UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20212023

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from: _____________to______________

Commission File Number: 001-39199

TRxADE HEALTH, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 46-3673928 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| 2420 Brunello | ||

| Lutz, Florida | 33558 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (800) 261-0281

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Common Stock, $0.00001 Par Value Per Share | MEDS | The NASDAQ Stock Market LLC (The NASDAQ Capital Market) |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No No☒ ☒

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $16,921,89011,457,013. For purposes of calculating the aggregate market value of shares held by non-affiliates, we have assumed that all outstanding shares are held by non-affiliates, except for shares held by each of our executive officers, directors and 5% or greater stockholders. In the case of 5% or greater stockholders, we have not deemed such stockholders to be affiliates unless there are facts and circumstances which would indicate that such stockholders exercise any control over our company, or unless they hold 10% or more of our outstanding common stock. These assumptions should not be deemed to constitute an admission that all executive officers, directors and 5% or greater stockholders are, in fact, affiliates of our company, or that there are no other persons who may be deemed to be affiliates of our company. Further information concerning shareholdings of our officers, directors and principal stockholders is included or incorporated by reference in Part III, Item 12 of this Annual Report on Form 10-K.

As of March 28, 2022,April 22, 2024, there were 1,406,348 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 20222024 annual meeting of stockholders (the “2022“2024 Proxy Statement”Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The 20222024 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

TABLE OF CONTENTS

| 2 |

GLOSSARY

The following are abbreviations and definitions of certain terms used in this Report, which are commonly used in the pharmaceutical industry:

“ACA” means the Patient Protection and Affordable Care Act, often shortened to the Affordable Care Act, nicknamed Obamacare, which is a U.S. federal statute which provides numerous rights and protections that make health coverage fairer and easier to understand, along with subsidies (through “premium tax credits” and “cost-sharing reductions”) to make it more affordable. The law also expands the Medicaid program to cover more people with low incomes.

“ADR” means Authorized Distributor of Record. Under current federal law, an ADR means a distributor with whom a manufacturer has established an ongoing relationship to distribute such manufacturer’s products.

“ANDA” means an abbreviated new drug application which contains data which is submitted to the FDA for the review and potential approval of a generic drug product.

“CMS” means the Centers for Medicare & Medicaid Services, which is a federal agency within the HHS that administers the Medicare program and works in partnership with state governments to administer Medicaid.

“CSA” means the Controlled Substances Act, the statute establishing federal U.S. drug policy under which the manufacture, importation, possession, use, and distribution of certain substances is regulated.

“DEA” means the Drug Enforcement Administration, a United States federal law enforcement agency under the United States Department of Justice, tasked with combating drug trafficking and distribution within the United States.

“DQSA” means the Drug Quality and Security Act which is a law that amended the FFDCA to grant the FDA more authority to regulate and monitor the manufacturing of compounded drugs.

“EUA” means an Emergency Use Authorization filed with the FDA. Under section 564 of the FFDCA, the FDA Commissioner may allow unapproved medical products or unapproved uses of approved medical products to be used in an emergency to diagnose, treat, or prevent serious or life-threatening diseases or when there are no adequate, approved, and available alternatives.

“FDA” means U.S. The Food and Drug Administration, which is a federal agency of the United States Department of Health and Human Services. The FDA is responsible for protecting the public health by ensuring the safety, efficacy, and security of human and veterinary drugs, biological products, and medical devices; and by ensuring the safety of U.S. food supply, cosmetics, and products that emit radiation.

“FDAAA” means the Food and Drug Administration Amendments Act of 2007 which reviewed, expanded, and reaffirmed several existing pieces of legislation regulating the FDA.

“FFDCA” means the Federal Food, Drug and Cosmetic Act, which is a set of U.S. laws passed by Congress in 1938 giving authority to the FDA to oversee the safety of food, drugs, medical devices, and cosmetics.

“Generic drugs” are copies of brand-name drugs that have exactly the same dosage, intended use, effects, side effects, route of administration, risks, safety, and strength as the original drug.

“Health plan” means health insurance coverage provided by an individual or group that provides or pays the cost of medical care. Health plans can be provided by public (Medicaid) or private (an employer) entities.

“HHS”, the U.S. Department of Health and Human Services also known as the Health Department, is a cabinet-level department of the U.S. federal government with the goal of protecting the health of all Americans and providing essential human services.

| 3 |

“HIPAA” means the Health Insurance Portability and Accountability Act of 1996, which has the goal of making it easier for people to keep health insurance, protect the confidentiality and security of healthcare information and help the healthcare industry control administrative costs.

“Individually identifiable health information” is defined by HIPPA to mean information that is a subset of health information, including demographic information collected from an individual, and: (1) is created or received by a health care provider, health plan, employer, or health care clearinghouse; and (2) relates to the past, present, or future physical or mental health or condition of an individual; the provision of health care to an individual; or the past, present, or future payment for the provision of health care to an individual; and (a) that identifies the individual; or (b) with respect to which there is reasonable basis to believe the information can be used to identify the individual.

“Medicaid” is a federal and state health insurance program in the U.S. that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services.

“Medicare” is a national health insurance program in the U.S. It primarily provides health insurance for Americans aged 65 and older, but also for some younger people with disability status as determined by the Social Security Administration, as well as people with end stage renal disease and amyotrophic lateral sclerosis (ALS or Lou Gehrig’s disease).

“NDC” means a National Drug Code, a unique 10-digit, 3-segment number. It is a universal product identifier for human drugs in the United States. The code is present on all non-prescription (OTC) and prescription medication packages and inserts in the U.S. The 3 segments of the NDC identify the labeler, the product, and the commercial package size.

“PBM” means a Pharmacy Benefits Manager. In the United States, a PBM is a third-party administrator of prescription drug programs for commercial health plans, self-insured employer plans, Medicare Part D plans (prescription drug plans), the Federal Employees Health Benefits Program, and state government employee plans.

“PDMA” means the Prescription Drug Marketing Act of 1987. The PDMA establishes legal safeguards for prescription drug distribution to ensure safe and effective pharmaceuticals and is designed to discourage the sale of counterfeit, adulterated, misbranded, subpotent, and expired prescription drugs.

“Pedigree tracking laws” mean laws which help ensure the integrity of the U.S. drug supply chain through the use of drug pedigrees, verifiable written or electronic documents that track each move in a drug’s journey from manufacturer to patient.

“PPE” means personal protective equipment, which is worn to minimize exposure to hazards that cause serious workplace injuries and illnesses. When used below, PPE typically refers to protective equipment used by medical personnel, including masks, sanitizers and gloves.

“Rebates” these are provided by manufacturers and are typically based on the ability of a payer to move market share for the manufacturer’s product. Rebates are confidential.

“SNI” means Serialized Numerical Identifier. Pursuant to FDA requirements, a product’s SNI has to include the item’s NDC and unique Serial Number (SN).

“Wholesaler” typically, the wholesaler is the first purchaser of a drug product – direct from the manufacturer. Wholesalers buy large quantities and then resell either direct to provider-purchasers (like a large health system, pharmacy or pharmacy chain), or resell to smaller, regional distributors for regional or local distribution to retail pharmacies and hospitals.

| 4 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K (this “Report”) contains statements that constitute forward-looking statements withinwhich are subject to the meaningsafe-harbor provisions of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. Statements that are not historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Some of the statements in this Annual Report constitute forward-looking statements because they relate to future events or our future performance or future financial condition. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our company, our industry, our beliefs and our assumptions. Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. In some cases, you can identify forward-looking statements by the following words: “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” or the negative of these terms or other comparable terminology, although not allsimilar expressions may identify forward-looking statements, containbut the absence of these words. Forward-looking statements arewords does not mean that a guarantee of future performance or results, and willstatement is not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this Report.forward-looking. These factors include those set forth below and those disclosed under “Risk Factors”, below. These factorsForward-looking statements in this Annual Report may include, but are not limited to:for example, statements about:

| ● | Risks related to our history of operating losses and that our operations may not | |

| ● | Claims relating to alleged violations of intellectual property rights of others; | |

| ● | Technical problems with our websites; | |

| ● | Risks relating to implementing our acquisition | |

| ● | Our ability to manage our growth; | |

| ● | Negative effects on our operations associated with the opioid pain medication health crisis; | |

| ● | Regulatory and licensing requirement risks; | |

| ● | Risks related to changes in the U.S. healthcare environment; | |

| ● | The status of our information systems, facilities and distribution networks; | |

| ● | Risks associated with the operations of our more established competitors; | |

| ● | Regulatory changes; | |

| ● | Healthcare fraud; |

| 5 |

| ● | ||

| ● | Changes in laws or regulations relating to our operations; | |

| ● | Privacy laws; | |

| ● | System errors; | |

| ● | Dependence on current management; | |

| ● | Our growth strategy; and | |

| ● | Other risks disclosed below under, and incorporated by reference in, |

You should read the matters described and incorporated by reference in “Risk Factors” and the other cautionaryThe forward-looking statements madecontained in this Annual Report are based on our current expectations and incorporated by reference herein, as being applicable to all relatedbeliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements wherever they appear in this Report. We cannot assure youinvolve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that the forward-looking statements in this Report will provemay cause actual results or performance to be accurate and therefore prospective investors are encouraged not to place undue reliance onmaterially different from those expressed or implied by these forward-looking statements.

Forward-lookingThese risks and uncertainties include, but are not limited to, those factors described under the section of this Annual Report entitled “Risk Factors”. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, speak onlywhether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

We use words such as “anticipates,” “believes,” “expects,” “intends,” “seeks,” “plans,” “estimates,” “targets” and similar expressions to identify forward-looking statements. The forward-looking statements contained in this Annual Report involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Part I — Item 1A. Risk Factors” in this Annual Report.

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statements in this Annual Report should not be regarded as a representation by us that our plans and objectives will be achieved.

We have based the forward-looking statements included in this Annual Report on information available to us on the date of this Annual Report, or the date of any document incorporated by reference in this Report, as applicable. Except to the extent required by applicable law or regulation,and we do not undertake anyassume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise or update any forward-looking statements to reflectin this Annual Report, whether as a result of new information, future events or circumstances afterotherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we may file in the date of this Report or to reflectfuture with the occurrence of unanticipated events.Securities and Exchange Commission (the “SEC”), including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

PART I

| ITEM 1. | BUSINESS |

INTRODUCTION

This information included in this Annual Report on Form 10-K should be read in conjunction with the consolidated financial statements and related notes in “Item 8. Financial Statements and Supplemental Data” of this Report.

Please see the “Glossary” above for a list of abbreviations and definitions used throughout this Report.

Our logo and some of our trademarks and tradenames are used in this Report. This Report may also includesinclude trademarks, tradenames and service marks that are the property of others. Solely for convenience, trademarks, tradenames and service marks referred to in this Report may appear without the ®, ™ and SM symbols. References to our trademarks, tradenames and service marks are not intended to indicate in any way that we will not assert to the fullest extent under applicable law our rights or the rights of the applicable licensors if any, nor that respective owners to other intellectual property rights will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

The market data and certain other statistical information used throughout this Report are based on independent industry publications, reports by market research firms or other independent sources that we believe to be reliable sources. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We are responsible for all of the disclosures contained in this Report, and we believe these industry publications and third-party research, surveys and studies are reliable. While we are not aware of any misstatements regarding any third-party information presented in this Report, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors” beginning on page 1917 of this Report. These and other factors could cause our future performance to differ materially from our assumptions and estimates. Some market and other data included herein, as well as the data of competitors as they relate to TRxADE HEALTH, INC., is also based on our good faith estimates.

Our fiscal year ends on December 31st. Interim results are presented on a quarterly basis for the quarters ended March 31st, June 30th, and September 30th, the first quarter, second quarter and third quarter, respectively, with the quarter ending December 31st being referenced herein as our fourth quarter. “Fiscal 2023” means the Fiscal 2021year ended December 31, 2023, whereas “Fiscal 2022” means the year ended December 31, 2021, whereas fiscal 2020 means the year ended December 31, 2020.2022.

Unless the context requires otherwise, references to the “Company,” “we,” “us,” “our,” “Trxade”, “Trxade Group” and “TRxADE HEALTH, INC.” refer specifically to TRxADE HEALTH, INC. and its consolidated subsidiaries.

In addition, unless the context otherwise requires and for the purposes of this Report only:

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; | |

| ● | “SEC” or the “Commission” refers to the United States Securities and Exchange Commission; and | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended. |

Where You Can Find OtherAvailable Information

We file annual, quarterly, and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov and are available for download, free of charge, soon after such reports are filed with or furnished to the SEC, on the “NASDAQ: MEDS,” “SEC Filings” page of our website at www.rx.trxade.comwww.trxadehealth.com. Copies of documents filed by us with the SEC are also available from us without charge, upon oral or written request to our Secretary, who can be contacted at the address and telephone number set forth on the cover page of this Report. Our website addresses arewww.trxadehealth.comwww.rx.trxade.com www.trxadegroup.com, www.rx.trxade.com, www.bonumhealth.com, www.comsprx.com, and www.rxintegra.com. Information on our websites is not incorporated by reference into this Form 10-K. The information on, or that may be accessed through, our website iswebsites not incorporated by reference into this Report and should not be considered a part of this Report.

CORPORATE AND ORGANIZATIONAL HISTORY

Background of XCEL

Our Company was incorporated in Delaware on July 15, 2005, as “Bluebird Exploration Company” (“Bluebird”). Bluebird was originally formed to engage in the exploitation of mineral properties. In December 2008, Bluebird changed its name to “Xcellink International, Inc.” (“XCEL”), and subsequently announced that its business plan was being expanded to include the development and marketing of platform-independent customer-centric payment systems and methodologies. XCEL was unable to raise the funds necessary to implement its business strategy, and never generated any revenue and was reporting as a “shell” corporation.revenue. On January 9, 2014, Trxade Group, Inc., a then privately held Nevada corporation, merged with and into XCEL, and XCEL changed its name to “Trxade Group, Inc.” On June 1, 2021, the Company changed its name from “Trxade Group, Inc” to “TRxADE HEALTH, INC.”

| 7 |

Background of Trxade

PharmaCycle LLC, a Nevada limited liability company (“PharmaCycle”), was formed in August 2010 by Prashant Patel, our President, to serve as a web-based market platform designed to enable trading among healthcare buyers and sellers of pharmaceuticals, accessories and services. In January 2013, PharmaCycle converted into a Florida corporation and changed its name to Trxade, Inc. (“Trxade Florida”). In May 2013, Trxade Florida created a new wholly-owned subsidiary, Trxade Group, Inc., a Nevada corporation (“Trxade Nevada”). Trxade Nevada acquired Trxade Florida pursuant to a reverse triangular merger, resulting in Trxade Florida becoming a wholly-owned subsidiary of Trxade Nevada (the “Nevada-Florida Merger”). The sole purpose of the Nevada-Florida Merger was to provide for a holding company to own Trxade Florida, the operating company. At all times, up to the Nevada-Florida Merger, Trxade Florida was capitalized exclusively by cash capital contributions from Messrs. Suren Ajjarapu and Patel, our Chief Executive Officer and President, respectively. Immediately following the Nevada-Florida Merger, Messrs. Ajjarapu and Patel collectively owned 99% of Trxade Nevada. After the Nevada-Florida Merger (but prior to the merger with XCEL), Trxade Nevada raised $670,000 through the sale of its preferred stock in private placements made to third party investors.

Reverse Merger with Trxade

On September 26, 2008, Mark Fingarson, the former President, sole Director and controlling shareholder of XCEL, sold 80,000,000 shares of XCEL (prior to the Merger Reverse Split and Reverse Stock SplitSplits (each discussed and defined below)) to XCEL’s then attorney, Ron McIntyre.. On November 22, 2013, Trxade Nevada acquired Mr. McIntyre’s controlling interest of 80,000,000 shares in XCEL pursuant to a Purchase and Sale Agreement dated November 7, 2013. At the time of the sale, XCEL had 104,160,000 shares of common stock issued and outstanding, including the 80,000,000 shares of stock acquired by Trxade Nevada (prior to the Merger Reverse Split and Reverse Stock SplitSplit(s) (each discussed and defined below)).

On December 16, 2013, Trxade Nevada and XCEL entered into a definitive merger agreement (the “Merger Agreement”) providing for the merger (the “Merger”) of Trxade Nevada with and into XCEL, with XCEL continuing as the surviving corporation. The Merger closed on January 8, 2014. Under the terms of the Merger Agreement, we amended our certificate of incorporation and changed our name to “Trxade Group, Inc.,” and changed our trading symbol to “TRXD”.

Recapitalization of Common Stock by a Reverse Split and Increase of Authorized Shares of Stock

We also reversed our issued and outstanding stock at the ratio of one for one thousand (1:1,000) shares effective upon the closing of the Merger (the “Merger Reverse Split”). In connection with the Merger Reverse Split, 104,160,000 outstanding shares of our common stock, including the 80,000,000 shares held by Trxade Nevada, were exchanged for 104,160 post-Merger Reverse Split shares of common stock. As a result of the Merger, Trxade Nevada stockholders holding 28,800,000 shares of common stock and 670,000 shares of Series A Preferred Stock converted their shares on a one-to-one basis into 28,800,000 shares of our common stock and 670,000 shares of our Series A Preferred Stock, for an aggregate total of 29,470,000 shares. Further, 100,000 shares of our common stock (on a post-Reverse Split basis and considering the Reverse Stock SplitSplit(s) (discussed below)) were issued following the Merger in connection with the conversion of our promissory notes. The 80,000,000 pre-Merger shares held by Trxade Nevada, which amounted to 13,334 shares (on a post-Reverse Split basis and taking into account the Reverse Stock Split)Split(s)), reverted to treasury stock of the Company. Except as otherwise disclosed, the share amounts in the paragraph above have not been adjusted for the Merger Reverse Split or the Reverse Stock Split.

February 2020 Reverse Stock Split and NASDAQ Capital Market Listing

On October 9, 2019, our Board of Directors, and on October 15, 2019, stockholders holdingIn February 2020, the Company effected a majority of our outstanding voting shares, approved resolutions authorizing a1-for-6 reverse stock split of the then outstanding shares of our common stock in the range from one-for-two (1-for-2) to one-for-ten (1-for-10), and provided authority to our Board of Directors to select the ratio of the reverse stock split in their discretion (the “Stockholder Authority”). On February 12, 2020, the Board of Directors of the Company approved a stock split ratio of 1-for-6 (“Reverse Stock Split”) in connection with the Stockholder Authority and the Company filed a Certificate of Amendment with the Secretary of Delaware to affect the Reverse Stock Split. The Reverse Stock Split became effective at 12:01 a.m. Eastern Standard Time on February 13, 2020. The Reverse Stock Split was completed in order to allow us to meet the initial listing criteria of The NASDAQ Capital Market.

Our common stock was approved for listing on The NASDAQ Capital Market under the symbol “MEDS”, on February 13, 2020.

| 8 |

June 2023 Reverse Stock Split.

In June 2023 the Company effected a 1-for-15 reverse stock split of its issued and outstanding common stock.

Subsidiaries

We own 100% of Trxade Inc. (a Florida corporation). This subsidiary is included in our attached consolidated financial statements and is engaged in the same line of business as Trxade. Trxade Inc. iswas the subsidiary through which we previously operated a web-based market platform that enablesto enable commerce among healthcare buyers and sellers of pharmaceuticals, accessories and services. On February 16, 2024, we entered into an asset purchase agreement with Trxade, Inc. and Micro Merchant Systems, Inc. (“MMS”), under which MMS purchased for cash substantially all of the assets of Trxade, Inc. in a transaction that closed on February 16, 2024.

We own 100% of Integra Pharma Solutions, LLC (formerly Pinnacle Tek, Inc., a Florida corporation) founded by Mr. Suren Ajjarapu, our CEO, in 2011 (“Integra”). Until the end of 2016, Integra served as our technology consultant provider, but we discontinued that line of business in 2016. Integra now serves as our logistics company for pharmaceutical distribution.

We own 100% of Community Specialty Pharmacy, LLC, an independent retail specialty pharmacy with a focus on specialty medications.Former Subsidiaries

WeIn February of 2022 we entered into an agreement with Exchange Health to own 100%51% of Alliance Pharma Solutions, LLC (d.b.a. DelivMeds), a Florida limited liability company, which was founded in January 2018 (“Alliance”). Alliance previously owned 30% of SyncHealth MSO, LLC (“SyncHealth”) which was part of a joint venture formed in January 2019 with PanOptic Health, LLC (“PanOptic”) with the goal of enabling independent retail pharmacies to better compete with large national pharmacies on pricing, distribution and logistics. We did not realize any income from the joint venture, and we terminated the joint venture agreements pursuant to their terms effective as of January 31, 2020, and assigned the 30% ownership of SyncHealth back to PanOptic. As of February 1, 2020, we own no equity in SyncHealth and only the terms of the agreements relating to confidentiality, non-solicitation and each party’s obligation to cease use of the other party’s intellectual property survive the termination.

We own 100% of Bonum Health,SOSRx, LLC a Delaware limited liability company which owns our “Bonum Health Hub”company. In December of 2022 management determined that the subsidiary did not generate significant revenue and the assets and operations as discussed in further detail below.

We previously ownedwere 100% impaired. In February of MedCheks, LLC, a Delaware limited liability company which was formed in January 2021, had no revenue in 2021 and was dissolved in December 2021.2023 we voluntarily withdrew from the agreement with Exchange Health.

We previously owned 100% of PharmCentrix,Community Specialty Pharmacy, LLC (“CSP”) and Alliance Pharma Solutions, LLC (d.b.a. DelivMeds) (“APS”). Our interests in CSP and APS were sold in September 2023 and have been included in discontinued operations.

As of December 31, 2023 we owned 100% of Superlatus, Inc. (“Superlatus”), and its wholly owned subsidiary Sapientia Technologies, LLC. Superlatus is a Delaware limited liabilitydiversified food technology company which had no revenuewith distribution capabilities and systems to optimize food security and population health via innovative Consumer Packaged Goods products, agritech, foodtech, plant-based proteins and alt-protein and includes, Sapientia, a food tech business. In March 2024 we divested our entire interest in 2020 and was dissolved in December 2020.Superlatus.

Acquisition of Community Specialty Pharmacy, LLC

On October 15, 2018, the Company entered into and consummated the purchase ofWe previously owned 100% of the equity interestsThe Urgent Company, Inc. (“The Urgent Company” or “TUC”), a retail and distribution provider of Community Specialty Pharmacy, LLC, a Florida limited liability company, (“CSP”), pursuant to the terms and conditions of the Membership Interest Purchase Agreement, entered into by and among the Company as the buyer, and CSP, and Nikul Panchal, the equity owner of CSP, a non-executive officer of the Company (collectively, the “Seller”). The purchase price for the 100% equityprepackaged, prepared foods. We divested our interest in CSP was $300,000 in cash, a promissory note issued by theThe Urgent Company in the amount of $300,000, and warrants to purchase 67,585 shares of common stock of the Company (on a post-Reverse Split basis and taking into account the Reverse Stock Split) of which 33% of such warrants were revocable by the Company prior to October 15, 2019 (but were not revoked); 33% were revocable by the Company prior to October 15, 2020 (but were not revoked); and the remaining 33% of such warrants are revocable by the Company prior to October 15, 2021 (which were revoked on September 23, 2021), which are exercisable for eight (8) years from the issuance date at a strike price of $0.06 per share. As of the date of this Report, there are no warrants to purchase shares of common stock remain outstanding in connection with the purchase.our divestiture of Superlatus.

SyncHealth MSO, LLC Joint Venture

On January 17, 2019, the Company and Alliance Pharma Solutions, LLC, a Delaware limited liability company and wholly-owned subsidiary of the Company (hereafter “Alliance,” with Alliance and Trxade referred to collectively herein as the “Trxade Parties”), entered into a transaction effective as of January 17, 2019 with PanOptic Health, LLC, a Delaware limited liability company (“PanOptic”), to create a new entity, SyncHealth MSO, LLC (“SyncHealth”) as part of a joint venture to enable independent retail pharmacies to better compete with large national pharmacies on pricing, distribution and logistics. As part of the transaction Alliance owned 30% of SyncHealth. We did not realize any income from the joint venture, and we terminated the joint venture agreements pursuant to their terms effective as of January 31, 2020, and assigned the 30% ownership of SyncHealth back to PanOptic. As of February 1, 2020, we own no equity in SyncHealth and only the terms of the agreements relating to confidentiality, non-solicitation and each party’s obligation to cease use of the other party’s intellectual property survive the termination.

Bonum Health Asset Acquisition

On October 23, 2019, Bonum Health, LLC, a Delaware limited liability company, and a then newly formed wholly-owned subsidiary of the Company (“Bonum Health”) entered into an Asset Purchase Agreement with Bonum Health, LLC, a Florida limited liability company (“Seller”) and the sole member of the Seller (the “Member”). Pursuant to the Asset Purchase Agreement, the Company (through Bonum Health) acquired from the Seller, certain specified assets and certain specified contracts associated with the assets of the Seller’s operation as a telehealth service provider (the Tele Meds Platform)(the “Assets”). Included with the acquisition of the Assets, were contracts (relating to the Assets), intellectual property for the Bonum Health Tele Medicine software & Technology and personal computers. The Company agreed to provide the Seller consideration equal to 41,667 shares of restricted common stock of the Company at the closing, and the Seller had the right to earn up to an additional 108,334 shares of restricted common stock of the Company in the event certain milestones were met within the first anniversary of the Closing date, none of which were met.

The Asset Purchase Agreement includes a three year non-compete requirement, prohibiting the Seller and the Member from competing against the Assets, customary representations and indemnification obligations, subject to a $25,000 minimal claim amount and certain limitations on liability disclosed in the Asset Purchase Agreement.

Subsequent to the acquisition, the Company determined that the assets were not usable and wrote off the value of the assets amounting to approximately $369,000.

| 9 |

BUSINESS OF TRXADE

Company Overview

We are a health services IT company focused on digitalizing the retail pharmacy experience by optimizing drug procurement, the prescription journey and patient engagement in the U.S. and have designed and developed, and now own and operate, a business-to-business web-based marketplace. Our core service brings the nation’s independent pharmacies, accredited national suppliers, and manufacturers of pharmaceuticals together to provide efficient and transparent buying and selling opportunities.

We began operations as Trxade Group, Inc., a Nevada corporation (“Trxade Nevada”) in August of 2010 and spent over two years creating and enhancing our web-based services. The Company changed its name on June 1, 2021, from “Trxade Group, Inc” to “TRxADE HEALTH, INC.” Our services provideprovided pricing transparency, purchasing capabilities and other value-added services on a single platform focused on serving the nation’s approximately 19,397 independent pharmacies with annual purchasing power of $67.1 billion (according to the National Community of Pharmacists Association’s 2021 Digest). Our national wholesale supply partners and manufacturers are able to fulfill orders on our platform in real-time and provide pharmacies and wholesale suppliers with cost-saving payment terms and next-day delivery capabilities in unrestrictive states. We have expanded significantly since 2015 and now serveserved approximately 13,100+14,400+ registered members on our sales platform.

Our Principal Products and Services and their Markets.Markets

Trxade.com is apreviously operated the Company’s web-based pharmaceutical marketplace engaged in promoting and enabling commerce among independent pharmacies, small chains, hospitals, clinics, and alternate dispensing sites with large pharmaceutical suppliers nationally. OurThat marketplace hashad over 60 national and regional pharmaceutical suppliers providing over 120,000 branded and generic drugs, including over-the-counter drugs (OTCs), and drugs available for purchase by pharmacists. We serveserved approximately 13,100+14,400+ registered members, providing access to Trxade’s proprietary pharmaceutical database and data analytics regarding medication pricing. We generategenerated revenue from these services by charging a transaction fee to the seller of the products for sales conducted via the Trxade platform. The buyers do not bear the cost of transaction fees for the purchases that they make, nor do they pay a fee to join or register with our platform. In February 2024 we divested substantially all of our assets related to our web-based pharmaceutical marketplace previously operated through TRxADE, Inc. Substantially all of our revenues during the years ended December 31,Fiscal 2023, Fiscal 2022, and Fiscal 2021 and 2020, were from platform revenue generated on www.rx.trxade.com, product sales through Integra Pharma Solutions, LLC, and prescription sales through Community Specialty Pharmacy, LLC.

Status of current products and services.services and business plans; Status of former business products and initiatives

We havepreviously had a number of products and services stillfocused on the US market in development,operation and business assets, which are described below. In addition, in 2024 we expect to explore other strategic transactions and acquisitions as a means to monetize and enhance the Company’s current assets and operations, which transactions may involve effecting acquisitions of new businesses in industries that differ from our legacy operations.

Integra Pharma Solutions, LLC. Integra is intended to serve as our logistics company for pharmaceutical distribution.

We currently distribute through our manufacturer and strategic distribution partners prescription medication, medical devices and over the counter medication to over 1,600 pharmacies and medical clinics across 38 states.

Community Specialty Pharmacy, LLC. We acquired Community Specialty Pharmacy, LLC, a Florida limited liability company (“CSP”), on October 15, 2018. CSP is an accredited pharmacy located in St. Petersburg, Florida. CSP has a focus on specialty medications. The company operates with an innovative pharmacy model which offers home delivery services to any patient thereby providing convenience.

| 10 |

Delivmeds.com. Delivmeds.com was launched in late 2018 as a consumer-based app to provide delivery of pharmaceutical products associated with Alliance Pharma Solutions, LLC. We are currently working on reformulating the application from a prescription delivery portal to a fully integrated, interoperable, end-to-end prescription delivery and medication adherence tool. The new product has been rebranded and is targeted for consumer re-release and use in the near future. To date, we have not generated any revenue from this product.

Trxade Prime. Trxade Prime allows previously allowed pharmacy members on the Trxade platform to process, consolidate and ship purchase orders that are placed directly with Trxade suppliers via the Trxade Prime service.Prime. This isservice was provided at no cost, with the goal of offering a single tool with one low order minimum, one invoice, one package and one delivery from multiple quality wholesalers and distributors. Revenue hashad been generated from this service thoughthrough our Integra subsidiary, which provides the consolidation of the orders.

Bonum Health Hub and Application. The “Bonum Health Hub”, a self-enclosed, free standing virtual examination room, was launched by the Company’s wholly-owned Bonum Health, LLC subsidiary, in November 2019 and was expected to be operational in April 2020; however, due to the COVID-19 pandemic, the Company does not anticipate installations moving forward, and has taken a write off of the hubs purchased at June 30, 2021 in the amount of $143,891, which is included under loss on inventory investments in the statement of operations for the year ended December 31, 2021, in Note 8 - Other Receivables” to the Notes to Consolidated Financial Statements included herein under “Item 8. Financial Statements and Supplemental Data”.

The “Bonum Health app,”, which provides previously provided an overall healthcare experience comparable to a Primary Care practitioner, and an online portal as a personal electronic medical record and scheduling system iswas available on a subscription basis, primarily as a stand-alone telehealth software application that can be licensed on a business-to-business (B2B) model to clients as an employment health benefit for the clients’ employees. Revenue has beenwas generated from this service through our Bonum subsidiary.

Bonum+ Business to Business (B2B). Bonum+ bundlespreviously bundled telehealth, a COVID-19 risk assessment tool and a Personal Protective Equipment (PPE) purchasing tool, through a secure mobile dashboard for corporate clients. The B2B platform easeseased pressure on employees who arewere required to report any relevant health issues daily, centralizing communication and contact tracing to deliver risk scores. This allowsallowed employers to monitor employee COVID-19 risk profiles and streamlinesstreamlined the ordering of new PPE as needed. An integrated artificial intelligence (AI) tool offersoffered health recommendations and connects employees with board certified physicians, as needed. To date, we have notNo revenue was generated any revenue from this product.

MedCheks Health Passport. The Health Passport is a patient-centered, digital, precision healthcare platform that lets patients consolidate and control their health data via a digital Health Passport and allows them to share their health profile, tests and vaccinations simply and safely. Secured in a blockchain, the Health Passport includes health and vaccination status verification via a QR code, which is available for travel, entry into stadiums, concert venues, events, offices, industrial plants, warehouses, and other physical access points. The Passport stores all of a user’s health records securely in one place. We have not generated any revenue from this product to date and the product was discontinued at the end of December 2021. We previously owned 100% of MedCheks, LLC, a Delaware limited liability company which was formed in January 2021, had no revenue in 2021 and was dissolved in December 2021.

SOSRx, LLC. On February 15, 2022, the Company entered into a relationship with Exchange Health, LLC, a technology company providing an online platform for manufacturers and suppliers to sell and purchase pharmaceuticals (“Exchange Health”). SOSRx LLC, a Delaware limited liability company (“SOSRx”), was formed, which is owned 51% by the Company and 49% by Exchange Health. SOSRx did not generate material revenue and in February of 2023, the Company voluntarily withdrew from the joint venture agreement. The asset impairment is reflected in the statement of operations for Fiscal 2022 as impairment of intangible asset. Additionally, the Company contributed a cash investment of $275,000 in February of 2022 when the joint venture was formed. The Company did not recover this investment as part of the withdrawal settlement.

Superlatus. As of December 31, 2023, Superlatus was a wholly owned subsidiary of the Company as a result of a merger transaction that closed in July 2023. Superlatus is a diversified food technology company with distribution capabilities and systems to optimize food security and population health via innovative Consumer Packaged Goods products, agritech, foodtech, plant-based proteins and alt-protein and includes wholly-owned subsidiary, Sapientia, Inc., a food tech business. Subsequent to December 31, 2023, the Company divested its entire interest in Superlatus.

All of our product offerings are focused on the United States markets. Some products are restricted just to certain states, depending upon the various applicable state regulations and guidelines pertaining to pharmaceuticals, particularly, and drug businesses, generally. Our services are distributed through our online platform

| 11 |

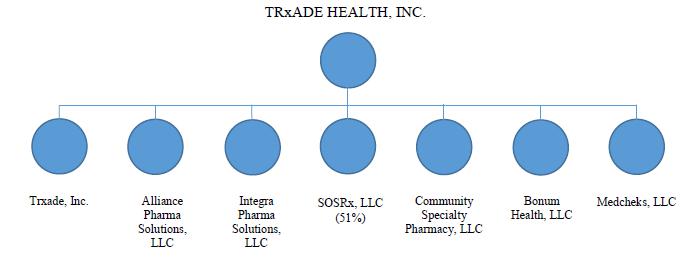

Organizational Structure

The diagram below depicts our current organizational structure:

The Pharmaceutical Industry

According to the NCPA 2020 Digest Report, United States pharmaceutical companies comprise a burgeoning estimated $685 billion industry by 2023, consisting of over 65,000 pharmacy facilities. Management believes that few platforms are currently in place to bring these participants together to share market knowledge, product pricing transparency and product availability. According to this, theThe pharmaceutical market is comprised primarily of three wholesalers that control an estimated approximately 92% of the market. Our management believes that this concentration has, over the years, led to a lack of price and cost transparency, thereby resulting in severe limitations on the purchasing choices of industry participants. These market dynamics have enabled these large wholesalers (McKesson, Cardinal Health and AmerisourceBergen), known as ADR distributors, to dominate the industry with respect to both generic and brand pharmaceuticals.

To fuel this change, insurance companies (Pharmacy Benefits Management (“PBM”) and private health payers) and the federal government have initiated lower medication reimbursement payments to healthcare providers. We believe that pharmacies face increasing pressure to source medications as inexpensively as possible and improve operational efficiency. Trxade seeksHealth aims to be in the forefront of solvingaddress these transparency and pricing concerns by providing independent, retail pharmacies with real-time, pharmacy acquisition cost (“PAC”) benchmarks to the National Drug Code (the “NDC”) standard. The NDC mark is a unique product identifierexceptional service and pricing on their most commonly used in the United States for drugs intended for human use.pharmaceuticals by partnering with strategic manufacturers and other authorized suppliers.

Competitive Business Conditions, Our competitive positionCompetitive Position in our Industry, and our Methods of Competition.Competition

We expect to face competition from the three large ADR distributors (McKesson,(including McKesson, Cardinal Health and AmerisourceBergen), other pharmaceutical distributors, buying groups, software products, and other start-up companies. Most of our competitors’ operations have substantially greater financial- and manufacturer-backed resources, longer operating histories, greater name recognition, and more established relationships in the industry.

Other Start-up Companies Which Provide Competitive Services.Services

We have identified start-ups that provide for supplier-pharmacyThere are currently several smaller regional and national secondary distributors of pharmaceuticals such as (Anda Pharmaceutical, Masters Pharmaceutical etc)as well as other innovative trading platforms such as PharmaBid, RxCherrypick, PharmSaver, MatchRx and GenericBid, and provide web-based services similar to ours, allowingthat allow pharmacies to buy from several suppliers. TrxadeIntegra differentiates itself from these exchangesdistributors by providing our pharmacies with bothunique specialty, brand and generic pharmaceutical products. Additional companies target “direct-to-consumer” pharmacy deliveries, including Amazon.com’s PillPack, Capsule, Costplusdrugs, products that are in short supply and GetRoman.com.offered via limited distribution channels.

Buying Groups.Groups

Buying Groups provide discounted prices to their members by negotiating better pricing with one primary wholesaler, while charging administrative fees generally ranging from 3 to 5 percent. Some Buying Groups are structured like co-operatives (such as Independent Pharmacy Cooperative (IPC) and American Pharmacy Cooperative, Inc. (APCI)) and offer their members monthly or quarterly rebates. Although they can function well to bring pricing competition to the industry, they often offer rebates only after the purchase. Management does not believe Buying Groups will provide long-term savings to customers with this model given the increased transparency and competition in the industry.

| 12 |

Pharmaceutical Software.Software

Some pharmaceutical software companies compete with us to varying degrees at different levels. SureCost, for example, provides inventory management software enabling pharmacies to comply with primary supplier contracts. This software is fee-based and requires training.

Pharmacies may be reluctant to buy pharmaceuticals on the internet due to the historical negativity and uncertainty with respect to the origin and purity of drugs purchased off the web. Trxade management believes that as we continue to develop our brand, our customer base, and our vast product offerings, we will gain the trust of the market and overcome the negativity associated with purchasing via a pharmaceutical online marketplace.from multiple distributors outside of their primary vendor agreements.

One advantage that we believe we have over our competition is our ability to be flexible and fast moving in adjusting our business model to address the needs of our customer base. Trxade started by offering pharmacies a reverse auction model to enhance savings on the purchase of their pharmaceuticals. Customer feedback suggested that pharmacies prefer a more “buy now” format, which we implemented. This resulted in a “one-stop-one-search” platform to buy quality pharmaceuticals for less and a data-rich platform to help pharmacies overcome the complexities related to supply chain purchasing.

Telehealth Providers

We also anticipatepreviously anticipated facing competition in the telehealth industry (in connection with “Bonum Health”) from current and future health care companies in the telehealth market including, Teladoc Health, Inc., MDLive, Inc., American Well Corporation and Grand Rounds, Inc., among other smaller industry participants.

Sources and Availability of Raw Materials; Principal Suppliers.Suppliers

Trxade is a web-based technology platform. Because we are not a manufacturing company, we do not need any raw materials. Our module on the platform is drug supplier-to-retailer. We bring buyers and sellers together on this platform. Our suppliers include National Apothecary Solutions, Integral RX, and South Pointe Wholesale, Inc.

Dependence on One or More Major Customers.Customers

As of the date of this filing, we have approximately 13,100+1600 registered members and over 3010 pharmaceutical suppliers as customers, with an estimated market potential of approximately 19,39720,000+ independent pharmacies and 1,500 regional and local suppliers. We have a working relationship with over 25 wholesalers and the nation’s largest buying group. Although we believe those entities are satisfied with their business relationship with Trxade, if our buying group and two or three of the largest wholesalers decided no longer to do business with Trxade, the resulting supplier void would materially and adversely affect our competitiveness in the marketplace.pharmacies.

Intellectual Property.Property

Although we believe that our name and brand are protected by applicable state common law trademark laws, we do not currently have any patents, concessions, licenses, royalty agreements, or franchises, provided that we do currently maintain a number of registered trademarks and our pharmaceutical pricing benchmarks, PAC. Our business operates under a proprietary software system which includes trade secrets within our database, business practices and pricing model. We also maintain a number of websites.franchises.

We believe that we have taken all necessary steps to protect our proprietary rights, but no assurance can be given that we will be able to successfully enforce or protect our rights in the event that they are infringed upon by a third party.

Need for Government Approval of Products and Services.Services

We are required to hold state pharmaceutical business licenses and to follow applicable state and federal government regulations detailed herein. In October 2018, we acquired Community Specialty Pharmacy, LLC, an accredited independent retail pharmacy with a focus on specialty medications, which requires state approval, which have been obtained in 36 states.

Effect of Existing or Probable Government Regulations on the Business.

Federal Drug Administration Guidelines

On April 12, 1988, President Ronald Reagan signed into law the Prescription Drug Marketing Act of 1987 (PDMA), setting the baseline for wholesale distribution regulations. The final regulations were published in 1999, establishing the minimum wholesale distribution requirements for state licensure. With the intent to prevent the introduction and retail sale of substandard, ineffective, or counterfeit drugs into the distribution system, state licensing systems moved to update their standards to match those provided federally as guided under FDA’s Guidelines for State Licensing of Wholesale Prescription Drug Distributors (21 CFR 205). PDMA established minimum federal pedigree requirements to trace the ownership of prescription drugs through the supply chain. The principal goal of the PDMA was to further secure the nation’s drug supply from counterfeit and substandard prescription drugs. The law establishes two types of distributors: “Authorized distributor[s] of record” or ADRs; and “Unauthorized distributor[s],” such as wholesalers. The pedigree requirement was to require each person engaged in the wholesale distribution of a prescription drug in interstate commerce, who is not the manufacturer or an authorized distributor of record for that drug, to provide a pedigree to the recipient. After meeting resistance from various stakeholders, the FDA delayed the effective date of the regulations several times, until final implementation in December 2006.

At the federal level the implementation of the track and trace legislation which went into effect in 2018, requires the use of pharmaceutical pedigree to track the movement of pharmaceuticals along the supply chain. The costs of complying with this new legislation may be too burdensome for many of the smaller suppliers.

State Drug Administration Guidelines

There are a number of national and state-wide regulations that have an effect on our business. All drug wholesalers must be licensed under state licensing systems, which must in turn meet the FDA guidelines under State Licensing of Wholesale Prescription Drug Distributors (21 CFR Part 205). The regulations set forth minimum requirements for prescription drug storage and security as well as for the treatment of returned, damaged, and outdated prescription drugs. Further, wholesale drug distributors must establish and maintain inventories and records of all transactions regarding the receipt and distribution of prescription drugs and make these available for inspection and copying by authorized federal, state, or local law enforcement officials. In most states, wholesale distributor licenses are issued by the State Boards of Pharmacy and require periodic renewal. Approximately 40 states also require out-of-state wholesalers that distribute drugs within their borders to be licensed as well.

| 13 |

On February 4, 2022, the FDA published a proposed rule to set national standards for the licensing of prescription drug wholesale distributors and third-party logistics providers. The comment period was open until June 6, 2022. New regulations and requirements for wholesale distributors and third-party logistics providers could be too burdensome and could impact our registered suppliers on the Trxade platform.

California, Florida, Nevada, New Mexico and Indiana define the normal distribution channel to not include the lateral sales of pharmaceuticals between wholesalers. The Supply Chain Act, part of the Quality Drug Act, which was signed into federal law in December 2013, precludes all states from restricting, investigating or inspecting the distribution channel and transactional history. Until the federal government provides guidelines for the new federal law, no state regulation or guideline exists.

The warehousing of pharmaceuticals is also restricted and requires additional state licenses. Some licenses require bonds and written exams and may take some time to approve. Currently, Integra Pharma Solutions, LLC, our wholesale distributor, asks for formal pedigrees from the ADR wholesalers and provides pedigrees to those entities they sell to in the marketplace. This requirement limits liability and provides assurance if a recall is warranted that Trxade and its participants will receive value for the commodity.

Our national wholesale supply partners are able to fulfill orders on our platform in real-time and provide pharmacies with cost-saving payment terms and next-day delivery capabilities in unrestrictive states under the Model State Pharmacy Act and Model Rules of the National Association of Boards of Pharmacy (Model Act).

Potential New Regulations; Price Gouging Rules

In addition to the above, regulatory mandates in response to certain unexpected events, such as viral outbreaks, could negatively impact sales. For example, in December 2019 an outbreak of a coronavirus surfaced in China and resulted in governments around the world adopting restrictions on public gatherings, travel and restrictions on companies’ (including our) ability to conduct normal business operations.

Price gouging may be an issue in the coming months due to the continued effects of the coronavirus and responses thereto and supply chain issues associated therewith and separately; as of the date of this Report, 42 states have enacted price gouging laws of one kind or another. The laws vary from state to state, but one constant throughout is a prohibition to charge “excessive” or “unconscionable” prices for consumer goods. Some states define “excessive” or “unconscionable” while others define what makes a prima faciafacie case for price gouging and what constitutes a prima faciafacie defense, shifting the burden of proof to the accuser. In almost all of the 42 states with price gouging laws on the books, a price is excessive or unconscionable if the price of a good has increased, in some states by a certain percentage, over the price of the good prior to the onset of the abnormal disruption of the market. Some states have clearly excepted from the price gouging definition a rise in prices caused by an increase in the merchant’s cost of delivering that good for sale – whether it be increased shipping costs, gasoline prices or simply the cost of the good itself. Other states have less defined exceptions – Virginia for example only treats the fact of increased input costs as a merchant’s prima faciafacie defense to an accusation of price gouging. Several states except from the price gouging definition prices that do not exceed a normal margin (i.e., the merchant’s margin immediately prior to the market disruption) PLUS 10%. In general, while the lawlaw may not specifically define what constitutes an “unconscionably excessive price,” the statutes typically provide that a price may be “unconscionably excessive” if: the amount charged represents a “gross disparity” from the price such goods or services were sold or offered for sale immediately prior to the onset of the abnormal disruption of the market. Merchants may provide evidence that justifies their higher prices were justified by increased costs beyond their control. We will need to comply with the excessive price statutes; as of the date of this Report, we believe we were in compliance with all 42 states’ price gouging laws.

| 14 |

U.S. Federal and State Fraud and Abuse Laws

Federal Stark Law

We are subject to the federal self-referral prohibitions, commonly known as the Stark Law. Where applicable, this law prohibits a physician from referring Medicare patients to an entity providing “designated health services” if the physician or a member of such physician’s immediate family has a “financial relationship” with the entity, unless an exception applies. The penalties for violating the Stark Law include the denial of payment for services ordered in violation of the statute, mandatory refunds of any sums paid for such services, civil penalties, disgorgement and possible exclusion from future participation in the federally funded healthcare programs. A person who engages in a scheme to circumvent the Stark Law’s prohibitions may be subject to fines for each applicable arrangement or scheme. The Stark Law is a strict liability statute, which means proof of specific intent to violate the law is not required. In addition, the government and some courts have taken the position that claims presented in violation of the various statutes, including the Stark Law can be considered a violation of the federal False Claims Act (described below) based on the contention that a provider impliedly certifies compliance with all applicable laws, regulations and other rules when submitting claims for reimbursement. A determination of liability under the Stark Law could have a material adverse effect on our business, financial condition and results of operations.

Federal Anti-Kickback Statute

We are also subject to the federal Anti-Kickback Statute. The Anti-Kickback Statute is broadly worded and prohibits the knowing and willful offer, payment, solicitation or receipt of any form of remuneration in return for, or to induce, (i) the referral of a person covered by Medicare, Medicaid or other governmental programs, (ii) the furnishing or arranging for the furnishing of items or services reimbursable under Medicare, Medicaid or other governmental programs or (iii) the purchasing, leasing or ordering or arranging or recommending purchasing, leasing or ordering of any item or service reimbursable under Medicare, Medicaid or other governmental programs. In addition, a person or entity does not need to have actual knowledge of this statute or specific intent to violate it to have committed a violation. Moreover, the government may assert that a claim including items or services resulting from a violation of the Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the False Claims Act, as discussed below. Violations of the Anti-Kickback Statute can result in exclusion from Medicare, Medicaid or other governmental programs as well as civil and criminal penalties and fines. Imposition of any of these remedies could have a material adverse effect on our business, financial condition and results of operations.

Federal False Claims Act & HIPAA

BothThe federal and stateFalse Claims Act provides, in part, that the federal government agenciesmay bring a lawsuit against any person whom it believes has knowingly presented, or caused to be presented, a false or fraudulent request for payment from the federal government, or who has made a false statement or used a false record to get a claim approved. In addition, amendments in 1986 to the federal False Claims Act have continued civil and criminal enforcement efforts as part of numerous ongoing investigations of healthcaremade it easier for private parties to bring “qui tam” whistleblower lawsuits against companies and their executives and managers. Although there are a number of civil and criminal statutes that can be applied to healthcare providers, a significant number of these investigations involveunder the federal False Claims Act. These investigations can be initiated not only by the government but also by a private party asserting direct knowledge of fraud. Penalties include significant civil monetary penalties for False Claims Act violations include fines,each false claim, plus up to three times the amount of damages sustained bythat the federal government.government sustained because of the act of that person. Qui tam actions have increased significantly in recent years, causing greater numbers of healthcare companies to have to defend a false claim action, pay fines, be excluded from Medicare, Medicaid or other federal or state healthcare programs, or be subject to integrity oversight and reporting obligations to resolve allegations of non-compliance, as a result of an investigation arising out of such action.

There are other federal anti-fraud laws that that prohibit, among other actions, knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program, including private third-party payors, knowingly and willfully embezzling or stealing from a healthcare benefit program, willfully obstructing a criminal investigation of a healthcare offense, and knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services.

Additionally, HIPAA established two federal crimes for healthcare fraud and false statements relating to healthcare matters. The healthcare fraud statute prohibits knowingly and willfully executing a scheme to defraud any healthcare benefit program, including private payors. The false statements statute prohibits knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. A False Claims Act violation of either of these statutes is a felony and may provide the basis forresult in fines, imprisonment, exclusion from the federally fundedMedicare, Medicaid or other federal or state healthcare programs. In addition, some states have adopted similar fraud, whistleblowerprograms, or integrity oversight and false claims provisions.reporting obligations to resolve allegations of non-compliance.

State Fraud and Abuse Laws

Several states in which we operate have also adopted similar fraud and abuse laws as described above. The scope of these laws and the interpretations of them vary from state to state and are enforced by state courts and regulatory authorities, each with broad discretion. Some state fraud and abuse laws apply to items or services reimbursed by any payor, including patients and commercial insurers, not just those reimbursed by a federally funded healthcare program. A determination of liability under such state fraud and abuse laws could result in fines and penalties and restrictions on our ability to operate in these jurisdictions.

Other Healthcare Laws

The federal Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act, or HITECH, and their implementing regulations, which we collectively refer to as HIPAA, established several separate criminal penalties for making false or fraudulent claims to insurance companies and other non-governmental payors of healthcare services. Under HIPAA, these two additional federal crimes are: “Healthcare Fraud” and “False Statements Relating to Healthcare Matters.” The Healthcare Fraud statute prohibits knowingly and recklessly executing a scheme or artifice to defraud any healthcare benefit program, including private payors. A violation of this statute is a felony and may result in fines, imprisonment or exclusion from government sponsored programs. The False Statements Relating to Healthcare Matters statute prohibits knowingly and willfully falsifying, concealing or covering up a material fact by any trick, scheme or device or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. These provisions are intended to punish some of the same conduct in the submission of claims to private payors as the federal False Claims Act covers in connection with governmental health programs.

In addition, the Civil Monetary Penalties Law imposes civil administrative sanctions for, among other violations, inappropriate billing of services to federally funded healthcare programs and employing or contracting with individuals or entities who are excluded from participation in federally funded healthcare programs. Moreover, a person who offers or transfers to a Medicare or Medicaid beneficiary any remuneration, including waivers of copayments and deductible amounts (or any part thereof), that the person knows or should know is likely to influence the beneficiary’s selection of a particular provider, practitioner or supplier of Medicare or Medicaid payable items or services may be liable for civil monetary penalties for each wrongful act. Moreover, in certain cases, providers who routinely waive copayments and deductibles for Medicare and Medicaid beneficiaries can also be held liable under the Anti-Kickback Statute and civil False Claims Act, which can impose additional penalties associated with the wrongful act. One of the statutory exceptions to the prohibition is non-routine, unadvertised waivers of copayments or deductible amounts based on individualized determinations of financial need or exhaustion of reasonable collection efforts. Although this prohibition applies only to federal healthcare program beneficiaries, the routine waivers of copayments and deductibles offered to patients covered by commercial payers may implicate applicable state laws related to, among other things, unlawful schemes to defraud, excessive fees for services, tortious interference with patient contracts and statutory or common law fraud.

Climate Change Regulation

The U.S. government and foreign governments are currently in the process of considering new or expanded laws to address climate change. Such laws, if adopted, may include limitations on greenhouse gas (“GHG”) emissions, mandates that companies implement processes to monitor and disclose climate-related matters, additional taxes or offset charges on specified energy sources, and other requirements. Compliance with climate-related laws may be further complicated by different regulatory approaches and requirements in the various jurisdictions in which we operate. New or expanded climate-related laws could impose substantial costs on us. Until the timing and extent of climate-related laws are clarified, we cannot predict their potential effect on our capital expenditures or our results of operations.Status as a Public Company

Environmental Regulations

Our operations are subject to regulations under various federal, state, local and foreign laws concerning the environment, including laws addressing the discharge of pollutants into the air and water, the management and disposal of hazardous substances and wastes, and the cleanup of contaminated sites. We could incur substantial costs, including cleanup costs, fines and civil or criminal sanctions and third-party damage or personal injury claims, if in the future we were to violate or become liable under environmental laws. We are not awarean “emerging growth company,” as defined in Section 2(a) of any costs or effects of our compliance with environmental laws.

Jumpstart Our Business Startupsthe Securities Act,

In April 2012, as modified by the Jumpstart Our Business Startups Act (“JOBSof 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act,”) was enacted into law. The JOBS Act provides, among other things: reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

In general, under the JOBS Act a company is an “emerging growth company” if its initial public offering (“IPO”) of common equity securities was affected after December 8, 2011, and the company had less than $1.07 billion of total annual gross revenues during its last completed fiscal year. A company will no longer qualify as an “emerging growth company” after the earliest of

The JOBS Act provides additional new guidelines and exemptions for non-reporting companies and for non-public offerings. Those exemptions that impact the Company are discussed below.

Financial Disclosure. The financial disclosure in a registration statement filed by an “emerging growth company” pursuant to the Securities Act, will differ from registration statements filed by other companies as follows: