UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | | | |

☒þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20222023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission file number: 001-37798

Selecta Biosciences,Cartesian Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 26-1622110 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 65 Grove Street, Watertown, MA704 Quince Orchard Road, Gaithersburg, MD | 0247220878 | |

| (Address of principal executive offices) | (Zip Code) | |

(617) 923-1400

Registrant’s telephone number, including area code

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | SELBRNAC | The Nasdaq Stock Market LLC |

| | |

| Securities registered pursuant to Section 12(g) of the Act: |

| | |

| Title of each class |

| Contingent Value Rights |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ýþ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ýþ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐þ | |

| Non-accelerated filer | ☒☐ | | Smaller reporting company | ☒þ | |

| | | | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attested to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. oþ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒þ

The aggregate market value of common stock held by non-affiliates of the registrant based on the closing price of the registrant’s common stock as reported on the Nasdaq Stock Market on June 30, 2022,2023, the last business day of the registrant’s most recently completed second quarter, was $149,708,988.$128,805,952.

As of February 24, 2023March 1, 2024, the registrant had 153,318,915161,948,618 shares of common stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to its 20222024 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission are incorporated by reference into Part III of this Annual Report on Form 10-K.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or the Annual Report, contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future results of operations and financial position, business strategy, prospective products, product approvals, research and development costs, timing and likelihood of success, the plans and objectives of management for future operations and future results of anticipated products, the impact of the resurgence of the COVID-19 pandemic or emergence of another pandemic on our business and operations and our future financial results, and the period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses and capital expenditure requirements are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”, or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Annual Report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including the factors described under the sections in this Annual Report titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as the following:

•our expectations regarding the conversion of the Series A Preferred Stock (as defined below) into our common stock;

•any future payouts under the contingent value right, or CVR, issued to our holders of record as of the close of business on December 4, 2023;

•our ability to achieve the expected benefits or opportunities and related timing with respect to the Merger (as defined below) or to monetize any of our legacy assets;

•our future results of operations and financial position, business strategy, and the length of time that we believe our existing cash resources will fund our operations;

•our market size and our potential growth opportunities;

•our preclinical and future clinical development activities;

•the efficacy and safety profile of our product candidates;

•the potential therapeutic benefits and economic value of our product candidates;

•the timing and results of preclinical studies and clinical trials;

•the expected impact of macroeconomic conditions, including inflation, increasing interest rates and volatile market conditions, current or potential bank failures;

•global events, including the ongoing conflicts between Russia and Ukraine and between Hamas and Israel and geopolitical tensions in China on our operations;

•the receipt and timing of potential regulatory designations, approvals and commercialization of product candidates;

•potential litigation related to the Merger (as defined below) instituted against us or our directors;

•our ability to prevent or minimize the effects of litigation and other contingencies;

•our ability to realize any benefits or opportunities from the Merger;

•our status as a preclinical and development-stage company and our expectation to incur losses in the future;future, and the possibility that we never achieve or maintain profitability;

•uncertainties with respect to our ability to access future capital needs and our need to raise additional funds;capital;

•our ability to build amaximize the value of our pipeline of product candidates and develop and commercialize such pipeline;candidates;

•our unproven approach to therapeutic intervention;

•our ability to enroll patients in clinical trials, timely and successfully complete those trials and receive necessary regulatory approvals;

•our ability to continue to grow our manufacturing capabilities and resources;

•our ability to manufacture our product candidates, which in some cases are manufactured on a patient-by-patient basis;

•our ability to access manufacturing facilities and to receive or manufacture sufficient quantities of our product candidates;

•our ability to maintain our existing or future collaborations or licenses;licenses and to seek new collaborations, licenses or partnerships;

•the continuing impact of resurgence of the COVID-19 pandemic on our operations, the continuity of our business, including our preclinical studies and clinical trials, and general economic conditions;

•our ability to protect and enforce our intellectual property rights;

•federal, state, and foreign regulatory requirements, including U.S. Food and Drug Administration, or FDA, regulation of our product candidates;

•our ability to obtain and retain key executives and attract and retain qualified personnel; and

•developments relating to our competitors and our industry, including the impact of government regulation; and

•our ability to successfully manage our growth.regulation.

Moreover, we operate in an evolving environment. New risks and uncertainties may emerge from time to time, and it is not possible for management to predict all risk and uncertainties.

You should read this Annual Report and the documents that we reference in this Annual Report completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

PART I

Item 1. Business

Our Corporate History and Background

The Company (formerly known as Selecta Biosciences, Inc., or Selecta) was incorporated in Delaware on December 10, 2007, and is headquartered in Gaithersburg, Maryland. On November 13, 2023, the Company and the Delaware corporation which, immediately prior to the Merger (as defined below), was known as Cartesian Therapeutics, Inc., or Old Cartesian, entered into an Agreement and Plan of Merger, or the Merger Agreement, by and among the Company, Sakura Merger Sub I, Inc., a Delaware corporation and a wholly owned subsidiary of the Company, or First Merger Sub, Sakura Merger Sub II, LLC, a Delaware limited liability company and wholly owned subsidiary of the Company, or Second Merger Sub, and Old Cartesian. Pursuant to the Merger Agreement, and simultaneously with execution thereof, (i) First Merger Sub merged with and into Old Cartesian, pursuant to which Old Cartesian was the surviving corporation, or the First Step Surviving Corporation, and became a wholly owned subsidiary of the Company, or the First Merger, and (ii) immediately following the First Merger, Old Cartesian (as the First Step Surviving Corporation) merged with and into Second Merger Sub, pursuant to which Second Merger Sub was the surviving company, or the Surviving Company, and continued under the name “Cartesian Bio, LLC”, or the Second Merger and, together with the First Merger, the Merger. In connection with the Merger and pursuant to the Merger Agreement, the Company (which was known as Selecta Biosciences, Inc. until immediately prior to the Merger) changed its corporate name to Cartesian Therapeutics, Inc.

Overview

We are a clinical-stage biotechnology company leveraging our ImmTOR® platform to develop tolerogenicdeveloping mRNA cell therapies designed to selectively mitigate unwanted immune responses. With a proven ability to induce tolerance to highly immunogenic proteins, ImmTOR hasfor the potential to amplify the efficacytreatment of biologic therapies, including redosing of life-saving gene therapies, as well as restore the body's natural self-tolerance in autoimmune diseases. We have severalleverage our proprietary technology and partnered programsmanufacturing platform to introduce one or more mRNA molecules into cells to enhance their function. Unlike DNA, mRNA degrades naturally over time without integrating into the cell’s genetic material. Therefore, our mRNA cell therapies are distinguished by their capacity to be dosed repeatedly like conventional drugs, administered in our pipeline focused on enzyme therapies, gene therapies,an outpatient setting, and given without pre-treatment chemotherapy required with many conventional cell therapies. In an open-label Phase 2 clinical trial in patients with myasthenia gravis, or MG, a chronic autoimmune diseases.

In preclinical studies,disease that causes disabling muscle weakness and fatigue, we have observed that ImmTOR may have synergistic activityour lead product candidate, Descartes-08, generated a deep and durable clinical benefit.

Autoimmune diseases, where the immune system mistakenly attacks the body, are a family of more than 80 disorders. Autoimmune diseases are typically treated with interleukin-2,immunosuppressant medications, such as steroids. These treatments must be administered continually and carry risks, including infection, osteoporosis, and metabolic disease. Newer agents that block the complement pathway or IL-2, molecules that have been engineered toinhibit the neonatal Fc receptor, or FcRn, must also typically be selective for regulatory T cells, or Tregs. Treg-selective IL-2 molecules have been shown to transiently expand all pre-existing Tregs in preclinical and clinical studies conducted by others. We have observed in preclinical studies that the combination of ImmTOR, a Treg-selective IL-2 molecule and an antigen exhibited substantial synergistic activity in inducing and expanding antigen-specific Tregs beyond ImmTOR alone with evidence of enhanced durability of immune tolerance and the potential for ImmTOR dose sparing. This combination of ImmTOR with a Treg selective IL-2 molecule represents an evolution of the ImmTOR platform, which we call ImmTOR-IL™.administered continually. We believe this combination has the potential to bethere is a "first-in-class" antigen specific IL-2 therapysignificant unmet need for autoimmune disease.outpatient treatments, completed over a short period of time, that provide deep, durable clinical benefit.

We believe ImmTOR and ImmTOR-ILCell therapies have the potential to enable novel therapeutic modalitiesprovide this benefit, but conventional cell therapies that use DNA are associated with toxicities, including cytokine release syndrome, neurotoxicity, transformation to cancer, and death. Further, conventional cell therapies typically require pre-treatment with chemotherapy, which suppresses the immune system and increases the risk of infection, anemia, and neurotoxicity. As a result, conventional DNA cell therapies typically require close monitoring in autoimmune disease as well as enhance bothan inpatient setting, increasing the efficacytotal cost of care and safety of biologicgenerally limiting their reach to only the sickest patients.

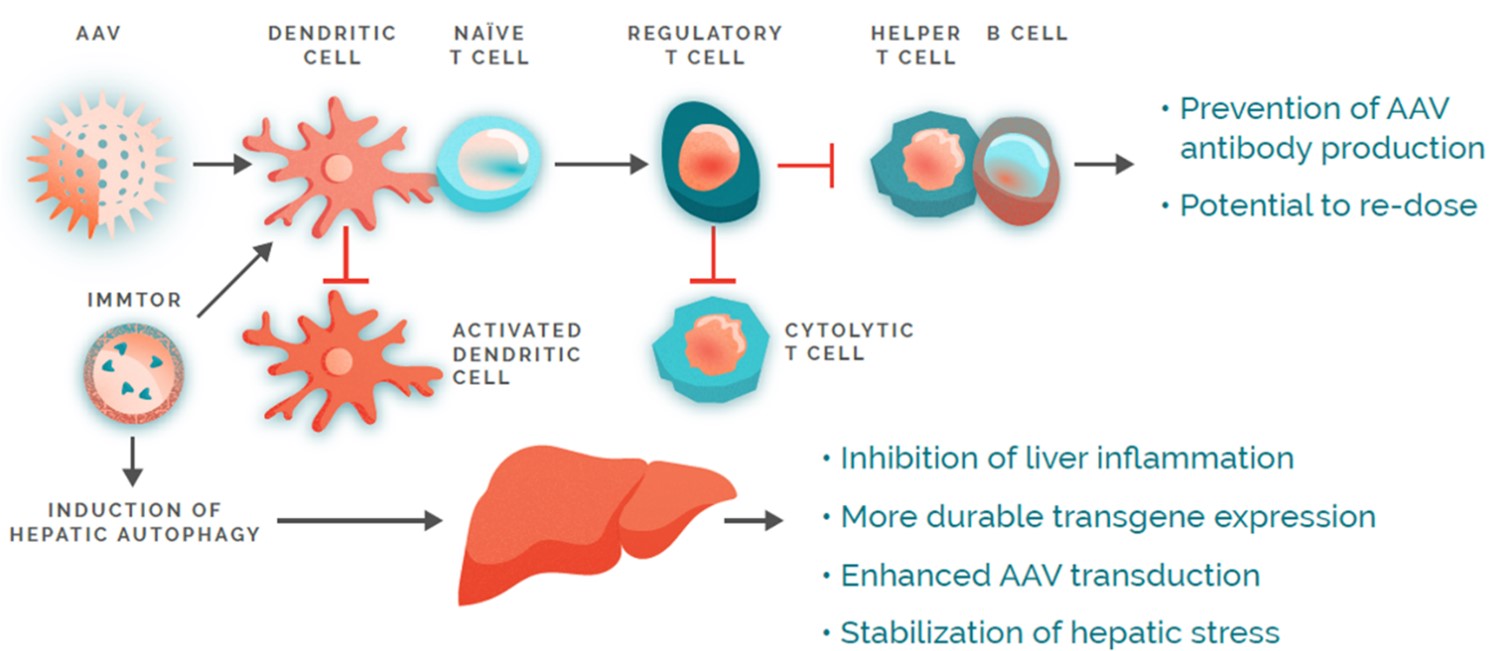

We believe our mRNA cell therapies (including gene therapies) and improve product candidates under development. In clinical trials, ImmTOR has been observed to inhibit the formation of neutralizing antibodies to adeno-associated virus (AAV) capsids, potentially enabling re-dosing of gene therapies. Additionally, based on preclinical data in AAV gene therapies, we believe that ImmTOR hashave the potential to improve efficacy and safety by increasing transgene expression, reducing hepatic inflammation and inhibiting undesired immune responsesdeliver deep, durable clinical benefit to both the AAV capsid and the transgene product that can occur with the first dose of gene therapy.

In biologic therapies, clinical activity of ImmTOR in humans has been observed with pegadricase, a highly immunogenic pegylated uricase enzyme being developed for the treatmentbroad group of patients with chronic refractory gout. The combinationautoimmune diseases because they can be administered over a short period of ImmTORtime, in an outpatient setting, and pegadricase is currently being evaluated in a Phase 3 clinical trial that wewithout pre-treatment chemotherapy.

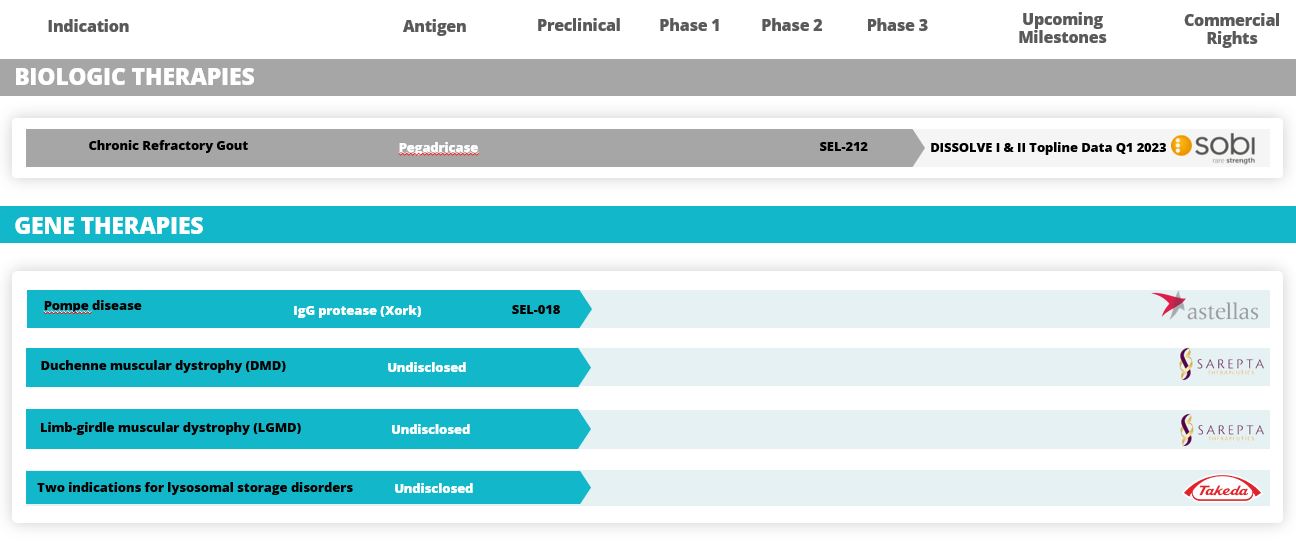

We are conducting on behalf ofleveraging our partner Swedish Orphan Biovitrum AB, or Sobi.

We intendproprietary technology and manufacturing platform, RNA Armory®, to pursue development ofdevelop mRNA cell therapies for autoimmune diseases where expansion of either all Tregsacross three modalities. Our mRNA CAR-T modality is a personalized approach that collects a patient’s T-cells and uses mRNA to introduce a chimeric antigen receptor, or antigen-specific Tregs has been shown to, or we believe is, likely to have a beneficial effect. We believe that ImmTOR and ImmTOR-IL have the potential to unlock antigen-specific therapies for autoimmune diseases and that ImmTOR-IL can further improve the efficacy and safety profile of biologic therapies beyond ImmTOR alone.

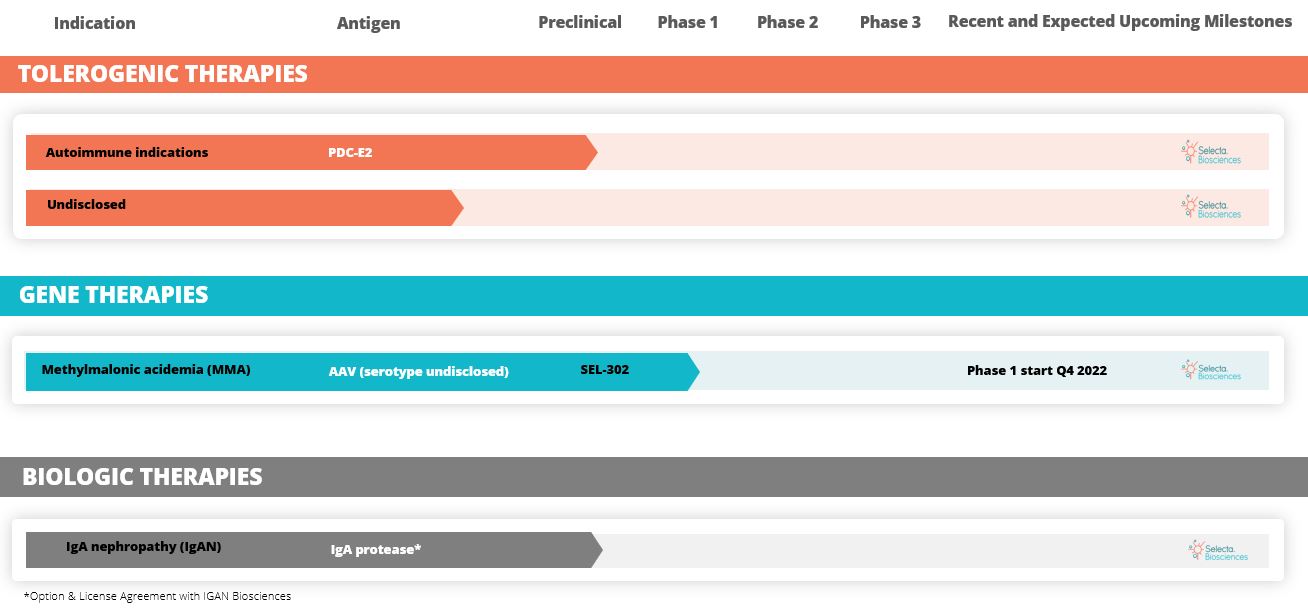

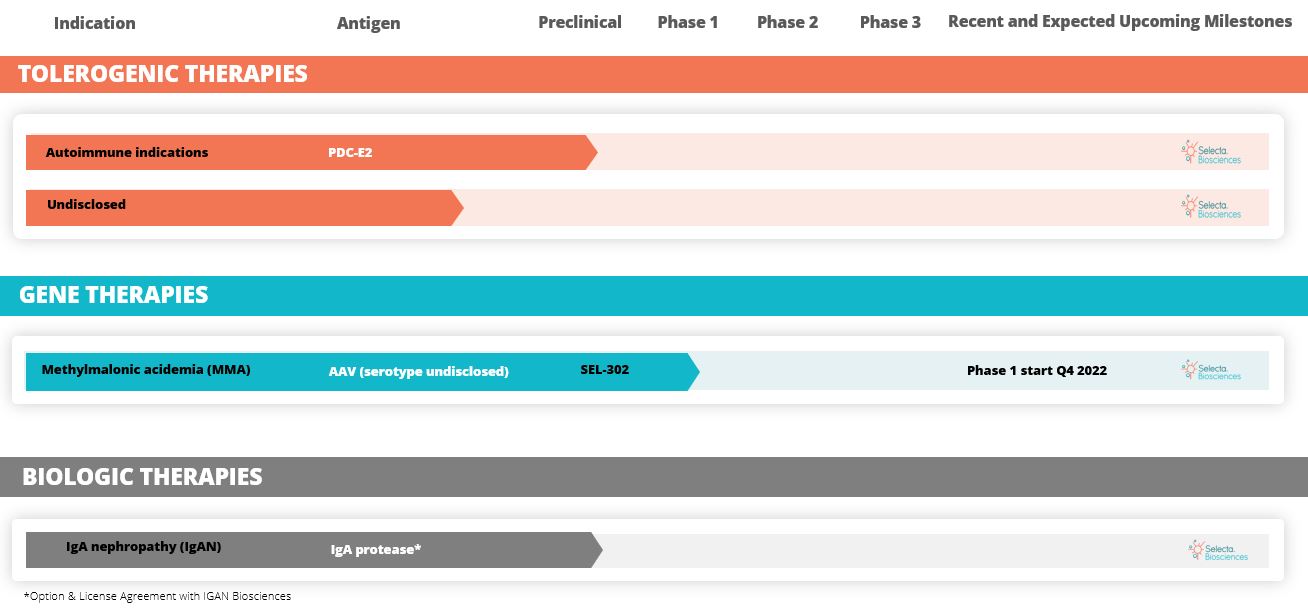

We have developed a portfolio of wholly owned and partnered candidates across gene therapies, biologic therapies and tolerogenic therapies for autoimmune diseases that leverage our ImmTOR platform. We plan to continue to develop proprietary compounds and pursue collaboration-driven development in certain disease areas, which could include strategic collaborations, out-licensing, and in-licensing transactions.

Our ImmTOR Platform

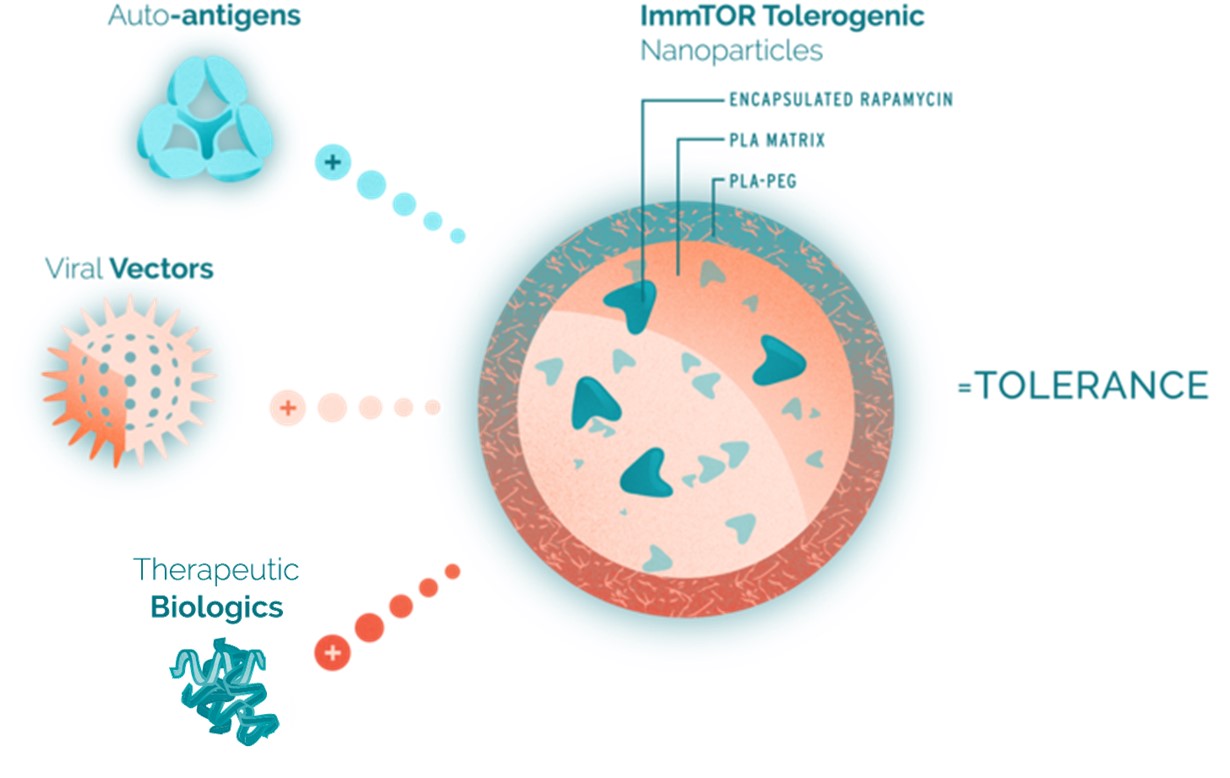

ImmTOR consists of biodegradable nanoparticles encapsulating the immunomodulator rapamycin. Rapamycin is the active ingredient of Rapamune, an immunosuppressant that has been used extensively in humans and is currently FDA-approved as a prophylaxis of organ rejection in kidney transplant patients aged 13 or older. The rapamycin component of ImmTOR is embedded in a matrix of synthetic polymers called poly(D,L-lactide), or PLA, and poly(D,L-lactide)-block-poly(ethylene-glycol), or PLA-PEG. PLA is part of the broader poly(lactic-co-glycolic acid), or PLGA, family of biodegradable polymers that have more than 30 years of commercial use and are formulation components in a number of approved products. Polyethylene glycol, or PEG, has been widely studied in clinical trials and is also a formulation component in many approved biologic products.

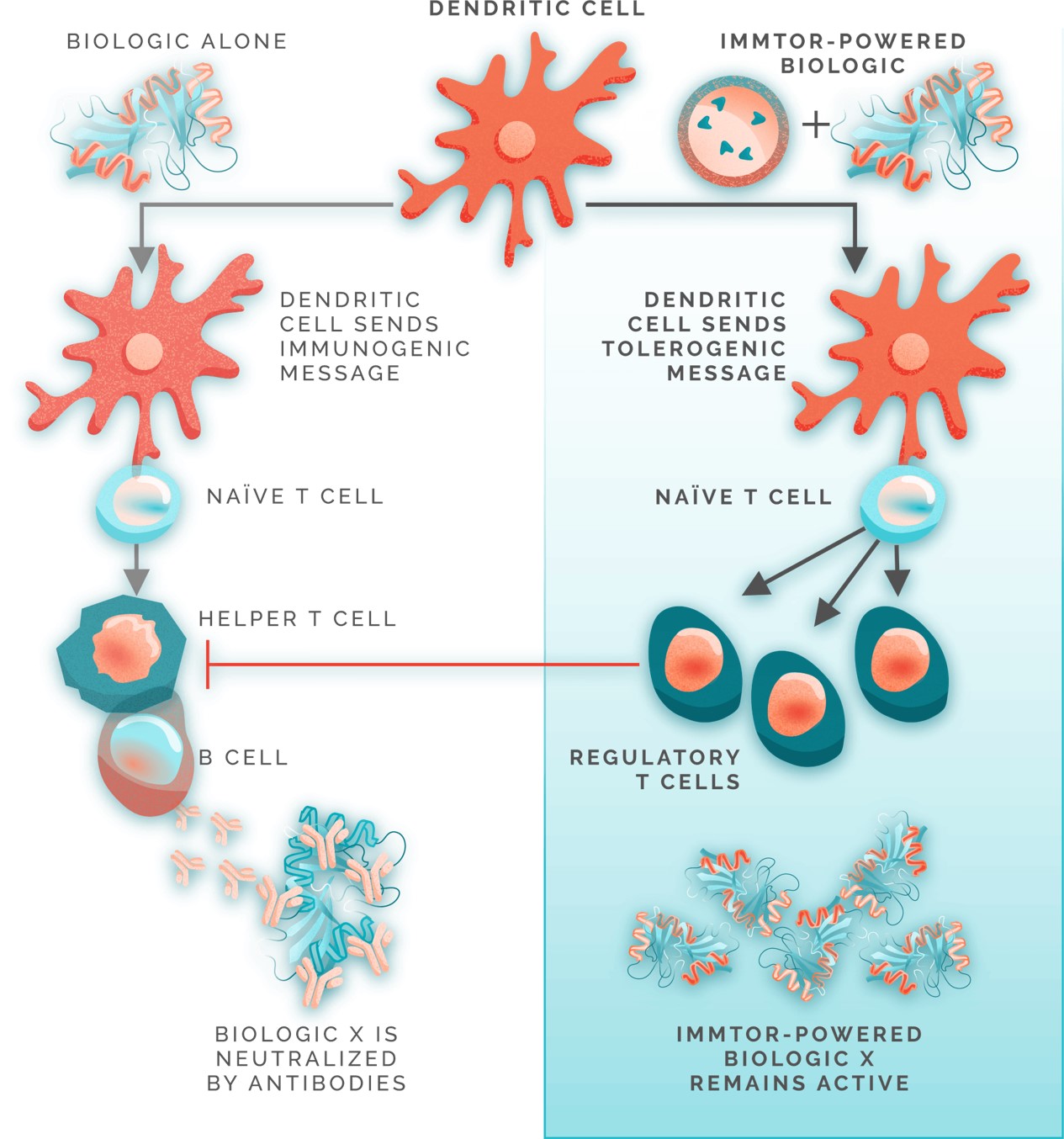

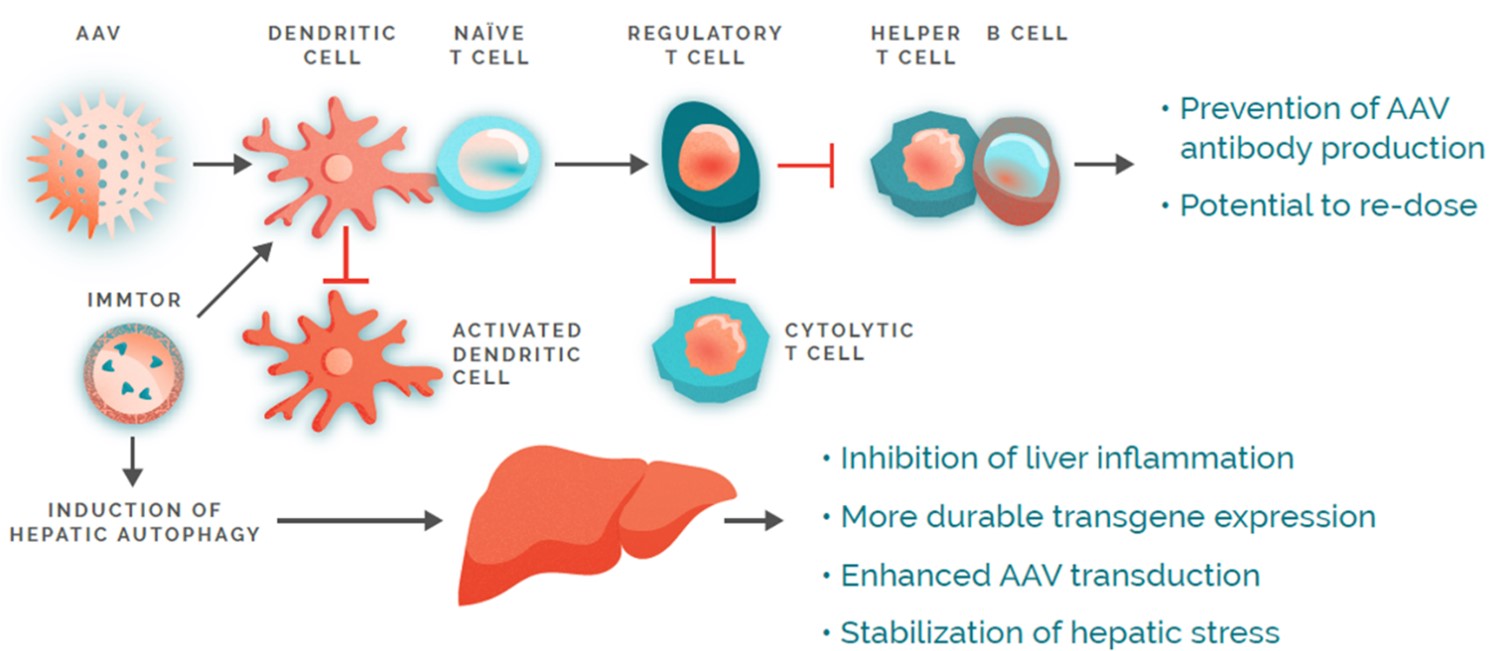

Our nanoparticles are designed to remain intact after injectionCAR, into the bodycell. The CAR redirects the T-cells to target and accumulate predominantlydestroy pathogenic self-reactive cells. Our mRNA MSC modality is an allogeneic approach that introduces one or more mRNAs into donor-sourced mesenchymal stem cells, or MSCs, enabling them to produce proteins that target key pathways involved in lymph nodes, the spleen,autoimmunity. These cells are banked and the liver, where immune responses are coordinated. The nanoparticles are designed to be processed by specialized immune cells, such as dendriticadministered off-the-shelf to any patient. Our mRNA in situ modality is designed to deliver mRNA into a patient’s lymph node to generate CAR-T cells and other antigen-presenting cells,proteins that initiate and regulate immune responses. ImmTOR is intended to induce a tolerogenic phenotype in these antigen-presenting cells, which then process and present co-administered antigens in a manner that results in the induction of antigen-specific regulatory T cells. To mitigate unwanted immune responses by inducing precision immune tolerance in the body, we administer our ImmTOR with the desired antigen, such as an auto-antigen in the case of an autoimmune disease, a viral vector in the case of our gene therapy program, or a therapeutic enzyme, as depicted in the figure below.

target autoimmunity

In the case of a biologic drug, ImmTOR is designed to be administered in conjunction with such biologic drugs to mitigate the formation of ADAs without requiring the alteration of the drug or its dose regimen. As a result, we believe ImmTOR may provide us with significant opportunities to co-administer ImmTOR with a variety of biologic drugs, including therapeutic enzymes and gene therapies. We believe each pairing of ImmTOR with a biologic drug also offers us the opportunity to pursue distinct proprietary product candidates, which we believe have the potential to be separately patented, approved and marketed. ImmTOR is manufactured in facilities subject to current good manufacturing practice, or cGMP, requirements using well-defined commercial operations, which, we believe, further enhances the scalability of our tolerance programs.

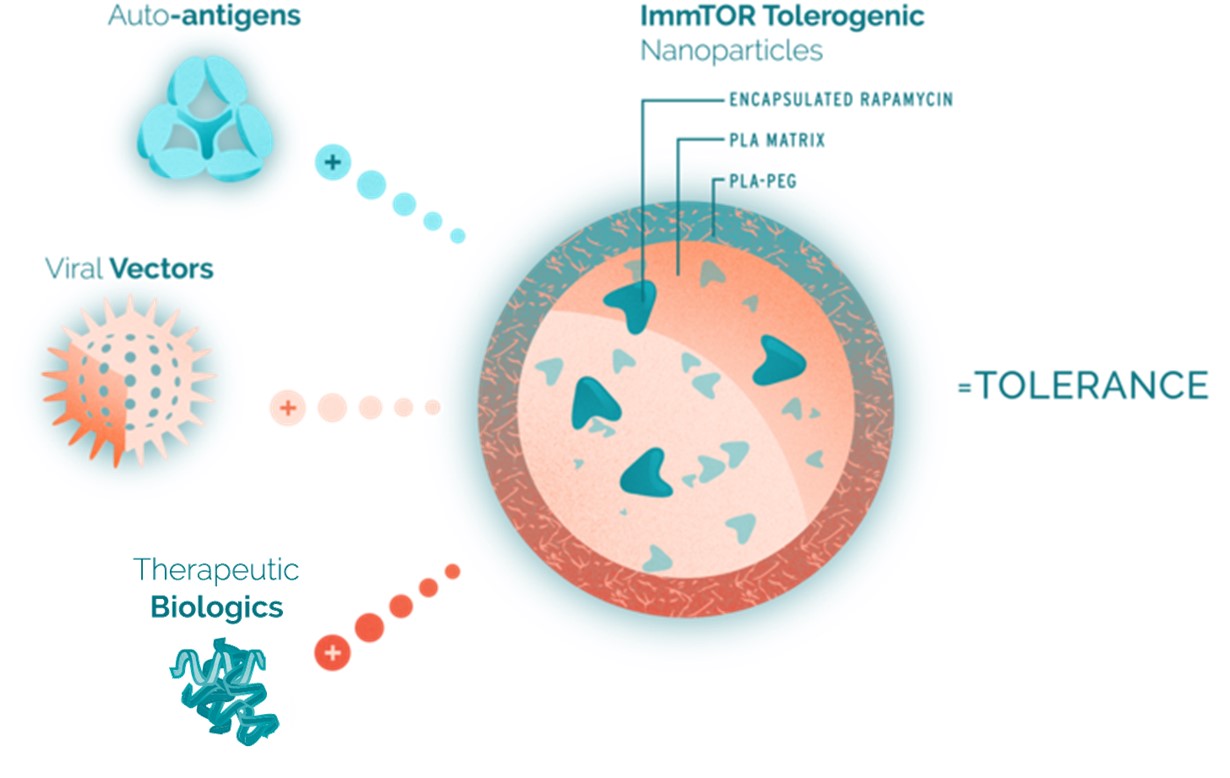

In preclinical studies, we observed that delivering an antigen together with ImmTOR provided the appropriate signals in vivo to induce regulatory T cells, which, in turn, inhibited effector immune responses, such as the formation of ADAs. In additional preclinical studies, we observed that ImmTOR labeled with a fluorescent dye selectively accumulated in the spleen and the liver following intravenous dosing, where it was processed by antigen-presenting cells, such as dendritic cells.. The figure below depicts a model of how we believe ImmTOR would be taken up by a dendritic cell in the spleen. We believe that both the biologic drug and ImmTOR are taken up and processed by dendritic cells and other antigen presenting cells in a manner that may result in the activation of antigen-specific regulatory T cells, which can potentially block the activation of helper T cells, thus mitigating the formation of ADAs.

ImmTOR-IL

The table below summarizes key information about our development pipeline.

Our lead product candidate, Descartes-08, is an autologous mRNA CAR-T directed against the B cell maturation antigen, or BCMA, that we are developing for the treatment of autoimmune diseases. Descartes-08 has been granted Orphan Drug Designation by the FDA for the treatment of MG. Descartes-08 was observed to be safe and well-tolerated in a Phase 1b/2a trial of 14 patients with MG who received outpatient treatment without pre-treatment chemotherapy. All seven participants who received six once-weekly infusions at the highest dose continued to experience marked and long-lasting clinical improvement across validated MG disease scoring systems at month nine follow-up. At month 12, five of these seven participants maintained clinically meaningful improvement. One participant, who lost response after one year, experienced rapid improvement in clinical scores after re-treatment, which was ongoing at month six of follow-up. Clinical responses correlated with large reductions in autoantibody titers. We are currently enrolling in a Phase 2b randomized, double-blind, placebo-controlled trial in patients with MG, for which we expect to report topline results in mid-2024.

We lookare also developing Descartes-08 for waysthe treatment of other autoimmune diseases. We have received FDA allowance for our investigational new drug application, or IND, for a Phase 2 trial of Descartes-08 for the treatment of patients with systemic lupus erythematosus, or SLE, a chronic autoimmune disease that causes systemic inflammation affecting multiple organ systems. We expect this Phase 2 trial to enhanceinitiate in the first half of 2024.

Descartes-15 is our ImmTOR platform. Recentnext-generation autologous anti-BCMA mRNA CAR-T. In preclinical studies, we have observed Descartes-15 to be 10-fold more potent than Descartes-08. We intend to test the safety of Descartes-15 in an open label, single-arm Phase 1 trial in patients with relapsed/refractory multiple myeloma. This program has already received IND allowance from the FDA and is expected to enroll the first patient in the first half of 2024. We expect that these Phase 1 trial data generated bywill inform our scientific teams suggest that ImmTOR may have profound synergistic activity with engineered IL-2 molecules that are selectiveclinical development plan for Tregs. The IL-2 pathway influences critical aspects of both immune stimulation and immune regulation. Tregs express a high affinity form of the IL-2 receptor. Low doses of IL-2 have been shown by others to selectively activate Tregs resulting in expansion of pre-existing Tregs. Clinical trials of low dose IL-2 have generated evidence of efficacyDescartes-15 in autoimmune diseases. Other investigators have shown that IL-2 can be engineered to selectively bind to the high affinity IL-2 receptor and expand pre-existing Tregs.

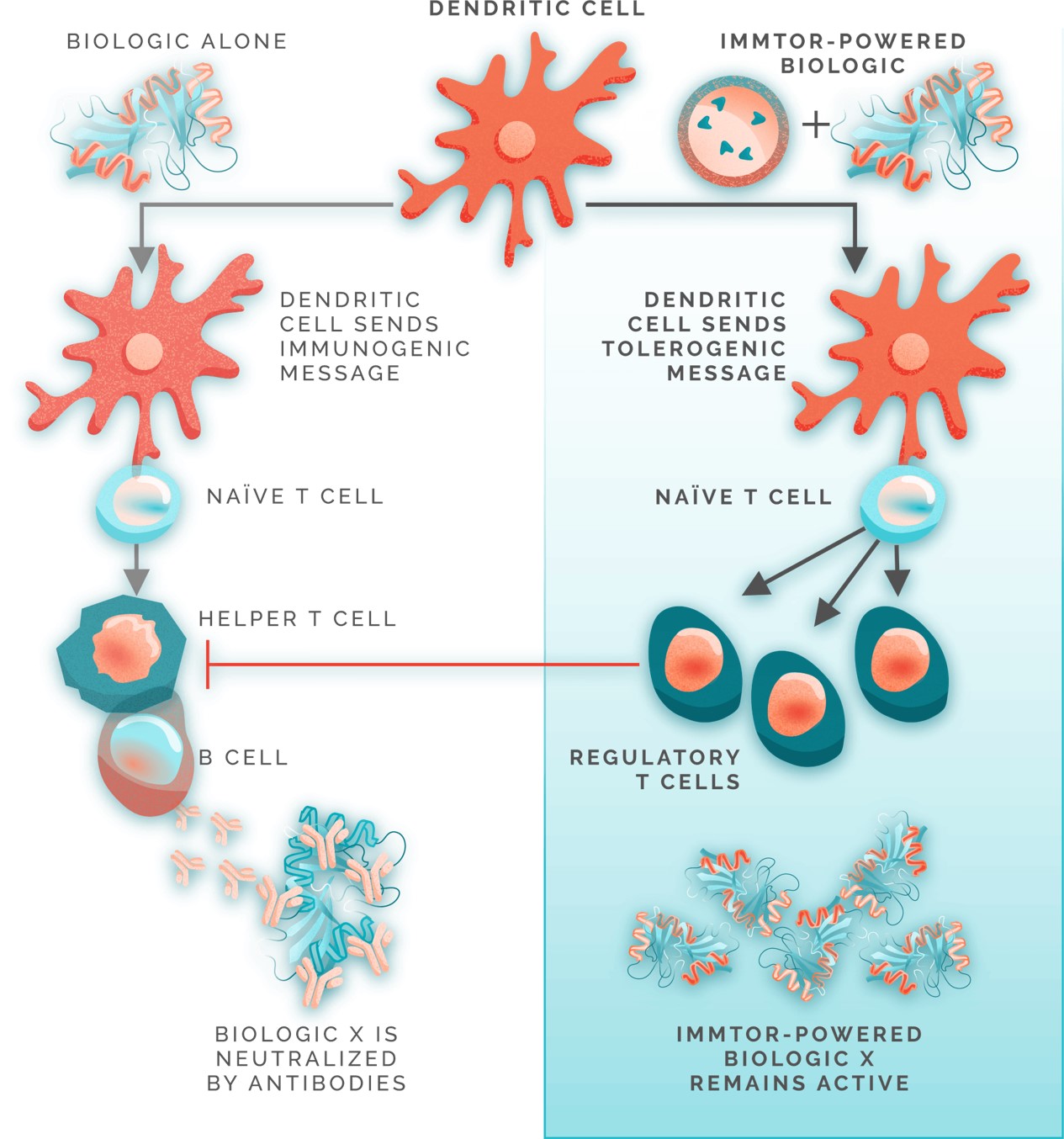

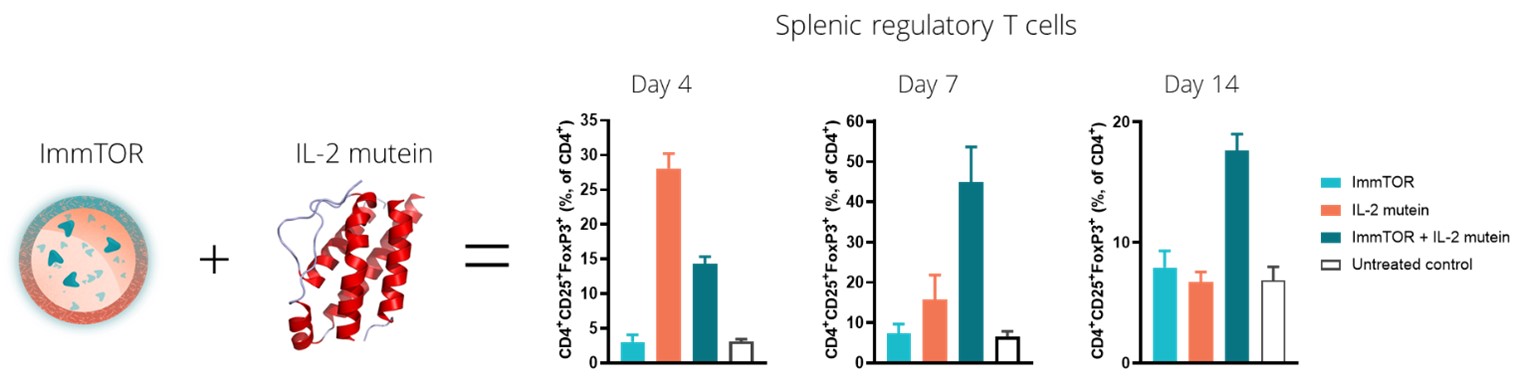

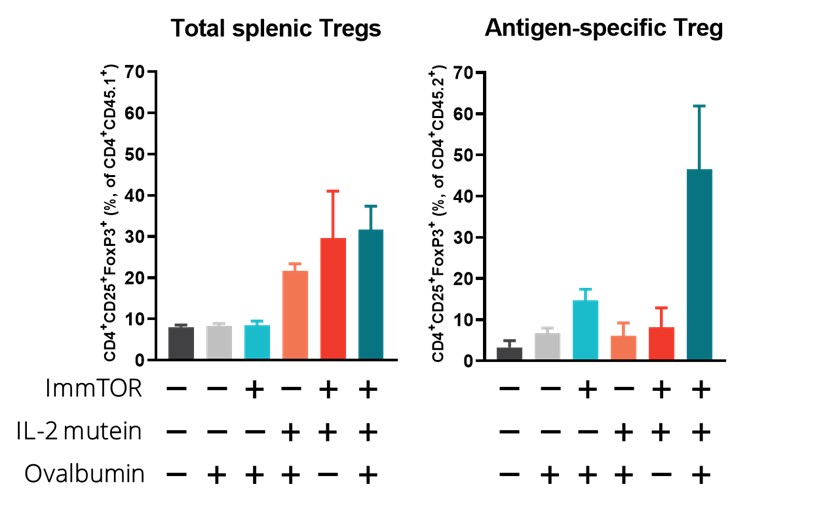

In our preclinical studies, we observed that ImmTOR combined with a Treg-selective IL-2 mutant protein, or IL-2 mutein, exhibited substantial synergistic activity in increasing the percentage and durability of total Treg expansion in the spleen. We believe that this combination has the potential to be a best-in-class therapy in diseases where expansion of total Treg may prove beneficial. The tables below show the synergistic expansion of total Treg we observed with treatment with ImmTOR and a Treg-selective IL-2 mutein. In the study, seven C57BL/6 mice per group were untreated, treated with ImmTOR alone, treated with IL-2 mutein alone or treated with a combination of ImmTOR and IL-2 mutein. Expansion of CD4+, CD25+ and FoxP3+ T regulatory cells in the spleen was assessed at four, seven and 14 days after treatment.

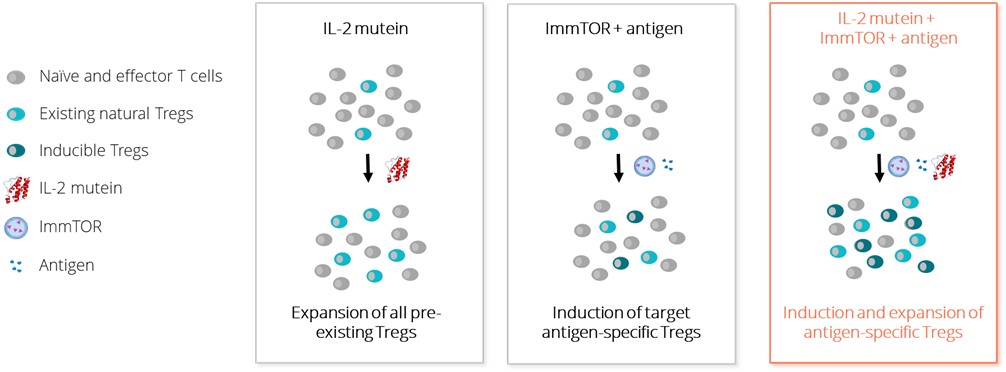

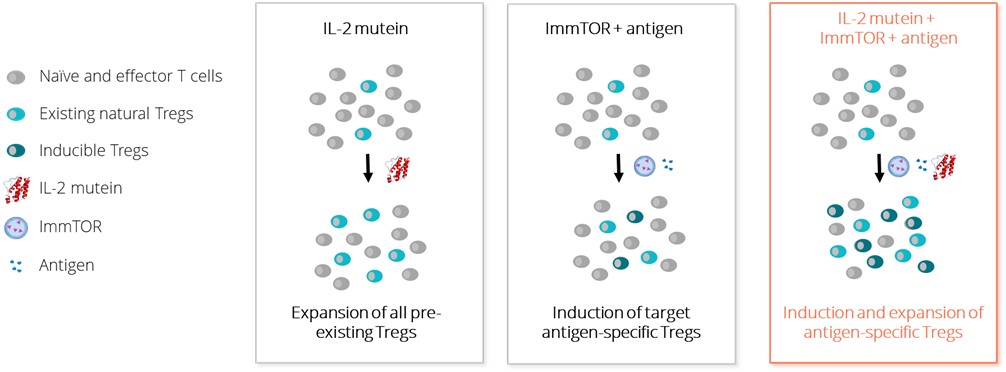

We believe that the power of ImmTOR is the ability to induce antigen-specific Treg to co-administered antigens. The ability to induce antigen-specific Treg may be beneficial in autoimmune diseases where the auto-antigens are well characterized. We believe the combination of a Treg-selective IL-2 with ImmTOR and an antigen has the potential to induce and/or expand antigen specific Treg. The image below illustrates the possibility that the combination of a Treg-selective IL-2 with ImmTOR plus an antigen could give rise to the induction and/or expansion of an antigen-specific Treg.

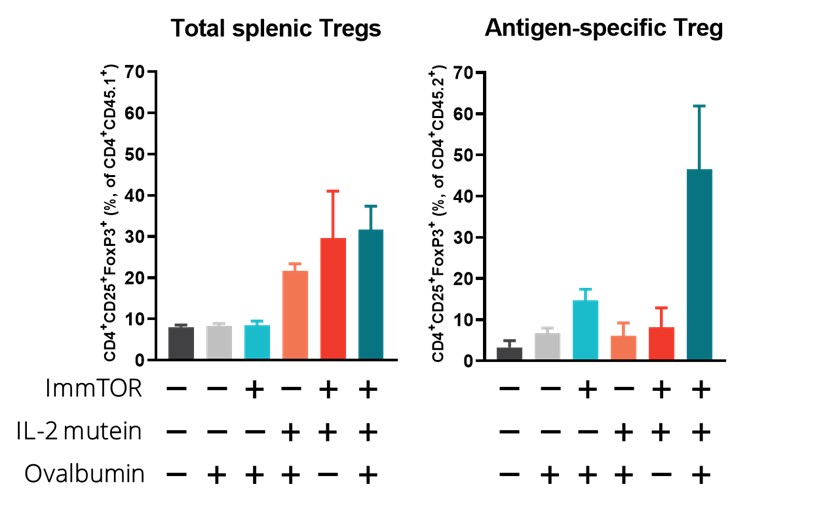

In a preclinical study, we evaluated the potential of a Treg-selective IL-2 to further expand antigen-specific Treg when combined with ImmTOR and an antigen. In this preclinical study, transgenic T cells expressing a T cell receptor specific for the antigen ovalbumin were adoptively transferred into wildtype mice. The next day, the mice were treated, left untreated or treated with ovalbumin or various combinations of ovalbumin with ImmTOR and/or IL-2 mutein. When total Treg were evaluated, we observed no increase an expansion of total Treg by IL-2 mutein + ovalbumin with a further increase in animals treated with ovalbumin + IL-2 mutein + ImmTOR. As we had expected, ImmTOR + ovalbumin alone did not increase total Treg. However, when ovalbumin-specific Treg were evaluated, we observed a significant increase in antigen-specific Treg in animals treated with the combination of ovalbumin + ImmTOR + IL-2 mutein. Animals treated with only ImmTOR + ovalbumin also were observed to have an increase in ovalbumin-specific Tregs but at levels that were approximately three-fold lower than those in the former group. The following graphs show expansion of antigen-specific Treg in mice treated with ImmTOR plus IL-2 mutein plus ovalbumin antigen.

Immune homeostasisLimitations of Current DNA-Based Cell Therapy Treatments in Autoimmune Disease

Conventional DNA cell therapies have been associated with cytokine release syndrome, neurological toxicities and Parkinsonism, infection, risk of secondary malignancy, and death. The acute toxicities are from exponential amplification of the modified cell, and the pre-treatment chemotherapy administered to enable cell amplification.

Conventional DNA-engineered CAR-T cells are in clinical development for several autoimmune diseases. DNA CAR-T cells are typically administered to patients in a subtherapeutic dose, which means that the cells must proliferate to reach therapeutic numbers in the body. However, this proliferation is not controlled in magnitude or duration, varies from patient to patient, and can be unpredictable. This proliferation occurs because the CAR gene is irreversibly integrated into the T-cell’s genome, causing a dynamic process balancing immune stimulatory and immune tolerizing signals. This balance is thought to be mediatedcascade in part bywhich every daughter cell carries the ratio of antigen-specific Treg to antigen-specific effector Tsame CAR as the parent cells. The expansionresulting unconstrained proliferation frequently exceeds the toxicity threshold, leading to serious adverse events. In November 2023, the FDA announced that it is investigating the risk of antigen-specific TregsT-cell malignancies in approved DNA CAR-T cell immunotherapies.

The proliferation of DNA CAR-T cells has typically required pre-treatment chemotherapy, usually fludarabine and cyclophosphamide administered for several days before CAR-T cell treatment. This chemotherapy is toxic, suppressing the immune system and increasing the risk of infection, anemia, and neurotoxicity.

Given these risks and requirements, conventional DNA cell therapies are administered under close monitoring in an inpatient setting, increasing their cost and limiting their reach to only the sickest patients.

Our Autoimmune Disease Solution

We believe that mRNA cell therapy has the potential to better withstandbe a potent immune stimulatory signalsyet safer alternative to DNA cell therapy for treating autoimmune diseases. We believe the mRNA cell therapies we are developing have the potential to deliver deep, durable clinical benefit to many patients with autoimmune diseases because they can be administered over a short period of time, in an outpatient setting, and provide better durabilitywithout pre-treatment chemotherapy. These attributes may extend the reach and potential of immune tolerance. In a preclinical study, we evaluated the ability of ImmTOR and IL-2 mutein to mitigate the immunogenicitymRNA cell therapy to a co-administered AAV vector. Mice were injectedbroader group of patients with a doseautoimmunity.

mRNA CAR-T cells locate their target, become activated, and proliferate like DNA CAR-T cells. However, because mRNA does not replicate and degrades naturally over time, the maximum number of 2.7E12 vg/kg AAV8 on Day 0mRNA molecules can be determined by the dose. The actual number of mRNA molecules declines to zero over time. The number of mRNA molecules determines the degree of CAR protein expression, and 5.0E12 vg/kg on Day 56 with or without IL-2 mutein and/or ImmTOR on the same days. Mice treated with AAV alone showed a robust antibody response to the AAV capsid, as we had expected. Co-treatment with IL-2 mutein on Days 0 and 56 showed a modest attenuationpersistence of the antibody response. Co-treatmentmRNA molecules determines the duration of mRNA CAR-T cell activity. Thus, unlike DNA CAR-T cells, our mRNA CAR-T cells provide pharmacokinetic control. In other words, a patient’s exposure to our cells is determined by the dose. The time, course and duration of that exposure are substantially determined by the nature of the mRNA we use. Therefore, while DNA CAR-T therapies are administered at subtherapeutic levels, we can administer a therapeutic number of mRNA CAR-T cells and re-dose these cells over time, much like a conventional drug. Because the mRNA cannot be replicated, we believe, and have thus far observed, that mRNA CAR-T cells do not cause the types of severe toxicity associated with ImmTOR on Days 0 and 56 showed a dose-responsive effect on the antibody response, withDNA CAR-T cells. Also, because mRNA CAR-T is dosed at a therapeutic dose and does not rely on cell proliferation to reach the therapeutic window, there is no need to administer pre-treatment chemotherapy. The graphs below contrast our mRNA cell therapy approach with that of 200 µg ImmTOR providing inhibition of antibodies against AAV through at least Day 75, or 19 days after the second dose. At Day 91, some animals showed breakthroughconventional DNA cell therapy.

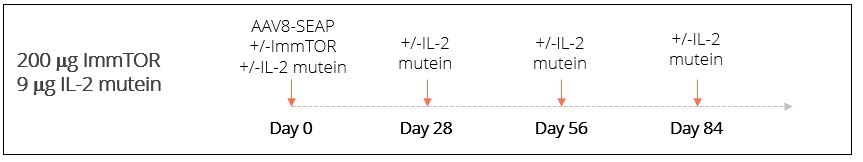

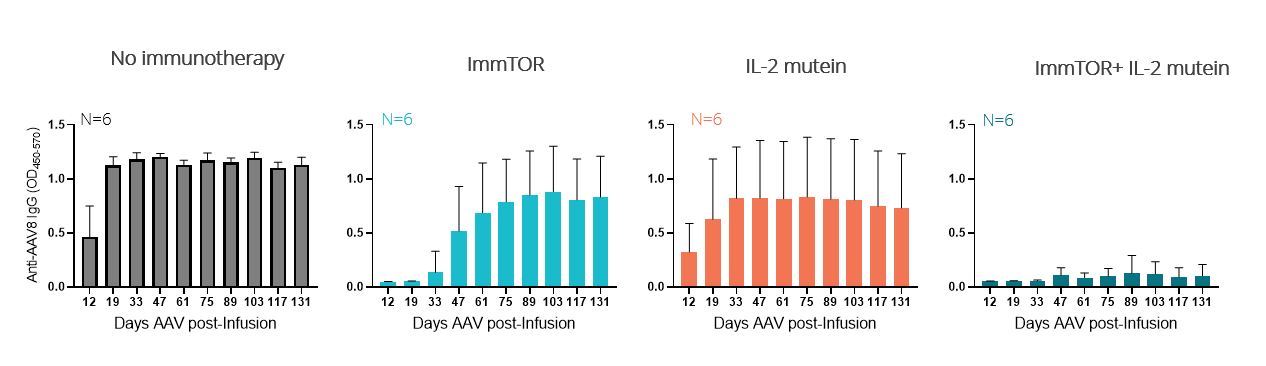

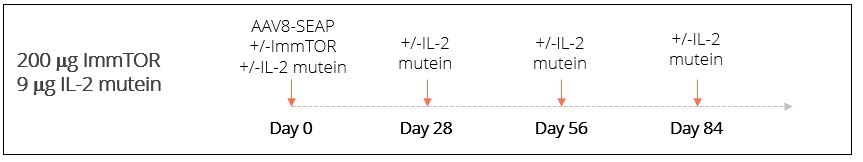

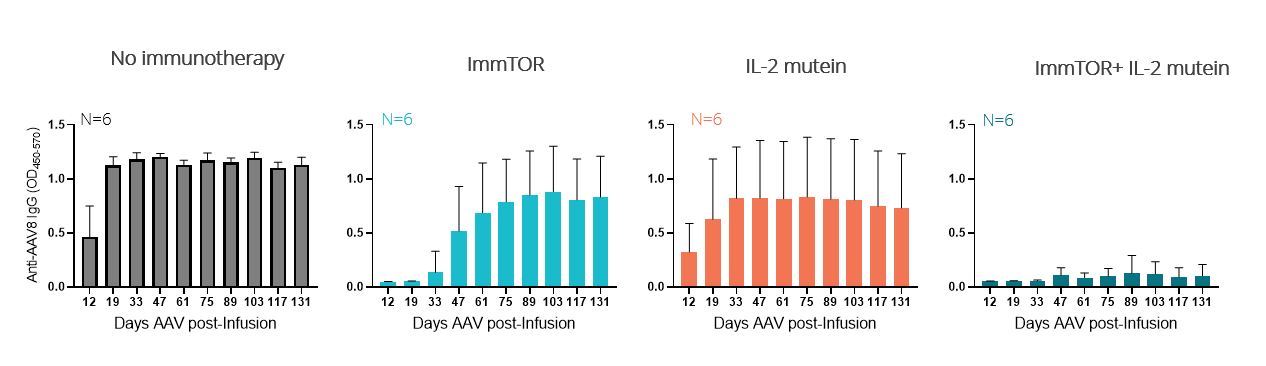

As of the antibody response. ImmTOR doses2023 safety cutoff date, we have administered Descartes-08 to over 60 patients suffering from one of 50MG, multiple myeloma, and 100 µg alone were sub-optimal. However, when ImmTOR was combined with IL-2 mutein, weother diseases in open-label trials on an outpatient basis, many at community clinics. We have not observed inhibitionproduct-related cytokine release syndrome, neurotoxicity or infection of antibody formation through Day 117, 61 days after the second dose and the last time point measured. Importantly full inhibition of anti-AAV immunoglobulin G, or IgG, antibodies was observed even when IL-2 mutein was combined with 50 and 100 µg doses of ImmTOR. We believe these results suggest that the addition of a Treg-selective IL-2 to ImmTOR has the potential to increase the durability of tolerance allow for dose-sparing of ImmTOR and thus, potentially enabling chronic dosing of ImmTOR-IL in the treatment of autoimmune disease.any grade. The following graphs illustrate that the combination of ImmTOR and IL-2 mutein mitigated the formation of anti-AAV antibodies in response to a high vector dose of 5E13 vg/kg. These results suggest that ImmTOR-IL has the potential to enable repeat dosing of AAV vectors at 5E13 vg/kg which could be used as a strategy to avoid the toxicities that have been observed at doses of 1E14 vg/kg or higher in some clinical trials.

adverse events observed—headache, nausea and fever—were self-limited and resolved within 72 hours of onset. One participant with MG with a history of allergic reaction to biologics developed hives after the third infusion and was hospitalized for monitoring. The patient’s hives resolved completely after a brief course of steroids.

Our Product Candidates

Descartes-08

Our ImmTOR platform haslead product candidate is Descartes-08, a broad range of potential applications. Our product development strategy is builtfirst-in-class mRNA CAR-T. Descartes-08 targets BCMA, which exists on the following three distinct pillars.

Biologic therapies. Biologic therapiessurface of long-lived plasma cells, or LLPCs, and plasmacytoid dendritic cells, or pDCs. LLPCs, which can survive for decades, are the main producers of disease-causing autoantibodies. pDCs, which secrete type-I interferons, may also play a class of biologic drugs frequently usedcritical role in autoimmunity. While the lead indication for Descartes-08 is MG, we believe that Descartes-08 has potential to treat rare diseases. Through our analysis of biologic drugs, including in our preclinical studies, we have observed that enzymes foreign to the human body,other autoimmune diseases, such as enzymes derived from microbes or replacement enzymes inlupus.

Descartes-08 for the caseTreatment of patients that are deficient inMG

Overview

Descartes-08 has been granted Orphan Drug Designation by the specific enzyme, are especially prone to causing undesired immune responses. Our partnered product candidate, SEL-212, which is currently in Phase 3 clinical development, consists of ImmTOR co-administered with pegadricase, a pegylated uricase enzyme of fungal origin. This is an example of an immunogenic enzyme that we are combining with ImmTOR with the intention of improving the enzyme’s efficacy and safety. We believe that ImmTOR has the potential to enable and expand the use of enzymes derived from microbial sources, such as bacterial immunoglobulin A, or IgA, proteaseFDA for the treatment of IgA nephropathy.MG. We selectedchose MG as our lead indication because the pathogenesis for MG is common to many autoimmune diseases.

Background Information About MG

MG is a next generation IgA protease candidate from a commensal bacteriarare autoimmune disease that causes debilitating muscle weakness and fatigue. It is estimated to affect over 120,000 patients in the U.S. and Europe. MG patients develop antibodies that lead to an immunological attack on critical signaling proteins at the junction between nerve and muscle cells, thereby inhibiting the ability of nerves to communicate properly with a lower levelmuscles. This results in muscle weakness in tissues throughout the body, potentially manifesting in partial paralysis of baseline ADAs from IGAN Biosciences for the treatment of IgA nephropathy. By combining ImmTOR with this next generation IgA protease candidate, we believe our novel approach has the potential to mitigate the formation of new ADAseye movements, problems in chewing and address the underlying pathophysiologyswallowing, respiratory problems, speech difficulties and weakness in skeletal muscles. The symptoms of the disease.

Additionally, we believe advances in protein engineering may lead to innovative therapeutic enzymes with improved pharmaceutical properties or entirely novel specificity and/or activity, but which may be recognized as foreign by the immune system. We are partnering with Ginkgo Bioworks, or Ginkgo, to design novel enzymes and proteins with transformative therapeutic potential whichdisease can be paired with ImmTOR to advance treatments for orphantransient and rare diseases. We intend to seek, if appropriate, licenses to other enzymes to evaluate in combination with ImmTOR.

Gene therapies. We believe gene therapies have the potential to address key unmet medical needs for many rare genetic diseases, but undesired immune responses to the viral vectors used for gene replacement, augmentation and editing may be restricting their broader use. AAV immunogenicity and AAV toxicity represent two major challenges for the gene therapy field; in many cases these two issues are inextricably linked. Immunogenicity of AAV vectors is thought to cause or exacerbate manyearly stages of the adverse events associated with AAV gene therapy. Inductiondisease can remit spontaneously. However, as the disease progresses, symptom-free periods become less frequent and disease exacerbations can last for months. Disease symptoms reach their maximum levels within two to three years in approximately 80% of acute inflammationpatients. Up to 20% of MG patients experience a respiratory crisis at least once in their lives. During the crisis phase, decline in respiratory function can become life-threatening. Patients in crisis often require intubation and capsid-specific CD8 T cells by AAV gene therapy is thought to contribute to observationsmechanical ventilation.

There are no known cures for MG and the current standard of hepatotoxicity, which has been associated with losscare consists of transgene expression. The formationchronic use of neutralizing antibodies against AAV after initial treatment with AAV mediated gene therapies effectively preventssteroids and other immunosuppressants. These treatments must be administered continually and carry risks such as infection, osteoporosis, and metabolic diseases. Newer agents, such as those that block the possibilitycomplement pathway or inhibit FcRn, are typically administered continually.

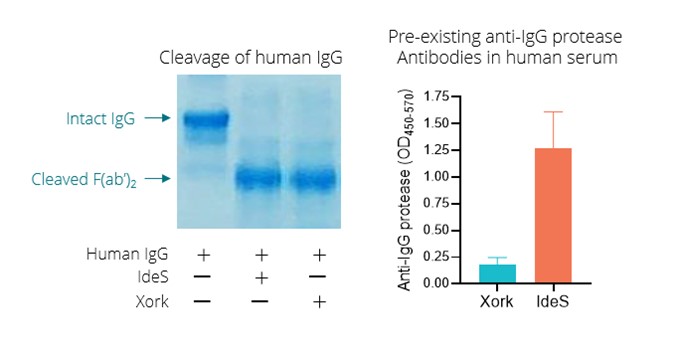

Clinical Development

To date, we have completed the Phase 1b portion of re-dosingthe Phase 1/2 trial of Descartes-08 in patients who may benefit from additional doses due to either the failure to achieve therapeutic benefit or loss of transgene expression over time. Additionally, a significant number of patients who would benefit from treatment by gene therapies are ineligible due to pre-existing immunity to the AAV vectors from a natural infection. This pre-existing immunity could potentially be addressed through an IgG protease pre-treatment to open a dosing window for AAV gene therapies. We believe that the combination of ImmTOR and Xork could simultaneously address the two key issues facing the AAV gene therapy modality and make them more accessible while also making them safer and more durable.

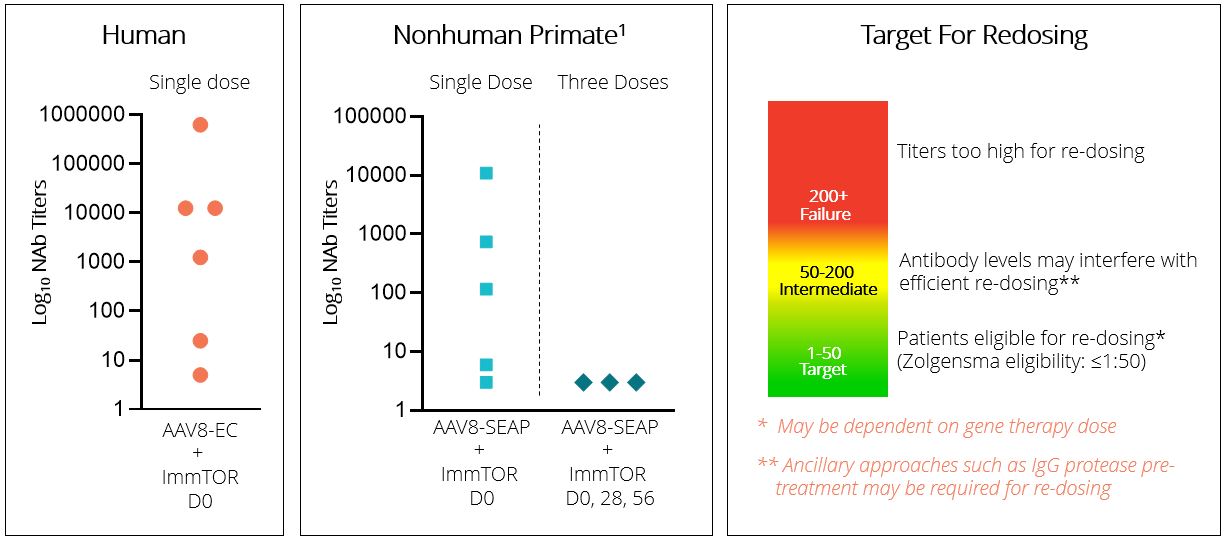

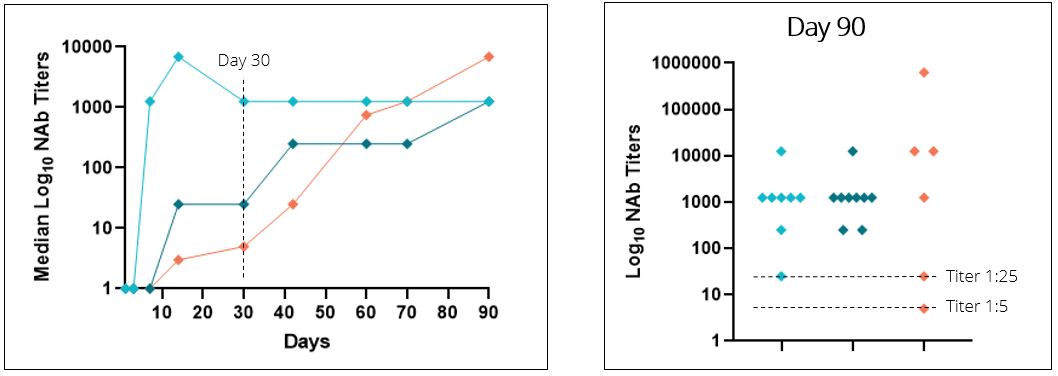

We have observed that ImmTOR, when used in combination with AAV gene therapy vectors, inhibited the immune response to the viral vector and enabled successful re-dosing in both mice and non-human primates. Currently, the ability to re-administer systemic AAV gene therapy is limited by the development of neutralizing antibodies. The ability to safely re-dose AAV may help achieve therapeutic benefit in patients who are under-dosed; it may also help restore transgene expression in patients, particularly pediatric patients, who may lose expression over time as they grow. In a study conducted in non-human primates, or NHP, we observed that co-administration of AAV vector and ImmTOR resulted in higher and more durable transgene expression after the first dose of gene therapyMG, as well as robust inhibitionthe primary readout of anti-AAV8 immunoglobulin G,the Phase 2a portion of the trial. We continue to enroll patients to the Phase 2b portion of the trial.

The primary objective of the Phase 1b portion of the trial was to determine the maximum tolerated dose of Descartes-08 for patients with MG. To assess the safety and manufacturability of Descartes-08, the product candidate was administered in three ascending doses (3.5 x106 cells/kg; 17.5 x106 cells; 52.5 x106 cells/kg) to three patients with MG. After each infusion, patients were observed for at least one week, and a higher dose level was administered if there were no significant adverse effects observed at the initial dose. We observed Descartes-08 to be well-tolerated by the three patients who participated in this portion of the trial with no cytokine release syndrome or IgGother serious product-related adverse events.

The primary objective of the Phase 2a portion of the trial was to determine the optimal dosing schedule for patients with MG using the highest dose level tested in Phase 1b (52.5 x106 cells/kg). This portion of the trial was designed to assess the safety and neutralizing antibodies. We believepreliminary efficacy of Descartes-08 when administered across three different treatment schedules (six doses given twice-weekly, once-weekly, or once-monthly). This portion of the observationtrial evaluated 11 patients with particularly advanced disease as assessed by both patient and clinician-reported outcomes. 79% of the 14 patients included in the Phase 1b and Phase 2a portions of the trial were classified at screening to have Class III or IV disease, as defined by the Myasthenia Gravis Foundation of America, indicating they have moderate-to-severe weakness affecting their muscles.

The results of the Phase 2a portion of the trial, published in the Lancet Neurology in July 2023, indicated that co-administrationafter six weekly infusions of AAV vectorDescartes-08, the average improvement in all disease severity scores was three-to-five-fold greater than what is considered clinically meaningful by expert consensus. As shown in the figure below, clinical improvements persisted in all patients at month nine, and ImmTOR can lead to higher transgene expression illustratesin five of the potential forseven remaining patients at a final, 12-month follow-up. Of the two participants who lost response, one was retreated and experienced rapid improvement in clinical scores, which was ongoing at month six of

dosing lower levelsfollow-up. Descartes-08 was observed to be well-tolerated with no reports of AAV gene therapies when combined with ImmTOR. Integrating ImmTOR into a gene therapy protocol has the potential to provide a first dose benefit by enhancing liver-directed transgene expression and durability, as well as the potential to enable re-dosing to restoredose-limiting toxicities, cytokine release syndrome or augment transgene expression.neurotoxicity.

We have observed in preclinical studies that ImmTOR may also have hepatoprotective effects in mouse models of inflammation. As hepatotoxicity is associated with higher vector doses, one potential strategy that we are pursuing is to use ImmTOR to enable multiple lower doses of AAV vectors to mitigate toxicity risks associated with high vector doses. We are concurrently working with our partner Ginkgo to develop a proprietary AAV capsid with improved transduction for liver-directed gene therapy. The below illustration depicts the potential benefits of ImmTOR in systemic AAV gene therapy.

A–C: Mean change from Baseline (line) and standard error (bands) in Myasthenia Gravis Activities of Daily Living Score (MG-ADL, A), Quantitative Myasthenia Gravis Score (QMG, B), Myasthenia Gravis Composite Score (MGC, C) during 12 months of follow-up for MG-001 participants who received six once-weekly doses (n=7). MG-ADL is self-reported; MGC and QMG are neurologist-assessed. D: Change from Baseline in MGC Score after initial dosing and retreatment in a participant experiencing relapse at Month 12. E: Relative change in serum anti-acetylcholine receptor antibody levels in the three participants with detectable antibodies at baseline. Each line represents one patient.

All three participants with detectable anti-acetylcholine receptor antibody levels before treatment had an average 42% reduction in antibody levels by month six. These reductions deepened to 68% by month nine and persisted at month 12. In summary, we observed continued clinical improvement and autoantibody reductions after BCMA-directed mRNA CAR-T treatment for MG that persisted through the one-year follow-up period.

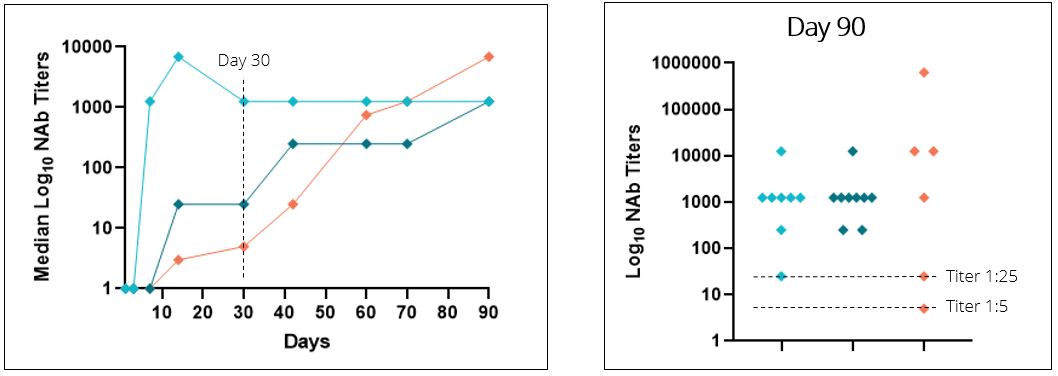

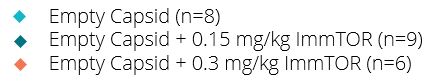

We conducted a human proof-of-conceptare currently enrolling patients in the Phase 2b randomized, double-blind, placebo-controlled portion of the Phase 1/2 trial. We expect to report topline results in mid-2024. The trial, (SEL-399) in healthy volunteers who were treated with an empty AAV8 capsid (EMC-101), which is an AAV capsid containing no transgene, aloneexpected to have at least 30 completers, is designed to assess the primary endpoint of the proportion of patients achieving a five-point or greater reduction in combination with ImmTOR. This clinical trial was conductedtheir MGC score at day 85. Patients will receive six weekly infusions at the dose established in Belgium in partnership with Asklepios BioPharmaceutical, Inc., or AskBio (a Bayer AG subsidiary)Phase 1b (52.5 x106 cells/kg). The goaltrial also involves a crossover component, in which any patient originally assigned to placebo will be given the opportunity to receive Descartes-08 after completing trial treatment.

Secondary endpoints are designed to assess a variety of additional clinical outcomes, including determining safety and tolerability, quantifying the SEL-399 clinical trial waseffect of Descartes-08 over one year, assessing changes through day 85 in QMG, MG QoL 15R, MG Composite and MG post-intervention status and comparing the effect of Descartes-08 versus placebo on MG scales through day 85 in patients who cross over from placebo to evaluateDescartes-08.

Descartes-08 for the appropriate doseTreatment of ImmTOR in humans to mitigateSystemic Lupus Erythematosus

Overview

We are also developing Descartes-08 for the formationtreatment of antibodies to AAV capsids used in gene therapies. Top-line results indicatedSLE, a chronic autoimmune disease that AAV8 empty capsids elicited peak median anti-AA8 neutralizing antibody, or NAb, titers of 1:6875. Median day 30 NAb titers were reduced to titers of 1:25 and 1:5 in the 0.15 mg/kg and 0.3 mg/kg ImmTOR cohorts, respectively, representingcauses systemic inflammation which affects multiple organ systems.

Background Information About Systemic Lupus Erythematosus

SLE is a 50-fold and 250-fold difference, respectively, compared to the median of control subjects dosed with AAV8 empty capsid alone, as depicted in the figure below. Further, we observedchronic, immune-mediated connective tissue disease that at Day 30, six of six, or 100%, of subjects that received 0.3 mg/kg exhibited NAb titers of 1:25 or less, and four of six, or 67%, of those subjects at this dose exhibited NAb titers of 1:5 or less. We observed at Day 30 that six of nine, or 67%, of subjects that received 0.15 mg/kg of ImmTOR exhibited NAb titers of 1:25 or less, and two of nine, or 22%, of subjects at this dose had a titer of 1:5 or less. At Day 90, two of six subjects in the 0.3 mg/kg cohort were observed to have sustained control of neutralizing antibodies with titers of 1:25 or less. Consistent with preclinical data, we observed that the single dose ImmTOR cohorts showed delayed formation of neutralizing antibodies which eventually reached similar median levels of neutralizing antibodies to the control group by Day 90. Similar data were observed in NHP receiving a single dose of ImmTOR with an AAV gene therapy vector in a preclinical study. Importantly, we observed that two additional doses of ImmTOR, or a total of three monthly doses, provided durable inhibition of neutralizing antibodies in NHP. Although we could not evaluate three-monthly doses of ImmTOR in healthy volunteers, we intend to employ a three-monthly dose regimen in clinical trials performed in patients. ImmTOR showed safety results consistent with prior human studies and was generally well tolerated. No serious adverse events were reported.can impact nearly all major organ systems. The most common treatment-related adverse events included mild-to-moderate stomatitismanifestations of SLE are cutaneous and rash. We believe this promising trial in healthy volunteers provides support for the potential usemusculoskeletal symptoms, although neurological, gastrointestinal, hematological, and renal symptoms are regularly observed as well. Patients with SLE are at a substantially increased risk of ImmTOR for the inhibition of neutralizing antibodies to AAV8 in gene therapy clinical trials. The following graphs depict the effect of ImmTOR on the formation of neutralizing antibodies to AAV8 capsid in humans and NHP.

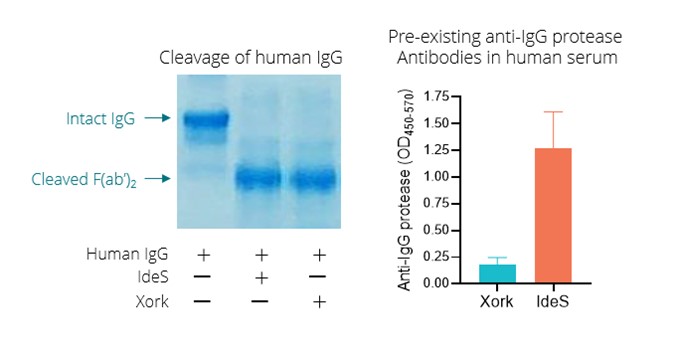

Finally, pre-existing neutralizing antibodies, which develop asDescartes-15

Descartes-15 is a result of prior infection with wildtype AAV, are a major exclusion factor in clinical trials causing many potential patientsnext-generation, autologous anti-BCMA mRNA CAR-T. Using our proprietary technology and manufacturing platform, we designed Descartes-15 to be ineligible for gene therapy.more resistant than Descartes-08 to recycling of the CAR upon multiple antigen exposures. We have licensedbelieve this is a bacterial IgG protease, or Xork, from Genovis AB (publ.), or Genovis. IgG proteases have been shown by othersparticularly important feature to transiently cleave IgG and enable dosingincrease the durability of AAV vectorsCAR expression on the surface of these cells. We observed that Descartes-15 was 10-fold more potent than Descartes-08 in preclinical studies, as illustrated in the presence of pre-existing antibodies in NHP. However, IgG proteases, being of bacterial origin, are themselves immunogenic. The most commonly studied IgG protease, called IdeS or imlifidase, is derived from Streptococcus pyogenes, a common human pathogen. Most healthy individuals have been exposed to S. pyogenes and have pre-existing antibodies against IdeS. We believe that Xork is a differentiated product candidate, as it is derived from a Streptoccocal species that does not infect humans and so the enzyme shows very low cross reactivity to naturally existing antibodies in most human serum. We plan to develop Xork with the intention of enabling access to AAV gene therapy for those patients who are currently excluded due to pre-existing anti-AAV antibodies.below charts. In JanuaryNovember 2023, we announced an exclusive licensingreceived IND allowance from the FDA to initiate the Phase 1 trial to test the safety of Descartes-15 in patients with multiple myeloma.

Next Steps

We intend to leverage our preclinical and clinical observations from the Descartes-08 development agreementprogram and the Descartes-15 Phase 1 program to inform our clinical strategy for Xork to be developedDescartes-15 for use with AT845, Astellas Gene Therapies' investigational AAV-basedthe treatment of autoimmune diseases.

Allogeneic Product Candidate

Descartes-33 is our allogeneic mRNA MSC in preclinical development for Late-Onset Pompe disease in adults.treatment of autoimmune diseases. We are responsible fordeveloping Descartes-33 to deliver a combination of therapeutic proteins that target key drivers in the early development activities and manufacturingpathogenesis of Xork and will maintain the rights for the development of additional indications beyond Pompe disease.

Through our analysis of genetic diseases, we have identified applications and patient segments that we believe would benefit from our ImmTOR platform. Our initial area of focus is on genetic metabolic diseases but may also include lysosomal storage diseases and genetic muscular diseases. We believe we are the first company to systematically pursue the development of AAV gene therapy product candidates with the goal of enabling repeat administration. We have engaged third parties with experience in gene therapy and rare diseases to support the development of our proprietary products. We also have licensed our ImmTOR platform to AskBio, Sarepta Therapeutics, Inc., or Sarepta, and Takeda Pharmaceuticals USA, Inc., or Takeda, for certain pre-specified targets.autoimmunity.

Tolerogenic Therapies for Autoimmune Disease: Autoimmune diseases are caused by a breakdown in natural tolerance to our own self-antigens. With over 24 million Americans afflicted with autoimmune diseases, there is a large unmet medical need. As the ImmTOR platform is designed to induce or expand antigen specific T regulatory cells, we believe the ImmTOR platform has the potential to treat autoimmune diseases by restoring self-tolerance to auto-antigens.Manufacturing

Recent preclinical data generated by our scientific team suggest that ImmTOR mayWe have profound synergistic activity with engineered IL-2 molecules that are selective for Tregs. The IL-2 pathway influences critical aspects of both immune stimulationestablished wholly owned internal manufacturing and immune regulation. Tregs express a high affinity form of the IL-2 receptor. Low doses of IL-2 have been shown by others to selectively activate Tregs resulting in expansion of pre-existing Tregs.

In our preclinical studies, we observed that ImmTOR combined with a Treg-selective IL-2 molecule exhibited substantial synergistic activity in increasing the percentage and durability of total Treg expansion in the spleen. We believe that this combination has the potential to be a best-in-class therapy in diseases where expansion of total Treg may prove beneficial. This antigen specificity differentiates ImmTOR-IL from other IL-2 molecule approaches which do not show an antigen specific T-cell expansion. Thus, we believe that not only is ImmTOR-IL a potentially "best-in-class" IL-2 where generalized T cell expansion can be beneficial, but also a “first-in-class” antigen specific IL-2 therapy. Furthermore, in our preclinical studies, when we combined ImmTOR-IL with an antigen, we measured an approximately three-fold increase in antigen-specific T regulatory cells versus ImmTOR alone.

Our Product Candidates

Below is a summary of our ongoing discovery, research and development programs:capabilities, which allow us to optimize processes rapidly and in an iterative manner. Our main manufacturing facility is located in Gaithersburg, Maryland and operates under current good manufacturing practice, or cGMP. This facility enhances our control of product quality and production schedules and costs, allowing us to move assets from discovery to preclinical to clinical development quickly. We also entered into an agreement to lease additional manufacturing space located in Frederick, Maryland to transition and expand our clinical and commercial manufacturing capabilities for our maturing pipeline of innovative mRNA cell therapies for the treatment of autoimmune disease.

Our cGMP cell manufacturing facilities, with their dedicated quality management system, are also capable of mRNA production used in Descartes-08. We manufacture Descartes-08 in-house and are typically able to process and release lots for infusion within approximately three weeks. Our autologous cell therapy product candidates, including Descartes-08, are manufactured on a patient-by-patient basis. We have optimized our manufacturing processes through over 200 cGMP runs. We also maintain FDA-reviewed human umbilical cord MSC cell collection and banking operations.

Intellectual Property

In addition to patent protection, we also rely on trade secrets, know-how, trademarks, confidential information, other proprietary information and continuing technological innovation to develop, strengthen and maintain our competitive position. We seek to protect and maintain the confidentiality of proprietary information to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection. Although we take steps to protect our proprietary information and trade secrets, including through contractual means with our employees, consultants, contractors and collaborators, third parties may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets or disclose our technology. Thus, we may not be able to meaningfully protect our trade secrets. It is our policy to require our employees, consultants, outside scientific collaborators, sponsored researchers and other advisors to execute confidentiality and invention assignment agreements upon the commencement of employment or consulting relationships with us. However, such confidentiality agreements can be breached, and we may not have adequate remedies for any such breach. For more information regarding the risks related to our intellectual property, see the section titled “Risk factors—Risks related to intellectual property.”

Key Agreements

Biogen License Agreement

On September 8, 2023, we entered into a non-exclusive, sublicensable, worldwide, perpetual patent license agreement, or the Biogen Agreement, with Biogen MA, Inc, or Biogen, to research, develop, make, use, offer, sell and import products or processes containing or using an engineering T-cell modified with an mRNA comprising, or encoding a protein comprising, certain sequences licensed under the Biogen Agreement for the prevention, treatment, palliation and management of autoimmune diseases and disorders, excluding cancers, neoplastic disorders, and paraneoplastic disorders. We are not obligated to pay Biogen any expenses, fees, or royalties.

We may terminate the Biogen Agreement for any reason or no reason, and Biogen may terminate the agreement after a notice-and-cure period of 30 days if we fail to pay a fee owed to Biogen or for any other material breach of the agreement. The Biogen Agreement will otherwise expire when all claims of all issued patents within the patents and patent applications licensed

Biologic Therapies – Chronic Refractory Gout

SEL-212 consists of ImmTOR co-administered with pegadricase. Our pegadricase consiststo us under the Biogen Agreement have expired or been finally rendered revoked, invalid or unenforceable by a decision of a yeast-derived uricase modifiedcourt or government agency.

NCI License Agreement

Effective September 16, 2019, we entered into a nonexclusive, worldwide license agreement, or the NCI Agreement, with polyethylene glycol moieties. Uricase is an enzyme endogenous to all mammals, except for humansthe U.S. Department of Health and certain primates, which converts serum urate to the more soluble metabolite, allantoin. There is a natural limit to the amount of serum urate that can be excretedHuman Services, represented by the kidneys, which decreases with ageNational Cancer Institute of the National Institutes of Health, or NCI.

Under the NCI Agreement, we were granted a license under certain NCI patents and can be reduced by some medications. By converting serum uratepatent applications designated in the agreement, to allantoin, uricase provides an additional way formake, use, sell, offer and import products and processes within the body to reduce serum urate.

Pegadricase is designedscope of the patents and applications licensed under the NCI Agreement when developing and manufacturing anti-BCMA CAR-T cell products for the treatment of patientsMG, pemphigus vulgaris, and immune thrombocytopenic purpura according to methods designated in the NCI Agreement.

In connection with chronic gout, refractoryour entry into the NCI Agreement, we paid to standard serum urate lowering treatment, by breaking downNCI a one-time $100,000 license royalty payment. Under the excess serum urate, or SU,NCI Agreement, we are further required to pay NCI a low five-digit annual royalty. We must also pay earned royalties on net sales in a low single-digit percentage and pay up to $0.8 million in benchmark royalties upon our achievement of designated benchmarks that are based on the commercial development plan agreed between the parties.

Under the NCI Agreement, we must use reasonable commercial efforts to bring licensed products and licensed processes to the more soluble allantoin. However,point of Practical Application (as defined in the immune responseNCI Agreement). Upon our first commercial sale, we must use reasonable commercial efforts to pegadricase limits administrationmake licensed products and licensed processes reasonably accessible to a single dose which is effective for less than one month. The addition of ImmTOR to pegadricase (SEL-212) allows multiple monthly doses to be administered, thus reducing serum urate for a prolonged time.

In preclinical studies and in our Phase 1b and Phase 2 clinical trials, we observed that ImmTOR, when co-administered with pegadricase, SEL-212 substantially reduced the formation of associated ADAs. We believe that SEL-212 serves as proof of concept for the ImmTOR platform in ameliorating the unwanted immune response to an immunogenic biologic. SEL-212 is in two pivotal Phase 3 studies versus placebo, which we refer to as DISSOLVE I and DISSOLVE II, with top-line data expected first quarter of 2023. SEL-212 has been licensed (except as to Greater China) to Sobi, pursuant to our license and development agreement dated June 11, 2020, with Sobi, or the Sobi License.

Enrollment into the DISSOLVE II trial is complete and the study is being conducted in the United States public. After our first commercial sale, we must make reasonable quantities of licensed products or materials produced via licensed processes available to patient assistance programs and four countries across eastern Europe. Asdevelop educational materials detailing the licensed products. Unless we obtain a result of the ongoingwaiver from NCI, we must have licensed products and rapidly evolving geopolitical situation in Ukraine and Russia, we have proactively undertaken mitigation steps to prioritize the safety of our patients and investigators, as well as address any potential disruptions. We have reserved existing clinical trial supplies in these countries for those already enrolled in the DISSOLVE II trial. In agreement with our study partner, Sobi, we increased enrollment in DISSOLVE II to 153 subjects for potential loss of subjects enrolled in Russia and Ukraine due to operational or other issues arising from instability in the region. As of the filing of this Annual Report, we expect to report DISSOLVE I and DISSOLVE II topline results in the first quarter of 2023.

The market for gout therapy

Gout is a painful and potentially disabling form of arthritis associated with elevation of SU levels caused by an overproduction of serum urate and/or an inability of the kidneys to excrete adequate amounts of serum urate from the body. High concentrations of SU lead to formation of serum urate crystals in joints and tissues, causing pain, inflammation and joint damage, and increase the risk for other conditions, including cardiovascular, cardiometabolic, joint and kidney disease.

Patients who are unable to reduce their SU levels below 6.0 mg/dL with oral drugs are defined as having refractory gout. Chronic refractory gout constitutes a subset of gout patients exhibiting chronic high SU levels and painful and damaging serum urate deposits. We estimate that there are approximately 160,000 chronic refractory gout patients in the U.S.

We believe SEL-212 may potentially address several key unmet needs in the treatment of chronic refractory gout: the durable control of SU levels, the elimination of painful and damaging serum urate deposits, reduction in incidence and severity of flares, based on our preclinical studies, clinical trials, and market research. SEL-212 is designed to address these unmet medical needs while improving the dosing regimen to a once-monthly treatment.

SEL-212 Clinical Development

We conducted Phase 1a, Phase 1b, and Phase 2 clinical trials for SEL-212 at multiple siteslicensed processes manufactured substantially in the United States. These trials were designedPrior to demonstrate the inductionfirst commercial sale, upon NCI’s request, we are obligated to provide NCI with commercially reasonable quantities of an immune responselicensed products made through licensed processes to pegadricase and the ability of ImmTORbe used for in vitro research.

Additionally, we must use reasonable commercial efforts to mitigate that immune response to both single and multiple doses. The table below summarizes the trial designs and objectives of these clinical trials.

| | | | | | | | |

| Design | Objective |

Phase 1a

SEL-212/101 | •Subjects with hyperuricemia

•Single dose of pegadricase

•n=22

| •Evaluate safety and tolerability

•Define dose of pegadricase that would support monthly dosing

•Demonstrate formation of ADAs

|

Phase 1b

SEL-212/101 | •Subjects with hyperuricemia

•Single dose of SEL-212

•n=53

| •Evaluate safety and tolerability

•Proof-of-biological activity:

•Mitigation of ADAs after single dose

•Select dose to take forward into Phase 2

|

Phase 2

SEL-212/201 | •Subjects with symptomatic gout and hyperuricemia

•Repeated monthly dosing of SEL ‑212

•n=152

| •Evaluate safety and tolerability

•Clinical proof-of-concept:

•Demonstrate sustained reduction of SU with repeat dosing

•Select dose to take intoinitiate a Phase 3

|

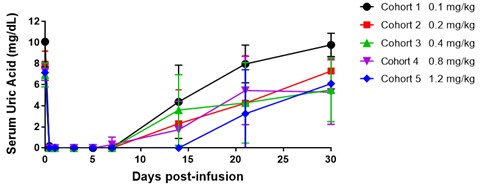

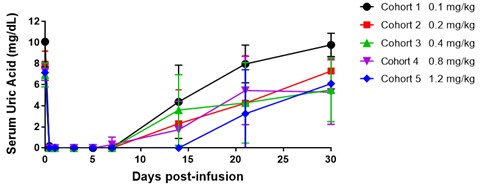

In the Phase 1a trial, we observed that a single dose of pegadricase rapidly reduced SU levels below 6.0 mg/dL for each dose level, although SU levels returned close to baseline by day 30. Consistent with our preclinical studies in animals, pegadricase induced uricase-specific ADAs in all patients with varying levels in this Phase 1a trial. The following table depicts the observations from the single ascending dose trial of pegadricase in patients with hyperuricemia. In this trial, patients with SU > 6 mg/dL at screening were assigned to one of five cohorts receiving a single IV infusion of pegadricase (0.1, 0.2, 0.4, 0.8 or 1.2 mg/kg). Each cohort consisted of five patients, except for cohort 5 (1.2 mg/kg) which enrolled two patients.

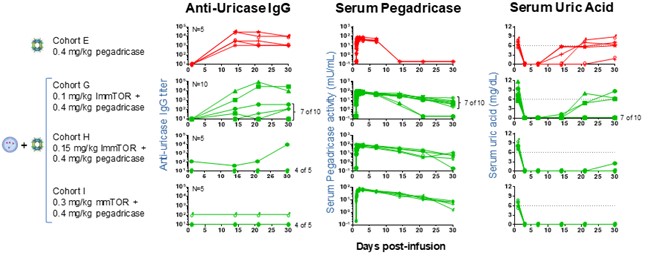

In the Phase 1b clinical trial, we observed the potential for increasing doses of ImmTOR to mitigate the formation of pegadricase ADAs and sustain the anti-uricase enzyme activity through 30 days. The cohort of subjects who received a single 0.4 mg/kg dose of pegadricase alone showed development of uricase ADAs, a short pegadricase half-life, and poor control of SU at 30 days. Three cohorts who received 0.4 mg/kg of pegadricase plus ascending doses of ImmTOR (0.1, 0.15 and 0.3 mg/kg) showed a dose related reduction in uricase ADAs, an increase in pegadricase half-life, and substantial reduction in SU. This graphs below depict the observed correlation of SU with anti-uricase IgG and serum pegadricase activity. In these graphs, anti-uricase IgG titers, serum pegadricase activity, and SU are plotted against time for individual patients in cohorts A, G, H, and I. Each line represents an individual patient.

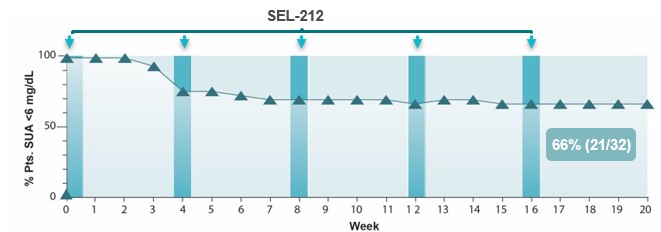

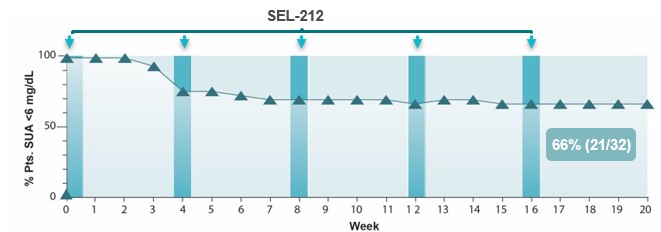

The Phase 2 trial included patients with symptomatic gout and elevated SU levels in an open-label, multiple ascending-dose clinical trial of SEL-212a licensed product by the fourth quarter of 2024, submit a biologics license application, or BLA, with respect to demonstrate sustained reductiona licensed product by the fourth quarter of SU2026, and identifymake a first commercial sale of a licensed product by the best dose for Phase 3. Five monthly dosesfourth quarter of SEL-212 reduced SU2028.

The NCI Agreement terminates upon the expiration of the last to less than 6.0 mg/dLexpire of the patent rights licensed thereunder, if not sooner terminated. NCI has the right to terminate this agreement, after giving written notice and providing a cure period in 21accordance with its terms, if we are in default of 32 evaluable patients, or 66%. In distinct contrast, pegadricase alone reduced SU to less than 6.0 mg/dL in only three of 19 patients one month after a single injection (data from pegadricase alone cohorts from the SEL-037/101, SEL-212/101, and SEL-212/201 trials). We believe these results support our view that the addition of ImmTOR to pegadricase is able dramatically enhance the efficacy of pegadricase in the long-term reduction of SU in gout patients. The chart below depicts SU after five monthly doses of SEL-212.

material obligation. We have observed that SEL‑212 and its components, ImmTOR and pegadricase, were generally well-toleratedthe unilateral right to terminate the agreement in the Phase 1a, 1b, and 2 clinical trials. In the Phase 1a trial we observed no serious adverse events,any country or SAEs, and that pegadricase was well tolerated at the five dose levels tested. Of the six SAEs in the Phase 1b trial, three were determinedterritory by giving NCI 60 days’ written notice. We agreed to not to be related to study drug by investigators. Of the remaining three SAEs that were determined to possiblyindemnify NCI against any liability arising out of our, sublicensees’ or likely be related to study drug, two were cases of stomatitis that occurred at the highest dose of ImmTOR tested (0.5 mg/kg), leading us to define 0.3 mg/kg as the maximum tolerated dose of ImmTOR in this patient population. The remaining SAE was a case of drug hypersensitivity that occurred at a dose of 0.1 mg/kg of ImmTOR in combination with 0.4 mg/kg of pegadricase. In the Phase 2 trial, 20 subjects reported a total of 23 SAEs, nine in the five dose combination cohorts, seven of which were reported to be not related or unlikely related to study drug, and two of which were infusion reactions. All SAEs were successfully treated without residual effects.

Phase 2 head-to-head clinical trial

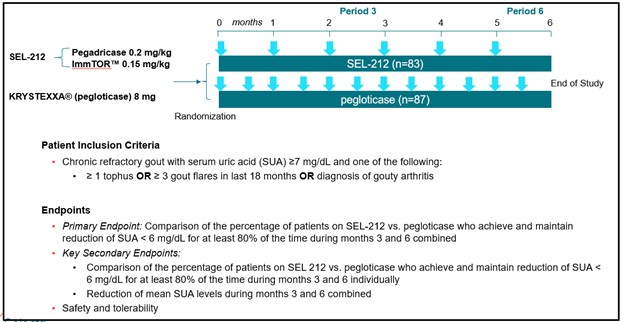

In March 2019, we initiated a non-registrational Phase 2 head-to-head clinical trial of SEL-212, which we refer to as COMPARE, in which SEL-212 was compared against the current FDA-approved therapy for chronic refractory gout, pegloticase, in multiple clinical sites in the United States.

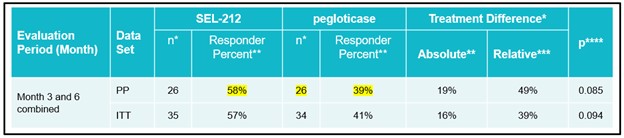

In September 2020, we announced top-line results from the COMPARE trial. We observed a numerically higher response rate to pegloticase on the primary endpoint during months three and six combined but did not meet the primary endpoint of statistical superiority. SEL-212 did generate a statistically significant higher response rate to pegloticase during the third month of treatment, as well as a statistically significant greater overall reduction in mean SU levels in SEL-212 versus pegloticase in months three and six combined. We observed a numerically higher response rate of SEL-212 during the sixth month of treatment. In patients with tophi at baseline, we observed substantially higher responder rates for SEL-212 compared to pegloticase on the primary endpoint, and a statistically significant reduction in mean SU levels when compared to pegloticase.

Approximately 41% of patients in the Phase 2 COMPARE trial had visible tophi at baseline, which is lower than we expected for the general refractory gout population. However, in these most severe patients with tophi, SEL-212 was superior to pegloticase with a 58% responder rate for SEL-212 versus a 39 % responder rate for pegloticase. Response rates observed in patients with tophi at baseline are depicted below.

SEL-212 showed a favorable safety profile and was well-tolerated. There were no deaths during the study. There were no notable differences in serious TEAEs, treatment-related serious TEAEs, or infusion reactions between the two groups. A full analysis of safety signals, including gout flare incidence and severity, requires evaluationparties’ use of the full data setlicensed patent rights and will be reported together with the full efficacy analysis in a manuscript in a medical journal.

Phase 3 DISSOLVE clinical program

In September 2020, we commenced the Phase 3 clinical program of SEL-212, which we refer to as DISSOLVE. We are responsible for the execution of the DISSOLVE program and are being reimbursed by Sobi on a quarterly basis for expenses incurredlicensed products or licensed processes developed in connection with these activities. The Phase 3 clinical program consists of two double-blinded, placebo-controlled trials of SEL-212. We refer to these trials as DISSOLVE I and DISSOLVE II. Each trial was expected to enroll up to 120 patients, with up to 40 patients receiving 0.1 mg/kg of ImmTOR and 0.2 mg/kg of pegadricase, up to 40 patients receiving 0.15 mg/kg of ImmTOR and 0.2 mg/kg of pegadricase, and up to 40 patients receiving placebo. An additional 15 patients were added to the study sample size to account for potential treatment discontinuations due to the ongoing COVID-19 pandemic as a result of the emergence of COVID-19 variants which were not accounted for in the sample size calculations. In agreement with our study partner, Sobi, we increased enrollment in DISSOLVE II to 153 subjects for potential loss of subjects enrolled in Russia and Ukraine due to operational or other issues arising from instability in the region.licensed patent rights.

We commenced enrollment of DISSOLVE I in September 2020 and DISSOLVE II in December 2020. In December 2021, we announced the completion of enrollment of the DISSOLVE I trial. DISSOLVE I has a six-month primary endpoint followed by a six-month safety extension. In June 2022, we announced the completion of enrollment of the DISSOLVE II trial. DISSOLVE II will have a six-month primary endpoint with no extension. The primary endpoint of the DISSOLVE program is

the maintenance of SU levels below 6 mg/dL at six months. As of the filing of this Annual Report, we expect to report DISSOLVE I and DISSOLVE II topline results in first quarter of 2023.

Biologic Therapies – IgA Nephropathy

The second development program in biologic therapies is in IgA nephropathy, an autoimmune kidney disease that occurs when immune complexes of a subclass of antibodies called immunoglobulin A1, or IgA1, accumulates in the kidneys. Previous studies in animal models conducted at independent laboratories demonstrated that bacterial IgA protease has the potential to remove injurious IgA immune complexes from kidneys and reduce inflammation, fibrosis, and hematuria. We believe these results suggest that IgA protease can potentially decrease the rate of disease progression and possibly even reverse the disease. The barrier to IgA protease commercialization has been the bacterial origin of the protease, which makes it highly immunogenic. Based on the learnings of SEL-212, we believe the combination of ImmTOR with an IgA protease could potentially enable repeated dosing to treat IgA nephropathy.

In clinical trials, we have observed ImmTOR mitigating the formation of ADAs to immunogenic enzymes. We intend to combine an IgA protease with our ImmTOR platform to develop a novel combination product candidate for the treatment of IgA nephropathy and IgA-mediated diseases. In December 2022, we announced the selection of a next generation IgA protease candidate from IGAN Biosciences for its IgA nephropathy program.

In October 2020, we entered into an Option andAstellas License Agreement or the IGAN Agreement, with IGAN Biosciences, Inc., or IGAN. Pursuant to the IGAN Agreement, IGAN granted us an exclusive license to research, evaluate, and conduct pre-clinical development activities on IGAN’s proprietary IgA proteases. We had an initial option term of 24 months, during which we could elect to obtain an exclusive license to further develop and commercialize the product candidate to treat all IgA-mediated diseases, including IgA nephropathy, Linear IgA bullous dermatitis, IgA pemphigus, and Henoch-Schonlein purpura (also known as IgA vasculitis).

In May 2022, we entered into Amendment No. 1 to the IGAN Agreement, or the First IGAN Amendment, with IGAN. The First IGAN Amendment provided an extension to the option term of 24 months from the date of the First IGAN Amendment.