| x | |||||||||

2023

| o | |||||||||

________________

| Nevada | 8211 | ||||||||||||||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial | ||||||||||||||

Classification Code Number) | (I.R.S. Employer Identification Number) | ||||||||||||||

BOXLIGHT CORPORATION

1045 Progress Circle

Lawrenceville,

Phone: (678) 367-0809

30097

code:

(678)367-0809| Title of each class | Ticker Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.0001 par value | BOXL | The Nasdaq Stock Market LLC | ||||||||||||

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [ ]

| Large accelerated filer | Accelerated filer | ||||||||||||||||

| Non-accelerated filer | Smaller reporting company | ||||||||||||||||

| Emerging growth company | |||||||||||||||||

State

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

quarter was $20,384,326.

9,728,465.

Portions

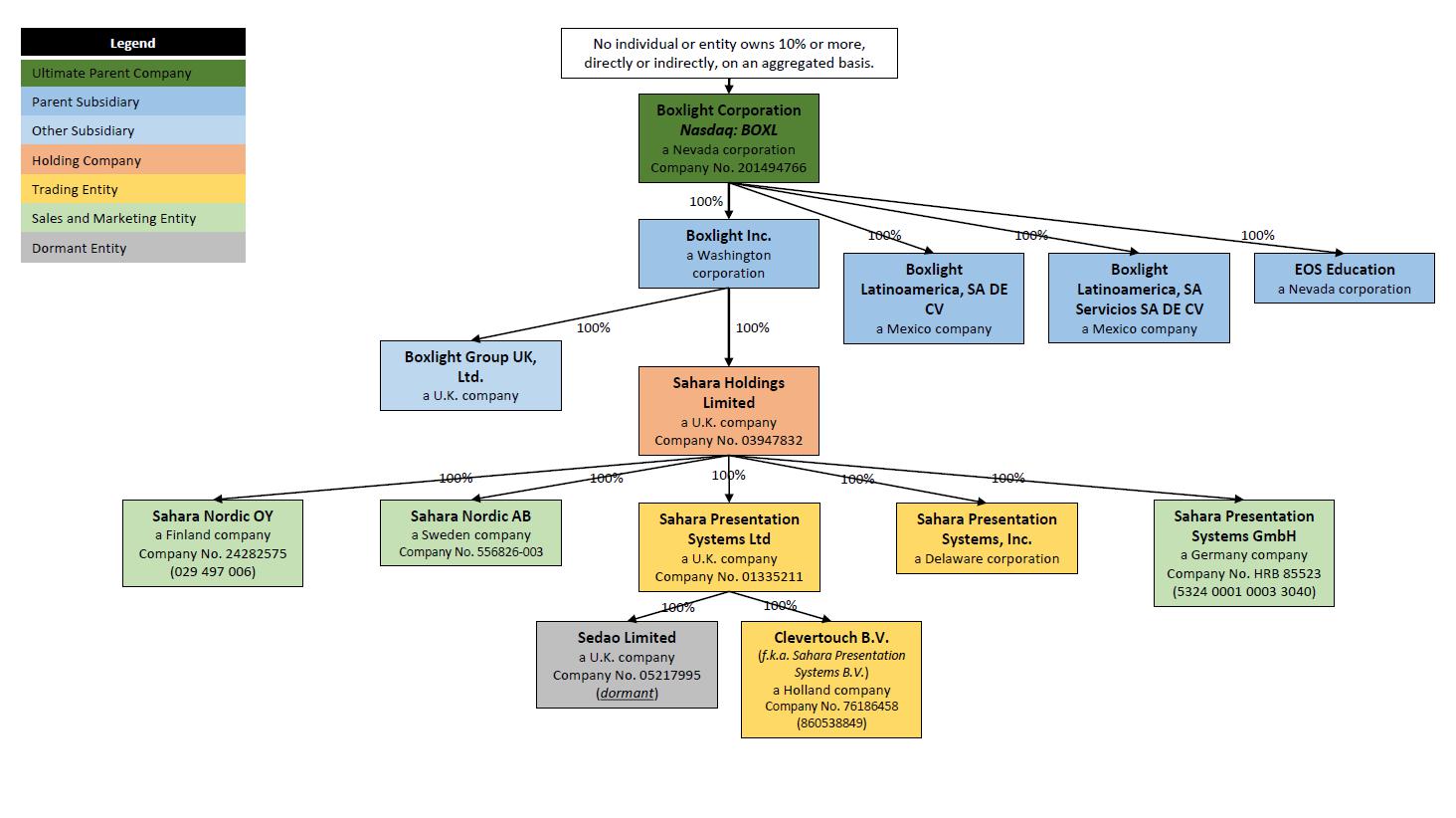

direct and indirect subsidiaries, and the term “Boxlight” refers to Boxlight Inc., a Washington corporation and a wholly owned subsidiary of Boxlight Corporation. The terms “year” and “fiscal year” refer to our fiscal year ending December 31 is not incorporated into, this Annual Report. distributor of interactive technologies and subsequently renamed to Sahara Presentation Systems (Interactive) Europe BV. The company has been our key distributor in Belgium and Luxembourg. education. 2027. We believe highly fragmented allowing the Company to position itself for increased market share in each of these sectors. more IT in their classrooms. We believe this scrutiny will cause there to be increased investment into the education sector. Growth in the E-learning Market Products professional learning, campus wide communication, or any situation where presentation, interaction, or engagement occurs. Pro The presenter has full control over what is shared and can show up to LYNX whiteboarding app to create and capture outcomes, share content, collaborate, and distribute ad-hoc content via cloud services through a dynamic QR code; Clevershare mirroring app used on all models of Boxlight Interactive Flat-Panel Displays that allows teachers to orchestrate up to six simultaneous displays across Windows, Chrome OS, Android and iOS, and casting of the MimioPro 4 to all the devices in a classroom; NDMS (Network Device Management Systems), a cloud-based device management system to remotely manage displays, troubleshoot, message, and schedule; and CleverStore – app store which houses curated Android applications that are safe for teachers to install onto the display. zone-specified communications. to provide the “glue” that integrates the hardware to provide a Connected Classroom; help educators inform their decisions in the classroom, through more systematic data about their students’ performance and behaviors; make learning more engaging, interactive, accessible, and innovative; and support teachers in becoming more efficient in planning, preparation, reporting and analysis, and effective in instruction and assessment. bring vibrancy to their lessons with a built-in media search. In addition, LYNX Whiteboard provides searchable images, GIFs and videos, allowing users to drag content into whiteboard presentations, all in a safe search enabled environment. With teacher favorites, such as Rainbow Pen and Spotlight included, as well as interactive learning tools, LYNX Whiteboard is packed with features to make lessons flow seamlessly. our Clevertouch displays. professional learning experiences are: Turkey. COVID-19 pandemic or any future pandemics; chain in the event of sanctions or shipping embargoes caused by any conflict, war, or pandemics. We use resellers and distributors to promote and sell our products. Regulations Operations Company. We may be exposed to risks relating to evaluations of controls required by Sarbanes-Oxley Act of 2002. approximately $13,000 per month. This warehouse space rental agreement will expire on April 30, 2028. Proceeds Historical results may not indicate future performance. Our forward-looking statements reflect our current views about future events, are based on assumptions and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those contemplated by these statements. We undertake no obligation to publicly update or revise any forward-looking statements, including any changes that might result from any facts, events, or circumstances after the date hereof that may bear upon forward-looking statements. Furthermore, we cannot guarantee future results, events, levels of activity, performance, or achievements. In addition, we offer professional training services related to our technology to our U.S. educational customers. To date, we have generated We have modern classroom. service include third-party products and services and are generally sold separately from the Company’s products. Operating expenses 2022 EMEA markets. revenues. General and Administrative Expense. certain markets. each year. and Adjusted EBITDA equivalents, a working capital balance of $62.8 million, and a current ratio of 2.29. available cash. Our cash requirements consist primarily of day-to-day operating expenses, capital expenditures and contractual obligations with respect to facility will be successful in refinancing its debt, or on terms acceptable to the Company. triggering event had occurred as a result of our market capitalization that suggested one or more of the reporting units may have fallen below the carrying amounts. In addition, changes in our reporting segments resulted in a change in the composition of our reporting units. As a result of these changes, we determined the Company had two reporting units for purposes of testing based upon entities that comprise the Americas and EMEA reporting segments. For purposes of impairment testing, we allocated goodwill to the reporting units based upon a relative fair value allocation approach and assigned approximately $22.4 million and $2.8 million of goodwill to the Americas and EMEA reporting units, respectively. vesting as they occur. the United States of America. this uncertainty. 14, 2024 2022 December 31, 2020 December 31, 2019 thousands except share and per share amounts) 2022 (338 (16,490 (9,402 2022 Closing fees related to public offering Public offering - - 142,857 Other share-based payments Conversion of restricted shares - - - - - (338 Notes to Consolidated Financial Statements any future non-compliance with the Senior Leverage Ratio, or refinance its Credit Agreement with a different lender on more favorable terms. The Company is actively working to refinance its debt with new lenders. While the Company is confident in its ability to refinance its existing debt, it does not have written or executed agreements as of the issuance of this Form 10-K. The Company’s ability to refinance its existing debt is based upon credit markets and economic forces that are outside of its control. We believe we have a good working relationship with our current lender. However, there can be no assurance that the Company will be successful in refinancing its debt, or on terms acceptable to the Company. LOSS EXPECTED CREDIT LOSS 2022. Americas and EMEA reporting units, respectively. December 31, 2023. See Note 10 “Derivative Liabilities” for more information. on a recurring basis. Nature of Products and Services and Related Contractual Provisions Significant Judgments Variable Consideration 2022. December 31, 2020 December 31, 2019 (in thousands) $550,000. TAX to conform to the 2023 presentation. (Unaudited) (in thousands) (Unaudited) (in thousands) (in thousands) 2023 and 2022, respectively. 22,742 Third Amendment. 429,263. 464,385. 2025 and bears 1% interest. 147 2022: TAX : capitalized research and development costs. directors. Each authorized series of preferred stock is described below. Series B Preferred Stock and Series C Preferred Stock The aggregate estimated fair value of the Series B and C Preferred Stock of $28.5 million was included as part of the total consideration paid for the purchase of Sahara. 2022. vesting as they occur. 1.76 2.90 2022: 2023 and 2022. Company’s equity incentive plan. Agreements agreement. 2022. 2022. the Board. Management’s Report on Internal Control Over Financial Reporting effective, including: 14, 2024Page Description of Business4Item 1A173131313232324344454546444747474748SIGNATURES53Operations)Operations, the "Annual Report") contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.●our possible or assumed future results of operations;●our business strategies;●our ability to attract and retain customers;●our ability to sell additional products and services to customers;●our cash needs and financing plans;●our competitive position;●our industry environment;●our potential growth opportunities;●expected technological advances by us or by third parties and our ability to leverage them;●Our inability to predict, adapt to, or anticipate the duration or long-term economic and business consequences of the ongoing COVID-19 pandemic;●the effects of future regulation; and●our ability to protect or monetize our intellectual property.SEC.Securities and Exchange Commission (the "SEC"). Actual events or results may vary significantly from those implied or projected by the forward-looking statements due to these risk factors. No forward-looking statement is a guarantee of future performance. You should read this Annual Report, on Form 10-K, the documents that we reference in this Annual Report on Form 10-K and the documentation we have filed as exhibits thereto with the Securities and Exchange Commission, or the SEC, with the understanding that our actual future results and circumstances may be materially different from what we expect.reportAnnual Report refer to Boxlight Corporation and its consolidated subsidiaries.DESCRIPTION OF BUSINESSwhich are also sold intofor the health,corporate and government and corporate sectors. We are seeking to become a worldwide leading innovator and integrator of interactive products and software for schools, as well as for businesssolutions and government learning spaces.improve collaboration and effective communication in meeting environments. We currently design, produce and distribute interactive technologies including flat panels, projectors, whiteboardsour interactive and non-interactive flat-panel displays, LED video walls, media players, classroom audio and campus communication, cameras and other peripherals for the education market and non-interactive solutions including flat-panels, LED video walls and digital signage for the Enterprise market. We also distribute science, technology, engineering and math (or “STEM”) products, including our 3D printing and robotics solutions, and our portable science lab. All of our products are integrated into our classroom software suite that provides tools for whole class learning, assessment and collaboration. In addition, we offer professional training services related to our technology to our U.S. educational customers. To date, we have generated substantially allthe majority of our revenue in the U.S. and internationally from the sale of our software and interactive displays and related software to the educational market. In EMEA approximately 75% ofWe have sold our revenues relate to the education sector and the remainder comes from health, government and corporate including the banking and financial services sector.In the education sector we provide educators with hardware, engineering and manufacturing, software and content development for use in the classroom. We provide comprehensive services to our clients and customers, including installation, training, consulting and maintenance. We seek to provide easy-to-use solutions combining interactive displays with robust software to enhance the educational environment, ease the teacher technology burden, and improve student outcomes. Our goal is to become a single source solution to satisfy the needs of educators around the globe and provide a holistic approach to the modern classroom. Our products are currently sold in approximately 60into more than 70 countries and our software is available in 32 languages, helping children learn in over 850,000 classrooms.into more than 1.5 million classrooms and meeting spaces. We sell our products and software through more than 5001,000 global reseller partners. We believe we offer the most comprehensive and integrated line of interactive display solutions, audio products, peripherals and accessories, software and professional development for schools and enterprises. Ourenterprises on the market today. The majority of our products are backed by nearly 30 years of research and development. We introduced the world’s first interactive projector in 2007obtained patents to the technology in 2010.thehigher demand for video, as well as control cloud and data storage challenges. Our design teams are able to quickly customize systems and configurations to serve the needs of clients so that existing hardware and software platforms can communicate with one another. We have created plug-ins for annotative software that make existing and legacy hardware interactive and allows interactivity with or without wires through our MimioTeach product. Our goal is to become a single source solution to satisfy the needs of educators around the globe and provide a holistic approach to the modern classroom.●In 2020, UX Pro won Collaboration Innovation of the Year from AV News Awards, Best in Show for InfoComm Awards and AvTechnology Europe Best of Show at ISE> IMPACT Plus won Innovation Design, high-quality, functionality, ergonomics and ecology from Plus X Awards in Germany, Collaboration Innovation from AV News Awards, Best in Show at InfoComm from Tech & Learning magazine, Best at Show at InfoComm from Installation magazine and Best at ISE Show from Installation.In 2019, Clevertouch won Interactive Display of the Year at AV Magazine’s AV Awards, Keiba Awards, Best of Show from Installation and best of Show for IMPACT Plus at Best of Show Tech&Learning awards, as well as the Pro Series Technology for Conferencing and Collaboration at the Innovation Awards, and the AV Display Innovation of the Year at the AV News Awards●In 2018, Clevertouch won Best in Show for InfoComm from Tech&Learning magazine and Collaboration Product of the Year for Plus Series, as well as the Collaboration Product of the Year for Pro Series and Marketing Professional of the Year for Adam Kingshott.●In 2017, Clevertouch’s Plus Series won Interactive Screen of the year at AV Magazine’s AV Awards. Our MimioStudio with MimioMobile BETT Awards finalist in the tools for teaching, learning and assessment area, our Labdisc product was named Best of BETT 2017 for the Tech & Learning award, won the Best in Show at TCEA and our P12 Projector Series won the Tech & Learning best in show award at ISTE in 2017,●In 2016, Clevertouch won Interactive Screen of the Year at AV Magazine’s AV Awards with Plus Series. Our MimioMobile App with Mimio Studio Classroom Software won the 2016 Cool Tool Award and we received the 2016 Award of Excellence for our MimioTeach at the 34th Tech & Learning Awards of Excellence program honoring new and upgraded software.●In 2015, Clevertouch won manufacturer of the Year at AV Magazine’s AV Awards.Since the Company launched its patented interactive projectors in 2007, we have sold them to public schools in the United Statesscreen mirroring software. At the 5th annual EdTech Breakthrough Awards, Boxlight received Best Technology Solution for Student Safety. Boxlight won 9 Tech and Learning Best for Back to School Awards for its MimioWall, MimioDS, MyBot Recruit, IMPACT Lux and Teacher Action! Mic., while Clevertouch by Boxlight won signage Technology of the Year for the CleverLive products.49 other countries, as well asthe EdTech Breakthrough Awards, Tech and Learning Best of Show for ISTELive 22, multiple awards from Tech & Learning’s Back to the DepartmentSchool Awards of Defense International Schools,Excellence, 4 awards for new products from THE Journal, multiple awards from Tech and in approximately 3,000 classrooms in 20 countries, including the Job Corp, the Library of Congress, the CentersLearning for Disease ControlMimio, Clevertouch and Prevention, the Federal Emergency Management Agency, nine foreign governmentsFrontRow solutions and the CityCampus Technology New Product of Moscowthe Year award for CleverLive digital signage.numerous Fortune 500 companies, including Verizon, GE Healthcare, Pepsico, First Energy, ADT, Motorola, First DataSecondary levels for: MimioConnect® blended learning platform, MimioSTEM solutions, Boxlight‐EOS Professional Development Learning Solutions, and Transocean. In addition, we custom built 4,000 projectorsour ProColor interactive flat-panel. Clevertouch was awarded for Best Business Growth and Corporate Social Responsibility by Inavation Awards and 4 AV Awards for Product, Manufacturer, Distributor, and Channel Team of the Israeli Defense Forces.The COVID-19 pandemic has had a significant impact on economies worldwide, resulting in workforce and travel restrictions, and supply chain and production disruptions across many sectors. While factors have had a significant impact on our supply chain, the financial performanceYear.fivefour subsidiaries, consisting of Boxlight Inc., a Washington State corporation, Sahara Holdings Limited, an England and Wales corporation ("Sahara"), Boxlight Latinoamerica, S.A. DE C.V.(“BLS”) and Boxlight LatinamericaLatinoamerica Servicios, S.A. DE C.V., (“BLA”), both BLS and BLA are incorporated in Mexico,Mexico. BLS and BLA are currently inactive. Our Sahara Holding Limited subsidiary has eight directly and indirectly owned subsidiaries located in the United States, the United Kingdom, the Netherlands, Belgium, Sweden, Finland and Germany, and our subsidiary Boxlight Group UK Ltd.Inc., in turn, has six directly and indirectly owned subsidiaries located in the United States, Australia, Northern Ireland, Canada and Denmark.the UK,Belgium and EOSEDU, LLC, a Nevada limited liability company.the Companywe acquired Sahara Presentation Systems PLC,Sahara., a leader in distributed AV products and a manufacturer of multi-award winningmulti-award-winning touchscreens and digital signage products, including the globally renowned Clevertouch and Sedao brands.brand. Headquartered in the United Kingdom, Sahara hasand its subsidiaries have a strong presence in the EMEA interactive flat panelflat-panel display (IFPD) market selling into Education, Health, Government, Militaryeducation, health, government, military and Corporatecorporate sectors.Boxlight Inc.we acquired substantially all the assets and assumed certain liabilities of MyStemKits Inc. (“MyStemKits”). MyStemKits is in the business of developing, selling and distributing 3D printable science, technology, engineering and math curriculums incorporating 3D printed project kits for education, and owns the right to manufacture, market and distribute Robo 3D branded 3D printers and associated hardware for the global education market.Effectivethe Company entered into an asset purchase agreement withwe acquired Modern Robotics Inc. (MRI)(“MRI”), a company based in Miami, Florida. MRI is engaged in the business of developing, selling and distributing science, technology, engineering and math (STEM), robotics and programming solutions to the global education market. 100% of the membership interest equity of EOS, an Arizona limited liability company owned by Daniel and Aleksandra Leis. EOS is in the business of providing technology consulting, training, and professional development services to create sustainable programs that integrate technology with curriculum in K-12 schools and districts.Effectivepursuant to a stock purchase agreement, Boxlight Corporation acquired 100% ofits subsidiary Qwizdom UK Limited (together, the capital stock of the Qwizdom Companies.“Qwizdom Companies”). The Qwizdom Companies develop software and hardware solutions that are quick to implement and designed to increase participation, provide immediate data feedback, and, most importantly, accelerate and improve comprehension and learning. The Qwizdom Companies have offices outside Seattle, WA and Belfast, Northern Ireland and deliver products in 44more than 40 languages to customers around the world through a network of partners. Over the last three years, over 80,000 licenses have been distributed for the Qwizdom Companies’ interactive whiteboard software and online solutions.and pursuant to a stock purchase agreement, we acquired 100% of the share capital of Cohuborate, Ltd., a United Kingdom corporation based in Lancashire, England. Cohuborate produces, sells and distributedistributes interactive display panels designed to provide new learning and working experienceexperiences through high-quality technologies and solutions through in-room and room-to-room multi-device multi-user collaboration. Although a development stage company with minimal revenues to date, we believe that Cohuborate will enhance our software capability and product offerings.IncInc. with and into Boxlight, Inc. August 31, 2018, we purchased 100% of the membership interest equity of EOSEDU, LLC, an Arizona limited liability company owned by Daniel and Aleksandra Leis. EOSEDU is in the business of providing technology consulting, training, and professional development services to create sustainable programs that integrate technology with curriculum in K-12 schools and districts.Effective July 18, 2016, we acquired BLA and BLS (together, “Boxlight Group”). The Boxlight Group sells and distributes a suite of patented, award-winning interactive projectors that offer a wide variety of features and specifications to suit the varying needs of instructors, teachers and presenters. With an interactive projector, any wall, whiteboard or other flat surface becomes interactive. Images that have been created through the projected interactive surface can be saved as computer files.Effective May 9, 2016, we acquired Genesis.Genesis Collaboration LLC, a Georgia limited liability company (“Genesis”). Genesis, is a value-added reseller of interactive learning technologies, selling into the K-12 education market in Georgia, Alabama, South Carolina, northern Florida, western North Carolina and eastern Tennessee. Genesis also sells ourEffectiveMimio.Mimio LLC, a Delaware limited liability company (“Mimio”). Mimio designs, produces and distributes a broad range of Interactive Classroom Technology products primarily targeted at the global K-12 education market. Mimio’s core products include interactive projectors, interactive flat panelflat-panel displays, interactive touch projectors, touchboardstouch boards and MimioTeach, which can turn any whiteboard interactive within 30 seconds. Mimio’s product line also includes an accessory document camera, teacher pad for remote control and an assessment system. Manufacturing is by ODMs and OEMs in Taiwan and Mainland China. Mimio products have been deployed in over 600,000 classrooms in dozens of countries. Mimio’s software is provided in over 30 languages. Effective October 1, 2016, Mimio LLC was merged into our Boxlight Inc. subsidiary.For a description of the terms of our acquisitions of Sahara, Cohuborate, the Qwizdom Companies, EOSEDU and the acquisitions of the assets of Modern Robotics and MyStemKits, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Recent Acquisitions” elsewhere in this Annual Report.