Washington, D. C. 20549

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

From time to time, our management or persons acting on our behalf make forward-looking statements to inform existing and potential security holders about our company. These statements may include projections and estimates concerning the timing and success of specific projects and our future backlog, revenues, income and capital spending. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “plan,” “intend,” “seek,” “will,” “should,” “goal” or other words that convey the uncertainty of future events or outcomes. These forward-looking statements speak only as of the date on which they are first made, which in the case of forward-looking statements made in this report is the date of this report. Sometimes we will specifically describe a statement as being a forward-looking statement and refer to this cautionary statement.

In addition, various statements contained in this Annual Report on Form 10-K, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. Such forward-looking statements appear in Item 1—“Business” and Item 3—“Legal Proceedings” in Part I of this report; in Item 5—“Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities,” Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” Item 7A—“Quantitative and Qualitative Disclosures About Market Risk” and in the Notes to Consolidated Financial Statements we have included in Item 8 of Part II of this report; and elsewhere in this report. These forward-looking statements speak only as of the date of this report. We disclaim any obligation to update these statements, and we caution you not to relyplace undue reliance on them unduly.them. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks, contingencies and uncertainties relate to, among other matters, the following:

decisions about exploration and development projects to be made by oil and gas exploration and production companies;

the continued demand for drilling services or production services in the geographic areas where we operate;

our future financial performance, including availability, terms and deployment of capital;

the success or failure of our acquisition strategy, including our ability to finance acquisitions, manage growth and effectively integrate acquired businesses and manage growth;acquisitions; and

changes in, or our failure or inability to comply with, governmental regulations, including those relating to the environment.

We believe the items we have outlined above are important factors that could cause our actual results to differ materially from those expressed in a forward-looking statement contained in this report or elsewhere. We have discussed many of these factors in more detail elsewhere in this report. Unpredictable or unknown factors we have not discussed in this report could also have material adverse effects on actual results of matters that are the subject of our forward-looking statements. We do not intendundertake no duty to update our description of important factors each time a potential important factor arises,or revise any forward-looking statements, except as required by applicable securities laws and regulations. We advise our security holders that they should (1) be aware that unpredictable or unknown factors not referred to above could affect the accuracy of our forward-looking statements and (2) use caution and common sense when considering our forward-looking statements. Also, please read the risk factors set forth in Item 1A—“Risk Factors.”

From 2004 through 2008, domestic exploration and production spending increased as oil and natural gas prices increased. From late 2008 and into late 2009, there was substantial volatility and a decline in oil and natural gas prices due to the downturn in the global economic environment. In response, our customersclients curtailed their drilling programs and reduced their production activities, particularly in natural gas producing regions, which resulted in a decrease in demand and revenue rates for certain of our drilling rigs and production services equipment. Additionally, there was uncertainty in the capital markets and access to financing was limited. These conditions adversely affected our business environment.

With generally increasing oil prices in 2010 and natural gas prices during 2010,2011, exploration and production companies modestly increased their exploration and production spending for 2010 and industry rigequipment utilization and revenue rates improved, particularly in oil-producing regions and in certain shale regions. IncreasedDuring 2012, modest increases in exploration and production spending resulted in modest increases in industry equipment utilization and revenue rates during 2012, as compared to 2011. Though oil prices decreased sharply in mid-2012 for a brief period of time, they have since recovered with no meaningful upward or downward trend for the year. In addition, excess natural gas production in the U.S. shale regions continues to depress natural gas prices, butprices. If oil prices continued to increase during 2011, resulting in continued increases in exploration and production spending during 2011, as compared to 2010. As a result, we experienced continued increases in industry rig utilization and revenue rates during 2011, as compared to 2010. We expect continued modest increases in exploration and production spending for 2012, which we expect will result in modest increases in industry equipment utilization and revenue rates in 2012, as compared to 2011. However, if oil prices remain steady but natural gas prices further decline, to historically low levels for the remainder of 2012, then industry equipment utilization and revenue rates could decrease.decrease domestically and in Colombia.

For additional information concerningColombia has experienced significant growth in oil production since 2008 largely due to the effectsinfusion of capital by international exploration and production companies as a result of the volatilitycountry's improved regulation and security. Historically, Colombian oil prices have generally trended in oil and gas prices and uncertainty in capital markets, see Item 1A – “Risk Factors” in Part I of this Annual Report on Form 10-K.

On February 10, 2012, the spot price forline with West Texas Intermediate crude(WTI) oil was prices. However, fluctuations in oil prices have a less significant impact on demand for drilling and production services in Colombia as compared to the impact on demand in North America. Demand for drilling and production services in Colombia is largely dependent upon the national oil company's long-term exploration and production programs.$98.67

, the spot price for Henry Hub natural gas was $2.51 and the Baker Hughes U.S. land rig count was 1,932, a 14%increase from 1,696 on February 4, 2011.

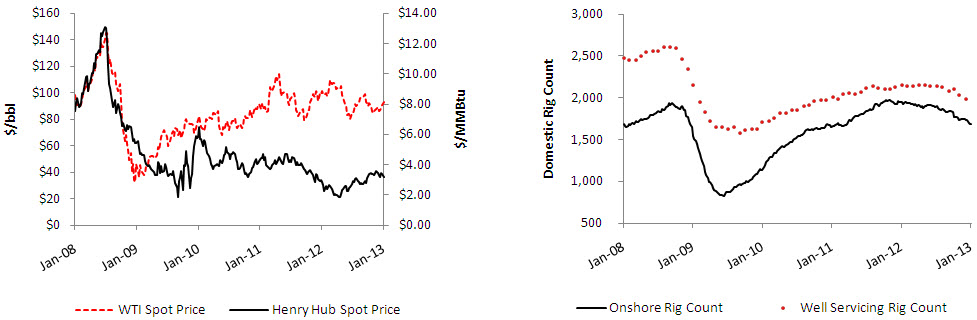

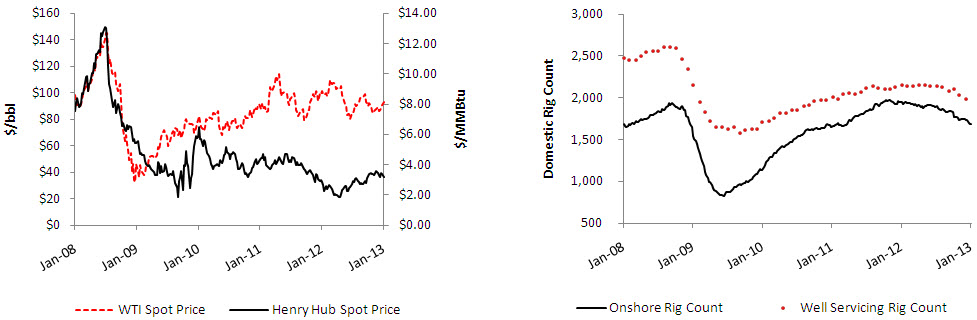

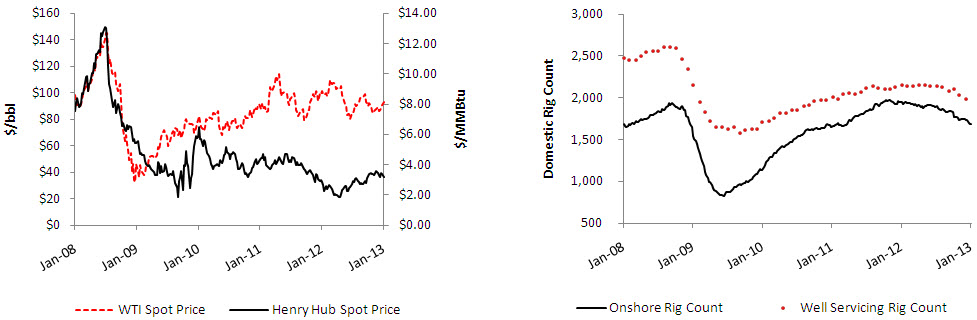

The average weeklytrends in spot prices of West Texas IntermediateWTI crude oil and Henry Hub natural gas, and the average weeklyresulting trends in domestic land rig count per thecounts (per Baker Hughes land rig count,Hughes) and the average monthly domestic well serviceservicing rig count for eachcounts (per Guiberson/Association of Energy Service Companies) over the last five years were:are illustrated in the graphs below.

|

| | | | | | | | | | | | | | | | | | | |

| | Year ended December 31, |

| | 2011 | | 2010 | | 2009 | | 2008 | | 2007 |

| Oil (West Texas Intermediate) | $ | 94.94 |

| | $ | 79.39 |

| | $ | 61.81 |

| | $ | 99.86 |

| | $ | 72.71 |

|

| Natural Gas (Henry Hub) | $ | 3.95 |

| | $ | 4.35 |

| | $ | 3.85 |

| | $ | 8.81 |

| | $ | 6.90 |

|

| U.S. Land Rig Count | 1,829 |

| | 1,493 |

| | 1,035 |

| | 1,792 |

| | 1,670 |

|

| U.S. Well Service Rig Count | 2,075 |

| | 1,854 |

| | 1,735 |

| | 2,514 |

| | 2,388 |

|

IncreasesAs shown in the charts above, the trends in industry rig counts are influenced by fluctuations in oil and natural gas prices, from 2004 to late 2008 resulted in corresponding increases inwhich affect the U.S. land rig countslevels of capital and U.S. well service rig counts, while declines in prices from late 2008 to late 2009 led to decreases in the U.S. land rig counts and U.S. well service rig counts. Since late 2009, increases primarily in oil prices have caused increases in exploration and production spending and the corresponding increases in drilling and well services activities are reflectedoperating expenditures made by increases in the U.S. land rig counts and the U.S. well service rig counts in 2010 and 2011.our clients.

Our business is influenced substantially by both operating and capital expenditures by exploration and production companies. Exploration and production spending is generally categorized as either a capital expenditure or operating expenditure.

Capital expenditures by oil and gas exploration and production companies tend to be relatively sensitive to volatility in oil or natural gas prices because project decisions are tied to a return on investment spanning a number of years. As such, capital expenditure economics often require the use of commodity price forecasts which may prove inaccurate in the amount of time required to plan and execute a capital expenditure project (such as the drilling of a deep well). When commodity prices are depressed for long periods of time, capital expenditure projects are routinely deferred until prices return to an acceptable level.

In contrast, both mandatory and discretionary operating expenditures are more stable than capital expenditures for exploration.exploration as these expenditures are less sensitive to commodity price volatility. Mandatory operating expenditure projects involve activities that cannot be avoided in the short term, such as regulatory compliance, safety, contractual obligations and certain projects to maintain the well and related infrastructure in operating condition. Discretionary operating expenditure projects may not be critical to the short-term viability of a lease or field but these projectsand are less sensitive to commodity price volatility as compared to capital expenditures for exploration. Discretionary operating expenditure work isgenerally evaluated according to a simple short-term payout criterion whichthat is far less dependent on commodity price forecasts.forecasts.

Because existing oil and natural gas wells require ongoing spending to maintain production, expenditures by exploration and production companies for the maintenance of existing wells are relatively stable and predictable. In contrast, capital expenditures by exploration and production companies for exploration and drilling are more directly influenced by current and expected oil and natural gas prices and generally reflect the volatility of commodity prices.

Competitive Strengths

Our competitive strengths include:

One of the Leading Providers in the Most Attractive Regions. Our 6470 drilling rigs operate in many of the most attractive producing regions in the Americas, including the Bakken, Marcellus and Eagle Ford shales, and Permian and Uintah Basins, as well as Colombia. Our drilling rigs are located in seven divisions throughout the United States and Colombia, diversifying our geographic exposure and limiting the impact of any regional slowdown. We believe the varied capabilities of our drilling rigs make them well suited to these areas where the optimal rig configuration is dictated by local geology and market conditions. Furthermore, certain of our division locations,divisions, such as Colombia, North Dakota, Utah, West Texas and parts of our South Texas division, location, are in regions with oil-focused drilling, which reduces our relative exposure to changes in natural gas drilling activity.

High Quality Assets. We have purchased 3038 new-build drilling rigs since 2001, eight of which we constructed over the majority of these constructed from 2004 to 2006,last two years, and currently have term contracts foranother tentwo new-build AC drilling rigs under construction that are fit for purpose for domestic shale plays. The majority of our drilling rig fleet is fast moving and has preferred equipment such as more efficient and lower emission engines, rounded bottom mud tanks and matched horsepower mud pumps. Approximately 80%86% of our drilling rig fleet has a horsepower rating of overat least 1000 horsepower and the majority of our fleet is equipped with top drives, allowing us to pursue opportunities in shale plays, which typically require higher specification rigs than traditional areas. Approximately 64%70% of our production services assets have been built since 2007, and all but oneof our well serviceservicing rigs have at least 550 horsepower. We believe that our modern and well maintained fleet allows us to realize higher contract and utilization rates by beingbecause we are able to offer our customersclients equipment that is more reliable and requires less downtime than older equipment.

Provide Services Throughout the Well Life Cycle. By offering our customersclients both drilling production and relatedproduction services, we capture revenue throughout the life cycle of a well and diversify our business. Our Drilling Services DivisionSegment performs work prior to initial production, and our Production Services DivisionSegment provides services such as logging, completion, perforation, workover and maintenance throughout the productive life of a well. We also provide certain end-of-well-life activities such as plugging and abandonment. Drilling and production services activity have historically exhibited different degrees of demand fluctuation, and we believe the diversity of our services reduces our exposure to decreases in demand for any single service activity. TheFurther, the diversity of our service offerings enables us to cross-sell our services, also enhances customer revenues bybenefiting our clients, allowing us to cross-sellgenerate more business from existing clients and increasing our profits as we expand our services in our various business divisions.within existing markets.

Excellent Safety Record. Our safety program called “Live Safe”“LiveSafe” focuses on creating an environment where everyone is committed to and recognizes the possibility of always working without incident or injury. We believe that by building strong relationships among our people we can achieve outstanding accomplishments. Our excellent safety record and reputation are critical to winning new business and expanding our relationships with existing customers.clients. Our commitment to safety helps us to keep our employees safe and reduces our business risk.

Experienced Management Team. We believe that important competitive factors in establishing and maintaining long-term customerclient relationships include having an experienced and skilled management team and maintaining employee continuity. Our CEO, Wm. Stacy Locke, joined Pioneer in 1995 as President and has over 2530 years of industry experience. Our two divisionsegment presidents, F.C. “Red” West and Joe Eustace, have over 7080 years of combined oilfield services experience. Our management team has operated through numerous oilfield services cycles and provides us with valuable long-term experience and a detailed understanding of customerclient requirements. We also seek to maximize employee continuity and minimize employee turnover by maintaining modern equipment, a strong safety record, ongoing growth and competitive compensation. We have devoted, and will continue to devote, substantial resources to our employee safety and training programs and maintaining low employee turnover.

Longstanding and Diversified Customers.Clients. We maintain long-standing, high quality customerclient relationships with a diverse group of majorlarge independent oil and gas exploration and production companies including EOG Resources, Inc., Cabot Oil and Gas Corporation, Whiting Petroleum Corporation, andwhich accounted for approximately 10% of our 2012 consolidated revenues, Apache Corporation, Chesapeake Energy Corporation.Corporation, Hess Corporation and Continental Resources. We also maintain a high quality relationship with Ecopetrol, which accounted for approximately 14%10% of our 20112012 consolidated revenues. No other single customer accounted for more than 11% of consolidated revenues during the same period. We believe our relationships with our customersclients are excellent and offer numerous opportunities for future growth.

Strategy

In past years, our strategy was to become a premier land drilling and production services company through steady and disciplined growth. We executed this strategy by acquiring and building a high quality drilling rig fleet and production services business thatwhich we operate in activethe most attractive drilling markets inthroughout the United States and in Colombia. Our long-term strategy is to maintain and leverage our position as a leading land drilling and production services company, continue to expand our relationships with existing customers,clients, expand our customerclient base in the areas in whichwhere we currently operate and further enhance our geographic diversification through selective international expansion. The key elements of this long-term strategy include:are focused on our:

Further Strengthen our Competitive Position in the Most Attractive Domestic Markets. Shale plays and non-shale oil or liquid rich environments are increasingly important to domestic hydrocarbon production and not all drilling rigs are capable of successfully drilling in these unconventional opportunities. We are currently operating in unconventional areas in the Bakken, Marcellus and Eagle Ford shales and Permian and Uintah Basins,Basins. All of the eight drilling rigs we have constructed over the last two years are currently operating in domestic shale plays and we intend to addexpect the remaining tentwo new-build drilling rigs that willcurrently under construction to be operating in shale or unconventional plays by the shale playsend of the first quarter of 2013. Additionally, in 2012. We also intend to continue addingrecent years, we have added significant capacity to our wireline, coiled tubing, and well servicing product offerings,production services fleets, which are well positioned to capitalize on increased shale development.

Increase our Exposure to Oil-DrivenOil and Liquids Rich Natural Gas Drilling Activity. We believe that our flexible drilling and production services fleets allow us to pursue varied opportunities, enabling us to focus on a favorable mix of natural gas, oil and liquids rich natural gas activity. In recent years, we have intentionally increased our exposure to oil-related activities by redeploying certain of our assets into predominately oil-producing regions and we continue to actively seekingseek contracts with oil-focused producers. As of February 10, 2012January 31, 2013, approximately 87%91% of our working drilling rigs and 78% of our production services assets are operating on wells that are targeting or producing oil or liquids rich natural gas. We believe that our flexible rig fleet and production services assets allow us to target opportunities focused on both natural gas and oil.

Selectively Expand our International OperationsPresence. In early 2007, we announced our intention to selectively expand internationally and began a relationship with Ecopetrol S.A. in Colombia after a comprehensive review of international opportunities wherein we determined that Colombia offered an attractive mix of favorable business conditions, political stability, and a long-term commitment to expanding national oil and gas production. We are continuously evaluating additional international expansion opportunities and intend to target international markets that share the favorable characteristicsCurrently, all of our Colombian operations andeight drilling rigs in Colombia are working, six of which would allow us to deploy sufficient assets in order to realize economiesare under term contracts that were extended through the first quarter of scale.2013.

Continue Growth withThrough Select Capital Deployment. We intend to investhave historically invested in the growth of our business by continuing to strategically upgradeupgrading our existing assets, selectively engaging in new-build opportunities, and potentially makingthrough selective acquisitions. Our capital investment decisions are determined by an analysis of the projected return on capital employed, which is based on the terms of secured contracts whenever possible, and the investment must be consistent with our strategic objectives. We currently have term contracts for ten new-build AC drilling rigs that are fit for purpose for domestic shale plays, five of which we estimate will begin workingcontinued to make significant investments in the first halfgrowth of 2012, withour business over the remaining five to begin operating by the end of 2012. Onpast several years. For example, on December 31, 2011, we acquired thea coiled tubing service company, Go-Coil,services business to complementexpand our existing production services offerings. We have also significantly increasedadded significant capacity to our other production services fleets withthrough the addition of 2157 wireline units and 1534 well serviceservicing rigs inover the last three years. In 2011, we began construction, based on term contracts, of 2011. We expect to add another 18ten wireline units,new-build AC drilling rigs, 13eight well service rigsof which are currently operating in domestic shale plays, and we expect the remaining threetwo coiled tubing units to be operating by the end of 2012the first quarter of 2013. When these capital projects are completed, we intend to shift our near-term focus toward reducing capital expenditures and using excess cash flows from operations to reduce outstanding debt balances and reposition ourselves for continued long-term growth.

Overview of Our Segments and Services

Drilling Services DivisionSegment

There are numerous factors that differentiate land drilling rigs, including their power generation systems and their drilling depth capabilities. A land drilling rig consists of engines, a hoisting system, a rotating system, pumps and related equipment to circulate drilling fluid, blowout preventers and related equipment. Generally, drilling rigs operate with crews of five to six persons.

Diesel or gas engines are typically the main power sources for a drilling rig. Power requirements for drilling jobs may vary considerably, but most land drilling rigs employ two or more engines to generate between 500 and 2,000 horsepower, depending on well depth and rig design. Most drilling rigs capable of drilling in deep formations, involving depths greater than 15,000 feet, use diesel-electric power units to generate and deliver electric current through cables to electrical switch gears, then to direct-current electric motors attached to the equipment in the hoisting, rotating and circulating systems.

Drilling rigs use long strings of drill pipe and drill collars to drill wells. Drilling rigs are also used to set heavy strings of large-diameter pipe, or casing, inside the borehole. Because the total weight of the drill string and the casing can exceed 500,000 pounds, drilling rigs require significant hoisting and braking capacities.

Generally, a drilling rig’s hoisting system is made up of a mast, or derrick, a traveling block and hook assembly that attaches to the rotating system, a mechanism known as the drawworks, a drilling line and ancillary equipment. The drawworks mechanism consists of a revolving drum, around which the drilling line is wound, and a series of shafts, clutches and chain and gear drives for generating speed changes and reverse motion. The drawworks also houses the main brake, which has the capacity to stop and sustain the weights used in the drilling process. When heavy loads are being lowered, a hydraulic or electric auxiliary brake assists

the main brake to absorb the great amount of energy developed by the mass of the traveling block, hook assembly, drill pipe, drill collars and drill bit or casing being lowered into the well.

The rotating equipment from top to bottom consists of a top drive or a swivel, the kelly, and kelly bushing, the rotary table, drill pipe, drill collars and the drill bit. We refer to the equipment between the top drive or swivel and the drill bit as the drill stem. In a top drive system, the top drive hangs from a hook at the bottom of the traveling block. The top drive has a passageway for drilling mud to get into the drill pipe, and it has a heavy-duty electric motor connected to a threaded drive shaft which connects to and rotates the drill pipe. In a kelly drive system, the swivel assembly sustains the weight of the drill stem, permits its rotation and affords a rotating pressure seal and passageway for circulating drilling fluid into the top of the drill string. The swivel also has a large handle that fits inside the hook assembly at the bottom of the traveling block. Drilling fluid enters the drill stem through a hose, called the rotary hose, attached to the side of the swivel. The kelly is a triangular, square or hexagonal piece of pipe, usually 40 feet long, that transmits torque from the rotary table to the drill stem and permits its vertical movement as it is lowered into the hole. The bottom end of the kelly fits inside a corresponding triangular, square or hexagonal opening in a device called the kelly bushing. The kelly bushing, in turn, fits into a part of the rotary table called the master bushing. As the master bushing rotates, the kelly bushing also rotates, turning the kelly, which rotates the drill pipe and thus the drill bit. Drilling fluid is pumped through the kelly on its way to the bottom. The rotary table, equipped with its master bushing and kelly bushing, supplies the necessary torque to turn the drill stem. The drill pipe and drill collars are both steel tubes through which drilling fluid can be pumped. Drill pipe, sometimes called drill string, comes in 30-foot sections, or joints, with threaded sections on each end. Drill collars are heavier than drill pipe and both are threaded on the ends. Collars are used on the bottom of the drill stem to apply weight to the drilling bit. At the end of the drill stem is the bit, which chews up the formation rock and dislodges it so that drilling fluid can circulate the fragmented material back up to the surface where the circulating system filters it out of the fluid.

Drilling fluid, often called mud, is a mixture of clays, chemicals and water or oil, which is carefully formulated for the particular well being drilled. Drilling mud accounts for a major portion of the cost incurred and equipment used in drilling a well. Bulk storage of drilling fluid materials, the pumps and the mud-mixing equipment are placed at the start of the circulating system. Working mud pits and reserve storage are at the other end of the system. Between these two points, the circulating system includes auxiliary equipment for drilling fluid maintenance and equipment for well pressure control. Within the system, the drilling mud is typically routed from the mud pits to the mud pump and from the mud pump through a standpipe and the rotary hose to the drill stem. The drilling mud travels down the drill stem to the bit, up the annular space between the drill stem and the borehole and through the blowout preventer stack to the return flow line. It then travels to a shale shaker for removal of rock cuttings, and then back to the mud pits, which are usually steel tanks. The reserve pits, usually one or two fairly shallow excavations, are used for waste material and excess water around the location.

Drilling rigs use long strings of drill pipe and drill collars to drill wells. Drilling rigs are also used to set heavy strings of large-diameter pipe, or casing, inside the borehole. Because the total weight of the drill string and the casing can exceed 500,000 pounds, drilling rigs require significant hoisting and braking capacities. The actual drilling depth capability of a rig may be less than or more than its rated depth capability due to numerous factors, including the size, weight and amount of the drill pipe on the rig. The intended well depth and the drill site conditions determine the amount of drill pipe and other equipment needed to drill a well.

In a continuing effort to improve our drilling rig fleet, we have installed top drives in 3645 rigs (with threefive additional spare top drives available for installation), iron roughnecks in 4958 rigs (with sixone additional spare iron roughnecks available for installation), walking/skidding systems in 1624 rigs and automatic catwalks in eight27 rigs. These upgrades provide our customersclients with drilling rigs that have more varied capabilities for drilling in unconventional plays, and they improve our efficiency and safety. Top drives provide maximum torque and rotational control, improved well control and better hole conditioning. In horizontal drilling, operators can utilize top drives to reach formations that may not be accessible with conventional rotary drilling. An iron roughneck is a remotely operated pipe handling feature on the rig floor, which is used to help reduce the occurrence of repetitive motion injuries and decrease drill pipe tripping time. Walking systems increase efficiency by allowing multiple wells to be drilled on the same pad site and permitting the drilling rig to move between wells while drill pipe remains in the derrick, thus reducing move times and costs. Our walking system enables the drilling rig to move forward, backward, and side to side which affords the operator additional flexibility. An automated catwalk is a drill pipe handling feature used to raise drill pipe, drill collars, casing, and other necessary items to the drilling rig floor. Its function significantly reduces pick up and lay down time, thereby decreasing operator costs for handling casing.

There are numerous factors that differentiate land drilling rigs, including their power generation systems and their drilling depth capabilities. The actual drilling depth capability of a rig may be less than or more than its rated depth capability due to numerous factors, including the size, weight and amount of the drill pipe on the rig. The intended well depth and the drill site conditions determine the amount of drill pipe and other equipment needed to drill a well. Generally, land rigs operate with crews of five to six persons.

The following table sets forth historical information regarding utilization for our drilling rig fleet:

| | | | Year ended December 31, | Year ended December 31, |

| | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | 2012 | | 2011 | | 2010 | | 2009 | | 2008 |

| Average number of operating rigs for the period | 69.3 |

| | 71.0 |

| | 70.7 |

| | 67.4 |

| | 66.1 |

| 65.0 |

| | 69.3 |

| | 71.0 |

| | 70.7 |

| | 67.4 |

|

| Average utilization rate | 73 | % | | 59 | % | | 41 | % | | 89 | % | | 89 | % | 87 | % | | 73 | % | | 59 | % | | 41 | % | | 89 | % |

We believe that our drilling rigs and other related equipment are in good operating condition. Our employees perform periodic maintenance and minor repair work on our drilling rigs. We rely on various oilfield service companies for major repair work and overhaul of our drilling equipment when needed. We also engage in periodic improvement of our drilling equipment. In the event of major breakdowns or mechanical problems, our rigs could be subject to significant idle time and a resulting loss of revenue if the necessary repair services are not immediately available.

As of February 10, 2012January 31, 2013, we own a fleet of 5455 trucks and related transportation equipment that we use to transport our drilling rigs to and from drilling sites. By owning our own trucks, we reduce the overall cost of rig moves and reduce downtime between rig moves. This is most beneficial to us in periods of high rig utilization and in regions where there is less pad drilling.

We obtain our contracts for drilling oil and gas wells either through competitive bidding or through direct negotiations with customers.clients. Our drilling contracts generally provide for compensation on either a daywork, turnkey or footage basis. Contract terms generally depend on the complexity and risk of operations, the on-site drilling conditions, the type of equipment used, and the anticipated duration of the work to be performed. Generally, our contracts provide for the drilling of a single well and typically permit the customerclient to terminate on short notice. During periods of high rig demand, or for our newly constructed rigs, we enter into longer-term drilling contracts. Currently, we have contracts with terms of six months to four years in duration. As of February 10, 2012January 31, 2013, we have 4443 drilling rigs operating under term contracts. Of thesecontracts, as well as term contracts for another 44two contracts,new-build AC drilling rigs which we expect to begin working by the end of the first quarter of 2013. As of January 31, 2013, if not renewed at the end of their terms, the expiration of the 21 will expire by July 10, 2012, 22 will expire by February 10, 2013 and one will expire by February 10, 2014. We have term contracts for an additional three drilling rigs that we expect will begin operating in the first quarter of 2012 and we have ten43 term contracts for new-build AC drilling rigs, five ofunder which we estimate will begin working in the first half of 2012, with the remaining five to beginare currently operating by the end of 2012.is as follows:

|

| | | | | | | | | | | | | | | | | | |

| | | | | Term Contract Expiration by Period |

| | | Total

Term Contracts | | Within

6 Months | | 6 Months

to 1 Year | | 1 Year to

18 Months | | 18 Months

to 2 Years | | 2 to 4 Years |

| United States | | 37 |

| | 23 |

| | 6 |

| | 2 |

| | 1 |

| | 5 |

|

| Colombia | | 6 |

| | 6 |

| | — |

| | — |

| | — |

| | — |

|

| | | 43 |

| | 29 |

| | 6 |

| | 2 |

| | 1 |

| | 5 |

|

As a provider of contract land drilling services, our business and the profitability of our operations depend on the level of drilling activity by oil and gas exploration and production companies operating in the geographic markets where we operate. The oil and gas exploration and production industry is a historically cyclical industry characterized by significant changes in the levels of exploration and development activities. During periods of reduced drilling activity or excess rig capacity, price competition tends to increase and the profitability of daywork contracts tends to decrease. In this competitive price environment, we may be more inclined to enter into turnkey contracts that expose us to greater risk of loss but which offer higher potential contract profitability.

During the last three fiscal years, our drilling contracts have primarily been for daywork drilling and we have not performed any footage contract work. The following table presents, by type of contract, information about the total number of wells we completed for our customersclients during each of the last three fiscal years.

| | | | Year ended December 31, | Year ended December 31, |

| Types of Contracts | 2011 | | 2010 | | 2009 | 2012 | | 2011 | | 2010 |

| Daywork | 655 |

| | 453 |

| | 323 |

| 881 |

| | 655 |

| | 453 |

|

| Turnkey | 17 |

| | 11 |

| | 14 |

| 11 |

| | 17 |

| | 11 |

|

| Footage | — |

| | — |

| | 1 |

| |

| Total number of wells | 672 |

| | 464 |

| | 338 |

| 892 |

| | 672 |

| | 464 |

|

Daywork Contracts. Under daywork drilling contracts, we provide a drilling rig and required personnel to our customerclient who supervises the drilling of the well. We are paid based on a negotiated fixed rate per day while the rig is used. Daywork drilling contracts specify the equipment to be used, the size of the hole and the depth of the well. Under a daywork drilling contract, the customer

client bears a large portion of the out-of-pocket drilling costs and we generally bear no part of the usual risks associated with drilling, such as time delays and unanticipated costs.

Turnkey Contracts. Under a turnkey contract, we agree to drill a well for our customerclient to a specified depth and under specified conditions for a fixed price, regardless of the time required or the problems encountered in drilling the well. We provide technical expertise and engineering services, as well as most of the equipment and drilling supplies required to drill the well. We often subcontract for related services, such as the provision of casing crews, cementing and well logging. Under typical turnkey drilling arrangements, we do not receive progress payments and are paid by our customerclient only after we have performed the terms of the drilling contract in full.

The risks to us under a turnkey contract are substantially greater than on a well drilled on a daywork basis. This is primarily because under a turnkey contract we assume most of the risks associated with drilling operations generally assumed by the operator in a daywork contract, including the risk of blowout, loss of hole, stuck drill pipe, machinery breakdowns, abnormal drilling conditions and risks associated with subcontractors’ services, supplies, cost escalations and personnel. We employ or contract for engineering expertise to analyze seismic, geologic and drilling data to identify and reduce some of the drilling risks we assume. We use the results of this analysis to evaluate the risks of a proposed contract and seek to account for such risks in our bid preparation. We believe that our operating experience, qualified drilling personnel, risk management program, internal engineering expertise and access to proficient third-party engineering contractors have allowed us to reduce some of the risks inherent in turnkey drilling operations. We also maintain insurance coverage against some, but not all, drilling hazards. However, the occurrence of uninsured or under-insured losses or operating cost overruns on our turnkey jobs could have a material adverse effect on our financial position and results of operations.

Footage Contracts. Under footage contracts, we are paid a fixed amount for each foot drilled, regardless of the time required or the problems encountered in drilling the well. We typically pay more of the out-of-pocket costs associated with footage contracts as compared to daywork contracts. Similar to a turnkey contract, the risks to us on a footage contract are greater because we assume most of the risks associated with drilling operations generally assumed by the operator in a daywork contract, including loss of hole, stuck drill pipe, machinery breakdowns, abnormal drilling conditions and risks associated with subcontractors’ services, supplies, cost escalation and personnel. As with turnkey contracts, we manage this additional risk through the use of engineering expertise and bid the footage contracts accordingly. We also maintain insurance coverage against some, but not all, drilling hazards. However, the occurrence of uninsured or under-insured losses or operating cost overruns on our footage jobs could have a material adverse effect on our financial position and results of operations.

Production Services DivisionSegment

Well ServicesServicing. Our well servicesservicing rig fleet provides a range of well services,servicing, including the completion of newly-drilled wells, maintenance of existing wells,and workover of existing wells, completion of newly-drilled wells, and plugging and abandonment of wells at the end of their useful lives.

Newly drilled wells require completion services to prepare the well for production. Well servicing rigs are frequently used to complete newly drilled wells to minimize the use of higher cost drilling rigs in the completion process. The completion process may involve selectively perforating the well casing in the productive zones to allow oil or gas to flow into the well bore, stimulating and testing these zones and installing the production string and other downhole equipment. The completion process typically requires a few days to several weeks, depending on the nature and type of the completion, and generally requires additional auxiliary equipment. Accordingly, completion services require less well-to-well mobilization of equipment and can provide higher operating margins than regular maintenance work. The demand for completion services is directly related to drilling activity levels, which are sensitive to changes in oil and gas prices.

Regular maintenance is generally required throughout the life of a well to sustain optimal levels of oil and gas production. We believe regular maintenance comprises the largest portion of our work in this business segment. Common maintenance services include repairing inoperable pumping equipment in an oil well and replacing defective tubing in a gas well. Our maintenance services involve relatively low-cost, short-duration jobs which are part of normal well operating costs. The need for maintenance does not directly depend on the level of drilling activity, although it is somewhat impacted by short-term fluctuations in oil and gas prices. Accordingly, maintenance services generally experience relatively stable demand; however, when oil or gas prices are too low to justify additional expenditures, operating companies may choose to temporarily shut in producing wells rather than incur additional maintenance costs.

In addition to periodic maintenance, producing oil and gas wells occasionally require major repairs or modifications called workovers, which are typically more complex and more time consuming than maintenance operations. Workover services include extensions of existing wells to drain new formations either through perforating the well casing to expose additional productive zones not previously produced, deepening well bores to new zones or the drilling of lateral well bores to improve reservoir drainage patterns. Our well serviceservicing rigs are also used to convert former producing wells to injection wells through which water or carbon dioxide is then pumped into the formation for enhanced oil recovery operations. Workovers also include major subsurface repairs

such as repair or replacement of well casing, recovery or replacement of tubing and removal of foreign objects from the well bore. These extensive workover operations are normally performed by a well serviceservicing rig with additional specialized auxiliary equipment, which may include rotary drilling equipment, mud pumps, mud tanks and fishing tools, depending upon the particular type of workover operation. All of our well serviceservicing rigs are designed to perform complex workover operations. A workover may require a few days to several weeks and generally requires additional auxiliary equipment. The demand for workover services is sensitive to oil and gas producers’ intermediate and long-term expectations for oil and gas prices.

Completion services involve the preparation of newly drilled wells for production. The completion process may involve selectively perforating the well casing in the productive zones to allow oil or gas to flow into the well bore, stimulating and testing these zones and installing the production string and other downhole equipment. We provide well service rigs to assist in this completion process. Newly drilled wells are frequently completed by well service rigs to minimize the use of higher cost drilling rigs in the completion process. The completion process typically requires a few days to several weeks, depending on the nature and type of the completion, and generally requires additional auxiliary equipment. Accordingly, completion services require less well-to-well mobilization of equipment and generally provide higher operating margins than regular maintenance work. The demand for completion services is directly related to drilling activity levels, which are sensitive to changes in oil and gas prices.

Well serviceservicing rigs are also used in the process of permanently closing oil and gas wells no longer capable of producing in economic quantities. Many well operators bid this work on a “turnkey” basis, requiring the service company to perform the entire job, including the sale or disposal of equipment salvaged from the well as part of the compensation received, and complying with state regulatory requirements. Plugging and abandonment work can provide favorable operating margins and is less sensitive to oil and gas pricing than drilling and workover activity since well operators must plug a well in accordance with state regulations when it is no longer productive. We perform plugging and abandonment work throughout our core areas of operation in conjunction with equipment provided by other service companies.

When we provide well services, weWe typically bill customersclients for our well servicing on an hourly basis during the period that the rig providing services is actively working. As of February 10, 2012January 31, 2013, our fleet of well serviceservicing rigs totaled 91108 rigs. These rigs, are locatedwhich we operate through 12 locations, mostly in the Gulf Coast and ArkLaTex regions, though we also have 1113 rigs in North Dakota. Our fleet is among the newest in the industry, consisting primarily of premium,ninety-eight 550 horsepower and ten 600 horsepower rigs capable of working at depths of 20,000 feet.

Wireline Services. We provide both open and cased-hole wireline services with our fleetWireline trucks, like well servicing rigs, are utilized throughout the life of 109 wireline units, asa well. Wireline trucks are often used in place of February 10, 2012. We provide these servicesa well servicing rig when there is no requirement to remove tubulars from the well in Texas, Kansas, Colorado, Utah, Montana, North Dakota, Louisiana, Oklahoma, Wyoming and Mississippi. order to make repairs.

Wireline services typically utilize a single truck equipped with a spool of wireline that is used to lower and raise a variety of specialized tools in and out of the wellbore. Electric wireline contains a conduit that allows signals to be transmitted to or from tools located in the well. These tools can be used to measure pressures and temperatures as well as the condition of the casing and the cement that holds the casing in place. In order for oil and gas exploration and production companies to better understand the reservoirs they are drilling or producing, they require logging services to accurately characterize reservoir rocks and fluids. We provide both open and cased-hole logging services, including the latest pulsed-neutron technology.

Other applications for wireline tools include placing equipment in or retrieving equipment from the wellbore, orinstalling bridge plugs, perforating the casing andin order to prepare the well for production, or cutting off pipe that is stuck in the well so that the free section can be recovered. Electric

We provide both open and cased-hole logging services, including the latest pulsed-neutron technology. As of January 31, 2013, our wireline contains a conduit that allows signals to be transmitted to or from tools locatedservices fleet totaled 120 wireline units, including four offshore units, which we operate through 24 locations in the well. Wireline trucks are often used in place of a well service rig when there is no requirement to remove tubulars from the well in order to make repairs. Wireline trucks, like well service rigs, are utilized throughout the life of a well.Texas, Kansas, Colorado, Utah, Montana, North Dakota, Louisiana, Oklahoma, Wyoming and Mississippi.

Coiled Tubing Services. Coiled tubing is an important element of the well serviceproduction services industry today that allows operators to continue production during service operations without shutting in the well, thereby reducing the risk of formation damage. Coiled tubing services involve the use of a continuous metal pipe spooled on a large reel for oil and natural gas well applications, such as wellbore clean-outs, nitrogen jet lifts, through-tubing fishing, formation stimulation utilizing acid, chemical treatments and fracturing. Coiled tubing is also used for a number of horizontal well applications such as milling temporary plugs between frac stages. OurAs of January 31, 2013, our coiled tubing business consists of tennine coiled tubingonshore and four offshore units, which are currently deployed in Texas, Louisiana Oklahoma and Pennsylvania.Oklahoma.

Fishing and Rental Services. Our rentalfishing and fishingrental tool business provides a range of specialized services and equipment that are utilized on a non-routine basis for both drilling and well servicing operations. Drilling and well serviceservicing rigs are equipped with a complement of tools to complete routine operations under normal conditions for most projects in the geographic area where they are employed. When downhole problems develop with drilling or servicing operations, or conditions require non-routine equipment, our customersclients will usually rely on a provider of rental and fishing tools to augment equipment that is provided with a typical drilling or well serviceservicing rig package. The important rental tools that we offer include air drilling equipment, foam units, power swivels, and blowout preventers.

The term “fishing” applies to a wide variety of downhole operations designed to correct a problem that has developed when drilling or servicing a well. Often, the problem involves equipment that has become lodged in the well and cannot be removed without special equipment. Our customersclients employ our technicians and our tools that are specifically suited to retrieve the trapped equipment, or “fish,” in order for operations to resume.

Our Production Services

12

Seasonality

All our production services operations are impacted by seasonal factors. Our business can be negatively impacted during the winter months due to inclement weather, fewer daylight hours, and holidays. Because our well serviceservicing rigs, wireline units and coiled tubing units are mobile, during periods of heavy snow, ice or rain, we may not be able to move our equipment between locations.

CustomersClients

We provide drilling services and production services to numerous major and independent oil and gas exploration and production companies that are active in the geographic areas in which we operate. The following table shows our three largest customersclients as a percentage of our total revenue for each of our last three fiscal years.

|

| | | |

Customer | | Total Revenue Percentage |

| Fiscal year ended December 31, 2012 | | |

| Whiting Petroleum Company | | 10.1 | % |

| Ecopetrol | | 9.7 | % |

| Apache Corporation | | 5.5 | % |

| | |

| Fiscal year ended December 31, 2011 | | |

| Ecopetrol | | 13.5 | % |

| Whiting Petroleum Corporation | | 10.6 | % |

| Talisman Energy USA, Inc. | | 3.6 | % |

| | | |

| Fiscal year ended December 31, 2010 | | |

| Ecopetrol | | 17.7 | % |

| Whiting Petroleum Corporation | | 8.9 | % |

| Chesapeake Operating, Inc. | | 3.7 | % |

| | |

Fiscal year ended December 31, 2009 | |

|

Ecopetrol | | 16.2 | % |

Anadarko Petroleum Corporation | | 5.9 | % |

Cabot Oil and Gas Corporation | | 5.6 | % |

Competition

Drilling Services DivisionSegment

We encounter substantial competition from other drilling contractors. Our primary market areas are highly fragmented and competitive. The fact that drilling rigs are mobile and can be moved from one market to another in response to market conditions heightens the competition in the industry.

The drilling contracts we compete for are usually awarded on the basis of competitive bids. Our principal competitors are Helmerich & Payne, Inc., Precision Drilling Trust, Patterson-UTI Energy, Inc. and Nabors Industries, Ltd. In addition to pricing and rig availability, we believe the following factors are also important to our customersclients in determining which drilling contractors to select:

the type and condition of each of the competing drilling rigs;

the mobility and efficiency of the rigs;

the quality of service and experience of the rig crews;

the safety records of the rigs;our company;

the offering of ancillary services; and

the ability to provide drilling equipment adaptable to, and personnel familiar with, new technologies and drilling techniques.

While we must be competitive in our pricing, our competitive strategy generally emphasizes the quality of our equipment, theour safety record, of our rigs andability to offer ancillary services, the experience of our rig crews and the quality of service we provide to differentiate us from our competitors.

Drilling companies compete primarily on a regional basis, and the intensity of competition may vary significantly from region to region at any particular time. If demand for drilling services improves in a region where we operate, our competitors might respond by moving in suitable rigs from other regions. An influx of rigs from other regions could rapidly intensify competition and make any improvement in demand for drilling rigs in a particular region short-lived.

Some of our competitors have greater financial, technical and other resources than we do. Their greater capabilities in these areas may enable them to:

better withstand industry downturns;

compete more effectively on the basis of price and technology;

better retain skilled rig personnel; and

build new rigs or acquire and refurbish existing rigs so as to be able toand place rigsthem into service more quickly than us in periods of high drilling demand.

Production Services DivisionSegment

The market for production services is highly competitive. Competition is influenced by such factors as price, capacity, availability of work crews, type and condition of equipment and reputation and experience of the service provider. We believe that an important competitive factor in establishing and maintaining long-term customerclient relationships is having an experienced, skilled and well-trained work force. In recent years, many of our larger customersclients have placed increased emphasis on the safety performance and quality of the crews, equipment and services provided by their contractors. We have devoted, and will continue to devote, substantial resources toward employee safety and training programs. Although we believe customersclients consider all of these factors, price is generally the primary factor in determining which service provider is awarded the work. However, we believe that most customersclients are willing to pay a slight premium for the quality and efficient service we provide.

The largest well serviceservicing providers that we compete with are Key Energy Services, Basic Energy Services, Nabors Industries, Superior Energy Services, Inc. and CC Forbes. In addition, there are numerous smaller companies that compete in our well serviceservicing markets.

The wireline market is dominated by Schlumberger Ltd. and Halliburton Company. These companies have a substantially larger asset base than we do and operate in all major U.S. oil and natural gas producing basins. Other competitors include Weatherford International, Baker Hughes, Superior Energy Services, Basic Energy Services, and KeyC&J Energy Services. The market for wireline services is very competitive, but historically we have competed effectively with our competitors based on performance and strong customerclient service.

The market for coiled tubing has increased due to the growth in deep well and horizontal drilling. Our primary competitors in the coiled tubing services market include Schlumberger Ltd., Baker Hughes, Halliburton Company, Key Energy Services, RPC Inc. and Superior Energy Services, Inc. In addition, numerous small companies compete in our coiled tubing services markets in the United States.

The fishing and rental tools market is fragmented compared to our other product lines. Companies that provide fishing services generally compete based on the reputation of their fishing tool operators and their relationships with customers.clients. Competition for rental tools is sometimes based on price; however, in most cases, when a customerclient chooses a specific fishing tool operator for a particular job, then the necessary rental equipment will be part of that job as well. Our primary competitors in this areaservice market include Baker Hughes, Weatherford International, Basic Energy Services, Key Energy Services, Quail Tools (owned by Parker Drilling) and Knight Oil Tools.

The need for well servicing, wireline, coiled tubing, and fishing and rental services fluctuates primarily in relation to the price (or anticipated price) of oil and natural gas, which in turn is driven by the supply of and demand for oil and natural gas. Generally, as supply of thosethese commodities decreases and demand increases, service and maintenance requirements increase as oil and natural gas producers attempt to maximize the productivity of their wells in a higher priced environment.

The level of our revenues, earnings and cash flows are substantially dependent upon, and affected by, the level of domestic and international oil and gas exploration and development activity, as well as the equipment capacity in any particular region. For a more detailed discussion, see Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Raw Materials

The materials and supplies we use in our drilling and production services operations include fuels to operate our drilling and well service equipment, drilling mud, drill pipe, drill collars, drill bits and cement. We do not rely on a single source of supply for any of these items. While

we are not currently experiencing any shortages, from time to time there have been shortages of drilling equipment and supplies during periods of high demand. Shortages could result in increased prices for drilling equipment or supplies that we may be unable to pass on to customers.clients. In addition, during periods of shortages, the delivery times for equipment and supplies can be substantially longer. Any significant delays in our obtaining drilling equipment or supplies could limit our drilling operations and jeopardize our relations with customers.clients. In addition, shortages of drilling equipment or supplies could delay and adversely affect our ability to obtain new contracts for our drilling rigs, which could have a material adverse effect on our financial condition and results of operations.

Operating Risks and Insurance

Our operations are subject to the many hazards inherent in the contract land drilling business, including the risks of:

blowouts;

fires and explosions;

loss of well control;

collapse of the borehole;

lost or stuck drill strings; and

damage or loss from natural disasters.

Any of these hazards can result in substantial liabilities or losses to us from, among other things:

suspension of drilling operations;

damage to, or destruction of, our property and equipment and that of others;

personal injury and loss of life;

damage to producing or potentially productive oil and gas formations through which we drill; and

environmental damage.

We seek to protect ourselves from some but not all operating hazards through insurance coverage. However, some risks are either not insurable or insurance is available only at rates that we consider uneconomical. Those risks include pollution liability in excess of relatively low limits. Depending on competitive conditions and other factors, we attempt to obtain contractual protection against uninsured operating risks from our customers.clients. However, customersclients who provide contractual indemnification protection may not in all cases maintain adequate insurance to support their indemnification obligations. Our insurance or indemnification arrangements may not adequately protect us against liability or loss from all the hazards of our operations. The occurrence of a significant event that we have not fully insured or indemnified against or the failure of a customerclient to meet its indemnification obligations to us could materially and adversely affect our results of operations and financial condition. Furthermore, we may not be able to maintain adequate insurance in the future at rates we consider reasonable.

Our current insurance coverage includes property insurance on our rigs, drilling equipment, production services equipment and real property. Our insurance coverage for property damage to our rigs, drilling equipment and production services equipment is based on our estimates of the cost of comparable used equipment to replace the insured property. The policy provides for a deductible on drilling rigs of $250,000$500,000 per occurrence ($500,000($750,000 deductible for rigs with an insured value greater than $10 million), and a deductible on production services equipment of $100,000$250,000 per occurrence. Our third-party liability insurance coverage is $76$76 million per occurrence and in the aggregate, with a deductible of $260,000$260,000 per occurrence. We also carry insurance coverage for pollution liability up to $20 million with a deductible of $250,000. We believe that we are adequately insured for public liability and property damage to others with respect to our operations. However, such insurance may not be sufficient to protect us against liability for all consequences of well disasters, extensive fire damage or damage to the environment.

In addition, we generally carry insurance coverage to protect against certain hazards inherent in our turnkey contract drilling operations. This insurance covers “control-of-well,” including blowouts above and below the surface, redrilling, seepage and pollution. This policy provides coverage of $3 million, $5 million, $10 million, $15 million or $20 million depending on the area in which the well is drilled and its target depth, subject to a deductible of the greater of 15%12.5% of the well’s anticipated dry hole cost or $150,000.$150,000. This policy also provides care, custody and control insurance, with a limit of $1$1 million, subject to a $100,000$100,000 deductible.

Employees

We currently have approximately 3,3303,750 employees. Approximately 300400 of these employees are salaried administrative or supervisory employees. The rest of our employees are working in operations for our Drilling Services DivisionSegment and Production Services DivisionSegment and are primarily compensated on an hourly basis. The number of employees in operations fluctuates depending

on the utilization of our drilling rigs, well serviceservicing rigs, wireline units and coiled tubing units at any particular time. None of our employment arrangements are subject to collective bargaining arrangements.

Our operations require the services of employees having the technical training and experience necessary to obtainachieve proper operational standards. As a result, our operations depend, to a considerable extent, on the continuing availability of such personnel. Although we have not encountered material difficulty in hiring and retaining employees in our operations, shortages of qualified personnel have occurred in our industry. If we should suffer any material loss of personnel to competitors or be unable to employ additional or replacement personnel with the requisite level of training and experience to adequately operate our equipment, our operations could be materially and adversely affected. While we believe our wage rates are competitive and our relationships with our employees are satisfactory, a significant increase in the wages paid by other employers could result in a reduction in our workforce, increases in wage rates, or both. The occurrence of either of these events for a significant period of time could have a material and adverse effect on our financial condition and results of operations.

Facilities

OurWe lease our corporate office facilities are located at 1250 N.E. Loop 410, Suite 1000 San Antonio, Texas 78209 and are leased through December 2020 with payments escalating from $29,839 per month in January 2012 to $42,635 per month in December 2020, for which the lease term is cancelable as early as December 2016 with applicable penalties.

78209. We conduct our business operations through 8268 other real estate locations, of which we own 14, in the United States (Texas, Oklahoma, Colorado, Utah, Montana, North Dakota, Pennsylvania, Wyoming, Mississippi, Arkansas, Louisiana and Kansas) and internationally in Colombia. These real estate locations are primarily used for regional offices and storage and maintenance yards. We own 10 of these real estate locations and the remaining 72 real estate locations are leased with payments ranging from $250 per month to $30,966 per month with non-cancelable lease terms expiring through August 2022.

Governmental Regulation

Our operations are subject to stringent laws and regulations relating to containment, disposal and controlling the discharge of hazardous oilfield waste and other non-hazardous waste material into the environment, requiring removal and cleanup under certain circumstances, or otherwise relating to the protection of the environment. In addition, our operations are often conducted in or near ecologically sensitive areas, such as wetlands and coastal areas of the Gulf of Mexico, which are subject to special protective measures and which may expose us to additional operating costs and liabilities for accidental discharges of oil, natural gas, drilling fluids or contaminated water, or for noncompliance with other aspects of applicable laws. We are also subject to the requirements of the federal Occupational Safety and Health Act (OSHA) and comparable state statutes. The OSHA hazard communication standard, the Environmental Protection Agency (EPA) “community right-to-know” regulations under Title III of the Federal Superfund Amendment and Reauthorization Act and comparable state statutes require us to organize and report information about the hazardous materials we use in our operations to employees, state and local government authorities and local citizens.

Environmental laws and regulations are complex and subject to frequent change. In some cases, they can impose liability for the entire cost of cleanup on any responsible party, without regard to negligence or fault, and can impose liability on us for the conduct of others or conditions others have caused, or for our acts that complied with all applicable requirements when we performed them. We may also be exposed to environmental or other liabilities originating from businesses and assets that we purchased from others. Compliance with applicable environmental laws and regulations has not, to date, materially affected our capital expenditures, earnings or competitive position, although compliance measures have added to our costs of operating drilling equipment in some instances. We do not expect to incur material capital expenditures in our next fiscal year in order to comply with current environment control regulations. However, our compliance with amended, new or more stringent requirements, stricter interpretations of existing requirements or the future discovery of contamination may require us to make material expenditures or subject us to liabilities that we currently do not anticipate.

There are a variety of regulatory developments, proposals or requirements and legislative initiatives that have been introduced in the United States and international regions in which we operate that are focused on restricting the emission of carbon dioxide, methane and other greenhouse gases. Among these developments are the United Nations Framework Convention on Climate Change, also known as the “Kyoto Protocol” (an internationally applied protocol, which has been ratified in Colombia, one of our reporting segments), the Regional Greenhouse Gas Initiative or “RGGI” in the Northeastern United States, and the Western Regional Climate Action Initiative in the Western United States.

The U.S. Congress has from time to time considered legislation to reduce emissions of greenhouse gases, primarily through the development of greenhouse gas cap and trade programs. In addition, more than one-third of the states already have begun implementing legal measures to reduce emissions of greenhouse gases.

In 2007, the United States Supreme Court in Massachusetts, et al. v. EPA, held that carbon dioxide may be regulated as an “air pollutant” under the federal Clean Air Act. On December 7, 2009, the EPA responded to the Massachusetts, et al. v. EPA decision and issued a finding that the current and projected concentrations of greenhouse gases in the atmosphere threaten the public health and welfare of current and future generations, and that certain greenhouse gases from new motor vehicles and motor vehicle engines contribute to the atmospheric concentrations of greenhouse gases and hence to the threat of climate change.

Based on these findings, in 2010 the EPA adopted two sets of regulations that restrict emissions of greenhouse gases under existing provisions of the federal Clean Air Act, including one that requires a reduction in emissions of greenhouse gases from motor vehicles and another that requires certain construction and operating permit reviews for greenhouse gas emissions from certain large stationary sources. The stationary source final rule addresses the permitting of greenhouse gas emissions from stationary sources under the Clean Air Act Prevention of Significant Deterioration construction and Title V operating permit programs, pursuant to which these permit programs have been "tailored" to apply to certain stationary sources of greenhouse gas emissions in a multi-step process, with the largest sources first subject to permitting. In addition, the EPA adopted rules requiring the monitoring and reporting of greenhouse gases from certain sources, including, among others, onshore oil and natural gas production facilities.

In April 2012, the EPA issued regulations specifically applicable to the oil and gas industry that will require operators to significantly reduce volatile organic compounds, or VOC, emissions from natural gas wells that are hydraulically fractured through the use of “green completions” to capture natural gas that would otherwise escape into the air. The EPA also issued regulations that establish standards for VOC emissions from several types of equipment at natural gas well sites, including storage tanks, compressors, dehydrators and pneumatic controllers.

Although it is not possible at this time to predict whether proposed legislation or regulations will be adopted as initially written, if at all, or how legislation or new regulations that may be adopted to address greenhouse gas emissions would impact our business, any such future laws and regulations could result in increased compliance costs or additional operating restrictions. Any additional costs or operating restrictions associated with legislation or regulations regarding greenhouse gas emissions could have a material adverse effect on our operating results and cash flows. In addition, these developments could curtail the demand for fossil fuels such as oil and gas in areas of the world where our customersclients operate and thus adversely affect demand for our services, which may in turn adversely affect our future results of operations. Finally, we cannot predict with any certainty whether changes to temperature, storm intensity or precipitation patterns as a result of climate change will have a material impact on our operations.

Hydraulic fracturing is a commonly used process that involves injection of water, sand, and a minor amount of certain chemicals to fracture the hydrocarbon-bearing rock formation to allow flow of hydrocarbons into the wellbore. The federal Energy Policy Act of 2005 amended the Underground Injection Control provisions of the federal Safe Drinking Water Act (SDWA) to exclude certain hydraulic fracturing practices from the definition of "underground injection." The EPA has asserted regulatory authority over certain hydraulic fracturing activities involving diesel fuel and has begun the process of draftingdeveloped draft guidance relating to such practices. In addition, repeal of the SDWA exclusion of hydraulic fracturing has been advocated by certain advocacy organizations and others in the public. LegislationCongress has also been introduced before Congressfrom time to time considered legislation to repeal the exemption for hydraulic fracturing from the SDWA, which would have the effect of allowing the EPA to promulgate new regulations and permitting requirements for hydraulic fracturing, and to require the disclosure of the chemical constituents of hydraulic fracturing fluids to a regulatory agency, which would make the information public via the Internet.

Scrutiny of hydraulic fracturing activities continues in other ways, with the EPA having commenced a study of the potential environmental impacts of hydraulic fracturing, the initial results of which are expected to be available by late 2012 and the final results of which are expected in 2014. In addition, in April 2012, the EPA issued the first federal air standards for natural gas wells that are hydraulically fractured, which will require operators to significantly reduce VOC emissions through the use of “green completions” to capture natural gas that would otherwise escape into the air. Moreover, the EPA is developing effluent limitations for the treatment and discharge of wastewater resulting from hydraulic fracturing activities and plans to propose these standards by 2014. The U.S. Department of the Interior has also announced that it will proposeproposed regulations relating to the use of hydraulic fracturing techniques on public lands and disclosure of fracturing fluid constituents.

In addition, some states and localities have adopted, and others are considering adopting, regulations or ordinances that could restrict hydraulic fracturing in certain circumstances, that would require, with some exceptions, disclosure of constituents of hydraulic fracturing fluids, or that would impose higher taxes, fees or royalties on natural gas production. Moreover, public debate over hydraulic fracturing and shale gas production has been increasing, and has resulted in delays of well permits in some areas.

Increased regulation and attention given to the hydraulic fracturing process could lead to greater opposition, including litigation, to oil and gas production activities using hydraulic fracturing techniques. Additional legislation or regulation could also lead to operational delays or increased operating costs in the production of oil and natural gas, including from the developing shale plays, incurred by our customers.clients. The adoption of any federal, state or local laws or the implementation of regulations or ordinances restricting or increasing the costs of hydraulic fracturing could cause a decrease in the completion of new oil and natural gas wells and an associated decrease in demand for our drilling and well servicing activities, any or all of which could adversely affect our financial position, results of operations and cash flows.

In addition, our business depends on the demand for land drilling and production services from the oil and gas industry and, therefore, is affected by tax, environmental and other laws relating to the oil and gas industry generally, by changes in those laws

and by changes in related administrative regulations. It is possible that these laws and regulations may in the future add significantly to our operating costs or those of our customers,clients, or otherwise directly or indirectly affect our operations.

Our wireline operations involve the use of radioactive isotopes along with other nuclear, electrical, acoustic, and mechanical devices. Our activities involving the use of isotopes are regulated by the U.S. Nuclear Regulatory Commission and specified agencies of certain states. Additionally, we use high explosive charges for perforating casing and formations, and we use various explosive cutters to assist in wellbore cleanout. Such operations are regulated by the U.S. Department of Justice, Bureau of Alcohol, Tobacco, Firearms, and Explosives and require us to obtain licenses or other approvals for the use of densitometers as well as explosive charges. We have obtained these licenses and approvals when necessary and believe that we are in substantial compliance with these federal requirements.