UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20152017

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ___________

Commission File Number 000-54557

GLOBAL EQUITY INTERNATIONAL,ARGENTUM 47, INC.

(Exact name of registrant as specified in its charter)

GLOBAL EQUITY INTERNATIONAL, INC.

(Former name of registrant until March 29, 2018)

| Nevada | 27-3986073 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

X3Cluster X, Building 3, Jumeirah Bay Towers, Office 3305, Jumeirah Lake Towers,JLT, Dubai, UAEU.A.E.

(Address of principal executive offices)

Registrant’s telephone number, including area code:+971 (0) 42767576 / + 1 321 200 0142+1-(321) 200-0142

Securities registered pursuant to Section 12(b) of the Act:None

Securities registered pursuant to Section 12(g) of the Act:

Title of Each Class

Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that he registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Sec. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit or post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S- KS-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed second fiscal quarter (June 30, 2015)2017) was approximately $187,682.$2,271,998.

As of March 18, 2016,April 6, 2018, there were 776,165,973525,534,409 shares of our common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Annual Report”), in particular the Management’s Discussion and Analysis of Financial Condition and Results of Operations appearing in Item 7 herein (“MD&A”) contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give expectations or forecasts of future events. The reader can identify these forward-looking statements by the fact that they do not relate strictly to historical or current facts. They use words such as “believe(s),” “goal(s),” “target(s),” “estimate(s),” “anticipate(s),” “forecast(s),” “project(s),” plan(s),” “intend(s),” “expect(s),” “might,” may” and other words and terms of similar meaning in connection with a discussion of future operating,operations, financial performance or financial condition. Forward-looking statements, in particular, include statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends of operations and financial results.

Any or all forward-looking statements may turn out to be wrong, and, accordingly, readers are cautioned not to place undue reliance on such statements, which speak only as of the date of this Annual Report. These statements are based on current expectations and the current economic environment. They involve a number of risks and uncertainties that are difficult to predict. These statements are not guarantees of future performance; actualperformance. Actual results could differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining the Company’s actual results and financial condition. The reader should consider the following list of general factors that could affect the Company’s future results and financial condition.

Among the general factors that could cause actual results and financial condition to differ materially from estimated results and financial condition are:

| ● | the success or failure of management’s efforts to implement their business strategy; | |

| ● | the ability of the Company to raise sufficient capital to meet operating requirements; | |

| ● | the uncertainty of consumer demand for our products and services; | |

| ● | the ability of the Company to compete with major established companies; | |

| ● | heightened competition, including, with respect to pricing, entry of new competitors and the development of new products or services by new and existing competitors; | |

| ● | absolute and relative performance of our products | |

| ● | the effect of changing economic conditions; | |

| ● | the ability of the Company to attract and retain quality employees and management; | |

| ● | the current global recession and financial uncertainty; and | |

| ● | other risks which may be described in our future filings with the U.S. Securities and Exchange Commission (“SEC”). |

No assurances can be given that the results contemplated in any forward-looking statements will be achieved or will be achieved in any particular timetable. We assume no obligation to publicly correct or update any forward-looking statements as a result of events or developments subsequent to the date of this Annual Report. The reader is advised, however, to consult any further disclosures we make on related subjects in our filings with the SEC.

BUSINESS DEVELOPMENT

BACKGROUND

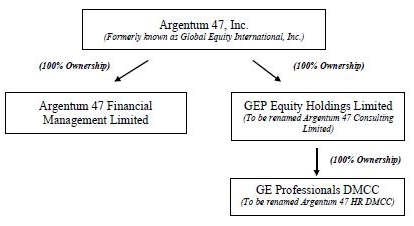

Argentum 47, Inc., formerly known as Global Equity International Inc. (“Company” or “GEI”“ARG”)), was incorporated on October 1, 2010, as a Nevada corporation, for the express purpose of acquiring Global Equity Partners Plc, a corporation formed under the laws of the Republic of Seychelles (“GEP”) on September 2, 2009. On August 22, 2014, GE Professionals DMCC was incorporated in Dubai as a fully ownedwholly-owned subsidiary of Global Equity Partners Plc. On June 10, 2016, ARG incorporated its wholly-owned subsidiary, called GEP Equity Holdings Limited, under the laws of the Republic of Seychelles.

On March 24, 2017, the Board of Directors of Global Equity Partners Plc. approved the assignment and transfer of GE Professionals DMMC to GEP Equity Holdings Limited.

On June 5, 2017, the Company sold 100% of the common stock of Global Equity Partners Plc. to a citizen of the Kingdom of Thailand. The consideration for the purchase of Global Equity Partners Plc. was the assumption by the purchaser of all liabilities and indebtedness of Global Equity Partners Plc.

On March, 29, 2018, the Secretary of State of Nevada approved the Company name change from Global Equity Partners PlcInternational, Inc. to Argentum 47, Inc.

GEP Equity Holdings Limited and its subsidiary, GE Professionals DMCC, are Dubai based firms that provide consulting services, such as corporate restructuring, advice on management buy outs, management recruitment and development for corporate marketing, investor and public relations, regulatory compliance and introductions to financiers, to companies desiring to be listed on stock exchanges in various parts of the world.

Our authorized capital consists of 1,000,000,000950,000,000 shares of common stock, $0.001 par value, and 50,000,000 shares of preferred stock, $0.001 par value.

On November 15, 2010, As of December 31, 2017, we entered into a Plan and Agreementhad 525,534,409 shares of Reorganization (“Plan of Reorganization”) with GEP and its sole shareholder, Peter J. Smith, pursuant to which we would acquire 100% of the common stock issued and outstanding. We also have two series of GEP. We consummated the Planpreferred stock designated and authorized: Series “B” Preferred Stock and Series “C” Preferred Stock. As of Reorganization effective December 31, 2010, by issuing 20,000,0002017, we had 45,000,000 shares of our common stock to Peter J. Smith, atSeries “B” Preferred Stock authorized, issued and outstanding. As of December 31, 2017, we had designated and authorized 5,000,000 shares of Series “C” Preferred Stock, 2,400,000 shares of which time GEP became our wholly owned subsidiarywere issued and Peter J. Smith was appointed as our President, Chief Executive Officeroutstanding. We do not have any Series “A” Preferred Stock authorized, issued or outstanding. We have 2,600,000 shares of Series “C” Preferred Stock designated and Director.authorized, which could be issued in the future.

As a result of January 12, 2018, in accordance with two funding agreements, our acquisitionmanagement agreed to lock-up all outstanding shares of GEP, weSeries “B” and “C” Preferred Stock, so that those shares may not be sold or converted into common stock prior to September 27, 2020.

We provide corporate advisory services to companies desiring to have their shares listed on stock exchanges or quoted on quotation bureaus in various parts of the world. We have offices in Dubai and London. We have affiliations with firms located in some of the world’s leading financial centers such as London, New York, Frankfurt and Dubai. These affiliations are informal and are comprised of personal relationships with groups of people or people and institutions with whom our Company or our management has done, or attempted to do, business in the past. We do not have any contractual arrangements, written or otherwise, with our affiliations.

Argentum 47 Financial Management Limited is a United Kingdom based holding company that will acquire various financial advisory firms with funds under management around the world. These financial advisory firms act as intermediaries between their clients and the insurance companies. In effect, the advisory firms sell insurance policies to their clients. These types of financial advisory firms receive recurring and non-recurring trail fees for each insurance policy that is sold.

GEP Equity Holdings Limited and its Dubai subsidiary, GE Professionals DMCC, look for companies that require capital funding for growth and acquisition, and ultimately a listing of their shares on a recognized stock exchange or quotation on the OTC Markets. The Company introduces these clients to private and institutional investors in our network of over 100 “financial introducers” around the world. These financial introducers are groups of people or institutions that are presently introducing new clients to us or who have introduced new clients to our management in the past. We do not have any contractual arrangements, written or otherwise, with these financial introducers.

Presently, GEP Equity Holdings Limited, its Dubai subsidiary, GE Professionals DMCC, and Argentum 47 Financial Management Limited are our only operating businesses. ARG´s present operations are limited to ensuring compliance with regional, state and national securities regulatory agencies and organizations. In addition, ARG, as the parent company, is charged with (i) handling our periodic reporting obligations under the Securities Exchange Act of 1934; (ii) managing our investor relations; and (iii) raising debt and equity capital necessary to fund our operations, and to enhance and grow our business. ARG does not offer or conduct any consulting or advisory services, as such services are performed solely by GEP Equity Holdings Limited and GE Professionals DMCC. As stated above, Argentum 47 Financial Management Limited will serve as a holding company for the financial advisory firms to be acquired.

We currently offer the following services to our clients:

| ● | General business consulting | |

| ● | Corporate restructuring | |

| ● | Exchange listings | |

| ● | Management recruitment | |

| ● | Investor relations | |

| ● | Regulatory compliance |

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a Company with less than $1 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (also known as the “JOBS Act”). As an emerging growth company, we are entitled to take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| ● | Only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; | |

| ● | Reduced disclosure about our executive compensation arrangements; | |

| ● | Not having to obtain non-binding advisory votes on executive compensation or golden parachute arrangements; and | |

| ● | Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1 billion in annual revenues, if we have more than $700 million in market value of our stock held by non-affiliates, or if we issue more than $1 billion of non-convertible debt over a three-year period. We may take advantage of these exemptions until the last day of the fiscal year of the Company following the fifth anniversary of the date of the first sale of our common equity securities in an effective registration statement under the Securities Act of 1933, as amended.Note: To date, we have not sold or issued any of our common equity securities under an effective Form S-1, Form S-3, Form S-4 or Form S-8 or other form of registration statement under the Securities Act of 1933, as amended. We may choose to take advantage of some but not all of these reduced burdens in the future. We have irrevocably elected to opt out of the extended transition period for complying with new or revised accounting standards pursuant Section 107(b) of the JOBS Act.

Peter Smith initially founded Global Equity Partners Plc. in 2009 to assist small to medium size businesses with management restructuring and corporate restructuring, in general, and also to obtain, if requested by its clients, access to capital markets via equity and debt financings.FUND MANAGEMENT

Global Equity Partners Plc.In common with the overall financial services sector, the micro fund management market is undergoing significant changes. We will take advantage of these changes and its subsidiary GE Professionals DMCC look for companies that require capital fundingacquire a significant selection of international and ultimately a listingUnited Kingdom based financial advisory firms with Funds under Management. These acquisitions shall form part of their shares on a recognized stock exchange. The Company introduces these clients to privateArgentum 47 Financial Management Limited which is under one efficient and institutional investors in our network of over 100 “financial introducers” around the world. These financial introducers are groups of people or institutions that are presently introducing new clients to us or who have introduced new clients to our management in the past. We do not have any contractual arrangements, written or otherwise, with these financial introducers.cost effective umbrella.

Presently, Global Equity Partners Plc and its Dubai subsidiary, GE Professionals DMCC, are our only operating businesses. GEI´s present operations are limited to insuring compliance with regional, state and national securities regulatory agencies and organizations. In addition, GEI is charged with (i) handling our periodic reporting obligations under the Securities Exchange Act of 1934; (ii) managing our investor relations; and (iii) raising debt and equity capital necessary to fund our operations, and to enhance, and grow our business. GEI does not offer or conduct any consulting or advisory services, as such services are performed solely by our foreign subsidiary, GEP.

We currently offer the following services to our clients:

| ||

CORPORATE RESTRUCTURING SERVICES

We advise and assist our clients in determining the corporate structure that is most suitable to their business models. We recommend management changes where necessary. We also offer them corporate governance models customized to their specific organizations and desired exchange listings. We also review and analyze their balance sheets and capital structures and make recommendations on debt consolidations, equity exchanges for debt, proper capital structures and viability and timing of equity and debt offerings. We do not presently recommend and we do not intend in the future to recommend that our clients merge with, or be acquired by, shellalready trading companies.

MANAGEMENT BUY OUTSRECRUITING

We assist our clients in every aspect of management buyouts from corporate restructuring to debt financing and also introduce buyers and sellers to financiers for private equity placements.

MANAGEMENT RECRUITING AND EMPLOYMENT PLACEMENTS

We assist our clients with the recruitment of management and board members through our various contacts around the world. Management recruitment and retention is also an important part of our Corporate Restructuring Services and these services often overlap.

INVESTOR AND PUBLIC RELATIONS

Since our clients and future clients will likely desire to have their shares listed or continue to be listed on a stock exchange or quoted on one of the quotation bureaus, we will advise our clients on the necessary requirements for communicating with their equity holders and stakeholders, their customers and potential customers. We will assist our clients in this area by recommending third party financial professionals and investor relations and public relations organizations to provide them with such services.

REGULATORY COMPLIANCE

We have organized a cadre of third party securities attorneys and accountants to assist our clients with their compliance with the many reporting and other requirements of stock exchanges, quotation bureaus and securities regulatory agencies and organizations in the states and countries where their shares will be or are listed or traded.

EXCHANGE LISTINGS

We also assist our clients with the selection of stock exchanges and over the counter quotation boards and markets that may be suitable to our clients. Various exchanges have listing requirements and standards that vary from one exchange to another. Typical listing requirements and standards relate to a number of things, such as pre-tax income, cash flows, revenue, net tangible assets, market value of a company’s listed securities, minimum trading prices of a company’s securities, minimum shareholders’ equity, operating history, number of shareholders, number of market makers, and corporate governance. We will try to identify appropriate exchanges for our clients based on the particular client’s operating history, pre-tax income, cash flow, revenue, net tangible assets, shareholder base and other factors described above.

We will assist our clients with retention of attorneys and accountants having experience with publicly held companies and stock exchanges in various countries. We will also assist our clients in locating market makers, investment bankers and broker-dealers to assist them with accessing capital markets.

INTRODUCTIONS TO FINANCIERS

After reviewing the business plans, prospects and problems that are unique to each of our clients, we will use our best efforts to introduce our clients to various third party financial resources around the world who may be able to assist them with their capital funding requirements.

Special Note:As used throughout this Annual Report, references to “Global Equity International,“Argentum 47, Inc.” “GEI,” “Company,” “we,” “our,” “ours,”, “ARG”, “Company”, “we”, “our”, “ours”, and “us” refer to Global Equity International,Argentum 47, Inc. and our subsidiaries, unless the context otherwise requires. In addition, references to “financial statements” are to our consolidated financial statements contained herein, except as the context otherwise requires. References to “fiscal year” are to our fiscal year which ends on December 31 of each calendar year. Unless otherwise indicated, the terms “Common Stock,” “common stock” and “shares” refer to our shares of $0.001 par value, common stock.

HISTORICAL BUSINESS TRANSACTED

BUSINESS TRANSACTED IN 20122015

During 2012, we gained the following clients:

(1) REGIS CARDS LIMITED.

On May 25, 2012, we entered into a contract with Regis Card Limited (“Regis”), a “Pre-Paid” credit card company based in the U.S. and in the U.K.

We have contracted to provide Regis the following services:

(2) BTI / SCORPION PERFORMANCE INC.

On December 5, 2012, we entered into a contract with Scorpion Performance Inc. (“Scorpion”), a U.S. corporation based in Ocala, Florida. Scorpion manufactures precision metal performance engine components and also precision medical instruments.

We have contracted to provide Scorpion the following services:

(3) UNIVERSAL ENERGY SOLUTIONS BV

Universal Energy Solutions BV (“Universal”), a Netherlands green energy company, that desires to list its stock on the Dubai Nasdaq, but first requires our Company to source a Dubai sponsor that would agree to underwrite and sponsor the proposed public listing. We agreed to a fee of $10,000 and have been paid in full. We have subsequently sourced an appropriate Dubai sponsor, however the client decided not to pursue the public listing in the Dubai NASDAQ.

(4) INNOVEAS AG

Innoveas AG is a German company and a technology incubator that wishes to also list its shares on the Dubai Nasdaq, but also requires our Company to source a Dubai sponsor that would be in agreement to underwrite and sponsor the proposed public listing. We agreed to a fee of $10,000 and have been paid in full. We subsequently sourced an appropriate Dubai sponsor, but the client decided not to pursue the public listing in the Dubai NASDAQ.

(5) ARABIAN NUBIAN RESOURCES LIMITED

Arabian Nubian Resources Limited (“Arabian”), a United Kingdom based company with mining contacts in North East Africa that wanted to list its shares on the Dubai Nasdaq, but required our Company to source a Dubai sponsor that would be in agreement to underwrite and sponsor the proposed public listing. We agreed to a fee of $10,000 and have been paid in full. We were unable to source a sponsor in Dubai for Arabian; hence, Arabian decided not to pursue the public listing in the Dubai NASDAQ.

At the date of this filing, only Regis Cards Limited is considered to be an ongoing client.

BUSINESS TRANSACTED IN 2013

During 2013, we gained the following clients:

(1) SCANDINAVIAN AGRITEX CO. LIMITED

Scandinavian Agritex Co. Limited (“SAC”) is a U.K. and Sri Lankan based company that is a green “Agriculture Technology and Textile” company whose business is situated in Sri-Lanka, Norway and the U.K. whose main purpose is to develop and rapidly expand the organic cotton industry in the country. SAC was founded by textile professionals, fashion brand owners, and finance people with significant international management experience. SAC has an extensive management team comprised of highly skilled and competent agronomists, farmers and textile professionals. SAC´s long term objective is to operate in the entire textile value chain, including cultivation of cotton, ginning, spinning, weaving, garment manufacture, fashion and retail, with the objective of retaining control and generating significant margins on each step of the chain. Furthermore, SAC intends to produce organic cotton fabrics to be used in the sustainable clothing lines of well-known fashion brands and retailers.

We have contracted to provide SAC with the following services:

| 7 |

BUSINESS TRANSACTED IN 2016

During 2016, we gained following 9 clients:

| 1. | Granite Power Limited | |

SAC agreed to pay us $255,000 and to date we have been paid $145,000. In addition, we have agreed that we will receive a 6% equity stake in SAC upon its initial public offering on the NASDAQ OTCQB.

At the date of this filing, Scandinavian Agritex Co. Limited is still considered to be an ongoing client.

BUSINESS TRANSACTED IN 2014

During 2014, we gained the following eight clients:

(1) ATC Enterprises DMCC

ATC Enterprises DMCC (“ATC”) is a Dubai based company that has an innovative way to buy and sell diamonds. ATC DMCC is working with the Dubai Diamond Exchange to establish regular sales and tenders of rough cut diamonds in Dubai. The first of these was in January 2005. ATC has an extensive list of buyers from the UAE, Bombay, Surat, Ahmedabad, New York, Antwerp and the Far East, giving suppliers access to reliable and legitimate buyers throughout the world as well as the chance to trade in the unique and innovative environment in Dubai.

We have contracted to provide ATC with the following services:

ATC agreed to pay us $30,000 for this initial ground work. A possible listing on a recognized stock exchange will be subject to a separate agreement.

(2) Authenta Trade Inc.

Authenta Trade Inc. (“Authenta”) is a Canadian company based in Calgary, Canada with offices in Singapore and Cyprus. Authenta is in the business of developing a high security digital currency exchange. Authenta was formed specifically to address security concerns in the market place, is currently developing software that will tighten security to new levels and will also bring technology to the marketplace in order to make transacting in digital currencies such as Bitcoin, much simpler.

We have contracted to provide Authenta with the following services:

Authenta agreed to pay us $60,000 for this initial ground work. A possible listing on a recognized stock exchange will be subject to a separate agreement.

(3) Duo World Inc.

Duo World Inc. (“Duo”), a Nevada corporation, is a software company with subsidiaries in Sri Lanka, India and Singapore. Duo is an information technology and software solutions company, focused on bringing value to its clients through every customer interaction. Duo´s business model allows it to deliver consistent, quality service, at a scale and in the geographies that meet its clients’ business needs. They leverage their breadth and depth of capabilities to help companies create quality customer experiences across multiple channels, while increasing revenue and reducing their cost to serve their customers.

We have contracted to provide Duo with the following services:

BUSINESS TRANSACTED IN 2017

During 2017, we gained following 8 clients:

| 1. | Blackstone Natural Resources SA | |

Duo agreed to pay us $250,000 and to date we have been paid $170,000. In addition, we have agreed that we will receive a 10% equity stake in Duo upon its initial public offering.

(4) Medinas Holdings BV

Medinas Holdings BV (“Medinas”) is a Netherlands company with subsidiaries in the Netherlands and also in the U.S. that is the sole proprietor and holder of an FDA approved cure for peritoneal cancer.

We have contracted to provide Medinas with the following services:

Medinas agreed to pay us $465,000 and to date we have been paid $230,000. In addition, we have agreed that we will receive a 5% to 7% (depending on certain agreed upon milestones) equity stake in Medinas upon its initial public offering.

(5) Precious Cells International Limited

Precious Cells International Limited (“Precious”), aU.K. company, is based in London. Precious is a medical technology company founded in 2009, with a key focus on the development of clinical technologies in the innovation of adult stem cells, cord blood stem cells and regenerative medicine. Regenerative medicine consists of innovative medical therapies that will enable the body to repair, replace, restore and regenerate damaged or diseased cells, tissues and organs. These therapies are targeting the repair of damaged heart muscle following heart attacks, replacement of skin for burns victims, restoration of movement after spinal cord injury, regeneration of pancreatic tissue for insulin production in diabetics and provide new treatments for Parkinson’s and Alzheimer’s disease.

We have contracted to provide Precious with the following services:

Precious agreed to pay us $30,000 for this initial ground work. A possible listing on a recognized stock exchange will be subject to a separate agreement.

(6) Unii LimitedOUR BUSINESS IN 2017

Unii Limited (“Unii”) is a U.K. based company and sole proprietor of the social media application “Fling – Message the World” that can be found in the Google Play Store and in Apple´s App Store and has grown virally to more than 3 million users at the date of this filing.

We have contracted to provide Unii with the following services:

Unii agreed to pay us $60,000 for this initial ground work. Then in February of 2015, Unii agreed to a new contract whereby our Company would assist with a listing of their shares on a recognized exchange. The first part of this new agreement, $385,000, was paid to our Company in 2015.

(7) VT Hydrocarbon Holdings (Pte.) Ltd.

VT Hydrocarbon Holdings (Pte.) Ltd (“VTH”) is a Singapore based company whose ground operations are based in the Aqaba Special Economic Zone in Aqaba, Jordan. VTH is looking to acquire, operate, manage and build hydrocarbon storage farms in Aqaba and expand to repeat the formula in other parts of the world. VTH´s main business focus will be to provide Liquid Petroleum Gas storage as well as other wet fuel facilities.

We have contracted to provide VTH with the following services:

VTH agreed to pay us $20,000 for the initial ground work and a success fee for any funds that the company raises as a result of our introductions, of 1% (cash fee) and 1.5% (equity fee). A possible listing on a recognized stock exchange and a possible larger equity fee will be subject to a separate agreement.

(8) Your MD AS

Your MD AS (“Your MD”) is a Norwegian based company and sole proprietor of the medical diagnostic application “Your MD” that can be found in the Google Play Store and in Apple´s App Store. This service brings healthcare advice to those in areas where primary healthcare is needed most; whether that’s due to large expense, poor access, and poor quality primary health or for those who are unable to travel. Your MD is primarily focused on emerging markets.

We have contracted to provide Your MD with the following services:

Your MD agreed to pay us $25,000 for this initial ground work. A possible listing on a recognized stock exchange will be subject to a separate agreement.

At the date of this filing, all 2014 clients with the exception of Your MD AS and Precious Cells International Limited are considered to be ongoing clients.

OUR BUSINESS IN 2015

1) Advanced Imaging Projects LLC.

Advanced Imaging Projects LLC. (“AIP”), based in Florida, is a clinical stage specialty biopharmaceutical company that develops medicines for prevention, diagnosis and treatment of rare diseases in oncology, neurology and infectious diseases. Its mission is to make a meaningful difference to those impacted by maladies for which there are limited or no curative options. AIP has an industry-leading pipeline of promising new drugs that have the potential to treat Parkinson’s disease, Tuberculosis and Cancer. These products make fundamental contributions to medical progress and form an integral part of the companion diagnostic, individualized immunotherapy and orphan drug arsenal, among the fastest growing and most successful segments in the pharmaceutical sector.

We have contracted to provide AIP with the following services:

AIP agreed to pay us a cash success fee on any capital funding raised and a further success equity fee based on AIP’s issued and outstanding shares, post capital funding. A possible listing on a recognized stock exchange will be subject to a separate agreement.

2) Energy Equity Resources (Norway) Limited.

Energy Equity Resources (Norway) Limited (“EER”) is an oil and gas company that is focused on the acquisition and development of concessions in proven hydrocarbon provinces in Nigeria.

We have contracted to provide EER with the following services:

EER agreed to pay us a $30,000 cash fee and a 1.5% cash success fee on any capital funding raised and a further 2.5% success equity fee based on EER’s issued and outstanding shares, post capital funding. A possible listing on a recognized stock exchange will be subject to a separate agreement.

3) Hoqool Petroleum.

Hoqool Petroleum (“HOQ”) is an independent oil and gas exploration and production company, incorporated in the Kingdom of Bahrain. Hoqool is an Arabic word that means fields and particularly oil and gas fields. Hoqool was established in 2010. The founders combine vast and deeply rooted leaders who are experienced, knowledgeable and well recognized, both locally and internationally, covering the upstream sector of the oil and gas with more than 175 years of experience.

We have contracted to provide HOQ with the following services:

HOQ agreed to pay us a 1.5% cash success fee on any capital funding raised and a further 10% success equity fee based on the company issued and outstanding shares post capital funding. A possible listing on a recognized stock exchange will be subject to a separate agreement.

4) INSCX Exchange (Central Clearing) Limited.

��

INSCX Exchange (Central Clearing) Limited. (“Exchange” or “INSCX”) is the world’s first Nano-technology commodities exchange for the guaranteed physical delivery of Nano-Tech and other specialist materials, such as Polymers, Base Oils and Titanium Dioxide, more traditional materials where the exchange offers the only physical delivery hedging tool for producers and end users. INSCX offers the only global track and trade reporting system for engineered nanomaterials. The Exchange offers a highly effective, secure, regulatory and compliant framework for the emerging Nano-Tech industry. Commissioned by Lloyds (Bank) of London in 2010, INSCX is proving pivotal to enabling insurers to engage fully with upstream and downstream interest in this broad suite of materials.

We have contracted to provide INSCX with the following services:

INSCX agreed to pay us a $60,000 non-refundable cash fee and also a 5% cash success fee on any capital funding raised and a further 3% success equity fee based on INSCX’s issued and outstanding shares, post capital funding. A possible listing on a recognized stock exchange will be subject to a separate agreement.

5) International FIM SRL.

International FIM SRL is a reputable Italian automotive parts manufacturer based in Bergamo (Milan, Italy). The company has a 17,000 square meter (153,000 square feet) factory located in Bergamo (Milan, Italy) just 100 miles north of Maranello (Modena) where Ferrari has its headquarters and employs over 180 people that manufacture automotive parts such as engine covers, front grills, wheel caps, emblems for the front hood, decorative emblems, airbag emblems, door emblems, instrument panels and chrome parts for the interior and exterior of cars along with many more items. The Company, previous called Lupini Targhe SPA, has been in operation since the 1960´s and has an impressive client list that varies from luxury brand names such as Lamborghini, Ferrari, Maserati, Porsche and Bentley to more common brand names such as General Motors, Ford, Alfa Romeo, Jaguar, Land Rover, BMW, Volkswagen, Fiat (Abarth), Audi, Skoda and many more.

We have contracted to provide FIM with the following services:

FIM agreed to pay us a 10% cash success fee on any capital funding raised and a further 10% success equity fee based on International FIM SRL’s issued and outstanding shares, post capital funding. A possible listing on a recognized stock exchange will be subject to a separate agreement.

6) Primesite Developments Limited.

Primesite Developments Limited and its subsidiaries (“PS”), is a commercial and residential property development group based in the North West of England (United Kingdom).

We have contracted to provide PS with the following services:

PS agreed to pay us a $300,000 cash fee and also a 5% equity fee. To date the company has paid us $150,000 and has issued us 5,606,521 common shares and a further 450,000 Series “A” preferred shares.

7) Quartal Financial Solutions AG.

Quartal Financial Solutions AG (“QFS”) a Zurich - Switzerland based Financial Technology Company. QFS is a market leading Financial Technology software company providing specialized financial solutions to the global financial and insurance industry. Their suite of products focuses on complex fee billing, revenue, commission, expense management and sophisticated high end reporting for global asset managers, banks, brokers, custodians, fund administrators, insurance companies, transfer agents and capital market firms.

We have contracted to provide QFS with the following services:

QFS agreed to pay us a $300,000 cash fee. QFS also agreed to pay us a 5% equity fee and a further 3% cash success fee based on the capital funding QFS raises. To date, QFS has paid us $150,000 and has issued us with 5% of QFS’ issued and outstanding shares.

8) TAM Mining Limited.

TAM Mining Limited is a North East African natural resources company.

We have contracted to provide TAM with the following services:

TAM agreed to pay us a $60,000 non-refundable cash fee.

We have threefour distinct divisions (none of which will be treated as a segment for financial reporting purposes):

1.Introducers NetworkNetwork.. We have developed and continue to develop a number of finance professionals, accountants, attorneys and financial advisers who will introduce us to their clients. We will review businesses introduced to us through these introducers and we will compensate them on sum “to be determined” based on the event that we are engaged to assist the companies they introduce to us.

2.Project Review. Our management team and advisors will carefully review and vet each business plan and opportunity submitted to us. Our management team and advisors will determine which services we can offer these clients and assess the potential propositions to best assist our clients in achieving their goals.

3.Placing. Working with our business associates in Dubai, Europe and the United States, we will use our best efforts to assist our clients with listings on stock exchanges in these cities and countries in order to maximize their exposure to capital markets and to access funding via debt and equity offerings.

4.Management Recruiting.We assist our clients with the recruitment of management and board members through our various contacts around the world. Management recruitment and retention is also an important part of our Corporate Restructuring Services and these services often overlap.

FUTURE PLANS

MILESTONES FOR 2016:2018-2019:

Our specific plan of operations and milestones through March 2017 are as follows:

To date, we have 158 clients under contract that we deem to be active and are either seeking a listing on a recognized stock exchange or quoted on the OTC Markets or seeking funding for acquisition and growth:growth or seeking Human Resources Recruitment services:

| No. | Company | Sector | Location | |||

| 1 | Emaar | Construction - Dubai Government Entity | Kingdom of Saudi Arabia | |||

| 2 | Graphite Resources (DEP) Ltd | Waste to Energy | United Kingdom | |||

| 3 | Blackstone Natural Resources SA | Natural Resources | BVI | |||

| 4 | Ali Group MENA FZ-LLC | Hospitality | United Arab Emirates | |||

| 5 | Fly-A-Deal | Travel | Kingdom of Saudi Arabia | |||

| 6 | Falcon Eye Technology | Construction and System Integrators | United Arab Emirates | |||

| 7 | Veolia Middle East | Waste to Energy | Oman | |||

| 8 | OCS ROH | Facilities Management | Thailand |

Our specific plan of operations and milestones through March 2019 are as follows:

ACQUIRE CERTAIN FINANCIAL ADVISORY FIRMS WITH MONEY UNDER MANAGEMENT

Initially, the Company intends to acquire four licensed financial advisory firms with funds under management on or before April 15, 2018, two of which are based in the United Kingdom and the other two are based in Malaysia. These four financial advisory firms currently have an aggregate US$150 million of funds under management. These targeted acquisitions have been identified, non-binding letters of intent have already been agreed to and signed and their two-year financial statement audits are almost complete. Each acquisition will form part of the newly incorporated subsidiary called Argentum 47 Financial Management Limited. These acquisitions will be, in essence, the acquisition of stable and long term recurring and non-recurring revenues.

Once the Company acquires these initial four financial advisory firms, the Company intends to continue growing in 2018 and 2019 by acquiring more financial advisory firms that already have been identified.

The acquisition of these entities will open up a new controlled network for the services of:

| Distribution of new funds / products | ||||

| Maximizing the current books of business being bought | ||||

| Expand both Malaysia and UK business via more financial advisors | ||||

| Expand the Isle of Man company by making its offering to a wider audience on a global basis | ||||

| ● | ||||

DEVELOP THE INTRODUCER NETWORK FURTHER IN ORDER TO CONTINUE ATTRACTING NEW INTEREST FOR OUR SERVICES.

We currently are relying on introductions to potential clients by the following firms in the Middle East, South East Asia, Europe and the US:

| ● | Certain | |

| ● | An Austrian management consultancy firm based in | |

| ● | Various | |

| ● | Certain Private Banks based in Amsterdam, | |

| ● | Various | |

| ● | Various introducers to | |

| ● | Various introducers to | |

| ● | ||

We intend to develop relationships with a further six “introducers” to potential new business for the Company within the next 12 months.

REBRANDING OF OUR ENTIRE CORPORATE STRUCTURE

During next 12 months, we believe that we have the capacity to sign at least another 12 new clients in various sectors and located around the globe.

We will continue to establish a firm presence in Dubai, UAE where we are attracting clients, relationships and awareness. Our Dubai operation is currently a branch office of the Company allowing us a license to trade in the area. This branch office will continue to recruit new members of staff that will allow us to grow and become more efficient in Dubai.

We will continue to establish a firm presence in South East Asia where we are attracting clients, relationships and awareness.

Within the next 12 months, we plan to open an office on the east coast of the USA in order to substantially expand our network of introducers to new business and also professionals and consultants.

We intend to form relationships with mergerrebrand our business and acquisition specialists duringanalyze our entire corporate structure. We will adapt the next 12 months, whichnew brand towards the Financial Advisory firms that we will hopefully enable us to:acquire and ensure a uniform image of our corporate structure including new websites and email addresses for all companies within our structure. The reporting structures of each subsidiary will also be examined for maximum effect. In due course, we will change the name of GEP Equity Holdings Limited and GE Professionals DMCC to Argentum 47 Consulting Limited and Argentum 47 HR DMCC, respectively.

EXPAND OUR HUMAN RESOURCES DEPARTMENT IN DUBAI – KINGSMAN JAMES.

Commencing initially with one member we will start to develop a proprietary program allowing us to easily monitor a client’s development status and work in progress. We will also use this tool to manage our pipeline of clients and therefore it will become vital in our cash flow forecasting.

The Company created an in-house human resources department called “Kingsman James” (http://kingsmanjames.com/kingsmanjames.com) with a view to be able to provide its existing clients and other new clients with the possibility of restructuring their companiescompanies’ management with seasoned professionals, if required. We intend to continue expanding this human resources department throughout the next 12 months.

EXPAND OUR NETWORK OF CONTACTS WITHIN THE INVESTMENT COMMUNITY

During the next 12 months, we intend to substantially expand our Middle Eastern, South East Asian and also our USU.S. networks in order to enable us to make introductions on a more institutional level. At present, we are being received with open arms by all of the financial communities with whom we have contact; hence, we have plans to host various hospitality events for our current clients, our key contacts and upper management of the Company.

We intend to take our consultancy service outside of the Middle East and Europe and into Asia and Sri Lanka. We will expand on a “Commission Only” basis for the individuals or companies who take on our service to offer to their clients. Accountants, lawyers and finance professionals are the target market for overlaying our service into their existing client banks in return for a percentage of fees received. We also intend to add at least two new members to our administration team during the next 12 months.

We will continue working on different “Road shows” in Dubai, Europe, South East Asia and the US.

We intend to cement the relationships created. The target markets for attracting clients are: Thailand, Sri Lanka, China, Hong Kong and Singapore. To service the clients generated from these markets, we will spend time creating a network of service companies who we can utilize to assist us on a local basis. We will explore the possibilities of dual listings for our clients in Singapore to allow us a local market for any Asian clients we will attract and giving the Company a firm foothold in the Asian territory.

| 10 |

FURTHER EXPAND OUR RANGE OF BUSINESS AND CONTACTS

We will explore alternative methods of servicing our clients by utilizing contacts already made in Europe to allow us to offer a wider service to our current and future clients. We will have a focus on Singapore, United Kingdom and Canada for this expansion

NEW OFFICES

Once we have acquired the initial four Financial Advisory firms in the United Kingdom and Malaysia, we will have four offices in total, one in Dubai, one in the Isle of Man, one in Kuala Lumpur (Malaysia) and the other in the North East of the UK. In due course, during 2018, we will also open a central office in London (UK). In addition, we are exploring the expansion of our Kuala Lumpur operation to open an office in Bangkok (Thailand) where we have an opportunity to attract several financial advisors under our licensed Malaysian brand.

COMPETITION

We face intense competition in every aspect of our business, and particularly from other firms which offer management, compliance and other consulting services to private and public companies. We would prefer to accept a relatively low cash component as our fee for management consulting and regulatory compliance services and take a greater portion of our fee in the form of restricted shares of our private clients’ common stock. We also face competition from a large number of consulting firms, investment banks, venture capitalists, merchant banks, financial advisors and other management consulting and regulatory compliance services firms similar to ours. Many of our competitors have greater financial and management resources and some have greater market recognition than we do. There are many institutions around the globe that are executing a roll-up strategy by acquiring Financial Advisory firms around the world; hence, we will face completion but we believe that there is still room for our Company to have a place within the Financial Advisory world.

REGULATORY REQUIREMENTS.

We are not required to obtain any special licenses, nor meet any special regulatory requirements before establishing our business, other than a simple business license. If new government regulations, laws, or licensing requirements are passed that would restrict or eliminate delivery of any of our intended products, then our business may suffer. Presently, to the best of our knowledge, no such regulations, laws, or licensing requirements exist or are likely to be implemented in the near future that would reasonably be expected to have a material impact on orour sales, revenues, or income from our business operations.

We are not a broker-dealer. We are not an investment adviser or an investment company. We are not a hedge fund or a mutual fund or any similar type of fund. We are primarily an operating business that offers and performs corporate consultancy services.

EFFECT OF EXISTING OR PROBABLE GOVERNMENTAL REGULATIONS.

The Company’s common stock is registered pursuant to Section 12(g) of the Securities Exchange Act of 1934 (“1934 Act”). As a result of such registration, the Company is subject to Regulation 14A of the “1934 Act,” which regulates proxy solicitations. Section 14(a) requires all companies with securities registered pursuant to Section 12(g) thereof to comply with the rules and regulations of the Commission regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to stockholders of the Company at a special or annual meeting thereof or pursuant to a written consent will require the Company to provide its stockholders with the information outlined in Schedules 14A or 14C of Regulation 14; preliminary copies of this information must be submitted to the Securities and Exchange Commission (“Commission”) at least 10 days prior to the date that definitive copies of this information are forwarded to stockholders.

The Company is also required to file annual reports on Form 10-K and quarterly reports on Form 10-Q with the Commission on a regular basis, and will be required to disclose certain events in a timely manner (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business; and bankruptcy)business, etc.) in a Current Report on Form 8-K.

WE ARE SUBJECT TO THE REQUIREMENTS OF SECTION 404 OF THE SARBANES-OXLEY ACT OF 2002. IF WE ARE UNABLE TO TIMELY COMPLY WITH SECTION 404 OR IF THE COSTS RELATED TO COMPLIANCE ARE SIGNIFICANT, OUR PROFITABILITY, STOCK PRICE AND RESULTS OF OPERATIONS AND FINANCIAL CONDITION COULD BE MATERIALLY ADVERSELY AFFECTED.

The Company is required to comply with the provisions of Section 404 of the Sarbanes-Oxley Act of 2002, which requires that we document and test our internal controls and certify that we are responsible for maintaining an adequate system of internal control procedures for the 20152018 and 20162019 fiscal years. We are currently evaluating our existing controls against the standards adopted by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). During the course of our ongoing evaluation and integration of the internal controls of our business, we may identify areas requiring improvement, and we may have to design enhanced processes and controls to address issues identified through this review (see Item 9A,9.A, below for a discussion of our internal controls and procedures).

We believe that the out-of-pocket costs, the diversion of management’s attention from running the day-to-day operations and operational changes caused by the need to comply with the requirement of Section 404 of the Sarbanes-Oxley Act could be significant. If the time and costs associated with such compliance exceed our current expectations, our results of operations and the future filings of our Company could be materially adversely affected.

DEPENDENCE ON KEY EMPLOYEES.

The Company is heavily dependent on the abilityabilities of our President, Peter Smith and our Chief Financial Officer, Enzo Taddei and our New Business Managing Director, Patrick V. Dolan.Taddei. The loss of the services of Mr. Smith Mr. Taddei and/or Mr. DolanTaddei would seriously undermine our ability to carry out our business plan.

In the event of future growth in administration, advisory, marketing manufacturing and customer support functions, the Company may have to increase the depth and experience of its management team by adding new members. The Company’s success will depend to a large degree upon the active participation of its key officers and employees, as well as the continued service of its key management personnel and its ability to identify, hire, and retain additional qualified personnel. There can be no assurance that the Company will be able to recruit such qualified personnel to enable it to conduct its proposed business successfully.

REPORTS TO SECURITY HOLDERS.

The public may view and obtain copiesWe are subject to the informational requirements of the Company’sSecurities Exchange Act of 1934, as amended, and in accordance therewith, we file annual, quarterly and current reports, as filedproxy and information statements and other information with the Securities and Exchange Commission. Such reports, proxy statements and other information can be read and copied at the Securities and Exchange Commission’s public reference facilities at 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. Please call the Securities and Exchange Commission at 1-800-732-0330 for further information on the SEC’s Public Reference Roomoperation of the public reference facilities. In addition, the Securities and Exchange Commission maintains a website that contains reports, proxy and information statements and other information regarding registrants that file electronically with the Securities and Exchange Commission. The address of the Securities and Exchange Commission’s website is www.sec.gov.

We make available free of charge on or through our website at 100 F Street, NE, Room 1580, Washington, D.C. 20549.www.arg47.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with or otherwise furnish it to the Securities and Exchange Commission. Information on the Public Reference Roomour website is availablenot incorporated by calling the SEC at 1-800-SEC-0330 1-800-SEC-0330 FREE. Additionally, copiesreference in this Annual Report and is not a part of the Company’s reports are available and can be accessed and downloaded via the internet on the SEC’s internet site at http://www.sec.gov.this Annual Report.

An investment in our Common Stock involves a high degree of risk. Prospective investors should carefully consider the following risk factors and the other information in this Annual Report and in our other filings with the SECSecurities and Exchange Commission (sometimes referred to herein as the “SEC”) before investing in our Common Stock. Our business and results of operations could be seriously harmed by any of the following risks. You should carefully consider the risks described below, the other information in this Annual Report and the documents incorporated by reference herein when evaluating our Company and our business. If any of the following risks actually occurs, our business could be harmed. In such case, the trading price of our Common Stock could decline and investors could lose all or a part of the money paid for our Common Stock.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. IF ANY OF THE FOLLOWING RISKS ACTUALLY MATERIALIZES, OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS WOULD SUFFER AND OUR SHAREHOLDERS COULD LOSE ALL OR PART OF THEIR INVESTMENT IN OUR SHARES.

RISKS ASSOCIATED WITH OUR COMPANY

BECAUSE OUR AUDITORS HAVE ISSUED A GOING CONCERN OPINION, THERE IS SUBSTANTIAL UNCERTAINTY THAT WE WILL CONTINUE OPERATIONS IN THAT CASE INVESTORS COULD LOSE THEIR INVESTMENTS IN OUR COMMON STOCK.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next twelve months. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue in business. As such, we may have to cease operations and you could lose your investment.

WE ARE AN “EMERGING GROWTH COMPANY” AND WE CANNOT BE CERTAIN IF WE WILL BE ABLE TO MAINTAIN SUCH STATUS OR IF THE REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES WILL MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 or “JOBS Act,” and we may adopt certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirement of holding a nonbinding advisory vote on executive and stockholder approval of any golden parachute payments not previously approved. We may remain an “emerging growth company” for up to five full fiscal years following our initial public offering.offering of our common equity securities.Note: To date, we have not sold or issued any of our common equity securities under an effective Form S-1, Form S-3, Form S-4 or Form S-8 or other form of registration statement under the Securities Act of 1933, as amended. We would cease to be an emerging growth company, and, therefore, ineligible to rely on the above exemptions, if we have more than $1 billion in annual revenue in a fiscal year, if we issue more than $1 billion of non-convertible debt over a three-year period, or if we have more than $700 million in market value of our common stock held by non-affiliates as of June 30 in the fiscal year before the end of the five full fiscal years. Additionally, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result of our reduced disclosures, there may be less active trading in our common stock (assuming a market ever develops) and our stock price may be more volatile.

AS A RESULT OF OUR INTENSELY COMPETITIVE INDUSTRY, WE MAY NOT GAIN ENOUGH MARKET SHARE TO BE PROFITABLE.

The corporate consulting business isand funds management businesses are intensely competitive and due to our small size and limited resources, we may be at a competitive disadvantage, especially as a public company. There are several firms offering similar services. Many of our competitors have proven track records and substantial human and financial resources, as opposed to our Company whichwho has limited human resources and little cash. Also, the financial burden of being a public company, which will cost us approximately $50,000$75,000 per year in auditing fees and legal fees to comply with our reporting obligations under the Securities Exchange Act of 1934 and compliance with the Sarbanes-Oxley Act of 2002, will strain our finances and stretch our human resources to the extent that we may have to price our Consultancy service fees higher than our non-publicly held competitors just to cover the costs of being a public company.

WE ARE VULNERABLE TO THE CURRENT ECONOMIC CRISISCATASTROPHIC EVENTS WHICH MAY NEGATIVELY AFFECT OUR PROFITABILITY AND ABILITY TO CARRY OUT OUR BUSINESS PLAN.

We are currently in a severe worldwide economic recession. Runaway deficit spending by the United States governmentpotentially vulnerable to catastrophic events that could affect our profitability and other countries further exacerbates the United States and worldwide economic climate and may delay or possibly deepen the current recession. Currently, a lot of economic indicators such as rising commodity prices suggest higher inflation, dwindling consumer confidence and substantially higher taxes. Demand for the services we offer tendsour ability to decline during recessionary periods when disposable revenue is lower and may impact sales ofcarry out our services. In addition,business plan. For example, sudden disruptions in business conditions as amay result of afrom terrorist attackattacks similar to the events of September 11, 2001 in the United States, many other terrorist attacks in Europe and the United States in the past three years, including further attacks, retaliation and the threat of further attacks or retaliation, war, civil unrest in the Middle East, chaotic immigration problems in Europe, adverse weather conditions or other natural disasters, such as Hurricane Katrina,hurricanes and tsunamis, pandemic situations or large scale power outages can have a short term or, sometimes, long term impact on spending. The worldwide recession is placing severe constraints on the ability of all companies, particularly smaller ones, to raise capital, borrow money, and operate effectively and profitably and to plan for the future.

BECAUSE OUR BUSINESS MODEL ANTICIPATES OUR RECEIVING EQUITY STAKES IN OUR CLIENTS, MOST OF WHOM WILL BE DEVELOPMENT STAGE COMPANIES, WE MAY NOT BE ABLE TO RESELL SUCH EQUITY AT SUITABLE PRICES, IF AT ALL, WHICH COULD MATERIALLY IMPACT OUR EARNINGS AND ABILITY TO REMAIN IN BUSINESS.

Our business model anticipates that we will receive, as partial compensation for our consulting services, equity stakes in our clients, many of whom will be development stage companies. We will have to value those equity stakes at the time we receive them. Investments in development stage companies are risky because many of such companies’ securities are illiquid, thinly traded (if at all) and the value of such securities will be subject to adjustments should the value of such securities decline, should such securities be delisted from an exchange or cease being quoted on a stock quotation medium or should such businesses fail, which could cause us to write-down or write-off the value of such securities and result in a negative impact to our earnings and possibly cause us to cease or curtail our operations.

WE MAY BE SUBJECT TO FURTHER GOVERNMENTAL REGULATION, INCLUDING THE INVESTMENT COMPANY ACT OF 1940, WHICH COULD ADVERSELY AFFECT OUR OPERATIONS.

As part of our business model, GEP Equity Holdings Limited accepts equity securities in our clients as partial compensation for our services. Prior to 2012,2016, 40% or more of our income was derived from the receipt of equity securities and more than 40% of our assets were comprised of equity securities that we received in exchange for some of our services. In 2012, only 9.85%2017, none of our income was derived from the receipt of equity securities. As of December 31, 2013, 1.00%2017, 97.6% of our assets were comprised of equity securities. As of December 31, 2014, 3.69%In 2017, we did not receive any new equity or shares in any of our assets were comprisedclients; hence, none of our operating income in 2017 was derived from equity securities albeit we did sell 98,900 shares of equity securities. As of December 31, 2015, 94.42% of our assets were comprised of equity securities.that we received from a client in prior years.

Although we do not believe we are engaged in the business of investing, reinvesting or trading in securities, and we do not currently hold ourselves out to the public as being engaged in those activities, it is possible that we may be deemed to be an “inadvertent investment company” under section 3(a)(1)(C) of the Investment Company Act of 1940, as amended (“ICA”), if more than 40% of our future income and/or more than 40% of our assets are derived from “investment securities” (as defined in the ICA), and if we are deemed to be, or perceived to be, primarily engaged in the business of investing, reinvesting or trading in securities.

If we were deemed or found to be an investment company by the Securities and Exchange Commission or a court of law, then we would face dire consequences and a maze of additional regulatory obligations. For example, registered investment companies are subject to extensive, restrictive and potentially adverse regulation relating to, among other things, operating methods, management, capital structure, dividends and transactions with affiliates. If it were established that we are an unregistered investment company, there would be a risk, among other material adverse consequences, that we could become subject to monetary penalties or injunctive relief, or both, in an action by the SEC, that we would be unable to enforce contracts with third parties or that third parties with whom we have contracts could seek to obtain rescission of transactions with us undertaken during the period it was established that we were an unregistered investment company.

WE COULD BE SUBJECT TO THE INVESTMENT ADVISERS ACT OF 1940, WHICH WOULD BE DETRIMENTAL TO OUR BUSINESS.

Although we do not believe we are engaged in the investment advisory business and we do not hold ourselves out to be investment advisers, it is possible that the SEC could deem or find us to be an unregistered investment adviser due to the types of consulting services offered by us. If we were deemed or found to be an investment adviser by the Securities and Exchange Commission or a court of law, then we would face dire consequences and a maze of additional regulatory obligations. For example, registered investment advisers are subject to extensive, restrictive and potentially adverse regulation relating to, among other things, operating methods, fees, management, capital structure, dividends and transactions with affiliates. If it were established that we are an unregistered investment adviser, there would be a risk, among other material adverse consequences, that we could be become subject to monetary penalties or injunctive relief, or both, in an action by the SEC, that we would be unable to enforce contracts with third parties or that third parties with whom we have contracts could seek to obtain rescission of transactions with us undertaken during the period it was established that we were an unregistered investment adviser.

OUR SHAREHOLDERS MAY BE DILUTED SIGNIFICANTLY THROUGH OUR EFFORTS TO OBTAIN FINANCING, FUND OUR OPERATIONS AND SATISFY OUR OBLIGATIONS THROUGH ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK.

We will likely have to issue additional shares of our Common Stock to fund our operations and to implement our plan of operation. Wherever possible, our board of directors will attempt to use non-cash consideration to satisfy obligations. In many instances, we believe that the non-cash consideration will consist of restricted shares of our common stock.stock issued in lieu of cash. Our board of directors has authority, without action or vote of the shareholders, to issue all or part of the remaining 173,834,027424,465,591 authorized, but unissued, shares of our common stock net of the issued and reserved of 776,165,973 and 50,000,000 respectively.stock. Future issuances of shares of our common stock will result in dilution of the ownership interests of existing shareholders, may further dilute common stock book value and that dilution may be material.

FINRA SALES PRACTICE REQUIREMENTS MAY LIMIT A STOCKHOLDER’S ABILITY TO BUY AND SELL OUR STOCK.

The FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity and liquidity of our common stock. Further, many brokers charge higher transactional fees for penny stock transactions. As a result, fewer broker-dealers may be willing to make a market in our common stock, which may limit your ability to buy and sell our stock.

OUR ARTICLES OF INCORPORATION AUTHORIZE THE ISSUANCE OF PREFERRED STOCK.

Our Articles of Incorporation authorize the issuance of up to 50,000,000 shares of preferred stock with designations, rights and preferences determined from time to time by its Board of Directors. Accordingly, our Board of Directors is empowered, without stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting, or other rights which could adversely affect the voting power or other rights of the holders of the common stock.

We have no preferred stock45,000,000 shares of Series “B” Preferred Stock outstanding at this time.time, which shares are owned by our management. We have 2,400,000 shares of Series “C” Preferred Stock outstanding at this time, which shares are owned by our management. All shares of our Series “B” and “C” Preferred Stock are contractually locked-up until September 27, 2020; hence, such shares cannot be sold or converted into common stock on any prior date.

We have an additional 2,600,000 shares of Series “C” Preferred Stock authorized and designated, but not issued or outstanding.

We no longer have any shares of Series “A” Preferred Stock authorized, designated or outstanding.

THIS ANNUAL REPORT CONTAINS FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO US, OUR INDUSTRY AND TO OTHER BUSINESSES.

These forward-looking statements in this Annual Report are based on the beliefs of our management, as well as assumptions made by and information currently available to our management. When used in this Annual Report, the words “estimate,” “project,” “believe,” “anticipate,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are subject to risks and uncertainties that may cause our actual results to differ materially from those contemplated in our forward-looking statements. We caution you not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We do not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events.

ITEM 1B.UNRESOLVED STAFF COMMENTS.

Not applicable.

The Company does not own any property. Our executive offices are located at X3 Jumeirah Bay, Office 3305, Jumeirah Lake Towers, Dubai, U.A.E.; this office consists of 1,400 square feet of office space for which we pay a monthly rent of $2,675. We also have a satellite-serviced office located in London based in another office in Level 17 Dashwood House, 69 Old Broad Street, London EC2M 1QS, United Kingdom.$2,500. Peter J. Smith, our President and Chief Executive Office,Officer, is now based in Dubai,the UK, and Enzo Taddei, our Chief Financial Officer, is based between Europe and Dubai.

On October 9, 2013, the Company secured a two month loan for GBP 75,000 (equivalentWe are not subject to $120,420) and issued 10,000 restricted shares of common stock to the lender, The Able Foundation, on December 7, 2013, and also repaid 35,000 GBP (equivalent to $56,196) in lieu of interest. As the principal and interest was not paid back to the lender on time, the Company compensated the lender with an additional 20,000 restricted shares of common stock in consideration for a five month extension on the loan. This stock compensation was issued to the lender also on December 12, 2013. The Company is currently in litigation, in the courts of Dubai, regarding the Able Foundation loan.

The plaintiff, the Able Foundation, is requesting a settlement of $411,272, which is the $226,616 currently owed, and an additional $184,656 accrued in 2015 as a provision for potential damages.

On, June 1, 2015, the Company (the defendant) retained the legal services of a Dubai based law firm called Al Safar & Partners. Currently, there is a judgment against the Company (the defendant) for the recovery of $411,272.

The Company’s Dubai lawyers, Al Safar & Partners, have subsequently appealed this judgement based on the fact that they believe from a legal stand point that:

According to the Dubai lawyers, the judgement issued against the Company (the defendant) by the Dubai First Instance Court bears no legality and void therefore the Plaintiff´s claim should be rejected in its entirety.

These legal proceedings and appeal are currently ongoing. The Company intends to vigorously defend the litigation. At this time, the Company cannot predict the outcome of theany other pending or threatened litigation.

ITEM 4.MINE SAFETY DISCLOSURES.

Not applicable.

ITEM 5.MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

As of December 31, 2015,2017, the Company’s Common Stock was quoted on the Over-the-Counter Bulletin Board under the symbol “GEQU.OB.”GEQU. Effective April 2, 2018, our new trading symbol is ARGQ. The market for the Company’s Common Stock is limited, volatile and sporadic and the price of the Company’s Common Stock could be subject to wide fluctuations in response to quarterly variations in operating results, news announcements, trading volume, sales of Common Stock by officers, directors and principal shareholders of the Company, general market trends, changes in the supply and demand for the Company’s shares, and other factors. The following table sets forth the high and low sales prices for each quarter relating to the Company’s Common Stock for the last two fiscal years. These quotations reflect inter-dealer prices without retail mark-up, markdown, or commissions, and may not reflect actual transactions.

| Fiscal 2015 | High | Low | ||||||

| First Quarter(1) | $ | 0.009 | $ | 0.002 | ||||

| Second Quarter(1) | $ | 0.003 | $ | 0.001 | ||||

| Third Quarter(1) | $ | 0.008 | $ | 0.002 | ||||

| Fourth Quarter(1) | $ | 0.045 | $ | 0.01 | ||||

| Fiscal 2014 | High | Low | ||||||||||||||

| Fiscal 2017 | High | Low | ||||||||||||||

| First Quarter(1) | $ | 0.37 | $ | 0.08 | $ | 0.0200 | $ | 0.0120 | ||||||||

| Second Quarter(1) | $ | 0.28 | $ | 0.05 | $ | 0.0141 | $ | 0.0050 | ||||||||

| Third Quarter(1) | $ | 0.22 | $ | 0.14 | $ | 0.0053 | $ | 0.0028 | ||||||||

| Fourth Quarter(1) | $ | 0.35 | $ | 0.008 | $ | 0.0094 | $ | 0.0019 | ||||||||

| Fiscal 2016 | High | Low | ||||||||||||||

| First Quarter(1) | $ | 0.037 | $ | 0.019 | ||||||||||||

| Second Quarter(1) | $ | 0.030 | $ | 0.011 | ||||||||||||

| Third Quarter(1) | $ | 0.024 | $ | 0.015 | ||||||||||||

| Fourth Quarter(1) | $ | 0.021 | $ | 0.013 | ||||||||||||

| (1) | This represents the closing bid information for the stock on the OTC Bulletin Board. The bid and ask quotations represent prices between dealers and do not include retail markup, markdown or commission. They do not represent actual transactions and have not been adjusted for stock dividends or splits. |