UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20162017

Commission file number: 333-185103

Synergy CHC Corp.

(Exact name of registrant as specified in its charter)

| Nevada | 99-0379440 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 865 Spring Street Westbrook, ME | 04092 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 615-939-9004

Securities registered pursuant to Section 12(b) of the Act:None

Securities registered pursuant to Section 12(g) of the Act:Common Stock, par value $0.00001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ][X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Emerging growth company [ ] (Do not check if a smaller reporting company) |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any news or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.[ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the registrant’s common stock held by non-affiliates as of June 30, 20162017 was approximately $14.1$10.7 million based upon the closing price of the common stock as quoted by the Over-the-Counter Bulletin Board (the “OTC Bulletin Board”)

As of March 21, 2017,30, 2018, there were 88,764,35789,862,683 shares of the registrant’s common stock, par value $0.00001 per share, outstanding.

Table of Contents

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information contained in this annual report contains “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are contained principally in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” and are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. As used herein, “we,” “us,” “our” and the “Company” refers to Synergy CHC Corp. and its wholly owned subsidiaries.

The forward-looking statements herein represent our expectations, beliefs, plans, intentions or strategies concerning future events, including, but not limited to: our future financial performance; the continuation of historical trends; the sufficiency of our cash balances for future needs; our future operations; our sales and revenue levels and gross margins, costs and expenses; the relative cost of our operation as compared to our competitors; new product introduction, entry and expansion into new markets and utilization of new sales channels and sales agents; improvements in, and the relative quality of, our technologies and the ability of our competitors to copy such technologies; our competitive technological advantages over our competitors; brand image, customer loyalty and expanding our customer base; the sufficiency of our resources in funding our operations; and our liquidity and capital needs.

Our forward-looking statements are based on our current expectations and beliefs concerning future developments, and there can be no assurance that any projections or other expectations included in any forward-looking statements will come to pass. Moreover, our forward-looking statements are subject to various known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements.

Except as required by applicable laws, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

| 3 |

Overview

We are a consumer health care and beauty company that is in the process of building a portfolio of best-in-class consumer product brands. Our strategy is to grow both organically and by further acquisition.

Corporate History

We were organized as a corporation under the laws of the State of Nevada on December 29, 2010 under the name “Oro Capital Corporation”. On April 7, 2014, an Agreement and Plan of Merger (the “Merger Agreement”) was entered into by and among us, Synergy Merger Sub, Inc., a Delaware corporation and our wholly owned subsidiary formed for the purpose of the transactions under the Merger Agreement (“Merger Sub”), and Synergy Strips Corp., a Delaware corporation incorporated on January 24, 2012 (“SSC”). The Merger Agreement provided for the merger of Merger Sub with and into SSC (the “Merger”), with SSC surviving the merger as our wholly owned subsidiary. On April 17, 2014, we issued a share dividend to our shareholders in order to effect a 30-for-1 forward stock split. The Merger was consummated on April 21, 2014. On April 21, 2014, we changed our fiscal year end from July 31 to December 31. On April 28, 2014, we changed the name of the Company from “Oro Capital Corporation” to “Synergy Strips Corp.” On August 5, 2015, we changed the name to “Synergy CHC Corp.”

20162017 Fiscal Year Developments

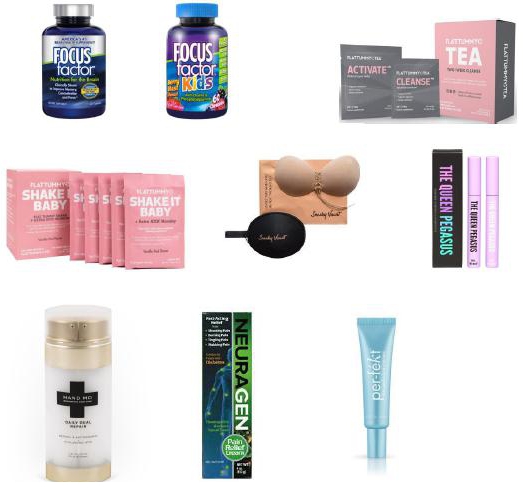

During 20162017 we created a new Canadian subsidiary, Synergy CHC Inc., for the purpose of operating a technology center in Halifax, Nova Scotia. The new center is an online marketing arm of the company, called The Synergy Effect. We created another new subsidiary, Sneaky Vaunt Corp.,Queen Pegasus, for the purpose of developing, marketing and selling specialty cosmetic products. We also purchased a cosmetic line, Per-fekt Beauty, and we also focused on executing our current brands and creating line extensions that willwe expect to launch in 2017.2018.

Description of the Business

FOCUSfactor is sold at America’s leading retailers such as Costco, Sam’s Club, BJ’s, Walmart, Walgreens, CVS and The Vitamin Shoppe. FOCUSfactor is a brain-health nutritional supplement that includes a proprietary blend of brain supporting vitamins, minerals, antioxidants and other nutrients. In December 2012, the United States Patent and Trademark Office issued US Patent 8,329,227 covering FOCUSfactor’s proprietary formulation “for enhanced mental function.” The issuance of the patent marked one of the few times a patent has been issued for a nationally branded nutritional supplement. FOCUSfactor is clinically tested with results demonstrating improvements in focus, concentration and memory in healthy adults. FOCUSfactor is a material product to our revenue base, representing 37%47% of revenue.

Flat Tummy Tea is a uniquely formulated two-step herbal detox tea that works to naturally help speed metabolism, boost energy and reduce bloating. Flat Tummy Tea is sold exclusively online at www.flattummytea.com.www.flattummyco.com and at The Vitamin Shoppe. Flat Tummy Tea is a material product to our revenue base, representing 60%36% of revenue.

Hand MD is the world’s first anti-aging skincare line formulated specifically for the hands. Hand MD is sold exclusively online at www.buyhandmd.com.www.handmd.com.

Neuragen is a topical product that works directly at the site of pain as opposed to oral products. Neuragen reduces the spontaneous firing of damaged peripheral nerves. By calming these nerves, Neuragen is clinically shown to reduce shooting and burning pains quickly and without side effects. Neuragen is sold at Walgreens and through various distribution channels.

UrgentRx is a line of fast-acting, portable OTC medications that prove ‘right now relief’ for today’s busy, on the go consumer. UrgentRx fast powders are innovative, fast acting flavored powdered medications in patented credit card sized packets. They can be taken without water, providing immediate relief for a wide variety of every day ailments such as allergy attacks, headaches, aches and pains, heartburn and upset stomach. UrgentRx can be found

Sneaky Vaunt is a backless, strapless, stick on, push up bra. Sneaky Vaunt is sold exclusively online at convenience storeswww.sneakyvaunt.com.

The Queen Pegasus is a two step eyelash elixir kit for longer and drugstoresfuller looking natural eyelashes. The Queen Pegasus is sold exclusively online atwww.thequeenpegasus.com.

Per-fekt Beauty is a line of cosmetics that merges advanced skincare formulations with color. Per-fekt Beauty products are sold in retailers across the United States.country such as Ulta, Beauty Brands and online atwww.perfektbeauty.com.

| 4 |

Products

Current Products

Development and Commercialization Strategy

We intend to expand on the current retail strategies and build out a strong online sales model.

Research and Development

We currently outsource our research and development to our manufacturers, as they are experienced in the development of new products and line extensions.

Manufacturing

We currently outsource the manufacturing of our products to third parties who have the necessary equipment and technology to provide mass quantities as required. FOCUSfactor is manufactured by Atrium Innovations and Vit-Best Nutrition. Flat Tummy Tea is manufactured by Caraway Tea Company. Neuragen is manufactured by C-Care. Hand MD is manufactured by HealthSpecialty. Urgent Rx is manufactured by Capstone Nutrition. Sneaky Vaunt is manufactured by Dongguan Jingrui. The Queen Pegasus is manufactured by Skin Actives and Ningbo Beautiful Day Cosmetics.

Commercialization

We are highly dependent on two retailers for the sale of our FOCUSfactor product: Costco Wholesale Corporation and Sam’s West, Inc./Walmart (a/k/a Sam’s Club), which comprise 88% of our net revenue for FOCUSfactor. We intend to diversify our sales network and generate revenue by selling our consumer-ready products to retailers across North America, which retailers may then sell to end consumers through retail distribution channels. We also sell direct to wholesalers and distributors at a reduced cost as a means to grow our revenue base quickly and to penetrate the market more effectively.

| 5 |

Intellectual Property

Our success depends in part upon our ability to protect our core technology and intellectual property. To establish and protect our proprietary rights, we will rely on a combination of patents, patent applications, trademarks, copyrights, trade secrets, including know-how, license agreements, confidentiality procedures, non-disclosure agreements with third parties, employee disclosure and invention assignment agreements, and other contractual rights.

In December 2012, the United States Patent and Trademark Office issued U.S. Patent 8,329,227 covering FOCUSfactor’s proprietary formulation “for enhanced mental function.” The issuance of the patent marked one of the few times a patent has been issued for a nationally branded nutritional supplement. The issuance of the patent for FOCUSfactor came after a 2011 clinical study report which showed that FOCUSfactor improved memory, concentration and focus in healthy adults participating in the study. The clinical study of FOCUSfactor was sponsored by Factor Nutrition Labs, the owner of the Focus Factor Business at the time, and was conducted by Cognitive Research Corporation, a full-service contract research organization that specializes in the effects of nutritional supplements and pharmaceutical products on human cognition. The study was conducted in compliance with all applicable country requirements for the conduct of clinical studies, including those outlined by the International Conference on Harmonization, Consolidated Guidelines on Good Clinical Practices, and the Food and Drug Administration.

In February 2013, the United States Patent and Trademark Office issued U.S. Patent 8,376,140 covering UrgentRx’s portable powder delivery system and method.

Distribution and Marketing

We plan to focus on selling to retailers and distributors who currently are active in the consumer product space with the aim to expedite the penetration of market acceptance of the product. We are currently conducting research with focus groups to find out what the best approach for marketing efforts is and how to do so onin the most cost-effective manner. We also plan to develop an online sales channel.

Markets

We sell our products in mostly American retail locations along with other developed countries with similar retail landscapes to North America.

Competition

Although there are many competing products on the market, in all our current product categories, FOCUSfactorFOCUSFactor is the only product in its category with both a patent and clinical study to support its claims. TheseFOCUSFactor’s competitors include a wide range of products, from targeted brain-enhancement supplements to indirect competitors such as energy drinks that claim to improve concentration.

Government Regulation

The products that we sell, and those that we are developing for future sale, may be subject to U.S. Food and Drug Administration (“FDA”) approval for packaging compliance. With respect to the products we currently sell, our regulatory counsel has reviewed all of our products and we believe we are compliant with the current rules. Since the current products sold are considered nutraceuticals, cosmeceuticals and over the counter products, minimal regulations are placed on the product with the exception of the appropriate labeling and warnings on the packaging.

The Company will

Wewill rely on legal and operational compliance programs, as well as local counsel, to guide its businesses in complying with applicable laws and regulations of the jurisdictions in which it doeswe do business.

The Company does

| 6 |

We donot anticipate, at this time, that the cost of compliance with U.S. and foreign laws will have a material financial impact on its operations, business or financial condition. There are however no guarantees that new regulatory and tariff legislation may not have a material negative effect on its business in the future.

Employees

As of March 21, 2017,30, 2018, we had 3666 full-time employees and no part-time employees. We intend to grow our employee base in response to the demands and requirements of the business.

As a “smaller reporting company,” as defined by Item 10 of Regulation S-K, we are not required to provide this information.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not Applicable.None.

The following table describes our principal properties leased as of March 21, 2017:30, 2018:

| Purpose | Location | Square Footage | ||||

| Technology Center (1) | Halifax, NS | 6,800 | ||||

| Main Office (2) | Westbrook, ME | 3,510 | ||||

(1) Monthly rental payments are $8,050 CDN per month on a month to month basisbasis.

(2) Monthly rental payments are $4,290 per month on a month to month basisbasis.

(3) Monthly rental payments are $8,923$19,500 per month less a $3,010 per month sublease through March 2017May 31, 2021.

(4) Monthly rental payments are $5,900 AUD per month (approximately $4,480 USD) through April 2017.

We are not a party to any legal proceedings and we are not aware of any claims or actions pending or threatened against us. In the future, we might from time to time become involved in litigation relating to claims arising from our ordinary course of business.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

| 7 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Only a sporadic and limited market exists for our securities. There is no assurance that a regular trading market will develop, or if one develops, that it will be sustained. Therefore, a shareholder in all likelihood will be unable to resell his, her or its securities in our Company. Furthermore, it is unlikely that a lending institution will accept our securities as pledged collateral for loans unless a regular trading market develops. Our securities are traded on the OTCQB operated by OTCMarkets.com under the symbol “SNYR”.The table below provides the high and low prices for the periods presented.

| Quarter Ended | High | Low | ||||||

| 12/31/16 | $ | 0.74 | $ | 0.46 | ||||

| 9/30/16 | $ | 0.70 | $ | 0.40 | ||||

| 6/30/16 | $ | 1.00 | $ | 0.35 | ||||

| 3/31/16 | $ | 0.43 | $ | 0.30 | ||||

| 12/31/15 | $ | 0.74 | $ | 0.46 | ||||

| 9/30/15 | $ | 0.70 | $ | 0.40 | ||||

| 6/30/15 | $ | 1.00 | $ | 0.35 | ||||

| 3/31/15 | $ | 0.43 | $ | 0.30 | ||||

| 12/31/14 | $ | 0.55 | $ | 0.31 | ||||

| 9/30/14 | $ | 0.60 | $ | 0.31 | ||||

| 6/30/14 | $ | 2.00 | $ | 0.30 | ||||

| 3/31/14 | $ | 0.33 | $ | 0.33 | ||||

| Quarter Ended | High | Low | ||||||

| 12/31/17 | $ | 0.56 | $ | 0.40 | ||||

| 9/30/17 | $ | 0.55 | $ | 0.38 | ||||

| 6/30/17 | $ | 0.78 | $ | 0.34 | ||||

| 3/31/17 | $ | 0.69 | $ | 0.45 | ||||

| 12/31/16 | $ | 0.74 | $ | 0.46 | ||||

| 9/30/16 | $ | 0.70 | $ | 0.40 | ||||

| 6/30/16 | $ | 1.00 | $ | 0.35 | ||||

| 3/31/16 | $ | 0.43 | $ | 0.30 | ||||

Shareholders

As of March 21, 2017,30, 2018, we had 3937 shareholders of record of our common stock.

Dividend Policy

We have not declared any cash dividends. We do not intend to pay dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations. The payment of cash dividends in the future, if any, will be at the discretion of our board of directors and will depend upon such factors as earnings levels, capital requirements, our overall financial condition and any other factors our board deems relevant.

Equity Compensation Plans

The information required by Item 5 of Form 10-K regarding equity compensation plans is incorporated herein by reference to “Item 11. Executive Compensation” in this report.

ITEM 6. SELECTED FINANCIAL DATA.

As a “smaller reporting company,” as defined by Item 10 of Regulation S-K, we are not required to provide this information.

| 8 |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion is an overview of the important factors that management focuses on in evaluating our business;business, financial condition and operating performance and should be read in conjunction with the financial statements included in this Annual Report on Form 10-K. This discussion contains forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of any number of factors, including those set forth in the Company’s reports filed with the SEC on FormForms 10-K, 10-Q and 8-K as well as in this Annual Report on Form 10-K. Given the uncertainties that surround such statements, you are cautioned not to place undue reliance on such forward-looking statements.

Overview

The Company is We arein the business of marketing and distributing consumer branded products through various distribution channels primarily in the health and wellness industry. The Company’sOur strategy is to grow both organically and by future acquisition.

Our management’s discussion and analysis of our financial condition and results of operations are only based on our current business and should be read in conjunction with our audited Consolidated Financial Statements and accompanying notes thereto included elsewhere in this Annual Report Form 10-K. Key factors affecting our results of operations include revenues, cost of revenues, operating expenses and income and taxation.

Non-GAAP Financial Measures

We currently focus on Adjusted EBITDA to evaluate our business relationships and our resulting operating performance and financial position. Adjusted EBITDA is defined as EBITDA (net income plus interest expense, income tax expense, depreciation and amortization), further adjusted to exclude certain non-cash expenses and other adjustments as set forth below. We present Adjusted EBITDA because we consider it an important measure of our performance and it is a meaningful financial metric in assessing our operating performance from period to period by excluding certain items that we believe are not representative of our core business, such as certain non-cash items and other adjustments.

We believe that Adjusted EBITDA, viewed in addition to, and not in lieu of, our reported results in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”), provides useful information to investors.

| December 31, 2016 | ||||

| Net loss | $ | (796,161 | ) | |

| Interest income | (5,107 | ) | ||

| Interest expense | 1,567,867 | |||

| Taxes | 944,358 | |||

| Depreciation | 44,480 | |||

| Amortization | 2,961,751 | |||

| EBITDA | $ | 4,717,188 | ||

| Loss on change in fair value of derivative liability | (1,380,600 | ) | ||

| Stock-based compensation | 2,200,160 | |||

| One-time expenses for 2015 acquisitions | 109,163 | |||

| Stock issued for services | 50,000 | |||

| Settlement Expenses | 56,250 | |||

| Directors Fees | 40,000 | |||

| Loss on extinguishment of debt | 657,180 | |||

| Focus Factor Kids return | 1,249,487 | |||

| Impairment of Intangible Assets | 2,176,910 | |||

| Loss on foreign currency translation and transaction | 40,842 | |||

| Write off of obsolete inventory | 300,187 | |||

| Non-cash implied interest | 114,213 | |||

| Adjusted EBITDA | $ | 10,330,980 | ||

| December 31, 2017 | ||||

| Net income | $ | 499,568 | ||

| Interest income | (20 | ) | ||

| Interest expense | 1,044,277 | |||

| Taxes | 316,012 | |||

| Depreciation | 108,126 | |||

| Amortization | 1,608,350 | |||

| EBITDA | $ | 3,576,313 | ||

| Stock-based compensation | 1,458,850 | |||

| One-time expenses, net of other income | 170,895 | |||

| Loss on foreign currency translation and transaction | 69,724 | |||

| Adjusted EBITDA | $ | 5,275,782 | ||

| 9 |

EBITDA and Adjusted EBITDA are considered non-GAAP financial measures. EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA represents EBITDA, further adjusted to exclude the impact of higher-than-normal revenue change order activity and certain expenses and transactions that we believe are not representative of our core operating results, including loss on change in fair value of derivative liability; stock-based compensation; one-time expenses for acquisitions; and loss on foreign currency translation and transaction; and the write off of obsolete inventory.transaction. The Company’s definitions of EBITDA and adjusted EBITDA might not be comparable to similarly titled measures reported by other companies.

Results of Operations for the Years Ended December 31, 20162017 and December 31, 20152016

During 2015,2017, we completed five acquisitions, with at least one in each of the three targeted verticals of Nutraceuticals, Cosmeceuticalsacquisition and Over the Counter (OTC).developed two new brands. Our objective is to grow all threefour of our targeted verticals (Nutraceuticals, Over the Counter (OTC), Consumer Goods and Cosmeceuticals) to provide a balanced and synergistic portfolio that drives consumer demand via multiple channels. During 2016, we focused on growing and managing our existing brands.

Revenue

For the year ended December 31, 2016,2017, we had revenues of $34,840,394$35,596,035 from sales of our products, as compared to revenue of $13,456,377$34,840,394 for the year ended December 31, 2015.2016. This is primarily due to having a full year of operations of the acquisitions we completed during 2015 and is comprised of the following categories:

| December 31, 2016 | December 31, 2015 | December 31, 2017 | December 31, 2016 | |||||||||||||

| Nutraceuticals | $ | 33,877,529 | $ | 13,030,006 | $ | 29,903,714 | $ | 33,877,529 | ||||||||

| Over the Counter (OTC) | 907,401 | 416,417 | 1,203,034 | 907,401 | ||||||||||||

| Consumer Goods | 3,614,090 | - | ||||||||||||||

| Cosmeceuticals | 55,464 | 9,954 | 875,197 | 55,464 | ||||||||||||

| $ | 34,840,394 | $ | 13,456,377 | $ | 35,596,035 | $ | 34,840,394 | |||||||||

The decrease in our Nutraceutical category was due to the shift of resources to new brands. The increase in both the consumer goods and cosmeceuticals categories was due to a new product line.

Cost of Revenue

For the year ended December 31, 2016,2017, our cost of revenue was $10,205,324.$9,818,406. Our cost of revenue for the year ended December 31, 2015,2016, was $5,308,130.$10,205,324. This increase is also due to having a full year of operations of the acquisitions we completed during 2015 and is comprised of the following categories:

| December 31, 2016 | December 31, 2015 | December 31, 2017 | December 31, 2016 | |||||||||||||

| Nutraceuticals | $ | 10,020,273 | $ | 5,194,831 | $ | 9,290,854 | $ | 10,020,273 | ||||||||

| Over the Counter (OTC) | 167,784 | 110,637 | 89,280 | 167,784 | ||||||||||||

| Consumer Goods | 345,926 | - | ||||||||||||||

| Cosmeceuticals | 17,267 | 2,662 | 92,346 | 17,267 | ||||||||||||

| $ | 10,205,324 | $ | 5,308,130 | $ | 9,818,406 | $ | 10,205,324 | |||||||||

The decrease in our Nutraceutical category was due lower revenue due to a shift in focus to new brands. The increase in both the consumer goods and cosmeceuticals categories was due to a new product line.

| 10 |

Gross Profit

Gross profit was $24,635,070,$25,777,629, or 71%,72% of gross revenue, for the year ended December 31, 2016,2017, as compared to gross profit of $8,148,247,$24,635,070, or 61%,71% of gross revenue, for the same period in 2015,2016, an increase of $16,486,825,$1,142,559, or 202%5%. The increase in gross profit and gross profit margin is directly related to increase in sales and better negotiated deals with manufacturers, utilizing volume purchasing to avail lower prices and purchasing finished goods instead of buying components.

Operating Expenses

Selling and Marketing Expenses

For the year ended December 31, 2016,2017, our selling and marketing expenses were $10,334,075$14,043,870 as compared to $3,685,727$10,334,075 for the year ended December 31, 2015, which2016. The increase is primarily due to marketing our various products in multiple media channels including print, television and online. This increase is also due to having a full year of operations of the acquisitions we completed during 2015.

General and Administrative Expenses

For the year ended December 31, 2017, our general and administrative expenses were $8,418,159. For the year ended December 31, 2016, our general and administrative expenses were $8,019,722. For the year ended December 31, 2015, our general and administrative expenses were $3,368,495, the change in which was primarilyThe increase is a modest due to having a full year of operations of the acquisitions we completed in 2015.normal operating expenses and increased personnel.

Depreciation and Amortization Expenses

For the year ended December 31, 20162017 our depreciation and amortization expenses were $1,170,778$1,493,285 as compared to $608,002$1,170,778 for the year ended December 31, 2015.2016. The increase in 20162017 is due to the acquisitions completed during 2015.2017.

Impairment of Intangible Assets and Goodwill

During review of intangible assets and goodwill as of December 31, 2016, it was determined that the carrying value of the intangible assets and goodwill for one of our subsidiaries may not be recoverable, so the assets were fully impaired. ForAs a result, for the year ended December 31, 2016, we recorded non-cash intangible asset and goodwill impairment charges of $2,176,910 related to a subsidiary.

| 11 |

Other Income and Expenses

For the year ended December 31, 2017, we had other (income) and expense items of the following:

| Interest income | $ | (20 | ) | |

| Interest expense | 1,044,277 | |||

| Remeasurement gain on translation of foreign subsidiary | (50,825 | ) | ||

| Amortization of debt issuance cost | 223,191 | |||

| Loss on the sale of assets | 2,877 | |||

| Otherincome | (212,765 | ) | ||

| Total | $ | 1,006,735 |

For the year ended December 31, 2016 we had other (income) and expense items of the following:

| Interest income | $ | (5,107 | ) | |

| Interest expense | 1,567,867 | |||

| Remeasurement loss on translation of foreign subsidiary | 54,345 | |||

| Gain on change in fair value of derivative liability | (1,380,600 | ) | ||

| Amortization of debt discount | 1,620,151 | |||

| Amortization of debt issuance cost | 215,302 | |||

| Settlement expense | 56,250 | |||

| Loss on extinguishment of debt | 657,180 | |||

| Total | $ | 2,785,388 |

For the year ended December 31, 2015 we had other (income) and expense items of the following:

| Interest income | $ | (1,460 | ) | |

| Interest expense | 958,740 | |||

| Remeasurement gain on translation of foreign subsidiary | (7,740 | ) | ||

| Loss on change in fair value of derivative liability | 1,028,921 | |||

| Amortization of debt discount | 5,499,640 | |||

| Amortization of debt issuance cost | 154,525 | |||

| Total | $ | 7,632,626 |

The increasedecrease in interest expense in 20162017 was due to the pay down of loans issued for the purpose of acquisitions of various companies’companies during 2015. We also issued warrants along with the loans and paid debt issuance cost in 2015 which lead to the amortization of debt discount and debt issuance cost during 2015.2016. We issued warrants with a reset provision in 2015 which lead to the calculation of warrant derivative liability and hence we recorded a loss on change in fair value of derivative liability. In 2016, we cancelled those warrants and issued shares, which resulted in a loss on extinguishment of debt.

Income tax expense

For the years ended December 31, 20162017 and 20152016 we incurred income tax expense of $944,358$316,012 and $389,945,$944,358, respectively, primarily related to our subsidiary, NomadChoice Pty Limited (NomadChoice), located in Australia, and which we acquired in 2015.

Net LossIncome (Loss)

For the year ended December 31, 2017, our net income was $499,568. For the year ended December 31, 2016 our net loss was $796,161. For the year ended December 31, 2015 our net loss was $7,536,548. This was primarily due to non-operating expenses such as amortization of debt discounts and the change in the fair valueloss on extinguishment of derivative liabilities in 2015. In 2016, we had a full year of operations of the companies we acquired in 2015.debt during 2016.

Liquidity and Capital Resources

Overview

As of December 31, 2017, we had $1,955,614 cash on hand and a $3,278,903 working capital surplus. In addition, we also have restricted cash of $139,071 which is held for credit card collateral.

As of December 31, 2016, we had $2,517,642 cash on hand and a $4,944,587 working capital deficit. In addition, we also havehad restricted cash of $100,000 which is held for credit card collateral.

| 12 |

As of December 31, 2015, we had $3,640,893 cash on hand and a $6,029,421 working capital deficit. The deficit is largely due to the future liability we’ve accrued for in relation to an earn-out payment of $2,551,500 in which payments are due based solely on future earnings and a derivative liability for stock warrants outstanding of $3,096,179. In addition, we also had restricted cash of $607,084 which was comprised of $510,605 for the earn-out payment held in escrow account, $46,479 for a rolling reserve with Paypal and $50,000 for credit card collateral.

Going Concern

The Company’s consolidated financial statements are prepared using U.S. GAAP applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company had an accumulated deficit at December 31, 2016 of $9,366,000. The Company had a working capital deficit of $4,944,587 as of December 31, 2016. During the year ended December 31, 2016, the Company incurred net loss of $796,161. Due to acquisitions during 2015 of revenue producing products, the Company believes it has established an ongoing source of revenue that is sufficient to cover its operating costs and has income from operations of $2,933,585. The ability of the Company to continue as a going concern is dependent on the Company continuing to execute the sales of their products.

Due to acquisitions during 2015 of revenue-producing products, the Company believes it has established an ongoing source of revenue that is sufficient to cover its operating costs. Management’s plans to continue as a going concern include raising additional capital through borrowing and/or sales of equity and debt securities. However, management cannot provide any assurances that the Company will be successful in accomplishing any of its plans.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph and eventually secure other sources of financing and attain profitable operations. The accompanying consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. In their report accompanying our audited financial statements, our independent registered public accounting firm expressed substantial doubt as to our ability to continue as a going concern.

Year Ended December 31, 20162017 and 20152016

Net Cash (Used in) Provided by (Used in) Operating Activities

For the year ended December 31, 2016,2017, we had net cash provided byused in operating activities of $6,038,620,$831,070, as compared to $644,316 used in$6,038,620 provided by operating activities for the year ended December 31, 2015.2016. The decrease was primarily attributable to a changepurchases of inventory and an increase in accounts receivable.

For 2017, the business due to acquisitions during 2015.$831,070 consists of our net income of $499,568 adjusted by:

| Amortization of debt issuance cost | $ | 223,191 | ||

| Depreciation and amortization | 1,493,285 | |||

| Stock based compensation | 1,458,850 | |||

| Foreign currency transaction loss | 120,549 | |||

| Remeasurement gain on translation of foreign subsidiary | (50,825 | ) | ||

| Non cash implied interest | 73,763 | |||

| Loss on sale of assets | 2,877 | |||

| Increase in accounts receivable | (2,085,778 | ) | ||

| Increase in inventory | (1,449,425 | ) | ||

| Decrease in prepaid expenses | 205,351 | |||

| Decrease in deferred revenue | (32,942 | ) | ||

| Decrease in accounts payable and accrued expenses | (1,289,534 | ) |

| 13 |

For 2016, the $6,038,620 consists of our net loss of $796,161 increasedadjusted by:

| Amortization of debt issuance cost | $ | 215,302 | ||

| Depreciation and amortization | 1,170,778 | |||

| Stock based compensation | 2,200,160 | |||

| Amortization of debt discount | 1,620,151 | |||

| Stock issued for services | 50,000 | |||

| Settlement expense | 56,250 | |||

| Foreign currency transaction gain | (13,503 | ) | ||

| Loss on extinguishment of debt | 657,180 | |||

| Change in the fair value of derivative liability | (1,380,600 | ) | ||

| Remeasurement loss on translation of foreign subsidiary | 54,345 | |||

| Impairment of goodwill and intangible assets | 2,176,910 | |||

| Non cash implied interest | 114,213 | |||

| Write-off of inventory | 180,122 | |||

| Decrease in accounts receivable | 1,734,466 | |||

| Increase in inventory | (547,295 | ) | ||

| Increase in prepaid expenses | (1,051,168 | ) | ||

| Increase in deferred revenue | 36,000 | |||

| Decrease in accounts payable and accrued expenses | (438,530 | ) |

For 2015, the $644,316 consists of our net loss of $7,536,548 reduced by:

| Amortization of debt issuance cost | $ | 154,525 | ||

| Depreciation and amortization | 608,002 | |||

| Stock based compensation | 551,714 | |||

| Amortization of debt discount | 5,499,640 | |||

| Foreign currency transaction loss | 54,600 | |||

| Change in the fair value of derivative liability | 1,028,921 | |||

| Remeasurement gain on translation of foreign subsidiary | (7,740 | ) | ||

| Bad debt allowance | 50,000 | |||

| Increase in accounts receivable | (1,317,050 | ) | ||

| Increase in inventory | (19,632 | ) | ||

| Increase in prepaid expenses | (194,889 | ) | ||

| Increase in accounts payable and accrued expenses | 484,141 |

Net Cash Used in Investing Activities

For the year ended December 31, 2016,2017, we used net cash of $2,346,643$1,947,828 in investing activities, as compared to $4,399,856$2,346,643 used in investing activities for the year ended December 31, 2015.2016. The decreaseincrease was primarily attributabledue to the acquisitionspayment of brand development fees.

Investing activities during 2015.2017:

| Payments for acquisition of fixed assets | $ | (153,021 | ) | |

| Restricted cash | (39,071 | ) | ||

| Cash received from sale of assets | 6,199 | |||

| Payments for brand development fees | (1,761,928 | ) |

Investing activities during 2016:

| Payments for acquisition of fixed assets | $ | (302,227 | ) | |

| Restricted cash | 507,084 | |||

| Payment of earn out liability | (2,551,500 | ) |

Investing activities during 2015:

| Payments for acquisition of fixed assets | $ | (7,833 | ) | |

| Restricted cash | (607,084 | ) | ||

| Payments for acquisition of Focus Factor assets | (4,500,000 | ) | ||

| Payments for acquisition of Neuragen assets | (250,000 | ) | ||

| Payments for acquisition of NomadChoice Pty Ltd | (2,918,200 | ) | ||

| Cash acquired in acquisitions | 3,883,261 |

Net Cash (Used in) Provided by Financing Activities

For the year ended December 31, 2016,2017, financing activities used $4,831,250,provided $2,310,881, as compared to $8,684,727 provided by$4,831,250 used in financing activities for the year ended December 31, 2015.2016. The decreaseincrease was primarily attributable to paymentsthe receipt of notes payable issued in connection with the acquisitionscash pursuant to a new loan.

Financing activities during 2016.2017:

| Proceeds from notes payable | $ | 10,000,000 | ||

| Repayment of notes payable | (7,456,250 | ) | ||

| Payment of debt issuance cost | (452,869 | ) | ||

| Proceeds from sale of common stock | 220,000 |

Financing activities during 2016:

| Repayment of notes payable | $ | (4,831,250 | ) |

Financing activities during 2015:

| 14 |

| Advances from related party | $ | 16,077 | ||

| Proceeds from notes payable | 11,500,000 | |||

| Repayment of notes payable | (1,150,000 | ) | ||

| Payment of debt issuance costs | (533,377 | ) | ||

| Payment of dividends on subsidiary | (1,173,975 | ) | ||

| Proceeds from exercise of warrants | 2 | |||

| Proceeds from issuance of common stock | 26,000 |

Key 20172018 Initiatives

During 2017,2018, we have plans for organic growth within our current product lines by developing and launching new products and brands. Our technology center in Halifax, Nova Scotia will be in full operations for all of our brands. We have new marketing campaigns in process and intend to expand our online presence for each product. While we intend to grow further through additional acquisitions, we feel it is important to also develop our existing products.

Contractual Obligations and Off-Balance Sheet Arrangements

Contractual Obligations

None.

Off-Balance Sheet Arrangements

None.

Inflation

The effect of inflation on the Company’sour operating results was not significant.significant in either 2017 or 2016.

Summary of Significant Accounting Policies

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, the disclosure of contingent assets and liabilities and the reported amounts of revenue and expenses during the reported periods. The more critical accounting estimates include estimates related to revenue recognition and accounts receivable allowances. We also have other key accounting policies, which involve the use of estimates, judgments and assumptions that are significant to understanding our results, which are described in Note 2 to our audited consolidated financial statements appearing elsewhere in this report.

Recent Accounting Pronouncements

Note 2 to our audited consolidated financial statements appearing elsewhere in this report includes Recent Accounting Pronouncements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

As a “smaller reporting company,” as defined by Item 10 of Regulation S-K, we are not required to provide this information.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The information required by this Item is set forth in the consolidated financial statements and notes thereto beginning at page F-1 of this Form 10-K.

| 15 |

CONSOLIDATED FINANCIAL STATEMENTS

Synergy CHC Corp.

| 16 |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of

Synergy CHC Corp. and subsidiaries

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Synergy CHC Corp. and subsidiaries (the “Company”)Company) as of December 31, 20162017 and 2015,2016, and the related consolidated statements of operations, comprehensive loss,income (loss), stockholders’ equity, and cash flows for each of the two years in the two year period ended December 31, 2016. 2017, and the related notes (collectively referred to as the consolidated financial statements). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2017 and 2016, and the results of its operations and its cash flows for each of the years in the two year period ended December 31, 2017, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on thesethe Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.misstatement, whether due to error or fraud. The companyCompany is not required to have, nor were we engaged to perform, an audit of the Company’sits internal control over financial reporting. OurAs part of our audits, included considerationwe are required to obtain an understanding of internal control over financial reporting, as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence supportingregarding the amounts and disclosures in the financial statements, assessingstatements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statement presentation.statements. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Synergy CHC Corp. at December 31, 2016 and 2015, and the results of its operations and its cash flows for each of the two years in the period ended December 31, 2016, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company suffered a net loss, has accumulated deficit and has a net working capital deficiency, which raises substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ RBSM LLP | |

| |

We have served as the Company’s auditor since 2014. | |

| New York, | |

April 2, 2018 |

| F-1 |

| December 31, 2016 | December 31, 2015 | December 31, 2017 | December 31, 2016 | |||||||||||||

| Assets | ||||||||||||||||

| Current Assets | ||||||||||||||||

| Cash and cash equivalents | $ | 2,517,642 | $ | 3,640,893 | $ | 1,955,614 | $ | 2,517,642 | ||||||||

| Restricted cash | 100,000 | 607,084 | 139,071 | 100,000 | ||||||||||||

| Accounts receivable, net | 2,195,391 | 3,979,857 | 4,333,608 | 2,195,391 | ||||||||||||

| Prepaid expenses | 1,348,602 | 422,434 | 1,143,251 | 1,348,602 | ||||||||||||

| Inventory, net | 1,102,777 | 686,655 | 2,842,376 | 1,102,777 | ||||||||||||

| Total Current Assets | 7,264,412 | 9,336,923 | 10,413,920 | 7,264,412 | ||||||||||||

| Fixed assets, net | 257,386 | 12,017 | 293,205 | 257,386 | ||||||||||||

| Goodwill | 7,793,240 | 11,496,402 | 7,793,240 | 7,793,240 | ||||||||||||

| Intangible assets, net | 5,145,434 | 5,915,262 | 5,532,210 | 5,145,434 | ||||||||||||

| Total Assets | $ | 20,460,472 | $ | 26,760,604 | $ | 24,032,575 | $ | 20,460,472 | �� | |||||||

| Liabilities and Stockholders’ Equity | ||||||||||||||||

| Current Liabilities: | ||||||||||||||||

| Accounts payable and accrued liabilities | $ | 4,558,919 | $ | 5,032,102 | $ | 4,328,548 | $ | 4,558,919 | ||||||||

| Deferred revenue | 36,000 | - | 3,058 | 36,000 | ||||||||||||

| Provision for income taxes payable | 973,177 | 910,894 | 94,956 | 973,177 | ||||||||||||

| Earn out payment | - | 2,551,500 | ||||||||||||||

| Current portion of long-term notes payable, net of debt discount and debt issuance cost, related party | 5,890,903 | 3,025,669 | 2,487,233 | 5,890,903 | ||||||||||||

| Current portion of long-term notes payable | 750,000 | 750,000 | - | 750,000 | ||||||||||||

| Warrant derivative liability | - | 3,096,179 | ||||||||||||||

| Royalty payable | 221,222 | - | ||||||||||||||

| Total Current Liabilities | 12,208,999 | 15,366,344 | 7,135,017 | 12,208,999 | ||||||||||||

| Long-term Liabilities: | ||||||||||||||||

| Note payable | - | 750,000 | ||||||||||||||

| Royalty payable | 313,752 | 258,897 | - | 313,752 | ||||||||||||

| Notes payable, net of debt discount and debt issuance cost, related parties | 830,245 | 4,965,650 | 7,464,279 | 830,245 | ||||||||||||

| Total long-term liabilities | 1,143,997 | 5,974,547 | 7,464,279 | 1,143,997 | ||||||||||||

| Total Liabilities | 13,352,996 | 21,340,890 | 14,599,296 | 13,352,996 | ||||||||||||

| Commitments and contingencies | - | - | - | |||||||||||||

| Stockholders’ Equity: | ||||||||||||||||

| Common stock, $0.00001 par value; 300,000,000 shares authorized; 88,764,357 and 81,692,954, shares issued and outstanding, respectively | 888 | 817 | ||||||||||||||

| Common stock to be issued (125,000 and 213,742 shares, respectively) | 56,250 | 68,000 | ||||||||||||||

| Common stock, $0.00001 par value; 300,000,000 shares authorized; 89,862,683 and 88,764,357, shares issued and outstanding, respectively | 899 | 888 | ||||||||||||||

| Common stock to be issued (0 and 125,000 shares, respectively) | - | 56,250 | ||||||||||||||

| Additional paid in capital | 16,400,316 | 13,920,735 | 18,376,801 | 16,400,316 | ||||||||||||

| Accumulated other comprehensive income | 16,022 | - | ||||||||||||||

| Accumulated other comprehensive (loss) income | (77,989 | ) | 16,022 | |||||||||||||

| Accumulated deficit | (9,366,000 | ) | (8,569,841 | ) | (8,866,432 | ) | (9,366,000 | ) | ||||||||

| Total stockholders’ equity | 7,107,476 | 5,419,713 | 9,433,279 | 7,107,476 | ||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 20,460,472 | $ | 26,760,604 | $ | 24,032,575 | $ | 20,460,472 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements

| F-2 |

Consolidated Statements of Operations and Comprehensive LossIncome (Loss)

For the year Ended | For the year ended | For the year Ended | For the year ended | |||||||||||||

| December 31, 2016 | December 31, 2015 | December 31, 2017 | December 31, 2016 | |||||||||||||

| Revenue | $ | 34,840,394 | $ | 13,456,377 | $ | 35,596,035 | $ | 34,840,394 | ||||||||

| Cost of Sales | 10,205,324 | 5,308,130 | 9,818,406 | 10,205,324 | ||||||||||||

| Gross Profit | 24,635,070 | 8,148,247 | 25,777,629 | 24,635,070 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Selling and marketing | 10,334,075 | 3,685,727 | 14,043,870 | 10,334,075 | ||||||||||||

| General and administrative | 8,019,722 | 3,368,495 | 8,418,159 | 8,019,722 | ||||||||||||

| Impairment of goodwill and intangible assets | 2,176,910 | - | - | 2,176,910 | ||||||||||||

| Depreciation and amortization | 1,170,778 | 608,002 | 1,493,285 | 1,170,778 | ||||||||||||

| Total operating expenses | 21,701,485 | 7,662,224 | 23,955,314 | 21,701,485 | ||||||||||||

| Income from operations | 2,933,585 | 486,023 | 1,822,315 | 2,933,585 | ||||||||||||

| Other (income) expenses | ||||||||||||||||

| Interest income | (5,107 | ) | (1,460 | ) | (20 | ) | (5,107 | ) | ||||||||

| Interest expense | 1,567,867 | 958,740 | 1,044,277 | 1,567,867 | ||||||||||||

| Remeasurement loss (gain) on translation of foreign subsidiary | 54,345 | (7,740 | ) | |||||||||||||

| (Gain) loss on change in fair value of derivative liability | (1,380,600 | ) | 1,028,921 | |||||||||||||

| Remeasurement (gain) loss on translation of foreign subsidiary | (50,825 | ) | 54,345 | |||||||||||||

| Gain on change in fair value of derivative liability | - | (1,380,600 | ) | |||||||||||||

| Amortization of debt discount | 1,620,151 | 5,499,640 | - | 1,620,151 | ||||||||||||

| Amortization of debt issuance cost | 215,302 | 154,525 | 223,191 | 215,302 | ||||||||||||

| Settlement expense | 56,250 | - | - | 56,250 | ||||||||||||

| Loss on extinguishment of debt | 657,180 | - | - | 657,180 | ||||||||||||

| Otherincome | (212,765 | ) | - | |||||||||||||

| Loss on the sale of assets | 2,877 | - | ||||||||||||||

| Total other expenses | 2,785,388 | 7,632,626 | 1,006,735 | 2,785,388 | ||||||||||||

| Net income (loss) before income taxes | $ | 148,197 | $ | (7,146,603 | ) | |||||||||||

| Net income before income taxes | 815,580 | 148,197 | ||||||||||||||

| Income tax expense | 944,358 | 389,945 | 316,012 | 944,358 | ||||||||||||

| Net loss after tax | $ | (796,161 | ) | $ | (7,536,548 | ) | ||||||||||

| Net income (loss) after tax | $ | 499,568 | $ | (796,161 | ) | |||||||||||

| Net loss per share – basic and diluted | $ | (0.01 | ) | $ | (0.11 | ) | ||||||||||

| Net income (loss) per share – basic and diluted | $ | 0.01 | $ | (0.01 | ) | |||||||||||

| Weighted average common shares outstanding | ||||||||||||||||

| Basic and diluted | 81,650,381 | 68,852,305 | ||||||||||||||

| Comprehensive loss | ||||||||||||||||

| Net loss | $ | (796,161 | ) | $ | (7,536,548 | ) | ||||||||||

| Basic and Diluted | 89,241,212 | 81,650,381 | ||||||||||||||

Comprehensive income (loss): | ||||||||||||||||

| Net income (loss) | $ | 499,568 | $ | (796,161 | ) | |||||||||||

| Foreign currency translation adjustment | 16,022 | - | (94,011 | ) | 16,022 | |||||||||||

| Comprehensive loss | $ | (780,139 | ) | $ | (7,536,548 | ) | ||||||||||

| Comprehensive income (loss) | $ | 405,557 | $ | (780,139 | ) | |||||||||||

The accompanying notes are an integral part of these consolidated financial statements

| F-3 |

Consolidated Statement of Stockholders’ Equity (Deficit)

| Common stock | Additional Paid in | Common Stock to be | Accumulated Other Comprehensive | Accumulated | Total Stockholders’ Equity | Common stock | Additional Paid in | Common Stock to be | Accumulated Other Comprehensive | Accumulated | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Capital | issued | Income | Deficit | (Deficit) | Shares | Amount | Capital | issued | Income (Loss) | Deficit |

| |||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2014 | 62,100,000 | $ | 621 | $ | 867,004 | $ | 40,000 | $ | - | $ | (1,033,291 | ) | $ | (125,666 | ) | |||||||||||||||||||||||||||||||||||||||||

| Common stock issued for cash | 40,000 | 1 | 25,999 | 26,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock issued as part of the Contribution Agreement with Hand MD | 2,142,857 | 21 | 1,499,978 | - | - | 1,500,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock issued for acquisitions of Breakthrough Products, Inc. | 3,000,000 | 3 0 | 2,549,970 | - | - | 2,550,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock issued for acquisitions of NomadChoice Pty Ltd. | 3,571,428 | 36 | 1,749,964 | - | - | 1,750,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock issued to settle accounts payable | 292,857 | 3 | 204,997 | - | - | 205,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of notes payable | 400,000 | 4 | 99,996 | 100,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock issued for exercise of warrants | 10,145,812 | 101 | (99 | ) | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair value of warrants issued along with notes payable | - | - | 5,968,801 | - | - | 5,968,801 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair value of vested stock options | - | - | 523,714 | - | - | 523,714 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair value of warrants issued to Breakthrough Products, Inc. as part of acquisition | - | - | 430,411 | - | - | 430,411 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock to be issued for services | - | - | - | 28,000 | - | 28,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | (7,536,548 | ) | (7,536,548 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2015 | 81,692,954 | $ | 817 | $ | 13,920,735 | $ | 68,000 | $ | - | $ | (8,569,839 | ) | $ | 5,419,713 | 81,692,954 | $ | 817 | $ | 13,920,735 | $ | 68,000 | $ | - | $ | (8,569,839 | ) | $ | 5,419,713 | ||||||||||||||||||||||||||||

| Adjusting the value of goodwill for the value of shares issued related to acquisition of Breakthrough Products, Inc. | (1,170,000 | ) | (1,170,000 | ) | (1,170,000 | ) | (1,170,000 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock cancelled | (713,767 | ) | (7 | ) | (124,993 | ) | (125,000 | ) | (713,767 | ) | (7 | ) | (124,993 | ) | (125,000 | ) | ||||||||||||||||||||||||||||||||||||||||

| Common stock to be issued | 56,250 | 56,250 | 56,250 | 56,250 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock issued for services | 285,170 | 3 | 117,997 | (68,000 | ) | 50,000 | 285,170 | 3 | 117,997 | (68,000 | ) | 50,000 | ||||||||||||||||||||||||||||||||||||||||||||

| Common stock issued in conjunction with cancellation of warrants and options issued concurrent with debt | 7,500,000 | 75 | 1,456,417 | 1,456,492 | 7,500,000 | 75 | 1,456,417 | 1,456,492 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Fair value of vested stock options | 2,200,160 | 2,200,160 | 2,200,160 | 2,200,160 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation gain | 16,022 | 16,022 | 16,022 | 16,022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | (796,161 | ) | (796,161 | ) | (796,161 | ) | (796,161 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2016 | 88,764,357 | $ | 888 | $ | 16,400,316 | $ | 56,250 | $ | 16,022 | $ | (9,366,000 | ) | $ | 7,107,476 | 88,764,357 | $ | 888 | $ | 16,400,316 | $ | 56,250 | $ | 16,022 | $ | (9,366,000 | ) | $ | 7,107,476 | ||||||||||||||||||||||||||||

| Common stock issued for acquisition of Per-fekt Beauty | 473,326 | 5 | 241,391 | 241,396 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock issued as part of employment agreement | 100,000 | 1 | 54,999 | 55,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sale of common stock | 400,000 | 4 | 219,996 | 220,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock to be issued now issued | 125,000 | 1 | 56,249 | (56,250 | ) | - | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair value of vested stock options | 1,403,850 | 1,403,850 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation loss | (94,011 | ) | (94,011 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | 499,568 | 499,568 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2017 | 89,862,683 | $ | 899 | $ | 18,376,801 | $ | - | $ | (77,989 | ) | $ | (8,866,432 | ) | $ | 9,433,279 | |||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements

| F-4 |

Consolidated Statements of Cash Flows

For the year Ended | For the year ended | |||||||

| December 31, 2016 | December 31, 2015 | |||||||

| Cash Flows from Operating Activities | ||||||||

| Net loss | $ | (796,161 | ) | $ | (7,536,548 | ) | ||

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | ||||||||

| Amortization of debt issuance cost | 215,302 | 154,525 | ||||||

| Depreciation and amortization | 1,170,778 | 608,002 | ||||||

| Stock based compensation expense | 2,200,160 | 551,714 | ||||||

| Stock issued for services | 50,000 | - | ||||||

| Settlement expense | 56,250 | - | ||||||

| Loss on extinguishment of debt | 657,180 | - | ||||||

| Amortization of debt discount | 1,620,151 | 5,499,640 | ||||||

| Impairment of goodwill and intangible assets | 2,176,910 | - | ||||||

| Foreign currency transaction (gain) loss | (13,503 | ) | 54,600 | |||||

| Change in the fair value of derivative liability | (1,380,600 | ) | 1,028,921 | |||||

| Remeasurement loss (gain) on translation of foreign subsidiary | 54,345 | (7,740 | ) | |||||

| Non cash implied interest | 114,213 | - | ||||||

| Write-off of inventory | 180,122 | - | ||||||

| Bad debts | - | 50,000 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 1,734,466 | (1,317,050 | ) | |||||

| Inventory | (547,295 | ) | (19,632 | ) | ||||

| Prepaid expense and other current assets | (1,051,168 | ) | (194,889 | ) | ||||

| Deferred revenue | 36,000 | - | ||||||

| Accounts payable and accrued liabilities | (438,530 | ) | 484,141 | |||||

| Net cash provided by (used in) operating activities | 6,038,620 | (644,316 | ) | |||||

| Cash Flows from Investing Activities | ||||||||

| Payments for acquisition of fixed assets | (302,227 | ) | (7,833 | ) | ||||

| Restricted cash | 507,084 | (607,084 | ) | |||||

| Payments for acquisition of Focus Factor | - | (4,500,000 | ) | |||||

| Payments for acquisition transaction with Knight Therapeutics Inc. | - | (250,000 | ) | |||||

| Payment of earn out liability | (2,551,500 | ) | - | |||||

| Payments for acquisition of NomadChoice Pty Ltd | - | (2,918,200 | ) | |||||

| Cash acquired in acquisitions | - | 3,883,261 | ||||||

| Net cash used in investing activities | (2,346,643 | ) | (4,399,856 | ) | ||||

| Cash Flows from Financing Activities | ||||||||

| Advances from related party notes | - | 16,077 | ||||||

| Proceeds from notes payable | - | 11,500,000 | ||||||

| Repayment of notes payable | (4,831,250 | ) | (1,150,000 | ) | ||||

| Payment of debt issuance cost | - | (533,377 | ) | |||||

| Dividends paid | - | (1,173,975 | ) | |||||

| Proceeds from exercise of warrants | - | 2 | ||||||

| Proceeds from issuance of common stock | - | 26,000 | ||||||

| Net cash (used in) provided by financing activities | (4,831,250 | ) | 8,684,727 | |||||

| Effect of exchange rate on cash and cash equivalents | 16,022 | - | ||||||

| Net (decrease) increase in cash and cash equivalents | (1,123,251 | ) | 3,640,554 | |||||

| Cash and Cash Equivalents, beginning of period | 3,640,893 | 338 | ||||||

The accompanying notes are an integral part of these consolidated financial statements

| Cash and Cash Equivalents, end of period | $ | 2,517,642 | $ | 3,640,893 | ||||

| Supplemental Disclosure of Cash Flow Information: | ||||||||

| Cash paid during the period for: | ||||||||

| Interest | $ | 1,488,123 | $ | 806,740 | ||||

| Income taxes | $ | 864,864 | $ | 12,688 | ||||

| Supplemental Disclosure of Non-cash Investing and Financing Activities: | ||||||||

| Common stock issued for conversion of notes payable | $ | - | $ | 100,000 | ||||

| Beneficial conversion feature on warrants issued concurrent with debt | $ | - | $ | 5,968,801 | ||||

| Derivative liability at inception | $ | - | $ | 2,067,258 | ||||

| Assumption of liabilities as part of asset purchase agreement with Factor Nutrition Labs, LLC | $ | - | $ | 1,912,827 | ||||

| Assumption of liabilities as part of acquisition transaction with Knight Therapeutics Inc. | $ | - | $ | 969,532 | ||||

| Note issued as part of asset purchase agreement with Factor Nutrition Labs, LLC | $ | - | $ | 1,500,000 | ||||

| Common stock issued as part of contribution agreement with Hand MD | $ | - | $ | 1,500,000 | ||||

| Common stock issued for the acquisition of Breakthrough Products, Inc. | $ | - | $ | 2,550,000 | ||||

| Common stock issued for the acquisition of NomadChoice Pty Ltd. | $ | - | $ | 1,750,000 | ||||

| Fair value of warrants issued as part of acquisition of Breakthrough Products, Inc. | $ | - | $ | 430,411 | ||||

| Net liabilities taken over as part of acquisition of Breakthrough Products, Inc. | $ | - | $ | 422,749 | ||||

| Net assets taken over as part of acquisition of NomadChoice Pty Ltd. | $ | - | $ | 70,801 | ||||

| Common stock issued to settle payables | $ | - | $ | 205,000 | ||||

| Reallocation of goodwill related to acquisition of Factor Nutrition to intellectual property | $ | 450,000 | $ | - | ||||

| Reallocation of goodwill related to acquisition of Breakthrough Products, Inc. to intellectual property | $ | 150,000 | $ | - | ||||

| Reallocation of non-compete agreement related to acquisition of Breakthrough Products, Inc. to goodwill | $ | 50,000 | $ | - | ||||

| Adjusting the value of goodwill for the value of shares issued related to acquisition of Breakthrough Products, Inc. | $ | 1,170,000 | $ | - | ||||

| Reallocation of blogger database and intellectual property related to acquisition of Nomadchoice Pty Ltd. to customer database | $ | 215,000 | $ | - | ||||

| Common stock to be issued now issued | $ | 68,000 | $ | - | ||||

| Cancellation of common stock | $ | 125,000 | $ | - | ||||

| Common stock issued in conjunction with cancellation of warrants and options issued concurrent with debt | $ | 1,456,492 | $ | - | ||||

| Adjustment of accounts receivable and payables created during acquisition of Neuragen | $ | 24,592 | $ | - | ||||

| Inventory written-off and adjusted against accounts receivable and payables created during acquisition of Neuragen | $ | 48,949 | $ | - |

For the year Ended | For the year ended | |||||||

| December 31, 2017 | December 31, 2016 | |||||||

| Cash Flows from Operating Activities | ||||||||

| Net income (loss) | $ | 499,568 | $ | (796,161 | ) | |||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | ||||||||

| Amortization of debt issuance cost | 223,191 | 215,302 | ||||||

| Depreciation and amortization | 1,493,285 | 1,170,778 | ||||||

| Stock based compensation expense | 1,458,850 | 2,200,160 | ||||||

| Stock issued for services | - | 50,000 | ||||||

| Settlement expense | - | 56,250 | ||||||

| Loss on extinguishment of debt | - | 657,180 | ||||||

| Amortization of debt discount | - | 1,620,151 | ||||||

| Impairment of goodwill and intangible assets | - | 2,176,910 | ||||||

| Foreign currency transaction loss (gain) | 120,549 | (13,503 | ) | |||||

| Change in the fair value of derivative liability | - | (1,380,600 | ) | |||||

| Remeasurement (gain) loss on translation of foreign subsidiary | (50,825 | ) | 54,345 | |||||

| Non cash implied interest | 73,763 | 114,213 | ||||||

| Write-off of inventory | - | 180,122 | ||||||

| Loss on sale of assets | 2,877 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (2,085,778 | ) | 1,734,466 | |||||

| Inventory | (1,449,425 | ) | (547,295 | ) | ||||

| Prepaid expense and other current assets | 205,351 | (1,051,168 | ) | |||||

| Deferred revenue | (32,942 | ) | 36,000 | |||||

| Accounts payable and accrued liabilities | (1,289,534 | ) | (438,530 | ) | ||||

| Net cash (used in) provided by operating activities | (831,070 | ) | 6,038,620 | |||||

| Cash Flows from Investing Activities | ||||||||

| Payments for acquisition of fixed assets | (153,021 | ) | (302,227 | ) | ||||

| Restricted cash | (39,071 | ) | 507,084 | |||||

| Cash received from sale of assets | 6,199 | - | ||||||

| Payments for brand development fees | (1,761,935 | ) | - | |||||

| Payment of earn out liability | - | (2,551,500 | ) | |||||

| Net cash used in investing activities | (1,947,828 | ) | (2,346,643 | ) | ||||

| Cash Flows from Financing Activities | ||||||||

| Proceeds from notes payable | 10,000,000 | - | ||||||

| Repayment of notes payable | (7,456,250 | ) | (4,831,250 | ) | ||||

| Payment of debt issuance cost | (452,869 | ) | - | |||||

| Proceeds from sale of common stock | 220,000 | - | ||||||

| Net cash provided by (used in) financing activities | 2,310,881 | (4,831,250 | ) | |||||

| Effect of exchange rate on cash and cash equivalents | (94,011 | ) | 16,022 | |||||

| Net decrease in cash and cash equivalents | (562,028 | ) | (1,123,251 | ) | ||||

| Cash and Cash Equivalents, beginning of year | 2,517,642 | 3,640,893 | ||||||

The accompanying notes are an integral part of these consolidated financial statements

| F-5 |

| Cash and Cash Equivalents, end of year | $ | 1,955,614 | $ | 2,517,642 | ||||

| Supplemental Disclosure of Cash Flow Information: | ||||||||

| Cash paid during the period for: | ||||||||

| Interest | $ | 842,248 | $ | 1,488,123 | ||||

| Income taxes | $ | 1,194,233 | $ | 864,864 | ||||

| Supplemental Disclosure of Non-cash Investing and Financing Activities: | ||||||||

| Reallocation of goodwill related to acquisition of Factor Nutrition to intellectual property | $ | - | $ | 450,000 | ||||

| Reallocation of goodwill related to acquisition of Breakthrough Products, Inc. to intellectual property | $ | - | $ | 150,000 | ||||

| Reallocation of non-compete agreement related to acquisition of Breakthrough Products, Inc. to goodwill | $ | - | $ | 50,000 | ||||

| Adjusting the value of goodwill for the value of shares issued related to acquisition of Breakthrough Products, Inc. | $ | - | $ | 1,170,000 | ||||

| Reallocation of blogger database and intellectual property related to acquisition of Nomadchoice Pty Ltd. to customer database | $ | - | $ | 215,000 | ||||

| Common stock to be issued now issued | $ | 56,250 | $ | 68,000 | ||||

| Cancellation of common stock | $ | - | $ | 125,000 | ||||

| Common stock issued for the acquisition of assets of Per-fekt | 241,396 | - | ||||||

| Common stock issued in conjunction with cancellation of warrants and options issued concurrent with debt | $ | - | $ | 1,456,492 | ||||

| Adjustment of accounts receivable and payables created during acquisition of Neuragen | $ | - | $ | 24,592 | ||||

| Inventory written-off and adjusted against accounts receivable and payables created during acquisition of Neuragen | $ | - | $ | 48,949 |

The accompanying notes are an integral part of these consolidated financial statements

| F-6 |

SYNERGY CHC CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1 – Nature of the Business

Synergy CHC Corp. (“Synergy”, “we”, “us”, “our” or the “Company”) (formerly Synergy Strips Corp.) was incorporated on December 29, 2010 in Nevada under the name “Oro Capital Corporation.” On April 21, 2014, the Company changed its fiscal year end from July 31 to December 31. On April 28, 2014, the Company changed its name to “Synergy Strips Corp.”. On August 5, 2015, the Company changed its name to “Synergy CHC Corp.”

The Company is a consumer health care company that is in the process of building a portfolio of best-in-class consumer product brands. Synergy’s strategy is to grow its portfolio both organically and by further acquisition.

Synergy is the sole owner of fivesix subsidiaries: Neuragen Corp., Breakthrough Products, Inc., NomadChoice Pty Ltd., Synergy CHC Inc., and Sneaky Vaunt Corp., and The Queen Pegasus Corp., and the results have been consolidated in these statements.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“US GAAP”).

All amounts referred to in the notes to the consolidated financial statements are in United States Dollars ($) unless stated otherwise.

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates. At December 31, 20162017 and 20152016 significant estimates included are assumptions about collection of accounts receivable, useful life of fixed and intangible assets, impairment analysis of goodwill and intangible assets, estimates used in the fair value calculation of stock based compensation, beneficial conversion feature and derivative liability on warrants using Black-Scholes Model.

Cash and Cash Equivalents

The Company considers all cash on hand and in banks, including accounts in book overdraft positions, certificates of deposit and other highly-liquid investments with maturities of three months or less, when purchased, to be cash and cash equivalents. As of December 31, 20162017, and 20152016, the Company had no cash equivalents. The Company maintains its cash and cash equivalents in banks insured by the Federal Deposit Insurance Corporation (FDIC) in accounts that at times may be in excess of the federally insured limit of $250,000 per bank. The Company minimizes this risk by placing its cash deposits with major financial institutions. At December 31, 20162017 and 2015,2016, the uninsured balances amounted to$2,038,985to $1,557,373 and $3,453,290,$2,038,985, respectively.

Capitalization of Fixed Assets

The Company capitalizes expenditures related to property and equipment, subject to a minimum rule, that have a useful life greater than one year for: (1) assets purchased; (2) existing assets that are replaced, improved or the useful lives have been extended; or (3) all land, regardless of cost. Acquisitions of new assets, additions, replacements and improvements (other than land) costing less than the minimum rule in addition to maintenance and repair costs, including any planned major maintenance activities, are expensed as incurred.

| F-7 |

Intangible Assets

We evaluate the recoverability of intangible assets periodically and take into account events or circumstances that warrant revised estimates of useful lives or that indicate that impairment exists. All of our intangible assets are subject to amortization except intellectual property of $1,450,000 acquired as part of an Asset Purchase Agreement entered into with Factor Nutrition Labs LLC on January 22, 2015 and $10,000 acquired as part of an Asset Purchase Agreement entered into with Perfekt Beauty Holdings LLC and CDG Holdings, LLC on June 21, 2017. Intangible assets are amortized on a straight line basis over the useful lives. As of December 31, 2017, our qualitative analysis of intangible assets with indefinite lives did not indicate any impairment.

Long-lived Assets

Long-lived assets include equipment and intangible assets other than those with indefinite lives. We assess the carrying value of our long-lived asset groups when indicators of impairment exist and recognize an impairment loss when the carrying amount of a long-lived asset is not recoverable when compared to undiscounted cash flows expected to result from the use and eventual disposition of the asset.