Unless the context otherwise requires, the terms “the Company,” “we,” “us,” and “our” in this reportAnnual Report refer to Boxlight Corporation and its consolidated subsidiaries.direct and indirect subsidiaries, and the term “Boxlight” refers to Boxlight Inc., a Washington corporation and a wholly owned subsidiary of Boxlight Corporation. The terms “year” and “fiscal year” refer to our fiscal year ending December 31st.

ITEM 1.

DESCRIPTION OF BUSINESS

We are a technology company that develops, sells and services interactive solutions predominantly for the global education market, but also for the corporate and government sectors. We are seeking to become a worldwide leading distributorinnovator and integrator of interactive projectors, high definitionproducts and software solutions and improve collaboration and effective communication in meeting environments. We currently design, produce and distribute interactive technologies including our interactive and non-interactive flat-panel displays, LED flat panels,video walls, media players, classroom audio and campus communication, cameras and other peripherals for the education market and non-interactive solutions including flat-panels, LED video walls and digital signage for the Enterprise market. We also distribute science, technology, engineering and math (or “STEM”) products, including our 3D printing and robotics solutions, and our portable science lab. All products are integrated into our classroom accessory products.software suite that provides tools for whole class learning, assessment and collaboration. In addition, we offer professional training services related to our technology to our U.S. educational customers. To date, we have generated the majority of our revenue in the U.S. and internationally from the sale of interactive displays and related software to the educational market. We have sold our solutions into more than 70 countries and into more than 1.5 million classrooms and meeting spaces. We sell our products and software through more than 1,000 global reseller partners. We believe we offer the most comprehensive and integrated line of interactive display solutions, audio products, peripherals and accessories, software and professional development for schools and enterprises. Ourenterprises on the market today. The majority of our products are backed by nearly 30 years of research and development. We introduced the world’s first interactive projector in 2007Our website address is https://boxlight.com. Information available on our website is not a part of, and received patents in 2010. We focus on developing easy-to-use solutions combining interactive displays with robust software to enhance the educational environment, ease the teacher technology burden, and focus on improving student outcomes.is not incorporated into, this Annual Report.

Advances in technology and new options for

the introduction

of technology into the classroom have forced school districts to look for solutions that allow teachers and students to bring their own devices into the classroom, provide school

districtdistricts with information technology departments with the means to access data with or without internet access, handle

thehigher demand for video,

andas well as control cloud and data storage challenges. Our design teams are able to quickly customize systems and configurations to serve the needs of clients so that existing hardware and software platforms can communicate with one another.

We have created plug-ins for annotative software that make existing and legacy hardware interactive and allows interactivity with or without wires through our MimioTeach product. Our goal is to become a single source solution to satisfy the needs of educators around the globe and provide a

wholisticholistic approach to the modern classroom.

We pride ourselves in providing industry-leading service and support and have received numerous product awards. Our STEM product, Labdisc, wonawards:

•In 2023, Boxlight received multiple awards from various industry events and publications. Boxlight's Clevertouch brands were awarded three best of show awards at the BETT Awards 2018 inISE conference for LYNX Whiteboard, IMPACT Max and UX Pro 2. At the tools for teaching, learningEdTech awards, Attention!® was named winner of the EDTech Cool Tool Award and assessment category. In 2017, our MimioStudio with MimioMobileClevershare was a BETT Awards finalist in the toolsscreen mirroring software. At the 5th annual EdTech Breakthrough Awards, Boxlight received Best Technology Solution for teaching, learningStudent Safety. Boxlight won 9 Tech and assessment area. Our Labdisc product was namedLearning Best for Back to School Awards for its MimioWall, MimioDS, MyBot Recruit, IMPACT Lux and Teacher Action! Mic., while Clevertouch by Boxlight won signage Technology of the Year for the CleverLive products.

•In 2022, Boxlight received awards from various industry publications including Overall EdTech Company of the Year in the EdTech Breakthrough Awards, Tech and Learning Best of BETT 2017Show for theISTELive 22, multiple awards from Tech & Learning award. In 2017 our Labdisc product won Best In Show at TCEA. Our P12 Projector Series won the Tech & Learning best in show award at ISTE in 2017. Our MimioMobile App with Mimio Studio Classroom Software won the 2016 Cool Tool Award. We received the 2016 Award of Excellence for our MimioTeach at the 34th Tech & LearningLearning’s Back to School Awards of Excellence, program honoring4 awards for new products from THE Journal, multiple awards from Tech and upgraded software.Since the Company launched its patented interactive projectors in 2007, we have sold them to public schools in the United StatesLearning for Mimio, Clevertouch and in 49 other countries, as well as to the Department of Defense International Schools, and in approximately 3,000 classrooms in 20 countries, the Job Corp, the Library of Congress, the Center for Disease Control, the Federal Emergency Management Agency, nine foreign governmentsFrontRow solutions and the CityCampus Technology New Product of Moscowthe Year award for CleverLive digital signage.

•In 2021, Boxlight received Tech & Learning’s 2021 Awards of Excellence ‐ Best Tools for Back to School, in both Primary and numerous Fortune 500 companies, including Verizon, GE Healthcare, Pepsico, First Energy, ADT, Motorola, First DataSecondary levels for: MimioConnect® blended learning platform, MimioSTEM solutions, Boxlight‐EOS Professional Development Learning Solutions, and Transoceanour ProColor interactive flat-panel. Clevertouch was awarded for Best Business Growth and custom built 4,000 projectorsCorporate Social Responsibility by Inavation Awards and 4 AV Awards for Product, Manufacturer, Distributor, and Channel Team of the Israeli Defense Forces.Year.

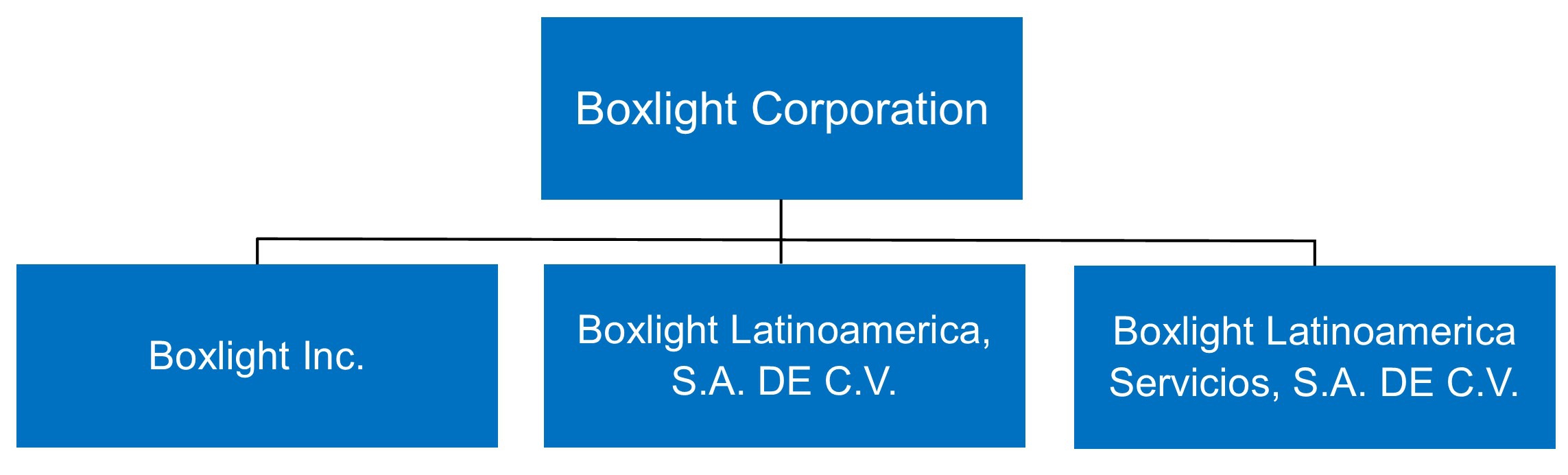

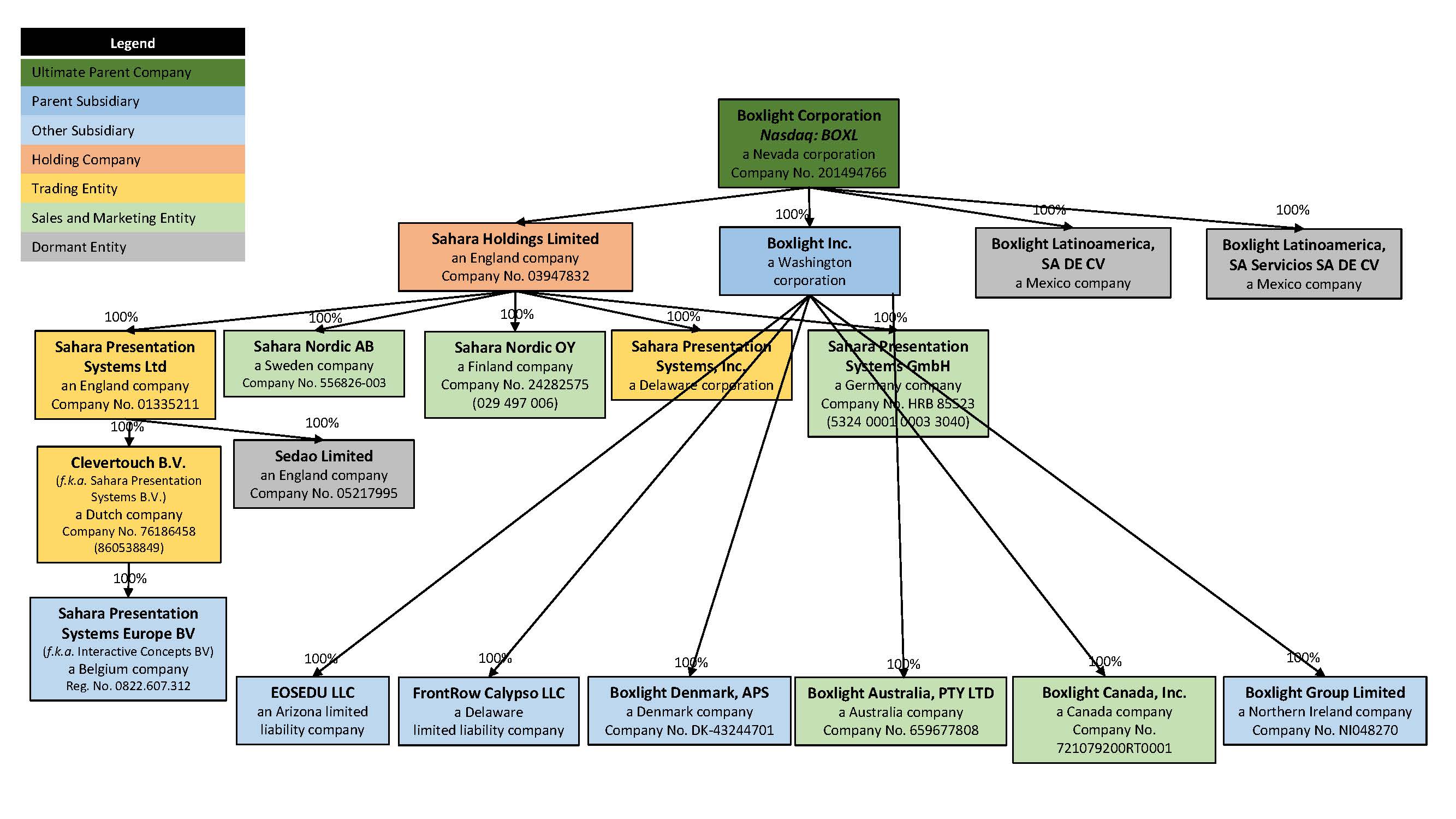

Boxlight Corporation was incorporated in Nevada on September 18, 2014 for the purpose of acquiring technology companies that sell interactive products into the education market. As of the date of this Annual Report, we have

threefour subsidiaries, consisting of Boxlight Inc.,

a Washington State corporation, Sahara Holdings Limited, an England and Wales corporation ("Sahara"), Boxlight Latinoamerica, S.A. DE C.V.

(“BLS”) and Boxlight

LatinamericaLatinoamerica Servicios, S.A. DE C.V.

, (“BLA”), both BLS and BLA are incorporated in Mexico. BLS and BLA are currently inactive. Our Sahara Holding Limited subsidiary has eight directly and indirectly owned subsidiaries located in the United States, the United Kingdom, the Netherlands, Belgium, Sweden, Finland and Germany, and our subsidiary Boxlight Inc., in turn, has six directly and indirectly owned subsidiaries located in the United States, Australia, Northern Ireland, Canada and Denmark.

On December 31, 2021, we acquired FrontRow Calypso LLC, a California company and a leader in classroom and campus communication solutions for the education market.

On March 23, 2021, we acquired Interactive Concepts BV, a company incorporated and registered in Belgium and a distributor of interactive technologies and subsequently renamed to Sahara Presentation Systems (Interactive) Europe BV. The company has been our key distributor in Belgium and Luxembourg.

On September 24, 2020, we acquired Sahara., a leader in distributed AV products and a manufacturer of multi-award-winning touchscreens and digital signage products, including the globally renowned Clevertouch brand. Headquartered in the United Kingdom, Sahara and its subsidiaries have a strong presence in the EMEA interactive flat-panel display (IFPD) market selling into education, health, government, military and corporate sectors.

On April 17, 2020, we acquired MyStemKits Inc. (“MyStemKits”). MyStemKits is in the business of developing, selling and distributing 3D printable science, technology, engineering and math curriculums incorporating 3D printed project kits for education, and owns the right to manufacture, market and distribute Robo 3D branded 3D printers and associated hardware for the global education market.

On March 12, 2019, we acquired Modern Robotics Inc. (“MRI”), a company based in Miami, Florida. MRI is engaged in the business of developing, selling and distributing science, technology, engineering and math (STEM), robotics and programming solutions to the global education market.

On August 31, 2018, we purchased EOS, an Arizona limited liability company owned by Daniel and Aleksandra Leis. EOS is in the business of providing technology consulting, training, and professional development services to create sustainable programs that integrate technology with curriculum in K-12 schools and districts.

On June 22, 2018, we acquired Qwizdom, Inc. and its subsidiary Qwizdom UK Limited (together, the “Qwizdom Companies”). The Qwizdom Companies develop software and hardware solutions that are quick to implement and designed to increase participation, provide immediate data feedback, and, most importantly, accelerate and improve comprehension and learning. The Qwizdom Companies have offices outside Seattle, WA and Belfast, Northern Ireland and deliver products in more than 40 languages to customers around the world through a network of partners.

On May 9, 2018, we acquired Cohuborate, Ltd., a United Kingdom corporation based in Lancashire, England. Cohuborate produces, sells and distributes interactive display panels designed to provide new learning and working experiences through high-quality technologies and solutions through in-room and room-to-room multi-device multi-user collaboration.

On December 20, 2018, Cohuborate Ltd. transferred all of its assets and liabilities to Qwizdom UK Limited and changed its name to Qwizdom UK Limited. On December 20, 2018, Qwizdom UK Limited changed its name to Boxlight Group Ltd. On January 24, 2019, we merged Qwizdom, Inc. with and into Boxlight, Inc.

The businesses previously conducted by Cohuborate Ltd. and Qwizdom UK Limited are now operated by the Boxlight Group Ltd., a wholly owned subsidiary of Boxlight, Inc.

On May 9, 2016, we acquired Genesis Collaboration LLC, a Georgia limited liability company (“Genesis”). Genesis, is a value-added reseller of interactive learning technologies, selling into the K-12 education market in Georgia, Alabama, South Carolina, northern Florida, western North Carolina and eastern Tennessee. Genesis also sells our

interactive solutions into the business and government markets in the United States. Effective August 1, 2016, Genesis was merged into our Boxlight Inc. subsidiary.

On April 1, 2016,

Boxlight Corporationwe acquired Mimio LLC,

a Delaware limited liability company (“Mimio”). Mimio designs, produces and distributes a broad range of Interactive Classroom Technology products primarily targeted at the global K-12 education market. Mimio’s core products include interactive projectors, interactive

flat panelflat-panel displays, interactive touch projectors,

touchboardstouch boards and MimioTeach, which can turn any whiteboard interactive within 30 seconds. Mimio’s product line also includes an accessory document camera, teacher pad for remote control and an assessment system.

Mimio was founded on July 11, 2013 and maintained its headquarters in Boston, Massachusetts. Manufacturing is by

ODM’sODMs and

OEM’sOEMs in Taiwan and

Mainland China. Mimio products have been deployed in over 600,000 classrooms in dozens of countries. Mimio’s software is provided in over 30 languages. Effective October 1, 2016, Mimio

LLC was merged into

our Boxlight Inc.

Effective May 9, 2016, Boxlight Corporation acquired Genesis Collaboration LLC (“Genesis”). Genesis is a value added reseller of interactive learning technologies, selling into the K-12 education market in Georgia, Alabama, South Carolina, northern Florida, western North Carolina and eastern Tennessee. Genesis also sells our interactive solutions into the business and government markets in the United States. Effective August 1, 2016, Genesis was merged into Boxlight Inc.

Effective July 18, 2016, Boxlight Corporation acquired Boxlight, Inc., Boxlight Latinoamerica, S.A. DE C.V. (“BLA”) and Boxlight Latinoamerica Servicios, S.A. DE C.V. (“BLS”) (together, “Boxlight Group”). The Boxlight Group sells and distributes a suite of patented, award-winning interactive projectors that offer a wide variety of features and specifications to suit the varying needs of instructors, teachers and presenters. With an interactive projector, any wall, whiteboard or other flat surface becomes interactive. A teacher, moderator or student can use the included pens or their fingers as a mouse to write or draw images displayed on the surface. As with interactive whiteboards, interactive projectors accommodate multiple users simultaneously. Images that have been created through the projected interactive surface can be saved as computer files. The new Company’s new ProjectoWrite 12 series, launched in February 2016, allows the simultaneous use of up to ten simultaneous points of touch.

We are a leading technology company that focuses on the education and learning industry. We produce and distribute products including interactive projectors, 65”-98” ultra hi-resolution interactive LED panels, integrated STEM (Science, Technology, Engineering, & Mathematics) data logging products, and develop new products utilizing a combination of technologies utilizing Boxlight’s intellectual property portfolio. We invest in significant research and development, leverage our international manufacturing capabilities, and utilize an established global reseller network. Our goal is to become a single source, world-leading innovator, manufacturer and integrator of interactive products for schools and universities, as well as for training and instruction for business and governmental agencies.

subsidiary.

The organizational structure of our companies

as of the date of this Annual Report is as follows:

We believe that the United States, whichglobal interactive technology education industry is ourundergoing a significant transition, as primary market, we sell and distribute interactive educational products for K-12secondary school districts, colleges and universities, as well as governments, corporations and individuals around the world are increasingly recognizing the importance of using technology to both publicmore effectively educate,

communicate and private schools,collaborate. Across the globe, state governments along with local communities continue to make sustained investments in education.

The K-12 education sector represents one of the largest industry segments.

In addition to its size, theThe U.S.

K-12 education market is highly decentralized and is characterized by complex content adoption processes. The sector is comprised of approximately 15,600 public school districts across the 50 states and 132,000 public and private elementary and secondary schools.

In addition to its size, the U.S. and certain EMEA K-12 education markets are highly decentralized and are characterized by complex content adoption processes. We believe this market structure underscores the importance of scale and industry relationships and the need for broad, diverse coverage across states, districts and schools. Even while we believe certain initiatives in the education sector, such as the Common Core State Standards, a set of shared math and literacy standards benchmarked to international standards, have increased standardization in K-12 education content, we believe significant state standard specific customization still exists, and we believe the need to address customization provides an ongoing need for companies in the sector to maintain relationships with individual state and district policymakers and expertise in state-varying academic standards.

According to a December 2023 report by FutureSource Consulting Ltd.("Futuresource"), the U.S. display market is expected to reach $44 billion by 2027. While the education sector has historically represented the majority of displays sold, growth in the corporate sector continue to outpace the education sector with sales to the corporate sector expected to reach approximately 44% of the global display market in 2027. We believe the growth in both the education and corporate sectors provides the Company with significant growth opportunities. In addition, the display market is highly fragmented allowing the Company to position itself for increased market share in each of these sectors.

Our Opportunity

Globally it is widely acknowledged that long-term economic growth is closely correlated to investment in education and educational technology, thus sustaining long-term growth in the market, even during periods of economic downturn. Further details of our solution and favorable macro-economic analysis are set forth below:

Growth in U.S. K-12 Market Expenditures

Significant resources are being devoted to primary and secondary education, both in the United States and abroad. As set forth in a December 2023 report by Futuresource, US Schools are budgeting for more IT in their classrooms.

The market for K-12 services and technology has historically grown above the pace of inflation, averaging 7.2% growth annually since 1969. Deviations around this mean occur during periods of economic growth and recession causing peaks and troughs in the K-12 market, albeit below other sectors.

HolonIQ reported in the Global EdTech Venture Capital Report that there has been some $32 billion in venture capital investment in the education/technology sector in the last decade (approximately 33% within the US) and predicts nearly triple that investment through to 2030. Further, the report estimates that the global “expenditure on education and training from governments, parents, individuals and corporates continues to grow to historic levels and is expected to reach USD $10 trillion by 2030.”

Increasing Focus on Accountability and the Quality of Student Education

U.S. K-12 education has come under significant political scrutiny in recent years,

due to the recognition of its importance to U.S. society at large and concern over the perceived decline in U.S. student competitiveness relative to international peers. An independent task force report published in March 2012 by the Council on Foreign Relations, a non-partisan membership organization and think tank, observedwith findings that American students rank far behind

other global leaders in international tests of literacy, math and science,

concludingwith the resulting conclusion that the current state of U.S. education severely impairs the United States’ economic, military and diplomatic security as well as broader components of America’s global leadership.

Also, the Executive Office of the President Council of Economic Advisors, in a report titledUnleashing the Potential of Educational Technology, stated that “many observers are concerned about declines in the relative quality of U.S. primary and secondary education, and improving performance of our schools has become a national priority.” We believe

that the customization of learning programs could enhance innovative and growth strategies geared towards student performance in our nation’s schools.The global education industry is undergoing a significant transition, as primary and secondary school districts, colleges and universities, as well as governments, corporations and individuals around the world are increasingly recognizing the importance of using technologythis scrutiny will cause there to more effectively provide information to educate students and other users.

According to “All Global Market Education & Learning”, an industry publication, the market for hardware products is growing due to increases in the use of interactive whiteboards and simulation-based learning hardware. Educational institutions have become more receptive to the implementation of hi-tech learning tools. The advent of technology in the classroom has enabled multi-modal training and varying curricula. In general, technology based tools help develop student performance when integrated with the curriculum. The constant progression of technology in education has helped educators to create classroom experiences that are interactive, developed and collaborative.

According to market research report “Markets and Markets Interactive Projector Market”2016 research report,the interactive projector market was valued at $670 million in 2015 and is expected to reach $2,602 million by 2022, growing at a CAGR of 21.5% between 2016 and 2022. The increasing adoption of interactive projectors inbe increased investment into the education segment, the low cost of interactive projectors compared to interactive whiteboards, and significant advantages of interactive projectors over conventional projectors are some of the factors that are driving the growth of the interactive market. Low awareness of the consumers regarding interactive projectors in developing countries restrains the growth of the market in those areas. The major players in the interactive projector market include Seiko Epson Corp. (Japan), BenQ Corp. (Taiwan), Boxlight (U.S.), Dell Technologies Inc. (U.S.), Panasonic Corp. (Japan), CASIO COMPUTER Co., Ltd. (Japan), NEC Display Solutions, Ltd. (Japan), Optoma Technology Inc. (U.S.), Touchjet Inc. (Singapore), and Delta Electronics Inc. (Taiwan).

Our Opportunity

We believe that our patented product portfolios and the software and products we intend to develop either alone or in collaboration with other technology companies positions us to be a leading manufacturer and provider of interactive educational products in the global educational and learning market. We believe that increased consumer spending driven by the close connection between levels of educational attainment, evolving standards in curriculum, personal career prospects and economic growth will increase the demand for our interactive educational products. Some of the factors that we believe will impact our opportunity include:

Growth in U.S. K-12 Market Expenditures

Significant resources are being devoted to primary and secondary education, both in the United States and abroad. As set forth in the Executive Office of the President, Council of Economic Advisers report, U.S. education expenditure has been estimated at approximately $1.3 trillion, with K-12 education accounting for close to half ($625 billion) of this spending. Global spending is roughly triple U.S. spending for K-12 education.

While the market has historically grown above the pace of inflation, averaging 7.2% growth annually since 1969, as expenditures by school districts and educational institutions are largely dependent upon state and local funding, the world-wide economic recession caused many states and school districts to defer spending on educational materials, which materially and adversely affected our historical revenues as well as those of many of our competitors. However, expenditures and growth in the U.S. K-12 market for educational content and services now appears to be rebounding in the wake of the U.S. economic recovery. Although, the economic recovery has been slower than anticipated, and there is no assurance that any further improvement will be significant, nonetheless, states such as Florida, California and Texas were all scheduled to adopt interactive educational materials for certain subjects, including reading and math, by 2016.

International Catalysts Driving Adoption of Learning Technology

According toAmbient Insights 2012 Snapshot of the Worldwide and US Academic Digital Learning Market, substantial growth in revenues for e-learning products in the academic market segment are anticipated throughout the world due to several convergent catalysts, including population demographics such as significant growth in numbers of 15-17 year old students and women in education in emerging markets; government-funded education policies mandating country-wide deployment of digital learning infrastructures; large scale digitization efforts in government and academic markets; significant increases in the amount of digital learning content; migration to digital formats by major educational publishers and content providers; mass purchases of personal learning devices and strong demand for learning platforms, content and technology services; and rapid growth of part-time and fulltime online student enrollments.

Rising Global Demand

We expect to profit from the rising global demand for technology based learning products by offering our interactive product hardware and software in the United States and expanding into foreign countries. In recent years, the global education sector has seen movement towards the adoption of interactive learning devices. As examples:

| ● | In 2010, the Peruvian government spent $3.0 billion for an education technology rollout to provide all teachers and students with individual tablet computers and network infrastructure and classroom displays; |

| | |

| ● | In August 2011, the Russian government announced a plan to deploy tablets, “on a massive scale” in the Russian educational system, to replace printed textbooks; |

| | |

| ● | In October 2011, the Indian government launched its heavily subsidized school-designed tablet called Aakash; and |

| | |

| ● | In July 2011, the Thailand government announced that it intends to give every child in grades 1-6 a tablet starting with first grade students in the 2012 school year. The multi-year program is expected to equip over 5.0 million primary students with handheld devices. |

Growth in the E-learning Market

According to the “E-learning Market – Global Outlook and Forecast 2018-2023”

The introduction of technology-enabled learning that helps organizations train human resource is driving the growth of the global e-learning market. These training modules offer continuous and effective learning at an optimal cost and provide customized course content that meets the specific requirements of end-users. The advent of cloud infrastructure, peer-to-peer problem solving, and open content creation will help to expand business opportunities for service providers in the global e-learning market.

Vendors are also focusing on offering choices on the course content at competitive prices to gain the share in the global e-learning market. The exponential growth in the number of smartphone users and internet connectivity across emerging markets is driving the e-learning market in these regions. The introduction of cloud-based learning and AR/VR mobile-based learning is likely to revolutionize the e-learning market during the forecast period.

Major vendors are introducing technology-enabled tools that can facilitate the user engagement, motivate learners, and help in collaborations, thereby increasing the market share and attracting new consumers to the market. The growing popularity of blended learning that enhances the efficiency of learners will drive the growth of the e-learning market. The e-learning market is expected to generate revenue of $65.41 billion by 2023, growing at a CAGR of 7.07% during the forecast period.

sector.

Trends in Tech-Savvy Education

While industries from manufacturing to health care have adopted technology to improve their results, according to Stanford Business School in itsTrends in Tech-Savvy Education, the education field remains heavily reliant on “chalk and talk” instruction conducted in traditional settings; however, that is changing as schools and colleges adopt virtual classrooms, data analysis, online games, highly customized coursework, and other cutting-edge tools to help students learn.Demand for Interactive Projectors is on the Rise

The interactive projector market was valued at $670.3 million in 2015 and is expected to reach $2.602M by 2022, growing at a CAGR

The delivery of digital education content is also driving a substantial shift in the education market. In addition to

whiteboards, interactive

projectors and interactive flat panels,flat-panels, other technologies are being adapted for educational uses on the Internet, mobile devices and through cloud-computing, which permits the sharing of digital files and programs among multiple computers or other devices at the same time through a virtual network. We intend to be a leader in the development and implementation of these additional technologies to create effective digital learning environments.

Handheld Device Adoption

Handheld devices, including smartphones, tablets, e-readers and digital video technologies, are now fundamental

Growth in the E-learning Market

According to the way students communicate. A 2010 FCC survey provides evidence that“E-learning Market – Global Outlook and Forecast 2020-2025,” the rates of handheld use will increase dramatically. It reported that while 50% of respondents currently use handhelds for administrative purposes, 14% of schools and 24% of districts use such devices for academic or educational purposes. Furthermore, 45% of respondents plane-learning market is expected to start using such devices for academic and educational purposes withindisplay significant growth opportunities in the next 2five years. While the growth curve is uniform in terms of the number of users, the same is not the case by revenues; the average cost of content creation and delivery with the same is undergoing a consistent decline. However, the advent of cloud infrastructure, peer-to-peer problem solving, open content creation, and rapid expansion of the target audience has enabled e-learning providers to 3 years. The survey stated that, “The userein in economies of digital video technologieschoice and offer course content at a competitive price. While the growth prospects of the e-learning market remain stable, the rise of efficient sub-segments is changing the learning and training landscape gradually.

Vendors are also focusing on offering choices on the course content at competitive prices to

support curriculum is becoming increasingly popular as a way to improve student engagement.”Natural User Interfaces (NUIs)

Tablets and the new class of “smart TVs” are part of a growing list of other devices built with natural user interfaces that accept inputgain market share in the form of taps, swipes, and other ways of touching; hand and arm motions; body movement; and increasingly, natural language. Natural user interfaces allow users to engage in virtual activities with movements similar to what they would useglobal e-learning space. The exponential growth in the real world, manipulating content intuitively.number of smartphone users and internet connectivity across emerging markets is driving the e-learning market in these regions. The ideaintroduction of being ablecloud-based learning and Augmented/Virtual reality mobile-based learning is likely to have a completely natural interaction with a device is notrevolutionize the e-learning market during the forecast period.

Major vendors are introducing technology-enabled tools that can facilitate user engagement, motivate learners, and help in collaborations, thereby increasing the market share and attracting new

but neither has its full potential been realized. For example, medical students increasingly rely on simulators employing natural user interfacesconsumers to

practice precise manipulations, such as catheter insertions,the market. The growing popularity of blended learning that

would be far less productive if they hadenhances the efficiency of learners will drive the growth of the e-learning market. According to

try to simulate sensitive movements with a mouse and keyboard. NUIs make devices seem easier to use and more accessible, and interactions are far more intuitive, which promotes exploration and engagement. (NMC Horizon ProjectTechnology Outlook STEM+ Education 2012-2017).The Business and Government Market

The business and governmentan article by Futuresource in December 2023, the education market for interactive flat-panel displays represents an attractive growth opportunity for us becauseis expected to comprise of the desire56% by 2027.

Our Portfolio of

organizations to improve the quality of training, development and collaboration.In meeting rooms, our solutions help achieve the following:

| ● | Enhance brainstorming and collaboration by providing a real-time focal point upon which participants can share their ideas with the entire group of attendees, including those in remote locations; |

| | |

| ● | Add a tangible, interactive dimension to conferencing that enables attendees to visualize a situation or concept and make decisions based on that visualization; |

| | |

| ● | Save time and enhance productivity by enabling users to save and distribute their collective work product from a meeting without the inconsistencies and subjectivity that may result from individual note taking; |

| | |

| ● | Realize cost savings not only by reducing travel needs, but also by improving internal communication and team building; and |

| | |

| ● | Enable participants to access digital files and use applications in real time. |

In training centers, we believe that our solutions help to enhance achievement levels with multi-modality (visual, auditory and kinesthetic) learning capabilities, improved interactivity and engagement and real-time assessment and feedback. Our solutions may also help improve an enterprise’s return on investment by providing better trained employees reducing training time and getting employees back to their jobs, reduced travel expenses, improved customers service from well-trained employees and reduced employee turnover.

Federal and State Funding According to “State of the K-12 Market Reports 2016”

New Student Support and Academic Enrichment Grant (SSAEG) dollars will likely begin to expand the market somewhat in the 2017-2018 school year. SSAEG is a new funding mechanism that provides flexible funding focused on efforts to promote a well-rounded education, create safe and healthy learning environments for students, and support the effective use of technology. Congress initially authorized SSAEG at $1.6 billion.

Despite the attention paid to the federal education budget, school funding continues to come primarily from state and local sources. For the 2014-2015 school year, state funding provided nearly half (46%) of total funding for K-12 schools, with local funding providing 44% of K-12 funding. The federal contribution was an average of 10%. Overall funding for all public and private K-12 education in the United States is currently about $665 billion.

States spend a significant amount of their overall budgets to support education. According to the National Association of State Budget Officers, states devote 20% of their overall spending to K-12 education. In FY2016, 41 states enacted spending increases for K-12 education resulting in a net increase of $14.7 billion, up from an $11.1 billion increase in FY2015. Thirty-five states also enacted spending increases for higher education. Only four states—Alaska, Hawaii, West Virginia, and Wisconsin—cut K-12 spending in FY2016.

Governors in 43 states called for higher spending in their FY2017 budget recommendations. As has been true for several years, governors’ proposed budgets direct most additional dollars to K-12 funding and Medicaid, the two largest areas of state general fund expenditures.

The Fiscal Survey of States, Spring 2016 confirms that state budgets continue to show moderate growth and stability. FY2016 (July 1, 2015 to June 30, 2016) marked the first time that aggregate spending levels surpassed the pre-recession peak level of FY2008, adjusted for inflation. For the most part, states have been able to close budget gaps and minimize mid-year budget cuts. Unemployment rates are going down, rainy day funds are growing, and states are focused on resolving issues around unfunded pension programs, ongoing health care and education costs, and pent-up infrastructure demand. Enacted 2016 budgets showed state revenues reaching $798 billion, an increase of 4%, compared with the 3% gain in fiscal 2015, when revenues stood at $748 billion. Revenue growth was widespread: 43 states enacted spending increases in FY2016, compared with 2015 levels. A small number of states face revenue shortfalls brought on by the decline in oil and natural gas prices.

Technology Budget Outlook Per “State of the K-12 Market Reports 2016”

The outlook for district technology budgets in the 2016-2017 school year continues the improvement seen last year, confirming schools’ emergence from the long shadow of the recession. Tech directors generally have quite positive expectations about their 2016-2017 budget. Compared with the prior two years, the 2016-2017 outlook is generally strong. Clearly technology directors are making some trade-offs from year to year, increasing spending in one category and balancing that increase by holding steady or slightly decreasing other categories.

Even in the schools’ worst recession years of 2010-2011 through 2012-2013, hardware and teacher training were most likely to see the largest percentage of districts planning to increase spending. The implementation of Common Core assessments likely drove some of this investment in hardware and teacher training in the past; however, the desire to increase overall student access to technology also plays a role. Districts may not be saying that one-to-one is their goal, but they continue to move in that direction. Their budget plans also reflect a clear awareness that teacher training is an essential element of any expansion of technology use.

District characteristics (size, metropolitan status, and region) are sometimes associated with differences in plans for technology spending. While no significant differences are seen by metropolitan status of region, looking at projected increases by district size reveals a difference in budget plans for hardware purchases. Medium-size districts are significantly more likely than their smaller counterparts to be planning increases in hardware budgets.

Our Current Products

We currently offer

products within the following

products:MimioStudio Interactive Instructionalcategories:

•Front-of-Class Display (Mimio and Clevertouch brands)

•FrontRow Classroom Audio and IP-based school-wide communication systems for bells, paging, intercom, and alerting

•STEM

•Educational SoftwareMimioStudio Interactive Instructional Software enables the creation, editing, & Content (Mimio Connect, LYNK Whiteboard, OKTOPUS, MimioStudio)

•Peripherals and Accessories

•Professional Development

The Boxlight portfolio of solutions is designed to create dynamic teaching, learning, and presentation

of interactive instructional lessons and activities. These lessons and activities can be presented and managed from the front of the classroom using any of Boxlight’s front of classroom display systems including MimioTeach +experiences. When integrated, our

non-interactive projectors, ProColor Interactive LED panels, MimioBoard Touch + our non-interactive projectors, MimioFrame + our non-interactive projectors or ProjectoWrite “P” Series interactive projectors in either pen or touch controlled versions. MimioStudio can also be operated using MimioPad as a full-featured remote control or a mobile device such as an iPad or tablet which includes a display screen that fully replicates the front-of-classroom display generated by MimioStudio. Operation with a mobile device is enabled via the three-user license for MimioMobile, see next, provided with the MimioStudio license that accompanies all front-of-classroom devices from Mimio.MimioMobile Collaboration and Assessment Application

The introduction of MimioMobile, a software accessory for MimioStudio, in 2014 introduced a new era of fully interactive student activities that are able to be directly and immediately displayed on the front-of-classroom interactive displays through MimioStudio.

MimioMobile allows fully interactive activities to be pushed to student classroom devices. The students can manipulate objects within the activities, annotate “on top” of them, and even create completely new content on their own handheld devices. MimioMobile also enables assessment using the mobile devices. The teacher can create multiple choice, true\false, yes\no, and text entry assessment questions. The students can respond at their own speed and their answers are stored within MimioStudio from which the teacher can display graphs showing student results. This “continuous assessment” allows formative assessment that can help guide the teacher as to whether to re-teach the material if understanding is low or move forward in the lesson. We believe that this interactive and student dependent instructional model can dramatically enhance student outcomes.

BoxlightFront-of-Classroom Interactive Displays

Boxlightoffers the broadest line of interactive displays, each of which provides large image size and interactive technology that complements the capabilities of MimioStudio and MimioMobile.

Boxlight InteractiveProjectors

We offer a suite of patented, award-winning interactive projectors with a wide variety of features and specifications to suit the varying needs of instructors, teachers and presenters around the world. With an interactive projector any wall , whiteboard or other flat surface can become an interactive surface and enable computer control. A user can utilize a pen stylus or finger as a mouse or to write or draw images displayed on the screen. As with interactive whiteboards, the interactive projector accommodates multiple users simultaneously. Images that have been created through the projectors can be saved as computer files. Except for the ProjectorWrite 12 series, all the Boxlight Group interactive projectors use LCD or DLP technology.

We offer interactive projectors using lamp and laser illumination technologies. Each ultra-short throw model is available with pen-based interactivity using infra-red emitting pens or touch-based technology using an emitter that generates a laser curtain over the entire surface of an associated whiteboard.

The pen versions of these interactive projectors can display images as large as 130” diagonally in 16:10 aspect ratio. The touch-based versions can display images as large as 100” in the same 16:10 aspect ratio. All models support up to ten simultaneous interactions meaning multiple students can simultaneously work. The projectors come with high quality audio and appropriate wall mounting hardware.

TheProjectoWrite 9 series provides wired interactivity and features 60 frames per second. These projectors have built-in storage of up to 1.5 GB for on-the-go display; a USB or EZ WiFi LAN connection from the PC, Mac or mobile device to the interactive projector is required for interactivity with the projected images. The ProjectoWrite 9 interactive projector series allowsinnovative solutions provide opportunity for a maximumholistic approach to in-person or virtual learning experiences, meetings and professional learning, campus wide communication, or any situation where presentation, interaction, or engagement occurs.

Front-of-Class Display Category

Boxlight offers a choice of

ten interactive pens working simultaneously. Utilizing its patented embedded interactive CMOS camera at 60 frames per second, response time is less than 12 ms.Interactive Flat-Panel Displays (IFPD), Interactive Whiteboards (IWB), and

accuracy is within 3 pixels.TheProjectoWrite 12series is first in the Boxlight Group’s lineNon-Interactive Flat-Panel Displays. Each comes with licensed copies of patented finger-touch interactive projectorsour software, access to offer a driverless installation. With the additionprepared content and Professional Development modules. These present upsell opportunities for our software and Professional Development modules.

Clevertouch, IMPACT Plus

The IMPACT Plus interactive LED panelsflat-panels deliver a truly intuitive experience and are available in fivefour sizes 55,” 65,” 75,” and 86”. With 4K resolution, 20 points of Interactive Flat Panel Displaystouch and built-in collaboration screen sharing with touchback capabilities, IMPACT Plus is built with teacher requirements for a new generation of front of class displays. Running Android 8 with an optional slot in PC, Clevertouch is designed to run and fit into any technology set up. Standard features include built in line array microphones for distance learning, proximity sensors that boot up the screen or shuts down the screen when the room is not in use, built in app store with hundreds of educational apps, enhanced USB-C connectivity and device charging, cloud accounts to log into personal settings and cloud drives; built in digital signage, to display messaging a cloud-based LYNX Whiteboard for lesson planning and deployment and Snowflake software. Every screen runs Over-the-Air (OTA) updates and comes with Mobile Device Management to run diagnostics on each screen.

Clevertouch, IMPACT

The Clevertouch IMPACT is the perfect all-around solution for the modern classroom. Featuring high precision technology, LYNX Whiteboard, Cleverstore, and Snowflake – IMPACT helps save time lesson planning with lots of resources. Available in three sizes 65”, 75” and 86”, each panel is 4K with 20 points of touch, comes with an optional slot in PC and runs on Android 8. All IMACT screens have Cleverstore, which has hundreds of educational apps to keep young minds learning. Also included is the cloud-based LYNX Whiteboard for lesson planning and deployment and Snowflake software as standard. Every screen runs OTA updates and comes with Mobile Device Management to run diagnostics on each screen.

Clevertouch UX Pro

UX Pro interactive LED flat-panels are designed for the modern meeting space and are available in four sizes - 55”, 65”, 70”, 75”, and 86” measured diagonally. Each offers a. With 4K resolution, and an optional PC Module slot for embedded Windows 10 and also include embedded Android computing capability for control, applications, and annotation that produce extraordinarily sharp images suitable for a range of classroom sizes. ProColor Interactive LED panels utilize infrared touch tracking technology, offering 1020 points of touch and built-in collaboration screen sharing with touchback capabilities, the UX Pro is built around meeting requirements with Stage software to enable remote meetings in which participants can annotate on documents, while the launcher will give instant access to favorite unified communication apps at the touch of a button. Running Android 8 with an optional slot in PC, the UX Pro is designed to run and fit into any technology set up. Key features include built-in line array microphone for simultaneous interaction of multiple users. ProColor’smeetings; proximity sensors that boot up the screen or shuts down the screen when the room is not in use; enhanced USB-C connectivity and device charging; cloud accounts to log into personal settings and cloud drives; built-in speakers add room filling sounddigital signage to display messages; every screen runs OTA updates and comes with Mobile Device Management to run diagnostics on each screen; and Clevershare to enable instant screen sharing through the display’s vivid colors.app or dongle to engage and enhance collaboration.

Clevershare

Clevershare allows users to share content with any device from either the dongle and the USB C connection or the Clevershare app. Up to 50 devices can connect with the Clevertouch screen and share content – images, video, and audio with touch-back for two-way control. The

interactive LED panels feature Korean glass with optical coatings that are highly scratch resistantpresenter has full control over what is shared and

improve viewing angles and ambient light interference.

ProColor Display 490 Interactive Touch Table

The ProColor Display 490 Interactive Touch Table enablescan show up to four studentsdevice screens simultaneously, increasing collaboration and participation within every session.

CleverLive Digital Signage

CleverLive is a unique cloud-based cloud management platform (or CMP) for managing all Clevertouch device endpoints, designed to work collaborativelycustomize the user interface based on device functionality, CleverLive combines simplicity of use with feature rich functionality. The platform comes standard with 200+ editable templates enabling a mix of multimedia content. Features include built-in presentation creation tools for designing bespoke layouts, wayfinding screens and touch interfaces, scheduling, grouping, instant emergency messaging, and QR code creation and display for an audience interactive experience. Rounding off the unique features is the built-in Cleverstore from which users can download apps for their touch screens.

Clevertouch CM Series

The CM Series non-touch large format professional display for meeting presentations and digital signage is available in six sizes - 43′′, 49′′, 55′′, 65′′, 75′′, and 86′′. This 4K UHD, non-touch meeting room collaboration screen has wireless display connectivity and RS232 control for professional meeting room integration with control systems. The built-in Android system includes the CleverLive app for managing digital signage content of full screen capacity or individuallycan be

packaged with a Clevertouch Media Player to enhance digital signage playout multimedia functionality. With 16/7 display, the CM Series has a built-in scheduler to manage on/off timing of messages, including instant messaging when needed. The CleverLive digital signage feature sets this display apart from screens in the marketplace.

Clevertouch Live Rooms

Live Rooms is a room booking solution that simplifies the meeting room booking process. Live Rooms features a 10” tablet that is manufactured with integrated room booking and digital signage software to deliver a powerful product to a busy marketplace. The tablet features red and green LED side lighting for instant availability recognition and is capable of at-the-source and calendar (O365 and ME) room booking with instant updates, to prevent booking overlaps. With analytics that identify users, rooms booked, frequencies and more, Live Rooms offers a smart room booking solution that, when not in use, can also serve as digital signage and provide instant messages for emergency alerts.

Clevertouch PRO V4

As the enterprise-level media player, the PRO V4 allows organizations to engage with their audience 24/7 or deploy dedicated messages via power scheduling for startup/shutdown and auto reboots. A slimline design, power boosting WIFI connectivity, and both HDMI and DisplayPort Outputs enables connection to multiple screens, the PRO V4 can be connected to a kiosk or UX Pro for touch interaction or a non-touch screen for feature-rich digital signage. The PRO V4 can connect to Clevertouch physical button technology for managing emergencies and instant messaging away from the CMP. With multimedia-zoned presentation playout, the PRO V4 can livestream web pages and URL KPIs, text, images, videos, posters, RSS Feeds, social media content, audio, and more.

Clevertouch PICO MK5

PICO MK 5 is a mid-range media player with 24/7 playout capability, WIFI connectivity, and is designed for multimedia-zoned presentations with text, images, videos, posters, RSS Feeds, social media content, and audio.

CleverWall

CleverWall is an all-in-one intelligent display solution, for enriched interaction in large spaces, lecture halls, meeting rooms, and more. This videowall solution is available in nine sizes – 120", 138”, 150”, 165”, 180”, 199”, 220”, 249”, and 299”, the latter three being ultra-wide options or larger spaces like lecture halls. The large displays with in-built audio system and 178-degree viewing angle create an immersive user experience that is unmatched. Its plug-and-play design – one button on/off and smart remote control – make this LED solution user-friendly. Standard features include built-in Android technology, real-time wireless screen-sharing from up to four devices simultaneously, synchronized annotating from multiple devices, and syncing with CleverLive accounts for messaging (instant and scheduled) to all displays for campus or location-wide communication.

MimioPro 4

MimioPro Series 4 adds power to any learning ecosystem – a true Connected Classroom. The MimioPro 4 is a touchscreen UHD HDR display with 20 points of touch, digital passive pen and eraser, and comes in three sizes – 65”, 75” and 86”. Its natural user interface and rich features support teachers to effectively and efficiently realize learning objectives. For example, in Windows Ink compliant applications such as Office 365, the passive digital pen draws, the eraser block erases digital ink (while cleaning the glass), and touches provide gestures without having to use the software’s user interface. The MimioPro 4 has a custom inbuilt Android 11 Launcher tailored for an interactive large screen and comes with: LYNX whiteboarding app to create and capture outcomes, share content, collaborate, and distribute ad-hoc content via cloud services through a dynamic QR code; Clevershare mirroring app used on a horizontal surface particularly well-suitedall models of Boxlight Interactive Flat-Panel Displays that allows teachers to younger students or those with motor skill limitations. The heightorchestrate up to six simultaneous displays across Windows, Chrome OS, Android and iOS, and casting of the table can be adjusted electricallyMimioPro 4 to accommodateall the devices in a wide rangeclassroom; NDMS (Network Device Management Systems), a cloud-based device management system to remotely manage displays, troubleshoot, message, and schedule; and CleverStore – app store which houses curated Android applications that are safe for teachers to install onto the display.

Mimio DS Series Non-Interactive Display

The Mimio DS Series displays are high-definition displays that feature enhanced color calibration, precise picture quality adjustment, flicker-free and

even wheelchairs.Boxlight’sMimioBoard Interactive Touch Boards

Boxlight’sInteractive Touch Boardsanti-glare viewing and are available in 78” 4:six sizes – 43", 55”, 65”, 75”, 86”, and 98”. The Mimio DS series runs on Android 11 with seamless OTA upgrading, includes a quad-core CPU, 4 GB of RAM, and an invisible IR receiver. Connectivity is made easy with multi-functional USB Type-C ports that enable 4K audio and video transmission, network connections, charging external devices, and provide access to external microphone and camera. The displays can be orientated vertically or horizontally and tilt up to 15-degree for easy viewing from high places. Multiple displays can daisy chain via HDMI ports, up to 3 aspect ratioby 3, and 87” 16:10 aspect ratio. These boardscreate a larger, unified display through screen splicing. The displays come with CleverLive management and digital signage platform for enhanced control of content on all displays.

MimioWall

MimioWall LED all-in-one display solution is designed to enrich any space, including classrooms, entryways, hallways, shared spaces, and more. Available in nine different sizes (120” - 299”) including three ultra-wide screen options, the 4K UHD Android digital display and built-in speakers provide

sophisticated interactivityusers an exceptional and immersive experience. Key features include integrated design with

any projector because the touch interactivity is built into the board. Unlike many competitive products, Boxlight’s touch boards are suited for useno external devices; 3-in-1 board that integrates power supply, a receiving card, and hub board; smart remote-control access to settings; plug-and-play system with

dry erase markers. Many competitive products advise against using dry erase markers because their boards stain. Boxlight’s touch boards use a porcelain-on-steel surface for durabilityone button on/off; and

dry erase compatibility.Boxlight’sunified hardware. MimioWall enables users to screen-share wirelessly to/from up to four devices (smartphones, tablets, laptops) simultaneously. Also comes with CleverLive digital signage platform to deliver campus- and site-wide communication of information, announcements, and emergency alerts.

MimioTeach Interactive Whiteboard

Boxlight’s

MimioTeach is one of

the company’sour best known and longest-lived products. Hundreds of thousands of MimioTeach

portable digital interactive

whiteboardswhiteboard systems and its predecessor models are used in classrooms around the world. MimioTeach can turn any whiteboard (retrofit) into an interactive whiteboard in as little as 30 seconds. This portable product fits into a tote bag with room for a small desktop projector, which is attractive to teachers who move from classroom to classroom. For schools where “change is our normal,” MimioTeach eliminates the high cost of moving fixed-mount

implementationsBoxlight’s implementations.

MimioFrame

retro-fittable Touch

BoardBoxlight’s Kit

MimioFrame can turn a

conventional whiteboardprojection (dry erase) board into

a touchboardan Interactive Whiteboard in 10-15 minutes. Millions of classrooms already have a conventional whiteboard and a non-interactive projector. MimioFrame

useruses infrared (IR) technology embedded in the four sides of the frame to turn that non-interactive combination into a modern

10-touch-interactive10touch-interactive Digital Classroom. No drilling or cutting is required, MimioFrame easily and quickly attaches with industrial-strength double-sided tape.

Boxlight’s MimioSpace ultra-wide 135” TouchBoard System

MimioSpace combines

Classroom Audio and School-wide Communication Category

Juno

Juno® is the towering standard of sound quality that reinforces a eleven-foot-wide 32-touch interactive whiteboardteacher’s voice so that every student gets a FrontRow seat. Juno sets up in minutes — and yet evenly fills the classroom with the kind of exciting, multi-layered stereo sound typical of larger installed systems. Juno is superior to other products in the classroom audio category, offering premium features such as feedback suppression, digital EQ, Bluetooth, and teacher voice priority. Juno is also uniquely expandable, with the ability to add modules for additional microphones, speakers, analog page override, and Conductor compatibility for networked campus communication.

EzRoom

EzRoom™ is an integrated AV solution designed for larger capital projects such as technology retrofits or new school construction. A highly customizable solution, EzRoom offers wall and ceiling mountable enclosures with pre-installed options customized for a 16:6 aspect ratio ultra-wide projector to produceschool’s needs, simplifying the installation process for AV integrators (resellers). EzRoom is an extraordinary combination“everything but the display” solution, providing sound reinforcement, microphones, speakers, AV control devices, AV wall plates, and networked cameras. The depth and breadth of the solution necessitates a service layer of pre-sale and post-sale support for the channel, supplied by FrontRow architectural/engineering consultant liaisons, providing design support, and the FrontRow Technical Services Group, offering system commissioning and customization. EzRoom

can use FrontRow’s SmartIR transmission technology or take advantage of FrontRow’s latest wireless voice technology – ELEVATE – that boasts the benefits of digital

classroom technologyRF (Radio Frequency) microphone systems, combined with flexible programmability and

the extremely wide working surface of classical blackboard-based classrooms.Peripherals and accessories

We offer a line of peripherals and accessories, including amplified speaker systems, mobile carts, installation accessories and adjustable wall-mount accessories that complement its entire line of interactive projectors, LED flat panels and standard projectors.ease-of-use features found nowhere else. The height and tilt adjustable DeskBoard mobile cart, which won the Best of ISTE in June 2014 for Best Hardware product,ELEVATE teacher microphone can be used as a wearable alert device, notifying administrators of urgent situations in the classroom.

Lyrik

The Lyrik™ amplification solution is a small yet portable system for instruction and audio media to be heard anywhere, from the classroom to the bus line, or even online. The tower has an integrated rechargeable battery and can be connected to a computer or other auxiliary audio source either directly using cables or wirelessly using Bluetooth®. Weighing less than 10 pounds, Lyrik is designed to be taken anywhere voice reinforcement is needed whether on campus or off.

Conductor

The Conductor™ School Communication System is an IP-based, campus-wide communication and control solution that allows administrators to manage their day-to-day operations with Bells, Paging, Intercom, and Alerts. Built on a client-server architecture that utilizes a school’s existing network, Conductor streams digital audio directly to FrontRow EzRoom and Juno Connect equipped classrooms, and interfaces with legacy analog paging systems for common areas to provide comprehensive audio coverage for announcements and alerts. The recently introduced Attention! feature integrates the CleverLive digital signage service with Conductor to synchronize audio with visual alerts to Clevertouch and Mimio interactive screenpanels to maximize the impact of school-wide or interactive desktopzone-specified communications.

STEM Category

Through the acquisitions of Modern Robotics, Robo3D and MyStemKits, Boxlight has added to its portfolio a growing category of STEM (science, technology, engineering, and math) products.

Mimio MyBot

The Mimio MyBot system bridges the gap between learning about robotics in the classroom and the application of robotics in the real world. The intuitive and accessible system helps students develop core skills in programming, engineering, and robotics. We provide a system to facilitate learning and ignite a passion in students with the

ProjectoWrite 8 ultra-short throw interactive projectors.Boxlight’sMimioVote Student Assessment System

freedom and flexibility to build, code, and test new and unique models. Mimio MyBot allows students to explore and learn freely while removing common obstacles such as requiring network infrastructure changes or expensive workstations.

Robo3D

Robo E3, and the Robo E3 Pro are smart, safe, and simple 3D printers that come with access to over 300+ lessons of 3D printable STEM curriculum, replacement materials and accessories.

MyStemKits

MyStemKits offers hundreds of standards-driven lesson plans, activities, assessments, and Design Challenges for grades K-12 math and science teachers. High-quality lessons plans are developed and studied by The Florida Center for Research in Science. Technology, Engineering, and Mathematics (FCR-STEM), which is part of one of the nation’s oldest and most productive university-based education research organizations.

MimioView document camera

Boxlight’s

MimioVoteMimioView 350U is a

handheld “clicker” that enables student assessment with essentially zero training. MimioVote is so simple it genuinely qualifies as intuitive, an elusive and often proclaimed attribute that is actually merited by MimioVote. MimioVote fully integrates into the MimioMobile environment and offers everything from attendance to fully immersive and on-the-fly student assessment. The MimioVote was specifically designed to survive the rigors of even kindergarten and elementary classrooms where being dropped, stepped on, and kicked are all part of a normal day. The handset’s non-slip coating helps keep it from sliding off desktops or out of little hands. Should they take wing, the rugged construction keeps them working.Boxlight’sMimioPad wireless pen tablet

MimioPad is a lightweight, rechargeable, wireless tablet used as a remote control for the MimioStudio running on a teacher’s Windows, Mac, or Linux computer. MimioPad enables the teacher to roam the classroom which significantly aids classroom management. MimioPad is a classroom management tool which can be handed off to enable a student to be part of the interactive experience – all without getting up and going to the front of the room.

Boxlight’sMimioView document camera

Boxlight’sMimioView is a4K document camera that is integrated with MimioStudio to make the combination easy to use with a single cable connection that carries power, video, and control. MimioView 350U is fully integrated into our MimioStudio software solution and is controlled through theMimioStudio’s applications menu of the quick menu. With 2two clicks, the teacher or user can turn on, auto-focus, and illuminate the included LED lights for smooth high-definition images.

Audio Solutions

We offer SoundLite audio solutions

Educational Software Category

The Mimio suite of software and applications is a combination of titles from acquisitions of Mimio, Qwizdom, and Sahara (Clevertouch) - leading brands in the IWB and Formative Assessment Software Categories, and since then capabilities have been built upon that IP. The premise of our software is to provide the “glue” that integrates the hardware to provide a Connected Classroom; help educators inform their decisions in the classroom, through more systematic data about their students’ performance and behaviors; make learning more engaging, interactive, accessible, and innovative; and support teachers in becoming more efficient in planning, preparation, reporting and analysis, and effective in instruction and assessment.

MimioStudio Interactive Instructional Software

MimioStudio Interactive Instructional Software enables the creation, editing, and presentation of interactive instructional lessons and activities. These lessons and activities can be presented and managed from the front of the classroom using any of Boxlight’s front-of-classroom display systems including MimioTeach, ProColor Interactive LED panels, MimioPro 4, and MimioFrame. MimioStudio can also be operated using a mobile device such as an affordableiPad or tablet that fully replicates the front-of-classroom display generated by MimioStudio. Operation with a mobile device is enabled via the three-user license for MimioMobile, provided with the MimioStudio license that accompanies all front-of-classroom devices from Mimio.

MimioMobile Collaboration and easy-to-install amplified speaker systemAssessment Application

The introduction of MimioMobile, a software accessory for MimioStudio, in 2014 introduced a new era of fully interactive student activities that are directly and immediately able to be displayed on the front-of-classroom interactive displays through MimioStudio.

MimioMobile allows fully interactive activities to be pushed to student classroom devices. The students can manipulate objects within the activities, annotate “on top” of them, and even create completely new content on their own handheld devices. MimioMobile also enables assessment using mobile devices. The teacher can create multiple choice, true\false, yes\no, and text entry assessment questions. The students can respond at their own pace and their answers are stored within MimioStudio from which the teacher can display graphs showing student results. This “continuous assessment” provides formative assessment that can help guide the teacher as to whether to re-teach the material if understanding is low or move forward in the lesson. We believe that this interactive and student dependent instructional model can dramatically enhance student outcomes.

OKTOPUS Instructional and Whiteboarding Software

Designed specifically for touch-enabled devices, OKTOPUS Interactive Instructional Software enables the creation, editing, and presentation of interactive instructional lessons and activities. More than 70 interactive widgets, tools, and classroom game modes make it simple and fun to run ad-hoc or pre-planned sessions. Similar to MimioStudio, these lessons and activities can be presented and managed from the front of the classroom using any of Boxlight’s front-of-classroom display systems.

Notes+ Collaboration and Assessment Application

Notes+ is a software accessory for use with OKTOPUS Software or a PPT plugin that allows students to view and interact with the teacher presentation during a live class session. Students can answer questions, annotate, request help, and share content with the main display from nearly any mobile device or laptop. Question types supported include multiple choice, multiple mark, yes/no, true/false, sequencing, numeric and text response.

GameZones Multi-student Interactive Gaming Software

GameZones allows up to four students to work simultaneously on a touch screen or tablet to complete interactive ‘game style’ activities. The solution is extremely simple and easy to use and includes over 150 educational activities.

MimioConnect Student Engagement Platform

MimioConnect is an online student engagement platform that combines innovative lesson building and instructional tools to create an active learning environment. Teachers can create interactive content and assessments from scratch, import existing lessons and content, or draw from 10,000+ premade digital lessons in the lesson library. Built-in tools for collaboration, instant polling, assessment, student monitoring and management, make classroom teaching and discussion more impactful. Other modes extend usage outside of the classroom, allowing students to complete homework or review daily lessons at their own pace. MimioConnect also integrates deeply with all of our projectors. The 30 watt SoundLite productthe major LMS (Learning Management System). Users can sign in and access assignments through their LMS, use existing rosters, and pass data back to the LMS. MimioConnect helps teachers and students connect, collaborate, and learn more effectively from anywhere, making it a perfect solution for inside and outside the classroom. A MimioConnect Classroom license (lifetime) and MimioConnect Pro license (1 year) accompanies all front-of-classroom Boxlight displays.

LYNX

Designed for interactive displays, LYNX Whiteboard is

availablea free-to-use lesson building app, enabling student collaboration and allowing teachers to bring vibrancy to their lessons with a

wireless RF microphone. This device produces quality stereo soundbuilt-in media search. In addition, LYNX Whiteboard provides searchable images, GIFs and videos, allowing users to drag content into whiteboard presentations, all in

any room.Features in future SoundLite models will have a security-enabled systemsafe search enabled environment. With teacher favorites, such as Rainbow Pen and IP addressable audio classroom solution allowing point-to-point addressSpotlight included, as well as interactive learning tools, LYNX Whiteboard is packed with features to make lessons flow seamlessly.

Peripherals and Accessories

We offer a network wide area address. A panic switch online of peripherals and accessories, mobile carts, installation accessories, and adjustable wall-mount accessories that complement our entire line of interactive LED flat-panels and audio solutions.

LessonCam Instructional Camera

The FrontRow LessonCam is a high-definition Pan, Tilt, Zoom (PTZ) instructional camera with 12x optical zoom, enabling dynamic and engaging remote-only, hybrid, or asynchronous learning. LessonCam integrates with the wireless transmitters will enable live broadcastFrontRow EzRoom and Juno classroom audio systems with popular video conferencing solutions such as Microsoft Teams, Microsoft Skype, Zoom, Google Meet, and Cisco Webex. LessonCam is a stand-out educational tool for teachers who want to engage with students wherever they are learning.

Clever Peripherals

Our Ever-growing suite of Clevertouch products includes a variety of Clever Peripherals such as OPS PC modules, which is a windows i5 and i7 modular PC, and our sensor module which plugs into the Clevertouch screens and measures temperature, humidity CO2 and air quality as well as an NFC.RFID sensor for logging into screens. In addition, we also offer our Clever Connect device that allows users to mirror directly to the screen. These and other Clever Peripherals continue to enhance the user experience of our Clevertouch displays.

Boxlight-EOS Professional Development

Mimio strives to provide the best tools to help teachers improve student outcomes. Through our subsidiary, EOS Education, we can extend our commitment to schools and districts by providing a rich portfolio of classroom

audiotraining, professional development, and

simultaneously trigger predetermined alerts. This feature is designededucator certification. EOS Education provides engaging and differentiated professional development for teachers to

work over a school’s existing network infrastructure.Non-Interactive projectors

We distribute a full line of standard, non-interactive projectors. The Cambridge Series features embedded wireless display functions and isensure that every student benefits from the technology tools available in shorttheir classrooms and standard throw options. Offering brightness from 2,700schools. Programs can be customized, building comfort, confidence, and competence using the specific hardware and software platforms available to 4,000 lumens, each teacher.

EOS Education unique professional learning experiences are:

•Teacher-centric - We help teachers use the technology they have access to for their specific instructional purposes—we furnish projectors for small classroomsgo beyond just point and click.

•Hands-on - Teachers have an opportunity to large classrooms with the Cambridge platform. This series is availablepractice new technical skills during sessions.

•Differentiated - Adjusted to current skills, knowledge, and teachers’ in-classroom practices.

•Job-embedded - Grounded in both XGA and WXGA resolutions to replace projectors on existing interactive whiteboards in classrooms operating on limited budgets. The Boxlight Group has designed this platform to provide easy user maintenance with side-changing lamps and filters and developed HEPA filtration systems for harsh environments.Over the past several years, we have together with strategic allies, provided customized products that fit specific needs of customers, such as the Israeli Ministry of Defense. Working with Nextel Systems, the Boxlight Group delivered approximately 4,000 projectors, with special kitting performance, asset tagging, custom start up screens, operating defaults appropriate for harsh environments, and other unique product specifications. the Boxlight Group also met requirements that each projector contain at least 51% U.S. content and be assembled in the United States. A service center was appointed in Israel to provide warranty service and support. The US Army in connection with the Israeli Defense Forces found the Boxlight Groupday-to-day teaching to be the only manufacturer ablerelevant, engaging, and practical to meet the stringent requirements, leading not onlyimplement.

•Student context - Introducing technology tools to the original multi-year contract, butstudents and how to extensions for favorable execution and performance.engage them with purpose.

We have centralized our business management for all acquisitions through an enterprise resource planning

system.(ERP) system which offers streamlined subsidiary integration utilizing a multi-currency platform. We have

streamlinedstrengthened and refined the process to drive front-line sales forecasting to factory production. Through the

enterprise resource planningERP system, we have synchronized five separate accounting and customer relationship management systems through a cloud-based interface to improve inter-company information sharing and allow management

atof the Company to have immediate access to snapshots of the performance of each of our

subsidiaries.subsidiaries in a common currency. As we grow, organically or through acquisition, we plan to

movequickly integrate each subsidiary or division into the Company to

a multi-currency modelallow for clearer and earlier visibility of

our enterprise resource planning system.Logistics; Suppliers

performance to enable timely and effective business decisions.

Logistics (Suppliers)

Logistics is currently provided

in the US by our Lawrenceville, Georgia

facility.facility and internationally by the Sahara team in London. Together these teams manage multiple third-party logistics partners throughout the world (3PL’s). These 3PL partners allow Boxlight to provide affordable freight routes and shorter delivery times to our customers by providing on-hand inventory in localized markets. Contract manufacturing for

Boxlight’sBoxlight products

areis through

ODMoriginal design manufacturer (ODM) and

OEMoriginal equipment manufacturer (OEM) partners according to

Boxlight’s specific engineering specifications and utilizing IP developed and owned by Boxlight. Boxlight’s factories for ODM and OEM are located in

the USA, Taiwan,

Mainland China,