UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20152021

or

| ☐ | TRANSITIONAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transitional period from _____________ to ______________

��

Commission file number 333-189731

| DIEGO PELLICER WORLDWIDE, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 33-1223037 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

3435 Ocean Park Blvd.6160 Plumas Street, #107-610, Santa Monica, CA 90405Suite 100, Reno, NV89519

(Address of principal executive offices) including zip code)(Zip Code)

(516) 900-3799

(Registrant’s telephone number, including area code: (516) 900-3799code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class registered: | Trading Symbol(s): | Name of each exchange on which registered: | ||

| N/A |

Securities registered pursuant to section 12(g) of the Act:None

Common Shares, par value $0.00001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] ☐ No [X] ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: Yes [ ] ☐ No [X] ☒

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day. Yes [ ] ☒ No [X]☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] ☒ No [ ]☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” anda “smaller reporting company”company,” and emerging growth company in Rule 12b-2 if the Exchange Act.

| Large Accelerated filer | Accelerated filer | ☐ | |||

| Non-accelerated filer | Smaller reporting company | ||||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] ☐ No [X] ☒

There was no active public trading market as

As of June 30, 2021, the last business day of the Company’s second fiscal quarter, so there was no aggregate market value of the shares of the registrant’s common equity held by non-affiliates was approximately $7,039,615, using the June 30, 2021 closing price of the Registrant’s common stock of $0.036/share. Shares of the registrant’s common stock held by non-affiliates.each executive officer and director and by each person who beneficially owns 10 percent or more of the registrant’s outstanding common stock have been excluded in that such persons may be deemed to be “affiliates” of the registrant for purposes of the above calculation. This determination of affiliate status is not a conclusive determination for other purposes.

As of April 18, 2016,8, 2022, the registrant had 41,572,082 shares issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

None.

TABLE OF CONTENTS

1

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Annual Report”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Unless otherwise provided in this Annual Report, references to the “Company,” “Diego,” “we,” “us” and “our” refer to Diego Pellicer Worldwide, Inc.

2

PART I

Business Overview of the Market

The cannabis market has a multi-billion dollar potential. The industry is still in a development stage, and is being rapidly propelled towards its potential by the state legalization and the rush by suppliers to meet the pent-up demand. Most suppliers are small, unsophisticated but capable operators. The federal legal constraints provide an opportunity to those companies early to the market to gain a first mover advantage and to the successful ones, an opportunity to be a consolidator in the industry.

What is Diego’s Strategy, Phases One and Two?

Diego is a real estate and a consumer retail development company that is focused on high quality recurring revenues resulting from leasing real estate to licensed cannabis operators, and the management of operations for these and other third party cannabis operators deriving income from management and royalty fees. Diego provides a competitive advantage to these operators by developing “Diego Pellicer” as the world’s first “premium”premium marijuana brand and by adhering toestablishing the highest quality and standards for its facilities along with both cannabis and non-cannabis products.

The Company’s initial focusfirst phase strategy is to acquirelease and develop legally compliantthe most prominent and convenient real estate locations for the purposes of leasing them to state licensed companiesoperators in the cannabis industry. Diego does not grow or sell marijuana or marijuana infused products in the early stages of this plan.

Diego’s initialfirst phase revenues deriveresult from leasing real estate and selling non-cannabis related products; however, when it is federally legalaccessories to do so, Diego will be properly positioned to take advantage of pre-negotiated acquisition contracts with selected Diego tenants in marijuana retail and production facilities throughout the country. Diego’s business model will allow it to become a nationally branded marijuana retailer and producer, instantaneously, with the change of federal law.our tenants. The Company will not implement this business model until it becomes legal under federal law to sellhas developed a brand name strategy, providing training, design services, branded accessories, systems and produce marijuana.

To operate within the constraints set forth by the US government, the purpose of this business plan is to describe Diego; however, to better describe the future growth plan for the Company, we will also describe the grow and retail operations of other entities with which Diego has pre-negotiated acquisition contracts or plans to have pre-negotiated acquisition contracts in the future. At this time, we only have one pre-negotiated acquisition contract in place with Diego Pellicer, Inc. a Washington Corporation. These external operations are presented as DP Grow and DP Retail, and the results of these operations as presented will not directly benefit Diego until after Federal legalization.

Merger and Share Exchange Agreement

On March 13, 2015 (the “Closing Date”), Diego Pellicer Worldwide, Inc. (f/k/a Type 1 Media, Inc.) (the “Company” or “PubCo”) closed on a merger and share exchange agreement (the “Merger Agreement”) by and among (i) the Company, and (ii) Diego Pellicer World-wide 1, Inc., a Delaware corporation, (“Diego”), and (iii) Jonathan White, the majority shareholder of the Company (the “Majority Shareholder”). Pursuant to the terms of the Merger Agreement, Diego shall be merged with and into the Company, with the Company to continue as the surviving corporation (the “Surviving Corporation”) in the Merger, and the Company succeeding to and assuming all the rights, assets, liabilities, debts, and obligations of Diego (the “Merger”).

In connection with the closing of the Merger, on the Closing Date, Jonathan White and Thomas Baxter submitted to the Company a resignation letter pursuant to which they resigned from their positions as officers and members of the Board of Directors of the Company. Messrs. White and Baxter’s resignations were not a result of any disagreements relating to the Company’s operations, policies or practices. On the Closing Date, the board of directors of the Company (the “Board”) and the majority stockholders of the Company (the “Shareholders”) accepted the resignations of Messrs. White and Baxter and, contemporaneously appointed: (i) Philip Gay to serve as the Chief Executive Officer and member of the Board of Directors, (ii) Ron Throgmartin to act as Chief Operating Officer, (iii) Nick Roberts to act as Chief Financial Officer; and (iv) Alan Valdes, Douglas Anderson, and Stephen Norris to serve as members of the Board of Directors.

Subsequent to the Merger and Share Exchange Agreement, on May 22, 2015, Philip Gay resigned as the Chief Executive Officer and as a member of the board of directors, and Nick Roberts resigned as Chief Financial Officer. Mr. Gay and Mr. Roberts resignations were not the result of any disagreement with the Company on any matter relating to its operation, policies (including accounting or financial policies), or practices. The board of directors of the Company appointed Ron Throgmartin, the Company’s Chief Operating Officer as the Chief Executive Officer and David R. Wells as the Company’s Interim Chief Financial Officer.

On January 29, 2016, the Board of Directors accepted the resignation of David R. Wells as Chief Financial Officer of the Company. On January 29, 2016, the Board appointed Christopher Strachan, as the Company’s new Chief Financial Officer.

Our Corporate History and Background

Diego Pellicer Inc. was formed in the state of Washington of December 5, 2012, with the intent to produce and sell cannabis in the state of Washington. The Company determined that in order to be successful and avoid any potential violation of federal law, it would form a new corporation that would not produce or sell cannabis directly. Therefore, Diego Pellicer Worldwide, Inc. was formed as a Delaware corporation, on August 26, 2013. The Company was developed to position itself in such a way that if the cannabis industry were to federally legalize, then it would be in an advantageous position to quickly become one of the first luxury integrated brands in the industry. Currently, the Company’s focus is to acquire and develop legally compliant real estate locations for the purposes of leasing them to state licensed companies in the cannabis industry. Diego does not grow or sell marijuana or marijuana infused products at this time.

Mission

At this time, Diego Pellicer is a development stage company and is only in the early stages of implementing its business plan. In states where recreational and/or medical marijuana sales and cultivation is legal under State law, the Company plans to lease property to tenants who will grow and/or sell the highest quality of marijuana. As a tenant of Diego, these operators will have access to Diego’s world class management team with expertise in real estate, retail management, agriculture and USDA experts, legal, marketing and branding, product development and creative teams.

When the US and countries around the world legalize commerce of marijuana on a national and international platform, Diego hopes to be in a position to dominate the marijuana marketplace. Diego will accomplish this by positioning the Company, through its business model, to be the first fully integrated marijuana retail operation and premium brand, known for its beautifully designed user friendly retail stores offering the finest quality products at competitive prices, when the USsystems training, locational selection, and other countries legalize the sale of marijuana.

Philosophy

We believe that legalizing marijuana, regulating it and taxing it, will cause less harm and do more good than the prohibition environment. We believe marijuana should be elevatedadvisory services to its proper place among other legal recreational intoxicants such as fine wines, liquors, beers, cigars, etc. There is an overwhelming amount of scientific evidence that supports our philosophy, as well as a growing number of supporters ranging from high-ranking US and foreign politicians to prominent figures in the entertainment industry. In addition, we believe that legalization will help unlock the phenomenal power of cannabis as a medicinal treatment for numerous ailments from headaches to cancer.

Brand History

Diego Pellicer was a Spanish colonial vice governor of Cebu, a major island in the Philippine archipelago. He grew to become the largest grower of hemp in the world and is our name sake. He serves as an inspiration to our executive team, as well as distinctive brand befitting the quality of Diego Pellicer Worldwide.

Vision

Our vision is to continue to develop Diego Pellicer as a premium brand that is valued and positioned to appeal to a broad customer base.

In addition, Diego believes that in the very near future, the US and other countries will embrace the will of the people, and legalize the responsible adult use of marijuana. Legalizing national and international commerce of marijuana, will allow Diego to take its brand and unmatched quality standards to markets all around the globe.

Value Proposition

The initial value proposition of Diego consists of a standardized approach to the build-outs of real estate holdings, customized for premium marijuana grow and retail operations. The build-out model is optimized to maximize resources while minimizing costs and overhead. With each build-out, Diego pre-negotiates with select tenants, acquisition contracts with licensed DP Grow and DP Retail tenants, which, upon changes to federal law, introduces our second value proposition—ownership of operations from seed to sale in an industry that is projected to exceed $8 billion by 2018 and we hope will soon rival that of traditional markets such as tobacco and alcohol.

Market Size

The US state-sanctioned medical and recreational marijuana market generated a total revenue of $5.4 billion in 2015, boosted by an incredible growth in the recreational sector of sales, from $351M to $998M, an estimated increase of 184% over 2014. By comparison, the marijuana market is less than 3% of the US tobacco market, a $144 billion market that has no medicinal value, and less than 3% of the alcohol market, which valued at $113.5 billion in 2014 (Marijuana Business Daily 2016;2016 Statistic Brain Research Institute). As states legalize marijuana, and international markets develop, the emerging legalized marijuana industry will begin to rival that of tobacco and alcohol and could see $45B in revenues by 2020.

Target Geographies

Diego has entered a rapid growth and expansion stage in its evolution toward becoming an internationally recognized brand. The target geographies for Diego are all US states in which recreational or medicinal marijuana is legalized. This is a phased implementation that carefully pre-stages funding and materials to be first to market, as each state rules on legalization. In certain scenarios, Diego may choose to allow weak competitors to fail, making available prime real estate that otherwise would be inaccessible.

Target Consumers

There are an estimated 1.5 million medical marijuana patients in the US and more than 4,500 retailers. California and Washington have the largest number of marijuana patients at more than 775,000 for each state, followed by Michigan at 344,000 and Colorado with 107,534. (Marijuana Business Daily 2016).

The demographics for consumers that have tried marijuana at least once, range between ages 18 to 49, with the greatest numbers between the ages 26 and 34. These consumers are predominantly male and college educated.

Alaska has the fastest growing population of potential consumers, followed by Washington DC, Colorado, New Mexico and Hawaii, with Washington just a few points below. In 2012, Montana, Colorado, California, and Washington had the greatest increase in disposable income, thus increasing the breadth of target consumers.

Material Agreements

On April 19, 2014, the Company entered into a commercial agreement and merger agreement with Diego Pellicer, Inc., a Washington corporation (“Diego Washington”). Diego Washington agreed to making a capital contribution from its current investors of not less than $350,000 in the Company and that the Company agreed to offer to the holders of Series A Preferred Stock of Diego Washington and to current holders of convertible promissory notes convertible for shares of Diego Washington, the right to exchange that same number of shares to shares the Company.

On September 19, 2013, the Company entered into a Lease Agreement with M-P Properties whereby the Company agreed to lease the property located at 2215 4thAvenue, Seattle, Washington, for a term of five years with an option to renew. The Company agreed to pay $78,000 per year.

On March 1, 2014, the Company entered into a Sublease Agreement with Diego Pellicer, Inc., a Washington entity whereby the Company agreed to sublease the property located at 2215 4thAvenue, Seattle, Washington, for a term of four years.

On June 12, 2014, the Company entered into a Lease Agreement with Shamira, LLC whereby the Company agreed to lease the property located at 4242 Elizabeth Street, Denver, Colorado, for five years with an option to renew. The Company agreed to pay $360,000 per year for the first year of the agreement, with an increase of 3% for year subsequent year.

On August 14, 2014, the Company entered into a Commercial Sublease Agreement with DPCO, Inc., a Colorado corporation, whereby the Company subleased the property located at 4242 Elizabeth Street, Denver, Colorado for a term of five years.

On July 14, 2014, the Company entered into a Lease Agreement with 2949 W. Alameda Ave LLC whereby the Company agreed to lease the property located at 2949 W. Alameda Avenue, Denver, Colorado, for five years with an option to renew. The Company agreed to pay $20,000 per month in rent.

On August 14, 2014, the Company entered into a Sublease Agreement with DPCO, Inc., a Colorado corporation, whereby the Company agreed to sublease the property located at 2949 W. Alameda Avenue, Denver Colorado for a year of five years.

On August 13, 2014, the Company entered into a Sublease Agreement with M and S LLC whereby the Company agreed to lease the property located at 755 South Jason Street, Denver, Colorado, for four years. The Company agreed to pay $25,000 per month in rent.

On August 14, 2014, the Company entered into a Sublease Agreement with DPCO, Inc. a Colorado corporation, whereby the Company subleased the property located at 755 South Jason Street, Denver, Colorado for a term of four years.

Our Industry

their tenants. We are in a burgeoning industry, centered on the production and sales of medical and recreational marijuana. Diego Pellicer is focused on providing legally compliant retail and production facilities to State licensed operators. In addition, Diego Pellicer offers branding opportunities to state licensed producers and retailers that meet our stringent qualifications.

In addition to providing fully branded and built real estate to qualified tenants, Diego Pellicer offers non-cannabis infused products, apparel, and other tangible products at a wholesale rate. To become a qualified tenant, Diego requires its tenants to strictly adhere to testing and labeling requirements along with all state laws and federal guidelines to assure quality and consistency of marijuana products, ensuring safe sale and consumption. Table 7 provides a list of our current property portfolio.

Our Business Strategy

Market Definition and Roles

The marijuana market consists of medical and recreational regulators, producers, testers, processors, wholesalers, retailers, collectives, consumers and real estate holders. Since data pertaining to specific aspects of marijuana sales, such as processor revenues, is virtually non-existent for the marijuana market, the market is valued according to retail sales data provided by state and federal governing bodies. Below is a brief summary of each role:

Market Strategy

Our short-term strategy is to profit only from the lease payments of our real estate holdings and from the sale of branded, non-cannabis products. Diego will have pre-negotiated acquisition contracts with selected tenants that trigger only when it is legal, or not illegal, to conduct interstate commerce in marijuana. We intend to enter into branding agreements with our tenants going forward that will require our tenants to have certain quality controls and procedures to ensure our they comply with the law, safety and quality.tenants. In addition, part of the vetting process in finding the proper tenant is selecting a tenant that shares the Company’s values and strictly complies with respective state laws, follows strict safety and testing requirements and provides consistent, high-quality products. If the tenants do not comply, they will not be allowed to use the brand. At this time, we have one pre-negotiated acquisition contract in place with

The second phase of our strategy is to secure options to purchase the tenant’s operations. When mutually advantageous for Diego Pellicer Worldwide Washington and are in the process of negotiating additional pre-negotiatedtenant, Diego will negotiate acquisition contracts with selected Diego operators/tenants. When it becomes federally legal to do so, Diego will execute the acquisition contracts, consolidate our selected tenants and become a nationally branded marijuana retailer and producer concurrent with the change of federal law.

Diego Pellicer Management Company, a wholly owned subsidiary, will license the upscale Diego Pellicer (“DP”) brand to qualified operators and receive royalty payments, while providing expertise in retail, product and manufacturing from Diego’s management team.

Value Proposition

Value Proposition 1:

By providing branding, management experience, training, unique accessories, purchasing services, locational experience, standardized design, and experienced construction supervision, the tenant reduces his startup time, reduces cash drain, increases his efficiency, and builds his gross margin. Diego provides the capital for preopening lease costs and tenant improvements. This results in a turnkey retail location for the tenant. Thus, Diego’s real estate, management, consulting and accessory sales are positioned to deliver a premium return on our investment.

Value Proposition 2:

With each lease, Diego negotiates an acquisition contract with selected licensed tenants to acquire their operations. This contract will be executed at Diego’s option, and upon changes to federal law, introduces our second value proposition-ownership of operations.

Revenue Generation and Growth

Diego generates current revenue and stages future revenue streams through the following processes:

| ● | Acquire target properties to be improved for the growing, processing, distribution, and sale of medical and recreational marijuana, extracts and ancillary products. |

| ● | Build and lease turnkey Retail, Processing and/or Growing facilities. |

| ● | The Company may choose to secure management contracts with other retail and grow facilities to manage the business the “Diego Way.” This will generate additional revenue with which we can further expand our network of stores. |

| ● | Negotiate merger agreements with favored partners that will trigger when marijuana commerce becomes legal federally. |

| ● | Own DP Brands and other intellectual property. |

| ● | Charge reasonable rents and management fees to tenants or operators to recover all build-out, start-up investment plus profit margin, and management expertise over the lease term. |

3

| ● | Sell non-cannabis branded products lines such as apparel and edibles to Diego stores, other retail stores and for wholesale. |

| ● | Create an e-commerce platform selling non-cannabis branded merchandise |

| ● | Continue to build and market the brand utilizing all forms of media including traditional and digital media, social media, e-commerce, and strategic partners. |

Why We Believe this is a Winning Strategy

Should the United States and countries around the world legalize the commerce of marijuana, Diego is positioning itself to be a dominate player in the marijuana marketplace. Diego will accomplish this by being a fully integrated marijuana retail operation and premium brand, capitalizing on the beautifully designed retail stores offering the finest quality products at competitive prices.

Most industries evolve through the same business cycle. Many small independent companies initially operate in fragmented markets in the early stages. Then there is a consolidation of the industry, with the consolidators thriving and the independent companies dwindling. The larger companies have access to cheaper capital, lower costs, better merchandising, brand name recognition, and more efficient operations. This is what we offer our tenants when negotiating the lease: an agreement to acquire them when marijuana is legalized. This gives the tenant the ultimate opportunity to participate in the rapid consolidation that we believe will happen when marijuana is legalized. This consolidation will result in companies that have been unable to participate in the rapidly growing industry to be scrambling to enter the space. Diego and its tenants will already be established and consolidated. As an exit strategy, we want to position Diego to be a likely candidate for acquisition or a major player in the marketplace.

Recent Developments

2021 was a time of continued growth and a change of focus for the Company. An effective and experienced team was assembled from within our operators to develop our management company, and to complement the current executives with knowledge and experience in real estate operations, banking, site selection, branding, marketing, facility design, corporate finance, investor relations, store management, and grow expertise, Additional capital needed to be raised in order to have sufficient capital to help support our operators expand within their markets, and to begin the expansion into different markets in the US. Much of the Company’s debt is being renegotiated, and additional commitments were formalized for the expansion in the Colorado market. New markets had to be explored, new alliances forged, and opportunities prioritized.

New markets were explored. Three facilities continued to see solid revenues, which lead to rental revenue cash-flow to the Company. In 2021, Diego focused on our Colorado operations in Denver. Diego received revenues from the Colorado facilities and received revenues from a divested leased property in 2020. Diego now has two facilities generating rent in 2021 and we have actively been expanding in the Colorado markets with potential acquisitions for our tenants, and our management company. Although our tenants continue to strengthen their presence in the marketplace, post COVID-19 sales have tapered off slightly as the general workforce returns to work. Diego worked with these tenants, partially forbearing on their rent so as to allow these operators to strengthen their position and become capable of paying full rents. The properties generating rents in 2021 are as follows:

Table 1: Property Portfolio

| Purpose | Size | City | State | |||

| Retail store (recreational and medical) | 3,300 sq. | Denver | CO | |||

| Cultivation warehouse | 14,800 sq. | Denver | CO |

Diego’s Denver Colorado tenant opened our first grow store in Seattle in October 2016. On October 21 2020, the Company entered into an agreement with a third party, to which the Company sold the Elizabeth Street leased location operation securing all the future premium rents due under the extended lease agreement The Colorado tenant opened the Diego Denver branded grow facility in February 2017. The retail facilities have shown steady growth in sales since their opening. The three Colorado properties were subleased to a single entity. The Company is currently exploring the acquisition of other tenants.entities to increase cash flow and value for the company.

4

Diego Pellicer Denver

Diego will continue this strategy in states where recreational or medical marijuana sales and cultivation is legal under state law. Our business model is recurring lease revenue, royalties, management fees, and is entirely scalable. Our success will dependent upon continuing to raise capital for expansion, continual improvement of our business model, standardizing store design, controlling costs, new store management opportunities, and continuing to develop the brand.

On February 8, 2022, the Company entered into an Equity Purchase Agreement (the “Purchase Agreement”), with Hemp Choice Distribution, LLC, a Colorado limited liability company (“HCD”), its owners (the “Sellers”), and Gabriela Vergara (the “Sellers’ Representative”), pursuant to which we have agreed to acquire all of the issued and outstanding equity interests of HCD (“Membership Interests”). The closing of the transaction is expected to occur within 90 days from the date of the Purchase Agreement (the “Closing”).

The purchase price for the Membership Interests shall be the aggregate amount of $4,400,000 payable at the Closing as follows: (i) $250,000 in cash by wire transfer of immediately available funds; (ii) the number of restricted shares of the Company’s common stock that is equal to $250,000 divided by the current market price at the time of Closing, but such price shall not be greater than $.05 per share or less than $.02 per share: and (iii) three pillarsmillion nine hundred thousand dollars ($3,900,000) in the form of 390,000 shares of redeemable preferred stock (with a stated value of $10.00 per share) of the Company. The terms of the redeemable preferred shares shall be specifically and fully set forth in a Certificate of Designations to be filed with the State of Delaware at the time of Closing. After the Closing, the Purchaser agrees to provide HCD with a line of credit or assist it in obtaining a line of credit from a third party of up to $1,000,000. In addition, the business of HCD shall continue to be managed by Sellers’ Representative subject to the conditions of an employment agreement to be entered into by the Company and Sellers’ Representative prior to the Closing.

What does our strategy are:premium branding accomplish?

A very important aspect of our marketing plan is to build Diego Pellicer as a luxury brand. This not only enables us to establish further and exploit Diego Pellicer as a premium brand, but also to generate significant revenues off of non-cannabisfrom non- cannabis products.

5

Market Size

The USCompany is establishing several levels of branding and will use these to appeal to the various segments of the marketplace depending upon the location, competition, legal constraints, and budget. Standard store templates are being developed, complimentary accessories selectively designed, and customer preferences and segments analyzed.

Our Denver stores have been met with enthusiastic demand and quickly growing revenues. This is proving the initial Diego concept.

6

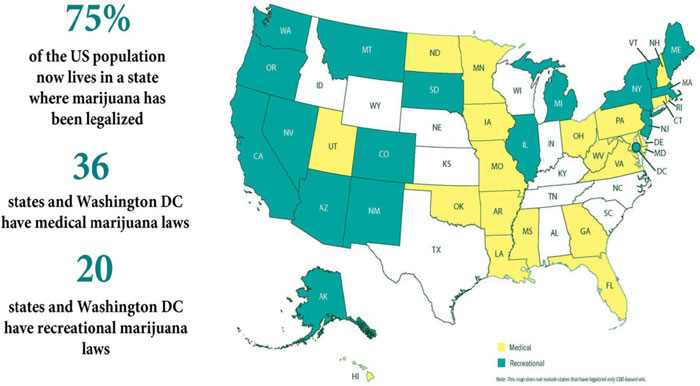

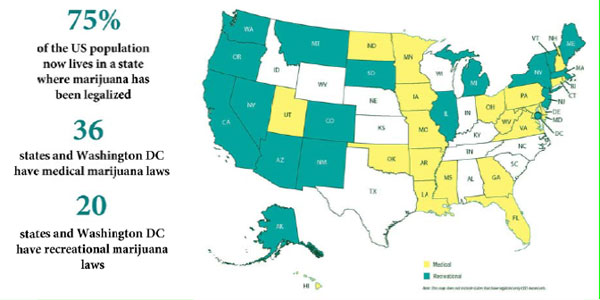

The Industry: Retail Sales Continue to Rise

Legalization of marijuana is a very recent movement. California was the first to legalize in 1996 when medical marijuana was approved. Eleven states and the District of Columbia have legalized the drug for recreational purposes, according to the National Conference of State Legislatures. More than half the states (36) – plus the District of Columbia, Guam and Puerto Rico – have legalized it for medical purposes. The list of states that have legalized marijuana could expand this November. Marijuana remains illegal under U.S. federal law.

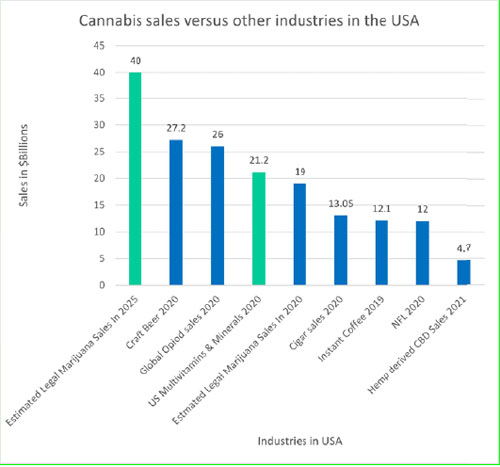

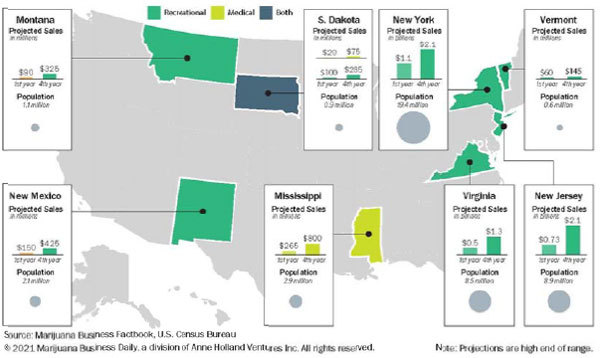

Source: 2021 Marijuana Business Daily, a division of Anne Holland Ventures Inc.

7

Source: 2021 Marijuana Business Daily, a division of Anne Holland Ventures Inc, National Institutes of Health,

New Leaf Data Services, LLC, Cigar Association of America, Inc.

The growth in public support for legal marijuana and hemp derived CBD comes as a growing number of states have legalized the drug for medical or recreational purposes in recent years.

About 7-in-10 Americans (74%) say the use of marijuana should be legalized, reflecting a steady increase over the past decade, according to a new Pew Research Center survey. The share of U.S. adults who support marijuana legalization has changed from about 2 years ago – when 62% favored it – but it is more than double what it was in 2000 (31%).

As in the past, there are wide generational and partisan differences in views of marijuana legalization. Majorities of Millennials (74%), Gen Xers (63%) and Baby Boomers (54%) say the use of marijuana should be legal. Members of the Silent Generation continue to be the least supportive of legalization (39%), but they have become more supportive in the past year.

Source: Pew Research Center

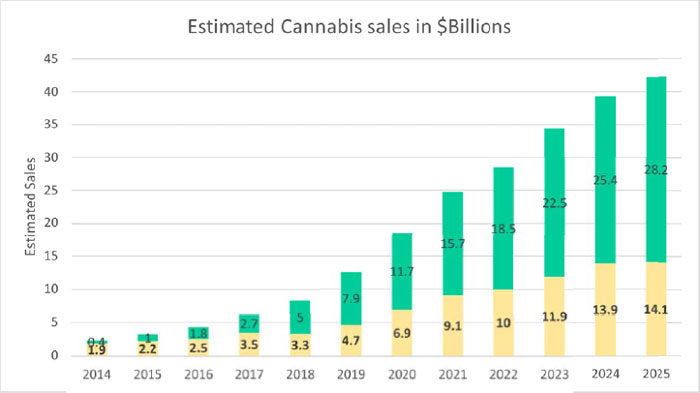

Annual cannabis retail sales continue to grow year-over-year as new markets emerge and more states legalize medical and recreational marijuana. Sales in 2024 are projected to increase to over $30 billion

By 2024, annual retail marijuana sales in the United States could top $40 billion, which would represent more than a 30% increase from 2019.

8

Source: 2021 Marijuana Business Daily, a division of Anne Holland Ventures Inc.

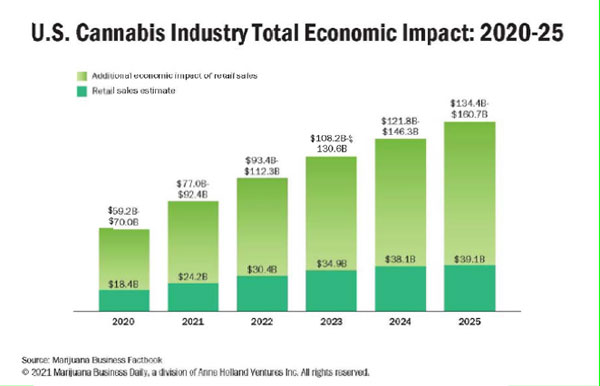

The retail and medical marijuana industry brought in an estimated $59.2 - $70 billion of economic impact in 2020 just in the USA. By 2025, we expect the potential for the industry to surpass $135 billion in annual economic benefit.

Estimates for economic impact are based on an impact multiplier of 3.5. This means that for every $1 consumers spend at dispensaries or recreational stores, another $2.50 in economic benefit will be created in the cities, states and ultimately the nation.

Here are some of the factors in this overall economic impact:

| ● | The launch of new businesses | |

| ● | Hundreds of millions of dollars in state and local taxes | |

| ● | Real estate investments | |

| ● | Visiting tourists spending money to legally consume | |

| ● | Marijuana employees circulating earnings back into the economy |

The marijuana labor market has experienced rapid, chaoticincreased about 38% over last year with marijuana industry supporting about 240,000-295,000 employees. A majority of this growth has come from other states legalizing marijuana use over the last few years including California, which is the next market Diego is focusing its attention on for acquisitions, and branding agreements. In 2019, marijuana employment surpassed that of the technology industry of web developers and is fast approaching the number of clergy in the USA.

The continued growth in recent years, whichthe cannabis market, including legalizing the growing and retailing of hemp based products, has boosted the rapid growth in employees and retail sales. The industry is setexpected to add more than 430,000 full-time jobs between now and 2024 with compounding annual growth rates of 22% and should lead to over 575,000 jobs by 2024.

9

Outside of California, however, sales are expected to continue beyondclimbing, bolstered by ongoing growth in mature markets like New Mexico and Arizona, increased patient access in Florida and new Medical Marijuana (MMJ) programs coming online in Maryland and Pennsylvania. The transition to fully regulated, state-licensed MMJ sales in Michigan has caused some short-term instability, but it remains one of the forecast targetlargest medical markets in the country and will likely continue to form the foundation of 2019 due primarilythe MMJ industry for years to regulatory misalignment between state and federal governments.come.

The marijuana secondary and tertiary markets have not yet been analyzed as sources of revenue; however, emerging secondary markets such as marijuana tourism could become a significant source of income for recreational legal states. As a point of comparison, Holland earns $48.55 billion per year in tourist dollars. Of the 10 million tourists, 5.5 million or 55% of tourists visit bars and cafes, generating a total of nearly $27 billion and 220,000 jobs (NBTC, 2009). This equals roughly 30% of all business revenue generated in Washington state in 2012 (Washington State Department of Revenue, 2014).

The US state-sanctionedmore states continue to legalize medical and recreational marijuana market generated a total revenuesales, an ever increasing number of $5.4adults are introduced, or re-introduced to the product. Continued research into the benefits of Cannabidiol (CBD) derived from both the Marijuana and hemp plants, has catapulted the cannabis industry into the mainstream media. Legal sales of recreational and medical marijuana reached about $25.2 billion in 2015, boosted by an incredible growthsales for 2021, about half that spent on tobacco cigarettes. It is estimated that total demand for cannabis including legally produced product is in excess of $50 - $60 billion

By 2025, we project total retail and medical marijuana sales in the recreational sectorUnited States will reach approximately $38.4-45.9 billion annually - more than a threefold increase from estimated annual sales in 2017. Our estimates account for the fact that more states will likely legalize medical or adult-use marijuana in the coming years - though it’s difficult to predict when that will happen and how big those markets will be. Using a range of estimates that incorporate several factors - such as the likelihood of a given state passing a legalization measure, the size of the customer/patient base and time frame for the launch of sales from $351M- helps account for this uncertainty. Our approach is refined over time as more information becomes available.

It’s important to $998M.=, an estimated increase of 184% over 2014. By comparison,point out that the marijuana market is less than 3%industry has a big and growing impact on the economy at large as the revenue it generates ripples across a community, city and/ or state - as well as the nation. To understand an industry’s economic impact, traditional macroeconomic multipliers can range anywhere from 10 to 20 times the original dollar spent. Based on new data from other industries, we’ve settled on a standard multiplier of 3.5 for the US tobacco market, a $144 billion market that has no medicinal value, and less than 3% of the alcohol market, which valued at $113.5 billion in 2014 (2016 Statistic Brain Research Institute). As states legalize marijuana, and international markets develop, the emerging legalized marijuana industry - a slight revision from last year’s multiplier of four.

In other words, for every $1 consumers/patients spend at dispensaries and rec stores, an additional $2.50 of economic value will begin to rival thatbe injected into the economy - much of tobacco and alcohol and could see $45B in revenues by 2020.it at the local level.

10

Marijuana has become a major issue in state elections as voters are seeking politicians that support legalization (Gutwillig, 2014). As states legalize marijuana, and international markets develop, the emerging legalized marijuana industry will begin to rival that of tobacco and alcohol. Table 1 summarizes 2016 estimated revenues generated by marijuana retail sales based on a number of sources, including state marijuana program reports.

Table 1: Projected US Marijuana Retail Sales, 2016

| State | 2016 | |||

| Alaska | $ | 40,000,000 | ||

| Arizona | $ | 300,000,000 | ||

| California | $ | 1,000,000,000 | ||

| Colorado | $ | 1,100,000,000 | ||

| Connecticut | $ | 18,000,000 | ||

| DC | $ | 8,000,000 | ||

| Delaware | $ | 2,000,000 | ||

| Hawaii | $ | 22,000,000 | ||

| Illinois | $ | 25,000,000 | ||

| Maine | $ | 35,000,000 | ||

| Maryland | $ | 35,000,000 | ||

| Massachusetts | $ | 32,000,000 | ||

| Michigan | $ | 170,000,000 | ||

| Minnesota | $ | 8,000,000 | ||

| Montana | $ | 4,000,000 | ||

| Nevada | $ | 32,000,000 | ||

| New Hampshire | $ | 4,000,000 | ||

| New Jersey | $ | 16,000,000 | ||

| New Mexico | $ | 47,000,000 | ||

| New York | $ | 13,000,000 | ||

| Oregon | $ | 340,000,000 | ||

| Rhode Island | $ | 24,000,009 | ||

| Vermont | $ | 5,000,000 | ||

| Washington | $ | 775,000,000 | ||

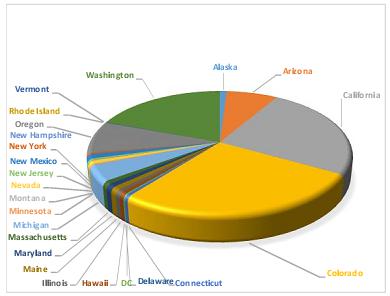

Source: (Marijuana Business Daily 2016; Illinois Cannabis Patients Association, 2010; Leal, 2014;2021 Marijuana Business Daily, 2013)a division of Anne Holland Ventures Inc. (Note that our goal is to provide conservative, realistic financial forecasts that reflect the high degree of uncertainty in the industry. Total cannabis sales in any given calendar year are highly dependent upon progress made - or not made - in each individual state. California is currently the big wild card, as the slow rollout of its statewide regulatory system makes it difficult to get a handle on the exact size of this enormous market. As more information comes to light over time, it could change our estimates for California and, therefore, the industry at large.)

Figure 2 illustratesWhere are the Greatest Market Opportunities?

All eyes are on California.

That’s the reality for nearly everyone involved in the global marijuana market. Companies around the world - from Europe to Canada to Israel and beyond - want a piece of the California market. But there are plenty of practical ramifications. No other state or federal government in the world has tried to implement such a wide-ranging regulatory system that affects tens of thousands of existing black- and gray-market businesses.

The bottom line: The sheer immensity of the California cannabis market structureis topped only by its complexity. And that complexity has led to major struggles and big wait times for entrepreneurs looking to tap the California market potential. California’s Marijuana (MJ) regulatory system covers a population of 40 million and includes incentives for existing businesses to transition to the licit tax-paying industry.

There are plenty of other hurdles for existing and future businesses as well, including local license caps from towns and counties that are hesitant to grant permits to any type of cannabis companies. As of early October 2018, only a fraction of local governments had opted to allow recreational use companies to set up shop within their borders, and state business permits are dependent on a company first obtaining local authorization of some sort. Plenty of companies are striving to play by the rules, but they’re often unable to stay in business while doing so because they haven’t been able to find locations that fit all the legal parameters for licensing.

The same is true for thousands of small-scale growers in California, as well as edibles makers, concentrate producers and estimated retail sales revenuesother plant-touching businesses. One option for 2016. Ofsuch companies, at least for now, is to focus on the 24 statesmedical marijuana market instead of recreational. Far more local governments allow limited medical companies than adult-use businesses. Obtaining such permits could be a stopgap move because, as time goes on, it’s likely that more and more local governments will decide to permit recreational use. Another option could be to pivot into an alternate cannabis sector, such as distribution or testing labs, given that there’s a dearth of both key business types in whichthe state.

Hemp and CBD

Hemp was once prized for making rope. Two hundred years later, the plant still has us tied in knots. From a patchwork of state hemp rules to confusion among cannabis entrepreneurs about the definition of hemp, uncertainty reigns in the hemp industry. Hemp has long been bedeviled by its conflation with marijuana, is legal, Colorado is expected to generatedand the most revenue at $51,100M, followed by California at $1,000M and Washington at $775M. Most States operatingControlled Substances Act banned its production for decades. That changed in 2014, experienced doublewhen the U.S. Farm Bill opened the door for a hemp revival in states willing to experiment (and control) the crop’s return to legal production. The federal government defines hemp as cannabis sativa with a THC content at or below 0.3%.

The Farm Bill set off an explosion of hemp production and triple digit growth into 2015, with the exceptionexperimentation and has given cannabis entrepreneurs new opportunities to California, which has leveled out.

Figure 1 Estimated US Marijuana Retail Sales, 2016

Various industry reports estimate thatgrow, sell and buy cannabis in a nonintoxicating form. The Farm Bill allows limited interstate commerce for hemp - something still off-limits to marijuana sales could generate as much as $8.7 billion in stateentrepreneurs. Hemp businesses report fewer banking and federal taxes; however, data to support that estimate is not yet available. (Marijuana Business Daily 2016)

Market Growthregulatory headaches.

The performanceU.S. hemp experiment is still unfolding. Market conditions vary widely. Though the laws vary from state to state, it is more or less legal to produce hemp in most American states. America is finally getting its staple agriculture back. This can greatly benefit America as it will revolutionize several of its key industries – textiles, biomass, natural gas, building materials among others.

11

Not all U.S. states use the federal THC guidelines to define hemp, and the 0.3% THC threshold has little basis in science, meaning that scientists don’t agree about how much THC a plant needs to produce a high when heated and consumed. Cannabis plants have more than 100 cannabinoids, of which THC is only one, and hemp products with no detectable THC can still be considered psychoactive if they contain cannabinoids that relieve anxiety or depression. At least one state, Iowa, explicitly dictates that cannabidiol is legal but high THC marijuana is not legal - then goes on to say it accepts cannabidiol with a THC limit 10 times higher than the federal threshold for legal hemp.

Still, the 0.3% THC threshold is a useful metric for dividing marijuana from hemp, and it is the standard used in the industry.

Longtime hemp prohibition in the United States has left the industry frozen in time. There is little modern agricultural equipment appropriate for hemp harvesting and processing, and the crop likely won’t match the market share it enjoyed before the Industrial Revolution, when hemp fibers were commonly used in commercial fabrics. Today, hemp’s value comes mostly from its flower, rich in cannabinoids beyond THC. The most valuable as of this report is forecastCBD, a cannabinoid with established therapeutic uses including pain relief and reducing muscle spasms associated with epilepsy or muscular sclerosis.

Hemp Industry Daily estimates that the U.S. market for hemp-derived CBD will hit approximately $4.7 billion in 2021, with the potential to accelerate, with an anticipated growth of an average of 27% overeclipse $6 billion annually by 2024 - a substantial increase in just a few years.

Expect hemp-derived cannabinoid products low in THC to take increasing market share (and media attention) in the next four years to an expected market value greater than $45 billion by the end of 2020. Table 2 and Figure 3 provide estimated market growth from 2011 to 2018. This growth assumes that no additional states legalize. If additional states legalize, growth estimates will likely increase significantly.overall cannabis industry.

Table 2: US Industry Estimates, 2013 to 2018

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |||||||||||||||||||||||||

| Medicinal | 1.5 | 1.2 | 1.6 | 1.9 | 2.3 | 2.9 | 3.5 | 4 | ||||||||||||||||||||||||

| Recreational | 0.07 | 1.4 | 2 | 2.5 | 4.2 | |||||||||||||||||||||||||||

| Total | 1.5 | 1.2 | 1.6 | 1.97 | 3.7 | 4.9 | 6 | 8.2 | ||||||||||||||||||||||||

Billions of Dollars, US

Source: (Brown and Resnick, 2013; California Department of Public Health, 2014b; CannaBusiness Media, 2014; Colorado Office of Research and Analysis, 2013a, 2013b, 2013d, 2013e, 2014; Fairchild, 2013a, 2013b; Galvin, 2013; Illinois Cannabis Patients Association, 2010; Leal, 2014;2021 Marijuana Business Daily, 2013; Officea division of Financial Management, 2012)Anne Holland Ventures Inc.

Figure 3: US Industry Estimates, 2011 to 2018

Market Distribution

Market distribution must be measured indirectly with registered medical consumers and dispensaries. As expected, California has the largest numberStatus of marijuana patients at more than 775,000, followed by Michigan at 179,000 and Colorado with 107,000. Washington is at 125,000 registered patients as listed in Table 3 and illustrated in Figure 4. There are currently an estimated 1.5 million medical marijuana patients in the US.

Table 3: Registered Medical Marijuana Patients 2015

Source: (Marijuana Business Daily 2016; Illinois Cannabis Patients Association, 2010; Leal, 2014; Marijuana Business Daily, 2013)

Figure 4: Registered Medical Marijuana Patients

Another indirect measure of market distribution is the number of medical marijuana dispensaries. Table 4 and Figure 5 provide the distribution of dispensaries across the US. The number of patients and dispensaries are mostly aligned; however, certain states such as Michigan have much higher ratio of patients to dispensaries than other states. This could be the result of inaccurate data.

Table 4: Registered Medical Marijuana Dispensaries

Source: (Marijuana Business Daily 2016; Illinois Cannabis Patients Association, 2010; Leal, 2014; Marijuana Business Daily, 2013)

Figure 5: Registered Medical Marijuana Dispensaries

Competitive Analysis and Benchmarking

Diego was one of the first to the market with a real estate holding and branding business model; however, other companies have since adopted similar strategies. Key differentiators between Diego and its competitors are superior branding, optimized build-out and turnkey grow and retail development, and, most importantly, pre-negotiated acquisition contracts. As with other marijuana-related financial data, collecting benchmark data on Diego competitors was especially challenging in that many of these companies fail to report or are unable to report the fundamentals of financial information. Table 5 provides a financial benchmark of Diego’s nearest competitors.

Table 5: 2013 Real Estate Holding and Branding Financial Benchmark-$000

| Market Cap | Rev | Cost of Rev | Gross Margin % | EBITDA Margin % | Net Profit | |||||||||||||||||||

| Medbox, Inc. (MDBX) | $ | 258,700 | $ | 5,203 | $ | 2,657 | 51.1 | % | -14.8 | % | $ | (660 | ) | |||||||||||

| Advanced Cannabis Solutions, Inc. (CANN) Grey Market (3 Qtrs) | $ | 59,600 | $ | 129 | $ | 23 | 82.2 | % | (542 | %) | $ | (1,277 | ) | |||||||||||

| Mountain High Acquisitions Corp. (MYHI) OTCQB | $ | 14,300 | - | - | - | $ | (1,336 | ) | ||||||||||||||||

| Agritek Holdings, Inc. (AGTK) | $ | 8,410 | $ | 79 | $ | 86 | 7.6 | % | (1189 | %) | $ | (1,453 | ) | |||||||||||

| Home Treasure Finders, Inc. (HMTF)(MJ real estate lessor) | $ | 4,160 | $ | 203 | $ | 0 | INF | (44 | %) | $ | (92 | ) | ||||||||||||

Source: Finance.yahoo.com and CNBC.com

Tourism Effect

The secondary and tertiary effects of the marijuana market have received little attention by market analyst; however, markets such as marijuana tourism could become a significant source of revenue for recreationally legal states. For example, The Netherlands earns $48.55 billion per year in tourist dollars. Of the 10M tourists, 5.5 million or 55% visit marijuana bars and cafes, generating a total of nearly $27 billion and 220,000 jobs. Likewise, Colorado reported note that marijuana tourism is responsible for 90% of all retail sales in resort towns (Weissmann, 2014).

Peak Sales and Product Segmentation

Peak marijuana sales occur during two calendar periods: December/January and July/August. Smokable Marijuana sales exceed other product categories representing 87% of the market, which is followed by concentrates at 7% and edibles at 4% while drinks, topicals, accessories and clones generate the least amount of revenue at less than 1% each. The top marijuana product according to an analysis of a market leading dispensary is Bruce Banner followed by 303 Kush.

Legalization by State

Support for medical and recreational marijuana use has increased significantly over the past 20 years. According to a recent CNN poll, greater than 50% of the US population supports marijuana legalization. Figure 6 illustrates a select set of CNN poll results.

Figure 6: CNN/ORC Poll Results on Marijuana Use in the US

Two states, Colorado and Washington, have passed legislation for recreational marijuana. As the popularity of recreational marijuana becomes more accepted by Americans, it is the Company’s belief that several of the States in which medical marijuana is currently legal will likely follow suit and legalize recreational marijuana. States are learning from one another, refining legislation and establishing realistic tax strategies. The Obama administration has pledged to end Federal raids on state-sanctioned dispensaries (Furlow, 2012). Similar movements are occurring in other democratic countries such as Australia in which several states have decriminalized possession (Thies, 2012). Table 6 lists recreational and medicinal marijuana legalization status by state.

Table 6: State Recreational Marijuana Laws

Source: (Marijuana Business Daily 2016; California State Board of Equalization, 2009; Gacek, 2014; ProCon.org, 2014; U.S. Office of National Drug Control Policy, 2014)

Target Geographies

Diego has entered a rapid growth and expansion stage in its evolution toward becoming an internationally recognized brand. The target geographies for Diego are all US states in which recreational or medicinal marijuana is legalized. This is a phased implementation that carefully pre-stages funding and materials to be first to market, as each state rules on legalization. In certain scenarios, Diego may choose to allow weak competitors to fail, making available prime real estate that otherwise would be inaccessible.

Target Consumers

There are an estimated 1.5M medical marijuana patients in the US and over 5,000 retailers. California has the largest number of marijuana patients at more than 775,000, followed by Colorado with 625,000 and Michigan at 179,000. Washington is a close 4th at 125,000 registered patients.

The demographics for consumers that have tried marijuana at least once, range between ages 18 to 49, with the greatest numbers between the ages 26 and 34. These consumers are predominantly male, and college educated.

Alaska has the fastest growing population of potential consumers, followed by Washington DC, Colorado, New Mexico and Hawaii, with Washington just a few points below. In 2012, Montana, Colorado, California, and Washington had the greatest increase in disposable income, thus increasing the breadth of target consumers.

Future Markets

Studies on marijuana use in The Netherlands have demonstrated that the availability of marijuana in café’s has had very little effect on increasing or decreasing marijuana use (MacCoun, 2011). As such, the next progression in the US market, following Federal legalization, is the establishment of café’s or other types of service centers for marijuana consumption. The number of café’s in The Netherlands has ranged between 700 and 800 over the past 15 years, and currently operates about 700 or 1 per 29,000 citizens, employing 4,000 workers and generating $832.2M annually (Monshouwer, Van Laar, and Vollebergh, 2011). Extrapolating this to the US market would indicate approximately 10,000 café’s and service centers where actual consumption of cannabis can take place.

Primary Service

Our primary service is fully branded and built real estate to qualified tenants. Our branding includes non-cannabis infused products, apparel, and other tangible products at a wholesale rate. To become a qualified tenant, Diego requires its tenants to strictly adhere to testing and labeling requirements along with all state laws and federal guidelines to assure quality and consistency of marijuana products, ensuring safe sale and consumption. Table 7 provides a list of our current property portfolio.

Table 7: Property Portfolio

Diego Pellicer creates a user friendly customer experience regardless of venue or form of media making it easy and safe for them to purchase. A major aspect of our marketing plan is to inform and educate consumers in a way that allows them to rely on DP as a trusted and valued brand. DP information and products will be available in all forms of media with a variety of different forms of content including videos, social media, online newsletters and blogs and TV.

This will give our brand, products and content the flexibility and portability that consumers demand. This digital syndication strategy will be executed through a series of revenue sharing deals with partners through viral seeding strategies and via paid media through specific targeted websites and venues.

Revenue Generation and Growth

Diego generates current revenue and stages future revenue streams through the following processes:

U.S. Federal Law

While marijuana is legal under the laws of several U.S. States, (with vastly differing restrictions), at the present time the concept of “medical marijuana” and “retail marijuana” do not exist under U.S. federal law. The United StatesFederal Controlled SubstancesSubstance Actclassifies “marijuana”marijuana as a Schedule I drug. UnderAs defined under U.S. federal law, a Schedule I drug or substance has a high potential for abuse, no accepted medical use in the United States, and a lack of safety for the use of the drug under medical supervision.

The United States Supreme Court has ruled in a number ofseveral cases that the federal government does not violate the federal constitution by regulating and criminalizing cannabis, even for medical purposes. Therefore, federal law criminalizing the use of marijuana pre-empts state laws that legalizes its use for medicinal and recreational purposes.

12

In a memorandum dated August 29, 2013 addressed

Attorney General Jeff Sessions’ January 2018 decision to “All United States Attorneys” from James M.rescind the Cole Memo raised some concerns in the marijuana industry that federal officials may try to interfere with legal cannabis. Those concerns, for the most part, haven’t materialized, but the scare did get many marijuana businesses thinking about the possibility of federal interference and what could be done about it.

The memo was drafted during the Obama administration by former U.S. Deputy Attorney General (“James Cole Memo”),in 2013 as a way to minimize the threat of federal crackdowns against legal marijuana businesses. The document essentially instructed federal law enforcement not to interfere with state-licensed marijuana businesses complying with state laws and certain conditions, such as not selling product to minors or into the black market.

While the Cole Memo clearly expressed an Obama administration policy of leaving legal marijuana businesses alone, it was not a legal change - which only Congress can do. Therefore, the Cole Memo technically allowed U.S. attorneys to go after marijuana businesses if they wanted. With the sending of the Cole Memo to the proverbial shredder, U.S. attorneys no longer have guidelines on how to deal with state-licensed marijuana businesses. But in an April 2018 conversation with Republican U.S. Sen. Cory Gardner, President Donald Trump pledged to keep the Department of Justice acknowledged that certain U.S. States had enactedfrom interfering with state cannabis laws relatingand, perhaps more significantly, support legislation protecting state-legal marijuana businesses. White House officials later confirmed the president’s policy stance.

As the Biden administration continues to dive deeper into its policy agenda, cannabis is a topic to watch. Though the administration has been focused on tackling immediate priorities, marijuana is likely to rise to the surface in the near term.

Several bills have been introduced to Congress seeking to reform federal marijuana laws in different ways, including the removal of cannabis from the list of controlled substances, allowing MJ companies to access traditional banking services and amending the IRS code to more fairly tax cannabis businesses. Similar bills have been introduced in previous sessions of Congress, but none have gained significant traction. This time, however, may be different, as marijuana reform has become a bipartisan issue that has the support of many prominent Democrats and Republicans.

The Current Landscape

President Biden’s views on marijuana legalization—as well as the Democratic Party’s—have evolved over time, as reflected in the 2020 Democratic Party Platform. In it, the party stated it would “decriminalize marijuana use and reschedule it through executive action on the federal level. [It would] support legalization of medical marijuana, and outlinedbelieve[d] states should be able to make their own decisions about recreational use.” Medical marijuana is legal in 36 states and, since February 2021, when New Jersey passed its own legalization bill, recreational cannabis is legal in 15 states. Additionally, some states such as Mississippi, where recreational use is not legal, have agreed to lessen the U.S.penalties for possession, while other states like Illinois are expunging arrests related to marijuana possession. New York Governor Andrew M. Cuomo has signed legislation (S.854-A/A.1248-A) legalizing adult-use cannabis, fulfilling a key component of his 2021 State of the State agenda

With Democrats controlling Congress and the White House, and with the cannabis industry growing ever larger, many expect Congress to soon take up the issue of cannabis in earnest. “Ending the federal government’s enforcement prioritiesmarijuana prohibition is necessary to right the wrongs of this failed [War on Drugs] and end decades of harm inflicted on communities of color across the country,” said Senate Majority Leader Chuck Schumer (D-NY), along with Cory Booker (D-NJ) and Ron Wyden (D-OR), in a February 2021 joint statement.

Bipartisan support is swelling. A December 2020 poll found that two-thirds of all Americans, including 51 percent of Republicans, supported a December 2020 bill to federally legalize marijuana. Although the House omitted marijuana legalization in its most recent COVID relief bill, there are three marijuana-related pieces of major legislation that could pass during this congressional term:

The SAFE Banking Act, which provides a path for the financial system with respect to cannabis.

The MORE Act, which addresses some of the societal injustices created by the War on Drugs.

The STATES Act, which protects individuals who comply with state laws regulating marijuana.

All three bills are expected to be re-addressed during this congressional term.

The Biden administration has yet to formally weigh in on or issue an executive order concerning marijuana notwithstandingreform. However, when asked at his confirmation hearing if he thought 2014 Financial Crimes Enforcement Network (FinCEN) guidance should be updated to “set expectation for financial institutions that provide services to cannabis-related industries” and what steps he would take, Deputy Secretary of Treasury nominee Adewale Adeyamo said that he planned to address the fact that certainissue if confirmed.

What This Means for Business

Organizations of all types should be mindful of the current landscape as it relates to cannabis, given the impact the pending legislation will have on law and rulemaking in the workplace. However, two sectors should pay particularly close attention to action in this space: the investment community and the financial services industry.

Investment Community

Descheduling and decriminalizing marijuana, as well as legalizing it to any degree, would open a larger window of opportunity to list cannabis-related stocks on U.S. Statesexchanges. While providing more legal oversight of the industry would offer the potential for more jobs and revenue by supplying incentive for more people and entities to dive into the industry, it would also open the door for fraud risk. New market entrants should be vetted, as the risk of counterfeit products is high. As they do when deciding to fund any new product or venture, investors should assess their safeguards and risk mitigation framework before diving in.

Financial Services Industry

Banks in particular have legalizedlong had a complicated relationship with marijuana-related businesses (MRBs). For the most part, MRBs do not have access to the banking industry. They are unable to accept credit cards, deposit revenues, access loans, or decriminalizedwrite checks to meet payroll or pay taxes, which makes them vulnerable. However, until cannabis is federally legal, financial services will continue to be handled by local providers, such as credit unions, which presents both opportunities and risks. Since regulations vary from state to state, bringing on a MRB client is complex and does not always align with prescribed risk. However, as the use, sale and manufacture of marijuana:$56 billion industry continues to grow, banks must continue to evaluate whether it makes financial sense to consider banking this contradictory industry.

13

ThereEven if the current administration makes banking MRBs more feasible, financial institutions should still evaluate clients on a case-by-case basis, ensuring compliance is no guaranteestrong at the core. Banks will need to ensure that MRBs—like other high-risk clients—are equipped with the right technology, ample compliance staff training, and clear parameters on risks and red flags. As compliance teams increasingly find their mandates growing and their resources stagnating or shrinking, looking to outsourced financial crimes risk management solutions can also provide some reprieve and support for managing this risk.

Despite movement on the federal marijuana front, organizations of all types should be mindful that the current presidential administration willlaw has not changed yet—and if change its stated policy regardingdoes occur at the low-priority enforcement of U.S. federal laws that conflictlevel, consulting with state laws. Additionally,legal counsel and third-party risk experts before engaging in any new U.S. federal government administration that follows could change this policy and decide to enforce the U.S. federal laws vigorously. Any such change in the U.S. federal government’s enforcement of current U.S. federal laws could cause adverse financial impact to the Company’s business. See“Risk Factors.”sector or product remains advisable.

In February 2014, FinCEN issued guidelines allowing banks to legally provide financial services to Licensed Operators that hold a valid License (“FinCEN Memo”). The rules re-iterated the guidance provided by the Cole Memo, stating that banks can do business with Licensed Operators and “may not” be prosecuted. The guidelines provide that “it is possible [for the banks] to provide financial services” to Licensed Operators and while remaining in compliance with federal anti-money laundering laws. The guidance falls short of the explicit legal authorization that banking industry officials anticipated and the outcome of the banks relying on this guidance in transacting with Licensed Operators is currently unclear. See“Risk Factors.”Source: K2 Integrity New York, NY

Employees

We presently have 5 full-time employees and 0 part-time employees. We consider our relationship with our employees to be excellent. We also had independent consultants under contract to provide financial management services, business development services, and sales management services. In addition to the diverse technical, intellectual property, legal, financial, marketing and business expertise of our professional team, from time to time we rely on advice from outside specialists to fulfill unique technology and other needs.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Item 1B.Unresolved Staff Commentsitems

None.

Our principal executive office is located at 3435 Ocean Park Blvd.6160 Plumas St. Suite 100, Reno NV 89519.

The Company leases real estate to licensed marijuana operators.

The properties generating rents in 2021 and 2020 are as follows:

| Purpose | Size | City | State | |||

| Retail store (recreational and medical) | 3,300 sq. | Denver | CO | |||

| Cultivation warehouse – terminated October 2020 | 18,600 sq. | Denver | CO | |||

| Cultivation warehouse | 14,800 sq. | Denver | CO |

The Company’s three properties in Denver, CO (one terminated in October 2020) are leased to Royal Asset Management, LLC (“RAM”). RAM opened the Diego Denver branded flagship store in February 2017. This store is known as “Diego Colorado”. The retail facilities have shown steady growth in sales since opening. For the other two properties subleased (one terminated in October 2020), #107-610, Santa Monica, CA 90405,RAM uses these properties for its cultivation facilities in Denver, CO. Production at these facilities began in late 2016. The Company is currently in litigation with RAM regarding outstanding amounts due on the leases.

In October 2020, the master lease and sublease associated with the 18,600 sq. cultivation warehouse in Denver were terminated.

Our premises are suitable for our telephone number is (516) 900-3799.current operations.

On May 10, 2021, a lawsuit was filed against the Company, along with other defendants, by plaintiff Erin Turoff in the District Court, City and County of Denver, State of Colorado. The specific allegations against the Company include civil theft and civil conspiracy and the plaintiff is seeking actual and compensatory damages. No specific monetary amount was demanded in the lawsuit. On July 8, 2021, the Company filed an answer to the complaint, denying the allegations. The Company believes that the suit is without merit and that the Company will ultimately prevail in any litigation.

From time to time,

Other than as listed above. we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims against the Company that we believe will have a material adverse effect on our business, financial condition or operating results.

Item 4. Mine Safety Disclosures

Not applicable.

14

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The table below sets forth the range of quarterly high and low closing sales prices for its common stock for 2021 and 2020. The quotations below reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions:

| High | Low | |||||||

| Year ended December 31, 2021 | ||||||||

| First Quarter | $ | 0.18 | $ | 0.01 | ||||

| Second Quarter | $ | 0.07 | $ | 0.03 | ||||

| Third Quarter | $ | 0.04 | $ | 0.01 | ||||

| Fourth Quarter | $ | 0.02 | $ | 0.01 | ||||

| High | Low | |||||||

| Year ended December 31, 2020 | ||||||||

| First Quarter | $ | 0.01 | $ | 0.01 | ||||

| Second Quarter | $ | 0.02 | $ | 0.01 | ||||

| Third Quarter | $ | 0.02 | $ | 0.01 | ||||

| Fourth Quarter | $ | 0.01 | $ | 0.01 | ||||

There is no established public trading market for our Common Stock. As of the date of this Report, there are outstanding options and warrants to purchase 3,425,798 shares of Common Stock of the Registrant.

Record Holders

As of April 19, 2016,8, 2022, there were approximately 143205 shareholders of record holding a total of 41,572,082260,661,121 shares of Common Stock.common stock, including shares held in “street name” by banks, brokerage clearing houses, depositories or otherwise in unregistered form. The Company does not know the beneficial owners of such shares, or the number of beneficial holders of the Common Stock are entitled to one vote for each share held of record on all matters submitted to a vote of shareholders. Holders of the Common Stock have no preemptive rights and no right to convert their Common Stock into any other securities. There are no redemption or sinking fund provisions applicable to the Common Stock.such shares.

DividendsDividend Distributions

The RegistrantCompany has not declared any cash dividends since inception and does not anticipate paying any dividends in the foreseeable future. The payment of dividends is within the discretion of the Board of Directors and will depend on the Company’s earnings, capital requirements, financial condition, and other relevant factors. There are no restrictions thatWe currently limitexpect to use all available funds to finance the Registrant’s ability to payfuture development and expansion of our business and do not anticipate paying dividends on its Commonour common Stock in the foreseeable future.

Penny Stock

Our common stock is considered “penny stock” under the rules the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market System, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the Commission, that: