UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X]☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedMarch 31 2017, 2022

[ ]☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission File Number:000-55167

PetVivo Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | | 99-0363559 |

(State or other jurisdiction of

| | (I.R.S. Employer |

| incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

5251 Edina Industrial Blvd.Blvd. Edina, Minnesota | | 55439 |

|

| (Address of principal executive offices) | | (Zip Code) |

(612) 296-7305(952)405-6216

(Registrant’s Telephone Number, Including Area Code)

Securities registered under Section 12(b) of the Act:

| Title of each class registered: | | Name of each exchange on which registered: |

| None | | None |

Securities registered under Section 12(g) of the Act:

Title of each class registered: | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock par value $0.001 | | PETV | | Nasdaq Stock Market Inc. |

| Warrants | | PETVW | | Nasdaq Stock Market Inc. |

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ]

☐ Yes [X] ☒ No

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ]

☐ Yes [X] ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [ ] ☒ Yes [X] ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [X] ☒ Yes [ ] ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated file, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ]☐ | Accelerated filer | [ ]☐ |

| Non-accelerated filer | [ ]☐ | Smaller reporting company | [X]☒ |

(Do not check if a smaller reporting company) | | Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ]

☐ Yes [X] ☒ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. quarter $16,361,168.

As of March 31, 2017, it was approximately $30,577,083.

As of December 4, 2017,June 28, 2022, there were 16,689,3349,988,361 shares of the issuer’s $.001 par value common stock issued and outstanding.

Documents incorporated by reference. There are no annual reports to security holders, proxy information statements, or any prospectus filed pursuant to Rule 424 of the Securities Act of 1933 incorporated herein by reference.

TABLE OF CONTENTS

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by those sections. For more information, see “Cautionary Statement Regarding Forward-Looking Statements.”

As used in this report, the terms “we,” “us,” “our,” “PetVivo,” and the “Company” mean PetVivo Holding Company, Inc. and our consolidated wholly-owned subsidiaries, unless the context indicates another meaning.

Except as otherwise specifically indicated, all information in this Annual Report on Form 10-K has been retroactively adjusted to give effect to a 1-for-4 reverse stock split (“Reverse Stock Split”) that was effective as of December 29, 2020.

The information contained on or connected to our website is not incorporated by reference into this report.

PART I

Cautionary Statement Regarding Forward-Looking Information

This Annual Report of PetVivo Holdings, Inc. on Form 10-K contains forward-looking statements, particularly those identified with the words, “anticipates,” “believes,” “expects,” “plans,” “intends,” “objectives,” and similar expressions. These statements reflect management’s best judgment based on factors known at the time of such statements. The reader may find discussions containing such forward-looking statements in the material set forth under “Management’s Discussion and Analysis and Plan of Operations,” generally, and specifically therein under the captions “Liquidity and Capital Resources” as well as elsewhere in this Annual Report on Form 10-K. Actual events or results may differ materially from those discussed herein. The forward-looking statements specified in the following information have been compiled by our management on the basis of assumptions made by management and considered by management to be reasonable. Our future operating results, however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. No assurance can be given that any of the assumptions relating to the forward-looking statements specified in the following information are accurate, and we assume no obligation to update any such forward-looking statements.

PART I

ITEM 1. BUSINESS

BACKGROUNDOverview

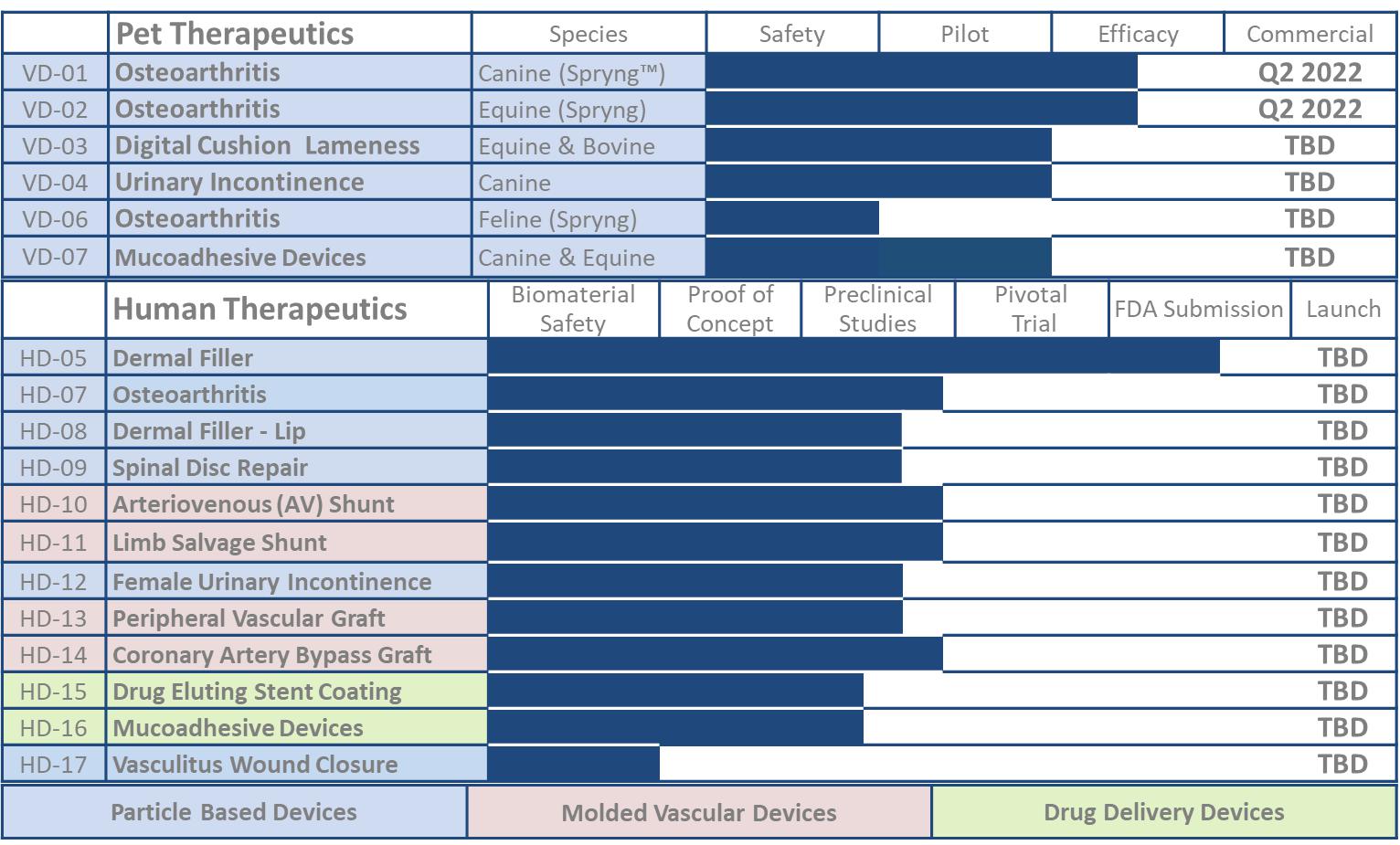

We were incorporatedPetVivo Holdings, Inc. (the “Company,” “PetVivo,” “we” or “us) is an emerging biomedical device company focused on the manufacturing, commercialization and licensing of innovative medical devices and therapeutics for animals. The Company has a pipeline of seventeen products for the treatment of animals. A portfolio of nineteen patents protects the Company’s biomaterials, products, production processes and methods of use. The Company began commercialization of its lead product Spryng™ with OsteoCushion™ Technology, a veterinarian-administered, intraarticular injection for the management of lameness and other joint afflictions such as Pharmascan Corp.osteoarthritis in dogs and horses, in the Statesecond quarter of Nevada onits fiscal year ended March 31, 2009. On September 21, 2010,2022.

In August 2021, we filedreceived net proceeds of approximately $9.7 million in a Certificateregistered public offering (“Public Offering”) of Amendment2.5 million units at a public offering price of $4.50 per unit. Each unit consisted of one share of our common stock and one warrant to purchase one share of our Articlescommon stock at an exercise price of Incorporation and changed our name to Technologies Scan Corp. On April 1, 2014, we filed a Certificate of Amendment to our Articles of Incorporation and changed our name to “PetVivo Holdings, Inc.” (the “Name Change”).

Minnesota PetVivo

On March 11, 2014, our Board of Directors authorized the execution of that certain securities exchange agreement dated March 11, 2014 (the “Securities Exchange Agreement”) with PetVivo Inc., a Minnesota corporation (“PetVivo”), and the shareholders of PetVivo who hold of record the total issued and outstanding$5.625 per share. The shares of common stock of PetVivo (the “PetVivo Shareholders”).and warrants were transferable separately immediately upon issuance. In accordanceconnection with the termsPublic Offering, the Company’s common stock and provisionswarrants were registered under Section 12(b) of the Securities Exchange Agreement, we acquired allAct and began trading on The Nasdaq Capital Market, LLC under the symbols “PETV” and “PETVW,” respectively

The Company was incorporated in March 2009 under Nevada law. The Company operates as one segment from its corporate headquarters in Edina, Minnesota. For further information, see Note 1, Description of the issued and outstanding shares of stock of PetVivo fromBusiness, in the PetVivo Shareholders, thus making PetVivo our wholly-owned subsidiary, in exchange for the issuancenote to the PetVivo Shareholders of an aggregate 2,310,939,804 shares of our restricted common stock.consolidated financial statements in Part II, Item 8.

PetVivo was founded in 2013 by John Lai and John Dolan, andBusiness Description

The Company is based in suburban Minneapolis, Minnesota. PetVivo is a biomedical device companyprimarily engaged in the business of acquiring/in-licensingcommercializing and adapting human biomedical technology andlicensing products for commercial sale in the veterinary market to treat petsand/or manage afflictions of companion animals such as dogs and other animals suffering from arthritis and other afflictions. PetVivo’s initial product, which is now being commercialized, is a medical device featuring the injectionshorses. Most of patented gel-like protein-based biomaterials into the afflicted body parts of pets and other animals suffering from osteoarthritis. PetVivo obtained the exclusive rights in a License Agreement for commercialization of this product from Gel-Del for the treatment of pets and other animals.

Gel-Del Technologies Inc.

Gel-Del is a biomaterial and medical device development and manufacturing company with its offices and production facilities based in Edina, Minnesota, andour technology was founded in 1999 by its chief executive officer, Dr. David B. Masters. Dr. Masters developed Gel-Del’s proprietary biomaterials that simulate a body’s cellular tissue and thus can be readily and effectively utilized to manufacture implantable therapeutic medical devices. The chief advantage of Gel-Del biomaterials is their enhanced biocompatibility with living tissues throughout the body. We are commercializing their technology in the veterinary field for the treatment of osteoarthritis. Gel-Del has also successfully completed a pivotal clinical trial using their novel thermoplastic biomaterial as dermal filler for human cosmetic applications. Gel-Del’s core competencies are developing and manufacturing medical devices containing its proprietary thermoplastic protein-based biomaterials that mimic the body’s tissue to allow integration, tissue repair, and regeneration for long-term implantation. These biomaterials are produced using a patented and scalable self-assembly production process. The inherent thermoplastic properties of these biomaterials are then utilized to manufacture or coat implantable devices.

While working together relating to their licensing agreement, in early 2014 our management and the management of Gel-Del determined to combine the two companies into one business entity producing, marketing and selling medical products based on Gel-Del technology for both humans and animals.

AGREEMENT AND PLAN OF MERGER

On March 20, 2017, we entered into triangular merger with our wholly-owned subsidiary, PetVivo Holdings Newco Inc. (“Newco”) and Gel-Del (the “Merger Agreement”). In accordance with the terms and provisions of the Merger Agreement, we effected a statutory merger transaction resulting in an exchange by the shareholders of Gel-Del on a pro rata basis of 100% of all outstanding Gel-Del capital stock in exchange for 5,450,000 shares of our restricted common stock, which represented approximately 30% of the total issued and outstanding shares of our common stock post-merger.

On April 10, 2017, the Merger Agreement was consummatedbiomedical applications, and we completed the acquisition of the total issued and outstanding shares of common stock of Gel-Del from the Gel-Del shareholders. The acquisition was completed and consummated through a statutory merger between Gel-Del and NewCo, which resulted in Gel-Del being the surviving entity and becoming our wholly-owned subsidiary. The Merger Agreement became effective upon the filing with the Secretary of State of Minnesota on April 10, 2017. Upon the effectiveness of the Merger Agreement, each share of Gel-Del common stock issued and outstanding immediately prior to the consummation of the Merger Agreement was converted into the right to receive 0.798 common share of the Company. Gel-Del did not have any outstanding options, warrants or other derivative securities or rights convertible into securities.

In accordance with this merger transaction, we acquired all Gel-Del technology and related patents and other intellectual property (IP) and production techniques, as well as Gel-Del’s modern and secure biomedical product manufacturing facilities being constructed in Edina, Minnesota.

Company Overview

We are based in suburban Minneapolis, Minnesota. We are a biomedical device company, which has been primarily engaged in the business of adapting human biomedical technology for products to be introduced for commercial sale in the veterinary market to treat pets and other animals suffering from arthritis and other afflictions. Our initial product, now being commercialized, is a medical device featuring injections of patented gel-like biomaterials into the afflicted body parts of pets or other animals suffering from osteoarthritis. The technology and manufacturing capability of this product was developed by Gel-Del and acquired by us for use to treat dogs, horses and other animals, but not for treatment of human afflictions. While working together pursuant to our initial license agreement, we and Gel-Del determined to combine our two companies through a stock exchange merger for the purpose of creating one combined entity utilizing Gel-Del technology to produce, market, and sell medical products based on Gel-Del technology for both animals and humans. After lengthy negotiations the parties entered into a definitive agreement for this merger, which resulted in the consummation of the merger in April, 2017.

CURRENT BUSINESS OPERATIONS

General

| | We are an emerging biomedical device company focused on the licensing and commercialization of innovative medical devices and therapeutics for pets, based in Minneapolis, Minnesota. We operate in the $15 billion US veterinary care market that has grown at a CAGR of 6.4% over the past five years according to the American Pet Products Association. Despite the market size, veterinary clinics and hospitals have very few treatments and/or drugs for use in pets and other animals.

The role of pets in the family has greatly evolved in recent years. Many pet owners consider their pets an important member of the family. They are now willing to spend greater amounts of money on their pets to maintain their health and quality of life.

|

We intend to leverage the investments already expended in thetheir development of human therapeutics to commercialize treatments for pets in a capital and time efficienttime-efficient way. A key component

Many of this strategythe Company’s products are derived from proprietary biomaterials that simulate a body’s cellular tissue by virtue of their reliance upon natural protein and carbohydrate compositions which incorporate such “tissue building blocks” as collagen, elastin and heparin. Since these are naturally-occurring in the body, we believe they have an enhanced biocompatibility with living tissues compared to synthetic biomaterials such as those based upon alpha-hydroxy polymers (e.g PLA, PLGA and the like) and other “natural” biomaterials that may lack the multiple proteins incorporated into our biomaterials. These proprietary protein-based biomaterials appear to mimic the body’s tissue thus allowing integration and tissue repair in long-term implantation in certain applications.

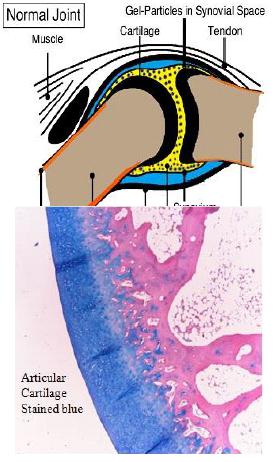

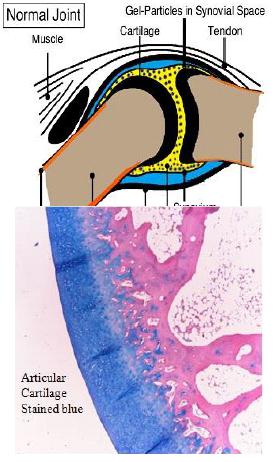

Our initial product, Spryng™ is the accelerated timeline to revenues fora veterinary medical devices,device designed to help reinforce articular cartilage tissue for the management of lameness and other joint related afflictions, such as osteoarthritis, in companion animals. Spryng™ is an intra-articular injectible product of biocompatible and insoluble particles that are slippery, wet-permeable, durable and resilient to enhance the force cushioning function of the synovial fluid and cartilage. The particles mimic natural cartilage in composition, structure and hydration. Multiple joints can be treated simultaneously. Our particles are comprised of collagen, elastin and heparin, similar components found in natural cartilage. These particles show an effectiveness to reinforce and augment the cartilage, which enterenhances the functionality of the joint (e.g. provide cushion or shock-absorbing features to the joint and to provide joint lubricity).

Osteoarthritis, a common inflammatory joint disease in both dogs and horses, is a chronic, progressive, degenerative joint disease that is caused by a loss of synovial fluid and/or the deterioration of joint cartilage. Osteoarthritis affects approximately 14 million dogs and 1 million horses in the $11 billion companion animal veterinary care and product sales market.

Despite the market earlier than the more stringently regulatedsize, veterinary pharmaceuticals clinics and hospitals have very few treatments and/or human therapeutics.

We are planning to aggressively launch our lead product Kush™ Caninedrugs for use in Q4 2017. Kush Canine is a veterinarian-administered joint injection for the treatment oftreating osteoarthritis in dogs.dogs, horses and other pets. As there is no cure for osteoarthritis, current solutions treat symptoms, but do not manage the cause. The Kush Canine device is made from natural components thatcurrent treatment for osteoarthritis in dogs generally consists of the use of nonsteroidal anti-inflammatory drugs (or “NSAIDs”) which are lubricious and cushioningapproved to perform like cartilage for the treatment ofalleviate pain and inflammation associated with osteoarthritis.

We believe that Kush Canine is a superior treatment that safely improves joint function. The reparative Kush Canine particles are lubricious, cushioning and long lasting. The spongy protein-based particles in Kush Canine mimic the composition and protective function of cartilage (i.e., providing both a slippery cushion and healing scaffolding). The Kush Canine particles protect the joint as an artificial cartilage.

Using industry sources we estimate osteoarthritis afflicts 20 million owned dogs in the United States and the European Union, making canine osteoarthritis a $2.3 billion market opportunity. See Johnston, Spencer A. “Osteoarthritis. Joint anatomy, physiology, and pathobiology.” The Veterinary clinics of North (1997):699-723;

http://www.humanesociety.org/issues/petoverpopulation/facts/pet_ownership_statistics.html; andhttp://www.americanpetproducts.org/press_industrytrends.asp.

| |  |

Osteoarthritis is a condition with degenerating cartilage, creating joint stiffness from mechanical stress resulting in inflammation and pain. The lameness caused by osteoarthritis worsens with time from the ongoing loss of protective cushion and lubricity (i.e., loss of slippery padding). There is no current treatmentbut present the potential for osteoarthritis, only palliative pain therapy or joint replacement. Non-steroidal anti-inflammatory drugs (NSAIDs) are used to alleviate the pain and inflammation, but long-term use has been shown to cause gastric problems. NSAIDs do not treat the cartilage degeneration issue to halt or slow the progression of the osteoarthritis condition.

|

We believe that our Kush Canine osteoarthritis treatment is far superior to current methodology of using NSAIDs. NSAIDs have many side effects especially in canines, whereasrelating to gastrointestinal, kidney and liver damage and do not halt or slow joint degeneration. The Company offers an alternative to traditional treatments that only address the company’s injected Kush Canine treatmentsymptoms of the affliction. Spryng™ with OsteoCushion™ technology addresses the affliction, loss of synovial fluid and/or the deterioration of joint cartilage, rather than treating just the symptoms and, to the best our knowledge, has been found to elicit noelicited minimal adverse side effects. Remarkably, Kush treatedeffects in dogs showand horses. Spryng™-treated dogs and horses have shown an increase in activity even after they no longer are receiving pain medication.

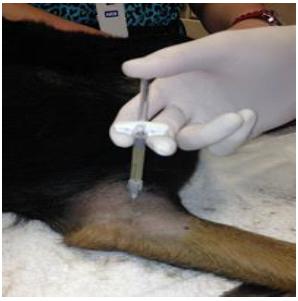

No special training is requiredmedication or other treatments. Other treatments for the administration of the Kush Canine devices. The treatment is injected into synovialosteoarthritis include steroid and/or hyaluronic acid injections, which are used for treating pain, inflammation and/or joint space using standard intra-articular injection technique and multiple jointslubrication, but can be treated simultaneously. Kush Canine immediately treats effects of osteoarthritis with no special post treatment requirements.slow acting and/or short lasting.

We believe Spryng™ is an optimal solution to safely improve joint function in animals for several reasons:

| ● | Spryng™ addresses the underlying problems which relate to deterioration of cartilage causing bones to contact each other and a lack of synovial fluid. Spryng™ provides a biocompatible lubricious cushion to the joint, which establishes a barrier between the bones, thereby protecting the remaining cartilage and bone. |

| ● | Spryng™ is easily administered with the standard intra-articular injection technique. Multiple joints can be treated simultaneously. |

| ● | Case studies indicate many dogs and horses have long-lasting multi-month improvement in lameness after having been treated with Spryng™. |

| ● | After receiving a Spryng™ injection, many canines are able to discontinue the use of NSAID’s, eliminating the risk of negative side effects. |

| ● | Spryng™ is an effective and economical solution for treating osteoarthritis. A single injection of Spryng™ is approximately $600 to $900 per joint and typically lasts for at least 12 months. |

Historically, drug sales represent up to 30% of revenues at a typical veterinary practice (Veterinary Practice News). Revenues and margins at veterinary practices are being eroded because online, big boxbig-box and traditional pharmacies have recently started filling veterinary prescriptions. Veterinary practices are looking for ways to replace the lost prescription revenues. Our treatments expand practice revenues & margins because they are veterinarian-administered. Our Kush Caninewith safe and effective products. Spryng™ is a veterinarian-administered medical device is veterinarian-administered tothat should expand practice revenues and margins. We believe that the increased revenues and margins provided by Kush CanineSpryng™ will accelerate its adoption rate and propel it forward as the standard of care for canine osteoarthritis.

Our product launch schedule includes at least two additional product releases in 2018. Our Kush Equine device for the treatment ofand equine lameness related to or impacting synovial joints is scheduled for launch in Q1 2018. The Kush Equine product has similar features and benefits as our Kush Canine device. In addition to being a treatment for osteoarthritis, the joint cushioning and lubricity effects of our devices have shown an ability to treat equine lameness that is due to navicular disease (a problem associatedsynovial joint issues.

Spryng™ is classified as a veterinary medical device under the United States Food and Drug Administration (“FDA”) rules and pre-market approval is not required by the FDA. Spryng™ completed a safety and efficacy study in rabbits in 2007. Since that time, more than 800 horses and dogs have been treated with misalignmentSpryng™. We entered into a clinical trial services agreement with Colorado State University on November 5, 2020. We expect this university clinical study to be completed in November 2023. Additionally, the Company successfully completed an equine tolerance study in March 2022 and began a canine clinical study with Ethos Veterinary Health in May of joints2022 with anticipated completion in fiscal 2023. We anticipate these and bonesother studies that we plan to initiate will be primarily used to expand our distribution outlets since the large international and national distributors generally require a third-party university study and other third-party studies prior to including a product in their catalog of products.

We commenced sales of Spryng™ in the hoofsecond quarter of fiscal 2022 and digits). We anticipate launchingplan to increase our Kush Digital Cushion (DC) device for the treatmentcommercialization efforts of navicular disease in 2018.

Based on a variety of industry sources we estimate that 1 million owned horsesSpryng™ in the United StatedStates through the use of sales reps, clinical studies and European Union suffer from lameness and/or navicular disease each year, makingmarket awareness to educate and inform key opinion leaders on the equine lamenessbenefits of Spryng™. We plan to support our commercialization efforts with the use of social media and navicular disease market an annual opportunity worth $600 million. See Kane, Albert J., Josie Traub-Dargatz, Willard C. Losinger,other methods to educate and Lindsey P. Garber; “The occurrenceinform key opinion leaders and causes of lamenessdecision makers at the top distributors and laminitis in the US horse population” Proc Am Assoc Equine Pract. San Antonio (2000): 277-80; Seitzinger, Ann Hillberg, J. L. Traub-Dargatz, A. J. Kane, C. A. Kopral, P. S. Morley, L. P. Garber, W. C. Losinger, and G. W. Hill. “A comparisonhigh prescriber veterinarians for companion animals of the economic costsavailability and benefits of equine lameness, colic,Spryng™.

We have established an ISO 7 certified clean room manufacturing facility located in our Minneapolis facility using a patented and equine protozoal myeloencephalitis (EPM).” In Proceedings, pp. 1048-1050. 2000;scalable self-assembly production process, which reduces the infrastructure requirements and Kilby, E. R. 10 CHAPTER, The Demographics ofmanufacturing risks to deliver a consistent, high-quality product while being responsive to volume requirements. We recently began manufacturing commercial quantities and anticipate our ISO 7 certified facility will be able to handle projected production in units for at least the U.S. Equine Population, The State of the Animals IV: 2007.next five years.

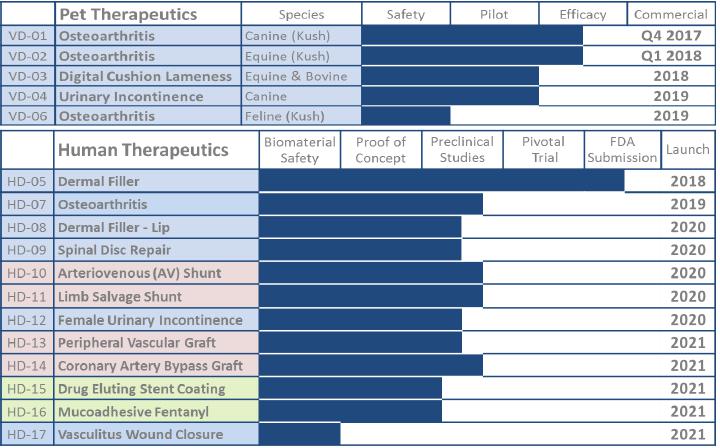

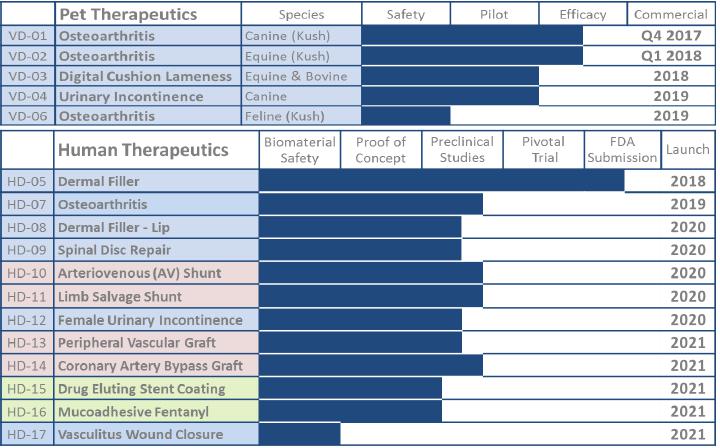

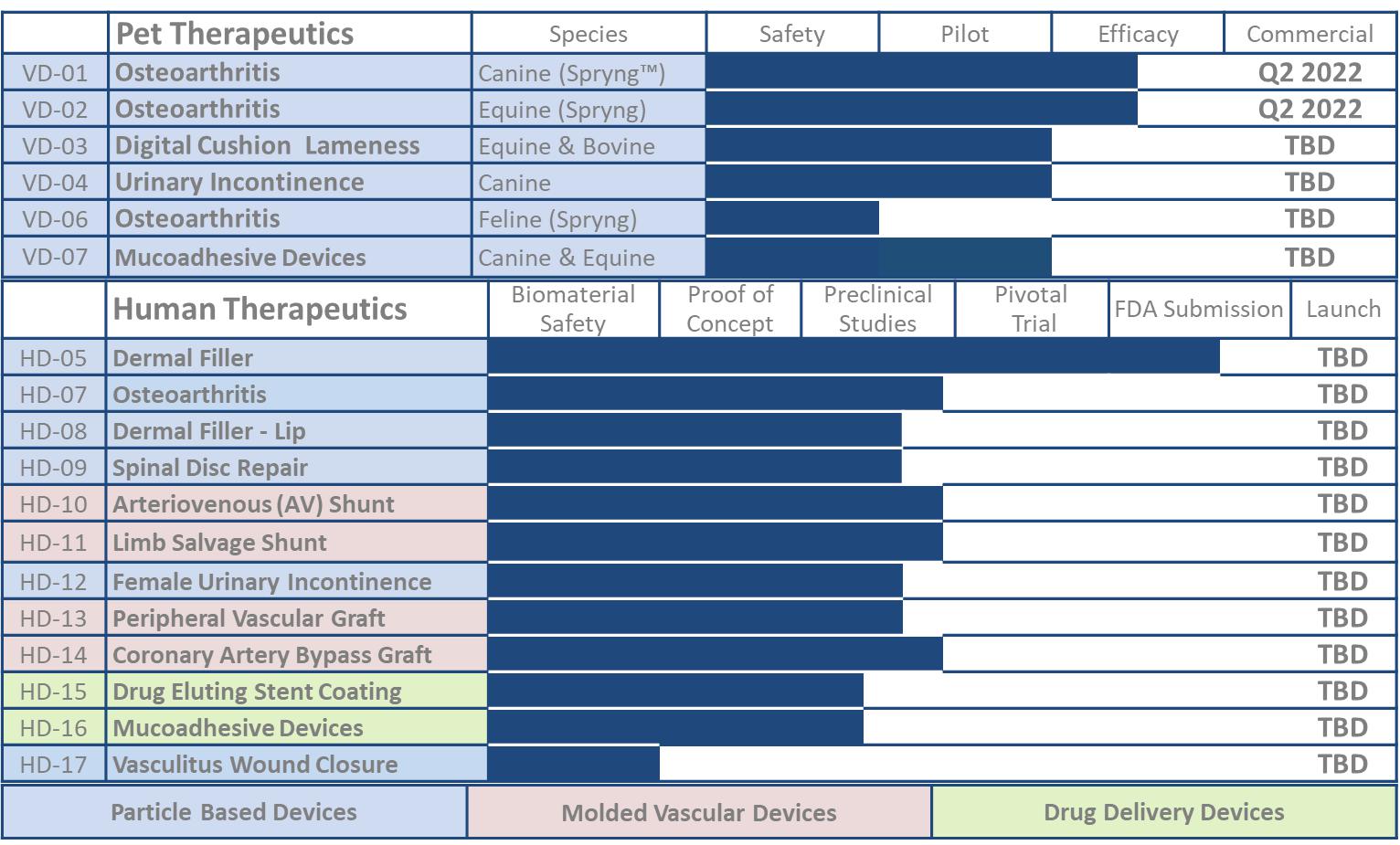

Our currentWe also have a pipeline which includes 17 therapeutic devices for both veterinary and human clinical applications.

Some such devices may be regulated by the FDA or other equivalent regulatory agencies, including but not limited to the Center for Veterinary Medicine (“CVM”). We anticipate growing our product pipeline through the acquisition or in-licensing of additional proprietary products from human medical device companies specifically for use in pets. In addition to commercializing our own products in strategic market sectors and in view of the Company’s vast proprietary product pipeline, the Company anticipates establishingmay establish strategic out-licensing partnerships to provide secondary revenues.

Product Pipeline

We plan to commercialize our products in the United States through distribution relationships supported by regional and national distributors and complemented by the use of social media educating and informing the pet owners, and in Europe and rest of world through commercial partners.

Most veterinarians in the United States buy a majority of their equipment and supplies from one of six veterinary products distributors. Combined, these six distributors delivery more than 85%, by revenue, of the products sold to companion animal veterinarians in the U.S. Our product distribution will leverage the existing supply chain and veterinary clinic and clinician relationships already established by these large distributors. We plan to support this distribution channel with regional sales representatives. Our representatives will support our distributors and the veterinary clinics and hospitals. We will also target pet owners with product education and treatment awareness campaigns utilizing a variety of social media tools. The unique nature and the anticipated benefits provided by our products are expected to generate significant consumer response.

Gel-Del Particles have been through a human trial and have been classified as a medical device. The FDA does not require submission of a 510(k) or formal pre-market approval for medical devices used in veterinary medicine. We anticipate initial commercial production and sales in early 2018. We anticipate selling through existing veterinary distributors. See — “Gel-Del Technology” below.

Gel-Del Technology

Our wholly-owned subsidiary entered into that certain exclusive license agreement and manufacturing and supply agreement dated August 2, 2013 (the “License Agreement”) with Gel-Del pertaining to the manufacture and supply of products by Gel-Del derived from certain technology, including protein-based biomaterials and devices, which are beneficial for the veterinary treatment of animals having orthopedic joint afflictions (the “Technology”). We have since terminated the License Agreement based upon consummation of the Stock Exchange Agreement, which was terminated pursuant to the Agreement and Plan of Merger transaction with Gel-Del.

Gel-Del is a biomaterial and medical device manufacturing company based in Edina, Minnesota. We will be working together to commercialize Gel-Del’s technology in the veterinary field for the treatment of osteoarthritis. Gel-Del has also successfully completed a pivotal clinical trial using their novel thermoplastic biomaterial as dermal filler for human cosmetic applications. Gel-Del’s core competencies are developing and manufacturing medical devices containing its proprietary thermoplastic protein-based biomaterials that mimic the body’s tissue to allow integration, tissue repair, and regeneration for long-term implantation. These biomaterials are produced using a patented and scalable self-assembly production process. The inherent thermoplastic properties of these biomaterials are then utilized to manufacture or coat implantable devices.

Below is a listing of Gel-Del technologies:applications of our technology that we plan to commercialize or out-license to strategic partners:

Dermal Filler

| Gel-Del®biomaterials are constructed from purified water, protein, and carbohydrate, tailored to simulate different body tissues that biologically integrate (bio-integration). Gel-Del’s technology is used to manufacture CosmetaLife®, dermal filler for wrinkle treatment by injection. These formed gel-particles fill, integrate and rejuvenate dermal skin tissue to remove the wrinkle. |

Our biomaterials are constructed from purified water, protein, and carbohydrate, tailored to simulate different body tissues that biologically integrate (bio-integration). Our biomaterials can be manufactured and used as a dermal filler for wrinkle treatment by injection. These formed, gel particles fill, integrate and rejuvenate dermal skin tissue to remove the wrinkle. This product was taken through an FDA clinical trial under the name CosmetaLife®, see the results here: www.clinicaltrials.gov (NCT00414544).

Cardiovascular Devices

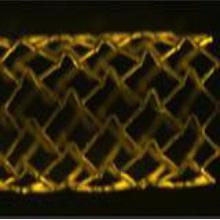

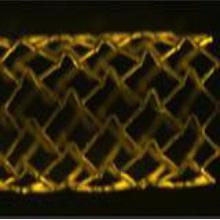

| The blood compatible Gel-Del material, which allows blood contact and bio-integrative processes to occur without clotting, platelet attachment, or thrombogenesis, is used to repair cardiovascular tissue. VasoGraft™, a blood vessel graft made from Gel-Del VasoCover™ material, is designed to mimic natural blood vessel tissue in almost every respect, including the components used. |

Our blood-compatible biomaterial, which allows blood contact and bio-integrative processes to occur without clotting, platelet attachment, or thrombogenesis, is used to repair cardiovascular tissue. VasoGraft®, a blood vessel graft made from VasoCover™ material, is designed to mimic natural blood vessel tissue in almost every respect, including the components used.

Drug Delivery

| Unique fabrication techniques allow Gel-Del’s material to homogeneously distribute drug in milligram to nanogram amounts, resulting in optimum performance and manufacturing capabilities for a variety of delivery methods, such as coatings, injectables, implantables or transmucosal delivery. The first planned transmucosal product, OraPatch™, has been optimized and tested with peptide drugs with better efficacy than oral dosing via swallowing. |

Unique fabrication techniques allow us to homogeneously distribute drug in milligram to nanogram amounts, resulting in optimum performance and manufacturing capabilities for a variety of delivery methods, such as coatings, injectables, implantables or transmucosal delivery. The first planned transmucosal product has been optimized and tested with peptide drugs with better efficacy than oral dosing via swallowing.

Orthopedic Devices

| Gel-Del material will be used in a variety of shapes for orthopedic and dental applications. The first products, OrthoGelic™ and OrthoMetic™, will be aimed at difficult to heal,Another of our materials can be used in a variety of shapes for orthopedic and dental applications. The first products, OrthoGelic™ and OrthoMetic™, will be aimed at difficult-to-heal, non-union broken bones, by using particles to fill the empty space. The orthopedic biomaterial, made to mimic the structural components of bone, can allow integration and healing to fill in the break and exclude non-bone tissue infiltration. |

Wound Healing and In Vitro Devices

The ability of Gel-Del material to simulate body tissue is the technology behind BioSimix products. Applying bio-integrative materials to troubled soft tissue by itself or with cells, can aid the healing-repair process. The first products planned, WoundGelic™ and CelGelic™, mimic the structural components of tissue tobone, can allow integration and healing withto fill in the break and without cells, respectively.exclude non-bone tissue infiltration.

Intellectual Property

Our intellectual property portfolio is comprised of patents, patent applications, trademarks and trade secrets. We have eightten issued United States Patents with an additional seven US patent applications pending.Patents. In addition to the United States patent portfolio we also have 12eight patents issued or allowedgranted in key markets around the world including Canada, Australia and countries within the European Union. We have an additional nine applications pending in those key foreign markets.

Our patent portfolio is currently held in our wholly owned subsidiary Gel-Del Technologies. We believe we have developed a broad and deep patent portfolio around our biomaterials and manufacturing processes in addition to the application of these biomaterials for use as medical devices, medical device coatings and pharmaceutical delivery devices. The Company secures other technological know-how by trade secret law and also possesses fiveseveral trademarks that are either registered or protected pursuant to trademark common law.

United States Patents:

United States Patents:

| ● | 10,967,104 – Encapsulated or Coated Stent Systems |

| ● | 10,850,006 – Protein Biomaterials and Bioacervates and Methods of Making and Using Thereof |

| ● | 10,744,236 – Protein Biomaterial and Biocoacervate Vessel Graft Systems and Methods of Making and Using Thereof |

| ● | 10,016,534 – Protein Biomaterial and Biocoacervate Vessel Graft Systems and Methods of Making and Using Thereof |

| ● | 9,999,705 – Protein Biomaterials and Bioacervates and Methods of Making and Using Thereof |

| ● | 9,107,937– Wound Treatments with Crosslinked Protein Amorphous Biomaterials 8,871,267– Protein Matrix Materials, Devices and Methods of Making and Using Thereof

|

| ● | 8,623,393– Biomatrix Structural Containment and Fixation Systems and Methods of Use Thereof |

| ● | 8,529,939– Mucoadhesive Drug Delivery Devices and Methods of Making and Using Thereof |

| ● | 8,465,537– Encapsulated or Coated Stent Systems |

| ● | 8,153,591– Protein Biomaterials and Biocoacervates and Methods of Making and Using Thereof 7,662,409– Protein Matrix Materials, Devices and Methods of Making and Using Thereof

6,342,250– Drug Delivery Devices Comprising Bio-degradable Protein for the Controlled Release of Pharmacologically Active Agents & Method of Making

12 Foreign Patents Granted & Allowed

16 Patent Apps Pending (US & Foreign)

|

|

8 Foreign Patents Granted & Allowed

7 Patent Apps Pending (US & Foreign)

To maximize the strength and value of our patent portfolio, many of the claims use the transitional term “comprising”, which is synonymous with “including,” This use of transitional language is inclusive or open-ended and does not exclude additional, unrecited elements or method steps. Our patents also include method claims covering many of the applications and uses of the biomaterials as medical devices and drug delivery systems. With eight issued or allowed United States Patents that contain 328 claims,We believe our intellectual property portfolio strongly protects our proprietary technology, including the composition of raw elements used to produce our formulations, the fabricated biomaterials and their application in end products, thereby making our material and devices much more attractive to industry partners.

We will seek to protect our products and technologies through a combination of patents, regulatory exclusivity, and proprietary know-how. Our goal is to obtain, maintain and enforce patent protection for our products, formulations, processes, methods and other proprietary technologies, preserve our trade secrets, and operate without infringing on the proprietary rights of other parties, both in the United States and in other countries. Our policy is to actively seek to obtain, where appropriate, the broadest intellectual property protection possible for our current compounds and any future compounds in development.developed. We also strenuously protect our proprietary information and proprietary technology through a combination of contractual arrangements, trade secrets and patents, both in the United States and abroad. However, even patent protection may not always afford us with complete protection against competitors who seek to circumvent our patents.

We depend upon the skills, knowledge and experience of our scientific and technical personnel, including those of our company, as well as that of our advisors, consultants and other contractors, none of which is patentable. To help protect our proprietary know-how, which may not be patentable, and inventions for which patents may be difficult to obtain or enforce, we rely on trade secret protection and confidentiality agreements to protect our interests. To this end, we generally require all of our employees, consultants, advisors and other contractors to enter into confidentiality agreements that prohibit disclosure of confidential information and, where applicable, require disclosure and assignment of ownership to us the ideas, developments, discoveries and inventions important to our business.

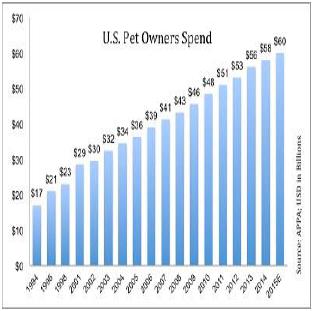

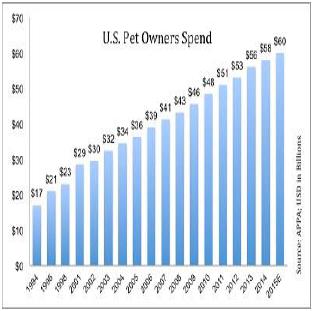

Companion Animal Market

Over the last several decades, we believe the animal health market and industry has a strong component in the overall U.S. economy and is more resistant to economic cycles. The veterinary sector is as an attractive area to participate in the growth of the broader healthcare industry without reimbursement risk. Based on our best knowledge, U.S. consumers will spend an estimated $60 billion on pets this year—a number that has been growing at a pace of more than 5% over the past decade. Therapeutics constitutes a small portion of this market (less than $2 billion) but we believe it is poised to expand as pet care becomes more complex and companies launch new products for unmet needs. The growth in the U.S. companion animal market has been continuing to increase due to the increase in the number of pet owning households.

The American Pet Products Association (APPA) 2013-2014 National Pet Owners Survey indicates U.S. pet ownership reached record levels in 2013. Specifically, 68% of all U.S. households owned a pet in 2013, up from 62% in 2002. The number of pet owning households totaled 82.5 million, representing a 10-year CAGR of 2.5%. In 2012, dogs and cats were the most popular pet species, owned by 46.7% and 37.3% of U.S. households, respectively. APPA also reported that there were 83.3 million dogs (10-year CAGR of +2.5%) and 95.6 million cats (10-year CAGR of +2.1%) in the U.S. In comparison, the total U.S. human population increased at +0.9% CAGR over the last decade. APPA reported that 2.8% of U.S. households owned horses in 2012. According to the APPA the total number of horses owned by U.S. households increased to 8.3 million in 2012, a 5% increase over the previous APPA survey conducted two years earlier.

| |  |

Over the last several decades, we believe the animal health market and industry has a strong component in the overall U.S. economy and is more resistant to economic cycles. The veterinary sector is as an attractive area to participate in the growth of the broader healthcare industry without reimbursement risk. The American Pet Products Association (APPA) 2021-2022 National Pet Owners Survey indicates that $123.6 billion was spent on pets in the U. S. in 2021. Vet Care and product sales constitutes about $34.3 billion of the market. The growth in the U.S. companion animal market has been continuing to increase due to the increase in the number of pet-owning households.

The APPA 2021-2022 National Pet Owners Survey indicates U.S. pet ownership reached record levels in 2022. Specifically, 70% of all U.S. households owned a pet in 2022. That’s 90.5 million pet-owning households, up from 84.6 million in 2018. In 2022, dogs and cats were the most popular pet species, owned by 69% and 45% of U.S. households, respectively. APPA also reported that there were 69.0 million dogs and 45.3 million cats in the U.S. APPA reported that 3.5% of U.S. households owned horses in 2022. According to the American Horse Council, the total number of horses owned by U.S. households was 7.2 million.

Osteoarthritis Market.Market

Osteoarthritis, the most common inflammatory joint disease in both dogs and horses, is a progressive condition that is caused by a deterioration of joint cartilage. Over time, the joint cartilage deterioration creates joint stiffness from mechanical stress resulting in inflammation, pain and loss of range of motion, which may be referred to as lameness. Osteoarthritis joint stiffness and lameness worsens with time from gradual cartilage degeneration and an ongoing loss of protective cushion and lubricity (i.e., loss of slippery padding). As there is no cure for osteoarthritis, the various treatment methods are focused on managing the related symptoms of pain and inflammation. Veterinarians recommend several treatments depending on the severity of the disease, including a combination of rest, weight loss, physical rehabilitation, and a regimen of pain and anti-inflammatory drugs (NSAIDs). Non-steroidal anti-inflammatory drugs (NSAIDs) are used to alleviate the pain and inflammation caused by OA, but long-term NSAIDs cause gastric problems. Moreover, NSAIDs do not treat the cartilage degeneration issue to halt or slow progression of the OA condition.condition.

The prevalence of companion animal osteoarthritis is estimated through a variety of methods. In looking at the dog osteoarthritis incidence Spence Johnston’s article“Osteoarthritis. Joint anatomy, physiology, and pathobiology”is often cited, this article reportsMorris Animal Foundation estimates that 20% of allOA effects approximately 14 million adult dogs over the age of one year suffer from osteoarthritis. Using this simple methodology, management has estimated that 20% of the total dog population is under age one.

83.3 million – 20% = 66.6 million x 20% with OA = 13.3 million dogs with OA in U.S.

Our osteoarthritis market data has been validated by a number of reports evaluating a new NSAID that is estimated to be ready for commercial sale by Aratana Therapeutics, Inc. (PETX) in 2016. Craig-Hallum’s July 22, 2013 institutional research report on Aratana Therapeutics estimates the U.S. dog osteoarthritis market at 16.6 million dogs. William Blair & Company, L.L.C. releasedand owners consistently report it as a July 25, 2013 Equity Research report by Aratana Therapeutics that concluded that roughly 10% of dogs and cat suffer from osteoarthritis. (83.3 million dogs x 10% = 8.3 million dogs with OA) Stifel issued report on Aratana Therapeutics dated July 22, 2013 that estimated the osteoarthritis market to be 55% of dogs over the age of 10. This equates to a US market in 2014 of 7.1 million dogs with osteoarthritis.top concern.

Horse Osteoarthritis (Lameness)

The equineEquine osteoarthritis is the most common cause of lameness in horses. TheEquine OA is expensive to manage, with estimated annual average costs for diagnosis and treatment of equine lameness $3,000as high as $10,000-15,000 per horse with downtime & homecare costs being much higher (Oketo diagnose, treat, and McIlwraith, 2010). “The USDA National Economic Cost of Equine Lameness…medicate, researchers found in one study as referenced in the United States” published by 1978 places the annual incidence of lameness at 8.5-13.7 lameness events/100 horses.Horse – Equine Monthly.

As noted previously, the APPAAmerican Horse Council reported the total number of horses owned by U.S. households increasedwas 7.2 million. According to 8.3 millionan annual National Equine Health Survey conducted in 2012. A 2007 publication by Emily Kilby “The Demographicscollaboration with the British Equine Veterinary Association in 2016, 26% of the U.S. Equine Population” concludes the horse population for 9,464,200 in 2006 with racehorses being 9% of that population or 846,000 horses. The article “The Occurrence and Causes of Lameness and Laminitishorses suffered from lameness. As referenced in the U.S. Horse Population” estimates that 17%– Equine Monthly (June 2020), studies show 60% of racehorses and 5.4% of the rest of the horse population go lame annually.all lameness issues are related to OA. Based on the above assumptions we calculate that there are up to 611,658 new lameapproximately 1.1 million horses each year.suffering from OA.

Distribution

Most U.S. veterinarians buy a majority of their equipment and supplies from a preferred distributor. More than 75% of veterinarians name Covetrus North America/Butler Schein Animal Health, Inc., WebsterPatterson Veterinary, Supply Inc. (recently acquired by Patterson), MWI, Midwest Veterinary Supply, Inc. or Victor Medical Company as their preferred distributor. Combined, these top tiertop-tier distributors sell more than 85%, by revenue, of the products sold to companion animal veterinarians in the U.S. Butler, WebsterCovetrus, Patterson and MWI are recognized by manufacturers, distributors and veterinarians as the pre-eminent national companion animal veterinary supply distributors in the US. There are no other distributors that provide equivalent levels of service to manufacturers and regularly visit veterinarians in as wide a geographic area as Butler, WebsterCovetrus, Patterson or MWI. Midwest and Victor are large, regional distributors, also with strong reputations for high-quality service.distributors. The above data in this paragraph was sourced from File No. 101 0023 at the U.S. Federal Trade Commission.

OurWe plan to have our product distribution will leverage the existing supply chain and veterinary clinic and clinician relationships already established by these large distributors. We intend to support and supplement this distribution channel with regional business development & training representatives. OurWe plan to have our business development representatives will provide product training to distribution representatives, veterinarians and other veterinary staff. In addition, we intend to have our representatives willand veterinarian partners exhibit at key veterinary conferences in addition to supportingas well as support ongoing case studies. All of these sales, distribution, marketing and education efforts will also be supported by both veterinarian and pet owner product education and treatment awareness campaigns that will be conducted utilizing a variety of socialdigital media tools. The unique nature and the anticipated benefits provided by our firstSpryng™ product are expected to generate significant consumer response.

Our primary distribution channel is through the existing stocking distributors who having operating typical margins between fourteen to sixteen percent. We have budgeted a twenty percent margin for our distributors and a full fifty percent margin for the veterinary practices.

Gel-Del Particle Devices

Orthopedic Joint Treatments

A treatment for joint pain, which is made of injected protein-based gel-particles. In vivo studies indicate that the gel particle device can easily be combined with synovial fluid in a rabbit knee to form a joint cushion, buffering the adjacent bones/cartilage where no damage was caused to the cartilage from replacing the synovial fluid. The particles show an effectiveness to repair, reconstitute or remodel the tissue, cartilage, ligaments and/or bone and/or enhance the functionality of the joint (e.g. repair deteriorated components present in the joint to provide cushion or shock absorbing features to the joint and to provide joint lubricity) | |  |

| |

AppTec Laboratories accomplished a gel-particle rabbit study. In short, New Zealand white rabbits (6) were injected in both stifle joints (knees) to fill but not extend the synovial space (~0.5 cc GDP/site).Rabbits were tested every other day for abnormal clinical signs including range of motion and joint observations until sacrifice. Behavioral testing revealed no abnormal scores for range of motion, withdrawal response, or joint observations (all animals were 100% normal). At one week and at four weeks the animals were sacrificed. AppTec pathologists evaluated knee joint histology. The reported cartilage surfaces of the femoral and tibia condyles and the menisci were grossly and histologically 100% normal for all animals and test sites. The test particles were found in all of the injection sites. | |

| |

The test article did not cause changes in the articular cartilage of the femur or tibia when injected into the stifle joint of rabbits. The test article and control rabbit knees were not different for either 1 or 4 week time points for all histological measurements. In conclusion, the particles do not cause inflammation or damage to knee joint and will stick to exposed tissues and biologically integrate with those tissues. The particles were not found to stick to articular cartilage in any sample. | |

Our lead product, Spryng™, is a treatment for joint pain, which is made of injected, protein-based, biocompatible particles. In vivo studies indicate that the biocompatible particle device can easily be combined with synovial fluid in a rabbit knee to form a joint cushion, buffering the adjacent bones/cartilage where no damage was caused to the cartilage from replacing the synovial fluid. The particles show an effectiveness to augment and reinforce the tissue, cartilage, ligaments and/or bone and/or enhance the functionality of the joint (e.g. reinforce deteriorated components present in the joint to provide cushion or shock-absorbing features to the joint and to provide joint lubricity).

We retained AppTec Laboratories, an independent research organization, to conduct a gel-particle rabbit study in New Zealand in 2007. In this study, six white rabbits (6) were injected in both stifle joints (knees) to fill but not extend the synovial space (~0.5 cc GDP/site). Rabbits were tested every other day for abnormal clinical signs including range of motion and joint observations until sacrifice. Behavioral testing revealed no abnormal scores for range of motion, withdrawal response, or joint observations (all animals were 100% normal). At one week and at four weeks the animals were sacrificed. AppTec pathologists evaluated knee joint histology. The reported cartilage surfaces of the femoral and tibia condyles and the menisci were grossly and histologically 100% normal for all animals and test sites. The test particles were found in all of the injection sites.

The test particle did not cause changes in the articular cartilage of the femur or tibia when injected into the stifle joint of rabbits. The test article and control rabbit knees were not different for either 1 or 4-week time points for all histological measurements. In conclusion, the particles do not cause inflammation or damage to knee joint and will stick to exposed tissues and biologically integrate with those tissues. The particles were not found to stick to articular cartilage in any sample.

Regenerative Characteristics

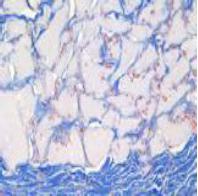

The particlesparticle devices for joint injections have been extensively studied for a broad range of applications including the treatment of wrinkles as dermal filler. Here is an overview of the pre-clinical and clinical studies completed onfor CosmetaLife, which is the name used for the particle device when theyit was used as a dermal filler.

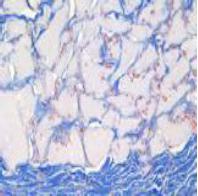

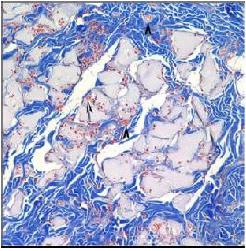

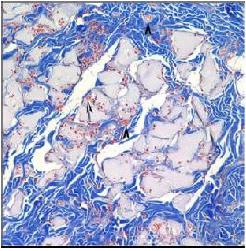

| | Particle Integration after 12 Weeks

The image at left shows collagen in blue, fibroblasts in red and CosmetaLife in gray. Note the typical cellularization and integration of collagen within the CosmetaLife matrix perimeter. Also notice the fibroblasts (collagen producers) are integrated throughout the injection site. Microvascularization, indicated by arrowheads, is also present in several locations. There is little to no sign of inflammation.

Trichrome Stain - 20x Objective

CosmetaLife (GDP) Particles

|

CosmetaLife is an easy-to-inject, water-protein-based dermal filler that not only fills nasolabial wrinkle depressions but also helps rejuvenate the dermal tissues, counteracting damage that causes wrinkles. The dermal cells are attracted to the CosmetaLife gel-particles, attach to them, and then slowly replace them with natural dermal material (extracellular matrix). The natural biological replacement process of CosmetaLife to collagen is estimated to take 6-12 months. CosmetaLife clinical trial on nasolabial folds supports this estimate. According to current scientific thought, the resulting natural extracellular matrix, comprised mostly of collagen, is estimated to last 10-16 years.

CosmetaLife injections allow the body to create more natural dermal structure in and around every particle. Enhancing the natural process of dermal tissue construction with CosmetaLife allows for long-term dermal contouring, corrections, and rejuvenation with little to no adverse side effects noted in clinical trials.

Particle Device Clinical Studies.Studies

| | The Company has conducted several biocompatibility animal studies. In the implantation study, no abnormal clinical signs were noted for any of the rabbits. The results of the sensitization study in guinea pigs showed a sensitization response equivalent to the negative controls.

The results of the histological report on the rabbit skin biopsies clearly demonstrate structural integration of the particles into the host tissues by week 12. Evaluators observed the particle material integration with normal tissue, remodeled and/or new collagen, and fibroblasts throughout the injected particles, mild to no inflammation, and new collagen-matrix production.

|

The Company has conducted several biocompatibility animal studies. In the implantation study, no abnormal clinical signs were noted for any of the rabbits. The results of the sensitization study in guinea pigs showed a sensitization response equivalent to the negative controls.

A Food and Drug Administration (FDA) IDE approved pivotal human clinical trial was begunbegan with CosmetaLife late in 2006. The clinical trial was a randomized, double blind,double-blind, parallel assignment, multi-center comparison of the safety and efficacy of CosmetaLife versus Restylane®Restylane® (Control) for the correction of nasolabial folds. One hundred seventy-one patients were skin tested and 145 were treated at six trial sites. The number of study exits after treatment totaled four subjects. This clinical trial was reported and published at www.clinicaltrial.govwww.clinicaltrials.gov (NCT00414544).

The feedback from physician investigators has beenwas positive with respect to CosmetaLife injection qualities, cosmetic appearance, and its feel to the touch. During the first three to four months of the study, CosmetaLife showed no decrease in efficacy, as compared to Restylane that showed an 11 percent decrease in efficacy. The FDA/IDE approved human clinical trial for the CosmetaLife product through twelve months was found to be the same as compared to control hyaluronic acid product, Restylane (For(for each interval the consensus of the blinded subjects tested preferred CosmetaLife or showed no preference at 3, 6, 9 and 12 months).

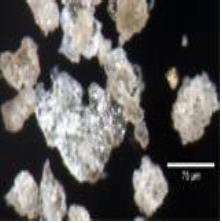

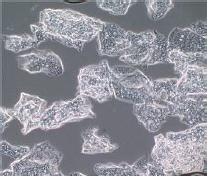

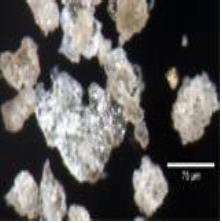

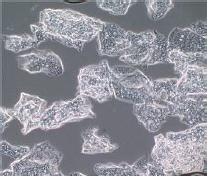

| | CosmetaLife particles, shown in figure to the left, were photographed from a light microscope under high magnification. GDP particles were immersed in a saline solution to help disperse them for better viewing. These particles are approximately 100 microns in size (0.1 mm in diameter). |

Gel-Del Technologies usesWe use existing, scalable processes to reduce the infrastructure requirements and manufacturing risks to deliver a consistent, high qualityhigh-quality product while being responsive to volume requirements. Gel-Del is scalingWe are able to scale the manufacturing process for Gel-Del Particles production, to date makinghaving made batches in up to 2.0-kilogram quantities to near GMP (Good Manufacturing Practices) standards acceptable for human clinical trials.standards.

Particles Safety Study.Study

Patients injected with CosmetaLife were found to have no or mild inflammatory, irritation, or immunogenic responses. These results suggest the particles are biocompatible because it closely matches the skin structure, composition, and moisture content. The no to lowno-to-low immunogenic responses are attributed to the tight cross-linking of the GDPCosmetaLife matrix, which prevents immunogenic progenitor cells from producing antibodies.antibodies to the matrix.

| | In the clinical trial, the incidence of possible reaction to a skin test was 2.55 percent, with only one subject showing a reaction to a second test or 0.6%, (1 out of 171). We also have a study report by AppTec, Inc., our Contract Research Organization, that GDP (CosmetaLife) did not produce an antibody response during the clinical trial further supporting our belief that GDP is safe to use.

Gel-Del Particles are composed of materials that approximately meet the Generally Regarded As Safe (GRAS) requirements of the FDA. GDP contains materials from certified bovine and porcine tissue sources that do not harbor prion disease or BSE. Additionally, steps in the manufacturing process have been validated for deactivating all viruses.

|

In the clinical trial, the incidence of possible reaction to a skin test was 2.55 percent, with only one subject showing a reaction to a second test or 0.6%, (1 out of 171). We also have a study report by AppTec, Inc., our Contract Research Organization, that [CosmetaLife] did not produce an antibody response during the clinical trial further supporting our belief that it is safe to use.

CosmetaLife is composed of materials that approximately meet the Generally Regarded As Safe (GRAS) requirements of the FDA. CosmetaLife contains materials from certified bovine and porcine tissue sources that do not harbor prion disease or BSE. Additionally, steps in the manufacturing process have been validated for deactivating all viruses.

Extrusion force testing and the Clinical Trial usage both demonstrate the consistent and easy injection of GDP.

CosmetaLife. Twenty-five month stability testing shows that GDPCosmetaLife is stable at room temperature conditions. Moreover, GDPCosmetaLife has been shown to be stable at 40 °C (104 °F) conditions for at least 3 months.

Competition

The development and commercialization of new animal health medicines is highly competitive, and we expect considerable competition from major pharmaceutical, biotechnology and specialty animal health medicines companies. As a result, there are, and likely will continue to be, extensive research and substantial financial resources invested in the discovery and development of new animal health medicines. Our potential competitors include large animal health companies, such as Zoetis, Inc.; Merck Animal Health, the animal health division of Merck & Co., Inc.; Merial, the animal health division of Sanofi S.A.; Elanco, the animal health division of Eli Lilly and Company; Bayer Animal Health, the animal health division of Bayer AG; NAH, the animal health division of Novartis AG; Boehringer Ingelheim Animal Health, the animal health division of Boehringer Ingelheim GmbH; Virbac Group; Ceva Animal Health; Vetoquinol and Dechra Pharmaceuticals PLC. We are also aware of several smaller early stage animal health companies, such as Kindred Bio, Aratana Therapeutics Inc. (recently acquired by Elanco), NextVet and VetDC that are developing products for use in the pet therapeutics market.

Regulation – Human and Veterinary Use

Our lead product, Spryng™ and a number of the medical devices that we may manufacture for veterinary applications and human applications, are subject to regulation by numerous regulatory bodies, including the FDA and comparable international regulatory agencies. These agencies require manufacturers of medical devices to comply with applicable laws and regulations governing the development, testing, manufacturing, labeling, marketing and distribution of medical devices. Medical devices are generally subject to varying levels of regulatory control, the most comprehensive of which requires that a clinical evaluation program be conducted before a device receives approval for commercial distribution.

In the EU, medical devices are required to comply with the Medical Devices Directive and obtain CE Mark certification in order to market medical devices. The CE Mark certification, granted following approval from an independent Notified Body, is an international symbol of adherence to quality assurance standards and compliance with applicable European Medical Devices Directives. Distributors of medical devices may also be required to comply with other foreign regulations such as Ministry of Health Labor and Welfare approval in Japan. The time required to obtain these foreign approvals to market our products may be longer or shorter than that required in the U.S., and requirements for those approvals may differ from those required by the FDA. In Europe, our devices are classified as Class IIa or IIb, and will need to conform to the Medical Devices Directive.

In the U.S., specific permission from the FDA to distribute a new device is usually required (that is, other than in the case of very low risk devices), and we expect that some form of marketing authorization will be necessary for our devices. Marketing authorization is generally sought and obtained in one of two ways. The first process requires that a pre-market notification (510(k) Submission) be made to the FDA to demonstrate that the device is as safe and effective as, or “substantially equivalent” to, a legally-marketed device that is not subject to pre-market approval (“PMA”). A legally-marketed device is a device that (i) was legally marketed prior to May 28, 1976, (ii) has been reclassified from Class III to Class II or I, or (iii) has been found to be substantially equivalent to another legally-marketed device following a 510(k) Submission. The legally-marketed device to which equivalence is drawn is known as the “predicate” device. Applicants must submit descriptive data and, when necessary, performance data to establish that the device is substantially equivalent to a predicate device. In some instances, data from human clinical studies must also be submitted in support of a 510(k) Submission. If so, these data must be collected in a manner that conforms with specific requirements in accordance with federal regulations including the Investigational Device Exemption (IDE) and human subjects protections or “Good Clinical Practice” regulations. After the 510(k) application is submitted, the applicant cannot market the device unless FDA issues “510(k) clearance” deeming the device substantially equivalent. After an applicant has obtained clearance, the changes to existing devices covered by a 510(k) Submission which do not significantly affect safety or effectiveness can generally be made without additional 510(k) Submissions, but evaluation of whether a new 510(k) is needed is a complex regulatory issue, and changes must be evaluated on an ongoing basis to determine whether a proposed change triggers the need for a new 510(k), or even PMA. The 510(k) clearance pathway is not available for all devices: whether it is a suitable path to market depends on several factors, including regulatory classifications, the intended use of the device, and technical and risk-related issues for the device.

The second, more rigorous, process requires that an application for PMA be made to the FDA to demonstrate that the device is safe and effective for its intended use as manufactured. This approval process applies to most Class III devices. A PMA submission includes data regarding design, materials, bench and animal testing, and human clinical data for the medical device. Again, clinical trials are subject to extensive FDA regulation. Following completion of clinical trials and submission of a PMA, the FDA will authorize commercial distribution if it determines there is reasonable assurance that the medical device is safe and effective for its intended purpose. This determination is based on the benefit outweighing the risk for the population intended to be treated with the device. This process is much more detailed, time-consuming, and expensive than the 510(k) process. Also, FDA may impose a variety of conditions on the approval of a PMA.

Both before and after a device for the U.S. market is commercially released, we would have ongoing responsibilities under FDA regulations. The FDA reviews design and manufacturing practices, labeling and record keeping, and manufacturers’ required reports of adverse experiences and other information to identify potential problems with marketed medical devices. We would also be subject to periodic inspection by the FDA for compliance with the FDA’s quality system regulations, which govern the methods used in, and the facilities and controls used for, the design, manufacture, packaging, and servicing of all finished medical devices intended for human use. In addition, the FDA and other U.S. regulatory bodies (including the Federal Trade Commission, the Office of the Inspector General of the Department of Health and Human Services, the Department of Justice (DOJ), and various state Attorneys General) monitor the manner in which we promote and advertise our products. Although physicians are permitted to use their medical judgment to employ medical devices for indications other than those cleared or approved by the FDA, we are prohibited from promoting products for such “off-label” uses and can only market our products for cleared or approved uses. If the FDA were to conclude that we are not in compliance with applicable laws or regulations, or that any of our medical devices are ineffective or pose an unreasonable health risk, the FDA could require us to notify health professionals and others that the devices present unreasonable risks of substantial harm to the public health, order a recall, repair, replacement, or refund of such devices, detain or seize adulterated or misbranded medical devices, or ban such medical devices. The FDA may also impose operating restrictions, enjoin and/or restrain certain conduct resulting in violations of applicable law pertaining to medical devices, including a hold on approving new devices until issues are resolved to its satisfaction, and assess civil or criminal penalties against our officers, employees, or us. The FDA may also recommend prosecution to the DOJ. Conduct giving rise to civil or criminal penalties may also form the basis for private civil litigation by third-party payers or other persons allegedly harmed by our conduct.

The delivery of our devices in the U.S. market would be subject to regulation by the U.S. Department of Health and Human Services and comparable state agencies responsible for reimbursement and regulation of health care items and services. U.S. laws and regulations are imposed primarily in connection with the Medicare and Medicaid programs, as well as the government’s interest in regulating the quality and cost of health care.

The process of obtaining clearance to market products is costly and time-consuming in virtually all of the major markets in which we expect to sell products and may delay the marketing and sale of our products. Countries around the world have recently adopted more stringent regulatory requirements, which are expected to add to the delays and uncertainties associated with new product releases, as well as the clinical and regulatory costs of supporting those releases. No assurance can be given that any of our other medical devices will be approved on a timely basis, if at all. In addition, regulations regarding the development, manufacture and sale of medical devices are subject to future change. We cannot predict what impact, if any, those changes might have on our business. Failure to comply with regulatory requirements could have a material adverse effect on our business, financial condition and results of operations.

Pertaining to our Spryng™ product (offered for veterinary use only), in the U.S., the FDA does not require submission of a 510(k), PMA, or any pre-market approval for devices used in veterinary medicine. Device manufacturers who exclusively manufacture or distribute veterinary devices are not required to register their establishments and list veterinary devices and are exempt from post-marketing reporting. The FDA does have regulatory oversight over veterinary devices and can take appropriate regulatory action if a veterinary device is misbranded or adulterated. It is the responsibility of the manufacturer and/or distributor of these articles to assure that these animal devices are safe, effective, and properly labeled.

Exported devices are subject to the regulatory requirements of each country to which the device is exported. Some countries do not have medical device regulations, but in most foreign countries medical devices are regulated. Frequently, medical device companies may choose to seek and obtain regulatory approval of a device in a foreign country prior to application in the U.S. given the differing regulatory requirements. However, this does not ensure approval of a device in the U.S.

Research and Development

The Company is currently pursuing advancements in the composition, methods of manufacture and use for its proprietary biomaterials. It is anticipated that within the next twelve months the Company will pursue additional third-party studies related to the use of Spryng™ for the treatment of osteoarthritis in canine and equine patients. The Company also anticipates that resources will be expended to advance and improve the manufacturing systems for Spryng™ that will increase product volume and overall efficiency. Finally, the Company anticipates that research and testing will be conducted in the next eighteen months involving the existing Spryng™ formulation and other variations to identify and determine the next commercial product(s) that may be administered to the digital cushion of horses for the treatment of navicular disease.

Employees and Human Capital

As of June 28, 2022, we had 15 employees. We also engage outside consultants to assist with research and development, clinical development and regulatory matters, investor relations, operations, and other functions from time to time.

The Company believes that its success depends on the ability to attract, develop, and retain key personnel. It also believes that the skills, experience, and industry knowledge of its employees significantly benefits its operations and performance. The Company believes that it offers competitive compensation and other means of attracting and retaining key personnel. None of our employees are represented by a labor union and we believe that our relationships with our employees are good.

Insurance

We currently maintain a “life science” commercial insurance policy with coverage in the amount of $5 million for our products and operations. The policy has been designed for those engaged in the life science business. We may face claims in excess of the limits of such insurance. As well, claims made against us may fall outside of our coverage. The policy is a “claims made” policy. Thus, our coverage must be maintained at the time a claim is made for us to be entitled to seek coverage from the issuer of the policy for such claims.

Available Information

The Company files annual, quarterly and current reports, proxy statements and all amendments to these reports and other information with the SEC. The Company makes available free-of-charge, on or through its website at http://www.petvivo.com, the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and all amendments to those filings, as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The information on the Company’s website is not incorporated by reference in this Annual Report on Form 10-K. Reports, proxy statements and other information regarding issuers that file electronically with the SEC, including the Company’s filings, are also available to the public from the SEC’s website at http://www.sec.gov.

ITEM 1A. RISK FACTORS

An investment in our securitiescommon stock and warrants involves a high degree of risk. You should carefully consider the risksfollowing described belowrisks together with all of the other information included in this reportprospectus before making an investment decision with regard to our securities.this offering. If anyone or more of the following risks actually occurs, our business, financial condition, and/orand results of operations coulduld be harmed. In that case,materially harmed, which most likely would result in a decline in the trading price of our common stock could decline, and you may losewarrants and investors losing part or even all or part of yourtheir investment. You should only purchase our securities if you can afford

Risks Relating to suffer the loss of your entire investment.Our Financial Condition

RISKS RELATED TO OUR BUSINESS

We have incurred substantial losses to date and could continue to incur such losses.

We have incurred substantial losses since commencing our current business. For the year ended March 31, 2022, we lost approximately $5 million without obtaining any significant commercial revenues and had an accumulated deficit of approximately $63 million. In order to achieve and sustain future revenues, we must succeed in our current efforts to commercialize Spryng™ for treatment of dogs and horses suffering from osteoarthritis. That will require us to produce our products effectively in commercial quantities, establish adequate sales and marketing systems, conduct clinical trials and tests which show the safety and efficacy of Spryng™ in dogs and horses and gain significant support from veterinarians in the use of our products. We expect to continue to incur losses until such time, if ever, as we succeed in significantly increasing our revenues and cash flow beyond what is necessary to fund our ongoing operations and pay our obligations as they become due. We may never generate revenues sufficient to become profitable or to sustain profitability.

If we are unable to obtain sufficient funding, we may have to reduce materially or even discontinue our business.