Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐☒ No ☒☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

| | | | | | | | |

| | Page |

| PART I. | | |

| Item 1. | | |

| Item 1A. |

|

Table of Contents

| | | | | | Page | PART I. | | | Item 1.1B. | | | Item 1A.1C. | | | Item 1B.2. | | | Item 2.3. | | | Item 3.4. | | | Item 4. | | | | | | | PART II. | | | | Item 5. | | | | Item 6. | | | | Item 7. | | | | Item 7A. | | | | Item 8. | | | | Item 9. | | | | Item 9A. | | | | Item 9B. | | | | Item 9C. | | | | | | | PART III. | | | | Item 10. | | | | Item 11. | | | | Item 12. | | | | Item 13. | | | | Item 14. | | | | | | | PART IV. | | | | Item 15. | | | | Item 16. | | | | | | | | |

PART I Forward-Looking Statements

This Annual Report on Form 10-K, including the sections entitled "Business," "Risk Factors," and "Management's Discussion and Analysis of Financial Condition and Results of Operations," contains forward-looking statements that involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Statements that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “predict,” “project,” “potential,” “should,” “will,” or “would,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These forward-looking statements include, but are not limited to, statements concerning the following:

our ability to effectively manage or sustain our growth and to achieve profitability;

our market opportunity and the expansion of our core software markets in general;

the effects of increased competition as well as innovations by new and existing competitors in our market;

our ability to adapt to technological change and effectively enhance, innovate and scale our platform and professional services;

our expected use of proceeds;

our ability to attract and retain qualified employees and key personnel and further expand our overall headcount;

our ability to maintain, or strengthen awareness of, our brand;

perceived or actual problems with the integrity, reliability, quality or compatibility of our platform, including unscheduled downtime or outages;

potential acquisitions and integration of complementary businesses and technologies;

future revenue, hiring plans, expenses, capital expenditures, capital requirements and stock performance;

our ability to stay abreast of new or modified laws and regulations that currently apply or become applicable to our business both in the United States and internationally;

our ability to maintain, protect and enhance our intellectual property;

costs associated with defending intellectual property infringement and other claims; and

the future trading prices of our Class A common stock and the impact of securities analysts’ reports on these prices.

These statements represent the beliefs and assumptions of our management based on information currently available to us. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed in the section titled “Risk Factors” included under Part I, Item 1A. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this report.

Item 1. Business.

Overview

Appian providesCorporation (together with its subsidiaries, “Appian,” “the Company,” “we,” or “our”) is a software company that automates business processes and operationalizes artificial intelligence (“AI”) with low-code design, providing rapid time to value for our customers. We empower our customers to transform the way they work by using our platform to combine people, technologies, and data in end-to-end processes that can maximize our customers' resources and dramatically improve business results.

We believe organizations across all industries face pressure to keep up with a rapid pace of technological innovation, particularly in AI. The past year has ushered in a whole new economy, in which AI promises to transform workflows to drive efficiency and innovation. As we enter 2024, the focus will shift from exploring these technologies to actively leveraging them to innovate with new products, services, and value creation for customers and employees alike. We believe companies that can quickly incorporate AI's full potential into their business processes will lead the future AI economy.

We are dedicated to helping our customers navigate this new AI economy and realize transformational change. We see a human-centric future for AI, one of teamwork rather than replacement, where AI adds value to data and employees, and where all customers and businesses—not big tech—are the winners.

We recognize AI is not a standalone technology. It is highly dependent on two foundational technologies: data and process.

Data is the intellectual fuel for AI, empowering it to make smart, informed decisions. The more data AI gets, and the better that data is, the better the AI answers may be. Data was already among the most important assets for leading organizations; now, it’s worth more than ever. Process is the necessary layer for customers to create a mixed autonomy, routing tasks between humans and AI automations. We believe customers will increasingly rely on AI to accelerate common tasks but must ensure humans maintain control and oversight of business processes.

We offer leading expertise in all three areas. We have been leveraging AI technologies for many years as part of our automation suite. We have a leading data fabric which powered billions of data fabric queries in 2023, and we offer innovative process platforms, supporting billions of transactions every day. We weave all three elements together in a single product that empowers our customers to achieve rapid value.

The Appian Platform

The Appian Platform enables customers to easily design, automate, and optimize their mission-critical business processes, driving continuous innovation. Through Appian's unified platform, customers can swiftly develop new digital solutions using a low-code software developmentapproach, creating applications and workflows tailored to their unique business requirements.

We catalyze the AI-driven enterprise by combining AI, data, and process capabilities in a single platform. Our low-code design experience delivers solutions for customers quickly. It is unified, reduces training times and dependencies on additional tools, and is built for enterprise-grade applications requiring high reliability, security, and scalability. Appian’s architecture is based on our four critical capabilities: process automation, data fabric, total experience, and continuous improvement through process mining.

Process Automation

We are a long-time innovator in process automation. Our process capabilities are crucial in orchestrating AI alongside humans and systems within business environments. Our business rules technology allows organizations to encode and enforce policies and routing decisions that reduce risk, while our native RPA and AI enable organizations to automate process steps to deliver greater efficiency and increase customer and employee satisfaction. We sell our platform as a serviceunified set of automation technologies that enables organizationsaccelerates customer implementation times and return on investment.

Data Fabric

Data is at the heart of AI's transformative power, and we excel in enabling customers to rapidly develop powerful and unique applications. The applications created onutilize data effectively. By leveraging our platform help companies drive digital transformation and competitive differentiation. With our platform,sophisticated data fabric, organizations can rapidlyunify data across the enterprise into a single virtual data model, empower users to make informed decisions, and easily design, buildtrain AI models, transforming reservoirs of enterprise data into a source of powerful innovation. This capability is pivotal in feeding AI algorithms and implement powerful, enterprise-grade custom applications throughhuman workers with quality data and extracting meaningful insights that drive business decisions. In addition, the secure infrastructure of our intuitive, visual interface with little or no coding required.data fabric architecture is designed to provide a safe environment for storing and handling sensitive information, ensuring confidential data remains protected.

Total Experience

Total experience is about creating superior experiences across desktop and mobile devices for every user, uniting customers and employees in a seamless workflow. Our customers have used applications built on our low-code platform to launch new business lines, automate vital employee workflows, manage complex trading platforms, accelerate drug development and build global procurement systems. With our platform, decision makers can reimagine their products, services, processes and customer interactions by removing much of the complexity and many of the challenges associated with traditional approaches to software development. Organizations across industries are digitally transforming—leveraging software to automate and optimize mission critical operations, enhance customer experiences and drive competitive differentiation. Historically, organizations have principally relied on packaged software and custom software solutions to operationalize and automate their businesses. Packaged software often fails to address unusual use cases or to enable differentiation and requires organizations to conform their individual processes, needs and systems of record to standardized frameworks. While traditional custom software solutions can be differentiated and tailored to meet strategic objectives, development requires a long, iterative and cumbersome process, as well as costly integration, and relies on scarce developer talent.

We enable organizations to differentiate themselves from their competition through software-enabled digital transformation. Our low-code platform employs an intuitive, visual interface and pre-built development modules that reduce the time required to build powerful and unique applications. We believe that developing applications on our platform can be as simple as drawing a picture. Our platform automates the creation of forms, data flows, records, reports and other software elements that would otherwise need to be manually coded or configured. This functionality greatly reduces the iterative development process, allowing for real-time application optimization and ultimately shortening the time from idea to deployment. Further, our patented Self-Assembling Interface Layer, or SAIL, technology ensuresuser experience architecture delivers the speed and flexibility to provide new experiences that applications developedcapture our customers’ brands quickly and instantly work on our platform can be immediately and natively deployed across a full range of mobile and desktop devices with no additional customization, including desktopthe latest web browsers tablets and mobile phones. Updatesdevices.

Continuous Improvement

Our integrated process mining and process analytics capabilities enable customers to applications developedmeasure and track their process performance accurately. Customers can gain a deeper understanding of their business operations and pinpoint areas for improvement. Using this data, customers can drive continuous process improvement and optimize their processes for maximum efficiency and effectiveness. These features provide customers with SAIL disseminate automatically across device typesthe necessary insights to ensure that all users benefit frommake informed decisions and optimize their operations to meet the most up-to-date functionality. At the same time, we unify enterprise data in a single searchable environment, providing organizations with a comprehensive viewevolving needs of customer, product, organizational asset and other critical information. Rich reporting dashboards capture detailed performance metrics, providing valuable business intelligence and analytics that enable business process optimization. Moreover, our platform can be deployed in the cloud, on-premises or using a hybrid approach, with organizations able to access the same functionality and data sources in all cases.their business.

Go-to-Market Strategy

Our go-to-market strategy consists of both direct sales and to a lesser extent, sales through strategic partners. We sell our software almost exclusively through subscriptions andas subscriptions. We intend to grow our revenue both by adding new customers, and increasing the numberproduct usage of users at existing customers, that use applications developed on our platform. As of December 31, 2017, we had 356 customers in a wide variety of industries, of which 285 customers were commercial and 71 customers were government or non-commercial entities.expanding product usage across new business processes and applications. Our customers include financial services, healthcare, government, telecommunications, media, energy, manufacturingstrategic partners work with organizations undergoing digital transformation projects, and transportation organizations. As of December 31, 2017, 29% of our commercial customers were Global 2000 organizations and included 44 Fortune 500 companies. We determined relevant global financial services and healthcare companies by referencing certain independent industry data from S&P Global Market Intelligence. Customers receive all of the modules and functionality ofwhen they recognize an opportunity for our platform, with their initial subscription, which facilitates the seamless creation of new applications. they often introduce us to potential customers.

Many of our customers begin by building a single application and grow to buildcreate dozens of applications on our platform, which implicitly reduces the per-user cost of each application.increases their return on investment. Generally, the development of new applications results in the expansion of our user baseproduct usage within an organization and a corresponding increase in our revenue due to us because we charge subscription fees on a per-user basis for the significant majority of our customer contracts.fees. Every additional application that an organization creates on our platform increases the value of our platform for that organization because it further integrates people, processprocesses, and data across the organization and facilitates knowledge sharing. Applications built on our platform may be used only on our platform and only while customers have active subscriptions, creating a substantial incentive for customers to avoid the difficulties and costs associated with moving to a different software platform. At the same time, our industry-leading professional services organization enables ourCustomer Success team helps customers to more easily build and deploy applications on our platform to achieve their digital transformation goals.goals more quickly.

Our Growth Strategy

Key elements of our growth strategy include:

•Expand our customer base. We continue to grow our customer base in various industries, including financial services, government, life sciences, insurance, manufacturing, energy, healthcare, telecommunications, and transportation. We believe thatthe market for our platform is still in its early stages, and we have a significant market opportunity to add additional large enterprise and government customers globally. We also have a strong ecosystem of strategic partners that help identify new customer opportunities for us. •Grow revenue from key industry verticals. While our platform is industry-agnostic, we continue to make investments to enhance the expertise of our sales and marketing organization within our key industry verticals of financial services, government, life sciences, insurance, and manufacturing. In 2023, we generated over 76% of our subscriptions revenue from customers in helping organizations accelerate theirthese verticals. We believe focusing on the digital transformation needs of organizations within these industry verticals helps drive adoption of our platform. •Continue to innovate and enhance our platform.We continue to invest in research and development to strengthen our platform and expand the number of features available to our customers. We offer multiple upgrades each year that allow our customers to benefit from ongoing innovation. As we continue to increase the functionality of our platform and further reduce the amount of developer skill required to quickly deliver value for our customers, we believe we have the potential to expand the use of our platform. •Offer industry solutions to accelerate customer usage.Our platform enables our customers to build applications quickly. We, along with our partners, offer pre-built solutions in certain of our key industries such as financial services, government acquisition, and insurance to give our customers an even faster start. Every Appian solution is built on our platform and designed to be standardized, upgradeable, and compatible with each other. •Expand our international footprint. Our platform is designed to be natively multilingual to facilitate collaboration and address challenges in multinational organizations. Appian Cloud meets the data residency requirements of our global customers by leveragingoperating in 16 countries across 33 regions and 105 availability zones. In 2023, approximately 36% of our low-codetotal revenue wasgenerated from customers outside of the United States. We believe we have a significant opportunity to continue to grow our international footprint. We are investing in new geographies through direct and indirect sales channels, professional services and customer support, and implementation partners. •Leverage our partner base. We have strategic partnerships including with Accenture, Capgemini, Deloitte, EY, KPMG, PwC, and TCS. These partners work with organizations undergoing digital transformation projects. When they recognize an opportunity for our platform, they introduce us to potential customers. Additionally, they go to market with their own pre-built solutions using our platform, delivering software development platform. license revenue to Appian. We intend to further leverage our base of partners to provide broader customer coverage and solution delivery capabilities.

Human Capital Resources and Management

Employees, Culture, and Labor Relations

Our current core software markets,distinct culture of innovation is an important contributor to our success as a company. We promote an inclusive environment where our employees can contribute their unique perspectives to help create transformative solutions for our customers. Our culture was purposefully cultivated by our four founders, who are still heavily involved in operating our business, including recruiting, interviewing, and educating new employees at Appian. Led by Matt Calkins, one of our founders and our Chief Executive Officer, we have grown our business organically by employing a unified team to maximize the cohesion and simplicity of our platform and our company.

As of December 31, 2023, we had a total global workforce of 2,243 full-time employees, 1,518 of which include the markets for low-code development platforms, case management software, business process management and platform-as-a-

service, are expected to represent a combined $23.6 billion market opportunity by 2018 and a combined $44.4 billion market opportunitywere based in the near term.United States. None of our U.S. employees are covered by collective bargaining agreements. We believe our employee relations are good, and we have not experienced any work stoppages. Additionally, we are subject to, and comply with, local labor law requirements in all countries in which we operate.

Talent Acquisition and Development

We have a robust talent acquisition program to attract, recruit, and retain new talent. We utilize an extensive campus recruiting program, provide an employee referral program, and offer opportunities for internal transfers, as well as competitive compensation and benefits programs. We also provide resources to help our employees grow in their current roles and build new skills, including access to Appian University, a system that houses Appian's in-house learning and development solutions.

Inclusion and Diversity

We respect all people. We believe diversity of ideas and an inclusive environment are paramount to our continued success. We also believe our individual experiences, knowledge, and ways of working enable us to learn from one another and discover creative solutions. We sponsor a number of affinity groups, initiated by employees, that aim to build stronger internal and external networks and partnerships, create a positive lasting impact through social and educational outreach, and create development opportunities for future leaders.

Facilities

As of December 31, 2023, we lease our headquarters office in McLean, Virginia, and we also have five leased offices in cities outside the United States. In addition to our leased offices, we occupied seven flexible workspaces outside of the United States. Our use of flexible workspaces is dependent upon our current core software markets,business needs. We believe our facilities are adequate to meet our ongoing needs, including substantial rights to expand within certain properties we lease. If we require additional space in the future, we believe that our platform better meets certainwe will be able to obtain additional facilities on commercially reasonable terms.

Seasonality

We have historically experienced seasonality in terms of when we enter into agreements with customers. See “Seasonality - Management Discussion and Analysis Financial Condition and Results of Operations” for a discussion of the needs that have been historically addressed by manually-developed custom enterprise software, which is expectedseasonality of our business.

Our Customers

Our customers operate in various industries, including financial services, government, life sciences, insurance, manufacturing, energy, healthcare, telecommunications, and transportation. As of December 31, 2023, we had approximately 1,000 customers. Generally, our sales team targets its efforts to represent a $169organizations with over 2,000 employees and $2 billion market in 2018. Further, based on the totalannual revenue. The number of global companies and government institutionscustomers paying us in 2017 in relevant industries and our industry-specific averageexcess of $1 million of annual recurring revenue has grown from 94 at the end of 2022 to 110 at the end of 2023. No single end customer accounted for customers asmore than 10% of December 31, 2017, we internally estimateour total revenue in 2023, 2022, or 2021.

Our Competition

Our main competitors fall into three categories: (1) providers of custom software solutions that address, or are developed to address, some of the use cases that applications developed on our platform target; (2) providers of low-code development platforms; and (3) providers of one or more automation technologies, including business process management, case management, process mining, and robotic process automation.

As our market opportunitygrows, we expect it will attract more highly specialized vendors as well as larger vendors that may continue to have been approximately $31 billionacquire or bundle their products more effectively. The principal competitive factors in 2017. See "—Our Opportunity" for additional information.our market include: We have experienced strong revenue growth,

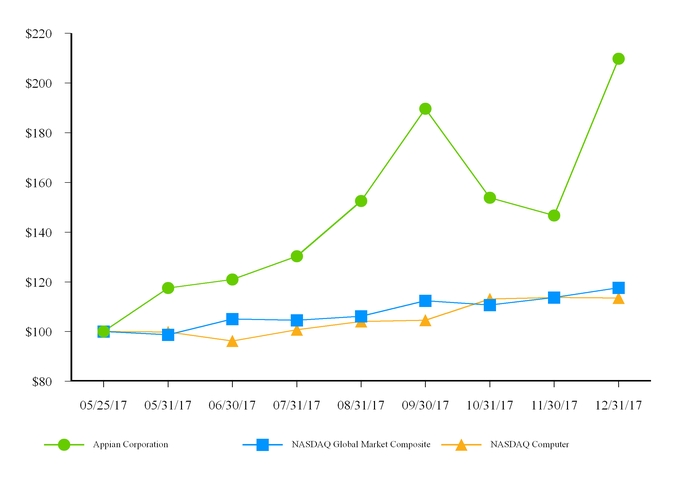

•Platform features, reliability, performance, and effectiveness; •Ease of use and speed; •Data Fabric; •Platform extensibility and ability to integrate with revenueother technology infrastructures; •Deployment flexibility; •Robustness of $176.7 million, $132.9 million and $111.2 million in 2017, 2016 and 2015, respectively. Our subscription revenue was $82.8 million, $60.0 million and $41.5 million in 2017, 2016 and 2015, respectively, representing year-over-year growth rates of 38% from 2016 to 2017 and 45% from 2015 to 2016. Our professional services revenue was $85.2 million, $63.0 million and $58.0 million in 2017, 2016customer support; •Price and 2015, respectively. Over time, as the need for professional services associated with user deployments decreasestotal cost of ownership; •Strength of platform security and the numberadherence to industry standards and certifications; •Strength of end users increases, we expect the mix of total revenue to shift more toward subscription revenue. We have invested in developing our platform, expanding our sales and marketing efforts; and

•Brand awareness and research and development capabilities, and providing general and administrative resources to supportreputation.

We believe we generally compete favorably with our growth. As a result, we incurred net losses of $31.0 million, $12.5 million and $7.0 million in 2017, 2016 and 2015, respectively. We also had operating cash flows of $(9.1) million, $(7.8) million and $(2.1) million in 2017, 2016 and 2015, respectively. Recent Developments

In November 2017, we completed a secondary offering pursuant to which stockholders sold an aggregate of 4,370,000 shares of Class A common stock at a price of $20.25 per share, including 570,000 shares pursuantpeer group with respect to the underwriters' option to purchase additional Class A shares. We did not receive any proceeds from the sale of the sharesfeatures, security, and performance of our Class A common stock offeredplatform, the ease of integration of our applications, and the relatively low total cost of ownership of our applications.

We feel this is validated by the fact Gartner ranked Appian #1 for the Business Workflow Automation with Integration Use Case in the secondary offering. Industry and Market Data

Information contained in this Annual Report on Form 10-K concerning our industry and the market in which we operate, including our general expectations and market position, market opportunity and market size is based on information from various sources, including independent industry publications by Forrester Research Inc.,2023 Gartner® Critical Capabilities for Enterprise Low-Code Application Platforms, or Forrester, Aite Group, LLC, or Aite, International Data Corporation, or IDC, Gartner, Inc., or Gartner, and S&P Global Market Intelligence. In presenting this information, we have also made assumptions based on such data and other similar sources, and on our knowledge of, and in our experience to dateLCAP, report as well as positioned as a Leader in the markets2023 Gartner® Magic Quadrant for our services. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although we have not independently verified the accuracy or completeness of any third-party information, we believe the market position, market opportunity and market size information included in this Annual Report is reliable. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the “Risk Factors” section. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

The Forrester studies described herein, one of which was commissioned by us, represent data, research, opinions or viewpoints prepared by Forrester and are not representations of fact. We have been advised by Forrester that its studies speak as of their original date (and not as of the date of this Annual Report on Form 10-K) and any opinions expressed in the studies are subject to change without notice.

TheEnterprise LCAP. Gartner, report described in this Annual Report on Form 10-K represents data, research opinion or viewpoints published, as part of a syndicated subscription service, byCritical Capabilities for Enterprise Low-Code Application Platforms, October 2023 Gartner, and are not representations of fact. The Gartner report speaks as of its original publication date, and not as of the date of this Annual Report, and the opinions expressed in the Gartner report are subject to change without notice.Magic Quadrant for Enterprise Low-Code Application Platforms, October 2023 Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

GARTNER and Magic Quadrant are registered trademarks and service marks of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved. The S&P Global Market Intelligence dataGartner content described herein, represents proprietary data gathered(the "Gartner Content") represent(s) research opinion or viewpoints published, as part of a syndicated subscription service, by S&P Global Market IntelligenceGartner, Inc. ("Gartner"), and isare not a representationrepresentations of fact. The S&P Global Market Intelligence data isGartner Content speaks as of February 2, 2017its original publication date (and not as of the date of this Annual Report on Form 10-K)10K) and isthe opinions expressed in the Gartner Content are subject to change without notice.

Industry Background

Software-enabled digital transformation. Organizations across industries are digitally transforming—leveraging software to automate and optimize mission critical operations, enhance customer experiences and drive competitive differentiation. Software has revolutionized mass transportation, drug development, business-customer interactions and operational management. Software has evolved from being a method for modernization to an opportunity for differentiation. Several key trends are fueling software-enabled digital transformation, including the rise of cloud computing and the Internet of Things and the proliferation of mobile devices. Decision makers are increasingly recognizing the need to capitalize on these trends, as 87% of Global 2000 executives planned digital transformation projects for 2017 and 47% of Global 2000 executives cited digital transformation as their highest corporate priority in 2017, according to a survey conducted by LTM Research, an industry research firm, which was commissioned by us.

Challenges to effective digital transformation. Historically, organizations have principally relied on packaged software and custom software solutions to operationalize and automate their businesses. However, these solutions are challenged in their ability to facilitate effective software-enabled digital transformation. More specifically:

Packaged software is inadequate. Packaged software, whether delivered in the cloud or on-premises, is a one-size-fits-all solution that performs industry-agnostic functions, such as customer relationship management or enterprise resource management, or serves specific industry verticals without organization-specific differentiation. Organizations are often unable to use packaged software to address unusual use cases and differentiate themselves and must conform their individual processes, needs and systems of record to standardized frameworks. Moreover, for both cross-industry and industry-specific software, the limited scope of functionality often forces organizations to adopt numerous point solutions that can be difficult to integrate.

Traditional custom software solutions are expensive and difficult to create. In contrast, traditional custom solutions are built to address particular organization-specific use cases.Although this allows organizations to better manage their operations and differentiate their businesses, traditional custom software solutions have historically been hampered by several limitations:

Traditional application development is a long and cumbersome process, requiring complex coding and an iterative feedback cycle. According to one example cited by Forrester, the coding of custom software took an estimated 2.7 years to complete, and therefore the output from a development project may not meet user needs and intentions even on the first day of deployment. In the same report, Forrester found that the use of low-code software development was six to 20 times faster than traditional software development. Further, traditional custom software projects require on-going maintenance and enhancement, without which the resulting software will not keep pace with future needs.

The proliferation in mobile devices and the competition among mobile device manufacturers means that device operating systems are continuously being updated, modified and customized for specific hardware configurations. This continual change means that traditional custom software needs to be updated continuously in order to remain relevant across an organization’s entire technology environment. Updating such custom software so that it can be used across devices adds another layer of complexity to the entire process.

The need for organizations to manage their operations utilizing all of these devices and environments necessitates costly integrations in an attempt to avoid creating information silos. Otherwise, organizations could not effectively share information across applications and processes, which would inhibit collaboration, effective analytics and real-time decision making.

Developer talent is scarce and hiring developers to create custom software is costly. According to an LTM Research survey of Global 2000 executives, which was commissioned by us, 79% of respondents said they were concerned that their digital transformation initiatives would be impacted by challenges in hiring and retaining skilled developers. Software developer costs can be greater than $100,000 per year, depending on location. Given its labor intensive nature, traditional custom software can be very expensive to design, implement and maintain.

Low-code software development platforms have emerged to address the limitations associated with packaged software and traditional custom software solutions. These low-code solutions seek to enable both professional software developers and business users to rapidly build organization-specific applications. However, many existing low-code platforms are either limited in functionality such that they do not support the development of enterprise-grade applications or continue to require significant manual coding, and therefore are not truly “low-code.”

Benefits of Our Platform

We enable organizations to differentiate themselves from their competition through software-enabled digital transformation. With our platform, organizations can rapidly and easily design, build and implement powerful, enterprise-grade custom applications through our intuitive, visual interface, with little or no coding required. Our patented SAIL technology ensures that applications developed on our platform can be immediately and natively deployed across a full range of mobile and desktop devices with no additional customization, including desktop web browsers, tablets and mobile phones. We also enable organizations to easily modify and enhance applications and automatically disseminate these updates across device types to ensure that all users benefit from the most up-to-date functionality.

Key benefits of our platform include:

Rapid and simple innovation through our powerful platform. Our low-code platform employs an intuitive, visual interface and pre-built development modules that reduce the time required to build powerful and unique applications. Our platform automates the creation of forms, data flows, records, reports and other software elements that would otherwise need to be manually coded or configured. This functionality greatly reduces the iterative development process, allowing for real-time application optimization and ultimately shortening the time from idea to deployment. In turn, organizations can better leverage scarce and costly developer talent to accomplish more digital transformation objectives.

Powerful applications to solve complex challenges.At the core of our platform is an advanced engine that enables the modeling, modification and management of complex processes and business rules. Our heritage as a business process management, or BPM, company provides us with this differentiated understanding of complex processes, and we have incorporated that expertise into our platform to enable the development of powerful applications. Organizations have used our platform to launch new business lines, build large procurement systems, manage retail store layouts, conduct predictive maintenance on field equipment and manage trading platforms, among a range of other use cases. For example, the Defense Information Systems Agency of the U.S. federal government, or DISA, utilizes our platform to manage its large and complex procurement organization, having processed nearly $3.5 billion worth of contract value on our platform since 2009.

Create once, deploy everywhere. Our patented SAIL technology allows developers to create an application once and deploy it everywhere with the consistency of experience and optimal performance levels that users expect. Applications developed on our platform can be immediately and natively deployed across a full range of mobile and desktop devices with no additional customization, including desktop web browsers, tablets and mobile phones.

Seamless integration with existing systems and data. In contrast to typical enterprise software, our platform does not require that data reside within it in order to enable robust data analysis and cross-department and cross-application insight. Our platform seamlessly integrates with many of the most popular enterprise software applications and data repositories and can be used within many legacy environments. For example, organizations frequently use our platform to extend the life and enhance the functionality of legacy systems of record, such as those used for enterprise resource planning, human capital management and customer relationship management, by building new applications that enhance the functionality of those systems and by leveraging the data within those systems to further optimize and automate operations.

Deployment flexibility to serve customer needs. Our platform can be installed in the cloud, on-premises or using a hybrid approach, with organizations able to access the same functionality and data sources in all cases. Our flexible deployment model also preserves a seamless path to future cloud deployments for organizations initially choosing on-premises or hybrid approaches for their most sensitive workloads.

Industry-leading security. Our platform is designed to meet the highest demands of our federal government and large enterprise customers. Our cloud platform holds some of the highest security certifications from government agencies and industry organizations, including being one of the first low-code software companies to achieve Federal Risk and Authorization Management Program, or FedRAMP, compliance. Our platform also meets the Payment Card Industry Data Security Standard, or PCI DSS, and the United States Health Insurance Portability and Accountability Act standard.

Our approach to digital transformation goes beyond simply enabling organizations to build custom applications fast. We empower decision makers to reimagine their products, services, processes and customer interactions with software by removing much of the complexity and many of the challenges associated with traditional approaches to software development. Because we make application development easy, organizations can build specific and competitively differentiated functionality into applications to deliver enhanced user experiences and streamlined business operations.

Our Growth Strategy

Key elements of our growth strategy include:

Expand our customer base. As of December 31, 2017, we had 356 customers in a wide variety of industries, including financial services, healthcare, government, telecommunications, media, energy, manufacturing and transportation. We believe that the market for our software development platform is in its early stages and that we have a significant opportunity to add additional large enterprise and government customers.

Grow through our differentiated land and expand model. Customers receive all of the modules and functionality of our platform with their initial subscription, which facilitates the seamless creation of new applications. Many of our customers begin by building a single application and grow to build dozens of applications on our platform, which implicitly reduces the per-user cost of each application. Generally, the development of new applications results in the expansion of our user base within an organization and a corresponding increase in revenue to us because we usually charge subscription fees on a per-user basis. Every additional application that an organization creates on our platform increases the value of our platform for that organization because it further integrates people, process and data across the organization and facilitates knowledge sharing. Applications built on our platform may be used only on our platform while customers have active subscriptions, creating substantial switching costs for customers to move to a different software platform. We believe that organizations will develop additional applications and add users to our platform as they continue to recognize these benefits.

Grow revenue from key industry verticals. While our platform is industry-agnostic, we have recently made, and plan to continue to make, investments to enhance the expertise of our sales and marketing organization within our key industry verticals of financial services, healthcare and U.S. federal government. In 2017, we generated over 66% of our subscription revenue from customers in these verticals. We believe that focusing on the digital transformation needs of organizations within these industry verticals can help drive adoption of our platform.

Continue to innovate and enhance our platform. We have made, and will continue to make, investments in research and development to strengthen our platform and expand the number of features available to our customers. We typically offer multiple upgrades each year that allow our customers to benefit from ongoing innovation. Most recently, we expanded our offering to include Quick Apps, which enables non-professional developers to develop native web and mobile applications in minutes with no coding. In addition, our platform allows our customers to embed artificial intelligence, or AI, concepts into their business processes and to use our pre-built integrations to leading providers of AI services. Our platform also incorporates best practices in the field of data science into a tool for our customers to automate the training, deployment and management of AI predictive models. We are also collaborating with other companies to include cognitive computing and Robotic Process Automation capabilities on our platform, allowing the delivery of even more powerful and intelligent applications using an agile delivery capability. As we continue to increase the functionality of our platform and further reduce the amount of developer skill that is required to build robust applications on our platform, we believe that we have the potential to expand the use of our platform.

Expand our international footprint. Our platform is designed to be natively multi-lingual to facilitate collaboration and address challenges in multi-national organizations. In 2017, approximately 27% of our total revenue was generated from customers outside of the United States. Today, we operate in 11 countries and believe that we have a significant opportunity to grow our international footprint. We are investing in new geographies, including through investment in direct and indirect sales channels, professional services and customer support and implementation partners.

Grow our partner base. We have several strategic partnerships including with Deloitte, KPMG and PricewaterhouseCoopers. These partners work with organizations that are undergoing digital transformation projects and are therefore able to refer potential customers to us. When these partners recognize an opportunity for our platform, they often introduce us to potential customers. We intend to further grow our base of partners to provide broader customer coverage and solution delivery capabilities.

Our Opportunity

We believe that we have a significant market opportunity in helping organizations accelerate their digital transformation by leveraging our low-code software development platform.

Current core software markets. We believe that our platform addresses several key core software markets, as follows:

Low-code. According to Forrester, the market for low-code development platforms is expected to total $4.4 billion in 2018 and is expected to grow at a 49% compound annual growth rate to $21.2 billion in 2022. We were included as a “Leader” in the Forrester Wave: Low-Code Development Platforms in 2017, which is an evaluation of current offering, strategy and market presence.

Case management.Case management applications are designed to support complex processes that require a combination of human workflows and collaboration, electronic workflows, data management and processing of files and cases. According to Aite, the market for case management software was expected to total $1.3 billion in 2017 and is expected to grow at a 9% compound annual growth rate to $1.6 billion in 2019. We were included as a “Leader” based on the strength of our current offering, our strategy and our market presence in the Forrester Wave: Dynamic Case Management in 2016.

BPM. BPM applications are designed to support the optimization of business processes, including process identification, improvement implementation, and monitoring and analysis. According to Gartner, the market for Business Process Management Suites is expected to total $3.0 billion in 2018 and is expected to grow at a 7% compound annual growth rate to $3.7 billion in 2021 worldwide*. We were included as a "Leader" based on our ability to execute and the completeness of our vision in the Gartner Magic Quadrant for Intelligent Business Process Management Suites 2017.**

Application PaaS. Application platform as a service, or application PaaS, is a cloud service that provides the necessary infrastructure to enable the development, deployment and hosting of software applications. We believe that we are well positioned to capture a portion of the application platform-as-a-service, or application PaaS, market, which IDC estimated to reach $14.9 billion in 2018, and which is expected to grow at a 6% compound annual growth rate to $17.9 billion in 2021.

Taken together, these current core software markets were expected to represent a combined $23.6 billion market opportunity by 2018 and a combined $44.4 billion market opportunity in the near term.

Traditional custom enterprise software market.In addition to our current core software markets, we believe that our platform better meets certain of the needs that have been historically addressed by manually-developed custom enterprise software, which is expected to represent a $169 billion market in 2018, according to Forrester.

Our internal estimate.Based on approximately 140,000 global companies and government institutions in 2017 in relevant industries and revenue-based size segments, and our industry- and size-specific average annual recurring revenue for customers as of December 31, 2017, we internally estimate our market opportunity to have been approximately $31 billion in 2017. We determined relevant global companies and government institutions by industry and size by referencing certain independent industry data from S&P Global Market Intelligence. We calculated industry- and size-specific average annual recurring revenue as of December 31, 2017 by adding the aggregate annual recurring revenue from all existing customers within each industry and size segment and dividing the total by the number of our existing customers in each industry and size segment.

Our Platform

With our platform, organizations can rapidly and easily design, build and implement powerful, enterprise-grade custom applications through our intuitive, visual interface, with little or no coding required. We also enable organizations to easily modify and enhance applications and automatically disseminate these updates across device types to ensure that all users benefit from the most up-to-date functionality. Through the speed and power of our platform, organizations can make their digital transformations happen more effectively and efficiently than could be achieved through building an application with Java or other standard programming languages. We believe that developing applications can be as simple as drawing a picture.

Sources: **Gartner, Magic Quadrant for Intelligent Business Process Management Suites, Rob Dunie et al, 24 October 2017 and *Gartner, Forecast: Enterprise Software Markets, Worldwide, 2014-2014, 4Q17 Update, Hai Hong Swinehart et al, 15 December 2017.

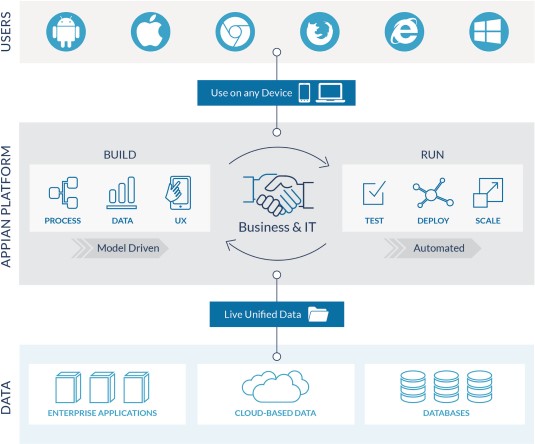

At the core of our platform is an advanced engine that enables the modeling, modification and management of complex processes and business rules. Our heritage as a BPM company provides us with this differentiated understanding of complex processes, and we have incorporated that expertise into our platform to enable the development of powerful applications. The following graphic shows our architecture:

We believe that the key elements of our technology infrastructure are as follows:

Web-Based Development Environment

The Appian design interface is a model-driven, web-based development environment for application creation, testing, deployment and performance optimization. Appian design is a shared repository of all Appian components—interfaces, process models, APIs, new component builders and user collaboration modules—and administration utilities for managing people, processes and data.

The Appian design repository incorporates best practices and years of lessons learned from digital transformation initiatives. Common development operations tasks require just a few clicks and can be automated for hands-off deployment. Dramatic improvements in developer productivity can be achieved through user-friendly capabilities such as fast impact analysis of all changes; auto-updating applications and components when data types change; and live views of interfaces under development.

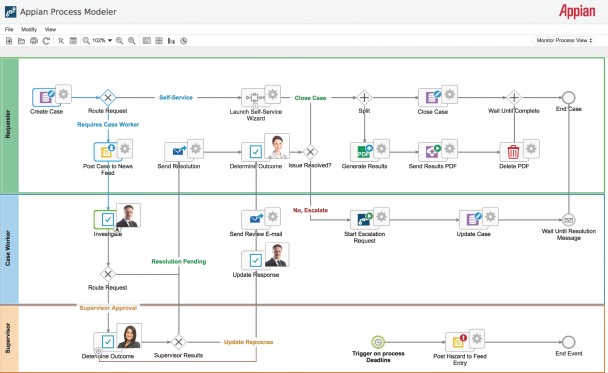

Appian design guides developers through the necessary steps to create the foundation elements of reusable interfaces, records and business processes, while providing all the power that developers need to design, build and implement enterprise systems at scale. The following graphic shows our process modeler.

Organizations have used our platform to launch new business lines, build large procurement systems, manage retail store layouts, conduct predictive maintenance on field equipment and manage trading platforms, among a range of other use cases. For example, the Defense Information Systems Agency utilizes our platform to manage its large and complex procurement organization, having processed over 150,000 contract negotiation correspondences and nearly $3.5 billion worth of contract value on our platform since 2009.

Our Patented SAIL Technology

SAIL is our patented technology that allows developers to create dynamic and responsive web and native-mobile user interfaces through a “create once, deploy everywhere” architecture. SAIL interfaces only need to be created once and SAIL automatically assembles customer applications for optimal viewing on each device type, including desktop web browsers, tablets and mobile phones, and each device operating system, including iOS and different permutations of Android. SAIL leverages native functionality inherent across a myriad of devices and operating systems to ensure the consistency of experience and optimal performance levels that users expect. Updates to applications developed with SAIL are automatically disseminated across device types to ensure that all users benefit from the most up-to-date functionality. This approach enables enterprise mobility without the extensive time and resources that other development approaches require. The following graphic shows how our end-user interface appears across different devices.

We believe that SAIL provides a significant advantage over other platforms that both require extensive customization for various devices at the time of the creation of the new applications and on an on-going basis as mobile device manufacturers continue to update their software and capabilities. Further, in regulated industries, each traditional custom software application must generally undergo its own security assessment and accreditation process, while applications created with SAIL are designed to be compliant with stringent security and numerous rigorous regulatory requirements.

Unified Data

Appian Records is an advanced data management technology that allows end users to discover and unite enterprise data into a single searchable environment, providing a comprehensive view of an organization’s data. In contrast to typical enterprise software, our platform does not require that data reside within it in order to enable robust data analysis and cross-department and cross-application insight. Using standard database software and service connection frameworks, including APIs, our platform seamlessly integrates with many of the most popular enterprise software applications and data repositories and can be used within many legacy environments. Users simply need to assign a name to a given topic and then decide which existing data sources within the enterprise they want to capture. Users can categorize important information by business topic, not just by where that information resides, thereby allowing organizations to unify their data and their processes and effectively access information buried in existing systems. For example, a Record for “Customer A” might bring together data from customer relationship management, accounting and customer support systems to give users a complete view of the customer in their organization. In addition to the benefits of having an immediate snapshot of all centralized data relating to the customer, product, employee or service request. Records also allows organizations to analyze the end-to-end journeys of any given person, entity or asset. Once the connections are established, users may navigate, analyze, collaborate and take action on data from our intuitive dashboards and interactive reports.

Unified End User Interfaces

Our end user interfaces enable end users to discover data, collaborate with other end users and participate in process actions. The end user experience begins with a news feed that allows end users to monitor key events from processes, systems and other end users, providing a unified view of all applications and activity in one place. End users can collaborate with others, obtain status updates, send direct and secure messages and create social tasks for other end users. Our activity stream is designed to be intuitive for end users familiar with popular consumer social interfaces, allowing them to instantly track important events and occurrences and collaborate with little to no training. We also enforce company security policies, so end users can confidently collaborate without fear of compromising regulatory compliance. Our end user interfaces solve the problem of information silos, allowing organizations to respond to constituent feedback in real time by uniting the right team with the right information.

At the same time, our platform provides transparency, visibility and control across all of our applications through a dynamic and powerfully flexible tasking environment. We provide detailed tracking of all human process tasks on our platform, including when tasks have been assigned, addressed and completed by any user. Business Activity Monitoring reports display real-time enterprise performance, bottleneck detection and process optimization while scaling to millions of tasks.

Deployment Flexibility In the Cloud or On-Premises

Our platform can be deployed in the cloud, on-premises or using a hybrid approach, with organizations able to access the same functionality and data sources in all cases. Our flexible deployment model also enables organizations not yet ready to move their most sensitive workloads to the cloud to deploy our platform in an on-premises or hybrid manner while preserving a path to potential future cloud deployments.

Technology

We designed our platform to support large global enterprises and government organizations at scale, in the cloud, on-premises and through a hybrid or private cloud approach. We designed, deploy and manage our platform with the goal of it being a “joy to use” for both developers and users of applications.

Our customers build powerful and unique applications using our proprietary and patented SAIL technology, which we also use ourselves to develop features of our platform. We also employ cutting-edge React technology for building web and mobile user interfaces. We use third-party proprietary database and database language technology licensed from Kx Systems, Inc., or Kx, to power the high-performance in-memory database of our platform. Under our agreement with Kx, we are permitted to distribute Kx’s software as a component part of our software platform as well as to host Kx’s software on behalf of our customers through our cloud offering. Our agreement requires Kx to provide maintenance directly to us on the software we license as long as it provides maintenance to any other customers. We pay a variable license fee based on the number of applications built by our customers, subject to an overall cap on payment. We have paid Kx the overall license fee cap in each

of the last five years. We may maintain the contract as long as we pay maintenance fees. Kx may terminate the agreement if we materially breach the agreement, become insolvent, make an assignment for the benefit of creditors, or if a bankruptcy proceeding is initiated against us. Unless we fail to pay amounts due under the contract or violate certain of Kx’s intellectual property rights, Kx may not terminate the agreement until either it has successfully litigated a breach action or six months, whichever is earlier.

Our cloud offering is hosted by Amazon Web Services and is available in more than 33 availability zones in eight countries. Data in our cloud offering is written simultaneously to multiple availability zones to protect against loss of customer data. Our software also is able to run in the Microsoft Azure cloud as of the third quarter of 2017. Our enablement of the Microsoft Azure cloud is consistent with our principle of platform neutrality.

Our platform can be deployed in the cloud, on-premises or using a hybrid approach, with organizations able to access the same functionality and data sources in all cases. Further, customers choosing to install our platform on-premises or using a hybrid approach can do so in a flexible manner. We have also implemented a wide set of technical, physical and personnel-based security controls designed to protect against the compromise of confidential data that belongs to both our customers and us.

Professional Services

Since inception, we have invested in our professional services organization to help ensure that customers are able to deploy and adopt our platform. More recently, we have expanded our professional services partner network to further support our customers. We believe our investment in professional services, as well as efforts by partners to build their practices around Appian, will drive increased adoption of our platform.

When we first acquire a new customer, our professional services experts or our deployment partners’ professional services experts start the implementation process, which typically takes several weeks. Delivery specialists facilitate deployment of our platform and training personnel provide comprehensive support throughout the implementation process. Customers have access to our Appian Academy, which caters to a diverse range of skill sets and roles within organizations and trains developers on our platform. We also provide instructor-led courses at our Reston, Virginia headquarters and certain of our other offices, as well as virtual classrooms for self-paced learning and on-site training at our customers’ offices.

Once our customers have deployed and implemented our platform, our Appian Architects review our customers’ programs and applications to find potential issues and provide recommendations on best practice. Our professional services team also assists customers by building applications on our platform for them.

Over time, we expect professional services revenue as a percentage of total revenue to decline as we increasingly rely on strategic partners to help our customers deploy our software.

Customer Support

Our customer support personnel are trained engineers and designers who can work with customers on the front lines to address support issues. We provide email and phone support, with teams in the United States, the United Kingdom and Australia. Developers can also find answers to their questions on the Appian Forum, a community site that provides online customer support; real-time collaboration and networking; a growing knowledge base of answers for common questions; and live product webinars and training. The Appian Forum also includes documentation, methodologies and reusable components for our platform. We have consistently been able to achieve at least a 98% customer satisfaction rating for our customer support organization, based on our surveys.

Our Customers

Our customers operate in a variety of industries, including financial services, government, education, technology, media and telecom, consumer, healthcare and industrials. As of December 31, 2017, we had 356 customers in a wide variety of industries, of which 285 customers were commercial and 71 customers were government or non-commercial entities. Our customers include financial services, healthcare, government, telecommunications, media, energy, manufacturing and transportation organizations. Our number of customers paying us in excess of $1 million of annual recurring revenue has grown from 19 at the end of 2016 to 24 at the end of 2017. As of December 31, 2017, 29% of our commercial customers were Global 2000 organizations and included 44 Fortune 500 companies. Generally, our sales force targets its efforts to organizations with over 2,000 employees and $2 billion in annual revenue. No single end-customer accounted for more than 10% of our total revenue in 2017, 2016 or 2015. Some of our representative customers by sector include the following:

Culture and Employees

We believe that fostering our distinct culture of innovation is an important contributor to our success as a company. When we started Appian, we used to debate about everything. It was second nature since half the founding team had been competitive debaters in college. Debate proved to be a great way to reach the best decisions. Bad ideas couldn’t survive; good ideas got better. We encourage everyone to speak up, but we also delegate every decision to a single person. So we can disagree, and we still reach firm resolutions.

We strive to hire the most talented individuals, from top universities and from industry, with an eye towards intelligence, passion and personal generosity. We place those individuals within small, agile teams to maximize their autonomy, creativity and collaboration. That may be why we’ve been named a top workplace by The Washington Post for four years running.

We started the business as a bootstrap, in the midst of a venture capital boom. We did it because we believe in self-reliance. Paying for our own expenses has made us stronger. A commitment to financial self-sufficiency is woven into our DNA.

Appian is an open, transparent, and data-rich environment because we run Appian on Appian software. We have approximately 100 applications internal to Appian that run on Appian including everything from cloud operations to pipeline management to free-food alerts. As our own best customer, we get to know our platform deeply, and we can improve it faster.

Our culture was purposefully created by our four founders, who are still heavily involved in operating the business, including recruiting, interviewing and educating all new employees at Appian. Our founders, led by Matt Calkins, our Chief Executive Officer, have intentionally grown our business organically, focusing on developing a single solution—the Appian platform. We do so employing a unified development team located in a single office in the Washington, D.C. metropolitan area to maximize the cohesion and simplicity of our platform and our company. When a client buys Appian software, they get a piece of Appian culture along with it.

As of December 31, 2017, we had 705 full-time employees in the United States and 154 full-time employees internationally. During 2017, we had a voluntary attrition rate of 11% among all employees of our company. We believe that this low voluntary attrition rate is a testament to our company culture. None of our U.S. employees are covered by collective bargaining agreements. We believe our employee relations are good and we have not experienced any work stoppages.

Our Competition

Our main competitors fall into three categories: (1) providers of low-code development platforms, such as salesforce.com and ServiceNow; (2) providers of business process management and case management software, such as IBM, OpenText, Oracle, Pegasystems and SAP; and (3) providers of custom software and customer software solutions that address, or are developed to address, some of the use cases that can be addressed by applications developed on our platform.

As our market grows, we expect that it will attract more highly specialized vendors as well as larger vendors that may continue to acquire or bundle their products more effectively. The principal competitive factors in our market include:

platform features, reliability, performance and effectiveness;

ease of use and speed;

platform extensibility and ability to integrate with other technology infrastructures;

deployment flexibility;

robustness of professional services and customer support;

price and total cost of ownership;

strength of platform security and adherence to industry standards and certifications;

strength of sales and marketing efforts; and

brand awareness and reputation.

We believe we generally compete favorably with our competitors with respect to the features and performance of our platform, the ease of integration of our applications and the relatively low total cost of ownership of our applications. However, many of our competitors have substantially greater financial, technical and other resources, greater name recognition, larger sales and marketing budgets, broader distribution, more diversified product lines and larger and more mature intellectual property portfolios.

Backlog

Backlog represents future amounts to be invoiced and recognized under subscription agreements. As of December 31, 2017 and 2016, we had backlog of approximately $214 million and $167 million, respectively. Approximately 58% of our backlog as of December 31, 2017 is not expected to be filled in 2018.

We expect that the amount of backlog relative to the total value of our contracts will change from quarter to quarter and year to year for several reasons, including the specific timing and duration of large customer subscription agreements, the specific timing of customer renewals, changes in customer financial circumstances and foreign currency fluctuations.

We often sign multiple-year subscription agreements, the length in years of which may vary widely. Backlog may vary based on changes in the average non-cancellable term of subscription agreements. The change in backlog that results from changes in the average non-cancellable term of subscription agreements may not be an indicator of the likelihood of renewal or expected future revenue. Accordingly, we believe that fluctuations in backlog are not a reliable indicator of future revenue, and we do not utilize backlog as a key management metric internally.

Seasonality

We have historically experienced seasonality in terms of when we enter into agreements with customers. We typically enter into a significantly higher percentage of agreements with new customers, as well as renewal agreements with existing customers, in the fourth quarter and, to a lesser extent, the second quarter. The increase in customer agreements for the fourth quarter is attributable to large enterprise account buying patterns typical in the software industry. Furthermore, we usually enter into a significant portion of agreements with customers during the last month, and often the last two weeks, of each quarter. However, we recognize substantially all of our revenue ratably over the terms of our subscription agreements, which generally occurs over a one to five-year period. As a result, a substantial portion of the revenue that we report in each period will be derived from the recognition of deferred revenue relating to agreements entered into during previous periods. Consequently, a decline in new sales or renewals in any one period may not be immediately reflected in our revenue results for that period. This

decline, however, will negatively affect our revenue in future periods. Accordingly, the effect of significant downturns in sales and market acceptance of our platform and potential changes in our rate of renewals may not be fully reflected in our results of operations until future periods.

Financial Information About Segments and Geographic Areas

We consider our business activities to constitute a single segment.For information regarding our revenue by geographic area and long-lived assets by geographic area, please refer to Note 12 in the notes to our consolidated financial statements included elsewhere in this Annual Report on Form 10-K. For financial information about our segment, please refer to the section entitled “Management's Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of Part II and to our consolidated financial statements and the related notes thereto included elsewhere in this Annual Report on Form 10-K. For information regarding risks associated with our international operations, please refer to the section entitled “Risk Factors” in Item 1A of Part I in this Annual Report on Form 10-K.

Sales and Marketing

Sales

Our sales organization is responsible for account acquisition and overall market development, which includes the management of the relationships with our customers. While our platform is industry-agnostic, we have recently made, and plan to continue to make, investments to enhance the expertise of our sales organization within our core industry verticals of financial services, healthcare and government. We also expect to continue to grow our sales headcount in all of our principal markets and expand our presence into countries where we currently do not have a direct sales presence.

Marketing

Our marketing efforts focus on building our brand reputation and increasing market awareness of our platform. Marketing activities include sponsorship of, and attendance at, trade shows and conferences; our annual Appian World event; social media and advertising programs; management of our corporate web site and partner portal; press outreach; and customer relations.

Research and Development

Our engineering department is responsible for design, development, testing and release of our platform. Our engineering team closely coordinates with our executive management, which is responsible for creating a vision for our platform, and with our professional services and sales teams, which relay customer demands and possible new use cases or enhancements. Our development efforts focus on the critical areas of our platform, including infrastructure, ease-of-use and flexibility, end-user experience and ability to integrate with other enterprise systems. Research and development expense totaled $34.8 million, $23.0 million and $16.8 million for 2017, 2016 and 2015, respectively.

Intellectual Property

Our success depends in part upon our ability to protect our core technology and intellectual property. We rely on patents, trademarks, copyrights, and trade secret laws, confidentiality procedures, and employee disclosure and invention assignment agreements to protect our intellectual property rights.

As of December 31, 2017,2023, we had two issued16 granted patents relatingand nine patents pending related to our SAIL technologyplatform and two patent applications pending in the United States relating to our platform. Bothits technology. None of our issued patents expire inbefore 2034. We cannot assure youprovide complete assurance that any of our

patent applications will result in the issuance of a patent or that the examination process will not require us to narrow our claims. Any patents thatwe may issuebe issued may be contested, circumvented, found unenforceable, or invalidated, and we may not be able to prevent third parties from infringing them. We also license software from third parties for integration into our products, including open source software and other software available on commercially reasonable terms. We control access to and use of our proprietary software and other confidential information through the use of internal and external controls, including contractual protections with employees, contractors, end-customersend customers, and partners, and our software is protected by U.S. and international copyright and trade secret laws. Despite our efforts to protect our trade secrets and proprietary rights through intellectual property rights, licenses, and confidentiality agreements, unauthorized parties may still copy or otherwise obtain and use our software and technology. In addition, we intend to expand our international operations, and effective patent, copyright, trademark, and trade secret protection may not be available or may be limited in foreign countries.

Facilities

We have offices in four U.S. cities and 11 cities outside the United States. Our headquarters are located in Reston, Virginia. We believe that our current facilities are adequate to meet our ongoing needs, and that, if we require additional space, we will be able to obtain additional facilities on commercially reasonable terms.

Corporate Information Appian Corporation was incorporated under the laws of the State of Delaware in August 1999.

Our principal executive offices are located at 11955 Democracy Drive, Suite 1700, Reston, Virginia 20190. Our telephone number is (703) 442-8844. We completed our initial public offering in May 2017 and our Class A common stock is listed on Thethe Nasdaq Global Market under the symbol "APPN".“APPN.”

Our corporate headquarters is located at 7950 Jones Branch Drive, McLean, Virginia 22102, and our telephone number is (703) 442-8844.

“Appian”,Appian,” the Appian logo, and other trademarks or service marks of Appian Corporation appearing in this Annual Report on Form 10-K are the property of Appian Corporation. This AnnulAnnual Report on Form10-KForm 10-K contains additional trade names, trademarks, and service marks of others, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this Annual Report on Form 10-K may appear withoutexclude the ® or ™TM symbols.

Available Information