UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K10-K/A

(Amendment No. 1)

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

COMMISSION FILE NUMBER: 001-36689

INSPIRED ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 47-1025534 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

250 West 57th Street, Suite 415

New York, New York 10107

(646) 565-3861

(Address, including zip code, of principal executive offices

and telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share | INSE | The Nasdaq Stock Market LLC |

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Date File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of the chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 126-2 of the act): Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

The aggregate market value of the registrant’s common stock, other than shares held by persons who may be deemed to be affiliates of the registrant, computed by reference to the closing sales price for the registrant’s common stock on June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, as reported on the Nasdaq Capital Market, was approximately $187.3 million. For the purpose of this disclosure, executive officers, directors and holders of 10% or more of the registrant’s common stock are considered to be affiliates of the registrant.

As of March 13, 2023, there were shares of the registrant’s common stock, par value $0.0001 per share, outstanding.

As of February 22, 2024, there were shares of the registrant’s common stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement relating to the 2023 annual meeting of stockholders are incorporated by reference in Part III. The proxy statement will bewas filed with the Securities and Exchange Commission no later than 120 days after the conclusion of the registrant’s fiscal year ended December 31, 2022. If such proxy statement is not filed on or before such date, the information called for by Part III will be filed as part of an amendment to this Annual Report on Form 10-K on or before such date.April 12, 2023.

TABLE OF CONTENTS

| i |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and other information set forth in this report, including in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere herein, may relate to future events and expectations, and as such constitute “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). Our forward-looking statements include, but are not limited to, statements regarding our business strategy, plans and objectives and our expected or contemplated future operations, results, financial condition, beliefs and intentions. In addition, any statements that refer to projections, forecasts or other characterizations or predictions of future events or circumstances, including any underlying assumptions on which such statements are expressly or implicitly based, are forward-looking statements. The words “anticipate”, “believe”, “continue”, “can”, “could”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”, “possible”, “potential”, “predict”, “project”, “scheduled”, “seek”, “should”, “would” and similar expressions, among others, and negatives expressions including such words, may identify forward-looking statements.

Our forward-looking statements reflect our current expectations about our future results, performance, liquidity, financial condition, prospects and opportunities, and are based upon information currently available to us, our interpretation of what we believe to be significant factors affecting our business and many assumptions regarding future events. Actual results, performance, liquidity, financial condition, prospects and opportunities could differ materially from those expressed in, or implied by, our forward-looking statements. This could occur as a result of various risks and uncertainties, including the following :

| ● | government regulation of our industries; | |

| ● | our ability to compete effectively in our industries; | |

| ● | the effect of evolving technology on our business; | |

| ● | our ability to renew long-term contracts and retain customers, and secure new contracts and customers; | |

| ● | our ability to maintain relationships with suppliers; | |

| ● | our ability to protect our intellectual property; | |

| ● | our ability to protect our business against cybersecurity threats; | |

| ● | our ability to successfully grow by acquisition as well as organically; | |

| ● | fluctuations due to seasonality; | |

| ● | our ability to attract and retain key members of our management team; | |

| ● | our need for working capital; | |

| ● | our ability to secure capital for growth and expansion; | |

| ● | changing consumer, technology and other trends in our industries; | |

| ● | our ability to successfully operate across multiple jurisdictions and markets around the world; | |

| ● | changes in local, regional and global economic and political conditions; and | |

| ● | other factors. |

In light of these risks and uncertainties, and others discussed in this report, there can be no assurance that any matters covered by our forward-looking statements will develop as predicted, expected or implied. Readers should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason. We advise you to carefully review the reports and documents we file from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

| ii |

EXPLANATORY NOTE

This Amendment No. 1 to Form 10-K (this “Amendment” or “Form 10-K/A”) amends the Annual Report on Form 10-K for the year ended December 31, 2022 originally filed with the Securities and Exchange Commission (“SEC”) on March 16, 2023 (the “Original Filing”) by Inspired Entertainment, Inc. (the “Company,” “we,” “our” or “us”).

Restatement and Revision

As previously reported by the Company in a Current Report on Form 8-K filed with the SEC on November 8, 2023, the Audit Committee (the “Audit Committee”) of the Board of Directors of the Company, in consultation with the Company’s management, determined that (i) the Company’s previously issued audited consolidated financial statements as of December 31, 2021 and 2022 and for the years ended December 31, 2020, 2021 and 2022 included in the Company’s Annual Report on Form 10-K, (ii) associated reports of the Company’s independent registered public accounting firm, Marcum LLP (“Marcum”), and (iii) the Company’s previously issued unaudited condensed consolidated financial statements during those years and for the first and second quarters of 2023 included in the Company’s Quarterly Reports on Form 10-Q (the “Subject Periods”) contained accounting errors primarily relating to compliance with U.S. GAAP in connection with the Company’s accounting policies for capitalizing software development costs. The errors related primarily to the application of the relevant accounting standards to projects, including the timing of capitalization with respect to software development projects and the nature of costs eligible for capitalization. As a result of these errors, the Audit Committee determined that the Company’s previously issued consolidated financial statements for the Subject Periods should no longer be relied upon and should be restated. Similarly, any previously issued or filed reports, press releases, earnings releases, investor presentations or other communications of the Company describing the Company’s financial results or other financial information relating to the Subject Periods should no longer be relied upon. As a result of the Company evaluation, additional errors were identified, which are further described below. Additionally, the previous reports of Marcum on the Company’s consolidated financial statements as of December 31, 2021 and 2022 and for the years ended December 31, 2020, 2021 and 2022 likewise should no longer be relied upon.

The purpose of this Amendment is to restate the Company’s previously issued audited consolidated financial statements as of December 31, 2021 and 2022 and for the fiscal years ended December 31, 2020, 2021 and 2022, respectively. The restatement of the annual periods has been reflected within Part II, Item 8 “Financial Statements and Supplementary Data-Note 2 to the Consolidated Financial Statements.

Management has also revised Item 9A of this Form 10K/A after reassessing the control environment and identifying additional material weaknesses.

The Company has also revised its unaudited consolidated financial statements for the three months ended March 31, 2023 and 2022, the three and six months ended June 30, 2023 and 2022, and the three and nine months ended September 30, 2022 for these periods, and these revisions will be affected in connection with the future filing of the Company’s Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

Although on December 31, 2023, the Company was a smaller reporting company, as defined in Rule 12b-2 promulgated under the Exchange Act, the Company ceased to be a smaller reporting company for periods on and after January 1, 2024.

Changes Reflected in the Restatement

For the convenience of the reader, this Amendment sets forth our Original Filing in its entirety, as amended by the changes related to the restatement. This Amendment does not reflect events occurring after the filing of our Original Filing, or modify or update those disclosures, except as applicable in our financial statement footnote subsequent event disclosures. The following sections of our Original Filing have been amended:

● Part I- Item 1 – Business;

● Part I - Item 1A Risk Factors;

● Part II - Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations;

● Part II - Item 8 – Report of Independent Registered Public Accounting Firm;

● Part II - Item 8 - Financial Statements;

● Part II - Item 9A – Controls and Procedures;

● Part II - Item 9A - Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting; and

● Part IV - Item 15 – Exhibits, Certifications.

This Amendment has been signed as of the date hereof and all certifications of our Principal Executive Officer and Principal Financial Officer are given as the date hereof. Accordingly, this Amendment should be read in conjunction with our filings made with the Securities and Exchange Commission subsequent to the filing of the Original Filing, including any amendments to those filings.

| iii |

Restatement Background

As previously reported by the Company on a Current Report on Form 8-K filed with the SEC on March 23, 2023, on March 17, 2023, the Company dismissed Marcum as its independent registered public accounting firm and engaged KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 and the related interim periods. In connection with the preparation of the financial statements of the Company for the quarterly period ended September 30, 2023, KPMG identified certain accounting errors relating to compliance with U.S. GAAP in connection with the Company’s accounting policies for capitalizing software development costs. The errors related primarily to the application of the relevant accounting standards to projects, including the timing of capitalization with respect to software development projects and the nature of costs eligible for capitalization.

As previously reported by the Company on Form 8-K filed with the SEC on November 8, 2023, on November 2, 2023, the Audit Committee, in consultation with the Company’s management, determined that (i) the Company’s previously issued audited consolidated financial statements as of December 31, 2021 and 2022 and for the years ended December 31, 2020, 2021 and 2022 included in the Company’s Annual Report on Form 10-K, (ii) associated reports of the Company’s independent registered public accounting firm, and (iii) the Company’s previously issued unaudited condensed consolidated financial statements during those years, and for the first and second quarters of 2023 included in the Company’s Quarterly Reports on Form 10-Q contained the accounting errors set forth above. Following the determination by the Audit Committee, the Company retained independent accounting consultants and undertook an investigation with respect to the appropriate accounting treatment of its software development costs and other matters.

As previously reported by the Company on a Current Report on Form 8-K filed with the SEC on November 29, 2023, on November 22, 2023, the Company dismissed KPMG as its independent registered public accounting firm and re-engaged Marcum as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 and the related interim periods.

Other Adjustments

In addition to the material software development matters described above, various other material and immaterial prior period errors or misstatements have been identified including in the areas of revenue, inventory, leasing, pension, earnings per share and other reclassification and minor items. For additional information regarding the revision of prior annual periods see Part II, Item 8 “Financial Statements and Supplementary Data-Note 2 to the Consolidated Financial Statements – Restatement of Previously Issued Financial Statements.”

Internal Control Over Financial Reporting

Management has reassessed its evaluation of the effectiveness of its internal control over financial reporting as of December 31, 2022, based on the framework established in Internal Control-Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. Management has concluded that, due to the additional material weaknesses identified relating to the failure to properly design and operate monitoring control activities, the Company did not maintain effective internal control over financial reporting as of December 31, 2022. As such, Management’s Reports on Internal Control over Financial Reporting as of December 31, 2022 should no longer be relied upon. For a description of the material weakness in internal control over financial reporting and actions taken, and to be taken, to address the material weakness, see Part II, Item 8 “Financial Statements and Supplementary Data” and Item 9A. “Controls and Procedures” of this Form 10-K/A. In addition, the Company’s independent registered public accounting firm has restated its report on the Company’s internal control over financial reporting and issued an adverse opinion.

| iv |

PART I

ITEM 1. BUSINESS.

Overview

Inspired Entertainment, Inc. (the “Company”, “Inspired”, “we” or “us”) is a global gaming technology company, supplying content, platform and other products and services to online and land-based regulated lottery, betting and gaming operators worldwide through a broad range of distribution channels, predominantly on a business-to-business basis. We provide end-to-end digital gaming solutions (i) on our own proprietary and secure network, which accommodates a wide range of devices, including land-based gaming machine terminals, mobile devices and online computer applications and (ii) through third party networks. Our content and other products can be found through the consumer-facing portals of our interactive customers and, through our land-based customers, in licensed betting offices, adult gaming centers, pubs, bingo halls, airports, motorway service areas and leisure parks.

Our customer base includes regulated operators of lotteries, licensed sports bookmakers, gaming and bingo halls, casinos and regulated online operators, adult gaming centers, pubs, holiday parks, and motorway service areas. Some of our key customers include William Hill, SNAI, Sisal, Lottomatica, Betfred, Paddy Power, Betfair, Genting, bet365, Sky Bet, Fortuna, the Greek Organisation of Football Prognostics S.A. (OPAP.), Entain, the Pennsylvania Lottery, Bourne Leisure, Greentube, Stonegate, Mitchells & Butler, Marstons, Greene King, JD Wetherspoon, Parkdean Resort, CentreCenter Parcs Resorts and Novomatic. Geographically, 73%74% of our revenues (excluding VAT-related revenue) for the year ended December 31, 2022 were generated from our UK operations, with the remainder generated from Greece and the rest of the world. Our products are designed to operate within applicable gaming and lottery regulations and our customers are regulated gaming or lottery operators or are otherwise licensed to operate our products.

We conduct business across different jurisdictions of which Great Britain, Italy and Greece have historically contributed the most significant recurring revenues. Recently we have begun to conduct a meaningful amount of business in North America as well. We are licensed or certified (as applicable) by the Gambling Commission in the United Kingdom, and by the Hellenic Gaming Commission in Greece, and registered with L’Agenzia delle dogane e dei Monopoli (“ADM”) in Italy. We are licensed by regulators in other jurisdictions such as the Malta Gaming Authority, Licensing Authority of Gibraltar, the Alderney Gambling Control Commission, the Belgian Commission, Autorité Des Marchés Financiers (Quebec), the Romanian National Gambling Office, Oficiul National pentru Jocuri de Noroc and we hold licenses with the US States of Connecticut, Illinois, Michigan,, New Jersey, Oregon, Pennsylvania, West Virginia and the Canadian provinces of Alberta, Nova Scotia, Ontario and Saskatchewan.

| 1 |

We are headquartered in the United States, with principal operating facilities located in the United Kingdom, India and Italy. As of December 31, 2022, we had approximately 1,600 employees, approximately 1,500 of which were full-time. We generated total revenue of $285.4$281.6 million and Adjusted EBITDA of $99.6$99.0 million for the year ended December 31, 2022.

The Company is publicly listed on the NASDAQ and had an equity market capitalization of approximately $328.27 million as of December 31, 2022 (based upon a closing stock price of $12.67 on December 30, 2022).

Certain product and company names referred to herein are trademarks™ or registered® trademarks of their respective holders.

Our Products

We operate in four business segments: Gaming, Virtual Sports, Interactive and Leisure, as further described below.

Gaming Segment

Our Gaming segment supplies gaming terminals as well as gaming software and games for the terminals provided to betting offices, casinos, gaming halls and high street adult gaming centers. It utilizes our Server Based Gaming (“SBG”) technology to supply products to our customers’ global land-based gaming venues. SBG products offer an extensive portfolio of games through digital terminals. Our games are currently deployed through more than 35,000 digital terminals. Because our SBG products are fully digital, they interact with a central server and are provided on a “distributed” basis, which allows us to access a wide geographic footprint through internet and proprietary networks.

Our SBG game portfolio includes a broad selection of popular omni-channel slots titles including the CenturionTM game family and Super Hot Fruits® (featuring the Sizzling Hot SpinsTM game family). These games offer customers a wide range of volatilities, return-to-player and other special features, which we collectively refer to as “game math.” We also offer a range of more traditional casino games through our SBG network, such as roulette, blackjack and numbers games.

We distribute games to devices through different game management systems (“GMS”), each tailored to a specific operator or sector. Our CORETM GMS is designed for distributed street-gaming sectors and uses Inspired cabinets in combination with gaming content from Inspired, as well as a wide portfolio of content from independent game developers. CORE-CONNECT is our American Gaming Association G2S standard-based VLT GMS, currently deployed in the Greek VLT sector and North America. Our SBG products comply with all requirements in the UK (B2/B3), Italy (6B), Greece (G2S) and Illinois (G2S).

Our SBG terminals in the United Kingdom account for a material portion of all SBG terminal placements, and we offer over 100 games for play across this portfolio. We are also a material supplier to customers in Greece and Italy. Over the past two years, we have grown our business in North America where we have sold products in Illinois and to the Western Canada Lottery Corporation. We offer SBG terminals such as the Flex4k curved screen, Vantage ®, EclipseTM, ValorTM, PrismaticTM and Sabre HydraTM, each offering a different size terminal, graphics, technology and price proposition.

As of December 31, 2022, we had a total installed base of 35,00334,903 units, which were operated primarily under participation-based contracts. We generate revenue by participating, typically as a function of gross revenue from each machine, in a percentage of volumes generated by these machines. Because we participate in our customers’ revenues under such contracts, we are aligned with our customers in benefitting from the introduction of our new content, which can drive growth of the win per unit per day of our installed base. Additionally, we earn revenue through the sale of units, as well as receiving a fixed daily fee for some of our installed units. During 2022, we sold 2,9273,027 units, 53% of these in the UK and 47% internationally. With our participation-driven business model, approximately 96% of service revenue for our Gaming segment was recurring in nature in 2022 (excluding $2.0 million of performance bonus revenue and $1.0 million of VAT-related revenue) and derived under long-term contracts. We have successfully renewed contracts with our three largest customers in the UK LBO market.

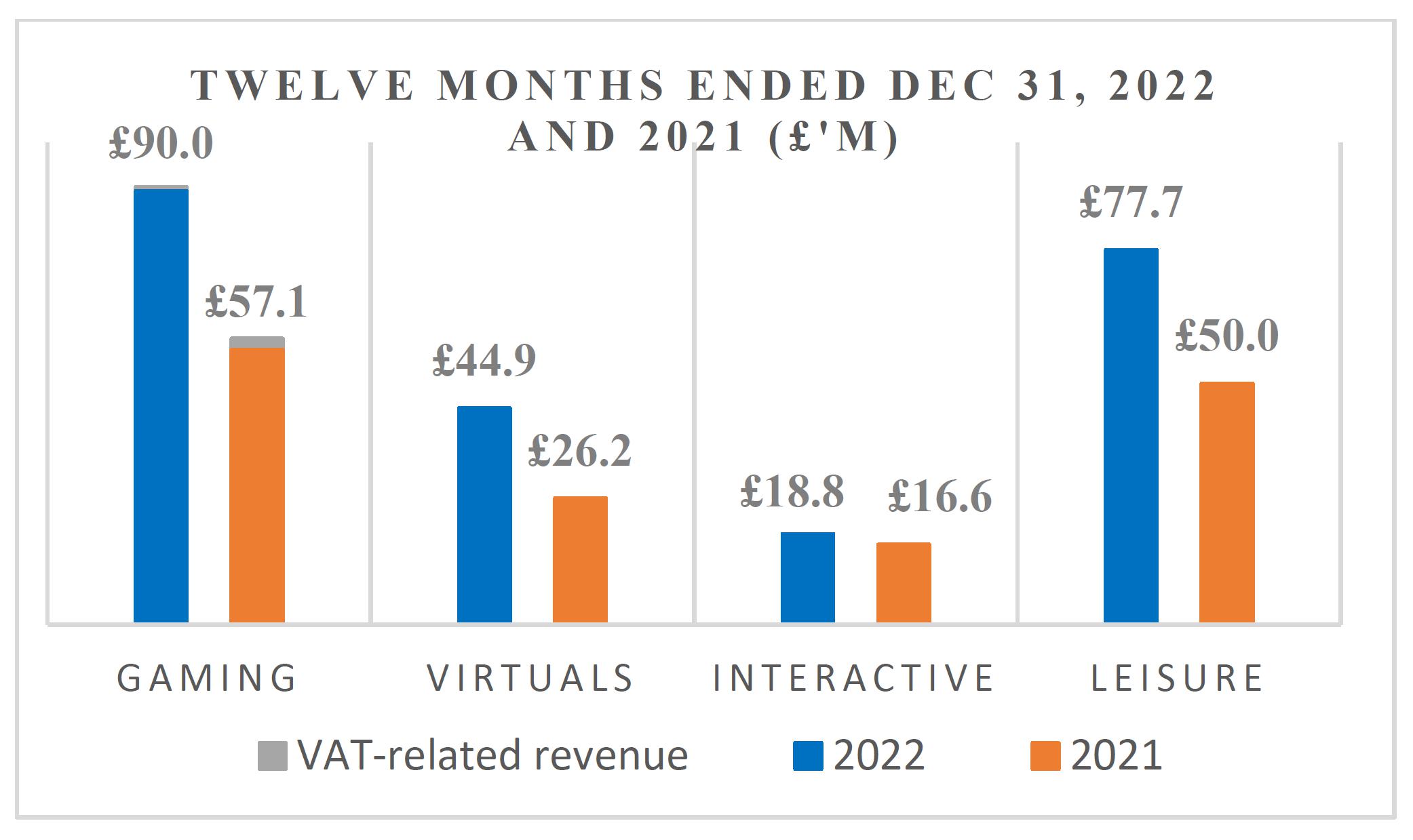

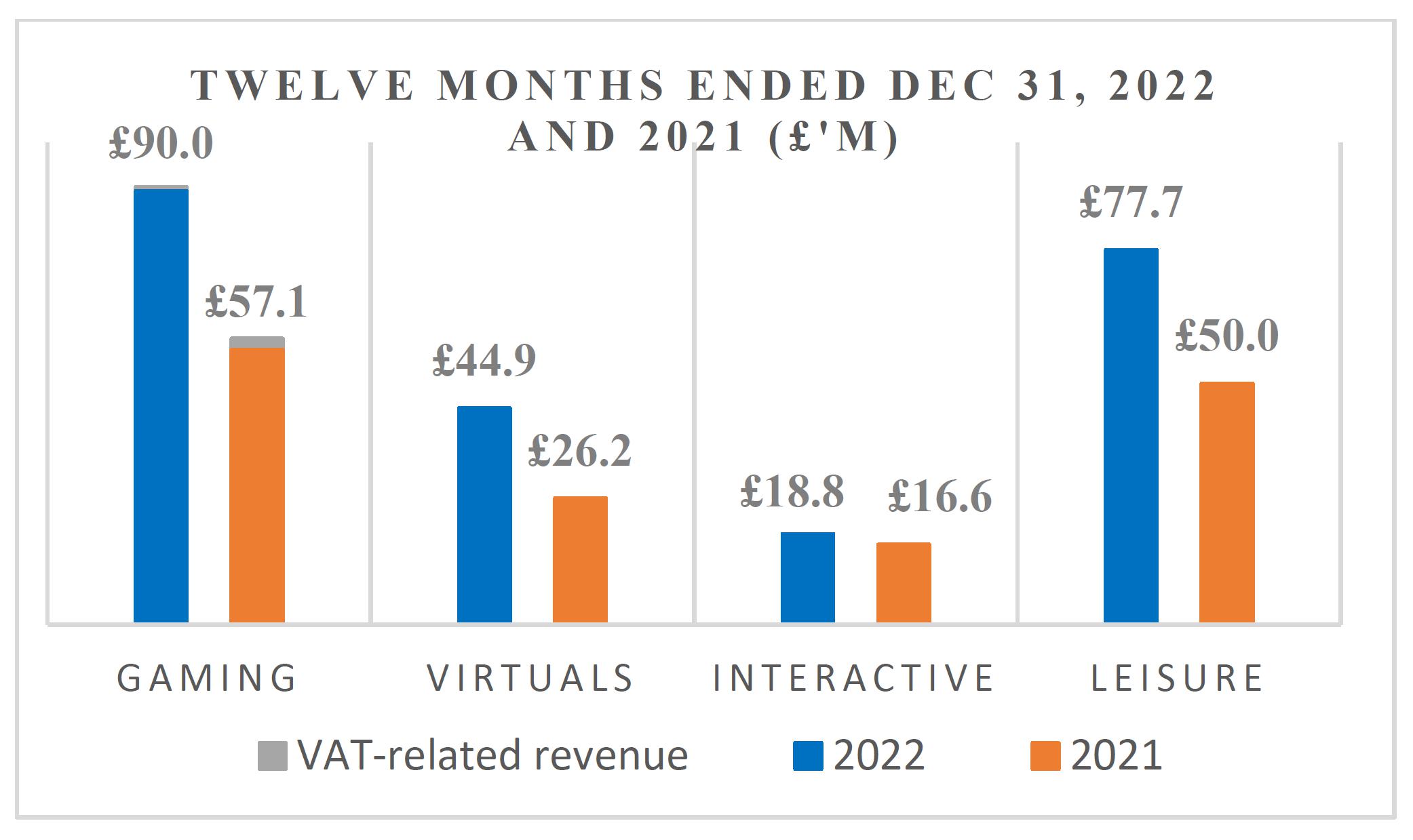

For the year ended December 31, 2022, our Gaming segment generated revenue and Adjusted EBITDA of $111.7$111.3 million and $41.6$43.7 million, respectively (excluding VAT related income), as compared to the year ended December 31, 2021, during which we generated $81.4 million and $26.1$26.7 million in revenue and Adjusted EBITDA, respectively (excluding VAT related income).

| 2 |

Virtual Sports Segment

Our Virtual Sports business designs, develops, markets and distributes ultra-high-definition games that create an always-on sports wagering experience in betting shops, other locations and online. Our Virtual Sports product comprises a complex software and networking package that provides fixed odds wagering on an ultra-high definition computer rendering of a simulated sporting event, such as soccer, football or basketball. Players can bet on the simulated sporting event, overcoming the relative infrequency of live sporting events. We have developed this product using an award-winning TV and film graphics team with advanced motion capture techniques.

We believe we are one of the most innovative suppliers of Virtual Sports gaming products in the world. We offer a wide range of sports and numbers games to approximately 32,000 retail venues as well as through various online websites. Our products are installed in over 20 gaming jurisdictions worldwide, including the UK, Italy, Greece, Turkey, Morocco, and the U.S.

Our Virtual Sports game portfolio includes titles such as V-Play SoccerTM, V-Play Women’s SoccerTM, V-Play Football TM, V-Play Basketball TM, V-Play Baseball TM, and V-Play NFLA TM, as well as greyhounds, other horse racing products, tennis, motor racing, cycling, cricket, speedway, golf and darts. We have also licensed the use of images of certain sports brands in our games, including with the NFL Alumni. In 2021, we entered into an exclusive licensing agreement with the Major League Baseball Players Alumni Association to create and license a new V-Play Home Run Shoot-out Legends TM virtual baseball product.

Our customers are many of the largest operators in lottery, gaming and betting worldwide. We are contracted to supply Virtual Sports to mobile and online operators in the United Kingdom; the U.S. states of Nevada, Pennsylvania, D.C. and New Jersey; Gibraltar and other regulated EU sectors, including Italy, Greece and Poland; and other jurisdictions such as Ontario, Turkey and Morocco. Virtual Sports can be adapted to function in sports betting, lottery, or gaming environments and is therefore available to a wide range of customers in both public and private implementations.

The Virtual Sports events are capable of being offered to millions of customers, through retail, online and mobile platforms, many of them available 24 hours per day, 7 days per week, and often concurrently within the same location or interactive platform. We have multiple hosting solutions capable of fulfilling the product delivery needs of our customers including our proprietary Virtual Plug and Play end to end online and mobile turnkey solutions. In addition, a cloud-based solution is available to customers who require an XML sportsbook integration that is fully hosted and operated by Inspired.

Our Virtual Sports products are typically offered to operators on a participation basis, whereby we receive a portion of the gaming revenues generated, plus an upfront software license fee. With our participation-driven business model, our Virtual Sports segment produces approximately 99% of total revenue on a recurring basis under long-term contracts for which our standard term is three years in duration.

For the year ended December 31, 2022, our Virtual Sports segment generated revenue and Adjusted EBITDA of $55.1$54.2 million and $46.3$44.9 million, respectively, as compared to the year ended December 31 2021, during which we generated $36.0$35.0 million and $28.4$27.5 million in revenue and Adjusted EBITDA, respectively. Virtual Sports revenue generated through online and mobile channels has increased from $26.1$34.3 million in 2021 to $43.4$53.9 million in 2022.

| 3 |

Interactive Segment

Our Interactive business uses unique interactive-only content as well as offerings from our Gaming and Virtual Sports segments to create games that are hosted on remote gaming servers to allow online gaming operators to use our games and content online and on mobile devices worldwide. Our interactive content includes a wide range of premium random number generated casino content from feature-rich bonus games to European-style casino free spins and table games incorporating well-known first and third-party brands including Space Invaders®, 20p RouletteTM, Jagr’s Super SlotTM, Super Hot Fruits® and Reel King MegawaysTM. Inspired releases several new titles per month and new games can be seamlessly deployed to the full estate of operators and aggregators through its proprietary Virgo RGS™. Games are available on over 300 websites across much of regulated Europe including the UK, Gibraltar, Malta, Spain, Sweden, Italy, Germany, the Netherlands, Romania, Greece and Belgium as well as in New Jersey, Michigan, Pennsylvania, Connecticut, Ontario and Quebec. We expect to next go live in West Virginia and Alberta during 2023.

Inspired’s Virgo RGS™ is integrated with a number of best known casino brands, including William Hill, Entain, bet365, Flutter, 888, Kindred, Gamesys, BetFred, Rank, Leo Vegas, OPAP and Stoiximan. We are also now live with thirteen North American operators: Bet MGM, Draft Kings, Caesars, Resorts/Mohegan, Rush Street Interactive, Wynn, Unibet, Ballys, Tipico, Ocean, 888 and Golden Nugget and with Loto Quebec in Canada.

Our Interactive products are typically offered to operators on a participation basis, whereby we receive a percentage of total amount of stakes wagered or a percentage of net gaming revenue. For the year ended December 31, 2022, our Interactive segment generated revenue and Adjusted EBITDA of $23.1$20.6 million and $12.3$11.3 million, respectively. With our participation-driven business model, approximately 100% of revenue for our Interactive segment is recurring in nature and derived under long-term contracts for which our standard term is three years in duration. We have successfully renewed all of our key Interactive contracts expiring over the last three years. We believe the COVID-19 global pandemic accelerated the market adoption of interactive gaming by end-users, and that our EBITDA margins in this segment will expand as our revenue grows due to the low variable costs we expect to incur on incremental revenue, versus our existing base of revenue.

| 4 |

Leisure Segment

We are a supplier of gaming terminals and amusement machines to the Leisure and Hospitality sectors and one of the largest operators of “pay to play” gaming terminals and amusement machines in the UK. As of December 31, 2022, we supplied and operated over 11,000 gaming terminals and 4,500 pool tables, prize vending and jukeboxes located in pubs, bingo halls, and adult gaming centers. We also service approximately 2,800 gaming terminals under maintenance only contracts. The increasing majority of gaming terminals we operate are server based, allowing us to distribute content supplied by our “in house” design studios as well as some of the most popular content titles from our strategic partners.

In addition, we also supply and operate approximately 9,500 amusement machines and 2,200 gaming terminals in family entertainment centers and adult gaming centers located in holiday parks, bowling centers and other entertainment venues. These include virtual reality simulators and arcade games, redemption and skill with prize games, basketball, air hockey and cue sports. Commercial arrangements are typically structured as either revenue participations or rental agreements.

Our customers in this segment include the vast majority of recognizable brands that participate in the geographies and sectors in which we operate. These customers include large pub operators JD Wetherspoons, Stonegate Pub Company, Greene King, Mitchells and Butler, Whitbread Marstons and Admiral Taverns. In the Bingo sector, we supply gaming terminals and services to Buzz Bingo and Mecca. We supply gaming terminals and services to transport hub operators, Moto and Welcome Break and major airports, including Heathrow. We also operate our own adult gaming centers under the QuicksilverTM brand in Extra Motorway Services. We have joint venture agreements with holiday park operators including Parkdean Resorts, Bourne Leisure and Butlins, where we supply machines and trained staff to manage and operate family entertainment centers.

Overall, our Leisure segment had, as of December 31, 2022, an installed base of over 16,000 gaming terminals, which were operated primarily under participation-based contracts. We generate revenue by participating, typically as a function of gross revenue from each machine, in a percentage of volumes generated by these machines. Because we participate in our customers’ revenues under such contracts, we are aligned with our customers in benefitting from the introduction of our new content, which can drive growth in the win per unit per day of our installed base. Additionally, we earn revenue through the sale of units, as well as a fixed daily fee for certain of our installed units. With our participation-driven business model, approximately 96%97% of revenue for our Leisure segment is recurring in nature and derived under long-term contracts. Notably, we have successfully renewed contracts with pub operators Greene King, Marstons PLC, Mitchells & Butlers, Admiral Taverns, Stonegate and Whitbread. We have also secured new contracts with Bourne Leisure and Butlins.

For the year ended December 31, 2022, our Leisure segment generated revenue and Adjusted EBITDA of $95.5 million and $24.4$24.3 million, respectively.

| 5 |

Our Strengths

We believe key factors that give us an advantage in the gaming technology space include:

Established presence across multiple Product Verticals

We have a substantial installed base across each of our product verticals, including over 31,800 digital terminals in the Gaming segment located across key jurisdictions in the United Kingdom, Greece, Italy and South America, with approximately 13,700 terminals installed in UK Licensed Betting Offices and approximately 8,700 installed in Greek video lottery terminals (“VLTs”). In our Leisure segment, we supply and operate an installed base of approximately 16,000 gaming terminals (including approximately 2,200 gaming terminals under maintenance only contracts) and 7,000 pool tables, prize vending and jukeboxes to pubs, bingo halls and adult gaming centers. In addition, we also supply and operate approximately 9,300 amusement machines and 2,200 gaming terminals in family entertainment centers located in holiday parks, bowling centers and other entertainment venues. We have award winning content and products in our Virtual Sports segment, which offers a wide range of sports and numbers games through approximately 32,000 retail venues as well as through various online channels. Our Virtual Sports gaming products are installed in approximately 35 gaming jurisdictions worldwide, including the United Kingdom, Italy, Greece, Morocco and the United States, our customers being many of the largest operators of lottery, gaming, and betting operations worldwide. Additionally, our Interactive segment provides a wide range of premium iGaming content to large operators primarily located in the United Kingdom, Italy, Greece and North America, as well as several other countries across Europe through over 170 websites.

Highly Diversified Business Underpinned by Longstanding Customer Relationships

We operate in several business segments and geographic locations that provide us a diversified revenue and cash flow stream that has proven to be resilient under various economic environments. While our Gaming segment has represented the largest proportion of our revenue in each of the last three years, our Virtual Sports and Interactive segments represent substantial growth opportunities as demonstrated by recent trends, including during the COVID-19 global pandemic, which are expected to continue to diversify our business. Additionally, we continue to expand in high growth markets, such as North America, which are expected to drive further geographic diversification across business segments. We have over 600 customers, including major lottery, sports betting and gaming operators (both interactive and location-based) within regulated sectors worldwide. Many of our customer relationships in the UK and European sectors are long-standing and in excess of 10 years. We expect that our diverse customer base will afford us opportunities to sell incremental products to certain of these customers in the future.

Substantial Recurring Revenue Supported by Long-Term Participation-Based Contracts

We believe our robust recurring revenue business model will drive our performance and free cash flow generation. For the year ended December 31, 2022, our recurring revenue, which included revenue generated from participation-based contracts and licensing arrangements, represented 86% of total revenue (87% excluding VAT-related revenue and $2.0 million of performance bonus), as compared to approximately 86%85% of total revenue (87%(86% excluding VAT-related revenue) for the year ended December 31, 2021. Our content and products, which are provided primarily pursuant to long-term contracts, are essential to generating revenue for our customers and satisfying the demand of our end users. Our long-term contracts typically have an initial duration of three to five years depending on the business segment and the customer and, over the last three years, we have successfully renewed the significant majority of expiring contracts with key customers in our Gaming, Virtual Sports and Interactive segments, and have successfully renewed all expiring contracts with key customers in our Leisure segment since the Company’s acquisition of the Gaming Technology Group of Novomatic UK Ltd., a division of Novomatic Group, an international supplier of gaming equipment and solutions in October 2019 (the “NTG Acquisition”).

| 6 |

Proprietary Technology and Track-Record of Strong Content Development

We are dedicated to being at the forefront of our industry in terms of technology and innovation. We combine complementary expertise in technology and operations, positioning us as a provider of superior technical solutions. As of December 31, 2022, we held approximately 15 patents and approximately 200 trademarks worldwide. We focus our product development efforts on emerging technology trends, utilizing a combination of customer research, design experience and engineering excellence. We are committed to developing innovative products for our customers and are focused on improving player entertainment and customer profitability.

We believe convergence trends in the gaming industry emphasize the importance of proprietary content, including licensed content. Such content is needed to successfully promote a compelling game offering across multiple platforms and to develop distinctive products for operator-clients. Our proprietary content drives engagement across gaming platforms. Our full suite of high-quality gaming products, services and multichannel distribution capabilities, extensive traditional content library, sizeable installed gaming machine base and deep relationships with operator-customers help make us an attractive partner for potential licensors of branded content.

Our Interactive business has expanded rapidly, with revenue growing at an approximate compound annual growth rate of 103%65% on a functional currency at constant rate basis between 2019 and 2022. We believe this growth has been driven, in part, by our content library of over 100 slot games . Many of our recent game launches, including Gold Cash Free SpinsTM, Big Fishing FortuneTM, and the Reel King ® family of games, have been omni-channel, offering a premium player experience across multiple platforms – though, unlike our older games, they originated online and, once proved successful, were migrated to retail platforms.

Inspired’s award-winning Virtual Sports products offer a wide range of betting markets and what we consider to be superior graphics. Our Virtual Sports revenue has been growing fast and has achieved high Adjusted EBITDA margins, while providing an attractive recurring-revenue base.

Positioned To Benefit From Key Market Trends

With our proprietary digital gaming platform and content comprising an end-to-end product offering and our multi-channel capabilities and robust relationships across the client spectrum, we believe we are well-positioned to benefit from emerging gaming sector trends, including growth stimulated by liberalization of government gaming regulations, the emergence of multi-channel offerings and the increasing importance of proprietary content.

Our multi-channel offerings are well-positioned to benefit from the increased prevalence of smart phones and tablets and the legalization of online gaming in certain parts of the United States, Canada and other jurisdictions. Such jurisdictions have provided new growth opportunities for gaming and lottery operators through the introduction of new channels and portals for delivering games to customers. This supplements the existing broad-based online gambling market across Europe. Our multi-channel solutions and customer relationship management capabilities position us to take advantage of new opportunities to extend our gaming solutions across different channels for our customers to reach new players, expand the player demographic base and access players wherever they are whenever they want to play. Our technology extends play for existing players and has the capability to reach new player segments. This and other technology help position us for future online real-money gaming opportunities by offering play-for-fun online gaming options in jurisdictions where online real-money gaming may be legalized in the future.

Government initiatives, such as the legalization of casino operations in new jurisdictions, increases in the number of casinos allowed to operate in a given jurisdiction and the legalization of new products, have helped stimulate growth in the gaming market. In the United States, legislative change has led to an increase in the legalization of sports betting. As of December 31, 2022, 21 U.S. states and the District of Columbia have legalized sports betting.

| 7 |

Experienced Management Team

Our seasoned management team is led by our Executive Chairman, Lorne Weil, who is known as a gaming industry innovator and whose past leadership includes growing a diversified global gaming technology company both organically and through extensive acquisitions and joint ventures further bolstering the business. Other members of the Company’s Office of the Executive Chairman (the “OEC”) are our President and Chief Executive Officer, Brooks H. Pierce; our Executive Vice President and Chief Financial Officer, Stewart F.B. Baker; and our Executive Vice President and General Counsel, Carys Damon. The OEC executes the day-to-day management of the Company. Our management team has broad and deep experience in the gaming industry, working with lotteries, casino operators, betting platforms, and online operators. The members of the OEC have, on average, decades of experience in the gaming industry, including relationships with customers around the world, helping them build and sustain revenue growth. In addition, the members of the OEC have centered their careers on identifying, acquiring and integrating, through the implementation of value creation initiatives, complementary businesses.

Our Strategy

We seek to deliver innovative and differentiated products that provide value to our customers and exciting experiences to their players in multiple jurisdictions throughout the world while achieving long-term growth in revenues, profit and cash flow. We place great emphasis on developing creative solutions, in terms of game content and play that deliver and sustain superior performance through operators across interactive and location-based channels. Our technology often allows us to update our games and operating software remotely, keeping pace with evolving requirements in game play, security, technology and regulations. We seek to achieve these goals as we:

Extend our positions in each of the sectors in which we operate by developing new content and products which can often be utilized across multiple distribution channels.

We continually invest in new content and product development in each of the business segments in which we operate. We believe these investments can benefit our existing and prospective customers by making new content and products available to them and bringing exciting entertainment experiences to their players. Our approach, which seeks to distribute our content across a wide range of channels, protocols and regulatory standards, allows us to distribute our content across multiple sectors in which we operate on a cost-efficient basis. We have continued to focus on channels where we believe there is considerable growth available – especially in our digital businesses. We believe our technological approach allows us to quickly adapt to changes in player preferences.

Continue to invest in content and technology in order to grow our existing customers’ revenues and penetrate new customers in our existing markets.

Over the last three years, a substantial portion of our annual revenue has been recurring and based on long-term contracts with customers, where our revenues typically grow in line with the growth of our customers’ gaming revenues from our content and products. We seek to work closely with our customers to assist in the optimization of their operations so they can achieve growth in their revenues generated by our content and products, which we believe is to our benefit. Accordingly, we continually invest in new content and technology offerings that we believe will enable our customers to keep their offerings fresh and allow them to offer their players new forms of entertainment. As our content demonstrates successful commercial results, we seek to place it with additional customers who recognize its performance. We believe content development is a key aspect of our strategy and we intend to continue this strategic priority for each of the businesses in which we operate.

Add new customers by expanding into underpenetrated markets.

We believe our historical growth has been driven by our entry into new geographies, and supplemented by increasing our share in existing markets. We expect to continue to focus on North American markets in the Gaming, Virtual Sports and Interactive segments for such expansion. We believe North America is a major gaming market in which we currently have limited participation, but where our products are well positioned, or can be positioned, for future success. For example, in 2021 and 2022, we placed 399 and 1,006 VLT terminals, respectively, in North America. We also believe there are likely to be growth opportunities in Latin America which will be available to us in the future.

Pursue targeted mergers and acquisitions to expand our product portfolio and distribution footprint.

In addition to growing our business organically, we have pursued, and continue to pursue, merger and acquisition opportunities that we believe will help strengthen and scale our operations and take further advantage of our competitive position. Our management team shares a combination of operating, investing, financial and transactional experience that we believe will serve the Company well as it seeks to identify opportunities for value-adding acquisitions and negotiate and close on beneficial acquisition transactions. In December 2021, we completed the acquisition of Sportech Lotteries, LLC (currently Inspired Entertainment Lotteries LLC), which is our first lottery-focused acquisition, further diversifying our business model on a product, customer, and geographic level.

| 8 |

Industry Overview

We operate within the global gaming and lottery industry. Global gaming and lottery growth has been resilient in the face of economic cycles over the last decade. According to the H2 Database, the global gaming and lottery industry has grown at a 2% compounded annual growth rate from 2012 to 2022, which has been driven by increased consumer spend and the introduction of new regulated sectors but declined dramatically in 2020 due to land-based venues being closed due to COVID-19 mandated shutdowns and restrictions.

During this period, the digital online and mobile gaming and lottery sectors have grown at a faster pace than the industry as a whole. According to the H2 Database, these industry sectors have grown at a 15% compounded annual growth rate from 2012 to 2022, driven by rapid growth in the deployment of digital games and technologies, including many of our products, into land-based venues in the primary sectors in which we operate, where regulators have supported the transition to digital, online and retail channels. According to the H2 Database, the total global gaming and lottery industry is projected to grow an average of 6% per year from 2022 to 2027 driven by the projected growth in mobile and online gaming.

We believe the global gaming and lottery industry will return to a growth trajectory, with more robust growth in the digital gaming and lottery sectors, as further described below. We believe the industry is content driven and, much like music, videogames and motion pictures, will continue to be transformed by the propagation of digitally-networked technologies.

As a gaming and lottery business-to-business supplier focused on digital products and technologies, we believe we are well-positioned to benefit from these trends.

Influencers of Digital Adoption

We believe the digital segment of the global gaming and lottery industry will continue to grow, including as a result of the following factors:

Governments: Opening of new gaming territories. Many national and state governments operating in developed economies in Europe and the United States are suffering from structural funding deficits. The regulation and liberalization of gaming and lottery is frequently relied upon to raise new sources of revenue for these governments. In most cases, we believe such liberalization does not favor buildouts of large new destination resort casinos, but rather focuses on smaller distributed gaming (“EDGE”) venues with lottery, gaming and sports betting, combined with online or mobile gaming.

Digital Multi-Channel Offerings: Replacement of legacy analog machines with larger volume of smart digital devices, both interactive and location based. In many established sectors, as existing gaming sectors mature, governments and regulatory authorities have implemented regulations to upgrade the established terminal base to digital operation.

Smartphones and Mobile Devices: Rapid adoption of gaming and lottery applications on growing volume. In certain sectors, mobile play on sports betting and gaming now exceeds such play on personal computers. According to the H2 Database, mobile gaming revenues in such sectors exhibited a 27.0% compound annual growth rate between 2010 and 2021. Mobile gaming and lottery is now expanding in other sectors, and mobile play has recently been approved in other sectors for gaming or lottery.

In addition to the foregoing, we believe there are significant benefits for our customers in adopting digitally networked gaming and lottery technologies. We believe our digitally-enabled products allow operators to remotely manage their operations with minimal disruption to their businesses. The system centralization enabled by digital operations offers flexibility to rotate or change games, tailor game availability to time-of-day, target specific player demographics and take advantage of seasonal and themed marketing opportunities. New games often can be phased in without the interim revenue declines often associated with replacing games on traditional slot machines. In addition, digital operations permit more games per terminal, enabling operators to test new games and new suppliers, seek to appeal to a broader base of players with minimal cost or risk, commission games from third-party suppliers on an open game interface and reduce procurement risk. Moreover, digital operations can significantly reduce the need for on-site repairs, improve terminal up-time and should extend terminal life cycles as well as the time period over which capital costs can be depreciated.

| 9 |

Regulatory Framework

We conduct business in a number of different jurisdictions, of which Great Britain, Italy and Greece have historically contributed the most significant recurring revenues. The gaming regulator responsible for our activities in Great Britain is the Gambling Commission of Great Britain (the “UK Gambling Commission” or the “Gambling Commission”). In Italy, the operation of gaming machines and remote gaming is regulated by L’Agenzia delle dogane e dei Monopoli (“ADM”). In Greece, the operation of gaming machines and remote gaming is regulated by the Hellenic Gaming Commission. In addition, we are licensed or certified (as applicable) in a number of other jurisdictions by regulators such as the Malta Gaming Authority, Licensing Authority of Gibraltar, the Alderney Gambling Control Commission, the Belgian Commission, Autorité Des Marchés Financiers (Quebec) and state regulators in various jurisdictions in North America.

Great Britain

In the British sector, we supply and distribute Category B3 gaming machines (with maximum betting stakes for players of £2) and ETG machines to third parties who are licensed to operate such machines in bricks-and-mortar premises. In addition, we operate a number of Adult Entertainment Centers. We also supply virtual racing software to local retail venues and to online operators who are licensed to target the British sector. We also supply our Interactive product to remote operators who are licensed to target the British sector. The provision of our products and services in relation to the British sector is authorized by a series of licenses issued by the UK Gambling Commission, namely remote and non-remote Gaming Machine Technical (Full) operating licenses, a remote casino operating license, a remote and non-remote gambling software license and a remote general betting standard (virtual events) license gaming machine general adult gaming center license and a gaming machine general family entertainment center license.

British Betting and Gaming Laws and Regulations. The Gambling Act 2005 (the “GA05”) is the principal legislation in Great Britain governing gambling (other than in relation to the National Lottery, which is governed by separate legislation). The GA05 applies to both land-based gambling (referred to as “non-remote” gambling) and online and mobile gambling (referred to as “remote” gambling).

| 10 |

The GA05 provides that it is an offense to make a gaming machine available for use without an appropriate operating license. There are a number of different categories of licensable gaming machines (the GA05 provides for category A to D machines, although no category A machines are currently in operation); each category is subject to different levels of maximum stakes and prize limits. In addition, there are limits on the numbers and types of gaming machines that can be operated from licensed premises: for example, a licensed betting office is permitted to house up to four category B3 to D machines, while a large casino may house up to 150 category B to D machines (subject to satisfying certain ratios of machines to gaming tables).

Gaming machine suppliers are required to hold an operating license in order to manufacture, supply, install, adapt, maintain or repair a gaming machine or part of a gaming machine. Gaming machine suppliers must also comply with the Gaming Machine Technical Standards published by the Gambling Commission in relation to each category of machine, and such machines must meet the appropriate testing requirements.

In relation to remote gambling, the GA05 (as amended by the Gambling (Licensing and Advertising) Act 2014 provides that it is an offense to “provide facilities” for remote gambling either (a) using “remote gambling equipment” situated in Great Britain, or (b) which are used by players situated in Great Britain, in each case without a remote gambling operating license. It is also an offense to manufacture, supply, install or adapt gambling software in Great Britain without an appropriate gambling software license.

A remote gambling operating license holder providing facilities for remote gambling to British players is required to use gambling software manufactured and supplied by the holder of a gambling software license (and failure to do so is an offence). Where gambling software is used or supplied for use in relation to the British sector, it must satisfy the Remote Gambling and Software Technical Standards published by the Gambling Commission.

The holder of a British gambling operating license is subject to a variety of ongoing regulatory requirements, including, but not limited to, the following:

| ● | Shareholder disclosure: An entity holding a gambling license must notify the Gambling Commission of the identity of any shareholder holding 3% or more of the equity or voting rights in the entity (whether held or controlled either directly or indirectly). |

| ● | Change of corporate control: Whenever a new person becomes a “controller” (as defined in section 422 of the Financial Services and Markets Act 2000) of a company limited by shares that holds a gambling operating license, the licensed entity must apply to the Gambling Commission for permission to continue to rely on its operating license in light of the new controller. A new controller includes any person who holds or controls (directly or indirectly, including ultimate beneficial owners who hold their interest through a chain of ownership) 10% or more of the equity or voting rights in the licensed entity (or who is otherwise able to exercise “significant influence” over it). The Gambling Commission must be supplied with specified information regarding the new controller (which, in the case of an individual, includes detailed personal disclosure) and this information will be reviewed by the Gambling Commission to assess the suitability of the new controller to be associated with a licensed entity. If the Gambling Commission concludes that it would not have issued the operating license to the licensed entity had the new controller been a controller when the application for the operating license was made, the Gambling Commission is required to revoke the operating license. It is possible to apply for approval in advance from the Gambling Commission prior to becoming a new controller of a licensed entity. | |

| ● | Compliance with the License Conditions and Codes of Practice (LCCP): The LCCP is a suite of license conditions and code provisions which attach to operating licenses issued by the Gambling Commission. The provision of gambling facilities in breach of a license condition is an offense under the GA05. Certain specified “Social Responsibility” code provisions are accorded the same weight as license conditions in this regard (whereas breach of an “ordinary” code provision is not an offense in itself, but may be evidence of unsuitability to continue to hold a gambling license). The LCCP imposes numerous operational requirements on licensees, including compliance with the Gambling Commission’s Remote Gambling and Software Technical Standards, segregation of customer funds, the implementation of a variety of social responsibility tools (such as self-exclusion), anti-money laundering measures, age verification of customers and a host of consumer protection measures. The Gambling Commission regularly reviews and revises the LCCP. | |

| ● | Regulatory returns and reporting of key events: The LCCP requires licensees to submit quarterly returns to the Gambling Commission detailing prescribed operational data. Licensees are also required to notify the Gambling Commission as soon as practicable and in any event within 5 working days of becoming aware of the occurrence of certain specified “key events” which, in summary, are events which could have a significant impact on the nature or structure of the licensee’s business. Licensees are also required to notify suspicion of offenses and suspicious gambling activity. | |

| ● | Personal licenses: Key management personnel are required to maintain personal licenses authorizing them to discharge certain responsibilities on behalf of the operator. These personal licenses are subject to renewal every five years. Personal licenses are subject to compliance with certain license conditions. |

| 11 |

Italy

We operate two different gaming businesses in Italy. We provide platform and games for video lottery terminals (“VLTs”), we also supply platforms for bets on Virtual Sports events to betting shops and online platforms. Our businesses are operated through the Italian branches of certain of our UK subsidiaries. These branches hold police licenses and are enrolled in the ADM Register of Gestori, as further described below. We supply our platform and games and Virtual Sports products only to operators licensed under Italian gaming laws and regulations.

Our VLT and Virtual Sports platforms must be connected over the internet to servers operated by the ADM. Information regarding gaming sessions and the amounts wagered and won is provided in real time through the ADM servers, in order to enable the ADM to monitor the operation of machines and games and to verify the amount of taxes due.

Italian Betting and Gaming Laws and Regulations. Operators of betting premises offering VLTs (including the entities managing the networks connecting such VLTs to ADM servers), and operators of betting premises or online platforms offering Virtual Sports products, must hold an Italian gaming license. No gaming license is required in order to supply VLTs or Virtual Sports products to such operators. Such VLT platforms, machines and games, and Virtual Sports platforms and games, must be certified and approved by either SOGEI, an entity controlled by the Italian Ministry of Finance and authorized to conduct such certifications or testing labs accredited with ADM. Such certifications and approvals must be obtained by such operators, rather than the suppliers of such VLT platforms, machines and games, and Virtual Sports platforms and games.

Suppliers of gaming machines, including VLTs, must hold a police license (as prescribed by article 86, paragraph 3, of the Italian United Text of Public Security Law (TULPS) provided by the Royal Decree 18 June 1931, No. 773) and be enrolled in a registry prescribed by article 1, paragraph 82 of Law No. 220/2010 and managed by ADM (known as the “ADM Register of Gestori”). If a supplier of gaming machines is not enrolled in the ADM Register of Gestori, any agreement it enters into regarding the supply of gaming machines is null and void. In addition, if the enrollment is not renewed, existing agreements regarding the supply of gaming machines become null and void. Enrollment in the ADM Register of Gestori is subject to, among other things, a review of the suitability of the applicant business entity and its directors. In the event of a change of control of the entity enrolled in the ADM Register of Gestori (but not of such entity’s direct or indirect parent entities), the details of such change must be notified to the ADM and suitability must be reconfirmed.

Suppliers of Virtual Sports products are not required to hold a police license, be enrolled in the Register of Gestori or otherwise be licensed or registered.

Greece

In Greece, we supply VLTs, including the terminal machines themselves, the related online platforms and the games available on the machines, to brick-and-mortar gaming locations operated by OPAP, the country’s sole licensed operator of gaming machines. We supply such VLTs under a certification provided by the Hellenic Gaming Commission (the “HGC”). We also supply Virtual Sports products within retail venues operated by OPAP and via self-service betting terminals within OPAP venues and supply interactive games and Virtual Sports to online operators in Greece including Stoiximan, OPAP and Novibet.

Greek Betting and Gaming Laws and Regulations: According to Article 44 par. 2 of Law 4002/2011, as well as according to HGC’s Decision No 225/2/25.10.2016 as well as Ministerial Decision 79314/23.07.2020 (GG B’ 3263/5 August 2020) as amended with Decision 13530 /02.02.2022 (GG B’ 356 03.02.2022) and again with Decision 187634/27.12.2022 (GG B’ 6716/2712.2022) and 79305/05.08.2020 (GG B’ 3262/5 August 2020), all suppliers of gaming machines in Greece must be certified by the HGC in order to legally supply, sell, lease, offer or distribute any VLT or virtual game or any other game of chance (i.e. games including wagers or bets and the result of which games depends, even partly, on the influence of luck). Moreover, for Manufacturers which are defined under the aforesaid Decision 79305 as “the person or entity which manufactures (indicatively, studies, designs, assembles, produces, programs) and in any way makes available to an Operator and/or Importer any Technical Means and Hardware, and has received a Suitability License by the HGC to this end, as well as the person that holds a license for a Studio”, Decision 79305, provides in Article 9 for a Suitability License provided a Manufacturers (type A.1 licence) and in Article 10 to Importers/Distributors (type E1 and E2)Accordingly, manufacturers need to obtain a Suitability License Type A1, while importers/distributors need to obtain a Suitability License Type E1 or E2.

| 12 |

As regards online gaming, Articles 45 -52 of Law 4002/2011 (GG A’ 180/22.8.2011), which was recently amended by Law 4635/2019 (GG A’ 167/30.10.2019), introduces several new provisions such as the two exclusive types of online licenses for online gaming operators: a) Online Betting License; and b) a license for Other Online Games (it covers online casino games and online poker games and variants thereof). Furthermore, Article 14 of the HGC’s Decision No 79835/05.08.2020 (GG B’ 3265/5.8.2020) states that all Manufacturers have to submit an application to the HGC, accompanied by the required compliance certificates, for the following elements: i. the Gaming Platform (Betting Platform); ii. the Random Number Generator (RNG) per type/group of Games that the Manufacturer offer to each License Holder; and iii. each individual game or multigame. Lastly, Suitability Licenses for suppliers are also divided into two types: a) Manufacturers Suitability License and b) Importers/Distributors Suitability License (according to articles 9 and 10 of Decision No 79305/05.08.2020). Accordingly, manufacturers need to obtain a Suitability License Type A1 or A2 (depending on whether the manufacturer provides management services to the operator or not), while importers/distributors need to obtain a Suitability License Type E1 or E2.

Gaming Regulation and Changes in Ownership

In all of the jurisdictions in which we are subject to gaming regulations, regulators require us to keep them informed as to our ownership structure and composition and, to varying extents and in various circumstances, require us to disclose certain information regarding the persons who directly or indirectly hold our shares. Depending on the regulator, we may need to provide such information not only when we first seek licenses or certifications, but also when material changes (measured at different levels) occur in the ownership of our shares. As a result, material changes in our shareholdings may be subject to special procedures in order to ensure the continuation of our gaming licenses and certifications.

Content Development

We continually invest in new product development in each of our Gaming, Virtual Sports, Interactive and Leisure business segments. Inspired has a full stack game development structure, combining its proprietary technology frameworks together with some of the industry’s best math, art, creative and production personnel spread across 3 game studios (Inspired, Astra and Bell Fruit). We release over 100 games each year onto our own priority gaming system, Interactive RGS and to our G2S clients around the world in markets such as North America, UK, Greece, Spain, Belgium, Italy, Sweden and more. Whilst many of our game launches are omni-channel, we have a focus on building the right game for the right market and take pride in tweaking and modifying the math and themes for the target player. In Virtual Sports we combine graphical assets and software that controls those assets to schedule events and generate results via a random number generator, as well as supplying on demand versions of our content. In 2020, we launched the Virtual Plug and Play (VPP) product range. Using our award winning Virtuals assets, with our Interactive RGS and the addition of a Virtuals Bet Management System, VPP gives our operators a Virtuals Sportsbook in a box, with ease of integrations and operation. We account for our development costs as software development costs and these are typically amortized over a two-year period.

Suppliers

Our principal supply arrangements concern the supply of our terminal components, content provision and outsourced labor. We work closely with our key suppliers to ensure a high level of quality of goods and services is obtained and have worked with many of these suppliers for many years. We have achieved significant cost savings through centralization of purchases.

Customers

Our customer base includes regulated operators of lotteries, licensed sports bookmakers, gaming and bingo halls, casinos, pubs, adult gaming centers, holiday parks and regulated online operators. We typically implement design and content variations to customize their terminals and player experiences. Our license agreements with customers for the provision of machines, content and Virtual Sports products include provisions to protect our intellectual property rights in our games and other content.

Customer Contracts – Gaming

Our contracts in the Gaming segment involve supplying gaming terminals and licensing gaming software and games for the terminals. We supply the terminals on an exclusive or non-exclusive basis for all terminals of a customer or for specific locations. Under these contracts, we have general obligations to deliver, install, upgrade and service the terminals and software. The contracts may be terminated early in various circumstances such as if we fail to meet performance targets in servicing the machines.

Under some contracts, we receive an upfront fee for the provision of the terminals but more typically generate revenue as a percentage of income generated on terminals. With our participation-driven business model, approximately 94% of service revenue (excluding VAT related income) for our Gaming segment is recurring in nature and derived under long-term contracts that are typically between three and five years (although may be shorter for contract extensions). Over the last three years, we have renewed a significant majority of contracts that were expiring.

| 13 |

Customer Contracts – Virtual Sports

Our contracts in the Virtual Sports segment typically involve the supply of licenses to operators to make available, either via online or retail channels, virtual sporting events such as darts, cricket, or basketball, and to enable end-users to place bets on these events. These are typically one-time non-exclusive licenses specific to the virtual sporting event. We may agree to customize and brand the virtual sporting events for the operator or to provide language variations of the event. The contracts may be terminated early in various circumstances, including, for example, if the operator fails to pay an invoice within 60 days of receipt.

Our Virtual Sports products are typically offered to operators on a participation basis, whereby we receive a portion of the gaming revenues generated, plus an upfront software license fee. With our participation-driven business model, our Virtual Sports segment produces approximately 99% of total revenue on a recurring basis under long-term contracts that average four years when entered into and we have historically had a 100% renewal rate over the last three years for contracts that expired.

Customer Contracts – Interactive

Our contracts in the Interactive segment vary but generally involve the provision of a limited, non-exclusive, non-transferable, revocable license to operators to display certain slot and casino content on which online bets are placed or to make our games available for play by end-users of an operator’s online gaming business operations. The contracts may be terminated early in various circumstances, including material breach or inability to operate due to a change in regulatory status.

Our Interactive products are typically offered to operators on a participation basis, whereby we receive a percentage of total amount of stakes wagered or a percentage of net gaming revenue. With our participation-driven business model, approximately 100% of revenue for our Interactive segment is recurring in nature and derived under long-term contracts that averaged three years from when we entered into these contracts. Over the last three years, we have renewed approximately 100% of these contracts for those customers that have continued to trade.

Customer Contracts – Leisure

Our contracts in the Leisure segment vary but generally involve (i) agreement whereby the operator or proprietor of certain leisure resorts contributes premises and we provide, on an exclusive basis, gaming and amusement terminals as well as gaming software and games for the machines provided, (ii) contracts to supply gaming terminals as well as gaming software and games for the terminals provided to leisure operators on a non-exclusive basis, and (iii) rental agreements, which we enter into with certain motorway services providers, whereby we rent unit space in motorway service areas and populate this space with our gaming terminals.

Depending on the contract type, we have general obligations to deliver, install, upgrade and service the terminals and software provided, to acquire licensing for the various prizes and toys, which may be used in the terminals, to keep the premises open for minimum operating hours and not to use the premises for certain business. These contracts may be terminated early in various circumstances, including for material breach or insolvency events.

Under our leisure contracts, we typically generate revenue on a participation-basis by participating, typically as a function of gross revenue from each terminal, in a percentage of volumes generated by these terminals. With our participation-driven or fixed weekly fee business model, approximately 100% of service revenue for our Leisure segment is recurring in nature and derived under long-term contracts that are usually between three and five years. Since the NTG Acquisition, within the Leisure segment we have successfully renewed or extended the significant majority of major contracts that have expired.

Operations and Employees

Our operations include game production, platform and hardware design, production, testing, and distribution; the maintenance, management, and extension of our centralized network for product distribution and product monitoring; the delivery and, in certain circumstances, maintenance of SBG terminals; gaming machine engineering, assembly, repair and storage; parts supply; change and release management; remote operational services; problem management; business development; market account management; and general administration and management, including Finance, Legal, People (Human Resources), Investor Relations, Marketing and Communications, Quality, Compliance and Information Security.

| 14 |

As of December 31, 2022, we had approximately 1,600 employees, approximately 1,500 of which were full-time. Of those employees, over 600 were dedicated to delivering our digital gaming platforms, content and manufacturing. Approximately 85 of our employees were assigned to the ongoing operation of our network, through which we supply and maintain our products. Approximately 600 of our employees were involved in UK field operations. Our management, sales and administration teams accounted for approximately 200 employees.

Intellectual Property