UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

FORM 10-K

(Mark One)

[X]☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31 2020, 2023

[ ]☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 001-36268

Akers Biosciences,MyMD Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| 22-2983783 | ||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| ||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (856)848-8698

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Trading Symbol(s) | Name of Each Exchange on Which Registered: | ||

| Shares of | The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] ☐ No [X] ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] ☐ No [X] ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] ☒ No [ ]☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] ☒ No [ ]☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ||||

| Non-accelerated filer | ☒ | Smaller reporting company | ||||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal controlscontrol over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [ ]☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ]☐ No [X]☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2020,2023, based on a closing price of $3.48$45.00 was $21,254,305.$63 million.

As of February 26, 2021,March 29, 2024, the registrant had 16,652,829 shares of its common stock, noCommon Stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.None.

EXPLANATORY NOTE

Reincorporation

On March 4, 2024 (the “Effective Date”), MyMD Pharmaceuticals, Inc., a New Jersey corporation (“MyMD New Jersey” or, prior to the Reincorporation (as defined below), the “Company”) merged with and into its wholly-owned subsidiary, MyMD Pharmaceuticals, Inc., a Delaware corporation (“MyMD Delaware” or, following the Reincorporation, the “Company”), with MyMD Delaware being the surviving corporation, pursuant to that certain Agreement and Plan of Merger, dated as of March 4, 2024, by and between MyMD New Jersey and MyMD Delaware (the “Plan of Merger”), for the purpose of changing the Company’s state of incorporation from New Jersey to Delaware (the “Reincorporation”). The Plan of Merger and the Reincorporation were approved by the Company’s stockholders at the 2023 annual meeting of stockholders, held on July 31, 2023 (the “2023 Annual Meeting”).

MyMD Delaware is deemed to be the successor issuer of MyMD New Jersey under Rule 12g-3 of the Securities Exchange Act of 1934, as amended.

The Reincorporation did not result in any change in the Company’s name, business, management, fiscal year, accounting, location of the principal executive offices, assets or liabilities. In addition, the Company’s common stock retains the same CUSIP number and continues to trade on the Nasdaq Capital Market under the symbol “MYMD.”

As of the Effective Date of the Reincorporation, the rights of the Company’s stockholders are governed by the Delaware General Corporation Law, the MyMD Delaware Certificate of Incorporation, and the Bylaws of MyMD Delaware.

See Note 1 of the Consolidated Financial Statements for additional information.

Reverse Stock Split

Effective as of 4:05 p.m. Eastern Standard Time on February 14, 2024, we effected a one-for-thirty reverse stock split of our common stock (the “Reverse Stock Split”). Simultaneously with the Reverse Stock Split, number of shares of our common stock authorized for issuance was reduced from 500,000,000 shares to 16,666,666 shares, and our authorized capital stock was reduced from 550,000,000 shares to 66,666,666 shares. All share and per share information in this report have been retroactively adjusted to reflect the Reverse Stock Split.

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Annual Report”) and the documents we have filed with the Securities and Exchange Commission (which we refer to herein as the “SEC”) that are incorporated by reference herein contain “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “anticipates,” “assumes,” “believes,” “can,” “could,” “estimates,” “expects,” “forecasts,” “future,” “guides,” “intends,” “is confident that,”, “may,” “plans,” “seeks,” “projects,” “targets,” and “would” or the negative of such terms or other variations on such terms or comparable terminology. These statements relate to future events or our future financial performance or condition and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements.

Examples of forward-looking statements in this Annual Report and our other SEC filings include, but are not limited to, our expectations regarding our business strategy, business prospects, operating results, operating expenses, working capital, liquidity and capital expenditure requirements. These statements are based on our management’s expectations, beliefs and assumptions concerning future events affecting us, which in turn are based on currently available information and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, without limitation, the risks and uncertainties set forth under “Risk Factors” in Item 1A of this Annual Report on Form 10-K, which discussions are incorporated herein by reference.

These risks and uncertainties include, but are not limited to:

| ● |

| ||

| ● | the impact of dilution on our | ||

| ● |

| ||

| |||

| |||

| ● | the impact of our ability to realize the anticipated tax impact of the Merger; | ||

| ● | delisting of our Common Stock from the Nasdaq Capital Market; | ||

| ● | the availability of and our ability to continue to obtain sufficient funding to conduct planned research and development efforts and realize | ||

| ● |

| ||

| ● | the impact of the complexity of the regulatory landscape on our ability to seek and obtain regulatory approval for our product candidates, both within and outside of the U.S.; | ||

| ● | the required investment of substantial time, resources and effort for successful clinical development and marketization of our product candidates; | ||

| ● | challenges we may face with maintaining regulatory approval, if achieved; | ||

| ● | the potential impact of changes in the legal and regulatory landscape, both within and outside of the U.S.; | ||

| ● | the impact of public health emergencies such as the COVID-19 pandemic on the administration, funding and policies of regulatory authorities, both within and outside of the U.S.; | ||

| ● | our dependence on third parties to conduct pre-clinical and clinical trials and manufacture its product candidates; | ||

| 3 |

| ● | the impact of public health emergencies such as the COVID-19 pandemic on our results of operations, business plan and the global economy; | ||

| ● | challenges we may face with respect to our product candidates achieving market acceptance by providers, patients, patient advocacy groups, third party payors and the general medical community; | ||

| ● | the impact of pricing, insurance coverage and reimbursement status of our product candidates; | ||

| ● | emerging competition and rapidly advancing technology in our industry; | ||

| ● | our ability to obtain, maintain and protect our trade secrets or other proprietary rights, operate without infringing upon the proprietary rights of others and prevent others from infringing on its proprietary rights; | ||

| ● | our ability to maintain adequate cyber security and information systems; | ||

| ● | our ability to achieve the expected benefits and costs of the transactions related to the acquisition of | ||

| ● | |||

| |||

our ability to effectively execute and deliver our plans related to commercialization, marketing and manufacturing capabilities and strategy; | ||

| ● | emerging competition and rapidly advancing technology in our industry; | |

| ||

| ● | challenges we may face in identifying, acquiring and operating new business opportunities; | |

| ● | our ability to retain and attract senior management and other key employees; | |

| ● | our ability to quickly and effectively respond to new technological developments; | |

| ● | the outcome of litigation or other proceedings to which are subject as described in the “Legal Proceedings” section of this Annual Report on Form 10-K, or to we may become subject to in the future; | |

| ● | increased levels of competition; | |

| ● | changes in political, economic or regulatory conditions generally and in the markets in which we operate; | |

| ||

| ● | changes in the market acceptance of our products and services; | |

| ● |

| |

| our compliance with all laws, rules, and regulations applicable to our business and | ||

| ● | risks of mergers and acquisitions including the time and cost of implementing transactions and the potential failure to achieve expected gains, revenue growth or expense savings; | |

| ||

| ● | other risks, including those described in the “Risk Factors” section of this Annual |

We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all of those risks, nor can we assess the impact of all of those risks on our business or the extent to which any factor may cause actual results to differ materially from those contained in any forward-looking statement. The forward-looking statements in this Annual Report on Form 10-K and our other filings with the SEC are based on assumptions management believes are reasonable. However, due to the uncertainties associated with forward-looking statements, you should not place undue reliance on any forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and unless required by law, we expressly disclaim any obligation or undertaking to publicly update any of them in light of new information, future events, or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this Annual Report and the documents we have filed with the SEC.

| 4 |

Unless the context provides otherwise, all references in this Annual Report to “Akers”, the “Company”, “we”, “our” and “us” refer to Akers Biosciences, Inc.

WeMyMD is a clinical stage pharmaceutical company committed to extending healthy lifespan. MyMD is focused on developing and commercializing two therapeutic platforms based on well-defined therapeutic targets, MYMD-1 and Supera-CBD:

| ● | MYMD-1 is a clinical stage small molecule that regulates the immunometabolic system to treat autoimmune disease, including (but not limited to) rheumatoid arthritis, and inflammatory bowel disease. MYMD-1 is being developed to treat age-related illnesses such as frailty and sarcopenia. MYMD-1 works by regulating the release of numerous pro-inflammatory cytokines, such as TNF-α, interleukin 6 (“IL-6”) and interleukin 17 (“IL-17”) | |

| ● | Supera-CBD is a synthetic analog of CBD being developed to treat various conditions, including, but not limited to, epilepsy, pain and anxiety/depression, through its effects on the CB2 receptor, opioid receptors and monoamine oxidase enzyme (“MAO”) type B. |

The rights to Supera-CBDTM were incorporatedpreviously owned by Supera and were acquired by MyMD Florida (as defined below) immediately prior to the closing of the Merger (as defined below) that occurred in 1989 in the state of New Jersey2021.

MyMD Background and Corporate History

MyMD was organized under the name “A.R.C. Enterprises, Inc,” which was changed to “Akers Research Corporation” on September 28, 1990 and “Akers Laboratories, Inc.” on February 24, 1996. Pursuant to the Amended and Restated Certificate of Incorporation filed on March 26, 2002, the corporation’s name was changed to “Akers Biosciences, Inc.”

We were historically a developer of rapid health information technologies. On March 23, 2020, we entered into that certain membership interest purchase agreement (the “Original MIPA” and, as subsequently amended by Amendment No, 1 on May 14, 2020, the “MIPA”) with the members of Cystron (the “Cystron Sellers”), pursuant to which we acquired 100%laws of the membership interestsState of Cystron (the “Cystron Membership Interests”). Cystron was incorporated on March 10, 2020 and is a party to a license agreement with Premas whereby Premas granted Cystron, among other things, an exclusive license with respect to Premas’ genetically engineered yeast (S. cerevisiae)-based vaccine platform, D-Crypt™,Florida in November 2014 for the developmentpurpose of developing and commercializing certain technology and patent rights relating to MYMD-1 that were developed and/or held by the company’s founder, Jonnie R. Williams, Sr. The company’s sole initial stockholder was The Starwood Trust, a vaccine against COVID-19 and other coronavirus infections. Since our entry intotrust for which Mr. Williams is settlor/grantor. During the MIPA, we have beenperiod from November 2014 through November 2016, MyMD was primarily focused on drug discovery and establishing its patent position through SRQ Patent Holdings, an entity affiliated with Mr. Williams. In November 2016, SRQ Patent Holdings assigned to MyMD all of the rapid developmentpatent rights and manufacturingother intellectual property relating to MYMD-1 pursuant to an agreement under which MyMD granted to SRQ Patent Holdings a royalty based on product sales and other revenue arising from the assigned intellectual property (as further described below).

During the period 2016 through October of 2020, MyMD’s principal business activities consisted of the execution and completion of in vitro assays, in vivo pre-clinical animal studies, and genotoxicity and toxicology studies relating to MYMD-1 (as further described below). On June 25, 2019, MyMD commenced a Phase 1 trial in healthy volunteers for pharmacokinetics and tolerability studies, and in December of 2019 MyMD filed an IND for MYMD-1 for treatment of Hashimoto thyroiditis. The Phase 1 trial was completed on January 30, 2020, after which MyMD commenced preparation of a COVID-19 vaccine candidate (the “COVID-19 Vaccine Candidate”),Phase 2 clinical trial for MYMD-1 The company has also commenced a Phase 2 clinical trial for patients with sarcopenia, with dosing begin in collaborationthe first quarter of 2022. The last patient visit took place on June 6, 2023. The clinical safety report is currently under development.

Additionally, MyMD is working with Premas.Charles River Laboratories to conduct a study titled “A 13 Week Electroencephalogram Safety Study of MYMD-1 by Oral Gavage Administration in Beagle Dog.” Dosing began on December 19, 2023.

Proposed

2021 Merger and Corporate Transactions

On April 16, 2021, pursuant to an Agreement and Plan of Merger and Reorganization, dated November 11, 2020 we entered into(as subsequently amended, the “Merger Agreement”), by and among the Company, previously known as Akers Biosciences, Inc., XYZ Merger Agreement, pursuant to which, among other things, subject to the satisfaction or waiverSub, Inc., a wholly-owned subsidiary of the conditions set forth in the Company (“Merger Agreement,Sub”), and MyMD Pharmaceuticals (Florida), Inc., a Florida corporation previously known as MyMD Pharmaceuticals, Inc. (“MyMD Florida”), Merger Sub will mergewas merged with and into MYMD,MyMD Florida, with MYMD beingMyMD Florida continuing after the merger as the surviving corporationentity and becoming a wholly owned subsidiary of the Company (the “Merger”). The Merger is intended to qualify for federal income tax purposes as a tax-free reorganization under the provisions of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). In addition, in connection with the execution of the Merger Agreement, Akers agreed to advance a bridge loan of up to $3,000,000 to MYMD pursuant to a secured promissory note (the “Note”). Upon completion of the merger, the combined company is expected to be renamed MyMD Pharmaceuticals, Inc.

Pursuant to the Merger Agreement, upon the effectiveness of the Merger, (i) holders of outstanding shares of MYMD common stock (“ MYMD stockholders”) will be entitled to receive (x) the number of shares of Akers common stock equal to an exchange ratio as described in the Merger Agreement (the “Exchange Ratio”) per share of MYMD common stock they hold, prior to giving effect to the proposed reverse stock split discussed below, (y) an amount in cash, on a pro rata basis, equal to the aggregate cash proceeds received by Akers from the exercise of any options to purchase shares of MYMD common stock assumed by Akers upon closing of the merger prior to the second-year anniversary of the closing of the merger (the “Option Exercise Period”), such payment (the “Additional Consideration”) to occur not later than 30 days after the last day of the Option Exercise Period, up to the maximum amount of cash consideration that may be received by MYMD stockholders without affecting the intended tax consequences of the merger, and (z)included potential milestone payments (“Milestone Shares”) of up to the number of shares of Akers common stock issued to MYMDpre-Merger MyMD Florida stockholders at closing of the Merger (“Milestone(the “Milestone Payments”) payable in shares of the Company’s Common Stock upon the achievement of certain market capitalization milestone events during the 36-month period immediately following the closing of the merger (the “Milestone Period”); and (ii) each outstanding option to purchase MYMD common stock granted under the Second Amendment to Amended & Restated 2016 Stock Incentive PlanMerger.

On November 11, 2020, in connection with an effective date of July 1, 2019, as established and maintained by MYMD (and, as amended and restated from time to time, the “MyMD Incentive Plan”) that has not previously been exercised prior to the closing of the Merger, whether or not vested, will be assumed by Akers subject to certain terms contained inentering into the Merger Agreement, and become an option to purchase a number of shares ofMyMD Florida entered into the Akers common stock equal to the number of shares of MYMD common stock underlying such option multiplied by the Exchange Ratio, which options to purchase MYMD common stock shall be amended to expire on the second-year anniversary of the closing of the Merger, and the exercise price for each share of Akers common stock underlying an assumed option to purchase MYMD common stock will be equal to the exercise price per share of the option to purchase MYMD common stock in effect immediately prior to the completion of the merger divided by the Exchange Ratio. Assuming the exercise in full of the outstanding pre-funded warrants to purchase 1,040,540 shares of our common stock (“Pre-Funded Warrants”) issued in connection with the private placement between Akers and certain institutional and accredited investors that closed on November 17, 2020 (the “Private Placement”) and the exercise in full of additional pre-funded warrants to purchase 932,432 shares of common stock issued certain investors in February 2021 upon cancellation of shares of common stock purchased in the Private Placement and including 9,979,664 shares of combined company common stock underlying options to purchase shares of MYMD common stock to be assumed at the closing of the Merger, (i) MYMD stockholders and optionholders will own approximately 80% of the equity of the combined company; and (ii) our current stockholders, holders of certain outstanding of our options and warrants (excluding shares issuable upon exercise of options and warrants having an exercise price in excess of $1.72, prior to giving effect to any such stock splits, combinations, reorganizations and the like with respect to the Akers common stock between the announcement of the Merger and the closing of the Merger) and holders of our outstanding restricted stock units (“RSUs”) immediately prior to the Merger will own approximately 20% of the equity of the combined company.

Pursuant to the Merger Agreement, on January 15, 2020, we and MYMD filed an initial Registration Statement on Form S-4 (Registration No. 333-252181) (together with the joint proxy and consent solicitation/prospectus included therein, the “S-4 Registration Statement”) describing the Merger and other related matters. Consummation of the Merger is conditioned upon, among other things, approval of the Merger by the stockholders of Akers (including (i) approval, for purposes of complying with Nasdaq Listing rule 5635(a), the issuance of shares of Akers common stock to MYMD stockholders and other parties in connection with the Merger, the Merger Agreement, and the transactions contemplated thereby or in connection therewith (the “Share Issuance Proposal”), (ii) approval of an amendment to the amended and restated certificate of incorporation of the combined company, which will be in effect at the effective time of the merger (the “A&R Charter”) to effect a reverse stock split, if applicable, at a reverse stock split ratio mutually agreed by the Company and MYMD and within the range approved by our stockholders immediately prior to the Effective Time (as defined in the Merger Agreement), which range shall be sufficient to cause the price of our common stock on the Nasdaq Capital Market following the reverse stock split and the Effective Time to be no less than $5.00 per share with respect to the issued and outstanding common stock of the combined company immediately following the merger (the “Reverse Stock Split Proposal”), and (iii) approval of the amended and restated certificate of incorporation of Akers which will be in effect upon consummation of the Merger (the “A&R Charter Proposal”), among others), approval of the Merger by the stockholders of MYMD, the continued listing of Akers’ common stock on The Nasdaq Capital Market after the Merger and satisfaction of a minimum cash threshold by Akers. In addition, the Merger Agreement requires that MYMD consummate the purchase of substantially all of the assets and certain liabilities of Supera Pharmaceuticals, Inc., a Florida corporation (“Supera”) pursuant to an Asset Purchase Agreement pursuant to which MYMDMyMD Florida agreed to acquire from Supera immediately prior to the completion of the Merger, substantially all of its assets (the “Supera Purchase”). After closing of the Merger, the operations of MYMD’s business will comprise substantially all of the combined company’s operations. There is no assurance when or if the Merger will be completed. Any delayassets (including all rights to Supera-CBD) and certain obligations of Supera in completing the Merger may substantially reduce the potential benefits that we expect to obtain from the Merger. Furthermore, the intended benefitsconsideration of the Merger may not be realized.

Coronavirus and COVID-19 Pandemic

In December 2019, SARS-CoV-2 was reportedissuance to have surfaced in Wuhan, China, and on March 12, 2020, the World Health Organization (“WHO”) declared the global outbreakSupera of COVID-19, the disease caused by SARS-CoV-2,an aggregate of 13,096,640 shares of MyMD Florida Common Stock. As partial consideration for such assignment, Supera has granted to beSRQ Patent Holdings II, LLC a pandemic. In an effort to contain and mitigate the spread of COVID-19, many countries, including the United States, Canada, China, and India, have imposed unprecedented restrictions on travel, quarantines, and other public health safety measures. According to the WHO situation report, dated as of February 16, 2021, approximately 108.2 million cases were reported globally and 2.4 million of these were deadly, making the development of effective vaccines to prevent this disease a major global priority. Multiple vaccine candidates against SARS-CoV-2 are under development, and in December 2020, certain large, multinational pharmaceutical companies were granted authorizations for emergency use by the FDA. Widespread distribution of the currently-available vaccines has begun pursuant to Operation Warp Speed, a partnership among components of the U.S. Department of Health and Human Services, the Centers for Disease Control and Prevention, the National Institutes of Health, the Biomedical Advanced Research and Development Authority, and the Department of Defense, as well as certain private firms and other federal agencies. The treatments for COVID-19, including symptomatic and supportive therapies, among other things, continue to be updated on a rolling basis by healthcare authorities and agencies.

Impact of the COVID-19 Pandemic on Our Business

The ultimate impact of the global COVID-19 pandemic or a similar health epidemic is highly uncertain and subject to future developments. These include but are not limited to the duration of the COVID-19 pandemic, new information which may emerge concerning the severity of the COVID-19 pandemic, and any additional preventative and protective actions that regulators, or our board of directors or management, may determine are needed. We do not yet know the full extent of potential delays or impacts on our business, our vaccine development efforts, healthcare systems or the global economy as a whole. However, the effects are likely to have a material impact on our operations, liquidity and capital resources, and we will continue to monitor the COVID-19 situation closely.

In response to public health directives and orders, we have implemented work-from-home policies for many of our employees and temporarily modified our operations to comply with applicable social distancing recommendations. The effects of the orders and our related adjustments in our business are likely to negatively impact productivity, disrupt our business and delay our timelines, the magnitude of which will depend, in part, on the length and severity of the restrictions and other limitations on our ability to conduct our business in the ordinary course. Similar health directives and orders are affecting third parties with whom we do business, including Premas, whose operations are located in India. Further, restrictions on our ability to travel, stay-at-home orders and other similar restrictions on our business have limited our ability to support our operations.

Severe and/or long-term disruptions in our operations will negatively impact our business, operating results and financial condition in other ways, as well. Specifically, we anticipate that the stress of COVID-19 on healthcare systems generally around the globe will negatively impact regulatory authorities and the third parties that we and Premas may engage in connection with the development and testing of our COVID-19 Vaccine Candidate.

In addition, while the potential economic impact brought by, and the duration of, COVID-19 may be difficult to assess or predict, it has significantly disrupted global financial markets, and may limit our ability to access capital, which could in the future negatively affect our liquidity. A recession or market correction resulting from the continuation of the COVID-19 pandemic could materially affect our business and the value of our common stock.

Coronavirus Vaccine Development

We have partnered with Premas on the development of the COVID-19 Vaccine Candidate as we seek to advance such candidate through the regulatory process, both with the U.S. Food and Drug Administration (“FDA”) and the office of the drug controller in India. Premas is primarily responsible for the development of the COVID-19 Vaccine Candidate through proof of concept and is entitled to receive milestone payments upon achievement of certain development milestones through proof of concept.

Premas’ D-Crypt platform has been developed to express proteins that are difficult to clone, express and manufacture and are a key component in vaccine development. Premas has identified three major structural proteins of SARS-CoV-2 as antigens for potential vaccine candidates for COVID-19: spike protein or S protein, envelope protein or E protein, and membrane protein or M protein. In April 2020, Premas used its D-Crypt platform to recombinantly express all three of such antigens, which we considered a significant milestone for development of a triple antigen vaccine. We believe including a combination of all three antigens will provide advantages against the likelihood of protein mutation, in which case a single-protein vaccine can be rendered non-efficacious, and therefore, enhance efficacy of our vaccine candidates. We believe the D-Crypt provides us advantages in vaccine production and manufacturing, as the technology platform is highly scalable with a robust process, which we expect will ultimately result in significant cost savings compared to other similar vaccine platforms. Based on genetically engineered baker’s yeast S. cerevisiae, the platform is highly scalable into commercial production quantities and has been previously utilized for the production of multiple human and animal health vaccines candidates during its 10-year development track record. Yeast has a large endoplasmic reticulum, or (“ER”), which is a desirable attribute for expressing membrane protein. In complex cells, ER is where the protein is formed. The larger the surface, the more membrane protein that can attach to the ER inside the cell. Yeast is also generally believed to be easily manipulated and allow for results to be gathered quickly. Yeast multiplies faster than mammalian cells and is cheaper to work with than mammalian systems, which are much more complex and slower to grow comparatively. Yeast has received “Generally Recommended as Safe” status from the FDA.

As of May 14, 2020, Premas successfully completed its vaccine prototype and obtained transmission electron microscopic (“TEM”) images of the recombinant virus like particle (“VLP”) assembled in yeast. A manufacturing protocol has also been established and large-scale production studies have been initiated for our COVID-19 Vaccine Candidate. Though the prototype is complete, the COVID-19 Vaccine Candidate is still in early stages of development, and, accordingly, must undergo pre-clinical testing and all phases of clinical trials before we can submit a marketing application (in this case, a Biologics License Application, or “BLA”) to the FDA. The BLA must be approved by the FDA before any biological product, including vaccines, may be lawfully marketed in the United States. We believe the most pivotal, yet difficult, stage in our anticipated development of the contemplated COVID-19 Vaccine Candidate is the requisite conduct of extensive clinical trials to demonstrate the safety and efficacy of our COVID-19 Vaccine Candidate. Additionally, after we complete the necessary pre-clinical testing, but before we may begin any clinical studies in the United States, we must submit an Investigational New Drug (“IND”) application to the FDA, as this is required before any clinical studies may be conducted in the United States. In some cases, clinical studies may be conducted in other countries; however, the FDA may not accept data from foreign clinical studies in connection with a BLA (or other marketing application) submission.

In July 2020, animal studies for our COVID-19 Vaccine Candidate were initiated in India. In addition, we announced that Premas has successfully completed the manufacturing process for the VLP vaccine candidate. On August 27, 2020, we announced with Premas positive proof of concept results from the animal studies conducted during a four-week test of the COVID-19 Vaccine Candidate in mice. The test had two primary endpoints, safety and immune responses, both of which were met. The study consisted of 50 mice, divided into 10 cohorts dosed with 5, 10 and 20 micrograms of the COVID-19 Vaccine Candidate. The COVID-19 Vaccine Candidate was generally well tolerated and safe at all doses, with no adverse events reported. The COVID-19 Vaccine Candidate was safe even at higher doses and generated a robust immune response against the three SARS-Cov2 antigens, S, E, and M. The COVID-19 Vaccine Candidate elicited neutralizing antibody titers levels in all the dose cohorts starting from 5 microgram to 20 microgram dose regimens. After three doses in mice, all the groups’ cohorts showed binding antibody levels similar to convalescent patients’ levels. Clinical testing is expensive, time consuming, and uncertain as to outcome. We cannot guarantee that any clinical trials will be conducted as planned or completed in a timely manner, if at all. Failures in connection with one or more clinical trials can occur at any stage of testing.

Premas owns, and has exclusively licensed rights to us to, two provisional Indian patent applications filed in January and March 2020. The scope of these Indian provisional patent applications is directed, respectively, to (i) a platform for the expression of difficult to express proteins (“DTE-Ps”), which might provide coverage for a method of making the to-be-developed vaccine; and (ii) an expression platform for SARS-CoV-2-like virus proteins, methods relevant thereto, and a relevant vaccine. If non-provisional patent rights are pursued claiming priority to each of these two provisional applications, any resulting patent rights that issue might not expire until approximately January 20, 2041 and March 4, 2041, if all annuities and maintenance fees are timely paid. The expiration dates may be extendable beyond these dates depending on the jurisdiction and the vaccine development process. As we do not own the patents or patent applications that we license, we may need to rely upon Premas to properly prosecute and maintain those patent applications and prevent infringement of those patents.

Competition

We face, and will continue to face, intense competition from large pharmaceutical companies, specialty pharmaceutical and biotechnology companies as well as academic and research institutions pursing research and development of technologies, drugs or other therapies that would compete with our products or product candidates. The pharmaceutical market is highly competitive, subject to rapid technological change and significantly affected by existing rival drugs and medical procedures, new product introductions and the market activities of other participants. Our competitors may develop products more rapidly or more effectively than us. If our competitors are more successful in commercializing their products than us, their success could adversely affect our competitive position and harm our business prospects.

Specifically, the competitive landscape of potential COVID-19 vaccines and treatment therapies has been rapidly developing since the beginning of the COVID-19 pandemic, with several hundreds of companies claiming to be investigating possible candidates and approximately 4,800 studies registered worldwide as investigating COVID-19 (source: clinicaltrials.gov). Given the global footprint and the widespread media attention on the COVID-19 pandemic, there are efforts by public and private entities to develop a COVID-19 vaccine as soon as possible, including large, multinational pharmaceutical companies such as AstraZeneca, GlaxoSmithKline, Johnson & Johnson, Moderna, Pfizer, and Sanofi. In December 2020, the FDA issued emergency use authorizations for vaccines developed by certain of these large, multinational pharmaceutical companies and it is possible that additional vaccines developed by such large, multinational pharmaceutical companies may receive further approvals and authorizations in the near term. Those other entities have vaccine candidates that are currently at a more advanced stage of development than our COVID-19 Vaccine Candidate and may develop COVID-19 vaccines that are more effective than any vaccine we may develop, may develop a COVID-19 vaccine that becomes the standard of care, may develop a COVID-19 vaccine at a lower cost or earlier than we are able to jointly develop any COVID-19 vaccine, or may be more successful at commercializing a COVID-19 vaccine. Many of these other organizations are much larger than we are and have access to larger pools of capital, and as such, are able to fund and carry on larger research and development initiatives. Such other entities may have greater development capabilities than we do and have substantially greater experience in undertaking nonclinical and clinical testing of vaccine candidates, obtaining regulatory approvals and manufacturing and marketing pharmaceutical products. Our competitors may also have greater name recognition and better access to customers. In addition, based on the competitive landscape, additional COVID-19 vaccines or therapeutics may continue be approved to be marketed. Should another party be successful in producing a more efficacious vaccine for COVID-19, such success could reduce the commercial opportunity for our COVID-19 Vaccine Candidate and could have a material adverse effect on our business, financial condition, results of operations and future prospects. Moreover, if we experience delayed regulatory approvals or disputed clinical claims, we may not have the commercial or clinical advantage over competitors’ products that we believe we currently possess. The success or failure of other entities, or perceived success or failure, may adversely impact our ability to obtain any future funding for our vaccine development efforts or for us to ultimately commercialize and market any vaccine candidate, if approved. In addition, we may not be able to compete effectively if our product candidates do not satisfy government procurement requirementsroyalty with respect to biodefense products.

Acquisitionproduct sales and License Agreements

On March 23, 2020, we acquired Cystron pursuant to the MIPA. Asother consideration for the Cystron Membership Interests, we delivered to the Cystron Sellers: (1) that number of newly issued shares of our common stock equal to 19.9% of the issued and outstanding shares of our common stock and pre-funded warrants as of the date of the MIPA, but, to the extent that the issuance of our common stock would have resulted in any Seller owning in excess of 4.9% of our outstanding common stock, then, at such Seller’s election, such Seller received “common stock equivalent” preferred shares with a customary 4.9% blocker (with such common stock and preferred stock collectively referred to as “Common Stock Consideration”), and (2) $1,000,000 in cash. On March 24, 2020, we paid $1,000,000 to the Cystron Sellers and delivered 411,403 shares of common stock and 211,353 shares of Series D Convertible Preferred Stock with a customary 4.9% blocker, with an aggregate fair market value of $1,233,057.

Additionally, we are required to (A) make an initial payment to the Cystron Sellers of up to $1,000,000 upon its receipt of cumulative gross proceedsarising from the consummation of an initial equity offering after the date of the MIPA of $8,000,000, and (B) pay to the Cystron Sellers an amount in cash equal to 10% of the gross proceeds in excess of $8,000,000 raised from future equity offerings after the date of the MIPA until the Cystron Sellers have received an aggregate additional cash consideration equal to $10,000,000 (collectively, the “Equity Offering Payments”). On May 14, 2020, we entered into an Amendment No. 1 to the MIPA with the Cystron Sellers, which provided that any Equity Offering Payments in respect of an equity offering that is consummated prior to September 23, 2020, shall be accrued, but shall not be due and payable until September 24, 2020. The other provisions of the MIPA remained unmodified and in full force and effect. Upon the achievement of certain milestones, including the completion of a Phase 2 study for a COVID-19 Vaccine Candidate that meets its primary endpoints, the Cystron Sellers are entitled to receive an additional 750,000 shares of our common stock or, in the event we are unable to obtain stockholder approval for the issuance of such shares, 750,000 shares of non-voting preferred stock that are valued following the achievement of such milestones and shall bear a 10% annual dividend (the “Cystron Milestone Shares”). At the 2020 annual meeting of our stockholders, held on August 27, 2020, pursuant to Nasdaq listing rule 5635(a), our stockholders approved of the issuance of Common Stock Consideration (as defined in the MIPA) and the potential future issuance of Cystron Milestone Shares in excess of 20% of our common stock outstanding prior to the closing of the Cystron acquisition.assigned intellectual property.

Pursuant to the MIPA, the Company shall make contingent payments for the achievement of certain development and commercial milestones as follows; (i) $250,000 upon the dosing of the first patient in a Phase I Clinical Trial, (ii) $500,000 upon the dosing of the first patient in a Phase II Clinical Trial, (iii) $5,000,000 upon the dosing of the first patient in a Phase III Clinical Trial, and (iv) $15,000,000 upon approval by the FDA of the NDA for the COVID-19 vaccine.

Pursuant to the Original MIPA, upon our consummation of the registered direct equity offering closed on April 8, 2020, we paid the Cystron Sellers $250,000 on April 20, 2020 (the “April Payment”). On April 30, 2020, Premas, one of the Cystron Sellers, returned to us $83,334, representing their portion of the $250,000 amount paid to the Cystron Sellers on April 20, 2020. Premas advised us that these funds were returned temporarily for Premas to meet certain regulatory requirements in India. We recorded liabilities of $892,500 (the “May Payment”) and $684,790 (the “August Payment”) to the Cystron Sellers upon the consummation of the registered direct equity offerings that closed on May 18, 2020 and August 13, 2020, respectively. These funds (including funds of $299,074 representing Premas’ portion of the cash purchase price and $83,334 representing Premas’ portion of the April Payment temporarily returned to us in April 2020) due the sellers under the MIPA were disbursed on September 25, 2020. On October 13, 2020, Premas returned $908,117 representing Premas’ portion of the initial cash component for the purchase of Cystron and Premas’ portion of the April Payment, May Payment and August Payment under the MIPA. Premas is working with the Reserve Bank of India to comply with regulations related to its ownership in a foreign entity and its ability to receive funds for the sale of that entity. The Company believes that (i) Premas will be successful inpreviously owned, through its efforts to resolve such regulatory matters with the Reserve Bank of India, (ii) the Company will disburse the amounts due to Premas under the MIPA, and (iii) the Company maintains a 100% membership interest in Cystron.

Upon the consummation of the Private Placement, the Company paid $1,204,525 of the proceeds from the Private Placement to three of the four former members ofsubsidiary Cystron and recorded a liability of $602,172 to the fourth former member of Cystron pursuant to the MIPA.

We shall also make quarterly royalty payments to the Cystron Sellers equal to 5% of the net sales of a COVID-19 vaccine or combination product by us for a period of five (5) years following the first commercial sale of the COVID-19 vaccine; provided, that such payment shall be reduced to 3% for any net sales of the COVID-19 vaccine above $500 million.

In addition, the Cystron Sellers shall be entitled to receive 12.5% of the transaction value, as defined in the MIPA, of any change of control transaction, as defined in the MIPA, that occurs prior to the fifth (5th) anniversary of the closing date of the MIPA, provided that we are still developing the COVID-19 Vaccine Candidate at that time. Following the consummation of any change of control transaction, the Cystron Sellers shall not be entitled to any payments as described above under the MIPA.

Support Agreement

On March 23, 2020, as an inducement to enter into the MIPA, and as one of the conditions to the consummation of the transactions contemplated by the MIPA, the Cystron Sellers entered into a shareholder voting agreement with us, pursuant to which each Cystron Seller agreed to vote their shares of our common stock or preferred stock in favor of each matter proposed and recommended for approval by our management at every meeting of the stockholders and on any action or approval by written consent of the stockholders.

Registration Rights Agreement

To induce the Cystron Sellers to enter into the MIPA, on March 23, 2020, we entered into a registration rights agreement with the Cystron Sellers, pursuant to which we filed with the SEC a Registration Statement on Form S-3, as amended, covering resale of the Common Stock Consideration, which was declared effective on June 12, 2020. We also agreed to subsequently register Cystron Milestone Shares, if such securities are issued in the future.

License Agreement

Cystron is a party to the License Agreement with Premas. As a condition to our entry into the MIPA, Cystron amended and restated the Initial License Agreement on March 19, 2020. Pursuant to the License Agreement, Premas granted Cystron, amongst other things,Biotech, LLC (“Cystron”), an exclusive license from Premas Biotech PVT Ltd. (“Premas”) with respect to Premas’ vaccine platform for the development of a vaccine against COVID-19 and other coronavirus infections.

Upon the achievement of certain developmental milestones by Cystron, Cystron shall pay to Premas a total of up to $2,000,000. On April 16, 2020, we paid Premas $500,0002021, pursuant to the Contribution and Assignment Agreement, dated March 18, 2021 (the “Contribution Agreement”) by and among the Company, Cystron, Oravax Medical, Inc. (“Oravax”) and, for the achievementlimited purpose set forth therein, Premas, the Company caused Cystron to contribute substantially all of the firstassets associated with its business of developing and manufacturing Cystron’s COVID-19 vaccine candidate to Oravax. Oravax is pursuing the development of the COVID-19 vaccine candidate. MyMD’s interest in Oravax consists of 13% of Oravax’s outstanding shares of capital stock and the rights to a 2.5% royalty on all future net sales. MyMD has evaluated several options with respect to its interest in Oravax, including a potential distribution of Oravax shares to the MyMD shareholders. This would make Oravax a publicly held company. In addition, MyMD currently has the right to designate a member of the board of directors of Oravax, pursuant to which Mr. Joshua Silverman, our Chairman of the Board, has been designated to serve as a director of Oravax.

| 5 |

Status of MyMD Florida

On April 8, 2022, the MyMD Florida subsidiary was dissolved and merged into the New Jersey corporation MyMD Pharmaceuticals, Inc. pursuant to an Agreement and Plan of Merger dated April 8, 2022.

Reincorporation

On March 4, 2024, the Reincorporation was effected, and the Company changed its state of incorporation from New Jersey to Delaware.

Drug Development

MyMD is developing two platform drugs targeting numerous disease indications. Below is MyMD’s development milestones. On May 18,pipeline:

| 6 |

Strategy

MyMD’s strategy is to focus on extending healthy life span through the development and commercialization of novel drug platforms based on well-defined therapeutic targets. Below are MyMD’s key clinical strategies:

| ● | Completed Phase 2 clinical trial in sarcopenia (i.e., age-related muscle loss) in the second quarter of 2023; In the process of completing the Clinical Safety Report (CSR); | |

| ● | Advance MYMD-1 into Phase 2 clinical trials for rheumatoid arthritis and Hashimoto’s Thyroiditis; | |

| ● | Execute on IND-enabling studies of Supera-CBD to enable submission of an IND for a Phase 1 clinical trial in healthy volunteers followed by Phase 2 clinical trials in epilepsy, addiction and anxiety disorders; | |

| ● | Identify and validate additional novel targets and utilize translational platforms to develop a pipeline of product candidates for aging and other autoimmune disease; | |

| ● | Maintain broad commercial rights to MyMD’s product candidates; and | |

| ● | Continue to strengthen and expand MyMD’s intellectual property portfolio. |

MYMD-1

Overview

MYMD-1 is a clinical stage drug that targets the immune system by inhibiting the release of pro-inflammatory cytokines, such as TNF-α. Cytokines are a broad category of molecules involved in immune system coordination. Immunometabolic regulation is the system of regulating the immune system and its pro-inflammatory cytokines in order to prevent and treat autoimmune diseases and age-related illnesses. By affecting the initial triggers that drive autoimmunity, MYMD-1 targets the underlying cause of these diseases rather than just their symptoms. Based on MYMD-1’s Phase 1 clinical trial, completed in January 2020, we paid Premas $500,000MyMD has completed a Phase 2 clinical trial for sarcopenia (age-related muscle loss) and is planning a Phase 2 clinical trial for rheumatoid arthritis. MyMD has an active IND with the Endocrinology Division at the FDA for other autoimmune diseases. Studies have been completed on the mechanisms of action and efficacy of MYMD-1 in several pre-clinical models of autoimmune diseases (i.e., experimental autoimmune encephalomyelitis (“EAE”) that models multiple sclerosis and autoimmune thyroiditis), and these studies have been published in peer reviewed journals. MyMD plans to pursue these indications.

MYMD-1: An Immunometabolic Regulator

Inflammation, activated through the release of TNF-α and other cytokines, is the body’s normal physiological defense against infections and pathogens, and under normal circumstances such inflammation quickly resolves once the intruder is neutralized. However, elevated levels of pro-inflammatory cytokines, including TNF-α, can lead to prolonged, chronic inflammation, which is closely linked to autoimmune diseases (such as multiple sclerosis, diabetes, rheumatoid arthritis) and aging (i.e., inflamm-aging) as well as cardiovascular disease and cancers, all of which may result in reduced health span (the period of life spent in good health).

The goal of immunometabolic regulatory drugs such as MYMD-1 is to target immune cells that overproduce pro-inflammatory cytokines, such as TNF-α, without preventing normal immune cell function. TNF-α is a cytokine that is released by immune cells that plays a key role in acute and chronic inflammation, autoimmune diseases and aging. Examples of currently approved immunometabolic regulating drugs include Dimethyl Fumarate (“DMF”) (approved for the achievementtreatment of multiple sclerosis) and Rapamycin (used in kidney transplants and being studied in aging).

MYMD-1 is a novel immunometabolic regulator that has demonstrated in vitro and in vivo ability to regulate the release of multiple cytokines from immune cells, including TNF-α. MYMD-1 is being developed to treat chronic inflammatory diseases, such as multiple sclerosis, diabetes, inflammatory bowel disease, rheumatoid arthritis, and aging.

MYMD-1 Regulates Multiple Cytokines

MyMD conducted an in vitro study to demonstrate that MYMD-1 regulates a broad range of cytokines, including TNF-α, interferon gamma (INFγ) and interleukins, including interleukin 2 (“IL-2”) and IL-17A. By blocking these cytokines that have been shown to play key roles in the development and maintenance of autoimmune diseases, MYMD-1 treats the causes—and not just the symptoms—of this class of illnesses.

Figure 1. MYMD-1 modulates the release of a broad spectrum of cytokines.

| 7 |

An additional in vitro study demonstrates that MYMD-1 has broad cytokine inhibiting activity including inhibition of TNF-α, IL-16 and IL-17a. The study also suggested MYMD-1 has limited toxicity, even at high doses, and none up to 2,000 micromoles.

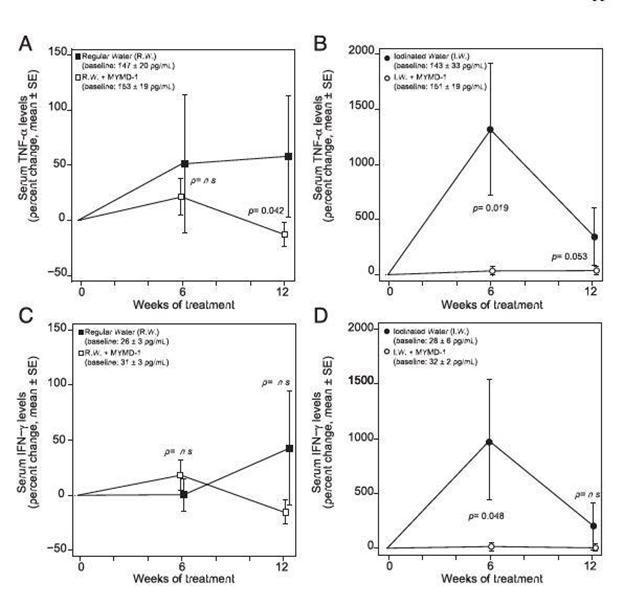

In an in vivo study (NOD.H2 mouse model), MYMD-1 decreased serum levels of TNF-α and INFγ.

Figure 2. MYMD-1 decreases the serum levels TNF-α and IFN-g in NOD.H-2h4 mice. NOD.H-2h4 mice were treated with either regular water or iodinated water (500 mg/l of sodium iodide), and each group was treated or not treated with MYMD-1 (185 mg/l). Cytokines were measured at baseline and after 6 and 12 weeks of treatment using a multiplex magnetic bead array. (A and B) MYMD-1 significantly decreased serum TNF-α levels in the regular water group and tended to decrease it in the iodinated water group. (C and D) MYMD-1 showed a modest effect on serum IFN-g in the iodinated water group. Results are from three independent experiments. Statistical comparisons were made by longitudinal data analysis with generalized estimating equations.

| 8 |

MYMD-1 Targets Autoimmune Diseases

MYMD-1 is designed to regulate the immunometabolic system and intended for development as a potential treatment for certain autoimmune diseases, including (but not limited to) multiple sclerosis, diabetes, rheumatoid arthritis, and/or inflammatory bowel disease. MYMD-1 is also being developed to treat age-related illnesses such as frailty and sarcopenia. Autoimmune diseases are a broad category of diseases that result from an overactive immune response, where immunometabolic system dysregulation is believed to play an important role. A healthy immune system defends the body against disease and infection. If the immune system malfunctions, it can mistakenly attack healthy cells, tissues, and organs. In response to an often-unknown trigger, the immune system starts producing antibodies that attack the body’s own cells instead of fighting infections.

TNF-α, produced primarily by specific white blood cells, belongs to a category of proteins called cytokines that act as chemical messengers throughout the body to regulate many aspects of the third development milestone. On July 7,immune system. Other key cytokines include IL-6, IL-17A, interleukin 10 (“IL-10”) and Interferon gamma (“INFγ”). Cytokines are essential to mounting an inflammatory response. However, chronic or excessive production of cytokines has been implicated in a number of acute and chronic inflammatory diseases.

A number of drugs target the immunometabolic system to treat autoimmune diseases, including DMF (approved for the treatment of multiple sclerosis) and Rapamycin (being studied in aging, rheumatoid arthritis, and other autoimmune diseases). Additional therapies for autoimmune diseases include anti-inflammatory drugs and immunosuppressive agents including drugs that non-selectively inhibit or block TNF-α (generally referred to as “TNF-α blocking drugs”). Currently available TNF-α blocking drugs must be injected or infused to work. In some instances, the efficacy of a given dosage of TNF-α blockers declines with repeated administration, and side effects can also be a concern. These non-selective TNF-α blockers can cause serious bacterial, fungal, and viral infections. MYMD-1 is a selective, oral TNF-α inhibitor that might provide a safer alternative to existing products on the market. The global market for TNF-α blockers was estimated at $41.6 billion in 2020 we agreedand is projected to reach $45.5 billion by 2027.

An in vitro study involving human blood cells analyzed the cytokine inhibitory effects of MYMD-1 together with Premas thatleading approved TNF-α blockers (monoclonal antibodies).

Figure 3. Comparison of inhibitory effect of MYMD-1 with other TNF-α blockers. MYMD-1 exhibits a dose-dependent reduction in release of several cytokine more effectively than Humira, Enbrel and Remicade.

We believe MYMD-1 is distinguishable from currently marketed TNF-α blockers because it selectively blocks TNF-α production related to adaptive immunity (involved in autoimmunity) but spares the fourth milestone under the License Agreement had been satisfied. Due to the achievementrole of this milestonecytokine in innate immunity (which plays a primary protective role in fighting off invading organisms). Because of the crucial role that TNF-α plays in front line protection by the innate immune system (e.g., from bacterial, fungal, and viral infections), the indiscriminate blockade of TNF-α by TNF-α blocking agents can cause serious and even fatal infections, which is one of the primary limiting factors in the use of this class of drugs. Based on July 7, 2020, Premas was paid $1,000,000our belief regarding the selectivity of MYMD-1 in blocking TNF-α, therefore, we intend to explore the extent to which MYMD-1 may be a safer alternative to treat infectious, inflammatory, and autoimmune conditions, as well as its potential to ameliorate immune mediated depression in such illnesses.

| 9 |

Pre-Clinical Study of MYMD-1 in Multiple Sclerosis Study (EAE Mouse Model)

Multiple sclerosis is an autoimmune disease in which T cells lead an attack on August 4, 2020.

Intellectual Property

We have exclusive rights in-licensed from Premas (as discussed above) to certain know-howoligodendrocytes and two provisional Indian patent applications filedneurons. Multiple sclerosis is the leading neurological cause of disability in Januaryadults aged 30–50, and March 2020. The following table summarizes the two provisional Indian patent applications.

As we do not own the patent applications that we in-license, we may need to rely upon Premas to properly prosecute and maintain those and additional related patent applications, and to prevent infringement of any resulting patents.

We have two U.S. registered trademarks for “Akers Bio.”

Government Regulation and Product Approval

Federal, state, and local government authoritiesapproximately one million people in the United States are affected with this debilitating disease. T cells are one of the major components of the adaptive immune system. Their roles include directly killing infected host cells, activating other immune cells, producing cytokines and regulating the immune response. When naïve, undifferentiated T cells become activated, they differentiate and acquire effector functions that can be delineated by the cytokines they secrete.

Preliminary in vivo studies of the therapeutic efficacy of MYMD-1 in the animal model for multiple sclerosis, known as EAE, indicate that MYMD-1 modulates autoreactive T cell activation in a dose-dependent manner, suppresses T cell activation and ameliorates the course of EAE. Further EAE mouse studies suggest that MYMD-1 suppresses the influx of CD4+ T cells into the brain.

Figure 4. Effects of MYMD-1 on the influx of T cells into the CNS early in EAE. To assess the effects of MYMD-1 on the infiltration of T cells into the CNS, mice were immunized and treated with either vehicle control or 25 mg/mouse/day MYMD-1. Ten to 14 days later, mice were perfused and brains collected for analysis. Infiltration was determined by flow cytometry. Analysis of Th1 and Th17 subsets are shown; data compiled from 2 to 3 experiments, n > 3/group per experiment). Student’s t-test was conducted for statistics.

MYMD-1 In Vivo Study of Autoimmune Thyroiditis (NODH.2 Mouse Model)

Thyroiditis or Hashimoto thyroiditis is an autoimmune disease characterized by lymphocytic infiltration of the thyroid gland. It has been shown that tobacco smoking has a protective effect against Hashimoto thyroiditis as tobacco smokers have a lower prevalence of thyroid autoantibodies than non-smokers.

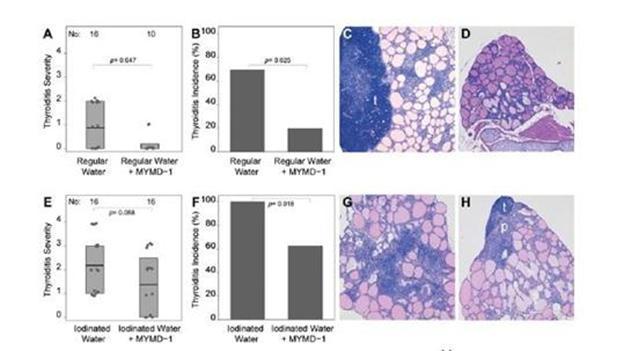

MyMD conducted an in vivo study of autoimmune thyroiditis in a spontaneous thyroiditis (NODH.2) mouse model. We believe the results of this study show MYMD-1’s ability to suppress TNF-α production by CD-4+ T cells in a dose dependent manner. Additionally, the study reported that MYMD-1 statistically decreases the incidence and severity (p <0.001) of thyroiditis in this mouse model. Pre-clinical studies have demonstrated that MYMD-1 ameliorated autoimmune thyroiditis in the thyroiditis mouse model.

| 10 |

Figure 5. MYMD-1 decreases the incidence and severity of autoimmune thyroiditis in NOD.H-2h4 mice, as assessed by H&E histopathology. At 8 weeks old, 58 NOD.H-2h4 mice were divided into regular water and iodinated water groups. In the regular water group, 10 mice (7 M, 3 F) drank water that contained MYMD-1 (185 mg/l), and 16 mice (10 M, 6 F) drank water without it. In the iodinated water group, the water was supplemented with 500 mg/l of sodium iodide and contained (16 mice: 10 M, 6 F) or did not contain (16 mice: 10 M, 6 F) MYMD-1 (185 mg/l). After 12 weeks of treatment, thyroids were removed and divided in half. (A and B) Thyroiditis severity and incidence assessed by histopathology in the regular water group. (C) A representative thyroid from a mouse in the regular water group, showing a severity score of 2. (D) A representative thyroid from a mouse in the regular water group treated with MYMD-1, showing thyroid follicle preservation and an overall normal glandular size (severity score of 0). (E and F) Thyroiditis incidence and severity scores assessed by histopathology in the iodinated water group. (G) A representative thyroid from a mouse in the iodine group, showing marked lymphocytic infiltration, follicular enlargement, and architectural disruption (severity score of 4). (H) A representative thyroid from a mouse in the iodine plus MYMD-1 group (severity score of 2). Results represent the summary of 10 independent experiments, each analyzing 4 to 6 mice, for a total of 58 mice.

MYMD-1 Targets Inflamm-Aging and Related Disorders

Aging is associated with a loss of tight regulation of the immune system. This leads to increased inflammatory activity in the body, including increased circulating levels of TNF-α. Chronic inflammation is a hallmark of aging, referred to as inflamm-aging. Inflamm-aging and chronic inflammation are closely linked to a number of disorders such as obesity, insulin resistance/type 2 diabetes, cardiovascular diseases, and cancers. TNF-α is a multifunctional pro-inflammatory cytokine which may play a part in the pathogenesis of certain age-related disorders such as atherosclerosis. A multi-year pre-clinical, proof of concept in vivo study in aging and longevity confirmed our belief regarding MYMD-1’s potential therapeutic effect on inflamm-aging and other age-related disorders, which we intend to explore further in clinical trials, pending our submission, and the corresponding acceptance, of the requisite regulatory and other relevant submissions.

Bascom Palmer Eye Institute Collaboration

On July 12, 2022, we announced a new collaboration with Bascom Palmer Eye Institute of Miami, Florida (“Bascom Palmer”) to collaborate on a pre-clinical study using MYMD-1 as a potential treatment for traumatic optic neuropathy (TON). To date, our collaboration with Bascom Palmer has included pre-clinical and clinical investigations.

Pre-Clinical

In July 2022 we entered into a Material Transfer Agreement with Bascom Palmer. Our collaboration was announced in a press release and in an article in Ophthalmology Times. Bascom Palmer confirmed in August 2022 that it had received a quantity of our MYMD-1 product candidate and MYMD provided a material safety datasheet and certification of analysis. In August 2022, Bascom Palmer researchers conducted a preliminary introductory study of TON in mice. Investigators ran a crush injury of the mice’s optic nerves with and without MYMD-1. The study drug was given once per day via oral gavage at a dosage of 30 mg/kg of body weight. The mice were treated for five days, untreated for two days, and then sacrificed, and their TNF-α levels were measured. The crush injury raised levels of TNF-α. After being dosed with MYMD, TNF-α levels were brought down in crush injury compared to controls, but the decrease did not meet statistical significance (p=0.095). Likely cause of the result not reaching p<0.05 may be attributed to rebound (e.g. TNF-α levels would have gone up when MYMD-1 stopped; daily dosing may need to me adjusted, crush injury may have been too severe for the medication, and/or possible contribution of ketamine which is an anti-inflammatory. Additional studies are not planned for now.

Clinical

In addition to the pre-clinical study described above, we collaborated with Bascom Palmer to plan a clinical study. In August 2022, Bascom Palmer researchers executed a confidentiality and non-disclosure agreement and Bascom Palmer produced a draft protocol synopsis entitled, Assessment of the Anti-Inflammatory Effects of MYMD-1 in Non-Infectious Anterior Uveitis: A Randomized Controlled, Double Blind Clinical Study. This program is not active.

MYMD-1 Commercialization Targets

MYMD-1 is being developed to address serious and debilitating autoimmune and inflammatory diseases, including sarcopenia, frailty resulting from aging process, and rheumatoid arthritis (RA). According to the U.S. Census Bureau, in 2020, there were approximately 54 million U.S. residents over 65 years of age, representing 16% of the U.S. population. This figure is expected to increase to nearly 22% by the year 2040.1 The Arthritis Foundation estimates that approximately 1.5 million people in the U.S. have RA.2

Supera-CBD

Supera-CBD is a synthetic small molecule that is an analog of naturally grown CBD derived from the Cannabis sativa plant. Supera-CBD is being developed to treat conditions with which CBD is often anecdotally associated but for which no natural or synthetic CBD-containing drugs have been approved by the FDA, such as pain, anxiety/depression and seizures from epilepsy. While naturally grown CBD is a constituent of Cannabis sativa, Supera-CBD is a synthetic analog of CBD, thus eliminating potential complications associated with the psychoactive effects of Tetrahydrocannabinol (“THC”), which is also a constituent of the Cannabis sativa plant. Studies have suggested that CBD may have broad therapeutic properties, including the treatment of neuropsychiatric disorders.

1 U.S. Department of Health and Human Services. 2020 Profile of Older Americans. May 2021 Page 3.

2 The Arthritis Foundation. Rheumatoid Arthritis: Causes, Symptoms, Treatments and More.

| 11 |

Overview

General Pharmacology and Therapeutic Profile

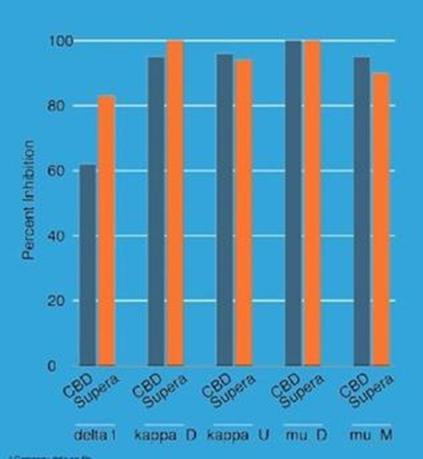

CBD inhibits a number of important receptors, including the CB2 receptor and opioid receptors, and can also inhibit MAO enzymes. In the immune system, one of the important functions of the CB2 receptor is in the regulation of cytokine release from immune cells. Antagonists targeting the CB2 receptor have been proposed for the treatment or management of a range of painful conditions as well as for treating several neurological diseases. The Company conducted an in vitro binding assay study to analyze the CB2 inhibition of Supera-CBD together with that of CBD derived from naturally grown plants.

Opioid receptors are widely expressed in the brain, spinal cord, peripheral nerves and digestive tract. MyMD conducted an in vitro binding analysis of Supera-CBD with the three types of opioid receptors. The profile suggests that Supera-CBD could possibly play a role in treating opioid addiction.

| 12 |

MAOs are enzymes involved in the catabolism, or digestion, of certain neurotransmitters. MyMD conducted an in vitro MAO inhibition study. In this study, Supera-CBD and commercial CBD were analyzed against positive and negative controls. In this study, Supera-CBD far exceeded CBD in dose-dependent inhibition of MAOs, particularly MAO-B. Drugs that inhibit MAOs have been commercially used for decades to treat depression, and more recent studies have suggested MAO-B inhibiting drugs might have a role to play in treating cognitive decline in aging.

Supera-CBD Early-Stage Plans for Development and Potential Commercialization Targets

Supera-CBD is in early-stage development for pain, anxiety, and sleep disorders. There are currently a number of over-the-counter CBD products marketed with unapproved therapeutic claims relating to these conditions, among other conditions. While there are a substantial number of such products on the market that have not been subject to regulatory enforcement action, the FDA has consistently reiterated, in guidance and warning letters against a number of the companies marketing such CBD products for such uses, that CBD products may not be lawfully marketed for therapeutic uses in the United States without first-obtaining FDA approval via the NDA process. CBD product sales in the US reportedly reached $5.3 billion in 2021, 15% growth over 2020 sales, and are projected to reach $16 billion by 2026.3 MyMD believes that if Supera-CBD is approved by the FDA, it may have competitive advantages over currently marketed CBD products that have not been approved by FDA as drug products, as approved drugs must undergo rigorous premarket study and generate results sufficient to support a finding that they are safe and effective for their intended use(s) and remain subject to ongoing FDA postmarket regulation, which provides additional assurances relating to quality, consistency and safety.

Currently, there is one FDA-approved drug with plant-derived CBD as an active ingredient. FDA subsequently approved three other cannabinoid-containing drugs, two of which utilize synthetic cannabinoids analogous or similar to THC as the active ingredient and the other, a combination of synthetic CBD and THC. Epidiolex is being commercialized by GW Pharmaceuticals, plc (“GWPH”) to treat seizures associated with Lennox-Gastaut syndrome or Dravet syndrome in patients two years of age and older. The reported revenues from Epidiolex in fiscal year 2019 were approximately $296 million. MYMD believes that, by utilizing synthetic, rather than naturally derived, CBD in Supera-CBD may mitigate a number of obstacles generally associated with growing and processing an active drug ingredient produced from naturally grown plant extracts.

On March 2, 2023, we announced that the U.S. Drug Enforcement Administration (DEA) has conducted a scientific review and determined that it would not Supera-CBD a controlled substance or listed chemical under the Controlled Substances Act (CSA) and its governing regulations. We believe that this decision will expedite future research involving Supera-CBD by relieving us or our research partners from having to comply with regulations relating to controlled substances.

Sales and Marketing

MyMD does not currently have sales and marketing infrastructure to support the launch of its products. MyMD intends to build such capabilities in North America prior to launch the commercial MYMD-1, if successfully developed and granted the requisite FDA approval. Outside of North America, MyMD may rely on licensing, co-sale and co-promotion agreements with strategic partners for commercialization of its products. If MyMD builds a commercial infrastructure to support marketing in North America, such commercial infrastructure could be expected to include a targeted sales force supported by sales management, internal sales support, an internal marketing group and distribution support. To develop the appropriate commercial infrastructure internally, MyMD would have to invest financial and management resources, some of which would have to be deployed prior to any confirmation that MYMD-1 or Supera-CBD will be approved, which cannot be guaranteed.

Competition

The biotechnology and biopharmaceutical industries are characterized by rapid evolution of technologies, fierce competition and vigorous defense of intellectual property. Any product candidates that MyMD successfully develops and commercializes will have to compete with existing and future new therapies. While MyMD believes that its drug candidates, development experience and scientific knowledge may provide it with certain competitive advantages, MyMD faces potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical and biotechnology companies, academic institutions, governmental agencies, and public and private research institutions.

Existing therapies for autoimmune diseases include anti-inflammatory drugs and immunosuppressive agents, including drugs that seek to selectively inhibit or block TNF-α (generally referred to as “TNF-α blocking drugs”). TNF-α blocking drugs are large molecules that are generally injected or infused. In some instances, the period of efficacy of a given dosage of TNF-α blockers can decline with repeated administration and side effects can be a concern. Leading TNF-α blocking drugs include Etanercept (Enbrel), Infliximab (Remicade), and Adalimumab (Humira). The total TNF-α market collectively represented approximately $41 billion in global sales in 2022.4 All of these existing TNF-α blocking drugs require injection, whereas MYMD-1 is being developed to be orally bioavailable. Our management believes patients and providers would view the fact that MYMD-1 can be administered orally as a significant advantage.

Unlike currently marketed TNF-α blockers, MYMD-1 is designed to selectively block TNF-α production related to adaptive immunity (involved in autoimmunity) but to spare the role of this cytokine in innate immunity (which plays the primary initial role in fighting off invading organisms). Because of the crucial role that TNF-α plays in front line protection by the innate immune system from bacterial, fungal, and viral infections, the indiscriminate blockade of TNF-α by TNF-α blocking agents can cause serious and even fatal infections, which is the primary limiting factor in the use of this class of drugs. MyMD thus believes that, if MYMD-1 is approved for marketing, the potential selectivity of MYMD-1 in blocking TNF-α might make it a preferrable alternative to some existing treatments for infectious, inflammatory, and autoimmune conditions, as well as simultaneously resulting in amelioration of immune mediated depression in such illnesses if it is also approved for such indication.

3 Benzinga: US Hemp CBD Market To Hit $5.3B In Sales In 2021.

4 https://www.thebusinessresearchcompany.com/report/tnf-alpha-inhibitor-global-market-report

| 13 |

Intellectual Property

MyMD’s policy is to develop and maintain MyMD’s proprietary position by, among other methods, filing or in-licensing U.S. and foreign patents and applications related to MyMD’s drug candidates and methods of treatment that are material to the development and implementation of MyMD’s business. MyMD also relies on trademarks, know-how, confidentiality agreements and invention assignment agreements to develop and maintain MyMD’s proprietary position.

MyMD’s patent portfolio includes protection for MYMD’s lead product candidates, MYMD-1 and Supera-CBD. Currently, there are multiple patent families relating to (i) age reversal and treatments of age-related disorders including sarcopenia; (ii) reduction of TNF-α levels and treatments of autoimmune disorders; (iii) addiction treatments; and (iv) methods of increasing hair growth. As of the date of this document, MyMD has 16 issued U.S. patents, three pending U.S. patent applications, 64 issued foreign patents, and 10 foreign patent applications pending in such jurisdictions as Australia, Canada, China, European Union, Israel, Japan and South Korea, which, if issued, are expected to expire between 2036 and 2041.