UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x[ ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011ended:

oor

[X] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________January 1, 2014, to __________June 30, 2014

Commission File Number: 000-53548

Calibrus, Inc.GROW CONDOS, INC.

(Exact (Exact name of registrant as specified in its charter)

| Nevada | | 86-0970023 |

| (State or other jurisdiction of | incorporation or organization) | (I.R.S. Employer I.D.Identification No.) |

incorporation or organization | | |

| | |

1225 West Washington Street, Suite 213, Tempe, AZ | | 85281 |

(Address of principal executive offices) | | (Zip Code) |

Issuer's722 W. Dutton Road

Eagle Point, OR 97524

(Address of principal executive offices)

541-879-0504

(Registrant’s telephone number, including area code: (602) 778-7500code)

Securities registered pursuant to sectionSection 12(b) of the Act: None

Title of each class | Name of each exchange on which registered |

None | N/A |

Securities registered pursuant to sectionSection 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class) $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

Act. Yes o[ ] No x[X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act

Exchange Act. Yes o[ ] No x[X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the pastpreceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

(1) Yes x[X] No o[ ] (2) Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site,Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).files. Yes [X] No [ ]

Yes x No o

Indicate by check mark if disclosure of delinquent filers in responsepursuant to Itemitem 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant'sregistrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.company:

Large Accelerated filer | o | |

| Large accelerated filer [ ] | Accelerated filer | ofiled [ ] |

| Non-accelerated filer | o | (Do not check if a smaller reporting company)[ ] | Smaller reporting company | x [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o[ ] No x[X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked pricesprice of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: quarter.

The Company’smarket value of the voting and non-voting common stock last tradedis $9,998,261, based on April 13, 2011 at $.15 per share giving the20,404,614 shares held by non-affiliates a value of $1,512,723. Sincenon-affiliates. The shares were valued at $0.49 per share, that being the Registrant does not have an active trading market these numbers may not be a reliable indicationclosing price on June 30, 2014, the last business day of the share price.registrant’s transition period.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Not applicable.

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

As of April 4, 2012,October 14, 2014, the Registrantregistrant had 13,808,58041,568,494 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the part of the Form 10-K (e.g., part I, part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or other information statement; and (3) Any prospectus filed pursuant to rule 424(b) or (c) under the Securities Act of 1933: NONESee Part IV, Item 15.

PART I

FORWARD LOOKING STATEMENTS

In this Annual Report, references to “Grow Condos,” the “Company,” “we,” “us,” “our” and words of similar import) refer to Grow Condos, Inc., a Nevada corporation, the registrant and, when appropriate, its subsidiary.

Statements made in this Form 10-K which are not purely historical are forward-looking statements with respect to the goals, plan objectives, intentions, expectations, financial condition, results of operations, future performance and business of Grow Condos. Such forward-looking statements include those that are preceded by, followed by or that include the words "may", "would", "could", "should", "expects", "projects", "anticipates", "believes", "estimates", "plans", "intends", "targets" or similar expressions.

Forward-looking statements involve inherent risks and uncertainties, and important factors (many of which are beyond our control) that could cause actual results to differ materially from those set forth in the forward-looking statements, including the following, in addition to those contained in this Annual Report: general economic or industry conditions nationally and/or in the communities in which we conduct business; legislation or regulatory requirements, including environmental requirements; conditions of the securities markets; competition; our ability to raise capital; changes in accounting principles, policies or guidelines; financial or political instability; acts of war or terrorism; and other economic, competitive, governmental, regulatory and technical factors affecting our operations, products, services and prices.

Accordingly, results actually achieved may differ materially from expected results in these statements. Forward-looking statements speak only as of the date they are made. Grow Condos does not undertake, and specifically disclaims, any obligation to update any forward-looking statements to reflect events or circumstances occurring after the date of such statements.

ITEM 1. BUSINESS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTSItem 1. Description of Business

This periodic report contains certain forward-looking statements with respect to the financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive positions, growth opportunities for existing products, plans and objectives of management. Statements in this periodic report that are not historical facts are hereby identified as “forward-looking statements.”History

Overview

Calibrus,Grow Condos, Inc. is(the “Company”) was incorporated on October 22, 1999, in the State of Nevada. From its inception, the Company was a technology basedcall center that contracted out as a customer contact center for a variety of business clients throughout the United States. Over time our main business became a third party verification service. After making a sale on the telephone, a company established in 1999. We have two business units that leverage our technology capabilities. We have provided Hosted Business Solutions for ten years and now plan to expand our offerings to offer a social networking site called JabberMonkey (Jabbermonkey.com) and a location-based, social networking application for smart phones called Fanatic Fans.

Through our Hosted Business Solutions, we provide Third Party Verification (TPV) Services, Hosted Call Recording Services and Interactive Voice Response/Voice Recognition Unit (IVR/VRU) Services to some telecom, cable and insurance companies. We estimate that we have processed over 50 million live agent calls/recordings and 5 million IVR calls/recordings to date serving these companies. With over 75 employees,would send the latest equipment and in-house designed software and solutions, we are the hosted solution company that companies can trust with their data.

Our technology provides us with the ability to provide fully-integrated live voice, data, and automated services and combinations of services out of a unified platform. Our system’s processes and functionality allow our IT staff to easily design and build systems that satisfy clients’ process requirements. Using our technology has allowed us to develop and build customized web-based solutions incorporating call recording, “click to call” and voice message broadcast functionality.

Calibrus has leveraged our technology capabilities to expand into the growing market of social marketing. Leveraging the software development experience we have obtained over the last 10 years, we created the site JabberMonkey.com. JabberMonkey is a site where users can have an interactive experience of asking questions of other members, post comments and have ongoing interactive video and text chats. We have also developed a location based social networking application that focuses on live events such as sporting events and music concerts.

Calibrus Products and Services - Calibrus Hosted Third Party Verification (TPV) Services

Calibrus' Third Party Verification service is easy to use and offers both Live Operator and IVR/VRU Third Party Verification services. Calibrus’ Live Operators process thousands of TPV calls daily. To date, Live Operator TPV has been the solution of choice for several of our largest customers. Live operators offer the best customer experience and typically higher success rates over IVR/VRU solutions. Our Automated IVR (Interactive Voice Response)/ VRU (Voice Recognition Unit) solution offers a low-cost alternative to a live voice agent while ensuring compliance with both FCC and State PUC (Public Utility Commission) Third Party Verification requirements. Our IVR systems feature intuitive scriptingCompany operator to automatically ensureconfirm the correct questions are asked. Our custom IVR solutions enable client’s customers to easily opt-out to a live agent at any time if they require personal attention.

What is Third Party Verification?

Third Party Verification is the confirmation of a customer’s order by an independent third party.order. This process protectsprotected both the customer and the company selling services from fraud and slamming/cramming of products onto their lines. Once the sale has been made, the customer is transferred to an independent Third Party, such as Calibrus, that will read a pre-determined script to which the customer will answer yes or no.

In 1996, the Federal Communications Commission, FCC, enacted the Telecommunications Act which forced the Regional Bell Operating Companies to open their lines to competition. Accordingly, telecom companies were required to allow competitors to lease their lines and provide service to customers at a rate set by each individual State’s Utility Commission. This was to promote competition and help new competitors compete with the larger telecom companies on a level playing field. Unfortunately, this led to another phenomena called slamming, customers being switched from one company to another without their approval, and sometimes without any knowledge whatsoever until they received their bill.telephone sales fraud.

In responseWhile continuing to slamming, legislation was enacted that required companies that were changing a customer’s dial tone or long distance to their services would have to first obtain the customer’s approval in one of three ways:

· | A written and signed Letter of Authorization indicating that customer agrees to the change. |

· | An automated or live agent independent third party that the customer is transferred to for the verification. |

· | An electronic Signature on an electronic Letter of Authorization, usually done on websites. |

Calibrus fulfills the second requirement, providing both automated IVR/VRU and Live Agent Third party Verification Services for our clients.

Automated IVR/VRU Service Highlights

· | Dual Channel Recording to Eliminate the Loss of Interactions/Customer Statements |

· | Very Low Implementation and Ongoing Cost |

· | Simple to Set Up, Implement and Launch |

· | Close to Real-Time Call Record and File Retrieval and Posting |

· | Dedicated Management and IT Resources, 24/7 Availability |

· | Superior Value and Cost Competitive IVR Services |

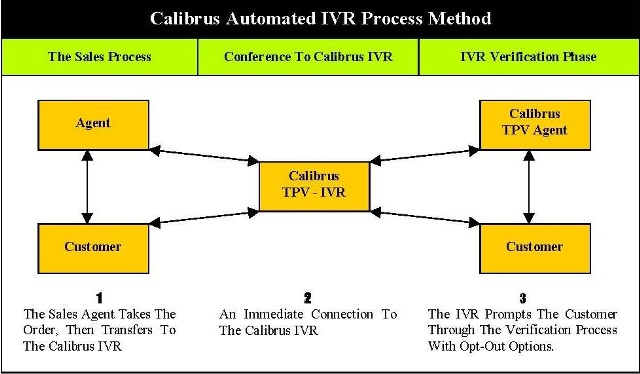

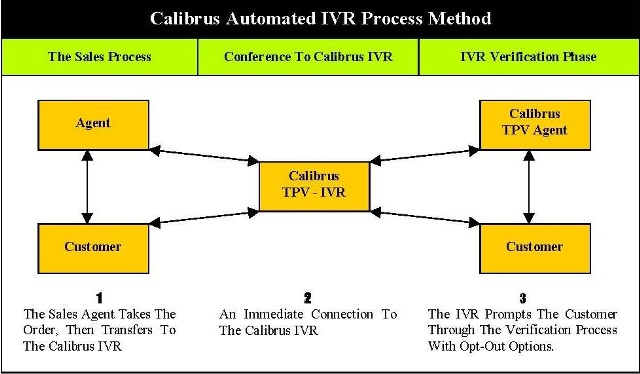

Our automated IVR verification method provides customers with a pre-determined script to comply with each client’s unique verification requirements. The following diagram demonstrates our basic Automated IVR Process Method:

Our Automated IVR/VRU TPV services are priced on per transaction or per minute usage.

Live Operator TPV

In addition to our automated TPV services, we also offer Live Operator TPV Service. When customers want to provide live interactions with ultimate flexibility, our Live Operator Services can be used in conjunction with our automated TPV services oroperate as a stand alone service. Customers that selectcall center, in 2008 we expanded our Live Operator service offering will see several benefits, such as:

· | Better Customer Experience |

· | Superior Universal Language Coverage (i.e. Spanish, Chinese, Japanese, Korean, etc.) |

· | Documented Higher Success Rates (success rates average over 96%)

|

· | Higher Success Rates Mean: |

o | Less Back Room Clean-up Expense |

o | Fewer Lost Sales due to Non-Verified TPV’s |

· | Close to Real-Time Call Record and File Retrieval and Posting |

· | Cost Competitive Live Operator Answering Service |

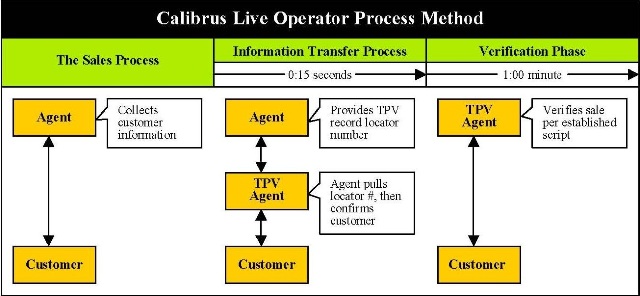

Calibrus has developed a TPV process that allows for a very efficient transfer of data from a sales agentbusiness plan to a Calibrus Live Operator. This process reduces call lengths, agent errors, and TPV costs. The following is a diagram of our Live Operator TPV Process Method.

Our Live Operator Third Party Verification solution helps our customers meet compliance requirements and improve their overall business processes. TPV revenue accounted for approximately 98.5% ofinclude the Company’s total revenue. For 2011, 77.1% of our TPV revenue was derived from Live Operator services and 21.6% was derived IVR/VRU services. Our TPV services are priced on per transaction or per minute usage.

VOIP Verifications

Calibrus Live Agent VOIP Verifications provide a solution for customers that want to provide live interactions with the ultimate flexibility. Automated IVR Verifications is a low-cost alternative to a live voice agent that still complies with both FCC and State PUC Third Party Verification requirements. Intuitive scripting ensures the correct questions are automatically asked. Customers can easily opt-out to a live agent at any time if they require personal attention.

Hosted Call Recording

Calibrus’ Call Recording service is easy to use and cost-effective and offers a number of features necessary for a superior call recording solution. Calibrus’ Hosted Call Recording solutions are an alternative for companies that do not wish to invest in expensive hardware, maintenance and supportdevelopment of a state-of-the-art call recording system.

Our Hosted Call Recording Features include:

· | All Inclusive Pay-As-You-Go Pricing Model by the Minute or by the Transaction/Call |

· | No Maintenance, Upgrade, Programming, Site/Seat Licensing or Change Fees |

· | Call Record & File Access 24/7 Via a Secured Website for Easy Retrieval |

· | Customized Reporting Options |

· | High Quality Recording with Redundant Systems and Disaster Recovery |

· | Compatible and Flexible Process can be used with Virtually Any System |

· | Optional Quality Control Monitoring and Evaluation Services |

Hosted Call Recording for the Insurance Industry

Our call recording solution assists insurance companies to record and retain valuable, mission critical conversations that occur during claim statements and interviews, while, we believe, improving efficiencies and reducing costs in the claims process.

Calibrus’ recording process is easy to use, secure and completely customizable. Insurance adjusters can set up a call and start recording quickly without expensive equipment. The Calibrus system ties important information for the claim, claim number, interviewee name, and other information to the file so customers can sort it later. The adjustor dials into Calibrus and records the conversation with the claimant and simply hangs up when finished. The recording will be processed and available within minutes after the call is finished and accessible via the reporting website. If necessary, Calibrus can send a confirmation email to the adjuster that includes a hyperlink to the recording for easy retrieval.

Once the recording has ended a secure password protected web-based reporting website allows claims managers, compliance officers and executives to access the recordings of the claim statements and interviews in seconds. Indexing of the data such as claim number, insured name, interviewee name, and adjuster ID allows authorized individuals the ability to search on things such as claim number and find all associated recordings for that claim. The reporting website serves as a quality assurance and management tool as well, providing the ability to pull up all recordings for an adjuster ID, and listen to every call that a particular adjuster did that day.

For independent/contracted adjusters out in the field, Calibrus has developed an upload tool to provide insurance companies with the ability to combine all of their digital claims recordings, whether done internally or externally by contracted companies, into one database. The Calibrus upload capability allows external adjustors/interviewers to record interviews “on the street” and then upload them to the Calibrus database using a secure web portal. Independent adjusters can use any handheld recorder that can download a recording into a .wav file format onto their computers.

The upload process is very simple to use: Access the secure web portal, enter in the information into the portal to be tied to the recording, mark the “Upload” existing file checkbox, identify the file and hit submit. The file is then uploaded into the Claims Recording Database and is then available to pull in the reporting website. Calibrus offers insurance companies the ability to switch to a hosted solution without having to invest heavily into an internal recording solution. By using our hosted solution, customers forgo having to invest in hardware, software,social networking site licenses, continuous upgrades, storage facilities and dedicated IT support. We handle all of that for our customers, and get a recording solution in place within weeks. Other benefits of using our solution are immediate access for playback of the recorded statement, back up redundancy of the digital .wav file for security purposes, enhanced call tracking and data analysis, ability by managers to quickly review calls and provide coaching easily, and customizable report capabilities. For 2011, .94% of our total revenue was derived from Call Recording services.

Voice Message Broadcasting (VMB)

Our web-based voice message broadcasting solution has the ability to contact hundreds to thousands of people in seconds. We can create dialing parameters based upon dialing lists, the message to be sentcalled JabberMonkey (Jabbermonkey.com) and the times to call out on, which can be adjusted to fit time zones across the nation. Customers can broadcast caller id and change and record their message in a matter of minutes.

Our voice message broadcasting programs can assist in:

· | Direct Customers to your Website |

· | Relationship Calls – Happy Birthday, Anniversary, etc. |

· | Political Campaigns – Get out to Vote |

· | Customer Loyalty Campaigns to Repeat Customers |

· | Meeting/Conference Notifications |

· | Sports Team Advertising |

· | School and Emergency Notifications |

Calibrus Click-To-Call Services “ClickTalk”

Calibrus “ClickTalk” service allows customers to put a button or icon on a website or web-listing that will allow customers to contact others by telephone automatically and anonymously. The “ClickTalk” functionality has a variety of uses:

· | Save Sales on Cancellations |

When someone presses the Calibrus “ClickTalk” button a pop up appears so that they can enter their phone number. Once a phone number is entered and they hit the submit button, the Calibrus system places an outbound call to them and once they have answered our system places a second call to a pre-programmed number and connects you with the customer. Currently we are not providing any click to call services.

Call Center Services

Calibrus, Inc. has been delivering call center services since 1999 to large and small businesses. Calibrus live operator agents can provide call center services to customers who want to grow their business or handle temporary, seasonal or overflow volume.

Several call center services Calibrus can provide are:

Outbound | Inbound |

| |

Cold Calls | Customer Support/Help Desk |

| |

Outbound Telemarketing | Order Taking/Fulfillment |

| |

Phone Surveys | Answering Service |

| |

Lead Qualifying | Sales Verifications |

| |

Direct Mail Follow up | Seminar Sign-up |

| |

Fundraising | |

| |

Political Campaigns | |

| |

Internet Sales Verifications | |

| |

Collections | |

For 2011, the Company was running one Customer Support program for a customer in the healthcare industry. Revenue related to this program totaled $4,626.

SpeechTrack.com

Calibrus has developed a hosted call recording utility that anyone can use from any phone. Through the SpeechTrack.com website anyone can record a phone conversation whether they are at work, home or on a cell phone. SpeechTrack enables phone conversations to be recorded easily, and securely, at a low per minute cost. SpeechTrack is an ideal solution for any individual, independent professional or small business owner. SpeechTrack is a hosted solution that requires no hardware or software to be purchased. SpeechTrack can also be used for dictation purposes. Customers can access their recordings online on SpeechTrack’s secure website. Customers can add notes to the recording file to keep track of their calls and they can also download the recordings to their computer. Our plan is to market SpeechTrack.com to small to midsize businesses and individual professionals through several different marketing channels, including internet advertising, radio ads, forums, blogs and traditional print media.

Businesses and individuals use SpeechTrack for:

Staffing and Training

Protection/Disputes/Resolution – Prove “who said what” in a dispute

Confirmation of Agreements or Document Replacement

Compliance

Best Practice/Advice or Instructions

SpeechTrack users use our service for a myriad of purposes. Below is a partial list of just some of the types of independent professionals/small business owners that may utilize Speechtrack.

Attorneys

Accountants

Contractors/Vendors

Doctors

Executive Coaching

Service Providers

Sales Professionals

Private Investigators

Project Manager/Coordinators

Insurance Agents

Mortgage/Financial Brokers

Conference Calls

Market Researchers

Technology

Using software based PBX (public exchange system – best known as a telephone switch), ACD (automated call distribution), network equipment, data storage arrays, and servers; we have developed object oriented software application building blocks and relational databases. Because we record every verification conversation digitally, our system allows clients to be actively involved in monitoring and managing our services through secure Internet sites, VPN (virtual private networks), and dedicated point-to-point connectivity. By allowing near real time review of data and verification conversations, this infrastructure allows our clients to actively participate in the management of their programs. We virtually eliminate data errors because the majority of the data is transferred electronically.

Redundancy and Safeguards

Calibrus has worked diligently to provide the necessary redundancy and disaster recovery requirements to our clients. We offer a number of safeguards for our clients including separate power generation units in the event of a failure by the utility; we have UPS’s (uninterrupted power supply) for all network and telecom equipment; we have a UPS on every agent station and our system up-time was over 99.9% for the last two years. For telecom access Calibrus utilizes two separate long distance providers that both have multiple access points into the Phoenix Metro area. One telecom company provides the primary number while the second provides the back-up number to prevent any downtime that could arise in a particular company’s network.

Calibrus’ facilities, equipment and technology are structured to ensure uptime and eliminate the worry of fiber cuts which could disrupt our business. Since Calibrus is connected to the telecom’s network, we are able to install additional T1’s or PTP (point-to-point) data circuits on a significantly reduced timeframe. It is common to have new circuits delivered and functioning within 10 business days, much quicker than the 30-45 business days most companies will receive. Calibrus uses multiple telephone switches, firewalls, routers and networks; and have automated tape back-up guards against data loss, corruption and down time.

The Company’s technology is capable of receiving and interpreting automatic number identification information. Calibrus can then use this information in conjunction with our computer telephone integration functionalities for reporting and indexing functionality.

Security

Calibrus understands the need to protect data belonging to our customers. With that understanding, we have developed strict guidelines to protect customer information. Controlled access to data centers, physical security measures, and strong passwords on all network equipment ensures that only authorized personnel can gain entrance to sensitive areas and protects Calibrus’ internal vulnerabilities. Firewalls, Access Control Lists and VPNs ensure that data is safe from external vulnerabilities.

We do offer several levels of securing access to our client’s data, as it can vary from client to client. With the web based utility that some clients utilize we offer password protection and unique individual logins that can be completely

controlled and maintained by the client by a custom interface, which can also be password protected, if necessary. Some of our clients find that task to be burdensome due to their number of agents and managers. For those specific clients, if they are coming through a proxy, we can limit access to the websites, both agent entry and to trusted internet protocol. This would limit the access to only those that are coming through the company’s client side channel to the Calibrus website.

Reporting

Calibrus custom builds all reports to suit our client’s needs because we have found that the information that each customer requires may be different from the information required by another customer. All telephone switches are centralized in our server databases and therefore, we can easily relate customer data with call data. As a result, we can custom build reports to the specifications of our clients and provide the data in any format to the client: Excel, fixed length and comma delimited, and deliver it in multiple ways, such as through a website, Web Service, e-mail, connect direct or FTP (file transfer protocol). We build all return files to client specifications and can deliver them at the times the client requests.

Regulations

Third Party Verification is mandated by both the FCC and State PUC agencies. Third Party Verification is the confirmation of a customer’s order by an independent third party. This process protects both the customer and the company selling from fraud and slamming/cramming of products onto their lines. Once the sale has been made the customer is transferred to an independent Third Party that will read a pre-determined script to which the customer will answer yes or no.

In 1996, the Federal Communications Commission, FCC, enacted the Telecommunications Act which forced the Regional Bell Operating Companies to open their lines to competition. Accordingly, they were required to allow competitors to lease their lines and provide service to customers at a rate set by each individual State’s Utility Commission. This was to promote competition and help new competitors compete with the large corporations on a level playing field.

This led to another phenomena called slamming, customers being switched from one company to another without their approval, and sometimes without any knowledge whatsoever until they received their bill.

In response to this, legislation was enacted that required companies that were changing a customer’s Dial Tone or Long Distance to their services would have to first obtain the customer’s approval in one of three ways.

· | A written and signed Letter of Authorization indicating that customer agrees to the change. |

· | An automated or live agent independent third party that the customer is transferred to for the verification. |

· | An electronic Signature on an electronic Letter of Authorization, usually done on websites. |

Calibrus fulfills the second requirement, providing both automated IVR, and Live Agent Third Party Verifications Services for our clients. Third Party Verification though intended to be a protection for the customer, is also a protection for the company initiating the switch as well. The necessity for TPV prevents companies from switching customers without their approval, and it also prevents a customer, or another company, from alleging that the company switched a customer without their approval. The protection that TPV provides for the company is critical as the fines levied by the FCC and the State PUCs can run in the millions of dollars and also include the loss of the ability to sell telecommunications products in a specific area.

Even though Calibrus acts as a Third Party Verification provider, Calibrus is not directly subject to any regulations. The service or process that we provide for our clients does have several defined rules and regulations that must be followed. For example, scripts that are implemented and used in both our Live Operator and IVR/VRU TPV services must be read verbatim to the customer. There are certain pre-defined questions that must be asked to the customer and certain types of information must be gathered from the customer in order for the TPV to be verified. The FCC and each State PUC has varying requirements in regards to the information that must be communicated to the customer and the information that must be captured. In addition, there are record keeping requirements for both data and voice for each Third Party Verification transaction. Whether the TPV is conducted by a Live Operator or IVR/VRU TPV there must be a voice recording of the customer responding to the script and the data that was captured during the transaction must also be recorded. The voice recordings and associated data must be archived and made available for up to thirty six (36) months.

Competitors

Calibrus faces numerous competitors both within and outside the United States. Many of Calibrus’ competitors are much larger and better financed. The only barrier to entry in Calibrus markets is sufficient start up capital to buy initial equipment and such costs are not substantial. With the low barriers to entry, Calibrus faces competition from a large number of competitors with similar capabilities. Most call centers, both inside and outside the United States, either have similar technology or could develop similar technology. We initially were able to stay ahead of competitors by having a low cost business model but many competitors have reduced their costs to be similar to our costs. As such, the competition for customers has become more competitive.

Some of Calibrus’ competitors include VoiceLog, now owned and operated by BSG Group, 3PV and Data Exchange. Although these are some of the larger competitors there are a substantial number of competitors of similar size to Calibrus that we compete against. Calibrus competes with these competitors for business by offering superior quality of service that is reliable and low cost in the market. Even with quality of services that we believe we offer, competition in our industry generally comes down to pricing. As such, there is constant pressure on margins and the need to keep costs low to be able to effectively compete in our industry.

Concentration of Customers

As the number of telecommunications companies has decreased, we have seen a concentration of revenues coming from two primary customers. In 2007 AT&T Communications and Cox Communications exceeded approximately eighty percent of our revenues for the first time. In 2011 Frontier Communications experienced a high volume and revenue increase due to their acquisition of 13 Verizon states land line operations. As a result of this they have decreased our concentration in AT&T and Cox. Currently nearly eighty percent of our revenues are still derived from three customers. For the years ended December 31, 2011 and 2010, AT&T Communications accounted for 50.6% and 68.1% and Cox Communications 16.7% and 16.6%, respectively, of our revenues. Frontier Communications accounted for 15.0% and 1.5% in 2011 and 2010, respectively. This revenue is derived from our TPV business. If we were to lose one of these customers before our other business lines start generating more revenue, it could have a detrimental effect on our ability to stay in business. We are actively moving away from the TPV business being our primary operations and are hopeful that we will be able to reduce our reliance on these customers. We made the decision to diversify our product offerings based on our belief that consolidation in the telecommunications industry has reduced the number of telephone customers changing carriers. As such, the need for third party verification has decreased. We believe there will continue to be customers changing phone carriers but as the number decreases the revenue we receive from our third party verification business continues to decline. We believe it is prudent to seek other sources of revenue.

Our contract with AT&T expired on December 31, 2009. We signed two short-term contract extensions with modified pricing through March 2010. On April 8, 2010 the Company signed a new contract with AT&T. The contract sets forth our pricing terms and provides the conditions on which we are to provide service to AT&T including that our services are deemed performed when provided. AT&T renewed the contract for a one year period in 2011. The renewal included a 2.5% pricing discount per the terms of the original contract signed in 2010. The Company also signed a new contract with Frontier Communications in May of 2011 which was done in conjunction with Frontier’s acquisition of 13 Verizon State landline operations.

Calibrus Social Media Products and Services - JabberMonkey.com and Fanatic Fans

Fanatic Fans

In the second half of 2010 we commenced development of a location based social networking application for smart phones called Fanatic Fans. The Fanatic Fans application has been live

JabberMonkey is a social expression site that features questions on issues and topics that are current and relevant to its members. JabberMonkey questions are on pertinent issues that in many instances evoke emotional responses from its members. Many of the Apple App Store and Android Marketplace since April of 2011. questions on JabberMonkey provide the individuals voting with a voice to cause an action or affect a result.

Fanatic Fans informsaim is to inform fans about upcoming live events in the Sportssports and Musicmusic industries by giving users the ability to interact with live events, share their experiences, and earn rewards for attending live events. Users canare able to browse a calendar of upcoming events which can be segmented by region and artist. UsersFrom here users can get detailed information on the event and discuss the event with other fans.

In March of 2014 the Company found an opportunity to acquire WCS Enterprises, LLC which is a real estate purchaser, developer and manager of specific use industrial properties providing “Condo” style turn-key grow facilities to support cannabis growers. In June 2014, we acquired 100% of the ownership of WCS Enterprises, LLC.

Fanatic Fans

In the second half of 2010 we commenced development of a location based social networking application (“App”) for smart phones called Fanatic Fans. The Fanatic Fans application was live on the Apple App Store and Android Marketplace since April 2011, however due to a lack of operating system upgrades, the applications have recently become unavailable on the App Store and Android Marketplace.

Fanatic Fans informs fans about upcoming live events in the Sports and Music industries. While at an event, users can share their experiences with social networks Facebook and Twitter, and communicate with other people at the event. Users can unlock virtual awards and earn virtual points in recognition of attending events. Within their profile, users can browse and view the items they have unlocked and receive news on their favorite artists. Finally, users can redeem their virtual points for food/drinks, apparel and purchase event tickets in the application award section.

Fanatic Fans rewards fans for their support of their favorite sports team, music artist or band. National and local businesses market to fans that attend the events by listing promotions (goods and services) on our application. Businesses list their promotions (i.e. After the Diamondbacks Game Come to Hanney’s Restaurant and Receive “One Free Beer” or “50% Off any Appetizer!” Redeem for 50 Points) and users can view and redeem these promotions and offers that are specific to their interests. Fanatic Fans offers contests and provides recognition to the most Fanatic Fans.

Functionality

When a user is at an event the app automatically determines the event their attending using the phones GPS. The user is able to view information on the show including a list of the artists performing at the show. There is a forum that users can make comments about upcoming events which also allows fans to interact with one another while at the show. Comments made by users can go directly to Facebook and Twitter if the user choose to link their Fanatic Fans account. While attending an event users can check in. By checking in the user will unlock a virtual award which can also be published to Facebook and Twitter. Users also earn virtual currency by checking into a location. After checking in the user will return to the comments page where they can continue to read and add comments about the show.

When users are not at a show they use Fanatic Fans to locate upcoming shows. They browse a calendar of all upcoming shows and sort by location and the artists that they follow. Users get information on the show including; time, location, and performing artists. Users can view tips created by other members and add tips of their own. Finally users confirm that they are going to attend an event and tell their friends by publishing to Facebook and Twitter.

Fanatic Fans features a profile page which allows users to view their past activity within the app and receive news updates on their favorite artists. They are able to view all of the awards that they have unlocked, and all the shows that they have attended. They also receive the latest news posts of some of their favorite music artist. Finally, users can adjust their personal settings from their profile including which artists they wish to follow, their home town, and their Facebook and Twitter account information.

Basic Functionality of Fanatic Fans

Check into an event

Get information on the event

Communicate with other fans at the event using a messaging board

Post comments, pictures and videos

Post comments, pictures and videos to Facebook and Twitter

Unlock virtual awards

Earn virtual points and badges

Look up upcoming events in your area, and entire tour schedules of your artists

View all your awards and your rank among other users

Redeem your points for goods

Vendor/Business can list promotions for users to redeem Fanatic Fan virtual points

Buy tickets to live events through a third party

Fanatic Fans Website

Live event content that is posted from users using Fanatic Fans is available to view on the Fanatic Fans website. Comments, pictures and videos uploaded to the Fanatic Fans app by fans using their mobile phone attending live events are instantly saved on the FanaticFans.com website. Users can watch videos, view pictures and see what people are saying about live sports or music events in real-time. As fans express and share their excitement, users can join in and make comments, upload pictures and videos before, during and after the live event and share to Facebook and Twitter.

Additionally, on FanaticFans.com website users can view a complete listing of discount offers by merchants on food, drinks, merchandise and tickets. Users can check out all upcoming sports and music events in their area and other cities around the nation and review all of their live event comments, pictures and videos in their profile page.

Fanatic Fans Facebook Application

The Fanatic Fand Facebook application allows sports and music fans to view user generated content and experience the live event on Facebook using the Fanatic Fans Facebook app. Fanatic Fans Facebook app allows Facebook users to access all live event sports and concert content without ever having to leave Facebook. Users can see photos and videos that fans took of their favorite sports team and/or music artist in real-time and hear what they thought of the big game or concert.

With the Fanatic Fans Facebook app Facebook users can see their favorite live events. Fanatic Fans app features a calendar of all sports and music events by region. Users can look up the location and time of an event and get a map with directions showing them exactly how to get there. When a user sees an event they are interested in they can share it with their Facebook friends, buy tickets to the event, make comments, post videos and pictures before, in real-time during, and after the event.

Facebook users can earn rewards for attending their favorite live events and using the Fanatic Fans Facebook or mobile applications. Facebook users can access a complete listing of merchant discount offers on food, drinks, merchandise and tickets and look up discounts nearby and redeem rewards using the Fanatic Fans mobile application.

Competition

Fanatic Fans will be entering intois part of one of the fastest growing segments of location based social networking and as such will face intense competition from applications such as Foursquare and Gowalla. Competitors in this space are very well financed and have the advantage of having already captured consumers that may be unwilling to switch to a new application. At this time, we have no intellectual property protection and are only now preparing preliminary patent and trademark filings. It is still unknown if any of our filings will lead to actually receiving provisional patents or final patents or trademarks.

Start-ups, such as SuperGlued and Flow'd, are recognizing the opportunities presented in specific market verticals related to check-in. Niche strategy is likely to be the next wave in location-based social-networking and we believe this is where the greatest opportunity for frequent sustained usage exists.

Marketing

Fanatic Fans marketing will develop awareness by cultivating partnerships with Universities, utilizing traditional advertising mediums and implementing web 2.0 marketing techniques with the goal of delivering Fanatic Fans to the right people at the right place. We will utilize in-house personnel and outside agency’sagencies to make Fanatic Fans relevant to its target audience. Fanatic Fans is a global application but our arketingmarketing strategies will initially be very targeted to just several geographic locations.

Fanatic Fans haspreviously partnered with Grand Canyon University, a school with 5,000 students in Phoenix, AZ and Denver University a school with 12,000 students in Denver, CO. Fanatic Fans has signed a Co-marketingco-marketing agreement with each school which calls for the following marketing initiatives by the Universities.

· | Promotion of Fanatic Fans at home games |

o | Co-develop unique promotions or contests to help increase user sign-up’s and fan loyalty within its fan base. |

o | Advertising for Fanatic Fans pre-event and during live events in the form of announcements, electronic display, and other appropriate forms as determined by the University. |

o | Provide booth space for Fanatic Fans at University events |

· | Fanatic Fans Promotion by University |

o | Market Fanatic Fans to Student Body fan club |

o | Market Fanatic Fans to Alumni |

o | Market Fanatic Fans to Season ticket holders |

o | Market to current University Vendors that advertise at the live events |

o | Marketing is to include the following: |

▪ | Email notifications making the University fan base aware of the Fanatic Fans partnership and benefits. |

▪

| Posts on the University athletics social network pages including Facebook and Twitter. |

▪

| Articles and advertisements in applicable University print media. |

· | Allow Fanatic Fans rewards points to be used for discounts on University tickets and merchandise. |

· | Place a Fanatic Fans link on University athletics website. |

· | Fanatic Fans will be able create Press Releases announcing our partnership with the University. |

school. The co-marketing agreements have expired.

Fanatic Fans hashad engaged the Artigue Agency, a local marketing company in Phoenix, AZ, to assist with the Fanatic Fans Marketing & Public Relations campaign. Fanatic Fans will utilizeutilized the Artigue Agency in certain marketing areas that providesprovided the best value and highest impact for creating Fanatic Fans app awareness and obtaining downloads.

The Artigue Agency, along with IMG, performed Event Marketing at every home football game of the Arizona State University Football games during September 2011– December 2011.Company has suspended any marketing and public relations related to Fanatic Fans was positioned in front of the college football target audiences by participation in various media advertisements.

Additionally, Fanatic Fansuntil it has developed a Fanatic Fans website and Facebook application whereby individuals can access the websitesufficient capital to view Fanatic Fans event content from the online website as well as Facebook users can access the Fanatic Fans content posted on Fanatic Fans without ever having to log out from their Facebook account. Facebook users will be able to access live event content such as comments, pictures and videos posted by Fanatic Fans. The Fanatic Fans Facebook app is currently available for download in the App section of Facebook.commence these activities.

Revenue Model

Our initial revenue model will be based on advertising. As such, we do not anticipate any revenue for some time. To be able to sell advertisements we will need to have a certain level of users. If we are not able to attract sufficient users, we will not be able to sell any advertisements.

The Company also intends on generating revenue from monthly fees for businesses listing promotions inside of the application. To be able to charge businesses a monthly fee we will need to have a certain level of users on the app.

If we are not able to attract sufficient users, we will not be able to charge a monthly fee.

Lastly, we intend to partner with one or several ticketing companies and achieve a revenue share agreement for tickets that are sold to live events through the Fanatic Fans application. To be able to achieve a revenue share agreement we will need to have a certain level of users on the app. If we are not able to attract sufficient users, it may be unlikely that we can achieve a revenue share agreement with any ticketing company.

Technology

The Fanatic Fans application can be used by Apple and Android Smart Phones. The application will utilize GPS functionality built into smart phones along with existing data and Wi-Fi capabilities.

Development

The Company has developed both an iphoneiPhone and Android version of Fanatic Fans and the Fanatic Fans website and Fanatic Fans Facebook Application. We currently have a development team continuingDue to limited cash flow, the Company has ceased current development on new enhancementsits Fanatic Fans project, but intends to bothcommence development if and when sufficient capital can be obtained.

To gain exposure for our iphonesocial networking websites, we applied in November 2013 for an office space at RocketSpace, a technology co-working space that unites tech startups in San Francisco CA. The Company was accepted by RocketSpace in November 2013. Only 5% of all companies that apply to RockeSpace get accepted. The Company has office space and Android apps and website and maintenancepays rent for office space at RocketSpace. The Company applied for office space at RocketSpace in hopes of finding software engineers to further the development of the Fanatic Fans applications.and JabberMonkey projects and to find others that may have an interest in our social networking projects. Brian Holmes, one of our employees working with Fanatic Fans moved to San Francisco to occupy and run the RocketSpace office. The Company pays expenses for Brian Holmes while at RocketSpace (i.e. Rent, conference/seminars fees, travel). Brian Holmes attends conferences and seminars to meet other people that could help grow Fanatic Fans and JabberMonkey.

JabberMonkey.com

As stated previously, JabberMonkey is a social expression site that features questions on issues and topics that are current and relevant to its members. JabberMonkey questions are on pertinent issues that in many instances evoke an emotional response from its members. Many of the questions on JabberMonkey provide the individuals voting with a voice to cause an action or affect a result.

There are many emotional issues or events that occur around the world that JabberMonkey posts questions about allowing JabberMonkey members to express themselves, participate and cause an action or outcome. One could imagine what some of these might be:

·A famous rock band might participate with JabberMonkey and allow JabberMonkey members to vote on the songs and the order the songs would be played at their next concert.

· A business wants to get individuals to provide feedback and name their next product. JabberMonkey members can vote, provide feedback about the product and name the new product.

·A famous sports athlete through a video blog asks the question “if I win the US Open Golf Tournament what charity should I donate $250,000 of the $1,000,000 prize money?” Whichever charity has the most votes, wins and that is who will get the money.

a)American Red Cross

b)PETA

c)The Make a Wish Foundation

d)Boys and Girls Club of America

e)Breast Cancer Research Foundation

JabberMonkey members vote and provide their comments on an issue and then see instant feedback on how others are feeling about a topic or issue and view comments made by others. JabberMonkey members express themselves by answering questions, posting their own questions, text blogging, video blogging, participating in forums, creating profiles, posting videos, photos, audio files, and rate other JabberMonkey membersmembers’ questions and content.

JabberMonkey members are able to meet new people and make new friends. When answering a question or participating in a group, members can meet people with similar interests and are able to become friends on JabberMonkey. They can then communicate via messaging, chat, and video voice calling as well as sharing photos, videos and other electronic media.

JabberMonkey questions range across all categories of life, and run the gamut from serious to silly. The categories and sub-categories will allow for targeted feedback. Categories range from Entertainment to Music and Business, etc. Each category contains subcategories to encompass a wide range of topics and interests.

In addition to being able to conduct polls and questions, JabberMonkey offers a unique user experience by being able to offer interactive communication and high definition video. While most social networking sites offer only a static page for the user, JabberMonkey offers video communications between multiple users at once, the ability to quickly load video, and the ability to set up groups or companies into secure sites. JabberMonkey also takes advantage of other companies’ storage by allowing links to other web sites such as YouTube or Google.

Calibrus’ focus has been to develop and distinguish JabberMonkey from the other social networking sites, which are very static and rely only on instant messaging and fixed web pages. Calibrus feels it has designed a site that is easy to use and is video intensive with user friendly software for video attachment and conferencing.

JabberMonkey completed its alpha testing and moved into beta testing in December 2009. The Beta testing ran through the end of November 2010 and the first official non-beta version of the website was released in December 2010. We do not have the capital required to commence our marketing plan related to the website and thus do not anticipate any revenue from JabbberMonkey until we can sufficiently launch a marketing campaign.

Competition

JabberMonkey will be entering intois in one of the fastest growing segments of the internet and as such will face intense competition from sites such as MySpace and Facebook. Although CalibrusGrow Condos believes the JabberMonkey site offers new features, it is likely the other sites will soon be able to offer similar features. Competitors in this space are very well financed and have the advantage of having already captured consumers that may be unwilling to switch to a new site. At this time, we have no intellectual property protection and are only now preparing preliminary patent and trademark filings. It is still unknown if any of our filings will lead to actually receiving provisional patents or final patents or trademarks. Although we believe our site offers unique features, we cannot say if other companies are developing similar features to their social networking sites. Additionally, many of the features of our site could be developed by other sites with variations that could possibly get around any intellectual property protections we are able to obtain.

The competition we face will make it difficult to attract customers from established sites such as Facebook and MySpace given their financial capabilities. Additionally, we believe we have only a small window to establish our site as being unique before the other social networking sites are able to come up with similar offerings. If we are unsuccessful in the short term in establishing a unique site that draws consumers, it will be difficult to compete against the other sites that we assume are working on similar interactive features. Additionally, some of these sites are backed by the largest players in the industry such as Google which can provide financial support far beyond anything we can raise at this time or in the perceived future.

Marketing

Our initial marketing will behas been aimed at attracting consumers from focusing on affinity sites and limited advertising on college and sports talk shows. We believe initial consumers can be attracted through links on web pages at Facebook, MySpace and Twitter. However, to attract these users we first must establish JabberMonkey as a unique interactive experience that differs from the other social networking sites.

This initial marketing effort will be directed at targeted groups and communities which would see the advantage of being able to communicate on their topic areas and have on-line conversations. Such groups would be gamers, sports enthusiast, school communities, clubs and political or civic organizations. To this end, we are reviewing the cost to advertise on radio, particularly sports radio, and on certain online sites. As our capital for marketing is very limited, we may have to focus initially on one advertising market or focus on slow growth and word of mouth communications depending on the final development cost of the JabberMonkey site and how much capital we were able to raise.

Currently, due to a lack of sufficient capital, no marketing activities are being pursued. However, we hope to gain exposure to and opportunity for JabberMonkey through our office space at RocketSpace in San Francisco.

Revenue Model

Our initial revenue model is based on advertising. As such, we do not anticipate any revenue for some time. To be able to sell advertisements on our site, we will need to have a certain level of users. If we are not able to attract sufficient users, we will not be able to sell any advertisements.

We will also look at data mining as another source of revenue. With our existing product line, we have gained some limited experience in data mining and believe it offers another revenue source to be able to obtain information from consumers using the JabberMonkey site and sell such information to companies that would be able to use the information in their advertising or other business needs. This would not be an initial source of revenue as we will have to have sufficient users to make data mining effective and it will have to be developed with a view to not drive away potential users.WCS Enterprises

We also are analyzing charging consumersOur wholly-owned subsidiary, WCS Enterprises, LLC (“WCS Enterprises”) is an Oregon limited liability company which was formed on September 9, 2013 and was acquired by us in June 2014 in exchange for certain featuresshares of our site butcommon stock. The acquisition of WCS Enterprises resulted in a change of control of the Company and at this time,or shortly after the closing of such acquisition, the persons designated by WCS Enterprises became the officers and directors of the Company. As a result of our acquisition of WCS Enterprises in June 2014, we became engaged in the real estate purchaser, developer and manager of specific use industrial properties business and continue to develop and operate our social networking projects.

WCS Enterprises Business Operations

Through WCS Enterprises, we are a real estate purchaser, developer and manager of specific use industrial properties providing “Condo” style turn-key grow facilities to support cannabis growers in the United States cannabis industry. We intend to own, lease, sell and manage multi-tenant properties so as to reduce the risk of ownership and reduce costs to the tenants and owners. We will offer tenants the option to lease, lease to purchase or buy their condo warehouse space that is divided into comparable 1,500- 2,500 square foot condominium units. Each Condo unit will be uniquely designed and have all necessary resources as an optimum stand-alone grow facility. We believe it is more importantthat Cannabis farmers will pay an above market rate to drive consumerslease or buy our condo grow facility. We will purchase and develop buildings that are divisible into separate units to attract multiple farmers and reduce the risk of single tenant leases. In addition to our site“Condo” turn-key growing facilities we intend to provide marijuana grow consulting services and will make everything availableequipment and supplies as part of our turn-key offerings. We are aggressively out looking for freeour next property in the western area of the United States where medical cannabis has been legalized and focus on advertising revenues. Once we obtain a certain levelwhere recreational cannabis has been or is in the process of users, we may start offering more products that we believe we can charge for such as storage or secure web pages for communications. At this time, we do not know when we would be able to start charging for such product offerings, if ever.

Development

legalization. The Company closed the alpha testing phase of development during December, 2009. The site reached the beta testing phaseis not directly involved in the first partgrowing, distribution or sale of December, 2009 and ran through November 2010. The first non-beta version of the website went into operation in December 2010. To date the Company has not begun to aggressively market the website due to a lack of sufficient capital.Cannabis.

During our alpha development we started limited testing on the software and functionality developed to run the JabberMonkey site. At this phase of development we had limited number of individuals, primarily our employees, testing the site and giving feedback as to its functionality. We also revised the software and tried to work out any issues found in the initial development. The beta stage of testing and development commenced in December 2009 and ran through November 2010. During the beta phase of development we expanded the number of users and continued testing and added enhancements to the functionality of the website.

Owned Properties

Even after completingWe have secured real estate in Eagle Point in Jackson County, Oregon representing our sole operating location. The building is 15,000 square feet and zoned to meet the beta phase, we could still have softwarerequirements for specific purpose industrial use and hardware development problems onceis divided into four 1,500 square feet condo style grow rooms which, is being leased to four tenants and one 7,500 square feet grow facility leased, for which the full launch of the siterent has not yet begun, to one tenant that is made and additional users are added. We cannot say how our software and hardware will function under the strain of a large number of users. related party.

Currently, JabbeMonkey is not engaged in new development but we do have several developers that maintain the JabberMonkey website.Sales & Leasing

Intellectual PropertyWe develop, lease, own and provide investment sales opportunities for commercial industrial properties focused in the cannabis production arena. The company has relationships with tenants, brokers and investors across the cannabis industry to leverage successful transactions for both lease-to-own option as well as investors looking to purchase facilities with qualified tenants providing positive cash-flow backed by commercial property.

In addition to our own development team, we have contracted with Meomyo Development out of India to assist in the development of our JabberMonkey website. Meomyo has expertise in the development of websites and interactive solutions for websites which our internal developers did not currently possess. Meomyo’s contract gives the work product and intellectual property rights to Calibrus. However, even with the rights provided to Calibrus, we cannot prevent them from taking their knowledge gained by working on the JabberMonkey site and applying it to other web developments. The contract does attempt to limit the ability of Meomyo to provide services to competitors of Calibrus but given the geographical difficulty of policing an India company with offices in Dubai, it may not be possible to stop Meomyo from providing services. Consulting

We will provide cannabis businesses with turnkey cultivation and processing management services, including facility design, licensing support, and the operational management required to produce premium cannabis and related products in an efficient manner to allow the user quicker access to market and professional-managed facilities.

Supplies and Equipment

We intend to provide operators state-of-the art equipment and methodology to provide efficient implementation for client to realize stabilized operations faster.

Financing

We intend to assist tenants with financing for space build-out as well as acquisition of commercial property.

Marketing

Our initial marketing will be dependentaimed at attracting customers through networking with real estate agencies, agents, commercial brokers and consulting groups that are involved in many ways,the cannabis industry. We will target specific trade shows, conferences and seminars associated with cannabis growers. As our capital for marketing is very limited we are reviewing the cost of advertising on the radio or in print or running ads on certain cannabis industry online websites.

Employees

We currently have two employees each of whom is an officer of the company. Our employees are not represented by unions and we consider our abilityrelationship with our employees to launchbe good.

Facilities

Our office is located at 722 W. Dutton Rd, Eagle Point, Oregon 97524 and is in the building that we own. We currently pay no rent. We believe this facility will be adequate for our siteneeds for the next twelve months.

Competition

The commercial real estate market is highly competitive. We believe finding properties that are zoned for the specific use of allowing cannabis growers may be limited as more competitors enter the market. Initially we will aggressively target states in the western US that legally allow for medical and attract consumers before ourrecreational cannabis to be grown. We have identified several competitors can develop features which would bethat appear to have offerings similar to ours. They are Cannabis-RX, Inc. (CANA), The Cannabis Business Group, Inc. (CBGI), Zoned Properties, Inc. (ZDPY), MJ Holdings, Inc. (MJNE), Home Treasure Finders, Inc. (HMTF) and Advanced Cannabis Solutions, Inc. Cannabis-Rx, Inc. – Cannabis-Rx, Inc. focuses on acquiring and selling/leasing real estate properties for licensed marijuana growers and dispensary owners. Cannabis-Rx currently is not a direct competitorfully reporting company. The Cannabis Business Group, Inc. - The Cannabis Business Group, Inc. operates as a real estate acquisition, leasing, and management company focusing on zoning issues in the United States. The Company acquires commercial property or land, and leases out the facilities for customers in the agricultural, industrial, commercial, and retail sectors.

Zoned Properties, Inc. - Zoned Properties, Inc., a real estate investment firm, focuses on acquiring free standing buildings, land parcels, and greenhouses in order to the features in our site. At this time, our abilityhave them re-zoned to be able to attract consumerscarry out aeroponic agricultural grow operations. It plans to operate primarily in Arizona, Illinois, Nevada, and Colorado. MJ Holdings, Inc. – MJ Holdings, Inc. acquires and leases real estate to licensed marijuana operators, including but not limited to providing complete turnkey growing space and related facilities to licensed marijuana growers and dispensary owners. Additionally, MJ Holdings plans to explore ancillary opportunities in the regulated marijuana industry.

Home Treasure Finders, Inc. – Home Treasure Finders, Inc. is unknown as weengaged in a real estate lead referral business in Colorado. It focuses on buying and selling properties; and leasing its real estate properties to cannabis growers for cannabis cultivation. The company also manages 55 rental units. Home Treasure Finders, Inc. was founded in 2008 and is based in Denver, Colorado. Advanced Cannabis Solutions, Inc. – Advanced Cannabis Solutions, Inc. a development stage company, focuses on providing real estate leasing services to the regulated cannabis industry in the United States. It plans to purchase real estate assets; and lease growing space and related facilities to licensed marijuana growers and dispensary owners for their operations. The company was founded in 2013 and is headquartered in Colorado Springs, Colorado.

Government Regulation

Currently, there are approximately twenty states plus the District of Columbia that have only just completed the beta phaselaws and/or regulations that recognize in one form or another legitimate medical uses for cannabis and consumer use of development and released the website for general use andcannabis in connection with medical treatment. Fifteen other states are not certainconsidering legislation to similar effect. As of the acceptancedate of our web sitethis writing, the policy and interactive features.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreementsregulations of the Federal government and its agencies is that cannabis has no medical benefit and a range of activities including cultivation and use of cannabis for personal use is prohibited on the basis of federal law and may or Labor Contracts, including Durationmay not be permitted on the basis of state law.

We protect somedo not produce, market, or sell cannabis. We are limiting ourselves to states where the state law allows for the production of cannabis. Beyond the state law allowing for cannabis production our construction must comply with all state and local building requirements as well as zoning requirements. We work closely with the local authorities regarding zoning and work closely with the local building inspectors to comply in every way with building regulations.

Legal Proceedings

We are not a party to any material legal proceedings and, to the best of our technology as trade secrets and, where appropriate, we use trademarks or register trademarks in connection with products and our core name. We currentlyknowledge, no such legal proceedings have two patent applications on file with the US Patent and Trademark Office related to our JabberMonkey social expression website. We have two trademarks covering our name “Calibrus” and “JabberMonkey” and have also applied for a trademark covering “Fanatic Fans”.been threatened against us.

Research and Development Costs During the Last Two Fiscal Years

For the years ended December 31, 2011 and 2010 the Company incurred Research and Development Costs of $1,472,113 and $232,327, respectively. Research and Development expenses related to the continued development of the Company’s JabberMonkey website and its additional project Fanatic Fans. We expect as we expand into new markets we will continue to incur additional research and development costs.

ITEM 1A. RISK FACTORS

Calibrus’ operations are subject to a number of risks including, but not limited to:

Management’s focus will be on the development and operations of JabberMonkey and Fanatic Fans, both of which are new businesses and we do not know if consumers will like the site or that we will be able to monetize the site to produce revenues.

Management made the determination in late 2008 that its existing business model was going to face continued revenue reduction due to the consolidation in the telecommunication industry. As such, management set out to develop alternative business operations that utilized the core expertise of Calibrus employees and technology. The result of this development was Fanatic Fans, a location based social networking applicationNot required for smart phones, and JabberMonkey, a social networking site that features interactive communications among its participants as opposed to the more traditional static pages found on most social networking sites. As Fanatic Fans and JabberMonkey will increasingly be the focus of the business going forward, we will face competition from well established and fundedsmaller reporting companies. Additionally, as a new business there is no guarantee our Fanatic Fans and JabberMonkey offerings will be successful in attracting users. These factors create substantial risk for investors and the strong likelihood that any investment could result in the loss of an investor’s entire investment.

Both Fanatic Fans and JabberMonkey, are entering a very crowded social networking marketplace where existing competitors have years of experience, are well financed and have the name recognition to draw consumers none of which we possess.ITEM 1B. UNRESOLVED STAFF COMMENTS

Management has determined that the future direction of Calibrus will focus on its Fanatic Fans and JabberMonkey offerings. This puts Calibrus’ business focus in a very competitive field dominated by several very large and well financed companies such as Facebook, MySpace and Twitter and a number of mobile social networking applications for smart phones, such as Fouresquare and Gowalla. These companies have established an online presence and community that have become destinations in themselves and it will be difficult to make inroads into this space. Calibrus will be dependent on a new twist to entry into this space but in the end, all social networking sites have similar features and it is likely that if any part of the Calibrus offering becomes compelling, the competitors will adjust their offerings to be directly competitive with Calibrus. This creates substantial uncertainty on Calibrus’ ability to survive in this space or to be able to attract enough users to be able to monetize its site to produce revenues.None

The revenue models for Fanatic Fans and JabberMonkey require we first obtain a sufficient number of users before we can sell advertisements or generate other revenue and it will take time to generate such users and to then monetize the site.

Fanatic Fans and JabberMonkey will be dependent on selling advertisements and finding other ways to monetize our users by selling add-on services. For a social networking site or application to be able to sell advertisements, they first must attract a sufficient number of users to gain the interest of advertisers in buying ads on the sites. It will take time and money to bring users to our site and application and there is no assurance any users will come. These time frames along with the general state of development create additional uncertainty as to the potential success of Calibrus. The site and application may not work as we plan and even if they do there can be no assurance any users will come, that advertisers will want to advertise or that Calibrus can monetize them. Additionally, it will be costly to maintain the offerings and market them to attract users.

We currently do not have any patents associated with our Fanatic Fans or JabberMonkey site and if we are not able to develop intellectual property protection around the offerings, we may not be able to prevent competitors from recreating our product offering.

We have filed for a trademark on our JabberMonkey name and received approval during the year ended December 31, 2010. We filed for a trademark for Fanatic Fans in July 2010. We do not have any intellectual property protection on the features and software behind Fanatic Fans or JabberMonkey. We have filed two patent applications with the US Patent and Trademark Office on various features of our JabberMonkey site. However, we do not know at this time if such applications will result in patents being issued. Even if we receive patent applications, there is no guarantee that one of our competitors will not be able to find a variation on our services that are not patent protected and be able to directly compete with our take on the social networking experience.

Calibrus’ projections do not show revenue from Fanatic Fans or JabberMonkey for some time and it will be dependent on additional capital to fund operations and continued improvements until such revenue can be generated.

Since a certain level of consumers must become users of Fanatic Fans and JabberMonkey before we can be monetized to produce revenue, management is of the belief that it will have to raise substantial more capital to reach profitability and drive users to the offerings. With a lack of capital to execute on the marketing plans of the offerings it is unknown when and if the we will be able to attract the required number of users to successfully monetize them. It is likely stockholders will suffer further dilution as we raise additional capital and if management cannot raise additional capital stockholders would likely lose their most, if not all, of their investment. There is no guarantee that we could raise such future capital.

Our existing management team has no experience in operating a social networking business or any other web based business.

Our current management does not have any experience in operating a social networking site and has never operated a web based business. Our software developers experience has been in developing tools for businesses and focusing on call center software. We will be expanding on our internal capabilities and be dependent on outside software engineers to drive our development. If our management is not able to execute on our business plan, it is likely stockholders would lose their entire investment.

Our existing business has seen decreasing revenues