UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

MARK ONE:

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year ended December 31 2020, 2023

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-30256

WORLD HEALTH ENERGY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 59-2762023 | |

(State or other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| 1825 NW Corporate Blvd. Suite 110, Boca Raton, FL | 33431 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(561) (561) 870-0440

(Registrant’s telephone number, including area code)

Securities registered under Section 12 (b) of the Exchange Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

| N/A | N/A | N/A |

Securities registered under Section 12 (g) of the Exchange Act: Common Stock, par value $0.0007

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] ☐ No [X] ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] ☐ No [X] ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] ☒ No [ ]☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] ☐ No [X] ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer | ||

| Non-accelerated filer | Smaller reporting company | ||

| Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ]☐ No [X]☒

As of April 10, 2021, 89,789,407,99614, 2024, there were shares of the registrant’s common stock, par value $0.0007$0.00001 per share, were outstanding. The aggregate market value of the common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2020)2023) was approximately $2.6 million,$8,414,607, as computed by reference to the closing price of such common stock on OTC Market on such date.

2020 ANNUA L2023 ANNUAL REPORT (SEC FORM 10-K)

INDEX

Securities and Exchange Commission

Item Number and Description

| 2 |

CAUTIONARY NOTE REGARING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains information that includes or is based upon forward-looking statements regarding our business, financial condition, results of operations and prospects.statements. The Securities and Exchange Commission (the “SEC”) encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This Quarterly Report on Form 10-Q and other written and oralThese statements often can be identified by the fact that we make from timethey do not relate strictly to time contain such forward-looking statements that set out anticipated results based on management’s plans and assumptions regarding future eventshistorical or performance. We have tried, wherever possible, to identify such statements by usingcurrent facts. They typically use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “should,” “will” and similar expressions with similar meaning in connection with any discussion of the Company’s future operating or financial performance. In particular, these include

Forward-looking statements relatingare not guarantees of future performance. Any or all forward-looking statements may turn out to future actions, future performancebe incorrect, and actual results could differ materially from those expressed or results ofimplied in forward-looking statements. Forward-looking statements are based on current and anticipated sales efforts, expenses, the outcome of contingencies, such as legal proceedings, and financial resultsexpectations and the effects of the COVID-19 pandemiccurrent economic environment. They can be affected by inaccurate assumptions or any similar pandemic.by known or unknown risks, uncertainties and other factors that are difficult to predict.

We caution that these factors could cause our actual results of operations and financial condition to differ materially from those expressed in any forward-looking statements we make and that investors should not place undue reliance on any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time, and it is not possible for us to predict all of such factors. Further, we cannot assess the impact of each such factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

We assume no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect subsequent events or circumstances or actual outcomes.

The following discussion should be read in conjunction with our unaudited financial statements and the related notes that appear elsewhere in this QuarterlyAnnual Report on Form 10-Q10-K as well as our other SEC filings.

| 3 |

Overview

World Health Energy Holdings Inc. (“we” “us” “our”WHEN” or the “Company” or “WHEN”“us” ) was incorporated on May 21, 1986is primarily engaged in the state of Delaware. WHEN is a diversified energy, health,global telecom and cybersecurity technology company with corporate offices that are located in Boca Raton, Florida and Ramat Gan, Israel.

field. On April 27, 2020, WHEN completed a reverse triangular merger pursuant to the Agreement and Plan of Merger (the “Merger Agreement”)Agreement among the Company, R2GA, Inc., a Delaware corporationUCG, SG, and a wholly owned subsidiary of the Company (“Sub”), UCG, Inc., a Florida corporation (“Seller”), SG 77 Inc., a Delaware corporation and wholly-owned subsidiary of Seller (“SG”), and RNA Ltd., an Israeli company and a wholly owned subsidiary of SG (“RNA”).RNA. Under the terms of the Merger Agreement, R2GA merged with and into SG, with SG remaining as the surviving corporation and a wholly-owned subsidiary of the Company (the “Merger”).Company. The Merger became effective as of April 29, 2020, upon the filing of a copy of the Merger Agreement and certificate of merger with the Secretary of State of the State of Delaware, whereby SG became a direct and wholly owned subsidiary of the Company and RNA indirect wholly owned subsidiary of the Company.27, 2020. Each of Gaya Rozensweig and George Baumeohl, directors of the Company, are also the sole shareholders and directors of UCG.

RNA is primarily a research and development company that has been performing software design services in the field of cybersecurity. SG is primarily engaged in the marketing and distribution of cybersecurity related products. In anticipation of the transaction contemplated under the Merger Agreement, SG was formed and all of the cybersecurity rights and interests held by UCG, including the share ownership of RNA, were assigned to SG.

Following the closing, each of SG 77 and RNA became wholly-owned subsidiaries of the Company.

OverviewAcquisition of CrossMobile

TheOn March 22, 2022 the Company, through SG and RNA, is primarily engaged in data security and analytics and provides intelligent security software and services to enterprises and individuals worldwide The Company leverages artificial intelligenceCrossMobile Sp z o.o., a company formed under the laws of Poland (“AI”CrossMobile”) and machine learningthe shareholders of CrossMobile (of which our CEO, Giora Rosenzweig, holds 40.67% and George Baumeohl, a director, holds 3.33%, of the issued preferred share capital of CrossMobile), entered into an Investment Agreement (the “Agreement”) pursuant to deliver innovative solutionswhich the Company purchased in July 2022 an initial 26% equity stake of the areasoutstanding common share capital of cybersecurity, safety focusingCrossMobile on a fully diluted basis, in consideration of the areasissuance by the Company to CrossMobile of endpoint security, endpoint management and encryption.

As10,000,000,000 restricted shares of Company . In addition, for 18 months following the digital transformationdate of enterprises continuesthe Agreement, the Company has the option to advance, workforces are becoming more dispersed and mobile, and data and applications are increasingly migratingpurchase additional shares of CrossMobile, (the “Additional Share Purchase Option”), such that following such additional purchase, the Company shall hold approximately 51% of CrossMobile’s outstanding share capital on a fully diluted basis. On October 25, 2022, the Company exercised the Additional Share Purchase Option to the cloud. As partacquire such additional shares of this trend, the number of connected endpoints is growing rapidly, as is their complexityCrossMobile and the volumeCompany now holds approximately 51% of data that they processCrossMobile’s outstanding share capital on a fully diluted basis and store. These endpoints, which include smartphones, laptops, desktops, servers, vehicles, industrial equipment and other connected devices inproportionally voting rights. In consideration for the Internet of Things (“IoT”), are increasingly a target for cyber adversaries. The COVID-19 pandemic has accelerated the decentralizationexercise of the workplace prompting many enterprisesAdditional Share Purchase Option, the Company issued to shift to substantially remote andCrossMobile an additional 10,000,000 shares of the Company’s common stock.

CrossMobile provides public mobile work models. At the same time, the threat environment has become increasingly hostile as the number of adversaries grows and the scale and sophistication of their attacks, increasingly focused on the endpoint, continue to develop.

The landscape of increasing vulnerability has created opportunities for secure communications platforms, endpoint cybersecurity and management solutions, analytic tools and relatedtelephone services that help enterprises and individuals to secure their connected endpoints.

Our software specializes in data protection, threat detection and response. Our Product offerings enable enterprises to protect data stored on premises and in the cloud, confidential data belonging to customers, financial records, strategic and product plans and other intellectual property and, on a parental or guardian level, to monitor minor children’s cyber activities.

Our product offering, built on proprietary technology, helps enterprises protect data against cyberattacks from both internal and external threats. Our products enable enterprises to analyze data, account activity and user behavior to detect attacks and prevents or limits unauthorized use of sensitive information and prevents potential cyberattacks and limits others by automatically locking down data, allowing access to those who need it. Our products efficiently sustain a secure state with automation and address additional important use cases including data protection, data governance, compliance, data privacy, classification and threat detection and response.

Strategy

Europe, (without its own radio infrastructure) We believe that the technology underlyingacquisition of CrossMobile provides an opportunity in our evolution and provides us with a strong foothold in the European mobile telecom market.. CrossMobile is planning to roll-out a comprehensive suite of value-added services for B2B and B2C customers in the telecom industry.

With our involvement in CrossMobile, we expect to provide advanced cybersecurity solutions and other next-generation value-added services to CrossMobile’s future product offerings.

The global telecom services market size was valued at USD $172.32 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030 1. The global cyber security market size is projected to grow from billion in 2023 to $424.97 billion in 2030, at a CAGR of 4.51%2 during the forecast years. By combining the telecom focus with our existing cyber security product offering, our plan is our primaryto bring to market a new standard of service in value added telecom and security solutions for B2B and B2C customers alike.

Through March 31, 2024, CrossMobile signed up approximately 2,000 paying subscribers, including B2B and B2C subscribers. CrossMobile intends during the next 12 months to build a strong telecom brand empowered by ‘state of the art’ technology, competitive advantage. The strength of our solution is driven by severalpricing and a product mix including proprietary technologiesAI and methodologies that we have developed, coupled with how we have combined them into our highly versatile platform. These advantages enable our end users toWHEN’s cybersecurity solutions.

| 4 |

The Company’s go-to-market strategy focuses principally on generating revenue from software, services and licensing. The Company intends to drive revenue growth and to achieve margins that are consistent with thoseAcquisition of other enterprise software companies.Instaview

We intend to sell substantially allOn Feb. 26, 2023 we completed the acquisition of our products and services to distributors and resellers, which will sell to end-user customers, which we refer to in this report as our customers.

We believe that the COVID-19 pandemic, which continues to impact allan initial 26% of society has increased our long-term opportunity to help our customers protect their data and detect threats. Companies around the world now have employees working remotely from potentially vulnerable home networks, accessing critical on-premises data storages and infrastructure through VPNs and sharing information in cloud data stores. We believe this trend is likely to continueInstaview Ltd. (“Instaview”), an emerging technology company in the long-termfield of AI-based image processing systems, thermal cameras, home and that we are striving to capitalize onenterprise security, livestock tracking and control appliances plus much more.

Instaview is engaged in the opportunity ahead.field of image processing systems and thermal cameras. Over the past 18 years, Instview has provided innovative security and managing solutions in hundreds of projects in Israel and overseas.

The implementationDuring the fourth quarter of our strategies is subject to our raising significant cash resources to,2023, the company amortized its investment in InstaView and recorded an impairment charge of which no assurance can be provided that we will be successful in raising the needed capital on commercially reasonable terms. As of the date of this report, we have no commitments for any capital raise.$151,015.

P

1 Grand View Research, from https://www.grandviewresearch.com/industry-analysis/global-telecom-services-market

2 https://www.fortunebusinessinsights.com/industry-reports/cyber-security-market-101165

roductCombined WHEN Product Offerings

Our Productproduct offerings are comprised of twothree complementary segments, onenamely

| 1. | Cyber Care, which is the long standing and core business segment of WHEN | |

| 2. | AI based image processing systems such as audio-video systems and security cameras solutions being an off-line extension of the on-line Cyber Care services entered through the acquisition of 26% shares in Instaview | |

| 3. | Mobile telecom GSM which is a new business segment, linking the off and on line business segments entered through the recent acquisition of CrossMobile |

All three are targeting for commercial enterprises (B2B) and one for the individual users (B2C).

Cyber Care

B2B Offerings—TheOur B2B Cybersecurity system software development and implementation program focusedfocuses on developing a threat management software that provides innovative solutions for the constantly evolving cyber challenges of businesses, non-governmental organizations (NGO’s) and governmental entities.

We recentlyIn 2021 we launched OTOGRAPH, our comprehensive cybersecurity and information security system, to enable business enterprises to monitor, analyze and prevent suspicious or harmful behavior on corporate networks and connected devices. The OTOGRAPH is designed to analyze and prevent internal or external abuse or abnormal activity on enterprise devices, such as PCs, mobile phones, servers or any other OS-based IOT device.operating system (OS)-based Internet of things (IOT) devices. IoT devices are the nonstandard computing devices that connect wirelessly to a network and have the ability to transmit data.

The rapid transition to open and cloud-based remote workforce has exposed businesses and organizations across the world to higher risks of cyber-attacks and information security breaches. To enable businesses to better protect their data and workflow, we developed a Business Behavioral Analysis (BBA) system that enables business leaders to track all activity from any given location on a one-stop dashboard. Developed over the past two years, OTOGRAPH provides aggregated data and a wide variety of real-time analytics such as real time monitoring of online behavior, applications and system behavior, data breaches, internal and external connections analytics, productivity analysis and psycholinguistic analysis. Corporations and organizations can then use the dashboard to detect suspicious human or device activities that put their company at risk.

OTOGRAPH was developed based on based on a state of the art intelligence technology combined with AI technology that processes and analyzes massive amounts of behavioral and communication data and enables organizations to make real time accurate preventive assessments and decisions to protect company assets and ensure operational efficiency.OTOGRAPH deploys a unique Business Behavioral Analysis (BBA) machine learning software. Behavioral digital data is extracted from all endpoint devices that are connected to the company’s network infrastructure – whether physically, wirelessly or remotely. The data is processed and analyzed to learn and to reveal the unique digital behavioral pattern of the organization as a whole and of every endpoint or individual.

OTOGRAPH then sets baselines of normal patterns for each, and constantly searches for anomalies – deviations from those expected patterns. The anomalies are detected automatically and instantly, categorized by their type and generate push alerts which are sent to the business leader’s dashboard and enabling him to respond to the threat.

OTOGRAPH is continuously learning and calibrating the normal patterns and their thresholds to minimize the number of false alarms and constantly adapt to the changing needs of organizations in real time.

B2C Cybersecurity —The Our B2C Cybersecurity division targets families concerned with external cyber threats and exposures in addition to monitoring a child’s behavioral patterns that may alert parents to potential tragedies caused by cyber bullying, pedophiles, other predators, and depression.

B2C

SG’s Parental System offers a comprehensive solution which is designed to enable parents wishing to observe their children’s online and offline behavior to learn if they are accessing inappropriate websites and content and/or to protect them from a range of threats including cyberbullying, pedophiles and other predators and identity theft.

The Parental System line is positioned as the “ultimate parental cyber solution”. This system incorporates a range of features enabling parents to view and manage their children’s phones.Android phones and devices. The key elements of our proprietary solutions include the following: analysis of all incoming and outgoing written data; analysis of all incoming and outgoing audio communication; real time location tracking; environmental surroundings analysis; and cyber activity analysis.

The Parental System has similar features to those of the B2B yet tailored to fit the needs of parents and guardians to protect their children. Such variations focus on online behavioral patterns whether vocally, via SMSshort message service (“SMS”) or social media platforms. If there is a change in behavior patterns, the product is designed to immediately send the parent or adult guardian an alert. For example, as stated in several international reports, one of the identifiable indicators before suicide is social withdrawal, something which today appears as a significant decrease in text message exchanges. The system categorizes this decrease as a red flag. Moreover, there are certain words and phrases which increase in use prior to suicide which the system will detect these it will put them in the red flag category.*

* https://www.mayoclinic.org/healthy-lifestyle/tween-and-teen-health/in-depth/teen-suicide/art-20044308

While analyzing voice calls based on; tone of speech, lengths of the conversation and the frequency of calls, Parental System Analytics is capable of identifying changes in behavioral patterns and flagging these changes. For example, studies showed that with deteriorating mental health, the frequency of calls decreases and the sentences along with the length of the conversations get shorter. Any such discrepancy in behavior patterns will send a real time alert to the parent or legal guardian, potentially avoiding a tragedy.

Strategy Cyber Care: We believe that the technology underlying our product offering is our primary competitive advantage. The strength of our solution is driven by several proprietary technologies and methodologies that we have developed, coupled with how we have combined them into our highly versatile platform incl. the mobile telecom platform discussed below. These advantages enable our end users to

| ● | Prevent trade secret and data leakage; | |

| ● | Protect against hackers; | |

| ● | Minimize loss of productivity; |

| 6 |

| ● | Detect embezzlements and thefts; | |

| ● | Defend employees from harassments; | |

| ● | Prevent talent and client poaching; | |

| ● | Avoid human errors; | |

| ● | Develop a new level of decision-making ability based on accurate and real-time data; and | |

| ● | Assist parents and legal guardians in monitoring their minor children’s’ cyber online activities. |

The Company’s go-to-market strategy focuses principally on generating revenue from software, services and licensing. The Company intends to drive revenue growth and to achieve margins that are consistent with those of other enterprise software companies.

We currently intend to sell substantially all of our products and services to distributors and resellers, which will sell to end-user customers, which we refer to in this report as our customers.

The implementation of our strategies is subject to our raising significant cash resources, of which no assurance can be provided that we will be successful in raising the needed capital on commercially reasonable terms. As of the date of this prospectus, we have no commitments for any capital raise.

Mobile telecom GSM

Following the first step, our next planned strategy is to add the advanced B2B and B2B Cyber Care bundled with the audio-video systems and security cameras solution and offer them as an integrated part of our GSM solutions. This will give our B2B the possibility to use the AI and BBA as a tool to increase not only security but as well efficiency in sales organizations where soft skills, emotions and personal relations are crucial.

In respect to the B2C market our strategy is to give families a tool to protect their assets and entire households in particular kids or pets and evenelderly members being fragile newcomers in the world of e-commerce, on-line banking and on-line dating.

The third step expected to be initiated in fourth quarter of 2024 in is to copy and paste the same scenario of combining Cyber Care and Mobile Telecom to other selected markets in North Africa, the USA and Europe.

| 7 |

Product and Sales strategy

CrossMobile will rollout the safest online communication highway in the world with stops where you buy

| ● | off-the-shelf, | |

| ● | modular | |

| ● | self-configurable |

value-added services such as

| a. | Private Care (WHEN solutions) |

| a. | Kid protection | |

| b. | Boost learning capability of you kids by making them feel safe online | |

| c. | Senior citizen protection against e-criminals | |

| d. | Mental Health monitoring | |

| e. | Sleep monitoring and apnea treatment | |

| f. | Secure online sessions with psychologist | |

| g. | Health insurance |

| b. | Internet of Things for Intelligent homes (Instaview solutions) |

| a. | Camera | |

| b. | Access control, | |

| c. | Electricity control | |

| d. | Smoke detection | |

| e. | Pet band with sim card | |

| f. | Home insurance |

| c. | Secure Business everywhere (WHEN solutions / in cooperation with local partner) |

| a. | Encrypted calls | |

| b. | Monitoring Calls by Virtual Number for marketing and selling products | |

| c. | Cloud IP PBX | |

| d. | IVR services | |

| e. | Virtual Conference rooms and calls | |

| f. | SMS for Business (API), Bot SMS, verification SMS | |

| g. | Protect your business ideas in the world of e-commerce | |

| h. | Outsmart the digital intruder | |

| i. | Business insurance |

| d. | Travel Services (in cooperation with local partner) |

| a. | Roaming | |

| b. | Travel insurance |

| e. | Financial service (in cooperation with local partner) |

| a. | Currency exchange |

| f. | OTOGRAPH Cybersecurity (WHEN solutions) |

| a. | Employee monitoring | |

| b. | Employee surveys with soft data analysis | |

| c. | Customer interaction profiling | |

| d. | Emotional intelligence navigator | |

| e. | Fence against digital intruder | |

| f. | Business insurance |

| g. | Asset Management (Instaview solutions) |

| a. | GPS tracker on assets in transport and remote locations |

| 8 |

That will meet demanding and ever-changing needs of customers, from large enterprises to individual consumer providing opportunities for rapid top-line growth.

The key word in all sales activities is “cross-selling”

Sales and Marketing

We currently license the vast majority of our products and services thru a global network of resellers and distributors that we refer to as our channel partners. In addition, we maintainOnly CrossMobile has a highly trained professionaldedicated direct sales force that is responsible for overall market development, including the management of the relationships with our channel partners and supporting channel partners in winning customers through product demonstrations and risk assessments.strategy. Our channel partners identify potential sales targets, maintain relationships with customers and introduce new products to existing customers. Sales to our channel partners are generally subject to our standard, non-exclusive channel partner agreement.

Research and Development

Our research and development efforts are focused primarily on improving and enhancing our existing products, as well as developing new products, features and functionality. Use of our products has expanded from data governance into areas such as data security, privacy, accessibility and retention, and we anticipate that customers and innovation will drive functionality into additional areas. We regularly release new versions of our products which incorporate new features and enhancements to existing ones. We conduct substantially all of our research and development activities in Israel, and we believe this provides us with access to world-class engineering talent. In addition, we continue to seek opportunities to extend our technological capabilities and grow our business from strategic technological tuck-in acquisitions.

Our research and development expense was $263,534 and $489,210 in 2019 and 2020, respectively.

Intellectual Property

We attempt to protect our technology and the related intellectual property under trade secret laws, confidentiality procedures and contractual provisions. No single intellectual property right is solely responsible for protecting our products. The nature and extent of legal protection of our intellectual property rights depends on, among other things, its type and the jurisdiction in which it arises. We currently have no issued patents.

We rely on our unpatented proprietary technology and trade secrets. We generally enter into confidentiality agreements with our employees, consultants, service providers, vendors and customers and generally limit internal and external access to, and distribution of, our proprietary information and proprietary technology through certain procedural safeguards. We also rely on invention assignment agreements with our employees, consultants and others, to assign to the Company all inventions developed by such individuals in the course of their engagement with the Company.

In addition to Company-owned intellectual property, we license software from third parties for integration into our solutions, including open sourceopen-source software and other software available on commercially reasonable terms. It may be necessary in the future to seek or renew licenses relating to various aspects of our products, processes and services. While we have generally been able to obtain such licenses on commercially reasonable terms in the past, we cannot provide assurance that such third parties will maintain such software or continue to make it available.

CompetitionFinancial Support

In November 2022, we entered into an investment agreement with George Baumeohl, our director, pursuant to which Mr. Baumeohl has agreed to support our operation by way of an equity investment of up to $3 million through August 2025, as needed. The agreement provides for sales of our common stock go Mr. Baumeohl at per share purchase prices ranging between $0.0003 and $0.0005. As of the date of this report, we have received an aggregate of $1,700,000 from Mr. Baumeohl

Competition

Our main competition in the global parental control software market are McAfee LLC (US), Avanquest (France), Bitdefender (Romania), SaferKid (US), Symantec Corporation (US), Webroot Inc. (US), Content Watch Holdings, Inc. (US), Verizon Communications Inc. (US), Mobicip LLC (US), and Trend Micro Inc. (Japan). These are companies that may have been in the market longer than our company, and/or have a more recognizable name, but our proprietary algorithms are designed to trace behavioral pattern changes in the user as opposed to the machine, thus providing a better understanding of the user.

With regards to the B2B product and software available to protect businesses, we believe that our B2B solution is truly unique. Our main known competitor is Checkpoint Systems, yet, our cyber software provides unique protection by analyzing inner company behavioral patterns as well as external, thus aiding our clients to foresee security breaches whether from an internal or external threat.

The mobile GSM market in Europe is in general very competitive. Based on own market research, we believe that by combining our thee business units, we possess competitive advantages.

Regulatory Environment

Foreign and domestic laws and regulations apply to many aspects of the Company’s business.

The Company collects and uses a wide variety of information for various purposes in its business, including to help ensure the integrity of its services and to provide features and functionality to customers. This aspect of the Company’s business is subject to a broad array of evolving privacy and data protection laws, including the European Union’s General Data Protection Regulation national and state laws within the United States, including the California Privacy Rights Act. These laws impose strict operational requirements and can provide for significant penalties for non-compliance. Elements of these evolving laws and regulations, as well as their interpretation and enforcement, remain unclear and the Company may be required to modify its practices to comply with them in the future.

Employees

As of December 31, 2020,April 14, 2024, we had nine (9) employees. Ofeight (14) employees, of which six (6)eight (8) are primarily engaged in research and development, two (2) engaged in selling and three (3)marketing and four (4) in administrative positions.

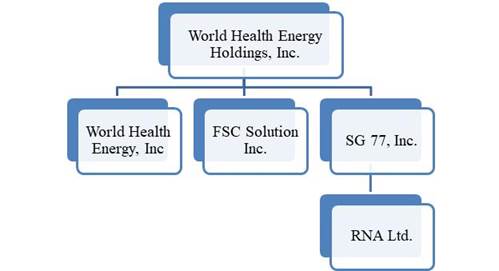

Other Corporate Holdings

We currently also have the following subsidiaries.subsidiaries, which are currently inactive.

FSC Solutions, Inc. On June 26, 2015, we entered into a Stock Purchase Agreement (the “Agreement”) with FSC and its shareholders which included Uri Tadelis, our former Chief Executive Officer and Director and our former Directors Chaim J. Lieberman and Gal Levy. The Agreement was effective as of July 1, 2015 which served as the closing date for the acquisition. Pursuant to the terms of the Agreement, we acquired all of the capital stock of FSC in exchange for the issuance of 70 billion shares of our unregistered common stock with the possibility of the issuance of an additional 130 Billion common shares upon FSC meeting certain milestones as outlined in the Agreement. Upon completion of the acquisition of FSC, we intended to employ FSC’s software and trading platform to enter the on-line trading industry. Subsequent to the completion of the acquisition, we determined that FSC did not have control over the trading platform and software we expected to acquire and operate. Please refer to Item 3 of this report.

World Health Energy, Inc. World Health Energy, Inc. owns an algae-tech business whose primary focus was the production of algae using their proprietary GB3000 growth system. The system quickly and efficiently grows algae for the production of biofuels and food protein. We also sought to produce and market high-quality, low-cost B100 biodiesel. Though, we believe that the Company has been successful in demonstrating the effectiveness of the GB3000 system on a small-scale the Company has not yet been able to raise the necessary capital to implement their technologies on a commercial scale.

Corporate Structure (Diagram)

The corporate structure of the WHEN Group is reflected below in this diagram

Available Information

The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov. The Company’s websites are located at http://www.worldhealthenergy.com/ and http://www.whengreenenergy.com/.located. Information contained on, or accessible through, these websites, or any website stated in this report, is not a part of, and is not incorporated by reference into, this report.

You should consider each of the following risk factors and any other information set forth in this Form. 10-K as the other Company’s reports filed with the SEC, including the Company’s consolidated financial statements and related notes, in evaluating the Company’s business and prospects. The risks and uncertainties described below are not the only ones that impact the Company’s operations and business. Additional risks and uncertainties not presently known to the Company, or that the Company currently considers immaterial, may also impair its business or operations. If any of the following risks actually occur, the Company’s business and financial condition, results or prospects could be harmed.

| 11 |

Risk Related to our Financial Position

The Company is dependent on the funding arrangement with its director and any disruption of such funding arrangement is likely to have a material adverse effect our liquidity and operations.

Management has prepared an assessment as to the Company’s ability to continue as a going concern in accordance with ASC 205-40, Going Concern (“ASC 205-40”) and has concluded the adverse conditions associated with the Company’s operating results and financial condition do not individually or in the aggregate raise substantial doubt about the Company’s ability to continue as a going concern as of the issuance date of the Company’s consolidated financial statements as of and for the period of year ended December 31, 2023 (the “issuance date”). Management reached this conclusion based on their belief, in consideration of the criteria prescribed by ASC 205-40, that it is probable the Company will be able to meet its obligations as they become due for the next twelve months beyond the issuance date based on the investment agreement with Mr. George Baumeohl, a Company director, entered into on November 1, 2022, where the director has committed to invest up to $3,000,000, as needed by the Company through the purchase of shares of the Company’s common stock. In addition, certain shareholders have agreed to provide additional financial support to the Company in the event that the remaining funds provided under the November 1, 2022 investment agreement are not sufficient to support operations. Notwithstanding management’s conclusion, in the event for whatever reason the funds under such investment agreement are not remitted to the Company as needed, then the Company’s operations and liquidity are likely to be materially adversely affected.

We have generated to date an insignificant amount of revenue from commercial sales to date and our future profitability is uncertain.

We are incorporated in Delaware and have a limited operating history, and our business is subject to all of the risks inherent in the establishment of a new business enterprise. Our likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with development and expansion of a new business enterprise. Since inception, we have incurred losses and expect to continue to operate at a net loss for at least the next year. Our net losses for the years ended December 31, 2023 and December 31, 2022, were $7,050,400 and $9,946,375, respectively, and our accumulated deficit as of December 31, 2023 and December 31, 2022 was $23,015,196 and $16,035,848, respectively. There can be no assurance that the products will be successfully commercialized, and the extent of our future losses and the timing of our profitability are highly uncertain. If we are unable to achieve profitability, we may be unable to continue our operations.

If we fail to obtain the capital necessary to fund our operations, we will be unable to continue or complete our product development and you will likely lose your entire investment.

We will need to continue to seek capital from time to time to continue development of our products and we cannot provide any assurances that any revenues they may generate in the future will be sufficient to fund our ongoing operations. We believe that we will need to raise substantial additional capital to fund our continuing operations and the development and commercialization of our products. We anticipate that we will need an additional $1,300,000 to build the infrastructure for our sustained growth.

Our business or operations may change in a manner that would consume available funds more rapidly than anticipated and substantial additional funding may be required to maintain operations, fund expansion, develop new or enhanced products, acquire complementary products, business or technologies or otherwise respond to competitive pressures and opportunities, such as a change in the regulatory environment. In addition, we may need to accelerate the growth of our sales capabilities and distribution beyond what is currently envisioned, and this would require additional capital. However, we may not be able to secure funding when we need it or on favorable terms. We may not be able to raise sufficient funds to commercialize the products we intend to develop.

If we cannot raise adequate funds to satisfy our capital requirements, we will have to delay, scale back or eliminate our research and development activities or future operations. We may also be required to obtain funds through arrangements with collaborators, which arrangements may require us to relinquish rights to certain technologies or products that we otherwise would not consider relinquishing, including rights to certain major geographic markets. This could result in sharing revenues which we might otherwise retain for ourselves. Any of these actions may harm our business, financial condition and results of operations.

The amount of capital we may need depends on many factors, including the progress, timing and scope of our product development programs; our ability to enter into and maintain collaborative, licensing and other commercial relationships; and our partners’ commitment of time and resources to the development and commercialization of our products.

| 12 |

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our products on unfavorable terms to us.

We may seek additional capital through a variety of means, including through private and public equity offerings and debt financings, collaborations, strategic alliances and marketing, distribution or licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of our stockholders will be diluted, and the terms of such financings may include liquidation or other preferences, anti-dilution rights, conversion and exercise price adjustments and other provisions that adversely affect the rights of our stockholders, including rights, preferences and privileges that are senior to those of our holders of common stock in the event of a liquidation. In addition, debt financing, if available, could include covenants limiting or restricting our ability to take certain actions, such as incurring additional debt, making capital expenditures, or declaring dividends and may require us to grant security interests in our assets. If we raise additional funds through collaborations, strategic alliances, or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, or products or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may need to curtail or cease our operations.

Risks Relating to Our Business and Industry

We will need to raise significant capital in order to realize our business plan and the failure to obtain the needed funding could lead to our operational failure.

We will need to raise additional working capital in order to design and develop our second-generation online security and data protection technologies, expand our market strategy and potentially acquire complementary technologies. Without adequate funding, we also may not be able to accelerate the development and deployment of our products, respond to competitive pressures and develop new or enhanced products. At the present time, we have no commitments for any financing, and there can be no assurance that capital will be available to us on commercially acceptable terms or at all. We may have difficulty obtaining additional funds as and when needed and we may have to accept terms that would adversely affect our stockholders. Any failure to achieve adequate funding will delay our development programs and product launches and could lead to abandonment of one or more of our development initiatives, as well as prevent us from responding to competitive pressures or take advantage of unanticipated acquisition opportunities.

Any additional equity financing may be dilutive to stockholders, and debt and certain types of equity financing, if available, may involve restrictive covenants or other provisions that would limit how we conduct our business or finance our operations.

Even if we raise funds to address our immediate working capital requirements, we also may be required to seek additional financing in the future to respond to increased expenses or shortfalls in anticipated revenues, accelerate product development and deployment, respond to competitive pressures, develop new or enhanced products, or take advantage of unanticipated acquisition opportunities.

These conditions raise substantial doubt as to our ability to continue as a going concern and may make it more difficult for us to raise additional capital when needed. The accompanying consolidated financial statements do not include any adjustments relating to the recoverability of reported assets or liabilities should we be unable to continue as a going concern.

Our independent registered public accounting firm has included an explanatory paragraph relating to our ability to continue as a going concern in its report on our audited financial statements included in this prospectus. Our audited financial statements at December 31, 2020 and 2019 and for the years then ended were prepared assuming that we will continue as a going concern.

Primarily as a result of our losses and limited cash balances and cash flows, the report of our independent registered public accounting firm included elsewhere in this prospectus contains an explanatory paragraph on our financial statements stating that our ability to continue as a going concern is highly contingent on our ability to raise capital for ongoing research and development and clinical trials as we expect to continue to incur losses for the foreseeable future. Such an opinion could materially limit our ability to raise additional funds through the issuance of new debt or equity securities or otherwise. There is no assurance that sufficient financing will be available when needed to allow us to continue as a going concern. The perception that we may not be able to continue as a going concern may also make it more difficult to operate our business due to concerns about our ability to meet our contractual obligations. We cannot provide any assurance that we will be able to raise additional capital.

If we are unable to secure additional capital, we may be required to curtail our clinical and research and development initiatives and take additional measures to reduce costs in order to conserve our cash in amounts sufficient to sustain operations and meet our obligations. These measures could cause significant delays in our clinical and regulatory efforts, which is critical to the realization of our business plan. The accompanying financial statements do not include any adjustments that may be necessary should we be unable to continue as a going concern. It is not possible for us to predict at this time the potential success of our business. The revenue and income potential of our proposed business and operations are currently unknown. If we cannot continue as a viable entity, you may lose some or all of your investment.

We have a history of losses and expect to incur losses and negative operating cash flows in the future.

We expect our operating losses to continue as we continue to expend resources to further develop and enhance our technology offering, to complete prototypes for proof-of-concept, obtain regulatory clearances or approvals as required, expand our business development activities and finance capabilities and conduct further research and development. We also expect to experience negative cash flow in the short-term until licensing revenues increase from our planned acquisitions.

| 13 |

The nature of the technology platforms utilized by us are complex and highly integrated, and if we fail to successfully manage releases or integrate new updates, it could harm our revenues, operating income, and reputation.

The technology platforms developed by us accommodate integrated applications that include our own developed technology and third-party technology, thereby substantially increasing their functionality. By enabling such system interoperability, our communications platform both reduces implementation and ongoing costs, and improves overall management efficiencies.

Due to this complexity and the condensed development cycles under which we operate, we may experience errors in our software, corruption or loss of our data, or unexpected performance issues from time to time. For example, our solutions may face interoperability difficulties with software operating systems or programs being used by our customers, or new releases, upgrades, fixes or the integration of acquired technologies may have unanticipated consequences on the operation and performance of our other solutions. If we encounter integration challenges or discover errors in our solutions late in our development cycle, it may cause us to delay our launch dates. Any major integration or interoperability issues or launch delays could have a material adverse effect on our revenues, operating income and reputation.

Security breaches, cyberattacks or other cyber-risks of our IT and production systems could expose us to significant liability and cause our business and reputation to suffer and harm our competitive position.

Our corporate infrastructure stores and processes our sensitive, proprietary and other confidential information (including as related to financial, technology, employees, marketing, sales, etc.) which is used on a daily basis in our operations. In addition to that, our software involves transmission and processing of our customers’ confidential, proprietary and sensitive information. We have legal and contractual obligations to protect the confidentiality and appropriate use of customer data.

High-profile cyberattacks and security breaches have increased in recent years, with the potential for such acts heightened as a result of the number of employees working remotely due to COVID-19.remotely. Security industry experts and government officials have warned about the risks of hackers and cyberattacks targeting IT products and enterprise infrastructure. Because techniques used to obtain unauthorized access or to sabotage systems change frequently and often are not recognized until launched against a specific target, we may be unable to anticipate these techniques or to implement adequate preventative measures. As we continue to increase our client base and expand our brand, we may become more of a target for third parties seeking to compromise our security systems and we anticipate that hacking attempts and cyberattacks will increase in the future. We cannot give assurance that we will always be successful in preventing or repelling unauthorized access to our systems. We also may face delays in our ability to identify or otherwise respond to any cybersecurity incident or any other breach. Additionally, we use third-party service providers to provide some services to us that involve the storage or transmission of data, such as SaaS, cloud computing, and internet infrastructure and bandwidth, and they face various cybersecurity threats and also may suffer cybersecurity incidents or other security breaches. Despite our security measures, our IT and infrastructure may be vulnerable to attacks. Threats to IT security can take a variety of forms. Individual and groups of hackers and sophisticated organizations, including state-sponsored organizations or nation-states, continuously undertake attacks that pose threats to our customers and our IT. These actors may use a wide variety of methods, which may include developing and deploying malicious software or exploiting vulnerabilities in hardware, software, or other infrastructure in order to attack our products and services or gain access to our networks, using social engineering techniques to induce our employees, users, partners, or customers to disclose passwords or other sensitive information or take other actions to gain access to our data or our users’ or customers’ data, or acting in a coordinated manner to launch distributed denial of service or other coordinated attacks. Inadequate account security practices may also result in unauthorized access to confidential and/or sensitive data.

Security risks, including, but not limited to, unauthorized use or disclosure of customer data, theft of proprietary information, theft of intellectual property, theft of internal employee’s PII/PHI information, theft of financial data and financial reports, loss or corruption of customer data and computer hacking attacks or other cyberattacks, could require us to expend significant capital and other resources to alleviate the problem and to improve technologies, may impair our ability to provide services to our customers and protect the privacy of their data, may result in product development delays, may compromise confidential or technical business information, may harm our competitive position, may result in theft or misuse of our intellectual property or other assets and could expose us to substantial litigation expenses and damages, indemnity and other contractual obligations, government fines and penalties, If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures and our products could be harmed, we could lose potential sales and existing customers, our ability to operate our business could be impaired, and we may incur significant liabilities, and we could suffer harm to our reputation and competitive position, and our operating results could be negatively impact our business.

The market opportunity for our products and services may not develop in the ways that we anticipate.

The demand for our products and services can change quickly and in ways that we may not anticipate because the market in which we operate is characterized by rapid, and sometimes disruptive, technological developments, evolving industry standards, frequent new product introductions and enhancements, changes in customer requirements and a limited ability to accurately forecast future customer orders. Our operating results may be adversely affected if the market opportunity for our products and services does not develop in the ways that we anticipate or if other technologies become more accepted or standard in our industry or disrupt our technology platforms.

If we are unable to maintain successful relationships with our channel partners, our business could be adversely affected.

We rely on channel partners, such as distribution partners and resellers, to sell licenses and support and maintenance agreements for our software and to perform some of our professional services. Our ability to achieve revenue growth in the future will depend in part on our success in maintaining successful relationships with our channel partners.

Our agreements with our channel partners are generally non-exclusive, meaning our channel partners may offer customers the products of several different companies. If our channel partners do not effectively market and sell our software, choose to use greater efforts to market and sell their own products or those of others, or fail to meet the needs of our customers, including through the provision of professional services for our software, our ability to grow our business, sell our software and maintain our reputation may be adversely affected. Our contracts with our channel partners generally allow them to terminate their agreements for any reason upon 30 days’ notice. A termination of the agreement has no effect on orders already placed. The loss of a substantial number of our channel partners, our possible inability to replace them, or the failure to recruit additional channel partners could materially and adversely affect our results of operations. If we are unable to maintain our relationships with these channel partners, our business, results of operations, financial condition or cash flows could be adversely affected. Finally, even if we are successful, our relationships with channel partners may not result in greater customer usage of our products and professional services or increased revenue.

The online security and device management industry is highly competitive, and we have a number of competitors that are larger and have greater resources.

We operate in an intensely competitive market which experiences rapid technological developments, changes in customer requirements and changes in industry standards. These in addition to the frequent new product introductions and improvements offered by our competitors. Our competitive position could weaken, and we could experience a drop-in revenue in we are not able to anticipate or react to competitive challenges or if new or existing competitors gain market share in any of our markets. In order to successfully compete, we must maintain a successful research and development effort to develop new product and enhance our existing products. Should we not be successful in responding to our competitors or to changing technological and customer demands, the outcome could be a negative effect on our competitive position and our financial results.

Another challenge is the growing competition from network equipment and computer hardware manufacturers as well as large operating system providers. These firms continuously develop and incorporate into their products data protection and storage and server management software that competes at some levels with our product offerings. Our competitive position could be adversely affected to the extent that our customers perceive the functionality incorporated into these products as replacing the need for our products.

Many of our competitors have deeper pockets, greater technical, sales, marketing, or other resources than we do and consequently may have the ability to influence customers to purchase their products instead of ours.

| 15 |

There is uncertainty as to market acceptance of our technology and services.

The demand for our products and services can change quickly and in ways that we may not anticipate because the market in which we operated is characterized by rapid, and sometimes disruptive, technological development.

We may not be able to complete or integrate successfully any potential future acquisitions, partnerships or joint ventures.

Acquisitions can involve a number of special risks and challenges, including but not limited to:

| ● | Complexity, time and costs associated with the integration of acquired business operations, workforce, products and technologies into our existing business, sales force, employee base, product lines, and technology. | |

| ● | Management distraction from our existing business and other business opportunities. | |

| ● | Employee termination could occur and thus inducing costs associated with the termination of those employees. | |

| ● | Assumption of debt or other liabilities of the acquired business, including litigation related to the acquired business. | |

| ● | Increased expenses and working capital requirements. | |

| ● | Dilution of existing stockholders’ shares. | |

| ● | Increased costs and efforts in connection with compliance with Section 404 of the Sarbanes-Oxley Act. |

Integrating an acquired business can be complex, time consuming, as well as an expensive process, which can impact the effectiveness of our internal control over financial reporting.

If such integration is unsuccessful, we may not realize the potential benefits of an acquisition or suffer from adverse effects that we currently cannot foresee.

Any of the foregoing, along with other factors, could harm our ability to achieve anticipated levels of profitability from such acquired businesses or to realize other anticipated benefits of such acquisitions. Due to the fact that acquiring high technology companies is inherently risky, there can be no assurance that future acquisitions will be successful and shall not adversely affect our business, financial condition or operating results.

If we cannot keep pace with rapid developments and changes in our industry and provide new services to our clients, the use of our services could decline, reducing our revenues.

Our future success depends on our ability to respond to the rapidly changing needs of our customers by developing product upgrades and introducing new products on a timely basis. Though we have and continue to incur, significant research and development expenses, the development and introduction of a new product involves significant resources and time commitment and is therefore subject to risks including:

| ● | Managing the length of the development cycle for new product enhancements, which could be longer than originally anticipated. | |

| ● | Adapting our products to the endlessly evolving industry standards and to our competitors’ technological developments. | |

| ● | Entering into new markets in which we have limited experience. | |

| ● | Incorporating acquired products and technologies. | |

| ● | Integrating our various security and storage technologies, management solutions, and support into unified enterprise security and storage solutions. | |

| ● | Developing or expanding efficient sales channels. |

| 16 |

In addition, if we cannot adapt our business models to keep pace with industry trends, our revenue could be negatively impacted.

If we are not successful in managing these risks and challenges, or if our new products, product upgrades, and services are not technologically competitive or do not achieve market acceptance, our business and operating results could be adversely affected.

Our cybersecurity system might be used for fraudulent, illegal or improper purposes, which could expose us to additional liability and harm our business.

Reputation in the cybersecurity field is an important corporate asset. An operating incident, significant cybersecurity disruption, or other adverse event may have a negative impact on our reputation. This, in turn, could make it more difficult for us to compete successfully for new opportunities, obtain necessary regulatory approvals, or could reduce consumer demand for our branded products.

Furthermore, such disruptions or fraudulent use could expose us to liabilities such as lawsuits and settlements. Such liabilities could be time consuming, costly and harmful to our business and funds.

We may be subject to the risks of doing business internationally.

We have significant operations outside of the U.S., including engineering, sales, customer support and production, these will be subject to risks in addition to those faced by our domestic operations such as:

| ● | Potential loss of proprietary information due to misappropriation or laws that may be less protective of our intellectual property rights that U.S. laws or may not be adequately enforced. | |

| ● | Governmental control and other foreign law requirements, including labor restrictions and related laws that can impact our business operations. |

| ● | Restrictions on our ability to repatriate cash from our international subsidiaries or to exchange cash availability for use in the U.S. | |

| ● | Fluctuations in currency exchange rates and economic instability such as higher interest rates in the U.S. and inflation could reduce our customers’ ability to obtain financing for software products or could make our products more expensive or could increase our costs of doing business in certain countries. | |

| ● | Longer payment cycles due to sales in foreign countries. |

| ● | ||

| Difficulties related to administering a stock plan in some foreign countries. | ||

| ● | Delays and costs related to developing software and providing support in various languages. | |

| ● | Political unrest, war, or terrorism, particularly in areas in which we have facilities. |

Costs of compliance with laws and regulations

We are subject to regulatory environment changes regarding privacy and data protection and could have a material impact on our results of operations.

The growth and expansion of the company into a variety of new fields may potentially involve new regulatory issues/requirements such as the EU General Data Protection Regulation (GDPR) or the New York Department of Financial Services (NYDFS) Cybersecurity Regulation. The potential cost of compliance with or imposed by new/existing regulations and policies that are applicable to us may affect the use of our products and services and could have a material adverse impact on our results of operations.

| 17 |

We may not be able to successfully protect the intellectual property we license and may be subject to infringement claims.

We rely on a combination of contractual rights, copyright, trademark and trade secret laws to establish and protect our proprietary technology. We customarily require our employees and independent contractors to execute confidentiality agreements or otherwise to agree to keep our proprietary information confidential when their relationship with us begins. Typically, our employment contracts also include clauses requiring our employees to assign to us all of the inventions and intellectual property rights they develop in the course of their employment and to agree not to disclose our confidential information. Nevertheless, others, including our competitors, may independently develop similar technology to that licensed by us, duplicate our services or design around our intellectual property. Further, contractual arrangements may not prevent unauthorized disclosure of our confidential information or ensure an adequate remedy in the event of any unauthorized disclosure of our confidential information. Because of the limited protection and enforcement of intellectual property rights in many foreign markets, our intellectual property rights may not be as protected as they may be in more developed markets such as the United States. We may have to litigate to enforce or determine the scope or enforceability of our intellectual property rights (including trade secrets and know-how), which could be expensive, could cause a diversion of resources and may not prove successful. The loss of intellectual property protection could harm our business and ability to compete and could result in costly redesign efforts, discontinuance of certain service offerings or other competitive harm. Additionally, we do not hold any patents for our business model or our business processes, and we do not currently intend to obtain any such patents in Mexico, the United States or elsewhere.

We may also be subject to costly litigation in the event our services or the technology that we license are claimed to infringe, misappropriate or otherwise violate any third party’s intellectual property or proprietary rights. Such claims could include patent infringement, copyright infringement, trademark infringement, trade secret misappropriation or breach of licenses. We may not be able to successfully defend against such claims, which may result in a limitation on our ability to use the intellectual property subject to these claims and also might require us to redesign affected services, enter into costly settlement or license agreements, pay costly damage awards, or face a temporary or permanent injunction prohibiting us from marketing or selling certain of our services. In such circumstances, if we cannot or do not license the infringed technology on reasonable terms or substitute similar technology from another source, our revenue and earnings could be adversely impacted. Additionally, in recent years, non-practicing entities have been acquiring patents, making claims of patent infringement and attempting to extract settlements from companies in our industry. Even if we believe that such claims are without merit and successfully defend these claims, defending against such claims is time consuming and expensive and could result in the diversion of the time and attention of our management and employees.

If we don’t have sufficient resellers it is possible we won’t have sufficient funds for aggressive advertising campaigns thus resulting in deficits.

We sell our products to customers around the world through resellers. Sales through indirect channels involve a number of risks, including:

| ● | Our resellers are not subject to minimum sales requirements or to any obligations to market our products to their customers | |

| ● | Our reseller agreements are generally nonexclusive and may be terminated at any time without cause. | |

| ● | It is possible that our resellers distribute competing products and may, occasionally, place a greater emphasis on the sale of these products due to pricing, promotions, and other terms offered by such competitors. |

| 18 |

We are subject to Currency exchange rate fluctuations

Our exposure to exchange risk mainly involves sales negotiated with customers in U.S. dollars net of expenses and possible investment or loan repayments in this currency. The change in foreign currencies compared to the Israeli Shekel may have an impact on the profit and loss statements for the Company.

Fluctuations in demand for our products and services are driven by many factors, and a decrease in demand for our products could adversely affect our financial result.

We are subject to fluctuations in demand for our products and services due to a variety of factors, including general economic conditions, competition, technological changes, changes in buying patterns, financial difficulties and or budget cuts of our actual and potential customers or resellers, awareness of security threats to IT systems, and other factors. Though such factors can at times increase our sales, yet such fluctuations could have a negative impact on our product sales. If for any reason the demand for our products declines, our revenues and gross margin could be adversely affected.

Our products are complex and operate in a wide variety of computer configurations, which could result in errors or product failures.

Due to the complexity of our product, there is a chance that our products contain undetected errors, failures, or bugs, especially when products are first introduced or when new versions are released. Our products are installed and used in large-scale computing environments, therefore are subject to different operating systems, system management software and network configurations, all of which may cause errors or a failure in our products. Furthermore, these may expose undetected errors, failures, or bugs in our products.

Errors, failures, or bugs in our products could result in negative reviews and publicity, causing damage to our brand name, product returns. These in turn could result in loss of market acceptance, loss of competitive position, or claims by customers. Finally, if an actual or perceived breach of information integrity or availability occurs in one of our customer’s systems, regardless of whether the breach is attributable to our products, the market perception of the effectiveness of our products could be harmed.

Solving any of these problems could require significant expenses and other resources and could cause interruptions, delays, or cessation of our product licensing, which could cause us to lose existing or potential customers and thus affect our operating results.

If we are unable to attract and retain qualified employees, lose key personnel, fail to integrate replacement personnel successfully, or fail to manage our employee base effectively, we may be unable to develop new and enhanced products and services, effectively manage or expand our business, or increase our revenues.

Our future success depends upon our ability to recruit and retain our key management, technical, sales, marketing, finance, and other critical personnel. Our officers and other key personnel are employees-at-will, and we cannot assure you that we will be able to retain them as the competition for workers with the specific skills that we require is significant. In order to attract and retain personnel in a competitive marketplace, we believe that we must provide a competitive compensation package, including cash and equity-based compensation. The unpredictability in our stock price may from time to time unfavorably affect our ability to recruit or retain employees. In addition, we may be unable to obtain required stockholder approvals of future increases in the number of shares available for issuance under our equity compensation plans, and accounting rules require us to treat the issuance of employee stock options and other forms of equity-based compensation as compensation expense. As a result, we may decide to issue fewer equity-based incentives and may be impaired in our efforts to attract and retain necessary personnel. If we are unable to hire and retain qualified employees, or conversely, if we fail to manage employee performance or reduce staffing levels when required by market conditions, our business and operating results could be adversely affected.

Similarly to every work place, from time to time, key personnel in our company may leave, which may in turn have a negative impact and result in significant disruptions to our operations, including harming the timeliness product release, the successful implementation and completion of company initiatives, effectiveness of our disclosure controls and procedures and our internal control over financial reports, and the results of our operations. Furthermore, recruiting, training and successfully integrating replacement employees could be time consuming and may result in additional disruptions to our operations, which could in turn negatively impact future revenues.

Third parties claiming that we infringe their proprietary rights could cause us to incur significant legal expenses and prevent us from selling our products.

There is a possibility of future claims that we allegedly infringed the intellectual property rights of others, including claims regarding patents, copyrights, and trademarks. In addition, former employers of our former, current, or future employees may assert claims that such employees have improperly disclosed to us the confidential or proprietary information of these former employers. Any such claim, with or without merit, could result in costly litigation and distract management from day-to-day operations. If we do not successfully defend our company of such claims, we could be forced to stop selling, or redesign our products, pay monetary amounts as damages, enter into royalty or licensing arrangements, or satisfy indemnification obligations that we have with some of our customers. We cannot assure you that any royalty or licensing arrangements that we may seek in such circumstances will be available to us on commercially reasonable terms or at all.

We must comply with governmental regulations setting privacy standards.