TABLE OF CONTENTS

| 2 |

| 6. | ||||||||

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this report are forward-looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim,” “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “outlook,” “plan,” “potential,” “project,” “projection,” “seek,” “should,” “will,” “would,” the negatives thereof and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. They appear in a number of places throughout this report and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

•

| ● | our ability to continue as a going concern; |

| ● | the impact of damage to or interruption of our information technology systems due to cyber-attacks or other circumstances beyond our control; |

| ● | business interruptions resulting from geopolitical actions, including war and terrorism; |

| ● | our ability to successfully implement our growth strategy; |

| ● | failure to achieve growth or manage anticipated growth; |

| ● | our ability to achieve or maintain profitability; |

| ● | the loss of key members of our senior management team; |

| ● | our ability to generate sufficient cash flow or raise capital on acceptable terms to run our operations, service our debt and make necessary capital expenditures; |

| ● | our dependence on our subsidiaries for payments, advances and transfers of funds due to our holding company status; |

| ● | our ability to successfully develop additional products and services or successfully market and commercialize such products and services; |

| ● | competition in our market; |

| ● | our ability to attract new and retain existing customers, suppliers, distributors or retail partners; |

| ● | allegations that our products cause injury or illness or fail to comply with government regulations; |

| ● | our ability to manage our supply chain effectively; |

| ● | our or our co-manufacturers’ and suppliers’ ability to comply with legal and regulatory requirements; |

| ● | the effect of potential price increases and shortages on the inputs, commodities and ingredients that we require, whether as a result of the continued actual or perceived effects of broader geopolitical and macroeconomic conditions, including the military conflict between Russia and Ukraine; |

| ● | our ability to develop and maintain our brand and brand reputation; |

| ● | compliance with data privacy rules; |

| ● | our compliance with applicable regulations issued by the U.S. Food and Drug Administration (“FDA”), the U.S. Federal Trade Commission (“FTC”), the U.S. Department of Agriculture (“USDA”), and other federal, state and local regulatory authorities, including those regarding marketing pet food, products and supplements; |

| ● | risk of our products being recalled for a variety of reasons, including product defects, packaging safety and inadequate or inaccurate labeling disclosure; |

| ● | risk of shifting customer demand in relation to raw pet foods, premium kibble and canned pet food products, and failure to respond to such changes in customer taste quickly and effectively; and |

| ● | other factors discussed under the headings “Risk Factors,” “Business,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K. |

risk of our products being recalled for a variety of reasons, including product defects, packaging safety and inadequate or inaccurate labeling disclosure;

•risk of shifting customer demand in relation to raw pet foods, premium kibble and canned pet food products, and failure to respond to such changes in customer taste quickly and effectively; and

NOTE REGARDING TRADEMARKS

We own or have rights to use the trademarks and trade names that we use in conjunction with the operation of our business. Each trademark or trade name of any other company appearing in this Annual Report on Form 10-K is, to our knowledge, owned by such other company. Solely for convenience, our trademarks and trade names referred to in this Annual Report on Form 10-K may appear without the ® or ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

| 3 |

PART I

| ITEM 1. | BUSINESS |

Our History

On December 17, 2018, Better Choice Company, Inc. (the “Company”, or “Better Choice”) made a $2.2 million investment in TruPet LLC ("TruPet"(“TruPet”), an online seller of pet foods, pet nutritional products and related pet supplies. On February 2, 2019, Better Choicethe Company entered into a definitive agreement to acquire the remainder of TruPet and we closed the acquisition on May 6, 2019.

On February 28, 2019, Better Choice Company entered into a definitive agreement to acquire all of the outstanding shares of Bona Vida, Inc. ("(“Bona Vida"Vida”) and we closed the acquisition on May 6, 2019.

On October 15, 2019, Better Choice Company entered into a Stock Purchase Agreement (as amended, the “Halo Agreement”) with Halo, Thriving Paws, LLC, a Delaware limited liability company (“Thriving Paws”), HH-Halo LP, a Delaware limited partnership (“HH-Halo” and, together with Thriving Paws, the “Sellers”) and HH-Halo, in the capacity of the representative of the Sellers. Pursuant to the terms and subject to the conditions of the Halo Agreement, among other things, wethe Company agreed to purchase from the Sellers 100% of the issued and outstanding capital stock of Halo, Purely for Pets, Inc. ("Halo"(“Halo”) (the “Halo Acquisition”). WeThe Company closed this acquisition, which we refer to as the Halo Acquisition on December 19, 2019.

Overview of Our Business

Better Choice is a rapidly growing pet health and wellness company committed to leading the industry shift toward pet products and services that help dogs and cats live healthier, happier and longer lives. Our mission is to become the most innovative premium pet food company in the world, and we are motivated by our commitment to making products with integrity and treating pets and their parents with respect. We believe that our broad portfolio of brandspet health and wellness products are well positioned to benefit from the trends of growing pet humanization and an increased consumer focus on health and wellness, and have adopted a laser focused, channel specific approach to growth that is driven by new product innovation. Our executive team has a proven history of success in both pet and consumer-packaged goods, and has over 50 years of combined experience in the pet industry and over 100 years of combined experience in the consumer-packaged goods industry.

We sell our premium and super-premium products (which we believe generally includes products with a retail price greater than $0.20 per ounce) under the Halo brand umbrella, including Halo Holistic™, Halo Elevate® and the former TruDog brands, bothbrand, which has been rebranded and successfully integrated under the Halo brand umbrella during the third quarter of which have a long history of providing high quality2022. Our core products sold under the Halo brand are made with high-quality, thoughtfully sourced ingredients for natural, science based nutrition. Each innovative recipe is formulated with leading veterinary and nutrition experts to pet parents.deliver optimal health. Our diverse and established customer base has enabled us to penetrate multiple channels of trade, which we believe enables us to deliver on core consumer needs and serve pet parents wherever they shop. We believe this omni-channel approach has also helped us respond more quickly to changing channel dynamics that have accelerated as a result of the COVID-19 pandemic, such as the increasing percentage of pet food that is sold online. We group these channels of trade into four distinct categories: E-Commerce,E-commerce, which includes the sale of product to online retailers such as Amazon and Chewy; Brick & Mortar, which primarily includes the sale of product to pet specialty chainsPet Specialty retailers such as Petco, PetSmart, Pet Supplies Plus select grocery chains and neighborhood pet stores;stores, as well as to select grocery chains; Direct to Consumer (“DTC”) which includes the sale of product through our online web platform to more than 20,000 unique customers and access to more than 500,000 customer emails;website halopets.com; and International, which includes the sale of product to foreign distribution partners and to select international retailers.

New product innovation represents the cornerstone of our growth plan, supported by our own research and development, and acquisitions. Our established supply and distribution infrastructure allows us to bring new products to market in nine months, generally. Our outsourced manufacturing model is flexible, scalable and encourages innovation allowing us to offer a breadth of assortment in dog and cat food products under the Halo and TruDog brands,brand, serving a wide variety of customer needs.

Halo is the brand for a new generation of pet parents. For millennial pet momsparents who view their pets as children, we believe Halo provides the world’s best nutrition for the world’s best kids. Halo offers two premium sub-lines of natural dog and cat food for this audience. audience - Halo Holistic, which includes the former TruDog brand, and Halo Elevate.

Halo Holistic is designed for the pet parent seeking high-quality ingredients for digestive health. Halo Holistic is the only super-premium pet food certified by the Global Animal Partnership and the Marine Stewardship Council, both of which are animal welfare organizations recognized worldwide. Halo Holistic also supports complete digestive health with prebiotics, probiotics and postbiotics. Additionally, it'sit’s made with whole animal proteins only and no meat meals.

Halo Elevate®, our second sub-line launching inwhich launched during 2022, provides best-in-class nutrition. We believe it'sit’s the only natural pet food with leading nutrient levels to support the top five pet parent health concerns which include digestive health, heart and immunity support, healthy skin and coat, hip and joint support and strength and energy. Each recipe delivers natural, science-based nutrition for optimal health. Both Halo Holistic and Halo Elevate® provide confidence and validation to empower millennial pet moms.

Our Products and Brands

We have a broad portfolio of over 100 active premium and super premium animal health and wellness products for dogs and cats, which includes products sold under the Halo and TruDog brandsbrand across multiple forms, including foods, treats, toppers, dental products, chews, grooming products and supplements. Our products consist of naturally formulated premium kibble and canned dog and cat food, freeze-dried raw dog food and treats, vegan dog food and treats, oral care products and supplements. Our products sold under the Halo brand are sustainably sourced, derived from real whole meat and no rendered meat meal and include non-GMO fruits and vegetables. Our products sold under the TruDog brand are made according to our nutritional philosophy of raw, meat-based nutrition and minimal processing.

Our products are manufactured by an established network of co-manufacturers in partnership with Better Choice. We have maintained each of our key co-manufacturing relationships for more than four years, with certain relationships in place for more than ten years and with the launch of Halo Elevate®, we have expanded and engaged two new co-manufacturing partners in 2022. Halo and TruDog products are co-manufactured in the U.S. and our third-party warehousing and logistics provider, Fidelitone, was located in Lebanon, Tennessee throughout 2021 and moved to Wauconda, Illinois in 2022.

| 4 |

Our Customers and Channels

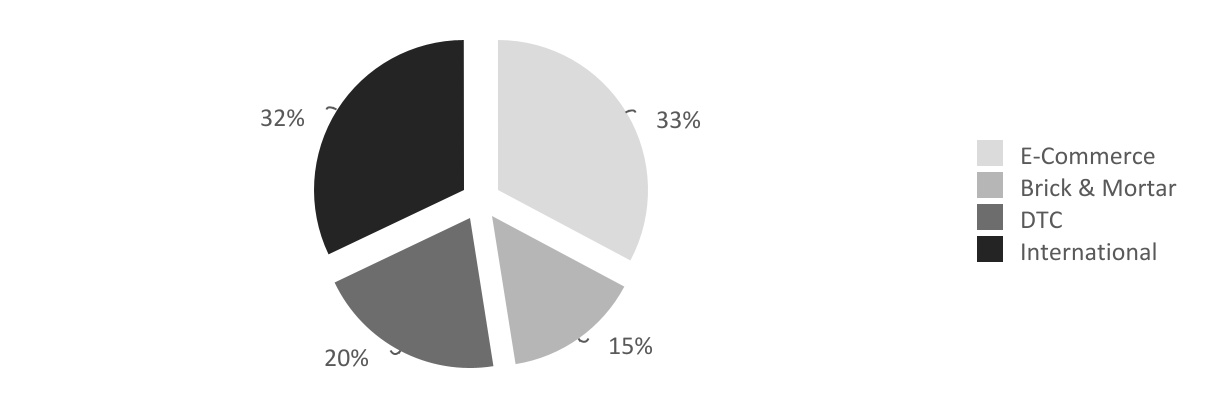

In 2021,2023, we generated $56.0$48.6 million of gross sales and $46.0$38.6 million of net sales. By channel in 2021,2023, E-Commerce generated approximately $21.8$19.1 million of gross sales and $15.1$13.4 million of net sales, Direct-to-Consumer generated approximately $10.8$6.4 million of gross sales and $9.4$5.6 million of net sales, Brick & Mortar generated approximately $8.6$9.4 million of gross sales and $6.7$5.9 million of net sales and International generated approximately $14.8$13.7 million of gross sales and $14.8$13.7 million of net sales. The following chart provides a breakdown of our net sales by channel for the year ended December 31, 2021:

In 2021, 53%2023, approximately 50% of our net sales were made online, through a combination of E-CommerceE-commerce partner websites, such as Amazon, Chewy, Petflow, Thrive Market and Vitacost, and our Direct-to-ConsumerDTC website, hosted on Shopify. A majority of our online sales are driven by repeat purchases from existing customers. Although industry-wide E-Commerce sales retreated somewhat followingIn Packaged Facts’ Surveys of Pet Owners, pet products and services are at the March 2020 pantry stocking,bottom of the salelist of household spending cutbacks, second only to human medicine and healthcare. Reflecting both the higher prices and Americans’ deep commitments to their pets, pet food and supplies online had increased 35% year-over-year accordingparents remain tenacious when it comes to Packaged Facts,pet care, with subscription sales nearly equal68% spending more in February 2023 vs. January 2022 even as they looked for ways to the March 2020 peak.economize. We anticipate our ability to reach a growing base of diverse customers online will continue to improve as E-CommerceE-commerce penetration increases. At the same time, we believe that our long-established relationships with key brick & mortar customers such as Petco and Pet Supplies Plus will enable us to jointly launch new products that are designed for in-store success, such as the national launch of Halo Elevate® in more than 2,000 Brick & Mortar locations in 2022.

In addition to our domestic sales channels, the Halo brand'sbrand’s international sales grew 71%declined (37)% in 2021, driven2023, resulting primarily by significant new customer acquisition and increased brand awarenessin an effort to normalize inventory levels in our key Asian markets. We believe that our growth in Asia is fueled bymarkets as well as macroeconomic factors impacting consumer behavior. With increasing levels of economic financial status in the Asian markets and demand for premium and super-premium, western manufactured products, with China representing the largest market opportunity for growth and 62%80% of Better Choice’s $14.8$13.7 million of international sales in 2021. We believe this growth is sustainable and we have more than $85.0 million of contracted minimum sales with our key Asian distribution partners from 2022 to 2025.

Supply Chain, Manufacturing and Logistics

Halo partners with a number of co-manufacturing partners to produce its products. Products sold today under the Halo Holistic brand are made strictly from naturally raised animals on sustainable farms and are manufactured in the U.S and use healthy, natural ingredients, with all purchases transacted in U.S. dollars. By sourcing cage-free poultry, pasture-raised beef, and wild-caught fish from certified sustainable fisheries and not including meat meals or other animal byproducts in its formulations, our Halo brand is able to provide pets and pet parents with a nutritious and highly digestible suite of food and treats. Halo partners with a number of co-manufacturing partners to produce its products. Halo’s dog and cat foods meet The Association of American Feed Control Officials (“AAFCO”) guidelines and are small-batch tested for common contaminants prior to leaving the manufacturer.

We utilize logistics service providers as a part of our supply chain, primarily for shipping and logistics support. Fulfillment of orders for both the Halo and TruDog brands is managed by a third-party warehousing and logistics partner, Fidelitone. Our warehouse was located in Lebanon, Tennessee throughout 2021 and relocated to Wauconda, Illinois in 2022. Our DTC ecosystem allows us to efficiently manage and customize the online shopping experience for customers, including a customer dashboard where shoppers can manage and track orders and order history. Our products are shipped by trusted carriers for expeditious and reliable delivery.

Raw Materials and Principal Suppliers

We rely upon the supply of raw materials that meet our high-quality specifications such as USA farm-raised beef,and sourcing requirements. We source Global Animal Partnership Certified Step 2 ("GAP 2"(“GAP”) cage-free whole chicken and associated broths, GAP 2 certified cage-free wholechicken, GAP certified cage-free turkey, and associated broths, Marine Stewardship Council ("MSC"(“MSC”) certified wild-caught salmon and MSC certified wild-caught whitefish and associated broths, and select non-GMO fruits and vegetables, such as peas, sweet potatoes and lentils. If any raw material is adulterated and does not meet our specifications, it could significantly impact our ability to source manufactured products and could materially and adversely impact our business, financial condition and results of operations.

For the supply and co-manufacturing of our products, we have relied onon: Alphia, Inc. (“Alphia” f/k/a “C.J. Foods”) for dry kibble sold under the Halo brand,which transitioned to Barrett Petfood Innovations during 2022, then back to Alphia during 2023; Simmons Pet Food, Inc. (“Simmons”) and Thai Union Manufacturing Co., LTD. for the majority of canned wet food sold under the Halo brand,food; BrightPet Nutrition Group, LLC (“BrightPet”) for vegan kibble and freeze dried treats sold under the Halo brand andtreats; Carnivore Meat Company, LLC (“Carnivore”) for the supply and co-manufacturing of freeze-dried food and treats sold under the TruDog brand. Together, Alphia, Simmons, and Carnivore represent approximately 74% of product volume sold across the Better Choice platform. In addition, wetreats. We sourced approximately 65%64% of inventory purchases from two vendors for the year ended December 31, 20212023 and approximately 76%69% from three vendors for the year ended December 31, 2020. With the launch of Halo Elevate®, we have expanded our co-manufacturing partners in 2022 to include Barrett Petfood Innovations and Thai Union Manufacturing Co., LTD.2022.

| 5 |

Sales and Marketing

Our marketing strategies are designed to clearly communicate to consumers about the benefits of our products and to build awareness of our brands. We deploy a broad set of marketing tools across various forms of media to reach consumers through multiple touch points and engage with a number of marketing agencies to develop content and product packaging. Our marketing initiatives include the use of social and digital marketing, Search Engine Optimization, email and SMS marketing, and paid media (Facebook, Instagram & YouTube), among other proven strategies to generate and convert sales prospects into loyal, satisfied customers. In addition to directly targeting and educating consumers of our products, we partner with a number of retailers such as Amazon, Chewy and Petco to develop joint sales and marketing initiatives to increase sales and acquire new customers.

In recent years, consumer purchasing behaviors have shifted dramatically and E-Commerce penetration has significantly increased. Although approximately 53%In the fourth quarter of Better Choice’s sales are made online today, we remain committed to partnering with select2023, management shifted from a Brick & Mortar retailerschannel focus to a digital first strategy as a result of its annual operating plan process and has strategically reallocated marketing investments to work more effectively and efficiently in pet specialty and neighborhood pet, as in-store recommendation and trial represent a significant opportunity for new customer acquisition. We believe that these in-store partnerships are complementary to the incentives that our E-Commerce partners offerits larger e-commerce platforms to drive monthly subscriptions,growth and build upon the recurring revenue that we generate online.

Competition

The pet health and wellness industry is highly competitive. Competitive factors include product quality, ingredients, brand awareness and loyalty, product variety, product packaging and design, reputation, price, advertising, promotion, and nutritional claims. We believe that we compete effectively with respect to each of these factors. We compete with manufacturers of conventional pet food such as Mars, Nestlé and Big Heart Pet Brands (part of the J.M. Smucker Company), and manufacturers of specialty and natural pet food such as Blue Buffalo (part of General Mills), Wellness, Fromm, Orijen, Merrick (part of Nestlé), Stella and Chewy, Open Farm and Freshpet. In addition, we compete with many regional niche brands in individual geographic markets.

Employees and Human Capital Resources

As of December 31, 2021,2023, we had 4331 full time employees all of whom are full-time.and one part time employee. Our human capital resource objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and additional employees. The principal purposes of our equity incentive plans are to attract, retain and motivate selected employees, consultants and directors through the granting of stock-based compensation awards. Our employees are not represented by any labor union or any collective bargaining arrangement with respect to their employment with us. We have never experienced any work stoppages or strikes as a result of labor disputes and we believe our overall relationships with our employees are positive and the strength of our team is a critical success factor in becoming the most innovative premium pet food company in the world. Our employees share an entrepreneurial spirit, a passion for excellence and the inspiration to drive the future of the pet health and wellness industry.

Our core values are Integrity, Respect, Working Smarter and Faster and Building Lasting Relationships in all that we do. We continually focus on employee engagement and a diverse, inclusive culture in order to ensure the continued strength and well-being of our workforce. We strive to create a workplace where employees feel engaged, believe in our mission, understand their role in our strategy and are passionate about the work they do. We conduct employee engagement surveys to provide us with valuable insights into employee perspectives and experiences. We also hold frequent virtual town-hall meetings and team building events to provide updates, celebrate milestones in the business, communicate initiatives, recognize significant individual accomplishments and provide a forum for employees to communicate and engage with our entire employee base. We value and embrace diversity by fostering a culture that encompasses the unique attributes, ideas, perspectives, and experiences of our employees, customers, suppliers and communities. We believe a more inclusive and diverse work environment allows us to achieve better results and makes us a stronger business.

We operate under a “Win From Anywhere” culture, which is our approach to creating a flexible and entrepreneurial working environment built for long term success. Winning from anywhere means our employees can work from anywhere in the country. We believe this culture provides the ability for us to attract the best talent and we now have employees all over the U.S. that are winning from anywhere.

Government Regulation

The regulation of animal food products is complex, multi-faceted, and continually changing. The U.S. Food and Drug Administration ("FDA"(“FDA”), the U.S. Federal Trade Commission ("FTC"(“FTC”), the U.S. Department of Agriculture ("USDA"(“USDA”) and other regulatory authorities at the federal, state and local levels, as well as authorities in foreign countries, extensively regulate, among other things, the research, development, testing, composition, manufacture, import, export, labeling, storage, distribution, promotion, marketing, and post-market reporting of animal foods. We are required to navigate a complex regulatory framework in the locations in which we wish to manufacture, test, import, export, or sell our products.

| 6 |

FDA Regulation of Animal Foods

The FDA regulates foods, including foods intended for animals, under the Federal Food, Drug and Cosmetic Act ("FDCA"(“FDCA”) and its implementing regulations. The FDCA defines “food” as articles used for food or drink for man or other animals, which includes products that are intended primarily for nutritional use, taste, or aroma and the components of such products. For animal foods in particular, this definition applies based on their intended use regardless of labelling as animal food, treats, or supplements. The FDA also imposes certain requirements on animal foods relating to their composition, manufacturing, labeling, and marketing. Among other things, the facilities in which our products and ingredients are manufactured must register with the FDA, comply with current good manufacturing practices (“cGMPs”) and comply with a range of food safety requirements.

Although pet foods are not required to obtain premarket approval from the FDA, any substance that is added to or is expected to become a component of a pet food must be used in accordance with a food additive regulation, unless it is generally recognized as safe (“GRAS”) under the conditions of its intended use or if it appears on an FDA-recognized list of acceptable animal food ingredients in the Official Publication of AAFCO. A food may be adulterated if it uses an ingredient that is neither GRAS nor an approved food additive, and that food may not be legally marketed in the U.S.

The labeling of pet foods is regulated by both the FDA and state regulatory authorities. FDA regulations require proper identification of the product, a net quantity statement, a statement of the name and place of business of the manufacturer or distributor and proper listing of all the ingredients in order of predominance by weight. The FDA also considers certain specific claims on pet food labels to be medical claims and therefore subject to prior review and approval by the FDA. The FDA has a list of specific factors it will consider in determining whether to initiate enforcement action against such products if they do not comply with the regulatory requirements applicable to drugs, including, among other things, whether the product is only made available through or under the direction of a veterinarian and does not present a known safety risk when used as labeled. The FDA may classify some of our products differently than we do and may impose more stringent regulations which could lead to possible enforcement action.

Under the FDCA, the FDA may require the recall of an animal food product if there is a reasonable probability that the product is adulterated or misbranded, and the use of or exposure to the product will cause serious adverse health consequences or death. In addition, pet food manufacturers may voluntarily recall or withdraw their products from the market. If the FDA believes that our products are adulterated, misbranded or otherwise marketed in violation of the FDCA, the agency make take further enforcement action, including: restrictions on the marketing or manufacturing of a product; required modification of promotional materials or issuance of corrective marketing information; issuance of safety alerts, press releases, or other communications containing warnings or other safety information about a product; warning or untitled letters; product seizure or detention; refusal to permit the import or export of products; fines, injunctions, or consent decrees; and/or imposition of civil or criminal penalties.

Chinese Regulations

General Administration of Quality Supervision, Inspection and Quarantine of the People’s Republic of China ("AQSIQ"(“AQSIQ”) is responsible for the unified inspection and quarantine of imported pet food (also referred to in the regulations as “Feed”). Only registered pet food manufacturers from AQSIQ approved countries (which includes the U.S.) can import pet food to China, and may do so only if they have first received an import registration certificate from the Ministry of Agriculture ("MOA"(“MOA”). In order to obtain an import registration certificate, a manufacturer must submit standardized application materials (in both English and Chinese) along with product samples to the MOA for approval, and if approved, such import registration certificate shall be valid for five years. Overseas companies are also prohibited from engaging in the direct sale of imported pet food within the territory of China and should establish a sales organization or appoint a sales agent within the territory of China and file a record with the MOA within six months from the date the manufacturer obtains its import registration certificate. All imported pet food must be packaged, and the packaging must comply with China'sChina’s safety and hygiene regulation and must have Chinese labels that are in conformity with the relevant regulations.

We are also subject to labor and employment laws, laws governing advertising, privacy laws, safety regulations and other laws, including consumer protection regulations that regulate retailers or govern the promotion and sale of merchandise. Our operations, and those of our distributors and suppliers, are subject to various laws and regulations relating to environmental protection and worker health and safety matters. We monitor changes in these laws and believe that we are in material compliance with applicable laws. See additional information under the heading “Risks Related to the Regulation of our Business and Products” in this Annual Report on Form 10-K for a discussion of risks relating to federal, state, local and international regulation of our business.

| 7 |

Our Trademarks and Other Intellectual Property

We believe that our intellectual property has substantial value and has contributed significantly to the success of our business. Our trademarks are valuable assets that reinforce our brand, our sub-brands and our consumers’ perception of our products. The current registrations of these trademarks in the U.S. and foreign countries are effective for varying periods of time and may be renewed periodically, provided that we, as the registered owner, or our licensees where applicable, comply with all applicable renewal requirements including, where necessary, the continued use of the trademarks in connection with the goods or services identified in the applicable registrations. In addition to trademark protection, we have registered more than 100 domain names, including www.betterchoicecompany.com, www.halopets.com, www.trupet.com, www.trudog.com and www.rawgo.com, that are important to the successful implementation of our marketing and advertising strategy. We rely on and carefully protect unpatented proprietary expertise, recipes and formulations, continuing innovation and other trade secrets to develop and maintain our competitive position.

Corporate Information

We were incorporated in the State of Nevada in 2001 under the name Cayenne Construction, Inc., and in 2009, changed our name to Sports Endurance, Inc. Effective March 11, 2019, we changed our name to Better Choice Company Inc. after reincorporating in Delaware. We have fourthree subsidiaries - Halo, Purely for Pets, Inc., TruPet LLC, Bona Vida, Inc. and Wamore Corporation S.A. Our principal executive offices are located at 12400 Race Track Road, Tampa, FL 33626. Our website is available at https://www.betterchoicecompany.com. Our website and the information contained on or connected to that site are not, and should not be deemed to be part of or incorporated into this Annual Report on Form 10-K.

Available Information

We file annual, quarterly and current reports and other information with the SEC that are publicly available at www.sec.gov. Our SEC filings are also available under the Investor Relations section of our website at www.betterchoicecompany.com as soon as reasonably practicable after they are filed with or furnished to the SEC. Information contained on or connected to our website are not incorporated into this Annual Report on Form 10-K.

ITEM 1A.RISK FACTORS

As a smaller reporting company, we are not required to provide a statement of risk factors. Nonetheless, we are voluntarily providing risk factors herein. You should consider carefully the following risk factors, together with all the other information in this Annual Report on Form 10‑K,10-K, and in our other public filings with the SEC. The occurrence of any of the following risks could harm our business, financial condition, results of operations and/or growth prospects or cause our actual results to differ materially from those contained in forward‑lookingforward-looking statements we have made in this report and those we may make from time to time. You should consider all of the risk factors described when evaluating our business.

Risks Related to Our Business and Industry

Increases in sourcing, manufacturing, freight and/or warehousing costs, supply shortages, interruption in our sourcing operations and/or supply changes could have an adverse effect on our business, financial condition, and operating results.

Our products are sourced from a limited number of independent third-party suppliers, which we depend upon for the manufacture of all our products. Some of the ingredients, packaging materials, and other products we purchase may only be available from a single supplier or a limited group of suppliers. While alternate sources of supply are generally available, the supply and price are subject to market conditions and are influenced by other factors beyond our control, including the continued impact of COVID-19.control. We do not have long-term contracts with many of our suppliers, and therefore they could increase prices or cease doing business with us. As a result, we may be subject to price fluctuations or demand disruptions.

The prices of raw materials, packaging materials and freight are subject to fluctuations in price attributable to, among other things, global competition for resources, weather conditions, changes in supply and demand of raw materials, or other commodities, fuel prices and government-sponsored agricultural programs. Volatility in the prices of raw materials and other supplies we purchase could increase our cost of sales and reduce our profitability, and we have no guarantees that prices will not rise. Our ability to pass along higher costs through price increases to our customers is dependent upon competitive conditions and pricing methodologies employed in the various sales channels in which we compete, and we may not be successful in implementing price increases. In addition, any price increases we do implement may result in lower sales volumes. Customers and consumers may choose to shift purchases to lower-priced private label or other value offerings which may adversely affect our results of operations.

We cannot control all of the various factors that might affect our ability to ship orders of our products to customers in a timely manner or to meet our quality standards. Such factors include, among other things, natural disasters or adverse weather and climate conditions; political and financial instability; strikes; unforeseen public health crises, including pandemics and epidemics such as the COVID-19 pandemic; acts of war or terrorism and other catastrophic events, whether occurring in the U.S. or internationally (including, without limitation, the conflict in Ukraine). From time to time, a co-manufacturer may experience financial difficulties, bankruptcy or other business disruptions, which could disrupt our supply of products or require that we incur additional expense by providing financial accommodations to the co-manufacturer or taking other steps to seek to minimize or avoid supply disruption, such as establishing a new co-manufacturing arrangement with another provider. Further, we may be unable to locate an additional or alternate co-manufacturing arrangement in a timely manner or on commercially reasonable terms, if at all. Any delay, interruption or increased cost in the proprietary value-branded products that might occur for any reason could affect our ability to meet customer demand, adversely affect our net sales, increase our cost of sales and hurt our results of operations, which in turn may injure our reputation and customer relationships, thereby harming our business.

| 8 |

Our ability to meet increases in demand may be impacted by our reliance on our suppliers and we are subject to the risk of shortages and long lead times. We may not be able to develop alternate sources in a timely manner. Therefore, we may not be able to source sufficient product on terms that are acceptable to us, or at all, which may undermine our ability to fill our orders in a timely manner. The occurrence of any of the foregoing could increase our costs, disrupt our operations, or could have a materially adverse impact on our business, financial condition, results of operations or prospects.

If we fail to maintain and expand our brand, or the quality of our products that customers have come to expect, our business could suffer.

The continued development and maintenance of our brand and the quality of our products is critical to our success. We seek to maintain, extend, and expand our brand image through marketing investments, including advertising and consumer promotions, and product innovation. Maintaining, promoting and positioning our brand and reputation will depend on, among other factors, the success of preserving the quality of our products, the availability of our products, marketing and merchandising efforts, the nutritional benefits provided to pets and our ability to provide a consistent, high-quality customer experience.

The success of our brand may suffer if our marketing plans or product initiatives do not have the desired impact on our brand’s image or its ability to attract customers. Brand value is based on perceptions of subjective qualities, and any incident that erodes the loyalty of our customers, suppliers or co-manufacturers, including adverse publicity or a governmental investigation or litigation, could significantly reduce the value of our brand and significantly damage our business. Further, our brand value could diminish significantly due to a number of factors, including consumer perception that we have acted in an irresponsible manner, adverse publicity about our products (whether or not valid), our failure to maintain the quality of our products, product contamination, the failure of our products to deliver consistently positive consumer experiences, inadequate labor conditions, health or safety issues at our co-manufacturers, or the products becoming unavailable to consumers.

If we are unable to build and sustain brand equity by offering recognizably superior products, we may be unable to maintain premium pricing over private label products. The growing use of social and digital media by consumers increases the speed and extent that information and opinions can be shared. Negative posts or comments about us or our brands or products on social or digital media could damage our brands and reputation. If we fail to maintain the favorable perception of our brands, our business, financial condition and results of operations could be negatively impacted.

We may not be able to successfully implement and/or manage our growth strategy on a timely basis or we may not grow at all.

Our future success depends on our ability to implement our growth strategy of introducing new products and expanding into new markets and attracting new consumers to our brand and sub-brands. Our ability to implement this growth strategy depends, among other things, on our ability to: establish our brands and reputation as a well-managed enterprise committed to delivering premium quality products to the pet health and wellness industry; partner with retailers and other potential distributors of our products; continue to effectively compete in specialty channels and respond to competitive developments; continue to market and sell our products through a multi-channel distribution strategy and achieve joint growth targets with our distribution partners; expand and maintain brand loyalty; develop new proprietary value-branded products and product line extensions that appeal to consumers; maintain and, to the extent necessary, improve our high standards for product quality, safety and integrity; maintain sources from suppliers that comply with all federal, state and local laws for the required supply of quality ingredients to meet our growing demand; identify and successfully enter and market our products in new geographic markets and market segments; execute value-focused pricing strategies; and attract, integrate, retain and motivate qualified personnel. We may not be able to successfully implement our growth strategy and may need to change our strategy in order to maintain our growth. If we fail to implement our growth strategy or if we invest resources in a growth strategy that ultimately proves unsuccessful, our business, financial condition and results of operations may be materially adversely affected.

If we succeed in growing our business, such growth could strain our management team and capital resources. Our ability to manage operations and control growth will be dependent on our ability to raise and spend capital to successfully attract, train, motivate, retain and manage new members of senior management and other key personnel and continue to update and improve our management and operational systems, infrastructure and other resources, financial and management controls, and reporting systems and procedures. Failure to manage our growth effectively could cause us to misallocate management or financial resources, and result in additional expenditures and inefficient use of existing human and capital resources. Such slower than expected growth may require us to restrict or cease our operations and go out of business. Additionally, our anticipated growth will increase the demands placed on our suppliers, resulting in an increased need for us to manage our suppliers and monitor for quality assurance and comply with all applicable laws. Any failure by us to manage our growth effectively could impair our ability to achieve our business objectives.

| 9 |

Our recurring losses have aand significant accumulated deficit and we expect to incur losses in the future; we may not be able to achieve or maintain profitability which could raisehave raised substantial doubt regarding our ability to continue as a going concern.

We have experienced recurring operating losses, during last three years and have a significant accumulated deficit.deficit and are required to maintain certain thresholds to comply with the financial covenants associated with the Alphia Term Loan, including minimum liquidity, minimum EBITDA, and maximum marketing spend ratio. We expect to continue to generate operating losses and consume significant cash resources forin the foreseeable future. Because we have a short operating history at scale, it is difficult for us to predict our future operating results. Thus, our losses may be larger than anticipated, and we may not achieve profitability when expected, or at all.

If our amortizable intangible assets become impaired, then we could havebe required to record a material adverse impact on our business, resultssignificant charge to earnings.

We evaluate intangible assets for impairment at least annually. We monitor the existence of operationspotential impairment indicators throughout the year and financial condition.

If we do not successfully develop additional products and services, or if such products and services are developed but not successfully commercialized, our business will be adversely affected.

Our success will depend, in part, on our ability to develop and market new products and improvements to our existing products. The process of identifying and commercializing new products is complex, uncertain and may involve considerable costs, and if we fail to accurately predict customers'customers’ changing needs and preferences, our business could be harmed. The success of our innovation and product development efforts is affected by, among other things, the technical capability of our team; our ability to establish new supplier relationships and third-party consultants in developing and testing new products, and complying with governmental regulations; our attractiveness as a partner for outside research and development scientists and entrepreneurs; and the success of our management and sales team in introducing and marketing new products.

We have already and may have to continue to commit significant resources to commercializing new products before knowing whether our investments will result in products the market will accept. Substantial promotional expenditures may be required to introduce new products to the market, or improve our market position. To remain competitive and expand and keep shelf placement for our products, we may need to increase our advertising spending to maintain and increase consumer awareness, protect and grow our existing market share or promote new products, which could affect our operating results. We may not always be able to respond quickly and effectively to changes in customer taste and demand due to the amount of time and financial resources that may be required to bring new products to market, which could result in our competitors taking advantage of changes in customer trends before we are able to and harm our brand and reputation.

| 10 |

Furthermore, developing and commercializing new products may divert management'smanagement’s attention from other aspects of our business and place a strain on management, operational and financial resources, as well as our information systems. We may not execute successfully on commercializing those products because of errors in product planning or timing, technical hurdles that we fail to overcome in a timely fashion, or a lack of appropriate resources. Launching new products or updating existing products may also leave us with obsolete inventory that we may not be able to sell or we may sell at significantly discounted prices. If we are unable to successfully develop or otherwise acquire new products, our business, financial condition and results of operations may be materially adversely affected.

Because we are engaged in a highly competitive business, if we are unable to compete effectively, our results of operations could be adversely affected.

The pet health and wellness industry is highly competitive. We compete on the basis of product and ingredient quality, product availability, palatability, brand awareness, loyalty and trust, product variety and innovation, product packaging and design, reputation, price and convenience and promotional efforts. The pet products and services retail industry has become increasingly competitive due to the expansion of pet-related product offerings by certain supermarkets, warehouse clubs, and other mass and general retail and online merchandisers and the entrance of other specialty retailers into the pet food and pet supply market, which makes it more difficult for us to compete for brand recognition and differentiation of our products and services. We face direct competition from companies that sell various pet health and wellness products at a lower price point and distribute such products to traditional retailers, which are larger than we are and have greater financial resources. Price gaps between products may result in market share erosion and harm our business. Our current and potential competitors may also establish cooperative or strategic relationships amongst themselves or with third parties that may further enhance their resources and offerings. Further, it is possible that domestic or foreign companies, some with greater experience in the pet health and wellness industry or greater financial resources than we possess, will seek to provide products or services that compete directly or indirectly with ours in the future.

Many of our competitors may have longer operating histories, greater brand recognition, larger fulfillment infrastructures, greater technical capabilities, significantly greater financial, marketing and other resources and larger customer bases than we do. These factors may allow our competitors to derive greater net sales and profits from their existing customer base, acquire customers at lower costs or respond more quickly than we can to new or emerging technologies and changes in consumer preferences or habits. These competitors may engage in more extensive research and development efforts, undertake more far-reaching marketing campaigns and adopt more aggressive pricing policies, which may allow them to build larger customer bases or generate net sales from their customer bases more effectively than we do.

Our competitors may be able to identify and adapt to changes in consumer preferences more quickly than us due to their resources and scale. They may also be more successful in marketing and selling their products, better able to increase prices to reflect cost pressures and better able to increase their promotional activity, which may impact us and the entire pet health and wellness industry. Increased competition as to any of our products could result in price reduction, increased costs, reduced margins and loss of market share, which could negatively affect our profitability. While we believe we are better equipped to customize products for the pet health and wellness market generally as compared to other companies in the industry, there can be no assurance that we will be able to successfully compete against these other companies. Expansion into markets served by our competitors and entry of new competitors or expansion of existing competitors into our markets could materially adversely affect our business, financial condition and results of operations.

If we fail to attract new customers, or retain existing customers, or fail to do either in a cost-effective manner, we may not be able to increase sales.

We are highly dependent on the effectiveness of our marketing messages and the efficiency of our advertising expenditures in generating consumer awareness and sales of our products. We may not always be successful in developing effective messages and new marketing channels, as consumer preferences and competition change, and in achieving efficiency in our advertising expenditures. We depend heavily on internet-based advertising to market our products through internet-based media and e-commerce platforms. If we are unable to continue utilizing such platforms, if those media and platforms diminish in importance or size, or if we are unable to direct our advertising to our target consumer groups, our advertising efforts may be ineffective, and our business could be adversely affected. The costs of advertising through these platforms have increased significantly, which could in decreaseddecrease efficiency in the use of our advertising expenditures, and we expect these costs may continue to increase in the future.

| 11 |

Consumers are increasingly using digital tools as a part of their shopping experience. As a result, our future growth and profitability will depend in part on:

•

| ● | the effectiveness and efficiency of our online experience for disparate worldwide audiences, including advertising and search optimization programs in generating consumer awareness and sales of our products; |

the effectiveness and efficiency of our online experience for disparate worldwide audiences, including advertising and search optimization programs in generating consumer awareness and sales of our products;

| ● | our ability to prevent confusion among consumers that can result from search engines that allow competitors to use or bid on our trademarks to direct consumers to competitors’ websites; |

•

| ● | our ability to prevent Internet publication or television broadcast of false or misleading information regarding our products or our competitors’ products; |

our ability to prevent confusion among consumers that can result from search engines that allow competitors to use or bid on our trademarks to direct consumers to competitors’ websites;

| ● | the nature and tone of consumer sentiment published on various social media sites; and |

| ● | the stability of our website and other e-commerce platforms we sell our products on. In recent years, a number of DTC, Internet-based retailers have emerged and have driven up the cost of basic search terms, which has and may continue to increase the cost of our Internet-based marketing programs. |

•

our ability to prevent Internet publication or television broadcast of false or misleading information regarding our products or our competitors’ products;

Food safety and food-borne illness incidents may materially adversely affect our business by exposing us to lawsuits, product recalls or regulatory enforcement actions, increasing our operating costs and reducing demand for our product offerings.

Selling food for consumption involves inherent legal and other risks, and there is increasing governmental scrutiny of and public awareness regarding food safety. Unexpected side effects, illness, injury or death related to allergens, food-borne illnesses or other food safety incidents caused by products we sell, or involving our suppliers or co-manufacturers, could result in the discontinuance of sales of these products or our relationships with such suppliers or co-manufacturers, or otherwise result in increased operating costs, regulatory enforcement actions or harm to our reputation. Shipment of adulterated or misbranded products, even if inadvertent, can result in criminal or civil liability. Such incidents could also expose us to product liability, negligence or other lawsuits, including consumer class action lawsuits. Any claims brought against us may exceed or be outside the scope of our existing or future insurance policy coverage or limits. Any judgment against us that is more than our policy limits or not covered by our policies or not subject to insurance would have to be paid from our cash reserves, which would reduce our capital resources.

The occurrence of food-borne illnesses or other food safety incidents could also adversely affect the price and availability of affected ingredients, resulting in higher costs, disruptions in supply and a reduction in our sales. Furthermore, any instances of food contamination or regulatory noncompliance, whether or not caused by our actions, could compel us, our suppliers, our distributors or our customers, depending on the circumstances, to conduct a recall in accordance with FDA regulations, comparable state laws or foreign laws in jurisdictions in which we operate. Food recalls could result in significant losses due to their costs, the destruction of product inventory, lost sales due to the unavailability of the product for a period of time and potential loss of existing distributors or customers and a potential negative impact on our ability to attract new customers due to negative consumer experiences or because of an adverse impact on our brand and reputation. The costs of a recall could exceed or be outside the scope of our existing or future insurance policy coverage or limits.

In addition, food companies have been subject to targeted, large-scale tampering as well as to opportunistic, individual product tampering, and we, like any food company, could be a target for product tampering. Forms of tampering could include the introduction of foreign material, chemical contaminants and pathological organisms into consumer products as well as product substitution. FDA regulations require companies like us to analyze, prepare and implement mitigation strategies specifically to address tampering (i.e., intentional adulteration) designed to inflict widespread public health harm. If we do not adequately address the possibility, or any actual instance, of intentional adulteration, we could face possible seizure or recall of our products and the imposition of civil or criminal sanctions, which could materially adversely affect our business, financial condition and operating results.

We may not be able to manage our manufacturing and supply chain effectively, which may adversely affect our results of operations.

We must accurately forecast demand for all of our products in order to ensure that we have enough products available to meet the needs of our customers. Our forecasts are based on multiple assumptions that may cause our estimates to be inaccurate and affect our ability to obtain adequate co-manufacturing capacity in order to meet the demand for our products. If we do not accurately align our manufacturing capabilities with demand, our business, financial condition and results of operations may be materially adversely affected.

In addition, we must continuously monitor our inventory and product mix against forecasted demand. If we underestimate demand, we risk having inadequate supplies. We also face the risk of having too much inventory on hand that may reach its expiration date and become unsalable, and we may be forced to rely on markdowns or promotional sales to dispose of excess or slow-moving inventory. If we are unable to manage our supply chain effectively, our operating costs could increase and our profit margins could decrease.

| 12 |

If any of our independent shipping providers experience delays or disruptions, our business could be adversely affected.

We rely on independent shipping service providers to ship raw materials and products from our third-party suppliers and to ship products from our manufacturing and distribution warehouses to our customers. Our utilization of any shipping companies that we may elect to use, is subject to risks, including increases in fuel prices, employee strikes, organized labor activities and inclement weather, which may impact the shipping company'scompany’s ability to provide delivery services sufficient to meet our shipping needs. If we are not able to negotiate acceptable terms with these companies or they experience performance problems or other difficulties, it could negatively impact our operating results and customer experience.

Our intellectual property rights may be inadequate to protect our business.

We attempt to protect our intellectual property rights, both in the U.S. and in foreign countries, through a combination of patent, trademark, copyright and trade secret laws, as well as licensing agreements and third-party nondisclosure and assignment agreements. Because of the differences in foreign trademark, patent and other laws concerning proprietary rights, our intellectual property rights may not receive the same degree of protection in foreign countries as they would in the U.S. Our failure to obtain or maintain adequate protection of our intellectual property rights for any reason could have a material adverse effect on our business, results of operations and financial condition.

We also rely on unpatented proprietary technology. It is possible that others will independently develop the same or similar technology or otherwise obtain access to our unpatented technology. To protect our trade secrets and other proprietary information, we require employees, consultants, advisors and collaborators to enter into confidentiality agreements. We cannot assure you that these agreements will provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. If we are unable to maintain the proprietary nature of our technologies, we could be materially adversely affected.

We rely on our trademarks, trade names, and brand names to distinguish our products from the products of our competitors, and have registered or applied to register many of these trademarks. We cannot assure you that our trademark applications will be approved. Third parties may also oppose our trademark applications, or otherwise challenge our use of the trademarks. In the event that our trademarks are successfully challenged, we could be forced to rebrand our products, which could result in loss of brand recognition, and could require us to devote significant additional resources to advertising and marketing new brands. Further, we cannot assure you that competitors will not infringe our trademarks, or that we will have adequate resources to enforce our trademarks.

We depend on the knowledge and skills of our senior management and other key employees, and if we are unable to retain and motivate them or recruit additional qualified personnel, our business may suffer.

We have benefited substantially from the leadership and performance of our senior management, as well as other key employees. Our success will depend on our ability to retain our current management and key employees, and to attract and retain qualified personnel in the future, and we cannot guarantee that we will be able to retain our personnel or attract new, qualified personnel. In addition, we do not maintain any “key person” life insurance policies. The loss of the services of members of our senior management or key employees could prevent or delay the implementation and completion of our strategic objectives, or divert management’s attention to seeking qualified replacements.

A failure of one or more key information technology systems, networks or processes may materially adversely affect our ability to conduct our business.

The efficient operation of our business depends on our information technology systems. We rely on our information technology systems to effectively manage our sales and marketing, accounting and financial and legal and compliance functions, engineering and product development tasks, research and development data, communications, supply chain, order entry and fulfillment and other business processes. We also rely on third parties and virtualized infrastructure to operate and support our information technology systems. The failure of our information technology systems, or those of our third-party service providers, to perform as we anticipate could disrupt our business and could result in transaction errors, processing inefficiencies and the loss of sales and customers, causing our business and results of operations to suffer.

In addition, our information technology systems may be vulnerable to damage or interruption from circumstances beyond our control, including fire, natural disasters, power outages, systems failures, security breaches, cyber-attacks and computer viruses. The failure of our information technology systems to perform as a result of any of these factors or our failure to effectively restore our systems or implement new systems could disrupt our entire operation and could result in decreased sales, increased overhead costs, excess inventory and product shortages and a loss of important information.

| 13 |

We rely heavily on third-party commerce platforms to conduct our businesses. If one of those platforms is compromised, our business, financial condition and results of operations could be harmed.

We currently rely upon third-party commerce platforms, including Shopify. We also rely on e-mail service providers, bandwidth providers, Internet service providers and mobile networks to deliver e-mail and “push” communications to customers and to allow customers to access our website. Any damage to, or failure of, our systems or the systems of our third-party commerce platform providers could result in interruptions to the availability or functionality of our website and mobile applications. As a result, we could lose customer data and miss order fulfillment deadlines, which could result in decreased sales, increased overhead costs, excess inventory and product shortages.

In the future, the loss of access to these third-party platforms, or any significant cost increases from operating on the marketplaces, could significantly reduce our revenues, and the success of our business depends partly on continued access to these third-party platforms. Our relationships with our third-party commerce platform providers could deteriorate as a result of a variety of factors, such as if they become concerned about our ability to deliver quality products on a timely basis or to protect a third-party’s intellectual property. In addition, third-party marketplace providers could prohibit our access to these marketplaces if we are not able to meet the applicable required terms of use. If for any reason our arrangements with our third-party commerce platform providers are terminated or interrupted, such termination or interruption could adversely affect our business, financial condition, and results of operations.

In addition, we exercise little control over these providers, which increases our vulnerability to problems with the services they provide. We could experience additional expense in arranging for new facilities, technology, services and support. The failure of our third-party commerce platform providers to meet our capacity requirements could result in interruption in the availability or functionality of our website and mobile applications, which could adversely affect our business and results of operations.

We may face difficulties as we expand our business and operations into jurisdictions in which we have no prior operating experience.

We plan in the future to expand our operations and business into jurisdictions outside of the jurisdictions where we currently carry on business, including internationally. There can be no assurance that any market for our products will develop in any such foreign jurisdiction. We may face new or unexpected risks or significantly increase our exposure to one or more existing risk factors, including economic instability, new competition, changes in laws and regulations, including the possibility that we could be in violation of these laws and regulations as a result of such changes, and the effects of competition.

In addition, it may be difficult for us to understand and accurately predict taste preferences and purchasing habits of consumers in new markets. It is costly to establish, develop and maintain operations and develop and promote our brands in new jurisdictions. As we expand our business into other jurisdictions, we may encounter regulatory, legal, personnel, technological and other difficulties that increase our expenses and/or delay our ability to become profitable in such countries, which may have a material adverse effect on our business and brand. These factors may limit our capability to successfully expand our operations in, or export our products to, those other jurisdictions.

There may be decreased spending on pets in a challenging economic climate.

A challenging economic climate, including adverse changes in interest rates, volatile commodity markets and inflation, contraction in the availability of credit in the market and reductions in consumer spending, or a slow-down in the general economy or a shift in consumer preferences to less expensive products may result in reduced demand for our products which may affect our profitability. Pet ownership and the purchase of pet-related products may constitute discretionary spending for some consumers and any material decline in consumer discretionary spending may reduce overall levels of spending on pets. As a result, a challenging economic climate may cause a decline in demand for our products which could be disproportionate as compared to competing pet food brands since our products command a price premium.

Since a significant portion of our revenue has been and is expected to be derived from China, a slowdown in economic growth in China could adversely impact the sales of our products in China, which could have a material adverse effect on our results of operations and financial condition. In addition, a deterioration in trade relations between the U.S. and China or other countries, or the negative perception of U.S. brands by Chinese or other international consumers, could have a material adverse effect on our results of operations and financial condition.

| 14 |

If economic conditions result in decreased spending on pets and have a negative impact on our suppliers or distributors, our business, financial condition and results of operations may be materially adversely affected.

Significant merchandise returns or refunds could harm our business.

We allow our customers to return products or obtain refunds, subject to our return and refunds policy. If merchandise returns or refunds are significant or higher than anticipated and forecasted, our business, financial condition, and results of operations could be adversely affected. Further, we modify our policies relating to returns or refunds from time to time, and may do so in the future, which may result in customer dissatisfaction and harm to our reputation or brand, or an increase in the number of product returns or the amount of refunds we make.

We may seek to grow our company and business through acquisitions, investments or through strategic alliances and our failure to identify and successfully integrate and manage these assets could have a material adverse effect on the anticipated benefits of the acquisition and our business, financial condition or results of operations.

We expect to consider opportunities to acquire or make investments in new or complementary businesses, facilities, technologies or products, or enter into strategic alliances, which may enhance our capabilities, expand our network, complement our current products or expand the breadth of our markets. In 2019, we completed three significant acquisitions that involved the combination of three businesses that historically have operated as independent companies. The success of these completed acquisitions and any future acquisitions will depend in large part on the success of our management team in integrating the operations, strategies, technologies and personnel. Potential and completed acquisitions, investments and other strategic alliances involve numerous risks, including: problems integrating the purchased business, facilities, technologies or products; issues maintaining uniform standards, procedures, controls and policies; assumed liabilities; unanticipated costs associated with acquisitions, investments or strategic alliances; diversion of management'smanagement’s attention from our existing business; adverse effects on existing business relationships with suppliers, manufacturers, and retail customers; risks associated with entering new markets in which we have limited or no experience; potential write-offs of acquired assets and/or an impairment of any goodwill recorded as a result of an acquisition; potential loss of key employees of acquired businesses; and increased legal and accounting compliance costs.

We may fail to realize some or all of the anticipated benefits of the acquisitions if the integration process takes longer than expected or is more costly than expected. Our failure to meet the challenges involved in successfully integrating acquisitions, including the operations of Halo, or TruPet, or to otherwise realize any of the anticipated benefits of the acquisitions could impair our financial condition and results of operations. Furthermore, we do not know if we will be able to identify additional acquisitions or strategic relationships we deem suitable or whether we will be able to successfully complete any such transactions on favorable terms or at all. Our ability to successfully grow through strategic transactions depends upon our ability to identify, negotiate, complete and integrate suitable target businesses, facilities, technologies and products and to obtain any necessary financing. These efforts could be expensive and time-consuming and may disrupt our ongoing business.

Premiums for our insurance coverage may not continue to be commercially justifiable, and our insurance coverage may have limitations and other exclusions and may not be sufficient to cover our potential liabilities.

We have insurance to protect our assets, operations and employees. While we believe our insurance coverage addresses all material risks to which we are exposed and is adequate and customary in our current state of operations, such insurance is subject to coverage limits and exclusions and may not be available for the risks and hazards to which we are exposed. No assurance can be given that such insurance will be adequate to cover our liabilities or will be generally available in the future or, if available, that premiums will be commercially justifiable. If we are unable to obtain such insurances or if we were to incur substantial liability and such damages were not covered by insurance or were in excess of policy limits, we may be prevented from entering into certain business sectors, our growth may be inhibited, and we may be exposed to additional risk and financial liabilities, which could have a material adverse effect on our business, results of operations and financial condition could be materially adversely affected.

Adverse litigation judgments or settlements resulting from legal proceedings relating to our business operations could materially adversely affect our business, financial condition and results of operations.

From time to time, we are subject to allegations, and may be party to legal claims and regulatory proceedings, relating to our business operations. Such allegations, claims and proceedings may be brought by third parties, including our customers, employees, governmental or regulatory bodies or competitors. Defending against such claims and proceedings, regardless of their merits or outcomes, is costly and time consuming and may divert management’s attention and personnel resources from our normal business operations, and the outcome of many of these claims and proceedings cannot be predicted. If any of these claims or proceedings were to be determined adversely to us, a judgment, a fine or a settlement involving a payment of a material sum of money were to occur, or injunctive relief were issued against us, our reputation could be affected and our business, financial condition and results of operations could be materially adversely affected.

| 15 |

Any claims of intellectual property infringement, even those without merit, could be expensive and time consuming to defend; could require us to cease selling the products that incorporate the challenged intellectual property; could require us to redesign, reengineer, or rebrand the product, if feasible; could divert management’s attention and resources; or could require us to enter into royalty or licensing agreements in order to obtain the right to use a third party’s intellectual property. Any royalty or licensing agreements, if required, may not be available to us on acceptable terms or at all.

A successful claim of infringement against us could result in our being required to pay significant damages, enter into costly license or royalty agreements, or stop the sale of certain products, any of which could have a negative impact on our business, financial condition, results of operations and our future prospects.

Failure to comply with the U.S. Foreign Corrupt Practices Act, other applicable anti-corruption and anti-bribery laws, and applicable trade control laws could subject us to penalties and other adverse consequences.

We operate our business in part outside of the U.S. and our operations are subject to the U.S. Foreign Corrupt Practices Act (the “FCPA”), as well as the anti-corruption and anti-bribery laws in the countries where we do business. In addition, we are subject to U.S. and other applicable trade control regulations that restrict with whom we may transact business, including the trade sanctions enforced by the U.S. Treasury, Office of Foreign Assets Control (“OFAC”). We also plan to expand our operations outside of the U.S. in the future and our risks related to the FCPA will increase as we grow our international presence. Any violations of these anti-corruption or trade controls laws, or even allegations of such violations, can lead to an investigation and/or enforcement action, which could disrupt our operations, involve significant management distraction, and lead to significant costs and expenses, including legal fees. In addition, our brand and reputation, our sales activities or our stock price could be adversely affected if we become the subject of any negative publicity related to actual or potential violations of anti-corruption, anti-bribery or trade control laws and regulations.

Our ability to utilize our net operating loss carryforwards may be limited.