|

|

|

|

WASHINGTON,

10-K/A

[X]

EXCHANGE

ACT OF 1934

OR

[ ]

EXCHANGE ACT OF 1934

from to_____________

NORTH AMERICAN GAMING AND ENTERTAINMENT CORPORATION

---------------------------------------------------

File Number: 000-52807

Delaware 75-2571032

------------------------------- -------------------

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

Seventeen Floor, Xinhui Mansion, Gaoxin Road,

Hi-Tech Zone, Xi'An P. R. China 710075

-----------------------------------------------------

(Address of principal executive offices) (Zip Code)

Issuer's telephone number, including area code: (86) 29-88331685

SECURITIES REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT: NONE

Nevada (State or Other Jurisdiction of Incorporation or Organization) | 75-2571032 (I.R.S. Employer Identification No.) |

| Seventeenth Floor, Xinhui Mansion, Gaoxin Road | +86(29) 8833-1685 |

| Hi-Tech Zone, Xi’An P.R. China 71005 | |

| (Address of Principal Executive Offices; Zip Code) | (Registrant’s Telephone Number) |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class | Name of each exchange on which registered |

| None | None |

value $.01$0.001 per share

Check whether

or Section 15(d) of the Exchange Act. Yes [ ] No [X]

Check[ü]

Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the pastpreceding 12 months

(or (or for such shorter period that the issuerregistrant was required to file such

reports),and (2) has been subjectbject to such filing requirements for the past 90

days. YES [X] NOYes [ ]

Check No [ü]

Regulation S-K (§ 229.405 of this chapter) is not contained herein, and none will not be contained, to the best of

registrant's registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Partart III of this Form 10-KSB10-K or any amendment to

this Form 10-KSB. [X]

10-K. [ü]

| (Check one): | ||

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [ü] |

Rule 12b-2 of the Exchange Act). Yes [ ]No [X]

The issuer's revenues for its most recent fiscal year were: $1,097,872.

] No [ü]

the issuer, based on the average bid and asked price of such stock, was

$484,321 $484,321 at December 31, 2009and the number of shares of voting seriesSeries C preferred stock

Preferred Stock issued and outstanding was 500,000.

value $.01 common stock.

stock, $0.01 par value.

Transitional Small Business Disclosure Format (check one): Yes ___ No X

FOR FISCAL YEAR ENDED DECEMBERREFERENCE

FORM 10-KSB ANNUAL REPORT

INDEX

PART I

Item 1.

DESCRIPTION OF BUSINESS

| TABLE OF CONTENTS | |

| PART I | |

| Item 1. Business | 5 |

| Item 1A. Risk Factors | 9 |

| Item 1B. Unresolved Staff Comments | 16 |

| Item 2. Properties. | 16 |

| Item 3. Legal Proceedings | 18 |

| Item 4. (Removed and Reserved) | 18 |

| PART II | |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 18 |

| Item 6. Selected Financial Data | 19 |

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

| Item 7A. Quantitative and Qualitative Disclosures About Market Risk | 28 |

| Item 8. Financial Statements and Supplementary Data | 29 |

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 29 |

| Item 9A. Controls and Procedures | 30 |

| Item 9B. Other Information | 31 |

| PART III | |

| Item 10. Directors, Executive Officers and Corporate Governance | 31 |

| Item 11. Executive Compensation | 34 |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 35 |

| Item 13. Certain Relationships and Related Transactions, and Director Independence | 35 |

| Item 14. Principal Accounting Fees and Services | 37 |

| PART IV | |

| Item 15. Exhibits, Financial Statement Schedules | 38 |

Item 2.

DESCRIPTION OF PROPERTY

15

Item 3.

LEGAL PROCEEDINGS

16

Item 4.

SUBMISSION OF MATTERS TO on Form 10-K/A VOTE OF SECURITY HOLDERS

17

PART II

Item 5.

MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND SMALL BUSINESS ISSUER PURCHASES OF EQUITY 17

Item 6.

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

17

Item 7.

FINANCIAL STATEMENTS

22

Item 8.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

32

Item 8A(T).

CONTROLS AND PROCEDURES

32

Item 8B.

OTHER INFORMATION

32

PART III

Item 9.

DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

33

Item 10.

EXECUTIVE COMPENSATION

33

Item 11.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS 35

Item 12.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

36

Item 13.

EXIBIT

Item 14.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

36

SIGNATURES

36

PART I

ITEM 1.DESCRIPTION OF BUSINESS

DESCRIPTION OF BUSINESS

GENERAL

North American Gamingis to amend and Entertainment Corporation ("North American") was

incorporated underrestate the lawsForm 10-K of the State of Delaware in 1969. TheChina Changjiang

changed its name from Western Natural Gas Company to North American Gaming and

Entertainment Corporation on October 17, 1994 in connection with its merger

with OM Investors, Inc. Until August 20, 2001, the Company was engaged in the

video gaming business through its partial ownership of three operating

companies that operated video poker machines located in truck stops in

Louisiana. Effective August 20, 2001, the Company sold all of the Company's

interest in the three operating companies. The Company did not liquidate as a

result of the sale of its assets but began to seek business and acquisition

opportunities, leading to the Transactions. Effective February 4, 2008, we

acquired a controlling interest in Shaanxi Chang Jiang Si You Neng Yuan Fa Zhang

Gu Feng You Xian Gong Si ("Chang Jiang" Ltd. (the “Company”), a China corporation, in exchange for

a controlling interest in the Company.

Since our acquisition of Chang Jiang our primary business activity is

exploration and we expect to begin mining, processing and distributing gold,

zinc, and lead in 2009. Currently all of our business is in the Shaanxi

Province, China . We have engaged in exploration and expect to begin to

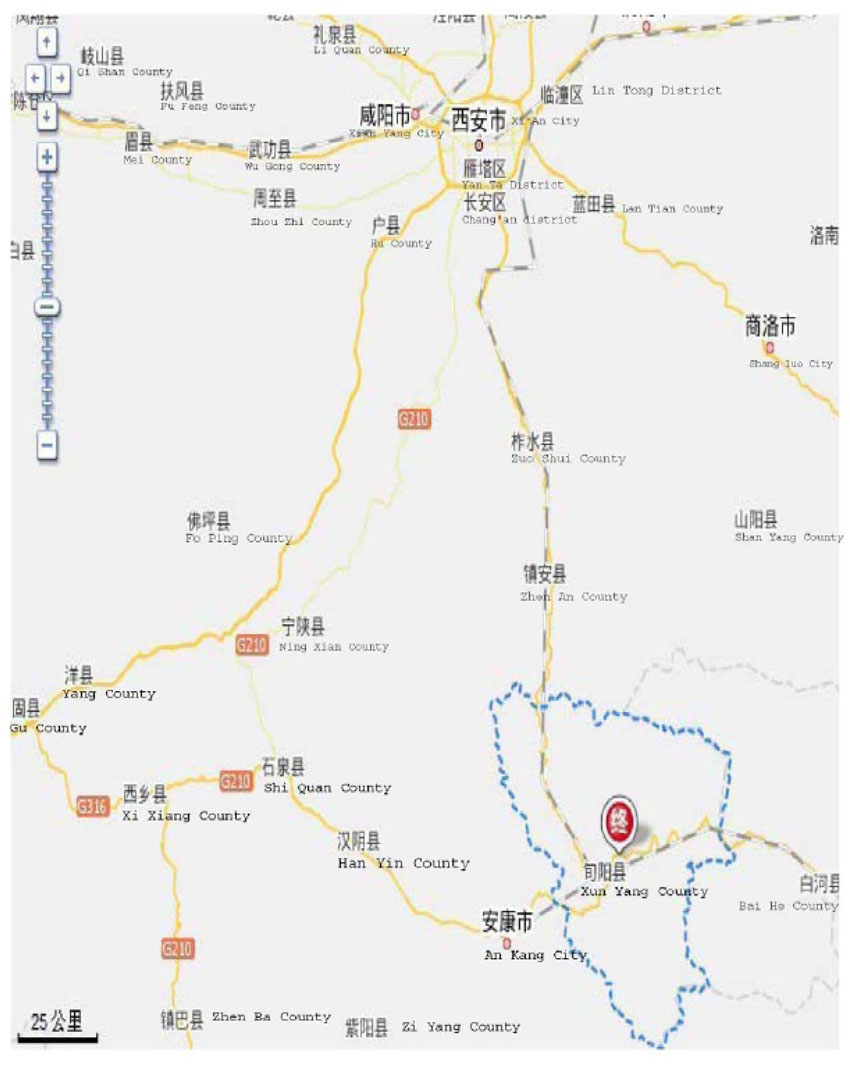

operate mines in the Qinba Mountain Area at a geologic junction of "Shan, Zha,

Zhen, Xun", which are the four primary metallogenic prospective areas in the

Shaanxi Province. This region has historically contained reserves of high-grade

minerals of gold, lead and zinc. As this has traditionally been a mining area,

we believe we can meet our requirements for experienced miners and general

labor teams at an attractive cost.

Chang Jiang was incorporated in the name of Weinan Industrial and Commercial

Company Limited as a limited liability company in the PRC on March 19, 1999.

The Company became a joint stock company in January 2006 with its business

activities as an investment holding company and development of theme park in

Xi'An, PRC. Beginning in August 2005, Chang Jiang contributed $7,928,532 by

injection of certain land use rights in lieu of cash to the registered capital

of Shaanxi Huanghe Wetland Park Company Limited ("Huanghe"), representing

92.93% of the equity of Huanghe. Later this interest was swapped for a 20% interest in Dongfeng Mining.

The Company also leases a portion of the land to Huanghe Wet Land Park Co. Ltd which is substantively occupied for the development and operation of a theme park. The Huanghe Wet Land Park Co. Ltd is a related company. Rental income was derived from this lease of $1,097,872 (rmb 7,500,000) for the year ended December 31, 2009, which represents allfiled with the

of the State of Nevada on December 4, 2008 and

The company did not owed the Huanghe Wet Land Park Co. Ltd,PRC. China remains a net importer of these metals, and also had no equity relationship with Huanghe, the

Leasing of Land use right is the only business with Huanghe.

In 2007 Chang Jiangwe believe a

exchanges that reorganized the company so that its operationsexploration for commercially

principally mining lead, zinc and gold in an 67.82 sq. kma

Zhai, Guo Jia Ling, Xunyang County, in the Shaanxi Province of China. The

transactions and historyTo

On February 5, 2007, Chang Jiang entered into an agreement withproven reserves. We also hold land use rights in a third party

to acquire 40% of the equity interest5.7 square

("Dongfang Mining") at a consideration of $3,117,267 payable in cash. Dongfang

Mining has engaged in exploration for lead, zinc and gold mining near the city

of Xi'AnHuanghe Nantan, Heyang County, in the Shaanxi Province of the, PRC.

On March 22, 2007, Chang Jiang entered into an agreement withChina. We lease a related party

portion

interest in Dongfang Mining owned by the related party.

On August 15, 2007, 97.2%development and operation of a theme park. The term of the stockholders of Chang Jiang entered into a

definitivelease agreement with Tai Ping Yang and the stockholders of Tai Ping Yang

in which they disposed their ownership in Chang Jiangis from January 1,

of ownership in Tai Ping Yang and cash of $1,328,940 payable on or before

December 31, 2007.

Hongkong Wah Bon Enterprise Limited ("Wah Bon") was incorporated2029. The annual rent is approximately $1.1 million. In November 2010, the Company

on July 7, 2006 as an investment holding company and wholly owned foreign

enterprise ("WOFE".) On September 2, 2007, Wah Bon acquired 100% ownershipthe amount of

Tai Ping Yang at a consideration of $128,205 in cash.

As a result of these various transactions, approximately US$601,504. For additional

is as follows:

a.

Wah Bon owns 100% of Tai Ping Yang;

b.

Tai Ping Yang owns 97.2% of Chang Jiang; and

c.

Chang Jiang owns 60% of Dongfang Mining.

The members have limited liability for the obligations or debtsbusiness activities of the entity.

The resulting corporate structure is diagrammed below:

In addttion,Company’s subsidiaries:

in the State of Nevada on September 19, 2008.China Changjiang shall be mergerred with NAGM,and replace the name of “NAGM”

in the future. There is no asset or liability for China Changjiang so far.

1 |Page

On February 4, 2008, we completed the Exchange pursuant to the Plan of Exchange

(the "Exchange"), by and among us, Chang Jiang, and the Chang Jiang

Shareholders. Under the Agreement, the Wah Bon shareholders received 500,000

shares of Series C Convertible Preferred Stock. The shares of Series C

Preferred Stock each carry the right to 1,218 votes per share and will be

convertible into common stock at a rate sufficient to yield an aggregate of 609

Million pre-split common shares upon conversion, as set forth in the

Certificate of Designations.

To comply with requirements of Chinese law (referred to as "WOFE"), we

established the acquisition of Wah Bon and Tai Ping Yang to serve as offshore

foreign entities for the purpose of consummating the acquisition. In the

opinion ofrequired government license, our Chinese counsel this permits the transfer of at least 97.2%

shares of Chang Jiang to the first WOFE entity (Tai Ping Yang), then 100%

shares of Tai Ping Yang to the second WOFE entity (Wah Bon.) Then 100% of the

shares of Wah Bon can be conveyed to NAGM, indirectly making Chang Jiang a

foreign entity. For purposes of the acquisition, all of Chang Jiang's rights,

responsibilities and benefits are assigned to and assumed by Wah Bon. This

procedure requires several stages of governmental approval by provincial

authorities in the PRC. As of the Closing Date all required approvals had been

obtained.

North American, Wah Bon, Tai Ping Yang, Chang Jiang and Dongfang Mining are

hereafter referred to as (the "Company").

On September 19, 2008, the Company reincorporated to the state of Nevada under the name “China Changjiang Mining and New Energy Company, Ltd.” The Company authorized 100,000,000 shares at a par value of $0.001 in anticipation of the 10 for 1 reverse split following the conversion of its Series C Preferred stock, which shall yield a net fully diluted amount of 60,900,000 new common shares. In December, 2009 an application was made on behalf of the Company to FINRA for approval of corporate changes, including the corporate name, the symbol, the recapitalization of the reverse split and the conversion of the Series C Preferred Shares. The Company has received two letters of comment from FINRA, to which it has responded, but the corporate changes have not yet been approved as of this filing.

Sales and Marketing

Although we have not yet begun to extract minerals from the property we have

established a sales and marketing department. These persons have focused on

identifying and establishing relationships with Companies that are likely to

require our products. Lead and zinc can be freely sold and marketed throughout

the PRC. As China remains a net importer of these metals, we believe a customer

base exists within China.

Mining Industry

General

Our

distributing gold, zinc, lead and gold, and other

modernizing economy has experienced rapid growth in its manufacturing capacity.

Despite high rankings in world production of nonferrous metals,products. China is still

currently a net importer of nonferrous metals including lead and zinc. China's natural

resources include coal, iron ore, petroleum, natural gas, mercury, tin,

tungsten, antimony, manganese, molybdenum, vanadium, magnetite, aluminum, lead,

zinc, and uranium.metals. There are governmental restrictions on foreign ownership of

mines for gold

mining activity in China, discussed further below.

increased demand for industrial raw

expect the priceprices of zinc and lead will reboundnon-ferrous metals to increase in China in the near future, and continue

to increase

Mineral Deposits

Mining area:Guo Jia Ling---Jiao Shan Zhai mining area is located in eastern Xunyang county, under the jurisdiction of Gouyuan villiage, Guankou town and Shuhe town. It covers an area of 61.27 square kilometres. Its length from east to west is 15.4 kilometers, and its width from south to north is 2.3 kilometers.

The mineral deposits within this area are mainly including: Si Ren Gou, Da Ni Gou, Huo Shao Gou, Guan Zi Gou, Nan Sha Gou, Xiao Shui He mineral deposit.

Traffic condition: the mining area is 19.5 kilometers far away from the county town. The Xiang-yu Railway and 316 State Highway along the Hanjing pass through the southern side of this area. In addition, Xunyang—Shuhe—Xiaohe North Ring Road passes through the southern side and eastern margin. fluctuations.

Industry within the area: There are cash crops such as yellow ginger, pepper, cured tobacoo,etc, abundant water resources electric power resources and labour resources, as well as various crop varieties, which isfavourable to develop the economies with distinct characteristics.

Previous working situation within mining area:

From Fifties to the beginning of Eighties, Shaanxi Regional Geological Survey Team, Geology & Mineral Bureau, the first geological team and other exploration units have successively carried out a lot of exploration work in this area. The results and materials achieved have been used for fundamental material in company’s mining and development. Since the mid- Eighties,the first geological team of Shaanxi Provincial Geology & Mineral Bureau have begun to conduct the geophysical prospecting and geochemical prospecting in this area. By this way, they have found the distribution of various minerals such as lead, zinc and gold, and have fixed distribution characteristics of tens of lead-zinc ore body, which provide the direction for company’s prospecting.

Especially in the mid- Eighties, the first geological team of Shaanxi Provincial Geology & Mineral Bureau have conducted the general investigation for Si Ren Gou—Nan Sha Gou area and have found:

Si Ren Gou: 19 lead and zinc ore bodies. They have ascertained 186,600 tons of lead-zinc metal D+E reserves, and 4,235,500 tons of mineral reserves in total. These ore bodies are shown in the -200 meters below in this mining area, and the general zinc grade is 1.56%——3.80%.

Lan Tan Gou: 5 lead-zinc ore bodies, the grade of zinc is 2.75%——11.60%, the grade of lead is 0.00——7.27%. These ore bodies are shown in 400 meters elevation below in this mining area.

Huo Shao Gou: 5 lead-zinc ore bodies, the grade of zinc is 4.65%——9.51%, the grade of lead is 2.32——6.04% accompanied by 5——70g/t silver. They have ascertained 44,400 tons of lead-zinc metal 333+334 resources, and 300,000 tons of mineral reserves in total. These ore bodies are shown in 500 meters elevation below in this mining area.

There are more ore bodies found in Guan Zi Gou. The K4—K8 ore body in the 200 meters below in deep part are the main mineral deposit in this area. They have ascertained 180,000 tons of lead-zinc metal 333+334 resources, and 2,540,000 tons of mineral reserves in total. These ore bodies are shown in 100 meters elevation ablve in this mining area.

They have found three ore bodies in Nan Sha Gou, that is K1、K2、K4. The grade of zinc is 9.99%——11.59%, the grade of lead is 1.70——5.96%. The mining elevation is 300 meters above in sea level. They have ascertained 290,000 tons of lead-zinc metal 333+334 resources, and 2,330,000 tons of mineral reserves in total. These ore bodies are shown in 0 meter elevation in this mining area.

Until the end of 2008, the company has found 15 gold ore bodies within area of gold mine in Jiao Shan Zhai and 7 gold mineralized bodies. According to the investigation on thickness and grade of K1、K2、K3 ore bodies, we speculated that the gold metal resources we can obtain is 1150.64 kilogram, and its value will be$33,700,000(230,000,000 RMB). The speculated lead-zinc resources in deep part of Si Ren Gou and Lan Tan Gou is100, 000 tons, the speculated lead-zinc resources in Huo Shao Gou—Guan Zi Gou and Xiao Shui He—Nan Sha Gou is both 100,000 tons. In addition, the speculated resources in exploration area is 300,000 tons, and its potential value is$ 702,000,000(4,800,000,000 RMB). The potential value of gold, lead-zinc resources in the mining area is over$ 730,000,000(5,000,000,000 RMB).

All of these miners will be the guarantee of generating benefit and basis of building the energy base of the company.

Nonferrous Metals - Zinc

Lead and zinc resources are relatively abundant around the world. There is no

deposit only of zinc under natural conditions, and ordinarily zinc exists with

metals such as lead, copper, or gold, in the form of polymetallic ore. China's

mining sector has experienced strong growth since 2001. Investment in mining

exploration totaled 316.2 billion yuan (42.6 billion U.S. dollars) in the first

nine months of 2007 according to Wang Min, Vice Minister of Land and Resources.

At the China Mining Conference 2007 (sponsored by China's Ministry of Land and

Resources), it was reported that China's mining output doubled to $190 Billion

for the period 2000-2005. Iron ore production increased 38% to 406 Million tons

and nonferrous metals increased 18% during that period. Nonetheless, China is

still a net importer of lead and zinc.

Zinc is a soft metal used to makes brass when mixed with Copper. Zinc is used

in the automotive and construction industries to galvanize steel, create metal

alloys and in certain chemical processes. Research is being conducted in the

area of zinc-air batteries.

According to the NONFERROUS METALS OUTLOOK, YEAR 2007 published by the

Department of Natural Resources for the Canada Ministry of Public Works,

deficits have occurred in each of the past five years for concentrate.

Stockpiles have fallen and prices have risen as a result. In September 2006

China eliminated its 5% export rebate on refined lead and zinc in September,

resulting in increased costs for metal exported from China. Chinese exports had

increased 16% in 2006 from the same ten months period in 2005.

On August 1, 2008, China eliminated the 5% export tax rebate on #0 zinc, which

decreases the export of zinc, increases the provide and ultimately worsen the market.

2 |Page

In 2007 China ranked 1st in the world both in zinc and lead production. The zinc

output in China reached 3.72 million tons in 2007. increasing 17.8% compared to

that of 2006 Calculated by the data in 2007, zinc output in China took up about

32.55% of the total global output

Worldwide zinc usage has increased from approximately 6.1 Million tons in 1985

to 11 Million tons in 2005. But only slightly increased to 11.4 million in 2007, and

11.75 million tons in 2008.Refers to the report of institute, CHR, the demand of zinc

in 2010 may slightly decrease to 11.1 million tons.

The recession of zinc partly because of the financial crisis, partly came from the

immoderate Development in the past several year. And the recession was considered the

natural adjustment Of the industry. In the long run ,the demand increase will recover.

Actually, the price of zinc has increase in a large range during 2009.

Average settlement prices for high grade zinc are listed below.

LONDON METAL EXCHANGE FOR HIGH GRADE ZINC (ANNUAL AVERAGE SETTLEMENT PRICES

2007

$3250.00

2008

$1925.00

2009

$2596.00

(US DOLLARS PER TON)

The 3 months zinc closing price of London metal exchange in April 4, 2010 has reached

$2,400 per ton, decreasing 8%, comparing that of 2009.

The bid/ask price for 15 months zinc the London Metals Exchange on April 4, 2010

was $2,438 for bid and $2,433 for ask. Source – London Metal Exchange

There are 433 above-surface mine enterprises in China, distributing in 24

provinces, cities and autonomous regions all over the country, including 37

enterprises whose respective annual output of zinc concentrate is more than 10

thousand tons and the total output of which takes up 45% of the nation's total.

In the first half of year 2008, zinc concentrate output of China was 1,430,700 tons

and zinc output was 1,920,200 tons, increasing 6.11% and 21.13% respectively compared

to those of 2007.

In 2009, the price of zinc in China increase rapidaly. The range of increase rank the top 3 amongNonferrous Metals.

We expected that the price of zinc shall go up for 2010, because the demand of zince increase

In the world, especially in USA and Europ and the economic are recovering from the 2008

Financial crisis.

Lead

Lead is the heaviest common metal known for malleability. Lead is resistant to

corrosion and used for protection against harmful X-Rays and radiation.

According to the Nonferrous Metals Outlook published by the Department of

Natural Resources for the Canada Ministry of Public Works, 75 % of the world's

demand for lead is for lead acid batteries for use in the automobile,

industrial and consumer sectors. It is also used to attenuate radiation from

radioactive sources and to provide corrosive resistant finishes to roofing.

World lead usage has increased from 4 Million Tons in 1985 to 5 1/2 Million

Tons in 2001. The forecasts are for increased usage up to approximately 6

Million tons. Usage slowed slightly from 1999 to 2004 as lawsuits in the U. S.

over lead based paints and emissions forced closures and damages. Exide, a U.

S. lead acid battery producer, was forced into bankruptcy and the Lead

Industries Association in the U. S. ceased its operations. Both cited the

lawsuits as the primary factor.

In 2007 China ranked the first in the production of lead with the total output

Of 2,757,400 tons which accounted for 34% of the global output. The Worldwide demand

is expected to be stable in the future several years.

The average closing prices for lead on the London Metals exchange are as

follows:

LONDON METAL EXCHANGE FOR LEAD

2007

2008

2009

$2,375

$2,175

$2,595

(ANNUAL AVERAGE SETTLEMENT PRICES, (US DOLLARS PER TON)

Though the average settlement prices in 2009 still stayed above $ 2,000 per ton, actually the price at the end of 2008 has lower than $1,000, and fluctuate between $950 and $ 1,300 during the first quarter of 2009. The settlement price is $1,230 at March 12,2009.

The bid/ask price for 15 months lead on the London Metals Exchange on April 4, 2010

was $2,228 for bid and $2,223 for ask. Source - london Metal Exchange.

As the tele industry is still booming in the future 10 year, the demand of lead shall be push up, but the supply of lead can not catch the demand, which may support the

price in the future 3 year.

Gold

In 2008, the gross industrial output value realized by gold enterprises over

the country was 282 ton, with a growth of 4.26% compared to the same period

of last year; and the gross production had growed for 2005,2006 and 2007, with

the grow rate of 5.51%,7.15% and 12.67%.

Gold is the rare metal, which makes it impossible to fluctuate much higher or lower

in supply. The market forcasts the slight increase of supply in the near future.

It is estimated that gold consumption in China will increase from previous 200

tons per year to 400-500 tons over the next several years, which may influence

the international gold market price to a certain extent.

Despite the recession of the global economy in 2008, the gold price increased from

$833 per ounce in the beginning year to $880 per ounce at year end, with the higest

Price of $1,032 per ounce. Going with the economy depression, more and more investors

choose the gold as the priority.

More and more investor consider the gold as a stable investment in the inflation.

The demand is expected to be further increase.

In 2009, the price of gold continue to increase, reache $1,096 per ounce, abount 25%

Increase comparing that of 2008. the price still keep slightly increase in the 1 quarter

Of 2010.

LONDON METAL EXCHANGE FOR GOLD

2007

2008

2009

$833

$880

$1096

Competition

Our competitors in the nonferrous metals markets are expected towill be local and

regional mining enterprise. enterprises.

include Dongshengmiaogold and that we consider to be likely competitors, include:

Co., Col, Ltd., Xinjiang WuqiaXinjian Woquia Tianzhen

Nonferrous Metal Development Co., Ltd. These competitors have

in the operation of mines and mining activities and have superior financial

resources than we do.

the markets for many other non-ferrous metals. Since supply in general cannot

meet demand we do not expect that we will have difficulty selling our

ore for the near future. The gold market on a worldwide basis has seen large

increases in demand since 2001, resulting in more than threefold increase in

prices per ounce, from $435 in 2004 to $872 in 2008, according to the London

Metals Exchange. China has traditionally protected its domestic metallurgy industry

with high tariffs, import quotas and restrictions on

These tariffs and import quotas were adopted Due to provide protections to

companies such as ours that were part of the domestic industry in China.

Due toChina’s WTO membership, China will lower tariffs, eliminate import quotashas reduced and

permit more foreign competition, resulting in reduced is expected to further reduce

companies against foreign competitors. To maintain its WTO membership, China

must

foreign enterprises opportunitiesthe opportunity to sell and

theyTariffs will eventually be eliminated altogether. This is expected to increase the effect

of

to predict the effect these

financial condition or the valuestrategies and near-term plans are as follows:

3 |Page

gold over a test area; and

We

the PRC. Regulations are issued or implemented by the State

division of the China State Council, and similar land use offices at the local

level. These regulationsother relevant government authorities cover virtually allmany aspects of

of natural resources, in China.

Chinese mining companies must obtain two separate permits from the land

resource divisions of the Provincial government. The first permit must be

obtained before a mining enterprise can conduct exploring activities. The

Company has obtained this license. The regulations also require a second mining

license for extraction activities. We have obtained the first license for zinc,

lead and gold. To maintain the licenses the Company must follow prescribed

procedures in its exploring or mining activities. During the period of obtaining

mining license,we can also gain the revenues from the sales of ores deriving from

exploration. Mining license will guarantee for our extraction activities.

On Dec. 31, 2009,The Ministry of Land and Resources Ministry issues a notice”including, but not limited to, futher regulate the

management of theexploration right”. It regulates and fixed a more high level on entry

conditions for the Mineral resources exploration which makes a more detailed requirements

for the newly approval, continuation, Merger, division, transfer and application of mining

upgrades. It requires to establish the public exploration right trading market to avoid the

self-dealing to protect the benefit of the Lawful holders. Based on this requirement, the

company will complete the valid applications of the lawful rights and interests to get the

approval.

It is hard to predict the length of time to get into the mining license,. Though it isindustry, the third year that we are in the process scope

License, we are confident of getting the license in these years because we are now performing the detail survey.

Chinesepermissible business activities, tariff policies and foreign investment.

certification. These are administered by the Administration of Work Safety

before it can engage in either mining or extracting activities. All of our

operating subsidiaries have obtained appropriate safety certification from the

Administration of Work Safety of local governments. We also have been granted

environmental certification from China Bureau of Environmental Protection.

Regulations governing the mining business in the PRC include:

ExplorationMineral Resources Law, which requires a mining business to have exploration and Mining Regulation (1958), amended to allow foreign

investment in 1996;

Explorationmining licenses from provincial or local land and Mining and Transfer of Rights Regulation (1998);

as well as numerous regulations governing safety by the resources agencies.

which requires a mining business to have a safe production license and provides for random safety inspections of mining facilities.

The Chinese legal system is still developing and there is often confusion and

uncertainty about the scope, interpretation and enforcement of its laws and

regulations. Thecompanies that seek to engage in mining industry has been under scrutiny for its safety and

environmental record and we cannot predict whether new laws or changes in

interpretation and scope of existing laws may adversely affect our intended

operations.

The Company has applied for excavationmust obtain two separate licenses in area for gold zinc and lead

mining withinfrom the land use area. The geographical locations for these sites are:

Eastern longitude: 109* 26' 30'' - 109* 38' 30''

Northern latitude: 32* 55' 45'' - 33 * 01 ' 00 ''

We expect to make application for the final required permits of gold by and expect to

obtain final approval this year. Upon approval, we will have the right to

mine the specified areas. We expect to apply for additionalmining licenses

within the land use area that have yielded positive results upon the conclusion

resource division

Summaryprovincial government. The first license must be obtained before an enterprise may commence mineral

4 |Page

Geological Survey

The company commissioned a geologicaldate of this report, we have

Team of Shaanxi Geological and Mineral Department. A report dated October 26,

2007 was obtained that showed favorable results in several areas of the land

use area. The report is summarized as follows:

1, Summary of the Geological Survey Report by the First Geological Research

Team of Shaanxi Geological and MineralEnvironmental Department dated January 13, 2008.

GEOLOGICAL CHARACTERISTICS OF THE MINING AREA

a. Stratum

The surveyed area is mainly composed of metamorphic rock formed in

middle-to-upper Silurian period and lower Devonian period. Most of the

rocks are phyllite, sandstone, calcirudite rock, lime and dolomite.

b. Structure

The surveyed area is situated in the northern margin of the draped belt

formed by Baishui River and Bai River. The frame of the structure is

composed by Tizi Rock-Shuhe faultage, which extends by an east-west

position. The Nan Yangshan faultage runs through the northern part of

the surveyed area. The main structure consists of on-growing fractures

and draped belts.

CHARACTERISTICS OF ORE / MINERALIZING ORE

Ore -containing layer of lead- zinc ore is explored out through the

stratigraphic identified by 1:10000 Geological Survey. In the fourth

lithologic section of middle Silurian period at Shuanghe town and the

merger layers of upper Silurian period at Shuidong channel, the mining

sections are mainly composed of brown ferruginous sandstone, siltstone

and grey-yellow powder phyllite containing sodium.. According to the

survey, three lead-zinc mines and one gold mine were pitched:

a. Lead zinc mine

Mine KH1 situates at Guan Men Zi Ya-Cai Miao Ya district and it's

1.0-1.5 meters wide, 700 meters long and averagely 0.76 meters thick.

The average grade of mineralization is Pb1.22%, Zn0.67%. Control

Engineering: TC9, TC3, YK1, TC6, TC18. The shape of the area is : 215

o -32 o {angle} 12 o -32 o.

Mine KH2 is shown in the Wang Jia Cao area and its 2.10 meters wide,

100 meters long and averagely2.06 meters thick. The average grade of

mineralization is Pb0.85% Zn0.23%. Control Engineering: CK1. The

shape of the area is: 325 o {angle} 16 o. (Note: Single engineering

control)

Mine KH3 is shown in the Gangou area and its 1-2 meters wide, 100

meters long and averagely1.19 meters thick. The average grade of

mineralization is Pb0.71% Zn0.02%. Control Engineering: D34 sampling

point. The shape of the area is: 350 o {angle} 32 o. (Note: single

engineering control)

b. Gold Mine

Mine KH is shown in the Dong Gou area and its 0.50 meter wide, 100

meters long and averagely 0.50 meter thick. The average grade of

mineralization is Au1.01g / t. Control Engineering: sampling point,

20 meter in the North of D206. The shape of the area is : 340 o

{angle} 17 o. (Note: single engineering control)

5 |Page

THE CHARACTERISTICS OF THE PROPOSED MINES

The study revealed approximately 16 gold minerals, primarily in 4 large

deposits located at areas denoted as K1, K2 ,K3 and K11. Samplings in

others areas are all single engineering control sites:

a. K1

The surface is controlled by six trenching structures. The length

are 360 meters and the thickness is 0.29-4.30 m,Security Department with an average

thickness of 1.23 m. Ore body grade is 1.24 - 10.06 g / t ,the average

grade of mineralization is 2.7 g/t and the ore body occurrence is1* -

356 * {angle} 11 * - 50 *.

b. K2

Being controlled by three trenching structures. The length are 130

meters and the thickness is 0.22-0.89 m, with an average thickness of

0.55 m. Ore body grade is 1.29-9.51 g / t. , the average grade is 5.71

g / t and the ore body occurrence is 24 * - 320 * {angle} 9 * - 24 * .

c. K3

Being controlled by two trenching structures. The length are 100

meters and the thickness is 0.43-3.48 m, with an average thickness

of 1.96 m. The Ore body grade is 5.10-12.94 g / t , the average grade

is 2.7 g / t and the ore body occurrence is -310 * - 320 * {angle} 20

* - 24 *.

d. K11

Being controlled by 1 trenching engineering and 2 pitting structures.

The length are 100 meters and the thickness is 0.13-1.62 m, with an

average thickness of0.86 m. The average grade is 4.86-7.76 g / t,

and the ore body occurrence is 225 * -255 * {angle} 16 * -24 *

GEOLOGICAL CONDITIONS OF THE ENGINEERING

The roof and floor of the mines in the area mainly consist of sericite

phyllite and sandstone. The fresh bedrock structure is dense. The cracks

and holes show minimal changes, indicating a stable rock layer. This layer

provides a very suitable foundation for excavation. During the course of

construction there may be some small-scale breaks and cracks that needregard to

be fortified. The transportation system is convenient and the water,

electricity resources are sufficient

ESTIMATION OF RESOURCES

Chang Jiang Shi You Neng Yuan Gong Si currently owns 3 main rich mining

areas with large-scale gold reserves. It is primarily estimated that there

are3-5 tons of gold reserves and there are 300 - 500 million tons of lead-

zinc reserves. The average grade is 8-15%, with some ranging as high as

45%.

6 |Page

BASIS

The estimation of resources methods and requirements of this exploration

is based on GB/T17766-1999" CLASSIFICATION FOR RESOURCES/RESERVES OF

SOLID FUELS AND MINERAL COMMODITIES " and GB/T13908-2002 " General

requirements for solid mineral exploration" DZ/T0214-2002 " Geological

prospecting criterion for copper, lead, zinc, silver, nickel and

molybdenum ore", "Reference manual of the mineral resource standard "and

combined with the "opinion to the gold ore industry standard in `Shaan Xi

Xun Yang Guo Jia Ling- Jiao Shan Zhai lead, zinc, gold ore exploration'" by

Shaan Dong Kuang Fa*2007*002.to make out the industry standard to Jiao Jin

Shan gold ore exploration.

Cutoff Grade 0.5 g / t

Minimum Industrial Grade 1.2 g / t

The average grade of ore deposit 1.6 g / t

The Minimum Mining Thickness *0.8 M

Thickness of the Interlayer to be Eliminated *2.0 M

When the ore body thickness is smaller than the Minimum Mining Thickness,

using m {multiply} g / t.

RESOURCE ESTIMATION RESULTS

As mines K2 and K11 are relatively small, so we just made resource

estimation to K1 and K3 getting the intrinsic economic resources (334) .The

ore is 69460.43 tons and the metal is 244.31 kg. The ore in K1 is 43639.07

TONS, AND THE metal is103.26 kg; The ore in K3 is 25821.36 TONS, AND THE

metal is 141.05 kg;

MINERALIZATION FORECAST

The exploration area is located in the northern margin of southern

Qinling, Indo- Fold Belt Baishui Jiang- Bai He Fold Belt; the South East

edge of Shan Zha Xun Chen Ji Pen Di. The area mainly exposes the sedimentary

of paleozoic shallow metamorphised clastic rocks and carbonate rocks. Da

Yang Synclinorium, Xun Yang anticline and Nan Yang Shan fault, Da Ling-Shu

He fault form the the backbone of this area. The structure line lies from

east to west. The characteristics of the rocks are easy of deformation and

weak of metamorphism.

1:50000 stream sediment survey and 1:10000 soil measurement fix a 5 km long,

four km wide gold anomalies area around Jiao Yang Shan Zhai about 15 square

kilometres, and the anomaly area is about 0.11-3.15 square kilometers with

abnormal value as high as 2900 PPbin the centrel concentration and 277.1ppb

for an average value.

7 |Page

date.

Impact

the State Environmental Protection

authorities canmay set local regulations which may be more restrictive than the

including disposal of solid waste,

of gases and emissions. The local authorities generally monitor and

the regulations, including the assessment and collection of fees and the imposition of fines and

We have only been engaged

impact has been limited. If we are successful in

operations, we expect to generate waste water, gases and solid waste. We will

therefore

activities.

We activities, and will likely require a licenselicenses for the

Licenses must

regulations including the rules governing watermaterially and solid waste disposal.

Research and Development

With the acquisition of Dong Fang we now have land use rightsin mineral explorationin 61.27 sq.km

parcel located in Xunyang County, Shaanxi Province, PRC.

two people in marketing, 1one in manufacturing, 4four in research and development and

quality control, 2 two

A breakdown

Full-time

Marketing

Researchthe SEC at www.sec.gov and

Financial and

Manufacturing

Management

development accounting

CHANG JIANG

10

1

0

3

0

6

DONG FANG

6

0

4

0

1

1

TAI PIN YANG

0

0

0

0

0

0

WAHBON

0

0

0

0

0

0

TOTAL

16

1

4

3

1

7

printed free of charge.

Our Company and its securities are subject to significant risks to its

business, operations and financial condition.FACTORS.

risks described

context of this report. If we are unable to manage these risks or if any of the risks are

realized, our business, operations, and financial condition and the value of

our stock would likely suffer. In that event our investors and stockholders

could lose all or part of their investment.

stage mining company that has acquiredwith land use rights and exploration permits

to a 61.27 square kilometer tract of land in an area traditionally associated with mining

Shaanxi Province of central China. China, which is not held for the purpose of mining.

segment, determining the degreecommercially adequate deposits of mineralization ofzinc, lead zinc and gold within

our properties. While we believe that there may be an opportunity to obtain

commercially viable amounts of lead, zinc and gold from our property, we still

face substantial hurdles. The

such as lead, zinc and gold incur involve significant financial risks. The results of

exploratory

conducted in strict compliance with professional guidelines.

exploration and extraction activities require substantial investment which must occur over a significant

quantity of minerals within any property is always finite. Many properties are

unable to

results. Successful extraction depends on very

drilling, mine construction and establishment of processing facilities. Mines

are also

exist. The Company must obtain additional permits

after permittingobtaining permission to begin extraction. We are unable to

ultimately be successful in meeting these challenges or even ifwhether we will commence

result in our mining operations becomingwould have a commercial viable or profitable

enterprise.

OUR INDEPENDENT AUDITORS HAVE NOTED THAT THERE IS SUBSTANTIAL DOUBT ABOUT OUR

ABILITY TO CONTINUE AS A GOING CONCERN.

Our independent auditors have noted that there is doubt that we can

continue as a going concern. Thouth we have generate the rental income in 2009,

and are expecting to receive the cash in 2010 As reflectedsubstantial adverse effect in the accompanying consolidated

financial statements, the Company has an accumulated deficit during the

exploration stagevalue of $13,366,785 at December 31, 2009 which includes a net loss

of $104,557 for the year ended December 31, 2009. The Company's current

liabilities exceed its current assets by $7,787,760our

in operation of $531,480. These factors raise substantial doubt about its

ability to continue as a going concern. In view of the matters described

above, recoverability of a major portion of the recorded asset amounts shown in

the accompanying consolidated balance sheet is dependent upon continued

operations of the company, which in turn is dependent upon the Company's

ability to raise additional capital, obtain financing and succeed in its future

operations. The financial statements do not include any adjustments relating

to the recoverability and classification of recorded asset amounts or amounts

and classification of liabilities that might be necessary should the Company be

unable to continue as a going concern.

8 |Page

WE HAVE NOT YET OBTAINED ALL OF THE EXTRACTION LICENSE NEWLY

REQUIRED BY THE CHINA NATURAL RESOURCES MINISTRYDURING THE

PRIOD OF GAINING THE REVENUE FROM EXPLORATION

China employs a two stage permitting process for permission to explore and

extract minerals. The first permit allows a mining company to engage in

exploration activities, such as boring exploratory holes, conducting mineral

assays, field testing and so on. The Company's subsidiary, Dongfang Mining,

acquired this license in 2003 and has since engaged in activities to determine

the estimated mineralization of the property and relative cost and process

needed to extract.

.

The second permit is for exploitation, which permits excavation and sale of

extracted minerals. The Company are ready to apply for the gold exploitation

permit, but has not yet obtained. While government officials have informally

suggested that the permit will be approved, there can be no assurance that the

Company will successfully obtain the required permit. In that event, the value

of our interest in the properties would be seriously impaired and would like

result in a significant loss of value for the Company's assets as well as its

securities. Although the revenues from the exploration would not be absolutely

prevented, the beneficial interest of the company would be obviously impaired.

We have not meet all of the conditions of getting the exploitation permit,the important

Factor of approval is the enough content of zinc, lead or gold. With the help of professional

Instruction from the team 1 of shaanxi geology exploration bureau, we are confident of

geting the permit in these years.

THERE IS NO ASSURANCE THAT OUR PROPERTY WILL CONTAIN SUFFICIENT QUANTITIES OF

COMMERCIALLY MARKETABLE MINERALS FOR US TO BECOME COMMERCIALLY VIABLE OR THAT

WE WILL BE ABLE TO ECONOMICALLY EXTRACT THE MINERALS.

We are an exploration stage Company and have not yet begun the process of

excavating minerals from our propertyin scale.. We have engaged in limited investigation

and geologic testing. Based on our preliminary findings, we believe there is

sufficient mineralization to begin a commercially viable mining business. There

can be no assurance however that our exploratory efforts will prove correct or

that a commercially mineable mineralization exists on our property. Even if the

conclusion that a sufficient quantity of minerals exists proves correct, it

still may not be economically feasible to profitably extract the minerals for a

wide variety of reasons, many of which are beyond the Company's ability to

control. Therefore we can offer no assurance that a profitable mining business

will result from our efforts.

WE ARE AN EXPLORATION STAGE COMPANY AND

HISTORY OF FINANCIAL LOSSES RESULTED FROM CURRENCY AND EQUITY.

9 |Page

We acquired a mining company that has begun attempts to the complete operation and revenue in the establish a mine for lead, zinc and gold in February 2008.

The Company, through its subsidiaries, obtained a permit to begin exploratory efforts in 2003 and has not yet commenced actual mining of the land. We intend to commence gold extractions in this year. We expect to obtain certain revenues in the future upon which to base an evaluation of our business and prospects.

LOSSES.

$ 921,675, $ 1,700,599, and ($1,141,537), respectively. Net losses during the years ended December 31, 2009 and 2008 were $104,557 and $1,467,426,

Our prospects mustyet have the second required license needed

such risksmaterially and adversely affected.

The company’s business contains two segments: mining and real estate. The using of the involved land is in compliance with theLand Use Rights provisions. The company is concentrating their strength and resources on the mining. Due to the impact of financial crisis, the world wide non-ferrous metal industry is in its trough in 2008 and the commodity value raising back slowly .China is a top tourism destination.One of the Eighth Wonder of the World---- terra-cotta warriors is in the province which ourproject lies in. The Yellow River wet land possessed by the company is the “transfer station”forSiberia migratory birds. In or der to make sure that the company owns a good future prospect and can develop the business well, the company participated inthe Yellow River wet land project by shares and the project is in constructionstage.

The Land use right has been leased out for the Hechuan ecologic park from the end of 2008 by the Huanghe Wet land park Company.Ltd. As the wet land park is underconstruction during 2009, there is no cash flow for the rental revenue of $ 1,097,872 (rmb7,500,000) in 2009. But the Wet land park is going to open in May 2010, and the Company was promised to be paid the rental in 2010.

DUE TO OUR LIMITED OPERATING HISTORY, WE WILL BE UNABLE TO ACCURATELY FORECAST

MINING REVENUES.

Due to our limited operating history and our planned growth through increased

sales, we are currently unable to accurately forecast our future mining revenues. Our

current and future expense levels are largely based on our investment plans and

estimates of future revenues, which are expected to increase. Revenues and

operating results generally depend on the effectiveness of our marketing

strategies to penetrate the market and the success of our research and

development efforts which are difficult to forecast as we are in a relatively

new company. We may be unable to adjust spending in a timely manner to

compensate for any unexpected revenue shortfall. Accordingly, any significant

shortfall in revenues in relation to our planned expenditures would have an

immediate adverse effect on our business, prospects, financial condition, and

results of operations. Furthermore, as a strategic response to changes in our

competitive environment, we may from time to time make certain pricing or

marketing decisions that could have a material adverse effect on our business,

prospects, financial condition, or results of operations.

10 |Page

BE ABLE TO

OUR OPERATIONS.

$1,159,435 488,698 and $253,521, $ 850,627,

land use rights that are illiquid. As we begin to implement our strategies to

excavate the property and exploit the minerals, weExploration activities will likely experiencegenerate cash

flow deficits

capital. We mayIn that event, we will need to fund our future operations withobtain additional

capital needs will depend on numerous factors affecting our profitability,

including (i) the time and expense of ramp up of the extraction activities,

(ii) the amount and quality of minerals extracted, (iii) our ability to contain

expenditures, especially for administrative and transportation costs, and (iv)

the amount of our expenditures. We cannot assure you that we will be able to

obtain funding in the future to meet our needs.

cannot provide any assurance that additional fundswe will

obtain funding in the future to meet our needs. Even if we locate available capital, it may be on

capital investments could dilute or otherwise materially and adversely affect

the holdings or

ofWe expect that our future

incurred arewill be generated in China, but our reporting currency is US dollars and reported

will affect our revenues and operating results. Presently we do not expect to

sell our products outside of China but we could sell to foreign interests as a

result of competitive forces or changes to our business plan.

11 |Page

For over a decade the value of the Chinese currency was pegged to the U. S.

Dollar and fluctuations in value were therefore relatively mild. In July 2005,

China abandoned the peg and changed to a floating exchange rate. The new rates

are market based compared to a basket of foreign currencies. These changes

would likely strengthenbetween the RMB as compared toand the U. S. Dollar and would

likely make our products more expensive for U. S. and foreign buyers.US dollar. We cannot

give any

against the US dollar or any

experience economic losses and negative impacts, on earnings and equityas reported in U.S.

result of foreign exchange rate fluctuations. Furthermore, any devaluation of

the RMB may adversely affect the dividends we may pay to our parent, thereby

adversely affecting the value of, and dividends payable on, our common stock.

We expect our revenues to consist almost entirely of Renminbi or "RMB", which

is the Chinese currency.

The Chinese government may restrict future access to

current account transactions. This may make it difficult for us to transfer

money from China to

even at all. It may also make it difficult for us to provide a returnpay cash

investment of foreign capital on a liquid basis.

capital.

which currently impose fees for

payment of fines for pollution, and provide for the closure by the PRC

cease or improve upon

the nature of ourthe mining business, wefuture mining operations

and solid waste materials during the course of our production. We believe our

environmental protection facilities and systems are adequate for us to comply

with the existingmaterials. Chinese national, provincial, and local environmental protection

regulations. However, PRC national, provincial, or

additional or more stringent regulations legal requirements which would require additional

expenditure expenditures on environmental

systems, the cost of which may exceed our financial resources.

12 |Page

Much of our

hire, and retain additional personnel, particular particularly

persons familiar with the marketing, manufacturing and administrative processes

associated

current key employees, such as Mr. Chen Wei

Chief Executive Officer. We may be unable to retain our existing key personnel

experienced miners or additional key

effect on our business and financial condition.

MINING MAY CAUSE SUBSTANTIAL DELAYS OF

incident to the exploration for and

minerals, any of which could result in damagedamages for which the Company may be held

rock formations, bad weather, and

or other unfavorable conditions that are unknown until we begin extraction of

minerals.conditions. If we

substantial delays and require significant additional

conditions would likely adversely affect the Company's business, financial

condition and the value of

industry that resulted in loss of life and serious

have collapsed or were otherwise forced to close due to unsafe conditions. We

would likely

the they would have a material adverse effect on our

maybe irreversible.

securities.

The Yellow River wet land project—Hechuan ecologic park lies in the Yellow River south beach, Heyang County, Shaanxi Province, China. Hechuan ecologic park contains six main functional areas: rural tourism & leisure resort, agricultural sightseeing demonstration plot,traditional aquaculture area, eco wet land recreation area, wet land aquaculture area and eco wet land protection area.

Our rental income depends on the operation of the them park. And the theme park located in the wild area,whose future income is unpredictable. We can not change the usage of purpose for the land use right because it is limited in the purpose of tourism and crop farming which may increase our risk in the rental income.

13 |Page

MARKET PRICES FOR NON-FERROUS METALS FLUCTUATE AND COULD ADVERSELY AFFECT THE

VALUE OF OUR COMPANY AND OUR SECURITIES.

Market prices for lead, zinc and gold, the metals we primarily intend to mine

experience significant fluctuations in price. We are entering the business at a

time that the prices of lead and zinc are going uo again, and just one year

ago the price were on the extraordinarily low level, which means the value

of the lead and zinc increase 1 time in a year. The profitability of our operations will

be directly related to the prices we will be able to obtain in the marketplace.

The market prices of lead, zinc, gold and non-ferrous metals are subject to factors

beyond our control. These factors include changes in legal and regulatory

requirements, changes in the exchange rates of the Renminbi and other currencies,

worldwide economic recession, political and economic factors and variations in

production costs among a number of other factors. A reduction in the price or demand

for our metals would adversely impact our expected revenues.

RIGHTS

RIGHTS TO

Despite modernization efforts in many areas,

scheme for ownership ofall property that essentially vests title tois owned by the entire

country in the Central Government. Rather thancentral government. Unlike deeds or other evidence of

a fee simple ownership

land use. time.

circumstances. Our land use right is 50 years and is amortized over its life.

We recorded accumulated amortization expense of $2,049,710 and $1,638,232 at

December 31, 2009 and 2008, respectively.

years. Disputes over mining claims are common. A loss of our property rights or

rights would likely cause irreversiblematerial damage to the Company and the price of

its securities and could result in the loss

NONFERROUS MINERALS ARE FINITE

PERFORMED ONLY LIMITED GEOLOGICAL STUDIES,COULD ADVERSELY AFFECT THE

PROPERTIES FOR NONFERROUS METALS MAY BE CURTAILED OR EXHAUSTED. WE HAVE NOT

ENGAGED IN EFFORTS TO INVESTIGATE THE ACQUISITION OF OTHER AREAS OR ANY

EXPANDED POTENTIAL FOR OUR PARCEL.

Mines haveSECURITIES.

regulatory requirements, changes in the exchange rates of the economically extractable minerals. We must continually seek to replace

RMB and expandother currencies, worldwide

properties. Significant competition exists for the acquisition of properties

producing or capable of producing gold and non-ferrous metals. We may be at a

competitive disadvantage in acquiring additional mining properties because we

must compete with other individuals and companies, many of which may have

greater financial resources and larger technical staffs than we have. As a

result of this competition, we may be unable to acquire attractive mining

properties on acceptable terms.

CHINA'S GROWTH HAD BEEN RAPIDLY ACCELERATING FOR THE PAST SEVERAL YEARS AND THE

FINANCIAL CRISIS DIRECTLY DEPRESS THE ECONOMY LAST YEAR, WHICH IMPLYS THE COMING

OF CONTRACTION BUSINESS CYCLE.

Essentially allvalue of our securities.

China. We expect to sell all of our extractedany minerals in we extract within

these minerals throughout the world is affected by the increasing demand for such minerals in

China. We

China to maintain demand for our lead and zinc and, to a lesser extent, gold.

mineral products. The financial crisis abruptly and sharply slow down China’s growth pace. The economy

Contractionrecent

Came down with a great extent in a short time. Many Company in the industry had to

Stock up the metals in order to lessen the impact.

Though theOur business and results of operation may

means, which may counteract some adverse effect. But the majority expected that

the lower growth is unavoidable and the bottom of the economy has not yet reached.

If the economic growth in China continuewere to slows or even reverses it would likely

have an adverse effect on our business, its revenues and financial condition, and

the value of our properties and securities. We cannot assure you when the economic

turning point will come.

decline.

resources such as input commodities,

labor. These shortages have caused, and may continue to cause, unanticipated

increases and delays in delivery times, potentially impacting operating costs,

capital expenditures and

OF

results and financial performance as well

be affected by any adverse changes in economic, political and social conditions

in

planned economy to a market driven economy in

the PRC has undergone rapid modernization, although the Chinese government

exerts a dominant force in the nation's economy. This continues to include

reservation to the state of land use

and includes controls on foreign exchange rates and restrictions or

lands in China are state owned and

conveyed to business enterprises or individuals.

the local government authorities in

typically a lengthy and difficult process with no guaranty of success.

the lands where our minesexploration activities are located were acquired through the grant of a land

use right,

This process may adversely affect our future business expansion.

five-year plans and even annual

associated with potential changes in these plans. Since theChina’s economic

have no precedent, there can be no assurance that future changes will not

create materially adverse

Some of the measures of The People's Republic of China are anticipated to

negatively affect on us. For example, the government maintains control over

capital investments in the mining of various precious metals, including gold.

While we believe we currently comply with all applicable regulations, changes

could be materially adverse. Also China has recently pronounced changes to tax

regulations and regulations pertaining to business acquisitions.

Due to the limited effectiveness of judicial review, public opinion and popular

voting there are few avenues available if the governmental action has a

negative effect. Any adverse changes in the economic conditions, in government

policies, or in laws and regulations in China could have a material adverse

effect on the overall economic growth, which in turn could lead to a reduction

in demand for our products and consequently have a material adverse effect on

our business.

United States and more developed other western

with respect to certain social, economic and political issues which could lead to

adjustment of reforms. There are also issues between China and the United

States that could result in

internationally theThe role of China and its government remain in flux both domestically and internationally,

suffer cause shocks or setbacks that may adversely affect our business.

CONSIDERABLYPROVIDING LESS

FOR INVESTORS TO SEEK LEGAL

DIRECTORS, INCLUDING CLAIMS THAT ARE

directors and officers are nationals or

of these persons are located outside the United States in China. The PRC legal

system is a civil law

system is based on written statutes in which decided legal

value as precedents. As a result there is no established body of law that has

precedential value as is the caseDifferences in most western legal systems. Differences in

interpretations and rulings can occur with littlelimited opportunity

or appeal.

As a result, it

United States U.S. or elsewhere outside China upon our officers and

if service of process waswere successful, considerable uncertainty exists as to

whether Chinese courts

United States. Federal U.S. federal and state securities laws inas the U.

substantial rights to investors and shareholders that have no equivalent in

China. Therefore a claim

final judgment in the U. S. based on U. S. may not be heardrecognized or enforced by the

and has approved manyenacted numerous laws regulating economic and business practices in the

PRC

our

it is generallyrelatively easier and faster to obtain

government approval. Changes to existing laws that repeal or alter the local

regulatory

our business and the value of our securities.

including investment in the mining businessesbusiness, are subject to

regulationsrevisions. They may change in a manner adverse to us and may affect percentage ownership allowed to foreign investment

or even controls on the return on equity. Further, the various proposals are

conflicting and we may not be aware of possible violations.

NEW our stockholders.

BUSINESSES IN CHINA.

New regulations on the acquisition of businesses commonly referred to as "SAFE"

regulations (State Administration of Foreign Exchange) were jointly adopted on

August 8, 2006 by six Chinese regulatory agencies with jurisdictional

authority. Known as the Regulations on Mergers and Acquisitions of Domestic

Enterprises by Foreign Investors the new Rule requires creation of offshore

Special Purpose Ventures, or SPVs, for overseas listing purposes. Acquisitions

of domestic Chinese companies require approval prior to listing securities on

foreign exchanges.

We obtained the approvals that we believe are required in making the

acquisitions that formed the present company. Nonetheless, our growth has

largely been by acquisition and we intend to continue to make acquisitions of

Chinese businesses. Since the "SAFE" rules are very recent there are many

ambiguities and uncertainties as to interpretation and requirements. These

uncertainties and any changes or revisions to the regulations could limit or

eliminate our ability to make new acquisitions of Chinese businesses in the

future.

WE MAY BE AFFECTED BY CHANGES TO CHINA'S FOREIGN INVESTMENT POLICY,

WHICH WILL CHANGE THE INCOME TAX RATE FOR FOREIGN ENTERPRISES.

On January 1, 2008, a new Enterprise Income Tax Law took effect. The new law

revises income tax policy and sets a unified income tax rate for domestic and

foreign companies at 25 percent. It also abolishes favorable treatment for

foreign invested enterprises. When the new law takes effect, foreign invested

enterprises will no longer receive favorable tax treatment. Any earnings we

may obtain may be adversely affected by the new law.

CHINA CONTROLS THE CURRENCY CONVERSION AND EXCHANGE RATE OF ITS CURRENCY, WHICH

COULD ADVERSELY AFFECT OUR FINANCIAL CONDITION.

The Chinese government imposes control over the conversion of the Chinese

currency, the Renminbi, into foreign currencies, although recent pronouncements

indicate that this policy may be relaxed. Under the current system, the

People's Bank of China publishes a daily exchange rate based on the prior day's

activity which controls the inter-bank foreign exchange market. Financial

institutions are permitted a narrow range above or below the exchange rate

based on then current market conditions. Since 1977 the State Council has

prohibited restrictions on certain international payments or transfers for

current account items. The regulations also permit conversion for distributions

of dividends to foreign investors. Investment in securities, direct investment,

and loans, and security investment, are still subject to certain restrictions.

For more than a decade the exchange rate for the Renminbi ("RMB") was pegged

against the United States dollar leaving the exchange rates relatively stable

at roughly 8 RMB for 1 US Dollar. The Chinese government announced in 2005 that

it would begin pegging the Renminbi exchange rate against a basket of

currencies, instead of relying solely on the U.S. dollar. This has recently

caused the dollar to depreciate as against the RMB. As of December 31, 2009,

the rate was 6.8282 RMB for 1 US Dollar. Since all of our expected operations

are in China, significant fluctuations in the exchange rate may materially and

adversely affect our revenues, cash flow and overall financial condition.

CHINESE LAW REQUIRES APPROVAL BY CHINESE GOVERNMENT AGENCIES AND COULD LIMIT OR

PROHIBIT THE PAYMENT OF DIVIDENDS FROM ANY PROCEEDS

OF OUR ASSETS.

governs the distributions that can be made in the event of

assets of foreign invested enterprises. While dividend distribution is allowed,

it is some distributions are

subject to

the event of liquidation insofar as it affects dividend

non-Chinese nationals.

CHINA HAS BEEN THE LOCALE FOR THE OUTBREAK OF VARIOUS DISEASES AND A PANDEMIC

CAUSED BY DISEASES SUCH AS SARS, THE AVIAN FLU, OR SIMILAR DISEASES COULD HAVE

A MATERIALLY ADVERSE EFFECT ON OUR WORKERS AND EVEN THE CHINESE ECONOMY IN

GENERAL, WHICH MAY ADVERSELY AFFECT BUSINESS.

17

The World Health Organization reported in 2004 that large scale outbreaks of

avian flu throughout most of Asia, including China, had nearly caused a

pandemic that would have resulted in high mortality rates and which could cause

wholesale civil and societal disruption. There have also been several

potential outbreaks of similar pathogens in China with the potential to cause

large scale disruptions, such as SARS, pneumonia and influenza. Any future

outbreak which infiltrates the areas of our operations would likely have an

adverse effect on our ability to conduct normal business operations.

CONVERSIONS AND

DIMINISH THE

The Company has issued 500,000

Stock in the exchange of securities that acquired our current assets and

operations. Each share of

votes per share. If each share is converted, the Series C Convertible Preferred

Stock will be convertible intoability of our other common stock atholders to have a rate sufficient to yield an

aggregatesignificant role in the election of approximately 609 Million common shares.After the pending reverse split at 1:10,

the company will issue 63,321,605.8 common shares.

sales of shares of our common stock or securities that are convertible

common stock could adversely affect the market price of our common stock. If

any of our principal

a large number of shares, the market price of our common

significantly decline. Moreover, the perception in the public market that our

principal stockholders

the market for our common stock.

THERE IS A LARGE NUMBER OF PREFERRED SHARES OUTSTANDING THAT WILL RECEIVE

PREFERENCES OVER THE COMMON STOCK IN THE DISTRIBUTION OF DIVIDENDS OR

LIQUIDATED ASSETS AND VOTING RIGHTS, WHICH WILL LIMIT THE ABILITY OF THE COMMON

STOCKHOLDERS TO HAVE AN EFFECTIVE VOICE IN THE MANAGEMENT OF THE COMPANY.

The shareholders of HongKong Wah Bon and its subsidiary, Shaanxi Changjiang Mining & New Energy Co., Ltd. (“CHAN JIANG”) as of February 4, 2008 acquired 500,000 shares of Series C Convertible Preferred stock outstanding

in exchange for all of the outstanding stock of Chang Jiang.. Each of the preferred shares is entitled to receive

preferential treatment in connection with the payment of dividends,

distributions upon liquidation and voting rights. Each preferred share carries

the right to vote the equivalent of 1,218 votes of common shares. Each

preferred share will be automatically converted into 1,218 common shares upon

approval and an amendment to the Certificate of Incorporation to increase the

number of authorized shares. This effectively eliminates the ability of the

common stock holders to participate in the management of the Company, such as

the election of directors and corporate changes or conversions.

traded in over the counter

to time. Currently there are severalquotations. The trading of our stock was suspended by the SEC in April 2011. There is

prices for our shares but there is no guarantee that they or any other brokers

will continue any activities.of common stock. Our

are were many days or weeks that the shares havedid not tradedtrade at all. There is no

sell thehis or her shares and there is no

continue to fluctuate significantly. Fluctuations could be rapid

may provide investors little opportunity to react. Factors such as changes in

commodity prices,

of operations, and a variety of other factors, many of which are beyond

control of the Company, could cause the market price of our common stock to

fluctuate substantially. Also,

extreme price and volume volatility. The market prices of sharesthe

smaller public companies securities are subject to volatility for reasons that

frequently are unrelated to the actual

recognized measurements of value. This volatility may cause declines,

very sudden and sharp declines, in the market price of our common stock. We

cannot assure investors that

market will be available to resell your securities or that the shares will

The Commission has adopted regulations which generally define a "penny stock"

to be any equity security that has a market price (as therein defined) less

than $5.00 per share or with an exercise price of less than $5.00 per share,

subject to certain exceptions. Additionally, if the equity security is not

registered or authorized on a national securities exchange, the equity security

also constitutes a "penny stock." As our common stock falls within the

definition of penny stock, these regulations require the delivery, prior to any

transaction involving our common stock, of a risk disclosure schedule

explaining the penny stock market and the risks associated with it. These

regulations generally require broker-dealers who sell penny stocks to persons

other than established customers and accredited investors to deliver a

disclosure schedule explaining the penny stock market and the risks associated

with that market. Disclosure is also required to be made about compensation

payable to both the broker-dealer and the registered representative and current

quotations for the securities. These regulations also impose various sales

practice requirements on broker-dealers. In addition, monthly statements are

required to be sent disclosing recent price information for the penny stocks.

The ability of broker/dealers to sell our common stock and the ability of

shareholders to sell our common stock in the secondary market is limited. As a

result, the market liquidity for our common stock is severely and adversely

affected. We can provide no assurance that trading in our common stock will not

be subject to these or other regulations in the future, which would negatively

affect the market for our common stock.

14 |Page

reporting

governance requirements including requirements under the Sarbanes-Oxley Act of

2002 and other rules implemented by the SEC.

rules and regulations to increase our legal and financial compliance

to make some activities more time-consuming and costly. We also expect that

these applicable rules and regulationsit may make itbecome more difficult

expensive for us to obtain director and officer liability insurance and we may

be required to accept

higher costs to obtain the same or similar coverage. As a

more difficult for us to attract and retain qualified individuals to serve on

our board of directors or

and monitoring developments with respect to these newly applicable rules, and

we cannot predict or estimate the amount of additional costs we may incur or

the timing of such costs.

dividends on our stock in the

earnings to expand our operations and explore additional areas and