UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20152017

OR

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ______ to ______

Commission File Number: 000-33167

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

(Exact name of registrant as specified in its charter)

| 77-0632186 | ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3200 Guasti Road, Suite #100, Ontario, California | 91761 | |

| ( | (Zip Code) |

310 N. Indian Hill Blvd., #702(909) 456-8828

Claremont, California 91711

(Address of principal executive offices)

(626) 715-5855

(Registrant’s telephone number, including area code)

| ||

3200 Guasti Road, Suite #100

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] NoOntario, CA 91761

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No(Former address)

Indicate by check mark whether the Registrantregistrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] YesNo [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ] Yes [X] No [ ]

Indicate by check mark whether the Registrantregistrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | Emerging growth company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] YesNo [X] No

The aggregate market valueAs of voting and non-votingMarch 30, 2018, the Company had 16,120,465 shares of common stock, held by non-affiliates of the registrant, based upon the closing bid quotation for the registrant’s common stock, as reported on the OTC Markets Group, Inc. Pink Limited Information Tier, as of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $309,000.

The number of shares of registrant’s common stock outstanding as of April 10, 2016 was 5,141,226.$0.001 par value, issued and outstanding.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2015

INDEX

TABLE OF CONTENTS

| 2 |

Special Note Regarding Forward-Looking Statements

On one or more occasions, we may make forward-looking statements in this Annual Report on Form 10-K regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events. Words or phrases such as “anticipates,” “may,” “will,” “should,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “targets,” “will likely result,” “will continue” or similar expressions identify forward-looking statements. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described elsewhere in this report and our other Securities and Exchange Commission filings.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related subjects in our subsequent annual and periodic reports filed with the Securities and Exchange Commission on Forms 10-K, 10-Q and 8-K and Proxy Statements on Schedule 14A.

References herein to “we,” “us,” “our” or “the Company” refer to Kiwa Bio-Tech Products Group Corporation and its wholly-owned and majority-owned subsidiaries unless the context specifically states or implies otherwise.

The Company

1. Organizational History

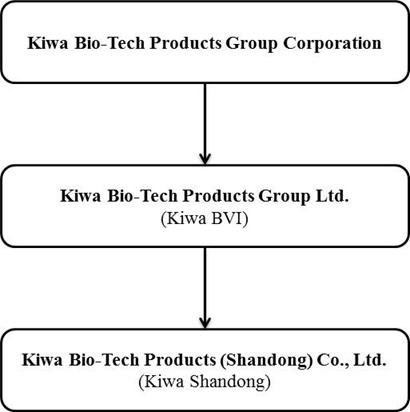

We are the result of a share exchange transaction completed in March 2004 between the shareholders of Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah, and the shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002. The share exchange resulted in a change of control of Tintic, with former Kiwa BVI stockholders owning approximately 89% of Tintic on a fully diluted basis and Kiwa BVI surviving as a wholly-owned subsidiary of Tintic. Subsequent to the share exchange transaction, Tintic changed its name to Kiwa Bio-Tech Products Group Corporation. On July 21, 2004, we completed our reincorporation in the State of Delaware. On March 8, 2017, we completed our reincorporation in the State of Nevada.

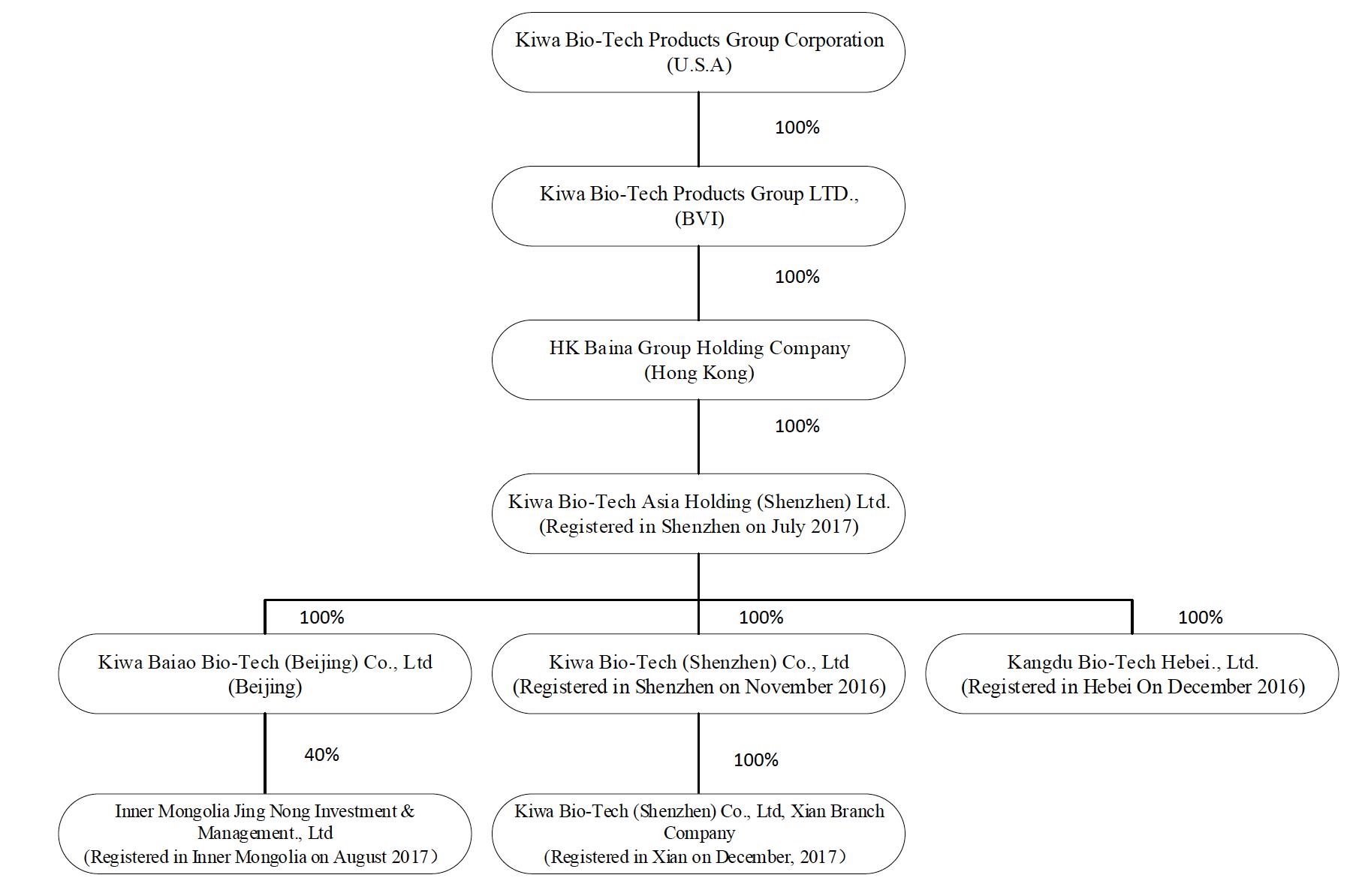

We established our subsidiaryThe Company operates through a series of subsidiaries in the Peoples Republic of China as detailed in the following Organizational Chart. The Company had previously operated its business through its subsidiaries Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”) in 2002 and Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin”Tianjin “). Kiwa Tianjin has been dissolved since July, 11, 2012. On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title, interest and liabilities in Kiwa Shandong to the Transferee for RMB 1.00. On April 12, 2017, the government processing of transfer has been completed. Currently, the Company mainly operates its business through its subsidiaries Kiwa Baiao Bio-Tech (Beijing) Co., Ltd, which was acquired in January 2016 and rename to Kiwa Baiao Bio-Tech (Beijing) Co., Ltd. from Oriental Baina Co., Ltd. in June, 2016; Kiwa Bio-Tech Products (Shenzhen) Co., Ltd, which was incorporated in China in November, 2016 and Kiwa Bio-Tech Products (Hebei) Co., Ltd., which was incorporated in December, 2016. In July, 2017, the Company established Kiwa Bio-Tech Asia Holding (Shenzhen) Ltd. (“Kiwa Asia”) to be the direct holding company of Kiwa Beijing, Kiwa Shenzhen and Kiwa Hebei. The Company established Inner Mongolia Jing Nong Investment & Management, Ltd. (“Kiwa Jing Nong”) in July 2006. Effective on July 11, 2012, theAugust 2017. The Company dissolvedestablished Kiwa Tianjin.Bio-Tech Asia Holding (Shenzhen) Ltd., Xian Branch Company in December 2017.

| 3 |

2. Overview of Business

We develop, manufacture, distribute and market innovative, cost-effective and environmentally safe bio-technological products for agriculture. Our products are designed to enhance the quality of human life by increasing the value, quality and productivity of crops and decreasing the negative environmental impact of chemicals and other wastes.

Bio-fertilizersOur Products

We have developed a number of bio-fertilizers and are continuing to develop new products in this area. In 2002, Kiwa BVI chartered Kiwa Shandong, a wholly-owned subsidiary organized under the laws of the PRC, as its offshore fertilizer manufacturing base to capitalize on low cost, high quality manufacturing advantages available in China. In October 2003, Kiwa Shandong completed the first phase of construction of its manufacturing facility in Shandong Province, China. In November 2003, Kiwa Shandong began shipping its bio-fertilizer products to the agricultural market in China. Since then, we have been devoted to expanding our market share.

In June 2008, Kiwa Shandong received approval from the Ministry of Commerce of the PRC to sell fertilizer products of other manufacturers on a wholesale basis, including chemical fertilizers, complex fertilizers, and compound fertilizers. Based on applicable tax laws in China, these products will be exempt from value-added tax.

During the last three years, the Company did not produce any products, had no market and failed to generate any revenue of material importance.

We have developed six bio-fertilizer products with bacillus sppspecies (“bacillus spp”) and/or photosynthetic bacteria as core ingredients. For the year ended December 31, 2017, we are currently generating revenues from two of our three bio-fertilizer products: 1) Biological Organic Fertilizer and 2) Compound Microbial Fertilizer. We expect to add one more bio-fertilizer product, 3) Bio-Water Soluble Fertilizer, to our revenue sources in 2018 and it is expecting to launch sometime in the third quarter of 2018.

Some of our products contain ingredients of both photosynthesis and bacillus bacteria. Bacillus spp is a species of bacteria that interacts with plants and promotes biological processes. It is highly effective for promoting plant growth, enhancing yield, improving quality and elevating resistances. Photosynthetic bacteria are a group of green and purple bacteria. Bacterial photosynthesis differs from green plant photosynthesis in that bacterial photosynthesis occurs in an anaerobic environment and does not produce oxygen. Photosynthetic bacteria can enhance the photosynthetic capacity of green plants by increasing the utilization of sunlight, which helps keep the photosynthetic process at a vigorous level, enhances the capacity of plants to transform inorganic materials to organic products, and boosts overall plant health and productivity.

| 4 |

Intellectual Property

Our bacillus bacteria based fertilizers are protected by patents. In 2004, we acquired patent no. ZL 93101635.5 entitled “Highly Effective Composite Bacteria for Enhancing Yield and the Related Methodology for Manufacturing” from China Agricultural University (“CAU”) for the aggregate purchase of $480,411, consisting of $60,411 in cash and 5,000 shares of our common stock, valued at $84.00 per share (aggregate value of $420,000). Our photosynthetic bacteria based fertilizers are also protected by trade secret laws.

The patent acquired from CAU covers six different species of bacillus which have been tested as bio-fertilizers to enhance yield and plant health. The production methods of the six species are also patented. The patent has expired on February 19, 2013.There are no limitations under this agreement on our exclusive use of the patent. Pursuant to our agreement with CAU, the University agreed to provide research and technology support services at no additional cost to us in the event we decide to use the patent to produce commercial products. These research and technology support services include: (1) furnishing faculty or graduate-level researchers to help bacteria culturing, sampling, testing, trial production and production formula adjustment; (2) providing production technology and procedures to turn the products into powder form while keeping live required bacteria in the products; (3) establishing quality standards and quality control systems; (4) providing testing and research support for us to obtain necessary sale permits from the Chinese government; and (5) cooperation in developing derivative products.

On January 5, 2011, the State Intellectual Property Office of the PRC (“Intellectual Property Office”) granted Kiwa Shandong two Certificates of Patent of Invention for (1) “A cucumber dedicated composite anti-continuous cropping effect probiotics and their specific strains with related application” with patent number of “ZL 2008 1 0144492.6”; and (2) “Cotton dedicated composite anti-continuous cropping effect probiotics and their special strains with related application” with patent number of “ZL 2008 1 0144491.1” These two patents have been developed by Kiwa-CAU R&D Center. These two patents will expire on August 5, 2028. These two patents can be used to develop specific environment-friendly bio-fertilizer.

We have obtained fivethree fertilizer registration certificates from the Chinese government - fourtwo covering our bacillus bacteria fertilizer and one covering our photosynthetic bacteria fertilizer. The five registration certificates are: (1) Microorganism Microbial InoculumBiological Organic Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture; (2) Photosynthetic BacteriaCompound Microbial Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture; (3) Amino Acid Foliar FomularCompound Microbial Water Soluble Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture; (4) Organic Fertilizer Registration Certificate issued by Agriculture Department of Shandong Province; and (5) Organic Matter-Decomposing Inoculants Registration Certificate issued by the PRC Ministry of Agriculture on February 16, 2008.Agriculture. Protected by these fivethree fertilizer registration certificates and five trademarks under the names of “KANGTAN” (Chinese translation name for Kiwa), “ZHIGUANGYOU,” “PUGUANGFU,” “JINWA” and “KANGGUAN,” we have developed sixthree series of bio-fertilizer products with bacillus spp and/or photosynthetic bacteria as core ingredients. Valid period of fertilizer registration certificates is five years and may be extended for another five years upon application from the owner of fertilizer registration certificates. The Company has determined to re-apply the Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture.

Our Customers

For the year ended December 31, 2017, three customers accounted for 46%, 26%, 17% of the Company’s sales.

1. Qingdao Lanhai Hanrui Bio-Tech Ltd. (46% of sales)

2. Wofu (Tianjing) Agriculture Development Ltd. (26% of sales)

3. Deluke Agriculture Bio-Tech (Shenzhen) Ltd. (17% of sales)

Should we lose any of these large scale customers in the future and are unable to obtain additional customers, our revenues and operation results might be adversely affected.

Our Suppliers

For the year ended December 31, 2017, two suppliers accounted for 49% and 47% of the Company’s total purchases, respectively. One of our supplier is named Weifang Deluke Fertilizer Co., Ltd. (“Weifang Deluke”), which is our subcontractor that purchase raw materials and produce our bio-fertilizer products. Prior to May 2017, all raw materials used to produce our bio-fertilizer were contributed by Weifang Deluke. Starting from May, 2017, we began making raw materials purchase orders from Shenzhen San Kang Life Agriculture Development Ltd. Co. (“Shenzhen San Kang”), who specializes in the supply chain business of agriculture industry. For the year ended December 31, 2017, Weifang Deluke was contributing approximately 49% of total purchases including raw materials and finished goods, and Shenzhen San Kang was contributing approximately 47% of total purchase which only included raw materials for producing our bio-fertilizer. Starting from 2018, Weifang Deluke was expected to contributing approximately 30%-40% raw materials for producing our bio-fertilizer, and Shenzhen San Kang was expected to contributing approximately 60%-70% raw materials for producing our bio-fertilizer.

| 5 |

Our Competition

We compete primarily on the basis of quality, technological innovation and price. Some of our competitors have achieved greater market penetration but with less sophisticated technological innovation than our products as there were in the transition period from being the chemical bio-fertilizer producers to the organically bio-fertilizer producers. We believe that we have a better competitive advantage over them as we are the pioneer within our markets. Some of our competitors competed within our markets have lesser financial and other resources than us as they have established their companies a few years behind us. If we are unable to compete successfully in our markets, our relative market share and profits could be reduced.

Our main competitors include China Green Agriculture, Inc., Genliduo Biotechnology Ltd., Shenzhen Baitan Ecotypic Engineering Co. Ltd., Hunan Taigu Biotechnology Co. Ltd. and Shanxi A.K. Quantum Agricultural Technology Corporation.

Kiwa-CAU Research and Development Center

In July 2006, we established a new research center with CAU through our subsidiary, Kiwa Shandong,China Agricultural University (“CAU”) which is known as Kiwa-CAU Bio-Tech Research & Development Center (the “Kiwa-CAU R&D Center”). Pursuant to an agreement between CAU and Kiwa Shandong dated November 14, 2006, Kiwa Shandong agreed to contribute RMB 1 million (approximately $160,000) each year to fund research at Kiwa-CAU R&D Center. The term of this agreement was ten years starting from July 1, 2006. Prof. Qi Wang, who became one of our directors in July 2007, has acted as the Director of Kiwa-CAU R&D Center since July 2006. Under the above agreement, the Kiwa-CAU R&D Center is responsible for fulfilling the overall research-and-development functions of Kiwa Shandong, including: (1) development of new technologies and new products (which will be shared by Kiwa and CAU); (2) subsequent perfection of existing product-related technologies; and (3) training quality-control personnel and technicians and technical support for marketing activities. The Company has spent $178,388 and $162,715 for its research and development activities during the years ended December 31, 2015 and 2014, respectively. The costs incurred by Company’s research and development activities are not borne directly by customers.

During fiscal 2014, Kiwa-CAU R&D Center had successfully isolated several strains of endophytic bacillus from plants. A number of strains had been observed to have the capability of boosting crop yield and dispelling chemical pesticide residual from soil. These strains could be used for developing not only new biological preparation but also environmental protection preparation.

Pursuant to The Company terminated its cooperation with CAU when the agreement expired on joint incorporation of the research and development center between CAU and Kiwa Shandong dated November 14, 2006, Kiwa Shandong agrees to invest RMB 1 million (approximately $160,000) each year to fund research at the R&D Center. The term of this agreement is ten years starting from July 1, 2006. Prof. Qi Wang, who became one of our directors in July 2007, has acted as2016. All the Director ofliabilities owed to Kiwa-CAU R&D Center since July 2006.

Other

According towere assumed by the Project Agreement with Zoucheng Municipal Government in 2002, we have committed to investing approximately $18 million to $24 million for developingTransferee of Kiwa Shandong when the manufacturing and research facilities in Zoucheng,Company disposed Kiwa Shandong Province. As of December 31, 2015, we had invested approximately $1.91 million for the project.on Feb 11, 2017.

On November 5, 2015, the Company signed a strategic cooperation agreement (the “Agreement”) with China Academy of Agricultural Science (“CAAS”)’s Institute of Agricultural Resources & Regional Planning (“IARRP”) and Institute of Agricultural Economy & Development (“IAED”). Pursuant to the Agreement, the Company will form a strategic partnership with the two institutes and establish an “International Cooperation Platform for Internet and Safe Agricultural Products”. To fund the cooperation platform’s R&D activities, the Company will provide RMB 1 million (approximately $160,000) per year to the Spatial Agriculture Planning Method & Applications Innovation Team that belongs to the Institutes.Institute. The term of the Agreement is for three years beginning November 20, 2015. However, the Company is only liable for the annual funds to be provided to the extent of the contract obligations performed by CAAS IARRP and IAED, and the agreement is terminable before the three years’ commitment date based on negotiations of both parties. Prof. Yong Chang Wu, the authorized representative of IARRP, CAAS, is also one of the Company’s directors effective since November 20, 2015.2015 until March 13, 2017.

| 6 |

On February 23, 2017, the Company agreed to a strategic relationship with ETS (Tianjin) Biological Science and Technology Development Co., Ltd. (“ETS”). The partnership will include the deployment and strategic use of ETS biotechnology to produce of bio-fertilizers for use in both China and internationally. Kiwa and ETS, together with the certain Chinese government departments, will work together to enhance China’s microbial fertilizer industry standards and China’s food safety industry chain standards. The parties will work together on the development of microbial technology and products in agriculture, environmental protection, soil management and other fields. Relying on the Chinese Academy of Sciences, ETS Environmental and Agricultural Microbial Technology Research Center and biotechnology project research results, Kiwa has introduced the ETS core technology to complete bio-fertilizer upgrading, transformation and to develop new product lines. In order to meet the growing global consumer demand to increase food supply and develop sustainable farming we are applying sustainable use of biotechnology and the use of biotechnology products to replace chemical products, which will strengthen environmental protection and promote international cooperation. As a result of strict management of many agricultural chemicals, such chemicals will continue to be abandoned, resulting is a growing demand for bio-fertilizers. It has been widely accepted that the application of ETS biotechnology facilitates agricultural sustainability and helps to protect the soil and improve grain output. The technology focuses on keeping soil healthy by restoring healthy microbes that are naturally present in healthy soils. As the technology gains worldwide recognition, it is imperative to popularize bio-fertilizer in developing countries to fulfill the needs of growing populations and promote environmentally friendly agriculture. Through the cooperation of Kiwa and ETS, the parties aim to enhance the usage of the bio-fertilizers in China. The cooperation will bring technological transformation and support for Kiwa to improve its existing manufacturing techniques. Kiwa and ETS will also collaborate to establish a comprehensive platform for producing, supplying, and marketing in China. Ultimately, Kiwa would look to introduce these products to the international market, including the United States.

Other

On November 30, 2015, we entered into an acquisition agreement (the “Agreement”) with the shareholders of Caber Holdings LTD, whose Chinese name is Hong Kong Baina Group Co., Ltd, located in Hong Kong (“Baina Hong Kong”), and Oriental Baina Co. Ltd. (hereinafter referred to as “Baina Beijing”), Baina Hong Kong’s wholly-owned subsidiary in Beijing, China. WhenAs a result of this acquisition is completed,Agreement, Kiwa will renamerenamed Baina Beijing to Kiwa Baiao Bio-Tech (Beijing) Co., Ltd. Kiwa Baiao Co. Ltd will replace Kiwa’s current subsidiary in China -, which replaced Kiwa Bio-Tech (Shandong) Co., Ltd (“Kiwa Shandong”) - to operate Kiwa’s bio-fertilizer market expansion and become Kiwa’s platform for future acquisitions of new agricultural-related projects in China. In accordance with the terms of the Agreement, Kiwa agreed to pay US$30,000approximately HKD 1.00 to the Baina Hong Kong Shareholders, a group of unrelated third parties, for the acquisition of 100% of the equity of Baina Hong Kong. As of December 31, 2015, the Company has paid RMB 220,000 (approximately $34,000) for the acquisition. The acquisition was completed on January 7, 2016. Both Baina Hong Kong and Baina Beijing had no activities before the acquisition date and had no assets and liabilities. The purpose of this acquisition was to acquire Baina Hong Kong’s corporation registration in Hong Kong and in China.

Thereafter, Baina Beijing formed four new subsidiaries—Kiwa Bio-Tech (Shenzhen) Co., Ltd (Registered in Shenzhen on November 2016); Kangdu Bio-Tech Hebei Co., Ltd. (Registered in Hebei on December 2016) , Kiwa Bio-Tech Asia Holding (Shenzhen) Ltd. (Registered in Shenzhen on July, 2017) and Inner Mongolia Jing Nong Investment & Management, Ltd. (Registered in Shenzhen on July, 2017).

On December 17, 2015, we entered into a distribution agreement (the “Agreement”) with Kangtan Gerui (Beijing) Bio-Tech Co., Ltd. (“Gerui”) and formally awarded Gerui a right to sell and distribute the Company’s fertilizer products in 3 major agricultural regions of China--China— Hainan Province, Hunan Province and Xinjiang Autonomous Region. The Company’s Research and Development department has been conducting application experiments in Hainan and Hunan Provinces since August 2015, in accordance with the market requirements. The experiment data indicates that the Company’s fertilizer products have fulfillfulfilled the requirements of reduction of content of heavy metals in soil and improveimproved crop yield. Gerui was founded in Beijing in April 2015 and relies on the sales network of China’s Supply and Marketing Cooperatives system. Currently, the Company and Gerui do not hold any interest in each other; however, a collaboration and integration may take place in the future. The term of the Agreement is for a period of three years commencing December 17, 2015. In September 2016, Kiwa Baiao Bio-Tech (Beijing) Co., Ltd obtained a fertilizer sales permit from the Chinese government and began to sale the products directly to customers in those 3 major agricultural regions. In September 2016, Kiwa Baiao Bio-Tech (Beijing) Co., Ltd obtained a fertilizer sales permit from the Chinese government and began to sale the products directly to customers in those 3 major agricultural regions.

| 7 |

On February 27, 2017, the Company signed a strategic cooperation agreement with the Beijing Zhongpin Agricultural Science and Technology Development Center (“Zhongpin Center”). Zhongpin Center is the Chinese Agricultural Science and Technology Innovation and Development Committee’s executive implementation agency (referred to as the Agricultural Science and Technology Commission). The Agricultural Science and Technology Commission is set up by the Chinese Central Government for the construction of the National Ecological Security Agriculture Industrial Chain standardization system. This includes the establishment of National Ecology Safe Agricultural Industrial Parks to build China’s Ecological Security and Agricultural Industrial in an orderly business environment, including completion of the National Soil Remediation Program and governance of the various government functions of the institutions. Through the guidance and support by the Zhongpin Center, Kiwa will participate and be involved in China’s National Soil Remediation Program and construction of the National Ecological Security Agriculture Industrial Chain Standardization System’s operation and process.

Employees

As of December 31, 2017, we employed 82 full-time employees. The following table sets forth the number of our full-time employees by function as of December 31, 2017.

Employees and their Functions

| Management & Administrative Staff | 33 | 40.24 | % | |||||

| Sales | 13 | 15.85 | % | |||||

| Technical & Engineering Staff | 36 | 43.90 | % | |||||

| Total | 82 | 100.00 | % |

As required by applicable PRC law, we have entered into employment contracts with all our officers, managers and employees. We believe that we maintain a satisfactory working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff.

In addition, we are required by PRC law to cover employees in China with various types of social insurance and believe that we are in material compliance with the relevant laws.

Insurance

We believe our insurance coverage is customary and standard for companies of comparable size in comparable industries in China.

Smaller reporting companies are not required to provide the information required by this item.

ITEM 1B. Unresolved Staff Comments

None.

In June 2002, Kiwa Shandong entered into an agreement with Zoucheng Municipal Government granting us the use of at least 15.7 acres in Shandong Province, China at no cost for 10 years to construct a manufacturing facility. Under the agreement, we have the option to pay a fee of approximately RMB 480,000 (approximately $78,155) per acre for the land use right at the expiration of the 10-year period. We may not transfer or pledge the temporary land use right. In the same agreement, we have also committed to invest approximately $18 million to $24 million for developing the manufacturing and research facilities in Zoucheng, Shandong Province. AsOn February 11, 2017 Kiwa Bio-Tech Products (Shandong) entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of December 31, 2015, we had invested approximately $1.91 million in plantshareholders’ right, title, interest and equipment for the project. The Company is in negotiation with Zoucheng Municipal Government to renew the agreement. However, there is no assurance that the Company will successfully renew the agreement with Zoucheng Municipal Government. In the future, the Company may consider moving the primary location of Kiwa Shandong’s operation to other locations in China.

From January 1, 2007, China central government adopted a series of policies to strengthen land management, including doubling the tenure tax to $3,320 per acre. In February 2008, the Ministry of Land and Resources of China issued “Controlling Indexes of Construction Land Use for Industrial Projects,” which requires that the building coverage be not less than 30%. Up to now, the current situationliabilities in Kiwa Shandong does not meet this requirement. Asto the Transferee for RMB $1.00. The completion of transfer was completed on April 12, 2017.

| 8 |

(a) On March 1, 2017, Kiwa Bio-Tech (Shenzhen) Co., Ltd, a company operating ag-biotech business, the building coverage may differ from thatnewly established subsidiary entered an office lease agreement with one-year term. Monthly lease payment is RMB 29,000 or approximately of typical manufacturers in other industries. However, there is no assurance that local authorities would not take back a portion of the land granted to us.USD $4,320. This lease was terminated on August 31, 2017.

The core ingredient(b) On June 20, 2017, Kiwa Bio-Tech (Shenzhen) Co., Ltd, a newly established subsidiary entered an office lease agreement with two-year term. Monthly lease payment is RMB 117,221 or approximately of our bio-fertilizer productsUSD $17,213 for the first year and RMB 124,254 or approximately of USD $18,245 for the second year. And the previous lease agreement terminated automatically since the landlord is bacillus spp. Photosynthetic bacteria is one of the ingredients used in some of our products. However, the upgrade of bio-fertilizer production facilities was not fully completed due to capital shortage.same one.

The Company leases its principal(c) On May 5, 2017, Kiwa Bio-Tech Products Group Corporation entered an office from a related party at the rent of $1,000 per month. This lease expired in January 2015.agreement with 13 months term. Monthly lease payment totaled USD $781.15.

(d) On July 1, 2017, Kiwa Bio-Tech Products Group Corporation entered an office lease agreement with one-year term. Monthly lease payment totaled USD $1,087.

None.

ITEM 4. Mine Safety Disclosures

Not applicable.

ITEM 5. Market for Registrants’ Common Equity, Related Stockholder Matters and Issuer Purchasers of Equity Securities

Market Information

The Company’s common stock has been quoted on the OTC Pink Sheets under the symbol “KWBT” since March 30, 2004. Our shares are currently traded on the OTCQB.

The following table sets forth the high and low bid quotations per share of our common stock as reported on the OTC Pink SheetsOTCQB for the periods indicated. The high and low bid quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions. All prices are adjusted to reflect the Company’s one for 200 reverse split which went effective January 28, 2016.

| Fiscal Year 2015 | High | Low | ||||||||||||||

| Fiscal Year 2017 | High | Low | ||||||||||||||

| First Quarter | $ | 1.47 | $ | 0.12 | $ | 1.49 | $ | 1.44 | ||||||||

| Second Quarter | $ | 0.44 | $ | 0.02 | $ | 2.61 | $ | 2.48 | ||||||||

| Third Quarter | $ | 0.32 | $ | 0.12 | $ | 2.52 | $ | 2.31 | ||||||||

| Fourth Quarter | $ | 0.70 | $ | 0.12 | $ | 1.92 | $ | 1.83 | ||||||||

| Fiscal Year 2014 | High | Low | ||||||||||||||

| Fiscal Year 2016 | High | Low | ||||||||||||||

| First Quarter | $ | 1.16 | $ | 0.22 | $ | 2.24 | $ | 0.20 | ||||||||

| Second Quarter | $ | 0.70 | $ | 0.20 | $ | 1.98 | $ | 1.30 | ||||||||

| Third Quarter | $ | 0.70 | $ | 0.22 | $ | 1.65 | $ | 0.62 | ||||||||

| Fourth Quarter | $ | 0.34 | $ | 0.22 | $ | 1.43 | $ | 0.80 | ||||||||

Holders

As of December 31, 2015,2017, there were approximately 435495 shareholders of record of our common shares.

| 9 |

Dividend Policy

We have not paid any dividends on our common shares since our inception and do not anticipate that dividends will be paid at any time in the immediate future.

Equity Compensation Plan Information

The information required by Item 5 regarding securities authorized for issuance under equity compensation plans is included in Item 12 of this report.

Recent Sales of Unregistered Securities

BelowThe following is a list of securities sold by usissued for cash or converted with debentures or as stock compensation to consultants during the period from January 1, 20152017 through April 10, 2016March 30, 2018, which were not registered under the Securities ActAct:

| Name of Purchaser | Issue Date | Security | Shares | Consideration | ||||||

| 3/ | Common | |||||||||

| 3/ | Common | |||||||||

| 3/ | Common | 70,000 | Consultant Fees | |||||||

| HAIPING LIU | 6/13/17 | Common | 19,380 | Consultant Fees | ||||||

| YANG YANG | 6/13/17 | Common | 96,900 | Stock Purchase | ||||||

| YUAN ZENG | 6/30/17 | Common | 21,100 | Stock Purchase | ||||||

| BAOYU OUYANG | 6/30/17 | Common | 17,000 | Stock Purchase | ||||||

| HONGHUA ZHANG | 6/30/17 | Common | 15,000 | Stock Purchase | ||||||

| WEIQIANG XU | 6/30/17 | Common | 10,000 | Stock Purchase | ||||||

| JIALIN XIONG | 6/30/17 | Common | 3,750 | Stock Purchase | ||||||

| KUN WEI | 6/30/17 | Common | 3,000 | Stock Purchase | ||||||

| YANYU GUO | 6/30/17 | Common | 2,000 | Stock Purchase | ||||||

| YANJIAO GUO | 6/30/17 | Common | 1,000 | |||||||

| MENGSHA YUAN | 6/30/17 | Common | 10,000 | Stock Purchase | ||||||

| MO HAN | 6/30/17 | Common | 15,000 | Stock Purchase | ||||||

| HEBE HAN | 6/30/17 | Common | 15,108 | Consultant Fees | ||||||

| QUANZHEN SHEN | 8/1/17 | Common | 98,000 | Stock Purchase | ||||||

| QUANZHEN SHEN | 8/1/17 | Common | 49,000 | Consultant Fees | ||||||

| YUAN WANG | 8/1/17 | Common | 39,000 | Consultant Fees | ||||||

| JUNWEI ZHENG | 8/1/17 | Common | 245,000 | Stock Purchase | ||||||

| YANWU ZHU | 8/18/17 | Common | 67,500 | Consultant Fees | ||||||

| ZHEN LIN | 8/18/17 | Common | 50,000 | Consultant Fees | ||||||

| HAIPENG LIU | 8/18/17 | Common | 50,000 | Consultant Fees | ||||||

| YANAN FU | 8/18/17 | Common | 206,000 | Consultant Fees | ||||||

| XIAOCHUN ZHANG | 8/18/17 | Common | 100,000 | Consultant Fees | ||||||

| YUEFENG SU | 8/18/17 | Common | 135,000 | Stock Purchase | ||||||

| ZHEN LIN | 8/18/17 | Common | 50,000 | Stock Purchase | ||||||

| HAIPENG LIU | 8/18/17 | Common | 50,000 | Stock Purchase | ||||||

| FIRSTTRUST GROUP, INC. | 10/19/17 | Common | 14,151 | Conversion of Note | ||||||

| DONGQING ZHAO | 10/24/17 | Common | 50,000 | Consultant Fees | ||||||

| LIYA WANG | 10/24/17 | Common | 50,000 | Consultant Fees | ||||||

| MING JI | 10/24/17 | Common | 50,000 | Consultant Fees | ||||||

| SHUMIN E | 10/24/17 | Common | 50,000 | Consultant Fees | ||||||

| XIUFANG GAO | 10/24/17 | Common | 50,000 | Consultant Fees | ||||||

| YUFANG YANG | 10/24/17 | Common | 50,000 | Consultant Fees | ||||||

| GENG LIU | 10/24/17 | Common | 500,000 | Consultant Fees | ||||||

| XUAN ZHANG | 10/24/17 | Common | 500,000 | Consultant Fees | ||||||

| HAIRONG CHEN | 10/24/17 | Common | 38,000 | Consultant Fees | ||||||

| ERLI WEI | 10/24/17 | Common | 38,000 | Stock Purchase | ||||||

| FIRSTTRUSTGROUP, INC. | 12/27/17 | Common | 105,095 | Conversion of Note | ||||||

| Wei Li | 12/28/17 | Ser. B Preferred | 811,148 | Debt Cancellation | ||||||

| YONGTAO YU | 12/29/17 | Common | 1,000,000 | Stock Purchase | ||||||

| TIANAO ZHANG | 12/29/17 | Common | 1,540,000 | Stock Purchase | ||||||

| WSMG ADVISORS | 1/11/18 | Common | 180,000 | Consultant Fees | ||||||

| ACORN MANAGEMENT PARTNERS, LLC. | 1/11/18 | Common | 187,500 | Consultant Fees | ||||||

| TING LI | 1/11/18 | Common | 400,000 | Consultant Fees | ||||||

| JIANPING GUO | 3/9/18 | Common | 100,000 | Consultant Fees | ||||||

| GUOHUI YU | 3/16/18 | Common | 50,000 | Consultant Fees | ||||||

| Total: | 8,202,632 | |||||||||

| 10 |

ITEM 6. Selected Financial Data

Not required.

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Annual Report on Form 10-K for the fiscal year ended December 31, 20152017 contains “forward-looking” statements within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, including statements that include the words “believes,” “expects,” “anticipates,” or similar expressions. These forward-looking statements include, among others, statements concerning our expectations regarding our working capital requirements, financing requirements, business, growth prospects, competition and results of operations, and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. The forward-looking statements in this Annual Report on Form 10-K for the fiscal year ended December 31, 20152017 involve known and unknown risks, uncertainties and other factors (described in “Business-Risk Factors” under Item 1) that could cause our actual results, performance or achievements to differ materially from those expressed in or implied by the forward-looking statements contained herein.

Overview

The Company took its present corporate form in March 2004 when the shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002 and Tintic Gold Mining Company a Utah public corporation (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah, entered into a share exchange transaction. The share exchange transaction with the shareholders of Kiwa BVI, a privately-held British Virgin Islands corporation that left the shareholders of Kiwa BVI owning a majority of Tintic and Kiwa BVI a wholly-owned subsidiary of Tintic, see “Business - The Company” under Item 1.Tintic. For accounting purposes this transaction was treated as an acquisition of Tintic Gold Mining Company by Kiwa BVI in the form of a reverse triangular merger and a recapitalization of Kiwa BVI and its wholly owned subsidiary, Kiwa Shandong.Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”). On July 21, 2004, we completed our reincorporation in the State of Delaware. On March 8, 2017, we completed our reincorporation in the State of Nevada.

On November 30, 2015, we entered into an acquisition agreement (the “Agreement”) with the shareholders of Caber Holdings LTD, whose Chinese name is Hong Kong Baina Group Co., Ltd, located in Hong Kong (“Baina Hong Kong”), and Oriental Baina Co. Ltd. (hereinafter referred to as “Baina Beijing”), Baina Hong Kong’s wholly-owned subsidiary in Beijing, China. Kiwa will rename Baina Beijing to Kiwa Baiao Co. Ltd. Kiwa Baiao Co. Ltd will replace Kiwa’s current subsidiary in China - Kiwa Bio-Tech (Shandong) Co., Ltd (“Kiwa Shandong”) - to operate Kiwa’s bio-fertilizer market expansion and become Kiwa’s platform for future acquisitions of new agricultural-related projects in China. In accordance with the terms of the Agreement, Kiwa agreed to pay approximately $34,000 (RMB 220,000) to the Baina Hong Kong Shareholders, a group of unrelated third parties, for the acquisition of 100% of the equity of Baina Hong Kong. The acquisition was completed on January 7, 2016. Both Baina Hong Kong and Baina Beijing had no activities before the acquisition date and had no assets and liabilities. The purpose of this acquisition was to acquire Baina Hong Kong’s corporation registration in Hong Kong and in China.

We havepreviously established a subsidiary in China, Kiwa Shandong in 2002, a wholly-owned subsidiary.subsidiary, engaging in the bio-fertilizer business. Formerly, our subsidiary Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin”), was engaged in the bio-enhanced feed business. At the end of 2009, our former subsidiary, Kiwa Tianjin discontinuedcould no longer use its business operations, because it lost possession of its primary assets including machinery and inventory necessary to its business operations due to an unsettled dispute. As a result, the Company has classified the bio-enhanced feed business as discontinued operations. Effective on July 11, 2012, the Company formally dissolved Kiwa Tianjin.

We generated no revenue in fiscal years 2015 and 2014. We incurred a net loss of $677,358 and $707,556 during fiscal 2015 and 2014, respectively.

Due to our limited revenues, we have relied on the proceeds from loans from both unrelated and related parties to provide the resources necessary to fund the development of our business plan and operations. Our financing activities generated $148,009 and $144,194 during fiscal 2015 and 2014, respectively. These funds are insufficient to execute our business plan as currently contemplated, which may result in the risks described in “Risk Factors” under Item 1 - Business.

Going Concern

The consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.operations. Kiwa Tianjin has been dissolved since July 11, 2012. On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title, interest and liabilities in Kiwa Shandong to the Transferee for RMB1.00. On April 12, 2017, the government processing of transfer has been completed.

| 11 |

Principal Factors Affecting Our Financial Performance

AsWe believe that the following factors that would affect our financial performance:

| ● | Change in the Chinese Government Policy on agricultural industry. The Chinese Government is continuously to promote green environment and implement quality standards and environmentally sensitive policies in the Agricultural industry. Below are a list of government policies issued by the Chinese Government to promote green environment and these policies are either directly or indirectly to encourage the end users of the bio-fertilizer to use more organic related products. Unfavorable changes to these policies could affect demand of our products that we produce and could materially and adversely affect the results of operations. Although we have generally benefited from these policies by using our bio-fertilizer to enhances the capacity of plants to transform inorganic materials to organic products, to boost overall plant health and productivity and not to deteriorate landfall soil. |

| ○ | In April 2008, the Ministry of Finance of PRC issued Circular No. 2008-56 to tax-exempt value-added taxes on all organically fertilizer related products effectively from June 1, 2008. | |

| ○ | In January 2016, the PRC State Council official website issued statements to fasten the agricultural modernization process. | |

| ○ | In June 2016, the PRC State Council issued Circular No. 2016-31 to prevent further deterioration of landfall soil action plan. | |

| ○ | In February 2017, the PRC State Council official website issued statements to promote agricultural structural reform on accelerating the cultivation in the agricultural development. | |

| ○ | In February 2017, the Ministry of Agriculture of PRC issued Circular No. 2017-02 to carry out replacement of chemical bio-fertilizers by organically bio-fertilizers action plan on vegetables, fruits and teas planting. | |

| ○ | In April 2017, the Ministry of Agriculture of PRC issued Circular No. 2017-06 to implementing five major action plans on agriculture green development with one of the action plan of replacing chemical bio-fertilizers by organically bio-fertilizers on vegetables, fruits and teas planting under action plan No. 2-2. |

| ● | Innovation Efforts. We strive to produce the most technically and scientifically advanced products for our customers and maintained close relationships with institutes in the PRC. |

| ○ | We signed a strategic cooperation agreement with China Academy of Agricultural Science’s Institute of Agricultural Resources & Regional Planning and Institute of Agricultural Economy & Development. Pursuant to the Agreement, we will form a strategic partnership with the two institutes and establish an “International Cooperation Platform for Internet and Safe Agricultural Products”. To fund the cooperation platform’s R&D activities, we will provide RMB 1 million (approximately $160,000) per year to the Spatial Agriculture Planning Method & Applications Innovation Team that belongs to the Institutes. The term of the Agreement is for three years beginning November 20, 2015 and will expire on November 19, 2018. | |

| ○ | Meanwhile, on February 23, 2017, the Company entered a strategic relationship with ETS (Tianjin) Biological Science and Technology Development Co., Ltd. (“ETS”). ETS technology was first established in the U.S., and commercialized and improved in Japan for nearly 30 years. In 2013, the ETS technology was introduced into Mainland China. It has been widely accepted that the application of ETS biotechnology facilitates agricultural sustainability and helps to protect the soil and improve grain output. The technology focuses on keeping soil healthy by restoring healthy microbes that are naturally present in healthy soils. As the technology gains worldwide recognition, it is imperative to popularize bio-fertilizer in developing countries to fulfill the needs of growing populations and promote environmentally friendly agriculture. The cooperation will include the deployment and strategic use of ETS biotechnology to produce of bio-fertilizers for use in both China and internationally. The cooperation will bring technological transformation and support for Kiwa to improve its existing manufacturing techniques. Kiwa and ETS will also collaborate to establish a comprehensive platform for producing, supplying, and marketing in China. Ultimately, Kiwa would look to introduce these products to the international market, including the United States. |

| 12 |

| ● | Experienced Management. Management’s technical knowledge and business relationships give us the ability to secure more sales orders with our customers. If there were to be any significant turnover in our senior management, it could deplete the institutional knowledge held by our existing senior management team. | |

| ● | Large Scale Customer Relationship. We have contracts with major customers that are distributors of our products. Our sales efforts focus on these distributors which place large recurring orders and present less credit risk to us. For the year ended December 31, 2017, three customers accounted for approximately 46%, 26%, and 17% of our sales. Should we lose any of these large scale customers in the future and are unable to obtain additional customers, our revenues and operation results may be adversely affected. | |

| ● | Competition. Our competition includes a number of publicly traded companies in the PRC and privately-held PRC-based companies that produce and sell products similar to ours. We compete primarily on the basis of quality, technological innovation and price. Some of our competitors have achieved greater market penetration but with less sophisticated technological innovation than our products as there were in the transition period from being the chemical bio-fertilizer producers to the organically bio-fertilizer producers. We believe that we have a better competitive advantage over them as we are the pioneer within our markets. Some of our competitors competed within our markets have lesser financial and other resources than us as they have established their companies a few years behind us. If we are unable to compete successfully in our markets, our relative market share and profits could be reduced. |

Results of Operations for the Year ended December 31, 2015,2017 and December 31, 2016

The following table summarizes the Company’s current liabilities substantially exceeded its current assets by $9,330,130. The Company had no sales duringresults of our operations for the years ended December 31, 20152017 and 2014, had an accumulated deficitDecember 31, 2016, respectively, and provides information regarding the dollar and percentage increase or (decrease) during such periods.

(All amounts, other than percentages, in thousands of $20,324,812U.S. dollars)

| Year Ended December 31, | Amount Increase | Percentage Increase | ||||||||||||||

| Statement of Operations Data: | 2017 | 2016 | (Decrease) | (Decrease) | ||||||||||||

| Revenues | $ | 17,270 | $ | 9,621 | $ | 7,649 | 80 | % | ||||||||

| Cost of goods sold | (11,846 | ) | (7,200 | ) | (4,646 | ) | 65 | % | ||||||||

| Gross profit | 5,424 | 2,421 | 3,003 | 124 | % | |||||||||||

| Operating expenses | ||||||||||||||||

| Research and development expense | 148 | 149 | (1 | ) | (1 | )% | ||||||||||

| Selling expenses | 483 | 530 | (47 | ) | (9 | )% | ||||||||||

| General and administrative expenses | 2,997 | 869 | 2,128 | 245 | % | |||||||||||

| Total operating expenses | 3,628 | 1,548 | 2,080 | 134 | % | |||||||||||

| Operating Income | 1,796 | 873 | 923 | 106 | % | |||||||||||

| Other income/(expense), net | ||||||||||||||||

| Trademark license income-related party | - | 786 | (786 | ) | (100 | )% | ||||||||||

| Change in fair value of derivative liabilities | 322 | - | 322 | 100 | % | |||||||||||

| Interest expenses | (524 | ) | (191 | ) | (333 | ) | 175 | % | ||||||||

| Other income/(expense) | 382 | (2 | ) | 384 | (18,375 | )% | ||||||||||

| Exchange loss | (59 | ) | - | (59 | ) | 100 | % | |||||||||

| Total other income/(expense), net | 121 | 593 | (472 | ) | (80 | )% | ||||||||||

| Income from continuing operations before income taxes | 1,917 | 1,466 | 451 | 31 | % | |||||||||||

| Income taxes | (1,103 | ) | (425 | ) | (678 | ) | 160 | % | ||||||||

| Income from continuing operations | $ | 814 | $ | 1,041 | $ | (227 | ) | (22 | )% | |||||||

| Income (loss) from discontinued operations, net of taxes | 4,495 | (150 | ) | 4,645 | (3,088 | )% | ||||||||||

| Net Income | $ | 5,309 | $ | 891 | $ | 4,418 | 496 | % | ||||||||

| 13 |

Revenue

Revenue increased by approximately $7.6 million or 80%, to approximately $17.3 million in the year ended December 31, 2017 from approximately $9.6 million in the year ended December 31, 2016. In August 2016, Kiwa Baiao Bio-Tech (Beijing) Co., Ltd obtained a fertilizer sales permit from the Chinese government and stockholders’ deficiencybegan to sell the products directly to customers in Northern areas of $11,100,454.China. Due to the good quality of our products, we have gained more reputation in the agricultural industry and were able to attract more customers. In addition, we established Kiwa Bio-Tech Products (Shenzhen) Co., Ltd. in November 2016 to support sales in Southern areas of China. Our strategy on the expansion of our business was to gain market share in the bio-fertilizer market, thereby, we have extended credit to our customers. Our current payment terms on these customers are ranging from 60 days to 9 months after receipts of the goods depending on the creditworthiness of these customers. These circumstances, among others, raise substantial doubt aboutcustomers are mainly agricultural cooperative company and distributors who then resell our products to individual farmers. Because the Company’scrop growing cycle usually takes approximately 3 to 9 months in the agricultural industry, it will take approximately similar time frame of 3 to 9 months for farmers to harvest crops and to realize profits to repay our distributors. As a result, for the sales contracts with these customers, the collectability of payment is highly dependent on the successful harvest of corps and the customers’ ability to continue as a going concern.collect money from farmers. The financial statements doCompany deemed the collectability of payment may not include any adjustmentsbe reasonably assured until after the Company is paid. For those sales contracts that might resultthe Company has shipped its products but the payment is contingent on collections of payments from the outcomedownstream customers, the Company considers the revenue recognition criteria are not met and therefore defers the revenue and cost of this uncertainty. The financial statements also do not include any adjustments relatinggoods sold until payments are collected. We have sold, shipped and collected our accounts receivable approximately $17.3 million of our products during the year ended December 31, 2017. As a result, our revenue increased accordingly for the year ended December 31, 2017 as compared to the recoverabilitysame period in 2016.

We currently realized revenue in two major product categories of Biological Organic Fertilizer and classificationCompound Microbial Fertilizer. Biological Organic Fertilizer is the first product category we launched into market in September 2016. Compound Microbial Fertilizer are our new products with higher effectiveness on the productivity of recorded asset amounts,crops and increasing the value and quality of the crops harvested, which was firstly introduced in March 2017. We sold and shipped Compound Microbial Fertilizer in the third quarter of 2017. We plan to launch another product category of Bio-Water Soluble Fertilizer in the third quarter of 2018. Our revenues from our major product categories are summarized as follows:

| For the year ended December 31, 2017 | For the year ended December 31, 2016 | Change | Change (%) | |||||||||||||

| Biological Organic Fertilizer | ||||||||||||||||

| Sold and shipped in USD | $ | 9,219,453 | $ | 9,620,929 | $ | (401,476 | ) | (4.2 | )% | |||||||

| Quantity sold in tons | 51,877 | 53,250 | (1,373 | ) | (2.6 | )% | ||||||||||

| Average selling price | $ | 177.72 | $ | 180.66 | $ | (2.94 | ) | (1.6 | )% | |||||||

| Compound Microbial Fertilizer | ||||||||||||||||

| Sold and shipped in USD | $ | 8,050,616 | $ | - | $ | 8,050,616 | 100.0 | % | ||||||||

| Quantity sold in tons | 24,781 | - | 24,781 | 100.0 | % | |||||||||||

| Average selling price | $ | 324.87 | $ | - | $ | 324.87 | 100.0 | % | ||||||||

Revenue from Biological Organic Fertilizer decreased by approximately $0.4 million or amounts4.2%, to approximately $9.2 million in the year ended December 31, 2017 from approximately $9.6 million in the year ended December 31, 2016. The decrease of revenue from Biological Organic Fertilizer mainly due to the combination of decrease of quantity sold and classificationsdecrease in average selling price for the year ended December 31, 2017 as compared to the same period in 2016. Quantity sold decreased by 1,373 tons or 2.6% mainly due to management’s revenue generating focus was toward the higher unit profit margin product, Compound Microbial Fertilizer, which was firstly introduced in March 2017. Average selling prices decreased by $2.94 or 1.6% during the year ended December 31, 2017 as compared to the year ended December 31, 2016 was mainly due to the appreciation of liabilitiesRenminbi against U.S. Dollar of approximately 1.7%. Average selling prices for both periods remained stable in Renminbi.

| 14 |

Because the Chinese Government is continuously to promote green environment and implement quality standards and environmentally sensitive policies in the Agricultural industry, we expect our revenues from our innovated and highly effective products, Compound Microbial Fertilizer and Bio-Water Soluble Fertilizer, will continue to grow in a higher rate than that might be necessary shouldfrom Biological Organic Fertilizer. Our Compound Microbial Fertilizer and Bio-Water Soluble Fertilizer generally have a higher effectiveness on the Company be unableproductivity of crops that are suitable for promoting green environment. In addition, our marketing team is expanding to the Western areas of China and Hainan province and we expect our revenues will continue to grow in 2018. Meanwhile, we expect to continue asto gain more market shares in our existing sales channel bases in the Northern and the Southern areas of China due to the good quality of the products and better reputation in the industry.

Compound Microbial Fertilizer is adding appropriate amount of nitrogen, phosphorus, potassium and other nutrients into Biological Organic Fertilizer. Through the action of organic matter and beneficial microorganisms, the utilization rate of nitrogen, phosphorus, potassium can be significantly improved. The Bio-Water Soluble Fertilizer is mainly another form of the biological fertilizer. It is in the form of powder which has high water solubility, and it is convenient for the farmers to use during the drop irrigation. Compound Microbial Fertilizer and Bio-Water Soluble Fertilizer generally contain more bacteria and have a going concern.higher effectiveness on the productivity of crops and increasing the value and quality of the crops harvested than Biological Organic Fertilizer. As a result, our Compound Microbial Fertilizer and Bio-Water Soluble Fertilizer generally have a higher average selling price.

The companysold and shipped amount of Compound Microbial Fertilizer increased by approximately $8.1 million or 100.0% in the year ended December 31, 2017 as we did not sell this product category during the year ended December 31, 2016.

Cost of Revenue

Our cost of revenues from our major product categories are summarized as follows:

| For the year ended December 31, 2017 | For the year ended December 31, 2016 | Change | Change (%) | |||||||||||||

| Biological Organic Fertilizer | ||||||||||||||||

| Cost of sold and shipped in USD | $ | 6,196,511 | $ | 7,199,888 | $ | (1,003,377 | ) | (13.9 | )% | |||||||

| Quantity sold and shipped in tons | 51,877 | 53,250 | (1,373 | ) | (2.6 | )% | ||||||||||

| Average unit cost | $ | 119.45 | $ | 135.21 | $ | (15.76 | ) | (11.7 | )% | |||||||

| Compound Microbial Fertilizer | ||||||||||||||||

| Cost of sold and shipped in USD | $ | 5,649,363 | $ | - | $ | 5,649,363 | 100.0 | % | ||||||||

| Quantity sold and shipped in tons | 24,781 | - | 24,781 | 100.0 | % | |||||||||||

| Average unit cost | $ | 227.97 | $ | - | $ | 227.97 | 100.0 | % | ||||||||

Cost of revenue from Biological Organic Fertilizer decreased by approximately $1.0 million or 13.9%, to approximately $6.2 million in the year ended December 31, 2017 from approximately $7.2 million in the year ended December 31, 2016. The decrease is mainly due to the combination of decrease in quantity sold and the decrease of average unit production cost. The decrease of $15.76 or 11.7% of average unit production cost is mainly due to the combination of decrease of price for raw materials (mainly includes nitrogen, phosphorus and potassium) used in the year ended December 31, 2017 and the appreciation of Renminbi against U.S. Dollar of approximately 1.7%.

Cost of sold and shipped from Compound Microbial Fertilizer increased by approximately $5.7 million or 100.0%. The increase was in line with the increase in the selling amount of Compound Microbial Fertilizer.

| 15 |

Gross Profit

Our gross profit from our major product categories are summarized as follows:

| For the year ended December 31, 2017 | For the year ended December 31, 2016 | Change | Change (%) | |||||||||||||

| Biological Organic Fertilizer | ||||||||||||||||

| Gross Profit | $ | 3,022,943 | $ | 2,421,041 | $ | 601,902 | 24.9 | % | ||||||||

| Gross Profit Percentage | 32.8 | % | 25.2 | % | 7.6 | % | 30.2 | % | ||||||||

| Compound Microbial Fertilizer | ||||||||||||||||

| Gross Profit | $ | 2,401,252 | $ | - | $ | 2,401,252 | 100.0 | % | ||||||||

| Gross Profit Percentage | 29.8 | % | - | 29.8 | % | 100.0 | % | |||||||||

Gross profit percentage for Biological Organic Fertilizer increased from 25.2% for the year ended December 31, 2016 to 32.8% for the year ended December 31, 2017 mainly due to the decrease in raw materials price in our unit production cost of our products for the reason as discussed above.

Research and Development Expenses

Research and development expenses was approximately $148,000 (RMB 1,000,000) for the year ended December 31, 2017, keeping the same as the prior comparable period of approximately $149,000 (RMB 1,000,000) for the year ended December 31, 2016. On November 20, 2015, the Company signed a strategic cooperation agreement (the “Agreement”) with China Academy of Agricultural Science (“CAAS”)’s Institute of Agricultural Resources & Regional Planning (“IARRP”) and Institute of Agricultural Economy & Development (“IAED”). Pursuant to the Agreement, the Company will form a strategic partnership with the two institutes and establish an “International Cooperation Platform for Internet and Safe Agricultural Products”. To fund the cooperation platform’s R&D activities, the Company will provide RMB 1 million (approximately $148,000) per year to the Spatial Agriculture Planning Method & Applications Innovation Team that belongs to the Institutes. The term of the Agreement is for three years beginning November 20, 2015 and will expire on November 19, 2018. However, the Company is only liable for the annual funds to be provided to the extent of the contract obligations performed by CAAS IARRP and IAED, and the agreement is terminable before the three years’ commitment date based on negotiations of both parties. The Company contributed approximately $148,000 (RMB 1,000,000) for the year ended December 31, 2017 and approximately $149,000 (RMB 1,000,000) for the year ended December 31, 2016. The Company plans to relycontribute the same R&D expense in quarterly installments in 2018 until the date of the Agreement expires on November 19, 2018.

Selling Expense

Selling expenses for the years ended December 31, 2017 and 2016 were approximately $483,000 and $530,000, respectively. Selling expenses include salaries of sales personnel, sales commission, travel and entertainment as well as freight out expenses. The decrease in selling expenses is mainly due to the decrease of freight out expenses of approximately $0.5 million offset by the increase in salary expenses of approximately $0.3 million and increase in promotional expenses of approximately $0.1 million in 2017. During the year ended December 31, 2016, we were responsible for freight out expenses while during the year ended December 31, 2017, our demand of the products was on a rise and our customers are willing to pay for the freight out expenses on their own. The increase in salary expenses is mainly because we have started hiring sales managers in the fourth quarter of 2016 for the marketing of our products in 2017. Prior to September 2016, there was no designated sales personnel since Kiwa Beijing just obtained the permit to sell bio-fertilizer in September 2016. With business expansion, we have hired more sales managers in Kiwa Beijing and in Kiwa Shenzhen to manage our sales activities in different regions of China from October 2016 and throughout 2017. In addition, we have incurred a lot of promotion and marketing activities in 2017 which also attributable to the increase of promotional expenses.

| 16 |

General and Administration

General and administrative (“G&A”) expenses increased by approximately $2.1 million or 245% from approximately $0.9 million in the year ended December 31, 2016 to approximately $3.0 million in the same period in 2017. General and administrative expenses include professional fees, officers’ compensation, depreciation and amortization, salaries, travel and entertainment, rent, office expense and telephone expense and the like. The increase in general and administrative expenses is mainly attributed to business expansion and the establishment of Kiwa Shenzhen in November 2016, Kiwa Hebei in December 2016 and Kiwa Asia in July 2017, which contributed approximately $1.0 million increase. In addition, approximately $0.6 million increase of G&A expenses are attributable to the increase of professional fees, such as attorneys, auditors, financial consultants, IT consultants, and business strategic and development consultants.

Right-to-use Trademark Income

Trademark license income totaled $0 for the year ended December 31, 2017, compared with $786,329 for the same period of 2016, reflecting a decrease of 100% from the same period of last year. Income was generated from licensing our trademark to Gerui. We signed the license agreement with Gerui to allow Gerui to sell fertilizer using our trademark in December 2015. We charged Gerui 10% of net sales of fertilizers bearing Kiwa trademark for using our trademark. Gerui began to sell fertilizers bearing Kiwa trademark in 2016. In August 2016, we obtained the government approval of selling fertilizers in China. As a result, we ceased the licensing arrangement cooperation with Gerui and started to sell our own bio-fertilizers from September 2016.

Other Income

Other income increased by approximately $0.4 million from $0 for the year ended December 31, 2016 to approximately $0.4 million in the same period in 2017. The increase is mainly attributable the accrued professional fees which were unclaimed for more than ten years and we have evaluated and reached the decision to discharge these liabilities.

Interest Expenses

Net interest expense was $ 524,333 and $ 190,552 for the year ended December 31, 2017 and 2016, respectively, representing an increase of $333,781 or 175%. Interest expense included accrued interest on convertible note and other note payable, and the amortization of the convertible note discount for the year ended December 31, 2017 and 2016. The increase in interest expenses is mainly attributed to newly issuance of two 15% convertible notes for the year ended December 31, 2017.

Income (Loss) from discontinued operations, net of taxes

Income from discontinued operations, net of taxes was $4,495,333 for the year ended December 31, 2017 and loss from discontinued operations, net of taxes was $150,471 for the year ended December 31, 2016, which results an increase of $4,645,804 gain from discontinued operations, net of taxes for the years ended December 31, 2017 and 2016. Due to suffering from losses for several years, on February 11, 2017, the Company executed an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) whereby the Company transferred all of its right, title and interest in Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Shandong”) to the Transferee for RMB 1.00. The government processing of the transaction was completed on April 12, 2017. Therefore, it’s resulted in the increase of income from discontinued operations, net of taxes.

Net Income

During the fiscal year 2017, net income was $5,309,036, compared with $891,030 for the same period of 2016, representing an increase of $4,418,006 or 496%. Such change was the result of the combination of the changes as discussed above.

| 17 |

Critical Accounting Policies and Estimates

We prepared our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Management periodically evaluates the estimates and judgments made. Management bases its estimates and judgments on historical experience and on various factors that are believed to be reasonable under current circumstances. Actual results may differ from these estimates as a result of different assumptions or conditions.

The following critical accounting policies affect the more significant judgments and estimates used in the preparation of our consolidated financial statements. In addition, you should refer to our accompanying consolidated balance sheets as of December 31, 2017 and 2016, and the consolidated statements of operations and comprehensive income (loss), changes in shareholders’ equity (deficiency) and cash flows for the fiscal years ended December 31, 2017 and 2016, and the related notes thereto, for further discussion of our accounting policies.

Revenue Recognition

The Company applies paragraph 605-10-S99-1 of the FASB Accounting Standards Codification for revenue recognition. The Company recognizes revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

The Company’s current payment terms on credits to its customers are ranging from 60 days to 9 months after receipts of the goods depending on the proceedscreditworthiness of its customers. The Company’s customers are mainly agricultural cooperative company and distributors who then resell the Company’s products to individual farmers. Because the crop growing cycle usually takes approximately 3 to 9 months in the agricultural industry for some of these Co-ops and distributors, will take approximately similar time frame of 3 to 9 months for farmers to harvest crops and to realize profits to repay the resellers. As a result, for the sales contracts with these customers, the collectability of payment is highly dependent on the successful harvest of corps and the customers’ ability to collect money from farmers. The Company deemed the collectability of payment may not be reasonably assured until after the Company get paid. For those sales contracts that the Company has shipped its products but the payment is contingent on collections of payments from the downstream customers, the Company considers the revenue recognition criteria are not met and therefore defers the revenue and cost of goods sold until payments are collected. These revenue and cost of goods sold are classified in the captioned “Deferred revenue” and “Deferred cost of goods sold” in the accompanying consolidated balance sheets. For other customers whose repayment is within normal business course and not highly dependent on the succession of corps being harvested, the Company recognized revenue when title and ownership of the goods are transferred upon shipment to the customer by the Company.

Accounts receivable and allowance for doubtful accounts

Accounts receivable represent customer accounts receivables. The Company provides an allowance for doubtful accounts equal to the estimated uncollectible amounts. The Company’s estimate is based on historical collection experience, the economic environment trends in the microbial fertilizer industry, and a review of the current status of trade accounts receivable. Management reviews its accounts receivable each reporting period to determine if the allowance for doubtful accounts is adequate. Such allowances, if any, would be recorded in the period the impairment is identified. It is reasonably possible that the Company’s estimate of the allowance for doubtful accounts will change. Uncollectible accounts receivables are charged against the allowance for doubtful accounts when all reasonable efforts to collect the amounts due have been exhausted.

Impairment of Long-Lived Assets

The Company’s long-lived assets consist of property and equipment. The Company evaluates its investment in long-lived assets for recoverability whenever events or changes in circumstances indicate the net carrying amount may not be recoverable. It is possible that these assets could become impaired as a result of legal factors, market conditions, operational performance indicators, technological or other industry changes. If circumstances require a long-lived asset or asset group to be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by that asset or asset group to its carrying value. If the carrying value of the long-lived asset or asset group is not recoverable on an undiscounted cash flow basis, an impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques, including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary.

| 18 |

Related Parties

The Company follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions. Pursuant to Section 850-10-20 the related parties include: a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly Influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The disclosures shall include: a. the nature of the relationship(s) involved; b. a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the consolidated financial statements; c. the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d. amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Income Taxes

The Company accounts for income taxes under the provisions of FASB ASC Topic 740, “Income Tax,” which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Deferred tax assets and liabilities are recognized for the future tax consequence attributable to the difference between the tax bases of assets and liabilities and their reported amounts in the financial statements. Deferred tax assets and liabilities are measured using the enacted tax rate expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company establishes a valuation when it is more likely than not that the assets will not be recovered.