UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31 2017, 2023

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-37428

RITTER PHARMACEUTICALS, INC.

Qualigen Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 26-3474527 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| ||

5857 Owens Avenue, Suite 300, Carlsbad, California92008

(Address of principal executive offices) (Zip Code)

(760)452-8111

Registrant’s telephone number, including area code: (310) 203-1000code

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of | ||

| Common Stock, par value $0.001 per share | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] ☐ No [X] ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] ☐ No [X] ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] ☒ No [ ]☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] ☒ No [ ]☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | Accelerated filer | |||

| Non-accelerated filer | Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the Registrantregistrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ]☐ No [X]☒

As of June 30, 2017 (the last business day of the registrant’s most recently completed second fiscal quarter),2023, the aggregate market value of the registrant’s common stock held by non-affiliates was approximately $8.1 million$4,570,535 based uponon the closing price for the common stock of $0.91 on that date. Shares of common stock held by the registrant’s executive officers and directors have been excluded from this calculation, as such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 25, 2024, there were shares of the registrant’s common stock of $0.55 as reported by the NASDAQ Capital Market on that date. For purposes of this calculation, the registrant has assumed that its directors, executive officers and holders of 5% or more of the outstanding common stock are affiliates.outstanding.

As of March 19, 2018, there were 49,406,521 shares outstanding of the registrant’s common stock, par value $0.001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

None.

RITTER PHARMACEUTICALS, INC.TABLE OF CONTENTS

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2017

Table of Contents

| 2 |

SPECIALCAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements by Qualigen Therapeutics, Inc. that involve substantial risks and uncertainties. Alluncertainties and reflect our judgment as of the date of this Report. These statements other than statements of historical facts contained in this Annual Report, including statements regardinggenerally relate to future events or our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements. The words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and similar expressions are intended toor operating performance. In some cases, you can identify forward-looking statements although not allbecause they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Such forward-looking statements contain these identifying words. These statements are subjectmay relate to, knownamong other things, potential future development, testing and unknown risks, uncertaintieslaunch of products and other important factors thatproduct candidates. Actual events or results may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Some of the factors that we believe could cause actual results to differ from those anticipated or predicted include:our expectations due to a number of factors.

These forward-looking statements include, but are not limited to, statements about:

| ● | our ability to procure sufficient working capital to continue and complete the development, testing and launch of our prospective drug products; | |

| ● | our ability to successfully develop any drugs; | |

| ● | our ability to progress our drug candidates through preclinical and clinical development; | |

| ● | our ability to obtain | |

| ● | ||

| our ability to | ||

| ● | ||

| ● | ||

| our ability to | ||

| ● | the likelihood that patents will issue on our in-licensed patent applications; | |

| ● | our ability to | |

| ● | ||

By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and healthcare, regulatory and scientific developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this Annual Report.

In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate, are consistent in some future periods with the forward-looking statements contained in this Annual Report, they may not be predictive of results or developments in other future periods. Any forward-looking statement that we make in this Annual Report speaks only as of the date of this Annual Report, and we disclaim any intent or obligation to update these forward-looking statements beyond the date of this Annual Report, except as required by law. This caution is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Future filings with the Securities and Exchange Commission (the “SEC”), future press releases and future oral or written statements made by us or with our approval, which are not statements of historical fact, may also contain forward-looking statements. Because such statements include risks and uncertainties, many of which are beyond our control, actual results may differ materially from those expressed or implied by such forward-looking statements. The forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date of this Annual Report. You should also read carefully the factors described in the “Risk Factors” section of this Annual Report to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements.on which they are made.

This Annual Report includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third-parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data.

| 3 |

As used in this Annual Report, unless the context suggests otherwise, “we,” “us,” “our,”or “the Company” refer to Qualigen Therapeutics, Inc.

Item 1. Business

Overview

We are an early-clinical-stage therapeutics company focused on developing treatments for adult and pediatric cancer. Our business now consists of one early-clinical-stage therapeutic program (QN-302) and one preclinical therapeutic program (Pan-RAS).

Our lead program, QN-302, is an investigational small molecule G-quadruplexes (G4)-selective transcription inhibitor with strong binding affinity to G4s prevalent in cancer cells (such as pancreatic cancer). Such binding could, by stabilizing the G4s against DNA “unwinding,” help inhibit cancer cell proliferation. QN-302 is currently undergoing a Phase 1a clinical trial at START Midwest in Grand Rapids, Michigan, and HonorHealth in Scottsdale, Arizona.

Our Pan-RAS program, which is currently at the preclinical stage, consists of a family of RAS oncogene protein-protein interaction inhibitor small molecules believed to inhibit or block mutated RAS genes’ proteins from binding to their effector proteins thereby leaving the proteins from the mutated RAS unable to cause further harm. In theory, such mechanism of action may be effective in the treatment of about one quarter of all cancers, including certain forms of pancreatic, colorectal, and lung cancers. The investigational compounds within our Pan-RAS portfolio are designed to suppress the interaction of endogenous RAS with c-RAF, upstream of the KRAS, HRAS and NRAS effector pathways.

On May 22, 2020, we completed a “reverse recapitalization” transaction with Qualigen, Inc. (not to be confused with the Company); pursuant to which our merger subsidiary merged with and into Qualigen, Inc. with Qualigen, Inc. surviving as a wholly owned subsidiary of the Company. The Company, which had previously been known as Ritter Pharmaceuticals, Inc., was renamed Qualigen Therapeutics, Inc., and the former stockholders of Qualigen, Inc. acquired, via the recapitalization, a substantial majority of the shares of the Company. Ritter/Qualigen Therapeutics common stock, which was previously traded on the Nasdaq Capital Market under the ticker symbol “RTTR,” commenced trading on Nasdaq, on a post-reverse-stock-split adjusted basis, under the ticker symbol “QLGN” on May 26, 2020. We are no longer pursuing the gastrointestinal disease treatment business on which Ritter Pharmaceuticals, Inc. develops novel therapeutic productshad focused before the reverse recapitalization transaction. On July 20, 2023, we sold our Qualigen, Inc. subsidiary, which contained our former FastPack® diagnostics business to Chembio Diagnostics, Inc., an American subsidiary of French diagnostics provider Biosynex, S.A. Accordingly, our former FastPack® diagnostics business is reported as Discontinued Operations in this Annual Report.

The aggregate net purchase price for Qualigen, Inc. was $5.4 million in cash, of which $450,000 is being held in escrow to satisfy certain Company indemnification obligations. Any amounts remaining in the escrow that modulatehave not been offset or reserved for claims will be released to us within five business days following January 20, 2025.

We own a minority interest in NanoSynex, Ltd. (“NanoSynex”), a privately-held microbiologics diagnostic company domiciled in Israel. NanoSynex’s technology is for Antimicrobial Susceptibility Testing that aims to enable better targeting of antibiotics for their most suitable uses to ultimately result in faster and more efficacious treatment, hence reducing hospitals’ mortality and morbidity rates. On May 26, 2022, we acquired a 52.8% interest in NanoSynex from our related party Alpha Capital Anstalt (“Alpha”) and NanoSynex, and entered into a Master Agreement for the gut microbiomeOperational and Technological Funding of NanoSynex with NanoSynex (the “NanoSynex Funding Agreement”). On July 20, 2023, we entered into an Amendment and Settlement Agreement with NanoSynex (the “NanoSynex Amendment”), pursuant to treat gastrointestinal diseases. which we agreed to, in exchange for eliminating all future Funding Agreement obligations for us to invest further cash in NanoSynex (except for obligations to lend NanoSynex $560,000 on or before November 30, 2023, and $670,000 on or before March 31, 2024), surrender 281,000 Series B Preferred Shares of NanoSynex held by us, resulting in our ownership in NanoSynex being reduced from approximately 52.8% to approximately 49.97% of the voting equity of NanoSynex; in addition, we agreed to surrender approximately $3.0 million of promissory notes which NanoSynex had issued to us under the Funding Agreement. On November 22, 2023 we further agreed to eliminate our obligations to lend NanoSynex $560,000 on or before November 30, 2023, and $670,000 on or before March 31, 2024, by instead surrendering shares of Series A-1 Preferred Stock of NanoSynex in an amount that reduced our ownership in NanoSynex voting equity from approximately 49.97% to 39.90%. NanoSynex was deconsolidated from our financial statements as of July 20, 2023, and is reported as Discontinued Operations in this Annual Report. Our investment in NanoSynex will be accounted for in the future as an equity method investment.

| 4 |

Product Pipeline

QN-302

We exclusively in-licensed the global rights to the G-Quadruplex (“G4”) selective transcription inhibitor platform from University College London (“UCL”) in January 2022. The licensed technology comprises lead compound QN-302 (formerly known as SOP1812) and back-up compounds that target regulatory regions of cancer genes that down-regulate gene expression in multiple cancer pathways. Developed by Dr. Stephen Neidle and his group at UCL, the G4 binding concept is derived from nucleic acid research conducted over more than over 30 years, including research on G4s, which are advancing gut health researchhigher order DNA and RNA structures formed by exploringsequences containing guanine-rich repeats. G4s are overrepresented in telomeres (a region of repetitive DNA sequences at the gut microbiotaend of a chromosome) as well as promoter sequences and translatinguntranslated regions of many oncogenes. Their prevalence is therefore significantly greater in cancer cells compared to normal human cells.

G4-selective small molecules such as QN-302 and backup compounds target the functionalityregulatory regions of prebiotic-based therapeutics into applications intended tocancer genes, which have a meaningful impact onhigh prevalence of enriched G4s. Stable G4-QN-302 complexes can be impediments to replication, transcription or translation of those cancer genes containing G4s, and the drugs’ binding to G4s are believed to stabilize the G4s against possible “unwinding.” G4 binders like QN-302 could be efficacious in a patient’s health.variety of cancer types with a high prevalence of G4s.

Our first novel microbiome modulator, RP-G28, an orally administered, high purity galacto-oligosaccharide, is currently under development for the treatment of lactose intolerance. RP-G28 is designed to selectively stimulate the growth of lactose-metabolizing bacteria in the colon, thereby effectively adapting the gut microbiome to assist in digesting lactose (the sugar found in milk)We believe that reaches the large intestine. RP-G28QN-302 has the potential to becomedemonstrate superior efficacy and activity against pancreatic ductal adenocarcinoma (“PDAC”), which represents 98% of pancreatic cancers. Pancreatic cancer is the first drug approvedtenth most common cancer in men and the seventh most common in women, but it is the fourth leading cause of cancer deaths in men and the third leading cause in women; it accounts for about 3% of all cancers in the United States but is responsible for about 8% of all cancer-related deaths. It has one of the lowest rates of survival of all cancer types.

In-vitro and in-vivo studies have shown that G4 stabilization by QN-302 resulted in inhibition of target gene expression and cessation of cell growth in various cancers, including PDAC. In in-vitro studies, QN-302 was potent in inhibiting the growth of several PDAC cell lines at low nanomolar concentrations. Similarly, in in-vivo studies, QN-302 showed a longer survival duration in a KPC genetic mouse model for pancreatic cancer than gemcitabine (the current standard of care for PDAC) has historically shown. Additional preclinical in-vivo studies suggest activity in gemcitabine-resistant PDAC. Data further demonstrated that QN-302 had significant anti-tumor activity in three patient-derived PDAC xenograft models. Early safety indicators in pancreatic cancer mouse in-vivo models suggest no significant adverse toxic effects at proposed therapeutic doses.

On January 9, 2023, the U.S. Food and Drug Administration (“FDA”) granted Orphan Drug Designation (“ODD”) to QN-302 for the treatmentindication of lactose intolerance. RP-G28 has been studiedpancreatic cancer. ODD provides advantages to pharmaceutical companies that are developing investigational drugs or biological products that show promise in Phase 2a and Phase 2b clinical trials and is a first-in-class compound.

On March 28, 2017, we announced top-line results from our Phase 2b clinical trial of RP-G28 for the treatment of lactose intolerance. The Phase 2b trial was a double-blind, placebo-controlled, three-arm, multi-center study evaluating safety, efficacy and tolerability of two dosing regimens of RP-G28 in patients with lactose intolerance. Enrollment was initiated in March 2016 and the last patient completed dosing in October 2016. The study aimed to evaluate a patient’s ability to consume dairy foods post-treatment with improved tolerance and reduced digestive symptoms. A total of 368 subjects were randomized in the trial with 18 clinical sites participating throughout the United States. Patients underwent a screening period and a 30-day treatment period, followed by a 30-day post-treatment “real world” observation of milk and dairy product consumption period.

A subset of subjects enrolled into a 12-month extension study to evaluate long-term durability of treatment. The extension study also evaluated each participant’s microbiome, expanding knowledge of the effectstreating rare diseases or conditions that RP-G28 may have on adapting the gut microbiota in a beneficial manner. We completed this study in the fourth quarter of 2017.

We held a Type C meeting with the FDA’s Division of Gastroenterology and Inborn Errors Products in March 2017, prior to the unblinding of our Phase 2b data, to discuss our development plans and Phase 2b clinical trial. The focus of the meeting was to obtain the FDA’s feedback on our Phase 2b clinical trial, including our statistical analysis plan (“SAP”), prior to unblinding any data.

We held an End-of-Phase 2 meeting with the FDA’s Division of Gastroenterology and Inborn Errors Products in August 2017. The purpose of the meeting was to obtain the FDA’s feedback on our Phase 3 program. We reached general consensus with the FDA on certain elements of our current Phase 3 program and have received clear guidance and recommendations on many necessary components of our Phase 3 program; including the clinical, non-clinical, and chemistry, manufacturing and controls (CMC) requirements needed to support an NDA submission.

We have incorporated much of this guidance into our Phase 3 program. Our current Phase 3 clinical program will consist of two confirmatory clinical trials of similar trial design as our Phase 2b clinical trial and will include additional components that may allow for claims for durability of effect. These additional trials may be run in parallel. We anticipate that the first Phase 3 clinical trial will begin in the second quarter of 2018.

The Gut Microbiome

The human gut is a relatively under-explored ecosystem but provides a great opportunity for using dietary intervention strategies to reduce the impact of gastrointestinal disease. The human body carries about 100 trillion microorganisms in the intestines, which is 10 times greateraffect fewer than the number of cells in the human body. This microbial population is responsible for a number of beneficial activities such as fermentation, strengthening the immune system, preventing growth of pathogenic bacteria, providing nutrients, and providing hormones. The increasing knowledge of how these microbial populations impact human health provides opportunities for novel therapies to treat an assortment of diseases such as neurological disease, cardiovascular disease, obesity, irritable bowel syndrome, inflammatory bowel disease, colon cancer, allergies, autism and depression.

Lactose Intolerance

Lactose intolerance is a common condition attributed to the absence or insufficient levels of the enzyme lactase, which is needed to properly digest lactose, a complex sugar found in milk and milk-containing foods.

Studies have suggested that lactose intolerance is a widespread condition affecting over one billion people worldwide and over 40 million200,000 people in the United States, (or 15%including seven-year marketing exclusivity and eligibility to receive regulatory support and guidance from the FDA in the design of an overall drug development plan.

There are also economic advantages to receiving ODD, including a 25% federal tax credit for expenses incurred in conducting clinical research on the orphan designated product within the United States. Tax credits may be applied to the prior year or applied to up to 20 years of future taxes. ODD recipients may also have their Prescription Drug User Fee Act (PDUFA) application fees waived, a potential savings of around $3.2 million (as of fiscal year 2023) for applications requiring covered clinical data, and may qualify to compete for research grants from the Office of Orphan Products Development that support clinical studies.

On August 1, 2023 we announced that the FDA had cleared our investigational new drug (“IND”) application for QN-302, and on November 1, 2023 the first patient in our Phase 1a clinical trial for QN-302 was dosed at START Midwest in Grand Rapids, Michigan.

We will require additional cash resources to be able to continue and complete this Phase 1a clinical trial.

| 5 |

Pan-RAS (formerly referred to as RAS or RAS-F)

In July 2020 we entered into an exclusive worldwide in-license agreement with the University of Louisville’s Research Foundation (“UofL” or “ULRF”) for the intellectual property covering the “RAS” family of pan-RAS inhibitor small molecule drug candidates, which are believed to work by blocking RAS mutations directly, thereby inhibiting tumor formation (especially in pancreatic, colorectal and lung cancers). Pursuant to the license agreement, we will seek to identify and develop a lead drug candidate from the compound family and, upon commercialization, will pay UofL royalties in the low-to-mid-single-digit percentages on net sales of Pan-RAS inhibitor licensed products. The license agreement with UofL for Pan-RAS was amended in March 2021 and June 2023.

RAS is the most common oncogene in human cancer. Activating mutations in one of the U.S. population),three human RAS gene isoforms (KRAS, HRAS or NRAS) are present in about one-fourth to one-third of all cancers. For example, mutant KRAS is found in 98% of pancreatic ductal adenocarcinomas, 52% of colon cancers, and 32% of lung adenocarcinomas. For these three cancer types, cancers with an estimated nine million of those individuals demonstrating moderate to severe symptoms.

Current annual spending on over-the-counter lactose intolerance aidsmutant KRAS are diagnosed in more than 170,000 people each year in the United States has been estimated at approximately $2.45 billionand cause more than 120,000 deaths. Drugs that target signaling downstream of RAS are available; however, such drugs have shown disappointing clinical durability because RAS is a “hub” that activates multiple effectors, so drugs that block a single pathway downstream may not account for the many other activated pathways.

We also had a sponsored research agreement with UofL for Pan-RAS research; that agreement expired in December 2023.

We currently do not have the resources to advance our Pan-RAS program, and so we are seeking to out-license it.

On February 15, 2024, we entered into a License and Sublicense Agreement with Pan-RAS Holdings, Inc., a New York corporation (“Pan-RAS Holdings”), which contemplated an exclusive out-license of our Pan-RAS drug development program, including our rights under the ULRF license agreement, Pan-RAS Holdings.

Although the License and Sublicense Agreement called for a closing by March 16, 2024, the License and Sublicense Agreement was in essence structured as a 30-day option in favor of Pan-RAS Holdings.

At the contemplated closing, Pan-RAS Holdings would have paid us an upfront fee of $1,000,000 in cash. In addition, Pan-RAS Holdings would have become responsible to pay on our behalf our in-license royalty obligations to ULRF, as and when required.

Finally, if the contemplated closing had occurred, Pan-RAS Holdings would have required to pay to us for our own account, on a semiannual basis, royalties equal to 1.0% of net sales of any RAS products.

We would have owed certain amounts to ULRF under our in-license agreement from them, if, as and when we received any Non-Royalty Sublicensing Income from Pan-RAS Holdings.

Pan-RAS Holdings did not effectuate the closing by March 16, 2024, and we and they voluntarily terminated the License and Sublicense Agreement effective as of March 16, 2024.

.Previous ProgramsHowever,

We have discontinued all of our efforts the following programs, and we do not plan to resume them:

| 1. | QN-247(formerly referred to as ALAN or AS1411-GNP) – an oligonucleotide aptamer-based, nucleolin-inhibiting anticancer drug candidate, consisting of QN-165 conjugated with gold nanoparticles. | |

| 2. | QN-165 (formerly referred to as AS1411) – an oligonucleotide aptamer-based drug candidate for the potential broad-spectrum treatment of infectious diseases such as COVID-19. | |

| 3. | Selective Target Antigen Removal System (STARS) – a therapeutic blood-filtering device product concept, which would be designed to remove circulating tumor cells, viruses, inflammation factors and immune checkpoints. |

Research and Development

For research and development of our drug candidates, we have historically leveraged the scientific and technical resources and laboratory facilities of UofL and UCL, through technology licensing, sponsored research, and other consulting agreements. We have engaged contract research organizations (“CROs”) and clinical sites for the Phase 1a clinical trial of QN-302. We intend to focus our internal research and development on oversight of these optionsCROs. We currently have no internal research and development facilities.

Regulatory Matters

We have obtained FDA clearance/approval for our QN-302 Phase 1a clinical trial. We have not obtained FDA or other regulatory approval for any other drug candidate.

| 6 |

United States—FDA Drug Approval Process

The research, development, testing, and manufacture of product candidates are limitedextensively regulated by governmental authorities in the United States and there is no long-term treatment available.other countries. In the United States, the FDA regulates drugs under the Food, Drug and Cosmetics Act and its implementing regulations.

Unlike many common gastrointestinal conditions,The steps required to be completed before a drug may be marketed in the United States include, among others:

| ● | preclinical laboratory tests, animal studies, and formulation studies, all performed in accordance with the FDA’s Good Laboratory Practice (“GLP”) regulations; | |

| ● | submission to the FDA of an IND application for human clinical testing, which must become effective before human clinical trials may begin and for which progress reports must be submitted annually to the FDA; | |

| ● | approval by an independent institutional review board (“IRB”) or Ethics Committee (“EC”) at each clinical trial site before each trial may be initiated; | |

| ● | adequate and well-controlled human clinical trials, conducted in accordance with applicable IND regulations, Good Clinical Practices (“GCP”), and other clinical trial related regulations, to establish the safety and efficacy of the drug for each proposed indication to the FDA’s satisfaction; | |

| ● | submission to the FDA of a New Drug Application (“NDA”) and payment of user fees for FDA review of the NDA (unless a fee waiver applies); | |

| ● | satisfactory completion of an FDA pre-approval inspection of one or more clinical trial site(s) at which the drug was studied in a clinical trial(s) and/or of us as a clinical trial sponsor to assess compliance with GCP regulations; | |

| ● | satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities at which the drug is produced to assess compliance with current GMPs regulations; | |

| ● | agreement with the FDA on the final labeling for the product and the design and implementation of any required Risk Evaluation and Mitigation Strategy; and | |

| ● | FDA review and approval of the NDA, including satisfactory completion of an FDA advisory committee review, if applicable, based on a determination that the drug is safe and effective for the proposed indication(s). |

Preclinical tests include laboratory evaluation of product chemistry, toxicity, and formulation, as well as animal studies. The conduct of the preclinical tests and formulation of the compounds for testing must comply with federal regulations and requirements, including GLP regulations. The results of the preclinical tests, together with manufacturing information and analytical data, are submitted to the FDA as part of an IND application, which must become effective before human clinical trials may begin. An IND application will automatically become effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions about issues such as irritable bowel syndrome, inflammatory bowel diseases, gastroesophageal reflux disease, or dyspepsia (among many others), lactose intolerance symptoms can be completely abated by avoiding dietary lactose.the conduct of the trials as outlined in the IND application, and places the clinical trial(s) on a clinical hold. In this regard, lactose intolerance is an avoidance condition, similar to celiac sprue, food intolerances, or various environmental allergies. However, dairy avoidance may lead to inadequate calcium and vitamin D intake, which can predispose individuals to decreased bone accrual, osteoporosis, hypertension, rickets, osteomalacia, and possibly certain cancers. Although supplements and calcium-rich foods are available, several studies have shown that lactose intolerance patients had an average calcium intake of only 300-388 mg/day, significantly less thansuch a case, the 1000-1200 mg/day adult dietary recommended levels. The 2010 National Institutes of Health conference on lactose intolerance highlighted the long-term consequences of dairy avoidance demonstrating both the importance of treating the conditionIND application sponsor and the needFDA must resolve any outstanding FDA concerns or questions before clinical trials can proceed. We cannot be certain that submission of an IND application will result in the FDA allowing clinical trials to find improved solutionsbegin.

| 7 |

Clinical trials necessary for patients.

Diagnosis

Lactose intolerance is often diagnosed by evaluating an individual’sproduct approval are typically conducted in three sequential phases, but the phases may overlap or be combined. The study protocol and informed consent information for study subjects in clinical history, which reveals a relationship between lactose ingestion and onset of symptoms. Hydrogen breath tests maytrials must also be utilizedapproved by an IRB for each institution where the trials will be conducted, and each IRB must monitor the study until completion. Study subjects must provide informed consent and sign an informed consent form before participating in a clinical trial. Clinical testing also must satisfy the extensive GCP regulations for, among other things, informed consent and privacy of individually identifiable information.

| ● | Phase 1—Phase 1 clinical trials involve initial introduction of the study drug in a limited population of healthy human volunteers or patients with the target disease or condition. These studies are typically designed to test the safety, dosage tolerance, absorption, metabolism and distribution of the study drug in humans, evaluate the side effects associated with increasing doses, and, if possible, to gain early evidence of effectiveness. | |

| ● | Phase 2—Phase 2 clinical trials typically involve administration of the study drug to a limited patient population with a specified disease or condition to evaluate the preliminary efficacy, optimal dosages and dosing schedule and to identify possible adverse side effects and safety risks. Multiple Phase 2 clinical trials may be conducted to obtain information prior to beginning larger and more expensive Phase 3 clinical trials. | |

| ● | Phase 3—Phase 3 clinical trials typically involve administration of the study drug to an expanded patient population to further evaluate dosage, to provide substantial evidence of clinical efficacy and to further test for safety, generally at multiple geographically dispersed clinical trial sites. These clinical trials are intended to establish the overall risk/benefit ratio of the study drug and to provide an adequate basis for product approval. Generally, adequate and well-controlled Phase 3 clinical trials are required by the FDA for approval of an NDA. |

Post-approval trials, sometimes referred to diagnose lactose malabsorption and a milk challengeas Phase 4 clinical trials, may be conducted after receiving initial marketing approval. These trials are used to differentiate between lactose malabsorptiongain additional experience from the treatment of patients in the intended therapeutic indication and lactose intolerance. Further tests canare commonly intended to generate additional safety data regarding use of the product in a clinical setting. In certain instances, the FDA may mandate the performance of Phase 4 clinical trials as a condition of approval of an NDA or, in certain circumstances, post-approval.

The FDA has various programs, including fast track designation, breakthrough therapy designation, priority review and accelerated approval, which are intended to expedite or simplify the process for the development, and the FDA’s review of drugs (e.g., approving an NDA on the basis of surrogate endpoints subject to post-approval trials). Generally, drugs that may be conductedeligible for one or more of these programs are those intended to rule out other digestivetreat serious or life-threatening diseases or conditions, including: stool examinationthose with the potential to document the presenceaddress unmet medical needs for those disease or conditions, and/or those that provide a meaningful benefit over existing treatments. For example, a sponsor may be granted FDA designation of a parasite, blood testsdrug candidate as a “breakthrough therapy” if the drug candidate is intended, alone or in combination with one or more other drugs, to determine the presence of celiac disease, and intestinal biopsies to determine mucosal problems leading to malabsorption, such as inflammatory boweltreat a serious or life-threatening disease or ulcerative colitis.

Health Consequences

Substantialcondition and preliminary clinical evidence indicates that lactose intolerancethe drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. If a drug is designated as breakthrough therapy, the FDA will take actions to help expedite the development and review of such drug. Moreover, if a major factor in limiting calcium intakesponsor submits an NDA for a product intended to treat certain rare pediatric or tropical diseases or for use as a medical countermeasure for a material threat, and that meets other eligibility criteria, upon approval such sponsor may be granted a priority review voucher that can be used for a subsequent NDA. From time to time, we anticipate applying for such programs where we believe we meet the applicable FDA criteria. A company cannot be sure that any of its drugs will qualify for any of these programs, or even if a drug does qualify, that the review time will be reduced.

The results of the preclinical studies and of the clinical studies, together with other detailed information, including information on the manufacture and composition of the drug, are submitted to the FDA in the dietform of individuals who are lactose intolerant. Studies suggest that these individuals avoid milkan NDA requesting approval to market the product for one or more proposed indications. The testing and dairy products, resultingapproval process requires substantial time, effort and financial resources. Unless the applicant qualifies for an exemption, the filing of an NDA typically must be accompanied by a substantial “user fee” payment to the FDA. To support marketing approval, the data submitted must be sufficient in an inadequate intakequality and quantity to establish the safety and efficacy of calcium and significant nutritional and health risks.

At the 2010 National Institute of Health (“NIH”) Consensus Development Conference: Lactose Intolerance and Health, the NIH highlighted numerous health risks tied to lactose intolerance such as: osteoporosis; hypertension; and low bone density.There is substantial evidence indicating that lactose intolerance is a major factor in limiting calcium and nutrient intakeproduct in the dietproposed patient population to the satisfaction of people whothe FDA. After an NDA is accepted for filing, the FDA substantively reviews the application and may deem it to be inadequate, and companies cannot be sure that any approval will be granted on a timely basis, if at all. The FDA may also refer the application to an appropriate advisory committee, typically a panel of clinicians, for review, evaluation and a recommendation as to whether the application should be approved, but is not bound by the recommendations of the advisory committee.

| 8 |

Before approving an NDA, the FDA usually will inspect the facility or the facilities at which the drug is manufactured and determine whether the manufacturing and production and testing facilities are lactose intolerant. Adequate calcium intakein compliance with cGMP regulations. The FDA also may audit the clinical trial sponsor and one or more sites at which clinical trials have been conducted to determine compliance with GCPs and data integrity. If the NDA and the manufacturing facilities are deemed acceptable by the FDA, it may issue an approval letter, and, if not, the Agency may issue a Complete Response Letter (“CRL”). An approval letter authorizes commercial marketing of the drug with specific prescribing information for a specific indication(s). A CRL indicates that the review cycle of the application is essentialcomplete and the application is not ready for approval. A CRL may require additional clinical data and/or an additional pivotal Phase 3 clinical trial(s), and/or other significant, expensive and time-consuming requirements related to reducingclinical trials, preclinical studies or manufacturing. Even if such additional information is submitted, the risksFDA may ultimately decide that the NDA does not satisfy the criteria for approval. The FDA could also require, as a condition of osteoporosisNDA approval, post-marketing testing and hypertension.In addition, chronic calcium depletion has been linkedsurveillance to increased arterial blood pressure, thereby establishingmonitor the drug’s safety or efficacy or impose other conditions, or a relationship between hypertensionRisk Evaluation and low calcium intake.Moreover, there is evidenceMitigation Strategy that may include both special labeling and controls, known as Elements to Assure Safe Use, on the distribution, prescribing, dispensing and use of a correlation between calcium intakedrug product. Once issued, the FDA may withdraw product approval if, among other things, ongoing regulatory requirements are not met, certain defects exist in the NDA, or safety or efficacy problems occur after the product reaches the market.

Intellectual Property

Information regarding our (in-licensed) issued patents and both colonpending patent applications, as of December 31, 2023, is as follows (excluding patents and breast cancerpending patent applications which pertain to programs which we have discontinued). As of that date we did not have any directly-owned issued patents and pending patent applications.

| Subject Matter | Issued | Pending | Geographic Scope | Patent Term | ||||

| In-Licensed Patents | ||||||||

| University College London (UCL) | ||||||||

| QN-302 | 3 | 10 | U.S., Europe, Australia, Canada, China, Hong Kong, India, Japan, Korea, Russia | 2030-2040 | ||||

| University of Louisville (ULRF) | ||||||||

| Pan-RAS | 0 | 12 | U.S., Europe, Australia, Canada, China, Hong Kong, India, Israel, Japan, Korea, Mexico, Russia, South Africa | 2039* | ||||

| TOTAL | 3 | 22 |

*Decreased Calcium Intake Increases the Risk for HypertensionAnticipated patent term

Numerous published reports show that chronic calcium depletion may leadHuman Capital Management

As of March 25, 2024, we had 4 employees, all of whom were full-time. None of our employees is represented by a labor union or covered by a collective bargaining agreement.

Diversity & Inclusion. With respect to increased arterial blood pressure. Many additional papers have corroborated this relationship between hypertensionour employees overall, fifty percent (50%) are women and a low calcium intake.0% are people of color.

A growing body of evidence indicates that a nutritionally sound diet rich in fruits, vegetables and a generous component of low-fat dairy foods (sometimes referred to as the DASH diet) is optimal for reducing the risk of hypertension. Several reports have confirmed this finding in middle-aged and elderly women. Further, it appears that the DASH diet with generous low-fat dairy is associated with low prevalence of metabolic syndrome. Studies have suggested that the levels of dairy foods (three to four servings per day) required to achieve these effects are well above current U.S. averages and even further above those of lactose intolerant individuals who are avoiding dairy due to symptoms.Additional Information

Our History

We wereRitter Pharmaceuticals, Inc. (our predecessor) was formed as a Nevada limited liability company on March 29, 2004 under the name Ritter Natural Sciences, LLC. Our first prototype, Lactagen™, was an alternative lactose intolerance treatment method. In 2004, clinical testing was conducted, which included a 61-subject double-blind placebo controlled clinical trial. The results were published in the Federation of American Societies for Experimental Biology in May 2005 and demonstrated Lactagen™ to be an effective and safe product for reducing symptoms for nearly 80% of the clinical participants who were on Lactagen™.

InSeptember 2008, we expanded our focus by developing a prescription drug development program. We initiated the program by developing RP-G28, a second generation edition of Lactagen™. We believe that RP-G28 enables us to state stronger claims, garner more medical community support and reach a wider market in the effort to treat lactose intolerance.

To help fund the development of RP-G28, we were awarded a grant from the United States government’s Health Care Bill program, the Qualifying Therapeutic Discovery Project, in 2008. The grant program provides support for innovative projects that are determined by the U.S. Department of Health and Human Services to have reasonable potential to result in new therapies that treat areas of unmet medical need and/or prevent, detect or treat chronic or acute diseases and conditions.

On September 16, 2008, wethis company converted into a Delaware corporation under the name Ritter Pharmaceuticals, Inc.

We completed our initial public offering in June 2015. Our common stock is traded on On May 22, 2020, upon completing the Nasdaq Capital Market under the trading symbol “RTTR”.

Our Leading Product Candidate — RP-G28

Overview

RP-G28 is“reverse recapitalization” transaction with Qualigen, Inc., Ritter Pharmaceuticals, Inc. was renamed Qualigen Therapeutics, Inc. and Qualigen, Inc. became a novel highly purified GOS, which is synthesized enzymatically. The product is being developed for the treatment of lactose intolerance. The therapeutic is taken orally (a powder solution mixed in water) for 30 consecutive days. The proposed mechanism of action of RP-G28 is to increase the intestinal growth and colonization of bacteria that can metabolize lactose to compensate for a patient’s intrinsic inability to digest lactose. Once colonization of bacteria has occurred, it is hypothesized that patients will continue to tolerate lactose as long as they maintain their microflora balance. RP-G28 has the potential to become the first FDA-approved drug for the reduction of symptoms associated with lactose intolerance.

Galacto-oligosaccharides (GOS)

RP-G28 is a >95% purified GOS product derived from a commercially available GOS food ingredient, which is designated as generally recognized as safe (GRAS) by the FDA. GOS refers to a group of compounds containing β-linkages of 1 to 6 galactose units with a single glucose on the terminal end and are found at low levels in human milk. GOS is purified to a pharmaceutical grade by minimizing residual glucose, lactose, galactose and other impurities. Further processing includes ultra-filtration, nano-filtration, decolorization, deionization, and concentration to yield GOS 95 syrup, which is the starting material for RP-G28.

GOS products resist hydrolysis by salivary and intestinal enzymes becausewholly-owned subsidiary of the configurationCompany. On July 20, 2023 we sold Qualigen Inc. to ChemBio Diagnostics, Inc., an American subsidiary of their glycosidic bonds and reach the colon virtually intact. The undigested GOS enhances the growth of beneficial, lactose metabolizing, colonic bacteria that already exist in the subject’s digestive track, including multiple species and strains of bifidobacteria and lactobacilli. Once colonies of these bacteria have increased, continued lactose exposure should maintain tolerability of lactose without further exposureFrench diagnostics provider Biosynex S.A.

Our website address is www.qlgntx.com. We post links to RP-G28.

While formal nonclinical studies evaluating the safety of RP-G28 have not been performed, other commercially available GOS products have been evaluated in acute and repeat-dose general toxicology studies, reproductive toxicology studies, juvenile toxicology studies, genetic toxicology studies, and in long-term safety studies.

Clinical studies of GOS products were reviewed as part of the safety evaluation to support the Investigational New Drug Application (“IND”) for RP-G28. These include studies in adults (including pregnant women and geriatrics), children, infants and newborns (preterm and full term). The safety of GOS products in humans has been evaluated in 1316 adults at doses of 2.5 to 20 g/day for up to 12 months, and in 1125 children > 1 year of age at doses of 2.0 to 12 g/day for up to 1 year. Overall, no safety concerns attributableour website to the consumption of GOS were reported. Where side effects were observed,following filings as soon as reasonably practicable after they were typically mild and limited to increased flatulence, abdominal discomfort, and changes in stool consistency and frequency; however, effects were not consistently observed in all studies. Similar observations of increased flatulence have been reported following the consumption fructo-oligosaccharies (FOS) (15 g/day) over a 7-day period (Alles, 1996), and this symptom represents a localized effect that is expected in associationare electronically filed with the consumption of indigestible fiber in large quantities. There were no reports of events in other System Organ Class (SOC) suggestive of systemic toxicity.

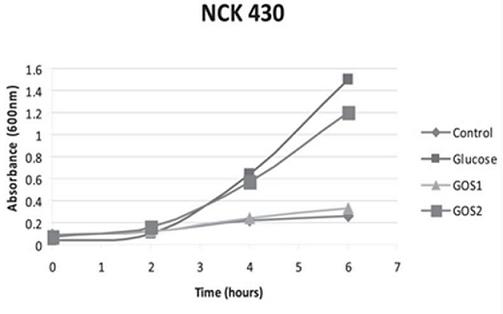

The significance of a higher purity GOS, namely RP-G28, was highlighted in a 2010 study by Klaenhammer. The in vitro study concluded that RP-G28 promoted growth of lactobacilli and bifidobacteria, but did not promote multiple strains of E. coli. In contrast, lower purity GOS stimulated both bifidobacteria as well as the strains of E. coli evaluated. (As seen below in Figure 1, NCK 430 (e. coli) grew in the presence of low purity GOS (GOS 2). Alternatively, the higher purity GOS (RP-G28/GOS 1) did not promote the growth of E. coli.).

Figure 1

Mechanism of Action

RP-G28 is understood to resist hydrolysis by salivary and intestinal enzymes dueor furnished to the configuration of their glycosidic bonds and consequently reach the colon virtually intact. The product is then broken down intracellularly by galactosidases, and eventually β-galactosidase hydrolyzes the terminal lactose. This leads to selective alterations in the composition and activity of the microbiome in which RP-G28 enhances the growth of lactose-metabolizing bacteria, including species of Bifidobacteria and Lactobacilli (30). In our Phase 2a Clinical Trial (G28-001), shifts in the fecal microbiome in 82% of participants on treatment and increases in relative abundance of both Bifidobacteria and Lactobacilli were reported. RP-G28 had a bifidogenic effect in 90% of responders, which included species Bifidobacterium longum, Bifidobacterium adolenscentis, Bifidobacterium catenulatum, Bifidobacterium breve, and Bifidobacterium dentium (30). The understood mechanism of action is that by increasing lactose-metabolizing bacteria, less undigested lactose is fermented, and thus reduces gas production and related LI symptoms. Data correlating bacterial taxa and symptom metadata support this proposed hypothesis. In the G28-001 study, microbiome changes correlated with clinical outcomes of improved lactose tolerance in which an increase in Bifidobacterium was associated with decreased pain and cramping outcomes.

Our Market Opportunity

Unmet Medical Needs

Lactose intolerance is a challenging condition to manage. According to a market research study conducted by Objective Insights in April 2012, approximately 60% of lactose intolerant sufferers reported experiencing symptoms daily, or bi-weekly. Not only can symptoms be painful and embarrassing, they can also dramatically affect one’s quality of life, social activities, and health. Currently there are few reliable, or effective, treatments available that provide consistent or satisfactory relief.

Currently, there is no approved prescription treatment for lactose intolerance. Most persons with lactose intolerance avoid ingestion of milk and dairy products while others substitute non-lactose-containing foods in their diet. However, complete avoidance of lactose-containing foods is difficult to achieve (especially for those with moderate to severe symptoms) and can lead to significant long-term morbidity (i.e., dietary deficiencies of calcium and vitamin D).

Treatment Options

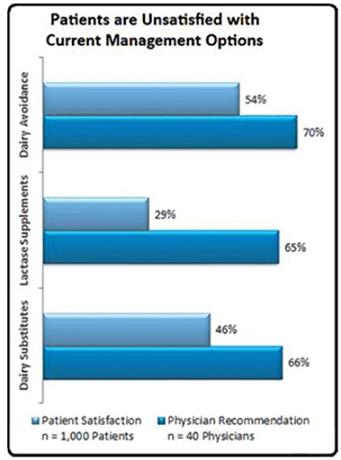

Doctors generally recommend the following treatments for the management of lactose intolerance: (1) dairy avoidance; (2) lactase supplements; (3) probiotics/dietary supplements; and (4) dairy substitutes/lactose free products. Despite educating their patients on all viable treatment options, physicians tend to advise their patients to refrain from consuming any dairy products whatsoever. However, in a 2008 survey conducted by Engage Health, 47% of lactose intolerance sufferers reported that this method was not effective (largely due to hidden dairy products in ingredients), and only 30% of lactose intolerance sufferers reported lactase supplements as being effective in managing their lactose intolerance.Further, while probiotics/dietary supplements have been demonstrated to aid and support one’s digestive system, helping break down general foods consumed, they don’t directly help with lactose intolerance. The 2008 survey by Engage Health suggests that the majority of lactose intolerance patients are dissatisfied with current treatment options.

Patients Unsatisfied with Current Management Options

Growing Awareness

Lactose intolerance is a condition that continues to expand as society advances and evolves. It has been estimated that gastroenterologists see approximately 15 new patients with lactose intolerance each month. Education and awareness have increased, and the American diet has greatly changed over the past decade to include more dairy-based goods. As the populace is growing older, the prevalence of lactose intolerance is increasing because more people tend to develop lactose intolerance later in life. Increased education and diagnosis is making more people aware of their allergies and digestive conditions. Physicians may compound the growth of lactose intolerance prevalence and its associated disorders by recommending individuals to avoid dairy products, a practice which in and of itself may increase severity of the intolerance.

Our Competitive Strengths

Market Opportunity

RP-G28 has the potential to become the first approved drug in the United States and Europe for the treatment of lactose intolerance.

Renowned Scientific Team and Management Team

Our leadership team has extensive biotechnology/pharmaceutical expertise in discovering, developing, licensing and commercializing therapeutic products. We have attracted a scientific team comprised of innovative researchers who are renowned in their knowledge and understanding of the host-microbiome in the field of lactose intolerance and gastroenterology.

Patent Portfolio

We have issued patents in the United States, in select countries in Europe (Germany, the United Kingdom, France, Spain, the Netherlands, Spain), and in other jurisdictions, directed to pharmaceutical compositions, methods of making such compositions, and methods of using such compositions for the treatment of lactose intolerance and certain of its symptoms. Additional worldwide patent applications are pending. The patent applications include claims covering pharmaceutical compositions, methods of making, methods of use, formulations and packaging.

In addition, in July 2015 we acquired the rights, title and interest to certain patents and related patent applications with claims covering a process for producing ultra-high purity galacto-oligosaccharide active pharmaceutical ingredients, including RP-G28 from our supplier. See “Manufacturing” for additional details regarding the second amendment to the exclusive supply agreement and our exercise of the exclusive option.

See “Intellectual Property” for additional information regarding our patent portfolio.

Our Growth Strategy

In order to achieve our objective of developing safe and effective applications to treat conditions associated with microbiome disfunctions, our near-term and long-term strategies include the following:

Clinical and Regulatory

IND Application/Phase 1

The IND for RP-G28 was activated initially to support a Phase 2a safety, tolerability and efficacy study in lactose intolerant patients. Standard Phase 1 single and repeat dose safety and tolerability studies in healthy volunteers were not needed because other GOS products that contain similar GOS constituents are generally regarded as safe (GRAS) and therefore supported the safety of RP-G28 in humans.

In 2018, a Phase 1 study will be conducted to understand the potential for systemic absorption of RP-G28 and any impact the presence of food may have on the pharmacokinetic profile of RP-G28. A Phase 1 QT/QTc study may be needed if there is measurable systemic exposure of RP-G28. Phase 1 systemic drug-drug-interaction (DDI) studies may also be needed if there is measurable systemic exposure of RP-G28, or if DDI potential within the gut is suggested by the results of in vitro DDI studies.

Phase 2a Study

We completed a double-blinded, randomized, multi-center, placebo-controlled Phase 2a clinical trial to validate the efficacy, safety and tolerance of RP-G28 compared to a placebo. We evaluated RP-G28 in 62 patients with lactose intolerance over a treatment period of 35 consecutive days. Post-treatment, subjects reintroduced dairy into their diets and were followed for an additional 30 days to evaluate lactose digestion, as measured by hydrogen production and symptom improvements. In order to confirm lactose intolerance and study participation, subjects underwent a 25-gram lactose challenge in the clinic. Lactose intolerance symptoms and hydrogen production via hydrogen breath test were assessed for six hours post-lactose dose. Eligible subjects were required to demonstrate a minimum symptom score and a “positive” hydrogen breath test in order to be eligible for randomization. A “positive” breath test was defined as a hydrogen gas elevation of 20 parts per million (ppm) at two time-points within the six hours following a lactose-loading dose. The primary endpoints included tracking patients’ gastrointestinal symptoms via a patient-reported symptom assessment instrument (a Likert Scale, measuring individual symptoms of flatulence, bloating, cramping, abdominal pain and diarrhea, on a scale of 0 (none) to 10 (worst)) at baseline, day 36 and day 66; as well as the measurement of hydrogen gas levels in their breath following a 25-gram lactose challenge.

Positive trends were seen when the entire per protocol study population was analyzed, including some statistically significant subgroup analysis, suggesting a therapeutically positive effect. Although there were few primary and secondary efficacy endpoints with statistically significant results, the combined data suggest that RP-G28 is exerting a positive therapeutic effect

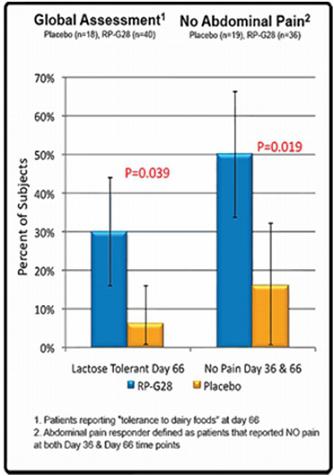

Key findings of the Phase 2a clinical trial included:

Figure 2

The clinical results of our Phase 2a study were published in Nutrition Journal in a manuscript entitled “Improving lactose digestion and symptoms of lactose intolerance with a novel galacto-oligosaccharide (RP-G28): a randomized, double-blind clinical trial.” The microbiome results were published in the Proceedings of the National Academy of Science in a manuscript entitled“Impact of short-chain galacto-oligosaccharides on the gut microbiome of lactose-intolerant individuals.”

Type C Meeting with the FDA

We held a Type C meeting with the FDA’s Division of Gastroenterology and Inborn Errors Products on February 2013. The purpose of the meeting was to obtain the FDA’s feedback on the planned Phase 2 program and Phase 3 programs, inform the FDA of our ongoing development plans, gain feedback on relevant clinical trial design and end points related to patient meaningful benefits, and to inform the FDA of the status of our product characterization.

Phase 2b Clinical Trial

Enrollment in our Phase 2b clinical trial of RP-G28 was initiated in March 2016 and completed in August 2016. The final patient completed dosing and all monitoring visits in October 2016.

The Phase 2b trial was a multi-center, randomized, double-blind, placebo-controlled, parallel-group trial of 368 subjects designed to determine the efficacy, safety, and tolerability of two dosing regimens of RP-G28 in subjects with moderate to severe lactose intolerance. Two hundred and forty-seven (247) subjects received RP-G28 while 121 subjects received placebo. Twenty-four (24) subjects were discontinued prematurely from the study and 344 (91.2%) completed the study.

The trial assessed patients with lactose intolerance symptoms as measured on a Likert scale after a lactose challenge. Entry criteria in the Phase 2b trial included a hydrogen breath test to validate lactase deficiency. The Phase 2b trial design included a screening period, a 30-day course treatment period, and a 30-day post-treatment “real world” observation period during which subjects were followed while lactose containing food products were re-introduced into their diets. The study was designed to escalate the dose beyond the 15 gm/day dose level evaluated in the Phase 2a study. Study subjects abstained from lactose containing food products and were then randomized evenly (1:1:1) to receive one of two doses of RP-G28 or placebo for 30 days.

The primary endpoint for the Phase 2b clinical trial was a LI symptom composite score response at day 31. A response was based on change from baseline (Day -7, visit 1) to end of treatment period at day 31 (visit 5), combined average of four maximum symptom scores taken over 0.5, 1, 2, 3, 4, and 5 hours for each symptom (abdominal pain, cramping, bloating, and gas movement) after a lactose challenge test. A response was defined as a 4-point or greater decrease from baseline or a composite score of zero at day 31. The Phase 2b trial further required the collection of fecal samples from patients enrolled to evaluate the baseline and changes to the patient’s microbiome that correlate to symptom reduction and lactose tolerance.

We held a Type C meeting with the FDA in March 2017, to discuss our development plans and Phase 2b clinical trial. The focus of the meeting was to obtain the FDA’s feedback on our Phase 2b clinical trial, including our SAP, prior to unblinding any data.

In order to gather long-term data on subjects exposed to RP-G28, we also offered enrollment in an observational 12-month extension study, G28-003XA, to subjects who completed the Phase 2b protocol. As RP-G28 is expected to provide extended relief from lactose intolerance symptoms beyond the initial 30-day treatment phase, this extension study for the Phase 2b program will assess the long-term treatment effect. The study is also evaluating each participant’s microbiome, expanding our knowledge of the effects that RP-G28 may have on adapting the gut microbiota in a beneficial manner. We completed this study in the fourth quarter of 2017. We intend for the results from this study to support durability of treatment and guide the need to evaluate an additional 30-day course of treatment in subjects who experience the return of lactose intolerance symptoms after an initial course of RP-G28.

Topline results of the Phase 2b clinical trial were announced in March 2017. Due to inconsistent data results from one study site, the data from this site was excluded from the primary analysis population (Efficacy Subset mITT). After excluding the data from the one anomalous study site, results showed a clinically meaningful benefit to subjects in the reduction of lactose intolerance symptoms across a variety of outcome measures. The majority of analyses showed positive outcome measures and the robustness of the data point to a clear drug effect. Treatment patients not only reported meaningful reduced symptoms, but also 30-days after taking the treatment, patients reported adequate relief from lactose intolerance symptoms and satisfaction with the results of the treatment, with RP-G28 preventing or treating their lactose intolerance symptoms. Greater milk and dairy product consumption was also reported by patients.

Because the efficacy data from one study site was found to be significantly different from that of the other study sites, the data from this site was excluded from the primary analysis population (Efficacy Subset mITT. n=296). It was decided that, in addition to the efficacy analysis for the mITT Population, the Efficacy Subset mITT population would be used to perform all efficacy analyses.

In the Efficacy Subset mITT Analysis group, the primary endpoint met statistical significance, (39.7% of the pooled dosing group compared to 25.8% of the placebo group responded (p=0.0159)). Because the primary analysis was statistically significant, the primary endpoint comparison between the high dose group and the placebo group was then tested and also met statistical significance (38.1% of the high dose group, compared to 25.8% of the placebo group responded (p=0.0294)). The comparison between the low dose group and the placebo group further met statistical significance (p=0.0434).

In the entire study population (mITT population), including patients from the excluded study site, taking at least one dose of drug (n=368), the comparison between the pooled treatment groups and the placebo group narrowly missed statistical significance (p=0.0618), (40.1% of the pooled treatment group responded compared to 31.4% of the placebo group). Both low dose and high dose group arms demonstrated a higher proportion of responders than the placebo group.

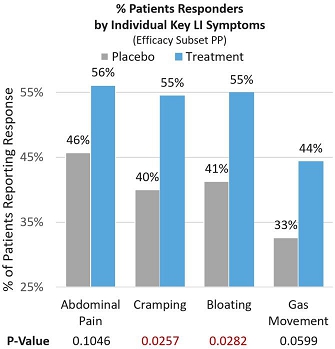

In the Efficacy Subset Per-protocol population (Efficacy Subset PP), significant and meaningful symptom improvement was consistently seen across key individual lactose intolerance symptoms by patients reporting a ≥4-point improvement from baseline (proportion of subjects on treatment that reported improvement in severity of each symptom). Of the treatment patients, 56.1% reported significant improvement in abdominal pain compared to 45.7% in the placebo group (p=0.1046). Of the treatment patients, 54.5% reported statistically significant improvement in cramping compared to 40.2% in the placebo group (p=0.0257). Of the treatment patients, 55% reported statistically significant improvement in bloating compared to 41.3% in the placebo group (p=0.0282). Finally, 44.4% of treatment patients reported significant improvement in gas movement compared to 32.6% in the placebo group (p=0.0599). See Figure 4 below.

Figure 4

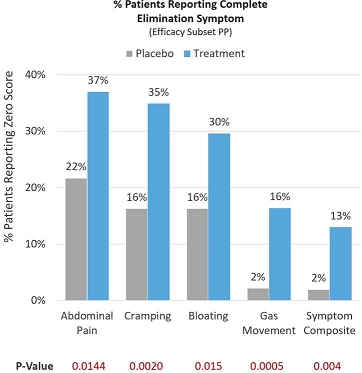

In a more stringent assessment, many patients reported that they experienced complete elimination of lactose intolerance symptoms, scoring a 0 out of 10 on a Likert pain scale post-treatment (Efficacy Subset PP). Of the treatment patients, 37.0% reported complete elimination of abdominal pain compared to 21.7% in the placebo group (p=0.0144). Of the treatment patients, 34.9% reported complete elimination of cramping compared to 16.3% in the placebo group (p=0.0020). Of the treatment patients, 29.6% reported complete elimination of bloating compared to 16.3% in the placebo group (p=0.015). Of the treatment patients, 16.4% reported complete elimination of gas movement compared to 2.2% in the placebo group (p=0.0005). Symptoms of abdominal pain, cramping, bloating and gas movement were then combined into a composite endpoint representing the key symptoms of lactose intolerance. Of the treatment patients, 13% experienced complete elimination of lactose intolerance symptoms compared to 2% in the placebo group (p=0.004). See Figure 5 below.

Figure 5

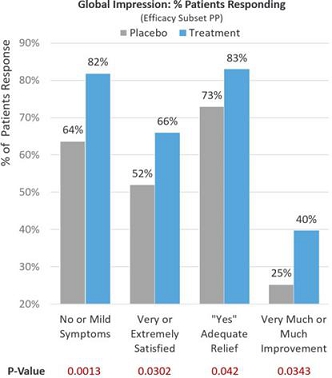

Observing global patient-reported assessments (Efficacy Subset PP) on multiple aspects of their symptom severity and treatment benefit experience 30 days after treatment and adding dairy and milk products back into their diets, 81.9% of treatment patients reported no or mild lactose intolerance symptoms compared to 63.7% in the placebo group (p=0.0013). Of the treatment patients, 66.3% reported being very or extremely satisfied with RP-G28 preventing or treating their lactose intolerance symptoms compared to 51.6% in the placebo group (p=0.0302). Of the treatment patients, 83.2% reported adequate relief from lactose intolerance symptoms compared to 72.5% in the placebo group (p=0.042). Of the treatment patients, 39.7% reported much or very much improvement in their lactose intolerance symptoms compared to 25.3% in the placebo group (p=0.0343). See Figure 6 below.

Figure 6

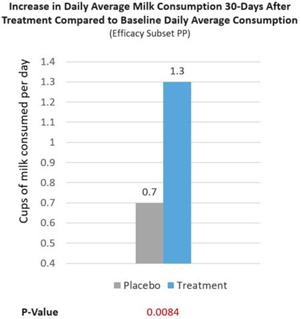

Further, a real-world milk intake assessment was conducted on treatment and placebo group patients (Efficacy Subset PP). At baseline, lactose intolerance patients reported consuming 0.2 cups/d of milk. After RP-G28, treatment patients increased their milk consumption to 1.5 cups/d of milk, consuming 1.3 cups/d more of milk (p=0.0084), 39% more milk consumed per day than placebo patients reported consuming (See Figure 7 below). We believe this is significant because the USDA recommends healthy individuals to consume 1.5 cups/d of milk. Overall, 62% of treatment patients consumed ≥1 cups/d of milk after being treated (p=0.0095). The increase in milk consumption is meaningful for dairy avoiders because it reflects increased lactose tolerance and may lead to more dietary calcium intake post-treatment as milk contains a higher percentage of one’s daily intake of calcium.

Figure 7

No serious adverse events related to treatment were reported and the number of adverse events reported was similar between treatment and placebo groups.

End-of-Phase 2 Meeting with the FDA

We held an End-of-Phase 2 meeting with the FDA’s Division of Gastroenterology and Inborn Errors Products in August 2017. The purpose of the meeting was to obtain the FDA’s feedback on our planned Phase 3 program. We reached general consensus with the FDA on certain elements of our Phase 3 program and have received clear guidance and recommendations on many necessary components of our Phase 3 program; including the clinical, non-clinical, and chemistry, manufacturing and controls (CMC) requirements needed to support an NDA. We have incorporated much of this guidance into our Phase 3 program.

Elements of our Phase 3 program are expected to include the following:

| ||

In preparation for Phase 3, we have had regular communications with the FDA and have received feedback from the FDA on the Phase 3 protocols, the statistical analysis plan (SAP), non-clinical matters, chemistry and controls, as well as other items.

The FDA has provided the following recommendations with respect to our revised Phase 3 protocols, SAP and other items (all of which we intend to implement):

Nonclinical Safety Plans

Given the established safety profile of GOS in humans and the lack of significant safety concerns with RP-G28 administered to subjects in the Phase 2a and Phase 2b clinical trials, it was agreed with the FDA (August 2017 End-of-Phase 2 meeting) that no additional non-clinical safety studies are required to support continued evaluation of RP-G28 in the Phase 3 program. The FDA also agreed that no rat fertility, rat peri-post natal reproductive toxicity, genotoxicity or, importantly, rodent carcinogenicity studies are needed for the NDA submission.

As recommended by the FDA, we will continue to evaluate females of child-bearing potential who are willing to use appropriate contraception throughout the duration of any study. ICH-compliant embryo-fetal development toxicology studies of RP-G28 in the rat and rabbit will be conducted to support the NDA submission. Additional general toxicity studies may also need to be conducted for the NDA submission.

Manufacturing

We do not own or operate manufacturing facilities, nor do we have plans to develop our own manufacturing operations in the foreseeable future. We have an exclusive worldwide agreement (the “Supply Agreement”) to manufacture a higher purity form of GOS (referred to as “Improved GOS”) with Ricerche Sperimentali Montaleor (“RSM”) in connection with our clinical and nonclinical studies we will need to conduct prior to receiving regulatory approval for RPG-28. RSM has also agreed that it will not, except as necessary for RSM to perform its obligations under the Supply Agreement, market or sell Improved GOS, or any galacto-oligosaccharides that are of greater purity to any third party.

Pursuant to the terms of the Supply Agreement, as amended on July 24, 2015, we purchased the exclusive worldwide assignment of all right, title and interest to the Improved GOS (the “Improved GOS IP”) on July 30, 2015 for $800,000. We also issued 100,000 shares of our common stock to RSM pursuant to a stock purchase agreement.

Under the terms of the Supply Agreement, as amended, if we fail to make any future option payment required under the terms of the Supply Agreement, we may be required to return the Improved GOS IP to RSM. The terms of the Supply Agreement, as amended, require us to pay RSM $400,000 within 10 days following FDA approval of a new drug application for the first product owned or controlled by us using Improved GOS as its active pharmaceutical ingredient.

Commercialization

Given our stage of development, we have not yet established a commercial organization or distribution capabilities. RP-G28, if approved, is intended to be prescribed to patients suffering from lactose intolerance. These patients are normally under the care of a gastroenterologist and/or a primary care physician. Our current plan is to evaluate a possible partnership to commercialize RP-G28 for the treatment of lactose intolerance in patients in the United States and Europe if it is approved. We may also build our own commercial infrastructure or utilize contract reimbursement specialists, sales people and medical education specialists, and take other steps to establish the necessary commercial infrastructure at such time as we believe that RP-G28 is approaching marketing approval. Outside of the United States and Europe, subject to obtaining necessary marketing approvals, we will likely seek to commercialize RP-G28 through distribution or other collaboration arrangements for patients suffering from lactose intolerance.

Competition

The biopharmaceutical industry is characterized by intense competition and rapid innovation. Although we know of no drug candidate, other than RP-G28, in advanced clinical trials for treating lactose intolerance, other biopharmaceutical companies may be able to develop compounds or drugs that are able to achieve similar or better results. Our potential competitors include major multinational pharmaceutical companies, established biotechnology companies, specialty pharmaceutical companies and universities and other research institutions. Some of the pharmaceutical and biotechnology companies we expect to compete with include microbiome-based development companies such as Second Genome, Inc., Seres Health, Inc., Enterome SA, Vedanta Biosciences, Inc., and Rebiotix, Inc. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies. We will also compete with providers of a wide variety of lactase supplements (the most widely used supplement in the United States being Lactaid®), probiotic/dietary supplements, and lactose-free and dairy-free products. We believe the key competitive factors that will affect the development and commercial success of our product candidates are efficacy, safety and tolerability profile, reliability, convenience of dosing, price and reimbursement.

Intellectual Property