UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ Annual Report under Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 20212023

or

☐Transitional Report under Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission File Number 001-39531

Processa Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 45-1539785 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

7380 Coca Cola Drive, Suite 106,

Hanover, Maryland 21076

((443)443) 776-3133

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.0001 par value per share | PCSA | The Nasdaq Stock Market LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its managements’ assessment of the effectiveness of its internal controls over financial reporting under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No No☒ ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates on June 30, 2021,2023, the last business day of the most recently completed second quarter, based upon the closing price of Common Stock on such date as reported on Nasdaq Capital Market, was approximately $95.410.2 million.

The number of outstanding shares of the registrant’s common stock as of March 24, 202221, 2024 was .

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the registrant’s 20222024 Annual Meeting of Stockholders (the “Proxy Statement”) to be filed within 120 days of the end of the fiscal year ended December 31, 20212023 are incorporated by reference into Part III hereof. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as a part hereof.

Table of Contents

| 2 |

GLOSSARY OF CERTAIN SCIENTIFIC TERMS

The medical and scientific terms used in this Annual Report on Form 10-K have the following meanings:

“Active metabolite” means a drug that is processed by the body into an altered form which effects the body.

“Agonist” means a chemical/drug that binds to a receptor in the body and activates that receptor to produce a biological response.

“Analog” means a compound having a structure similar to that of an approved drug but differing from it with respect to a certain component of the molecule which may cause it to have similar or different effects on the body.

“cGCP” means current Good Clinical Practices. The FDA and other regulatory agencies promulgate regulations and standards, commonly referred to as current Good Clinical Practices, for designing, conducting, monitoring, auditing and reporting the results of clinical trials to ensure that the data and results are accurate and that the rights and welfare of trial participants are adequately protected.

“cGMP” means current Good Manufacturing Practices. The FDA and other regulatory agencies promulgate regulations and standards, commonly referred to as current Good Manufacturing Practices, which include requirements relating to quality control and quality assurance, as well as the corresponding maintenance of records and documentation.

“CMO” means Contract Manufacturing Organization.

“CRO” means Contract Research Organization.

“Deuterated analog” means a small molecule in which one or more of the hydrogen atoms are replaced by deuterium.

“EMA” means the European Medicines Agency.

“FDA” means the Food and Drug Administration.

“FPI” means First Patient In (enrolled into the clinical trial).

“IND” means an Investigational New Drug Application. Before testing a new drug on human subjects, the company must file an IND with the FDA. Information must be produced on the absorption, distribution, metabolism, and excretion properties of the drug and detailed protocols for testing on human subjects must be submitted.

“Indication” means a condition which makes a particular treatment or procedure advisable.

“Moiety” means an active or functional part of a molecule.

“NDA” means a New Drug Application submitted to the FDA. Under the Food, Drug, and Cosmetic Act of 1938, an NDA is submitted to the FDA enumerating the uses of the drug and providing evidence of its safety.

“NGC” means Next Generation Chemotherapy, referring to the drugs in our pipeline that have active cancer killing metabolites that are the same or have very similar chemical structure to existing FDA-approved chemotherapy treatments, resulting in our NGCs killing cancer cells following the same mechanism as the FDA-approved treatments.

“NL” means Necrobiosis Lipoidica, a rare chronic and granulomatous disorder.

“Osteonecrosis” means the death of bone cells due to decreased blood flow. It can lead to pain and collapse of areas of bone.

| 3 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND RISK FACTOR SUMMARY

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts contained in this Form 10-K are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words or other comparable terminology. We have based these forward-looking statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors” and elsewhere in this Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Form 10-K may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These risks are discussed more fully in the “Risk Factors” section of this Annual Report on Form 10-K.10-K and are summarized below under the “Summary Risk Factors” section. These risks include, but are not limited to, the following:

| ● | our ability to obtain funding for our future | |

| ● | our ability to obtain and maintain regulatory approval of our product candidates; | |

| ● | our ability to contract with third-party suppliers, manufacturers and other service providers and their ability to perform adequately; | |

| ● | our ability to meet obligations under our license agreements; | |

| ● | the potential market size, opportunity and growth potential for our product candidates, if approved; | |

| ● | our ability to build our own sales and marketing capabilities, or seek collaborative partners, to commercialize our product candidates, if approved; | |

| ● | our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; | |

| ● | our ability to advance product candidates into, and successfully complete, clinical trials; | |

| ● | our ability to recruit and enroll suitable patients in our clinical trials; | |

| ● | the initiation, timing, progress and results of clinical trials and pre-clinical studies for our NGC drugs; | |

| ● | the timing or likelihood of the accomplishment of various scientific, clinical, regulatory filings and approvals and other product development objectives; | |

| ● | the pricing and reimbursement of our product candidates, if approved; | |

| ● | the rate and degree of market acceptance of our product candidates by physicians, patients, third-party payors and others in the medical community, if approved; | |

| ● | the implementation of our business model, strategic plans for our business, product candidates and technology; | |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology; | |

| ● | developments relating to our competitors and our industry; | |

| ● | the accuracy of our estimates regarding expenses, capital requirements and needs for additional financing; | |

| ● | our financial | |

| ● | other risks and uncertainties, including those described under part I, Item 1A. Risk Factors of this Annual Report. |

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable as of the date of this Form 10-K, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Form 10-K to conform these statements to new information, actual results or to changes in our expectations, except as required by law.

You should read this Form 10-K and the documents that we reference in this Form 10-K and have filed with the SEC as exhibits with the understanding that our actual future results, levels of activity, performance, and events and circumstances may be materially different from what we expect.

In this Form 10-K, “we,” “us”, “our”, “Processa” and “the Company” refer to Processa Pharmaceuticals, Inc. and its subsidiary.

| 4 |

SUMMARY RISK FACTORS

We are providing the following summary of the risk factors contained in our Form 10-K to enhance the readability and accessibility of our risk factor disclosures. We encourage our stockholders to carefully review the full risk factors contained in this Form 10-K in their entirety for additional information regarding the risks and uncertainties that could cause our actual results to vary materially from our recent results or from our anticipated future results.

Risks Related to Our Financial Position and Need for Additional Capital

| ● | We have a history of losses and we may never become profitable. | |

| ● | We have limited cash resources and will require additional financing. | |

| ● | Our financial statements contain a statement regarding a substantial doubt about our ability to continue as a going concern. | |

| ● | Our ability to use our net operating loss carryforwards and other tax attributes may be limited. |

Risks Relating to Clinical Development and Commercialization of Our Product Candidates

| ● | We currently do not have, and may never develop, any FDA-approved, licensed or commercialized products. | |

| ● | Our licenses are subject to termination by the licensor in certain circumstances. | |

| ● | If we fail to comply with our obligations contained in the agreements under which we license intellectual property rights from third parties, we could lose important license rights. | |

| ● | We depend entirely on the successful development of our product candidates, which have not yet demonstrated efficacy for their target indications in clinical trials. We may never be able to demonstrate efficacy for our product candidates, thus preventing us from licensing, obtaining marketing approval by any regulatory agency, and/or commercializing our product(s). | |

| ● | We must successfully complete clinical trials for our product candidates before we can apply for marketing approval. | |

| ● | We have little corporate history of conducting clinical trials. Our planned clinical trials or those of our collaborators may reveal significant adverse events, toxicities or other side effects not seen in our preclinical studies and may result in a safety profile that could inhibit regulatory approval or market acceptance of any of our product candidates. | |

| ● | Even if we receive regulatory approval for any of our product candidates, we may not be able to successfully license or commercialize the product and the revenue that we generate from its sales, if any, may be limited. | |

| ● | We are completely dependent on third parties to manufacture our product candidates, and our commercialization of our product candidates could be halted, delayed or made less profitable if those third parties fail to obtain manufacturing approval from the FDA or comparable foreign regulatory authorities, fail to provide us with sufficient quantities of our product candidates or fail to do so at acceptable quality levels or prices. | |

| ● | Even if we obtain marketing approval for any of our product candidates, we will be subject to ongoing obligations and continued regulatory review, which may result in significant additional expenses. | |

| ● | Obtaining and maintaining regulatory approval of our product candidates in one jurisdiction does not mean that we will be successful in obtaining regulatory approval of our product candidates in other jurisdictions. | |

| ● | Recently enacted and future legislation may increase the difficulty and cost for us to obtain marketing approval of and commercialize our product candidates and affect the prices we may obtain. | |

| ● | We could face competition from other biotechnology and pharmaceutical companies, and our operating results would suffer if we fail to innovate and compete effectively. | |

| ● | We rely on third parties to conduct clinical trials for our product candidates. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may not be able to obtain regulatory approval for or commercialize any of our product candidates and our business would be substantially harmed. | |

| ● | Clinical drug development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results. | |

| ● | Even though we may apply for orphan drug designation for a product candidate, we may not be able to obtain orphan drug marketing exclusivity. | |

| ● | Although we may pursue expedited regulatory approval pathways for a product candidate, it may not qualify for expedited development or, if it does qualify for expedited development, it may not actually lead to a faster development, regulatory review or approval process. | |

| ● | Third-party coverage and reimbursement, health care cost containment initiatives and treatment guidelines may constrain our future revenues. | |

| ● | Legal, regulatory and legislative changes with respect to reimbursement, pricing and contracting may adversely affect our business and future prospects. | |

| ● | We may face product liability exposure, and if successful claims are brought against us, we may incur substantial liability if our insurance coverage for those claims is inadequate. | |

| ● | If any of our product candidates are approved for marketing and we are found to have improperly promoted off-label uses, or if physicians misuse our products or use our products off-label, we may become subject to prohibitions on the sale or marketing of our products, product liability claims and significant fines, penalties and sanctions, and our brand and reputation could be harmed. | |

| ● | We may choose not to continue developing or commercializing any of our product candidates at any time during development or after approval, which would reduce or eliminate our potential return on investment for those product candidates. |

Risks Relating to Our Intellectual Property Rights

| ● | We depend on rights to certain pharmaceutical compounds that are or will be licensed to us. We do not own the intellectual property rights to these pharmaceutical compounds and any loss of our rights to them could prevent us from selling our products. | |

| ● | We cannot ensure protection of our licensed intellectual property rights. | |

| ● | Our product candidates may infringe the intellectual property rights of others, which could increase our costs and delay or prevent our development and commercialization efforts. | |

| ● | Obtaining and maintaining our patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements. |

General Company-Related Risks

| ● | We will need to grow the size of our organization, and we may experience difficulties in managing this growth. | |

| ● | If we lose key management personnel, or if we fail to recruit additional highly skilled personnel, our ability to identify and develop new or next generation product candidates will be impaired, could result in loss of markets or market share and could make us less competitive. | |

| ● | If our information technology systems or data, or those of third parties upon which we rely, are or were compromised, we could experience adverse consequences resulting from such compromise, including but not limited to regulatory investigations or actions, interruptions or disruptions to operations or clinical trials, reputational harm, litigation, fines and penalties. | |

| ● | We are exposed to cyber-attacks and data breaches, including the risks and costs associated with protecting our systems and maintaining integrity and security of our business information, as well as personal data of our guests, employees and business partners. |

Risks Related to Ownership of Our Common Stock

| ● | Our failure to maintain compliance with Nasdaq’s continued listing requirements could result in the delisting of our common stock. | |

| ● | Future equity offerings, license transactions or acquisitions may dilute our existing stockholders’ ownership and/or have other adverse effects on our operations. | |

| ● | Our common stock price is expected to be volatile. | |

| ● | We are a “smaller reporting company,” and the reduced disclosure requirements applicable to us as such may make our common stock less attractive to our stockholders and investors. | |

| ● | We do not currently intend to pay dividends to our stockholders in the foreseeable future, and consequently, your ability to achieve a return on your investment will depend on appreciation in our value. | |

| ● | If securities or industry analysts do not publish research or reports about our business, or if they publish negative evaluations of our stock or negative reports about our business, our stock price and trading volume could decline. | |

| ● | Provisions in our corporate documents and Delaware law could have the effect of delaying, deferring, or preventing a change in control of us, even if that change may be considered beneficial by some of our stockholders. | |

| ● | Provisions in our bylaws provide for indemnification of officers and directors, which could require us to direct funds away from our business and the development of our product candidates. |

| 5 |

Part I

Item 1. Business

Overview

We are a clinical-stage biopharmaceutical company focused on utilizing our “regulatory science” approach, including the principles associated with FDA’s Project Optimus Oncology initiative and the related FDA Draft Guidance, in the development of Next Generation Chemotherapy (“NGC”) oncology drug products. Our mission is to provide better treatment options than those that presently exist by extending a patient’s survival and/or improving a patient’s quality of life. This is achieved by improving upon FDA-approved, widely used oncology drugs or the cancer-killing metabolites of these drugs by altering how they are metabolized and/or distributed in the body, including how they are distributed to the actual cancer cells.

Our regulatory science approach was conceived in the early 1990s when the founders of Processa and other faculty at the University of Maryland worked with the FDA to develop multiple FDA Guidances. Regulatory science is the science of developing new tools, standards, and approaches to assess the safety, efficacy, quality, and performance of all FDA-regulated products. Over the last 30 years, two of our founders, Dr. David Young and Dr. Sian Bigora, have expanded the original regulatory science concept by including the pre-clinical and clinical studies to justify the benefit-risk assessment required for FDA approval when designing the development programs of new drug products.

Our regulatory science approach defines the scientific information that the FDA requires to determine if the benefit outweighs the risk of a drug in a specific population of patients and at a specific dosage regimen for a specific drug product. The studies are designed to obtain the necessary scientific information to support the regulatory decision.

Recently, the FDA has taken steps to define some of the regulatory science required for the FDA approval of oncology products. Through the FDA’s Project Optimus Oncology Initiative and the related Draft Guidance on determining the “optimal” dosage regimen for an oncology drug, the FDA has chosen to make the development of oncology drugs more science-based than in the past. Since the principles of the FDA’s Project Optimus and the related Draft Guidance have been used by our regulatory science approach in a number of non-oncology drugs, our experience with the principles of Project Optimus differentiates us from other biotechnology companies by focusing us not only on the clinical science, but also on the equally important regulatory process. We believe utilizing our regulatory science approach provides us with three distinct advantages:

| ● | greater efficiencies (e.g., the right trial design and trial readouts); | |

| ● | greater possibility of drug approval by the FDA or other regulatory authorities; and | |

| ● | greater ability to evaluate the benefit-risk of a drug compared to existing therapy, which allows prescribers to provide better treatment options for each patient. |

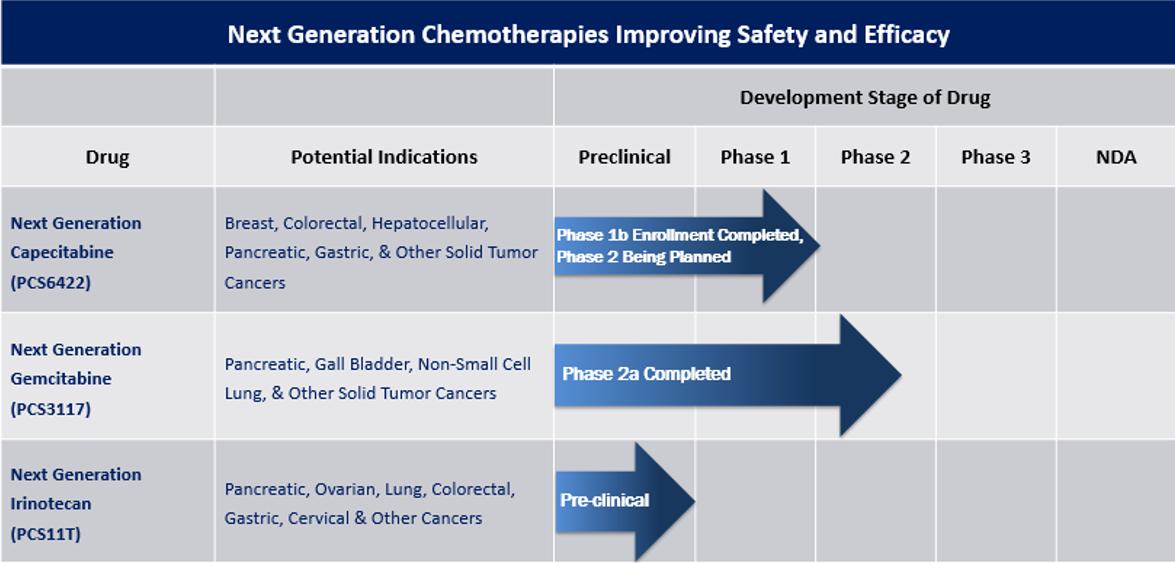

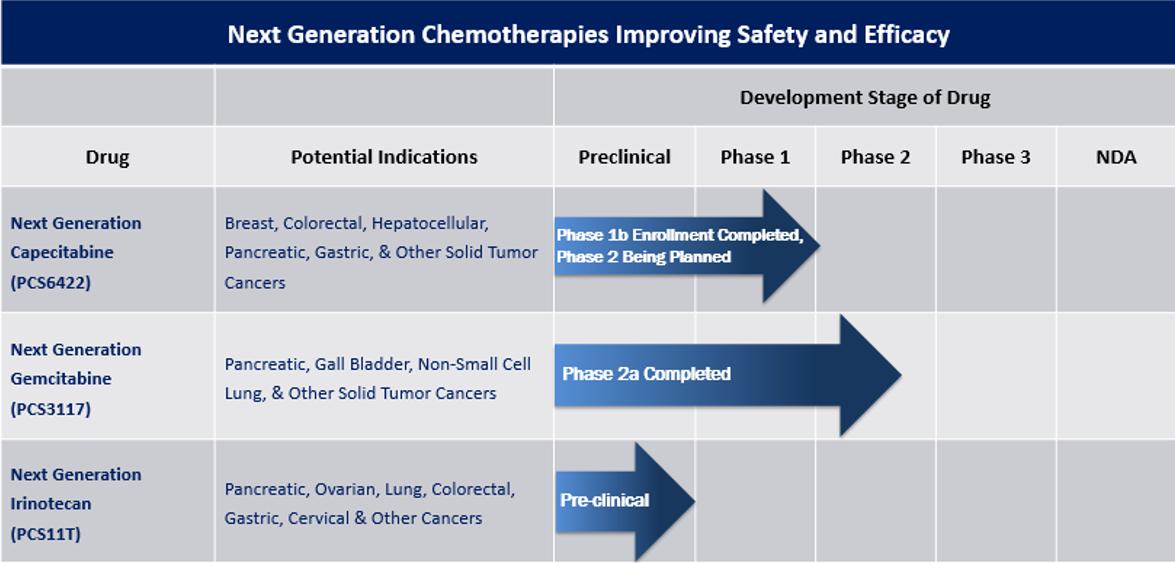

Our strategic prioritization is to advance our pipeline of NGC proprietary small molecule oncology drugs. The NGC products are new chemical entities, but they work by changing the metabolism, distribution and/or elimination of already FDA-approved cancer drugs or their active metabolites while maintaining the mechanism of how the drug kills cancer cells. We believe our NGC treatments will provide improved safety-efficacy profiles when compared to their currently marketed counterparts – capecitabine, gemcitabine, and irinotecan. All future studies of these drugs are subject to availability of capital to conduct the trials.

The three NGC treatments in our pipeline are as follows:

| ● | NGC-Capecitabine (also referred to as NGC-Cap) is a combination of PCS6422 and capecitabine, capecitabine being the oral prodrug of the cancer drug 5-fluorouracil (5-FU). PCS6422, without having any clinically meaningful biological effect itself, alters the metabolism of 5-FU, resulting in more 5-FU distribution to the cancer cells. In clinical trials, NGC-Cap has shown a safety profile different than capecitabine when administered alone. Side effects such as Hand-Foot Syndrome (HFS) and cardiotoxicity typically occur in up to 50-70% of patients treated with capecitabine and are caused by specific capecitabine metabolites. These types of toxicities frequently result in decreased doses, interrupted doses, or discontinuation of treatment with capecitabine. Since a much smaller amount of these metabolites are formed with NGC-Cap, these side effects appear in less patients and are less severe when they do occur. In addition, NGC-Cap has been found to be up to 50 times more potent than capecitabine based on the systemic exposure of the capecitabine metabolite 5-FU, which is metabolized to the cancer-killing metabolites. Like capecitabine, NGC-Cap could potentially be used to treat patients with various cancers, such as metastatic breast, colorectal, gastrointestinal, and pancreatic. On December 11, 2023, we had a successful meeting with the FDA regarding the next Phase 2 study supporting the advancement of NGC-Cap for cancer patients. The meeting with the FDA was supported by the interim results from the ongoing Phase 1B study that was fully enrolled in the first quarter of 2024. Following the meeting with the FDA, we decided the next NGC-Cap trial would be a Phase 2 trial in breast cancer. This decision was supported through discussions with the FDA where we agreed with the FDA that the development of NGC-Cap in breast cancer would be a more efficient development program than metastatic colorectal cancer and improve the likelihood of FDA approval. The FDA has agreed that the data from past and existing studies could be used to directly support the Phase 2 trial in breast cancer. Breast cancer is the most diagnosed cancer, representing approximately 15% of all new cancer patients in 2023. It has a prevalence of more than 3.8 million patients, with nearly 300,000 new diagnoses last year. Over 150,000 women are currently living with advanced or metastatic breast cancer. The NGC-Cap annual newly diagnosed incidence rate for breast, colorectal and other cancers is greater than 250,000 patients per year. |

| 6 |

| ● | PCS3117, also referred to as NGC-Gemcitabine (NGC-Gem), is an oral analog of gemcitabine that is converted to its active metabolite by a different enzyme system than gemcitabine resulting in a positive response in gemcitabine patients as well as some gemcitabine treatment-resistant patients. Like gemcitabine, NGC-Gem could be used to treat patients with various cancers such as pancreatic, biliary tract, lung, ovarian, and breast. We estimate more than 275,000 patients in the United States were newly diagnosed in 2022 with pancreatic, biliary tract, lung, ovarian, and breast cancer. We plan to meet with the FDA to discuss potential study designs including implementation of the Project Optimus initiative as part of the design in 2024. | |

| ● | PCS11T, also referred to as NGC-Irinotecan (NGC-Iri), is a prodrug of the active metabolite of irinotecan (SN-38). The chemical structure of NGC-Iri influences the uptake of the drug into cancer cells, resulting in more NGC-Iri entering cancer cells than normal cells in mice. These levels were significantly greater than those seen with irinotecan, resulting in lower doses of NGC-Iri having greater efficacy than irinotecan and improved safety in animal models. Like irinotecan, NGC-Iri could be used to treat patients with various cancers such as lung, colorectal, gastrointestinal, and pancreatic cancer. We estimate at least 200,000 patients in the United States were newly diagnosed in 2022 with lung, colorectal, gastrointestinal, and pancreatic cancer. We plan to conduct IND-enabling and toxicology studies in 2024-2025. |

We have completed our Phase 2A trial for PCS12852 in gastroparesis patients with positive results. Additionally, in February 2023, due primarily to the inability to identify and enroll patients in our rare disease Phase 2 trial for PCS499 in ulcerative Necrobiosis Lipoidica (uNL), we decided to cease further enrollment in the PCS499 trial and terminated the trial. We did not experience any safety concerns during the conduct of either the PCS12852 or PCS499 trial. We are currently evaluating options to monetize these non-core drug assets, which may include out-licensing or partnering these assets with one or more third parties.

Our shift in prioritization to NGC oncology drugs does not change our mission. We continue to be focused on drug products that improve the survival and/or quality of life for patients by improving the safety and/or efficacy of the drug in a targeted patient population, while providing a more efficient and probable path to FDA approval and differentiating our drugs from those on the market or are currently being developed.

Historically, much of oncology drug development has searched for novel or different ways to treat cancer. Our approach is to take three current FDA-approved cancer drugs and modify and improve how the human body metabolizes and/or distributes these NGC treatments compared to their presently approved counterpart chemotherapy drugs while maintaining the cancer-killing mechanism of action; thus, our reason for calling our drugs Next Generation Chemotherapy (or NGC) treatments. Part of the development includes determining the optimal dosage regimen based on the dose-response relationship as described in the FDA’s Project Optimus Initiative and Draft Optimal Dosage Regimen Oncology Guidance. To date, we have data that we believe suggests our NGC treatments are likely to have a better safety-efficacy profile than the current widely used marketed counterpart drugs, not only potentially making the development and approval process more efficient, but also clearly differentiating our NGC treatments from the existing treatment. We believe our NGC treatments have the potential to extend the survival and/or quality of life for more patients diagnosed with high unmet medical need conditions for which few or no treatment options currently exist. We are a clinical-stage development company, not a discovery company, that seeks to identify and develop drugs forcancer while decreasing the number of patients who need betterare required to dose-adjust or discontinue treatment options. In orderbecause of side effects or lack of response.

| 7 |

Our Strategy

Our strategy is to develop our pipeline of NGC proprietary small molecule oncology drugs using our regulatory science approach to determine the optimal dosage regimen of our oncology drugs. By changing either the metabolism, distribution, and/or elimination of already FDA-approved cancer drugs (e.g., capecitabine, gemcitabine, and irinotecan) or their active metabolites, we believe that our three new oncology drugs represent the next generation of chemotherapy with an improved safety profile, improved efficacy profile and/or potentially benefiting more patients while maintaining the mechanism of how the drug kills cancer cells. By combining these modified approved cancer treatments with our regulatory science approach and our experience using the principles of FDA’s Project Optimus initiative, we anticipate that we will be able to increase the probability of development success,FDA approval, improve the safety-efficacy profile over the existing counterparts of our pipeline only includesNGC drugs, which have previously demonstrated some efficacy in the targeted population or a drug with very similar pharmacological properties that has been shown to be effective in the population.

Our screening criteria for identifying and selecting new candidates include:

In many instances, these clinical candidates have significant pre-clinical and clinical data that we may leverage to high value inflection points while de-risking the programs and adding in optionality to potential future indications. Our regulatory science approach developed by our team over decades of work with regulatory authorities attempts to balance the “benefit/risk” equation to identify a regulatory path with higher clinical benefit and/or lower clinical risk with shorter timelines to deliver better treatment options to patients, physicians and caregivers.more efficiently develop each drug.

Our pipeline includes drugs thatof NGCs (i) already have clinical proof-of-concepthas data demonstrating the desired pharmacological activity in humans or minimally, clinical evidenceappropriate animal models and is able to provide improved safety and/or efficacy by some modification in the formformation and/or distribution of case studies or clinical experience demonstratingthe active moieties associated with the drug or a similar drug pharmacologically can successfully treat patients with the targeted indication;and (ii) target indicationstargets cancers for which a single positive pivotal studytrial demonstrating efficacy might provide enough evidence that the clinical benefits of the drug and its approval outweighs the risks associated with the drug or the present standard of care (e.g., some orphan indications, many serious life-threatening conditions, some serious quality of life conditions); and/or (iii) target indications where the prevalence of the condition and the likelihood of patients enrolling in a study meet the desired timeframe to demonstrate that the drug can, at some level, treat or potentially treat patients with the condition.drug.

To advance our mission, we have assembled an experienced and successful development team with a track record of drug approvals and successful exits. Our team is experienced in developing drug products through all principal regulatory tiers from IND enabling studies to NDA submission. The combined scientific, development and regulatory experience of our team members has resulted in more than 30 drug approvals by the FDA, over 100 meetings with the FDA and involvement with more than 50 drug development programs, including drug products targeted to patients who have an unmet medical need. Although we believe that the skills and experience of our team members in drug development and commercialization is an important indicator of our future success, the past successes of our team members in developing and commercializing pharmaceutical products does not guarantee that they will successfully develop and commercialize drugs in our current pipeline. In addition, the growth in revenues of companies at which our executive officers and directors served in was due to many factors and does not guarantee that they will successfully operate or manage us or that we will experience similar growth in revenues, even if they continue to serve as executive officers and/or directors.

Our ability to generate meaningful revenue from any products depends on our ability to out-license the drugs before or after we obtain FDA NDA approval. Even if our products are authorized and approved by the FDA, it should be noted that the products must still meet the challenges of successful marketing, distribution and consumer acceptance.

Our Strategy

Our strategy is to obtain and develop drugs that will not only treat patients with unmet medical need conditions but, with our regulatory science approach, also have the potential to be more efficiently developed with a greater probability of development success than what typically occurs in the biotech-pharma industry and a better return on investment given lower development costs, more efficient development and high commercial value. Given the prior successes of our regulatory science approach, we have selected drugs for our portfolio which may have greater chance for approval in a population of patients who desperately need better treatment options. We have applied rigorous standards to identify drugs for our portfolio, namely:

Our Team

Our drug development efforts are guided by our knowledge and experience in applying rigorousour regulatory science approach to decrease manageable risks, costs, and time toward achieving marketing authorization from regulatory authorities including the FDA. We have assembled a seasoned management team and development team with extensive experience in developing therapies, including advancing product candidates from preclinical research through clinical development and ultimately regulatory approval and commercialization. Our team is led by our ChairmanPresident of Research and CEODevelopment and Founder David Young, Pharm.D., Ph.D. who has extensive experience in research, regulatory approval and business development and who served at Questcor Pharmaceuticals for eight years, initially as an independent director on its Board of Directors and, subsequently, as its Chief Scientific Officer. Dr. Young’s guidance led

To execute our strategy, we assembled an experienced and development team with a successful track record of drug approvals and successful exits. Our team is experienced in developing drug products through all principal regulatory tiers from IND-enabling studies to New Drug Application (NDA) submission. Throughout their careers, the approvalcombined scientific, development and regulatory experiences of Actharour team members have resulted in Infantile Spasmsmore than 30 drug approvals in indications reviewed by almost every division of the FDA including the oncology divisions, over 100 meetings with the FDA and involvement with more than 50 drug development programs, including drug products targeted to patients who have an unmet medical need and cancer patients. In addition, the ultimate sale of Questcor in 2014.FDA Project Optimus Oncology initiative and recent FDA Oncology Guidance applies our regulatory science approach and principles used and refined by our Founders over the last 30 years.

| 8 |

Our Drug Pipeline

WeOur pipeline currently have five drugs: four in various stagesconsists of clinical development (PCS499, PCS12852,NGC-Cap, NGC-Gem and NGC-Iri (also identified as PCS6422, PCS3117 and PCS6422)PCS11T, respectively) and onetwo non-oncology drugs (PCS12852 and PCS499). The non-oncology drugs are not included in nonclinical development (PCS11T). We groupthe pipeline chart above, as we are exploring our options for those drugs, into non-oncology (PCS499 and PCS12852) and oncology (PCS3117, PCS6422 and PCS11T).which may include out-licensing or partnership opportunities. A summary of each drug is provided below:

below.

* Cleared by FDA for Clinical TrialNext Generation Chemotherapy Pipeline

PCS499

PCS499, an oral tablet of a deuterated analog of one of the major metabolites of pentoxifylline (PTX or Trental®), is classified by FDA as a new molecular entity. PCS499 and its metabolites act on multiple pharmacological targets that are important in a variety of conditions. We have targeted ulcerative Necrobiosis Lipoidica (uNL) as our lead indication for PCS499. NL is a chronic, disfiguring condition affecting the skin and tissue under the skin typically on the lower extremities with no currently approved FDA treatments. NL presents more commonly in women than in men and occurs more often in people with diabetes. Ulceration has been reported to occur in up to 30% of NL patients, which can lead to more severe complications, such as deep tissue infections and osteonecrosis threatening the life of the limb. Approximately 65,000 people in the United States and more than 120,000 people outside the United States are affected with uNL.

The degeneration of tissue occurring at the NL lesion site may be caused by a number of pathophysiological changes, which make it extremely difficult to develop effective treatments for this condition. Because PCS499 and its metabolites appear to affect most of the biological pathways that contribute to the pathophysiology associated with NL, PCS499 may provide a novel treatment solution for NL.

On June 18, 2018, the FDA granted orphan-drug designation for PCS499 for the treatment of NL. On September 28, 2018, the IND for PCS499 in NL became effective, such that we initiated and completed a Phase 2A multicenter, open-label prospective trial designed to determine the safety and tolerability of PCS499 in patients with NL. The study initially had a six-month treatment phase and a six-month optional extension phase. In December 2019, we informed patients and sites that the study would conclude after the treatment phase and there would no longer be an extension phase. The first enrolled NL patient in this Phase 2A clinical trial was dosed on January 29, 2019 and the study completed enrollment on August 23, 2019. The last patient visit took place in February 2020.

The primary objective of the Phase 2A trial was to evaluate the safety and tolerability of PCS499 in patients with NL (ulcerated and non-ulcerated patients) and to use the safety and efficacy data to design future clinical trials. Based on toxicology studies and healthy human volunteer studies, we and the FDA agreed that a PCS499 dose of 1.8 grams/day would be the highest dose administered to NL patients in this Phase 2A trial. As anticipated, the PCS499 dose of 1.8 grams/day, 50% greater than the maximum tolerated dose of PTX, appeared to be well tolerated with no serious adverse events (SAEs) reported. All adverse events (AEs) reported in the study were mild in severity. As expected, gastrointestinal symptoms were the most frequent AEs and reported in four patients, all of which resolved within 1-2 weeks of starting dosing.

Two of the twelve patients in the study presented with uNL and had ulcers for more than two months prior to dosing. At baseline, the reference ulcer in one of the two patients measured 3.5 cm2 and had completely closed by Month 2 of treatment. The second patient had a baseline reference ulcer of 1.2 cm2 which completely closed by Month 9 during the patient’s treatment extension period. In addition, while in the trial, both patients also developed small ulcers at other sites, possibly related to contact trauma, and these ulcers resolved within one month. The other ten patients, presenting with mild to moderate NL and did not have ulceration, had more limited improvement of the NL lesions during treatment. Historically, 13 - 20% of all the patients with NL naturally progress to complete healing over many years after presenting with NL. Although the natural healing of the uNL patients has not been evaluated independently, medical experts who treat NL patients suggest that the natural progression of an open ulcerated wound to complete closure may be significantly less than 13% over 1-2 years and probably close to 0% in patients with the larger ulcers.

On March 25, 2020, we met with the FDA and discussed the clinical program, as well as the nonclinical and clinical pharmacology plans to ultimately support the submission of the PCS499 New Drug Application (NDA) in the U.S. for the treatment of ulcers in NL patients. With input from the FDA, we designed the next trial as a randomized, placebo-controlled Phase 2B study to evaluate the ability of PCS499 to completely close ulcers in patients with NL and better understand the potential response of NL patients on drug and on placebo. We currently have selected six clinical trial sites in the United States and are evaluating additional sites to add to our study. We had four sites in Europe, but these sites were unable to recruit patients timely, largely due to COVID-19, so we decided to close them and concentrate our efforts on recruiting patients within the United States.

We began recruiting for the clinical trial in the first half of 2021. On May 19, 2021, we dosed our first patient in the randomized, placebo-controlled trial and are planning to complete an interim analysis of the data from this trial by the end of 2022. After obtaining the results from this Phase 2B study, we expect to have an end of Phase 2 meeting with the FDA to agree on the design of the Phase 3 study, with the intent to define a Special Protocol Assessment for the Phase 3 study and to agree on the next steps to obtain approval.

PCS12852

On August 19, 2020, we in-licensed PCS12852 (formerly known as YH12852) from Yuhan Corporation (“Yuhan”), pursuant to which we acquired an exclusive license to develop, manufacture and commercialize PCS12852 globally, excluding South Korea.

PCS12852 is a novel, potent and highly selective 5-hydroxytryptamine 4 (5-HT4) receptor agonist. Other 5-HT receptor agonists with less 5-HT4 selectivity have been shown to successfully treat gastrointestinal (GI) motility disorders such as gastroparesis, chronic constipation, constipation-predominant irritable bowel syndrome and functional dyspepsia. Less selective 5-HT4 agonists, such as cisapride, have been either removed from the market or not approved because of the cardiovascular side effects associated with the drugs binding to other receptors, especially receptors other than 5-HT4.

Two clinical studies, both which have demonstrated the effectiveness of PCS12852 on GI motility, have been previously conducted by Yuhan with PCS12852. In a Phase 1 trial (Protocol YH12852-101), the initial safety and tolerability of PCS12852 were evaluated after single and multiple oral doses in healthy subjects. PCS12852 was shown to increase GI motility in this study, increasing stool frequency with faster onset when compared to prucalopride, a less specific 5-HT4 agonist FDA-approved drug for the treatment of chronic idiopathic constipation. Based on an increase of ≥1 spontaneous bowel movement (SBM)/week from baseline during 7-day multiple dosing, the PCS12852 dose group had a higher percent of patients with an increase than the prucalopride group. All doses of PCS12852 were safe and well tolerated and no SAEs occurred during the study. The most frequently reported AEs were headache, nausea and diarrhea which were temporal, manageable and reversible within 24 hours. There were no clinically significant changes in platelet aggregation and ECG parameters including a change in QTc prolongation in the study. In a Phase 1/2A clinical trial (Protocol YH12852-102), the safety, tolerability, gastric emptying rate and pharmacokinetics of multiple doses of a PCS12852 immediate release (IR) formulation and a delayed release (DR) formulation were evaluated. PCS12852 was safe and well tolerated after single and multiple administrations. The most frequent AEs for both the IR and DR formulations of PCS12852 were headache, nausea and diarrhea, but the incidences of these AEs were comparable with those of the 2mg prucalopride group. These AEs, which were transient and mostly mild in severity, are also commonly observed with other 5-HT4 agonists. Both formulations of PCS12852 also increased the gastric emptying rate and increased GI motility.

Yuhan had also conducted extensive toxicological studies for the product that demonstrated that the product is safe for use and can be moved into Phase 2 studies.

We received guidance from the FDA in the first half of 2021 and in October 2021 we received notice of safe to proceed for PCS12852 evaluation in a Phase 2A randomized, placebo-controlled study in patients with gastroparesis. We anticipate beginning to enroll patients in the first half of 2022, with expected completion in the first half of 2023. The purpose of the Phase 2A trial is to evaluate the safety, efficacy and pharmacokinetics of two different dosing regimens for PCS12852. Data obtained from this study will be used to better design a future Phase 2/3 efficacy study. Since patients with gastroparesis have an abnormal pattern of upper GI motility in the absence of mechanical obstruction, the Phase 2A study was designed to evaluate the change in gastric emptying in patients with gastroparesis from two different dosing regimens of PCS12852 compared to placebo. The only FDA-approved drug to treat gastroparesis is metoclopramide, a dopamine D2 receptor antagonist that has documented serious side effects which limit dosing to no more than 12 weeks. Other 5-HT4 drugs have been used clinically but the side effects, caused mainly by binding to other receptors, has resulted in these drugs not being a viable option to treat patients with gastroparesis. It should be noted that PCS12852 is a highly specific 5-HT4 agonist that has been shown in nonclinical studies to have a cardiovascular side effect only at concentrations greater than 1,000 times the maximum concentration seen in humans.

PCS3117

On June 16, 2021, we executed a License Agreement with Ocuphire Pharma, Inc. (“Ocuphire Agreement”) under which we received a license to research, develop and commercialize PCS3117 (formerly RX-3117) globally, excluding Republic of Singapore, China, Hong Kong, Macau and Taiwan.

PCS3117 is a novel, investigational, oral small molecule nucleoside compound. PCS3117 is an analog of the endogenous nucleoside, cytidine, and an analog of the cancer drug gemcitabine. Once intracellularly activated (phosphorylated) by the enzyme UCK2, it is incorporated into the DNA or RNA of cells and inhibits both DNA and RNA synthesis, which induces apoptotic cell death of tumor cells. PCS3117 has received orphan drug designation from the FDA and the European Commission for the treatment of patients with pancreatic cancer.

Gemcitabine is usually used as second line therapy for metastatic pancreatic cancer and non-small cell lung cancer, as well as used as second line therapy for other types of cancer. The difference between PCS3117 and gemcitabine is how they are activated to cancer killing nucleotides. PCS3117 also has additional pharmacological pathways which will result in cancer cell apoptosis. Since 45% - 85% of pancreatic cancer and non-small cell lung cancer patients are inherently resistant or acquire resistance to gemcitabine, the differences between PCS3117 and gemcitabine could potentially provide a therapeutic alternative to patients who do not or will not respond to gemcitabine.

Resistance to gemcitabine or PCS3117 is likely caused by:

| ● | ||

| a | ||

PCS3117 has shown broad spectrum anti-tumor activity against over 100 different humanCapecitabine, as presently prescribed and FDA-approved, forms the cancer cell linesdrug 5-FU which is then further metabolized to anabolites (which kill both cancer cells and efficacy in 17 different mouse xenograft models. In preclinical trials, PCS3117 retained its anti-tumor activity in humannormal duplicating cells) and catabolites (which cause side effects and have no cancer cell lines made resistant to the anti-tumor effects of gemcitabine. In August 2012, the completion of an exploratory Phase 1 clinical trial of PCS3117 in cancer patients to investigate the oral bioavailability, safety and tolerability of the compound was reported. In that study, oral administration of a 50 mg dose of PCS3117 indicated an oral bioavailability of 56% and a plasma half-life (T1/2) of 14 hours. In addition, PCS3117 appeared to be well tolerated in all subjects throughout the dose range tested.

Final results from a Phase 1B clinical trial of PCS3117 were presented in June 2016 showing evidence of single agent activity. Patients in the study had generally received four or more cancer therapies prior to enrollment. In this study, 12 patients experienced stable disease persisting for up to 276 days and three patients showed evidence of tumor burden reduction. A maximum tolerated dose of 700 mg was identified in the study. At the doses tested, PCS3117 appeared to be well tolerated with a predictable pharmacokinetic profile following oral administration.

In March 2016, a multi-center Phase 2A clinical trial of PCS3117 in patients with relapsed or refractory pancreatic cancer was initiated to further evaluate safety and efficacy. The study was designed as a two-stage study with 10 patients in stage 1 and an additional 40 patients in stage 2. According to pre-set criteria, if greater than 20% of the patients had an increase in progression free survival of more than four months, or an objective clinical response rate and reduction in tumor size, additional pancreatic cancer patients would be enrolled into stage 2. Secondary endpoints included time to disease progression, overall response rate and duration of response, as well as pharmacokinetic assessments and safety parameters. In January 2018, the final data from this trial showed evidence of tumor shrinkage in some patients with metastatic pancreatic cancer that was resistant to gemcitabine and who had failed on multiple prior treatments was presented. In this study, 31% of patients experienced progression free survival for two months or more and five patients, or 12%, had disease stabilization for greater than four months. Although the pre-set criteria of 20% of the patients having an increase in progression free survival for four months was not met, some of the gemcitabine refractory patients did respond to PCS3117. However, an evaluation of why patients were resistant to PCS3117 was not undertaken within the study.

In November 2017, a Phase 2A trial of PCS3117killing properties). When capecitabine is given in combination with ABRAXANEPCS6422 in patients newly diagnosed with metastatic pancreatic cancer was initiated. The multicenter, single-arm, open-label study was designed to evaluate PCS3117NGC-Cap, PCS6422 significantly changes the metabolism of 5-FU, which results in combination with ABRAXANE in first line metastatic pancreatic cancer patients. In February 2019, the target enrollment of 40 evaluable patients in this trial was reached. An overall response rate of 23% had been observed in 40 patients that had at least one scan on treatment. Preliminary and unaudited data indicated that the median progression free survival for patientsa change in the study was approximately 5.6 months. The most commonly reported related adverse events were nausea, diarrhea, fatigue, alopecia, decreased appetite, rash, vomitingdistribution of 5-FU within the body. Due to this change in metabolism and anemia. Again, evaluationthe overall metabolite profile of anabolites and catabolites, the causeside effect and efficacy profile of treatment resistance to PCS3117 was not undertaken.

In order to identify patients who would more likely respond to PCS3117 than gemcitabine, we will be refining existing assays and developing new assays of biological molecules (i.e., biomarkers) over the next 6-12 months that could help to identify which patients are more likely to respond to or activate PCS3117 over gemcitabine.

PCS6422

On August 23, 2020, we in-licensed PCS6422 from Elion Oncology, Inc. (“Elion”), pursuant to which we acquired an exclusive license to develop, manufacture and commercialize PCS6422 globally.

PCS6422 is an oral, potent, selective and irreversible inhibitor of dihydropyrimidine dehydrogenase (DPD), the enzyme that rapidly metabolizes a common chemotherapy drug known as 5-FU, into inactive metabolites, such as α-fluoro-β-alanine (F-Bal). F-Bal is a metabolite thatNGC-Cap has no anti-cancer activity but causes unwanted side effects, which notably leads to dose interruptions and significantly affect a patient’s quality of life. F-Bal is thought to cause the neurotoxicity and Hand–Foot Syndrome (HFS) associated with 5-FU, and greater formation of F-Bal appearsbeen found to be associated with a decrease indifferent from capecitabine given without PCS6422. Since the antitumor activitypotency of 5-FU. HFS can affect activities of daily living, quality of life, and requires dose interruptions/adjustments and even therapy discontinuation resulting in suboptimal tumor effects. We believe that the inhibition of DPD by PCS6422 will significantly reduce 5-FU side effects related to a decrease in F-Bal, although the timeframe and magnitude for DPD inhibition has been shown to vary, ranging from 2-14 days depending on the de novo formation of DPD within a patient and the dosage regimen of PCS6422. With the inhibition of DPD, the level of the 5-FU anti-cancer metabolites couldNGC-Cap is also be potentially higher within cancer and normal cells leading to an improved efficacy profile and/or increased side effects associated with these antimetabolites such as neutropenia. By combininggreater than FDA-approved capecitabine (oral pro-drug form of 5-FU) with PCS6422, the change in 5-FU metabolism should result in an increase in the systemic exposure of 5-FU based on the 5-FU Area Under the Plasma Concentration Curve (AUC)systemic exposure per mg of capecitabine dosed. This resultsadministered, the amount of capecitabine anabolites formed from 1 mg of capecitabine administered in needing less capecitabine to kill cancer cells and treat each patient, makingNGC-Cap will, therefore, be much greater than formed from the combinationadministration of PCS6422 and capecitabine (the “Next Generation Capecitabine”) more potent than current FDA approved1 mg of existing capecitabine.

Fluoropyrimidines (e.g., 5-FU, capecitabine) remain the cornerstone of treatment for many different types of cancers, either as monotherapy or in combination with other chemotherapy agents by an estimated two million patients annually. Xeloda®, the brand name of capecitabine, is an oral pro-drug of 5-FU and approved as first-line therapy for metastatic colorectal and breast cancer. However, its use is limited by adverse effects such as the development of HFS in up to 60% of patients.

Elion evaluated the potential for the combination of PCS6422 with capecitabine as a treatment of advanced gastrointestinal (GI) tumors. Nonclinical efficacy data indicated that in colorectal cancer models, pretreatment with PCS6422 enhanced the antitumor activity of capecitabine. PCS6422 dramatically increased the antitumor potency of capecitabine without increasing the toxicity. The antitumor efficacy of the combination of PCS6422 and capecitabine was tested in several xenograft animal models with human breast, pancreatic and colorectal cancer cells. These preclinical xenograft models demonstrate that PCS6422 potentiates the antitumor activity of capecitabine and significantly reduces the dose of capecitabine required to be efficacious.

Other DPD enzyme inhibitors (e.g. Gimeracil used in Teysuno® approved only outside the US) act as competitive reversible inhibitors. These agents must be present when 5-FU or capecitabine are administered to inhibit 5-FU breakdown by DPD in order to improve the efficacy and safety profiles of 5-FU. Given the reversible nature of their effect on DPD, over time 5-FU metabolism to F-Bal will return if the reversible inhibitor is not present, decreasing the amount of 5-FU in the cancer cells and decreasing the potential cytotoxicity on the cancer cells. There is also evidence that administering large amounts of DPD inhibitors directly with 5-FU may also decrease the antitumor effect of the 5-FU. Because PCS6422 is an irreversible inactivator of DPD, it is dosed the day before capecitabine administration and its effect on DPD can last longer than the reversible DPD inhibitors and beyond the time 5-FU exists in the cancer cell, even after PCS6422 has been completely eliminated out of the body. We believe this can optimize the potential cytotoxic effect of the 5-FU nucleotide metabolites and minimize the catabolism of 5-FU to F-Bal.

Prior to Elion’s involvement, two multicenter Phase 3 studies were conducted in patients with colorectal cancer with PCS6422 administered in 10-fold excess to 5-FU and administered with the 5-FU. Unfortunately, we believe the dose of PCS6422 during these trials was not optimal and that PCS6422 was not administered early enough to irreversibly affect the DPD enzyme, thus the regimen tended to produce less antitumor benefit than the control arm with the standard regimen of 5-FU/leucovorin (LV) without PCS6422. Later preclinical work suggested that when PCS6422 was present at the same time as and in excess to 5-FU, it diminished the antitumor activity of 5-FU, which we believe supports the proposed dosing PCS6422 several hours before 5-FU to allow PCS6422 to be cleared before the administration of 5-FU.

Elion met with the FDA in 2019 and agreed upon the clinical development program required for the combination of PCS6422 and capecitabine as first-line therapy for metastatic colorectal cancer when treatment with fluoropyrimidine therapy alone is preferred. On May 17, 2020, an IND for the Phase 1B study was granted safe to proceed by the FDA. This Phase 1B study was designed to evaluate: i) the safety and tolerability of PCS6422 and several doses of capecitabine in advanced GI tumor patients; ii) the pharmacokinetics of PCS6422, capecitabine, 5-FU and selected metabolites; iii) the activity of DPD over time after PCS6422 administration; and iv) the maximum tolerated dose in up to 30 patients over multiple cycles. The study began patient recruitment in the second half of 2021. On August 2, 2021, we enrolled the first patient in the study.

Theour Phase 1B dose-escalation maximum tolerated dose trial in patients with advanced refractory gastrointestinal (GI) tract tumors. Our interim analysis of Cohorts 1 and 2 was recently conducted. DLTs, drug related2A of the ongoing clinical trial found no dose-limiting toxicities (DLTs), no drug-related adverse events of greater than Grade 1, and hand-foot syndrome were not observed in these patients. Also, this Next Generation Capecitabine effectively inhibited DPD enzyme activity 24-48 hours after PCS6422 administrationno adverse events associated with <10%the catabolites of 5-FU metabolized to F-Balsuch as compared to ~80% with the FDA approved capecitabine. Additionally, 5-FU potency based on the 5-FU AUC systemic exposure per mg of capecitabine dosed was 50 times greater with Next Generation Capecitabine. The interim analysis showed, however, that the improved metabolic profile and increased potency was not sustained at Day 7 after PCS6422 single dose administration.HFS. In February 2022, we submitted a modifiedthis Phase 1B trial, protocolit was demonstrated that the irreversible inhibition of DPD by PCS6422 could alter the metabolism, distribution and elimination of 5-FU, making NGC-Cap significantly (up to 50 times) more potent than capecitabine alone and potentially leading to higher levels of anabolites which can kill replicating cancer and normal cells. By administering NGC-Cap to cancer patients, the balance between anabolites and catabolites changes depending on the dosage regimens of PCS6422 and capecitabine used, making the efficacy-safety profile of NGC-Cap different than that of FDA-approved capecitabine and requiring further evaluation of the PCS6422 and capecitabine regimens to determine the optimal NGC-Cap regimens for patients.

| 9 |

In order for NGC-Cap to provide a safer and more efficacious profile for cancer patients compared to existing chemotherapy, understanding how the different regimens of PCS6422 and capecitabine may affect the systemic and tumor exposure to the FDAanabolites, as well as the systemic exposure to not only determine the MTDcatabolites, is required. This can be achieved by following the timeline of capecitabine but alsoDPD irreversible inhibition and the formation of new DPD using the plasma concentrations of 5-FU and its catabolites.

In an effort to further evaluatebetter estimate the timeline of DPD inhibition and de novo formation of new DPD, we modified the protocol for the Phase 1B trial and began enrolling patients in the amended Phase 1B trial in April 2022. On November 1, 2022, we announced that data from the Phase 1B trial identified multiple dosage regimens with potentially better safety and efficacy profiles than currently existing chemotherapy regimens. Since 5-FU exposure is dependent on both the PCS6422 regimen and the capecitabine regimen, safe regimens were identified as well as regimens that cause DLTs. One of the regimens in the Phase 1B trial did cause DLTs in two patients, one of whom died. The Phase 1B trial is continuing to enroll patients and is expected to complete enrollment in early 2024. The next trial will be a functionPhase 2 trial to determine which regimens provide an improved efficacy-safety profile over present therapy using the principles of PCS6422 dosing.the FDA’s Project Optimus initiative to help guide the design of the trial. This FDA initiative requires us to consider NGC regimens that are not at the maximum tolerated dose or exposure level.

We anticipate that this additional data will allow us to select PCS6422 dosage regimens that will maintain DPD inhibition throughout capecitabine dosing for each patient treated with this Next Generation Capecitabine. After interactingDiscussions with the FDA in April 2023 have clarified that the major goal for the next Phase 2 trial will be to evaluate and making protocol modifications,understand the dose- and exposure-response relationship for anti-tumor activity and safety. The specific dosage regimens for the trial will be defined following the determination of the MTD from our ongoing Phase 1B trial. Cohort 3 in the Phase 1B trial, which dosed patients with PCS6422 in combination with capecitabine at 150 mg BID (twice a day), completed with no dose-limiting toxicities. Enrollment in Cohort 4 was expanded to include six patients to further evaluate the safety at this dose. Enrollment in this cohort is now complete and to date, no DLTs have been observed in this cohort, but safety evaluation for this cohort is still ongoing. Once the cohort and the safety evaluation is complete, the need for any additional cohorts will be further evaluated. Following the FDA meeting on December 11, 2023, we have decided the next NGC-Cap trial would be a Phase 2 trial in breast cancer. This decision was supported through discussions with the FDA where we agreed with the FDA that the development of NGC-Cap in breast cancer would be a more efficient development program than metastatic colorectal cancer and improve the likelihood of FDA approval. The FDA has agreed that the data generated from past and existing studies could be used to directly support the Phase 2 trial in breast cancer. Capecitabine is already approved as both monotherapy and combination therapy in breast cancer, which contributes to the logic and efficiency of our current direction. In addition, the FDA’s agreement that our present data would support a Phase 2 trial in breast cancer makes the expansion seamless. The objective for the Phase 2 trial will be to provide safety-efficacy data to preliminarily demonstrate the benefit of NGC-Cap over capecitabine and other treatment options. Based on this expansion to breast cancer, we expanded our Oncology Advisory Board to include key breast cancer oncologists. We have already determined the Phase 2 study design, which we expect to restartshare with the Phase 1B studyFDA soon, and plan to use the funding from our January 2024 public offering to begin enrolling patients in the secondthird quarter of 2022 while defining the Next Generation Capecitabine regimens by the end of 2022. Although we are making modifications to the existing Phase 1B protocol, we expect that our overall timeline has not changed with a Phase 2B or 3 trial starting in 2023-2024 and NDA submission in 2027-2028.2024.

Our license agreement with Elion Oncology, Inc. (“Elion”) for NGC-Cap requires us to use commercially reasonable efforts, at our sole cost and expense, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that include dosing a first patient with a product in a Phase 2 or 3 clinical trial on or before October 2, 2024. We are currently conducting pre-trial activities and planning to dose the first patient in our Phase 2 trial in the third quarter of 2024.

| 10 |

| ● | NGC-Gem is a cytidine analog similar to gemcitabine (Gemzar®), but different enough in chemical structure that some patients are more likely to respond to PCS3117 than gemcitabine. In addition, we believe those patients inherently resistant or who acquire resistance to gemcitabine are likely not to be resistant to NGC-Gem. The difference in response occurs because NGC-Gem is metabolized to its active metabolite through a different enzyme system than gemcitabine. We continue to evaluate the potential use of NGC-Gem in patients with pancreatic and other potential cancers and to evaluate ways to identify patients who are more likely to respond to NGC-Gem than gemcitabine. We plan to meet with the FDA in 2024 to discuss potential trial designs including implementation of the Project Optimus initiative as part of the design. Similar to NGC-Cap, we will need to obtain additional funding before we can begin the Phase 2 trial for NGC-Gem. |

PCS11TOur license agreement with Ocuphire Pharma, Inc. (“Ocuphire”) for NGC-Gem requires us to use commercially reasonable efforts, at our sole cost and expense to oversee such commercialization efforts, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that consist of: (i) dosing a patient in a clinical trial prior to June 16, 2024; and (ii) dosing a patient in a pivotal clinical trial or in a clinical trial for a second indication of the drug prior to June 16, 2026. We are currently in discussions with Ocuphire to extend these deadlines.

| ● | NGC-Iri is an analog of SN38 (SN38 is the active metabolite of irinotecan) and should have an improved safety/efficacy profile in every type of cancer that irinotecan is presently used. The manufacturing process and sites for drug substance and drug product are presently being evaluated and IND-enabling toxicology studies will then be initiated. In addition, we are defining the potential paths to approval, which include defining the targeted patient population and the type of cancer. We plan to conduct IND enabling and toxicology studies in 2024, subject to available funding. |

On May 24, 2020, we in-licensed PCS11T (formerly known as ATT-11T) from Aposense, Ltd. (“Aposense”), pursuant to which we were granted Aposense’s patent rights and Know-How to develop and commercialize their next generation irinotecan cancer drug, PCS11T.

Non-Oncology Pipeline for Out-licensing or Partnership

PCS11T is a novel lipophilic anti-cancer pro-drug that is being developed for the treatment of the same solid tumors as prescribed for irinotecan. This pro-drug is a conjugate of a specific proprietary Aposense molecule connected to SN-38, the active metabolite of irinotecan. The proprietary molecule in PCS11T has been designed to allow PCS11T to bind to cell membranes to form an inactive pro-drug depot on the cell with SN-38 preferentially accumulating in the membrane of tumors cells and the tumor core. This unique characteristic may make the therapeutic window of PCS11T wider than other irinotecan products such that the antitumor effect of PCS11T could occur at a much lower dose with a milder adverse effect profile than irinotecan. Despite the widespread use of commercially marketed irinotecan products in the treatment of metastatic colorectal cancer and other cancers resulting in peak annual sales of approximately $1.1 billion, irinotecan has a narrow therapeutic window and includes an FDA “Black Box” warning for both neutropenia and severe diarrhea. There is, therefore, a substantial unmet need to overcome the limitations of the current commercially marketed irinotecan products, improving efficacy and reducing the severity of treatment emergent AEs. We believe the potential wider therapeutic window of PCS11T will likely lead to more patients responding with less side effects when on PCS11T compared to other irinotecan products.

| ● | PCS12852 is a highly specific and potent 5HT4 agonist that has already been evaluated in clinical studies in South Korea for gastric emptying and gastrointestinal motility in healthy volunteers and volunteers with a history of constipation. In October 2021, the FDA cleared our IND application to proceed with a Phase 2A trial for the treatment of gastroparesis. We enrolled our first patient on April 5, 2022 and completed enrollment of the trial on September 2, 2022. Results from this Phase 2A trial, which included 25 patients with moderate to severe gastroparesis, demonstrated improvements in gastric emptying in patients receiving 0.5 mg of PCS12852 as compared to placebo. The results indicated that for the patients in the PCS12852 group, the mean time for 50% of the gastric contents to empty (t50) compared to their baseline value (±SD) decreased by -31.90 min (±50.53) (compared to the change seen in the placebo group of only -9.36 min (±42.43). Significant gastric emptying differences were not observed between the placebo and the 0.1 mg dose. Adverse events associated with the administration of PCS12852 were generally mild to moderate as expected, limited in duration, and quickly resolved without any sequelae. There were no cardiovascular safety events or serious adverse events reported during the trial. Additionally, the 0.5 mg of PCS12852 showed a greater improvement than placebo in the gastroparesis symptomology scales used in the trial, including both total scores in the scales, as well as sub-scores such as nausea, vomiting and abdominal pain. With the trial now complete, we have the data necessary to finalize the development plan for the treatment of diabetic gastroparesis patients. We are exploring options for PCS12852, which may include licensing, partnering and/or collaborating opportunities. |

Pre-clinical studies conducted to date showed that PCS11T demonstrated tumor eradication at much lower doses than irinotecan across various tumor xenograft models. PCS11T does not affect acetyl choline esterase (AChE) activity in human and rat plasma in vitro, which would suggest that PCS11T will show an improved safety profile, compared to irinotecan, which is known for its cholinergic-related side effects.

| ● | PCS499 is an oral tablet of the deuterated analog of one of the major metabolites of pentoxifylline (PTX or Trental®). PCS499 is a drug that can be used to treat unmet medical need conditions caused by multiple pathophysiological changes. We completed a Phase 2A trial for PCS499 in patients with ulcerative and non-ulcerative necrobiosis lipoidica (uNL and NL, respectively) in late 2020, and in May 2021, we enrolled the first patient in our Phase 2B trial for the treatment of uNL. Although we initiated several recruitment programs to enroll patients in this trial, we were only able to recruit four patients. We experienced extremely slow enrollment in the trial given the extreme rarity of the condition (rarer than reported in the literature), the impact of COVID-19, and the reluctance of patients to be in a clinical trial. We completed the Phase 2B uNL trial for those currently enrolled but halted further efforts to enroll new patients in the trial and have terminated the trial. There were no safety concerns during the conduct of the trial. Although we believe that PCS499 can be effective in treating uNL, preliminary data indicated that the placebo response was likely to be much greater than the literature and clinical experts believe; thus, a much larger sample size would be required in a pivotal trial for an indication where it was extremely difficult to enroll even four patients. We are exploring options for PCS499 in other indications, which may include licensing, partnering and/or collaborating opportunities. |

We are currently planning to manufacture the product at a GMP facility, conduct the required toxicological studies required to file the IND in 2023 and initiate the Phase 1B study in oncology patients with solid tumors.

| 11 |

Manufacturing and Clinical Supplies

We do not own or operate, and currently have no plans to establish, any manufacturing facilities. We currently rely, and expect to continue to rely, on multiple third partythird-party contract manufacturing organizations (CMOs), for the supply of cGMP-gradecurrent Good Manufacturing Practices (cGMP)-grade clinical trial materials and commercial quantities of our product candidates and products, if approved. We require all of our CMOs to conduct manufacturing activities in compliance with cGMP. We have assembled a team of experienced employees and consultants to provide the necessary technical, quality and regulatory oversight of our CMOs.

We anticipate that these CMOs will have the capacity to support both clinical supply and commercial-scale production, but we do not have any formal agreements at this time with any of these CMOs to cover commercial production.