INDEX

| Page | |||

| PART I | |||

| Item 1. | |||

| Item 1A. | |||

| Item 1B. | |||

| Item 2. | |||

| Item 3. | |||

| Item 4. | |||

| PART II | |||

| Item 5. | |||

| Item 6. | |||

| Item 7. | |||

| Item 7A. | |||

| Item 8. | |||

| Item 9. | |||

| Item 9A. | |||

| Item 9B. | |||

| PART III | |||

| Item 10. | |||

| Item 11. | |||

| Item 12. | |||

| Item 13. | |||

| Item 14. | |||

| PART IV | |||

| Item 15. | |||

| Item 16. | |||

| Exhibit | |||

| Exhibit | |||

| Exhibit 21.1 | |||

| Exhibit 23.1 | |||

| Exhibit 31.1 | |||

| Exhibit 31.2 | |||

| Exhibit 32.1 | |||

Unless the context otherwise indicates or requires, as used in this annual report on Form 10-K, references to “we,” “us,” “our” or the “Company” refer to Verisk Analytics, Inc. and its subsidiaries.

In this annual report on Form 10-K, all dollar amounts are expressed in thousands,millions, unless indicated otherwise.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Verisk Analytics, Inc., or Verisk, has made statements under the captions “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and in other sections of this annual report on Form 10-K that are forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance, our anticipated growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including those factors discussed under the caption entitled “Risk Factors.” You should specifically consider the numerous risks outlined under “Risk Factors.”

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. We are under no duty to update any of these forward-looking statements after the date of this annual report on Form 10-K to conform our prior statements to actual results or revised expectations.

PART I

| Item 1. | Business |

Our Company

Verisk Analytics Inc. is a leading data analytics provider of information about risk to professionalsserving customers in insurance, healthcare,natural resources and financial services, government, supply chain, and risk management.services. Using advanced technologies to collect and analyze billions of records, we draw on industryunique data assets and deep domain expertise and unique proprietary data sets to provide innovations that may be integrated into customer workflows. We offer predictive analytics and decision-supportdecision support solutions to customers in fraud prevention, actuarial science, insurance coverages, fire protection,rating, underwriting, claims, catastrophe and weather risk, profitability optimization, data management,natural resources intelligence, economic forecasting, and many other fields. In the United States, or U.S., and around the world, we help customers protect people, property, and financial assets.

Our customers use our solutions to make better decisions about risk and opportunities with greater efficiency and discipline. We refer to these products and services as ‘solutions’solutions due to the integration among our services and the flexibility that enables our customers to purchase components or thea comprehensive package. These ‘solutions’solutions take various forms, including data, expert insight, statistical models orand tailored analytics all designed to allow our clientscustomers to make more logical decisions. We believe our solutions for analyzing risk positively impact our customers’ revenues and help them better manage their costs. In 2013,2016, our customers included all of the top 100 property and casualty, or P&C, insurance providers in the U.S. for the lines of P&C services we offer, our customers included alland 28 of the top 100 P&C insurance providers in the U.S., 24 of the top 2530 credit card issuers in North America, andthe United Kingdom and Australia, as well as 98 of the top 10 health planglobal energy providers inaround the U.S.world. We also work with a wide range of companies, governments and institutions across the energy, and metals and mining value chains. We believe that our commitment to our customers and the embedded nature of our solutions serve to strengthen and extend our relationships.

We help thosebelieve that Verisk is uniquely positioned because of the set of distinctives or competitive advantages we cultivate and continue to expand. Our existing businesses, addressin addition to new product innovations, integrate the following four singular qualities into the foundation of our strategy.

Our Distinctives

•Unique Data Assets - Data is at the core of what we believe are the four primary decision making processes essentialdo. We use our proprietary data assets to develop predictive analytics and transformative models for managingour customers.

•Deep Domain Expertise - We have specialized and in-depth knowledge in a number of defined vertical markets, including insurance, healthcare, energy, financial services, and risk as set forth belowmanagement. We understand that different verticals require different approaches, and our deep domain expertise adds value to our analytics in the Verisk Risk Analysis Framework:markets we serve.

We offer our solutions and services primarily through annual subscriptions or long-term agreements, which are typically pre-paid and represented approximately 73.6%over 80% of our revenues in 2013.2016. For the year ended December 31, 2013,2016, we had revenues of $1,595.7$1,995.2 million and net income of $348.4$591.2 million. For the five year period ended December 31, 2013,2016, our revenues and net income grew at a compound annual growth rate, or CAGR, of 15.1%13.9% and 28.8%15.8%, respectively.

Our History

We trace our history to 1971, when Insurance Services Office, Inc., or ISO, started operations as a not-for-profit advisory and rating organization providing services forto the U.S. P&C insurance industry. ISO was formed as an association of insurance companies to gather statistical data and other information from insurers and report to regulators, as required by law. ISO’s original functions also included developing programs to help insurers define and manage insurance products and providing information to help insurers determine their own independent premium rates. Insurers used and continue to use our offerings primarily in their product development, underwriting and rating functions. Today, those businesses form the core of our Risk Assessment segment.

Over the past decade,two decades, we have transformed our business beyond its original functions by deepening and broadening our data assets, developing a set of integrated risk management solutions and services and addressing new markets through our Decision Analytics segment. markets.

Our expansion into analytics began when we acquired the American Insurance Services Group, or AISG, and certain operations and assets of the National Insurance Crime Bureau in 1997 and 1998, respectively. Those organizations brought to the company large databases of insurance claims, as well as expertise in detecting and preventing claims fraud. To further expand our Decision Analytics segment,business, in 2002, we acquired AIR Worldwide, or AIR, in 2002, the technological leader in catastrophe modeling. In 2004, we entered the healthcare space by acquiring several businesses that now offer web-based analytical and reporting systems for health insurers, provider organizations and self-insured employers. In 2005, we entered the mortgage sector, acquiring the first of several businesses that now provide automated fraud detection, compliance and decision support solutions for the U.S. mortgage industry. In 2006, to bolster our position in the insurance claims field we acquired Xactware, a leading supplier of estimatingestimation software for professionals involved in building repair and reconstruction. In 2010, we acquired 3E Company, creating a scale presence in supply chain and environmental health and safety. In 2011 and 2012, we further bolstered our healthcare solutions by acquiring Health Risk Partners, LLC, or HRP, which provides solutions to optimize revenue, improve compliance and improve quality of care for Medicare Advantage health plans and MediConnect Global, Inc. or MediConnect, which provides medical record retrieval, digitization, coding, extraction, and analysis to the healthcare and property casualty industry. Also in 2012, we acquired Argus Information & Advisory Services, LLC, or Argus, to expand our global presence in providing information, competitive benchmarking, analytics, and customized services to financial institutions in the payments space globally.space. In 2015, we acquired Wood Mackenzie Limited, or Wood Mackenzie, to advance our strategy to expand internationally and position us in the global energy market.

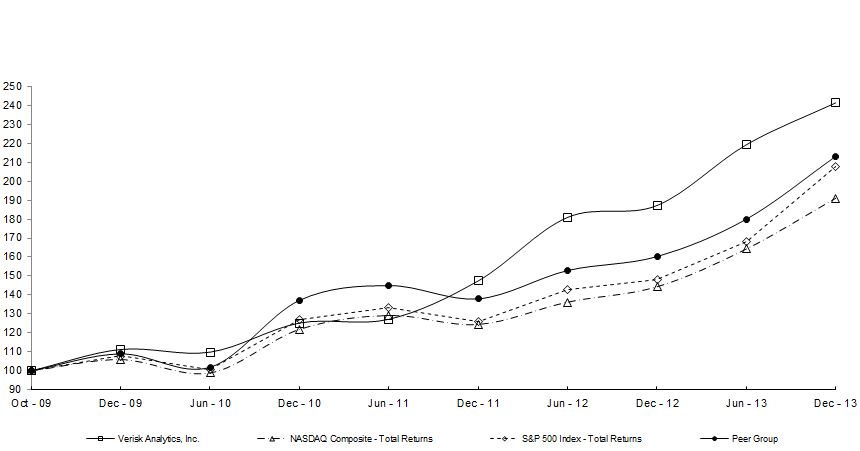

On May 23, 2008, in contemplation of our initial public offering, or IPO, ISO formed Verisk Analytics, Inc., or Verisk, a Delaware corporation, to be the holding company for our business. Verisk was initially formed as a wholly-owned subsidiary of ISO. On October 6, 2009, in connection with our IPO, the Company effected a reorganization whereby ISO became a wholly-owned subsidiary of Verisk. Verisk Class A common stock began trading on the NASDAQ Global Select Market on October 7, 2009, under the symbol “VRSK.”

Segments

We organize our business in two segments: Risk Assessment and Decision Analytics. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II of this annual report for additional information regarding our segments. See Note 18 of our consolidated financial statements included in this annual report on Form 10-K for further information.

Risk Assessment Segment

Our Risk Assessment segment serves our P&C insurance customers and focuses on the first two decision making processes in our Risk Analysis Framework: prediction of loss, and selection and pricing of risk. Within this segment, we also provide solutions to help our insurance customers complyrisk, and compliance with their reporting requirements in each U.S. state in which they operate. Our customers include most of the P&C insurance providers in the U.S. In recent years we have expanded our offerings to also serve certain non-U.S. markets.

Industry-Standard Insurance Programs

We are the recognized leader in the U.S. for industry-standard insurance programs that help P&C insurers define coverages and issue policies. We provide policy language, prospective loss costs, policy writing rules, and a variety of other solutions for 26 lines of insurance. Our policy language, prospective loss cost information and policy writing rules can serve as integrated turnkey insurance programs for our customers. Insurance companies need to ensure that their policy language, rules, and rates comply with all applicable legal and regulatory requirements. Insurers must also make sure their policies remain competitive by promptly changing coverages in response to changes in statutes or case law. To meet their needs, we process approximately 2,400 regulatory filings and interface with state regulators in all 50 states plus the District of Columbia, Guam, Puerto Rico and the Virgin Islands in excess of 3,000 filings each year ensuringto ensure smooth implementation of our rules and forms. When insurers choose to develop their own alternative programs, our industry-standard insurance programs also help regulators make sureensure that such insurers’ policies meet basic coverage requirements.

Standardized coverage language, which has been tested in litigation and tailored to reflect judicial interpretation, helps to ensure consistent treatment of claimants. As a result, our industry-standard language also simplifies claim settlements and can reduce the occurrence of costly litigation, because our language causes the meaning of coverage terminology to become established and known. Our policy language includes standard coverage language, endorsements and policy writing support language that assist our customers in understanding the risks they assume and the coverages they are offering.offer. With these policy programs, insurers also benefit from economies of scale. We have over 200more than 120 specialized lawyers and insurance experts reviewing changes in each state’s insurance rules and regulations, including onan average over 14,000of more than 16,500 legislative bills, 1,3006,100 regulatory actions and 2,000 court cases per year, to make any required changes to our policy language and rating information.

To cover the wide variety of risks in the marketplace, we offer a broad range of policy programs. For example, in the homeowner’shomeowners line of insurance, we maintain policy language and rules for 6 basic coverages, 250289 national endorsements, and 548601 state-specific endorsements. Overall, we provide policy language, prospective loss costs, policy writing rules, and a variety of other solutions for 26 lines of insurance.

The P&C insurance industry is heavily regulated in the U.S. P&C insurers are required to collect statistical data about their premiums and losses and to report that data to regulators in every state in which they operate. Our statistical agent services have enabled P&C insurers to meet thesethose regulatory requirements for over 40more than 45 years. We aggregate the data, and as a licensed or appointed “statistical agent” in all 50 states, Puerto Rico, and the District of Columbia, we report thesethose statistics to insurance regulators. We are able to capture significant economies of scale given the level of penetration of this service within the U.S. P&C insurance industry.

To provide our customers and the regulators the information they require, we maintain one of the largest private databases in the world. Over the past four decades, we have developed core expertise in acquiring, processing, managing, and operating large and comprehensive databases that are the foundation of our Risk Assessment segment. We use our proprietary technology to assemble, organize and update vast amounts of detailed information submitted by our customers. We supplement this data with publicly available information.

Each year, P&C insurers send us approximately 2.93.5 billion detailed individual records of insurance transactions, such as insurance premiums collected or losses incurred. We maintain a database of over 17.3more than 20.0 billion statistical records, including approximately 7.08.2 billion commercial lines records and approximately 10.311.8 billion personal lines records. We collect unit-transactionunit transaction detail of each premium and loss record, which enhances the validity, reliability and accuracy of our data sets and our actuarial analyses. Our proprietary quality process includes almost 2,500more than 2,800 separate checks to ensure that the data meetmeets our high standards of quality.

We provide actuarial services to help our customers analyze and price their risks. Using our large database of premium and loss data, our actuaries are able to perform sophisticated analyses using our predictive models and analytic methods to help our P&C insurance customers with pricing, loss reserving, and marketing. We distribute a number of actuarial solutions and offer

flexible services to meet our customers’ needs. In addition, our actuarial consultants provide customized services for our clientscustomers that include assisting them with the development of independent insurance programs, analysis of their own underwriting experience, development of classification systems and rating plans, and a wide variety of other business decisions. We also supply information to a wide variety of customers in other markets including reinsurance and government agencies.

We project customers' future losses and loss expenses utilizingusing a broad set of data. TheseThose projections tend to be more reliable than if our customers used solely their own data.data exclusively. We make a number of actuarial adjustments before the data is used to estimate future costs. Our customers can use our estimates of future costs in making independent decisions about the prices charged for their policies. For most P&C insurers, in most lines of business, we believe our estimates of future costs are an essential input to rating decisions. Our actuarial products and services are also used to create the analytics underlying our industry-standard insurance programs described above.

By building on our insurance industry expertise and recent acquisitions, we have expanded our solution set to serve customers in certain non-U.S. markets.

Property-Specific Rating and Underwriting Information

We gather information on individual properties and communities so that insurers can use our information to evaluate and price personal and commercial property insurance, as well as business owners, or BOP, commercial auto and general liability insurance.insurance, and workers compensation coverages. Our property-specific rating and underwriting information allow our customers to understand, quantify, underwrite, mitigate, and avoid potential loss for residential andto commercial properties. Our databaseProMetrix operating platform contains business and risk information on 26 million entities, loss costs and other vital information on more than 3.53.7 million commercial buildings in the United StatesU.S. and also holds information on more than 6.26.5 million individual businesses occupying those buildings. We have a staff of more thanapproximately 600 field representatives strategically located around the United StatesU.S. who observe and report on conditions at commercial and residential properties, evaluate community fire-protection capabilities and assess the effectiveness of municipal building-code enforcement. Each year, our field staff visits more than over 325,000285,000 commercial properties to collect information on new buildings and verify building attributes.

We also provide proprietary analytic measures of the ability offor individual communities to mitigate losses from important perils. Nearly every property insurer in the U.S. uses our evaluations of community firefighting capabilities to help determine premiums for fire insurance throughout the country. We provide field-verified and validated data on the fire protection services for more than 47,000approximately 46,000 fire response jurisdictions. We also offer services to evaluate the effectiveness of community enforcement of building codes and the efforts of communities to mitigate damage from flooding. Further, we provide information on the insurance rating territories, premium taxes, crime risk, and hazards of windstorm, earthquake, wildfire, and other perils. To supplement our data on specific commercial properties and individual communities, we have assembled, from a variety of internal and select third-party sources, information on hazards related to geographic locations representing every postal address in the U.S. Insurers use this information not only for policy quoting but also forand analyzing risk concentration in geographical

areas. We also make our data and analytics available to commercial real estate lenders to allow them to better understand risks associated with peopleproperties they lend against.

We have begun to expand our footprint of data and solutions to include both U.S. and international markets.

Decision Analytics Segment

In the Decision Analytics segment, we support all four phases of our Risk Analysis Framework. We develop predictive models to forecast scenarios and produce both standard and customized analytics that help our customers better predictmanage their businesses, including predicting loss, selectselecting and pricepricing risk, detectdetecting fraud before and after a loss event, and quantifyquantifying losses. TheOur businesses in this segment are categorized by the primary vertical end market for their services.

Insurance

Our insurance solutions which operate both beforeprovide our customers analytics in the areas of fraud detection, catastrophe modeling, loss estimation, and after loss events.

We are a leading provider of fraud-detection tools for the P&C insurance industry. Our fraudanti-fraud solutions improve our customers’ profitability by both predicting the likelihood that fraud is occurring and detecting suspicious activity after it has occurred. When a claim is submitted, our system searches our database and returns information about other claims filed by the same individuals or businesses (either as claimants or insurers) which, that helps our customers determine if fraud has occurred. The system searches for matches in identifying informationinformational fields, such as name, address, Social Security number, vehicle identification number, driver’s license number, tax identification number, or other parties to the loss. Our system also includes advanced name and address searching to perform intelligent searches and improve the overall quality of the matches. Information from match reports speeds payment of meritorious claims while providing a defense against fraud and can lead to denial of a claim, negotiation of a reduced award, or further investigation by the insurer or law enforcement.

We have a comprehensive system used by claims adjusters and investigations professionals to process claims and fight fraud. Claims databases are one of the key tools in the fight against insurance fraud. The benefits of a single all-claims database include improved efficiency in reporting data and searching for information, enhanced capabilities for detecting suspicious claims and superior information for investigating fraudulent claims, suspicious individuals, and possible fraud rings. Our database contains information on approximately 921 million1.1 billion claims and is the world’s largest database of P&C claims information used for claims and investigations. Insurers and other participants submit new claims , more than 210,000200,000 a day on average across all categories of the U.S. P&C insurance industry.

We also provide an expert scoring system that helps distinguish between suspicious and meritorious claims;claims, and products that use link-analysislink analysis technology to help visualize and fight insurance fraud.

We are also a leader in and pioneered the field of probabilistic catastrophe modeling used by insurers, reinsurers and financial institutions to manage their catastrophe risk. Our models of global natural hazards, which form the basis of our solutions, enable companies to identify, quantify and plan for the financial consequences of catastrophic events. We have developed models, covering natural hazards, including hurricanes, earthquakes, winter storms, tornadoes, hailstorms, and flood,floods, for potential loss events in more than 90 countries.100 countries, as well as pandemics worldwide. We have also developed and introduced a probabilistic terrorism model capable of quantifying the risk in the U.S. from this emerging threat, which supports pricing and underwriting decisions down to the level of an individual policy. Our newest model also addresses cyber losses.

We also provide data, analyticanalytics and networking products for professionals involved in estimating all phases of building repair and reconstruction. We provide solutions for every phase of a building’s life, including:

quantifying the ultimate cost of repair or reconstruction of damaged or destroyed buildings;buildings,

aiding in the settlement of insurance claims; andclaims,

tracking the process of repair or reconstruction and facilitating communication among insurers, adjusters, contractors, and policyholders.

To help our customers estimate repair costs, we provide a solution that assists contractors and insurance adjusters to estimatein estimating repairs using a patented plan-sketching program. The program allows our customers to sketch floor plans, roof plans

and wall-framing plans and automatically calculates material and labor quantities for the construction of walls, floors, footings, and roofs.

We also offer our customers access to wholesale and retail price lists, which include structural repair and restoration pricing for 467468 separate economic areas in North America. We revise this information monthly, and, in the aftermath of a major disaster, we can update the price lists as often as weekly to reflect rapid price changes. Our structural repair and cleaning database contains more than 17,000approximately 21,000 unit-cost line items. For each line item such as smoke cleaning, water extraction and hazardous cleanup, we report time and material pricing, including labor, labor productivity rates (for new construction and restoration), labor burden and overhead, material costs, and equipment costs. We improve our reported pricing data by several methods including direct market surveys and an analysis of the actual claims experienceexperiences of our customers. We estimate that about 80% of insurance repair contractors and service providers in the U.S. and Canada with computerized estimating systems use our building and repair pricing data. UtilizationUse of such a large percentage of the industry’s claims data leads to accurate reporting of pricing information, which we believe is unmatched in the industry.

Our estimates allow our customers to set loss reserves, deploy field adjusters and verify internal company estimates. Our estimates also keep insurers, their customers, regulators, and other interested parties informed about the total costs of disasters. We also provide our customers access to daily reports on severe weather and catastrophes and we maintain a database of information on catastrophe losses in the U.S. sincedating back to 1950.

We also are a leading provider of solutions for the personal underwriting markets, including homeowners and auto lines. We build and maintain widely used, industry-standard tools that assist insurers in underwriting and rating, i.e., measuring and selecting risks and pricing coverage appropriately to ensure fairness to the consumer and a reasonable return for the insurer. Our solutions apply advanced predictive analytics to our deep reservoir of data and information to quickly and precisely gauge the degree and cost of risk.

Our solutions span a wide range of property/casualty insurance, encompassing personal and commercial lines of coverage that protect private residences, private and commercial vehicles, and businesses.

We continually pursue new solutions that help our customers to keep abreast of changing markets and technology. For example, we provide tools and platforms to help insurers, their customers, and providers of products and services to leverage the growing “Internet of Things.” This technology connects devices, vehicles, and homes to the Internet and generates valuable data to underwrite, rate, and manage risk while enriching customer relationships. By ingesting, storing, and normalizing this data, Verisk makes it accessible for users to extract business insights at a significantly lower cost and logistical burden than they could achieve on their own.

Financial Services

We focus on providing competitive benchmarking, scoring solutions, analytics, and customized services to financial services institutions in Norththe Americas, Europe, the Middle East, Africa and South AmericaAsia-Pacific. We work with our customers to evaluate current market and Europe.audience selection. We measure the effectiveness of campaigns across the various media and the impact of multi-channel campaigns. We also maintain the most comprehensive de-personalizeddepersonalized direct observation consortiaconsortium data sets for the payments industry. We leverage this consortiaour consortium data and provide proprietary solutions and information that enable clientscustomers to achieve higher profitability and growth through enhanced marketing and risk management decisions. We have deployed unique technology to manage vast data sets efficiently and manage vast amount of payments data. We offer services and a suite of solutions to a clientcustomer base that includes credit and debit card issuers, retail banks and other consumer financial services providers, payment processors, insurance companies, and other industry stakeholders.

Our professionals have substantialsubstantive industry knowledge inabout providing solutions to the financial services sector. We are known for our unique ability to blend the highly technical, data-centered aspects of our projects with expert communication and business knowledge. Our solutions enhance our clients’customers’ ability to manage their businessesbusinesses' profitably and position them better to handle present day challenges (competitive, regulatory, and economic). Specifically, we use comprehensive transaction, risk, behavioral, and bureau-sourced account data to assist clientscustomers in making better business decisions through analysis and analytical solutions. We maintain a comprehensive and granular direct observation financial services industry database for credit card, debit card, and deposit transactions in the industry.transactions.

We are a leading provider of solutionsdata analytics for revenue & quality intelligencethe global energy, chemicals, and compliance for certain aspectsmetals and mining industries. We provide research and consulting services focusing on exploration strategies and screening, asset development and acquisition, commodity markets, and corporate analysis. We offer consultancy in the areas of the healthcare industry.business environment, business improvement, business strategies, commercial advisory, and transaction support. We have systems, including our revenue integrity business, which analyze Medicare data for compliance with CMS (Centers for Medicare & Medicaid Services) guidelines, assist payers in payment integrity, data collection,deliver analysis and encounter data submission. By using our ReconEdge™, a web-based risk adjustment reconciliation system, healthcare payers can assess their organizations’ opportunitiesadvice on assets, companies,

governments, and compliance in payments. In addition, we offer proprietary systemsmarkets. We provide comprehensive and services that facilitate the aggregation, retrieval, coding,integrated coverage and analysis of medical records.relevant commodities across the interconnected global energy sectors. We have gathered proprietary information, insight and analysis on thousands of oil and gas fields, mines, refineries and other assets, as well as detailed assessments of the market fundamentals across each value chain. Our experts analyze the data and work directly with customers to address their business challenges. Our growing customer base includes international and national energy companies, as well as chemicals, and metals and mining companies, financial institutions and governments. We work with a repositoryrange of medical records that are digitized, indexed,diverse teams, from strategy and securely hosted online. We use custom-built, proprietary technologypolicy makers, business developers and market analysts to deliver medical records from facilitiescorporate finance, risk teams and provider locations. Our clients can access the clinical data through a cloud-based workflow management system. We are also a provider of HEDIS® (Healthcare Effectiveness Data and Information Set) software solutions. Our solution suite allows managed care

We help businesses and governments better anticipate and manage climate-andclimate and weather-related risks. We prepare certain agencies and companies to anticipate, manage, react to and profit from weatherclimate and climate relatedweather-related risk. We serve our clientscustomers by providing state-of-the-art research, development and analysis delivered in reports, databases and software solutions. We are dedicated to the advancement of scientific understanding of the atmospheric, climate and weather, ocean, and planetary sciences. Through research conducted by our in-house scientific staff, and often in collaboration with world-renowned scientists at academic and other research institutions, we have developed analytical tools to help measure and observe theenvironmental properties of the environment and to translate thesethose measurements into useful information to take action. In 2013, we formed the Verisk Climate division in response to customers' needs for new solutions to manage enterprise climate and environmental risks.actionable information.

We also offer a comprehensive suite of data and information services that enablesenable improved compliance with global Environmental Health &and Safety, or EH&S, requirements related to the safe manufacturing, distribution, transportation, usage, and disposal of chemicals and products. From the supply chain or solutions lifecycle,life cycle, we deliver a program specific to the EH&S compliance information and management needs of our customers. We have aOur full solutions lifecyclelife cycle and cross-supply chain approach that provideprovides a single, integrated solution for managing customers' EH&S capabilities, resultingwhich results in improved processes, and reduced cost, risk, and liability while improving process.liability.

Our Growth Strategy

Over the past five years, we have grown our revenues at a CAGR of 15.1%13.9% through the successful execution of our business plan. TheseThose results reflect strong organic revenue growth, new product development, and acquisitions. We have made, and continue to make, investments in people, data sets, analytic solutions, technology, and complementary businesses. The key components of our strategy include:include the following:

Increase Solution Penetration with Customers. We expect to expand the application of our solutions in insurance customers’ internal risk and underwriting processes. Building on our deep knowledge of, and embedded position in, the insurance industry,various industries, we expect to sell more solutions to existing customers tailored to individual insurancemarket segments. By increasing the breadth and relevance of our offerings, we believe that we can strengthen our relationships with customers and increase our value to their decision making in critical ways. We also have opportunities to expand solution penetration into our healthinsurance, energy and financial services customers.

Develop New, Proprietary Data Sets and Predictive Analytics. We work with our customers to understand their evolving needs. We plan to create new solutions by enriching our mix of proprietary data sets, analytic solutions and effective decision support across the markets we serve. We constantly seek to add new data sets that can further leverage our analytic methods, technology platforms and intellectual capital.

Leverage Our Intellectual Capital to Expand into Adjacent Markets and New Customer Sectors. Our organization is built on overmore than four decades of intellectual property in risk management. We believe we can continue to profitably expand the use of our intellectual capital profitably and apply our analytic methods in new markets where significant opportunities for long-term growth exist. We also continue to pursue growth through targeted international expansion. We have already demonstrated the effectiveness of this strategy with our expansion into healthcare and non-insurancenon insurance financial services.

Pursue Strategic Acquisitions that Complement Our Leadership Positions. We will continue to expand our data and analytics capabilities across industries. While we expect this will occur primarily through organic growth, we have and will continue to acquire assets and businesses that strengthen our value proposition to customers. We have developed an internal capability to source, evaluate and integrate acquisitions that have created value for shareholders.

Our Customers

Risk Assessment Customers

The customers in our Risk Assessment segment for the lines of P&C services we offer include the top 100 P&C insurance providers in the United States,U.S., as well as insurers in international markets. Our statistical agent services are used by aA substantial majority of P&C insurance providers in the U.S. use our statistical agent services to report to regulators. Our actuarial servicesregulators, and industry-standard insurance programs are used by the majority of insurers and reinsurers in the U.S. use

our actuarial services and industry-standard insurance programs. In addition, certain agencies of the federal government as well as county and state governmental agencies and organizations use our solutions to help satisfy government needs for risk assessment and emergency response information.

Decision Analytics Customers

In the Decision Analytics segment, we provide our P&C insurance solutions to the majority of the P&C insurers in the U.S. Specifically, our claims database serves thousands of customers, representing overmore than 90% of the P&C insurance industry by premium volume, 27 state workers’ compensation insurance funds, 531more than 500 self-insurers, 425more than 400 third-party administrators, several state fraud bureaus, and many law-enforcement agencies involved in the investigation and prosecution of insurance fraud. We estimate that about 80% of insurance repair contractors and service providers in the U.S. and Canada with computerized estimating systems use our building and repair pricing data. In the U.S. healthcare industry, ourOur customers include 9included 28 of the top 10 health plan providers. Our customers included 24 of the top 2530 credit card issuers in North America, the United Kingdom and United Kingdom.Australia, as well as 8 of the top 10 global energy providers around the world. We also work with a wide range of companies, governments and institutions across the energy, and metals and mining value chains.

Our Competitors

We believe no single competitor currently offers the same scope of services and market coverage we provide. The breadth of markets we serve exposes us to a broad range of competitors as described below. Businesses that we acquire may introduce us to additional competitors.

Risk Assessment Competitors

Our Risk Assessment segment operates primarily in the U.S. P&C insurance industry, where we enjoy a leading market presence. We have a number of competitors in specific lines or services.

We encounter competition from a number of sources, including insurers whothat develop internal technology and actuarial methods for proprietary insurance programs. Competitors also include other statistical agents, including the National Independent Statistical Service, the Independent Statistical Service, Inc. and other advisory organizations, providingthat provide underwriting rules, prospective loss costs, and coverage language, such as the American Association of Insurance Services, Inc. and Mutual Services Organization, althoughOrganization. However, we believe none of our competitors hashave the breadth or depth of data we have.

Competitors for our property-specific rating and underwriting information are primarily limited to a number of regional providers of commercial property inspections and surveys, including Overland Solutions, Inc. and Regional Reporting, Inc. We also compete with a variety of organizations that offer consulting services, primarily specialty technology and consulting firms. In addition, a customer may use its own internal resources rather than engage an outside firm for these services. Our competitors also include information technology product and services vendors, management and strategy consulting firms, includingsuch as Deloitte Consulting LLP, and smaller specialized information technology firms and analytical services firms, including Pinnacle Consulting and EMB, a unit of Willis Towers Watson.

Decision Analytics Competitors

In the P&C insurance claims market and catastrophe modeling market, certain products are offered by a number of companies, including Risk Management Solutions (catastrophe modeling) and, CoreLogic (property replacement value), LexisNexis® Risk Solutions (loss histories and motor vehicle records for personal lines underwriting), Decision Insight or MSB (property value and claims estimator), and Solera Holdings, Inc. (personal automobile underwriting)., and Symbility. We believe that our P&C insurance industry expertise, combined with our ability to offer multiple applications, services and integrated solutions to individual customers enhances our competitiveness against these competitors with more limited offerings.are competitive strengths. In the healthcarenatural resources commercial intelligence market, certain products are offered by a number of companies, including Computer Sciences Corporation (evaluation of bodily injuryIHS Markit (natural resources), Rystad Energy (upstream), Global Data PLC (upstream), PIRA Energy Group (oil and workers’ compensation claims)gas markets), Fair Isaac Corporation (workers’ compensation and healthcare claims cost containment)CRU Group (metals). We believe that our global integrated value chain knowledge and OptumInsight, McKesson, Truven Health Analytics, Inovalon,insight, bottom-up proprietary data, and iHealth (healthcare predictive modeling and business intelligence). Competitive factors include application features and functions, ease of delivery and integration, ability of the providerlong-term trusted relationships enhance our competitive position in relationship to maintain, enhance and support the applications or services and price.those companies.

Development of New Solutions

We take a market-focused team approach to developing our solutions. Our operating units are responsible for developing, reviewing and enhancing our various products and services. Our data management and production team designs and manages our processes and systems for market data procurement, proprietary data production, and quality control. Our Joint Development Environment, or JDE, and Enterprise Data Management, or EDM, teams support our efforts to create new information and products from available data and exploresexplore new methods of collecting data. EDM is focused on understanding and documenting business-unit and corporate data assets and data issues;issues, sharing and combining data assets across the enterprise;enterprise, creating an enterprise data strategy;strategy, facilitating research and product development;development, and promoting cross-enterprise communication. Our Verisk Innovative Analytics, or VIA, team is a corporate center of excellence for analytical methods in applying modeling techniques to predict risk outcomes.

Our software development teams build the technology used in many of our solutions. As part of our product-development process, we continually solicit feedback from our customers on the value of our products and services and the market’s needs. We have established an extensive system of customer advisory panels, whichthat meet regularly throughout the year to help us respond effectively to the needs of our markets. In addition, we use frequent sales calls, executive visits, user group meetings, and other industry forums to gather information to match our product development efforts with the needs of the market with our product development efforts.market. We also use a variety of market research techniques to enhance our understanding of our clientscustomers and the markets in which they operate.

We also add to our offerings through an active acquisition program. Since 2009,2012, we have acquired twelve15 businesses, which have allowed us to enter new markets, offer new solutions and enhance the value of existing services with additional proprietary sources of data.

When we find it advantageous, we augment our proprietary data sources and systems by forming alliances with other leading information providers and technology companies and integrating their product offerings into our offerings. This approach gives our customers the opportunity to obtain the information they need from a single source and more easily integrate the information into their workflows.

Sales, Marketing and Customer Support

We sell our productssolutions and services primarily through direct interaction with our clients.customers. We employ a three-tier sales structure that includes salespeople, product specialiststechnical consultants and sales support. As of December 31, 2013,2016, we had a sales force of 285 people.295 people in our continuing operations. Within the company, several areas have sales teams that specialize in specific products and services. TheseThose specialized sales teams sell specific, highly technical productsolution sets to targeted markets in coordination with account management.

To provide account management to our largest customers in the insurance, financial and energy markets, we segment the insurance carrier marketour customers into three groups. Tier One or “National”“Global/National” Accounts, constitutesis comprised of our largest customers,customers. Tier Two, or “Strategic” Accounts, representsrepresent both larger carrier groupslarge and middle-market carriers.customer groups. Tier Three are theis comprised of small insuranceand specialized companies that may represent one line of business and/or may be one-state or regional writers. A Sales Generalist is assignedregionally focused. In Tier One and Tier Two segments, we have sales teams organized by the following specialities: Rating, Underwriting, Claims, Catastrophe Risk, and Energy. In the Tier Three segment, we assign a sales generalist with overall account management responsibility. Our tiered approach has proven to every insurer accountbe a successful sales model and is responsible for our overall relationship with these insurance companies.approach to building customer relationships. Our senior executives are also involvedregularly engage with the senior management of our customers.customers to ensure customer satisfaction and strategic alignment and to support mutual innovation partnership opportunities.

Sales people participate in both customer-service and sales activities. They provide direct support, interacting frequently with assigned customers to assure a positivesatisfactory experience using our services. Salespeople primarily seek out new sales opportunities and work with the various sales teams to coordinate sales activityactivities and provide the best solutions for our customers. We believe our salespeople’s product knowledge, skills to develop relationships of trust, and local presence differentiatesdifferentiate us from our competition. Product specialistsTechnical consultants are subject-matter experts and work with salespeople on specific opportunities for their assigned products.products and segments. Both salespeople and product specialiststechnical consultants have responsibility for identifying new sales opportunities. A team approach and a common customer relationship management system allow for effective coordination betweenamong the two groups.

Sources of ourOur Data

The data we use to perform our analytics and power our solutions are sourced through sevensix different kinds of data arrangements. First, we gather data from our customers within agreements that also permit our customers to use the solutions

created uponfrom their data. TheseThose agreements remain in effect unless the data contributor chooses to opt out and represent our primary method of data gathering.opt. It is very rare that contributors elect not to continue providing us data. Second, we have agreements with data contributors in which we specify the particular uses of their data and provide to the data contributors their required levels of privacy, protection of data and where necessary, de-identification of data. TheseThe agreements represent no cost to us, and generally feature a specified period of time for the data contributions, and requirerequired renewal. Third, we “mine” data found inside the transactions supported by our solutions; as an example, we utilizeuse the claims settlement data generated inside our repair cost estimating solution to improve the cost factors used in our models. Again, thesethose arrangements represent no cost to us, and we obtain the consent of our customers to make use of their data in this way. Fourth, we source data generally at no cost from public sources, including federal,

state, and local governments. Fifth, we gather data about the physical characteristics of commercial properties through the direct observation of our field staff thatmembers, who also perform property surveys at the request of, and facilitated by, property insurers. Sixth,Lastly, we purchase data from data aggregators under contracts that reflect prevailing market pricing for the data elements purchased, including county tax assessor records, descriptions of hazards such as flood plains and professional licenses. Lastly, we retrieve medical records from facilities and provider locations at prevailing market prices under agreements between our insurer customers and their provider networks. In all our modes of data collection, weWe are the owners of whateverthe derivative solutions we create using the data. Our costs for data received from our customers were 1.3% and 1.4% of revenues for the years ended December 31, 2013 and 2012, respectively.we collect.

Information Technology

Technology

Our information technology systems and the more recent adoption of cloud computing are fundamental to our success. They are used for the storage, processing, access, and delivery of the data whichthat forms the foundation of our business and the development and delivery of ourthe solutions providedwe provide to our clients.customers. Much of the technology we use and provide to our customers is developed, maintained, and supported by approximately 1,289 employees.25% of our employee population. We generally own, or have secured ongoing rights to use for the purposes of our business, all the customer-facing applications, whichthat are material to our operations. We support and implement a mix of technologies, focusedand focus on implementing the most efficient technology for any given business requirement or task.

Data Centers

We have two primary data centers in Jersey City,Somerset, New Jersey and Orem,Lehi, Utah, creating redundancy and back-up capabilities. In addition, we have data centers dedicated to certain business units located in other states.

Disaster Recovery

We are committed to a framework for business continuity management and carry out annual reviews of the state of preparedness of each business unit. All of our critical databases, systems and contracted clientcustomer services are also regularly recovered. We also have documented disaster recovery plans in place for each of our major data centers and each of our solutions. Our primaryThe data center in Somerset, New Jersey is the recovery site is in New York State, approximately 50 miles northwest of Jersey City, New Jersey.for the Lehi, Utah data center and vice versa.

Security

We have adopted a wide range of measures to ensure the security of our IT infrastructure and data. Security measures generally cover the following key areas: physical security;security, logical security of the perimeter;perimeter, network security such as firewalls;firewalls, logical access to the operating systems;systems, deployment of virus detection software;software, and appropriate policies and procedures relating to removable media such as laptops. All laptops are encrypted, and media leaving our premises that isand sent to a third-party storage facility isfacilities are also encrypted. ThisOur commitment to security has led us to achieve certificationearned from CyberTrust Security Certification (an industry leader in information security certification) since 2002.

Intellectual Property

We own a significant number of intellectual property rights, including copyrights, trademarks, trade secrets, and patents. Specifically, our policy language, insurance manuals, software, and databases are protected by both registered and common law copyrights, and the licensing of those materials to our customers for their use represents a large portion of our revenue. We also own in excess of 500 trademarks in the U.S. and foreign countries, including the names of our products and services and our logos and tag lines, many of which are registered. We believe many of our trademarks, trade names, service marks, and logos to be of material importance to our business as they assist our customers in identifying our products and services and the quality that stands behind them. We consider our intellectual property to be proprietary, and we rely on a combination of statutory (e.g.,(for example, copyright, trademark, trade secret, and patent) and contractual safeguards in a comprehensive intellectual property enforcement program to protect them wherever they are used.

We also own several software method and processing patents and have several pending patent applications in the U.S. that complement our products. The patents and patent applications include claims, whichthat pertain to technology, including a patent

for our ISO Claims Outcome Advisor® software and for our Xactware Sketch® product. We believe the protection of our proprietary technology is important to our success and we will continue to seek to protect those intellectual property assets for which we have expended substantial research and development capital and whichthat are material to our business.

general practice, employees, contractors and other parties with access to our proprietary information sign agreements that prohibit the unauthorized use or disclosure of our proprietary rights, information and technology.

Employees

As of December 31, 2013,2016, we employed 6,3686,148 full-time and 727166 part-time employees.employees in our continuing operations. None of our employees are represented by unions. We consider our relationship with our employees to be good and have not experienced interruptions of operations due to labor disagreements.

Our employees include over 190more than 200 actuarial professionals, including 4939 Fellows and 2535 Associates of the Casualty Actuarial Society, as well as 158149 Chartered Property Casualty Underwriters, 1823 Certified and 23 Associate Insurance Data Managers, and 530more than 900 professionals with advanced degrees, including PhDs in mathematics and statistical modeling who review both the data and the models.

Regulation

Because our business involves the distribution of certain personal, public, and non-public data to businesses and governmental entities that make eligibility, service, and marketing decisions based on such data, certain of our solutions and services are subject to regulation under federal, state, and local laws in the United StatesU.S. and, to a lesser extent, in foreign countries. Examples of such regulation include the Fair Credit Reporting Act, which regulates the use of consumer credit report information; the Gramm-Leach-Bliley Act, which regulates the use of non-publicnon public personal financial information held by financial institutions and applies indirectly to companies that provide services to financial institutions; the Health Insurance Portability and Accountability Act, which restricts the public disclosure of patient information and applies indirectly to companies that provide services to healthcare businesses; the Drivers Privacy Protection Act, which prohibits the public disclosure, use or resale by any state’s department of motor vehicles of personal information about an individual that was obtained by the department in connection with a motor vehicle record, except for a “permissible purpose”, and various other federal, state and local laws and regulations.

We are also licensed as a rating, rate service, advisory, or statistical organization under state insurance codes in all fifty50 states, Puerto Rico, Guam, the U.S. Virgin Islands, and the District of Columbia. As such an advisory organization, we provide statistical, actuarial, policy language development, and related products and services to property/casualty insurers, including advisory prospective loss costs, other prospective cost information, manual rules, and policy language. We also serve as an officially designated statistical agent of state insurance regulators to collect policy-writingpolicy writing and loss statistics of individual insurers and compile that information into reports used by the regulators.

Many of our products, services and operations as well as insurerinsurers' use of our services are subject to state rather than federal regulation by virtue of the McCarran-Ferguson Act. As a result, many of our operations and products are subject to review and/or approval by state regulators. Furthermore, our operations involving licensed advisory organization activities are subject to periodic examinations conducted by state regulators, and our operations and products are subject to state antitrust and trade practice statutes within or outside state insurance codes, which are typically enforced by state attorneys general and/or insurance regulators.

Available Information

We maintain an Investor Relations website on the Internet at investor.verisk.com. We make available free of charge on or through this website, our annual, quarterly, and current reports and any amendments to those reports as soon as reasonably practicable following the time they are electronically filed with or furnished to the U.S. Securities and Exchange Commission, or SEC. ToFor access these,to the filings, click the “SEC Filings" link on the “Financial Information” — “SEC" link foundtab on our Investor Relations homepage. Verisk trades on the NASDAQ Global Market in the Nasdaq Global Select Market segment under the ticker symbol “VRSK.” Our stock was first publicly traded on October 7, 2009.

The public may read and copy any materials filed by Verisk with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov.SEC.

| Item 1A. | Risk Factors |

You should carefully consider the following risks and all of the other information set forth in this annual report on Form 10-K before deciding to invest in any of our securities. If any of the following risks actually occurs, our business, financial condition or results of operations would likely suffer. In such case, the trading price of our securities, including our Class A common stock, could decline due to any of these risks, and you may lose all or part of your investment.

We could lose our access to data from external sources, which could prevent us from providing our solutions.

We depend upon data from external sources, including data received from customers and various government, and public record services, for information used in our databases. In general, we do not own the information in these databases, and the participating organizations could discontinue contributing information to the databases. Our data sources could withdraw or increase the price for their data for a variety of reasons, and we could also become subject to legislative, judicial, or contractual restrictions on the use of such data, in particular if such data is not collected by the third parties in a way whichthat allows us to legally use and/or process the data. In addition, some of our customers are significant stockholders of our company. Specifically, a portion of Class A common stock is owned by insurers who are also our customers. If our customers’ percentage of ownership of our common stock decreases in the future, there can be no assurance that our customers will continue to provide data to the same extent or on the same terms. If a substantial number of data sources, or certain key sources, were to withdraw or be unable to provide their data, or if we were to lose access to data due to government regulation or if the collection of data became uneconomical, our ability to provide solutions to our customers could be impacted, which could materially adversely affect our business, reputation, financial condition, operating results, and cash flows.

Agreements with our data suppliers are short-term agreements. Some suppliers are also competitors, which may make us vulnerable to unpredictable price increases and may cause some suppliers not to renew certain agreements. Our competitors could also enter into exclusive contracts with our data sources. If our competitors enter into such exclusive contracts, we may be precluded from receiving certain data from these suppliers or restricted in our use of such data, which would give our competitors an advantage. Such a termination or exclusive contracts could have a material adverse effect on our business, financial position, and operating results if we were unable to arrange for substitute sources.

Fraudulent or unpermitted data access and other security or privacy breaches may negatively impact our business and harm our reputation.

Security breaches in our facilities, computer networks, and databases may cause harm to our business and reputation and result in a loss of customers. Our systems may be vulnerable to physical break-ins, computer viruses, attacks by hackers and similar disruptive problems. Third-party contractors also may experience security breaches involving the storage and transmission of

proprietary information. If users gain improper access to our databases, they may be able to steal, publish, delete or modify confidential third-party information that is stored or transmitted on our networks.

In addition, customers’, employees’ or other’s misuse of and/or gaining unpermitted access to or failure to properly secure our information or services could cause harm to our business and reputation and result in loss of customers. Any such misappropriation and/or misuse of or failure to properly secure our information could result in us, among other things, being in breach of certain data protection and related legislation.

A security or privacy breach may affect us in the following ways:

deterring customers from using our solutions;

deterring data suppliers from supplying data to us;

harming our reputation;

exposing us to liability;

increasing operating expenses to correct problems caused by the breach;

affecting our ability to meet customers’ expectations; and/or

causing inquiry from governmental authorities.

Incidents in which consumer data has been fraudulently or improperly acquired or viewed, or any other security or privacy breaches, may occur and could go undetected. The number of potentially affected consumers identified by any future incidents is obviously unknown. Any such incident could materially and adversely affect our business, reputation, financial condition, operating results and cash flows.

We derive a substantial portion of our revenues from U.S. P&C primary insurers. If there is a downturn in the U.S. insurance industry or that industry does not continue to accept our solutions, our revenues will decline.

Revenues derived from solutions we provide to U.S. P&C primary insurers account for a substantial portion of our total revenues. During the year ended December 31, 2016, approximately 48.9% of our revenue was derived from solutions provided to U.S. P&C primary insurers. Also, invoices for certain of our solutions are linked in part to premiums in the U.S. P&C insurance market, which may rise or fall in any given year due to loss experience and capital capacity and other factors in the insurance industry that are beyond our control. In addition, our revenues will decline if the insurance industry does not continue to accept our solutions.

Factors that might affect the acceptance of these solutions by P&C primary insurers include the following:

changes in the business analytics industry,

changes in technology,

our inability to obtain or use state fee schedule or claims data in our insurance solutions,

saturation of market demand,

loss of key customers,

industry consolidation, and

failure to execute our customer-focused selling approach.

A downturn in the insurance industry, pricing pressure or lower acceptance of our solutions by the insurance industry could result in a decline in revenues from that industry and have a material adverse effect on our financial condition, results of operations and cash flows.

Acquisitions could result in operating difficulties, dilution and other harmful consequences, and we may not be successful in achieving growth through acquisitions.

Our long-term business strategy includes growth through acquisitions. Future acquisitions may not be completed on acceptable terms and acquired assets, data or businesses may not be successfully integrated into our operations, and we may ultimately divest unsuccessful investments. Any acquisitions or investments will be accompanied by the risks commonly encountered in the acquisitions of businesses. Such risks include, among other things:

failing to implement or remediate controls, procedures and policies appropriate for a larger public company at acquired companies that prior to the acquisition lacked such controls, procedures and policies,

paying more than fair market value for an acquired company or assets,

failing to integrate the operations and personnel of the acquired businesses in an efficient, timely manner,

assuming potential liabilities of an acquired company,

managing the potential disruption to our ongoing business,

distracting management focus from our core businesses,

failing to retain management at the acquired company,

difficulty in acquiring suitable businesses, including challenges in predicting the value an acquisition will ultimately contribute to our business,

possibility of overpaying for acquisitions, particularly those with significant intangible assets that derive value using novel tools and/or are involved in niche markets,

impairing relationships with employees, customers, and strategic partners,

incurring expenses associated with the amortization of intangible assets particularly for intellectual property and other intangible assets,

incurring expenses associated with an impairment of all or a portion of goodwill and other intangible assets due to changes in market conditions, weak economies in certain competitive markets, or the failure of certain acquisitions to realize expected benefits, and

diluting the share value and voting power of existing stockholders.

The anticipated benefits of many of our acquisitions may not materialize. Future acquisitions or dispositions could result in the incurrence of debt, contingent liabilities or amortization expenses, or write-offs of goodwill and other intangible assets, any of which could harm our financial condition.

We typically fund our acquisitions through our debt facilities. Although we have capacity under committed facilities, those may not be sufficient. Therefore, future acquisitions may require us to obtain additional financing through debt or equity, which may not be available on favorable terms or at all and could result in dilution.

In addition, to the extent we cannot identify or consummate, on terms acceptable to us, acquisitions that are complementary or otherwise attractive to our business, we may experience difficulty in achieving future growth.

There may be consolidation in our end customer market, which could reduce the use of our services.

Mergers or consolidations among our customers could reduce the number of our customers and potential customers. This could adversely affect our revenues even if these events do not reduce the aggregate number of customers or the activities of the consolidated entities. If our customers merge with or are acquired by other entities that are not our customers, or that use fewer of our services, they may discontinue or reduce their use of our services. The adverse effects of consolidation will be greater in sectors that we are particularly dependent upon, for example, in the P&C insurance sector. Any of these developments could materially adversely affect our business, financial condition, operating results, and cash flows.

If we are unable to develop successful new solutions or if we experience defects, failures and delays associated with the introduction of new solutions, our business could suffer serious harm.

Our growth and success depends upon our ability to develop and sell new solutions. If we are unable to develop new solutions, or if we are not successful in introducing and/or obtaining regulatory approval or acceptance for new solutions, or products we develop face sufficient pricing pressure to make them unattractive to pursue, we may not be able to grow our business, or growth may occur more slowly than we anticipate. In addition, significant undetected errors or delays in new solutions may affect market acceptance of our solutions and could harm our business, financial condition or results of operations. In the past, we have experienced delays while developing and introducing new solutions, primarily due to difficulties in developing models, acquiring data and adapting to particular operating environments. Errors or defects in our solutions that are significant, or are perceived to be significant, could result in rejection of our solutions, damage to our reputation, loss of revenues, diversion of development resources, an increase in product liability claims, and increases in service and support costs and warranty claims.

We will continue to rely upon proprietary technology rights, and if we are unable to protect them, our business could be harmed.

Our success depends, in part, upon our intellectual property rights. To date, we have relied primarily on a combination of copyright, patent, trade secret, and trademark laws and nondisclosure and other contractual restrictions on copying and distribution to protect our proprietary technology. This protection of our proprietary technology is limited, and our proprietary technology could be used by others without our consent. In addition, patents may not be issued with respect to our pending or future patent applications, and our patents may not be upheld as valid or may not prevent the development of competitive products. Businesses we acquire also often involve intellectual property portfolios, which increase the challenges we face in protecting our strategic advantage. Any disclosure, loss, invalidity of, or failure to protect our intellectual property could negatively impact our competitive position, and ultimately, our business. Our protection of our intellectual property rights in the U.S. or abroad may not be adequate and others, including our competitors, may use our proprietary technology without our consent. Furthermore, litigation may be necessary to enforce our intellectual property rights, to protect our trade secrets, or to determine the validity and scope of the proprietary rights of others. Such litigation could result in substantial costs and diversion of resources and could harm our business, financial condition, results of operations, and cash flows.

We could face claims for intellectual property infringement, which if successful could restrict us from using and providing our technologies and solutions to our customers.

There has been substantial litigation and other proceedings, particularly in the U.S., regarding patent and other intellectual property rights in the information technology industry. There is a risk that we are infringing, or may in the future infringe, the intellectual property rights of third parties. We monitor third-party patents and patent applications that may be relevant to our technologies and solutions and we carry out freedom to operate analysis where we deem appropriate. However, such monitoring and analysis has not been, and is unlikely in the future to be, comprehensive, and it may not be possible to detect all potentially relevant patents and patent applications. Since the patent application process can take several years to complete, there may be currently pending applications, unknown to us, that may later result in issued patents that cover our products and technologies. As a result, we may infringe existing and future third-party patents of which we are not aware. As we expand our operations there is a higher risk that such activity could infringe the intellectual property rights of third parties.

Third-party intellectual property infringement claims and any resultant litigation against us or our technology partners or providers, could subject us to liability for damages, restrict us from using and providing our technologies and solutions or

operating our business generally, or require changes to be made to our technologies and solutions. Even if we prevail, litigation is time consuming and expensive to defend and would result in the diversion of management’s time and attention.

If a successful claim of infringement is brought against us and we fail to develop non-infringing technologies and solutions or to obtain licenses on a timely and cost effective basis, this could materially adversely affect our business, reputation, financial condition, operating results, and cash flows.

Regulatory developments could negatively impact our business.

Because personal, public and non-public information is stored in some of our databases, we are vulnerable to government regulation and adverse publicity concerning the use of our data. We provide many types of data and services that already are subject to regulation under the Fair Credit Reporting Act, Gramm-Leach-Bliley Act, Driver’s Privacy Protection Act, the European Union’s Data Protection Directive, the Dodd Frank Wall Street Reform and Consumer Protection Act and to a lesser extent, various other federal, state, and local laws and regulations. These laws and regulations are designed to protect the privacy of the public and to prevent the misuse of personal information in the marketplace. However, many consumer advocates, privacy advocates, and government regulators believe that the existing laws and regulations do not adequately protect privacy. They have become increasingly concerned with the use of personal information, particularly social security numbers, department of motor vehicle data and dates of birth. As a result, they are lobbying for further restrictions on the dissemination or commercial use of personal information to the public and private sectors. Similar initiatives are under way in other countries in which we do business or from which we source data. In addition, on October 6, 2015 the Court of Justice of the European Union, or E.U., invalidated the Safe Harbor provisions used by the Company and numerous other U.S. businesses to comply with E.U.’s Data Protection Directive 95/46/EC. The Company has implemented various measures to comply with the Data Protection Directive, however, there can be no assurances that such methods will not be invalidated as well. If the Company is unable to comply with the transfer mechanisms adopted pursuant to the Data Protection Directive, it will impede the ability to conduct business between the U.S. and the E.U. which could have a material adverse effect on our business, financial position, results of operations or cash flows.

The following legal and regulatory developments also could have a material adverse effect on our business, financial position, results of operations or cash flows:

amendment, enactment, or interpretation of laws and regulations which restrict the access and use of personal information and reduce the supply of data available to customers;

changes in cultural and consumer attitudes to favor further restrictions on information collection and sharing, which may lead to regulations that prevent full utilization of our solutions;

failure of our solutions to comply with current laws and regulations; and

failure of our solutions to adapt to changes in the regulatory environment in an efficient, cost-effective manner.

We typically face a long selling cycle to secure new contracts that requiresrequire significant resource commitments, which result in a long lead time before we receive revenues from new relationships.

We typically face a long selling cycle to secure a new contract and there is generally a long preparation period in order to commence providing the services. We typically incur significant business development expenses during the selling cycle and we may not succeed in winning a new customer’s business, in which case we receive no revenues and may receive no reimbursement for such expenses. Even if we succeed in developing a relationship with a potential new customer, we may not be successful in obtaining contractual commitments after the selling cycle or in maintaining contractual commitments after the implementation cycle, which may have a material adverse effect on our business, results of operations and financial condition.

We may lose key business assets, includingthrough the loss of data center capacity or the interruption of telecommunications links, the internet, or power sources, which could significantly impede our ability to do business.