brought to proximityclose together on the cell membrane surface, or dimerize, either through a ligand, or binding molecule, that binds to the extracellular receptor, or through some other process,and the intracellular protein-kinasetyrosine kinase domains can autophosphorylate, and activate downstream processes, including cell signaling pathways that can lead to either cell cycle arrest or cell growth and proliferation. EGFRs and kinases can act similarly to a switch that turns “on” and “off” when phosphate groups are either added or taken away. Mutated kinases can have a malfunctioning on/off switch, causing the switch to be stuck in the “on” position or failing to turn the switch “off,” leading to the loss of control of cell control.growth.

Cancer and the Immune System. Cancer can also spread when the body’s natural immune functions are impaired, including by the cancer cells themselves. PD-1, or Programmed Death-1, is a receptor expressed on the surface of activated T cells, which are part of the body’s immune system. PD-L1 is a protein/receptorligand for PD-1 which is expressed on the surface of cancer and other cells. The binding of PD-1 to PD-L1 has been speculated to contribute to cancer cells’ ability to evade the body’s immune response. PD-1 and similar molecules are called immune checkpointscheckpoint inhibitors because they can impede the normal immune response, for example by blocking the T cells from attacking the cancer cells. In many cancers, PD-L1 receptors areis up-regulated. Substantial research is now beinghas been performed in the emerging field of immuno-oncology to discover drugs or antibodies that could block PD-L1PD-1 and similar receptors. It is believed that blocking the PD-1/PD-L1 interaction pathway and other similar checkpoints, such as cytotoxic T-lymphocyte-associated protein 4, or CTLA-4, with drugs called checkpoint inhibitors can prevent cancer cells from inactivating T cells.cells, leading to an attack of the immune system on the cancer.

Current Treatment of NSCLC. Chemotherapy is the standard treatment for the majority of NSCLC patients, as it is for many other cancer patients. Because it is a non-selective systemic treatment, rather than a targeted approach to treating cancer, chemotherapy also kills healthy cells and has a number of other undesirable side effects.

A subset of NSCLC patients carry one or both ofa mutation in EGFR, which makes their tumors sensitive to EGFR tyrosine kinase inhibitors (“EGFR TKIs”). The two EGFR mutations,most common are referred to as exon 19 deletion and exon 21 substitution, which make their tumors sensitive to tyrosine kinase inhibitors ("EGFR TKIs"). Because EGFR is frequently overexpressed in lung tumors, it has become a favored therapeutic target for pharmaceutical companies.substitution. Several pharmacological and biological approaches, including EGFR TKIs, have been developed specifically to block activated EGFR for cancer therapy. The class of drugs functioning as protein kinase inhibitors ("KIs") comprises the majority of targeted therapies for lung cancer, accounting for most sales and use. Of the KIs, the EGFR TKI drugs are the most common with drugs targeting EGFR kinases leading the sector growth.targeted therapies used in lung cancer. Several EGFR TKI therapies are marketed commercially including, but not limited to, Tagrisso, Tarceva, Iressa and Gilotrif.

Approximately 7%10% to 20% of NSCLC patients of North American and European descent and approximately 30%40% to 50% of NSCLC patients of Asian descent have activating EGFR mutations. This means that the majority of NSCLC patients do not have activating EGFR mutations and are therefore “EGFR negative” and not optimal candidates for EGFR TKIs.

However, while EGFR TKIs are most effective in patients who have an activating EGFR mutation and are therefore described as “EGFR positive,” they are significantly less effective in overall NSCLC populations and are generally not effective in patients without an activating EGFR mutation.

In addition, even among those patients who are EGFR positive and benefit from EGFR TKI therapy, nearly all eventually become resistant to and ultimately no longer respond to EGFR TKI therapy, resulting in eventual disease progression. For example, according to the FLAURA study, sponsored by AstraZeneca, the median time to tumor progression for lung cancer patients on Tagrisso monotherapy is approximately 18 months. Furthermore, although recent clinical trials have shown that combining EGFR TKIs with conventional chemotherapy does not increaseincreases progression free survival for lung cancer patients.patients with EGFR mutations compared to Tagrisso monotherapy, it is not yet clear whether the combination of Tagrisso and chemotherapy initially leads to longer overall survival than treatment with Tagrisso monotherapy (which has relatively few side effects) and then treatment with chemotherapy at the time of disease progression.

Current Treatment of SCLC. SCLC is staged as limited stage, in which the cancer is only on one side of the chest and can be treated with a single radiation therapy field, or as extensive stage (ES), which includes all other patients. Since SCLC is an aggressive disease, the vast majority of patients have extensive stage SCLC at the time of initial diagnosis. The standard treatment for ES-SCLC for many years was a combination chemotherapy with carboplatin and etoposide for 4 cycles of treatment, as treatment with chemotherapy for longer duration or treatment including other agents was not shown to be beneficial. In the last several years the addition of immune checkpoint inhibitors has been shown to have improved efficacy when added to 4 cycles of chemotherapy. Thus, standard treatment now consists of either Tecentriq or Imfinzi added to 4 cycles of carboplatin and etoposide, and then Tecentriq or Imfinzi are continued as maintenance therapy until disease progression.

However, treatment of ES-SCLC is not curative, and patients progress quickly. In patients receiving Tecentriq and chemotherapy, the progression free survival (“PFS”) after starting maintenance Tecentriq is only 2.6 months. Further improvements in the treatment of ES-SCLC are needed.

Epidemiology of Non-Small Cell Lung Cancer. According to the World Health Organization in 2019,2023, lung cancer was the leading cause of cancer deaths worldwide, causingworldwide. According to the American Cancer Society in 2023, lung cancer accounts for about one in five of all cancer deaths in the United States, and causes more deaths in the U.S. with more people dying of lung cancer in the U.S. than colorectal,of colon, breast liver or stomach cancers.and prostate cancers combined. In 2020, there were more than 2 million new lung cancer cases and approximately 1.8 million deaths from lung cancer worldwide. In the United States,U.S., according to the American Cancer Society, it is estimated that in 20212024 there will be more than 235,000234,000 new cases of lung cancer and more than 131,000125,000 deaths from this disease. The American Society of Clinical Oncology reports that NSCLC represents 84%about 82% of all lung cancers and has a 24%the five-year survival rate. However, according to the National Cancer Institute, 57%rate for patients with NSCLC with distant spread is 9 percent. SCLC represents about 14% of lung cancer diagnoses are distant, or have metastasized,patients and the five-year relative survival rate for Stage 4 (metastatic) NSCLCpatients with SCLC with distant spread is approximately 5%.3 percent. With limited benefit from current therapies, we believe there is a significant unmet medical need for new treatments for NSCLC and SCLC in the United StatesU.S. and globally, and we believe REQORSA may be suitable for athe majority of NSCLClung cancer patients.

REQORSA™®

Our REQORSA™REQORSA® immunogene therapy (generic name: quaratusugene ozeplasmid) is designed to (i) interrupt cell signaling pathways that cause replication and proliferation of cancer cells, (ii) to target and kill cancer cells, via receptor pathways, and (iii) to stimulate the natural immune responses against cancer. REQORSA is an immunogene therapy in that it combines features of gene therapy and immunotherapy. It up-regulates TUSC2 expression in the cell, and also increases the anti-tumor immune cell population and down-regulates PD-L1, receptors, thereby potentially boosting the immune response to cancer.

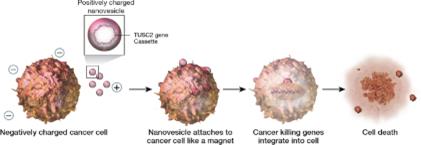

REQORSA consists of thea TUSC2 gene expressing plasmid encapsulated in non-viral lipid-based nanoparticles in a non-viral nanoparticle made from lipid moleculeslipoplex form (our ONCOPREX Nanoparticle Delivery System) with, which has a positive electrical charge. REQORSA is injected intravenously and specifically targets cancer cells. Cancer cells have elevated metabolism compared to healthy cells and as a result, are negatively charged compared to healthy cells, which are positively charged, or chargedgenerally charge neutral. REQORSA is designed to deliver the functioning TUSC2 gene to cancer cells while minimizing their uptake by normal tissue. Tumor biopsyLaboratory studies conducted at MD Anderson show that in three patients, the uptake of TUSC2 in tumor cells in vitro after REQORSA treatment was 10 to 33 times the uptake in normal cells. Biopsies in three patients with NSCLC treated with REQORSA show major increases in TUSC2 protein expression in the tumor cells one day after REQORSA administration. We believe that REQORSA unlike other gene therapies, which either need to be delivered directly into tumors or require cells to be removed from the body, re-engineered and then reinserted into the body, is the first systemic gene therapy to be used for cancer in humans. Many other gene therapies require complex procedures, such as removal of cells from a patient and modification of those cells which are then reinfused into the patient, and many, unlike REQORSA, lead to permanent changes in a patient’s DNA.

Many approved cancer therapeutics target only single molecules or a single specific genetic abnormality related to driving the proliferation and survival of cancer cells. In contrast, REQORSA has been shown to have a multimodal mechanism of action whereby it interrupts cell signaling pathways that cause replication and proliferation of cancer cells, re-establishes pathways for programmed cell death (apoptosis) in cancer cells, and modulates the immune response against cancer cells. REQORSA also has been shown to block mechanisms that create drug resistance.be complementary with targeted drugs and immunotherapies.

REQORSA is a pan-kinase inhibitor shown to simultaneously inhibit the EGFR and Protein kinase B, also known as AKT, oncogenic kinase pathways in vitro and in vivo. Once the cancer cell takes up the nanoparticles containing the TUSC2 expressing plasmid, it is reprogrammed to die. Resistance to targeted drugs and checkpoint inhibitors developoften develops through activation of alternate bypass pathways. For example, when PD-1 is blocked, the TIM-3 checkpoint is up-regulated. We believe that REQORSA’s multimodal activity will block emerging bypass pathways, thereby potentially reducing the probability that drug resistance develops.

Many approved cancer therapeutics target only single molecules or a single specific genetic abnormality related to driving the proliferation and survival of cancer cells. In contrast, REQORSA is designed to work by targeting several molecules within the cancer cell to interrupt cell signaling pathways that cause replication and proliferation of cancer cells, to target and kill cancer cells, to block mechanisms that create drug resistance and to stimulate the natural immune response.

Our preclinical and clinical data indicatesindicate that REQORSA is well tolerated and may be effective alone or in combination with targeted small molecule therapies. Preclinical data indicatesindicate that REQORSA may also be effective with immunotherapies, and in a three-drug combination with immunotherapy and chemotherapy. By facilitating the action of both drugs, we believe thereThese data suggest that REQORSA, when combined with other therapies, may be an expandedeffective in a large population of patients who may benefit from these advanced therapy regimens.lung cancer patients.

TUSC2, the Active AgentTumor Suppressor Gene in REQORSA™REQORSA®

TUSC2 is a multifunctional gene that plays a vital role in cancer suppression and normal cell regulation. Key TUSC2 anti-cancer mechanisms of action include the inactivation of multiple oncogenic kinases, the induction of apoptosis, the control of cell signaling and inflammation, and modulation of the immune system to fight cancer. REQORSA has also been shown to block mechanisms that create drug resistance.be complementary with targeted drugs and immunotherapies. Our preclinical data indicatesindicate that REQORSA in combination with both EGFR TKIs and with immunotherapies can achieve results more favorable than results achieved with either REQORSA or such other therapies alone, and may make those drugs effective for patients with drug resistance who would not otherwise benefit from them.

Normal TUSC2 function is often inactivated at the early onset ofin cancer development, making TUSC2 a potential target for all stages of cancer, including metastatic disease. The TUSC2 protein is reduced or absent in approximately 85%82% of lung cancers.NSCLCs and in 100% of SCLCs. In patients with NSCLC, the loss of TUSC2 expression has been associated with significantly worse overall survival than when TUSC2 expression is not impaired.decreased.

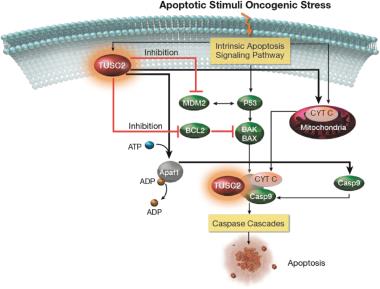

Studies show TUSC2 protein functions as a key mediator in the Apaf1-mediated mitochondrial apoptosis pathway by recruiting and directing cytoplasmic Apaf1 protein to a critical cellular location and activating it in situ,and by thereby up-regulating activity of other proapoptotic effectors. Normal TUSC2 function mediatesfunctions to mediate apoptosis in cancer cells through interaction with Apaf1 and also down-regulates multiple tyrosine kinases that control cell growth, including EGFR, AKT, platelet-derived growth factor receptor ("PDGFR"(“PDGFR”), c-Kit, and c-Abl. TUSC2 mediates apoptosis in cancer cells but not normal cells through its interaction with Apaf1 and down-regulates tyrosine kinases including EGFR, PDGFR, c-Kit, and c-Abl.

In normal cells, the proteins involved in the PI3K/AKTAKT/mTOR pathway (also called the mTOR pathway),play an important role in whichcellular function and cellular trafficking. In this pathway, PI3K, a kinase, generates messenger molecules required to translocate AKT, another protein kinase, to the cell’s plasma membrane where it is phosphorylated and activated, play an important role in cellular function and cellular trafficking.activated. These proteins are often found to be aberrantly active in cancers, causing cells to lose their ability to control cell growth, proliferation, and differentiation. Thus, mutations in PI3K (overexpression) and its upstream receptors,activators, such as EGFR, have been associated with many forms of cancers.

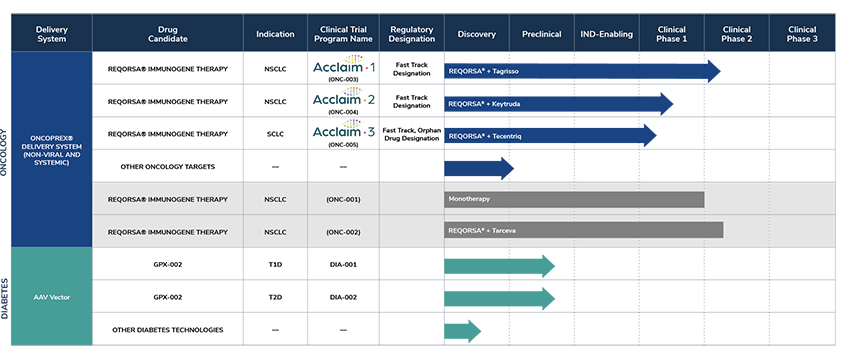

Similarly, proteins in the Ras/MAPK pathway, which is a signal transduction pathway that transduces signals to the cell nucleus where specific genes are activated for cell growth, division and differentiation, play a critical role in cellular responses to various stress stimuli, including osmotic stress, DNA damage, and proinflammatory factors.inflammation. As shown in the figures below, the TUSC2 protein, a potent pan-kinase inhibitor, blocks multiple cell signalingcell-signaling pathways downstream of the EGFR receptor (EGFR in the figures), leadingand leads to cell cycle interruption, and thereby preventing cancer cell proliferation and survival.

Under stress conditions, such as oncogenic stress, cells go through a regulated process of programmed cell death, also known as apoptosis,apoptosis. As illustrated in order to control cell development and replication. Thethe schematic below, the TUSC2 protein interacts via various apoptotic signaling pathways such as Apa1 to stimulate programmed cell death via the release of caspases, enzymes that play a significant role in apoptosis.

Pan-Kinase Inhibition by TUSC2

Stimulation of Apoptotic Signaling by TUSC2

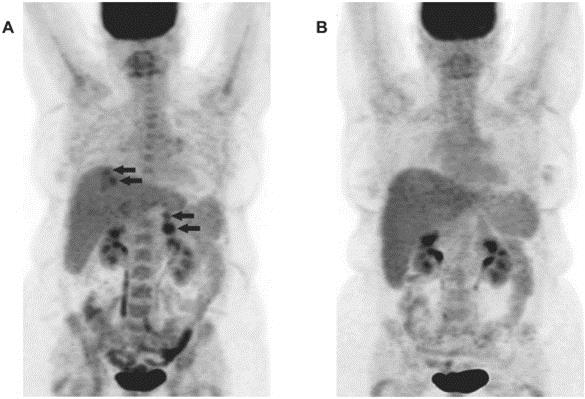

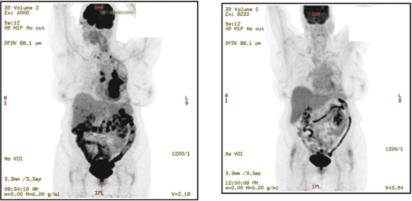

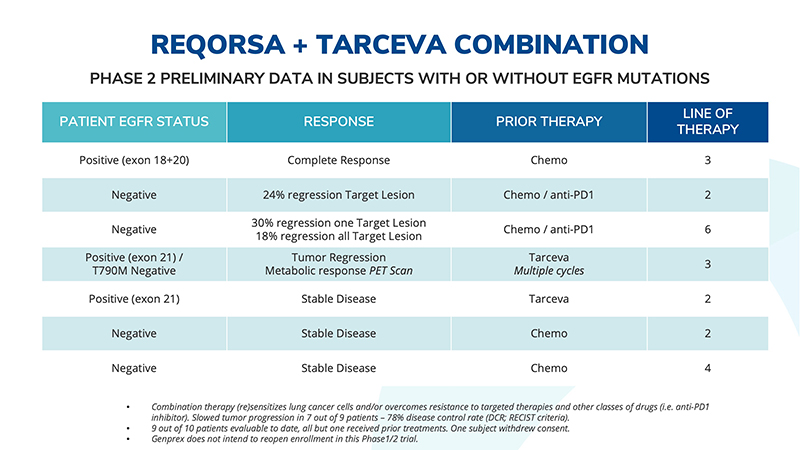

Our clinical and preclinical data indicatesindicate that the combination of REQORSA with EGFR TKIs, may increase anti-tumor activity in cancers with or without the EGFR mutations and in cancers that have become resistant to EGFR TKI therapy, thus potentially expanding the number of patients who could benefit from those drugs.

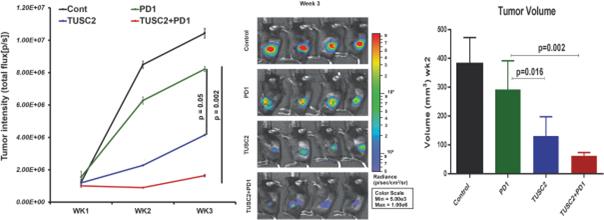

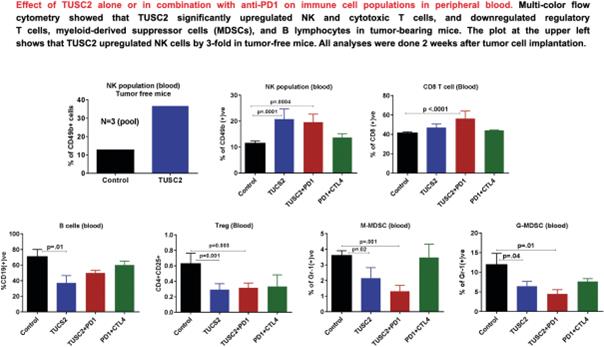

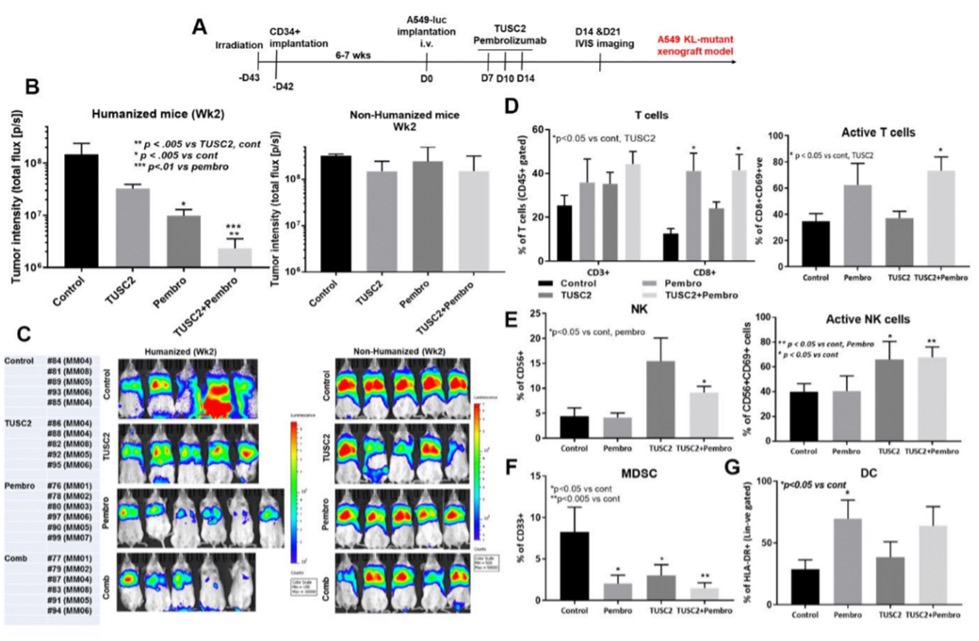

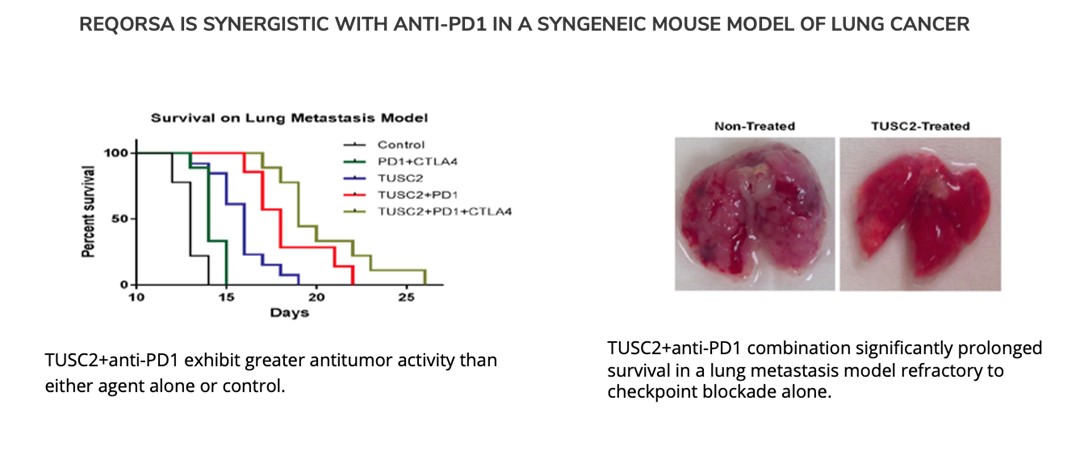

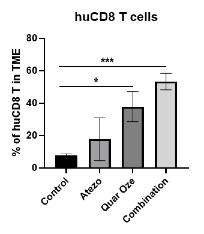

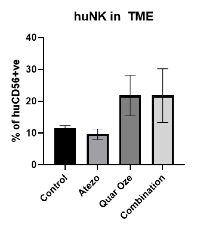

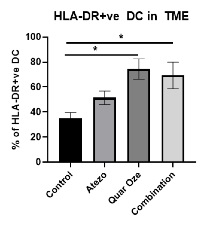

TUSC2 and the Immune Response. In addition to its pro-apoptotic cytotoxicity and tyrosine kinase inhibitory activity, TUSC2 enhances the immune response to cancer. Data from preclinical studies at MD Anderson has shown a therapeutic benefit from the combination of TUSC2 and anti-PD-1 antibody and a key role for TUSC2 in regulating immune cell subpopulations including cytokines, natural killer ("NK"(“NK”) cells, and T lymphocytes. In addition, TUSC2 has been found to down-regulate PD-L1 receptors on the surface of cancer cells. ByAs a result, lymphocytes expressing the PD-1 receptor are more likely to recognize the cancer cell as an altered cell that should be destroyed. In addition, by inducing tumor cell apoptosis TUSC2 increases antigen release and presentation, thus promoting an enhanced antitumor response in the presence of other immune regulators.

NK cells, an important part of the innate immune system, have developed several mechanisms to distinguish healthy cells from target cells. These mechanisms allow NK cells to kill cells that are deemed dangerous to the host, including cancer cells. However, one of the consequences of malignant transformation is the ability of the cancer cell to evade the immune system. Cancer cells do so via the up-regulation and interplay of receptors, including checkpoint inhibitors such as PD-1 and PD-L1.

As shown in the illustration below, TUSC2 has been found to stimulate the release of interleukin-15, or IL-15, resulting in up-regulation of mature NK cells that circulate and target cancer cells.

Modulation by TUSC2 of the Immune Response to Cancer

In work presented in an abstract for the 2024 American Association of Cancer Research (AACR) meeting, our clinical collaborators have shown that TUSC2 has metabolic effects both in lung cancers and in normal cells. TUSC2 is encoded by the nuclear DNA, but the TUSC2 protein resides in the inner membrane of the mitochondria. TUSC2 has been shown to play a critical role in mitochondrial respiration/energy metabolism, reactive oxygen species production, and in Ca2+ flux to and from mitochondria. This recent work demonstrated that TUSC2 re-introduction to TUSC2-deficient cancer cells consistently suppressed both glycolysis and mitochondrial ATP production, thus leaving cells without sufficient energy to support their vital functions. This suggests that TUSC2 protein introduced to cancer cells lacking TUSC2 can decrease the high metabolic rate that is characteristic of cancer cells, leading to marked decreases in cell growth. The data also showed that both glycolytic and mitochondrial metabolism of a normal epithelial cell line were strengthened after the introduction of TUSC2, suggesting a beneficial role of TUSC2 for the metabolic health of normal cells. This suggests that TUSC2 effects on metabolism in normal lymphocytes could lead to the increased immune response to lung cancers seen in animal models receiving REQORSA. The study further suggested that REQORSA may play an important role as a cancer treatment to target and disrupt the metabolism of cancer cells, leading to a decrease in the rate of glycolysis.

ONCOPREX®Nanoparticle Delivery System

Our immunogene therapyoncology platform consists of anti-cancer genes expressing DNA plasmids expressing tumor suppressor genes contained in non-viral lipidlipid-based nanoparticles in a lipoplex form (“lipoplexes”) delivered intravenously. Lipoplexes (see figure below) have lipid-based nanoparticles that clump together, thus protecting the DNA between them from being destroyed in the bloodstream. REQORSA our lead drug candidate, utilizes the ONCOPREX® Nanoparticle Delivery System to encapsulate the TUSC2 gene in positively charged nanoparticleslipoplexes that bindare attracted to actively replicating (and therefore negatively charged)charged cancer cells, and then enter the cancer cell through selective endocytosis, a process by which cells take in substances from outside the cell by engulfing them in a vesicle. The nanoparticles in our system differ significantly from liposomes historically used for drug delivery in that they are true particles encapsulating the therapeutic payload within a bilamellar lipid coat.

Operation of the ONCOPREX Nanoparticle Delivery System

The particle size is small enough to allow REQORSA to cross tight barriers in the lung, but large enough to avoid accumulation or clearance in the liver, spleen and kidney. The cationic (positive) charge of the nanoparticleslipoplexes helps to target cancer cells, and direct nanoparticle fusion avoids target cell endocytosis.which have a slight negative charge due to their high glycolytic rate. A Phase 1 clinical trial showed that intravenous REQORSA therapy selectively and preferentially targeted primary and metastatic tumor cells, resulting in anticancer activity. The nanoparticleslipoplexes are non-immunogenic, allowing repetitive therapeutic dosing and providing extended half-life in the circulation.

The ONCOPREX Nanoparticle Delivery System is based on a non-viral delivery system. MostMany gene therapies rely on viral based delivery systems. The benefit of the viral system is that viruses are skilled at penetrating cells. However, viruses can also affect more than one type of cell and it is possible that the virus may infect additional cells not justother than the targeted cells containing mutated genes. If this happens, healthy cells may be damaged causing other illness or diseases, such as cancer. WithOnce REQORSA once it is taken up into a cancer cell, the TUSC2 gene is expressed into aand TUSC2 protein that is capable of restoring certain defective functions arising in the cancer cell. REQORSA has been designed using the ONCOPREX Nanoparticle Delivery System to deliver the functioning TUSC2 gene to cancer cells while minimizing their uptake by normal tissue. Tumor biopsyLaboratory studies conducted at MD Anderson showed that in three patients, the uptake of TUSC2 in tumor cells after REQORSA treatment was 10 to 33 times the uptake in normal cells.cells, and studies in three NSCLC patients showed a major increase in TUSC2 expression in tumor tissue one day after REQORSA administration. REQORSA is also delivered systemically as opposed to many other gene therapies which are locally delivered.

REQORSA Origins, Development Rationale, and Strategy

TUSC2 was discovered through a lung cancer research consortium from MD Anderson and The University of Texas Southwestern Medical Center along with the National Cancer Institute. The TUSC2 discovery teams included Jack A. Roth, MD, FACS, chairman of our Scientific and Medical Advisory Board.

Our technology discoveries and research and development programs have been the subjects of numerous peer-reviewed publications and have been supported by Small Business Innovation Research ("SBIR") grants and grants from the National Institutes of Health, the United States Department of Treasury, and the State of Texas. We hold a worldwide, exclusive license from MD Anderson to patents covering the therapeutic use of TUSC2 and other genes that have been shown to have cancer fighting properties, as well as a number of related technologies, including 27 issued patents and 17 pending patent applications. The rights we have obtained pursuant to our license agreement with MD Anderson are made subject to the rights of the U.S. government to the extent that the technology covered by the licensed intellectual property was developed under a funding agreement between MD Anderson and the U.S. government.

REQORSA Development Rationale and Strategy

Our goal is to utilize our novel immunogenegene therapy platform to provide more effective treatments to large patient populations suffering from devastating illness with more effective treatments.illness.

REQORSA, our lead oncology product candidate, initially is being developed as a potential treatment for NSCLC.NSCLC and SCLC. Clinical and preclinical data indicatesindicate that REQORSA, when combined with EGFR TKIs such as Tagrisso, Tarceva and Iressa, provides a synergistic effect that could also benefit the larger population of NSCLC patients who are EGFR negative (which means they are not expected to benefit from EGFR TKI drugs alone).effect. Further, our data shows that REQORSA may re-sensitize EGFR positive patients who become resistant to, and therefore no longer benefit from, EGFR TKIs alone. Thus, REQORSA may both significantly expand the benefit of EGFR TKIs to the majority of patients who do not have EGFR activating mutations, and also extend the usefulness and benefit of EGFR TKIs for the population of NSCLC patients who are EGFR positive, but whose tumors progress on EGFR TKIs. Preclinical and clinical data support our belief that REQORSA may provide medical benefit in several subpopulations of NSCLC patients for which there is an unmet medical need, such as NSCLC patients with EGFR mutations, and ALK positive NSCLC patients. These data also served as the basis for the receipt from the FDA in January 2020 of aour first Fast Track Designation. In granting our Fast Track Designation, the FDA found that REQORSA may provide a benefit over existing therapies for patients whose tumors progress on Tagrisso. TheThis FDA Fast Track Designation is for use of the combination of REQORSA with TKI Tagrisso for the treatment of NSCLC patients with EGFR mutations whose tumors progressed after treatment with Tagrisso.

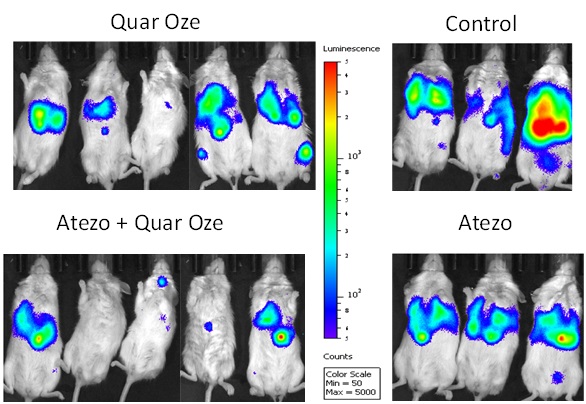

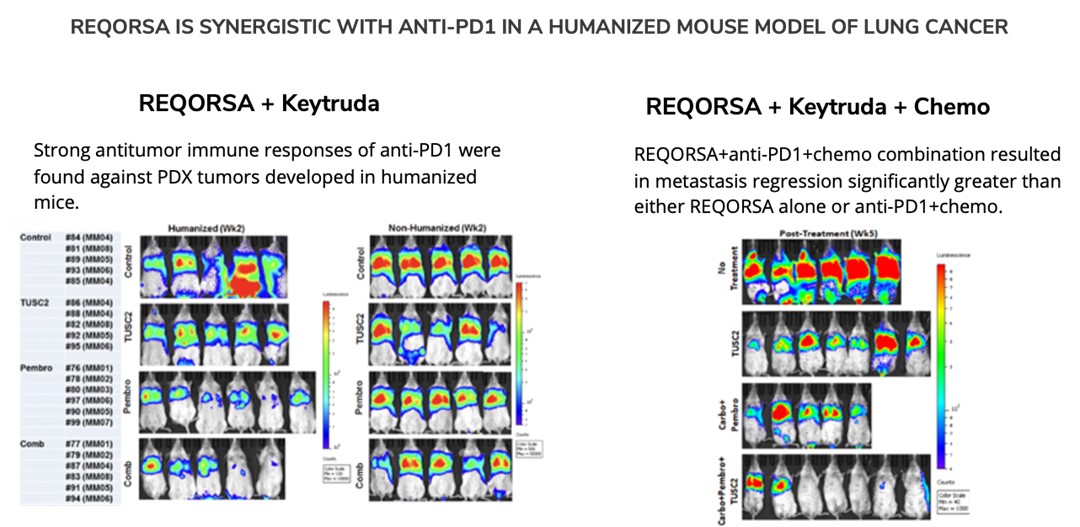

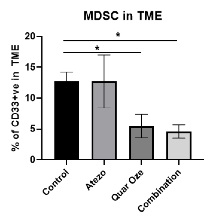

Pre-clinicalPreclinical data also hashave shown that REQORSA enhances the immune response to cancer. Data from preclinical studies at MD Anderson hashave shown a therapeutic benefit from the combination of TUSC2 and anti-PD-1 antibody or anti-PD-L1 antibody and a key role for TUSC2 in regulating immune cell subpopulations including cytokines, NK cells, and T lymphocytes. In addition, TUSC2 has been found to down-regulate PD-L1 receptors on the surface of cancer cells. These data, along with our previous preclinical and clinical data, provided the basis for the receipt from the FDA in December 2021 of our second Fast Track Designation. In granting this Fast Track Designation, the FDA found that REQORSA has the potential to provide a benefit over existing therapies for patients whose tumors progress on Keytruda. This FDA Fast Track Designation is for use of the combination of REQORSA with Keytruda for the treatment of NSCLC patients whose tumors progressed after treatment with Keytruda.

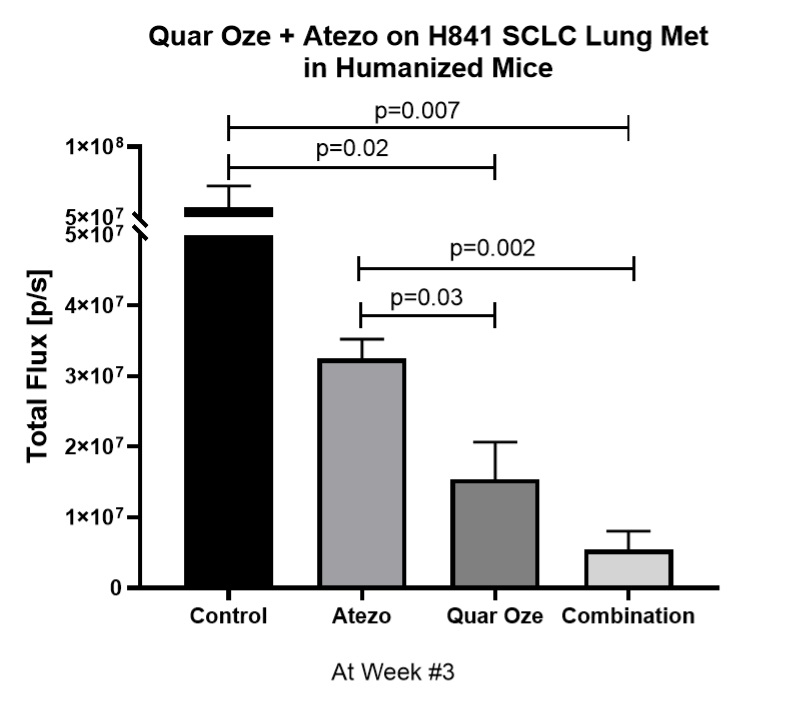

Pre-clinicalOur study in SCLC builds on the preclinical data showing that REQORSA enhances the immune response to cancer, and that the combination of REQORSA and immune checkpoint inhibitors demonstrates a therapeutic benefit over immune checkpoint inhibitors alone. Immune checkpoint inhibitors, such as Tecentriq, have recently been approved for use in ES-SCLC. Tecentriq, for instance, is used in combination with the chemotherapy drugs carboplatin and etoposide for 4 cycles of therapy, and then Tecentriq is administered alone as maintenance therapy until disease progression. Unfortunately, this is a relatively short time since the median PFS after starting maintenance therapy is 2.6 months. Our goal with combining REQORSA and Tecentriq as maintenance therapy is to prolong PFS and survival of ES-SCLC patients. In June 2023, the FDA granted our third Fast Track Designation. In granting this Fast Track Designation, the FDA found that REQORSA has the potential to provide a benefit over existing therapies for patients with ES-SCLC. This FDA Fast Track Designation is for the use of the combination of REQORSA with Tecentriq as maintenance therapy in patients with ES-SCLC who did not develop tumor progression after receiving Tecentriq and chemotherapy as initial standard treatment. In August 2023, the FDA also granted Orphan Drug Designation to REQORSA for the treatment of SCLC.

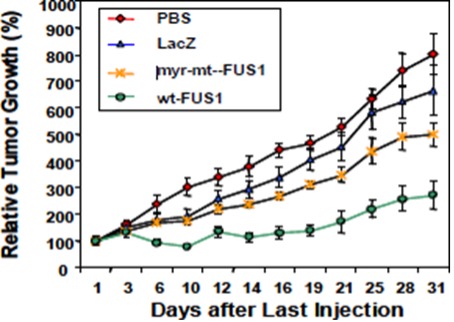

Preclinical studies by MD Anderson researchers have included combining REQORSA with:

● | the EGFR TKI gefitinib (marketed as Iressa® by AstraZeneca Pharmaceuticals) in animals and in human NSCLC cells; |

● | third generation EGFR TKIs such as osimertinib (marketed as Tagrisso® by AstraZeneca Pharmaceuticals); |

● | MK2206 in animals (MK2206 is an inhibitor of AKT kinases, which affect cell signaling pathways downstream from tyrosine kinases); |

● | the |

● |

|

● |

|

|

|

|

|

|

|

The manufacturers of the marketed drugs were not involved in any of our clinical or preclinical studies. In clinical studies involving marketed drugs, the drugs were administered concurrently with REQORSA without being modified in any way, and the antibodies used in our preclinical studies that did not use the marketed drugs were the non-humanized equivalent to marketed drugs.

Data from these clinical and preclinical studies indicates that combining REQORSA with these other therapies yields results more favorable than either these therapies or REQORSA alone, with minimal side effects relative to other lung cancer drugs, thereby potentially making REQORSA a therapy complementary to these cancer treatments.

Our Fast Track Designation, clinical and preclinical data have provided the basis for the Company’s development strategy for REQORSA and its use in treating NSCLC. Accordingly, we are planning to initiate, our Acclaim-1 and Acclaim-2 clinical trials in late-stage NSCLC in 2021.

Acclaim-1

InAs described above, in January 2020, we received Fast Track Designation from the FDA for use of REQORSA in combination with TKI Tagrisso for the treatment of NSCLC patients with EGFR mutations whose tumors progressed after treatment with Tagrisso. Given

We currently are enrolling and treating patients in the poor prognosis for these patients andPhase 2a expansion portion of our FDA Fast Track Designation, we are prioritizing this drug combination and patient population and plan to initiate a Phase 1/2 Acclaim-1 clinical trial, in 2021.

The Acclaim-1 trial is a Phase 1/2 Open-Label, Dose-Escalationan open-label, dose-escalation and Clinical Response Studyclinical response study of REQORSA in Combinationcombination with Tagrisso in patients with advanced, EGFR-mutant, metastatic non-small-cell lung cancer who have progressed after treatment with Tagrisso. We anticipate enrolling patients at approximately 15 clinical sites and estimate that the Phase 1 portion of the Acclaim-1 trial will enroll up to 18 patients and that the Phase 2 portion will enroll approximately 74 patients (a 1:1 ratio of REQORSA and Tagrisso combination therapy versus Tagrisso monotherapy). Patients will be treated until a second progression event or unacceptable toxicity is experienced. Patients must have histologically confirmed unresectable stage III or IV EGFR-positive NSCLC (any histology) with:

● | radiological progression on Tagrisso (third generation EGFR-TKI); and |

● |

|

We enrolled 12 patients in the completed Phase 1 dose escalation portion of the Acclaim-1 study and estimate that the Phase 2a expansion portion will enroll approximately 66 patients in 2 cohorts, and the randomized Phase 2b portion will enroll approximately 74 patients. Starting with the Phase 2a expansion portion of the study, all patients receiving REQORSA in this study are required to submit an archival biopsy specimen that can be evaluated for TUSC2 expression. Half of the patients enrolled in the Phase 2a expansion portion of the study will be patients who received only prior Tagrisso treatment and the other half will be patients who received prior Tagrisso treatment and chemotherapy. The aim is to determine toxicity and efficacy profiles of patients with different eligibility criteria. There will be an interim analysis following the treatment of 19 patients in each cohort. In connection with the Phase 2 expansion portion of the trial, we are in the process of adding approximately 3-5 additional clinical sites and we expect to enroll patients at approximately 10-15 U.S. clinical sites for the Acclaim-1 study. We opened the Phase 2a expansion portion of the Acclaim-1 study and enrolled and dosed the first patient in January 2024. We expect to complete the enrollment of the 19 patients in each cohort of the Phase 2a expansion portion of the study by the end of 2024, and thus we expect the interim analyses in early 2025. Patients enrolled in the Phase 2b portion of the study will be randomized 1:1 to either REQORSA and Tagrisso combination therapy or to platinum-based chemotherapy. Patients will be treated until disease progression or unacceptable toxicity is experienced.

The primary endpoint of the Phase 1 portion isof the Acclaim-1 study was to determine a dose limiting toxicity ("DLT"), defined as ≥Grade 3 prolonged non-hematologicalwith DLT or, ≥Grade 4 prolonged hematological toxicity occurring duringif DLT was not experienced, to determine the first cyclerandomized RP2D. Since no DLTs were experienced in Phase 1, the 0.12 mg/kg dose of therapy and consideredREQORSA was determined to be possibly, probably, or definitely related to REQORSA and Tagrisso combination therapy.the RP2D. The primary endpoint of the Phase 22a expansion portion is overall response rate (ORR). The primary endpoint of the Phase 2b randomized portion of the trial is progression-free survivalPFS which is defined as time from randomization after first progression on Tagrisso, to first event (seconddisease progression) or death. Patients will be followed for upsurvival.

In October 2023, one of our clinical collaborators presented a poster presentation at the 2023 AACR-NCI-EORTC International Conference on Molecular Targets and Cancer Therapeutics detailing the Phase 1 results of the Acclaim-1 study. While the Phase 1 portion of the Acclaim-1 study was designed primarily to assess safety, we believe promising efficacy results were also observed. The reported results showed no DLTs, established a RP2D of 0.12 mg/kg (the highest dose level administered in the trial) and provided data showing early efficacy of REQORSA in combination with Tagrisso. Of the 12 patients treated with escalating doses of REQORSA and standard doses of Tagrisso, all of whom had progressed on Tagrisso containing regimens, three patients, as of data from January 2024, had experienced prolonged time to progression, including one with continuing partial response. Specifically, one patient at the 0.06 mg/kg dose level, previously treated with carboplatin, pemetrexed, and Tagrisso, had a partial remission by investigator evaluation and treatment is now ongoing in the trial after 28 cycles, which is approximately 19.5 months. A second patient at the 0.12 mg/kg dose level who was previously treated with cisplatin, pemetrexed, carboplatin, and Tagrisso has stable disease and is continuing to receive REQORSA after 14 cycles, or approximately 10 months. And a third patient who was at the 0.09 mg/kg dose level, previously treated with Tagrisso, had stable disease and received 14 cycles, over approximately 10 months followingbefore disease progression occurred. The extended PFS of each of these patients is consistent with long-term PFS seen in several patients in prior early stage clinical trials of REQORSA and is not expected with treatment with Tagrisso alone after progression on Tagrisso. REQORSA administration was generally well tolerated and there were no DLTs. The administration was associated with a delayed infusion-related reaction of muscle aches, fever and chills in some patients, which we believe is similar to reactions seen with the administration of their last doseantibodies routinely used in oncology treatment. This was managed with prophylactic steroids, acetaminophen and diphenhydramine, and symptoms decreased with repeat cycles. We believe this new mechanism and novel approach targeting lung cancer, which comes with a strong safety profile and early signs of Tagrisso. We have received centralized institutional review board ("IRB") approval for Acclaim-1.efficacy, is paving new ground in the fight against lung cancer.

Acclaim-2

In December 2021, we received Fast Track Designation from the FDA for use of REQORSA in combination with the checkpoint inhibitor Keytruda for the treatment of advanced NSCLC patients whose tumors progressed after treatment with Keytruda.

In 2019, preclinical data waswere presented by MD Anderson collaborators relating to the combination of TUSC2, the active agent in REQORSA, with Keytruda showing that TUSC2 combined with the checkpoint blockade mechanism of action of Keytruda was more effective than Keytruda alone in increasing the survival of mice with a human immune cellssystem (humanized mice) that had metastatic lung cancer with a human lung cancer. MD Anderson also presented preclinical data in 2019 for the combination of TUSC2, Keytruda and chemotherapy for the treatment of some of the most resistant metastatic lung cancers. This study found that the addition of TUSC2 demonstrates synergy with Keytruda and also with Keytruda combined with chemotherapy, and thus, may improve on the first-line standard of care for lung cancer. In May 2020, we entered into a worldwide, exclusive license agreement with The Board of Regents of the University of Texas System on behalf of MD Anderson for the use of TUSC2 in combination with immunotherapies, including Keytruda, and also for the use of TUSC2 in a three-drug combination of TUSC2, immunotherapy andcancer which includes chemotherapy.

The Acclaim-2 trial is aWe currently are enrolling and treating patients in the Phase 1 dose escalation portion of our Phase 1/2 Acclaim-2 clinical trial, combiningan open-label, dose-escalation and clinical response study of REQORSA in combination with Keytruda in patients whose disease haswith advanced, metastatic non-small-cell lung cancer who have progressed on Keytrudaafter treatment with Keytruda. Patients must have histologically confirmed unresectable stage III or IV NSCLC (any histology) with:

| ● | radiological progression on Keytruda; and | |

| ● | an ECOG performance status of 0 to 1. |

Starting in NSCLC2024, all patients whoreceiving REQORSA in this study are low expressors (1%required to 49%)submit an archival biopsy specimen that can be evaluated for TUSC2 expression. We expect to enroll patients at approximately 10 U.S. clinical sites and estimate that the dose escalation portion of PD-L1. We plan to initiate the Acclaim-2 trial will enroll up to 18 patients, the Phase 2a expansion portion will enroll 36 patients, and the Phase 2b randomized portion will enroll approximately 126 patients. Patients enrolled in 2021.the Phase 2b randomized portion of the study will be randomized 2:1 to either REQORSA and Keytruda combination therapy in the experimental arm or to chemotherapy (docetaxel with or without ramucirumab), or to the investigator’s choice of therapy in the control arm. Patients will be treated until disease progression or unacceptable toxicity is experienced.

The primary endpoint of the dose escalation portion is DLT, defined as ≥Grade 3 prolonged non-hematological or ≥Grade 4 prolonged hematological toxicity occurring during the first cycle of therapy and considered to be possibly, probably, or definitely related to REQORSA and Keytruda combination therapy. The primary endpoint of the Phase 2a expansion portion and the Phase 2b randomized portion of the trial is progression-free survival which is defined as time from randomization to disease progression or death. Patients will be followed for survival.

Patients are currently being treated at the 0.06 mg/kg dose level and, subject to Acclaim-2 SRC approval, we will treat the two successive cohorts of patients at the 0.09 mg/kg and 0.12 mg/kg dose levels. In March 2023, we amended the Acclaim-2 protocol to include additional treatments in the control group with the goal of accelerating enrollment in the study by making the trial more attractive to a wider variety of investigators. We expect enrollment in the Phase 1 dose escalation portion of the Acclaim-2 trial will be completed in the second half of 2024. We will then initiate and evaluate patients in the Phase 2a expansion portion of the study at the MTD or RP2D to expand the safety and efficacy profile at that dose in order to better evaluate efficacy and to increase the likelihood of a successful Phase 2b randomized trial, which will follow the expansion portion.

Acclaim-3